Common menu bar links

Breadcrumb Trail

ARCHIVED - Industry Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

MinisterÆs Message

The past year has been a challenging one for the Canadian economy, as it has been for the economies

of all industrialized countries. The global economic crisis put the fiscal and economic frameworks of all countries to the

test. But Canada entered the recession with solid fundamentals Ś balanced budgets, decreasing debt and taxes, a strong financial

sector and robust economic policies. Consequently, Canada is in a comparatively good position to effectively respond to

this time of economic challenge.

The past year has been a challenging one for the Canadian economy, as it has been for the economies

of all industrialized countries. The global economic crisis put the fiscal and economic frameworks of all countries to the

test. But Canada entered the recession with solid fundamentals Ś balanced budgets, decreasing debt and taxes, a strong financial

sector and robust economic policies. Consequently, Canada is in a comparatively good position to effectively respond to

this time of economic challenge.

The Industry Portfolio played a significant role in developing CanadaÆs resiliency and ability to weather the current crisis. Composed of Industry Canada and 10 other agencies, Crown corporations and quasi-judicial bodies, the Portfolio includes major instruments in the Government of CanadaÆs tool kit for building a competitive economy.

Industry Canada focuses on helping Canadians contribute to the knowledge economy and improving the countryÆs productivity and innovative capacity through three strategic outcomes:

- a fair, efficient and competitive marketplace;

- an innovative economy; and

- a competitive industry and sustainable communities.

To accomplish these outcomes, the Department focuses on developing effective marketplace framework policies and making strategic investments in key sectors to broaden CanadaÆs innovative capacity. In 2008¢09, such measures included the following:

- an auction of radio spectrum for advanced wireless services, stimulating better service and more choices for businesses and consumers and resulting in more than $4 billion in bids for licences;

- amendments to the Competition Act and the Investment Canada Act in response to the Competition Policy Review PanelÆs recommendations for a competitiveness agenda;

- a streamlined Canada Not-for-profit Corporations Act to eliminate unnecessary regulation and reduce red tape for not-for-profit corporations;

- strategic investments in science and technology initiatives, such as the Canada Excellence Research Chairs program and the Vanier Canada Graduate Scholarship program, and in major industries such as the automotive sector (through the Automotive Innovation Fund and a commitment to support long-term restructuring efforts) and the aerospace sector (through the Strategic Aerospace and Defence Initiative); and

- continued support for the Federal Economic Development Initiative for Northern Ontario to enable businesses and communities in the region to thrive.

In January 2009, the government introduced CanadaÆs Economic Action Plan, which contained stimulative measures to respond to the global recession. Industry Canada and its Portfolio members played, and will continue to play, a central role in developing and implementing a signficant number of these critical initiatives. These measures range from programs to upgrade research infrastructure at CanadaÆs universities and colleges, to helping small businesses bring innovative products to market, to supporting major tourism events, to enhancing community and recreational facilities and other municipal infrastructure in Ontario. For more information, visit the CanadaÆs Economic Action Plan website.

As a country, we are emerging from the recession by creating a climate that encourages innovation, productivity and competitiveness Ś helping Canadian industry move to the forefront of the global knowledge economy. Industry Canada, the Portfolio members, and other federal departments and agencies are working in partnership so that Canada continues to enjoy a high standard of living and a prosperous future.

It is my pleasure to present Industry CanadaÆs Departmental Performance Report for 2008¢09.

Tony Clement

Minister of Industry

Section 1: Departmental Overview

1.1 Summary Information

Raison dÆĻtre

- provides more and better-paying jobs for Canadians;

- supports stronger economic growth through continued improvements in productivity and innovation performance;

- gives businesses, consumers and investors confidence that the marketplace is fair, efficient and competitive; and

- integrates the economic, environmental and social interests of Canadians.

Responsibilities

The Minister of Industry is responsible for carrying out Industry CanadaÆs mandate and for advancing sustainable development through the Department and the Industry Portfolio. The Minister has jurisdiction over policy issues related to industry, trade and commerce; science; consumer affairs; corporations and corporate securities; competition and restraint of trade, including mergers and monopolies; bankruptcy and insolvency; intellectual property; telecommunications; investment; small businesses; and regional economic development across Canada.

The Deputy Minister and Senior Associate Deputy Minister are accountable for the stewardship of Industry Canada. They provide strategic direction and sound management to ensure that the Department contributes effectively to achieving the governmentÆs priorities and that its wide range of activities is well coordinated and produces concrete results.

From an operational point of view, Industry CanadaÆs governance structure is functionally expressed through its committee structure at both the working and senior management levels, which support senior executives and ultimately the Minister. The committee structure is traditional in nature Ś divided between operations (Management Committee) and policy (Deputy MinisterÆs Policy Table). These committees provide oversight and decision-making authority in a number of areas including policy; IM/IT; and project management, procurement and contracting. They determine how allocation and reallocation decisions are made; and how programs are coordinated and managed to achieve the DepartmentÆs Strategic Outcomes communicated to Parliament.

Organizational Changes within Industry Canada

The DepartmentÆs organizational chart reflects a number of organizational changes that occurred in 2008¢09 and that are outlined in further detail below. It is important to note that this yearÆs performance report does not reflect the revised organizational structure, but is instead based on the DepartmentÆs Program Activity Architecture (PAA) for 2008¢09. Given the timing of the machinery of government changes outlined below, they were not reflected in the 2008¢09 PAA and are therefore not shown in this yearÆs performance report.

Organizational Changes:

- Small Business and Marketplace Services and Regional Operations Sector: The previous Operations Sector was split into the Small Business and Marketplace Services Sector and Regional Operations Sector. The program activities were renamed to reflect this change for the 2008¢09 PAA and repositioned in the 2009¢10 PAA to reflect this change at the program activity level following a realignment of Industry CanadaÆs operational agenda.

- Technology Partnerships Canada: In February 2007, Technology Partnerships Canada (TPC) was replaced by the Industrial Technologies Office (ITO) within Industry Canada as the Special Operating Agency to manage both the Strategic Aerospace and Defence Initiative (SADI) and projects previously contracted through the TPC program.

- Genome Canada: Genome Canada was originally placed under the Program Activity Industry Sector Ś Science and Technology and Innovation, and was transferred to the Program Activity Science and Innovation Sector Ś Science and Technology in August 2006. In future PAAs, and in future Parliamentary reporting documents, Genome Canada, along with its Planned Spending and other financial information, will be under the Program Activity Science and Innovation Sector Ś Science and Technology and Innovation.

- The Automotive Innovation Fund (AIF): The AIF was approved by the Treasury Board Secretariat on June 11, 2008. The AIF was originally placed under the Strategic Outcome Competitive Industry and Sustainable Communities. In future PAAs, and in future Parliamentary reporting documents, the AIF, along with its Planned Spending and other financial information, will be under An Innovative Economy.

- The Perimeter Institute: The grant to the Perimeter Institute was originally mistakenly placed under the Program Activity Industry Sector Ś Science and Technology and Innovation. In future PAAs, and in future Parliamentary reporting documents, the grant, along with its Planned Spending and other financial information, will be under Science and Innovation Sector Ś Science and Technology and Innovation.

Machinery of Government Changes

In 2008¢09 the following machinery of government changes impacted Industry Canada:

- Mackenzie Gas Project: The Mackenzie Gas Project (MGP) is a proposed 1,220-kilometre natural gas pipeline system through the Mackenzie Valley in the Northwest Territories that will connect northern onshore gas fields with North American markets. The project has the potential to make key contributions to CanadaÆs role as an energy superpower. The MGP was transferred from Indian and Northern Affairs Canada to Industry Canada late in 2007-08 and was subsequently transferred to Environment Canada on October 30, 2008. The PAA chart in this report does not reflect these transfers.

Strategic Outcomes

In order to effectively pursue its mandate, Industry Canada aims to achieve the following three strategic outcomes:

- A fair, efficient and competitive marketplace

- An innovative economy

- Competitive industry and sustainable communities

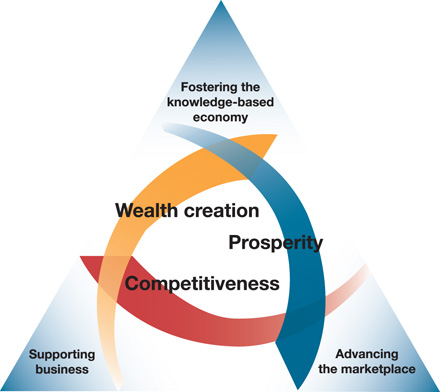

The many and varied activities Industry Canada carries out to deliver on its mandate are organized around three interdependent and mutually reinforcing strategic outcomes, each linked to a separate key strategy. The key strategies are shown in the illustration below:

A fair, efficient and competitive

marketplace

A fair, efficient and competitive

marketplace

- By advancing the marketplace, we are developing and administering economic framework policies that promote innovation and competition and instill business, investor and consumer confidence.

An innovative economy

An innovative economy

- By fostering the knowledge-based economy, we support foundational investments in science and technology to create new knowledge and equip Canadians with the skills and training they need to compete in the global knowledge-based economy.

Competitive industry and sustainable

communities

Competitive industry and sustainable

communities

- By supporting business, we anchor and support business innovation and productivity, because businesses are the organizations that create wealth and generate jobs.

Industry CanadaÆs 2008¢09 Program Activity Architecture

The chart below shows the full framework of Industry CanadaÆs Program Activities and Program Sub-Activities. These activities contribute to progress towards the DepartmentÆs three strategic outcomes for 2008¢09.

Strategic Outcomes 2008¢09 |

||

|---|---|---|

| A Fair, Efficient and Competitive Marketplace | An Innovative Economy | Competitive Industry and Sustainable Communities |

Program Activities |

||

| Strategic Policy Sector Ś Marketplace | Science and Innovation Sector Ś Science & Technology (S&T) and Innovation | Strategic Policy Sector Ś Economic Development |

Sub-Activities

|

Sub-Activities

|

Sub-Activities

|

Small Business and Marketplace Services and Regional Operations Sector Ś Marketplace |

Industry Sector Ś S&T and Innovation |

Small Business and Marketplace Services and Regional Operations Sector Ś Economic Development |

Sub-Activities

|

Sub-Activities

|

Sub-Activities

|

Spectrum, Information Technologies and Telecommunications Sector Ś Marketplace |

Spectrum, Information Technologies and Telecommunications Sector Ś S&T and Innovation |

Industry Sector ¢ Economic Development |

Sub-Activities

|

Sub-Activities

|

Sub-Activities

|

| Office of Consumer Affairs | Communications Research Centre Canada | |

Sub-Activities

|

Sub-Activities

|

|

Competition Bureau |

Industrial Technologies Office Ś Special Operating Agency |

Spectrum, Information Technologies and Telecommunications Sector Ś Economic Development |

Sub-Activities

|

Sub-Activities

|

Sub-Activities

|

Canadian Intellectual Property Office Ś Revolving Fund |

||

| ($ millions) | 2006¢07 Actual | 2007¢08 Actual | 2008¢09 | |||

|---|---|---|---|---|---|---|

| Main Estimates | Planned Spending | Total Authorities | Total Actuals** | |||

| A Fair, Efficient and Competitive Marketplace | ||||||

| Strategic Policy Sector Ś Marketplace | 6.2 | 10.7 | 12.6 | 12.6 | 18.2 | 18.1 |

| Small Business and Marketplace Services and Regional Operations Sector Ś Marketplace | 86.5 | 82.4 | 95.7 | 95.6 | 116.6 | 107.3 |

| Spectrum, Information Technologies and Telecommunications Sector Ś Marketplace | 67.0 | 58.7 | 59.0 | 58.9 | 68.2 | 65.0*** |

| Office of Consumer Affairs | 5.9 | 6.4 | 5.1 | 5.1 | 6.4 | 6.3 |

| Competition Bureau | 42.1 | 46.4 | 49.8 | 49.8 | 62.2 | 59.1 |

| Canadian Intellectual Property Office Ś Revolving Fund | (28.5) | (21.3) | 4.9 | 4.9 | 139.5 | (12.9) |

| Subtotal | 179.3 | 183.4 | 227.0 | 226.9 | 411.2 | 242.8 |

| An Innovative Economy | ||||||

| Science and Innovation Sector Ś Science & Technology (S&T) and Innovation | 10.6 | 148.8 | 94.0 | 101.1 | 100.0 | 99.7 |

| Industry Sector Ś S&T and Innovation | 4.9 | 19.4 | 9.5 | 9.5 | 101.0 | 90.4 |

| Spectrum, Information Technologies and Telecommunications Sector Ś S&T and Innovation | 24.1 | 15.1 | 27.4 | 18.4 | 30.2 | 29.5**** |

| Communications Research Centre Canada | 50.6 | 42.9 | 42.7 | 43.1 | 60.3 | 57.4å |

| Industrial Technologies Office Ś Special Operating Agency | 409.9 | 431.8 | 265.8 | 311.8 | 333.5 | 294.6 |

| Subtotal | 500.1 | 658.0 | 439.3 | 483.9 | 625.0 | 571.6 |

| Competitive Industry and Sustainable Communities | ||||||

| Strategic Policy Sector Ś Economic Development | 12.2 | 11.7 | 6.6 | 6.6 | 15.5 | 15.4 |

| Small Business and Marketplace Services and Regional Operations Sector Ś Economic Development | 352.8 | 292.2 | 225.6 | 235.6 | 315.4 | 272.3 |

| Industry Sector Ś Economic Development | 68.4 | 168.6 | 66.0 | 66.0 | 81.4 | 77.9 |

| Spectrum, Information Technologies and Telecommunications Sector Ś Economic Development | 76.9 | 50.1 | 8.0 | 26.1ć | 43.7 | 43.6 |

| Mackenzie Gas Project | - | - | - | - | 7.9 | 5.0 |

| Subtotal | 510.3 | 522.6 | 306.2 | 334.2 | 464.0 | 414.2 |

| Budgetary Main Estimates | 1,189.6 | 1,363.9 | 972.5 | 1,045.0 | 1,500.1 | 1,228.6 |

| Non-Budgetary Main Estimates | - | - | 0.8 | 0.8 | 2.8 | - |

| Total | 1,189.6 | 1,363.9 | 973.3 | 1,045.8 | 1,502.9 | 1,228.6 |

| Less: Non-Respendable revenueś | (522.3) | (569.2) | N/A | (475.4) | N/A | (4,767.5) |

| Plus: Cost of services received without chargeś | 84.8 | 84.5 | N/A | 83.4 | N/A | 87.1 |

| Net Cost of Department | 752.2 | 879.2 | 973.3 | 653.8 | 1,502.9 | (3,451.8) |

| Full-Time Equivalents | 5,521 | 5,392 | 5,719 | 5,341 | ||

* Minor differences are due to rounding.

** Internal Services spending is prorated across all program activities.

***The variance between Planned Spending and Actual Spending relates to the increased salary costs from collective agreements and retroactive pays, as well as internal funding reallocations towards program legislative and regulatory priorities relating to spectrum / telecommunciations management.

**** The $28-million payment is the third instalment of the $120-million conditional grant for CANARIEÆs Advanced Network. The amount paid is based on CANARIEÆs cash flow requirements, reported annually to the Minister before an instalment is issued.

å The variance is a result of increased salary costs from collective agreements, recapitalization of scientific equipment, increased respendable revenues from collaborative research agreements and campus operations activities, and spectrum monitoring support for the Vancouver 2010 Winter Games.

ć No resources were reported in the RPP for the Community Access Program and the Computers for Schools program, as the program authorities were still pending at the time.

ś Non-Respendable Revenue and services received without charge are not included in the Main Estimates or Total Authorities of the Department. In 2008¢09, Industry Canada received funding for an auction sale in the amount of $4.3 billion, which is reported in total in the DPR and Public Accounts as revenue on a cash basis. From an accrual accounting perspective, this auction is considered as deferred revenues since the economic benefit will occur over 10 years.

1.2 Summary of Performance

| Strategic Outcome 1: A Fair, Efficient and Competitive Marketplace | ||||||

| Performance Indicators | Results | Trend | ||||

|---|---|---|---|---|---|---|

| Regulatory and administrative capacity | Canada placed the 6th-smallest administrative burden on start-ups amongst OECD countries in 2008 (up from the 8th-smallest burden in 2003)1 | Improving | ||||

| Program Activity | 2007¢08 Actual Spending ($ millions) |

2008¢09 ($ millions) | ||||

| Main Estimates | Planned Spending | Total Authorities | Actual Spending | Alignment to Government of Canada Outcomes | ||

| Strategic Policy Sector Ś Marketplace | 10.7 | 12.6 | 12.6 | 18.2 | 18.1 | A Fair and Secure Marketplace |

| Small Business and Marketplace Services and Regional Operations Sector Ś Marketplace | 82.4 | 95.7 | 95.6 | 116.6 | 107.3 | |

| Spectrum, Information Technologies and Telecommunications Sector Ś Marketplace | 58.7 | 59.0 | 58.9 | 68.2 | 65.0* | |

| Office of Consumer Affairs | 6.4 | 5.1 | 5.1 | 6.4 | 6.3 | |

| Competition Bureau | 46.4 | 49.8 | 49.8 | 62.2 | 59.1 | |

| Canadian Intellectual Property Office Ś Revolving Fund | (21.3) | 4.9 | 4.9 | 139.5 | (12.9) | |

* The variance between Planned Spending and Actual Spending relates to the increased salary costs from collective agreements and retroactive pays, as well as internal funding reallocations towards program legislative and regulatory priorities relating to spectrum / telecom management.

| Strategic Outcome 2: An Innovative Economy | ||||||

| Performance Indicators | Results | Trend | ||||

|---|---|---|---|---|---|---|

| Number of people in science and technology occupations as a share of total employment | 1.2 million in 2008, or 7% of total employment; an increase of 0.41 percentage points from 20042 | Improving | ||||

| Program Activity | 2007¢08 Actual Spending ($ millions) | 2008¢09 ($ millions) | ||||

| Main Estimates | Planned Spending | Total Authorities | Actual Spending | Alignment to Government of Canada Outcomes | ||

| Science and Innovation Sector Ś Science and Technology (S&T) and Innovation | 148.8 | 94.0 | 101.1 | 100.0 | 99.7 | Strong Economic Growth |

| Industry Sector Ś S&T and Innovation | 19.4 | 9.5 | 9.5 | 101.0 | 90.4 | |

| SITT Sector Ś S&T and Innovation | 15.1 | 27.4 | 18.4 | 30.2 | 29.5 | |

| Communications Research Centre Canada | 42.9 | 42.7 | 43.1 | 60.3 | 57.4* | |

| Industrial Technologies Office Ś Special Operations Agency | 431.8 | 265.8 | 311.8 | 333.5 | 294.6 | |

* The variance is a result of increased salary costs from collective agreements, recapitalization of scientific equipment, increased respendable revenues from collaborative research agreements and campus operation activities, and spectrum monitoring support for the Vancouver 2010 Winter Games.

| Strategic Outcome 3: Competitive Industry and Sustainable Communities | ||||||

| Performance Indicators | Results | Trend | ||||

| International ranking of Canada in the use of information and communications technologies | Canada ranks 19th out of 154 countries in terms of level of advancement in the use of information and communications technology (ICT), down from 9th in 20023 | Declining | ||||

| Program Activity | 2007¢08 Actual Spending ($ millions) | 2008¢09 ($ millions) | ||||

|---|---|---|---|---|---|---|

| Main Estimates | Planned Spending | Total Authorities | Actual Spending | Alignment to Government of Canada Outcomes | ||

| Strategic Policy Sector Ś Economic Development | 11.7 | 6.6 | 6.6 | 15.5 | 15.4 | Strong Economic Growth |

| Small Business and Marketplace Sector and Regional Operations Sector Ś Economic Development | 292.2 | 225.6 | 235.6 | 315.4 | 272.3 | |

| Industry Sector Ś Economic Development | 168.6 | 66.0 | 66.0 | 81.4 | 77.9 | |

| SITT Sector Ś Economic Development | 50.1 | 8.0 | 26.1* | 43.7 | 43.6 | |

| Mackenzie Gas Project | - | - | - | 7.9 | 5.0 | |

* No resources were reported in the RPP for the Community Access Program and the Computers for Schools program as the program authorities were still pending at the time.

Management Priorities

| Management Priority: Integration, Use and Reporting of Performance Information |

Type: Previous commitment |

Strategic Outcome(s): All strategic outcomes |

Status

|

||

| Management Priority: New recourse and disclosure process required under the Public Servants Disclosure Protection Act |

Type: Previous commitment |

Strategic Outcome(s): All strategic outcomes |

Status

|

||

| Management Priority: Corporate Performance Framework |

Type: Previous commitment |

Strategic Outcome(s): All strategic outcomes |

Status

|

||

| Management Priority: Integrated Risk Management |

Type: Previous commitment |

Strategic Outcome(s): All strategic outcomes |

Status

|

||

| Management Priority: Human Resources Modernization Initiatives |

Type: Previous commitment |

Strategic Outcome(s): All strategic outcomes |

Status

|

||

| Management Priority: Project Management Governance |

Type: Previous commitment |

Strategic Outcome(s): All strategic outcomes |

Status

|

||

| Management Priority: Integrated Human Resource and Business Planning |

Type: Previous commitment |

Strategic Outcome(s): All strategic outcomes |

Status

|

||

Risk Analysis

Industry CanadaÆs capacity to achieve its strategic outcomes depends on its ability to identify, manage and mitigate department-wide risks. In 2008¢09, the Department continued to make progress in this area, advanced its Integrated Risk Management Framework, and used the standard approach and principles set out in the framework to update its Corporate Risk Profile (CRP). The CRP established a clear direction for managing risks at Industry Canada and presented an assessment of the DepartmentÆs risks based on government priorities, external and internal organizational context, current management practices, and available resources. It also identified the strategic risks that need to be managed (such as people management, recruitment, development and retention) to enable Industry Canada to achieve its mandate, strategic outcomes and the expected results of its program activities.

The Department depends on its workforce to adapt its organizational structure to new and shifting priorities. As such, our renewal initiative priorities are focusing on people, retaining existing expertise and recruiting new staff with the necessary competencies. Early identification and detection of potential vacancies for specific groups and levels, e.g., research, IT and engineers, could help mitigate these risks. For those specific groups, management training courses were utilized to increase the pool of qualified candidates for succession planning. A career path was also developed for junior engineers and Computer Systems Administration (CS) functional groups.

Nationally, the performance of Canadian industry sectors has been impacted not only by the economic crisis, but also by rapidly changing technology, increased demands and trade barriers in international markets, and the convergence of network technologies and multimedia services. Some sectors have rescheduled projects, reduced production and laid off employees. Industry Canada addressed the challenges undermining the performance of Canadian industries by identifying and analyzing specific issues and developing strategic partnerships with research and development (R&D) organizations and other stakeholders to mitigate barriers to commercializing technologically intensive goods and services.

Expenditure Profile

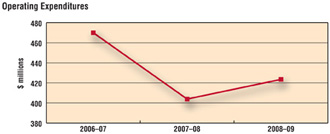

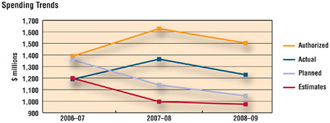

Industry CanadaÆs total actual spending for 2008¢09 was $1.23 billion. This represents a 9.5% decrease from 2007¢08 actual spending, which was primarily due to variations in grants and contributions and other transfer payments, including a $105-million reduction related to the Seven Centres of Excellence for which funding was for one year only.

Industry Canada increased its operating budget from $403.9 million in 2007¢08 to $423.5 million in 2008¢09. This 4.85% increase helped the Department to deliver more benefits to Canadians and better contribute to its strategic outcomes.

D

D

D

D

Voted and Statutory Items

This table illustrates the way in which Parliament approved Industry CanadaÆs resources and shows the changes in resources derived from supplementary estimates and other authorities, as well as how funds were spent.

| Vote # or Statutory Item (S) |

Truncated Vote or Statutory Wording | 2008¢09 ($ millions) | |||

| Main Estimates | Planned Spending | Total Authorities | Actual Spending | ||

| 1 | Operating Expenditures | 332.9 | 342.2 | 449.1 | 423.5 |

| 5 | Capital Expenditures | 12.6 | 13.0 | 21.9 | 17.7 |

| 10 | Grants and Contributions | 464.3 | 536.0 | 649.6 | 560.5 |

| (S) | Contributions to Employee Benefit Plans | 50.1 | 50.1 | 56.6 | 56.6 |

| (S) | Minister of Industry Ś Salary and Motor Car Allowance | 0.1 | 0.1 | 0.1 | 0.1 |

| (S) | Canadian Intellectual Property Office Ś Revolving Fund | 4.9 | 4.9 | 139.5 | (12.9) |

| (S) | Liabilities under the Small Business Loans Act | 2.1 | 2.1 | 0.6 | 0.6 |

| (S) | Liabilities under the Canada Small Business Financing Act | 81.7 | 81.7 | 110.3 | 110.3 |

| (S) | Grant to CANARIE Inc. (in connection with the Budget Implementation Act, 2007) | 24.0 | 15.0 | 28.0 | 28.0 |

| (S) | Grant to Perimeter Institute (in connection with the Budget Implementation Act, 2007) | - | - | 13.5 | 13.5 |

| (S) | Grant to Genome Canada | - | - | 29.5 | 29.5 |

| (S) | Spending of proceeds from the disposal of surplus Crown Assets | - | - | 0.6 | 0.3 |

| (S) | Refunds to amounts credited to revenues in previous years | - | - | 0.9 | 0.9 |

| Total Budgetary | 972.5 | 1,045.0 | 1,500.1 | 1,228.6 | |

|---|---|---|---|---|---|

| L15 | Payments pursuant to subsection 14(2) of the Department of Industry Act | 0.3 | 0.3 | 0.3 | - |

| L20 | Loan pursuant to paragraph 14(1)(a) of the Department of Industry Act | 0.5 | 0.5 | 0.5 | - |

| L97b | Advances to regional offices and employees posted abroad. Appropriation Act No. 1 1970. Limit $1,950,000 (net) | 2.0 | - | ||

| Total Non-Budgetary | 0.8 | 0.8 | 2.8 | - | |

| Total Department | 973.3 | 1,045.8 | 1,502.9 | 1,228.6 | |

Human Resources

| Human Resources 2008¢09 | Planned | Actual | Difference |

| Full-Time Equivalents (FTEs) | 5,719 | 5,341 | 378 |

1 Indicators of Product Market Regulation. Organisation for Economic Co-operation and Development, 2008

2 Employment by Industry. Statistics Canada, 2009

3 Measuring the Information Society: The ICT Development Index. International Telecommunications Union, 2009, p.32