Common menu bar links

Breadcrumb Trail

ARCHIVED - Industry Canada - Report

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Section 2: Analysis of Program Activities by Strategic Outcome

Strategic Outcome 1: The Canadian Marketplace is Efficient and Competitive

Strategic Outcome 1: The Canadian Marketplace is Efficient and Competitive

Industry Canada strives to achieve an efficient and competitive marketplace by developing and implementing policies necessary for the functioning of a market. These include laws and regulations governing intellectual property, bankruptcy and insolvency, competition and restraint of trade, corporations and corporate governance, foreign direct investment, internal trade, weights and measures, consumer affairs, and telecommunications. These policies help the Department in its role of promoting innovation, competition and productivity, and instill business, investor and consumer confidence. This was accomplished through the following program activities:

- Marketplace Frameworks and Regulations

- Marketplace Frameworks and Regulations for Spectrum, Telecommunications and the Online Economy

- Consumer Affairs Program

- Competition Law Enforcement and Advocacy

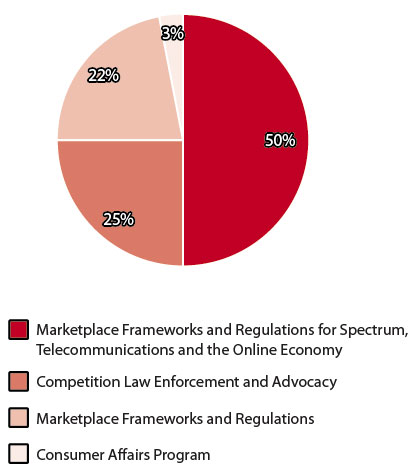

Distribution of spending by program activity in the area of The Canadian Marketplace is Efficient and Competitive

Industry Canada Success Story

In September 2010, the Competition Bureau published its Leniency Program Bulletin outlining factors it considers when making sentencing recommendations to the Public Prosecution Service of Canada (PPSC) and the process for seeking a recommendation for a

lenient sentence in a criminal cartel case. In addition, in May 2010, the Commissioner of Competition and the Director of Public Prosecutions entered into a MOU with respect to the investigation and prosecution of offences under the Competition Act, the Consumer Packaging and Labelling Act, the

Textile Labelling Act, and the Precious Metals Marking Act. The MOU, as well as the Leniency and Immunity Program, ensure transparency and predictability for the public and are among the Bureau's best tools to combat cartels and effectively manage its programs.

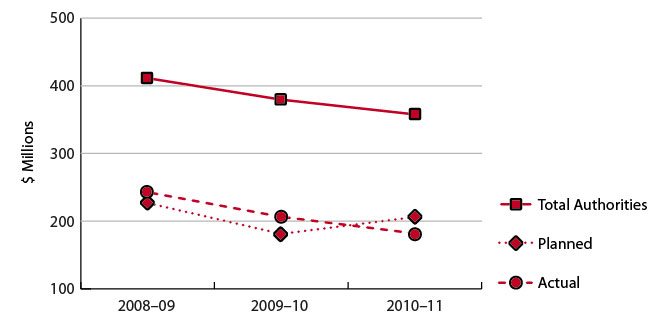

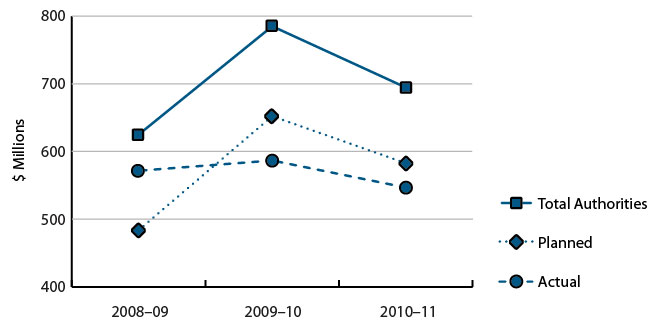

Financial Resources*

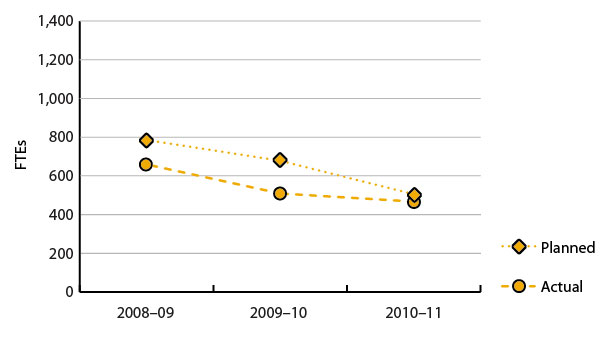

Human Resources**

** The decrease in human resources between 2008–09 and 2009–10 is largely due to a change in the requirements for reporting on the Internal Services activity in the DPR. In 2008–09, the Internal Services resources were allocated to each of the strategic outcomes. Starting in 2009–10, Internal Services was reported as a separate activity

Meeting Our Commitments

In an effort to ensure the Canadian marketplace is efficient and competitive, Industry Canada provided consumers with the opportunity to contribute to the development of government policies and to become effective marketplace participants. For example, following round table consultations across Canada and with foreign agencies, the Department has undertaken revisions to the Merger Enforcement

Guidelines. The Department also continued to administer several acts, including the Competition Act, Bankruptcy and Insolvency Act and the Investment Canada Act.

Program Activity: Marketplace Frameworks and Regulations

Program Activity Description

This program delivers effective regulatory regimes through regulations, policies, procedures and standards for bankruptcy, foreign direct investment, federal incorporation, intellectual property, and weights and measures to the Canadian marketplace (consumers, businesses and investors), while minimizing the regulatory compliance burden on small businesses.

| Planned Spending | Total Authorities | Actual Spending |

|---|---|---|

| 66.1 | 210.0* | 40.3** |

| Planned | Actual | Difference |

|---|---|---|

| 1,780 | 1,729 | 51 |

| Expected Results |

Performance Indicators |

Targets | Performance Status |

|---|---|---|---|

| Marketplace fairness, integrity, efficiency and competitiveness are protected in the areas of insolvency, foreign investment, weights and measures, federal incorporation, and intellectual property | Percentage of cases for which regulatory timelines and/or service standards are met | 80% |

Performance Status: Regulatory timelines and/or service standards are met in 87.6% of cases. This figure is represented as a percentage based on the following compliance rate:

This is an improvement from the 2009–10 result of 86.8% |

Performance Summary and Analysis of Program Activity

In keeping our commitments to ensure integrity and accountability in all areas of insolvency, Industry Canada, through the Office of the Superintendent of Bankruptcy (OSB), successfully rolled out enhancements to the accountability of all parties involved in Companies'

Creditors Arrangement Act (CCAA) filings in the regions. Development of our case management and integrated name search systems was completed to allow both Canadian and international stakeholders to efficiently search key information on CCAA filings. This allowed

CCAA monitors and foreign representatives to interact with the OSB more efficiently when filing regulatory forms used to populate the CCAA Registry. Stakeholders interested in researching insolvency files will save time

and money as the OSB will now act as an integral source of data for CCAA filings, as it already does for Bankruptcy and Insolvency Act (BIA) filings.

Following changes made to the Investment Canada Act and in an effort to improve the transparency and accountability of the foreign investment review framework in Canada, Industry Canada worked towards producing its first Investment Canada Act Annual Report in 2010–11. The final report will be completed in 2011–12.

Consultations for the proposed regulations of the Canada Not-for-Profit Corporations Act were held in spring/summer 2010, with the objective of establishing a modern governance framework for not-for-profit corporations. These consultations were approved by Treasury Board for pre-publication in Canada Gazette, Part I on February 26, 2011.

Industry Canada addressed stakeholder requests to make the NUANS the single comprehensive source of corporate names used in all Canadian federal, provincial and territorial jurisdictions. In response to the Department's efforts, the Northwest Territories in December 2011 announced their intention to use NUANS and the province of Quebec committed to submitting their corporate name data to NUANS by the end of March 2012.

Industry Canada, through the Canadian Intellectual Property Office (CIPO), promotes awareness of the benefits of intellectual property (IP) to increase its use for Canada's economic advantage. In 2010–11, CIPO's outreach strategy focused on promoting the economic value of IP among small and medium-sized enterprises (SMEs); promoting IP awareness among post-secondary students; building partnerships among key players in a position to disseminate IP awareness, knowledge and effective use; engaging intermediaries serving exporting small and medium-sized enterprises by providing them with the necessary training; and building the necessary capacity within the CIPO to deliver the outreach strategy.

Highlights of Challenges and Risk Areas

To mitigate the potential effects of the recession on CIPO's financial position and on its ability to finance key plans/projects, CIPO increased efforts to contain costs and reduce spending.

Lessons Learned

A significant indicator for the OSB is that insolvency "Registration will be complete within two business days of receiving completed documents." OSB invested in the development of an "E-Filing" system to allow for electronic filing. This addressed the potential risk of

not meeting OSB's two-business-days service standard because it would become difficult and costly for the OSB to keep manually registering insolvencies. Since June 2007, it has been mandatory that all trustees submit new summary and ordinary administration bankruptcies

and proposals made under Division I and Division II of Part III of the BIA electronically with the OSB using the E-Filing system.

This foresight enabled the OSB to maintain its service standards when, following the 2008 economic recession, filings started to increase. The increase reached a peak of 45 percent in 2009–10 compared with pre-recession levels and was still 30 percent higher at the end of 2010–11. Although there was an increase in workload associated with the registration of the high number of files, it was greatly lessened due to the E-Filing system.

Program Activity: Marketplace Frameworks and Regulations for Spectrum, Telecommunications and the Online Economy

Program Activity Description

This program encourages business innovation, competition and growth by ensuring that Canada develops, uses and benefits both domestically and internationally from spectrum, information and communications technologies, and the online economy. It achieves this by developing domestic regulations, policies, procedures and standards that govern Canada's spectrum and telecommunications industries and

the online economy. It also develops standards, promotes global telecommunications, and helps facilitate international online trade and commerce through participation in international bilateral and multilateral forums.

| Planned Spending | Total Authorities | Actual Spending |

|---|---|---|

| 87.2 | 95.2 | 91.0 |

| Planned | Actual | Difference |

|---|---|---|

| 686 | 693 | 7 |

| Expected Results |

Performance Indicators |

Targets | Performance Status |

|---|---|---|---|

| Canada's radiocommunications and telecommunications infrastructure and the online economy are governed by a modern, efficient and effective policy and regulatory framework. | Percentage of policies, legislation and regulations developed, updated or reviewed and consultations conducted as identified in annual branch business plans/strategic plans/operational plans |

80% of identified initiatives |

Performance Status: |

Performance Summary and Analysis of Program Activity

Industry Canada has made considerable progress in the areas of radiocommunications and telecommunications infrastructure and the online economy. The Department continued to undertake several actions to develop policies, regulations, standards and treaties to support effective spectrum management and the provision of new wireless services. Through its participation at the International

Telecommunication Union (ITU), Industry Canada was able to advance Canada's position on issues related to enhancement of the international spectrum regulatory framework, assign radio spectrum to new uses and align them globally to protect investments. By doing so, the Department encouraged innovation and mitigated interference among radio users of ITU member countries. As well, in 2010–11,

three cross-border frequency arrangements (treaties) for commercial and public safety services in the 700 MHz and 800 MHz bands for use by Canadians were developed in collaboration with the United States. Consultations on opening spectrum in the 28 MHz band in support of new commercial mobile systems were also held.

To enable broadcasters to bring high-definition television (HDTV) to the viewing public across the country, Industry Canada managed the technical aspects of the implementation of the Canadian Radio-television and Telecommunications Commission (CRTC) framework for the conversion of the over-the-air TV signal to a digital TV signal. The technical standards developed by the Department were accepted by industry and published in the Canada Gazette. All applications received were processed in a timely manner, including Federal Communications Commission (FCC) coordination. The Department also held major public consultations for mobile broadband in both the 700 MHz and 2500 MHz bands. The 700 MHz band and the 2500 MHz band are suitable for advanced mobile and broadband networks/services and enable the mobile Internet economy in Canada. Their auctioning will help support new mobile technologies and services in the Canadian marketplace and create opportunities for Canadian wireless carriers and manufacturers.

Canada's anti-spam legislation (Bill C-28) — previously referred to as the Electronic Commerce Protection Act— received Royal Assent on December 15, 2010. However, pre-publication of C-28 regulations in the Canada Gazette was delayed by the dissolution of Parliament. Personal Information Protection and Electronic Documents Act (PIPEDA) Amendments (C-29) were at second reading at the dissolution of Parliament for the 41st General Election. Both initiatives are aimed at providing a legislative framework to promote trust and confidence in the online marketplace.

To boost Canada's productivity and performance in the ICT sector, the Government of Canada launched an online public consultation to gather input from stakeholders on the objectives of a Digital Economy Strategy (DES) for Canada. The DES, which is currently being developed, aims to ensure that Canada is well positioned to take advantage of the innovative power of digital technologies.

Highlights of Challenges and Risk Areas

To ensure Industry Canada's ability to provide basic services or implement new services to Canadians is not hindered by aging Spectrum IT systems, the Department implemented measures to ensure the systems are replaced within the next five years. Through planned upgrades, the spectrum management system will provide Canadians with a modern, efficient and

effective policy and regulatory framework.

To ensure consultations for the development of a Digital Economy Strategy gathered the needed advice and feedback, and garnered support from stakeholders, the Department proactively engaged key government departments to align existing programming to support the digital economy strategy and encouraged them to direct their clients to the DES website. A comprehensive plan for targeted meetings with key stakeholders was also developed to ensure consumer interests are represented in the development of government policies.

Lessons Learned

As a result of the evaluation conducted in 2009, a Performance Measurement Strategy (PM Strategy) was developed in 2010 with the objective of enhancing reporting and evaluation of the Industry Canada–ITU program. The PM Strategy implementation is scheduled for July 2012 and will include indicators to better track and monitor the Department's annual contribution to the ITU.

Program Activity: Consumer Affairs Program

Program Activity Description

This program aims to ensure that consumers have a voice in the development of government policies and are effective marketplace participants. It is an element of the Department's consumer affairs role under the Department of Industry Act that directs the Minister to promote the interests and protection of consumers. There are two aspects of the program that are strongly interlinked.

Priority consumer issues are identified for the development and dissemination of consumer information and awareness tools. These priorities also guide research and analysis undertaken for policy development. This program is delivered in collaboration with provincial and territorial governments, as well as not-for-profit consumer organizations.

| Planned Spending | Total Authorities | Actual Spending |

|---|---|---|

| 6.0 | 5.2 | 5.0* |

| Planned | Actual | Difference |

|---|---|---|

| 23 | 23 | 0 |

| Expected Results |

Performance Indicators |

Targets | Performance Status |

|---|---|---|---|

| Consumer interests are represented in the marketplace and in the development of government policies. |

Number of new outreach initiatives to assist consumers in accessing information and tools that will help them make informed purchasing |

1 |

Performance Status: 2 major outreach initiatives to assist and inform consumers: |

|

Number of government policies and/or legislation developed, updated or reviewed by the Office of Consumer Affairs |

2 |

Performance Status: |

Performance Summary and Analysis of Program Activity

To aid consumers in facing the current economic climate and challenges, Industry Canada, in conjunction with the Consumer Measures Committee (CMC), hosted several teleconferences to address best practices in regulatory compliance and consumer/credit reporting. As a result, a

preliminary report on best practices in regulatory compliance was prepared, including information on flexible and cost-effective approaches to improving compliance with consumer protection laws. In addition, Industry Canada and the CMC launched the interactive version of the Canadian Consumer

Handbook to allow consumers to create a customized version by selecting topics of interest to them from a database of issues such as debt, credit reporting, contracts, housing and home renovations, identity theft, collection agencies, and much more. Along with consumer tips, the handbook includes a directory of useful government and non-government contacts.

The Department collaborated with the Treasury Board Secretariat in publishing the Consumer Impact Assessment Guide to offer a framework assisting policy analysts to assess and consider consumer impacts when designing or evaluating new policies or regulations. Industry Canada also collaborated with its international partners on a variety of consumer policy projects pertaining to sustainable consumption, consumer vulnerability and electronic commerce. The Department participated in the work of the Organisation for Economic Co-operation and Development (OECD) Committee on Consumer Policy (CCP) on enhancing the effectiveness and value of environmental claims. In addition to contributing to the OECD's Green Growth Strategy,Industry Canada also contributed to the development and publication of the Consumer Policy Toolkit.

Highlights of Challenges and Risk Areas

Under the new anti-spam legislation, consumers and businesses may not be fully aware of their roles and responsibilities regarding spam and other online threats. Therefore, Industry Canada began development of a communications strategy to inform Canadians and to manage expectations. This will continue in 2011–12.

Program Activity: Competition Law Enforcement and Advocacy

Program Activity Description

This program is an independent law enforcement agency that contributes to the prosperity of Canadians by protecting and promoting competitive markets and enabling informed consumer choice. The Competition Bureau is responsible for the administration and enforcement of the Competition Act, the Consumer Packaging and Labelling Act, the Textile Labelling Act and the

Precious Metals Marketing Act. Headed by the Commissioner of Competition, the organization investigates anti-competitive practices, promotes compliance with the laws under its jurisdiction and advocates in favour of market forces.

| Planned Spending | Total Authorities | Actual Spending |

|---|---|---|

| 46.7 | 47.3 | 45.6 |

| Planned | Actual | Difference |

|---|---|---|

| 452 | 418 | 34 |

| Expected Results |

Performance Indicators |

Targets | Performance Status |

|---|---|---|---|

| Competitive markets and informed consumer choices | Dollar savings to consumers from Bureau actions that stop anti-competitive activity |

$330 million |

Performance Status: $133.3 million |

| Percentage of economy subject to market forces |

82% of GDP |

Performance Status: |

Performance Summary and Analysis of Program Activity

Industry Canada, through the Competition Bureau (Bureau), continued to focus on the effective implementation of the amendments made to the Competition Act, as well as renewing its enforcement activities with a view to enhancing transparency and discharging its mandate. In an effort to provide businesses with clear guidelines and a predictable process, the Bureau released an updated

Fees and Service Standards Policy for Mergers and Merger-Related Matters, Fees and Service Standards Handbook for Mergers and Merger-Related Mattersand Procedures Guide for Notifiable Transactions and Advance Ruling Certificates under the Competition Act, and has undertaken moderate revisions to the Merger Enforcement Guidelines. The Bureau also revised the Enforcement

Guidelines for "Product of Canada" and "Made in Canada" claims, which took effect in July 2010.

As part of its ongoing enforcement efforts targeting domestic bid-rigging, the Bureau laid criminal charges against eight companies and five individuals accused of rigging bids for private sector ventilation contracts in the Montr�al area. The Bureau's investigation found evidence of criminal activity in five competitive bidding processes for contracts worth approximately $8 million. In addition, Embraco North America Inc. and Panasonic Corporation were each fined $1.5 million after pleading guilty to criminal charges that they fixed the price of hermetic refrigeration compressors in Canada. As cartels impose higher prices for goods and services and deprive consumers of the benefits of competition, enforcement in this area results in lower prices for consumers and deters others contemplating anti-competitive behaviour.

Additionally, following the Bureau's filing of a formal challenge with the Competition Tribunal in February 2010, the Bureau reached a consent agreement that fully resolved concerns regarding anti-competitive rules imposed by the Canadian Real Estate Association (CREA). As a result, real estate agents will have the flexibility to provide innovative service and pricing options to consumers, and consumers will have the ability to choose which services they want from a real estate agent when selling their home. The Bureau has already seen an emergence of new business models offering different and flexible pricing and service options.

In December 2010, the Bureau filed an application with the Competition Tribunal to strike down restrictive and anti-competitive rules that Visa and MasterCard impose on merchants who accept their credit cards, alleging that the rules effectively eliminate competition between the companies, resulting in increased costs to businesses and, ultimately, consumers. Merchants in Canada pay an estimated $5 billion annually in hidden credit card fees. Visa and MasterCard operate the two largest credit card networks in Canada and together they processed more than 90 percent of all credit card transactions by Canadian consumers in 2009, representing more than $240 billion in purchases.

The Bureau also focused on the effective and timely review of mergers. In 2010–11, the Bureau received 209 merger filings and cleared over 90 percent of merger filings within the prescribed service standards of each complexity level. In June 2010, the Bureau reached an agreement with IESI-BFC and WSI Services Inc. to resolve the Bureau's conclusion that the merger would substantially lessen or prevent competition in the supply of commercial waste collection services in a number of markets in Canada. In addition, in July 2010, the Bureau reached an agreement with generic drug manufacturers Teva Pharmaceutical Industries Ltd. and the Merckle Group (carrying on business as ratiopharm inc.), requiring divestitures to resolve the Bureau's conclusion that the merger would likely substantially lessen competition in the supply of two generic pharmaceutical products used for the relief of moderate to severe pain. Additionally, in August 2010, the Bureau reached an agreement with Novartis AG to resolve the Bureau's conclusion that Novartis AG's proposed acquisition of control of Alcon, Inc. would substantially lessen competition in Canada for the supply of certain ophthalmic products. Furthermore, in January 2011, the Bureau applied to the Competition Tribunal for an order to dissolve CCS Corporation's (CCS) acquisition of Complete Environmental Inc., the owner of the proposed Babkirk Secure Landfill, in northeastern British Columbia. Following a thorough review, the Bureau concluded that by purchasing, rather than competing with the Babkirk Secure Landfill, CCS would prevent the entry of competition into the market for secure hazardous waste disposal in northeastern British Columbia. These four cases alone will likely result in estimated annual savings of $31 million for Canadians.

In its continuing efforts to protect consumers from scams and fraudulent claims, the Bureau targeted mass marketing fraud (MMF) over the Internet. Of note, the Bureau took action against a recidivist continuing to market through a Canadian Internet business, making false and/or misleading claims relating to "well-paying job opportunities" in the oil industry. Taking advantage of the vulnerability of under- or unemployed individuals during the economic downturn, this job opportunities scam targeted those who were searching for employment in the oil industry and deceived Canadians and Americans into paying between $397 and $1,197 for services that were never provided, with no refunds granted. This action resulted in the arrest of the principal perpetrator and involved coordinated enforcement cooperation with the Bureau's international law enforcement partners. The Bureau also commenced legal proceedings against Rogers Communications Inc. (Rogers) to stop what the Bureau concluded were misleading advertising claims relating to Rogers' chatr discount wireless and text services. The alleged misleading and unsubstantiated claims suggested that subscribers would experience "fewer dropped calls than new wireless carriers." This advertising impacted new entrants who had only recently commenced operations following a government initiative to encourage greater competition in the wireless market in Canada. The Bureau viewed the effect of this conduct to be not only misleading to consumers, but also injurious to competition by undermining the new entrants' abilities to compete fairly in this marketplace. Following the Bureau's intervention, Rogers modified their representations.

To increase reliance on competition and to further strengthen the Canadian marketplace, the Bureau made a submission to Canadian Heritage's Review of the Revised Foreign Investment Policy in Book Publishing and Distribution, recommending that foreign investment and ownership restrictions be relaxed or removed to provide a broader array of capital options in the market.

Lessons Learned

In 2007–08, the Bureau undertook an evaluation of its anti bid-rigging program, which was initiated by the senior management of the Bureau and managed by the Audit and Evaluation Branch of Industry Canada. The evaluation examined the initiatives and activities put in place by the Bureau to combat bid-rigging. The evaluation

provided a baseline or interim report card to be used for comparative purposes in future potential evaluations. The results of this evaluation are available online. Specific initiatives undertaken in response to the evaluation included the development of an anti bid-rigging outreach strategy and the provision of anti

bid-rigging training for staff at Public Works and Government Services Canada.

Strategic Outcome 2: Science and Technology, Knowledge, and Innovation are Effective Drivers of a Strong Canadian Economy

Strategic Outcome 2: Science and Technology, Knowledge, and Innovation are Effective Drivers of a Strong Canadian Economy

Strategic S&T investments are key drivers in rebuilding the post-recession Canadian economy. With the current global and financial context, which could hinder corporations' ability to make program repayments, Industry Canada placed increased focus on firm-level financial analysis to foster innovation and commercialization of new technologies. This is fundamental to improving Canada's overall productivity and enhancing the country's competitiveness, and was accomplished through the following Program Activities:

- Canada's Research and Innovation Capacity

- Communications Research Centre Canada

- Commercialization and Research and Development Capacity in Targeted Canadian Industries

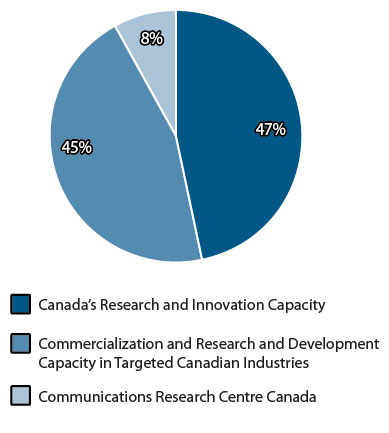

Distribution of spending by program activity in the area of Science and Technology, Knowledge, and Innovation are Effective Drivers of a Strong Canadian Economy

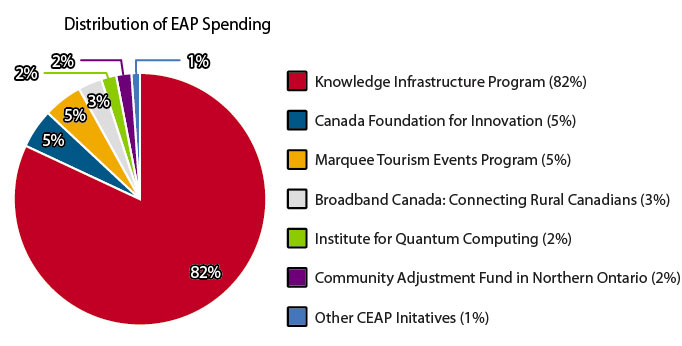

Success Story — Canada's S&T Advantages

Projects funded through the Knowledge Infrastructure Program (KIP) supported efforts to foster three key Canadian S&T advantages, as outlined in the Government of Canada's Science and Technology Strategy:

- Knowledge Advantage: Nearly $1.1 billion* in federal KIP funding has been allocated to over 140 projects supporting enhanced R&D capacity in Canadian post-secondary institutions.

- People Advantage: More than $700 million* in federal KIP funding has been allocated to over 120 projects supporting increased training capacity in advanced knowledge areas in Canadian post-secondary institutions.

- Entrepreneurial Advantage: Approximately $465 million* in federal KIP funding has been allocated to over 40 projects supporting the development of industry incubation facilities at Canadian post-secondary institutions.

KIP funding also provided benefits such as improved energy and enhanced campus health and safety.

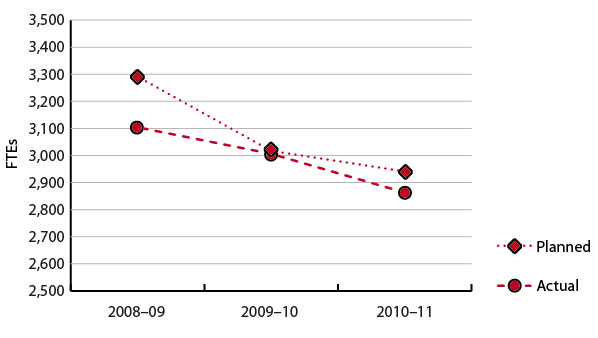

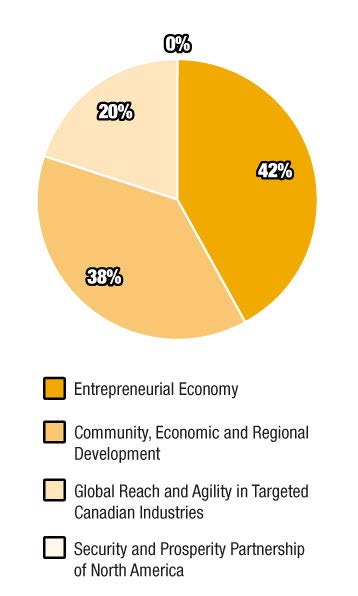

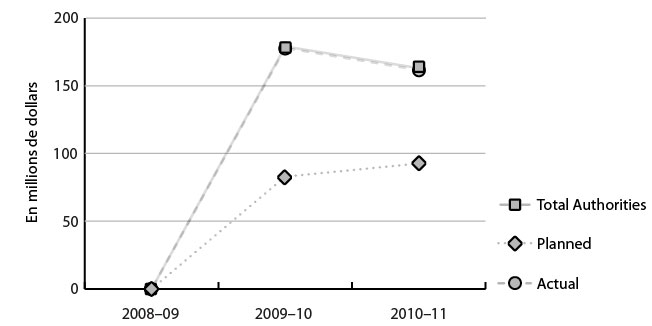

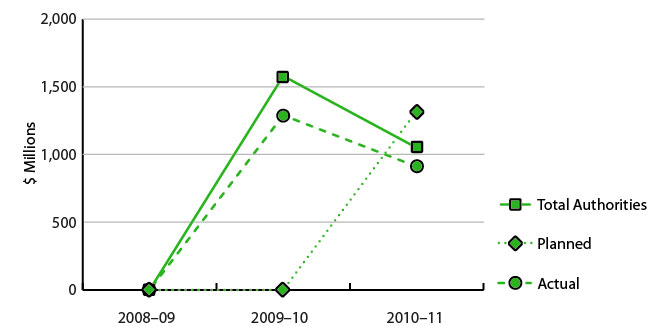

Financial Resources*

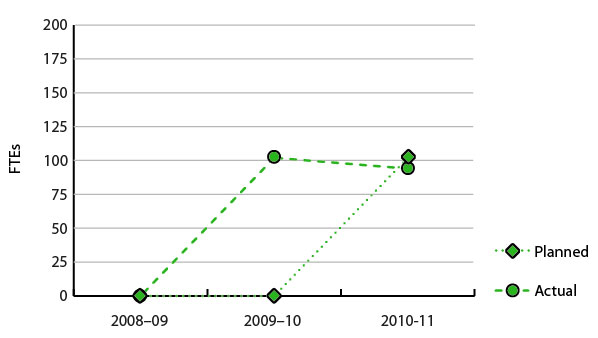

Human Resources**

* To ensure that readers have an appropriate year-over-year trend in Financial Resources between 2009–10 and 2010–11, the figures do not include EAP resources as indicated in the "How to read this report" section of this document. For more information on EAP Financial Resources and Human Resources, please refer to the EAP Section of this report. Changes in financial resources between 2008–09 and 2009–10 are largely due to a change in the requirements for reporting on the Internal Services activity in the DPR that decreased planned spending; however, this is offset by further funding that was received for various programs including AIF ($59.8 million), Bombardier CSeries ($13.2 million) and SADI ($56.7 million).

Meeting Our Commitments

In an effort to ensure that S&T, knowledge and innovation are effective drivers of a strong Canadian economy, Industry Canada encouraged leading-edge R&D and provided value-added knowledge and expertise to enhance conditions for commercialization and innovation in targeted Canadian industries. The

Department worked with the private sector, industry associations, academia and all levels of government to foster an environment conducive to innovation and scientific excellence.

Program Activity: Canada's Research and Innovation Capacity

Program Activity Description

This program activity supports the Minister of Industry in his/her responsibilities related to science and technology. It sets the strategic direction of policies and programs in support of science, technology and innovation in Canada. It works with other government departments and external stakeholders (from the private and public sectors) to foster an environment that is conducive to

innovation, and to promote scientific excellence and industrial competitiveness.

| Planned Spending | Total Authorities | Actual Spending |

|---|---|---|

| 248.6 | 251.5 | 255.9* |

| Planned | Actual | Difference |

|---|---|---|

| 82 | 83 | 1 |

| Expected Result | Performance Indicator |

Target | Performance Status |

|---|---|---|---|

| ST&I policy frameworks to enhance Canada's research and innovation capacity | Number of ST&I outreach activities with other government departments, agencies and external stakeholders |

20 |

Performance Status: |

Performance Summary and Analysis of Program Activity

To foster innovation and to ensure that Canadians benefit from scientific discoveries and innovation, Industry Canada continued to strengthen the effectiveness of its investments in S&T as outlined in the Government's S&T Strategy,

Mobilizing Science and Technology to Canada's Advantage. The Department also supported the Science, Technology and Innovation Council (STIC), provided analysis and conducted research in support of STIC's State of the Nation 2010 report production. This report provided an assessment of Canada's research and innovation and measures Canada's S&T performance against international standards of excellence. The Department's contribution to STIC provided the government with access to high-quality research and analysis.

Industry Canada worked with the granting councils to design and implement the Banting Postdoctoral Fellowship program, which will fund 70 new internationally competitive fellowships per year. The Department also commissioned an assessment from the Council of Canadian Academies (CCA) on research integrity to help inform the granting agencies' renewal of the Tri-Agency Framework for Integrity in Research. The CCA's report was released publicly on October 21, 2010, and supports the changes to the tri-agency policy to promote integrity in the conduct of federally-funded research.

Industry Canada also struck an independent Ad Hoc Panel on Canada Excellence Research Chairs (CERC) Gender Issues to examine the lack of female representation in the final stages of the inaugural CERC competition. The Panel provided recommendations on April 23, 2010, on how Canada can best pursue world-class excellence in attracting and retaining top researchers through the CERC program, while seeking a field of candidates that reflects both the talented women and men among the world's top-tier researchers.

To ensure contribution towards a knowledge-based economy, the Department worked closely with TRIUMF, the National Research Council (NRC) and the Canada Foundation for Innovation (CFI) to ensure that short- and medium-term operating cost pressures of TRIUMF, one of Canada's major science initiatives, are addressed, and to assess how TRIUMF's new initiative to build its Advanced Rare Isotope Laboratory (ARIEL) facility will complement the activities funded through the federal government's recent renewal of $222 million over the next five years.

In support of the S&T Strategy, the Department brought forward a number of proposals, including an additional $65 million for Genome Canada; $80 million in new funding over three years through the Industrial Research Assistance Program to help SMEs accelerate their adoption of key information and communications technologies through collaborative projects with colleges; and $50 million over five years beginning in 2012–13 to the Perimeter Institute for Theoretical Physics, to support research education and public outreach activities.

Lessons Learned

A Horizontal Audit of Management of Funding Agreements for Single Recipient Transfer Payments was conducted in 2010–11. The audit exercise recommended improvements in documenting oversight and monitoring practices and leveraging intra-departmental collaboration to improve oversight and monitoring. Currently, the Department is preparing a management response to address the recommendations

made in the internal audit.

Program Activity: Communications Research Centre Canada

Program Activity Description

This program conducts research and advanced telecommunications and information technologies to ensure an independent source of advice for public policy and to support the development of new products and services for the information and communications technologies (ICT) sector. Research projects are done through a combination of

in-house activities, tasks performed for other government departments on a cost-recovery basis, and partnerships with industrial and academic organizations. The work is done to provide an insight into future technologies to assist Industry Canada in developing telecommunications policies, regulations and program delivery; to improve decision making related to ICT by other government departments; and to close the innovation gap by transferring new technologies to Canadian small and medium-sized enterprises (SMEs).

| Planned Spending | Total Authorities | Actual Spending |

|---|---|---|

| 39.1 | 43.4 | 43.9* |

| Planned | Actual | Difference |

|---|---|---|

| 401 | 388 | 13 |

| Expected Results |

Performance Indicators |

Targets | Performance Status |

|---|---|---|---|

| Industry Canada and other government organizations receive high-quality, research-based technical inputs to develop telecommunications policies, regulations and standards and support government operations. | Client satisfaction survey (related to content, timeliness and usefulness) related to CRC technical inputs and advice used to develop telecommunications policies, regulations, programs and standards |

80% |

Performance Status: No formal client satisfaction survey was undertaken during the year. Note: This is being changed to a more appropriate performance indicator for subsequent years. |

| Canadian companies use CRC-developed technologies to enhance their product lines. | Increase in total sales revenues of Canadian communications companies with a link to CRC, compared to market averages |

20% (over 5 years) |

Performance Status: 61% according to the studies done by Doyletech Corporation on the Economic Impact of Technology Transfer from CRC Because historical data are unavailable, a trend analysis is not applicable for this performance result. The next study will be done in 2015. |

Performance Summary and Analysis of Program Activity

Industry Canada, through the CRC, is a key centre of excellence for ICT research in Canada and around the world and regularly provides advice and expertise in communications technologies. In June 2010, the G8 and G20 Summits were held in Toronto, and the CRC assisted with the security at both of these summits by providing 12 spectrum monitoring units with direction-finding capability for Industry Canada's Ontario region. These units were used to ensure public safety and security units could operate without interference.

In 2010–11, the CRC also provided the Department of National Defence (DND), Canadian Space Agency (CSA), Public Safety Canada and other government departments with advanced communications technology advice, demonstrations and designs to use in the development of their procurement requirements and to make available to their potential contractors. As part of a DND Technology Development Program project, CRC developed a Traffic Management System, aspects of which will be incorporated into the Navy's fleet network management requirements.

The Department, through the CRC, provides Canadian companies with access to technical innovations for industrial benefits that close innovation gaps and make them more competitive. During 2010–11, the following agreements were added to the CRC's Agreement portfolio:

- 26 new R&D contract agreements to provide technical expertise and/or to develop and transfer technology to Canadian small and medium-sized enterprises; and

- 26 new licence agreements to transfer technology to industry.

Highlights of Challenges and Risk Areas

To ensure CRC's R&D provides clients with high-quality, research-based technical inputs and sufficiently aligns with its client's strategic priorities, a review of research priorities was completed. Panels of experts were established to conduct this review, and they examined the relevance and

quality of the research.

Aging campus infrastructure may affect the operations of Industry Canada and other government department partners. In response to this, a multi-year capital plan was developed to identify the resources required to address critical infrastructure problems and health and safety requirements, and to reduce ongoing repair costs.

Lessons Learned

As part of an Industry Canada CRC review in 2009–10, conducted by three external consulting groups, it was recommended that CRC undertake a set of vertical expertise reviews, consisting of periodic peer reviews of CRC core programs. In

2010–11, CRC conducted the first review on the Photonics program, which resulted in some changes such as the closure of one lab facility, reassignment of personnel to other programs, re-focusing the work of some projects as well as a reaffirmation of the technical excellence in the CRC R&D. The results have established a process to be used for the reviews to be conducted in 2011–12.

Program Activity: Commercialization and Research and Development Capacity in Targeted Canadian Industries

Program Activity Description

This program advances leading-edge R&D in targeted Canadian industries and provides value-added knowledge and expertise to enhance conditions for commercialization and innovation. Relationships required to enhance Canadian innovation are fostered among the private sector, associations, academia and all levels of government. These collaborative

relationships help to advance technology transfer, spinoffs and innovation, and contribute to a skilled workforce. The Department also conducts research and analysis, often with its industry and government partners, to develop strategic information products. This research and analysis is disseminated to key decision makers and is essential when the Department advises on issues, regulations and

policies affecting commercialization and R&D in targeted industries. Government investments, such as repayable contributions, to foster Canadian private sector R&D are also targeted by this program activity that, in general, ensures that Canadians and Canadian businesses benefit from an innovative

and knowledge-based economy.

| Planned Spending | Total Authorities | Actual Spending |

|---|---|---|

| 295.0 | 399.6* | 247.0** |

| Planned | Actual | Difference |

|---|---|---|

| 249 | 178 | 71* |

| Expected Results |

Performance Indicators |

Targets | Performance Status |

|---|---|---|---|

| Leveraged leading-edge research and development in targeted Canadian industries | Dollar(s) of stakeholder investment leveraged per dollar of Industry Canada investments in R&D projects |

$2 |

Performance Status: |

Performance Summary and Analysis of Program Activity

Through knowledge sharing, engagement and program delivery, Industry Canada enhanced the research and development capacity of targeted Canadian industries. For example, in partnership with the NRC, Industry Canada created the Canadian HIV Technology Development component of the NRC's Industrial Research

Assistance Program (IRAP). Industry Canada also promoted the Canadian Biorefinery Knowledge Network and disseminated a study on the state of biorefineries in Canada and the challenges to their further development in collaboration with BIOTECanada. Key findings included the importance of identifying product markets, optimum biorefinery configuration

and partnerships. The study's findings sparked discussion among stakeholders on the prerequisites for success in this sector.

The Department collaborated with the Canadian Manufacturers and Exporters (CME) to determine how manufacturers invest in innovation and the impact that will have on their future operations. As a result, Industry Canada is better able to identify the drivers of innovation from an industry perspective, which will help inform innovation policy and enhance the competitiveness of manufacturers.

Industry Canada's largest research and development program, the Strategic Aerospace and Defence Initiative (SADI), has invested more than $824 million in funding to date in strategic R&D and innovation projects. In 2010–11, Industry Canada, through SADI, invested in seven new innovative and competitive projects aimed at improving Canada's innovation capacity and the commercialization of new technology. These projects also helped foster collaboration in R&D between A&D firms and academia across the country, including the University of British Columbia, Universit� Laval and �cole Polytechnique de Montr�al.

Industry Canada worked closely with its partners to promote the adoption and commercialization of new technologies. For example, in collaboration with the Department of National Defence, the Department successfully concluded the Development Phase (first of two phases) of the Soldier Systems Technology Roadmap (SSTRM). Over the past two years, seven workshops were facilitated that brought together 1,550 participants from industry, academia and governments, addressing future soldier capability gaps and needs, challenges and technology solutions. During the course of 2010–11, Industry Canada was restricted to guiding the development of one TRM, rather than the planned four, as per the corresponding RPP. This is partially a result of prioritization of work, a desire to focus on the SSTRM and an internal reorganization. The Department also worked with aerospace industry stakeholders through the industry-led Future Major Platforms (FMP) initiative and the Green Aviation Research and Development Network (GARDN) to promote and coordinate the development and adoption of new technologies, including ICT and clean energy technologies, for aerospace applications.

Highlights of Challenges and Risk Areas

To maintain the confidence of Canadians in its management of investments in high-risk leading-edge technology and innovation projects that generate economic and social benefits, Industry Canada implemented a combination of strong governance and oversight practices, robust risk management, recipient audit and internal audit activities and effective communication.

Lessons Learned

While recovering from tough economic times, industries are understandably reticent about investing in new R&D initiatives; however, it is imperative that Canada maintain and increase its knowledge and innovation capacity in order to compete globally. To address this issue, Industry Canada continued to implement and manage a number of initiatives

that encourage and invest in innovation and R&D opportunities, such as the Automotive Innovation Fund, which was audited in 2010–11. As a follow-up to recommendations, the project and program risk assessment processes, as well as file management procedures, have now been

strengthened. In addition, the Government also supported the development of the innovative capacity of companies in the aerospace, security, space and defence industries. This will help to ensure that the Canadian industry continues its recovery from the financial crisis and advances its innovation and R&D capacity, while promoting long-term

economic growth.

The Audit and Evaluation Branch completed an audit of the Industrial Technologies Office (ITO) Strategic Aerospace and Defence Initiative — in 2010–11. Findings were favourable, with some recommendations. As a result, ITO has implemented a risk-based monitoring template; periodic reviews and updates of program level risks at the Risk Management Committee; and an annual assessment of the Committee structure. As well, a memorandum of understanding outlining roles and responsibilities of the Chief Financial Officer and the Executive Director of ITO regarding SADI and TPC repayments has been approved.

Strategic Outcome 3: Competitive Businesses are Drivers of Sustainable Wealth Creation

Strategic Outcome 3: Competitive Businesses are Drivers of Sustainable Wealth Creation

Industry Canada's mandate is to help make Canadian industry more productive and competitive in the global economy. In doing so, the Department collaborated with associations, governments and industry to enhance Canada's industrial capabilities. Industry Canada is also committed to supporting Canadian companies in a variety of ways, and promotes economic development in communities to encourage the development of skills, ideas and opportunities across the country. This was accomplished through the following program activities:

- Entrepreneurial Economy

- Global Reach and Agility in Targeted Canadian Industries

- Community, Economic and Regional Development

- Security and Prosperity Partnership of North America — Canadian Secretariat

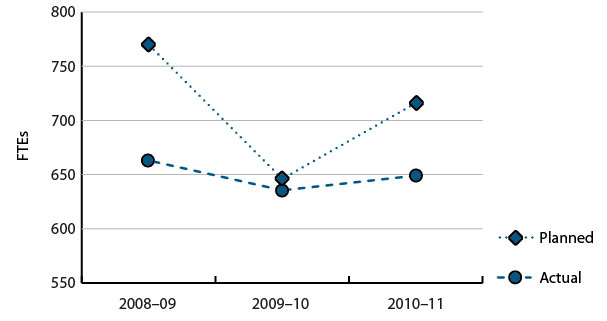

Distribution of spending by program activity in the area of Competitive Businesses are Drivers of Sustainable Wealth Creation

Success Story — Northern Ontario Development Program

With help from FedNor, and through the NODP, Algoma University in Sault Ste. Marie received $276,500 to establish a cutting-edge video game studio to produce products for the health care sector. The funding was used to hire three game development experts, as well as the technical support to create and test a game for stroke patients

requiring remedial speech therapy. The studio also helped attract students to the University's Master of Science in Computer Game Technology program, the only one of its kind in Canada. Once fully operational, the Algoma Games for Health studio is expected to employ 40 to 50 people and create an additional 50 permanent, highly skilled positions in related industry sectors.

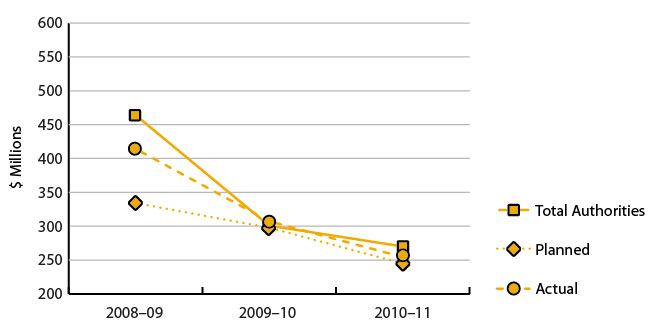

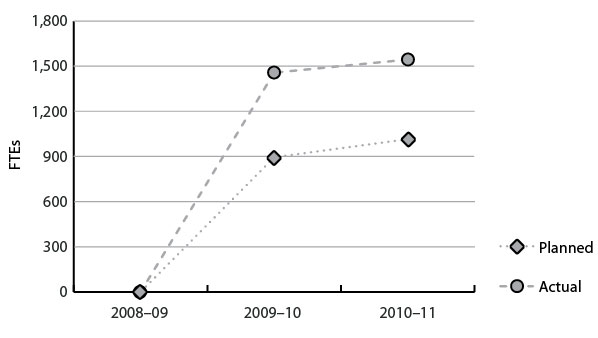

Financial Resources*

Human Resources**

* To ensure that readers have an appropriate year-over-year trend in Financial Resources between 2009–10 and 2010–11, the figures above do not include EAP resources as indicated in the "How to read this report" section of this document. For more information on EAP Financial Resources and Human Resources, please refer to the EAP Section of this report. The decrease in financial resources between 2008–09 and 2009–10 is largely due to a change in the requirements for reporting on the Internal Services activity in the DPR. In 2008–09, the Internal Services resources were allocated to each of the strategic outcomes. Starting in 2009–10, Internal Services was reported as a separate activity.

Meeting Our Commitments

In an effort to ensure that Industry Canada contributes to sustainable wealth creation, and ensuring that businesses are competitive, the Department continued to improve BizPaL and the Canada Business Network. Industry Canada addressed the ongoing need for a link between industry and government, and the emerging need for comprehensive firm and industry analysis, to better address the impact of

continued global competitiveness pressures and the evolving global supply chain on Canadian-based industries and firms.

Program Activity: Entrepreneurial Economy

Program Activity Description

This program raises government-wide awareness of the challenges facing small businesses by providing value-added knowledge and expertise, recommending policy options, and delivering programs that enhance small business growth and competitiveness and encourage entrepreneurship.

| Planned Spending | Total Authorities | Actual Spending |

|---|---|---|

| 104.3 | 109.0 | 106.1 |

| Planned | Actual | Difference |

|---|---|---|

| 113 | 101 | 12 |

| Expected Results |

Performance Indicators |

Targets | Performance Status |

|---|---|---|---|

| Small and medium-sized enterprises' (SMEs) use of government business-related information, programs and services, and facilitated compliance for business | Increase in number of clients using the Canada Business Network (CBN) website over the previous year |

10% |

Performance Status: Decrease of approximately 4.4%.^

Because historical data are unavailable, a trend analysis is not applicable for this performance result. * The Business Start-Up Assistant (BSA) was removed from the CBN website in September 2010. Its total visits were reported in the 2009–10 statistics (709,800). By removing the BSA statistics, the 2009–10 reporting would have been 1,950,785; thus the actual decrease to the CBN national website is only 4.4%. |

| Integrated business permit and licence information from all levels of government provides value to clients across Canada. | Percentage of clients that indicate satisfaction with the services provided |

80% |

Performance Status: Two rounds of moderated and two rounds of un-moderated usability testing designed to validate the implementation of the transformed BizPaL project, which will be implemented in May 2011 was conducted. The usability testing was successful in validating the project and garnered a 91% success rate of completed tasks among participants. Because historical data are unavailable, a trend analysis is not applicable for this performance result. |

Performance Summary and Analysis of Program Activity

To contribute to the competitiveness of businesses and to help create sustainable wealth, the BizPaL partnership network expanded its service to an additional 147 jurisdictions across Canada, resulting in a 34-percent increase to jurisdictional coverage since the 2009–10 fiscal year. In addition to licences and permits, BizPaL content has now been

expanded to include approvals, registrations and certificates.

Industry Canada continued to collaborate with federal/provincial/territorial partners as well as with other partners to discuss future business delivery strategies for the Canada Business Network (CBN). This is in an ongoing effort to assist Canadian small and medium-sized enterprises (SMEs) with their business information requirements. Through greater use of social media tools (Really SimpleSyndication [RSS] feeds, blogs and Twitter), CBN has increased its ability to obtain input from clients and boost awareness of its services.

Through a memorandum of understanding, Industry Canada has worked with the Government of Ontario's Ministry of Government Services (ServiceOntario) and Ministry of Economic Development and Trade to collaborate on services to business. Areas of collaboration included a single telephone number, the Business Info Line, and collaboration on website and content management, as well as communications and marketing. The use of a single phone number for both federal and provincial enquiries is also clearly aligned with the province of Ontario's Open for Business Initiative as it provides seamless service for Canadians and greater access to information and services for business.

Highlights of Challenges and Risk Areas

To meet client and stakeholders' expectations of BizPaL for current, accurate information services, the Department engaged and maintained strong networks with other governments, departments and agencies to ensure BizPaL content remained up to date and reflective of client needs. Integration of such information benefits clients across Canada.

Lessons Learned

Since a 2008 evaluation that identified a need for BizPaL to reach non-participating provinces and territories and to increase awareness of the BizPaL services, partnerships have increased from 9 to 11 provinces and territories and over 570 municipalities. This demonstrates a 28.5-percent increase in population coverage from

March 31, 2008, to March 31, 2011, in addition to a 412.4-percent increase in the number of municipalities participating in BizPaL over the same time frame. In 2009, Industry Canada contracted Hill and Knowlton to conduct a marketing strategy with the goal of increasing awareness of the BizPal service. In 2010, the BizPaL website and promotional material

(brochures and factsheets) were re-designed as per the marketing strategy recommendations.

Program Activity: Global Reach and Agility in Targeted Canadian Industries

Program Activity Description

Through value-added policy expertise, industry development and analysis, and strategic funding, this program aims to enhance the ability of targeted Canadian industries to take advantage of opportunities and respond to risks, ensure Canadian industry's link into global value chains, and assist businesses in strengthening partnerships both domestically and internationally. The desired result is agile Canadian industries that are able to adapt to the ever-changing economic landscape, respond appropriately to external shocks and compete internationally. This program works to mitigate strategic risk factors affecting Canadian industries' performance in global markets by analyzing the specific issues they face and using this knowledge to contribute to the development of policies, marketplace frameworks and strategies, including contributing to research and analysis aimed at achieving regulatory objectives in a manner that is sensitive to economic impacts. Departmental officials interact with associations, governments and leading firms in this program activity to assist with matchmaking among companies, improve conditions for market access and promote Canadian expertise. In addition, through this program, the Department invests in private sector initiatives that are aimed at maximizing productivity and facilitating access to capital. By helping Canadian industries mitigate risks and take advantage of opportunities in globalized markets, this program is committed to creating competitive businesses and sustainable wealth creation capability for Canadians.

| Planned Spending | Total Authorities | Actual Spending |

|---|---|---|

| 56.0 | 61.5 | 51.3* |

* The variance is due to a reprofiling of $7 million in Structured Financing Facility Program from 2010–11 to 2013–14 to ensure program integrity until federal procurement of ships begins, which will lead to new builds in 2013–14.

| Planned | Actual | Difference |

|---|---|---|

| 248 | 226 | 22* |

| Expected Result |

Performance Indicators |

Targets | Performance Status |

|---|---|---|---|

| Adaptable Canadian industries are linked to global value chains and have the capacity to prepare for and respond to risks and opportunities in the domestic and global markets. | Quantity of completed initiatives, designed to increase the global reach and agility of Canadian industries, as a percentage of initiatives identified in the sector's business plan |

80% |

Performance Status: 92.8% Most of the initiatives outlined in the business plan were completed. Some were not completed due to competing priorities and the significant reorganizations in the sector. This result is declining from last year's result of 100% of completed initiatives. |

| Stability or improvement in Canada's ranking in the World Economic Forum's Global Competitiveness Report |

10th place |

Performance Status: |

Performance Summary and Analysis of Program Activity

In 2010–11, Industry Canada collaborated with partners in academia, industry and government to improve the recognition of Canadian industrial capabilities as well as their competitiveness and agility in the global marketplace. For example, Industry Canada enhanced the Industry Collaboration and Exchange Environment (ICee) to better provide unique opportunities to exchange information with

its partners on future needs as well as industrial and academic capabilities. With over 450 registered users, ICee is currently being applied as a collaboration tool for the Soldier Systems Technology Roadmap. Industry Canada also coordinated company participation in trade shows and helped

them explore matchmaking opportunities. In collaboration with the provinces and territories, the Department organized a tourism mission to China, which took place in October 2010. As it was aimed at increasing tourism opportunities with China, the mission complemented Industry Canada's efforts in supporting the Minister of State's office in working with the Department of Foreign Affairs and

International Trade (DFAIT) to finalize the Approved Destination Status (ADS) with China. According to Conference Board of Canada forecasts, by 2015, the ADS will contribute to a 50-percent increase in the number of Chinese

travellers to Canada. Industry Canada also supported the Minister of State in holding two round table discussions with industry to identify policies and programs that have an impact on tourism and to discuss opportunities to broaden access to, and awareness of, Canadian tourist attractions.

In June 2010, Industry Canada implemented the Industrial and Regional Benefits (IRB) Policy enhancement to support the inclusion of Canadian firms in the major prime contractors' Global Value Chains (GVCs) as new, large-value Government of Canada defence procurement contracts take place. The Department also implemented the requirement for Corporate IRB Strategic Plans from major IRB contractors to Canada. These strategic plans will seek to identify new IRB opportunities for Canadian industry, including GVC activities within the contractor's overall corporate portfolio.

The Department increased the scale of its pharmaceutical company monitoring program to a total of 101 companies, an increase of 19 from the previous year. This program provides policy and decision makers with a greater understanding of companies, and the overall pharmaceutical industry and the challenges faced, and serves as the foundation for detailed analysis and advice to senior management in policy discussions. Its overall goal is to expand pharmaceutical investment in Canada. In October 2010, Industry Canada successfully hosted trilateral Canada–U.S.–Japan meetings in Vancouver. The meetings helped resolve some market access issues and sought clarification on Japanese standards and policies for wood products.

In 2010–11, Industry Canada put forth significant efforts in fostering Canadian industries that are adaptable and able to react to changes in market conditions. This work included collaborative research with industry and academia aimed at developing best practices across core manufacturing business functions; the ongoing monitoring of key trends in the automotive sector to determine their impact on competitiveness issues, including the development of an in-depth analysis of the global trends in the automotive sector and their impact on Canadian competitiveness. The work also included an analysis of China as an emerging market, that country's automotive manufacturers and suppliers, and its overall policy environment.

Lessons Learned

In 2010–11, Audit and Evaluation Branch (AEB) completed an evaluation of the Structured Financing Facility (SFF) to assess the needs and the responsiveness of the program, and to assess the linkages between program objectives

and federal government priorities. The findings of the evaluation highlighted that the SFF contributed to the creation of demand in Canadian shipyards. The program helped maintain skilled staff at both medium and large-sized shipyards and contributed to maintaining and developing shipyard skill levels. From the lessons learned for future program

development, it was suggested that program criteria be designed to ensure the full range of projects that would support policy objectives be eligible for funding, and that ways be considered to make project approval processes more timely.

Program Activity: Community, Economic and Regional Development

Program Activity Description

This program advances the economic development of Ontario communities in the same manner that regional development agencies support similar activities in other regions of Canada. The program supports and enhances the role and contribution of small and medium-sized businesses to Canada's economic well-being by building capacity, such as infrastructure, in non-metropolitan communities. This program

also promotes access to the Internet and ICT, and the skills to use them, in order to increase the capacity of individuals and communities across Canada to participate in the knowledge-based economy.

| Planned Spending | Total Authorities | Actual Spending |

|---|---|---|

| 82.5 | 97.9 | 96.9 |

| Planned | Actual | Difference |

|---|---|---|

| 136 | 140 | 4 |

| Expected Result |

Performance Indicators |

Targets | Performance Status |

|---|---|---|---|

| A significant increase in the capacity of selected Northern Ontario communities and businesses, helping them to thrive in the 21st century economy | Average leverage ratio of program funds |

1:2.13 |

Performance Status: 1:2.5 This is an improvement from last year's result of 1:1.9. |

| Total number of contribution agreements and grants approved |

233 |

Performance Status: Through Federal Economic Development Initiative for Northern Ontario (FedNor) programs, Industry Canada provided funding for 224 contribution agreements in Northern Ontario in 2010–11. Since this is a new indicator, and no historical data are available, a trend analysis is not applicable for this performance result. |

Performance Summary and Analysis of Program Activity

In 2010–11, Industry Canada continued to support Northern Ontario communities and their businesses through FedNor. Along with the regional development agencies, FedNor completed the renewal of the Community Futures Terms and Conditions beyond the October 2, 2010, expiration date in compliance with the current Treasury Board Policy on Transfer Payments. In keeping with the Policy on Transfer

Payments, a Performance Measurement Strategy was developed for the Community Futures Program. FedNor also continued to facilitate sustainable growth in Official Language Minority Communities (OLMCs) by delivering the Economic Development Initiative in Northern Ontario. The program provided financial support to organizations that address

the specific development needs of OLMCs by developing new business expertise through innovation, partnerships, the diversification of economic activities and increasing support for small businesses in francophone communities. Through a memorandum of understanding, FedNor also continued to provide support services to the Federal Economic

Development Agency for Southern Ontario (FedDev Ontario) — including those related to program delivery support services, corporate services, Contribution Management Information System (CMIS) input, and payment and monitoring services — ensuring a seamless program delivery to clients.

In 2010–11, the Computers for Schools program refurbished and delivered 67,684 computers to schools and not-for-profit learning organizations throughout the country. A total of 403 youth interns were employed through this program in 2010–11, providing youth with hands-on technical job experience. Through the Community Futures Program, FedNor also delivered the second year of a five-point Community Futures Development Corporation (CFDC) Stimulus Action Plan. This additional funding helped respond to the increase in loan requests from existing businesses normally serviced by conventional lenders as well as from new business start-ups. As a result, Northern Ontario CFDCs were in a better position to respond to the needs of their clients and increase their lending activity for the period ending March 31, 2011.

Lessons Learned

FedNor conducted a comprehensive review of the program components of the Northern Ontario Development Program (NODP) and developed a renewed focus on the program's core economic development mandate with a stronger emphasis on economic development and growth of

small and medium-sized enterprises. As a result, the program's priorities were realigned to achieve short- to medium-term, measurable results supporting the economic development and growth of Northern Ontario communities and businesses. NODP's guidelines and processes were updated and made accessible through the FedNor website to provide

Canadians with a strong understanding of the program. This enhanced focus of its priorities will allow FedNor to better achieve the program's mandate and to ensure that the program maximizes the impact of its investments.

Additionally, in response to a recommendation in the 2007 internal auditor's report of FedNor and the NODP, FedNor began to implement a Customer Relationship Management System to facilitate a coordinated approach to managing client interaction, enabling a more transparent and efficient means of sharing client information across the

organization.

Program Activity: Security and Prosperity Partnership of North America — Canadian Secretariat

Program Activity Description

This program supports the Minister of Industry in his/her responsibility for leading Canada's engagement in the Security and Prosperity Partnership (SPP). This program leads, in cooperation with other federal departments and agencies, the identification of strategic Canadian bilateral and trilateral priorities with respect to prosperity and security within North America; negotiations with the

United States and Mexico; and communications and reporting. This program also supports the Minister in his/her role as lead on the Prosperity Agenda focused on improving competitiveness and enhancing quality of life.

| Planned Spending | Total Authorities | Actual Spending |

|---|---|---|

| 2.2 | 1.8 | 0.0* |

| Planned | Actual | Difference |

|---|---|---|

| 8 | 0 | 8* |

| Expected Results |

Performance Indicators |

Targets | Performance Status |

|---|---|---|---|

| Industry Canada is successful in advancing its strategic priorities in the context of North America and other international bilateral and multilateral forums. | Number of bilateral or multilateral meetings at the senior management or ministerial level for which advice, planning or other deliverables are provided |

10 |

Performance Status: 15 Information, analysis and advice were developed for over 15 bilateral or multilateral meetings at the ministerial and senior management level. Since this is a new indicator, and no historical data are available, a trend analysis is not applicable for this performance result. |

Performance Summary and Analysis of Program Activity

Industry Canada provided guidance and advice to the Minister of Industry on Canada–U.S. and North American relations, as well as on other international issues relating to the global economy. Specifically, guidance and advice was provided to the Minister for participation in the North American Competitiveness, Innovation & Clean Energy

Conference 2010 in San Diego, as well as trilateral and bilateral meetings held on the margins of the Conference. Analysis and advice was also provided for The Americas Competitiveness Forum (ACF), held in Atlanta, where the Minister of Industry met with his counterparts from the U.S. and Mexico. In further support of North

American cooperation, the Secretariat has provided advice to the Minister and/or senior management on international economic issues and in preparation for meetings with representatives from other governments (United Kingdom, India, China, Netherlands, Italy, etc.)

Industry Canada was responsible for the management and coordination of the Research Fund on North American Borders, Security and Prosperity. An interdepartmental Director General Committee, coordinated and chaired by Industry Canada, oversaw the completion of 29 research studies focusing on building an evidence base for the impact of border measures on Canadian competitiveness by using a variety of data sources and methodologies. Findings were presented by Industry Canada to participants from government, the private sector and the academic community.

Lessons Learned

Sustained and strategic engagement by the Minister of Industry with his counterparts is required to address issues related to improving the competitiveness of Canadian industry as the global economy shifts, in addition to ensuring that research is disseminated appropriately to inform stakeholders and shape policy debate.

Program Activity: Internal Services

Program Activity: Internal Services

Program Activity Description

Internal Services is composed of groups of related activities and resources that are administered to support the needs of programs and other corporate obligations of an organization. These groups are Management and Oversight Services, Public Policy Services, Communications Services, Legal Services, Human Resources Management Services, Financial Management Services, Information Management

Services, information Technology Services, Real Property Services, Materiel Services, Acquisition Services, and Travel and Other Administrative Services. Internal Services includes only those activities and resources that apply across an organization and not to those provided specifically to a program.

Financial Resources*

Human Resources*

| Planned Spending | Total Authorities | Actual Spending |

|---|---|---|

| 92.6 | 163.0 | 160.6* |

* Since 1996, the Department has a funding model whereby it can access up to $66 million in operating funds from repayable contributions of the Defence Industry Productivity Program. These operating funds are accessed through Supplementary Estimates based on the amount collected in the previous year. To ensure the timely progress of program activities, Internal Services advances the funds to all other programs and replenishes itself when Supplementary Estimates are voted, which creates a significant variance between Planned and Actual total spending.

| Planned | Actual | Difference |

|---|---|---|

| 1,015 | 1,544 | 529* |

Performance Summary and Analysis of Program Activity

The Department's year-over-year Management Accountability Framework (MAF) ratings continue to improve. The Treasury Board (TB) assessment of 2010–11 was very positive, and indicated that even with the increased workload and the

delivery of EAP initiatives, Industry Canada's management capacity was very positive overall. In total, the Department was assessed on 12 Areas of Management and received five "Strong" ratings and seven "Acceptable" ratings. More specifically, the TB indicated that Industry Canada provided the appropriate level of

information for the Accounts of Canada and the Public Accounts of Canada, and demonstrated an exemplary and commendable progress in the management of internal controls over financial reporting.

The Internal Audit function and the Evaluation function within Industry Canada adhered to the respective plans for 2010–11 and achieved the intended coverage to provide assurance, measure performance and inform decision making. As well, in compliance with the 2009 Policy on Evaluation, the Department drafted the Annual Report on the State of Performance Measurement in Support of Evaluation. The draft report was presented to the Departmental Evaluation Committee. With this in mind, all TB submissions were reviewed to ensure that performance measurement strategies are well articulated, and outcomes are measurable and achievable.

On the Human Resources (HR) front, employee development and retention in 2010–11 was supported with orientation sessions, stay questionnaires for new recruits, a renewed employee recognition program, full-cycle implementation of the Employee Performance Management Framework, an initiative to support corporate memory and knowledge transfer, and exit questionnaires to inform improved HR activities and programs. The Department also developed and provided tools (including learning, competency attainment and talent management) to help Industry Canada's future leaders successfully prepare for and assume executive positions in the organizations.

Highlights of Challenges and Risk Areas

Industry Canada is funded through voted parliamentary spending authorities, statutory authorities and transfer payments, as well as specified types of respendable revenue. To address the Department's variable sources of funding, Industry Canada implemented rigorous, systematic reviews and strong financial management practices and processes to help ensure decisions were made within the allocated

resource level.

The Chief Information Office (CIO) used existing information technology (IT) governance processes and the 2010–11 Departmental IT Plan to allocate resources based on departmental priorities and continued to drive a departmental approach that promoted reuse and efficiency. This ensured the CIO had the resources to appropriately support current services and meet the demand for new services.

Successful employee recruitment, development and retention of the talent are needed to create and maintain a productive, sustainable, adaptable, competent and diverse workforce capable of meeting the Department's strategic outcomes. Industry Canada has developed and implemented a three-year People Management Strategy for Renewal and Results, which focuses on four main priority areas: Employee Engagement and Renewal; Leadership Development, HR Service Excellence and Service Improvement; and Integrity and Accountability. In 2010–11, Industry Canada began implementation of year two of this action plan.

Lessons Learned

The Audit and Evaluation Branch conducted an internal audit of staffing and recruitment at Industry Canada during summer/fall 2010 to assess the level of compliance, efficiency and effectiveness of staffing and recruitment processes and practices. The audit revealed a number of strengths, including a robust authority

sub-delegation process, HR advice consistent with legislation and policy requirements, and timely and relevant information for managers on staffing. The audit also identified a few areas requiring improvement, mostly relating to filing documentation and non-advertised appointment processes. Audit conclusions mirror findings resulting from internal monitoring

exercises, and also address issues and concerns raised by the PSC with respect to staffing across the Public Service.

Follow-up on the audit was discussed at Industry Canada's Management Committee, resulting in the approval of a detailed action plan for 2010–11 and 2011–12. As recommended in the audit, a Roles and Responsibilities document is currently being developed and will be communicated to managers in the next fiscal year.

Canada's Economic Action Plan

Canada's Economic Action Plan