Common menu bar links

Breadcrumb Trail

ARCHIVED - Industry Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Minister's Message

Our government is committed to positioning Canada to exit the current downturn quickly and emerge stronger and more competitive in the global economy. In doing so, Industry Canada and its Portfolio partners will continue to play their key roles in increasing the country's capacity to create jobs and economic growth — for next year and for the next decade.

While the recession originated beyond our borders, it had real consequences for Canadians and Canadian business. And despite improving conditions, there is work to be done. In 2010, a major focus will be completing the stimulus measures of Canada's Economic Action Plan. Introduced in Budget 2009, the Plan's full effect will be felt in 2010–11, and its measures will help solidify the recovery.

Over this period, Industry Canada and its Portfolio partners will work with industries and sectors hit hardest by the recession. Initiatives will include activities to boost community economic development and to extend broadband infrastructure to underserved or unserved areas across the country. To build on the momentum gained through our past investments in science and technology, significant effort will be directed to shaping the knowledge-based economy.

Industry Canada will also focus on supporting business and industry to capitalize on emerging opportunities at home and abroad. Getting our economic frameworks right, through forward-looking policies, is central to ensuring Canada's place in the global marketplace. We remain committed to two-way trade and investment, which raises our capacity to create jobs and economic growth and provides for sustainable prosperity.

I will work with my colleagues, the private sector and other governments to advance the recovery and build the foundation for a strong, competitive economy.

It is my pleasure to present this year's Report on Plans and Priorities for Industry Canada and its Portfolio partners.

Tony Clement

Minister of Industry

Section 1: Departmental Overview

1.1 Raison d'être

Mission

Industry Canada's mission is to foster a growing, competitive, knowledge-based Canadian economy.

The Department works with Canadians throughout the economy, and in all parts of the country, to improve conditions for investment, improve Canada's innovation performance, increase Canada's share of global trade, and build an efficient and competitive marketplace.

Mandate

Industry Canada's mandate is to help make Canadian industry more productive and competitive in the global economy, thus improving the economic and social well-being of Canadians.

The many and varied activities Industry Canada carries out to deliver on its mandate are organized around three interdependent and mutually reinforcing strategic outcomes, each linked to a separate key strategy. The key strategies are shown in the illustration below.

D

D  The Canadian marketplace is efficient

and competitive

The Canadian marketplace is efficient

and competitiveAdvancing the marketplace

Industry Canada fosters competitiveness by developing and administering economic framework policies that promote competition and innovation; support investment and entrepreneurial activity; and instill consumer, investor and business confidence.

Science and technology, knowledge, and

innovation are effective drivers of a strong Canadian economy

Science and technology, knowledge, and

innovation are effective drivers of a strong Canadian economyFostering the knowledge-based economy

Industry Canada invests in science and technology to generate knowledge and equip Canadians with the skills and training they need to compete and prosper in the global, knowledge-based economy. These investments help ensure that discoveries and breakthroughs take place here in Canada and that Canadians realize the social and economic benefits.

Competitive businesses are drivers of

sustainable wealth creation

Competitive businesses are drivers of

sustainable wealth creationSupporting business

Industry Canada encourages business innovation and productivity because businesses generate jobs and wealth creation. Promoting economic development in communities encourages the development of skills, ideas and opportunities across the country.

1.2 Responsibilities

Industry Canada is the Government of Canada's centre of microeconomic policy expertise. The Department's founding legislation, the Department of Industry Act, established the Ministry to foster a growing, competitive and knowledge-based Canadian economy.

Industry Canada is a department with many entities that have distinct mandates, with program activities that are widely diverse and highly dependent on partnerships. Industry Canada works on a broad range of matters related to industry and technology, trade and commerce, science, consumer affairs, corporations and corporate securities, competition and restraint of trade, weights and measures, bankruptcy and insolvency, intellectual property, investment, small business, and tourism.

1.3 Program Activity Architecture (PAA)

This Report on Plans and Priorities (RPP) is aligned with Industry Canada's Management, Resources and Results Structure (MRRS). The MRRS provides a standard basis for reporting to parliamentarians and Canadians on the alignment of resources, program activities and results.

Industry Canada's strategic outcomes are long-term, enduring benefits to the lives of Canadians that reflect our mandate and vision, and are linked to Government of Canada priorities and intended results.

The Department's Program Activity Architecture (PAA) is an inventory of all programs and activities undertaken. The programs and activities are depicted in a logical and hierarchical relationship to each other and to the strategic outcome to which they contribute. They also clearly link financial and non-financial resources.

2009–10 and 2010–11 PAA Crosswalk

Over the past year, Industry Canada has made changes to its PAA to ensure that it remains a complete and accurate inventory of Industry Canada's programs.

Putting Research and Development Funding

Together

Putting Research and Development Funding

TogetherThe Knowledge Advantage in Targeted Canadian Industries and the Industrial Technologies Office — Special Operating Agency program activities have been merged into a new program activity named “Commercialization and Research and Development Capacity in Targeted Canadian Industries.” The program activities were merged because they had similar goals and used similar tools.

Transferring Mackenzie Gas Project

Transferring Mackenzie Gas ProjectThe Mackenzie Gas Project Program Activity has been removed from Industry Canada's PAA to reflect its transfer to Environment Canada through an Order-in-Council (P.C. 2008-1730) on October 30, 2008.

Creating/Removing Sub-Activities

Creating/Removing Sub-ActivitiesA number of new sub-activities were created to provide a more complete inventory of the Department's programs. They include the Ontario Potable Water Program, the Brantford Greenwich–Mohawk Remediation Project, the Canada Strategic Infrastructure Program, the Building Canada Program, the Internal Trade Secretariat, Innovation Capacity in the Automotive Industry, and Research and Development Capacity in the Aerospace Industry. Subsequently, the Eastern Ontario Development Program, the Canada-Ontario Municipal Rural Infrastructure Program, the Ontario Municipal Infrastructure Top-Up Program, the Ontario Potable Water Program, the Brantford Greenwich–Mohawk Remediation Project, the Canada Strategic Infrastructure Program, and the Building Canada Program were transferred to the newly created Federal Economic Development Agency for Southern Ontario during 2009–10 as a result of Budget 2009 and are therefore no longer the responsibility of Industry Canada.

The sub-activities under the “Global Reach and Agility in Targeted Canadian Industries” program activity have been restructured. They are now structured around what the programs do, rather than by industry as they were in the past.

The Canadian Youth Business Foundation (CYBF) sub-activity was merged with the Small Business Growth and Prosperity sub-activity, since foundations are not to appear in the PAA as per Treasury Board Secretariat (TBS) guidelines. While the achievement of results is the responsibility of the CYBF, Industry Canada is responsible for managing the related funding agreements and this activity is included in the Small Business Growth and Prosperity sub-activity.

Changes to Program Titles and Descriptions

Changes to Program Titles and DescriptionsA number of programs were renamed, and a number of program descriptions were modified. The changes were made to reflect program changes or to improve compliance with the MRRS Instructions.

Industry Canada's 2010–11 Program Activity Architecture (approved by Treasury Board)

Strategic Outcomes |

||

|---|---|---|

| The Canadian Marketplace is Efficient and Competitive | Science and Technology, Knowledge, and Innovation are Effective Drivers of a Strong Canadian Economy | Competitive Businesses are Drivers of Sustainable Wealth Creation |

Program Activities |

||

| Marketplace Frameworks and Regulations | Canada's Research and Innovation Capacity | Entrepreneurial Economy |

Sub-Activities

|

Sub-Activities

|

Sub-Activities

|

| Marketplace Frameworks and Regulations for Spectrum, Telecommunications and the Online Economy | Communications Research Centre Canada | Global Reach and Agility in Targeted Canadian Industries |

Sub-Activities

|

Sub-Activities

|

Sub-Activities

|

| Consumer Affairs Program | Commercialization and Research and Development Capacity in Targeted Canadian Industries | Community, Economic and Regional Development |

Sub-Activities

|

||

| Competition Law Enforcement and Advocacy | Sub-Activities

|

Sub-Activities

Security and Prosperity Partnership of North America — Canadian Secretariat |

Sub-Activities

|

||

| Internal Services | ||

Industry Canada's 2010–11 Program Activity Architecture

(including Canada's Economic Action Plan initiatives)

Strategic Outcomes |

||

|---|---|---|

| The Canadian Marketplace is Efficient and Competitive | Science and Technology, Knowledge, and Innovation are Effective Drivers of a Strong Canadian Economy | Competitive Businesses are Drivers of Sustainable Wealth Creation |

Program Activities |

||

| Marketplace Frameworks and Regulations | Canada's Research and Innovation Capacity | Entrepreneurial Economy |

Sub-Activities

|

Sub-Activities | Sub-Activities

|

| Marketplace Frameworks and Regulations for Spectrum, Telecommunications and the Online Economy | Communications Research Centre Canada | Global Reach and Agility in Targeted Canadian Industries |

Sub-Activities

|

Sub-Activities

|

Sub-Activities

|

| Consumer Affairs Program | Commercialization and Research and Development Capacity in Targeted Canadian Industries | Community, Economic and Regional Development |

Sub-Activities

|

Sub-Activities

|

Sub-Activities

Security and Prosperity Partnership of North America — Canadian Secretariat |

| Competition Law Enforcement and Advocacy | ||

Sub-Activities

|

||

| Internal Services | ||

* Designates Economic Action Plan items

** Designates programs transferred to the Federal Economic Development Agency

for Southern Ontario

1.4 Planning Summary

Industry Canada's Financial and Human Resources

These two tables present Industry Canada's financial and human resources over the next three fiscal years.

| Financial Resources ($ millions)* | Human Resources (Full-Time Equivalent)*** | |||||

|---|---|---|---|---|---|---|

| 2010–11** | 2011–12 | 2012–13 | 2010–11 | 2011–12 | 2012–13 | |

| 2,448.6 | 1,151.2 | 1,058.6 | 5,279.0 | 5,176.0 | 5,176.0 | |

* Minor differences are due to rounding.

** The majority of funding for Canada's Economic Action Plan items ends in 2010–11.

*** Includes 112 FTEs for 2010–11

to deliver final year of Canada's Economic Action Plan

Summary Table by Strategic Outcome

Performance Indicator(s)

|

Target(s)

|

||||

| Program Activity | Forecast Spending 2009–10 | Planned Spending ($ millions)* | Alignment to Government of Canada Outcomes | ||

|---|---|---|---|---|---|

| 2010–11 | 2011–12 | 2012–13 | |||

| Marketplace Frameworks and Regulations | 59.5 | 66.1 | 68.4 | 63.9 | Economic Affairs: A Fair and Secure Marketplace |

| Marketplace Frameworks and Regulations for Spectrum, Telecommunications and the Online Economy | 91.1 | 87.2 | 86.4 | 85.6 | Economic Affairs: A Fair and Secure Marketplace |

| Consumer Affairs Program | 4.7 | 6.0 | 5.9 | 5.8 | Economic Affairs: A Fair and Secure Marketplace |

| Competition Law Enforcement and Advocacy | 47.5 | 46.7 | 48.1 | 49.5 | Economic Affairs: A Fair and Secure Marketplace |

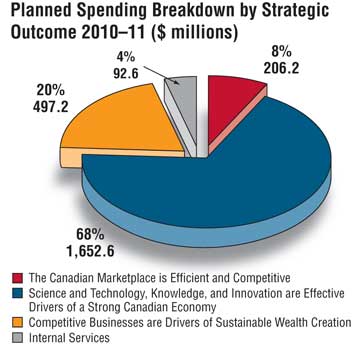

| Total | 202.8 | 206.2 | 208.9 | 204.9 | |

* Minor differences are due to rounding.

Performance Indicator(s)

|

Target(s)

|

||||

| Program Activity | Forecast Spending 2009–10 | Planned Spending ($ millions)* | Alignment to Government of Canada Outcomes | ||

|---|---|---|---|---|---|

| 2010–11 | 2011–12 | 2012–13 | |||

| Canada's Research and Innovation Capacity | 1,281.1 | 1,316.3 | 252.9 | 170.3 | Economic Affairs: An Innovative and Knowledge-based Economy |

| Communications Research Centre Canada 1 | 44.6 | 41.3 | 38.1 | 37.4 | Economic Affairs: An Innovative and Knowledge-based Economy |

| Commercialization and Research and Development Capacity in Targeted Canadian Industries | 419.7 | 295.0 | 312.4 | 322.4 | Economic Affairs: An Innovative and Knowledge-based Economy |

| Total | 1,745.4 | 1,652.6 | 603.4 | 530.1 | |

* Minor differences are due to rounding.

Performance Indicator(s)

|

Target(s)

|

||||

| Program Activity | Forecast Spending 2009–10 | Planned Spending ($ millions)* | Alignment to Government of Canada Outcomes | ||

|---|---|---|---|---|---|

| 2010–11 | 2011–12 | 2012–13 | |||

| Entrepreneurial Economy | 138.4 | 110.6 | 104.1 | 114.2 | Economic Affairs: Strong Economic Growth |

| Global Reach and Agility in Targeted Canadian Industries | 192.0 | 105.9 | 36.7 | 36.7 | Economic Affairs: Strong Economic Growth |

| Community, Economic and Regional Development 2,3 | 549.2 | 278.5 | 106.0 | 80.6 | Economic Affairs: Strong Economic Growth |

| Security and Prosperity Partnership of North America — Canadian Secretariat | 2.2 | 2.2 | - | - | International Affairs: A Strong and Mutually Beneficial North American Partnership |

| Total | 881.8 | 497.2 | 246.8 | 231.5 | |

* Minor differences are due to rounding.

| Program Activity | Forecast Spending 2009–10 | Planned Spending ($ millions)* | Alignment to Government of Canada Outcomes | ||

|---|---|---|---|---|---|

| 2010–11 | 2011–12 | 2012–13 | |||

| Internal Services | 160.4 | 92.6 | 92.2 | 92.2 | Contributes to all of Industry Canada's strategic outcomes and therefore contributes to the Government of Canada's outcomes |

| Total | 160.4 | 92.6 | 92.2 | 92.2 | |

* Minor differences are due to rounding.

Contribution of Priorities to Strategic Outcomes

Operational Priorities

| Operational Priority: Ensure marketplace policies help promote competitive markets and instill consumer confidence |

Type: Previously committed to |

Strategic Outcome(s): The Canadian marketplace is efficient and competitive |

Why is this a priority?

|

||

| Operational Priority: Foster business innovation |

Type: Previously committed to |

Strategic Outcome(s): Science and technology, knowledge, and innovation are effective drivers of a strong Canadian economy |

Why is this a priority?

|

||

| Operational Priority: Invest in science and technology (S&T) to enhance the generation and commercialization of knowledge |

Type: Previously committed to |

Strategic Outcome(s): Science and technology, knowledge, and innovation are effective drivers of a strong Canadian economy |

Why is this a priority?

|

||

| Operational Priority: Foster internationally competitive businesses and industries |

Type: Ongoing |

Strategic Outcome(s): Competitive businesses are drivers of sustainable wealth creation |

Why is this a priority?

|

||

| Operational Priority: Promote entrepreneurship, community development and sustainable development |

Type: Ongoing |

Strategic Outcome(s): Competitive businesses are drivers of sustainable wealth creation |

Why is this a priority?

|

||

Management Priorities

| Management Priority: People Management |

Type: Ongoing |

Strategic Outcome(s): All strategic outcomes |

Why is this a priority?

|

||

| Management Priority: Financial Management |

Type: New |

Strategic Outcome(s): All strategic outcomes |

Why is this a priority?

|

||

| Management Priority: Internal Audit |

Type: New |

Strategic Outcome(s): All strategic outcomes |

Why is this a priority?

|

||

| Management Priority: Procurement and Materiel Management |

Type: New |

Strategic Outcome(s): All strategic outcomes |

Why is this a priority?

|

||

| Management Priority: Business Continuity |

Type: New |

Strategic Outcome(s): All strategic outcomes |

Why is this a priority?

|

||

Operating Environment and Risk Analysis

Industry Canada's work is influenced by a wide variety of external and internal factors. The programs and services the Department delivers are driven by the policies and priorities of the Government of Canada and must continually adapt to economic, social and technological trends. The Department, its partners and the businesses, investors and consumers it serves, operate within complex and interconnected global, national and regional economic systems that provide both opportunities and challenges. Industry Canada attempts to identify these opportunities and challenges through its planning process and through program and sector risk assessments. These factors, as well as the following key program challenges and opportunities, form Industry Canada's operating context and play a critical role in shaping the Department's plans and priorities.

Recent Economic Developments

Over the last year, the Canadian economy has suffered from the repercussions of the global economic downturn. The challenges in the global financial markets have led to a significant loss of wealth for Canadian consumers and businesses, hampering consumer confidence and dampening spending. Through various initiatives, Industry Canada will ensure Canadian industries have the opportunity to capitalize on the evolving economic climate as the sectors hit hardest by the recession — such as manufacturing — rebound. The Department will also continue to monitor the performance of the economy as a whole and will align its resources to increase the innovation, research and development capacity in targeted Canadian industries and priority areas, specifically those hardest hit by the recession.

Over the medium to long term, the Canadian economy will undergo significant changes as industries respond to new competition, demands for new goods and services, and evolving global markets. There is increasing pressure on Canadian businesses to adapt to changing global conditions, especially with respect to the effects of emerging economies on the global economic environment, the internationalization of supply chains and rapid developments in new technologies.

Industry Canada will continue to support the health of Canadian businesses and industries by helping them understand and exploit the changing global landscape. The Department will continue to support skills development, post-secondary education and sector-specific knowledge growth that, together, will help ensure that businesses have the tools they need to grow and prosper over the long term.

Consumer Interests

Economic instability, the globalization of supply chains and dramatic shifts in the technologies used to market and sell goods and services all affect Canadian consumers in numerous ways and present a major challenge for Industry Canada as it seeks to protect their interests.

With difficult economic conditions expected to continue in 2010–11, Industry Canada will likely face pressure to shift its activities towards a greater focus on the consumer basics of buying and saving. With its partners in provincial and territorial governments, the Department will need to identify and share the most cost-effective ways to increase compliance with consumer protection laws across the country, improve the consumer voice in policy-making and offer relevant consumer information.

Partner and Stakeholder Relations

Sound, productive relationships with partners and stakeholders are essential to fulfilling Industry Canada's mandate. The Department maintains close, collaborative relationships with, among others, federal departments, provincial, territorial and international governments, industry and consumer representatives, and academic and not-for-profit institutions. The increased opportunities and challenges created by the global economic situation will ensure that partnerships and stakeholder relations remain a key priority for the Department.

Integrated Risk Management

Industry Canada has implemented an effective and tailored Integrated Risk Management Framework that outlines the steps and approaches taken by the Department to identify, monitor and manage the key risks that can affect program delivery and results. In addition to the operating context and more specific challenges noted above, Industry Canada has developed mitigation strategies and action plans for its 2009–10 corporate risks (e.g., grants and contributions programs, information management, real property management framework, Canada's Economic Action Plan initiatives). Key risks and challenges associated with each strategic outcome are presented under the relevant section of this document.

Expenditure Profile

Industry Canada's total planned spending for 2010–11 is $2.4 billion. The majority of planned spending is directed at Industry Canada's three strategic outcomes, with a cost-effective 4% being allocated to Internal Services.

Industry Canada will continue to implement strategies to ensure efficient use of its operating budget to better deliver benefits to Canadians.

A focus on efficient, high-performing programs will allow Industry Canada to continue to effectively deliver its mandate with a reduced operating budget in coming years and with evolving government priorities. More than ever, the results of audits, evaluations and strategic reviews will be critical in planning, priority setting and resource allocation.

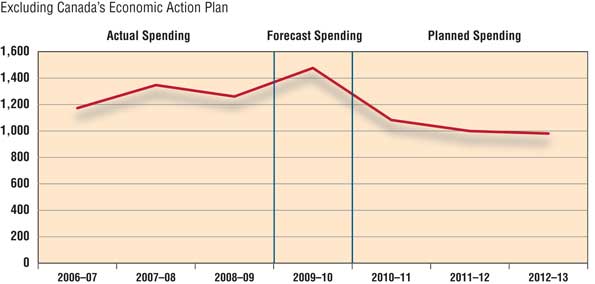

Canada's Economic Action Plan

In its 2009 budget, the Government of Canada announced Canada's Economic Action Plan, a set of initiatives aimed at providing a quick recovery from the economic downturn and ensuring long-term economic growth and prosperity for Canadian businesses and individuals. Industry Canada's role in Canada's Economic Action Plan has resulted in the Department's planned spending showing a dramatic temporary increase for 2009–10 of $1.5 billion. The Department expects to have a similar increase of $1.3 billion in 2010–11. A significant portion of those resources will be used to support science and technology, knowledge, and innovation, which, beyond providing short-term stimulus, will position the Canadian economy to excel in the future. This investment is made through initiatives such as the Knowledge Infrastructure Program, the Institute for Quantum Computing, the Canada Foundation for Innovation, and the modernization of Industry Canada's Communications Research Centre laboratory facilities. The Department will also promote economic recovery with initiatives aimed at specific economic sectors such as tourism, supporting small businesses and community economic development, and encouraging the development of broadband infrastructure in previously underserved or unserved areas across the country. Additional details on new Industry Canada initiatives emanating from Canada's Economic Action Plan are provided in Section 2 of this document.

Voted and Statutory Items

This table illustrates the way in which Parliament approved Industry Canada resources for 2009–10 and 2010–11.

| Vote No. or Statutory Item (S) | Truncated Vote or Statutory Wording | Main Estimates ($ thousands) * |

|

|---|---|---|---|

| 2009–10** | 2010–11 | ||

| 1 | Operating expenditures | 320,061 | 364,256 |

| 5 | Capital expenditures | 9,373 | 11,730 |

| 10 | Grants and contributions | 596,995 | 1,294,657 |

| (S) | Minister of Industry — salary and auto allowance | 78 | 79 |

| (S) | Minister of State (Small Business and Tourism) — auto allowance | 2 | |

| (S) | Minister of State (Science and Technology) — auto allowance | 2 | |

| (S) | Canadian Intellectual Property Office Revolving Fund | (1,203) | 13,659 |

| (S) | Liabilities under the Small Business Loans Act * | 1,650 | 125 |

| (S) | Liabilities under the Canada Small Business Financing Act * | 83,915 | 90,200 |

| (S) | Grant to CANARIE Inc. to operate and develop the next generation of Canada's Advanced Research Network (CAnet5) | 29,000 | 31,000 |

| (S) | Grant to GENOME | 88,800 | 43,000 |

| (S) | Grant to Perimeter | 10,000 | 10,000 |

| (S) | Contributions under the Knowledge Infrastructure Program | 500,000 | |

| (S) | Contributions to employee benefit plans | 49,374 | 53,998 |

| Total Budgetary | 1,188,043 | 2,412,708 | |

| L15 | Payments pursuant to subsection 14(2) of the Department of Industry Act | 300 | 300 |

| L20 | Payments pursuant to paragraph 14(1)(a) of the Department of Industry Act | 500 | 500 |

| Total Non-Budgetary | 800 | 800 | |

| Total Department | 1,188,843 | 2,413,508 | |

* Minor differences are due to rounding.

** Please note Budget 2009 funding for Canada's Economic Action Plan items

was allocated to the Department in Supplementary Estimates and is therefore not reflected in the amounts presented for 2009–10.

Spending Trend ($ millions)

The figures below illustrate Industry Canada's spending trend, including and excluding Canada's Economic Action Plan

items from 2006–07 to 2012–13.

1 Forecast and planned spending take into consideration the carry forward of funds of $253,000 from 2009–10 to future years ($176,000 in 2010–11, $56,000 in 2011–12 and $26,000 in 2012–13) for the Ivey Centre for Health Innovation and Leadership.

2 Forecast and planned spending take into consideration the carry forward of funds of $80 million from 2009–10 to 2010–11 for Broadband Canada: Connecting Rural Canadians.

3 Forecast spending excludes $22.5 million that represents the carry forward of funds of the Ontario Potable Water Program from 2009–10 to 2010–11. Please note that this program has been transferred to the new Federal Economic Development Agency for Southern Ontario in 2010–11.