ARCHIVED - Industry Canada - Report

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

2011-12

Report on Plans and Priorities

Industry Canada

The original version was signed by

The Honourable Christian Paradis

Minister of Industry and Minister of State (Agriculture)

Table of contents

- How to read this report

- Minister’s Message

-

Section 1: Departmental Overview

- 1.1 Raison d’être and responsibilities

- 1.2 Contribution to the Federal Sustainable Development Strategy

- 1.3 Program activity architecture

- 1.4 Planning summary

- 1.5 Contribution of priorities to strategic outcomes

- 1.6 Operating environment and risk analysis

- 1.7 Canada’s Economic Action Plan

- 1.8 Expenditure profile

- 1.9 Estimates by vote

- Section 2: Analysis of Program Activities by Strategic Outcome

- Section 3: Supplementary Information

- Section 4: Other Items of Interest

How to read this report

This Report on Plans and Priorities (RPP) presents Industry Canada’s 2011–12 plans for making progress toward its strategic outcomes through its program activities. The report contains an introductory message from the Minister, which summarizes the Department’s plans for serving Canadians and for contributing to government-wide objectives, followed by the four sections detailed below.

Section 1, Departmental Overview, contains the following:

- information on Industry Canada’s raison d’être and responsibilities;

- a quick view of Industry Canada’s framework of program activities and subactivities, which feed into and contribute to progress toward the Department’s three strategic outcomes;

- a summary of Industry Canada’s total financial and human resources;

- a summary of departmental plans at the program activity level, including planned spending, performance indicators and targets;

- a discussion of the Department’s operational and management priorities, including their links to the Department’s strategic outcomes;

- contextual information and a risk analysis explaining the effects of internal and external factors on the Department’s plans and priorities;

- a link to the 2011–12 Main Estimates on the Treasury Board of Canada Secretariat (TBS) website where the Department’s voted and statutory items may be found.

- the Department’s expenditure profile; and

Section 2, Analysis of Program Activities by Strategic Outcome, provides detailed information on Industry Canada’s plans at the program activity level and by strategic outcome, including planned spending and human resources, expected results, performance indicators and targets.

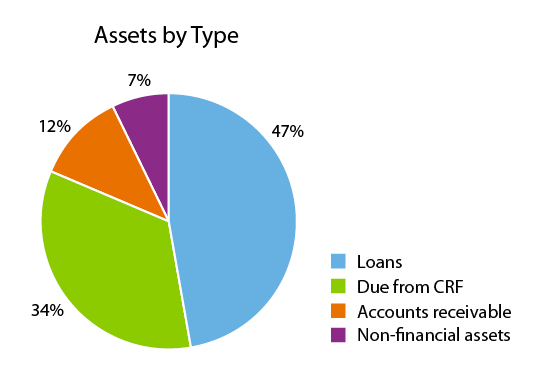

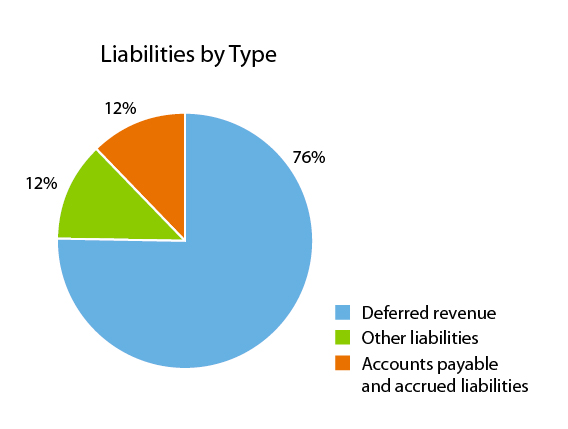

Section 3, Supplementary Information, includes highlights of Industry Canada’s financial position and provides a link to its future-oriented financial statements on the departmental website. This section also itemizes the Department’s supplementary information tables, which are available on the TBS website.

Section 4, Other Items of Interest, provides links to Industry Canada’s website, where information on the following may be found: information management and information technology at Industry Canada, titles and descriptions of Industry Canada’s program activities, a summary of departmental plans at the program subactivity level and the Department’s sustainable development activities.

In 2010–11, Industry Canada underwent a strategic review of its program expenditures as part of the government’s commitment to delivering programs and services that are efficient and effective, aligned with the priorities of Canadians and financially sustainable over the long term. Results of the strategic review were unavailable at the time this report was produced; however, an overview of the results is included in Budget 2011. Industry Canada’s 2011–12 Departmental Performance Report will elaborate on the results of the strategic review.

Due to rounding, figures may not add to the totals shown.

In our continuing effort to provide Canadians with online access to information and services, we are including web links to more information and highlights. These links are numbered and presented as endnotes.

We are committed to continuously improving our reporting and welcome your comments. Send comments by email to info@ic.gc.ca, by fax to 613-957-6543, or by mail to

Planning, Performance and Reporting Group

Comptrollership and Administration Sector

Industry Canada

2nd Floor, East Tower

235 Queen Street

Ottawa ON K1A 0H5

Minister’s Message

As Canada’s economy shows continued signs of growth following the global recession, the Harper government has a clear vision for Canada. We remain focused on creating jobs and economic growth in all regions of Canada. We remain committed to fighting protectionism, the number one impediment to global economic recovery. And we remain dedicated to supporting science, technology and innovation to improve the quality of life of Canadians.

In the coming year, Industry Canada and its Portfolio partners will seize the opportunities stemming from the evolving global economy. We will set the conditions for industrial success by improving policies we put in place, making strategic investments, and supporting business-focused programs and services. We are working to remove impediments to competition and to create the best climate for international investment. Industry Canada will lead efforts to develop major policy initiatives in support of Canada’s digital economy and to shape a whole-of-government strategy for federal tourism activities. The Department will also improve the cost-effectiveness and efficiency of its own operations and will work with recovering industries and sectors to help ensure a solid and prosperous future.

And, as always, I will work with my colleagues, the private sector and other governments to create the fundamentals for a strong and competitive economy.

It is my pleasure to present this year’s Report on Plans and Priorities for Industry Canada and its Portfolio partners.

Christian Paradis

Minister of Industry and Minister of State (Agriculture)

Section 1: Departmental Overview

1.1 Raison d’être and responsibilities

Mission

Industry Canada’s mission is to foster a growing, competitive, knowledge-based Canadian economy.

The Department works with Canadians throughout the economy, and in all parts of the country, to improve conditions for investment, improve Canada’s innovation performance, increase Canada’s share of global trade and build an efficient and competitive marketplace.

Mandate

Industry Canada’s mandate is to help make Canadian industry more productive and competitive in the global economy, thus improving the economic and social well-being of Canadians.

The many and varied activities Industry Canada carries out to deliver on its mandate are organized around three interdependent and mutually reinforcing strategic outcomes. Each outcome is linked to a separate key strategy, as outlined below. The key strategies are shown the figure below.

The Canadian marketplace is efficient and competitive

The Canadian marketplace is efficient and competitive

Advancing the marketplace

Industry Canada fosters competitiveness by developing and administering economic framework policies that promote competition and innovation; support investment and entrepreneurial activity; and instill consumer, investor and business confidence.

Advancements in science and technology, knowledge, and innovation strengthen the Canadian economy

Advancements in science and technology, knowledge, and innovation strengthen the Canadian economy

Fostering the knowledge-based economy

Industry Canada invests in science and technology to generate knowledge and equip Canadians with the skills and training they need to compete and prosper in the global knowledge-based economy. These investments help ensure that discoveries and breakthroughs happen here in Canada and that Canadians can realize the social and economic benefits.

Canadian businesses and communities are competitive

Canadian businesses and communities are competitive

Supporting business

Industry Canada encourages business innovation and productivity because businesses are the organizations that generate jobs and wealth creation. Promoting economic development in communities encourages the development of skills, ideas and opportunities across the country.

Under its founding legislation, the Department of Industry Act, Industry Canada is mandated not only to foster a growing, competitive, knowledge-based Canadian economy but also to promote sustainable development.

Industry Canada works on a broad range of matters related to industry and technology, trade and commerce, science, consumer affairs, corporations and corporate securities, competition, trade measurement, bankruptcy and insolvency, intellectual property, investment, small business, and tourism. Industry Canada is the Government of Canada’s centre of microeconomic policy expertise. The Department is composed of many organizational entities that have distinct mandates and diverse program activities, which are highly dependent on partnerships.

1.2 Contribution to the Federal Sustainable Development Strategy

Industry Canada is a participant in the Federal Sustainable Development Strategy (FSDS). The FSDS, with its inclusion of environmental sustainability and strategic environmental assessment as an integral part of government decision-making processes, represents a major step forward for the Government of Canada. Industry Canada’s contributions to the FSDS are presented in sections 2, 3 and 4 of this report.

Complete details on Industry Canada’s sustainable development activities are available on the Environment and Sustainability subsite of the departmental website. Industry Canada’s Greening Government Operations table, one of the supplementary information tables itemized in Section 3 of this report, is available on the Treasury Board of Canada Secretariat website. For complete details on the FSDS, please see the Environment Canada website.

The following icons, which correspond to the four environmental sustainability themes of the FSDS, will be used throughout this report to identify the departmental activities that support the FSDS.

Theme I: Addressing Climate Change and Air Quality

Theme I: Addressing Climate Change and Air Quality

Theme II: Maintaining Water Quality and Availability

Theme II: Maintaining Water Quality and Availability

Theme III: Protecting Nature

Theme III: Protecting Nature

Theme IV: Shrinking the Environmental Footprint – Beginning with Government

Theme IV: Shrinking the Environmental Footprint – Beginning with Government

1.3 Program activity architecture

This Report on Plans and Priorities is aligned with Industry Canada’s Management, Resources and Results Structure (MRRS). The MRRS provides a standard basis for reporting to parliamentarians and Canadians on the alignment of resources, program activities and results.

Industry Canada’s Program Activity Architecture (PAA) is an inventory of all of its programs. The programs are depicted in a logical and hierarchical relationship to each other and to the strategic outcome to which they contribute. The PAA also provides a framework through which to clearly link financial and non-financial resources to each program activity.

2010–11 and 2011–12 PAA crosswalk

Over the past year, Industry Canada has made changes to its PAA to ensure that it remains a complete and accurate inventory of Industry Canada programs.

Strategic Outcomes

Strategic Outcomes

Industry Canada’s strategic outcomes are long-term, enduring benefits to the lives of Canadians; reflect the Department’s mandate and vision; and are linked to Government of Canada priorities and intended results. Two of Industry Canada’s strategic outcomes have been updated in 2011–12: The strategic outcome “Science and technology, knowledge, and innovation are effective drivers of a strong Canadian economy” has been changed to “Advancements in science and technology, knowledge, and innovation strengthen the Canadian economy” and the strategic outcome “Competitive businesses are drivers of sustainable wealth creation” has been changed to “Canadian businesses and communities are competitive.” These changes were made to improve both measurability of the strategic outcomes and compliance with the MRRS instructions.

Removal of the Security and Prosperity Partnership program activity

Removal of the Security and Prosperity Partnership program activity

The Security and Prosperity Partnership of North America — Canadian Secretariat program activity has been removed because its funding expires on March 31, 2011, and will not be renewed.

Transfer of programs to FedDev Ontario

Transfer of programs to FedDev Ontario

A number of programs that were previously administered by Industry Canada have been transferred to FedDev Ontario. These include the Eastern Ontario Development Program, the Canada–Ontario Municipal Rural Infrastructure Program, the Ontario Municipal Rural Infrastructure Top-Up Program, the Ontario Potable Water Program, the Brantford Greenwich–Mohawk Remediation Project, the Canada Strategic Infrastructure Program and the Building Canada Program.

Streamlining of the structure

Streamlining of the structure

The structure of the PAA has been significantly streamlined in an effort to ensure its program activities and program subactivities appropriately reflect the programs and not the activities performed as part of a program. A result of this streamlining is that the 2011–12 PAA no longer contains any program sub-subactivities, thereby reducing the amount of overlap between the outcomes at different levels of the PAA. It also tells a more concise and clear performance story and reduces the repetition of performance data contained in the Performance Measurement Framework.

Changes to program titles and descriptions

Changes to program titles and descriptions

A number of programs were renamed and a number of program descriptions modified to reflect program changes or improve compliance with the MRRS instructions.

Industry Canada’s 2011–12 Program Activity Architecture

Strategic Outcome: The Canadian marketplace is efficient and competitive

Program Activities: Marketplace Frameworks and Regulations

Subactivities

- Measurement Canada

- Superintendent of Bankruptcy

- Corporations Canada

- Investment Review

- Intellectual Property

- Internal Trade Secretariat

Program Activities: Spectrum, Telecommunications and the Online Economy

Subactivities

- Spectrum Management and Telecommunications

- Electronic Commerce

Program Activities: Consumer Affairs

Program Activities: Competition Law Enforcement

Strategic Outcome: Advancements in science and technology, knowledge, and innovation strengthen the Canadian economy

Program Activities: Science, Technology and Innovation Capacity

Program Activities: Science, Technology and Innovation Capacity

Subactivities

- Government Science and Technology Policy Agenda

- Science and Technology Partnerships

Information and Communication Technologies Research and Innovation

Program Activities: Research and Development Financing

Program Activities: Research and Development Financing

Subactivities

- Automotive Innovation

- Aerospace Innovation

- Strategic Aerospace and Defence Initiative

- Technology Partnerships Canada

Strategic Outcome: Canadian businesses and communities are competitive

Program Activities: Small Business Research, Advocacy and Services

Subactivities

- Canada Small Business Financing

- Canada Business Network

- Small Business Internship

- Small Business Growth and Prosperity

Program Activities: Industrial Competitiveness and Capacity

Subactivities

- Industry-Specific Policy and Analysis

- Shipbuilding Capacity

- Industrial and Regional Benefits

Program Activities: Community Economic Development

Subactivities

- Community Futures

- Northern Ontario Development

- Computers for Schools

- Community Access

- Linguistic Duality and Official Languages

Internal Services

Internal Services

Legend:

Theme I: Theme I: Addressing Climate Change and Air Quality

Theme I: Theme I: Addressing Climate Change and Air Quality

Theme IV: Shrinking the Environmental Footprint – Beginning with Government

Theme IV: Shrinking the Environmental Footprint – Beginning with Government

1.4 Planning summary

Industry Canada’s financial and human resources

The following two tables present Industry Canada’s financial resources and human resources, expressed as full-time equivalents (FTE), for the next three fiscal years.

| 2011–12 | 2012–13 | 2013–14 |

|---|---|---|

| 1,407.5** | 1,425.7 | 1,147.1*** |

* Minor differences are due to rounding.

| 2011–12** | 2012–13** | 2013–14 |

|---|---|---|

| 5,649 | 5,622 | 5,633> |

Summary by strategic outcome

| Performance Indicators | Targets |

|---|---|

|

|

|

|

|

|

| Program Activity | Forecast Spending 2010–11 |

Planned Spending ($ millions)* |

Alignment to Government of Canada Outcomes | ||

|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | |||

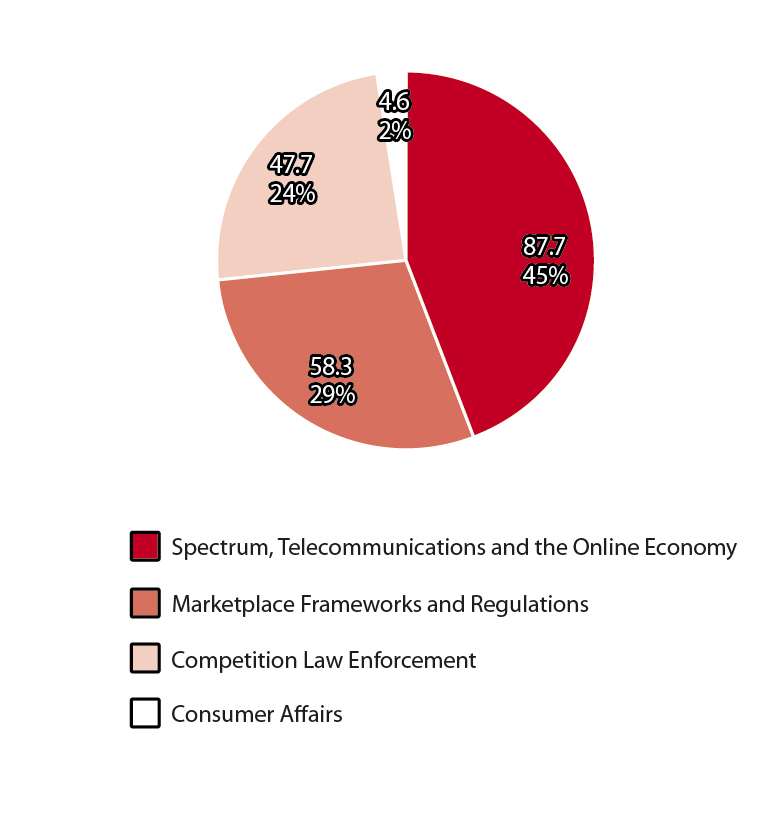

| Marketplace Frameworks and Regulations | 68.0 | 58.3 | 56.3 | 62.0 | Economic Affairs: A Fair and Secure Marketplace |

| Spectrum,Telecommunications and the Online Economy | 90.8 | 87.7 | 86.3 | 86.2 | Economic Affairs: A Fair and Secure Marketplace |

| Consumer Affairs | 4.7 | 4.6 | 4.6 | 4.6 | Economic Affairs: A Fair and Secure Marketplace |

| Competition Law Enforcement | 46.9 | 47.7 | 48.8 | 48.8 | Economic Affairs: A Fair and Secure Marketplace |

| Total Planned Spending | 198.3 | 196.0 | 201.7 | ||

* Minor differences are due to rounding.

| Performance Indicators | Targets |

|---|---|

|

|

|

|

|

|

| Program Activity | Forecast Spending 2010–11 |

Planned Spending ($ millions)* |

Alignment to Government of Canada Outcomes | ||

|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | |||

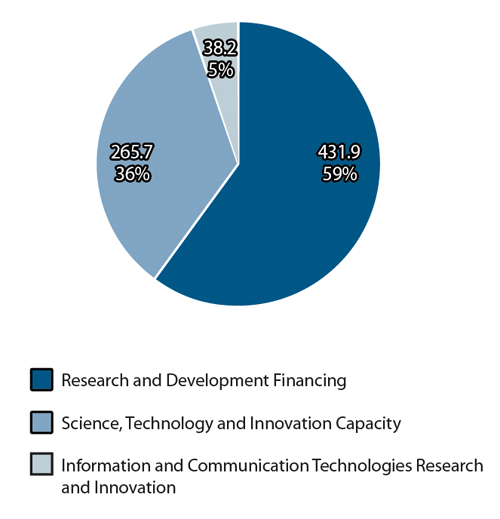

| Science, Technology and Innovation Capacity1 | 1,309.4 | 265.7 | 326.4 | 200.8 | Economic Affairs: An Innovative and Knowledge-based Economy |

| Information and Communication Technologies Research and Innovation | 43.6 | 38.2 | 37.5 | 37.5 | Economic Affairs: An Innovative and Knowledge-based Economy |

| Research and Development Financing2 | 358.6 | 431.9 | 462.6 | 323.3 | Economic Affairs: An Innovative and Knowledge-based Economy |

| Total Planned Spending | 735.8 | 826.4 | 561.6 | ||

* Minor differences are due to rounding.

| Performance Indicators | Targets |

|---|---|

|

|

|

|

|

|

| Program Activity | Forecast Spending 2010–11 |

Planned Spending ($ millions)* |

Alignment to Government of Canada Outcomes | ||

|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | |||

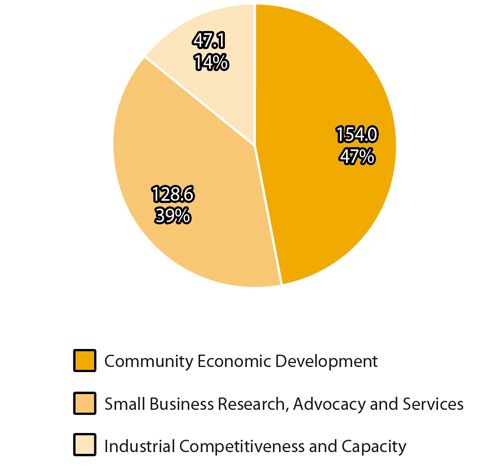

| Small Business Research, Advocacy and Services | 140.0 | 128.6 | 127.4 | 124.4 | Economic Affairs: Strong Economic Growth |

| Industrial Competitiveness and Capacity1 | 89.6 | 47.1 | 56.1 | 51.1 | Economic Affairs: Strong Economic Growth |

| Community Economic Development2 | 212.8 | 154.0 | 92.7 | 83.7 | Economic Affairs: Strong Economic Growth |

| Security and Prosperity Partnership of North America — Canadian Secretariat3 | 2.2 | — | — | — | |

| Total Planned Spending | 329.8 | 276.2 | 259.2 | ||

* Minor differences are due to rounding.

| Program Activity | Forecast Spending 2010–11 |

Planned Spending ($ millions)* | ||

|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | ||

| Internal Services1 | 169.3 | 143.6 | 127.1 | 124.6 |

* Minor differences are due to rounding.

1.5 Contribution of priorities to strategic outcomes

Operational priorities

| Operational Priority: Ensure marketplace policies help promote competition and instill consumer and investor confidence |

Type:1 Ongoing |

Strategic Outcome: The Canadian marketplace is efficient and competitive |

|---|---|---|

|

Why this is a priority

|

||

|

Plans for meeting the priority

|

||

| Operational Priority: Foster business innovation |

Type: Ongoing |

Strategic Outcome: Advancements in science and technology, knowledge, and innovation strengthen the Canadian economy |

|---|---|---|

|

Why this is a priority

|

||

|

Plans for meeting the priority

|

||

| Operational Priority: Invest in science and technology (S&T) to enhance the generation and commercialization of knowledge |

Type: Ongoing |

Strategic Outcome: Advancements in science and technology, knowledge, and innovation strengthen the Canadian economy |

|---|---|---|

|

Why this is a priority

|

||

|

Plans for meeting the priority

|

||

| Operational Priority: Foster internationally competitive businesses and industries |

Type: Ongoing |

Strategic Outcome: Canadian businesses and communities are competitive |

|---|---|---|

|

Why this is a priority

|

||

|

Plans for meeting the priority

|

||

| Operational Priority: Promote business growth, entrepreneurship and community development |

Type: Ongoing |

Strategic Outcome: Canadian businesses and communities are competitive |

|---|---|---|

|

Why this is a priority

|

||

|

Plans for meeting the priority

|

||

Management priorities

| Management Priority: People management |

Type:* Ongoing |

Strategic Outcome: All strategic outcomes |

|---|---|---|

|

Why this is a priority

|

||

|

Plans for meeting the priority

|

||

| Management Priority: Financial management |

Type: Ongoing |

Strategic Outcome: All strategic outcomes |

|---|---|---|

|

Why this is a priority

|

||

|

Plans for meeting the priority

|

||

| Management Priority: Internal audit |

Type: Ongoing |

Strategic Outcome: All strategic outcomes |

|---|---|---|

|

Why this is a priority

|

||

|

Plans for meeting the priority

|

||

| Management Priority: Management of business communication tools |

Type: New |

Strategic Outcome: All strategic outcomes |

|---|---|---|

|

Why this is a priority

|

||

|

Plans for meeting the priority

|

||

| Management Priority: Asset and materiel management |

Type: New |

Strategic Outcome: All strategic outcomes |

|---|---|---|

|

Why this is a priority

|

||

|

Plans for meeting the priority

|

||

1.6 Operating environment and risk analysis

Global context

Over the past year, Canada has recovered rapidly from the recession. Close to 400,000 jobs have been created since July 2009 — the strongest job growth in the G7 — and the economy has grown for five straight quarters. The unemployment rate has been declining, as economic growth and job creation are being buoyed by strong commodity prices, more sustained private sector demand, rising exports, increased business investment, and timely and strategic investments under Canada's Economic Action Plan. While Canada's medium-term growth prospects are healthy, there remains some uncertainty about the trajectory of the broader global economic recovery, which may lead to a moderation in Canada's growth outlook.

Rising commodity prices are supporting several resource-based industries, while the improved U.S. economic outlook is benefitting various export sectors. Private business investment is growing rapidly as firms take advantage of the strong dollar to import more productivity-enhancing machinery and equipment.

The Canadian economy faces several risks. The strong Canadian dollar and high household debt could constrain the growth of non-resource-related industries and private consumption, respectively. Global risks include weak domestic demand in most advanced economies, inflation in emerging economies, global trade imbalances and uncertainty in European sovereign debt markets. Risks related to global trade barriers and to government currency manipulation persist, despite progress by some countries in reducing investment restrictions and advancing trade negotiations.

Over the medium to long term, the Canadian economy will face pressures from an aging population and the changing global economic environment unless productivity improvements can make up for Canada's slowing labour force growth.

In addition, Canadian industries will be challenged to respond to intensifying global competition, the demand for new goods and services, and environmental and sustainability considerations. Industries will face pressure to expand their global reach, integrate into global supply chains and adopt cutting-edge new technologies.

Overall, Industry Canada is well positioned to continue supporting Canadian businesses and industries by helping them understand and exploit the changing global economic landscape; by promoting skills development and sector-specific knowledge growth; and by fostering business innovation, competitiveness and productivity.

Industry Canada risk context

Through the implementation of a tailored integrated risk management approach, Industry Canada has taken steps to proactively address some of the key risks that may impede the Department’s overall ability to deliver on its mandate. This approach meets the Department’s needs for sound risk management and allows it to monitor the mitigation strategies and action plans for its corporate risks. In 2011–12, Industry Canada will also continue to implement strong governance, oversight and risk management practices. The following table presents Industry Canada’s corporate risks and associated challenges and their alignment to departmental priorities. Highlights of program-specific risks and mitigation actions are presented in Section 2 of this report.

| Corporate Risks and Challenges* | Highlights of Alignment to Departmental Priorities** |

|---|---|

| Fully advancing a regulatory and policy framework that will ensure the continued evolution of telecommunications and wireless infrastructure | This aligns with Industry Canada’s operational priorities related to ensuring marketplace policies help promote competition and instill consumer and investor confidence; fostering business innovation; and investing in science and technology to enhance the generation and commercialization of knowledge. |

| Managing expectations and maintaining Industry Canada’s reputation among stakeholder groups, the public and the media | This aligns with Industry Canada’s operational priorities related to ensuring marketplace policies help promote competition and instill consumer and investor confidence; fostering business innovation; investing in science and technology to enhance the generation and commercialization of knowledge; fostering internationally competitive businesses and industries; and promoting business growth, entrepreneurship and community development. |

| Meeting the shifting and emerging priorities and demands of the recovering economy may affect Industry Canada’s ability to support program delivery and meet departmental and government priorities | This aligns with Industry Canada’s operational priorities related to ensuring marketplace policies help promote competition and instill consumer and investor confidence; fostering business innovation; investing in science and technology to enhance the generation and commercialization of knowledge; fostering internationally competitive businesses and industries; and promoting business growth, entrepreneurship and community development. |

| Responding to the current global economic environment and its shifting economic drivers may affect Industry Canada’s ability to appropriately support key stakeholders in their investment and innovation capacity and their ability to leverage leading-edge research and S&T discoveries | This aligns with Industry Canada’s operational priorities related to fostering business innovation and investing in science and technology to enhance entrepreneurship, community development, and the generation and commercialization of knowledge. |

Industry Canada will continue to update its Corporate Risk Profile as well as identify, monitor and mitigate corporate risks that may affect the Department’s ability to achieve its expected results and deliver its mandate.

Strategic review

Industry Canada underwent a strategic review in 2010–11. The strategic review process requires departments and agencies to review 100 percent of their programs with a view to better focusing programs and services, streamlining internal operations and transforming the way they do business, and achieving better results for Canadians. Through this process, organizations identify opportunities to redirect funding to other programs that meet the priorities of the government and Canadians. Results of the strategic review were unavailable at the time this report was produced; however, an overview of the results is included in Budget 2011. Industry Canada’s 2010–11 Departmental Performance Report will elaborate on the results of the strategic review.

1.7 Canada’s Economic Action Plan

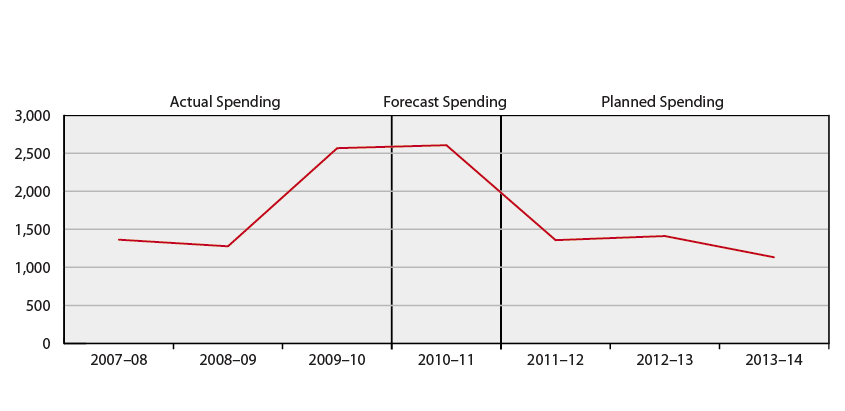

In Budget 2009: Canada’s Economic Action Plan, the Government of Canada announced a set of initiatives aimed at providing a quick recovery from the economic downturn and ensuring long-term economic growth and prosperity for Canadian businesses and individuals. These initiatives were to be implemented over a two-year time frame ending on March 31, 2011. This resulted in a temporary increase in Industry Canada’s spending for 2009–10 and 2010–11.

On December 2, 2010, the Government of Canada announced that the deadline for completing infrastructure projects under Canada’s Economic Action Plan would be extended from March 31, 2011, to October 31, 2011. The Knowledge Infrastructure Program is the only Industry Canada program affected by this announcement.

1.8 Expenditure profile

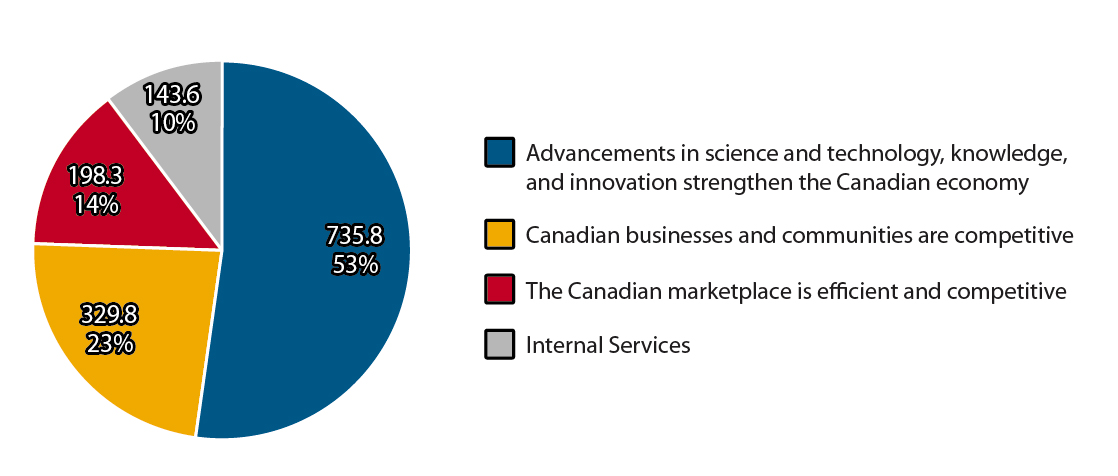

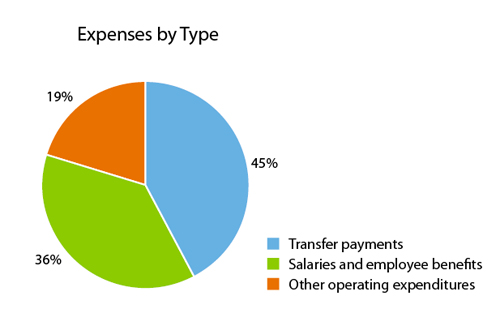

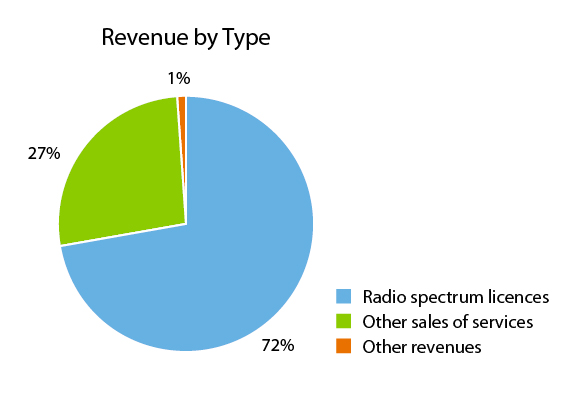

Industry Canada’s total planned spending for 2011–12 is $1.41 billion. The majority of planned spending is directed at Industry Canada’s three strategic outcomes, with a cost-effective 10 percent being allocated to Internal Services.

Industry Canada will continue to implement strategies to ensure efficient use of its operating budget to better deliver benefits to Canadians.

Breakdown of 2011–12 Planned Spending by Strategic Outcome ($ millions)

A focus on efficient, high-performing programs will allow Industry Canada to continue to effectively deliver its mandate, with a reduced operating budget, in the coming years and adapt to evolving government priorities. More than ever, the results of audits, evaluations and strategic reviews will be critical to planning, setting priorities and allocating resources.

Spending Trend ($ millions)

The figure below illustrates Industry Canada’s spending trend from 2007–08 to 2013–14.

Spending Trend ($ millions)

The increase in spending in 2009–10 and 2010–11 was primarily related to Canada’s Economic Action Plan. The decrease in spending in 2013–14 is mainly related to the Automotive Innovation Fund, which is scheduled to end in 2012–13, as well as decreases in funding to the Bombardier CSeries program, the Strategic Aerospace and Defence Initiative and the Canada Foundation for Innovation.

1.9 Estimates by vote

For information on Industry Canada’s votes and statuatory expenditures, please see the 2011–12 Main Estimates on the Treasury Board of Canada Secretariat website.

Section 2: Analysis of Program Activities by Strategic Outcome

2.1 The Canadian marketplace is efficient and competitive

2.1 The Canadian marketplace is efficient and competitive

The global economy continues to emerge from the economic downturn, and growth continues to be slow and uneven, resulting in significant uncertainty in the global marketplace. Therefore, the Canadian marketplace requires effective frameworks and regulations to provide businesses and consumers with some degree of certainty and predictability and to ensure that Canadian firms have every opportunity to innovate and succeed within current market conditions. Efficient marketplace frameworks and regulations are also necessary to facilitate competitiveness and to build and maintain consumer and investor confidence.

Breakdown of 2011–12 Planned Spending by Program Activity ($ millions)

Industry Canada strives to achieve an efficient and competitive marketplace by developing, implementing and enforcing policies that are fundamental to the effective functioning of a market. These policies strengthen Canada’s capacity for innovation, competition and productivity, which are key drivers of the economy.

| Financial Resources ($ millions)* | Human Resources (FTEs) | |||||

|---|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | 2011–12 | 2012–13 | 2013–14 | |

| 198.3 | 196.0 | 201.7 | 2,928 | 2,943 | 2,950 | |

* Minor differences are due to rounding.

Industry Canada contributes to an efficient and competitive Canadian marketplace by

- delivering sound regulatory regimes and frameworks and ensuring compliance with these regulatory regimes and frameworks, which include regulations, policies, procedures and standards for bankruptcy and insolvency, foreign direct investment, competition, internal trade, federal incorporations, intellectual property, trade measurement, radio frequency spectrum and telecommunications;

- securing Canada’s interest in the international regulation of radio frequency spectrum and telecommunications to protect Canadian access to spectrum and satellite orbit resources;

- providing support to existing federal not-for-profit corporations when the new provisions of the Canada Not-for-profit Corporations Act come into force; developing regulations to meet the needs of the not-for-profit sector; providing policies, guidelines and accessible tools to assist not-for-profit corporations in meeting statutory and regulatory obligations; and providing client-oriented services that are responsive and accessible;

- ensuring that consumers and investors are protected and have access to an honest, sound, safe and competitive marketplace, enabling them to be effective marketplace participants; and

- administering and enforcing, among others, the Competition Act, the Consumer Packaging and Labelling Act, the Textile Labelling Act, the Weights and Measures Act, the Electricity and Gas Inspection Act, the Bankruptcy and Insolvency Act, the Companies’ Creditors Arrangement Act, the Canada Business Corporations Act, the Investment Canada Act, the Radiocommunication Act, the Telecommunications Act and the Precious Metals Marking Act.

The following key activities will support this strategic outcome:

- monitoring domestic and international developments, including but not limited to technological and scientific developments, international financial trends, changes in other countries’ marketplace policy directions and international agreements, with a view to modernizing Canadian marketplace frameworks to promote competition and innovation, which is conducive to productivity growth and prosperity;

- ensuring clear and transparent rules govern foreign investment and maintain an internationally competitive marketplace environment that will attract investment and support economic growth in Canada;

- continuing to work in collaboration with partners to reduce unnecessary barriers to private sector cross-border data flow;

- administering the new provisions of the Canada Not-for-profit Corporations Act when they are brought into force (expected to come into force in June 2011);

- advancing next-generation networks by implementing and monitoring Broadband Canada projects, updating coverage maps and developing policy options for next steps;

- supporting cyber security and emergency telecom services and negotiating mutual recognition agreements (MRA) for conformity assessment of telecommunications equipment;

- securing Canadian interests in treaty revisions to both the international Radio Regulations and Telecommunications Regulations;

- improving accessibility and effective use of intellectual property information; and

- preventing anti-competitive mergers and combatting abuse of market dominance, domestic cartels and fraud in the digital economy through targeted enforcement action.

By focusing on these key activities in the coming years, Industry Canada will help improve the Canadian business environment, providing consumers and investors with access to a competitive marketplace.

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | |||

| FTEs | Planned Spending | FTEs | Planned Spending | FTEs | Planned Spending |

| 1,770 | 58.3 | 1,782 | 56.3 | 1,787 | 62.0 |

* Minor differences are due to rounding.

| Expected Result | Performance Indicator | Target |

|---|---|---|

| Legislation, regulations and policy are in place and are administered for Canadian markets. | Percentage of cases for which regulatory time frames or service standards are met | 80 percent |

Planning highlights and benefits for Canadians

Industry Canada will implement and administer the new provisions of the Canada Not-for-profit Corporations Act, which are expected to come into force in 2011–12. The Act will establish a modern governance framework for not-for-profit corporations and allow them to incorporate faster and be more efficient and effective in the competitive marketplace.

In response to stakeholder requests that NUANS become the single comprehensive source of corporate names used in all Canadian federal, provincial and territorial jurisdictions, Industry Canada will continue its efforts to have NUANS adopted Canada-wide by the 2014 target date.

Pending royal assent of the Fairness at the Pumps Act in 2010–11, which would amend the Weights and Measures Act and Electricity and Gas Inspection Act, Industry Canada will introduce mandatory frequencies for the inspection of measuring devices (e.g. scales, gas pumps), increased fines and administrative monetary penalties (AMP), which will align Canada with international practices for fair and accurate trade measurement and strengthen consumer and business protection against loss from inaccurate measurement.

The promotion of, and dissemination of information about, intellectual property (IP) in Canada will be ongoing, with a focus on the post-secondary education sector and intermediaries that support exporting small and medium-sized enterprises (SME). This will assure Canadians that their ideas and inventions are adequately protected, which in turn will support innovation in Canada.

Industry Canada will move forward with work aimed at modernizing IP legislation, aligning it with international IP administrative systems and treaties. This will better facilitate innovation and the commercialization of ideas, ensure effective rights enforcement, decrease uncertainty for businesses and inventors, and support inventors who operate on a global scale.

By improving conditions in the marketplace through the plans indicated above, Industry Canada will ensure that Canadians and Canadian businesses benefit from marketplace fairness, integrity, efficiency and competitiveness.

Highlights of challenges and risk areas

Pending royal assent of the Fairness at the Pumps Act in 2010–11, the introduction of AMPs will require Industry Canada to establish new processes and procedures to ensure the successful implementation of this new compliance strategy.

To effectively implement and administer the new provisions of the Canada Not-for-profit Corporations Act, Industry Canada must complete enhancements to its information technology system. The Department has developed a detailed project plan to ensure that the system is adequately prepared and that implementation is timely.

* Minor differences are due to rounding.

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | |||

| FTEs | Planned Spending | FTEs | Planned Spending | FTEs | Planned Spending |

| 703 | 87.7 | 719 | 86.3 | 721 | 86.2 |

| Expected Result | Performance Indicator | Target |

|---|---|---|

| Canada’s radiocommunication and telecommunications infrastructure and online economy are governed by an effective policy and regulatory framework. | Number of policies, legislation and regulations developed, updated or reviewed to strengthen the policy and regulatory framework | 5 |

Planning highlights and benefits for Canadians

Canada’s radiocommunication and telecommunications infrastructure and the online economy require modern, efficient and effective policy and regulatory frameworks. Demand continues to grow for advanced wireless services. This demand is driven by an expanding mobility market and broadband Internet access, which also require privacy protection. Industry Canada will undertake the development of policies, regulations, standards and treaties to support effective spectrum management and the provision of new wireless services.

Consultation on technical rules for auctions in both the 2500 MHz and 700 MHz bands will be completed and the results published. The auctioning of these bands will help support new mobile technologies and services in the Canadian marketplace and ensure that Canadians have sufficient and timely access to essential spectrum.

Industry Canada will implement anti-spam legislation, develop related regulations and establish a Spam Reporting Centre. Bill C-29, An Act to amend the Personal Information Protection and Electronic Documents Act (short title: the Safeguarding Canadians’ Personal Information Act), has been introduced to Parliament. Its purpose is to increase the protection of personal information in the online marketplace. Bill C-29 also requires that organizations report data breaches to the Privacy Commissioner and affected individuals.

A second statutory review of the Personal Information Protection and Electronic Documents Act (PIPEDA) will assess the effectiveness of the Act in the face of technological advances to ensure that it continues to effectively protect personal information in a commercial context and promote confidence in the online marketplace. Consultations with the provinces and territories will be held to align regimes for private sector privacy legislation, making it easier to understand and ensuring that Canadians have equivalent levels of privacy protection in Canada.

A cyber security strategy was launched by Public Safety Canada to protect Canadian governments, industries and consumers from cyber threats. In support, Industry Canada will implement the cyber security work plan, which includes risk analysis and mitigation of cyber security threats affecting the telecommunications infrastructure.

Industry Canada will be negotiating treaty revisions to the international Radio Regulations. Preparations, in consultation with private industry and other government departments, are underway. One of the key objectives of these treaty revisions is to secure and protect Canada’s interests in spectrum and satellite orbit resources. This includes facilitating communications across Canada and protecting Canadian sovereignty in remote areas through modern digital technologies.

Industry Canada plans to negotiate frequency-sharing arrangements with the U.S. to facilitate the deployment of new wireless systems. MRAs for conformity assessment of telecommunications equipment will be negotiated with trading partners so that Canadian standards pertaining to radiocommunications and telecommunications can be stipulated in international agreements and standards.

By delivering on these plans, Industry Canada will ensure that Canadians have access to advances in radiocommunications and telecommunications and to the online economy and that accompanying regulations are in place to sufficiently protect Canadians’ privacy.

Highlights of challenges and risk areas

Growth in mobile services over the next 10 years is expected to have an impact on spectrum availability and the ability to meet mobile services demands in a timely fashion. To ensure Canada does not lag in the new mobile Internet economy, Industry Canada is developing and implementing a multi-year plan to make spectrum available, to introduce market-based fees as an incentive for efficient use, and to update legislation to facilitate trade and reallocation of spectrum.

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | |||

| FTEs | Planned Spending | FTEs | Planned Spending | FTEs | Planned Spending |

| 23 | 4.6 | 23 | 4.6 | 23 | 4.6 |

* Minor differences are due to rounding.

| Expected Results | Performance Indicators | Targets |

|---|---|---|

| Citizens and policy-makers are aware of consumer issues in the Canadian marketplace. | Number of instances per year where consumer research and/or analysis contributes to consumer policy discussions | 3 |

| Number of visitors accessing information products on websites managed by the Office of Consumer Affairs (OCA) | 1.65 million | |

| Number of instances per year where research and analysis performed by consumer organizations supported by the OCA’s Contributions Program for Non-Profit Consumer and Voluntary Organizations contribute to policy discussions or media coverage | 12 |

Planning highlights and benefits for Canadians

In the current economic climate, the challenges facing consumers are ever changing and increasingly complex. Proactively addressing these challenges offers consumers some degree of certainty and is essential to maintaining their confidence in the marketplace. Industry Canada, through the OCA, will offer consumers information on areas where they may be particularly vulnerable and equip them with tools from the Canadian Consumer Handbook to help them make informed decisions, thereby contributing to a marketplace that is more efficient and competitive.

Industry Canada will continue to implement the OCA’s Partnership Strategy. This will expand the reach and impact of the analytical work that is performed to support federal, provincial and territorial deliberations.

In conjunction with the Consumer Measures Committee, Industry Canada will continue to explore measures to protect consumer interests through joint analysis of current consumer pressures in priority sectors and the sharing of best practices for regulatory compliance with federal, provincial and territorial consumer protection laws.

Industry Canada will implement a communications strategy for the anti-spam legislation, aimed at educating consumers and businesses about, and increasing their awareness of, spam and other online threats, which is critical for the safe use of the Internet. Creating the knowledge base, information and tools that lead to independent, safe and productive use of the Internet helps increase consumer confidence in the online marketplace.

Industry Canada will work with partners in other departments and international partners on a variety of consumer policy projects pertaining to sustainable consumption, consumer vulnerability and electronic commerce. International policy work will involve actively participating in the OECD’s Committee for Consumer Policy and various technical committees of the International Organization for Standardization (ISO) to modernize consumer protections in e-commerce, ensure environmental claims are meaningful and accurate, enhance consumer product safety, improve the readability of consumer utility bills and encourage social responsibility in organizations.

Through these actions, the interests of Canadian consumers will be better protected, and they will have access to tools and information to make informed decisions.

Highlights of challenges and risk areas

Consumers and businesses may not be aware of their roles and responsibilities regarding spam and other online threats under the new anti-spam legislation. In response, Industry Canada will implement a communications strategy, which will include an evaluation component, and provide information to educate stakeholders about the new legal provisions.

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | |||

| FTEs | Planned Spending | FTEs | Planned Spending | FTEs | Planned Spending |

| 432 | 47.7 | 419 | 48.8 | 419 | 48.8 |

* Minor differences are due to rounding.

| Expected Results | Performance Indicators | Targets |

|---|---|---|

| Canadian markets are competitive. | Estimated dollar savings per annum to consumers from Competition Bureau actions that stop anti-competitive activity | $330 million |

| Approximate percentage of Canada’s gross domestic product (GDP) subject to market forces | No less than 82 percent | |

| Businesses/individuals change their anti-competitive conduct following compliance interventions conducted by the Competition Bureau. | Percentage of recidivists | Less than 5 percent |

Planning highlights and benefits for Canadians

Well-designed competition law and effective competition law enforcement, including resolving cases of demonstrable benefit to consumers, promote increased efficiency and economic growth.

To ensure the Canadian marketplace is efficient and competitive, Industry Canada, through the Competition Bureau, will continue to vigorously and effectively enforce the laws under its jurisdiction. The Competition Bureau, as an independent law enforcement agency, ensures that Canadian businesses and consumers prosper in a competitive and innovative marketplace. The Competition Bureau will engage in enforcement actions targeting abuse of dominance and domestic cartels and will ensure timely and effective merger reviews, including resolution before the Competition Tribunal. In addition, the Competition Bureau will target fraud in the digital economy, particularly in the areas of health and the environment, and will continue to protect competitive markets by detecting, disrupting and deterring the most egregious forms of anti-competitive conduct.

Through the effective implementation of recent amendments to the Competition Act, the Competition Bureau will enhance its transparency and increase the predictability and effectiveness of its enforcement actions by using the full range of tools in the enforcement continuum, including litigation where necessary. Providing clarity and predictability to businesses and consumers is particularly important in the current uncertain economic climate.

Highlights of challenges and risk areas

What can be expected of the Competition Bureau and what it can accomplish with the new powers it will receive as a result of the anti-spam legislation may not be well understood by Canadians. The Competition Bureau will therefore ensure that the new enforcement provisions are effectively and efficiently implemented and will also develop a communications strategy to manage expectations.

2.2 Advancements in science and technology, knowledge, and innovation strengthen the Canadian economy

2.2 Advancements in science and technology, knowledge, and innovation strengthen the Canadian economy

Science and technology (S&T) are essential to building the knowledge-based economy of tomorrow. Fostering innovation and investing in S&T are fundamental to improving Canada’s productivity and global competitiveness. Canada holds a leading global position in some areas of the research and innovation system but faces challenges in other areas. Industry Canada supports a viable private sector innovation system and, in support of this objective, has launched a Research and Development Review Panel to determine how government support can best be used to advance and commercialize research. The Department works with its portfolio partners, the private sector, industry associations, academia and all levels of government to foster an environment that is conducive to innovation, scientific excellence and industrial competitiveness.

Breakdown of 2011–12 Planned Spending by Program Activity ($ millions)

It is through these relationships that the Department is helping to promote innovation, technology transfer and spinoffs as well as contributing to a skilled workforce and ensuring that Canadians and Canadian businesses benefit from an innovative and knowledge-based economy.

| Financial Resources ($ millions)* | Human Resources (FTEs) | |||||

|---|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | 2011–12 | 2012–13 | 2013–14 | |

| 735.8 | 826.4 | 561.6 | 534 | 523 | 522 | |

* Minor differences are due to rounding.

Industry Canada also supports further advancements in S&T, knowledge and innovation by focusing on the following:

- the attraction and retention of top research talent through effective S&T programs;

- the commercialization of Canadian research and development (R&D) and technology transfer to increase innovation;

- strategic, large-scale R&D projects in the automotive and aerospace sectors that support innovative, greener and more fuel-efficient vehicles and aircraft; and

- research in advanced telecommunications and information technologies to support the development of new products and services for the information and communication technologies (ICT) sector and the adoption of innovative ICT applications.

The following key activities will support this strategic outcome:

- advancing science policy advice and policy frameworks to fulfill commitments made in the multi-year science and technology strategy, Mobilizing Science and Technology to Canada’s Advantage – 2007;

- producing and launching the 2010 State of the Nation report on Canada’s science, technology and innovation system;

- working with portfolio agencies to ensure funding programs promote private sector innovation; and

- consulting and collaborating with external stakeholders and counterparts in other science-based departments to improve Canada’s science and innovation system.

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | |||

| FTEs | Planned Spending** | FTEs | Planned Spending*** | FTEs | Planned Spending |

| 69 | 265.7 | 69 | 326.4 | 69 | 200.8 |

* Minor differences are due to rounding.

| Expected Results | Performance Indicators | Targets |

|---|---|---|

| Canada’s S&T capacity is developed. | Canada’s rank in federal investment in higher education research and development (HERD) as a percentage of GDP | Leadership position in the G7 |

| Canada invests in skilled workers to drive innovation. | R&D workers in the workforce | Year-over-year increase |

| Knowledge Infrastructure Program: Provide economic stimulus in local economies across Canada through infrastructure investments at post-secondary institutions |

Total value of approved projects at colleges and universities | $2 billion by October 31, 2011 |

Programming in this area supports Theme I: Theme I: Addressing Climate Change and Air Quality.

Programming in this area supports Theme I: Theme I: Addressing Climate Change and Air Quality.

Planning highlights and benefits for Canadians

Innovation is a major driver of productivity growth. Scientific discoveries and new technologies provide solutions to many of the issues that are important to Canadians and contribute to a higher standard of living and better quality of life. The Government of Canada remains committed to strengthening the effectiveness of its investments in S&T, which were outlined in its S&T strategy, to ensure that Canadians benefit from scientific innovation.

In fulfilling commitments made in the S&T strategy, the Department will continue to provide science policy advice. It will do so in collaboration with its portfolio agencies, other science-based departments and agencies, the provinces and territories, and the regional development agencies.

The Department will also continue to support the Science, Technology and Innovation Council (STIC). The STIC, an advisory body established under the S&T strategy, provides the Government of Canada with policy advice on S&T issues. Industry Canada, in collaboration with the STIC, will produce and launch the 2010 State of the Nation report on Canada’s science, technology and innovation system. The report will provide an assessment of Canada’s research and innovation as well as its S&T performance against international standards of excellence to ensure that commitments made in the S&T strategy are fulfilled.

Industry Canada will focus on developing S&T and innovation policies to foster business innovation and to promote science and an entrepreneurial culture. This will be informed by economic research and analysis and consultations with Canadian and international partners.

Industry Canada will continue to monitor the effectiveness of research funding. Together with partners such as the federal granting councils, National Research Council Canada, the Canada Foundation for Innovation and Genome Canada, the Department will measure and maximize the impact of these investments to ensure that they advance S&T in Canada.

Industry Canada will also continue to provide science policy advice and policy frameworks and work with portfolio agencies to fulfill commitments made in the S&T strategy in the following priority areas: health and related life sciences,

environmental science and technologies, natural resources and energy, and information and communication technologies3.

Industry Canada will also continue to provide science policy advice and policy frameworks and work with portfolio agencies to fulfill commitments made in the S&T strategy in the following priority areas: health and related life sciences,

environmental science and technologies, natural resources and energy, and information and communication technologies3.

Through these activities and its work with portfolio partners, other government departments and external stakeholders from the private and public sectors, Industry Canada will endeavour to promote scientific excellence and foster an environment that is conducive to innovation.

Highlights of challenges and risk areas

Private sector investment in R&D in Canada continues to lag behind other countries, despite the Government of Canada’s considerable investment in business R&D. As announced in Budget 2010, an independent expert panel was created to review federal support of business R&D and make recommendations to maximize the impact of these initiatives. The panel will report back to the Minister of State for Science and Technology in October 2011.

Canada’s Economic Action Plan

The Knowledge Infrastructure Program (KIP), which was introduced in Budget 2009, provides funding of up to $2 billion over two years for R&D infrastructure projects at post-secondary institutions. On December 2, 2010, the Government of Canada announced that the program would be extended until October 31, 2011.

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | |||

| FTEs | Planned Spending | FTEs | Planned Spending | FTEs | Planned Spending |

| 377 | 38.2 | 366 | 37.5 | 365 | 37.5 |

* Minor differences are due to rounding.

| Expected Results | Performance Indicators | Targets |

|---|---|---|

| Industry Canada policy-making and program development sectors are made aware of new and emerging communication technologies and are provided with the technical information they need to make well-informed decisions. | Number of new and emerging communication technologies for which Communications Research Centre Canada (CRC) has provided advice or input to Industry Canada for the development of policy, standards and regulations and for contributions to international forums (e.g. the International Telecommunication Forum, or ITU) | 10 new technologies for which advice is sought or for demonstration |

| Canadian government departments and agencies (National Defence, Canadian Radio-television and Telecommunications Commission, Canadian Space Agency) are provided with the information they need to make well-informed decisions on new communication technologies. | Level of funding received from other federal government departments to conduct research and testing on communication technologies | $7 million |

| Canadian telecommunications companies realize industrial and economic benefits from CRC intellectual property (IP) and technology transfer. | IP revenue and contracting-in money received by CRC | $2 million |

Planning highlights and benefits for Canadians

Industry Canada is committed to a competitive Canadian ICT sector. Support for the development of new products and services for the ICT sector is provided through the CRC. In addition, the CRC enables Industry Canada to provide technical information to support well-informed decisions on such issues as cyber security, the transition to digital television, the sharing of the television spectrum and the implementation of digital radio and mobile television. Industry Canada will continue to support R&D activities targeted at promoting the adoption of innovative ICT applications.

Industry Canada will support the development of technologies to improve spectrum efficiency for intelligent radio, prediction of ultra high frequency (UHF), environment and white space interference, propagation analysis and wireless network convergence, as well as to increase information broadcasting capacity and quality through audio-visual coding, modulation and interference mitigation.

In addition, Industry Canada will support R&D in the following areas:

- technologies and infrastructure used in emergencies, with the purpose of improving technologies for rapidly deployable and interoperable radio and public alerting; and

- technologies and infrastructure for network attacks, emergency alerting and response, search and rescue, and surveillance and sensing, with the purpose of improving network security and public safety.

The Department will coordinate, at the national level, ICT-related international S&T agreements and participate in various international research consortiums.

Results of ICT-related R&D will be submitted to international organizations’ technical panels and working groups in support of Canadian interests in the areas of, for example, propagation (ITU-R WP3) and international search and rescue satellite systems.

Industry Canada will also investigate the use of broadcasting, satellite, wireless and optical communications systems to improve and expand broadband access.

The Department will develop and support new technology in the area of energy efficiency and greenhouse gas reduction as well as produce a report on the Smart Grid program.

These plans will be undertaken to support the development of ICT capacity and to close the innovation gap by facilitating the transfer of new technologies to Canadian industry.

Highlights of challenges and risk areas

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | |||

| FTEs | Planned Spending | FTEs | Planned Spending | FTEs | Planned Spending** |

| 88 | 431.9 | 88 | 462.6 | 88 | 323.3 |

* Minor differences are due to rounding.

| Expected Results | Performance Indicators | Targets |

|---|---|---|

| Investment in leading-edge R&D in targeted Canadian industries | Dollar value of disbursements to firms for R&D activities | $361.4 million |

| Dollars of investment leveraged per dollar of Industry Canada investments in R&D projects | $2.00 | |

| Development and commercialization of new and improved products, processes and services | Nature and extent of new and improved technologies developed | Description of technologies developed and commercialized |

Programming in this area supports Theme I: Theme I: Addressing Climate Change and Air Quality.

Programming in this area supports Theme I: Theme I: Addressing Climate Change and Air Quality.

Planning highlights and benefits for Canadians

Through strategic support of R&D projects, Industry Canada contributes to the advancement of Canada’s innovation capacity and expertise and to the creation and retention of jobs in Canada.

The Department will continue to effectively monitor the aerospace innovation program, manage its partnerships, and implement the Strategic Aerospace and Defence Initiative (SADI), thereby enhancing Canada’s capacity for R&D and the commercialization of new technologies in the Canadian aerospace industry.

The Industrial Technologies Office (ITO) will implement a performance management strategy to ensure that SADI’s benefits and results are being clearly communicated and to demonstrate that its objectives are being met.

To improve client service and increase efficiency without compromising due diligence, ITO will implement new measures to reduce the processing time for amendments to SADI and Technology Partnerships Canada contribution agreements.

The Automotive Innovation Fund will continue until 2013. This $250-million fund provides the automotive sector with support for strategic, large-scale R&D projects to develop innovative, greener and more fuel-efficient vehicles.

The Automotive Innovation Fund will continue until 2013. This $250-million fund provides the automotive sector with support for strategic, large-scale R&D projects to develop innovative, greener and more fuel-efficient vehicles.

By delivering on these plans, Industry Canada will help increase the capacity of Canadian firms to participate in leading-edge R&D and S&T innovation.

Highlights of challenges and risk areas

Given how rapidly technology advances and changes, Industry Canada faces the uncertainty that certain funded projects could become redundant or non-competitive. To address this, the Department considers the effect of technological change when analyzing the expected performance of key industries and leading firms.

2.3 Canadian businesses and communities are competitive

2.3 Canadian businesses and communities are competitive

Canada’s competiveness in the global economy may be attributable to the productivity of Canadian firms, as they are the generators of wealth, innovation, investment and employment within the economy. They will continue to face challenges as a result of increasing global competition. The Department therefore continues to strive to maximize Canadian productivity and competitiveness and enable Canadian industries to take advantage of opportunities and respond to risks, link into global value chains, and build and strengthen partnerships both domestically and internationally. The goal is for competitive and adaptable Canadian industries to have the knowledge and capacity to respond appropriately to external shocks within an uncertain economic climate and to compete internationally.

Breakdown of 2011–12 Planned Spending by Program Activity ($ millions)

Canada is facing challenges in its productivity growth, which affects its ability to attract foreign investment. There is increasing competition for investment from emerging economies that were not affected as significantly by the recession.

| Financial Resources ($ millions)* | Human Resources (FTEs) | |||||

|---|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | 2011–12 | 2012–13 | 2013–14 | |

| 329.8 | 276.2 | 259.2 | 592 | 561 | 562 | |

* Minor differences are due to rounding.

To ensure that Canadian businesses and communities are competitive, Industry Canada collaborates with businesses, governments and industry to enhance the recognition of Canadian industrial capabilities and to identify and address opportunities and risks affecting industry competitiveness within the globalized marketplace.

Additionally, Industry Canada supports small and medium-sized enterprises (SME), which play a role in and contribute to Canada’s economic well-being, by facilitating their access to financing and through capacity building in both physical infrastructure and ICT. Industry Canada works collaboratively with federal departments, the provinces and territories, and industry to gather knowledge about such sectors as ICT, energy, life sciences, automotive, services, and aerospace and defence to ensure that government policies and programs effectively support the competitiveness of these sectors. This increases the capacity of firms and communities across Canada to participate in a knowledge-based economy. This is one way in which the Department promotes business growth, entrepreneurship and community development.

Industry Canada further contributes to ensuring that Canadian businesses and communities are competitive by

- supporting the growth and competitiveness of small business and encouraging entrepreneurship;

- helping Canadian industries develop the capacity to adapt to the ever-changing economic landscape, respond appropriately to external shocks, and innovate and compete internationally;

- applying expertise to develop and contribute to policy, legislation and regulations and to engage various public and private stakeholders in strengthening Canada’s industrial capacity;

- encouraging growth and economic diversification to create sustainable communities; and

- informing communities about access to the infrastructure that is essential for participating in today’s economy by reporting on results of the Broadband Canada: Connecting Rural Canadians program.

The following key activities will support this strategic outcome:

- providing support to the Advisory Committee on Small Business and Entrepreneurship as it looks at ways to improve small business access to federal programs and services, which is one element of the Paperwork Burden Reduction Initiative;

- continuing to improve services for small businesses, saving them time and effort when seeking information on government programs and services;

- implementing recommendations from audits and evaluations of programs;

- encouraging and promoting the adoption and adaptation of new business processes, technologies and skills;

- monitoring and analyzing firms and trends in industry, thereby enabling the Department to advise stakeholders on key strategic issues and to bring an industry perspective to government decision making, policy formulation and business development; and

- implementing a digital economy strategy that is based on research, analysis and recommendations from stakeholder consultations.

By focusing on these activities in the coming years, Industry Canada will help support Canadian business competitiveness and productivity.

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | |||

| FTEs | Planned Spending | FTEs | Planned Spending | FTEs | Planned Spending |

| 123 | 128.6 | 123 | 127.4 | 122 | 124.4 |

* Minor differences are due to rounding.

| Expected Result | Performance Indicator | Target |

|---|---|---|

| Small businesses use government programs, tools and information. | Number of small businesses using government programs, tools and information to enhance their growth and competitiveness | 2,342,050 |

Planning highlights and benefits for Canadians

Industry Canada raises awareness across government of the challenges facing small businesses and provides statistical information about SMEs as well as analysis and expertise on SME-related issues, such as entrepreneurship, financing, innovation and growth firms. The Department also recommends policy options, works with SMEs to deliver programs that help support them and entrepreneurial activity across Canada, and provides analysis in relation to the Business Development Bank of Canada (BDC).

Industry Canada will support the Minister of Industry in the conduct of the 10-year legislative review of the BDC, which is to be conducted in consultation with the Minister of Finance. The Department will also support implementation of the resulting recommendations. The aim of the review is to encourage small business growth, competitiveness and entrepreneurship.

Based on the findings of the 2010 Comprehensive Review and discussions with stakeholders, improvements to the Canada Small Business Financing Program (CSBFP) are being developed. The aim of these improvements is to streamline the administrative process, make CSBFP loans more appealing for lenders to offer and mitigate the risks to government. The CSBFP helps to increase SMEs’ access to financing that would not otherwise be accessible without government support.

The Department will leverage partnerships to continue to deliver integrated business information service strategies for small business. It will also build and strengthen partnerships with other departments and agencies, other levels of government and national associations serving small business to increase awareness of the Canada Business Network, leverage access to content and identify future areas for collaborating on service-to-business delivery. This will ensure that SMEs have the necessary information to make informed business decisions and will also facilitate business compliance.

By continuing to assist SMEs in their adoption of e-business strategies through student internships, Industry Canada will enhance the growth and competitiveness of small business and encourage entrepreneurship.

As a result of the Department's efforts in this program area, Canada’s entrepreneurs and SMEs will contribute to strengthening the Canadian economy as it continues to emerge from the recession.

Highlights of challenges and risk areas

Consultations in support of the 10-year legislative review of the BDC are ongoing. While the Senate report has been received, there could be delays in receiving other input. Given this, Industry Canada has developed a flexible action plan to monitor and track input and incorporate it during report development.

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | |||

| FTEs | Planned Spending | FTEs | Planned Spending** | FTEs | Planned Spending |

| 305 | 47.1 | 298 | 56.1 | 299 | 51.1 |

* Minor differences are due to rounding.

| Expected Results | Performance Indicators | Targets |

|---|---|---|

| Canadian industries have the capacity to prepare for and respond to risks and opportunities in domestic and global markets. | Canada’s ranking for “Value chain breadth” (indicator 11.05 of the World Economic Forum’s Global Competitiveness Report) | 33rd or better (based on 2010–11 report) |

| Canada’s ranking for “Firm-level technology absorption” (indicator 9.02 of the World Economic Forum’s Global Competitiveness Report) | 22nd or better | |

| Industry perspective is considered in policy, legislation, regulations and agreements. | Number of collaborative policy projects focused on industry competitiveness and adaptability | 46 |

Planning highlights and benefits for Canadians

Departmental officials engage with associations, governments and leading firms to help Canadian industries become more innovative, enter into global value chains, strengthen partnerships both domestically and internationally, attract investment and promote Canadian expertise.

Should the government adopt and release a Federal Tourism Strategy, Industry Canada would lead its implementation. The strategy would further articulate the federal government’s approach to supporting tourism, building on the four priorities announced by the Prime Minister in June 2009:

- encouraging product development and investments in Canadian tourism assets and products;

- facilitating ease of access and movement for travellers, while ensuring the safety and integrity of Canada’s borders;

- increasing awareness of Canada as a premier tourist destination, including federal tourism assets; and

- fostering an adequate supply of skills and labour to enhance visitor experiences through quality service and hospitality.

The Department will also work in collaboration with the private sector on the development of technology roadmaps, including the Soldier Systems

Technology Roadmap that supports Canada’s soldier modernization efforts. Working with partners such as other departments and agencies, councils, research institutions and the private sector, Industry Canada will guide the completion of the development phase and will help establish the framework for successful implementation of this modernization effort. Technology roadmaps encourage and