Common menu bar links

Breadcrumb Trail

ARCHIVED - Industry Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Section 2: Analysis of Program Activities by Strategic Outcome

2.1 The Canadian Marketplace is Efficient and Competitive

2.1 The Canadian Marketplace is Efficient and Competitive

| Year | Financial Resources ($ millions)* |

Human Resources (FTEs) |

|---|---|---|

| 2010–11 | 206.2 | 2,940.6 |

| 2011–12 | 208.9 | 2,940.6 |

| 2012–13 | 204.9 | 2,940.6 |

* Minor differences are due to rounding.

As the global economy emerges from a deep recession,4 the Canadian marketplace requires effective frameworks and regulations to ensure Canadian businesses have every opportunity to innovate and succeed in the new economic climate.

Strong marketplace frameworks and regulations are also necessary to facilitate competitiveness and to build and maintain consumer confidence in both traditional and electronic commerce environments.

Industry Canada strives to achieve an efficient and competitive marketplace by developing and implementing policies fundamental to the functioning of a market. These include laws and regulations governing intellectual property, bankruptcy and insolvency, competition and restraint of trade, corporations and corporate securities, foreign direct investment, internal trade, weights and measures, consumer affairs, and telecommunications.

These policies are designed to promote innovation, competition and productivity, and instill business, investor and consumer confidence.

Industry Canada further contributes to an efficient and competitive Canadian marketplace by:

- delivering regulatory regimes through regulations, policies, procedures and standards for bankruptcy; foreign direct investment; federal incorporations; intellectual property; and weights and measures;

- developing domestic regulations, policies, procedures and standards that govern Canada's spectrum and telecommunications industries and the online economy;

- ensuring that consumers have a voice in the development of government policies and are effective marketplace participants; and

- administering and enforcing the Competition Act, the Consumer Packaging and Labelling Act, the Textile Labelling Act, the Weights and Measures Act, the Electricity and Gas Inspection Act, the Bankruptcy and Insolvency Act, the Canada Business Corporations Act, the Investment Canada Act and the Precious Metals Marking Act.

In the coming years, key priorities include:

- encouraging Canadians and non-Canadians to invest in Canada and contribute to economic growth and employment opportunities;

- developing policy tools to protect the online marketplace and promote the digital economy in the areas of authentication, cryptography and identity management;

- developing regulations to bring into force the new Canada Not-For-Profit Corporations Act;

- managing the implementation of the Canadian Radio-television and Telecommunications Commission (CRTC) framework for the conversion of the over-the-air TV to digital;

- promoting Canadian views and defending Canadian interests in international organizations on next-generation networks, cybersecurity, emergency telecom services and conformity assessment;

- minimizing the administrative cost and paperwork burden of regulatory compliance on small businesses; and

- advocating in favour of market forces.

Focusing on these priorities will help protect Canadian consumers and improve the Canadian business environment.

Challenges and Risk Areas:

The constant evolution of the global business environment, combined with the impact of rapidly changing technologies and increasing client demands, reinforces the importance of developing credible and timely strategies that promote competitive growth while meeting consumer and business needs in a recovering economy.

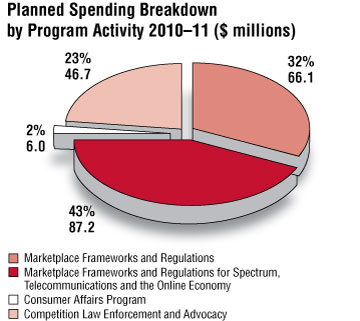

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2010–11 | 2011–12 | 2012–13 | |||

| FTEs | Planned Spending | FTEs | Planned Spending | FTEs | Planned Spending |

| 1,779.6 | 66.1 | 1,779.6 | 68.4 | 1,779.6 | 63.9 |

* Minor differences are due to rounding.

| Expected Result | Indicators | Targets | |||

|---|---|---|---|---|---|

| Marketplace fairness, integrity, efficiency and competitiveness are protected in the areas of insolvency, foreign investment, weights and measures, federal incorporation, and intellectual property | Percentage of cases for which regulatory timelines and/or service standards are met | 80% |

Planning Highlights and Benefits for Canadians:

Industry Canada will implement the legislative amendments reflected in Chapters 36 and 47 of the Statutes of Canada under the Companies' Creditors Arrangement Act. These new amendments will ensure integrity and accountability in all areas of insolvency in Canada, and will further enhance the status of Canada's insolvency system both at home and abroad.

Following changes made to the Investment Canada Act, Industry Canada will, in 2010–11, improve the transparency and accountability of the foreign investment review framework in Canada by producing its first Annual Report.

Industry Canada will develop regulations and seek approval of user fees to bring into force the Canada Not-for-Profit Corporations Act, which establishes a modern governance framework for not-for-profit corporations.

In response to stakeholder requests that NUANS 5 become the single comprehensive source of corporate names used in all Canadian federal, provincial and territorial jurisdictions, Industry Canada will strive in 2010–11 to ensure that Canadians and Canadian businesses benefit from marketplace efficiency by engaging non-participating jurisdictions on the usage of NUANS, and, in the case of Quebec, on the provision of its data to NUANS.

Industry Canada will promote the effective use of intellectual property (IP) assets and information to Canadian small and medium-sized enterprises and the education sector.

By improving marketplace conditions through these actions, Industry Canada will ensure that Canadians and Canadian businesses benefit from cutting-edge marketplace fairness, integrity, efficiency and competitiveness.

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2010–2011 | 2011–12 | 2012–13 | |||

| FTEs | Planned Spending | FTEs | Planned Spending | FTEs | Planned Spending |

| 686 | 87.2 | 686 | 86.4 | 686 | 85.6 |

* Minor differences are due to rounding.

| Expected Result | Indicators | Targets | |||

|---|---|---|---|---|---|

| Canada's radiocommunications and telecommunications infrastructure and the online economy are governed by a modern, efficient and effective policy and regulatory framework | Percentage of policies, legislation and regulations developed, updated or reviewed and consultations conducted as identified in annual business plans/strategic plans/operational plans | 80% of identified initiatives |

Planning Highlights and Benefits for Canadians:

Canada's radiocommunications and telecommunications infrastructure and the online economy require modern, efficient and effective policy and regulatory frameworks. There is growing demand for advanced wireless services driven by an expanding mobility market and broadband Internet access. Industry Canada will undertake several priority actions to develop the policies, regulations, standards and treaties that will support effective spectrum management and the provision of new wireless services.

The Department will manage the technical aspects of the implementation of the Canadian Radio-television and Telecommunications (CRTC) framework for the conversion of the over-the-air TV signal to a digital TV signal. When the conversion is completed, it will allow auctioning of the 700 MHz spectrum and allow broadcasters to bring high-definition television (HDTV) to the viewing public across Canada.

Consultation processes will take place in preparation for auctions in both the 2500 MHz and 700 MHz bands. Auctioning of these bands will help support new mobile technologies and services in the Canadian marketplace.

Industry Canada is establishing the Electronic Commerce Protection Act (ECPA) to help protect the online marketplace by deterring the most damaging and deceptive forms of spam and other related online threats from occurring in Canada. As well, the Personal Information Protection and Electronic Documents Act (PIPEDA) legislation will be updated to enhance the protection of personal information as well as consumer and business confidence in the online marketplace.

The Department is exploring options for a digital economy strategy to boost Canada's productivity performance by focusing on the objectives of strengthening Canada's domestic information and communications technologies (ICT) sector, and increasing rates of business ICT adoption and use. The digital economy is an economic enabler and thus critical to Canada's future prosperity.

By delivering on these priorities, Industry Canada will ensure that policies and regulations are in place to protect Canadians and their increasing use of radiocommunications, telecommunications and ICT. It is expected that increasing the rates of use of these technologies will boost Canada's future prosperity.

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2010–11 | 2011–12 | 2012–13 | |||

| FTEs | Planned Spending | FTEs | Planned Spending | FTEs | Planned Spending |

| 23 | 6.0 | 23 | 5.9 | 23 | 5.8 |

* Minor differences are due to rounding.

| Expected Result | Indicators | Targets | |||

|---|---|---|---|---|---|

| Consumer interests are represented in the marketplace and in the development of government policies | Number of new outreach initiatives to assist consumers in accessing information and tools that will help them make informed purchasing decisions | 1 | |||

| Number of government policies and/or legislation developed, updated or reviewed by OCA | 2 |

Planning Highlights and Benefits for Canadians:

The challenges that face consumers and families in the current economic climate are growing. Addressing these challenges is essential to maintaining consumer trust and confidence in the marketplace. Industry Canada, through the Office of Consumer Affairs (OCA), will support consumers by focusing on areas where they may be particularly vulnerable, and by equipping them with tools they can use to help them spend wisely, thus contributing to a marketplace that is more efficient and competitive.

In conjunction with the Consumer Measures Committee (CMC), Industry Canada will explore measures to protect consumer interests through the joint analysis of current consumer pressures in priority sectors, and by sharing best practices in regulatory compliance with federal, provincial and territorial consumer protection laws.

The Department will further develop its consumer information tools, including the joint federal-provincial-territorial site Consumerinformation.ca and the Canadian Consumer Handbook, to help consumers meet the challenges posed by current economic conditions.

Industry Canada will work with partners in other departments and internationally on a variety of consumer policy projects pertaining to sustainable consumption, consumer vulnerability and electronic commerce.

Through these actions, Canadian consumers' interests will be better protected and Canadians will be able to make more informed decisions.

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2010–11 | 2011–12 | 2012–13 | |||

| FTEs | Planned Spending | FTEs | Planned Spending | FTEs | Planned Spending |

| 452 | 46.7 | 452 | 48.1 | 452 | 49.5 |

* Minor differences are due to rounding.

| Expected Result | Indicators | Targets | |||

|---|---|---|---|---|---|

| Competitive markets and informed consumer choice | Dollar savings to consumers from Bureau actions that stop anti-competitive activity | $330 million | |||

| Percentage of economy subject to market forces | 82% of GDP |

Planning Highlights and Benefits for Canadians:

In 2010–11, the Competition Bureau will continue to focus its efforts on the effective implementation of the amendments made to the Competition Act on March 12, 2009. The Bureau will also clarify key enforcement issues in the areas of abuse of dominance, competitor collaborations and price maintenance, to ensure increased transparency, clarity and predictability for all Canadians.

The Bureau will continue to focus its enforcement efforts on domestic bid rigging, abuse of dominance, and timely and effective merger reviews.

As well, as part of its ongoing effort to ensure that Canadians know how to better protect themselves from fraudulent claims, to better recognize scams and to avoid falling victim to such scams, the Bureau will target Mass Marketing Fraud (MMF) over the Internet.

The Bureau will continue to advocate for greater reliance on competition and will work with federal and provincial governments, where appropriate, on strategies that address market inefficiencies to further strengthen the Canadian marketplace.

The Bureau, as a law enforcement agency, contributes to the prosperity of Canadians by protecting and promoting competitive markets in which efficiencies and innovation are fostered, and where consumers can make informed choices.

2.2 Science

and Technology, Knowledge, and Innovation are Effective Drivers of a Strong Canadian Economy

2.2 Science

and Technology, Knowledge, and Innovation are Effective Drivers of a Strong Canadian Economy

| Year | Financial Resources ($ millions)* |

Human Resources (FTEs) |

|---|---|---|

| 2010–11 | 1,652.6 | 747.5 |

| 2011–12 | 603.4 | 731.5 |

| 2012–13 | 530.1 | 732.5 |

* Minor differences are due to rounding.

Strategic science and technology (S&T) investments are key drivers in rebuilding the post-recession Canadian economy.

Fostering innovation and commercialization of new technologies is fundamental to improving Canada's overall productivity and enhancing Canada's competitiveness on a global scale during the economic recovery.

In support of this objective, Industry Canada advances leading-edge research and development (R&D) and provides value-added knowledge and expertise to enhance conditions for commercialization and innovation in targeted Canadian industries. The Department works with the private sector, industry associations, academia and all levels of government to foster an environment that is conducive to innovation and that promotes scientific excellence and industrial competitiveness.

These collaborative relationships advance technology transfer, spinoffs and innovation; contribute to a skilled workforce; and ensure that Canadians and Canadian businesses benefit from an innovative and knowledge-based economy.

Industry Canada further contributes to a strong Canadian economy driven by science and technology (S&T), knowledge and innovation by:

- sustaining knowledge and talent through world-class leadership in S&T policies and programs;

- promoting a business environment that supports excellence in innovation;

- contributing to strategic, large-scale R&D projects in the automotive sector that support innovative, greener and more fuel-efficient vehicles; and

- conducting research on advanced telecommunications and information technologies to support the development of new products and services for the ICT sector.

In the coming years, key priorities include:

- providing science policy advice and policy frameworks to fulfill commitments made in Mobilizing Science and Technology to Canada's Advantage, Canada's S&T strategy;

- producing the 2010 state of the nation report on Canada's science, technology and innovation system;

- working with partners to enhance the global competitiveness of Canada's health industries by encouraging the commercialization of biotechnology;

- continuing to collaborate with partners to enhance Canada's competitive advantage in hydrogen and fuel cell technology development and commercialization;

- encouraging and promoting the adoption and adaptation of new technologies and skills to business processes; and

- working with portfolio agencies to develop funding programs that promote R&D within Canadian industries.

Focusing on these priorities will spur innovation and ensure that Canadian businesses become increasingly competitive and successful.

Challenges and Risk Areas:

The current global and financial context, as well as shifting economic drivers, may impact the investment and innovation capacity of Canadian industries and their ability to leverage leading-edge research and S&T discoveries.

Canada's Economic Action Plan:

On January 27, 2009, the Government of Canada put forth a series of temporary measures aimed at stimulating economic growth, restoring confidence and supporting Canadians during the global recession. The following Budget 2009 initiatives will be reported on under this strategic outcome:

- Knowledge Infrastructure Program

- Institute for Quantum Computing

- Modernization of Federal Laboratories

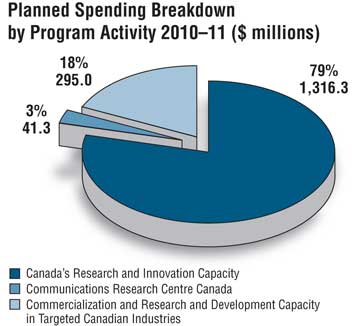

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2010–11 | 2011–12 | 2012–13 | |||

| FTEs | Planned Spending | FTEs | Planned Spending | FTEs | Planned Spending |

| 97.5 | 1,316.3 | 81.5 | 252.9 | 82.5 | 170.3 |

* Minor differences are due to rounding.

| Expected Result | Indicators | Targets | |||

|---|---|---|---|---|---|

| Science, technology and innovation (ST&I) policy frameworks to enhance Canada's research and innovation capacity |

Number of ST&I outreach activities with other government departments, agencies and external stakeholders | 20 | |||

| Knowledge Infrastructure Program: Provide economic stimulus in local economies across Canada through infrastructure investments at post-secondary institutions |

Total value of approved projects at colleges and universities | $2 billion | |||

| Institute for Quantum Computing (IQC): Support the construction of a new building, the operation of the IQC and scientific outreach activities |

Construction of the new IQC building completed | Completed by March 31, 2011 |

Planning Highlights and Benefits for Canadians:

Innovation is a major driver of productivity and growth. Scientific discoveries and new technologies provide solutions to many of the issues important to Canadians. The Government of Canada is committed to strengthening the effectiveness of its investments in S&T as outlined in the government's S&T strategy, Mobilizing Science and Technology to Canada's Advantage, to ensure Canadians benefit from scientific innovation.

The Department will support the Science, Technology and Innovation Council (STIC) which provides policy advice on science and technology issues to the Government of Canada. This will provide the government with access to high-quality research and analysis.

Industry Canada, in collaboration with the STIC, will produce the 2010 state of the nation report on Canada's science, technology and innovation system. This report will provide an assessment of Canada's research and innovation and will measure Canada's science and technology performance against international standards of excellence.

Industry Canada will work to improve the effectiveness of funding for higher-education research and to measure and maximize the impact of these investments with partners such as the federal granting councils, the Canada Foundation for Innovation and Genome Canada.

By strengthening the effectiveness of S&T investments in Canada, Industry Canada expects that further scientific innovations will contribute to fostering a knowledge-based economy.

Canada's Economic Action Plan:

The Knowledge Infrastructure Program (KIP) was introduced as part of Budget 2009 and will provide funding of up to $2 billion over two years for R&D infrastructure projects at post-secondary institutions. In 2010–11, Industry Canada will work with recipient institutions (through the provinces and territories) to follow up on program implementation.

Industry Canada will also be furthering Canada's research and innovation capacity through a grant to the Institute for Quantum Computing and a contribution to the Canada Foundation for Innovation.

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2010–11 | 2011–12 | 2012–13 | |||

| FTEs | Planned Spending | FTEs | Planned Spending | FTEs | Planned Spending |

| 401 | 41.3 | 401 | 38.1 | 401 | 37.4 |

* Minor differences are due to rounding.

| Expected Result | Indicators | Targets | |||

|---|---|---|---|---|---|

| Industry Canada and other government organizations receive high-quality, research-based technical inputs to develop telecommunications policies, regulations and standards and support government operations | Client satisfaction survey (related to content, timeliness and usefulness) related to CRC technical inputs and advice used to develop telecommunications policies, regulations, programs and standards | 80% | |||

| Canadian companies use CRC-developed technologies to enhance their product lines | Increase in total sales revenues of Canadian communications companies with a link to CRC, compared with market averages | 20% (over 5-year period) | |||

| Modernization of Federal Laboratories:

Reduce the risk of larger ad hoc repairs and ongoing repair costs |

Percentage of infrastructure installed | 90% |

Planning Highlights and Benefits for Canadians:

Industry Canada is committed to a competitive Canadian ICT sector. Through the Communications Research Centre Canada (CRC), technical input based on advanced research is provided to those working in ICT.

A key priority for Industry Canada is the G20 Summit to be held in Toronto in June 2010. The Department will provide the spectrum monitoring tools and equipment required to ensure security at the summit.

Industry Canada will provide government departments and agencies with technical information to help improve the decision making and operational capability related to ICT procurement and deployment.

The Department will provide Canadian industry with technical expertise, patent licences, patent licensed technology, and specialized software and hardware to help close innovation gaps in information and communications technologies and to make them more competitive.

By acting on these priorities, the government, Canadian businesses and Canada's ICT sector will benefit from cutting-edge ICT development and deployment.

Canada's Economic Action Plan:

To ensure the CRC is able to deliver on its mandate, some labs will be upgraded through the Modernizing Federal Laboratories Initiative.

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2010–11 | 2011-2012 | 2012-2013 | |||

| FTEs | Planned Spending | FTEs | Planned Spending | FTEs | Planned Spending |

| 249 | 295.0 | 249 | 312.4 | 249 | 322.4 |

* Minor differences are due to rounding.

| Expected Result | Indicators | Targets | |||

|---|---|---|---|---|---|

| Leveraged leading-edge research and development in targeted Canadian industries |

Dollar(s) of stakeholder investment leveraged per dollar of Industry Canada investments in R&D projects |

$2 |

Planning Highlights and Benefits for Canadians:

Through knowledge sharing, engagement and program delivery, Industry Canada enhances the innovation capacity of targeted industries.

Industry Canada will work with industry stakeholders to encourage and promote the adoption and adaptation of new technologies such as ICT, biotechnology and clean energy technologies. The Department will also guide the development of four Technology Roadmaps (TRM), including the Soldier System TRM, which supports Canada's soldier modernization efforts.

The Department will further improve the accessibility of the Strategic Aerospace and Defence Initiative (SADI) to SMEs to help increase investment in innovative and competitive aerospace and defence (A&D) firms and to foster collaboration in R&D between A&D industries and research institutes.

Stakeholders on key issues and policies affecting innovation will be consulted. For instance, Industry Canada will inform government decision making on the climate change policy agenda by advising on industry impacts and opportunities of potential climate change regulation and conveying government perspective back to industry.

Implementation of the Automotive Innovation Fund (AIF) will continue. The fund provides $250 million to support strategic, large-scale R&D projects in the automotive sector to develop innovative, greener and more fuel-efficient vehicles.

By delivering on these priorities, the Department will ensure that industrial sectors benefit from increased innovation potential, knowledge sharing and increased rates of commercialization.

2.3 Competitive Businesses are

Drivers of Sustainable Wealth Creation

2.3 Competitive Businesses are

Drivers of Sustainable Wealth Creation

| Year | Financial Resources ($ millions)* |

Human Resources (FTEs) |

|---|---|---|

| 2010–11 | 497.2 | 575.9 |

| 2011–12 | 246.8 | 552.9 |

| 2012–13 | 231.5 | 552.9 |

* Minor differences are due to rounding.

Canadian competitiveness and productivity are ultimately dependent on the success or failure of Canadian firms, as they are the generators of wealth and employment in the economy. To maximize this productivity and competitiveness, Industry Canada enhances the ability of Canadian industries to take advantage of opportunities and respond to risks, ensures Canadian industry's link into global value chains, and assists businesses in strengthening partnerships both domestically and internationally. The desired result is an agile Canadian industrial sector that can adapt to the ever-changing economic landscape, respond appropriately to external shocks and compete internationally.

To help create competitive businesses and promote sustainable wealth creation, Industry Canada collaborates with associations, governments and industry to enhance the recognition of Canadian industrial capabilities and to identify and address opportunities and risks affecting industry competitiveness and agility within the globalized marketplace.

Industry Canada also supports and enhances the role and contribution of small and medium-sized businesses to Canada's economic well-being by building capacity in both physical infrastructure and information and communications technologies in non-metropolitan communities. This increases the capacity of individuals and communities across Canada to participate in a knowledge-based economy. This is one way in which the Department promotes small business growth and competitiveness and encourages entrepreneurship.

Industry Canada further contributes to sustainable wealth creation through competitive businesses by:

- sustaining responsive and innovative departmental programs and services;

- achieving economic and social policies that rely on market forces to the greatest extent possible, while recognizing in rare circumstances that markets may not be complete, and that the international playing field may not be level; and

- using the least-intrusive measures when government intervention is required.

In the coming years, key priorities include:

- continuing improvements to online information for small businesses through BizPaL and the Canada Business Network web presence;

- developing collaborative working relationships between the Canada Business Network in Ontario, and the new Federal Economic Development Agency for Southern Ontario, and between the Canada Business Network in the Yukon, Northwest Territories and Nunavut, and the new Canadian Northern Economic Development Agency;

- engaging partners to manage federal involvement in Ontario's Open for Business Strategy;

- working with partners to encourage targeted pharmaceutical investment in Canada;

- encouraging firms to use and adopt value-added services as a strategy to increase their competitiveness and agility; and

- providing advice on bilateral and multilateral priorities related to competitiveness.

Focusing on these priorities will help support and bolster Canadian business competitiveness and productivity.

Challenges and Risk Areas:

The strength of the Canadian dollar, protectionist measures and other subsidy programs implemented by trading partners may have a negative impact on the competitiveness of Canadian industries and their ability to export goods and services.

Canada's Economic Action Plan:

On January 27, 2009, the Government of Canada put forward a series of temporary measures aimed at stimulating economic growth, restoring confidence and supporting Canadians during the global recession. The following Budget 2009 initiatives will be reported on under this strategic outcome:

- Marquee Tourism Events Program

- Community Adjustment Fund in Northern Ontario

- Broadband Canada

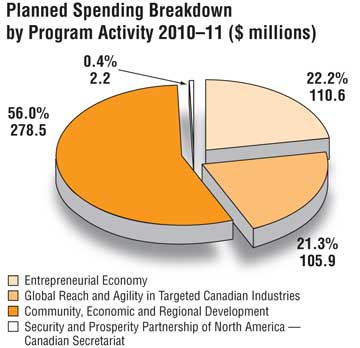

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2010–11 | 2011–12 | 2012–13 | |||

| FTEs | Planned Spending | FTEs | Planned Spending | FTEs | Planned Spending |

| 140.4 | 110.6 | 128.9 | 104.1 | 128.9 | 114.2 |

* Minor differences are due to rounding.

| Expected Result | Indicators | Targets | |||

|---|---|---|---|---|---|

| Small and medium-sized enterprise (SME) use of government business-related information, programs and services, and facilitated compliance for business | Increase in number of clients using the Canada Business Network website over the previous year | 10% | |||

| Integrated business permit and licence information from all levels of government provides value to clients across Canada | Percentage of clients that indicate satisfaction with the services provided | 80% |

Planning Highlights and Benefits for Canadians:

Industry Canada and its provincial/territorial partners will work together to accelerate the expansion of the BizPaL service by recruiting new jurisdictions and expanding BizPaL content beyond permits and licences to include other permissions-based content.

The Canada Business Network will improve the delivery of government business-related information, programs and services by implementing a new service strategy. This provides an opportunity to incorporate the recommendations of varied stakeholders to refresh the service and enhance its ability to strengthen the survival and growth rates of Canadian small and medium-sized enterprises (SMEs).

Industry Canada will be engaged with partners to manage the federal government's involvement in the province of Ontario's Open for Business Initiative, which aims to provide seamless service for SMEs in Ontario and greater access to information on government programs and services.

Through Industry Canada's work on the above priorities, Canada's entrepreneurs and small and medium-sized businesses will find it easier to play a strong role in Canada's economic recovery.

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2010–11 | 2011–12 | 2012–13 | |||

| FTEs | Planned Spending | FTEs | Planned Spending | FTEs | Planned Spending |

| 259 | 105.9 | 259 | 36.7 | 259 | 36.7 |

* Minor differences are due to rounding

| Expected Result | Indicators | Targets | |||

|---|---|---|---|---|---|

| Adaptable Canadian industries are linked to global value chains and have the capacity to prepare for and respond to risks and opportunities in the domestic and global markets | Quantity of completed initiatives, designed to increase the global reach and agility of Canadian industries, as a percentage of initiatives identified in the sector's business plan | 80% | |||

| Stability or improvement in Canada's ranking in the World Economic Forum's Global Competitiveness Report | 10th place | ||||

| Marquee Tourism Events Program:

Existing marquee tourism events will enhance their offerings and deliver world-class programs and experiences |

% of funded events with sustained or increased numbers of out-of-country and out-of-province tourists | 80% | |||

| % of funded events with sustained or increased tourism-related spending | 80% |

Planning Highlights and Benefits for Canadians:

Departmental officials collaborate with associations, governments and industry to enhance the recognition of Canadian industrial capabilities and to identify and address opportunities and risks affecting industry competitiveness and agility within the globalized marketplace.

In 2010–11, through the Industrial and Regional Benefits policy, Industry Canada will encourage Canadian participation in the Global Value Chains associated with multinationals that receive large procurement contracts from the Government of Canada. Additionally, the Department will continue to improve its pharmaceutical company monitoring program, which is focused on expanding investment in Canada. The Department will also host trilateral Canada–U.S.–Japan meetings to address market access issues related to wood products exported to Japan.

Industry Canada will also continue to contribute sector knowledge and expertise to develop and implement frameworks and strategies aimed at fostering Canadian industries that are able to adapt to changes in market conditions. The Department will also pursue collaborative research in service–business functions that contribute to improving company competitiveness by identifying key performance indicators, benchmarks and best-in-class practices.

Industry Canada's work in this program activity will enhance the capacity of targeted Canadian industries to anticipate and respond to the risks and opportunities presented in the current economic environment and under future market conditions.

Canada's Economic Action Plan:

Industry Canada will support the tourism industry in Canada by strengthening select marquee events through the Marquee Tourism Events Program. Through targeted short-term support, the Marquee Tourism Events Program will help existing marquee tourism events enhance their offerings and deliver world-class programs and experiences. This support will contribute to the long-term growth and viability of Canada's visitor economy by attracting more tourists from both within and outside Canada.

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2010–11 | 2011–12 | 2012–13 | |||

| FTEs | Planned Spending** | FTEs | Planned Spending** | FTEs | Planned Spending** |

| 168.5 | 278.5 | 165 | 106.0 | 165 | 80.6 |

* Minor differences are due to rounding.

** Variances in funding amounts are the result of Canada's Economic Action

Plan items ending over the next few years.

| Expected Result | Indicators | Targets |

|---|---|---|

| A significant increase in the capacity of selected Northern Ontario communities and businesses, helping them to thrive in the 21st-century economy | Average leverage ratio of program funds | 1:2.13 |

| Total number of contribution agreements and grants approved | 233 | |

| Community Adjustment Fund in Northern Ontario:

Support for adjustment measures in communities |

Total value of investments anticipated in businesses, organizations and communities | $75,469,467* |

| Number of jobs created (in person-months) | 9,600* | |

| Broadband: Broadband coverage extended to as many currently unserved and underserved households in Canada as possible |

Percentage of contribution agreements in place that support reaching as many households as possible | 100 |

* Over 2009–10 to 2010–11

Planning Highlights and Benefits for Canadians:

Industry Canada will further support Northern Ontario communities and their businesses through the granting of funds to ensure they are competitive in the Canadian marketplace. As an example, the Department will provide financial support to Community Futures organizations (CFOs) which, in collaboration with other partners, will provide support to new businesses, strengthen and expand existing businesses, and help create and maintain jobs in Northern Ontario. Industry Canada will also deliver the Economic Development Initiative in Northern Ontario under the Government of Canada's Roadmap to Linguistic Duality 2008-2013: Acting for the Future. This initiative will develop new expertise through innovation, diversification of activities, partnerships and increased support of small businesses.

Across Canada, the Computers for Schools program will distribute refurbished computers to schools, libraries and not-for-profit organizations, and engage youth interns to assist in computer refurbishment and ICT skill integration.

Selected communities and regions, through these priorities, will have better resources to attract and support businesses and support community development.

Canada's Economic Action Plan:

Budget 2009 led to the creation of the Federal Economic Development Agency for Southern Ontario, which now delivers many of the programs previously delivered by Industry Canada in Southern Ontario. This program activity is undergoing significant changes and is currently in the process of refocusing its activities to ensure maximum value and return for Canadians.

From Budget 2009, Industry Canada will also be delivering the Community Adjustment Fund in Northern Ontario and the Broadband Canada: Connecting Rural Canadians initiative to support community, economic and regional development.

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2010–11 | 2011–12 | 2012–13 | |||

| FTEs | Planned Spending** | FTEs | Planned Spending | FTEs | Planned Spending |

| 8 | 2.2 | 0 | 0.0 | 0 | 0.0 |

* Minor differences are due to rounding.

** Funding for the Security and Prosperity Partnership is scheduled to end

on March 31, 2011

| Expected Result | Indicators | Targets | |||

|---|---|---|---|---|---|

| Industry Canada is successful in advancing its strategic priorities in the context of North America and other international bilateral and multilateral fora | Number of bilateral or multilateral meetings at the senior management or ministerial level for which advice, planning or other deliverables are provided | 10 |

Planning Highlights and Benefits for Canadians:

Industry Canada will provide advice on regional/country strategies and memoranda to Cabinet relating to global economic issues and developments, and support and coordinate the Department's engagement in various international meetings and summits (e.g., North American Leaders' Summits, G8, G20). This work will assist Industry Canada in pursuing its strategic priorities within North America and other international engagements.

Industry Canada will continue to provide a leadership role in managing the Research Fund on North American Borders, Security and Prosperity. This interdepartmental research initiative will enhance understanding of the impacts of border measures on Canadian competitiveness.

Through these actions, aimed at promoting strategic Canadian economic interests, Industry Canada contributes to greater competitiveness for Canadian business and an enhanced quality of life for Canadian citizens.

| Human Resources (FTEs) and Planned Spending ($ millions)* | |||||

|---|---|---|---|---|---|

| 2010–11 | 2011–12 | 2012–2013 | |||

| FTEs | Planned Spending | FTEs | Planned Spending | FTEs | Planned Spending |

| 1,015 | 92.6 | 941 | 92.2 | 941 | 92.2 |

* Minor differences are due to rounding.

Internal Services are groups of related activities and resources that are administered to support the needs of programs and other corporate obligations of an organization.

These groups are Management and Oversight Services, Public Policy Services, Communications Services, Legal Services, Human Resources Management Services, Financial Management Services, Information Management Services, Information Technology Services, Real Property Services, Materiel Services, Acquisition Services, and Travel and Other Administrative Services.

Internal Services include only those activities and resources that apply across an organization and not to those provided specifically to a program.

4 Bank of Canada press release

5NUANS is an online search tool that determines the uniqueness of proposed business names by comparing new names with databases of existing corporate names and trademarks.