Common menu bar links

Breadcrumb Trail

ARCHIVED - Industry Canada - Report

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Section 2: Analysis of Program Activities by Strategic Outcome

2.1 The Canadian marketplace is efficient and competitive

2.1 The Canadian marketplace is efficient and competitive

The global economy continues to emerge from the economic downturn, and growth continues to be slow and uneven, resulting in significant uncertainty in the global marketplace. Therefore, the Canadian marketplace requires effective frameworks and regulations to provide businesses and consumers with some degree of certainty and predictability and to ensure that Canadian firms have every opportunity to innovate and succeed within current market conditions. Efficient marketplace frameworks and regulations are also necessary to facilitate competitiveness and to build and maintain consumer and investor confidence.

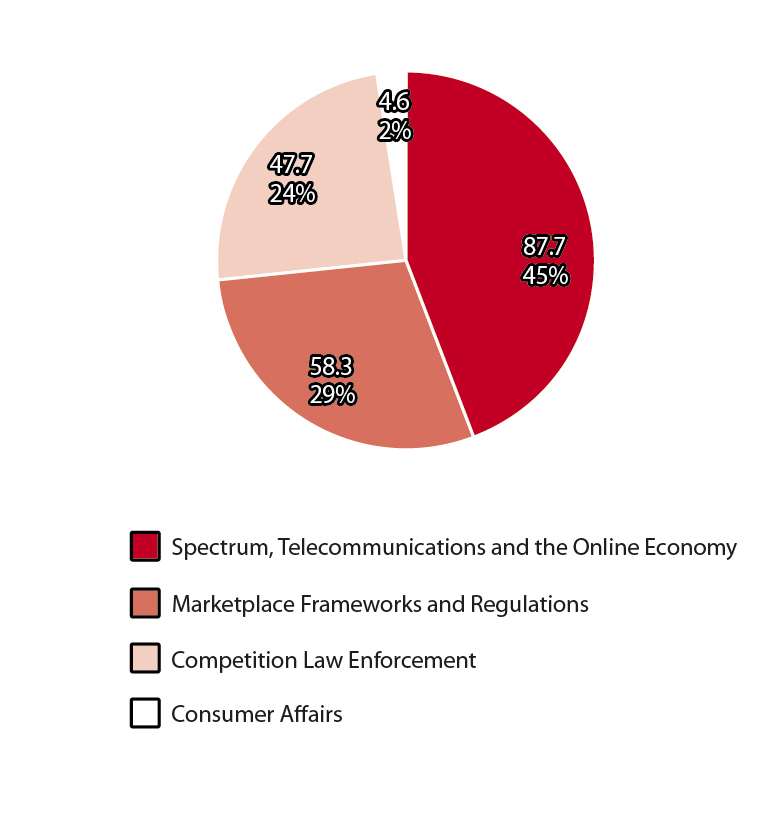

Breakdown of 2011–12 Planned Spending by Program Activity ($ millions)

Industry Canada strives to achieve an efficient and competitive marketplace by developing, implementing and enforcing policies that are fundamental to the effective functioning of a market. These policies strengthen Canada’s capacity for innovation, competition and productivity, which are key drivers of the economy.

| Financial Resources ($ millions)* | Human Resources (FTEs) | |||||

|---|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | 2011–12 | 2012–13 | 2013–14 | |

| 198.3 | 196.0 | 201.7 | 2,928 | 2,943 | 2,950 | |

* Minor differences are due to rounding.

Industry Canada contributes to an efficient and competitive Canadian marketplace by

- delivering sound regulatory regimes and frameworks and ensuring compliance with these regulatory regimes and frameworks, which include regulations, policies, procedures and standards for bankruptcy and insolvency, foreign direct investment, competition, internal trade, federal incorporations, intellectual property, trade measurement, radio frequency spectrum and telecommunications;

- securing Canada’s interest in the international regulation of radio frequency spectrum and telecommunications to protect Canadian access to spectrum and satellite orbit resources;

- providing support to existing federal not-for-profit corporations when the new provisions of the Canada Not-for-profit Corporations Act come into force; developing regulations to meet the needs of the not-for-profit sector; providing policies, guidelines and accessible tools to assist not-for-profit corporations in meeting statutory and regulatory obligations; and providing client-oriented services that are responsive and accessible;

- ensuring that consumers and investors are protected and have access to an honest, sound, safe and competitive marketplace, enabling them to be effective marketplace participants; and

- administering and enforcing, among others, the Competition Act, the Consumer Packaging and Labelling Act, the Textile Labelling Act, the Weights and Measures Act, the Electricity and Gas Inspection Act, the Bankruptcy and Insolvency Act, the Companies’ Creditors Arrangement Act, the Canada Business Corporations Act, the Investment Canada Act, the Radiocommunication Act, the Telecommunications Act and the Precious Metals Marking Act.

The following key activities will support this strategic outcome:

- monitoring domestic and international developments, including but not limited to technological and scientific developments, international financial trends, changes in other countries’ marketplace policy directions and international agreements, with a view to modernizing Canadian marketplace frameworks to promote competition and innovation, which is conducive to productivity growth and prosperity;

- ensuring clear and transparent rules govern foreign investment and maintain an internationally competitive marketplace environment that will attract investment and support economic growth in Canada;

- continuing to work in collaboration with partners to reduce unnecessary barriers to private sector cross-border data flow;

- administering the new provisions of the Canada Not-for-profit Corporations Act when they are brought into force (expected to come into force in June 2011);

- advancing next-generation networks by implementing and monitoring Broadband Canada projects, updating coverage maps and developing policy options for next steps;

- supporting cyber security and emergency telecom services and negotiating mutual recognition agreements (MRA) for conformity assessment of telecommunications equipment;

- securing Canadian interests in treaty revisions to both the international Radio Regulations and Telecommunications Regulations;

- improving accessibility and effective use of intellectual property information; and

- preventing anti-competitive mergers and combatting abuse of market dominance, domestic cartels and fraud in the digital economy through targeted enforcement action.

By focusing on these key activities in the coming years, Industry Canada will help improve the Canadian business environment, providing consumers and investors with access to a competitive marketplace.

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | |||

| FTEs | Planned Spending | FTEs | Planned Spending | FTEs | Planned Spending |

| 1,770 | 58.3 | 1,782 | 56.3 | 1,787 | 62.0 |

* Minor differences are due to rounding.

| Expected Result | Performance Indicator | Target |

|---|---|---|

| Legislation, regulations and policy are in place and are administered for Canadian markets. | Percentage of cases for which regulatory time frames or service standards are met | 80 percent |

Planning highlights and benefits for Canadians

Industry Canada will implement and administer the new provisions of the Canada Not-for-profit Corporations Act, which are expected to come into force in 2011–12. The Act will establish a modern governance framework for not-for-profit corporations and allow them to incorporate faster and be more efficient and effective in the competitive marketplace.

In response to stakeholder requests that NUANS become the single comprehensive source of corporate names used in all Canadian federal, provincial and territorial jurisdictions, Industry Canada will continue its efforts to have NUANS adopted Canada-wide by the 2014 target date.

Pending royal assent of the Fairness at the Pumps Act in 2010–11, which would amend the Weights and Measures Act and Electricity and Gas Inspection Act, Industry Canada will introduce mandatory frequencies for the inspection of measuring devices (e.g. scales, gas pumps), increased fines and administrative monetary penalties (AMP), which will align Canada with international practices for fair and accurate trade measurement and strengthen consumer and business protection against loss from inaccurate measurement.

The promotion of, and dissemination of information about, intellectual property (IP) in Canada will be ongoing, with a focus on the post-secondary education sector and intermediaries that support exporting small and medium-sized enterprises (SME). This will assure Canadians that their ideas and inventions are adequately protected, which in turn will support innovation in Canada.

Industry Canada will move forward with work aimed at modernizing IP legislation, aligning it with international IP administrative systems and treaties. This will better facilitate innovation and the commercialization of ideas, ensure effective rights enforcement, decrease uncertainty for businesses and inventors, and support inventors who operate on a global scale.

By improving conditions in the marketplace through the plans indicated above, Industry Canada will ensure that Canadians and Canadian businesses benefit from marketplace fairness, integrity, efficiency and competitiveness.

Highlights of challenges and risk areas

Pending royal assent of the Fairness at the Pumps Act in 2010–11, the introduction of AMPs will require Industry Canada to establish new processes and procedures to ensure the successful implementation of this new compliance strategy.

To effectively implement and administer the new provisions of the Canada Not-for-profit Corporations Act, Industry Canada must complete enhancements to its information technology system. The Department has developed a detailed project plan to ensure that the system is adequately prepared and that implementation is timely.

* Minor differences are due to rounding.

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | |||

| FTEs | Planned Spending | FTEs | Planned Spending | FTEs | Planned Spending |

| 703 | 87.7 | 719 | 86.3 | 721 | 86.2 |

| Expected Result | Performance Indicator | Target |

|---|---|---|

| Canada’s radiocommunication and telecommunications infrastructure and online economy are governed by an effective policy and regulatory framework. | Number of policies, legislation and regulations developed, updated or reviewed to strengthen the policy and regulatory framework | 5 |

Planning highlights and benefits for Canadians

Canada’s radiocommunication and telecommunications infrastructure and the online economy require modern, efficient and effective policy and regulatory frameworks. Demand continues to grow for advanced wireless services. This demand is driven by an expanding mobility market and broadband Internet access, which also require privacy protection. Industry Canada will undertake the development of policies, regulations, standards and treaties to support effective spectrum management and the provision of new wireless services.

Consultation on technical rules for auctions in both the 2500 MHz and 700 MHz bands will be completed and the results published. The auctioning of these bands will help support new mobile technologies and services in the Canadian marketplace and ensure that Canadians have sufficient and timely access to essential spectrum.

Industry Canada will implement anti-spam legislation, develop related regulations and establish a Spam Reporting Centre. Bill C-29, An Act to amend the Personal Information Protection and Electronic Documents Act (short title: the Safeguarding Canadians’ Personal Information Act), has been introduced to Parliament. Its purpose is to increase the protection of personal information in the online marketplace. Bill C-29 also requires that organizations report data breaches to the Privacy Commissioner and affected individuals.

A second statutory review of the Personal Information Protection and Electronic Documents Act (PIPEDA) will assess the effectiveness of the Act in the face of technological advances to ensure that it continues to effectively protect personal information in a commercial context and promote confidence in the online marketplace. Consultations with the provinces and territories will be held to align regimes for private sector privacy legislation, making it easier to understand and ensuring that Canadians have equivalent levels of privacy protection in Canada.

A cyber security strategy was launched by Public Safety Canada to protect Canadian governments, industries and consumers from cyber threats. In support, Industry Canada will implement the cyber security work plan, which includes risk analysis and mitigation of cyber security threats affecting the telecommunications infrastructure.

Industry Canada will be negotiating treaty revisions to the international Radio Regulations. Preparations, in consultation with private industry and other government departments, are underway. One of the key objectives of these treaty revisions is to secure and protect Canada’s interests in spectrum and satellite orbit resources. This includes facilitating communications across Canada and protecting Canadian sovereignty in remote areas through modern digital technologies.

Industry Canada plans to negotiate frequency-sharing arrangements with the U.S. to facilitate the deployment of new wireless systems. MRAs for conformity assessment of telecommunications equipment will be negotiated with trading partners so that Canadian standards pertaining to radiocommunications and telecommunications can be stipulated in international agreements and standards.

By delivering on these plans, Industry Canada will ensure that Canadians have access to advances in radiocommunications and telecommunications and to the online economy and that accompanying regulations are in place to sufficiently protect Canadians’ privacy.

Highlights of challenges and risk areas

Growth in mobile services over the next 10 years is expected to have an impact on spectrum availability and the ability to meet mobile services demands in a timely fashion. To ensure Canada does not lag in the new mobile Internet economy, Industry Canada is developing and implementing a multi-year plan to make spectrum available, to introduce market-based fees as an incentive for efficient use, and to update legislation to facilitate trade and reallocation of spectrum.

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | |||

| FTEs | Planned Spending | FTEs | Planned Spending | FTEs | Planned Spending |

| 23 | 4.6 | 23 | 4.6 | 23 | 4.6 |

* Minor differences are due to rounding.

| Expected Results | Performance Indicators | Targets |

|---|---|---|

| Citizens and policy-makers are aware of consumer issues in the Canadian marketplace. | Number of instances per year where consumer research and/or analysis contributes to consumer policy discussions | 3 |

| Number of visitors accessing information products on websites managed by the Office of Consumer Affairs (OCA) | 1.65 million | |

| Number of instances per year where research and analysis performed by consumer organizations supported by the OCA’s Contributions Program for Non-Profit Consumer and Voluntary Organizations contribute to policy discussions or media coverage | 12 |

Planning highlights and benefits for Canadians

In the current economic climate, the challenges facing consumers are ever changing and increasingly complex. Proactively addressing these challenges offers consumers some degree of certainty and is essential to maintaining their confidence in the marketplace. Industry Canada, through the OCA, will offer consumers information on areas where they may be particularly vulnerable and equip them with tools from the Canadian Consumer Handbook to help them make informed decisions, thereby contributing to a marketplace that is more efficient and competitive.

Industry Canada will continue to implement the OCA’s Partnership Strategy. This will expand the reach and impact of the analytical work that is performed to support federal, provincial and territorial deliberations.

In conjunction with the Consumer Measures Committee, Industry Canada will continue to explore measures to protect consumer interests through joint analysis of current consumer pressures in priority sectors and the sharing of best practices for regulatory compliance with federal, provincial and territorial consumer protection laws.

Industry Canada will implement a communications strategy for the anti-spam legislation, aimed at educating consumers and businesses about, and increasing their awareness of, spam and other online threats, which is critical for the safe use of the Internet. Creating the knowledge base, information and tools that lead to independent, safe and productive use of the Internet helps increase consumer confidence in the online marketplace.

Industry Canada will work with partners in other departments and international partners on a variety of consumer policy projects pertaining to sustainable consumption, consumer vulnerability and electronic commerce. International policy work will involve actively participating in the OECD’s Committee for Consumer Policy and various technical committees of the International Organization for Standardization (ISO) to modernize consumer protections in e-commerce, ensure environmental claims are meaningful and accurate, enhance consumer product safety, improve the readability of consumer utility bills and encourage social responsibility in organizations.

Through these actions, the interests of Canadian consumers will be better protected, and they will have access to tools and information to make informed decisions.

Highlights of challenges and risk areas

Consumers and businesses may not be aware of their roles and responsibilities regarding spam and other online threats under the new anti-spam legislation. In response, Industry Canada will implement a communications strategy, which will include an evaluation component, and provide information to educate stakeholders about the new legal provisions.

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | |||

| FTEs | Planned Spending | FTEs | Planned Spending | FTEs | Planned Spending |

| 432 | 47.7 | 419 | 48.8 | 419 | 48.8 |

* Minor differences are due to rounding.

| Expected Results | Performance Indicators | Targets |

|---|---|---|

| Canadian markets are competitive. | Estimated dollar savings per annum to consumers from Competition Bureau actions that stop anti-competitive activity | $330 million |

| Approximate percentage of Canada’s gross domestic product (GDP) subject to market forces | No less than 82 percent | |

| Businesses/individuals change their anti-competitive conduct following compliance interventions conducted by the Competition Bureau. | Percentage of recidivists | Less than 5 percent |

Planning highlights and benefits for Canadians

Well-designed competition law and effective competition law enforcement, including resolving cases of demonstrable benefit to consumers, promote increased efficiency and economic growth.

To ensure the Canadian marketplace is efficient and competitive, Industry Canada, through the Competition Bureau, will continue to vigorously and effectively enforce the laws under its jurisdiction. The Competition Bureau, as an independent law enforcement agency, ensures that Canadian businesses and consumers prosper in a competitive and innovative marketplace. The Competition Bureau will engage in enforcement actions targeting abuse of dominance and domestic cartels and will ensure timely and effective merger reviews, including resolution before the Competition Tribunal. In addition, the Competition Bureau will target fraud in the digital economy, particularly in the areas of health and the environment, and will continue to protect competitive markets by detecting, disrupting and deterring the most egregious forms of anti-competitive conduct.

Through the effective implementation of recent amendments to the Competition Act, the Competition Bureau will enhance its transparency and increase the predictability and effectiveness of its enforcement actions by using the full range of tools in the enforcement continuum, including litigation where necessary. Providing clarity and predictability to businesses and consumers is particularly important in the current uncertain economic climate.

Highlights of challenges and risk areas

What can be expected of the Competition Bureau and what it can accomplish with the new powers it will receive as a result of the anti-spam legislation may not be well understood by Canadians. The Competition Bureau will therefore ensure that the new enforcement provisions are effectively and efficiently implemented and will also develop a communications strategy to manage expectations.

2.2 Advancements in science and technology, knowledge, and innovation strengthen the Canadian economy

2.2 Advancements in science and technology, knowledge, and innovation strengthen the Canadian economy

Science and technology (S&T) are essential to building the knowledge-based economy of tomorrow. Fostering innovation and investing in S&T are fundamental to improving Canada’s productivity and global competitiveness. Canada holds a leading global position in some areas of the research and innovation system but faces challenges in other areas. Industry Canada supports a viable private sector innovation system and, in support of this objective, has launched a Research and Development Review Panel to determine how government support can best be used to advance and commercialize research. The Department works with its portfolio partners, the private sector, industry associations, academia and all levels of government to foster an environment that is conducive to innovation, scientific excellence and industrial competitiveness.

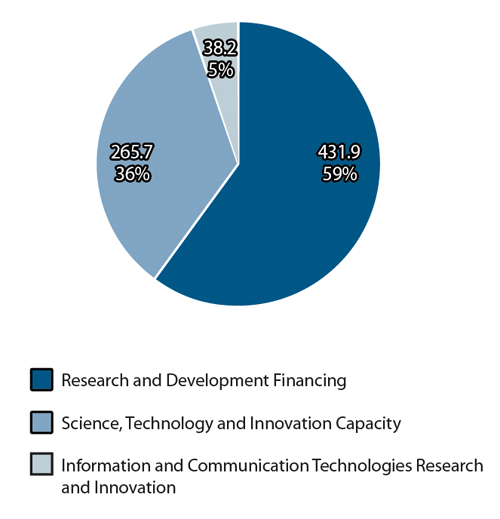

Breakdown of 2011–12 Planned Spending by Program Activity ($ millions)

It is through these relationships that the Department is helping to promote innovation, technology transfer and spinoffs as well as contributing to a skilled workforce and ensuring that Canadians and Canadian businesses benefit from an innovative and knowledge-based economy.

| Financial Resources ($ millions)* | Human Resources (FTEs) | |||||

|---|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | 2011–12 | 2012–13 | 2013–14 | |

| 735.8 | 826.4 | 561.6 | 534 | 523 | 522 | |

* Minor differences are due to rounding.

Industry Canada also supports further advancements in S&T, knowledge and innovation by focusing on the following:

- the attraction and retention of top research talent through effective S&T programs;

- the commercialization of Canadian research and development (R&D) and technology transfer to increase innovation;

- strategic, large-scale R&D projects in the automotive and aerospace sectors that support innovative, greener and more fuel-efficient vehicles and aircraft; and

- research in advanced telecommunications and information technologies to support the development of new products and services for the information and communication technologies (ICT) sector and the adoption of innovative ICT applications.

The following key activities will support this strategic outcome:

- advancing science policy advice and policy frameworks to fulfill commitments made in the multi-year science and technology strategy, Mobilizing Science and Technology to Canada’s Advantage – 2007;

- producing and launching the 2010 State of the Nation report on Canada’s science, technology and innovation system;

- working with portfolio agencies to ensure funding programs promote private sector innovation; and

- consulting and collaborating with external stakeholders and counterparts in other science-based departments to improve Canada’s science and innovation system.

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | |||

| FTEs | Planned Spending** | FTEs | Planned Spending*** | FTEs | Planned Spending |

| 69 | 265.7 | 69 | 326.4 | 69 | 200.8 |

* Minor differences are due to rounding.

| Expected Results | Performance Indicators | Targets |

|---|---|---|

| Canada’s S&T capacity is developed. | Canada’s rank in federal investment in higher education research and development (HERD) as a percentage of GDP | Leadership position in the G7 |

| Canada invests in skilled workers to drive innovation. | R&D workers in the workforce | Year-over-year increase |

| Knowledge Infrastructure Program: Provide economic stimulus in local economies across Canada through infrastructure investments at post-secondary institutions |

Total value of approved projects at colleges and universities | $2 billion by October 31, 2011 |

Programming in this area supports Theme I: Theme I: Addressing Climate Change and Air Quality.

Programming in this area supports Theme I: Theme I: Addressing Climate Change and Air Quality.

Planning highlights and benefits for Canadians

Innovation is a major driver of productivity growth. Scientific discoveries and new technologies provide solutions to many of the issues that are important to Canadians and contribute to a higher standard of living and better quality of life. The Government of Canada remains committed to strengthening the effectiveness of its investments in S&T, which were outlined in its S&T strategy, to ensure that Canadians benefit from scientific innovation.

In fulfilling commitments made in the S&T strategy, the Department will continue to provide science policy advice. It will do so in collaboration with its portfolio agencies, other science-based departments and agencies, the provinces and territories, and the regional development agencies.

The Department will also continue to support the Science, Technology and Innovation Council (STIC). The STIC, an advisory body established under the S&T strategy, provides the Government of Canada with policy advice on S&T issues. Industry Canada, in collaboration with the STIC, will produce and launch the 2010 State of the Nation report on Canada’s science, technology and innovation system. The report will provide an assessment of Canada’s research and innovation as well as its S&T performance against international standards of excellence to ensure that commitments made in the S&T strategy are fulfilled.

Industry Canada will focus on developing S&T and innovation policies to foster business innovation and to promote science and an entrepreneurial culture. This will be informed by economic research and analysis and consultations with Canadian and international partners.

Industry Canada will continue to monitor the effectiveness of research funding. Together with partners such as the federal granting councils, National Research Council Canada, the Canada Foundation for Innovation and Genome Canada, the Department will measure and maximize the impact of these investments to ensure that they advance S&T in Canada.

Industry Canada will also continue to provide science policy advice and policy frameworks and work with portfolio agencies to fulfill commitments made in the S&T strategy in the following priority areas: health and related life sciences,

environmental science and technologies, natural resources and energy, and information and communication technologies3.

Industry Canada will also continue to provide science policy advice and policy frameworks and work with portfolio agencies to fulfill commitments made in the S&T strategy in the following priority areas: health and related life sciences,

environmental science and technologies, natural resources and energy, and information and communication technologies3.

Through these activities and its work with portfolio partners, other government departments and external stakeholders from the private and public sectors, Industry Canada will endeavour to promote scientific excellence and foster an environment that is conducive to innovation.

Highlights of challenges and risk areas

Private sector investment in R&D in Canada continues to lag behind other countries, despite the Government of Canada’s considerable investment in business R&D. As announced in Budget 2010, an independent expert panel was created to review federal support of business R&D and make recommendations to maximize the impact of these initiatives. The panel will report back to the Minister of State for Science and Technology in October 2011.

Canada’s Economic Action Plan

The Knowledge Infrastructure Program (KIP), which was introduced in Budget 2009, provides funding of up to $2 billion over two years for R&D infrastructure projects at post-secondary institutions. On December 2, 2010, the Government of Canada announced that the program would be extended until October 31, 2011.

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | |||

| FTEs | Planned Spending | FTEs | Planned Spending | FTEs | Planned Spending |

| 377 | 38.2 | 366 | 37.5 | 365 | 37.5 |

* Minor differences are due to rounding.

| Expected Results | Performance Indicators | Targets |

|---|---|---|

| Industry Canada policy-making and program development sectors are made aware of new and emerging communication technologies and are provided with the technical information they need to make well-informed decisions. | Number of new and emerging communication technologies for which Communications Research Centre Canada (CRC) has provided advice or input to Industry Canada for the development of policy, standards and regulations and for contributions to international forums (e.g. the International Telecommunication Forum, or ITU) | 10 new technologies for which advice is sought or for demonstration |

| Canadian government departments and agencies (National Defence, Canadian Radio-television and Telecommunications Commission, Canadian Space Agency) are provided with the information they need to make well-informed decisions on new communication technologies. | Level of funding received from other federal government departments to conduct research and testing on communication technologies | $7 million |

| Canadian telecommunications companies realize industrial and economic benefits from CRC intellectual property (IP) and technology transfer. | IP revenue and contracting-in money received by CRC | $2 million |

Planning highlights and benefits for Canadians

Industry Canada is committed to a competitive Canadian ICT sector. Support for the development of new products and services for the ICT sector is provided through the CRC. In addition, the CRC enables Industry Canada to provide technical information to support well-informed decisions on such issues as cyber security, the transition to digital television, the sharing of the television spectrum and the implementation of digital radio and mobile television. Industry Canada will continue to support R&D activities targeted at promoting the adoption of innovative ICT applications.

Industry Canada will support the development of technologies to improve spectrum efficiency for intelligent radio, prediction of ultra high frequency (UHF), environment and white space interference, propagation analysis and wireless network convergence, as well as to increase information broadcasting capacity and quality through audio-visual coding, modulation and interference mitigation.

In addition, Industry Canada will support R&D in the following areas:

- technologies and infrastructure used in emergencies, with the purpose of improving technologies for rapidly deployable and interoperable radio and public alerting; and

- technologies and infrastructure for network attacks, emergency alerting and response, search and rescue, and surveillance and sensing, with the purpose of improving network security and public safety.

The Department will coordinate, at the national level, ICT-related international S&T agreements and participate in various international research consortiums.

Results of ICT-related R&D will be submitted to international organizations’ technical panels and working groups in support of Canadian interests in the areas of, for example, propagation (ITU-R WP3) and international search and rescue satellite systems.

Industry Canada will also investigate the use of broadcasting, satellite, wireless and optical communications systems to improve and expand broadband access.

The Department will develop and support new technology in the area of energy efficiency and greenhouse gas reduction as well as produce a report on the Smart Grid program.

These plans will be undertaken to support the development of ICT capacity and to close the innovation gap by facilitating the transfer of new technologies to Canadian industry.

Highlights of challenges and risk areas

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | |||

| FTEs | Planned Spending | FTEs | Planned Spending | FTEs | Planned Spending** |

| 88 | 431.9 | 88 | 462.6 | 88 | 323.3 |

* Minor differences are due to rounding.

| Expected Results | Performance Indicators | Targets |

|---|---|---|

| Investment in leading-edge R&D in targeted Canadian industries | Dollar value of disbursements to firms for R&D activities | $361.4 million |

| Dollars of investment leveraged per dollar of Industry Canada investments in R&D projects | $2.00 | |

| Development and commercialization of new and improved products, processes and services | Nature and extent of new and improved technologies developed | Description of technologies developed and commercialized |

Programming in this area supports Theme I: Theme I: Addressing Climate Change and Air Quality.

Programming in this area supports Theme I: Theme I: Addressing Climate Change and Air Quality.

Planning highlights and benefits for Canadians

Through strategic support of R&D projects, Industry Canada contributes to the advancement of Canada’s innovation capacity and expertise and to the creation and retention of jobs in Canada.

The Department will continue to effectively monitor the aerospace innovation program, manage its partnerships, and implement the Strategic Aerospace and Defence Initiative (SADI), thereby enhancing Canada’s capacity for R&D and the commercialization of new technologies in the Canadian aerospace industry.

The Industrial Technologies Office (ITO) will implement a performance management strategy to ensure that SADI’s benefits and results are being clearly communicated and to demonstrate that its objectives are being met.

To improve client service and increase efficiency without compromising due diligence, ITO will implement new measures to reduce the processing time for amendments to SADI and Technology Partnerships Canada contribution agreements.

The Automotive Innovation Fund will continue until 2013. This $250-million fund provides the automotive sector with support for strategic, large-scale R&D projects to develop innovative, greener and more fuel-efficient vehicles.

The Automotive Innovation Fund will continue until 2013. This $250-million fund provides the automotive sector with support for strategic, large-scale R&D projects to develop innovative, greener and more fuel-efficient vehicles.

By delivering on these plans, Industry Canada will help increase the capacity of Canadian firms to participate in leading-edge R&D and S&T innovation.

Highlights of challenges and risk areas

Given how rapidly technology advances and changes, Industry Canada faces the uncertainty that certain funded projects could become redundant or non-competitive. To address this, the Department considers the effect of technological change when analyzing the expected performance of key industries and leading firms.

2.3 Canadian businesses and communities are competitive

2.3 Canadian businesses and communities are competitive

Canada’s competiveness in the global economy may be attributable to the productivity of Canadian firms, as they are the generators of wealth, innovation, investment and employment within the economy. They will continue to face challenges as a result of increasing global competition. The Department therefore continues to strive to maximize Canadian productivity and competitiveness and enable Canadian industries to take advantage of opportunities and respond to risks, link into global value chains, and build and strengthen partnerships both domestically and internationally. The goal is for competitive and adaptable Canadian industries to have the knowledge and capacity to respond appropriately to external shocks within an uncertain economic climate and to compete internationally.

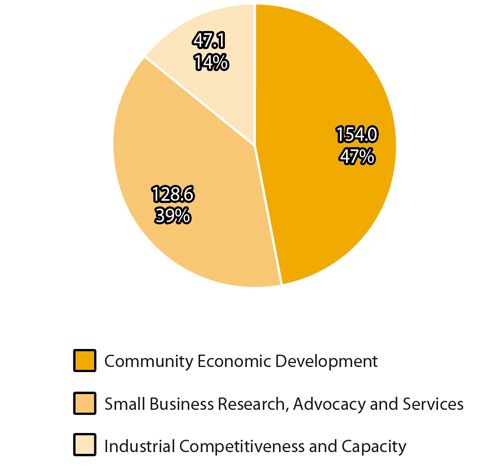

Breakdown of 2011–12 Planned Spending by Program Activity ($ millions)

Canada is facing challenges in its productivity growth, which affects its ability to attract foreign investment. There is increasing competition for investment from emerging economies that were not affected as significantly by the recession.

| Financial Resources ($ millions)* | Human Resources (FTEs) | |||||

|---|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | 2011–12 | 2012–13 | 2013–14 | |

| 329.8 | 276.2 | 259.2 | 592 | 561 | 562 | |

* Minor differences are due to rounding.

To ensure that Canadian businesses and communities are competitive, Industry Canada collaborates with businesses, governments and industry to enhance the recognition of Canadian industrial capabilities and to identify and address opportunities and risks affecting industry competitiveness within the globalized marketplace.

Additionally, Industry Canada supports small and medium-sized enterprises (SME), which play a role in and contribute to Canada’s economic well-being, by facilitating their access to financing and through capacity building in both physical infrastructure and ICT. Industry Canada works collaboratively with federal departments, the provinces and territories, and industry to gather knowledge about such sectors as ICT, energy, life sciences, automotive, services, and aerospace and defence to ensure that government policies and programs effectively support the competitiveness of these sectors. This increases the capacity of firms and communities across Canada to participate in a knowledge-based economy. This is one way in which the Department promotes business growth, entrepreneurship and community development.

Industry Canada further contributes to ensuring that Canadian businesses and communities are competitive by

- supporting the growth and competitiveness of small business and encouraging entrepreneurship;

- helping Canadian industries develop the capacity to adapt to the ever-changing economic landscape, respond appropriately to external shocks, and innovate and compete internationally;

- applying expertise to develop and contribute to policy, legislation and regulations and to engage various public and private stakeholders in strengthening Canada’s industrial capacity;

- encouraging growth and economic diversification to create sustainable communities; and

- informing communities about access to the infrastructure that is essential for participating in today’s economy by reporting on results of the Broadband Canada: Connecting Rural Canadians program.

The following key activities will support this strategic outcome:

- providing support to the Advisory Committee on Small Business and Entrepreneurship as it looks at ways to improve small business access to federal programs and services, which is one element of the Paperwork Burden Reduction Initiative;

- continuing to improve services for small businesses, saving them time and effort when seeking information on government programs and services;

- implementing recommendations from audits and evaluations of programs;

- encouraging and promoting the adoption and adaptation of new business processes, technologies and skills;

- monitoring and analyzing firms and trends in industry, thereby enabling the Department to advise stakeholders on key strategic issues and to bring an industry perspective to government decision making, policy formulation and business development; and

- implementing a digital economy strategy that is based on research, analysis and recommendations from stakeholder consultations.

By focusing on these activities in the coming years, Industry Canada will help support Canadian business competitiveness and productivity.

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | |||

| FTEs | Planned Spending | FTEs | Planned Spending | FTEs | Planned Spending |

| 123 | 128.6 | 123 | 127.4 | 122 | 124.4 |

* Minor differences are due to rounding.

| Expected Result | Performance Indicator | Target |

|---|---|---|

| Small businesses use government programs, tools and information. | Number of small businesses using government programs, tools and information to enhance their growth and competitiveness | 2,342,050 |

Planning highlights and benefits for Canadians

Industry Canada raises awareness across government of the challenges facing small businesses and provides statistical information about SMEs as well as analysis and expertise on SME-related issues, such as entrepreneurship, financing, innovation and growth firms. The Department also recommends policy options, works with SMEs to deliver programs that help support them and entrepreneurial activity across Canada, and provides analysis in relation to the Business Development Bank of Canada (BDC).

Industry Canada will support the Minister of Industry in the conduct of the 10-year legislative review of the BDC, which is to be conducted in consultation with the Minister of Finance. The Department will also support implementation of the resulting recommendations. The aim of the review is to encourage small business growth, competitiveness and entrepreneurship.

Based on the findings of the 2010 Comprehensive Review and discussions with stakeholders, improvements to the Canada Small Business Financing Program (CSBFP) are being developed. The aim of these improvements is to streamline the administrative process, make CSBFP loans more appealing for lenders to offer and mitigate the risks to government. The CSBFP helps to increase SMEs’ access to financing that would not otherwise be accessible without government support.

The Department will leverage partnerships to continue to deliver integrated business information service strategies for small business. It will also build and strengthen partnerships with other departments and agencies, other levels of government and national associations serving small business to increase awareness of the Canada Business Network, leverage access to content and identify future areas for collaborating on service-to-business delivery. This will ensure that SMEs have the necessary information to make informed business decisions and will also facilitate business compliance.

By continuing to assist SMEs in their adoption of e-business strategies through student internships, Industry Canada will enhance the growth and competitiveness of small business and encourage entrepreneurship.

As a result of the Department's efforts in this program area, Canada’s entrepreneurs and SMEs will contribute to strengthening the Canadian economy as it continues to emerge from the recession.

Highlights of challenges and risk areas

Consultations in support of the 10-year legislative review of the BDC are ongoing. While the Senate report has been received, there could be delays in receiving other input. Given this, Industry Canada has developed a flexible action plan to monitor and track input and incorporate it during report development.

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | |||

| FTEs | Planned Spending | FTEs | Planned Spending** | FTEs | Planned Spending |

| 305 | 47.1 | 298 | 56.1 | 299 | 51.1 |

* Minor differences are due to rounding.

| Expected Results | Performance Indicators | Targets |

|---|---|---|

| Canadian industries have the capacity to prepare for and respond to risks and opportunities in domestic and global markets. | Canada’s ranking for “Value chain breadth” (indicator 11.05 of the World Economic Forum’s Global Competitiveness Report) | 33rd or better (based on 2010–11 report) |

| Canada’s ranking for “Firm-level technology absorption” (indicator 9.02 of the World Economic Forum’s Global Competitiveness Report) | 22nd or better | |

| Industry perspective is considered in policy, legislation, regulations and agreements. | Number of collaborative policy projects focused on industry competitiveness and adaptability | 46 |

Planning highlights and benefits for Canadians

Departmental officials engage with associations, governments and leading firms to help Canadian industries become more innovative, enter into global value chains, strengthen partnerships both domestically and internationally, attract investment and promote Canadian expertise.

Should the government adopt and release a Federal Tourism Strategy, Industry Canada would lead its implementation. The strategy would further articulate the federal government’s approach to supporting tourism, building on the four priorities announced by the Prime Minister in June 2009:

- encouraging product development and investments in Canadian tourism assets and products;

- facilitating ease of access and movement for travellers, while ensuring the safety and integrity of Canada’s borders;

- increasing awareness of Canada as a premier tourist destination, including federal tourism assets; and

- fostering an adequate supply of skills and labour to enhance visitor experiences through quality service and hospitality.

The Department will also work in collaboration with the private sector on the development of technology roadmaps, including the Soldier Systems

Technology Roadmap that supports Canada’s soldier modernization efforts. Working with partners such as other departments and agencies, councils, research institutions and the private sector, Industry Canada will guide the completion of the development phase and will help establish the framework for successful implementation of this modernization effort. Technology roadmaps encourage and

promote the identification of key emerging or disruptive technologies so that Canadian companies in sectors such as ICT, advanced materials, biotechnology and clean energy technologies can seize opportunities in domestic and global markets.

The Department will also work in collaboration with the private sector on the development of technology roadmaps, including the Soldier Systems

Technology Roadmap that supports Canada’s soldier modernization efforts. Working with partners such as other departments and agencies, councils, research institutions and the private sector, Industry Canada will guide the completion of the development phase and will help establish the framework for successful implementation of this modernization effort. Technology roadmaps encourage and

promote the identification of key emerging or disruptive technologies so that Canadian companies in sectors such as ICT, advanced materials, biotechnology and clean energy technologies can seize opportunities in domestic and global markets.

Industry Canada will continue to engage with industry associations, key firms, other federal government departments and other levels of government to enhance its understanding of issues related to competitiveness so as to better align policies and leverage programs to create an environment that fosters business innovation and encourages investment in key industries.

Through the Industrial and Regional Benefits policy, which provides the framework for using federal defence procurement to leverage long-term industrial and regional development within Canada, Industry Canada is working with partners to ensure that Canadian companies participate in, or move up, the global value chains associated with major defence contracts.

Industry Canada’s efforts in this program area will help Canadian industries develop the capacity to adapt to the ever-changing economic landscape, respond appropriately to external shocks, and innovate and compete internationally, thereby strengthening Canada’s industrial capacity.

Highlights of challenges and risk areas

In many countries, recovery from the recession is slower than in Canada. This, coupled with the relatively high Canadian dollar, may limit opportunities for Canadian firms to sell their products and invest in key global markets. To address this, Industry Canada is analyzing business, financial and investment factors; advising government stakeholders on the impact of changing market conditions on industrial competitiveness; and also advising industry stakeholders on strategic risks and opportunities.

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | |||

| FTEs | Planned Spending** | FTEs | Planned Spending | FTEs | Planned Spending |

| 164 | 154.0 | 140 | 92.7 | 141 | 83.7 |

* Minor differences are due to rounding.

| Expected Results | Performance Indicators | Targets |

|---|---|---|

| Targeted businesses and organizations in northern Ontario create economic growth. | Number of northern Ontario businesses and organizations created, expanded or maintained | 3,398 |

| The Broadband Canada: Connecting Rural Canadians program is expected to expand broadband coverage to as many unserved and underserved households in Canada as possible, beginning in 2009–10. | Percentage of projects completed by March 31, 2012 | 100 percent |

Planning highlights and benefits for Canadians

By means of program funding through FedNor, Industry Canada will support northern Ontario communities and businesses to ensure that they are competitive in the Canadian marketplace. To achieve this, Industry Canada will continue to provide financial support through the Northern Ontario Development Program (NODP), FedNor’s core program designed to promote economic growth, diversification, job creation and sustainable communities in northern Ontario. An evalution of the program and the renewal of its Terms and Conditions will create opportunities to improve how the program is delivered, to revise program priorities and to consider the implementation of new directions that are aligned with the changing needs of the federal government, local businesses, communities and the economy of the region.

The Department will also continue providing financial support to Community Futures organizations. In collaboration with other partners, these organizations provide economic stability and contribute to growth in northern Ontario through the creation of diversified economies and sustainable communities. This environment is essential for attracting investment, which further contributes to job creation. The Department’s implementation of audit and evaluation recommendations will ensure the optimal administration of this program, including increased transparency in and accountability for its administrative processes.

Also in northern Ontario, Industry Canada will implement recommendations from the evaluation of the Economic Development Initiative, which is part of the Government of Canada’s Roadmap for Canada’s Linguistic Duality 2008–2013: Acting for the Future. This initiative encourages sustainable economic growth in Ontario’s Francophone communities through activities that enhance the competitiveness of SMEs while responding to their needs. There will also be a focus on examining SMEs in these communities to identify economic development issues as well as opportunities.

Through these plans, Industry Canada will enable northern Ontario communities to be better positioned to attract and support business and community economic development.

Through the Computers for Schools program, refurbished computers are being distributed to schools, libraries and not-for-profit organizations across Canada. Another component of the program involves engaging youth interns to assist in computer refurbishment and ICT skills integration. Industry Canada will develop and implement a marketing, communications and outreach strategy to increase awareness of the program and highlight program improvements.

Highlights of challenges and risk areas

In response to northern Ontario’s changing economic climate, the NODP’s priorities will be realigned to achieve short- to medium-term, measurable results supporting the economic development and growth of northern Ontario communities and businesses. The NODP’s updated criteria and guidelines will be accessible through the FedNor website and provide Canadians with comprehensive information about the program.

2.4 Internal Services

2.4 Internal Services

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | |||

| FTEs | Planned Spending | FTEs | Planned Spending** | FTEs | Planned Spending |

| 1,595 | 143.6 | 1,595 | 127.1 | 1,599 | 124.6 |

* Minor differences are due to rounding.

Programming in this area supports Theme I: Theme I: Addressing Climate Change and Air Quality.

Programming in this area supports Theme I: Theme I: Addressing Climate Change and Air Quality.

Internal Services are groups of related activities and resources that are administered to support the needs of programs and other departmental obligations.

Internal Services include management and oversight services, public policy services, communications services, legal services, human resources (HR) management services, financial management services, information management services, information technology services, real property services, materiel services, acquisition services, and travel and other administrative services.

Internal Services involve only those activities and resources that apply across the Department, not those that are specific to a program.

In support of environmental sustainability, Industry Canada will continue to promote industry’s development and use of corporate social responsibility (CSR) management tools and the use of CSR standards in the Canadian marketplace*.

In support of environmental sustainability, Industry Canada will continue to promote industry’s development and use of corporate social responsibility (CSR) management tools and the use of CSR standards in the Canadian marketplace*.

As a participant in the Federal Sustainable Development Strategy (FSDS), Industry Canada contributes to Greening Government Operations targets through its Internal Services program activity. The Department contributes to Theme IV of the FSDS, specifically the following

target areas:

As a participant in the Federal Sustainable Development Strategy (FSDS), Industry Canada contributes to Greening Government Operations targets through its Internal Services program activity. The Department contributes to Theme IV of the FSDS, specifically the following

target areas:

- establish green procurement targets (including targets related to training, performance evaluations, and management processes and controls);

- recycle all surplus electronic and electrical equipment in an environmentally sound manner;

- reduce internal paper consumption per employee by 20 percent from 2006–07 levels;

- achieve an 8:1 ratio of employees to printing units;

- adopt a guide for greening meetings and events; and

- reduce greenhouse gas emissions from fleet vehicles by 17 percent from 2005–06 levels by 20203.

Highlights of challenges and risk areas

Successful recruitment, development and retention of the talent needed to create and maintain a productive, sustainable, adaptable, competent and diverse workforce is fundamental to the Department’s meeting its strategic outcomes. In response, Industry Canada has adopted a comprehensive approach to HR management and planning, including the development of a three-year People Management Strategy for Renewal and Results. This strategy includes a series of people management initiatives focused on the following four main priority areas: employee engagement and renewal, leadership development, HR service excellence and service improvement, and integrity and accountability.