ARCHIVED - Department of Finance Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

2010-11

Report on Plans and Priorities

Department of Finance Canada

The original version was signed by

The Honourable James M. Flaherty

Minister of Finance

Table of Contents

Minister's MessageSection I: Departmental Overview

Strategic Outcome and Program Activity Architecture

Planning Summary

Risk Analysis

Contribution of Priorities to the Strategic Outcome

Expenditure Profile

Voted and Statutory Items

Program Activity 1.2: Transfer and Taxation Payment Programs

Program Activity 1.3: Treasury and Financial Affairs

Program Activity 1.4: Internal Services

Minister's Message

The past year was dominated by the worldwide economic and financial crisis. It originated globally, but it has had a significant impact on the Canadian economy.

Canada's Economic Action Plan is the Government's response to the deepest global recession since the Second World War. In January 2009, the Government introduced one of the most comprehensive stimulus packages in the industrialized world. At that time, there was considerable concern about the potential effect of the global recession on the Canadian economy and on Canadian workers and families. More recently, the Canadian economy has begun to show some signs of stabilization. The recovery, however, remains fragile, with both employment and output in Canada improving only modestly in recent months.

Canadians and their families continue to be significantly affected by the downturn. As a result, the Government's priority continues to be rapid and effective implementation of Canada's Economic Action Plan to benefit Canadian communities, businesses and workers.

In support of this commitment, the Department of Finance Canada will focus on four key priorities in 2010–11.

With respect to the first priority, sound fiscal management, the Department will play a major role in ensuring that the government continues to manage spending responsibly, maximizes the benefits of government assets to Canadians, and that measures are taken to ensure the effectiveness and to reduce the cost of government operations.

The second priority, promoting sustainable growth, will entail developing and implementing policies and programs that provide appropriate support for the drivers of productivity growth: business investment, public infrastructure, human capital, innovation, and financial market governance.

Our third key priority is promoting a sound social policy framework. Over the planning period, the Department will support the government in the effective implementation of measures to provide support to the provinces and territories, help the unemployed, create a more skilled workforce, support social housing, and foster Aboriginal economic development.

To advance our fourth priority, achieving effective international influence, the Department will work with other G20 countries to address the causes of the international financial crisis, determine actions to stabilize financial markets and growth, and reform the global financial system to prevent the reoccurrence of a similar crisis.

This Report on Plans and Priorities provides key details of the Department's strategies to lay the foundation for an entrenched recovery and truly sustainable prosperity.

Section I: Departmental Overview

Raison d'être and Responsibilities

The Department is committed to making a difference for Canadians by helping the Government of Canada develop and implement strong and sustainable economic, fiscal, tax, social, security, international and financial sector policies and programs. It plays an important role in ensuring that government spending is focussed on results and delivers value for taxpayer dollars. The Department interacts extensively with other federal departments and agencies and plays a pivotal role in the analysis and design of public policy across a wide range of issues affecting Canadians.

The Department of Finance Canada's responsibilities include the following:

- Preparing the federal budget and full economic and fiscal updates;

- Developing tax and tariff policy and legislation;

- Managing federal borrowing on financial markets;

- Administering major transfers of federal funds to the provinces and territories;

- Developing regulatory policy for the country's financial sector; and

- Representing Canada in various international financial institutions and groups.

The Department also plays an important central agency role, working with other departments to ensure that the government's agenda is carried out and that ministers are supported with first‑rate analysis and advice.

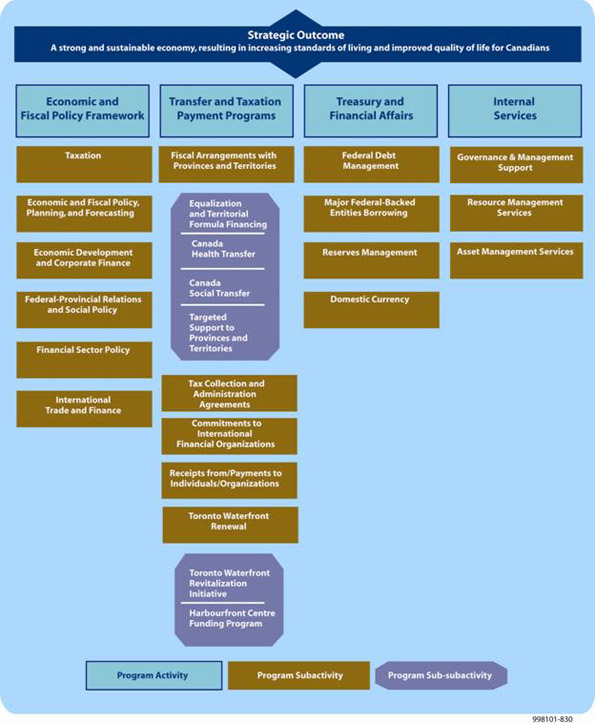

Strategic Outcome and Program Activity Architecture

The Department of Finance Canada provides effective economic leadership through its clear focus on one strategic outcome:

The Department's current program activity architecture (PAA) is represented below; it illustrates which departmental branches are responsible for each activity area.

Department of Finance Canada Program Activity Architecture - Text Version

Planning Summary

Financial Resources ($ thousands)

| 2010–11 | 2011–12 | 2012–13 |

|---|---|---|

| 88,652,817.11 | 92,087,126.1 | 96,859,001.1 |

Human Resources (Full-Time Equivalent, FTE)

| 2010–11 | 2011–12 | 2012–13 |

|---|---|---|

| 818 | 773 | 773 |

| Strategic Outcome: A strong and sustainable economy, resulting in increasing standards of living and improved quality of life for Canadians | |

|---|---|

| Performance Indicator | Targets |

| Real gross domestic product (GDP) growth | No target. The goal is to compare favourably with G7 counterparts. |

| Unemployment rate | No target. The goal is to compare favourably with G7 counterparts. |

| Annual fiscal balance as a share of GDP and debt-to-GDP ratio | No target. The goal is to compare favourably with G7 counterparts. |

($ thousands)

| Program Activity (PA) | 2009–10 Forecast Spending |

Planned Spending | Alignment with Government

of Canada Outcomes |

||

|---|---|---|---|---|---|

| 2010–11 | 2011–12 | 2012–13 | |||

| PA 1: Economic and Fiscal Policy Framework | 91,596.6 | 75,831.0 | 63,493.0 | 61,593.0 | Strong economic growth |

| PA 2: Transfer and Taxation Payment Programs | 50,175,205.0 | 54,570,801.0 | 53,974,457.0 | 55,272,231.0 | All outcomes2 |

| PA 3: Treasury and Financial Affairs | 42,911,231.1 | 33,960,231.1 | 38,006,231.1 | 41,482,231.1 | All outcomes |

| PA 4: Internal Services | 50,749.6 | 45,954.0 | 42,945.0 | 42,946.0 | |

| Totals | 93,228,782.3 | 88,652,817.1 | 92,087,126.1 | 96,859,001.1 | |

Risk Analysis

After entering the deepest global recession since the Second World War, there are signs that the Canadian economy has stabilized. However, the recovery remains fragile. Many Canadian communities, businesses and industries will continue to be affected by the economic downturn. This uncertainty is reflected in the wide range of private sector forecasts for Canada's nominal GDP.

The main short-term risk is that the global economic recovery will be weaker than currently projected if global consumer spending and business investment do not recover as quickly as expected. In particular, there is a risk that domestic demand in the United States could remain weak for an extended period of time as consumers, businesses and governments focus on reducing their accumulated debt and improving their balance sheets. This would have an important negative impact on the Canadian economy.

Combined with the impact of an aging population and low productivity growth relative to other developed countries, these factors all put added pressure on government programs and services in the longer term and require careful management and greater scrutiny to ensure that government programs and services remain sustainable, effective and accessible to all Canadians.

Despite the risks, the overall economic situation in Canada remains better than in most other major industrialized countries. Canada's banks and other financial institutions are sound and well capitalized. The financial position of Canadian households and businesses remains solid, and Canada has maintained the strongest fiscal performance of all G7 countries. Moreover, Canada's Economic Action Plan is providing significant and timely support to the economy.

Contribution of Priorities to the Strategic Outcome

The overarching goal of the Department of Finance Canada for 2010–11 will be to complete the effective and efficient implementation of the measures announced in Canada's Economic Action Plan. In doing so, the Department's ongoing efforts will focus on four key priorities.

Sound Fiscal Management

Over the planning period, the Department will continue to play a major role in ensuring that the government continues to manage spending responsibly, maximizes the benefits of government assets to Canadians and takes measures to reduce the cost of government operations while ensuring their effectiveness.

It will also work to protect Canada's macroeconomic framework and ensure the sustainability of Canada's social safety net. Maintaining a sound economic and fiscal framework, including a competitive, efficient and fair tax system, is critical in uncertain economic times.

Finally, the Department will continue to manage the government's funds in accordance with the guiding principles of transparency, regularity, liquidity and prudence. Sound management of public finances provides significant benefits to Canadians and businesses in Canada. It gives the government the strength to withstand fiscal and economic challenges and ensures that the costs of investments and services are not passed on to future generations.

Sustainable Economic Growth

The Department promotes sustainable economic growth by developing and implementing policies and programs that appropriately support the drivers of productivity growth: business investment, public infrastructure, human capital, innovation and financial market governance.

As the government's source of analysis and advice on economic and fiscal matters, the Department will continue to help ensure that policies and programs create the conditions necessary for both sustainable long-term economic growth and the country's emergence from the global economic downturn. This will include putting in place sound policies to help mitigate the downside risks to the economy and create the conditions necessary to secure long-term growth potential.

Sound Social Policy Framework

Through the effective design of payment programs and the sound administration of major federal transfers, the Department will support the government's efforts to enable the funding of national priorities while ensuring that reasonably comparable services are provided at reasonably comparable tax rates across the country. This will contribute to the government's efforts to ensure equality of opportunity for all citizens and to meet its objectives for the quality of life in Canada's communities and their health care, post-secondary education and social safety net programs.

The Department will also provide analysis and advice on the fiscal and economic implications of the government's social policies and programs related to health care, immigration, employment insurance and pensions, and post-secondary education; its Aboriginal and cultural programs; and its programs for seniors, persons with disabilities, veterans and children. Over the planning period, the Department, in collaboration with the provinces and territories, will support the government in the effective implementation of measures to help the unemployed, create a more skilled workforce, support social housing and foster Aboriginal economic development.

Effective International Influence

As chair of the G7 process in 2010 and co-chair of the G20 Leaders Summit in June 2010, the Department will play an important role in developing the agenda for international economic cooperation in 2010. This will be an opportunity to raise issues that are of critical importance to Canada and the rest of the world. The Department is working with other G20 countries to address the causes of the current international financial crisis, determine actions to support financial markets and growth, and reform the global economic and financial system to prevent the reoccurrence of a similar crisis.

The Department will also continue to advance Canada's leadership in a wide range of international financial institutions and economic organizations. This will help to strengthen global growth and stability, promote Canada's trade and investment interests, foster effective and innovative aid policies aimed at reducing global poverty, endorse policies and programs that support maintaining secure and open borders, and further international standards to prevent abuses to the international financial system, including anti-terrorist financing. Finally, the Department will assist the government in creating economic conditions that encourage Canadian firms to invest, flourish and take advantage of trade and foreign investment.

Expenditure Profile

For the 2010–11 fiscal year, the Department of Finance Canada plans to spend's spending trend by program activity from 2007–08 to 2012–13.

Spending for the Economic and Fiscal Policy Framework program activity mostly involves operating expenditures and the employee benefits plan. The increase in forecast spending in 2009–10 and planned spending for 2010–11 is mainly due to time-limited funding of various new initiatives during this period, including support for establishing a Canadian securities regulator, the 2010 Muskoka G8 Summit, the Task Force on Financial Literacy, tax harmonization, litigation related to the Proceeds of Crime (Money Laundering) and Terrorist Financing Act and its regulations, and an advertising campaign.

The slight increase in actual spending for Transfer and Taxation Payment Programs from 2007–08 to 2008–09 is mainly due to a $0.5-billion increase in grants and contributions, a $3.4‑billion increase in transfer payments (Fiscal Equalization, Canada Social Transfer, Canada Health Transfer, and Youth Allowances Recovery) and a net decrease of $3.3 billion in one-time statutory payments.

From 2009–10 onward, the increase in forecast and planned spending is due mainly to increased transfer payments for the Canada Health Transfer, the Canada Social Transfer, Fiscal Equalization and Territorial Formula Financing, which are forecast to grow as legislated until 2013–14. The Canada Health Transfer will grow by 6 per cent annually and the Canada Social Transfer by 3 per cent annually. Territorial Formula Financing will grow in line with its legislated funding framework, and the Equalization program will grow in line with the economy. The increase is also attributed to new transfer payments for the Implementation of the Harmonized Sales Tax and the Establishment of the Canadian Securities Regulation (CSR) Regime.

Treasury and Financial Affairs includes domestic coinage, interest and other costs related to the public debt, and loans to Crown corporations. The increase in actual spending from 2007–08 to 2008–09 is mostly due to a $127-billion increase in loans to Crown corporations offset by a decrease of $3 billion in interest and other costs of public debt.3 The forecast and planned spending vary depending on the forecasted interest rates and loans to Crown corporations.4

Spending for the Internal Services program activity mostly involves operating expenditures and the employee benefits plan. The increase in forecast and planned spending is mainly due to time-limited funding of the various new initiatives.

Voted and Statutory Items

($ thousands)

| Vote Number or Statutory Item (S) | Truncated Vote or Statutory Wording | 2009–10 Main Estimates |

2010–11 Main Estimates |

|---|---|---|---|

| 1 | Operating expenditures1 | 93,603 | 110,272 |

| 5 | Grants and contributions2 | 331,886 | 299,051 |

| (S) | Minister of Finance—Salary and motor car allowance | 78 | 78 |

| (S) | Territorial Financing (Part I.1—Federal-Provincial Fiscal Arrangements Act)3 | 2,497,926 | 2,663,567 |

| (S) | Payments to International Development Association | 384,280 | 384,280 |

| (S) | Contributions to employee benefits plan4 | 11,549 | 12,836 |

| (S) | Purchase of domestic coinage5 | 150,000 | 140,000 |

| (S) | Interest and other costs6 | 31,868,000 | 33,693,000 |

| (S) | Statutory subsidies (Constitution Acts, 1867–1982, and Other Statutory Authorities) | 32,000 | 32,000 |

| (S) | Fiscal Equalization (Part I—Federal-Provincial Fiscal Arrangements Act)7 | 16,086,136 | 14,372,000 |

| (S) | Canada Health Transfer (Part V.1—Federal-Provincial Fiscal Arrangements Act)8 | 23,987,062 | 25,426,286 |

| (S) | Canada Social Transfer (Part V.1—Federal-Provincial Fiscal Arrangements Act)9 | 10,860,781 | 11,178,703 |

| (S) | Wait Times Reduction Transfer (Part V.1—Federal-Provincial Fiscal Arrangements Act) | 250,000 | 250,000 |

| (S) | Youth Allowances Recovery (Federal-Provincial Fiscal Revision Act, 1964)10 | (688,935) | (655,786) |

| (S) | Alternative Payments for Standing Programs (Part VI—Federal-Provincial Fiscal Arrangements Act)11 | (3,124,006) | (2,976,719) |

| (S) | Incentive for Provinces to Eliminate Taxes on Capital (Part IV—Federal-Provincial Fiscal Arrangements Act)12 | 123,000 | 170,000 |

| (S) | Canadian Securities Regulation Regime Transition Office (Canadian Securities Regulation Regime Transition Office Act)13 | 0 | 11,000 |

| (S) | Payment to Ontario related to the Canada Health Transfer (Budget Implementation Act, 2009)14 | 0 | 213,800 |

| (S) | Establishment of a Canadian Securities Regulation Regime and Canadian Regulatory Authority (Budget Implementation Act, 2009)15 | 0 | 150,000 |

| (S) | Transitional assistance to provinces entering into the Harmonized Value-Added Tax Framework (Part III.1—Federal-Provincial Fiscal Arrangements Act)16 | 0 | 3,000,000 |

| (S) | Debt payments on behalf of poor countries to international organizations pursuant to section 18(1) of the Economic Recovery Act17 | 0 | 51,200 |

| Total budgetary | 82,863,360 | 88,525,568 | |

| L10 | In accordance with the Bretton Woods and Related Agreements Act, the issuance and payment of non-interest bearing, non-negotiable demand notes in an amount not to exceed $384,280,000 to the International Development Association18 | 0 | 0 |

| (S) | Payments and encashment of notes issued to the European Bank for Reconstruction and Development—Capital subscriptions19 | 1,749 | 0 |

| Total non-budgetary | 1,749 | 0 | |

| Total Department20 | 82,865,109 | 88,525,568 |

Notes:

1. The increase of $16.7 million (or 17.8 per cent) in operating expenditures is mainly due to increases for the Canadian securities regulator, the 2010 Muskoka G8 Summit, the Task Force on Financial Literacy, Canada's Economic Action Plan, tax harmonization, and litigation related to the Proceeds of Crime (Money Laundering) and Terrorist Financing Act and its regulations. The increase is offset primarily by the transfer of collective agreement funding to the Treasury Board of Canada Secretariat.

2. The decrease in grants and contributions is mainly due to the transfer of $51.2 million for debt payments on behalf of poor countries to international organizations to a new statutory vote and a decrease of contributions related to the Toronto Waterfront Revitalization Initiative.

3. The increase of $165.6 million in transfer payments for Territorial Formula Financing is a result of the formula that was announced in Budget 2007.

4. The increase in contributions to employee benefits plan reflects changes in salary costs included in operating expenditures.

5. The decrease of $10 million (or 6.7 per cent) in domestic coinage reflects the decrease in production costs for the $1 and $2 coins due to a change in metal composition as well as a reduction in production volumes due to a higher volume of recycled coins.

6. Forecast of public debt charges are higher as a result of an increase in projected debt levels, mainly resulting from higher projected budgetary deficits and higher-than-projected losses on investments.

7. The $16.1 billion figure for the Fiscal Equalization program is from the 2009–10 Main Estimates and represents the cost of the program based on earlier legislation before it was amended by the Budget Implementation Act, 2009. The impact of the legislation for 2009–10 was a reduction in payments of $1.9 billion (presented in Supplementary Estimates A) for a net amount of $14.2 billion for 2009–10. This legislation also put in place the sustainable growth path for the Equalization program first announced in November 2008 and set the level of the program at $14.4 billion for 2010–11.

8. The increase of $1.4 billion reflects the 6-per-cent increase funding commitment in the September 2004

10-Year Plan to Strengthen Health Care.

9. The increase of $317.9 million (or 2.9 per cent) represents the legislated increase of 3 per cent and, as announced in Budget 2007, the decrease in the transitional payments that protect provinces against declines in their Canada Social Transfer cash transfers.

10. The decrease in the recovery of $33.1 million is related to a decrease in the estimated value of personal income tax points.

11. The decreased recovery of $147.3 million is attributable to a decrease in the value of personal income tax points.

12. The amount of the incentive varies on a yearly basis depending on eligible provincial capital tax reductions. The increase reflects the incentive expected to be paid as a result of the gradual elimination of provincial capital taxes.

13. Section 14 of the Canadian Securities Regulation Regime Transition Office Act authorizes the Minister of Finance to make direct payments to the Transition Office, which it will use to fulfill its purpose, in an amount not to exceed $33 million for a three-year period commencing on July 13, 2009. The first instalment under this agreement is in the amount of $11 million.

14. The Budget Implementation Act, 2009 provides for separate payments to Ontario outside of the Canada Health Transfer (CHT) cash envelope for 2009–10 and 2010–11 to ensure its per capita cash entitlements in relation to the CHT are the same as for other Equalization-receiving provinces. The amount for 2009–10 was a legislated fixed amount, whereas the payment in 2010–11 will be formula-based.

15. In Budget 2009, the government indicated that it is prepared to enter into financial arrangements with participating jurisdictions as it moves toward a Canadian securities regulator. The Budget Implementation Act, 2009 provided up to $150 million to compensate the provinces and territories for matters relating to the transition.

16. Further transitional payments may be made under this authority, including a payment to Ontario in 2011–12 and payments to British Columbia, subject to fulfilling the terms of the Canada-British Columbia Comprehensive Integrated Tax Coordination Agreement.

17. The debt payments on behalf of poor countries to international organizations (Vote 5) grants in the 2009–10 Main Estimates became a statutory item in the 2010–11 Main Estimates, as legislated in the Budget Implementation Act, 2009 and with the passing of Bill C-51.

18. This L10 vote represents the value of a non-interest bearing, non-negotiable demand note to be issued to the International Development Association.

19. The decrease reflects the agreed schedule of Canada's payments and encashments for the European Bank for Reconstruction and Development's 1998 capital subscription increase and the impact of changes to the exchange rate.

20. The following adjustments were made subsequent to the Main Estimates through the Supplementary Estimates and other transfers to arrive at the total planned spending for fiscal year 2009–10:

| ($ thousands) | 2009–10 | |

|---|---|---|

| Main Estimates | 82,865,109 | |

| 1 | Operating expenditures | 35,744 |

| 5 | Grants and contributions | 30,320 |

| (S) | Interest and other costs | (1,209,000) |

| (S) | Adjustments to transfer payments | (905,480) |

| (S) | Funding for Canada's participation in the Global Trade Liquidity Program | 247,840 |

| (S) | Purchase of domestic coinage | (25,000) |

| (S) | Payments to CSR Regime Transition Office | 11,000 |

| (S) | Payment to International Finance Corporation for Canada's participation in the G8 food security and agricultural development initiative | 48,000 |

| (S) | Advances to BDC regarding Canadian Secured Credit Facility |

12,000,000 |

| (S) | Net loss on exchange | 125,056 |

| (S) | Other statutory votes | 5,193 |

| Total Planned Spending | 93,228,782 | |

Section II: Analysis of Program Activities by Strategic Outcome

The Department of Finance Canada provides effective economic leadership with a clear focus on one strategic outcome, which all program activities support.

Department of Finance Canada Program Activity Architecture - Text Version

This section presents the Department of Finance Canada's four program activities, their expected results and performance indicators, and the financial and non-financial resources that will be dedicated to each. This section also identifies how the Department plans to meet the expected results.

Program Activity 1.1: Economic and Fiscal Policy Framework

| Program Activity 1.1: Economic and Fiscal Policy Framework | |||||

|---|---|---|---|---|---|

| Human Resources (FTEs) and Planned Spending ($ thousands) | |||||

| 2010–11 | 2011–12 | 2012–13 | |||

| FTEs | Planned Spending | FTEs | Planned Spending | FTEs | Planned Spending |

| 535 | 75,831.0 | 499 | 63,493.0 | 499 | 61,593.0 |

| Program Activity Expected Results | Performance Indicators | Targets |

|---|---|---|

| An economic, social and fiscal framework that supports financial stability, sustainable growth, productivity, competitiveness and economic prosperity | Annual fiscal balance as a share of GDP and debt-to-GDP ratio | No target. The goal is to compare favourably with G7 counterparts. |

| Competitiveness and efficiency of Canada's tax system | No target. The goal is to continue to propose changes to the tax system that improve incentives to work, save, and invest. | |

| Stability of financial services sector | No target. The long-term goal is to contribute to low and stable interest rates. |

Summary

This program activity is the primary source of advice and recommendations to the Minister of Finance regarding issues, policies and programs of the Government of Canada in the areas of economic, fiscal and social policy; federal-provincial-territorial relations; financial affairs; taxation; and international trade and finance. The work conducted in this program area involves extensive research, analysis, and consultation and collaboration with partners in both the public and private sectors. In addition, it involves the negotiation of agreements and drafting of legislation.

To help develop first‑rate policy and advice to ministers, the Department of Finance Canada works with the public and Canadian interest groups; departments, agencies and Crown corporations; provincial, territorial and Aboriginal governments; financial market participants; the international economic and finance community; and the international trade community.

Canada's Economic Action Plan

Canada's Economic Action Plan, introduced in January 2009, is the Government of Canada's response to the deepest global recession since the Second World War. It presents one of the most comprehensive stimulus packages in the industrialized world.

Continued implementation of Canada's Economic Action Plan remains the overarching priority for the Department of Finance Canada in 2010–11. The Department will continue to work with and support departments in the timely and effective implementation of the Plan. Furthermore, it will monitor and assess the reported progress on the Plan's stimulus measures. The Department is also playing a lead role in strengthening Canada's financial system and was instrumental in enacting and implementing tax relief measures announced in the Plan.

Planning Highlights

Supporting prudent fiscal management

In 2010–11, the Department of Finance Canada will continue to conduct transparent, timely and accurate fiscal planning and develop sustainable fiscal policy in support of the government's commitment to returning to balanced budgets. This will include the presentation of economic and fiscal projections in future budgets and economic and fiscal updates, publication of The Fiscal Monitor, management of the fiscal framework and coordination of future budgets, and preparation of the Annual Financial Report.

The Department will continue to assess Canada's current and future economic conditions by regularly monitoring and forecasting economic performance, both in Canada and other countries, conducting private sector surveys of the Canadian economic outlook and examining factors that affect future growth prospects. The Department will also continue to fulfill its central agency role by providing advice to the Minister on the economic and fiscal implications of various policy and federal program issues.

Tax relief

Regarding the government's tax policy agenda, in the coming years the Department will focus on the following:

- Supporting the government's efforts in working with provinces and territories to move Canada toward the goal of a 25-per-cent combined federal-provincial statutory corporate income tax rate by 2012 as well as continued monitoring of G7 countries to ensure that Canada achieves and maintains the goal of having the lowest overall tax rate on new business investment in the G7 by 2010;

- Continuing to work with eligible provinces to ensure timely and accurate payments of the temporary financial incentive that was introduced in Budget 2007 to encourage provinces to remove their capital taxes;

- Considering ways to improve Canada's international tax system, including taking into account the final report of the Advisory Panel on Canada's System of International Taxation (submitted to the Minister of Finance on December 10, 2008);

- Determining appropriate actions following consultations initiated by the government in Budget 2009, including those relating to accelerated capital cost allowance for assets used in carbon capture and storage;

- Supporting federal-Aboriginal tax policy by negotiating and implementing the tax aspects of treaties and self-government agreements;

- Taking required measures in support of decisions by Ontario and British Columbia to enter into the harmonized sales tax framework;

- Developing proposals to make the personal income tax system more competitive for highly skilled workers;

- Developing proposals to improve work incentives for low-income Canadians; and

- Responding to recommendations of the Auditor General of Canada concerning outstanding technical income tax amendments by improving database management and usage and by implementing a plan to finalize packages of draft technical amendments that may be recommended for release in draft form or for tabling in Parliament.

Supporting the financial system

The 2008–09 global financial crisis made it difficult for Canadian financial institutions and a wide range of other borrowers to obtain funding. Budget 2009 contained several initiatives under the Extraordinary Financing Framework (EFF) to improve access to financing for Canadian households and businesses. The Department is the lead organization for these policy initiatives, actively coordinating operations with the Bank of Canada and federal Crown corporations (Business Development Bank of Canada, Canada Mortgage and Housing Corporation, and Export Development Canada) and providing its support to the Minister of Finance's external Advisory Committee on Financing.

In conjunction with managing an exit from these extraordinary measures and improving future access to financing, the Department of Finance Canada and partner agencies will be actively engaged in efforts to rebuild well-functioning private markets. The Department will also be providing advice on the development of Canada's financial sector, with particular emphasis on protecting the interests of consumers and businesses. With respect to the protection of these interests, the Department will be addressing payment systems issues with the introduction of a Code of Conduct governing practices in the credit and debit card market and supporting the December 2010 delivery of a national strategy for improving financial literacy by the independent, external Task Force on Financial Literacy.

The Department of Finance Canada will be implementing revisions, announced in fall 2009, to the legislative framework for the regulation of federally regulated private pension plans. The Department will also continue implementing legislative frameworks to combat financial crime on both the domestic and international fronts.

With respect to financial system and financial stability, in 2010–11 the Department of Finance Canada and its partner agencies (the Bank of Canada, the Office of the Superintendent of Financial Institutions, Canada Deposit Insurance Corporation and the Financial Consumer Agency of Canada) will continue to monitor financial conditions and the financial sector regulatory framework. The Department will play an active role in supporting the work of the multinational Financial Stability Board and be prepared to make recommendations to the Minister on any policy actions that may be required to increase the resilience of the Canadian financial system. As a matter of priority, the Department will be supporting the Canadian Securities Transition Office as it works toward the establishment of a Canadian securities regulator.

Supporting business competition, trade and foreign investment

In 2010–11, the Department will see an ongoing need to cooperate internationally to find innovative approaches to respond to global economic challenges, which are affecting world trade and investment and the ability of countries to make progress in multilateral liberalization efforts. The Department will continue to play a key role in government-wide efforts to open global markets further. The government has taken steps to provide tariff relief to Canadian industries to enhance their global competitiveness and to promote open markets globally. Further initiatives in this area are under consideration.

In 2010–11, a key priority for the Department is supporting Canada's presidency of the G8 process, its co-chairing of the June 2010 G20 Summit, and G7 and G20 Finance Ministers' meetings and related officials' meetings.

In addition, the Department is committed to the following:

- Developing and promoting positions that will lead to effective international cooperation on government support for trade finance;

- Providing high-quality advice on the key elements of a comprehensive International Monetary Fund (IMF) and World Bank reform exercise;

- Providing high-quality advice and leadership in the implementation of a global framework for sustainable growth, including addressing exit strategies, global imbalances and financial sector reform; and

- Providing advice on international financial assistance programs assembled by the IMF to help economies maintain stability and avoid financial crises.

Providing funding to provinces and territories in support of national priorities

In the Department's work with the provinces and territories, a key focus for the planning period is to continue to manage current and emerging issues related to social policy and major transfer programs resulting from uncertain global and domestic outlooks.

Additional commitments for 2010–11 include the following:

- Preparing legislation and regulations related to major transfer programs and other legislative requirements under the responsibility of the Minister of Finance;

- Continuing to manage and support the Canada Pension Plan Triennial Review process;

- Continuing to work with provinces and territories in effectively implementing Canada's Economic Action Plan and assessing reported progress on the Plan's measures; and

- Working with provinces and territories to analyze retirement income issues, as agreed to by the Finance ministers.

Gender-based analysis

The Department of Finance Canada will continue to fulfill its commitment to conduct gender-based analysis (GBA) on all new tax and spending measures developed for consideration by the Minister of Finance, where appropriate and where data exist, and to support the use of quality GBA in policy development through the delivery of training and other initiatives. In keeping with the government's GBA commitments and in response to recommendations made in the 2009 Spring Report of the Auditor General, the Department will implement appropriate GBA‑related actions.

Benefits for Canadians

Sound fiscal planning provides significant benefits to Canadians and businesses in Canada. It gives the government the strength to withstand fiscal and economic challenges and ensures that the costs of investments and services are not passed on to future generations. Sound economic and fiscal policies also enable the Canadian economy to better respond to various economic shocks.

Improvements to the competitiveness, efficiency, simplicity and fairness of Canada's tax system provide a basis for Canadians and Canadian businesses to realize their full potential, thereby encouraging investment, promoting economic growth and increasing Canadians' standard of living. These improvements also strengthen Canadians' confidence in the tax system.

Long-term, predictable, stable, formula-based transfer support for the provinces and territories and improvements to the social policy framework contribute to improved public services for Canadians, support the quality of life in Canada's communities and their health care, education, and social safety net programs, and promote equality of opportunity for all citizens.

A sound, efficient and competitive Canadian financial sector is necessary to support the savings and investment needs of individuals, businesses and the economy as a whole.

Canada's economic performance and future prosperity depend on a strong and stable global economy as well as trade and investment flows that are supported by high standards of multilateral, regional and bilateral trade and investment agreements. Canadian leadership and influence on international economic, financial, development and trade issues increase financial and economic stability.

Program Activity 1.2: Transfer and Taxation Payment Programs

| Program Activity 1.2: Transfer and Taxation Payment Programs | |||||

|---|---|---|---|---|---|

| Human Resources (FTEs) and Planned Spending ($ thousands) | |||||

| 2010–11 | 2011–12 | 2012–13 | |||

| FTEs | Planned Spending | FTEs | Planned Spending | FTEs | Planned Spending |

| 8 | 54,570,801.0 | 0 | 53,974,457.0 | 0 | 55,272,231.0 |

| Program Activity Expected Results | Performance Indicators | Targets |

|---|---|---|

| Design and administration of the provision of payments to Canadian provinces and territories, which supports delivery of public services to their residents, and to international organizations to help promote the economic advancement of developing countries | Legislation drafted to reflect changes made to transfer programs, as required | According to statutory requirements, or as determined by environment |

| Timely provision of information for Government of Canada reports | No target, as materials are generated on an as-needed basis according to environment | |

| Percentage of reporting requirements met, including reporting to Parliament, the Office of the Auditor General of Canada, internal auditors, the IMF and the Organisation for Economic Co-operation and Development | 100 per cent of requests fulfilled on time and in an accurate manner |

Summary

This program activity administers transfer and taxation payments to provinces, territories and Aboriginal governments. The payments, which are made in accordance with legislation and negotiated agreements, enable Canadian provinces and territories to provide their residents with public services and to support Aboriginal self-government. This program activity also covers commitments to and agreements with international financial institutions that are aimed at aiding the economic advancement of developing countries. These commitments can result in payments, generally statutory transfer payments, to a variety of recipients, including individuals, organizations and other levels of government. This program activity also includes payments to Canadian organizations for the development of social and cultural infrastructure in Toronto's waterfront area.

Planning Highlights

Fiscal arrangements with provinces and territories

Key commitments for 2010–11 include the following:

- Timely, accurate and transparent administration of major transfer programs; and

- Effective management of transfer programs, including the calculation of entitlements, the provision of payments, the provision of information for Government of Canada reports and the provision of information to federal auditors. Information concerning entitlements is provided to provincial and territorial officials, including auditors, and the Department holds ongoing consultations with provincial and territorial officials on transfer issues.

Moreover, the Department of Finance Canada willcontinue to further refine the data used in calculating major transfer entitlements, to update regulations and legislation where required and to enhance the transparancy of the federal transfer system.

Commitments to international financial organizations

The Department of Finance Canada will work to ensure that requests for transfer payments to compensate Export Development Canada and the Canadian Wheat Board for debt reduction are accurate and in accordance with the Paris Club Agreed Minutes, the Canadian Debt Initiative and the terms of reference of the signed memoranda of understanding (MOU) between the Department and the respective organizations.

The Department will also ensure that transfer payments to international organizations and Canadian creditors are processed appropriately and in a timely manner.

Tax collection and administration agreements

In 2010–11, the Department of Finance Canada will work to ensure that agreements with provinces, territories and Aboriginal governments meet policy and administrative objectives.

Toronto waterfront renewal

In 2010–11, the Department of Finance Canada will work to ensure delivery of the Toronto Waterfront Revitalization Initiative and the Harbourfront Centre Funding Program by the sunset date of March 31, 2011.

Benefits for Canadians

Equalization payments are made to eligible provincial governments in fulfillment of the constitutional commitment to ensure provincial governments have sufficient revenues to provide reasonably comparable levels of public services at reasonably comparable levels of taxation. Territorial Formula Financing achieves the same objective for all three territorial governments, recognizing the unique circumstances in the North.

The Canada Health Transfer (CHT) provides provincial and territorial governments with long-term, growing support for health care; its cash support is legislated to grow by 6 per cent annually until 2013–14. The CHT supports the government's commitment to maintain the Canada Health Act's national criteria (comprehensiveness, universality, portability, accessibility and public administration), conditions, and prohibitions against user fees and extra-billing as well as the commitments made under the 2000, 2003, and 2004 Health Accords.

The Canada Social Transfer (CST) provides provincial and territorial governments with long-term, growing support to assist them in financing social programs, post-secondary education and programs for children; its support is legislated to grow by 3 per cent annually until 2013–14. The CST gives provinces and territories the flexibility to allocate payments to those areas according to their priorities, and it supports the federal government's commitment to prohibit minimum residency requirements for social assistance.

Payments for these major transfers are made in accordance with the terms and conditions established in the Federal-Provincial Fiscal Arrangements Act and associated regulations.

Beyond the CHT and CST, on occasion the federal government commits to providing the provinces and territories with additional, time-limited support that targets areas of shared priority, including the health and social sectors. For example, the government has provided support for the development and implementation of patient wait time guarantees. These payments are made in accordance with the terms and conditions established in associated legislation and regulations.

Tax collection agreements with provinces and territories allow the government to streamline service and reduce compliance and administrative costs by having a single tax form and a single tax collector. Tax administration agreements with Aboriginal governments allow the federal government to vacate and share a negotiated portion of its goods and services tax and personal income tax room with Aboriginal governments and to administer harmonized Aboriginal taxes.

Bilateral and multilateral debt relief helps to reduce the debt load of developing countries, put them back onto a path of financial sustainability and free up resources in their national budgets to support their development objectives. This and other transfers to international financial organizations enable Canada to make a strong contribution to global stability and growth.

Investments in sustainable urban development and infrastructure renewal for Toronto's waterfront result in both social and economic benefits for the region. The projects that form part of the Toronto Waterfront Revitalization Initiative bring much-needed economic redevelopment to currently under-used areas of the city and draw more economic, social and cultural activity to the waterfront. In addition, the Harbourfront Centre Funding Program allows Harbourfront Centre to provide tourists and residents with continued access to cultural, recreational and educational programs and activities.

Program Activity 1.3: Treasury and Financial Affairs

| Program Activity 1.3: Treasury and Financial Affairs | |||||

|---|---|---|---|---|---|

| Human Resources (FTEs) and Planned Spending ($ thousands) | |||||

| 2010–11 | 2011–12 | 2012–13 | |||

| FTEs | Planned Spending | FTEs | Planned Spending | FTEs | Planned Spending |

| 23 | 33,960,231.1 | 23 | 38,006,231.1 | 23 | 41,482,231.1 |

| Program Activity Expected Results | Performance Indicators | Targets |

|---|---|---|

| Prudent and cost-effective management of the government's treasury activities and financial affairs | Achievement of operational and strategic objectives | 100 per cent of program line targets achieved |

| Control of financial and operational risks | Risk events do not disrupt program operations |

Summary

Canada's debt and reserves management activities include the funding of government operations, which involves the payment of debt service costs and investments in financial assets that are needed to maintain a prudent liquidity position. This program activity supports the ongoing refinancing of government debt coming to maturity, the execution of the budget plan and other financial operations of the government, including governance of the borrowing activities of major government-backed entities such as Crown corporations. This program area also includes oversight of the system for circulating Canadian currency (banknotes and coins) to meet the needs of the economy.

Planning Highlights

Actions taken to support access to financing, together with the funding of the budget deficit, have significantly increased the market debt stock. In 2010–11, the Department will work with Crown corporations and market participants to effectively manage operations and will provide advice on a prudent debt management strategy.

In the area of circulating currency, the Department will support the Bank of Canada's introduction of a new series of banknotes with enhanced security features to reduce the incidence of counterfeiting. The Department will also work with the Royal Canadian Mint to enhance the efficiency of the coinage circulation system, including reviewing and amending the Royal Canadian Mint MOU for the provision of domestic coinage.

Other activities for the period include the following:

- Managing the retail debt program to support key activities and reducing administrative costs in conjunction with the Bank of Canada; and

- Continuing to support and refine the consolidated borrowing framework for Crown corporations (Farm Credit Canada, Business Development Bank of Canada and the Canada Mortgage and Housing Corporation) and negotiating a cost-sharing MOU with them.

Benefits for Canadians

Managing treasury affairs means ensuring that the daily operational funding needs of the government are met without fail. This facilitates regular government payments to Canadians as well as the funding of initiatives under Canada's Economic Action Plan, such as those providing households and businesses with access to financing.

Reducing public debt helps keep interest rates down, better positions Canada to weather economic storms and improves intergenerational equity by ensuring that future generations do not have to pay for the benefits received by their predecessors. Moreover, an effective coinage circulation system ensures efficient trade and commerce across Canada.

Program Activity 1.4: Internal Services

Financial Resources ($ thousands)

| 2010–11 | 2011–12 | 2012–13 |

|---|---|---|

| 45,954.0 | 42,945.0 | 42,946.0 |

Human Resources (FTEs)

| 2010–11 | 2011–12 | 2012–13 |

|---|---|---|

| 251 | 251 | 251 |

Summary

Internal Services covers a variety of activities: departmental governance; legal services; public affairs and communications; internal audit and evaluation; and corporate services, which include human resources, financial management, facilities and asset management, information management, and information technology services.

Planning Highlights

Internal Services enables the Department to deliver its management agenda. The key priorities for 2010–11 in this program area are as follows.

As chair of the G7 and G8 in 2010, Canada will host a separate G8 Summit in June 2010 and will be looked upon to provide leadership on key international financial and economic priorities. The Department of Finance Canada will be actively engaged in effective planning and implementation of logistics in support of a number of related Ministers' and officials' meetings.

The Department of Finance Canada will continue to work in 2010–11 to ensure effective alignment and implementation of the Clerk of the Privy Council's Public Service Renewal priorities and support the Deputy Minister's accountability for people management following the changes made to human resources governance in 2009. These efforts will take place in the context of the completion of the implementation of the Department's three-year Integrated Human Resources Plan that covers the 2008–11 period and, more specifically, through the development, implementation and monitoring of the 2010–11 Department of Finance Human Resources Action Plan that is being integrated into the Department's Business Plan for 2010–11.

Over the coming year, the Department of Finance Canada will continue to implement improvements to the Department's Security Program Framework and Business Continuity Planning Program. This will include implementing the new Departmental Security Policy and Business Continuity Planning Program, as well as further incorporating business continuity planning into the integrated planning process.

Moreover, the Department will continue to advance initiatives undertaken in previous years. This will involve the following:

- Continuing implementation of the Values and Ethics Action Plan 2010–11 to 2012–2013, including requirements under the Department's Conflict of Interest Code and the Values and Ethics Code for the Public Service;

- Meeting requirements established under the new Treasury Board Policy on Evaluation and Policy on Internal Audit, which came into effect April 1, 2009, and July 1, 2009, respectively;

- Assessing and preparing for implementation of new government-wide policies on internal control, managing procurement, and departmental quarterly financial reports, among others; and

- Working to continuously improve the quality and level of corporate services provided to the Department.

Section III: Supplementary Information

Supplementary Information Tables

The following tables are available in the electronic version of the 2010–11 Report on Plans and Priorities, which can be accessed on the Treasury Board of Canada Secretariat's website at http://www.tbs-sct.gc.ca/rpp/2010-2011/index-eng.asp.

- Details on Transfer Payment Programs

- Green Procurement

- Horizontal Initiatives

- Internal Audits and Evaluations

- Sources of Respendable and Non-Respendable Revenue

- Sustainable Development Strategy

1. Includes statutory items not listed in the Main Estimates, such as payment of liabilities previously transferred to revenue, net loss on exchange, spending of proceeds from the disposal of surplus Crown assets, payments pursuant to the Halifax Relief Commission Pension Continuation Act, and refunds of amounts credited to revenue in previous years.

2. In accordance with input received from Treasury Board during the development of the Department's PAA, the Transfer and Taxation Payment Programs and Treasury and Financial Affairs program activities have been designated as aligning with all government outcomes.

3. Fiscal year 2009–10 includes a $12-billion advance to the Business Development Bank of Canada (BDC) related to the Canadian Secured Credit Facility.

4. The public debt charges included in the forecast and planned spending increase in each year as a result of an increase in projected debt levels.