Common menu bar links

Breadcrumb Trail

ARCHIVED - Industry Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Section 2: Analysis of Program Activities by Strategic Outcome

Strategic Outcome: A Fair, Efficient and Competitive Marketplace

Strategic Outcome: A Fair, Efficient and Competitive Marketplace

| Indicator | Result | Trend |

| Barriers to competition | Standards and regulations were identified as the most common barriers to competition in a survey of Canadian companies.1 | No Change* |

| According to the International Institute for Management Development (IMD) World Competitiveness Yearbook 2007, Canada continues to rank within the top 10 countries in the world for overall competitiveness.2 | No Change | |

| Canada ranks 11th in the world for the extent to which government policies are conducive to competitiveness.3 | No Change | |

| Regulatory and administrative capacity | ||

| According to the International Institute for Management Development (IMD) World Competitiveness Yearbook 2007, Canada remains 2nd in the world on the number of days it takes to start a business (i.e., 3 days).4 | No Change | |

*This was a one-time study that does not allow for trend analysis.

D

D

The Patent Prosecution Highway Pilot Program between the Canadian Intellectual Property Office and the United States Patent and Trademark Office was launched on January 28, 2008 to provide a means to significantly accelerate examination of patent applications and to improve patent quality.

Under the agreements, if claims of an application have been found to be acceptable by an intellectual property office in one country, an accelerated examination can be requested at the intellectual property office of the other country. The objective of the trial is to gauge the interest of applicants and to assess the anticipated benefits to each office.

Competitive markets enable business investment, innovation, productivity and growth, and are therefore essential to Canada’s long-term prosperity. Industry Canada works with other federal departments to create a business climate that is conducive to attracting and retaining investment, innovative industries, and talented workers. The department also develops policies that promote consumer confidence and are flexible and responsive to changing technologies, marketplace opportunities and an evolving global marketplace. By doing this, Industry Canada is helping to build a fair, efficient and competitive marketplace.

D

D D

D

Meeting Our Commitments

In an effort to continue to modernize marketplace frameworks in support of a highly competitive and innovative economy for the benefit of all Canadians, Industry Canada:

- Made recommendations resulting in Bill C-47, The Olympic and Paralympics Marks Act, which provides special, limited-time intellectual property protection for Olympic and Paralympic words and symbols and prohibits “ambush marketing” — marketing that seeks to capitalize on the goodwill of the Olympic movement by creating a false, unauthorized association with the Games without making the financial investment required to secure official sponsorship rights. The Act received Royal Assent on June 22, 2007.

- Consulted with over 1,200 stakeholders by email and contacted 50 companies and associations directly, as part of the review of the Weights and Measures Act and Electricity and Gas Inspection Act and identified the need to modernize the offence sections to ensure fines provide appropriate deterrents and consumer protection.

- Continued to assist and support provinces as they seek Order-in-Council designations to regulate payday lending, under the provisions of Section 347.1 of the Criminal Code of Canada, thus providing greater protection for consumers under these high-cost loans.

- Issued the policy framework as well as the licensing framework for the Auction for Spectrum licences for Advanced Wireless Services (AWS) in the 2 GHz range.

- Completed a study on Canada’s self-regulated professions in December 2007. The study found that rules that limit advertising, set prices for services and restrict who can offer professional services may go further than necessary to protect the public interest and, in fact, can lead to higher prices, limited choices and restricted access to the type of information consumers need to make decisions.

Industry Canada carries out its mandate in a fast-paced environment of continually shifting priorities. The Department has responded to this environment by accelerating the implementation of some initiatives to meet tight deadlines and has learned that any failure to consult targeted stakeholders during accelerated initiatives results in the need to make modifications at a later date to ensure those stakeholders are well served. This is particularly true in the development of marketplace frameworks.

In response, Industry Canada has renewed its commitment to using a measured and focused approach to ensure that all stakeholder views are brought to the table prior to implementation. By following through on this commitment, Industry Canada will improve stakeholder satisfaction and reduce the number of modifications that are required.

Performance Analysis

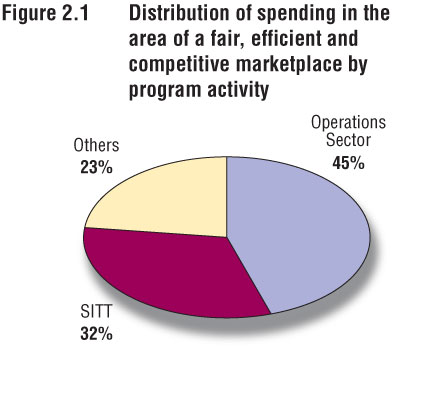

Through the following program activities Industry Canada continued building a fair, efficient and competitive marketplace.

Program Activity Policy Sector – Marketplace

| Description: Development of marketplace framework policy | ||

| Expected Result: Development and coordination of policy frameworks that support a fair, efficient and competitive marketplace | ||

| Indicator | Results | Trend |

| Legislative initiatives tabled and approved, aimed at improving Canada’s broad marketplace framework (e.g., copyright, insolvency, intellectual property, competition policy) | As of March 31, 2008, two bills were tabled and adopted. One dealing with the protection of Olympic and Paralympic trademarks received royal assent and the second made amendments to the Bankruptcy and Insolvency Act. A report and a government response were tabled in Parliament.5,6 | Not Applicable* |

*The introduction and adoption of legislative initiatives are the prerogatives of government and Parliament.

| Financial Resources ($ millions) 2007–08 |

Human Resources (Full-Time Equivalents) 2007–08 |

|||||

| Planned Spending |

Total Authorities |

Actual Spending |

Planned | Actual | Difference | |

| 9.1 | 12.1 | 10.7 | 87 | 74 | 13 | |

In Advantage Canada, the Government of Canada committed to adopt a principle-based approach to address the concern that there may be rare occasions when foreign investments by state-owned enterprises (SOEs) might not benefit Canada. This concern was addressed when, on December 7, 2007, the Minister of Industry issued guidelines clarifying that sound principles of corporate governance and commercial orientation will drive how investments will be reviewed under the Investment Canada Act by foreign SOEs.

Program Activity Operations Sector – Marketplace

| Description: Development of instruments and compliance with the marketplace framework | ||

| Expected Result: Marketplace fairness, integrity and efficiency is protected through regulation and promotion in the areas of insolvency, weights and measures, federal incorporation, and spectrum management | ||

| Indicator | Result | Trend |

| Public confidence in federal incorporation regime | Satisfaction with overall quality of online service met 86.6 percent.7 | Improving |

| Financial Resources ($ millions) 2007–08 |

Human Resources (Full-Time Equivalents) 2007–08 |

|||||

| Planned Spending |

Total Authorities |

Actual Spending |

Planned | Actual | Difference | |

| 91.7 | 90.9 | 82.4 | 1,332 | 1,308 | 24 | |

By relieving the administrative and paperwork burden on business, Industry Canada is ensuring that marketplace fairness, integrity and efficiency is being protected and promoted. Two measures announced in Advantage Canada exemplify this. One is e-filing, which allows trustees to file prescribed documents, and another is Pre-Approved Schedules Service (PASS), which decreases turnaround time for incorporation (a total of 1,300 certificates of incorporation were received via this new initiative in 2007–08).

Program Activity Spectrum, Information Technologies and Telecommunications Sector – Marketplace

| Description: Development of regulations, policies, procedures and standards governing Canada’s spectrum and telecommunications industries and the digital economy | ||

| Expected Result: A policy and regulatory framework to govern Canada’s radiocommunications and telecommunications infrastructure in support of Canadian marketplace requirements and shape the digital economy | ||

| Indicator | Result | Trend |

| Degree of client satisfaction in the Canadian marketplace with the current policy and regulatory framework | Not Available A Client Satisfaction Survey is being developed and will be conducted in 2008–09. |

Not Available |

| Financial Resources ($ millions) 2007–08 |

Human Resources (Full-Time Equivalents) 2007–08 |

|||||

| Planned Spending |

Total Authorities |

Actual Spending |

Planned | Actual | Difference | |

| 50.1 | 61.4 | 58.7 | 366 | 333 | 33 | |

As the underlying infrastructure of Canada’s economic activity, telecommunications services are key to the Canadian economy. In 2007–08, Industry Canada worked with stakeholders to advance the government’s agenda for telecommunications reform, including accelerating deregulation in areas where there is competition, and created the Commissioner for Complaints for Telecommunications Services Inc.

Industry Canada also successfully negotiated all Canadian proposals at the International Telecommunication Union (ITU) World Radiocommunication Conference 2007. This has resulted in the allocation and safeguarding of radio spectrum in the International Radio Regulations, which is a treaty text, to support such things as new advanced mobile services, aeronautical safety, next-generation navigation and environmental monitoring systems, and disaster relief and mitigation.

Improving confidence in the marketplace by protecting individual privacy and curbing threats to the Internet and online market continued to be a priority for Industry Canada. Key actions included the continued mandatory review of the Personal Information Protection and Electronic Documents Act (PIPEDA) and the development of options for introducing new initiatives to combat spam.

Program Activity Office of Consumer Affairs – Marketplace

| Description: Promotion of consumer interests | ||

| Expected Result: Strengthened responses to consumer issues | ||

| Indicator | Result | Trend |

| Number of initiatives responding to consumer issues with active engagement of OCA | 33 initiatives responding to consumer issues with active engagement of OCA.8 | Improving |

| Financial Resources ($ millions) 2007–08 |

Human Resources (Full-Time Equivalents) 2007–08 |

|||||

| Planned Spending | Total Authorities | Actual Spending | Planned | Actual | Difference | |

| 5.3 | 6.6 | 6.4 | 23 | 23 | – | |

Industry Canada, through its Office of Consumer Affairs contributed to increasing consumer confidence and a more fair and efficient marketplace by actively engaging in initiatives to respond to consumer issues. These initiatives included several projects to support the harmonization of federal/provincial/territorial consumer policies, collaborating with international partners such as the Organisation for Economic Co-operation and Development (OECD) and the International Organization for Standardization (ISO) to advance the development of international consumer policy and consumer protection models, and providing strategic consumer research and consumer information products designed to meet consumer needs in the modern marketplace.

Program Activity Competition Bureau – Marketplace

| Description: Development of and compliance with marketplace frameworks with respect to competition | ||

| Expected Result: Increased compliance with legislation under the Competition Bureau’s jurisdiction | ||

| Indicator | Result | Trend |

| Volume of commerce affected by Competition Bureau criminal enforcement activity | $330 million | New Indicator |

| Financial Resources ($ millions) 2007–08 |

Human Resources (Full-Time Equivalents) 2007–08 |

|||||

| Planned Spending |

Total Authorities |

Actual Spending |

Planned | Actual | Difference | |

| 45.7 | 47.4 | 46.4 | 446 | 421 | 25 | |

Through the efforts of the Competition Bureau, the Department increased legislative compliance through a variety of activities in competition enforcement and advocacy, as well as fraud prevention and awareness.

These activities included strengthening enforcement capacity in regional offices by giving them the responsibility of local cartels with a strong emphasis on bid rigging. In addition, the Community of Federal Regulators recognized the Competition Bureau with an innovation award for its work on Project FairWeb, which enables the Competition Bureau to redesign work processes involved in intelligence gathering and Internet sweep exercises in a more systematic manner, yielding positive results.

Program Activity Canadian Intellectual Property Office – Marketplace

| Description: Granting of intellectual property rights and the dissemination of intellectual property information in order to accelerate Canada’s economic development | ||

| Expected Result: Deliver quality and timely intellectual property products and services | ||

| Indicator | Result | Trend |

Turnaround times9 for:

|

72 percent of applications with a request for examination are processed in less than 24 months. | Improving |

|

Applications are processed within 6.8 months of filing date. | Declining |

|

Applications are processed within 1.8 working days of the receipt of application. | Improving |

|

Applications are processed within 10 months of the receipt of application. | Improving |

| Expected Result: Increase awareness and use of intellectual property | ||

| Indicator | Result | Trend |

| Percentage of increased awareness and use of intellectual property | 36 percent are familiar with intellectual property (baseline).10 | No Change |

| Financial Resources ($ millions) 2007–08 |

Human Resources (Full-Time Equivalents) 2007–08 |

|||||

| Planned Spending |

Total Authorities |

Actual Spending* |

Planned | Actual | Difference | |

| 1.0 | 117.9 | (21.3) | 1,037 | 945 | 92 | |

*As a Special Operating Agency within Industry Canada with a revolving fund authority, the Canadian Intellectual Property Office finances its operations entirely from revenues generated by fees received from the provision of intellectual property services.

As a roadmap to achieve its vision of becoming a leading Intellectual Property Office (IPO) as well as to support the government’s efforts to increase innovative activity by Canadians, Industry Canada, through the Canadian Intellectual Property Office (CIPO) adopted a Five-Year Strategic Plan entitled Moving Forward to Canada’s Advantage focusing on five strategic directions. These are: client services, outreach, the intellectual property framework, international activities, and our people.

As a critical element to deliver its Strategic Plan, CIPO launched a business transformation initiative called Enterprise-Business Renewal (EBR), a portfolio of projects directed to transform the way CIPO does business by improving business processes, renewing systems, and expanding the range of electronic services. For outreach, CIPO continued to foster greater awareness and more effective use of intellectual property by reaching out to small and medium-sized enterprises (SMEs) and working closely with Canada’s education sector in line with the government’s priorities in science and technology.

Strategic Outcome: An Innovative Economy

Strategic Outcome: An Innovative Economy

| Indicator | Result | Trend |

| Government expenditure on research and development (R&D) | Since 2002, government expenditures on research and development have remained steady at 18 percent of GERD.11 | No Change |

| Gross Domestic Expenditure on R&D (GERD) as a percentage of Gross Domestic Product (GDP) | Since 2001, GERD has accounted for approximately 2 percent of GDP.12 | No Change |

| University–Industry collaboration in R&D | Since 2005, the business sector has funded over $800 million/year of higher education R&D, accounting for more than 8 percent of total R&D performed by universities.13 | No Change |

D

D

Innovation — the transfer of knowledge to create new products or processes — is a key driver of growth and economic wealth in knowledge-based economies such as Canada.

In pursuit of a more innovative economy, Industry Canada is pursuing a strategy that invests in skilled knowledge workers, cutting-edge research and the adoption of new technologies. This support will encourage business, industry and the academic community to invest in innovation. Canadians will reap the benefits of medical advancements, a cleaner environment, improved education and employment opportunities.

The Government of Canada’s new S&T Strategy, Mobilizing Science and Technology to Canada’s Advantage, provides a multi-year policy framework to guide federal S&T policy and program decision-making.

The S&T Strategy sets out four core principles to guide government actions in this area: promote world-class excellence, focus on priorities, encourage partnerships and enhance accountability. The strategy also sets out three advantages distinct to S&T:

Entrepreneurial Advantage to translate knowledge into commercial applications that generate wealth for Canadians.

Knowledge Advantage to position Canada as a leader in generating new ideas and innovations.

People Advantage to make Canada a magnet for highly skilled people and create an economy with the best educated, most-skilled and most flexible workforce in the world.

Beginning in Budget 2007, the government launched a series of S&T initiatives to implement the S&T Strategy commitments and help position Canada as an R&D and innovation leader.

D

D

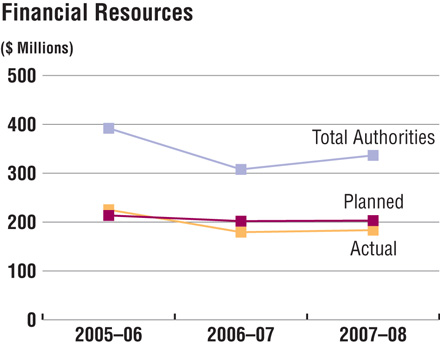

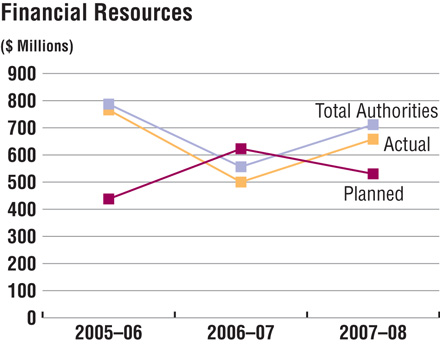

The variance between the planned and actual spending for 2007–08 is a result of an increased grants and contributions program allocation made in the Federal 2008 Budget. Additional details are outlined below in the Meeting Our Commitments section.

D

D

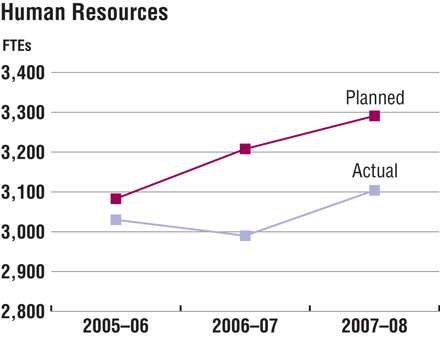

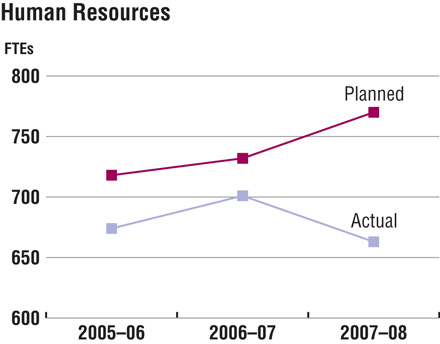

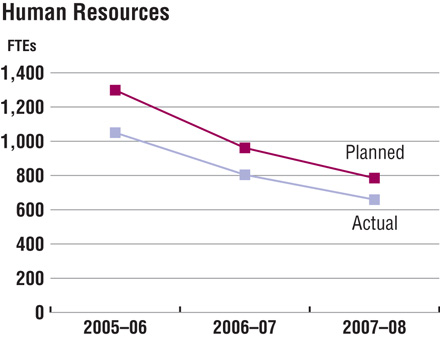

The decrease between the 2006–07 and 2007–08 actual Full-Time Equivalents (FTEs) is due to productivity gains in mature sectors allowing Industry Canada to streamline its regions.

Quality performance indicators are critical to properly assess a department’s work in achieving its strategic outcomes and program activities — a lesson Industry Canada learned in the assessment of the Technology Partnerships Canada Program and the design of the new Strategic Aerospace and Defence Initiative. The Department’s investment in the development of accurate and appropriate performance indicators ensures both programs will be properly assessed.

The Department’s experience in this area also led it to conduct a review of its planning and reporting infrastructure and to update its Program Activity Architecture to better define Industry Canada’s strategic outcomes and program activities. Treasury Board approved the new Program Activity Architecture for 2009–10 and the Department has started to develop performance measures that are aligned to the new Program Activity Architecture. The new planning and reporting structure will greatly assist Industry Canada in managing and communicating its performance to all stakeholders.

Meeting our Commitments

In 2007–08 Industry Canada, in delivering on its commitments to develop an innovative and knowledge-based economy, ensured the allocation of resources by:

- Developing evidence-based policy recommendations that contributed to two Federal 2008 Budget announcements: earmarking $75 million for the creation of a new Canadian Venture Capital fund, and changes to streamline processes related to eligible cross-border venture capital investment flows.

- Making key investments through Budget 2008 including $25 million over two years to establish the Vanier Canada Graduate Scholarships, $21 million over two years to establish the Canada Excellence Research Chairs, and $140 million to Genome Canada to build upon Canada's knowledge advantage in genomics.

- Acting as the administrator of the Program for Strategic Industrial Projects (PSIP), which provides the mechanism to fund, in whole or in part, strategic projects within the automotive sector.

Industry Canada also supported the generation and commercialization of knowledge by:

- Opening laboratories for photonics and antenna research at the Communications Research Centre Canada.

- Supporting cooperation activities between Canada, the United States and Mexico in the use of nanotechnology.

- Completing six Technology Roadmaps (TRM) that help industry, its supply-chain, academic and research groups and government come together to jointly identify and prioritize the technologies needed to support strategic research and development (R&D), marketing and investment decisions.

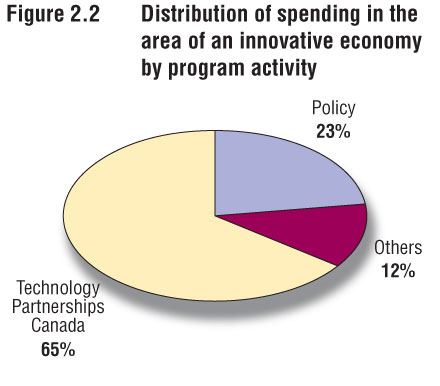

Performance Analysis

Through the following program activities Industry Canada continued to build an innovative economy.

Program Activity Policy Sector – S&T and Innovation

| Description: Development of economic and scientific policy | ||

| Expected Result: Development and coordination of policy frameworks in support of an innovative economy | ||

| Indicator | Result | Trend |

| Policy proposals that are brought forward reinforce the elements that advance an innovative economy and reflect a coordinated approach based on tools available across the sector | The federal S&T Strategy, Mobilizing Science and Technology to Canada’s Advantage, championed by Industry Canada to guide federal investments in S&T, was released in May 2007.14 | Not Applicable |

| Financial Resources ($ millions) 2007–08 |

Human Resources (Full-Time Equivalents) 2007–08 |

|||||

| Planned Spending |

Total Authorities |

Actual Spending |

Planned | Actual | Difference | |

| 52.6 | 148.9 | 148.8 | 114 | 85 | 29 | |

Recognizing that science and technology are key drivers that make Canada more productive and competitive and address social priorities, Industry Canada championed the development and implementation of the federal Science and Technology (S&T) Strategy, Mobilizing Science and Technology to Canada’s Advantage, released by the Prime Minister in May 2007.

This strategy focuses on advancing four core principles: promoting world-class excellence; focusing on priorities; fostering partnerships and enhancing accountability; and it fosters three key advantages of the Advantage Canada initiative: Entrepreneurial, Knowledge and People.

Program Activity Industry Sector – S&T and Innovation

| Description: Development of initiatives that stimulate research and development in order to accelerate commercialization in emerging technologies and priority sectors | ||

| Expected Result: A stronger knowledge-based economy in all industrial sectors | ||

| Indicator | Result | Trend |

Overall assessment of climate, programs, decisions and other major factors supporting innovation in Canadian industries, such as:

|

Scientists & engineers as a share of total employment: in Canada 10 percent,15 in U.S. 14.4 percent.16 | Improving |

| Financial Resources ($ millions) 2007–08 |

Human Resources (Full-Time Equivalents) 2007–08 |

|||||

| Planned Spending |

Total Authorities |

Actual Spending* |

Planned | Actual | Difference | |

| 11.8 | 24.1 | 19.4 | 123 | 79 | 44 | |

*The variance between the planned and actual spending for 2007–08 is due to two different factors. The Industry Sector transferred resources to the Economic Development program activity during 2007–08, and three grants were incorrectly coded to the Industry Sector’s S&T and Innovation program activity, which should have been coded to the Policy Sector – S&T and Innovation program activity.

Industry Canada completed a range of analyses, allowing government and industry to better identify and understand the challenges and opportunities surrounding emerging technology value chains in Canada in 2007–08. These included an analysis of opportunities for the development of new value chains that link the bio-resource, chemicals, and manufacturing sectors; facilitation of a strategic plan by the chemical cluster in Sarnia, to advance the adoption of underutilized agricultural and forest residues as renewable feedstock for production of chemicals, plastics, and fuels; the identification and assessment of opportunities for Canadian capabilities in hydrogen and fuel cells, waste-to-energy and solar power in the California market; and commissioning of a study, entitled Opportunities for Canadian Stakeholders in the North American Large Wind Turbine Supply Chain.

Program Activity Spectrum, Information Technologies and Telecommunications Sector – S&T and Innovation

| Description: Support advanced and applied research within the Canadian ICT Sector for the development of innovative technologies | ||

| Expected Result: Improved research capacity and commercialization of ICTs | ||

| Indicator | Result | Trend |

| Access to advanced research networks across Canada and the application of ICTs to industrial sectors | CANARIE Inc. improved access to advanced research networks across Canada by connecting 375 institutions. This is a 25-percent increase over the number of institutions connected in 2006–07. | Improving |

| Precarn Inc. supported 12 market-driven ICT project innovations in the areas of intelligent systems technologies and robotics. | Not Applicable | |

| Financial Resources ($ millions) 2007–08 |

Human Resources (Full-Time Equivalents) 2007–08 |

|||||

| Planned Spending |

Total Authorities |

Actual Spending |

Planned | Actual | Difference | |

| 27.0 | 18.2 | 15.1 | 4 | 4 | – | |

In 2007–08, Industry Canada continued to support the CANARIE Inc. objectives to expand and upgrade the advanced research network and to develop, demonstrate and implement next-generation technologies. This support helped pave the way to launch the Infrastructure Extensions Program and the Network-Enabled Platforms Program. In addition to this investment, Precarn Inc. funded 12 new technology projects across the country for a total of $4.4 million.

Program Activity Communications Research Centre Canada – S&T and Innovation

| Description: Conducts research on advanced telecommunications and information technologies to ensure an independent source of advice for public policy and to support the development of new products and services for the ICT Sector | ||

| Expected Result: Telecommunications policies, regulations and standards are developed using Communications Research Centre Canada (CRC) technical input | ||

| Indicator | Result | Trend |

| Number of CRC technical inputs (trends and assessments) to groups developing policies and regulations related to the telecommunications sector, including the Spectrum Information Technologies and Telecommunications Sector (SITT) of Industry Canada (IC), the International Telecommunication Union (ITU), the Institute of Electrical and Electronics Engineers (IEEE), and the Canadian Radio-television and Telecommunications Commission (CRTC) | 10 major technology-related inputs to Industry Canada, SITT, CRTC, ITU and IEEE.17 | New Indicator |

| Expected Result: Canadian companies in the telecommunications sector use CRC-developed technology to improve their product lines and their competitiveness |

||

| Indicator | Result | Trend |

| Number of intellectual property (IP) licences issued to Canadian companies | 11 new IP licences have been issued to Canadian companies in 2007–08 and an additional 23 internationally.18 | Improving* |

| Sales revenue of Canadian companies in the telecommunications sector that were formed as a result of CRC involvement or are spinoffs from these companies | $1.6 billion annual sales (data for 2005). $520 million cumulative sales revenue from CRC IP licensing (to 2005).19 ** |

Not Available |

* The numbers are very similar to those of last fiscal year, with only a very small upward trend.

** An economic impact study of company sales revenues resulting from CRC technologies and intellectual property licences is conducted every five years, with the next one scheduled for 2010.

| Financial Resources ($ millions) 2007–08 |

Human Resources (Full-Time Equivalents) 2007–08 |

|||||

| Planned Spending |

Total Authorities |

Actual Spending |

Planned | Actual | Difference | |

| 41.5 | 45.0 | 42.9 | 411 | 388 | 23 | |

Industry Canada, through the Communications Research Centre Canada (CRC), conducted research activities in support of spectrum policy and regulations in 2007–08. This included studies related to future Advanced Wireless Services, as well as on spectrum property rights. Input was also provided regarding the impact of emerging standards on licensing of rural broadband delivery systems.

In addition, Industry Canada carried out research projects in 2007–08 in support of the Department of National Defence (DND) valued at $7.38 million on a cost-recovery basis. Some of these projects included research into adaptive wireless systems for tactical mobile communications, as well as technical analysis and planning at the international level for the new constellation of search and rescue satellites.

Program Activity Technology Partnerships Canada – S&T and Innovation

| Description: Encouragement of commercialization through strategic investments in innovative research and development | ||

| Expected Result: Commercialization encouraged through strategic partnering in innovative research and development | ||

| Indicator | Result | Trend |

| Total number of projects (which represents the number of strategic partnerships)20 |

|

No Trend* |

*Trend information is unavailable as the Strategic Aerospace and Defence Initiative (SADI) program was launched in April 2007. TPC’s terms and conditions expired on December 31, 2006 and no new projects were contracted. The h2EA program ended on March 31, 2008.

| Financial Resources ($ millions) 2007–08 |

Human Resources (Full-Time Equivalents) 2007–08 |

|||||

| Planned Spending |

Total Authorities |

Actual Spending |

Planned | Actual | Difference | |

| 397.3 | 475.5 | 431.8 | 118 | 99 | 19 | |

In February 2008, the first Strategic Aerospace and Defence Initiative (SADI) project was announced. Diamond D-JET Corporation (Diamond) in London, Ontario received a $19.6-million SADI repayable investment towards its $95.2-million D-JET program. This SADI investment will enable Diamond to develop an all-composite single engine for use in its new class of small business jets. It will also help to develop the company’s expertise in products for general aviation. Additional benefits of the D-JET program include attracting foreign investment to Canada and leveraging private sector investment in R&D, both of which will create significant economic benefits, particularly in the London region.

Strategic Outcome: Competitive Industry and Sustainable Communities

Strategic Outcome: Competitive Industry and Sustainable Communities

| Indicator | Result | Trend |

| Investment in machinery and equipment as a proportion of GDP | Canada invested 7.47 percent of GDP in machinery and equipment in 2007.21 | No Change |

| Use of ICTs | Business and government use of ICTs rose to 77.5 percent and 99.88 percent respectively in 2006.22 | Improving |

BizPaL is an online service that simplifies the business permit, licence and other compliance regulation process for entrepreneurs, governments and third party business service providers. Easy and convenient, BizPaL provides Canadian businesses with one-stop access to permit and licence information for all levels of government. The service’s primary goals are to slash document research time and help entrepreneurs start up faster.

For government, BizPaL provides the assurance that business clients will have the information they need to meet all permit and licence requirements quickly and efficiently. It also provides a way to improve the service experience for business clients, while gaining a competitive edge over other jurisdictions. For more information, visit BizPaL website.

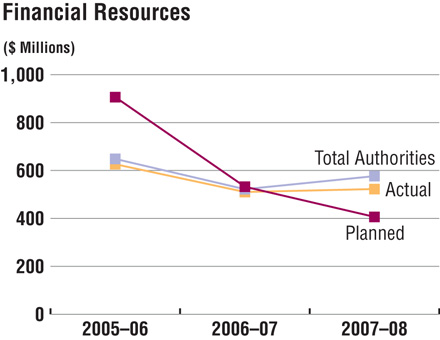

D

D

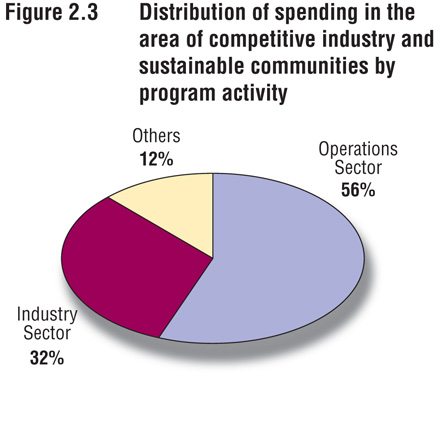

Competitive industries drive economic growth and thus are key to ensuring that the Canadian economy remains one of the strongest and healthiest among the seven leading industrial countries of the G7. Competitive industries also drive sustainable communities, and together these two key elements help to ensure a high quality of life for Canadians.

In today’s globalized marketplace, this competition for investment, skilled workers and customers has never been more intense. Industry Canada promotes competitive industries by offering a range of business services and by collaborating with business and business associations to ensure that industry views are taken into account in the development of broader trade, economic, environmental and social policies that may affect the business climate.

Meeting Our Commitments

In 2007–08 Industry Canada, in meeting its commitments to foster strong economic growth for Canada, strengthened export markets for Canadian products and services, improved the rules that govern international trade and reflected Canada’s domestic industrial agenda by working closely with the Department of Foreign Affairs and International Trade Canada (DFAIT) in the following international negotiations:

- Canada–Korea Free Trade Agreement

- Foreign Investment Promotion and Protection Agreements (FIPA) with India, China, Vietnam and Indonesia

- The Doha round of multilateral trade negotiations under the World Trade Organization

D

D  D

D

Industry Canada is finding new ways to improve service to Canadians through innovative partnerships with municipalities, industry and other key stakeholders. These arrangements require partners to work closely together with clearly defined objectives, well-defined roles and responsibilities, effective governance structures and accountability mechanisms. The BizPaL initiative is an excellent example of such an initiative.

These types of innovative partnerships result in the efficient and cost-effective delivery of government programs and services to citizens and stakeholders — services and programs that are more client-centred and which can reduce the paperwork burden.

Industry Canada also continued to pursue a variety of initiatives aimed at maintaining the competitiveness of Canadian business by:

- Addressing key policy issues related to Highly Qualified People (HQP), innovation, Scientific Research and Experimental Development (SR&ED) tax credits, procurement, commercialization, green information technology and ICT-related trade policy in policy forums and secured intelligence.

- Supporting increased business opportunities for the Canadian ICT sector by generating 718 sales leads. This was achieved through the support of Canadian pavilions at three key international trade shows in Singapore (CommunicAsia), China (PT ExpoComm) and Spain (Mobile World Congress).

- Supporting networking activities such as the Network for Women Entrepreneurs (NWE), delivered through the Canada–Ontario Business Service Centres (COBSC) a three-year Industry Canada program, to support women entrepreneurs in Ontario. This program provided Ontario businesswomen with access to networking, training, and information to help them start, operate and grow their own businesses. NWE client outreach activity had increased by 53 percent to serve 2,864 clients in 2007–08 over the previous fiscal year through 22 learning events and 36 trade shows and network/speaking events.

- Hosting a Global Value Chains (GVC) conference, that attracted 275 participants from governments, academia, think tanks and the private sector, which furthered our understanding of the implications of GVCs on industries and the economy, and clarified the role of governments in facilitating competitiveness in a globally linked value chain world.

Finally, Industry Canada continued working with Canadians to position them to take advantage of economic opportunities, support business development, provide long-term growth and promote sustainable development by:

- Supporting a study on the sustainability and corporate social responsibility (CSR) platforms of industry associations, the development of a roadmap tool for industry associations on how to effectively integrate sustainability into their organizations, and promoting these findings and tools.

- Continuing, through regional development organizations such as FedNor, to work with partners to help create an environment in which communities can thrive, businesses can grow and people can prosper.

Performance Analysis

More specifically, through the following program activities, Industry Canada continued building competitive industries and sustainable communities in 2007–08.

Program Activity Policy Sector – Economic Development

| Description: Development of industry and international business policy | ||

| Expected Result: Development and coordination of policy frameworks that support competitive industry and sustainable communities | ||

| Indicator | Result | Trend |

| Ongoing policy and program oversight and development is advanced with a view to enhancing industry competitiveness | Not Applicable | |

| Financial Resources ($ millions) 2007–08 |

Human Resources (Full-Time Equivalents) 2007–08 |

|||||

| Planned Spending |

Total Authorities |

Actual Spending |

Planned | Actual | Difference | |

| 11.2 | 12.1 | 11.7 | 89 | 68 | 21 | |

To meet shared objectives and public policy goals in filling gaps in the financial services offered to small and medium-sized enterprises (SMEs) and to improve their competitiveness, Industry Canada provided strategic direction to, and worked in partnership with, the Business Development Bank of Canada. In collaboration with the University of Ottawa, the Department also undertook two major research projects on SMEs engaged in exporting. Both projects were completed and reports on Canadian SME Exporters and Financing Canadian SME Exporters were published on Industry Canada’s website.

Program Activity Operations Sector – Economic Development

| Description: Delivery of programs, information and intelligence on investment and technology opportunities to the business community. Provision of a multi-channel, common entry point for business on behalf of the Government of Canada, and encouragement of client-centred service delivery and design | ||

| Expected Result: Improved access to capital and information for SMEs and communities targeted by Operations Sector programs | ||

| Indicator | Result | Trend |

| Number of SMEs — year over year — created or strengthened through FedNor | 3,835 SMEs were created or strengthened by FedNor through the Community Futures Development Corporation Investment Fund.25 | Improving |

| Increase in number of SMEs served through Canada Business Service Centres (service usage) |

Online Channel: 7,037,462 web hits (not including British Columbia) Officer Assisted Channels: 234,191 (i.e., telephone calls, in-person visits, email, mail and fax)26 |

Improving Declining |

| Financial Resources ($ millions) 2007–08 |

Human Resources (Full-Time Equivalents) 2007–08 |

|||||

| Planned Spending |

Total Authorities |

Actual Spending |

Planned | Actual | Difference | |

| 282.7 | 333.6 | 292.2 | 323 | 234 | 89 | |

In 2007–08, FedNor, as a regional development organization in Ontario, continued to work with partners to help create an environment in which communities can thrive, businesses can grow and people can prosper. Through the Northern Ontario Development Program alone, FedNor invested $44.2 million in 217 projects, leveraging $154.1 million in additional funds from other sources in a large and diverse geographic area stretching from the Muskoka Lakes to James Bay and from the Manitoba border to western Quebec.

In addition, improved collaboration agreements with regional partners, such as local chambers of commerce, Canada Business Service Centres, local Community Futures Development Corporations and Soci�t� d’aide au d�veloppement des collectivit�s helped ensure that Student Connections, an initiative that delivers affordable Internet and e-business training to Canadian SMEs through 14 centres across Canada, was a success.

Program Activity Industry Sector – Economic Development

| Description: Development of initiatives that support global competitiveness and sustainable economic growth in priority sectors and emerging technologies | ||

| Expected Result: Competitive and sustainable Canadian industries | ||

| Indicator | Result | Trend |

| Sales, trade and employment statistics* | GDP $527.6 billion ** (+2.4 percent change vs. previous year)27 |

Improving |

| Exports $259.2 billion (+0.5 percent change vs. previous year)28 |

No Change | |

| Employment 7,540,019 (+2.8 percent change vs. previous year)29 |

Improving | |

* This indicator is of less value to measure success and has been revised for 2008–09.

** This figure is the total GDP for sectors that Industry Canada works with.

| Financial Resources ($ millions) 2007–08 |

Human Resources (Full-Time Equivalents) 2007–08 |

|||||

| Planned Spending |

Total Authorities |

Actual Spending* |

Planned | Actual | Difference | |

| 68.6 | 180.2 | $168.6 | 234 | 247 | 13 | |

* The variance between the planned and actual spending in 2007–08 is attributed to a statutory payment of $108.4 million that was made in 2007–08. It was a loan loss sharing program, in partnership with private sector financial institutions, that was wound down in 2007–08 and a claim of $108.388 million was paid to the lender.

The Industrial and Regional Benefits (IRB) policy, managed by Industry Canada, provides the framework for using federal procurement as a lever to promote the federal government’s industrial and regional development objectives. It has allowed the federal government to secure over $1.6 billion in commitments from Lockheed Martin and Boeing in 2007–08. This will result in Canadian firms entering or moving up the global supply chains of these multinationals, as well as generating innovative R&D within the academic community.

Program Activity Spectrum, Information Technologies and Telecommunications Sector – Economic Development

| Description: Promotes economic development by ensuring that Canadians, communities and businesses have access to reliable, modern ICT infrastructure and the skills to fully participate in the digital economy. Enhances entrepreneurship and lifelong learning by fostering the creation of advanced, enabling applications and technologies. Supports the development of a competitive ICT industry in Canada | ||

| Expected Result: Canadians and communities overcoming barriers to, and gaining access to, modern Information Communication Technologies (ICT) infrastructure programs | ||

| Indicator | Result | Trend |

| Number of Canadians and communities accessing and using ICTs |

Community Access Program (CAP): Approximately 3,800 public Internet sites were supported. Approximately 1,400 Canadian youth were provided hands-on training in ICT-related work. Computers for Schools (CFS): 78,102 computers were refurbished and distributed in 2007–08.30 Approximately 360 Canadian youth were provided hands-on training in ICT-related work.31 |

Improving* |

| * Almost three-quarters (73 percent) or 19.2 million Canadians aged 16 and older went online for personal reasons during the 12 months prior to the most recent survey in 2007. This was up from just over two-thirds (68 percent) in 2005. (Statistics Canada’s Canadian Internet Use Survey – CIUS 2007) | ||

| Expected Result: Canadian ICT companies positioned for growth in the global marketplace | ||

| Indicator | Result | Trend |

| Level of awareness of opportunities, gaps and barriers affecting ICT sector growth | Continually improving awareness of the opportunities, gaps and barriers affecting ICT growth through ongoing analysis of the ICT sector, including: statistical reports on ICT sector performance and briefs on other critical issues and emerging trends, including: highly qualified people (HQP), R&D, intellectual property (IP) transfer, SR&ED, Science & Technology, as well as investment and trade. | Improving* |

* Due to expanded knowledge and value-added analysis.

| Financial Resources ($ millions) 2007–08 |

Human Resources (Full-Time Equivalents) 2007–08 |

|||||

| Planned Spending |

Total Authorities |

Actual Spending |

Planned | Actual | Difference | |

| 44.8 | 50.7 | 50.1 | 139 | 110 | 29 | |

ICTs are powerful enablers across the economy. They drive economic development productivity and are key to the social and economic inclusion of Canadians. In 2007–08, additional funding was secured to continue supporting such programs as Community Access Program (CAP) and the Computers for Schools (CFS) that play key roles in supplementing Canadians’ access to ICTs.

Industry Canada also supported the growth of the ICT sector by encouraging expansion and investment by undertaking over 25 corporate calls on Canadian and foreign multinational enterprises (MNEs). Issues were identified and fed into the policy process. This contributed to changes in Scientific Research and Experimental Development (SR&ED) credits, which provides claimants cash refunds and/or tax credits for their expenditures on eligible research and development (R&D) work done in Canada, as announced in the 2008 federal budget.

1Conference Board of Canada, Death by a Thousand Paper Cuts: The Effects of Barriers to Competition on Canadian Productivity, May 2006, p. 24.

2IMD World Competitiveness Yearbook 2007.

5Olympic and Paralympic Marks Act.

9Results can be found in Client Service Standards Report for 2007–08.

10 Survey was conducted in 2006–07 within the SME community.

11Statistics Canada, Domestic Spending on Research and Development (GERD).

12 Statistics Canada, Domestic Spending on Research and Development (GERD).

13 Conference Board of Canada, How Canada Performs 2007: A Report Card on Canada.

14www.budget.gc.ca/2008/home-accueil-eng.asp

15Statistics Canada, Labour Force Activity.

16www.nsf.gov/statistics/infbrief/nsf08305/

17Communications Research Centre Canada – S&T and Innovation

18Communications Research Centre Canada – S&T and Innovation

19Communications Research Centre Canada, Technology Transfer and Commercialization.

21www40.statcan.ca/l01/cst01/busi02a.htm/

22www40.st atcan.ca/l01/cst01/econ146a.htm?sdi=information communication technologies

23www.ic.gc.ca/epic/site/sd-dd.nsf/en/sd00545e.html

24www.ic.gc.ca/epic/site/sd-dd.nsf/en/sd00546e.html

27cansim2.stat.ca/cgi-win/cnsmcgi.exe?Lang=

E&C2Fmt=HTML20&CIITpl=SNA_&ResultTemplate

=THEMSNA4&CORCmd=GetWrap&CORId=1067

28www.ic.gc.ca/epic/site/tdo-dcd.nsf/en/home

29cansim2.statcan.ca/cgi-win/cnsmcgi.pgm?Lang=E&SP_

Action=Result&SP_ID=1803&SP_TYP=4&SP_Sort=1