Common menu bar links

Breadcrumb Trail

ARCHIVED - Courts Administration Service - Report

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Chief Administrator’s Message

The Departmental Performance Report for 2010-11 summarizes the accomplishments of the Courts Administration Service (CAS). It presents our ongoing work to provide responsive and modern administrativeservices to

four separate federal superior courts of law while safeguarding the independence of the judiciary from the government. We ensure that the public has timely and fair access to the litigation processes, and enable the courts to deliver results that matter to Canadians through their decisions in the areas of economic, social, international and government affairs.

The Departmental Performance Report for 2010-11 summarizes the accomplishments of the Courts Administration Service (CAS). It presents our ongoing work to provide responsive and modern administrativeservices to

four separate federal superior courts of law while safeguarding the independence of the judiciary from the government. We ensure that the public has timely and fair access to the litigation processes, and enable the courts to deliver results that matter to Canadians through their decisions in the areas of economic, social, international and government affairs.

Since my arrival in February 2011, I have worked with the CAS senior management team on various strategies and mechanisms to stabilize our financial situation, and improve our ability to deliver on our mandate. Our efforts have focused on security, information technology, resources, governance, and communications, as well as on our ability to meet policy and reporting requirements.

I am pleased with the progress made in 2010-11 and impressed by the dedicated efforts of our employees. CAS has been operating with limited resources and under heavy workload pressures for many years while rigorously pursuing innovation and improvements to meet the needs and expectations of the judiciary, the legal profession, litigants and the public. The challenges ahead of us are clear, and we are determined to continue to address them collaboratively and strategically. In this endeavour, I am working closely with the four Chief Justices, who have indicated their support for the approach we are taking. I will continue to seek their guidance in identifying our priorities and developing our strategies.

Through a multi-year plan to strengthen our information technology and business systems, CAS is working to lay the foundation for a wide range of service improvement initiatives and security enhancements. We can also point pride to the significant progress achieved in our people management strategy, and our ongoing commitment to strengthen planning and enhance accountability for use of public money in support of court administration.

In closing, I wish to commend the professionalism and commitment of our employees for their ongoing contributions. I would also like to express my thanks to the Chief Justices and all members of the judiciary for their support.

Daniel Gosselin, Chief Administrator

Section I – Organizational Overview

Raison d’�tre

The Courts Administration Service (CAS) was established on July 2, 2003 with the coming into force of the Courts Administration Service Act, S.C. 2002, c. 8. The Act Amalgamated the former registries and corporate services of the Federal Court of Canada and the Tax Court of Canada. The courts were created by the Parliament of Canada pursuant to its authority under section 101 of the Constitution Act, 1867 to establish courts “for the better administration of the Laws of Canada.”

Responsibilities

The role of CAS is to provide effective and efficient registry, judicial support and corporate services to four federal superior courts of record – the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada. Judicial independence is enhanced through the Act by placing the judiciary at arm’s length from the federal government while enhancing accountability for the use of public money.

The provision of administrative and registry services by an entity at arm’s length from the executive branch of the government is internationally recognized as a best practice.

CAS recognizes the independence of the courts in the conduct of their own affairs and aims to provide each with high quality administrative and registry services.Functions

- Provide the judiciary, litigants and counsel services relating to court hearings;

- Inform litigants about rules of practice, court directives and procedures;

- Maintain court records;

- Act as liaison between the judiciary, the legal profession and lay litigants;

- Process documents filed by or issued to litigants;

- Record all proceedings;

- Enable individuals seeking enforcement of decisions issued by the courts and federal administrative tribunals, such as the Canada Industrial Relations Board and the Canadian Human Rights Tribunal, to file pertinent documents;

- Provide members of the courts, prothonotaries and employees with library services, information technology services and support, appropriate facilities and security; and

- Provide judicial support to the judiciary.

To facilitate partie's access to the courts, CAS has approximately 610 employees in permanent offices in the following ten cities: Halifax, Fredericton, Qu�bec city, Montr�al, Ottawa, Toronto, Winnipeg, Calgary, Edmonton, and Vancouver. In addition, CAS has a satellite office in London, Ontario. Through agreements with various provincial and territorial partners (Newfoundland and Labrador, Prince Edward Island, New Brunswick, Saskatchewan, Nunavut, the Northwest Territories and Yukon), CAS provides registry services and access to courtrooms.

Judicial independence

Judicial independence is a cornerstone of the Canadian judicial system. The impartiality of the judges and access to justice are fundamental to a free and democratic society. As such, Canada's system of government is centered on three separate, yet interdependent, branches: legislative, executive and judicial. Each branch enjoys a necessary degree of independence and autonomy from the other. The independence of the judiciary ensures that judges are free to make their decisions based solely on the law and facts without interference or improper influence from any source, whether from private interest, political pressure, or otherwise. Judicial independence has three components: security of tenure, financial security, and administrative independence.

While CAS reports to Parliament through the Minister of Justice, the organization plays a critical role by placing the courts at arm's length from the Government of Canada. This model helps CAS enhance the independence of the courts and build public confidence in our institutions.

Strategic Outcome(s) and Program Activity Architecture (PAA)

CAS has one Strategic Outcome, supported by three Program Activities:

|

STRATEGIC OUTCOME |

|

|

The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada. |

|

|

|

|

|

PROGRAM ACTIVITIES |

|

|

Registry Services |

Judicial Services |

|

Provision of Registrar Services – Federal Court of Appeal and Court Martial Appeal Court of Canada, Federal Court and the Tax Court of Canada; Delivery of Registery Services for the four courts |

Judicial Executives Services; |

|

Internal Services |

|

|

Management and Oversight Services |

|

Organizational Priorities

Priority Status Legend

Exceeded: More than 100 per cent of the expected level of performance for the priority identified in the corresponding RPP was achieved during the fiscal year.

Met All: 100 per cent of the expected level of performance for the priority identified in the corresponding RPP was achieved during the fiscal year.

Mostly Met: 80 to 99 per cent of the expected level of performance for the priority identified in the corresponding RPP was achieved during the fiscal year.

Somewhat Met: 60 to 79 per cent of the expected level of performance for the priority identified in the corresponding RPP was achieved during the fiscal year.

Not Met: Less than 60 per cent of the expected level of performance for the priority identified in the corresponding RPP was achieved during the fiscal year.

| Priority: Service Improvement Initiatives |

Type1a : Ongoing |

Strategic Outcome: The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada |

|

Status: Mostly Met Although the quality of registry services across the country is high, employees are continuously looking for areas of improvement to increase client satisfaction. During the review period, particular attention was given to the following four areas: Registry processes and operational training

Responding to client needs

Service standards

Technological Improvements

|

||

| Priority: Investment in our People |

Type1b : New |

Strategic Outcome: The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada |

|

Status: Met all

|

||

| Priority: Strengthened Planning and Accountability |

Type1c : Ongoing |

Strategic Outcome(s) and/or Program Activity(ies): The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada |

|

Status: Mostly met

|

||

Risk Analysis

In the 2010–11 RPP, risk management was identified as a priority for CAS. Accordingly, the organization incorporated risk management into departmental planning and reporting through its integrated business planning approach. As part of this process, CAS conducted environmental scans to identify key potential risks and challenges, and established a set of risk management tools and frameworks. CAS is now able to engage in a continuous and integrated approach to managing its operational and strategic risks.

The organization approved a Corporate Risk Profile (CRP) during the reporting period. The CRP focuses on ten main areas of risk, which it addresses though several mitigation strategies. Highlights of the key critical risks facing CAS are described below.

It is important to note that some of the risks facing CAS could ultimately impact on the organization’s ability to support the courts and the Chief Justices who are responsible for ensuring timely and fair access to the judicial system.

Key Critical Risks

Information Technology Security

Ongoing advances in technology pose challenges to all government departments, and CAS is no exception. IT systems require continual investment in hardware, software and the personnel who manage them. Maintaining the security of these systems requires that particular attention be given to the practices adopted by users of the systems, as well as to the implementation of strategies to prevent harm. As with most government institutions, CAS relies heavily on its IT systems to maintain operations and ensure the security of the information it manages. Preventing disruption of these systems is critical to maintaining the business of the courts and the support CAS provides to them.

Accordingly, CAS updated its threat and risk assessments to identify vulnerabilities, and is taking corrective action where necessary. The organization began to invest in upgrading outdated and vulnerable IT infrastructure. To find the necessary resources, many important technology-enabled service improvement initiatives had to be put on hold, but addressing the urgent need to refurbish critical IT infrastructure could not be delayed. It was essential to ensure the business continuity of the federal courts, maintain secure and efficient operations and meet legislated requirements.

Resource Pressures

The most acute financial pressure during the reporting period resulted from the requirement for CAS to absorb the costs of a number of judicial positions previously funded from the Treasury Board management reserve. This temporary funding was ended in 2009-10. Since then, it has been necessary to reallocate major funding to this core activity from other priority areas.

In addition, increasing expectations of the judiciary and users of the courts, coupled with the need to meet legislative and Treasury Board requirements, challenged the ability of CAS to meet the obligations stemming from its mandate within available resource levels. Ultimately, if this situation is not resolved it could impede the functioning of court operations.

To address the situation, CAS identified key areas in which additional permanent funding was needed to mitigate the risks and to enable it to deliver the core program. It was calculated that some $10 million per year would be needed to ensure full program integrity across a range of activities, including the high priority areas of IT infrastructure, court and registry business systems, court-related security, and departmental accountability requirements. The request was partially met, and incremental annual funding rising from $2.65 million in 2011-12 to an ongoing $3.0 million by 2016-17 was provided for CAS in the 2011 Federal Budget.

During 2010-11, CAS managed the financial pressures on a mission-critical basis, seeking temporary funding where possible and redirecting available resources to the most critical areas, notably IT infrastructure.

A further challenge is created because close to 80% of CAS’ non-salary operating expenses are contracted costs for primarily non-discretionary services supporting the judicial process and court hearings. These costs are mostly driven by the number and type of hearings conducted in any given year. A risk management strategy is in place to monitor these costs and manage their fluctuation and related impacts on other key areas.

Physical Security

Due to the nature of their work, CAS employees and members of the courts may be exposed to incidents of threat and intimidation. In this regard, physical security gaps are increasingly of concern and must be addressed on an ongoing basis to protect people, assets and services.

To ensure the safety and security of members of the courts and employees, CAS developed a National Security Strategy. The organization is working to ensure appropriate controls and measures (procedures and equipment) for prevention, detection, response and recovery are in place and consistent across the organization.

Information Management

Information Management (IM) is a key operational priority for CAS and for the courts, whose records are extensive, requiring significant resources for their creation, management and storage. The loss of paper or digital records could have a serious impact on the four courts which are, by law, courts of record. CAS must have the capacity to support the Judicial Information Blueprint developed by the Canadian Judicial Council and IM security requirements for rigorous protection and management of records and information. As well, the organization must have the capacity to develop, implement and maintain IM policies, practices and tools.

People

The potential inability to attract and retain employees was identified as a key risk in the 2010-11 RPP. The organization relies on highly specialized, qualified and engaged employees. Many of the skills required are unique to the judicial or quasi-judicial environment, and the demands on staff are high. To staff key vacant positions and to ensure proper succession planning, CAS implemented many new strategies. Managers were encouraged to discuss acting assignments through the development of personal learning plans and during the conduct of performance reviews. To further develop employees, rotational acting assignments were offered instead of immediately filling positions. “Expressions of Interest” were used more frequently to solicit employees for developmental acting opportunities, and more training, mentoring and coaching was offered to help employees prepare for these competitive processes.

Summary of Performance

Faced with increasingly severe financial constraints and significant turnover at the senior management level, the organization focused its activities on key issues and initiated projects to address critical risk areas. Central to the organization’s efforts was the continuing provision of quality registry, judicial and corporate services, notwithstanding the difficult financial situation facing the organization. A key preoccupation was addressing severe risks to the information technology infrastructure, investing in employees, and developing the integrated risk management framework, including the corporate risk profile.

| Planned Spending | Total Authorities | Actual Spending |

|---|---|---|

| 59.7 | 64.9 | 63.6 |

| Planned | Actual | Difference |

|---|---|---|

| 615 | 617 | 2 |

There was a $5.2 million variance between total authorities and planned spending. The largest component of this was supplementary funds received to manage cases involving classified information under Division 9 of part 1 of the Immigration and Refugee Protection Act ($2.9 million) and to support the reform of Canada’s refugee determination system ($0.5 million). Additional funds were also received for collective agreements ($0.1 million), pay list requirements ($0.8 million), the operating carry forward ($0.8M) and the adjustments to employee benefits ($0.5 million). Funds were also returned in Supplementary Estimates for Budget 2010 cost containment measures ($0.4 million).

The variance between total authorities and actual spending represents a lapse of $1.3 million. Of this amount, $0.5 million related to funding set aside by Treasury Board, within the CAS budget, to support the reform of Canada’s refugee determination system. However, CAS was not authorized to use these funds until a new judicial appointment was made; since there was no such appointment during the year, the unused funding became a forced lapse for CAS.

The remaining $0.8 million lapse was due to the following factors:

- Resources were set aside to cover estimated court-reporting and transcript costs for hearings scheduled at year end. However, a higher number of hearings were postponed or cases resolved than expected, thus generating an unplanned surplus.

- For a number of transactions, the goods or services involved were not delivered until after fiscal year end; this occurred particularly in relation to the translation of judgments and the delivery of IT acquisitions.

- Net transfers from other government organizations materialized at year-end.

Finally, due to the expenditure restraint measures and the freeze on operating budgets there was a very small increase in staff.

CAS has one Strategic Outcome, supported by three ProgramcActivities:

| Performance Indicators | Targets | 2010-11 Performance |

|---|---|---|

| Satisfaction rate with CAS regarding access among parties participating in the judicial process | Surveys of clients and the judiciary – 85% satisfaction rate | The survey was designed but not carried-out due to the lack of resources and funding required for the acquisition of the software. The satisfaction rate was monitored through manual mechanisms and indicates a good satisfaction level from clients and the judiciary. |

| Program Activity | 2009-10 Actual Spending |

2010-113 | Alignment to Government of Canada Outcomes | |||

|---|---|---|---|---|---|---|

| Main Estimates |

Planned Spending |

Total Authorities |

Actual Spending |

|||

| Registry Services | 26.1 | 24.6 | 24.6 | 26.6 | 25.8 | Strong and independent democratic institutions |

| Judicial Services | 20.4 | 18.9 | 18.9 | 20.0 | 19.9 | |

| Total | 46.5 | 43.5 | 43.5 | 46.6 | 45.7 | |

| Program Activity | 2009-10 Actual Spending |

2010-112b | |||

|---|---|---|---|---|---|

| Main Estimates |

Planned Spending |

Total Authorities |

Actual Spending |

||

| Internal Services | 19.7 | 16.2 | 16.2 | 18.3 | 17.9 |

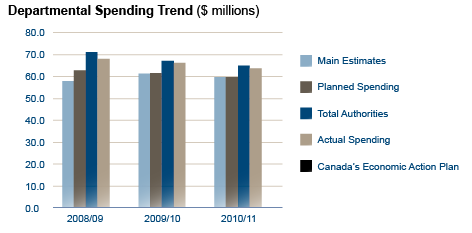

Expenditure Profile

Canada’s Economic Action Plan (CEAP)

No funding was received by CAS for the Canada Economic Action Plan.

Departmental Spending Trend

Estimates by Vote

For information on our organizational votes and/or statutory expenditures, please see the 2010–11 Public Accounts of Canada (Volume II) publication. An electronic version of the Public Accounts is available on the Public Works and Government Services Canada website.4

Footnotes

1a,b,c Type is defined as follows: Previously committed to—committed to in the first or second fiscal year before the subject year of the report; Ongoing—committed to at least three fiscal years before the subject year of the report; and New—newly committed to in the reporting year of the DPR.

2a,b Financial Resources should equal the Total line for Program Activities and Internal Services.

3 Commencing in the 2009–10 Estimates cycle, the resources for Program Activity: Internal Service is displayed separately from other program activities; they are no longer distributed among the remaining program activities, as was the case in previous Main Estimates. This has affected the comparability of spending and FTE information by Program Activity between fiscal years.

4 See Public Accounts of Canada 2010,

http://www.tpsgc-pwgsc.gc.ca/recgen/txt/72-eng-r2.asp.