Common menu bar links

Breadcrumb Trail

ARCHIVED - Industry Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Minister’s Message

As Minister of Industry, I am committed to the long-term competitiveness and prosperity of our country. Canada has many economic advantages upon which we must continue to build if we are to set the right conditions for our long-term success. With this in mind, Industry Canada and its Portfolio partners are striving toward the development of an innovative economy with robust sectors and an efficient and competitive marketplace.

Our priorities remain aligned with Advantage Canada, the government’s long-term economic plan. Here, we set out clear objectives, including the reduction of taxes, the encouragement of entrepreneurship, and the development of a knowledge-based economy.

In the 2009–2010 Report on Plans and Priorities, we recognize that as we look to the year ahead we are entering a period of continued global economic uncertainty, one that demands clear and strategic action on the part of the government to ensure we accomplish the long-term goals we have set for ourselves. Our departmental priorities and initiatives will be guided by a balanced consideration of the demands of the global economic situation and our long-term vision for Canada’s growth and prosperity.

In Budget 2009 — Canada’s Economic Action Plan, the government has developed a clear and comprehensive response to the slowdown in the global economy, which is in keeping with the continuing objectives of Advantage Canada. The economic action plan addresses short-term realities, while setting in place the conditions to strengthen Canada’s economy for generations to come.

Industry Canada and its Portfolio partners are at the heart of the government’s strategy to stimulate the Canadian economy. We are taking steps to improve the competitiveness of Canada’s traditional economy by providing short-term support for key sectors such as the auto industry. We are ensuring that all regions of Canada prosper by supporting economic diversification. We are fostering small businesses by improving access to credit and encouraging growth through tax reductions and incentives. We are supporting measures to develop a highly skilled workforce through such means as expanding the Canada Graduate Scholarships program. At this time of intense international competition for the world’s best and brightest, government support is helping to attract and retain these individuals in Canada. We are positioning Canada as a leader in the global knowledge economy.

In the ongoing pursuit of our mandate, we will continue to focus on innovation as a means to develop a globally competitive economy. Our ultimate goal is to help Canadians continue to enjoy a quality of life that is envied throughout the world.

It is my pleasure to present this year’s Report on Plans and Priorities for Industry Canada and its Portfolio partners, which will outline in greater detail the priorities and pursuits in which we will be engaged in the year to come.Section 1: Departmental Overview

1.1 Raison d’être

Mission

Industry Canada’s mission is to foster a growing, competitive, knowledge-based Canadian economy. The department works with Canadians throughout the economy, and in all parts of the country, to improve conditions for investment, improve Canada's innovation performance, increase Canada's share of global trade and build an efficient and competitive marketplace.

Mandate

Industry Canada's mandate is to help make Canadian industry more productive and competitive in the global economy, thus improving the economic and social well-being of Canadians.

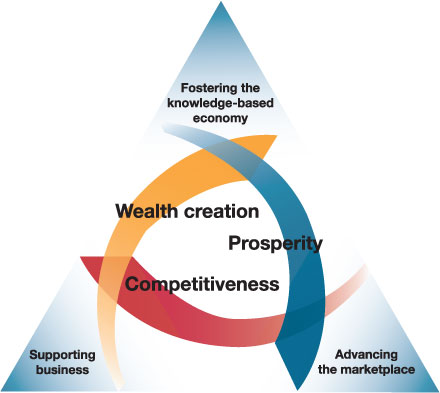

The many and varied activities Industry Canada carries out to deliver on its mandate are organized around three interdependent and mutually reinforcing strategic outcomes, each linked to a separate key strategy. The key strategies are shown in the adjacent illustration.

-

The Canadian Marketplace is Efficient and Competitive

The Canadian Marketplace is Efficient and CompetitiveAdvancing the marketplace

Industry Canada fosters competitiveness by developing and administering economic framework policies that promote competition and innovation, support investment and entrepreneurial activity, and instill consumer, investor and business confidence.

-

Science and Technology, Knowledge, and Innovation are Effective Drivers of a Strong Canadian Economy

Science and Technology, Knowledge, and Innovation are Effective Drivers of a Strong Canadian EconomyFostering the knowledge-based economy

Industry Canada invests in science and technology to generate knowledge and equip Canadians with the skills and training they need to compete in the global, knowledge-based economy. These investments help ensure that discoveries and breakthroughs happen here in Canada, and that Canadians can realize the social and economic benefits.

-

Competitive Businesses are Drivers of Sustainable Wealth Creation

Competitive Businesses are Drivers of Sustainable Wealth CreationSupporting business

Industry Canada encourages business innovation and productivity because businesses are the organizations that generate jobs and wealth. Promoting economic development in communities encourages the development of skills, ideas and opportunities across the country.

1.2 Responsibilities

Industry Canada is the Government of Canada’s centre of microeconomic policy expertise. The department’s founding legislation, the Department of Industry Act, established the ministry to foster a growing, competitive and knowledge-based Canadian economy.

Industry Canada is a department with many entities that have distinct mandates, with program activities that are widely diverse and highly dependent on partnerships. Industry Canada works on a broad range of matters related to industry and technology, trade and commerce, science, consumer affairs, corporations and corporate securities, competition and restraint of trade, weights and measures, bankruptcy and insolvency, patents and copyright, investment, small business, and tourism.

1.3 Program Activity Architecture (PAA)

This Report on Plans and Priorities (RPP) is aligned with Industry Canada’s Management, Resources and Results Structure (MRRS). The MRRS provides a standard basis for reporting to parliamentarians and Canadians on the alignment of resources, program activities and results.

Industry Canada’s strategic outcomes are long-term and enduring benefits to the lives of Canadians that reflect our mandate and vision, and are linked to Government of Canada priorities and intended results.

The department’s Program Activity Architecture (PAA) is an inventory of all programs and activities undertaken. The programs and activities are depicted in a logical and hierarchical relationship to each other and to the strategic outcome to which they contribute. They also clearly link financial and non-financial resources.

2009–2010 PAA Crosswalk

Over the past year, Industry Canada has made significant changes to its PAA to more accurately reflect the structure of the department. These changes are to ensure improved reporting and to reflect internal realignments that have taken place.

-

Updating Strategic Outcomes

Updating Strategic OutcomesModifications to the department’s strategic outcomes now allow a more results-based representation of how Industry Canada manages and delivers its programs and services.

-

Moving Policy Functions to Internal Services

Moving Policy Functions to Internal ServicesThe Strategic Policy Sector (SPS) of Industry Canada provides advice and services horizontally across the Program Activity Architecture (PAA). This advice and these services did not meet the definition of a program and their cost could not be directly attributed across specific programs.

-

Creation/Transfer of New Program Activities

Creation/Transfer of New Program ActivitiesFour new program activities have been created: Entrepreneurial Economy; Community, Economic, and Regional Development; the Security and Prosperity Partnership of North America – Canadian Secretariat; and the Mackenzie Gas Project. The Mackenzie Gas Project along with its funding, was subsequently transferred from Industry Canada to Environment Canada in November 2008. Please refer to Environment Canada’s RPP for information on the Mackenzie Gas Project.

-

Renaming or Moving Program Activities

Renaming or Moving Program ActivitiesThese changes allow Industry Canada to report its performance more clearly. Changes included renaming and/or moving/removing program sub-activities and program sub-sub-activities so as to better reflect how they contribute to the strategic outcomes to which they are linked.

Additional Items of Interest

The Automotive Innovation Fund, CSeries Program, Ontario Potable Water Program and Brantford Greenwich–Mohawk Remediation Project are new program sub-activities that were unable to be included in the 2009–2010 PAA review exercise.

The Automotive Innovation Fund and CSeries Program were approved by Treasury Board of Canada Secretariat (TBS) subsequent to the approval of the 2009–2010 PAA. The Automotive Innovation Fund, originally under Global Reach and Agility in Targeted Canadian Industries, has been moved, along with its planned spending, under Knowledge Advantage in Targeted Canadian Industries to join the CSeries Program.

The funding for the Ontario Potable Water Program and the Brantford Greenwich–Mohawk Remediation Project was reprofiled, increasing their funding threshold for 2009–2010. They are located under Community, Economic, and Regional Development.

Industry Canada is also reviewing and updating its Performance Measurement Framework (PMF). Expected results, indicators and targets for each level of the PAA are being reviewed to ensure that the department’s performance story is of the highest possible quality.

The structure of this RPP reflects the department’s 2009–2010 strategic outcomes and PAA. In this way, it articulates how Industry Canada’s sectors, branches and programs plan to contribute to the department’s three updated strategic outcomes. The updated PAA is the basis for Section 2 of this document. It illustrates 13 program activities and their associated program sub-activities as well as program sub-sub-activities.

Budget 2009 — Canada's Economic Action Plan

Budget 2009 — Canada’s Economic Action Plan, tabled in Parliament on January 27, 2009, detailed a variety of timely, targeted and temporary measures that will have an impact on Industry Canada. These include improving access to financing, supporting small businesses, helping municipalities build stronger communities through investments in infrastructure, and providing short-term support for key industrial and commercial sectors.

The timing of this report prevents a detailed description of specific impacts of the budget on Industry Canada's plans and priorities for 2009–2010. A detailed discussion and further information will be provided in Industry Canada's 2009–2010 Departmental Performance Report (DPR).

Industry Canada’s 2008–2009 PAA

|

Strategic Outcomes |

||

| A Fair, Efficient and Competitive Marketplace | An Innovative Economy |

Competitive Industry and Sustainable Communities |

|

Program Activities |

||

| Strategic Policy Sector — Marketplace | Science and Innovation Sector — Science & Technology (S&T) and Innovation | Strategic Policy Sector — Economic Development |

|

Sub-Activities

|

Sub-Activities

|

Sub-Activities

|

| Small Business and Marketplace Services and Regional Operations Sector — Marketplace | ||

|

Sub-Activities

|

||

|

Spectrum, Information Technologies and Telecommunications Sector — Marketplace |

Industry Sector — S&T and Innovation |

Small Business and Marketplace Services and Regional Operations Sector — Economic Development |

|

Sub-Activities

|

Sub-Activities

|

Sub-Activities

|

| Office of Consumer Affairs (OCA) | ||

|

Sub-Activities

|

||

|

Competition Bureau — Marketplace |

Spectrum, Information Technologies and Telecommunications Sector — S&T and Innovation |

Industry Sector — Economic Development |

|

Sub-Activities

|

Sub-Activities

|

Sub-Activities

|

|

Canadian Intellectual Property Office — Revolving Fund

|

Communications Research Centre Canada (CRC) | |

|

Sub-Activities

|

||

|

Industrial Technologies Office — Special Operating Agency |

Spectrum, Information Technologies and Telecommunications Sector — Economic Development |

|

|

Sub-Activities

|

Sub-Activities

|

|

| Internal Services | ||

Industry Canada's 2009–2010 PAA

|

Strategic Outcomes |

||

| The Canadian Marketplace is Efficient and Competitive | Science and Technology, Knowledge, and Innovation are Effective Drivers of a Strong Canadian Economy | Competitive Businesses are Drivers of Sustainable Wealth Creation |

|

Program Activities |

||

| Marketplace Frameworks and Regulations |

Canada’s Research and Innovation Capacity | Entrepreneurial Economy |

|

Sub-Activities

|

Sub-Activities

|

Sub-Activities

|

|

Marketplace Frameworks |

Communications Research Centre Canada |

Global Reach and Agility in Targeted Canadian Industries |

|

Sub-Activities

|

Sub-Activities

|

Sub-Activities

|

| Consumer Affairs Program | ||

|

Sub-Activities

|

||

| Competition Law Enforcement and Advocacy |

Knowledge Advantage in Targeted Canadian Industries | |

|

Sub-Activities

|

Sub-Activities

|

|

|

Community, Economic, and Regional Development |

||

|

Sub-Activities

|

||

|

Industrial Technologies Office — Special Operating Agency |

Security and Prosperity Partnership of North America — Canadian Secretariat |

|

|

Sub-Activities

|

Mackenzie Gas Project | |

| Internal Services | ||

1.4 Planning Summary

Industry Canada's Financial and Human Resources

These two tables present Industry Canada’s financial and human resources over the next three fiscal years.

| Financial Resources ($ millions)* | Human Resources (Full-Time Equivalent) | |||||

|---|---|---|---|---|---|---|

| 2009–2010 | 2010–2011 | 2011–2012 | 2009–2010 | 2010–2011 | 2011–2012 | |

| 1,214.1 | 1,060.9 | 964.9 | 5,273 | 5,272 | 5,272 | |

* Minor differences are due to rounding.

Summary Table by Strategic Outcome

|

Performance Indicator(s)

|

Target(s)

|

||||

| Program Activity | Forecast Spending 2008–2009 | Planned Spending ($ millions)* | Alignment to Government of Canada Outcomes | ||

|---|---|---|---|---|---|

| 2009–2010 | 2010–2011 | 2011–2012 | |||

| Marketplace Frameworks and Regulations | 59.4 | 46.9 | 47.7 | 51.2 | Economic Affairs: A Fair and Secure Marketplace |

| Marketplace Frameworks and Regulations for Spectrum, Telecommunications and the Online Economy | 92.4 | 87.2 | 82.7 | 82.5 | Economic Affairs: A Fair and Secure Marketplace |

| Consumer Affairs Program | 52.3 | 4.5 | 4.5 | 4.5 | Economic Affairs: A Fair and Secure Marketplace |

| Competition Law Enforcement and Advocacy | 49.6 | 42.6 | 42.6 | 42.6 | Economic Affairs: A Fair and Secure Marketplace |

| Total | 206.7 | 181.3 | 177.5 | 180.8 | |

* Minor differences are due to rounding.

Performance Indicator(s)

|

Target(s)

|

||||

| Program Activity | Forecast Spending 2008–2009 | Planned Spending ($ millions)* | Alignment to Government of Canada Outcomes | ||

|---|---|---|---|---|---|

| 2009–2010 | 2010–2011 | 2011–2012 | |||

| Canada’s Research and Innovation Capacity | 113.5 | 264.3 | 244.9 | 172.9 | Economic Affairs: An Innovative and Knowledge-based Economy |

| Communications Research Centre Canada | 36.7 | 35.4 | 35.3 | 35.3 | Economic Affairs: An Innovative and Knowledge-based Economy |

| Knowledge Advantage in Targeted Canadian Industries | 8.7 | 131.0 | 145.0 | 148.4 | Economic Affairs: An Innovative and Knowledge-based Economy |

| Industrial Technologies Office – Special Operating Agency | 385.0 | 221.1 | 130.9 | 127.2 | Economic Affairs: An Innovative and Knowledge-based Economy |

| Total | 543.9 | 652.1 | 556.1 | 483.8 | |

* Minor differences are due to rounding.

† New indicator. Preliminary target to be revised, if necessary, to reflect collected baseline data.

Performance Indicator(s)

|

Target(s)

|

||||

| Program Activity | Forecast Spending 2008–2009 | Planned Spending ($ millions)* | Alignment to Government of Canada Outcomes | ||

|---|---|---|---|---|---|

| 2009–2010 | 2010–2011 | 2011–2012 | |||

| Entrepreneurial Economy | 128.3 | 95.7 | 93.0 | 90.2 | Economic Affairs: Strong Economic Growth |

| Global Reach and Agility in Targeted Canadian Industries | 80.2 | 61.4 | 56.4 | 37.0 | Economic Affairs: Strong Economic Growth |

| Community, Economic, and Regional Development | 192.6 | 138.5 | 93.1 | 90.9 | Economic Affairs: Strong Economic Growth |

| Security and Prosperity Partnership of North America – Canadian Secretariat | 2.2 | 2.2 | 2.2 | - | International Affairs: A Strong and Mutually Beneficial North American Partnership |

| Mackenzie Gas Project | 7.1 | - | - | - | Economic Affairs: Strong Economic Growth |

| Total | 410.4 | 297.8 | 244.7 | 218.1 | |

* Minor differences are due to rounding.

† New indicator. Preliminary target to be revised, if necessary, to reflect collected baseline data.

| Program Activity | Forecast Spending 2008–2009 | Planned Spending ($ millions)* | Alignment to Government of Canada Outcomes | ||

|---|---|---|---|---|---|

| 2009–2010 | 2010–2011 | 2011–2012 | |||

| Internal Services | 116.3 | 82.9 | 82.6 | 82.2 | Not applicable |

| Total | 116.3 | 82.9 | 82.6 | 82.2 | |

* Minor differences are due to rounding.

Contribution of Priorities to Strategic Outcomes

Operational Priorities

| Operational Priority: Ensure marketplace policies help promote competitive markets and instill consumer confidence |

Type: Previously committed to |

Strategic Outcome(s): The Canadian Marketplace is Efficient and Competitive |

Why is this a priority?

|

||

| Operational Priority: Foster business innovation |

Type: Previously committed to |

Strategic Outcome(s): Science and Technology, Knowledge, and Innovation are Effective Drivers of a Strong Canadian Economy |

Why is this a priority?

|

||

| Operational Priority: Invest in S&T to enhance the generation and commercialization of knowledge. |

Type: Previously committed to |

Science and Technology, Knowledge, and Innovation are Effective Drivers of a Strong Canadian Economy |

Why is this a priority?

|

||

| Operational Priority: Foster internationally competitive businesses and industries |

Type: Ongoing |

Strategic Outcome(s): Competitive Businesses are Drivers of Sustainable Wealth Creation |

Why is this a priority?

|

||

| Operational Priority: Promote entrepreneurship, community development and sustainable development |

Type: Ongoing |

Strategic Outcome(s): Competitive Businesses are Drivers of Sustainable Wealth Creation |

Why is this a priority?

|

||

Management Priorities

| Management Priority: Corporate Performance Framework |

Type: Previously committed to |

Strategic Outcome(s): All strategic outcomes |

Why is this a priority?

|

||

| Management Priority: Integrated Risk Management (IRM) |

Type: Previously committed to |

Strategic Outcome(s): All strategic outcomes |

Why is this a priority?

|

||

| Management Priority: Human Resources Modernization Initiatives |

Type: Previously committed to |

Strategic Outcome(s): All strategic outcomes |

Why is this a priority?

|

||

| Management Priority: Information Management (IM) |

Type: New |

Strategic Outcome(s): All strategic outcomes |

Why is this a priority?

|

||

| Management Priority: Real Property Management |

Type: New |

Strategic Outcome(s): All strategic outcomes |

Why is this a priority?

|

||

Operating Environment and Risk Analysis

In a constantly changing, fast-paced global marketplace, Canada’s economy and businesses face a number of risks, both internally and externally. The uncertainty of the current economic climate only multiplies the potential impact of these risks. Industry Canada is working to identify these threats and develop an effective risk management strategy in order to reduce their potential impact.

Industry Canada is a department with many entities that have distinct mandates, with program activities that are diverse and highly dependent on partnerships. Internal audits and reviews are conducted on a continuing basis to ensure their efficiency and effectiveness.

As a part of the planning process, Industry Canada’s program sectors are conducting risk assessments in the context of achieving the department’s strategic outcomes and expected results.

Industry Canada has identified the following key program challenges and opportunities:

Science and Technology (S&T)

Global advancements in science and technology are happening at a rapid pace. Driven by knowledge and innovation, the strength of Canada’s economy depends on the ability to leverage existing, and generate new, scientific and technological advancements. Business expenditures in research and development (BERD) continue to be low in Canada compared to other developed countries. Industry Canada will continue to play a key role in advancing the government’s S&T agenda and stimulating investments in research and development (R&D).

Information and Communications Technology (ICT)

ICT is a dynamic and important sector of the economy, and it is being fuelled by consumers' embrace of the Internet and their demand for voice, video and data over a multitude of platforms and devices. Delivery of feature-rich services, any time and anywhere, is putting unprecedented demands on bandwidth of core and access networks. In addition to bandwidth, other connectivity challenges include the security of ICT networks and the development of next-generation applications and technologies. Industry Canada is well positioned to address these challenges, with the appropriate expertise and test-bed facilities to study solutions and applications. However, resource availability and information technology management are areas of concern.

Consumer Interests

There is constant change in where Canadian consumers shop, what they buy, and how they pay for it. This change arises from globalizing supply chains and the emergence of new technologies, new products, and new marketing techniques.

Understanding how all of these shifts affect consumers’ interest is a major challenge for Industry Canada and other policy-makers seeking to meet the protection and information needs of consumers. Industry Canada has a unique role to play in helping consumers meet these challenges by capitalizing on its recognized ability to maintain a wide reach and influence within domestic and international communities that specialize in consumer policy development and research, consumer-related standards development, and consumer advocacy.

International Competitiveness

In a world economy dependent on global value chains, global reach and agility are essential components for Canadian industry to compete in a new world with emerging economic powerhouses such as Brazil, Russia, India and China.

Several risks can impact the performance of Canadian industries in global markets, including the fluctuation of the Canadian dollar, a weakened American economy, access barriers in important international markets, interest rates and key input costs (e.g., oil prices), and the global financial and credit crisis.

Industry Canada works to mitigate these risks by analyzing the specific issues that industries face and by using its knowledge to contribute to the development of related sectoral policies, marketplace frameworks and programs (even though they may go beyond the department’s control and direct sphere of influence). Industry Canada builds strategic partnerships within its extensive industry and government network that increase the global reach and agility of targeted Canadian industries.

Expenditure Profile

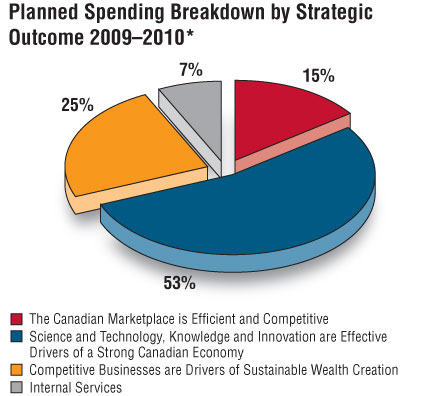

Industry Canada’s total planned spending for 2009–2010 is $1.2 billion. The majority of planned spending is directed at Industry Canada’s three strategic outcomes, with a cost-effective 7% being allocated to Internal Services.

Industry Canada will continue to implement strategies to ensure efficient use of its operating budget to better deliver benefits to Canadians.

A focus on efficient, high-performing programs will allow Industry Canada to continue to effectively deliver its mandate with a reduced operating budget in coming years and with evolving government priorities. More than ever, the results of audits, evaluations and strategic reviews will be critical in planning, priority setting and resource allocation.

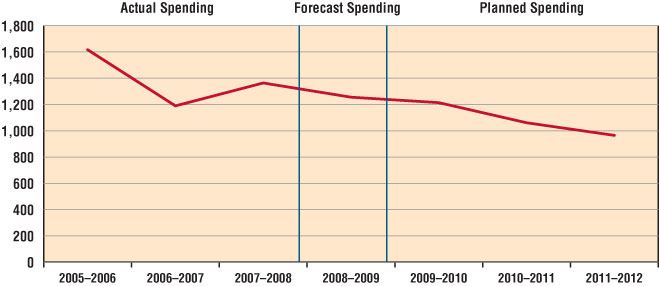

Spending Trend ($ millions)

The figure below illustrates Industry Canada’s spending trend from 2005–2006 to 2011–2012

Voted and Statutory Items

This table illustrates the way in which Parliament approved Industry Canada resources, and shows the changes in resources derived from Supplementary Estimates and other authorities, as well as how funds were spent.

| Vote No. or Statutory Item (S) | Truncated Vote or Statutory Wording | Main Estimates ($ millions) * |

|

|---|---|---|---|

| 2008–2009 | 2009–2010 | ||

| 1 | Operating expenditures | 332.9 | 320.1 |

| 5 | Capital expenditures | 12.6 | 9.4 |

| 10 | Grants and contributions | 464.3 | 597.0 |

| (S) | Minister of Industry – salary and auto allowance | 0.1 | 0.1 |

| (S) | Canadian Intellectual Property Office revolving fund | 4.9 | (1.2) |

| (S) | Liabilities under the Small Business Loans Act | 2.1 | 1.7 |

| (S) | Liabilities under the Canada Small Business Financing Act | 81.7 | 83.9 |

| (S) | Grant to CANARIE Inc. to operate and develop the next generation of Canada’s Advanced Research Network (CAnet5) | 24.0 | 29.0 |

| (S) | Grant to Genome Canada | - | 88.8 |

| (S) | Grant to Perimeter Institute for Theoritcal Physics | - | 10.0 |

| (S) | Contributions to employee benefit plans | 50.1 | 49.4 |

| Total Budgetary | 972.5 | 1,188.0 | |

| L15 | Payments pursuant to subsection 14(2) of the Department of Industry Act | 0.3 | 0.3 |

| L20 | Loans pursuant to paragraph 14(1) (a) of the Department of Industry Act | 0.5 | 0.5 |

| Total Non-Budgetary | 0.8 | 0.8 | |

| Total Department | 973.3 | 1,188.8 | |

* Minor differences are due to rounding.