ARCHIVED - Courts Administration Service - Report

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

2010-11

Departmental Performance Report

Courts Administration Service

The original version was signed by

The Honourable Rob Nicholson P.C., Q.C., M.P.

Minister of Justice and Attorney General of Canada

Table of Contents

Section I: Organizational Overview

- Raison d’être

- Responsibilities

- Strategic Outcome(s) and Program Activity Architecture (PAA)

- Organizational Priorities

- Risk Analysis

- Summary of Performance

- Expenditure Profile

- Estimates by Vote

Section II: Analysis of Program Activities by Strategic Outcome

- Strategic Outcome and Program Activites

- Program Activity 1: Registry Services

- Performance Summary and Analysis of Program Activity

- Lessons Learned – Registry Services

- Program Activity 2: Judicial Services

- Performance Summary and Analysis of Program Activity

- Lessons Learned – Judicial Services

- Program Activity 3: Internal Services

- Performance Summary and Analysis of Program Activity

Section III: Supplementary Information

- Financial Highlights

- Financial Highlights Charts/Graphs

- Financial Statements

- List of Supplementary Information Tables

Chief Administrator’s Message

The Departmental Performance Report for 2010-11 summarizes the accomplishments of the Courts Administration Service (CAS). It presents our ongoing work to provide responsive and modern administrativeservices to

four separate federal superior courts of law while safeguarding the independence of the judiciary from the government. We ensure that the public has timely and fair access to the litigation processes, and enable the courts to deliver results that matter to Canadians through their decisions in the areas of economic, social, international and government affairs.

The Departmental Performance Report for 2010-11 summarizes the accomplishments of the Courts Administration Service (CAS). It presents our ongoing work to provide responsive and modern administrativeservices to

four separate federal superior courts of law while safeguarding the independence of the judiciary from the government. We ensure that the public has timely and fair access to the litigation processes, and enable the courts to deliver results that matter to Canadians through their decisions in the areas of economic, social, international and government affairs.

Since my arrival in February 2011, I have worked with the CAS senior management team on various strategies and mechanisms to stabilize our financial situation, and improve our ability to deliver on our mandate. Our efforts have focused on security, information technology, resources, governance, and communications, as well as on our ability to meet policy and reporting requirements.

I am pleased with the progress made in 2010-11 and impressed by the dedicated efforts of our employees. CAS has been operating with limited resources and under heavy workload pressures for many years while rigorously pursuing innovation and improvements to meet the needs and expectations of the judiciary, the legal profession, litigants and the public. The challenges ahead of us are clear, and we are determined to continue to address them collaboratively and strategically. In this endeavour, I am working closely with the four Chief Justices, who have indicated their support for the approach we are taking. I will continue to seek their guidance in identifying our priorities and developing our strategies.

Through a multi-year plan to strengthen our information technology and business systems, CAS is working to lay the foundation for a wide range of service improvement initiatives and security enhancements. We can also point pride to the significant progress achieved in our people management strategy, and our ongoing commitment to strengthen planning and enhance accountability for use of public money in support of court administration.

In closing, I wish to commend the professionalism and commitment of our employees for their ongoing contributions. I would also like to express my thanks to the Chief Justices and all members of the judiciary for their support.

Daniel Gosselin, Chief Administrator

Section I – Organizational Overview

Raison d’être

The Courts Administration Service (CAS) was established on July 2, 2003 with the coming into force of the Courts Administration Service Act, S.C. 2002, c. 8. The Act Amalgamated the former registries and corporate services of the Federal Court of Canada and the Tax Court of Canada. The courts were created by the Parliament of Canada pursuant to its authority under section 101 of the Constitution Act, 1867 to establish courts “for the better administration of the Laws of Canada.”

Responsibilities

The role of CAS is to provide effective and efficient registry, judicial support and corporate services to four federal superior courts of record – the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada. Judicial independence is enhanced through the Act by placing the judiciary at arm’s length from the federal government while enhancing accountability for the use of public money.

The provision of administrative and registry services by an entity at arm’s length from the executive branch of the government is internationally recognized as a best practice.

CAS recognizes the independence of the courts in the conduct of their own affairs and aims to provide each with high quality administrative and registry services.Functions

- Provide the judiciary, litigants and counsel services relating to court hearings;

- Inform litigants about rules of practice, court directives and procedures;

- Maintain court records;

- Act as liaison between the judiciary, the legal profession and lay litigants;

- Process documents filed by or issued to litigants;

- Record all proceedings;

- Enable individuals seeking enforcement of decisions issued by the courts and federal administrative tribunals, such as the Canada Industrial Relations Board and the Canadian Human Rights Tribunal, to file pertinent documents;

- Provide members of the courts, prothonotaries and employees with library services, information technology services and support, appropriate facilities and security; and

- Provide judicial support to the judiciary.

To facilitate partie's access to the courts, CAS has approximately 610 employees in permanent offices in the following ten cities: Halifax, Fredericton, Québec city, Montréal, Ottawa, Toronto, Winnipeg, Calgary, Edmonton, and Vancouver. In addition, CAS has a satellite office in London, Ontario. Through agreements with various provincial and territorial partners (Newfoundland and Labrador, Prince Edward Island, New Brunswick, Saskatchewan, Nunavut, the Northwest Territories and Yukon), CAS provides registry services and access to courtrooms.

Judicial independence

Judicial independence is a cornerstone of the Canadian judicial system. The impartiality of the judges and access to justice are fundamental to a free and democratic society. As such, Canada's system of government is centered on three separate, yet interdependent, branches: legislative, executive and judicial. Each branch enjoys a necessary degree of independence and autonomy from the other. The independence of the judiciary ensures that judges are free to make their decisions based solely on the law and facts without interference or improper influence from any source, whether from private interest, political pressure, or otherwise. Judicial independence has three components: security of tenure, financial security, and administrative independence.

While CAS reports to Parliament through the Minister of Justice, the organization plays a critical role by placing the courts at arm's length from the Government of Canada. This model helps CAS enhance the independence of the courts and build public confidence in our institutions.

Strategic Outcome(s) and Program Activity Architecture (PAA)

CAS has one Strategic Outcome, supported by three Program Activities:

|

STRATEGIC OUTCOME |

|

|

The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada. |

|

|

|

|

|

PROGRAM ACTIVITIES |

|

|

Registry Services |

Judicial Services |

|

Provision of Registrar Services – Federal Court of Appeal and Court Martial Appeal Court of Canada, Federal Court and the Tax Court of Canada; Delivery of Registery Services for the four courts |

Judicial Executives Services; |

|

Internal Services |

|

|

Management and Oversight Services |

|

Organizational Priorities

Priority Status Legend

Exceeded: More than 100 per cent of the expected level of performance for the priority identified in the corresponding RPP was achieved during the fiscal year.

Met All: 100 per cent of the expected level of performance for the priority identified in the corresponding RPP was achieved during the fiscal year.

Mostly Met: 80 to 99 per cent of the expected level of performance for the priority identified in the corresponding RPP was achieved during the fiscal year.

Somewhat Met: 60 to 79 per cent of the expected level of performance for the priority identified in the corresponding RPP was achieved during the fiscal year.

Not Met: Less than 60 per cent of the expected level of performance for the priority identified in the corresponding RPP was achieved during the fiscal year.

| Priority: Service Improvement Initiatives |

Type1a : Ongoing |

Strategic Outcome: The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada |

|

Status: Mostly Met Although the quality of registry services across the country is high, employees are continuously looking for areas of improvement to increase client satisfaction. During the review period, particular attention was given to the following four areas: Registry processes and operational training

Responding to client needs

Service standards

Technological Improvements

|

||

| Priority: Investment in our People |

Type1b : New |

Strategic Outcome: The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada |

|

Status: Met all

|

||

| Priority: Strengthened Planning and Accountability |

Type1c : Ongoing |

Strategic Outcome(s) and/or Program Activity(ies): The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada |

|

Status: Mostly met

|

||

Risk Analysis

In the 2010–11 RPP, risk management was identified as a priority for CAS. Accordingly, the organization incorporated risk management into departmental planning and reporting through its integrated business planning approach. As part of this process, CAS conducted environmental scans to identify key potential risks and challenges, and established a set of risk management tools and frameworks. CAS is now able to engage in a continuous and integrated approach to managing its operational and strategic risks.

The organization approved a Corporate Risk Profile (CRP) during the reporting period. The CRP focuses on ten main areas of risk, which it addresses though several mitigation strategies. Highlights of the key critical risks facing CAS are described below.

It is important to note that some of the risks facing CAS could ultimately impact on the organization’s ability to support the courts and the Chief Justices who are responsible for ensuring timely and fair access to the judicial system.

Key Critical Risks

Information Technology Security

Ongoing advances in technology pose challenges to all government departments, and CAS is no exception. IT systems require continual investment in hardware, software and the personnel who manage them. Maintaining the security of these systems requires that particular attention be given to the practices adopted by users of the systems, as well as to the implementation of strategies to prevent harm. As with most government institutions, CAS relies heavily on its IT systems to maintain operations and ensure the security of the information it manages. Preventing disruption of these systems is critical to maintaining the business of the courts and the support CAS provides to them.

Accordingly, CAS updated its threat and risk assessments to identify vulnerabilities, and is taking corrective action where necessary. The organization began to invest in upgrading outdated and vulnerable IT infrastructure. To find the necessary resources, many important technology-enabled service improvement initiatives had to be put on hold, but addressing the urgent need to refurbish critical IT infrastructure could not be delayed. It was essential to ensure the business continuity of the federal courts, maintain secure and efficient operations and meet legislated requirements.

Resource Pressures

The most acute financial pressure during the reporting period resulted from the requirement for CAS to absorb the costs of a number of judicial positions previously funded from the Treasury Board management reserve. This temporary funding was ended in 2009-10. Since then, it has been necessary to reallocate major funding to this core activity from other priority areas.

In addition, increasing expectations of the judiciary and users of the courts, coupled with the need to meet legislative and Treasury Board requirements, challenged the ability of CAS to meet the obligations stemming from its mandate within available resource levels. Ultimately, if this situation is not resolved it could impede the functioning of court operations.

To address the situation, CAS identified key areas in which additional permanent funding was needed to mitigate the risks and to enable it to deliver the core program. It was calculated that some $10 million per year would be needed to ensure full program integrity across a range of activities, including the high priority areas of IT infrastructure, court and registry business systems, court-related security, and departmental accountability requirements. The request was partially met, and incremental annual funding rising from $2.65 million in 2011-12 to an ongoing $3.0 million by 2016-17 was provided for CAS in the 2011 Federal Budget.

During 2010-11, CAS managed the financial pressures on a mission-critical basis, seeking temporary funding where possible and redirecting available resources to the most critical areas, notably IT infrastructure.

A further challenge is created because close to 80% of CAS’ non-salary operating expenses are contracted costs for primarily non-discretionary services supporting the judicial process and court hearings. These costs are mostly driven by the number and type of hearings conducted in any given year. A risk management strategy is in place to monitor these costs and manage their fluctuation and related impacts on other key areas.

Physical Security

Due to the nature of their work, CAS employees and members of the courts may be exposed to incidents of threat and intimidation. In this regard, physical security gaps are increasingly of concern and must be addressed on an ongoing basis to protect people, assets and services.

To ensure the safety and security of members of the courts and employees, CAS developed a National Security Strategy. The organization is working to ensure appropriate controls and measures (procedures and equipment) for prevention, detection, response and recovery are in place and consistent across the organization.

Information Management

Information Management (IM) is a key operational priority for CAS and for the courts, whose records are extensive, requiring significant resources for their creation, management and storage. The loss of paper or digital records could have a serious impact on the four courts which are, by law, courts of record. CAS must have the capacity to support the Judicial Information Blueprint developed by the Canadian Judicial Council and IM security requirements for rigorous protection and management of records and information. As well, the organization must have the capacity to develop, implement and maintain IM policies, practices and tools.

People

The potential inability to attract and retain employees was identified as a key risk in the 2010-11 RPP. The organization relies on highly specialized, qualified and engaged employees. Many of the skills required are unique to the judicial or quasi-judicial environment, and the demands on staff are high. To staff key vacant positions and to ensure proper succession planning, CAS implemented many new strategies. Managers were encouraged to discuss acting assignments through the development of personal learning plans and during the conduct of performance reviews. To further develop employees, rotational acting assignments were offered instead of immediately filling positions. “Expressions of Interest” were used more frequently to solicit employees for developmental acting opportunities, and more training, mentoring and coaching was offered to help employees prepare for these competitive processes.

Summary of Performance

Faced with increasingly severe financial constraints and significant turnover at the senior management level, the organization focused its activities on key issues and initiated projects to address critical risk areas. Central to the organization’s efforts was the continuing provision of quality registry, judicial and corporate services, notwithstanding the difficult financial situation facing the organization. A key preoccupation was addressing severe risks to the information technology infrastructure, investing in employees, and developing the integrated risk management framework, including the corporate risk profile.

| Planned Spending | Total Authorities | Actual Spending |

|---|---|---|

| 59.7 | 64.9 | 63.6 |

| Planned | Actual | Difference |

|---|---|---|

| 615 | 617 | 2 |

There was a $5.2 million variance between total authorities and planned spending. The largest component of this was supplementary funds received to manage cases involving classified information under Division 9 of part 1 of the Immigration and Refugee Protection Act ($2.9 million) and to support the reform of Canada’s refugee determination system ($0.5 million). Additional funds were also received for collective agreements ($0.1 million), pay list requirements ($0.8 million), the operating carry forward ($0.8M) and the adjustments to employee benefits ($0.5 million). Funds were also returned in Supplementary Estimates for Budget 2010 cost containment measures ($0.4 million).

The variance between total authorities and actual spending represents a lapse of $1.3 million. Of this amount, $0.5 million related to funding set aside by Treasury Board, within the CAS budget, to support the reform of Canada’s refugee determination system. However, CAS was not authorized to use these funds until a new judicial appointment was made; since there was no such appointment during the year, the unused funding became a forced lapse for CAS.

The remaining $0.8 million lapse was due to the following factors:

- Resources were set aside to cover estimated court-reporting and transcript costs for hearings scheduled at year end. However, a higher number of hearings were postponed or cases resolved than expected, thus generating an unplanned surplus.

- For a number of transactions, the goods or services involved were not delivered until after fiscal year end; this occurred particularly in relation to the translation of judgments and the delivery of IT acquisitions.

- Net transfers from other government organizations materialized at year-end.

Finally, due to the expenditure restraint measures and the freeze on operating budgets there was a very small increase in staff.

CAS has one Strategic Outcome, supported by three ProgramcActivities:

| Performance Indicators | Targets | 2010-11 Performance |

|---|---|---|

| Satisfaction rate with CAS regarding access among parties participating in the judicial process | Surveys of clients and the judiciary – 85% satisfaction rate | The survey was designed but not carried-out due to the lack of resources and funding required for the acquisition of the software. The satisfaction rate was monitored through manual mechanisms and indicates a good satisfaction level from clients and the judiciary. |

| Program Activity | 2009-10 Actual Spending |

2010-113 | Alignment to Government of Canada Outcomes | |||

|---|---|---|---|---|---|---|

| Main Estimates |

Planned Spending |

Total Authorities |

Actual Spending |

|||

| Registry Services | 26.1 | 24.6 | 24.6 | 26.6 | 25.8 | Strong and independent democratic institutions |

| Judicial Services | 20.4 | 18.9 | 18.9 | 20.0 | 19.9 | |

| Total | 46.5 | 43.5 | 43.5 | 46.6 | 45.7 | |

| Program Activity | 2009-10 Actual Spending |

2010-112b | |||

|---|---|---|---|---|---|

| Main Estimates |

Planned Spending |

Total Authorities |

Actual Spending |

||

| Internal Services | 19.7 | 16.2 | 16.2 | 18.3 | 17.9 |

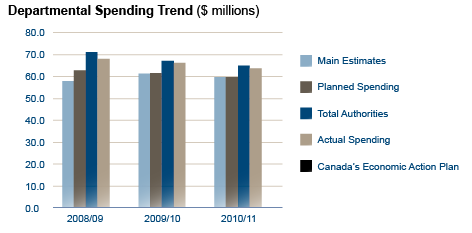

Expenditure Profile

Canada’s Economic Action Plan (CEAP)

No funding was received by CAS for the Canada Economic Action Plan.

Departmental Spending Trend

Estimates by Vote

For information on our organizational votes and/or statutory expenditures, please see the 2010–11 Public Accounts of Canada (Volume II) publication. An electronic version of the Public Accounts is available on the Public Works and Government Services Canada website.4

Footnotes

1a,b,c Type is defined as follows: Previously committed to—committed to in the first or second fiscal year before the subject year of the report; Ongoing—committed to at least three fiscal years before the subject year of the report; and New—newly committed to in the reporting year of the DPR.

2a,b Financial Resources should equal the Total line for Program Activities and Internal Services.

3 Commencing in the 2009–10 Estimates cycle, the resources for Program Activity: Internal Service is displayed separately from other program activities; they are no longer distributed among the remaining program activities, as was the case in previous Main Estimates. This has affected the comparability of spending and FTE information by Program Activity between fiscal years.

4 See Public Accounts of Canada 2010,

http://www.tpsgc-pwgsc.gc.ca/recgen/txt/72-eng-r2.asp.

Section II – Analysis of Program Activities by Strategic Outcome

Performance Status Legend

Strategic Outcome(s) and Program Activity

Courts Administration Service’s (CAS) Program Activity Architecture has one Strategic Outcome (SO) and three program activities in support of its mandate. The information presented in this section is organized according to the following structure:

|

STRATEGIC OUTCOME |

|

|

The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada. |

|

|

|

|

|

PROGRAM ACTIVITIES |

|

|

Registry Services |

Judicial Services |

|

Internal Services |

|

Program Activity 1: Registry Services

Program Activity Description

The Registry Services processes legal documents and applications for judicial review under the jurisdiction of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada. It also ensures the proper court records management and adequate operation of the litigation and court access process.

| 2010-11 Financial Resources ($ denomination) |

2010-11 Human Resources (FTEs) |

||||

|---|---|---|---|---|---|

| Planned |

Total Authorities |

Actual Spending |

Planned | Actual | Difference |

| 24.6 | 26.6 | 25.8 | 296 | 295 | (1) |

| Expected Results |

Performance Indicators |

Targets | Performance Status |

|---|---|---|---|

| Court files are always accurate and complete | Satisfaction rate of clients and judges | 85% satisfaction rates | The survey was not carried-out due to lack of resources and funding required for the acquisition of the software. Satisfaction of judges was monitored through formal and informal meetings with judges, generating good suggestions for service improvements and relaying high satisfaction. |

| Service standards are met | Service standards met 90% of the time | The organization’s performance related to service standards could not be monitored automatically as a result of delays and lack of funding for the implementation of a CRMS. Draft service standards are monitored manually on a quarterly basis and results are used to make operational adjustments. |

Performance Summary and Analysis of Program Activity

The following statistics provide an idea of the magnitude of Registry Services work for the four federal courts in 2010-11:

- 36,067 proceedings were instituted or filed with the four courts.

- 34,525 court judgements, Orders and Directions were processed.

- 5,770 files were prepared for hearings and heard in court (does not include matters settled or discontinued prior to hearings).

- 5,750 days in court.

- 417,570 recorded entries.

Despite this high volume of work only 15 minor complaints were received and immediately resolved in 2010-11. This is a clear indication of the high quality of the work and services provided by CAC employees across the country.

During the review period Registry Services’ employees focussed on implementing all the service improvements initiatives related to the following four areas described earlier: registry processes and operational training, responding to client needs, service standards, and improvements to technology-enabled business systems.

As mentioned before, CAS launched a two-year plan to address urgent problems with the IT infrastructure that had been identified in the Corporate Risk Profile. Progress was made on this project which is essential to support the development of many service initiatives and meet future demands on networks and systems.

The project could only be funded, however, by diversion of resources from other important initiatives. Most technology driven initiatives had to be virtually halted, including work on the development of the CRMS, e-filing of court documents, and other moves towards the introduction of technology-enabled courtrooms. Likewise, the planned survey of judges and courts users was put on hold for lack of resources.

Work did continue towards the provision of digital audio recording capacity for the Federal Court and the Tax Court of Canada. This included software testing to assess functionality against user requirements with very positive results. The next phases will be planning and implementing the solutions.

To stay informed about e-initiatives in other Canadian court jurisdictions, CAS continued to participate in various events organized by court related committees such as the Association of Canadian Court Administrators and the Centre for Canadian Court Technology.

As well, in collaboration with the Office of the Commissioner for Federal Judicial Affairs, Registry Services employees participated in an ongoing project in Ukraine and in a new project entitled “JUSTICE” (Judicial Systems Improvement for Commerce and Economy). The goal of this latest project is to strengthen the judicial and legal environment through building skills of the judiciary, court administrators and judicial training institutes in Jamaica, Ghana and Peru. In 2010-11 our employees contributed to the Jamaican mission and they will be involved in the others in 2011-12.

Lessons Learned – Registry Services

Moving to complete electronic court files remains an important objective for CAS. However, it has become evident that increasing e-filing and implementing e-courts cannot be achieved without a new CRMS in place, as well as a more robust and up-to-date IT infrastructure. However. Until resources are secured and a new CRMS is implemented, Registry Services and Internal Services will continue to work together to maintain and support the current legacy systems as well as the courts’ operations.

To ensure that new service improvement initiatives are successful, CAS needs to develop and improve communication between system developers and project stakeholders. Consequently, CAS needs to improve its capacity in both project management and business analysis. Work must continue to build a Project Management Office, complete the Investment Plan and strengthen governance around technology-enabled projects. This will allow the organization to achieve its goals and better identify, analyze and validate requirements for new business processes, policies and information systems.

Despite severe financial constraints, it was still possible to find innovative and creative ways to train employees. In 2010-11, CAS took advantage of in-house expertise and interdepartmental partnerships to offer employees a wider selection of courses to employees. This was an excellent initiative but as resources are already stretched, CAS must ensure that proper measures are put in place to avoid generating too much pressure on “in-house experts”.

Program Activity 2: Judicial Services

Program Activity Description

Judicial Services provides direct support to all the justices through the efforts of judicial assistants, law clerks, jurilinguists, chauffeurs and court attendants, and library personnel. The services provided include research, documentation, revision, editing, and linguistic and terminological advice, the object of which is to assist the judges in preparing their judgments and reasons for judgment.

| 2010-11 Financial Resources ($ denomination) |

2010-11 Human Resources (FTEs) |

||||

|---|---|---|---|---|---|

| Planned Spending |

Total Authorities |

Actual Spending |

Planned | Actual | Difference |

| 18.9 | 20.0 | 19.9 | 185 | 183 | (2) |

| Expected Results |

Performance Indicators |

Targets | Performance Status |

|---|---|---|---|

| Judges have the support and resources they require to discharge their judicial functions | Satisfaction rate of judiciary concerning the services they receive | 85% satisfaction rate | Assessment of the performance indicator for this fiscal year was limited to a combination of (i) feedback from formal plenary meetings of the courts along with (ii) comments and submissions from members of the bar and the public to the Secretary of the Federal Courts Rules Committee regarding proposed changes to the rules of practice, and (iii) ongoing anecdotal feedback on client service standards in regular discussions involving senior CAS management with the Chief Justices or judges overseeing Court management committees. The courts emphasized the continuing need for high-quality translations provided in a timely fashion for both administrative documents and court decisions, in line with obligations under the Official Languages Act. Feedback from these various sources indicate a good satisfaction level from judiciary with the services provided by CAS, in particular with law clerk, judicial assistant, library, and executive legal services. |

Performance Summary and Analysis of Program Activity

The Judicial Services Branch continued to provide the judges of the four courts the support required to enable them to execute their judicial functions efficiently and effectively.

The judicial assistants provide the judiciary with office management, and administrative services support. In 2010–11 the processes, practices, tools and training for the judicial assistants were reviewed and updated which led to improvements in the quality and consistency of the services provided. To expedite the hiring of judicial assistants and provide ongoing administrative support to the judges, a pool of pre-qualified candidates was created.

The Law Clerk Program provides opportunities for upcoming and recent graduates of law schools in Canada to apply for positions as law clerks to judges. Approximately 55 law clerks are employed annually by CAS, generally for a one-year period to meet their articling requirements. Under the direction of members of the judiciary, who may act as principals for articling purposes, law clerks prepare case summaries, research questions of law and prepare detailed memoranda on facts and legal issues. In 2010-11, twelve law clerks were hired by the Federal Court of Appeal, thirty-one by the Federal Court and twelve by the Tax Court of Canada. CAS investigated new options for an online system to streamline the application process and reduce the amount of paper used; thereby contributing to the greening of government operations strategy.

Through the website of the courts, Judicial Services Branch ensures that the parties, the legal profession and the public have electronic access to Media Bulletins and Decision Bulletins. The Branch also offers Media Contact support for questions about the Court and its decisions.

The Judicial Services Branch organized meetings of the Bench and Bar and the Rules Committees which gave the members of the bar, key stakeholders and the public, a forum to effect changes to the litigation process in certain areas. Discussion papers were posted on the courts websites inviting interested parties to submit their comments. CAS continued to support the courts in their involvement with the following Bench & Bar Liaison Committees in 2010-11:

- Bench and Canadian Bar Association Liaison Committee

- Federal Court – Aboriginal Law Bar Liaison Committee

- Federal Court Bench and Bar Liaison Committee (Immigration & Refugee Law)

- Intellectual Property Users Committee

- Montréal Bar – Liaison Committee with the Federal Court of Appeal and Federal Court

- Liaison Committee – Labour Law, Human Rights, Privacy and Access Review

The Judicial Services Branch continued the implementation of its revised Library Collection Development Policy, drafted its Library Client Services Policy, and implemented an easy-to-use client interface on its library integrated system. By completing the implementation of both policies in 2011-12, CAS will improve the quality of library service to the judiciary and employees across the country.

Lessons Learned – Judicial Services

Since final judicial decisions must be made available in both official languages, translation represents a major cost for the courts system. In 2010-11, a new framework was developed between CAS and the Translation Bureau to explore possible process improvements and cost saving measures. It will be important to pursue this initiative to achieve the potential benefits.

The need for consultation and feedback on possible changes to improve the functioning of the courts became clearer than ever in 2010-11. CAS participation in Bench and Bar Liaison meetings provided essential feedback from the Bar on behalf of lawyers as well as private and public litigants. Federal Courts Rules Committee consultations with members of the bar and the public regarding proposed changes involving technology and procedures will be especially important in identifying areas that require attention, especially concerning the use of technology in the courts.

Intensive case management to streamline litigation and improve the efficiency of the justice system for litigants is of special importance for the Federal Court. Some of the required initiatives may involve changes to both Registry and Judicial Support services and could have significant financial implications. CAS will need to monitor service standards to ensure that appropriate funding and resources are available.

Experience during 2010-11 emphasized the drawbacks of the current approach to recruiting law clerks for the courts. Applications from potential candidates and the associated materials are currently provided to the selection committees of the courts in paper form. A new, more efficient online application process is being developed and should be implemented in 2011-12.

A review of the policy on library collections continues, in consultation with the judges' library committee. A key aim must be to reduce the number of hard-copy subscriptions and thereby free up funding for the electronic research services that continue to grow in importance for the courts.

Program Activity 3: Internal Services

Program Activity Description:

Internal Services are groups of related activities and resources that are administered to support the needs of programs and other corporate obligations of an organization. These groups are: Management and Oversight Services; Communications Services; Legal Services; Human Resources Management Services; Financial Management Services; Information Management Services; Information Technology Services; Real Property Services; Materiel Services; Acquisition Services; and Travel and Other Administrative Services. Internal Services include only those activities and resources that apply across an organization and not to those provided specifically to a program.

| 2010-11 Financial Resources ($ denomination) |

2010-11 Human Resources (FTEs) |

||||

|---|---|---|---|---|---|

| Planned Spending |

Total Authorities |

Actual Spending |

Planned | Actual | Difference |

| 16.2 | 18.3 | 17.9 | 134 | 139 | 5 |

Performance Summary and Analysis of Program Activity

Service Improvement Initiatives

CAS developed a two-year plan to upgrade its ageing information technology infrastructure. Important progress was made during 2010-11 in addressing some of the most critical risks to court operations, but only at the expense of other high priority projects, such as CRMS, which had to be put on hold to free up resources for the initial phase of the IT infrastructure work. To enable the project to be completed, additional funding was sought; the request was successful and the necessary resources will be provided in 2011-12. When completed, this work will ensure more reliable operation, enable important improvements in support services and meet future demands on networks and systems.

In 2010-11, CAS began development of a more robust information management framework, including strategies for the safe keeping of records. The IM section also promoted across the organization a program emphasizing the need to incorporate IM requirements into all project and program planning. With respect to the digitization of court records and the acquisition of a corporate information management system, limited capacity meant that the organization could only make modest progress.

The physical security of the judiciary and other parties appearing in court or visiting registry counters continued to be a primary concern for CAS in 2010-11. To improve security measures, CAS implemented new access card systems in various offices, delivered training sessions to new employees, and made improvements to some facilities.

In February 2011, CAS completed the relocation of the registry counter for the Federal Court of Appeal, the Federal Court and the Court Martial Appeal Court of Canada at 90 Sparks Street, Ottawa. While the focus was on ensuring that the new location is more visible and accessible to the public, improving security for CAS employees was also a priority.

Additional funding was sought to ensure program integrity across a range of activities, including the high priority areas of business systems and security. It was calculated that some $10 million per year would be needed. This would restore resources that had been diverted to support unfunded judicial positions and would help to meet increasing needs for court support. The request was partially accepted, and incremental funding that will rise to $3 million per year by 2016-17 was provided for CAS in the 2011 Federal Budget.

Investment in our People

Human Resources Services undertook initiatives to attract, develop and retain knowledgeable, engaged and productive employees across the organization. These initiatives specifically addressed risks related to the potential loss or unavailability of highly specialized, knowledgeable employees.

The initiatives included:

- Greater emphasis on diversity, values and ethics as well as promoting a harassment-free and non-discriminatory work environment, and achieving work-life balance;

- Development of leadership capacities within the management team through the use of learning circles, acting opportunities, and other measures;

- Improved efficiency of the staffing process and development of a recruitment approach for the organization;

- Adopt a more systematic approach to learning and career development by improving the Performance Management Process, including individual agreements, personal learning plans and learning roadmaps;

- Development of an on-boarding program;

- Improved communication between staff and management through the implementation of a suggestion box and increased consultation with employees;

- Improved service to managers and employees through use of the intranet, website, and video conferencing.

Strengthened Planning and Accountability

CAS made good headway during the reporting period in applying an integrated and risk-based approach to planning, resource allocation and budget management. This was made possible by strengthening business planning and ensuring alignment of resources to corporate priorities and risks. As part of the effort to improve decision making and accountability, consultation with the Chief Justices of the courts was increased and financial reporting to the CAS Executive Committee was improved.

In addition, CAS implemented an Integrated Risk Management Framework (IRMF) and developed a Corporate Risk Profile (CRP). Development of priorities, choice of activities and allocation of resources are now directly informed by the CRP. The IRMF will be reviewed, refined and updated regularly to reflect the changing risk environment facing the organization.

During the reporting period, CAS made important progress on the development of project management and change management frameworks. By hiring specialized resources and training existing employees, the organization increased its capacity to manage both projects and change. This will help ensure that CAS meets future projects deliverables based on plans and requirements, and that resources are properly aligned with the project objectives and the priorities of the organization.

Work was undertaken to expand the use of information technology to support more efficient and effective management decision making through the provision of web-based financial information but had to be stopped as a result of lack of capacity. CAS remains committed to improve decision-support tools by expanding the use and maximizing the efficiency of the dashboard available to managers.

In 2010-11, CAS continued to work towards the creation of the Departmental Audit Committee. The organization appointed one external member and identified a second member to be appointed in 2011-12. Work continued to create an internal audit function, and innovative approaches are still being discussed with the Office of the Comptroller General.

Section III – Supplementary Information

Financial Highlights

| Condensed Statement of Financial Position As at March 31, 2011 |

% Change | 2010–11 | 2009–10 |

|---|---|---|---|

| Total assets | (18%) | 13,753 | 6,369 |

| Total liabilities | (10%) | 19,697 | 21,932 |

| Equity of Canada | (17%) | (5,944) | (5,060) |

| (18%) | 13,753 | 16,872 |

| Condensed Statement of Operations For the year ended March 31, 2011 |

% Change | 2010–11 | 2009–10 |

|---|---|---|---|

| Total expenses | 1% | 92,927 | 91,723 |

| Total revenues | (42%) | 7,977 | 13,753 |

| Net cost of operations | 9% | 84,950 | 77,970 |

Statement of Financial Position

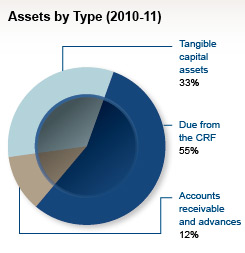

Assets: CAS' total assets as at March 31, 2011 reached $13,753 thousand, down from $16,872 thousand the year before. The largest component is the amount Due from the Consolidated Revenue Fund, which represents 56% of the total ($7,640 thousand). This decrease is primarily due to a reduction in accounts payable and accrued liabilities as at March 31, 2011 relative to March 31, 2010, as well as a decrease in the amounts held on deposit, in CAS’ Specified Purpose Accounts as at March 31, 2011 compared with the same time period in 2010. Tangible Capital Assets, the second largest category, represents 33% of the total ($4,519 thousand) and remained almost unchanged in 2011 relative to 2010.

Tangible capital assets are largely composed of Leasehold improvements and Computer hardware and software. Combined, they account for 75% of the cost (85% of the net book value) of tangible capital investments. In 2010-11, the amount of annual amortization, transfers, adjustments, disposals, and write-offs was greater than tangible capital asset acquisitions. Consequently there was a decline in the total net book value of tangible capital assets over the past year.

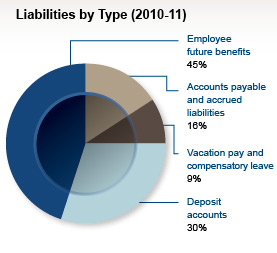

Liabilities: CAS’ total liabilities as at March 31, 2011 were $19,697 thousand, down from $21,932 thousand the year before. This decreased liability of $2,235 thousand is principally the net result of five factors:

- Decrease of $1,814 thousand in accounts payable, especially to other government departments, notably PWGSC.

- Increase of $220 thousand in CAS accrued liabilities, that is salaries earned but not paid at year-end; this mainly reflected the ending of the fiscal year on March 30.

- Decrease of $63 thousand in vacation pay and compensatory leave liabilities.

- Increase of $856 thousand in the allowance for future severance benefits, resulting in large part from a Treasury Board increase in the departmental contribution rate.

- Decrease of $1,434 thousand in deposit accounts maintained on behalf of litigants. Since members of the courts determine the payments in and out of the courts, depending on the case, these deposits may vary significantly from year to year.

Equity of Canada: CAS’ Equity of Canada is currently negative. As at March 31, 2011 the amount was ($5,944) thousand, compared to ($5,060) thousand as at March 31, 2010. This situation reflects obligations recognized as liabilities, for instance employee future benefits that will be paid out of future appropriations.

Statement of Operations

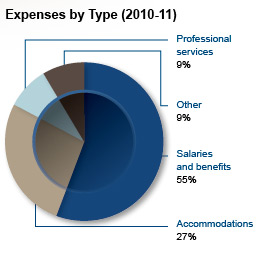

Expenses: CAS incurred total expenses of $92,927 thousand in 2010-11, an increase of 1% from $91,723 thousand in 2009-10, mainly due to a $2,003 thousand increase in 2010-11 collective bargaining agreement costs. This was partly offset by decreases in many other expense items as a result of budget restrictions.

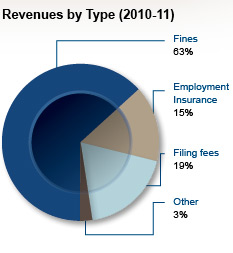

Revenues: CAS’ revenues were $7,977 thousand in 2010-11, a decline of 42% compared to $13,753 thousand in 2009-10. Revenues dropped by $5,776 thousand in 2010-11 mainly due to a reduction of fines. Since such fines are determined by the courts on a case-by-case basis, related revenues vary significantly from year-to-year.

CAS’ revenues consist primarily of fines, filing fees, and sales of copies of filed documentation, including copies of judgments and orders, collected pursuant to the legislation and Rules governing the courts. In addition, at the end of each fiscal year, CAScharges Human Resources and Skills Development Canada (HRSDC) for the costs associated with the administration of Employment Insurance (EI) cases in the courts. Such revenues are non-respendable and are therefore not a source of funds for CASoperations.

Risks and Uncertainties

Close to 80% of CAS’ non-salary operating expenses are contracted costs for primarily non-discretionary services supporting the judicial process and court hearings. They are mostly driven by the number and type of hearings conducted in any given year. A risk management strategy is in place to monitor these costs and manage their fluctuation and related impacts on other key areas.

Like many other federal government organizations, CAS faces serious budget constraints. Several factors have contributed to the current situation. Principal among these is the requirement for CAS to support additional judicial appointments without having a source of permanent funding. This long standing situation resulted in the diversion of resources from other key priorities and areas of risk, and created important program integrity issues.

Federal Budget 2010 announced cost containment measures that froze appropriations at their 2010-11 levels for the years 2011-12 and 2012-13. Consequently, like all departments, has been required to absorb the negotiated salary increases of its employees.

Federal Budget 2011 confirmed ongoing program integrity funding for CAS rising to an amount of $3,000 thousand per year in 2016-17 to address pressures affecting the delivery of the CAS mandate.

Further financial details are provided in the "Financial Statement Discussion and Analysis" available on-line at: http://cas-ncr-nter03.cas-satj.gc.ca/portal/page/portal/CAS/ DPR-RMR_eng/fsda-caef-2010-2011_eng.

Financial Highlights Charts/Graphs

Financial Statements

CAS financial statements can be found at: http://cas-ncr-nter03.cas-satj.gc.ca/portal/page/portal/CAS/DPR-RMR_eng.

List of Supplementary Information Tables

All electronic supplementary information tables found in the 2010–11 Departmental Performance Report can be found on the Treasury Board of Canada Secretariat’s website at: http://www.tbs-sct.gc.ca/dpr-rmr/2010-2011/index-eng.asp.

Tables: Sources of Respendable and Non-Respendable Revenue

Section IV – Other Items of Interest

Organizational Contact Information

Further information on the strategic planning portion of this document can be obtained by contacting:

Robert Monet

Acting Director, Corporate Secretariat

Courts Administration Service

Ottawa, Ontario

K1A 0H9

Robert.Monet@cas-satj.gc.ca

Further information on the financial portion of this document can be obtained by contacting:

Paul Waksberg

Director General, Finance and Contracting Services

Courts Administration Service

Ottawa, Ontario

K1A 0H9

Paul.Waksberg@cas-satj.gc.ca