Common menu bar links

Breadcrumb Trail

ARCHIVED - Industry Canada - Report

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

How to read this report

This Departmental Performance Report (DPR) presents the results of Industry Canada's strategic outcomes and program activities during the 2010–11 fiscal year, compared with the commitments stated in the Department's 2010–11 Report on Plans and Priorities (RPP). The report contains an introductory message from the Minister summarizing the Department's performance and the following four sections:

Section 1—Organizational Overview provides general information on the Department, contribution of organizational priorities to strategic outcomes, risk analysis and operating environment, performance summary information, and departmental expenditure profile.

Section 2—Analysis of Program Activities by Strategic Outcome includes detailed analysis of Industry Canada's performance at the program activity level by strategic outcome. Variance analysis is also provided at the program activity level between Planned and Actual financial and human resources when there is a difference of 10 percent or more. For the 2010–11 fiscal year, Industry Canada has also included results achieved under Canada's Economic Action Plan (EAP). Following new TBS guidance, a section specific to the EAP has been added at the end of Section 2, highlighting performance results for each EAP initiative under Industry Canada's responsibility.

As a result, Industry Canada's Human Resources and Financial Resources in sections 1 and 2 do not include EAP information. As well, to ensure proper comparison year-over-year, the Department has also removed Financial and Human Resources associated with the EAP from the 2009–10 figures and charts, more specifically in Section 2 under strategic outcomes two and three. For this reason, numbers in this DPR may not reflect Industry Canada's numbers in the corresponding Public Accounts, in the RPP and the 2009–10 DPR.

In response to the Public Accounts Committee (PAC) Meeting Number 15 recommendations, Industry Canada has broadened its presentation of risks in the DPR to better situate the Department's work and present a balanced and transparent performance story. Therefore, in Section 2, risk analysis is presented at the program activity level and under Canada's Economic Action Plan Section, where applicable.

The 2010–11 DPR reports on targets from the Department's approved Management, Resources and Results Structure at the program activity level. To assign performance status, we have used the following guide in accordance with instructions from the Treasury Board of Canada Secretariat:

Exceeded: More than 100 percent of the expected level of performance was achieved.

Met All: 100 percent of the expected level of performance was achieved.

Mostly Met: 80 to 99 percent of the expected level of performance was achieved.

Somewhat Met: 60 to 79 percent of the expected level of performance was achieved.

Not Met: Less than 60 percent of the expected level of performance was achieved.

Trend analysis continues to be provided, when possible and when historical data are available, to help readers establish year-over-year continuity and to better understand how Industry Canada achieves its strategic outcomes and contributes to whole-of-government outcomes. Industry Canada documents data sources and reference material for performance information and results for future reference.

Section 3—Supplementary Information includes information on the Department's financial highlights and provides links to the Department's financial statements, as well as supplementary information tables.

Section 4—Other Items of Interest, such as Information Management and Information Technology (IM/IT) and Responsibilities at Industry Canada, provides departmental contact information, as well as links to information available online.

For comparative purposes, some actual spending amounts for 2009–10 include programs that were later transferred to the Federal Economic Development Agency for Southern Ontario (FedDev Ontario).

For comparative purposes, some actual spending amounts for 2009–10 include programs that were later transferred to the Federal Economic Development Agency for Southern Ontario (FedDev Ontario).

One of the recommendations stemming from the Fifteenth Report of the Standing Committee on Public Accounts is that departments provide credible and balanced performance reports by clearly indicating where program performance was less than expected, explaining why, and discussing what steps were taken to modify program design and delivery in order to improve program performance. In response, Industry Canada improved its DPR to include program-specific risks, as well as a summary table that highlights key risks from the Corporate Risk Profile available online. Additionally, Industry Canada is including corrective actions through lessons learned at the program activity level in Section 2 of the document, in order to address issues that did not take place in the 2010–11 fiscal year as planned in the corresponding RPP.

In our continuing effort to provide Canadians with online access to information and services, we are including web links to more information and highlights. These links are numbered throughout the document and are presented as endnotes. We are committed to continuous improvement in our reporting. Should you have any comments, please contact the departmental contact listed in Section 4.

Minister's Message

Last year, Industry Canada and its Portfolio partners played a key role in advancing the Government's agenda in year two of Canada's Economic Action Plan.

Specific stimulus measures taken by Industry Canada were aimed at boosting economic development in both rural and urban communities through such initiatives as the Community Adjustment Fund, delivered by FedNor in Northern Ontario; extending broadband infrastructure to underserved and unserved areas across the country through the Broadband Canada: Connecting Rural Canadians program; and supporting festivals and events in communities across Canada through the Marquee Tourism Events Program. The Knowledge Infrastructure Program supported renovation and expansion projects at post-secondary institutions across Canada. Through targeted stimulus, we helped create jobs, build communities and nurture the roots of economic recovery.

In addition to fulfilling our Economic Action Plan responsibilities, Industry Canada remained focused on helping Canadian industry productivity and competitiveness in the global economy by advancing the following strategic outcomes:

- ensuring the Canadian marketplace is efficient and competitive;

- helping science and technology, knowledge, and innovation become more effective drivers of a strong Canadian economy; and

- encouraging a competitive business environment to advance sustainable wealth creation.

The Department continued to ensure that marketplace policies promoted business and consumer confidence while fostering commercialization and the knowledge-based economy. Amendments to the Weights and Measures Act and the Electricity and Gas Inspection Act were introduced to protect Canadian consumers from inaccurate measurement at gas pumps and other places where goods are measured. Canada's anti-spam legislation, which helps protect the online marketplace, was also passed, and a review of federal support for business-focused research and development was initiated to get the most out of taxpayer-funded investments.

Cultivating an environment for job creation, growth and competitiveness, both domestically and internationally, remains a priority for Industry Canada. We will work to improve cost-effectiveness and efficiency, contributing to the Government of Canada's priority to balance the budget and achieving real results for all Canadians.

It is my pleasure to present Industry Canada's Departmental Performance Report for 2010–11.

Christian Paradis

Minister of Industry and Minister of State (Agriculture)

Section 1: Organizational Overview

Raison d'�tre

Raison d'�tre

Mission

Industry Canada's mission is to foster a growing, competitive, knowledge-based Canadian economy. The Department works with Canadians throughout the economy, and in all parts of the country, to improve conditions for investment, improve Canada's innovation performance, increase Canada's share of global trade and build an efficient and competitive marketplace.

Mandate

Industry Canada's mandate is to help make Canadian industry more productive and competitive in the global economy, thus improving the economic and social well-being of Canadians.

The many and varied activities Industry Canada carries out to deliver on its mandate are organized around three interdependent and mutually reinforcing strategic outcomes, each linked to a separate key strategy. The key strategies are shown in the illustration below.

The Canadian Marketplace is Efficient and Competitive

The Canadian Marketplace is Efficient and Competitive

Advancing the marketplace:

Industry Canada fosters competitiveness by developing and administering economic framework policies that promote competition and innovation; support investment and entrepreneurial activity; and instill consumer, investor and business confidence.

Science and Technology, Knowledge, and Innovation are Effective Drivers of a Strong Canadian Economy

Science and Technology, Knowledge, and Innovation are Effective Drivers of a Strong Canadian Economy

Fostering the knowledge-based economy:

Industry Canada invests in science and technology to generate knowledge and equip Canadians with the skills and training they need to compete and prosper in the global, knowledge-based economy. These investments help ensure that discoveries and breakthroughs take place here in Canada and that Canadians realize the social and economic benefits.

Competitive Businesses are Drivers of Sustainable Wealth Creation

Competitive Businesses are Drivers of Sustainable Wealth Creation

Supporting business:

Industry Canada encourages business innovation and productivity because businesses are the organizations that generate jobs and wealth creation. Promoting economic development in communities encourages the development of skills, ideas and opportunities across the country.

Responsibilities

Responsibilities

Industry Canada is the Government of Canada's centre of microeconomic policy expertise. The Department's founding legislation, the Department of Industry Act, established the Ministry to foster a growing, competitive and knowledge-based Canadian economy.

Industry Canada is a department with many entities that have distinct mandates, with program activities that are widely diverse and highly dependent on partnerships. Industry Canada works on a broad range of matters related to industry and technology, trade and commerce, science, consumer affairs, corporations and corporate securities, competition and restraint of trade, weights and measures, bankruptcy and insolvency, intellectual property, investment, small business and tourism.

Strategic Outcomes and Program Activity Architecture

Strategic Outcomes and Program Activity Architecture

This DPR reflects the Program Activity Architecture (PAA) outlined in the 2010–11 RPP. The PAA depicts the Department's programs and activities in a logical and hierarchical relationship to each other and to one of three strategic outcomes. As begun with the 2009–10 Estimates cycle, the resources for Program Activity: Internal Services are displayed separately from other program activities; they are no longer distributed among the remaining program activities, as was the case in previous Main Estimates.

Industry Canada's 2011–12 Program Activity Architecture

(Including Industry Canada Economic Action Plan initiatives)

Strategic Outcome: The Canadian Marketplace is Efficient and Competitive

Program Activities: Marketplace Frameworks and Regulations

Subactivities

- Measurement Canada

- Superintendent of Bankruptcy

- Corporations Canada

- Paperwork Burden Reduction

- Investment Review

- Canadian Intellectual Property Office

- Internal Trade Secretariat

Program Activities: Marketplace Frameworks and Regulations for Spectrum, Telecommunications and the Online Economy

Subactivities

- Spectrum/Telecommunications Program (Operations and Engineering)

- International Telecommunication Union Participation Program

- Spectrum/Telecommunications Management and Regulations

- Regional Operations

- Electronic Commerce

Program Activities: Consumer Affairs Program

Subactivities

- Consumer Information

- Consumer Policy and Non-Profit Consumer and Coluntary Organizations Contributions Program

Program Activities: Competition Law Enforcement

Subactivities

- Competition Law Enforcement

- Advocacy in Favour of Market Forces

Strategic Outcome: Science and Technology, Knowledge, and Innovation are Effective Drivers of a Strong Canadian Economy

Program Activities: Canada's Research and Innovation Capacity

Subactivities

- Government Science and Technology Policy Agenda

- Science, Technology and Innovation Council Secretariat

- Knowledge Infrastructure Program*

- Institute for Quantum Computing*

Program Activities: Communications Research Centre Canada

Subactivities

- Information and Communications Technologies Expertise for Regulations, Standards and Programs

- Information and Communications Technologies Expertise for Other Federal Partners

- Innovation and Technology Transfer

- Modernizing Federal Laboratories*

Program Activities: Commercialization and Research and Development Capacity in Targeted Canadian Industries

Subactivities

- Industry-Specific Policy and Analysis for Innovation and Research and Development Investment

- Innovation Capacity in the Automotive Industry

- Research and Development Capacity in the Aerospace Industry

- Strategic Aerospace and Defence Initiative

- Program for Strategic Industrial Projects

- Technology Partnerships Canada - Research and Development Program

Strategic Outcome: Competitive Businesses are Drivers of Sustainable Wealth Creation

Program Activities: Entrepreneurial Economy

Subactivities

- Canada Small Business Financing

- Services to Business

- BizPal

- Small Business Internship (formerly Student Connections)

- Small Business Growth and Prosperity

Program Activities: Global Reach and Agility in Targeted Canadian Industries

Subactivities

- Industry-Specific Policy, Advice and Expertise

- Industry Development and Analysis

- Shipbuilding Capacity Development

- Industrial and Regional Benefits Policy and Program Management

- Marquee Tourism Events Program*

Program Activities: Community, Economic and Regional Development

Subactivities

- Federal Economic Development Initiative for Northern Ontario (FedNor)

- Community Futures Program

- Northern Ontatio Development Program

- Eastern Ontario Development Program**

- Linguistic Duality and Official Languages

- Canada-Ontario Municipal Rural Infrastructure Program**

- Ontario Municipal Rural Infrastructure Top-Up Program**

- Computers for Schools

- Community Access Program

- Ontario Potable Water Program**

- Brantford Greenwich-Mohawk Remediation Project**

- Canada Strategic Infrastructure Program**

- Building Canada Program**

- Community Adjustment Fund in Northern Ontario*

- Broadband Canada: Connecting Rural Canadians*

Program Activities: Security and Prosperity Partnership of North American — Canadian Secretariat

* Designates Economic Action Plan Items

** Designates programs transferred to the Federal Economic Development Agency for Southern Ontario

Organizational Priorities

Organizational Priorities

The achievements highlighted below correspond to commitments indicated in the 2010–11 RPP.

To assign an appropriate performance status, we have used the guide as outlined in "How to read this report" section of this document.

| Priority 1: Advancing the marketplace |

Type: Previously committed to |

Strategic Outcome(s): The Canadian Marketplace is Efficient and Competitive |

|---|---|---|

|

Ensure marketplace policies help promote competitive markets and install consumer confidence

|

||

|

Priority 2: |

Type: Previously committed to |

Strategic Outcome(s): |

|---|---|---|

|

Foster business innovation

Invest in science and technology (S&T) to enhance the generation and commercialization of knowledge

|

||

|

Priority 3: |

Type: Ongoing |

Strategic Outcome(s): Competitive Businesses are Drivers of Sustainable Wealth Creation |

|---|---|---|

|

Foster internationally competitive businesses and industries

Promote entrepreneurship, community development and sustainable development

|

||

|

Priority 4: |

Type: Ongoing/ Previously Committed to |

Strategic Outcome(s): Science and Technology, Knowledge, and Innovation are Effective Drivers of a Strong Canadian Economy; Competitive Businesses are Drivers of Sustainable Wealth Creation |

|---|---|---|

|

Status: Met All

|

||

|

Priority 5: |

Type: Ongoing/New |

Strategic Outcome(s): All strategic outcomes |

|---|---|---|

|

People Management (Ongoing):

Financial Management (New):

Internal Audit (New):

Procurement and Materiel Management (New):

Business Continuity (New):

|

||

Risk Analysis

Risk Analysis

Operating Environment

During the past year, the economic recovery in Canada gained momentum. Many governments moved to complete stimulus projects and have since announced measures to curtail new spending. In Canada, the related challenges had mainly led to a significant loss of wealth for Canadian consumers and Canadian businesses. Through many initiatives, whether through existing departmental programs or through

Canada's Economic Action Plan, Industry Canada continued to monitor the performance of the economy and develop the capacity of priority sectors and industries. The Department also concluded its participation in the most recent strategic review exercise; aligned resources to increase R&D and innovation capacity in targeted sectors; and supported skills development to ensure that businesses

have the tools they need to grow and prosper over the long term.

As the recovery gained strength, higher demand led to increased commodity and energy prices, which raised concerns about prices for basic necessities such as food and gasoline and about the impact of these price increases on consumers and businesses. These factors, as well as the following key areas, formed Industry Canada's operating context for 2010–11 and played an important role in the Department's delivery of its plans and priorities.

Canada's Economic Action Plan

The government successfully implemented year two of Canada's Economic Action Plan (EAP), with Industry Canada managing over eight EAP initiatives. These initiatives provided short-term stimulus and supported longer-term innovation, which will position the Canadian economy to excel in the future. In addition, several EAP initiatives in the Department's portfolio complemented other departmental

priorities, such as the implementation of the Science and Technology Strategy. Key accomplishments included the signing of 86 contribution agreements through the Broadband Canada: Connecting Rural Canadians program to provide $112 million to projects that will bring broadband Internet access to approximately 210,000 underserved and unserved Canadian households and improve connectivity for

citizens and businesses; delivering support through the Marquee Tourism Events Program (MTEP) to 47 festivals and events in communities across Canada; and delivering funding to provinces, territories and institutions through the Knowledge Infrastructure Program (KIP) to support Canadian S&T projects.

In the fall of 2010, the deadline for the KIP was extended. Industry Canada will continue to report on this initiative as well as Broadband Canada, which continue into the next fiscal year. The timely, targeted nature of the EAP programs required large expenditures under tight timelines, something that Industry Canada managed while mitigating risks through effective stewardship measures such as robust management and financial control frameworks; monitoring, review and oversight of initiatives through ongoing and ad hoc governance bodies; and third-party due diligence reviews. Risks related to the KIP and Broadband Canada will continue to be monitored through Industry Canada's Corporate Risk Profile, and additional reporting will occur as program spending winds down.

Competitive Marketplace

Over the course of the year, Industry Canada advanced a number of actions to ensure a fair and competitive Canadian marketplace. The Department played a role in advancing competition within the telecommunications sector by removing foreign ownership restrictions on Canadian satellite companies to provide Canadian firms with access to funds, knowledge and expertise needed to compete. Industry

Canada has launched consultations on policy and technical frameworks to auction spectrum in the 700 and 2500 MHz bands. The Department will use those consultations to design a spectrum auction that ensures effective and efficient use of the radio frequency spectrum. The Department also worked with Canadian Heritage to introduce proposed legislative amendments to modernize the Copyright

Act.

Innovation

In 2010–11, Industry Canada continued to support the competitiveness of specific industries hard hit by the recession through investments in the innovative capacity of firms in the automotive, shipbuilding, aerospace and defence industries. The Department also helped to launch the Review of Federal Support to Research and Development (R&D),

an independent panel of experts assessing federal support to business R&D. The results of the R&D review will be used to increase the efficiency and impact of federal expenditures on science and technology (S&T) and innovation policies.

Engagement with Partners and Stakeholders

To mitigate operating risks, Industry Canada remained committed to building strategic partnerships with other government departments, other national governments, international organizations and industry stakeholders. These relationships helped Industry Canada develop sound policies and programs.

Several Industry Canada initiatives developed over the past year included consultations with stakeholders, in particular for the development of the Digital Economy Strategy (DES) and for the R&D Review Panel. The DES consultations also included a federal/provincial/territorial ministerial meeting on the digital economy in January 2011. The Department continued to work with federal partners to advance trade negotiations at the World Trade Organization and in support of proposed initiatives such as the Canada–EU Trade Agreement. A recent key accomplishment was the completion of a number of collaborative studies through the Research Fund on North American Borders, Security and Prosperity that were presented to Canadian and U.S. stakeholders.

Consumer Interests

The challenges posed by the economic conditions of 2010–11 resulted in Industry Canada facing pressures to shift its activities towards a greater focus on the consumer basics of buying and saving. The Department published an online video to provide consumers with basic buying tips, focusing primarily on elements to consider before and after a purchase, and to encourage consumers to contact

their governments for additional information. The Department, through the Competition Bureau, also identified flexible and cost-effective ways to increase compliance with consumer protection laws across the country, helped improve the consumer voice in policy-making, and continued to focus on protecting consumers from fraud, particularly through the Competition Bureau's leadership in the Fraud

Prevention Forum and its participation in Fraud Prevention Month.

Risk Management

As part of its continued efforts to advance Integrated Risk Management, Industry Canada identified the corporate risks that had the potential to impact the Department's ability to achieve its mandate and strategic outcomes in its its 2010–11 Corporate Risk Profile (CRP). Also, in 2010–11, Industry Canada improved its corporate risk profiling

by focusing attention on program risks as part of a comprehensive risk management approach. The CRP process included the development, implementation and ongoing monitoring of mitigation strategies and action plans to ensure Industry Canada's risks were effectively managed. In response to the 15th Public Accounts Committee recommendations, Industry

Canada has broadened its presentation of risks in the DPR to better situate the Department's work and present a balanced and transparent performance story.

The Department also continued its rigorous management of risks related to the implementation of Industry Canada's Economic Action Plan (EAP) initiatives. Industry Canada was recognized by the Office of the Auditor General for its ongoing monitoring, mitigation and reporting of risks associated with its EAP initiatives.

The 2010–11 CRP identified the following five corporate risk categories for the Department: economic action plan program delivery, spectrum and telecommunication frameworks and regulations, reputational and stakeholder expectations, organizational adaptability, and innovation. Under each of these categories, a number of priority departmental risks were identified. Details on these risks and their associated mitigation strategies can be found in Section 2 of this report, under the appropriate program activity. A Corporate Risk Profile table is also included in Section 4 to provide better linkages to identified risk categories.

Industry Canada continues to update its Corporate Risk Profile as well as identify, monitor and mitigate corporate risks that may affect the Department's ability to achieve its expected results and deliver its mandate.

Summary of Performance

Summary of Performance

Industry Canada's Financial and Human Resources

The following two tables present Industry Canada's total financial and human resources for 2010–11, including resources associated with Canada's Economic Action Plan.

| Planned Spending | Total Authorities | Actual Spending |

|---|---|---|

| 2,448.6 | 2,534.3 | 2,055.0 |

| Planned | Actual | Difference |

|---|---|---|

| 5,279 | 5,617 | 338 |

Summary of Performance by Strategic Outcome

| Performance Indicators | Targets | 2010–11 Performance |

|---|---|---|

| Barriers to competition (Organisation for Economic Co-operation and Development [OECD] assessment of accessibility to Canadian market) | Maintain or improve 6th place ranking* |

Performance Status: Based on 2008 measure of the OECD Product Market Regulation (PMR) indicators, Canada was ranked as the 5th most inaccessible market among OECD countries. In the 2003 PMR report, Canada ranked 11th1. Canada's fall in ranking is primarily attributed to increased barriers to entry in services. The trend in this result is declining. (Raw score** in 2003: 2.00; and in 2008: 2.09. The decline is in 3 out of 4 areas of barriers to competition: legal barriers, barrier to entry in network sectors and barriers to entry in services.)*** |

| Number of days taken to register a new company | 3 days |

Performance Status: The process of registering a new company in Canada takes 5 days2. The number of days taken increased from 3 (2004–08) to 5 (2009–10) due to the combining of two applications process into a new integrated system and remains unchanged in 2010–11. Though registration days have increased, the process of registration has been streamlined to one simple registration process. Additionally, with a pre-reserved company name, registration can be completed within a day3. There is no change between this year's result and last year's. |

*** The 4th area of barriers to competition is Anti-Trust Exemptions.

| Program Activity | 2009–10 Actual Spending ($ millions) |

2010–11 ($ millions) | Alignment to Government of Canada Outcomes | |||

|---|---|---|---|---|---|---|

| Main Estimates |

Planned Spending |

Total Authorities |

Actual Spending |

|||

| Marketplace Frameworks and Regulations | 43.2 | 64.1 | 66.1 | 210.0* | 40.3** |

Economic Affairs: A Fair and Secure Marketplace |

|

Marketplace Frameworks and Regulations for Spectrum, Telecommunications and the Online Economy |

110.4*** | 87.1 | 87.2 | 95.2 | 91.0 | |

| Consumer Affairs Program | 5.1 | 4.6 | 6.0^ | 5.2 | 5.0 | |

| Competition Law Enforcement and Advocacy | 47.7 | 45.4 | 46.7 | 47.3 | 45.6 | |

| Total | 206.5*** | 201.3 | 206.2 | 357.7* | 182.0* | |

| Performance Indicators | Targets | 2010–11 Performance |

|---|---|---|

| Innovation Index (measure of the adoption of new technology, and the interaction between the business and science sectors) |

Maintain or improve 12th place ranking |

Performance Status: |

| International ranking of Canada in university–industry collaboration in R&D |

Maintain or improve 2nd place ranking5 |

Performance Status: |

| Number of people working in Research and Development (R&D) of total employment numbers | 8 per 1,000 |

Performance Status: |

* Germany and Spain, the previous holders of 1st and 2nd place (respectively) in the index. have not released official data as of June 2011.

Preliminary data suggest that Spain's Industry R&D expenditure will fall by greater than 1 percent. This will cause Canada to rise to its 2nd place ranking8.

| Program Activity | 2009–10 Actual Spending ($ millions) |

2010–11 ($ millions) | Alignment to Government of Canada Outcomes | |||

|---|---|---|---|---|---|---|

| Main Estimates |

Planned Spending |

Total Authorities |

Actual Spending |

|||

| Canada's Research and Innovation Capacity | 263.1 | 307.3 | 248.6 | 251.5* | 255.9* |

Economic Affairs: An Innovative and Knowledge-based Economy |

|

Communications Research Centre Canada |

45.9 | 39.1 | 39.1 | 43.4** | 43.9** | |

| Commercialization and Research and Development Capacity in Targeted Canadian Industries | 277.7 | 294.5 | 295.0 | 399.6*** | 247.0*** | |

| Total | 586.7 | 640.8 | 582.7 | 694.5 | 546.8 | |

| Performance Indicators | Targets | 2010–11 Performance |

|---|---|---|

| Percentage of gross domestic product (GDP) contributed by small and medium-sized businesses | Maintain or improve current (based on 2009 GDP levels) percentage (26%) |

Performance Status: Canadian small business accounted for 28% of GDP for 2009–10.* The trend is declining, from 2008–09 when Canadian small businesses accounted for 29%9. |

| Ratio of small and medium-sized businesses in rural vs. urban areas (defined by census subdivisions) |

1:3 |

Performance Status: The ratio of rural to urban small and medium-sized enterprises (SMEs) in Canada is 1:2.1. Rural SMEs account for 32% of total SME business activity, compared with the 68% contribution by urban SMEs**10. Calculated with the new methodology, the result shows no change from the previous year.

|

| Program Activity | 2009–10 Actual Spending ($ millions) |

2010–11 ($ millions) | Alignment to Government of Canada Outcomes | |||

|---|---|---|---|---|---|---|

| Main Estimates |

Planned Spending |

Total Authorities |

Actual Spending |

|||

| Entrepreneurial Economy | 135.2 | 104.9 | 104.3 | 109.0 | 106.1 | Economic Affairs: Strong Economic Growth |

| Global Reach and Agility in Targeted Canadian Industries | 59.6 | 56.4 | 56.0* | 61.5 | 51.3* | |

| Community, Economic and Regional Development | 320.7 | 51.5 | 82.5 | 97.9 | 96.9 | |

| Security and Prosperity Partnership of North America — Canadian Secretariat | 1.1 | 2.2 | 2.2 | 1.8 | 0.0** | International Affairs: A Strong and Mutually Beneficial North American Partnership |

| Total | 516.6 | 214.9 | 245.0 | 270.1 | 254.4 | |

** A misalignment of funds has resulted in Actual Spending for this program activity being coded to Internal Services ($1.03 million). The Security and Prosperity Partnership of North America ended in 2010–11, leading to lower Actual Spending as the program ramped down.

Program Activities Supporting All Strategic Outcomes

| Program Activity | 2009–10 Actual Spending ($ millions) |

2010–11 ($ millions) | |||

|---|---|---|---|---|---|

| Main Estimates |

Planned Spending |

Total Authorities* |

Actual Spending |

||

| Internal Services | 177.8 | 92.6 | 92.6 | 163.0 | 161.6 |

| Total | 177.8 | 92.6 | 92.6 | 163.0 | 161.6 |

| Canada's Economic Action Plan | 2009–10 Actual Spending ($ millions) |

2010–11 ($ millions) | |||

|---|---|---|---|---|---|

| Main Estimates |

Planned Spending |

Total Authorities |

Actual Spending |

||

| EAP | 1,080.0 | 1,263.9 | 1,322.1 | 1,049.1 | 910.2 |

| Total | 1,080.0 | 1,263.9 | 1,322.1 | 1,049.1* | 910.2 |

Expenditure Profile

Expenditure Profile

Canada's Economic Action Plan

Industry Canada continued its contribution to Canada's Economic Action Plan in fiscal year 2010–11. A significant portion of the Department's EAP resources was used to support S&T, knowledge and innovation, which helped position the Canadian economy to continue gaining momentum and strength in the

current global economic context. This was accomplished through initiatives such as the Knowledge Infrastructure Program, the Canada Foundation for Innovation, the Marquee Tourism Events Program and other EAP initiatives under Industry Canada's umbrella. The following table highlights EAP initiatives, including

their Total Authorities and Actual Spending, for the full year 2010–11.

Financial Resources in 2010–11 ($ millions)

| EAP Initiative | Total Authorities | Total Actual |

|---|---|---|

| Knowledge Infrastructure Program | 751.6 | 745.0 |

| Canada Foundation for Innovation | 50.0 | 50.0 |

| Institute for Quantum Computing | 17.0 | 17.0 |

| Modernizing Federal Laboratories | 2.2 | 2.2 |

| Broadband Canada: Connecting Rural Canadians | 158.4 | 30.0* |

| Marquee Tourism Events Program | 41.7 | 41.0 |

| Canada Business Network** | 5.9 | 5.3 |

| Community Adjustment Fund in Northern Ontario | 21.2 | 18.7 |

| Ivey Centre for Health Innovation and Leadership | 1.0 | 1.0 |

| TOTAL | 1,049.1 | 910.2 |

**While the program received funding from Canada's Economic Action Plan, Canada Business Network is an ongoing program. Please refer to the Program Activity of Entrepreneurial Economy in Section 2 under Strategic Outcome 3: Competitive Businesses are Drivers of Sustainable Wealth Creation.

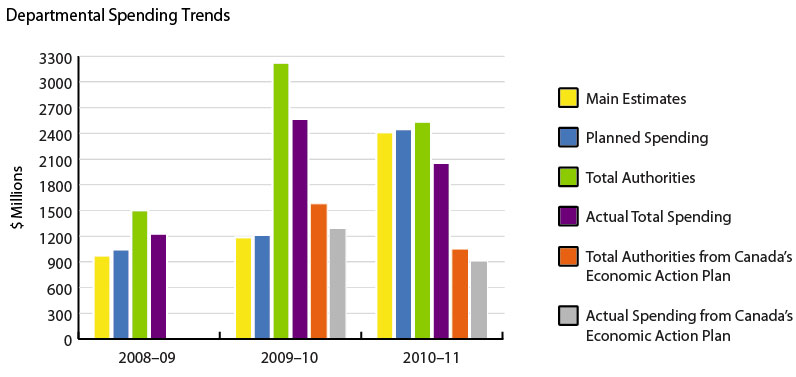

Departmental Spending Trend

Industry Canada's total actual spending, including EAP, for 2010–11 was $2.05 billion, which is less than the 2009–10 total actual spending of $2.56 billion. The Department's Operating Expenditures were $416.9 million in fiscal year 2010–11, compared with $459.2 million in 2009–10.

Estimates by Vote

Estimates by Vote

For information on organizational votes and/or statutory expenditures, please see the 2010–11 Public Accounts of Canada 2010 (Volume II) publication. An electronic version of the Public Accounts is available on the Public Works and Government Services Canada website.