Common menu bar links

Breadcrumb Trail

ARCHIVED - Department of Finance Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Minister's Message

The past year was dominated by the worldwide economic and financial crisis. It originated globally, but it has had a significant impact on the Canadian economy.

Canada's Economic Action Plan is the Government's response to the deepest global recession since the Second World War. In January 2009, the Government introduced one of the most comprehensive stimulus packages in the industrialized world. At that time, there was considerable concern about the potential effect of the global recession on the Canadian economy and on Canadian workers and families. More recently, the Canadian economy has begun to show some signs of stabilization. The recovery, however, remains fragile, with both employment and output in Canada improving only modestly in recent months.

Canadians and their families continue to be significantly affected by the downturn. As a result, the Government's priority continues to be rapid and effective implementation of Canada's Economic Action Plan to benefit Canadian communities, businesses and workers.

In support of this commitment, the Department of Finance Canada will focus on four key priorities in 2010–11.

With respect to the first priority, sound fiscal management, the Department will play a major role in ensuring that the government continues to manage spending responsibly, maximizes the benefits of government assets to Canadians, and that measures are taken to ensure the effectiveness and to reduce the cost of government operations.

The second priority, promoting sustainable growth, will entail developing and implementing policies and programs that provide appropriate support for the drivers of productivity growth: business investment, public infrastructure, human capital, innovation, and financial market governance.

Our third key priority is promoting a sound social policy framework. Over the planning period, the Department will support the government in the effective implementation of measures to provide support to the provinces and territories, help the unemployed, create a more skilled workforce, support social housing, and foster Aboriginal economic development.

To advance our fourth priority, achieving effective international influence, the Department will work with other G20 countries to address the causes of the international financial crisis, determine actions to stabilize financial markets and growth, and reform the global financial system to prevent the reoccurrence of a similar crisis.

This Report on Plans and Priorities provides key details of the Department's strategies to lay the foundation for an entrenched recovery and truly sustainable prosperity.

Section I: Departmental Overview

Raison d'être and Responsibilities

The Department is committed to making a difference for Canadians by helping the Government of Canada develop and implement strong and sustainable economic, fiscal, tax, social, security, international and financial sector policies and programs. It plays an important role in ensuring that government spending is focussed on results and delivers value for taxpayer dollars. The Department interacts extensively with other federal departments and agencies and plays a pivotal role in the analysis and design of public policy across a wide range of issues affecting Canadians.

The Department of Finance Canada's responsibilities include the following:

- Preparing the federal budget and full economic and fiscal updates;

- Developing tax and tariff policy and legislation;

- Managing federal borrowing on financial markets;

- Administering major transfers of federal funds to the provinces and territories;

- Developing regulatory policy for the country's financial sector; and

- Representing Canada in various international financial institutions and groups.

The Department also plays an important central agency role, working with other departments to ensure that the government's agenda is carried out and that ministers are supported with first‑rate analysis and advice.

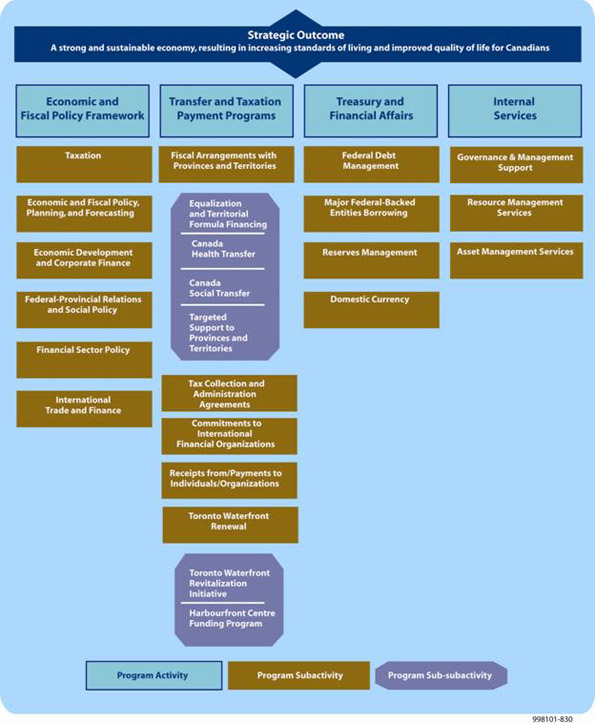

Strategic Outcome and Program Activity Architecture

The Department of Finance Canada provides effective economic leadership through its clear focus on one strategic outcome:

The Department's current program activity architecture (PAA) is represented below; it illustrates which departmental branches are responsible for each activity area.

Department of Finance Canada Program Activity Architecture - Text Version

Planning Summary

Financial Resources ($ thousands)

| 2010–11 | 2011–12 | 2012–13 |

|---|---|---|

| 88,652,817.11 | 92,087,126.1 | 96,859,001.1 |

Human Resources (Full-Time Equivalent, FTE)

| 2010–11 | 2011–12 | 2012–13 |

|---|---|---|

| 818 | 773 | 773 |

| Strategic Outcome: A strong and sustainable economy, resulting in increasing standards of living and improved quality of life for Canadians | |

|---|---|

| Performance Indicator | Targets |

| Real gross domestic product (GDP) growth | No target. The goal is to compare favourably with G7 counterparts. |

| Unemployment rate | No target. The goal is to compare favourably with G7 counterparts. |

| Annual fiscal balance as a share of GDP and debt-to-GDP ratio | No target. The goal is to compare favourably with G7 counterparts. |

($ thousands)

| Program Activity (PA) | 2009–10 Forecast Spending |

Planned Spending | Alignment with Government

of Canada Outcomes |

||

|---|---|---|---|---|---|

| 2010–11 | 2011–12 | 2012–13 | |||

| PA 1: Economic and Fiscal Policy Framework | 91,596.6 | 75,831.0 | 63,493.0 | 61,593.0 | Strong economic growth |

| PA 2: Transfer and Taxation Payment Programs | 50,175,205.0 | 54,570,801.0 | 53,974,457.0 | 55,272,231.0 | All outcomes2 |

| PA 3: Treasury and Financial Affairs | 42,911,231.1 | 33,960,231.1 | 38,006,231.1 | 41,482,231.1 | All outcomes |

| PA 4: Internal Services | 50,749.6 | 45,954.0 | 42,945.0 | 42,946.0 | |

| Totals | 93,228,782.3 | 88,652,817.1 | 92,087,126.1 | 96,859,001.1 | |

Risk Analysis

After entering the deepest global recession since the Second World War, there are signs that the Canadian economy has stabilized. However, the recovery remains fragile. Many Canadian communities, businesses and industries will continue to be affected by the economic downturn. This uncertainty is reflected in the wide range of private sector forecasts for Canada's nominal GDP.

The main short-term risk is that the global economic recovery will be weaker than currently projected if global consumer spending and business investment do not recover as quickly as expected. In particular, there is a risk that domestic demand in the United States could remain weak for an extended period of time as consumers, businesses and governments focus on reducing their accumulated debt and improving their balance sheets. This would have an important negative impact on the Canadian economy.

Combined with the impact of an aging population and low productivity growth relative to other developed countries, these factors all put added pressure on government programs and services in the longer term and require careful management and greater scrutiny to ensure that government programs and services remain sustainable, effective and accessible to all Canadians.

Despite the risks, the overall economic situation in Canada remains better than in most other major industrialized countries. Canada's banks and other financial institutions are sound and well capitalized. The financial position of Canadian households and businesses remains solid, and Canada has maintained the strongest fiscal performance of all G7 countries. Moreover, Canada's Economic Action Plan is providing significant and timely support to the economy.

Contribution of Priorities to the Strategic Outcome

The overarching goal of the Department of Finance Canada for 2010–11 will be to complete the effective and efficient implementation of the measures announced in Canada's Economic Action Plan. In doing so, the Department's ongoing efforts will focus on four key priorities.

Sound Fiscal Management

Over the planning period, the Department will continue to play a major role in ensuring that the government continues to manage spending responsibly, maximizes the benefits of government assets to Canadians and takes measures to reduce the cost of government operations while ensuring their effectiveness.

It will also work to protect Canada's macroeconomic framework and ensure the sustainability of Canada's social safety net. Maintaining a sound economic and fiscal framework, including a competitive, efficient and fair tax system, is critical in uncertain economic times.

Finally, the Department will continue to manage the government's funds in accordance with the guiding principles of transparency, regularity, liquidity and prudence. Sound management of public finances provides significant benefits to Canadians and businesses in Canada. It gives the government the strength to withstand fiscal and economic challenges and ensures that the costs of investments and services are not passed on to future generations.

Sustainable Economic Growth

The Department promotes sustainable economic growth by developing and implementing policies and programs that appropriately support the drivers of productivity growth: business investment, public infrastructure, human capital, innovation and financial market governance.

As the government's source of analysis and advice on economic and fiscal matters, the Department will continue to help ensure that policies and programs create the conditions necessary for both sustainable long-term economic growth and the country's emergence from the global economic downturn. This will include putting in place sound policies to help mitigate the downside risks to the economy and create the conditions necessary to secure long-term growth potential.

Sound Social Policy Framework

Through the effective design of payment programs and the sound administration of major federal transfers, the Department will support the government's efforts to enable the funding of national priorities while ensuring that reasonably comparable services are provided at reasonably comparable tax rates across the country. This will contribute to the government's efforts to ensure equality of opportunity for all citizens and to meet its objectives for the quality of life in Canada's communities and their health care, post-secondary education and social safety net programs.

The Department will also provide analysis and advice on the fiscal and economic implications of the government's social policies and programs related to health care, immigration, employment insurance and pensions, and post-secondary education; its Aboriginal and cultural programs; and its programs for seniors, persons with disabilities, veterans and children. Over the planning period, the Department, in collaboration with the provinces and territories, will support the government in the effective implementation of measures to help the unemployed, create a more skilled workforce, support social housing and foster Aboriginal economic development.

Effective International Influence

As chair of the G7 process in 2010 and co-chair of the G20 Leaders Summit in June 2010, the Department will play an important role in developing the agenda for international economic cooperation in 2010. This will be an opportunity to raise issues that are of critical importance to Canada and the rest of the world. The Department is working with other G20 countries to address the causes of the current international financial crisis, determine actions to support financial markets and growth, and reform the global economic and financial system to prevent the reoccurrence of a similar crisis.

The Department will also continue to advance Canada's leadership in a wide range of international financial institutions and economic organizations. This will help to strengthen global growth and stability, promote Canada's trade and investment interests, foster effective and innovative aid policies aimed at reducing global poverty, endorse policies and programs that support maintaining secure and open borders, and further international standards to prevent abuses to the international financial system, including anti-terrorist financing. Finally, the Department will assist the government in creating economic conditions that encourage Canadian firms to invest, flourish and take advantage of trade and foreign investment.

Expenditure Profile

For the 2010–11 fiscal year, the Department of Finance Canada plans to spend's spending trend by program activity from 2007–08 to 2012–13.

Spending for the Economic and Fiscal Policy Framework program activity mostly involves operating expenditures and the employee benefits plan. The increase in forecast spending in 2009–10 and planned spending for 2010–11 is mainly due to time-limited funding of various new initiatives during this period, including support for establishing a Canadian securities regulator, the 2010 Muskoka G8 Summit, the Task Force on Financial Literacy, tax harmonization, litigation related to the Proceeds of Crime (Money Laundering) and Terrorist Financing Act and its regulations, and an advertising campaign.

The slight increase in actual spending for Transfer and Taxation Payment Programs from 2007–08 to 2008–09 is mainly due to a $0.5-billion increase in grants and contributions, a $3.4‑billion increase in transfer payments (Fiscal Equalization, Canada Social Transfer, Canada Health Transfer, and Youth Allowances Recovery) and a net decrease of $3.3 billion in one-time statutory payments.

From 2009–10 onward, the increase in forecast and planned spending is due mainly to increased transfer payments for the Canada Health Transfer, the Canada Social Transfer, Fiscal Equalization and Territorial Formula Financing, which are forecast to grow as legislated until 2013–14. The Canada Health Transfer will grow by 6 per cent annually and the Canada Social Transfer by 3 per cent annually. Territorial Formula Financing will grow in line with its legislated funding framework, and the Equalization program will grow in line with the economy. The increase is also attributed to new transfer payments for the Implementation of the Harmonized Sales Tax and the Establishment of the Canadian Securities Regulation (CSR) Regime.

Treasury and Financial Affairs includes domestic coinage, interest and other costs related to the public debt, and loans to Crown corporations. The increase in actual spending from 2007–08 to 2008–09 is mostly due to a $127-billion increase in loans to Crown corporations offset by a decrease of $3 billion in interest and other costs of public debt.3 The forecast and planned spending vary depending on the forecasted interest rates and loans to Crown corporations.4

Spending for the Internal Services program activity mostly involves operating expenditures and the employee benefits plan. The increase in forecast and planned spending is mainly due to time-limited funding of the various new initiatives.

Voted and Statutory Items

($ thousands)

| Vote Number or Statutory Item (S) | Truncated Vote or Statutory Wording | 2009–10 Main Estimates |

2010–11 Main Estimates |

|---|---|---|---|

| 1 | Operating expenditures1 | 93,603 | 110,272 |

| 5 | Grants and contributions2 | 331,886 | 299,051 |

| (S) | Minister of Finance—Salary and motor car allowance | 78 | 78 |

| (S) | Territorial Financing (Part I.1—Federal-Provincial Fiscal Arrangements Act)3 | 2,497,926 | 2,663,567 |

| (S) | Payments to International Development Association | 384,280 | 384,280 |

| (S) | Contributions to employee benefits plan4 | 11,549 | 12,836 |

| (S) | Purchase of domestic coinage5 | 150,000 | 140,000 |

| (S) | Interest and other costs6 | 31,868,000 | 33,693,000 |

| (S) | Statutory subsidies (Constitution Acts, 1867–1982, and Other Statutory Authorities) | 32,000 | 32,000 |

| (S) | Fiscal Equalization (Part I—Federal-Provincial Fiscal Arrangements Act)7 | 16,086,136 | 14,372,000 |

| (S) | Canada Health Transfer (Part V.1—Federal-Provincial Fiscal Arrangements Act)8 | 23,987,062 | 25,426,286 |

| (S) | Canada Social Transfer (Part V.1—Federal-Provincial Fiscal Arrangements Act)9 | 10,860,781 | 11,178,703 |

| (S) | Wait Times Reduction Transfer (Part V.1—Federal-Provincial Fiscal Arrangements Act) | 250,000 | 250,000 |

| (S) | Youth Allowances Recovery (Federal-Provincial Fiscal Revision Act, 1964)10 | (688,935) | (655,786) |

| (S) | Alternative Payments for Standing Programs (Part VI—Federal-Provincial Fiscal Arrangements Act)11 | (3,124,006) | (2,976,719) |

| (S) | Incentive for Provinces to Eliminate Taxes on Capital (Part IV—Federal-Provincial Fiscal Arrangements Act)12 | 123,000 | 170,000 |

| (S) | Canadian Securities Regulation Regime Transition Office (Canadian Securities Regulation Regime Transition Office Act)13 | 0 | 11,000 |

| (S) | Payment to Ontario related to the Canada Health Transfer (Budget Implementation Act, 2009)14 | 0 | 213,800 |

| (S) | Establishment of a Canadian Securities Regulation Regime and Canadian Regulatory Authority (Budget Implementation Act, 2009)15 | 0 | 150,000 |

| (S) | Transitional assistance to provinces entering into the Harmonized Value-Added Tax Framework (Part III.1—Federal-Provincial Fiscal Arrangements Act)16 | 0 | 3,000,000 |

| (S) | Debt payments on behalf of poor countries to international organizations pursuant to section 18(1) of the Economic Recovery Act17 | 0 | 51,200 |

| Total budgetary | 82,863,360 | 88,525,568 | |

| L10 | In accordance with the Bretton Woods and Related Agreements Act, the issuance and payment of non-interest bearing, non-negotiable demand notes in an amount not to exceed $384,280,000 to the International Development Association18 | 0 | 0 |

| (S) | Payments and encashment of notes issued to the European Bank for Reconstruction and Development—Capital subscriptions19 | 1,749 | 0 |

| Total non-budgetary | 1,749 | 0 | |

| Total Department20 | 82,865,109 | 88,525,568 |

Notes:

1. The increase of $16.7 million (or 17.8 per cent) in operating expenditures is mainly due to increases for the Canadian securities regulator, the 2010 Muskoka G8 Summit, the Task Force on Financial Literacy, Canada's Economic Action Plan, tax harmonization, and litigation related to the Proceeds of Crime (Money Laundering) and Terrorist Financing Act and its regulations. The increase is offset primarily by the transfer of collective agreement funding to the Treasury Board of Canada Secretariat.

2. The decrease in grants and contributions is mainly due to the transfer of $51.2 million for debt payments on behalf of poor countries to international organizations to a new statutory vote and a decrease of contributions related to the Toronto Waterfront Revitalization Initiative.

3. The increase of $165.6 million in transfer payments for Territorial Formula Financing is a result of the formula that was announced in Budget 2007.

4. The increase in contributions to employee benefits plan reflects changes in salary costs included in operating expenditures.

5. The decrease of $10 million (or 6.7 per cent) in domestic coinage reflects the decrease in production costs for the $1 and $2 coins due to a change in metal composition as well as a reduction in production volumes due to a higher volume of recycled coins.

6. Forecast of public debt charges are higher as a result of an increase in projected debt levels, mainly resulting from higher projected budgetary deficits and higher-than-projected losses on investments.

7. The $16.1 billion figure for the Fiscal Equalization program is from the 2009–10 Main Estimates and represents the cost of the program based on earlier legislation before it was amended by the Budget Implementation Act, 2009. The impact of the legislation for 2009–10 was a reduction in payments of $1.9 billion (presented in Supplementary Estimates A) for a net amount of $14.2 billion for 2009–10. This legislation also put in place the sustainable growth path for the Equalization program first announced in November 2008 and set the level of the program at $14.4 billion for 2010–11.

8. The increase of $1.4 billion reflects the 6-per-cent increase funding commitment in the September 2004

10-Year Plan to Strengthen Health Care.

9. The increase of $317.9 million (or 2.9 per cent) represents the legislated increase of 3 per cent and, as announced in Budget 2007, the decrease in the transitional payments that protect provinces against declines in their Canada Social Transfer cash transfers.

10. The decrease in the recovery of $33.1 million is related to a decrease in the estimated value of personal income tax points.

11. The decreased recovery of $147.3 million is attributable to a decrease in the value of personal income tax points.

12. The amount of the incentive varies on a yearly basis depending on eligible provincial capital tax reductions. The increase reflects the incentive expected to be paid as a result of the gradual elimination of provincial capital taxes.

13. Section 14 of the Canadian Securities Regulation Regime Transition Office Act authorizes the Minister of Finance to make direct payments to the Transition Office, which it will use to fulfill its purpose, in an amount not to exceed $33 million for a three-year period commencing on July 13, 2009. The first instalment under this agreement is in the amount of $11 million.

14. The Budget Implementation Act, 2009 provides for separate payments to Ontario outside of the Canada Health Transfer (CHT) cash envelope for 2009–10 and 2010–11 to ensure its per capita cash entitlements in relation to the CHT are the same as for other Equalization-receiving provinces. The amount for 2009–10 was a legislated fixed amount, whereas the payment in 2010–11 will be formula-based.

15. In Budget 2009, the government indicated that it is prepared to enter into financial arrangements with participating jurisdictions as it moves toward a Canadian securities regulator. The Budget Implementation Act, 2009 provided up to $150 million to compensate the provinces and territories for matters relating to the transition.

16. Further transitional payments may be made under this authority, including a payment to Ontario in 2011–12 and payments to British Columbia, subject to fulfilling the terms of the Canada-British Columbia Comprehensive Integrated Tax Coordination Agreement.

17. The debt payments on behalf of poor countries to international organizations (Vote 5) grants in the 2009–10 Main Estimates became a statutory item in the 2010–11 Main Estimates, as legislated in the Budget Implementation Act, 2009 and with the passing of Bill C-51.

18. This L10 vote represents the value of a non-interest bearing, non-negotiable demand note to be issued to the International Development Association.

19. The decrease reflects the agreed schedule of Canada's payments and encashments for the European Bank for Reconstruction and Development's 1998 capital subscription increase and the impact of changes to the exchange rate.

20. The following adjustments were made subsequent to the Main Estimates through the Supplementary Estimates and other transfers to arrive at the total planned spending for fiscal year 2009–10:

| ($ thousands) | 2009–10 | |

|---|---|---|

| Main Estimates | 82,865,109 | |

| 1 | Operating expenditures | 35,744 |

| 5 | Grants and contributions | 30,320 |

| (S) | Interest and other costs | (1,209,000) |

| (S) | Adjustments to transfer payments | (905,480) |

| (S) | Funding for Canada's participation in the Global Trade Liquidity Program | 247,840 |

| (S) | Purchase of domestic coinage | (25,000) |

| (S) | Payments to CSR Regime Transition Office | 11,000 |

| (S) | Payment to International Finance Corporation for Canada's participation in the G8 food security and agricultural development initiative | 48,000 |

| (S) | Advances to BDC regarding Canadian Secured Credit Facility |

12,000,000 |

| (S) | Net loss on exchange | 125,056 |

| (S) | Other statutory votes | 5,193 |

| Total Planned Spending | 93,228,782 | |