Common menu bar links

Breadcrumb Trail

ARCHIVED - Industry Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Section 2: Analysis of Program Activities by Strategic Outcome

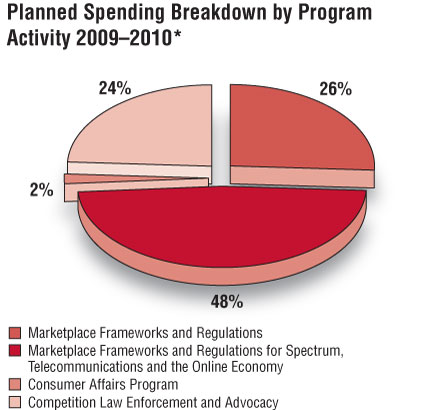

The Canadian Marketplace is Efficient and Competitive

The Canadian Marketplace is Efficient and Competitive

The global business environment is evolving rapidly. New business practices and operating realities require the modernization and harmonization of framework policies to maintain a marketplace that is reliable, efficient and responsive to the needs of businesses and consumers. Change is also needed to address Canadian marketplace regulations and policies that are too restrictive to ensure the continued attraction of foreign competition and investment.

| Year | Financial Resources ($ millions)* | Human Resources (FTEs) |

|---|---|---|

| 2009–2010 | 181.2 | 3,017 |

| 2010–2011 | 177.5 | 3,026 |

| 2011–2012 | 180.8 | 3,040 |

* Minor differences are due to rounding.

An effective marketplace is necessary to build and maintain consumer confidence and to foster an environment conducive to investment and sustainable development.

Framework policies are fundamental to the functioning of a market economy and include laws and regulations governing patents and copyright, bankruptcy and insolvency, competition and restraint of trade, corporations and corporate securities, foreign direct investment, internal trade, weights and measures, consumer affairs and telecommunications.

In support of Industry Canada’s strategic outcome The Canadian Marketplace is Efficient and Competitive, the department develops and administers economic framework policies that promote innovation, competition and productivity, and instil business, investor and consumer confidence.

Industry Canada further contributes to this strategic outcome by:

- Delivering regulatory regimes through regulations, policies, procedures and standards for bankruptcy, foreign direct investment, federal incorporations, intellectual property and weights and measures;

- Developing domestic regulations, policies, procedures and standards that govern Canada’s spectrum and telecommunications industries and the online economy;

- Ensuring that consumers have a voice in the development of government policies and are effective marketplace participants; and

- Administering and enforcing the Competition Act, the Consumer Packaging and Labelling Act, the Textile Labelling Act and the Precious Metals Marking Act.

In the coming years, key priorities include modernizing Canada's competition laws for the benefit of consumers and businesses, implementing many recommendations of the Competition Policy Review Panel, introducing legislation to protect Canadians from spam (unsolicited commercial email) and related threats online, updating intellectual property and copyright legislation while harmonizing this legislation with other industrialized countries, making policy changes in support of foreign direct investment and competition, and working with partners on ways to improve compliance with both federal and provincial consumer protection laws. These proposed marketplace changes are intended to protect consumers and improve the Canadian business environment.

* Minor differences are due to rounding.

| Expected Result | Indicators | Targets |

|---|---|---|

| Marketplace fairness, integrity, efficiency and competitiveness are protected in the areas of insolvency, foreign investment, weights and measures, federal incorporation, and intellectual property | Percentage of cases for which regulatory timelines and/or service standards are met | 80% |

Planning Highlights and Benefits for Canadians:

In keeping with our commitment to the protection of the fairness, integrity, efficiency and competitiveness of the Canadian marketplace through regulation and promotion, Industry Canada will work to modernize the Weights and Measures Act and Regulations, and the Electricity and Gas Inspection Act and Regulations, to improve measurement accuracy in the marketplace and reduce consumer and business risk of financial loss due to inaccurate measurement.

If Chapters 36 and 37 of the Statutes of Canada come into force in 2009, Industry Canada will also assume an important new supervisory role over proceedings filed under the Companies’ Creditors Arrangement Act. This will enable Industry Canada to ensure integrity and accountability in all areas of insolvency in Canada and will enhance the status of Canada's insolvency system both at home and abroad.

As part of its efforts to ensure an efficient and competitive marketplace, Industry Canada will pursue improvements to the Information Technology (IT) system and the internal processes to address evolving business and client needs and to provide efficient ways to better serve Canadian businesses.

Industry Canada will pursue its efforts to modernize the intellectual property (IP) regime to effectively respond to the evolving marketplace and therefore provide Canadians with competitive IP products and services.

By improving conditions in the marketplace through the priorities indicated above, Industry Canada can ensure that Canadians and Canadian businesses benefit from cutting edge marketplace fairness, integrity, efficiency and competitiveness.

* Minor differences are due to rounding.

| Expected Result | Indicators | Targets |

|---|---|---|

| Canada's radiocommunications and telecommunications infrastructure and the online economy are governed by a modern, efficient and effective policy and regulatory framework | Percentage of policies, legislation and regulations developed, updated or reviewed and consultations conducted as identified in annual branch business plans / strategic plans / operational plans | 80% of identified initiatives |

Planning Highlights and Benefits for Canadians:

Canada’s radiocommunications and telecommunications infrastructure and the online economy require modern, efficient and effective policy and regulatory frameworks. There is a growing demand for advanced wireless services driven by an expanding mobility market and broadband Internet access. Industry Canada will undertake several priority actions to develop the policies, regulations, standards and treaties that will support effective spectrum management and the provision of new wireless services.

To help meet this growing demand, Industry Canada plans to hold two spectrum auctions: one to enable the provision of new enhanced Air-Ground Services, such as Internet access onboard Canadian aircraft; and another for the residual licences in the 2.3 and 3.5 GHz bands that were not assigned during the February 2004 spectrum auction, for fixed services, such as Internet.

Industry Canada will take measures to ensure the highest quality of spectrum management to meet the needs of the Vancouver 2010 Olympic and Paralympic Winter Games and to help ensure safety and security at Olympic events.

The Canadian Radio-television and Telecommunications Commission (CRTC) has announced August 31, 2011 as the shutdown date for over-the-air analog television. Industry Canada will focus on finalizing new Broadcast Procedures and Rules (BPR) on digital television (DTV). The department will also process DTV coordination requests, DTV applications for technical compliance, and provide engineering expertise on policy, licensing and consumer issues.

Industry Canada will also undertake consultations on the renewal of Personal Communications Services (PCS) and cellular licences, and changes to various technical regulations to enable various mobile services and broadband data services. In addition, consultations will be initiated on the policy and licensing provisions to take advantage of the “digital dividend” when analog TV channels transition to digital.

Industry Canada will also implement the Government Response to the Statutory Review of the Personal Information Protection and Electronic Documents Act (PIPEDA), including proposals for Data Breach Reporting and Notification. The department will also develop measures aimed at combatting spam and other online threats and creating a safer online marketplace. In addition, Industry Canada will work with the Organisation for Economic Co-operation and Development (OECD) and other stakeholders on the implementation of the 2008 Seoul Declaration for the Future of the Internet Economy, which outlines the basic principles that will guide the future development of the Internet.

* Minor differences are due to rounding.

| Expected Result | Indicators | Targets |

|---|---|---|

| Consumer interests are represented in the marketplace and in the development of government policies | Number of new outreach initiatives to assist consumers in accessing information and tools that will help them make informed purchasing decisions | 1 |

| Number of government policies and/or legislation developed, updated or reviewed by OCA | 2 |

Planning Highlights and Benefits for Canadians:

The challenges facing consumers and families are growing. Addressing these challenges is essential to maintaining consumer trust and confidence in the marketplace. Industry Canada, through the Office of Consumer Affairs (OCA), will support consumers by focusing on areas where they may be particularly vulnerable, and by equipping them with tools they can use to help them spend wisely, thus contributing to a marketplace that is more efficient and competitive.

The department will rationalize its consumer websites and tools, including the joint federal-provincial site Consumerinformation.ca.

Online information and advice for consumers on the transition to digital television broadcasting will be updated regularly and disseminated through neighbourhood newspapers across the country.

With the Consumer Measures Committee (CMC), Industry Canada will explore measures to improve compliance with both federal and provincial consumer protection laws and to harmonize consumer credit reporting laws. The department will work with the Department of Justice and provincial governments to advance the adoption of provincial regulations that control the maximum cost of borrowing and create fair contract terms to protect consumers in the payday lending market.

Based on earlier research, Industry Canada will prepare a strategy to mitigate the challenges faced by the most vulnerable consumers, such as those living on low incomes or those with limited literacy skills. For 2009–2010, this will involve creating partnerships with stakeholders working on rural, literacy and low-income issues, in order to validate research findings and dig more deeply into specific consumer marketplace problems.

Industry Canada will continue to be an active participant in the follow-up to the United Nations Marrakesh Process on sustainable consumption and production.

In 2009–2010, Industry Canada will also streamline the administration of its contributions program for not-for-profit consumer organizations, to ensure that the program remains effective in supporting external policy research in the consumer interest. The program provides contributions to eligible groups to strengthen the consumer’s role in the marketplace though the promotion of timely and sound research and analysis and to encourage the financial self-sufficiency of consumer and voluntary organizations.

* Minor differences are due to rounding.

| Expected Result | Indicators | Targets |

|---|---|---|

| Competitive markets and informed consumer choice | Dollar savings to consumers from Bureau actions that stop anti-competitive activity | Increase over current dollar savings (estimated at $330 million) |

| Percentage of economy subject to market forces | Increase or maintain current percentage (approximately 82% of GDP) |

Planning Highlights and Benefits for Canadians:

A competitive marketplace is one of the main priorities of the Government of Canada, and Industry Canada, through the Competition Bureau, is committed to achieving this through its efforts to protect and promote competitive markets and to enable informed consumer choice.

Headed by the Commissioner of Competition, the Bureau is responsible for the administration and enforcement of the Competition Act, the Consumer Packaging and Labelling Act, the Textile Labelling Act and the Precious Metals Marking Act.

The Competition Act is designed to promote competition and efficiency in the Canadian marketplace. Containing both criminal and civil provisions, the Act forms a major part of Canada's economic framework legislation, applying, with few exceptions, to all industries and levels of trade. The Act's criminal provisions include conspiracy, bid-rigging, discriminatory and predatory pricing, price maintenance, misleading advertising and deceptive marketing practices. Civil provisions include mergers, abuse of dominant position, refusal to deal, consignment selling, exclusive dealing, tied selling market restrictions and delivered pricing. The Bureau also has a legislated mandate to advocate in favour of market forces before government legislators and decision-makers.

Combating international and domestic cartels are important enforcement priorities for the Bureau. In 2009–2010, the Bureau will continue to focus its efforts on domestic cartels. The Bureau will also focus on detecting and deterring agreements to rig bids, particularly in the public sector.

The Bureau will also target the increasing number of misleading and fraudulent performance claims affecting Canadians in the areas of health and the environment.

The Bureau will continue to review mergers and acquisitions and challenge those few that would result in a substantial lessening or prevention of competition.

In light of the recommendations made in the Final Report of the Competition Policy Review Panel (Compete to Win), the Bureau will continue to focus on being responsive to the evolving needs of business and the global economy.

As part of the Food and Consumer Safety Action Plan, the Bureau will engage in consultations to ensure the clarity of the terms “Product of Canada” and “Made in Canada.”

The Competition Bureau will also focus its advocacy efforts on certain key areas where it has the most potential to affect change, such as the health care sector, self-regulated professions and the Internet.

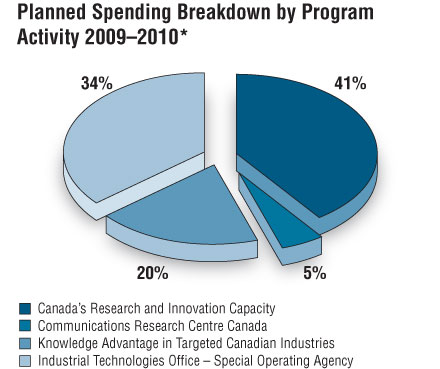

Science and Technology, Knowledge, and Innovation are Effective Drivers of a Strong Canadian Economy

Science and Technology, Knowledge, and Innovation are Effective Drivers of a Strong Canadian Economy

In the current economy, innovation is a driving force in creating wealth, economic growth and social development for Canadians. Globally, countries and jurisdictions are making significant investments to develop their science and technology (S&T)) capacity. As a result, there is fierce competition for capital, skills and intellectual property in S&T-anchored sectors, including information and communications technology (ICT), health and the life sciences and advanced manufacturing (e.g., aerospace and defence, nanotechnology).

Science, technology and innovation policies and programs improve Canada's research and development capacity through the support and application of research and research infrastructure, and the attraction, development and retention of highly qualified people.

| Year | Financial Resources($ millions)* | Human Resources (FTEs) |

|---|---|---|

| 2009–2010 | 652.1 | 683 |

| 2010–2011 | 556.1† | 683 |

| 2011–2012 | 483.8† | 683 |

* Minor differences are due to rounding.

† The reduction in financial resources is due to sunsetting programs, initiatives and conditional grants. Increases provided in Budget 2009 will be displayed in subsequent estimates documents.

Investments will also be made in new, world-class research facilities. The department supports foundational investments in S&T to create new knowledge, develop new products and services and to equip Canadians with the skills and training they need to compete in the global economy.

There will also be significant investment aimed at adapting and applying the best home-grown S&T know-how to create innovative business solutions. The federal S&T strategy provides an overarching framework to guide significant federal investments in research ($9.7 billion per year), and Canada’s Science, Technology and Innovation Council recently provided additional sectoral direction focusing on key sub-priorities that represent Canadian strengths and future economic opportunities. These priorities provide strategic direction and guidance for the department in its efforts to cultivate an innovative, knowledge-based Canadian economy.

Canada’s capacity to innovate is currently hampered by several factors, including low investments in research and development by the private sector, difficulty in commercializing basic research, low access to capital, and the need to train and apply the skills of highly qualified people. Canada ranks poorly in terms of overall research expenditures. Canadian universities perform a disproportionately large percentage of Canada’s research and development. To address S&T challenges, there were major new investments in science over the past three budgets ($2.4 billion in 2006, 2007 and 2008) and the government is committed to making additional investments in internationally recognized science and technology projects in Canada.

In support of Industry Canada’s strategic outcome Science and Technology, Knowledge, and Innovation are Effective Drivers of a Strong Canadian Economy, the department’s objectives include:

- sustaining knowledge and talent through world-class leadership in S&T policies and programs;

- promoting a business environment that supports excellence in innovation;

- creating business and academic partnerships that encourage and facilitate new ideas, entrepreneurship, and innovation; and

- requiring improved accountability on the results of government investments in innovation.

* Minor differences are due to rounding.

† The reduction in financial resources is due to sunsetting programs, initiatives and conditional grants. Increases provided in Budget 2009 will be displayed in subsequent estimates documents.

| Expected Result | Indicators | Targets |

|---|---|---|

| Science, technology and innovation policy frameworks to enhance Canada’s research and innovation capacity | Number of Science, Technology and Innovation (ST&I) outreach activities with other government departments, agencies and external stakeholders | 20 |

Planning Highlights and Benefits for Canadians:

Innovation is a major driver of productivity growth. Scientific discoveries and new technologies provide solutions to many of the issues important to Canadians. The Government of Canada is committed to strengthening the effectiveness of its investments in S&T to ensure Canadians benefit from scientific innovation.

Industry Canada will work, in collaboration with other science-based departments, agencies and external stakeholders, toward completion of commitments made in the government’s S&T strategy, Mobilizing Science and Technology to Canada’s Advantage.

Industry Canada will work with the Department of Finance Canada and other responsible departments to advance the government's S&T agenda, including developing and implementing new policies and programs, to enhance Canada’s research innovation capacity. The department will also take the lead in drafting government responses to S&T reviews and assessments conducted by parliamentary committees and external bodies.

Furthermore, in 2009–2010, Industry Canada will take the lead in managing the government’s science, technology and innovation policy responsibilities and obligations in multilateral fora. The department will also enhance its participation, with the Department of Foreign Affairs and International Trade (DFAIT) as the lead in Canada’s bilateral S&T agreements with China, India and California, in order to ensure that Canadian firms have greater access to the global pool of knowledge, talent and technology.

Through these initiatives, Industry Canada will continue developing policies to strengthen and advance Canada’s S&T strategy and innovative capacity and contribute to the Government of Canada’s priority of an innovative and knowledge-based economy.

* Minor differences are due to rounding.

| Expected Result | Indicators | Targets |

|---|---|---|

| Industry Canada and other government organizations receive high-quality, research-based technical inputs to develop telecommunications policies, regulations and standards and support government operations | Client satisfaction survey (on content, timeliness and usefulness) related to CRC technical inputs and advice used to develop telecommunications policies, regulations, programs and standards | 80% or higher |

| Canadian companies use CRC-developed technologies to enhance their product lines | Increase in total sales revenues every 5 years of Canadian communications companies with a link to CRC, compared to market averages | 20% |

Planning Highlights and Benefits for Canadians:

Industry Canada is committed to a competitive Canadian information and communications technologies (ICT) sector. Through the Communications Research Centre Canada (CRC), technical input based on advanced research is provided to those working in ICT.

Industry Canada will provide support to the development of policies and regulations for future communications services by providing forward-looking technical assessments for use within the department as well as to the Canadian Radio-television and Telecommunications Commission (CRTC), Natural Sciences and Engineering Research Council (NSERC) and Heritage Canada. This includes technical expertise to prepare for the transition to terrestrial digital television transmission and the implementation of digital radio in Canada. Industry Canada will also provide technical expertise to NSERC in the establishment of research priorities related to ICT, and will help in the development of highly qualified personnel by continuing to host graduate students from Canadian universities to work on projects of mutual interest.

A key priority for Industry Canada is the Vancouver 2010 Olympic and Paralympic Winter Games. The department will be providing five sets of spectrum monitoring and direction finding equipment to the Pacific Region in support of security infrastructure for the Olympics. This equipment is based on enhancements to the CRC-developed Spectrum-Explorer software already in use by Industry Canada.

ICT has been identified in the Government’s S&T strategy as one of four technology priority areas for Canada. Industry Canada is part of a consortium to create a sustainable platform for development of shared ICT-based health services: a focused collection of network-based services supporting patient treatment planning and preparedness in hospital operating and emergency rooms, general practice clinics, and at patients’ bedsides.

* Minor differences are due to rounding.

| Expected Result | Indicators | Targets |

|---|---|---|

| Strong engagement, knowledge sharing and program delivery to enhance capacity for research and development (R&D), technology adaptation, commercialization and innovation in targeted industries | Percentage of completed initiatives*, designed to increase knowledge and innovation in targeted Canadian industries, as a proportion of initiatives identified in the sector’s business plan | 80% † |

* Initiatives include items such as joint policy initiatives, frameworks, strategies, consultations, trade shows, knowledge products, publications and websites

† New indicator. Preliminary target to be revised, if necessary, to reflect collected baseline data.

Planning Highlights and Benefits for Canadians:

Through strong engagement, knowledge sharing and program delivery, Industry Canada enhances the innovation capacity in targeted industries.

The department engages with industry, academia and other governments by facilitating networks and industry-specific fora, and consults with stakeholders on key issues and policies affecting the innovation capacity of targeted industries such as biopharmaceuticals and aerospace.

Industry Canada has internationally-recognized expertise in the creation of Technology Roadmaps (TRM), the strategic tools that help firms identify the technologies needed to capture future market opportunities. Industry Canada will work with the private sector to develop a number of TRMs in 2009–2010. Examples include Electrical Mobility, Sustainable Housing, and Soldier of the Future.

Industry Canada also uses its expertise to help identify commercialization and industrial development opportunities for emerging technologies. Industry Canada will work closely with renewable and alternative energy stakeholders to examine these issues and to explore domestic and international partnerships for business development.

Through a variety of instruments, such as programs and funds, Industry Canada aims to foster the competitiveness of the Canadian economy. The Automotive Innovation Fund (AIF), for example, provides $250 million over five years to support strategic, large-scale R&D projects in the automotive sector to develop innovative, greener and more fuel-efficient vehicles.

With its dedicated support of innovation and knowledge sharing in several targeted industries, Industry Canada will work to ensure that the Canadian economy remains strong.

* Minor differences are due to rounding.

† The reduction in financial resources is due to sunsetting programs, initiatives and conditional grants.

| Expected Result | Indicators | Targets |

|---|---|---|

| ITO will leverage leading-edge research and development in targeted Canadian industries | Dollar of private sector investment leveraged per dollar of agency investment in ITO projects | 2 † |

† New indicator. Preliminary target to be revised, if necessary, to reflect collected baseline data.

Planning Highlights and Benefits for Canadians:

In the 2007 Speech from the Throne, the government committed to “support Canadian researchers and innovators in developing new ideas and bringing them to the marketplace through Canada’s Science and Technology Strategy.” In order to benefit all Canadians, the Government of Canada is investing in strategic research and development (R&D) projects through the Industrial Technologies Office (ITO), a special operating agency of Industry Canada.

Industry Canada, through ITO, leverages leading-edge R&D in targeted Canadian industries through the Strategic Aerospace and Defence Initiative (SADI), the Program for Strategic Industrial Projects (PSIP) and its legacy program, Technology Partnerships Canada (TPC). In 2009–2010, SADI will provide repayable contributions to the aerospace and defence (A&D) sector to encourage the development of innovative products and services that enhance the competitiveness of Canadian A&D firms.

SADI will foster innovation in the A&D sector by collaborating with research institutes, universities, colleges and the private sector. Canadian A&D companies invest in universities through partnership R&D projects involving professors as well as students. Encouraging collaborative R&D relationships helps to advance technology transfer, spinoffs and innovation, in addition to contributing to a skilled workforce and opportunities for on-the-job training.

As part of its continuous improvement approach, ITO will optimize SADI’s application and assessment processes to effectively and efficiently address the expected increase in applications in 2009–2010. ITO will also increase its internal audit activity to highlight areas where improvements can be made.

By leveraging leading-edge R&D, Industry Canada will ensure that Canadians and Canadian businesses benefit from the global knowledge-based economy.

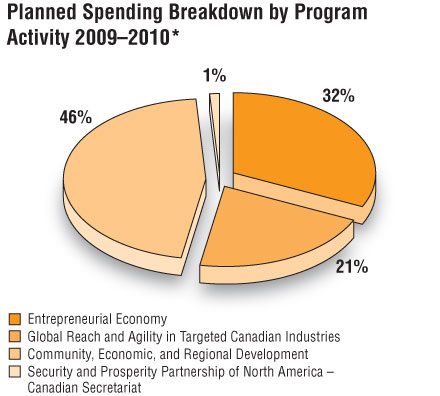

Competitive Businesses are Drivers of Sustainable Wealth Creation

Competitive Businesses are Drivers of Sustainable Wealth Creation

In a strong economy, businesses generate economic wealth by investing in labour and capital to produce new and innovative goods and services. The government's role is to create a supportive business environment by ensuring open, competitive and efficient markets that enable the free flow of labour, capital, goods and services. Canadian competitiveness and productivity are ultimately dependent on the success or failure of Canadian firms, as they are the generators of wealth and employment in the economy.

Industry Canada's mandate is to help make Canadian industry more productive and competitive in the global economy, thus improving the economic and social well-being of Canadians. Towards this goal, Industry Canada will use its legislative frameworks, policy levers, partnerships with industry, and administration of various programs to act as a catalyst for the private sector in driving the economy's growth. The department acts as a champion for business, and its programs and policies serve to support and bolster business competitiveness and productivity.

| Year | Financial Resources($ millions)* | Human Resources (FTEs) |

|---|---|---|

| 2009–2010 | 297.8 | 678 |

| 2010–2011 | 244.7 | 668 |

| 2011–2012 | 218.1 | 654 |

* Minor differences are due to rounding.

Domestically, Canadian firms face significant capacity and competition issues, and the department and its partners provide a wide range of programs and services to support Canadian industry. More broadly, the department acts to ensure that business views are taken into account in the development of broader economic and social policies. Industry Canada is committed to supporting Canadian companies in a variety of ways, including support for manufacturing industries, such as automotive and aerospace.

In support of Industry Canada’s strategic outcome Competitive Businesses are Drivers of Sustainable Wealth Creation, the department’s objectives include:

- sustaining responsive and innovative departmental programs and services;

- achieving economic and social policies that rely on market forces to the greatest extent possible, while recognizing in rare circumstances that markets may not be complete, and that the international playing field may not be level; and

- using the least-intrusive measures when government intervention is required.

* Minor differences are due to rounding.

| Expected Result | Indicators | Targets |

|---|---|---|

| Small and medium-sized enterprise (SME) use of government business-related information, programs and services, and facilitated compliance for business | Increase in number of clients using the Canada Business Network website over the previous year | 10% |

| Integrated business permit and licence information from all levels of government provides value to clients across Canada | Percentage of clients that indicate satisfaction with the services provided | 80% |

| Departmental and other government department (OGD) clients and external stakeholders are aware of small business perspectives and advice | Number of references of small business issues in research, policy and program documents (e.g., Memoranda to Cabinet (MCs), Treasury Board (TB) subs, research conference reports, consultation reports) | 30 |

Planning Highlights and Benefits for Canadians:

To create sustainable wealth in Canada, Industry Canada offers a wide range of support for entrepreneurs and small businesses, to ensure that they can remain competitive in a global economy.

As well, Industry Canada will collaborate with all interested provincial and territorial governments, and local governments within those provinces and territories, to accelerate the expansion of the BizPaL service to Canadians. Accelerated expansion will ensure that the BizPaL service is available to an increasing number of Canadians.

Industry Canada will also work with participating governments to introduce new business sectors, as well as new content beyond permits and licences, in order to increase the value and completeness of the service to Canadians.

The Canadian Youth Business Foundation (CYBF) helps young people to become entrepreneurs by providing access to financing and mentoring. It is a non-profit private sector organization funded jointly by Industry Canada and the private sector. Its program is delivered in partnership with other entrepreneurship organizations across communities in Canada. CYBF, as part of its business plan for 2009, has made a commitment to increase the number of start-ups it supports to 480. CYBF will also need to increase its mentor pool to meet the projected 480 start-ups, since working with a mentor is a mandatory requirement of any loan CYBF provides.

Through these and other programs, Industry Canada supports the government’s desire for strong economic growth in Canada. By fostering the development of small businesses and encouraging Canadian entrepreneurs, our economy will remain strong, even in a period of global uncertainty.

* Minor differences are due to rounding

| Expected Result | Indicators | Targets |

|---|---|---|

| Strong engagement, knowledge sharing and program delivery to enhance the capacity of targeted Canadian industries to prepare for and respond to risks and opportunities in globalized markets | Percentage of completed initiatives,* designed to increase the competitiveness of Canadian industries in globalized markets, as a proportion of initiatives identified in the sector’s business plan | 80% † |

* Initiatives include items such as joint policy initiatives, frameworks, strategies, consultations, tradeshows, knowledge products, publications and websites

† New indicator. Preliminary target to be revised, if necessary, to reflect collected baseline data.

Planning Highlights and Benefits for Canadians:

Industry Canada helps targeted industries prepare for and respond to risks and opportunities in a highly integrated global market through engagement, knowledge sharing and program delivery.

To encourage partnerships with firms operating globally, Industry Canada will engage both domestic and international stakeholders. Departmental officials interact with associations, governments and leading firms to improve conditions for market access, to identify strategic risks and opportunities to improve sectors’ value propositions, and to reinforce Canadian expertise.

Generating and disseminating knowledge is fundamental to the delivery of Industry Canada’s mandate. To better inform policy development within Industry Canada and other government departments, Industry Canada will conduct research and consultations with industry, other departments, the provinces, other countries and international organizations. The department works with stakeholders to identify, analyze and provide policy options and measures to strengthen the ability of Canadian industry to operate in global value chains.

Industry Canada is also working with the Department of National Defence and Public Works and Government Services Canada to ensure that Canadian companies participate in, or move up, the global value chains associated with large, foreign multinationals that receive procurement contracts from the Government of Canada. In 2009–2010, $500 million in business activity is expected to be generated within the Canadian economy as a result of the Industrial and Regional Benefits (IRB) Policy.

By helping Canadian industries mitigate risks and take advantage of opportunities in globalized markets, Industry Canada is committed to creating competitive businesses and sustainable wealth-creation capability for Canadians.

* Minor differences are due to rounding.

| Expected Result | Indicators | Targets |

|---|---|---|

| A significant increase in the capacity of selected Ontario communities and businesses, helping them to thrive in the 21st-century economy | Average leverage ratio of program funds | 1:2 |

| Average number of contribution agreements and grants approved | 35 |

Planning Highlights and Benefits for Canadians:

The department will effectively administer specific infrastructure projects in Ontario to enhance economic development in small and rural communities. Economic development in small and rural communities will be supported through the granting of funds, and through programs such as FedNor, to ensure that communities and their businesses are competitive in the Canadian and global marketplace.

The administration of infrastructure funding in Ontario, and economic development investments in community projects, will enhance growth, profitability and competitiveness by establishing reliable water, transportation and waste management infrastructure, and by building community capacity in sport, tourism, housing and other sectors.

Through the delivery of programs and services that support SME growth and competitive and self-sufficient communities, Industry Canada helps build economically healthier regions across Ontario that contribute to economic growth.

* Minor differences are due to rounding.

| Expected Result | Indicators | Targets |

|---|---|---|

| Canada is successful in advancing its strategic interests and priorities within the North American context | Degree of progress in advancing Canada's strategic interests in the context of North America priorities | Medium* |

* Degree of progress defined by:

High: All of Canada's major strategic interests are reflected in North American priorities

Medium: Most of Canada's major strategic interests are reflected in North American priorities

Low: A few of Canada's major strategic interests are reflected in North American priorities

Planning Highlights and Benefits for Canadians:

Industry Canada, through the Security and Prosperity Partnership (SPP) Secretariat, supports the Minister of Industry in his role as lead minister for Canada on the SPP, and as Canadian lead on the Prosperity Agenda. Industry Canada will provide advice and contribute to preparations for the 2009 North American Leaders’ Summit, to be hosted by Mexico.

Industry Canada will also work closely with other government departments, and officials from the United States and Mexico, to ensure that initiatives building on Leaders’ priorities, as outlined at the 2008 North American Leaders’ Summit in New Orleans (enhancing the global competitiveness of North America, smart and secure borders, sustainable energy and the environment, safe food and products, emergency management) are implemented.

The Secretariat will continue to provide a leadership role in managing the Research Fund on North American Borders, Security and Prosperity. This interdepartmental research initiative will improve the understanding of the impact of border measures on Canadian competitiveness.

Through these actions, aimed at promoting strategic Canadian interests with respect to prosperity and security within North America, Industry Canada contributes to greater competitiveness for Canadian business and an enhanced quality of life for Canadian citizens.

* Minor differences are due to rounding.

Internal Services are groups of related activities and resources that are administered to support the needs of programs and other corporate obligations of an organization.

These groups are: Management and Oversight Services, Public Policy Services, Communications Services, Legal Services, Human Resources Management Services, Financial Management Services, Information Management Services, Information Technology Services, Real Property Services, Materiel Services, Acquisition Services, and Travel and Other Administrative Services.

Internal Services include only those activities and resources that apply across an organization and not to those provided specifically to a program.