Common menu bar links

Breadcrumb Trail

ARCHIVED - Department of Finance Canada - Report

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Minister’s Message

I am pleased to present the 2012–13 Report on Plans and Priorities for the Department of Finance Canada. This Report presents a concise overview of Canada's fiscal and economic agenda for the coming year to address the challenges and opportunities facing our country as it works to ensure a sustainable economic recovery.

Despite a fragile global recovery, Canada's fiscal and economic fundamentals remain strong. Our financial system is ranked as the soundest in the world, with well-run financial institutions based on solid risk management. Our effective regulatory and supervisory framework has been consistently recognized as a world leader.

As outlined in the Economic Action Plan 2012, the overarching priority of the Department for 2012–13 is to support economic growth and job creation while managing the return to balanced budgets over the medium term. In doing so, the Department will focus on four program priorities.

The first, sound fiscal management will ensure the responsible management of the federal budget. An effective, credible fiscal framework contributes to a sound and stable macroeconomic environment and helps maintain the competitiveness, efficiency, fairness and simplicity of Canada's tax system and sustain our social infrastructure.

The second, sustainable economic growth, focuses on the Department's leadership role in developing sound macroeconomic, tax and structural policies; promoting competitiveness and innovation; and supporting a competitive, efficient, safe and sound financial sector.

The third, sound social policy framework, involves managing current and emerging pressures related to social policy and major transfer payment programs to ensure that those programs are sustainable and effective for all Canadians.

And the fourth, effective international influence, focuses on active engagement with key economic partners on bilateral, regional and multilateral issues to leverage Canada's strengths and promote Canadian trade and investment interests. This effort includes fostering innovative and effective aid policies to reduce global poverty and working toward a stable and secure international financial system.

This Report provides key details on the Department's plans to support these priorities and to ensure that Canada remains on track toward a sustainable economic recovery.

The Honourable James M. Flaherty

Minister of Finance

Section I: Organizational Overview

The Report on Plans and Priorities is a key ministerial accountability document to Parliament in which the Department of Finance Canada's expenditure plans are outlined. The Report provides details over a three-year period on the Department's priorities, plans and their expected results, including links to related resource requirements. The Report also discusses how the Department plans to make progress toward its strategic outcome through the program activities.

Raison d’être

The Department of Finance Canada contributes to a strong economy and sound public finances for Canadians. It does so by monitoring developments in Canada and around the world to provide first-rate analysis and advice to the Government of Canada and by developing and implementing fiscal and economic policies that support the economic and social goals of Canada and its people. The Department of Finance Canada also plays a central role in ensuring that government spending is focused on results and delivers value for taxpayer dollars. The Department interacts extensively with other federal organizations and acts as an effective conduit for the views of participants in the economy from all parts of Canada.

Responsibilities

Created in 1867, the Department of Finance Canada was one of the original departments of the Government of Canada and had as its primary functions bookkeeping, administering the collection and disbursement of public monies, and servicing the national debt. Today, the Department helps the Government of Canada develop and implement strong and sustainable economic, fiscal, tax, social, security, international and financial sector policies and programs. It plays an important central agency role, working with other departments to ensure that the government's agenda is carried out and that ministers are supported with high-quality analysis and advice.

The Department's responsibilities include the following:

- Preparing the federal Budget and the Update of Economic and Fiscal Projections;

- Preparing the Annual Financial Report of the Government of Canada and, in cooperation with the Treasury Board of Canada Secretariat and the Receiver General for Canada, the Public Accounts of Canada;

- Developing tax and tariff policy and legislation;

- Managing federal borrowing on financial markets;

- Designing and administering major transfers of federal funds to the provinces and territories;

- Developing financial sector policy and legislation; and

- Representing Canada in various international financial institutions and groups.

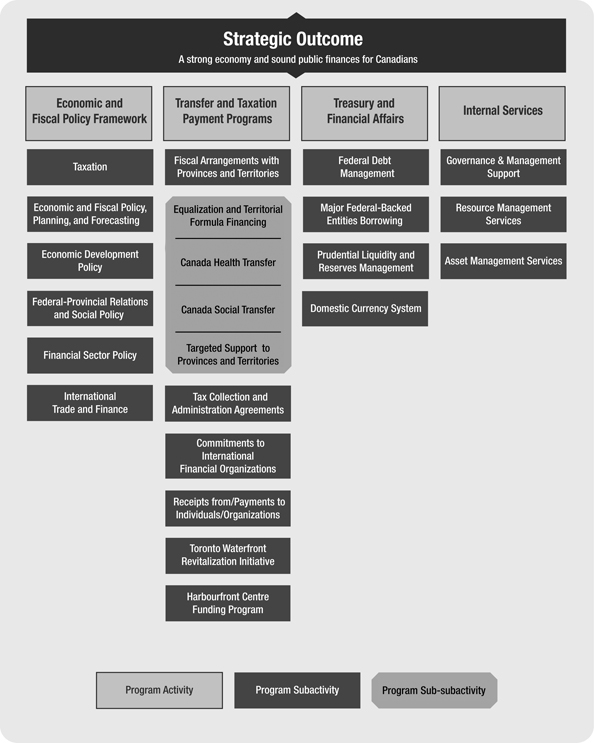

Strategic Outcome and Program Activity Architecture

Some adjustments have been made to the Department of Finance Canada's Program Activity Architecture (PAA) for fiscal year 2012–13. The scope of the Department's strategic outcome has been narrowed to focus more on fiscal and economic matters, including a closer alignment with the Department's raison d'être and responsibilities. The Toronto Waterfront Renewal

sub activity is now presented as two sub-subactivities, namely Toronto Waterfront Revitalization Initiative and Harbourfront Centre Funding Program. Overall, the changes have no impact on program spending.

The Department of Finance Canada provides effective economic leadership with a clear focus on one strategic outcome, which expresses a long-term and enduring benefit for Canadians:

- A strong economy and sound public finances for Canadians.

The Report on Plans and Priorities describes how plans and commitments for 2012–13 are linked to the Department's PAA, for which expected results and performance indicators were developed as part of the performance measurement framework.

The PAA provides an overview of how all of the program activities and subactivities contribute to the Department's strategic outcome.

The Department has four program activities, which each contain a varying number of program subactivities. The four program activities are Economic and Fiscal Policy Framework, Transfer and Taxation Payment Programs, Treasury and Financial Affairs, and Internal Services.

The Economic and Fiscal Policy Framework program activity is the primary source of advice and recommendations to the Minister of Finance on issues, policies and programs of the Government of Canada in the areas of economic, fiscal and social policy; federal-provincial relations; financial affairs; taxation; and international trade and finance.

The Transfer and Taxation Payment Programs program activity supports provinces and territories with funding for health, social programs and other shared priorities. Through transfer payments, this program activity enables less prosperous provincial governments to provide their residents with public services that are reasonably comparable to those in other provinces, at reasonably comparable levels of taxation, and provides territorial governments with funding to support public services, in recognition of the higher cost of providing programs and services in the North. This program activity also includes the collection and remittance of provincial, territorial and Aboriginal taxes under tax collection and administration agreements.

The Treasury and Financial Affairs program activity manages debt operations and other financial operations of the Government of Canada.

The Internal Services program activity includes a number of functions and resources that support the Department as a whole in achieving its strategic outcome. Thus, it supports each program activity within the PAA. The Department's PAA is presented in the graphic below.

Organizational Priorities

The overarching priority of the Department of Finance Canada for 2012–13 is to support economic growth and job creation while managing the return to balanced budgets over the medium term. In doing so, the Department will focus on six priorities. The first four priorities are operational in nature and focus on ways to improve value for money in the Department's program base. The last two priorities focus on improving the Department's management practices, including human resource and information management. These priorities, and the initiatives contained within, represent the Department's directions for action in advancing its strategic outcome. Each priority supports the Department's strategic outcome, which is aligned to the broader government-wide outcomes.

| Priority | Type1 | Program Activities |

|---|---|---|

| Sound fiscal management | Ongoing |

PA 1.1: Economic and Fiscal Policy Framework |

| Description The Department of Finance Canada will ensure effective management of the fiscal framework, including responsible management of the federal budget, ensuring the stability of the financial services sector and the competitiveness, efficiency, fairness and simplicity of Canada's tax system. |

||

|

Why is this a priority?

Plans for meeting the priority

|

||

| Priority | Type | Program Activity |

|---|---|---|

| Sustainable economic growth | Ongoing | PA 1.1: Economic and Fiscal Policy Framework |

| Description Strong sustainable growth requires sound macroeconomic, tax and structural policies that support the drivers of productivity and growth: business investment and innovation, human capital formation, renewed public infrastructure, and a safe and sound financial system. The Department will continue to play a leadership role by promoting measures that support competitiveness and innovation, financial sector reform, and a competitive, economically efficient, fair and simple tax system. |

||

|

Why is this a priority?

Plans for meeting the priority

|

||

| Priority | Type | Program Activities |

|---|---|---|

| Sound social policy framework | Ongoing |

PA 1.1: Economic and Fiscal Policy Framework |

| Description A sound social policy framework requires managing current and emerging pressures related to social policy and major transfer payment programs to ensure that those programs are sustainable and effective for all Canadians. |

||

|

Why is this a priority?

Plans for meeting the priority

|

||

| Priority | Type | Program Activities |

|---|---|---|

| Effective international influence | Ongoing | PA 1.1: Economic and Fiscal Policy Framework PA 1.2: Transfer and Taxation Payment Programs |

| Description Effective international influence requires active engagement with key economic partners on bilateral, regional and multilateral issues to leverage Canada's strengths and to promote Canadian interests. This effort includes promoting Canada's trade and investment interests, fostering effective and innovative aid policies aimed at reducing global poverty, and working toward a more stable and secure international financial system. |

||

|

Why is this a priority?

Plans for meeting the priority

|

||

| Priority | Type | Strategic Outcome Program Activities |

|---|---|---|

| Sound financial and human resources management in an environment of budgetary restraint | Previously committed to |

The strategic outcome and all the program activities |

| Description Continued fiscal restraint creates a greater need for sound and efficient management of the Department's operational budget and human resources through strategic recruitment, employee development, performance management and retention. |

||

|

Why is this a priority?

Plans for meeting the priority

|

||

| Priority | Type | Strategic Outcome Program Activities |

|---|---|---|

| Strengthen information management and information technology (IM/IT) infrastructure | New |

The strategic outcome |

| Description Given the nature of the Department's work and the need for effective information security safeguards, the Department will continue to make improvements to its IM/IT infrastructure and services to manage security concerns in a manner that addresses both security and work environment requirements |

||

|

Why is this a priority?

Plans for meeting the priority

|

||

Risk Analysis

The Department of Finance remains committed to the ultimate outcome of ensuring a strong economy and sound public finances for Canadians. As global uncertainties continue, the Department's priorities and associated plans are focused on addressing key risks for the planning period.

The global economic recovery has recently weakened, becoming more uneven and uncertain, and the world economy continues to face significant challenges, including the European sovereign and banking debt crisis. Going forward, private sector economists are calling for positive, but modest growth in Canada and the United States. With this forecast, the Department's program priorities and associated plans are designed to mitigate the risks to the Canadian economy while seizing opportunities to strengthen economic growth and job creation and to advance Canada's leadership internationally.

In particular, the Department will continue to manage the economic volatility risks by ensuring it has in place the infrastructure, resources and authorities needed to respond to an evolving economic and financial sector environment. The Department will also manage the increased requirement for coordinated international decision making to deal with uncertain world economic conditions, with attention to ensuring that responsible agencies take effective coordinated action to support the soundness, integrity and reputation of the Canadian financial system.

The Department recognizes that as a knowledge-based organization, its continued success depends on attracting, developing and retaining a highly skilled and adaptable workforce. The Department will continue to focus on staff retention, strategic recruitment, cost-effective training and development initiatives as a successful way of achieving desired outcomes.

Given the nature of its mandate, the Department requires a reliable and secure information technology (IT) infrastructure. In light of the prevalence of IT security incidents, in both public and private sectors, and the anticipated move of the Department's operations to another location, the Department will continue to strengthen its IT and information management (IM) infrastructure based on best practices, including continued improvements to the secure computer network environment in collaboration with Shared Services Canada, and strengthened IM practices.

Planning Summary

Financial Resources ($ thousands)

The financial resources presented below represent the total funds available to the Department of Finance Canada to deliver its mandate. They are composed of statutory votes and voted amounts.

| 2012–13 | 2013–14 | 2014–15 |

|---|---|---|

| 86,139,215.2 | 90,255,799.8 | 92,826,305.8 |

Human Resources (Full-Time Equivalent—FTE)

The following table summarizes the total planned human resources for the Department for the next three fiscal years. Human resources are presented as the number of full-time equivalents (FTEs)

| 2012–13 | 2013–14 | 2014–15 |

|---|---|---|

| 822 | 797 | 792 |

Planning Summary Tables

The tables below list the Department's strategic outcome and the associated performance indicators and targets, as well as program activities and the financial resources allocated to each.

| Performance Indicators | Targets |

|---|---|

| Real gross domestic product (GDP) growth | In line with G7 counterparts |

| Federal budgetary balance | In line with Government of Canada commitments |

| Unemployment rate | In line with G7 counterparts |

| Program Activity | Forecast Spending 2011–12 |

Planned Spending | Alignment to Government of Canada Outcomes | ||

|---|---|---|---|---|---|

| 2012–13 | 2013–14 | 2014–15 | |||

| PA 1.1: Economic and Fiscal Policy Framework | 246,323.7 | 72,940.0 | 64,006.0 | 62,373.0 | Strong Economic Growth |

| PA 1.2: Transfer and Taxation Payment Programs | 56,668,170.0 | 57,042,204.2 | 60,124,289.6 | 61,199,894.6 | All outcomes |

| PA 1.3: Treasury and Financial Affairs | 28,523,000.0 | 28,982,000.0 | 30,015,339.2 | 31,509,006.2 | Strong Economic Growth |

| Total Planned Spending | 86,097,144.2 | 90,203,634.8 | 92,771,273.8 | ||

| Program Activity | Forecast Spending 2011–12 |

Planned Spending | ||

|---|---|---|---|---|

| 2012–13 | 2013–14 | 2014–15 | ||

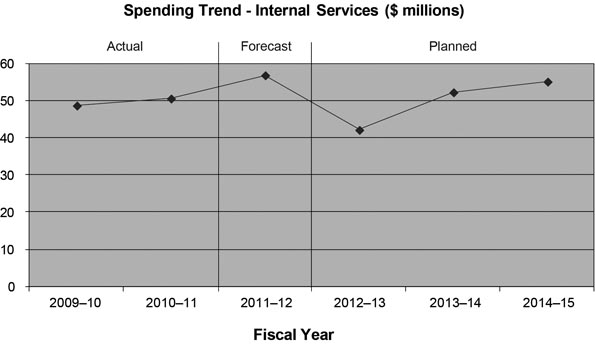

| PA 1.4 Internal Services | 56,741.9 | 42,071.0 | 52,165.0 | 55,032.0 |

| Total Planned Spending | 42,071.0 | 52,165.0 | 55,032.0 | |

Contribution to the Federal Sustainable Development Strategy

The Federal Sustainable Development Strategy (FSDS) outlines the Government of Canada's commitment to improving the transparency of environmental decision making by articulating its key strategic environmental goals and targets. The Department of Finance Canada ensures that consideration of these outcomes is an integral part of its decision-making processes. In particular, through the federal Strategic Environmental Assessment (SEA) process, any new policy, plan or program initiative includes an analysis of its impact on attaining the FSDS goals and targets. The results of SEAs are made public when an initiative is announced and include the impacts on achieving FSDS goals and targets.

The Department of Finance Canada contributes to Theme I: Addressing Climate Change and Air Quality; Theme III: Protecting Nature; and Theme IV: Shrinking the Environmental Footprint – Beginning with Government, as denoted by the visual identifiers below.

![]()

![]()

![]()

These contributions are components of the following program activities and are further explained in Section II of this Report:

- 1.1 Economic and Fiscal Policy Framework; and

- 1.4 Internal Services.

For additional details on the Department of Finance Canada's activities to support sustainable development, please see Section II of this Report and the Department's website. For complete details on the FSDS, please visit the Environment Canada website.

Expenditure Profile

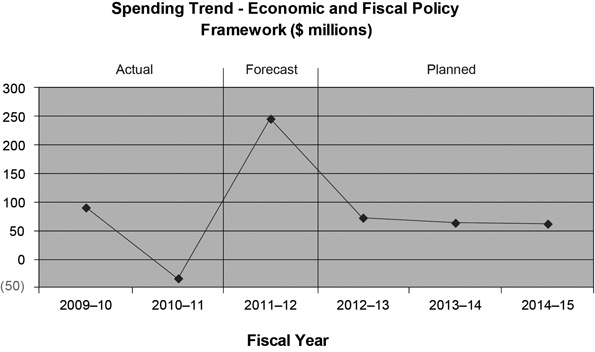

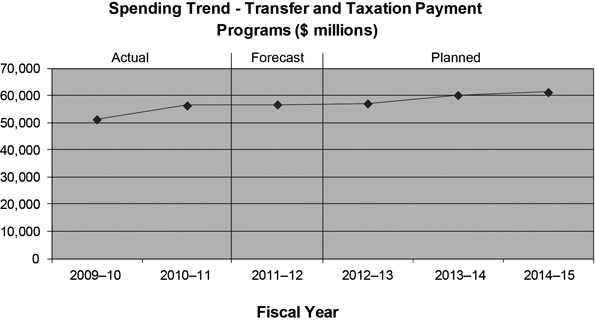

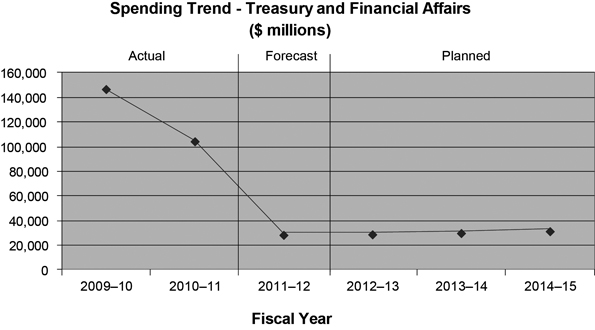

For the 2012–13 fiscal year, the Department of Finance Canada plans to spend $86.1 billion to meet the expected results of its program activities and contribute to its strategic outcome. The figures below illustrate the Department's spending trend by program activity from 2009–10 to 2014–15.

Spending in the Economic and Fiscal Policy Framework program activity includes departmental operating expenditures and employee benefits.

The decrease in 2010–11 actual expenditures is due mainly to the Canadian Millennium Scholarship Foundation ($121.3 million). The Foundation was dissolved in 2010–11, and the residual amount of the original payment made in 1998–99 was credited to the Consolidated Revenue Fund.

The sharp increase in 2011–12 forecast spending and the subsequent decrease in 2012–13 planned spending are due mainly to a planned one-time payment to provinces and territories of up to $150 million for matters relating to the transition to a Canadian Securities Regulator provided under the Budget Implementation Act, 2009. In light of the Supreme Court of Canada's decision on the proposed Securities Act (Reference re Securities Act), the payment planned for 2011–12 will not take place.

Departmental operating expenditures and employee benefits decrease from $73 million in

2012–13 to $64 million in 2013–14 and $62 million in 2014–15 because of the expiry of time-limited funding related to various initiatives, including the government's advertising program and the funding in support of Budget 2011 initiatives.

Spending in the Transfer and Taxation Payment Programs program activity includes transfer payments to the provinces and territories and transfers to international financial institutions for the purposes of debt relief, and financial and technical assistance to developing countries. In addition, the program activity also includes the administration of provincial, territorial and Aboriginal taxes under tax collection and administration agreements.

The increase from actual to forecast and planned spending is due mainly to increased transfer payments for the Canada Health Transfer, the Canada Social Transfer, Fiscal Equalization, and Territorial Formula Financing, which are forecast to grow as legislated until 2013–14. The Canada Health Transfer will grow by 6 per cent annually, and the Canada Social Transfer, by 3 per cent annually. Territorial Formula Financing will grow in line with its legislated funding framework, and the Equalization program will grow in line with the economy. Payments to provinces related to sales tax harmonization started in 2009–10 and are expected to end in 2013–14 with the payment provided for under a harmonization agreement with Quebec.

Spending in the Treasury and Financial Affairs program activity includes loans to Crown corporations, interest and other costs related to the public debt, and expenditures related to domestic coinage.

In Budget 2007, the government announced that the domestic borrowing needs of Farm Credit Canada, the Business Development Bank of Canada, and Canada Mortgage and Housing Corporation would be met through direct lending beginning April 1, 2008. Actual expenditures reflect loans to these organizations of $116.4 billion and $76.1 billion in 2009–10 and 2010–11 respectively. There is no forecast and planned spending for 2011–12 and subsequent years for direct lending to these Crown corporations because the gross borrowing requirements of Crown corporations are driven by the need to match the terms and structure of the borrowing requirements of their clients. These activities are influenced by current and expectations of future economic conditions and can vary greatly over a short period of time. Thus, there can be very large and significant variances both inter-year and intra-year.

Interest and other costs related to the public debt vary depending on changes to debt levels and interest rates. Actual expenditures reflect public debt costs of $27.0 billion and $27.9 billion in 2009–10 and 2010–11 respectively. Forecast and planned spending includes an amount of $28.4 billion in 2011–12 and $28.9 billion in 2012–13.

Costs for the production and distribution of domestic coinage vary based on metal composition, production volumes and distribution. Actual expenditures reflect costs of $133 million and $102 million in 2009–10 and 2010–11 respectively. Forecast spending includes an amount of $130 million in 2011–12 and $120 million in 2012–13.

The Internal Services program activity involves a group of related activities and resources that support program activities and other corporate obligations of the Department.

Spending for the Internal Services program activity mostly includes operating expenditures and employee benefits. The increase in forecast spending in 2011–12 is due mainly to funding for enhanced IT network administration. The decrease in 2012–13 can be explained by the transfer of funding to Shared Services Canada and to time-limited funding of various initiatives. The subsequent increase in 2013–14 and 2014–15 is due mainly to the redevelopment of a Crown site at 90 Elgin Street, Ottawa.Estimates by Vote

For information on our organizational appropriations, please see the 2012-13 Main Estimates publication.