Common menu bar links

Breadcrumb Trail

ARCHIVED - Courts Administration Service - Report

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Section III – Supplementary Information

Financial Highlights

| Condensed Statement of Financial Position As at March 31, 2011 |

% Change | 2010–11 | 2009–10 |

|---|---|---|---|

| Total assets | (18%) | 13,753 | 6,369 |

| Total liabilities | (10%) | 19,697 | 21,932 |

| Equity of Canada | (17%) | (5,944) | (5,060) |

| (18%) | 13,753 | 16,872 |

| Condensed Statement of Operations For the year ended March 31, 2011 |

% Change | 2010–11 | 2009–10 |

|---|---|---|---|

| Total expenses | 1% | 92,927 | 91,723 |

| Total revenues | (42%) | 7,977 | 13,753 |

| Net cost of operations | 9% | 84,950 | 77,970 |

Statement of Financial Position

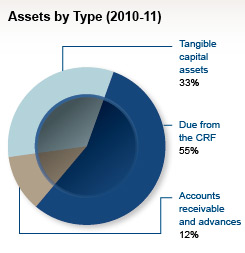

Assets: CAS' total assets as at March 31, 2011 reached $13,753 thousand, down from $16,872 thousand the year before. The largest component is the amount Due from the Consolidated Revenue Fund, which represents 56% of the total ($7,640 thousand). This decrease is primarily due to a reduction in accounts payable and accrued liabilities as at March 31, 2011 relative to March 31, 2010, as well as a decrease in the amounts held on deposit, in CAS’ Specified Purpose Accounts as at March 31, 2011 compared with the same time period in 2010. Tangible Capital Assets, the second largest category, represents 33% of the total ($4,519 thousand) and remained almost unchanged in 2011 relative to 2010.

Tangible capital assets are largely composed of Leasehold improvements and Computer hardware and software. Combined, they account for 75% of the cost (85% of the net book value) of tangible capital investments. In 2010-11, the amount of annual amortization, transfers, adjustments, disposals, and write-offs was greater than tangible capital asset acquisitions. Consequently there was a decline in the total net book value of tangible capital assets over the past year.

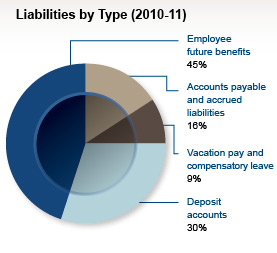

Liabilities: CAS’ total liabilities as at March 31, 2011 were $19,697 thousand, down from $21,932 thousand the year before. This decreased liability of $2,235 thousand is principally the net result of five factors:

- Decrease of $1,814 thousand in accounts payable, especially to other government departments, notably PWGSC.

- Increase of $220 thousand in CAS accrued liabilities, that is salaries earned but not paid at year-end; this mainly reflected the ending of the fiscal year on March 30.

- Decrease of $63 thousand in vacation pay and compensatory leave liabilities.

- Increase of $856 thousand in the allowance for future severance benefits, resulting in large part from a Treasury Board increase in the departmental contribution rate.

- Decrease of $1,434 thousand in deposit accounts maintained on behalf of litigants. Since members of the courts determine the payments in and out of the courts, depending on the case, these deposits may vary significantly from year to year.

Equity of Canada: CAS’ Equity of Canada is currently negative. As at March 31, 2011 the amount was ($5,944) thousand, compared to ($5,060) thousand as at March 31, 2010. This situation reflects obligations recognized as liabilities, for instance employee future benefits that will be paid out of future appropriations.

Statement of Operations

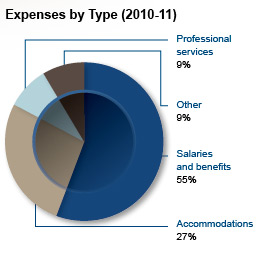

Expenses: CAS incurred total expenses of $92,927 thousand in 2010-11, an increase of 1% from $91,723 thousand in 2009-10, mainly due to a $2,003 thousand increase in 2010-11 collective bargaining agreement costs. This was partly offset by decreases in many other expense items as a result of budget restrictions.

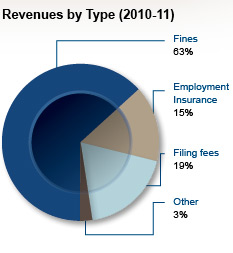

Revenues: CAS’ revenues were $7,977 thousand in 2010-11, a decline of 42% compared to $13,753 thousand in 2009-10. Revenues dropped by $5,776 thousand in 2010-11 mainly due to a reduction of fines. Since such fines are determined by the courts on a case-by-case basis, related revenues vary significantly from year-to-year.

CAS’ revenues consist primarily of fines, filing fees, and sales of copies of filed documentation, including copies of judgments and orders, collected pursuant to the legislation and Rules governing the courts. In addition, at the end of each fiscal year, CAScharges Human Resources and Skills Development Canada (HRSDC) for the costs associated with the administration of Employment Insurance (EI) cases in the courts. Such revenues are non-respendable and are therefore not a source of funds for CASoperations.

Risks and Uncertainties

Close to 80% of CAS’ non-salary operating expenses are contracted costs for primarily non-discretionary services supporting the judicial process and court hearings. They are mostly driven by the number and type of hearings conducted in any given year. A risk management strategy is in place to monitor these costs and manage their fluctuation and related impacts on other key areas.

Like many other federal government organizations, CAS faces serious budget constraints. Several factors have contributed to the current situation. Principal among these is the requirement for CAS to support additional judicial appointments without having a source of permanent funding. This long standing situation resulted in the diversion of resources from other key priorities and areas of risk, and created important program integrity issues.

Federal Budget 2010 announced cost containment measures that froze appropriations at their 2010-11 levels for the years 2011-12 and 2012-13. Consequently, like all departments, has been required to absorb the negotiated salary increases of its employees.

Federal Budget 2011 confirmed ongoing program integrity funding for CAS rising to an amount of $3,000 thousand per year in 2016-17 to address pressures affecting the delivery of the CAS mandate.

Further financial details are provided in the "Financial Statement Discussion and Analysis" available on-line at: http://cas-ncr-nter03.cas-satj.gc.ca/portal/page/portal/CAS/ DPR-RMR_eng/fsda-caef-2010-2011_eng.

Financial Highlights Charts/Graphs

Financial Statements

CAS financial statements can be found at: http://cas-ncr-nter03.cas-satj.gc.ca/portal/page/portal/CAS/DPR-RMR_eng.

List of Supplementary Information Tables

All electronic supplementary information tables found in the 2010–11 Departmental Performance Report can be found on the Treasury Board of Canada Secretariat’s website at: http://www.tbs-sct.gc.ca/dpr-rmr/2010-2011/index-eng.asp.

Tables: Sources of Respendable and Non-Respendable Revenue

Section IV – Other Items of Interest

Organizational Contact Information

Further information on the strategic planning portion of this document can be obtained by contacting:

Robert Monet

Acting Director, Corporate Secretariat

Courts Administration Service

Ottawa, Ontario

K1A 0H9

Robert.Monet@cas-satj.gc.ca

Further information on the financial portion of this document can be obtained by contacting:

Paul Waksberg

Director General, Finance and Contracting Services

Courts Administration Service

Ottawa, Ontario

K1A 0H9

Paul.Waksberg@cas-satj.gc.ca