Common menu bar links

Breadcrumb Trail

ARCHIVED - Department of Finance Canada - Report

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

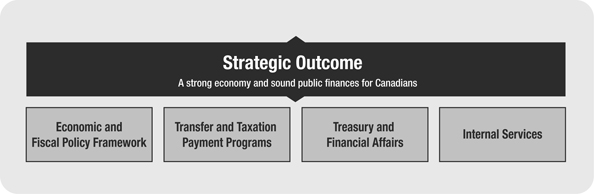

Section II - Analysis of Program Activities by Strategic Outcome

Section II presents the Department of Finance Canada plans for the four program activities, the program activities' expected results and associated performance indicators, as well as the financial and non-financial resources that will be dedicated to each program activity over the planning period. The plans will ensure that progress is made toward the strategic outcome.

Strategic Outcome

The Department of Finance Canada provides effective economic leadership with a clear focus on one strategic outcome, which all program activities support.

Program Activity 1.1: Economic and Fiscal Policy Framework

Program Activity Description

This program activity is the primary source of advice and recommendations to the Minister of Finance on issues, policies and programs of the Government of Canada related to the areas of economic, fiscal and social policy; federal-provincial relations; financial affairs; taxation; and international trade and finance. The work conducted by this program activity involves extensive research, analysis, and consultation and collaboration with partners in both the public and private sectors, including the Cabinet and the Treasury Board; Parliament and parliamentary committees; the public and Canadian interest groups; departments, agencies and Crown corporations; provincial and territorial governments; financial market participants; the international economic and finance community; and the international trade community. In addition, this program activity includes policy advice on the development of Memoranda to Cabinet, negotiation of agreements, drafting of legislation and sponsoring of bills through the parliamentary process, which are subsequently administered by other program activities within the Department and by other government departments and agencies.

Financial Resources ($ thousands)

| 2012–13 | 2013–14 | 2014–15 |

|---|---|---|

| 72,940.0 | 64,006.0 | 62,373.0 |

Human Resources (Full-Time Equivalent—FTE)

| 2012–13 | 2013–14 | 2014–15 |

|---|---|---|

| 561 | 536 | 531 |

| Program Activity Expected Results | Performance Indicators | Targets |

|---|---|---|

| An economic, social and fiscal framework that supports financial stability, sustainable growth, productivity, competitiveness and economic prosperity | Federal budget balance | In line with Government of Canada commitments. |

| Competitiveness and efficiency of Canada's tax system | No target. The goal is to continue to propose changes to the tax system that improve incentives to work, save and invest. | |

| Stability of financial services sector | No target. The long-term goal is to contribute to low and stable interest rates. |

Planning Highlights2

Planning Highlights2

Supporting prudent economic and fiscal management

The Department will continue to ensure the effective management of the fiscal framework, including the government’s plan to bring the budget back to balance over the medium term.

The Department will assess Canada's current and future economic conditions to formulate first-rate economic policy advice and to provide the basis for accurate fiscal planning. The activities will include regular monitoring and forecasting of Canada's and other countries' economic performance, conducting private sector surveys of the Canadian economic outlook, assessment of factors affecting future growth prospects, and development of contingency plans in the event of weaker than expected economic performance.

The Department will provide spending results related to the extension of selected Economic Action Plan (EAP) programs in the Annual Financial Report and Public Accounts for the 2011–12 fiscal year, to be released in fall 2012.

Improving the competitiveness, economic efficiency, fairness, and simplicity of the tax system

Improvements to the competitiveness, efficiency, fairness and simplicity of Canada's tax system provide a basis for Canadians and Canadian businesses to realize their full potential, thereby encouraging investment, promoting economic growth and increasing Canadians' standard of living. These improvements also strengthen Canadians' confidence in the tax system.

For fiscal year 2012–13, the Department will continue to develop analysis and evaluate options with respect to making the personal income tax system more competitive for highly skilled workers, and reduce disincentives to work for low and modest-income Canadians.

The Department will also continue to monitor the business tax system to ensure international competitiveness and economic efficiency. In addition, the Department will continue to collaborate with provinces and territories to ensure the smooth functioning of the tax system. For example, the Government of Canada will implement its transitional measures to facilitate the transition out of the Harmonized Sales Tax (HST) in British Columbia and will work with Quebec to implement the Canada-Quebec Comprehensive Integrated Tax Coordination Agreement.

At the international level, the Department will continue to review issues identified by the Advisory Panel on Canada's System of International Taxation. As well, the Department will contribute to the G20 initiative to rationalize fossil fuel subsidies by phasing out inefficient fossil fuel subsidies over the medium term. The Department will also continue to negotiate international tax treaties and tax information and exchange agreements with other countries in order to further the policies put forward in Budget 2007 concerning tax information exchange, and the international consensus reached at the G20 and the Organisation for Economic Co-operation and Development, to use tax information exchange to combat tax avoidance and tax evasion.

To maintain the integrity of the tax system and protect the government's revenue base, the Department will continue to analyze and develop options to address aggressive tax planning and tax avoidance.

Supporting the Government of Canada's economic agenda

In support of higher productivity and economic growth, the Department will work toward the implementation of the Government's economic agenda in several economic sectors, including the automotive, aerospace, manufacturing, transportation, tourism, agriculture, fisheries, information and communications technologies, shipbuilding and forestry sectors; as well as in the areas of energy and the environment, research and development, commercialization, regional economic development, infrastructure, defence and public safety.

Furthermore, the Department will continue to lead the systematic review of the government's corporate assets, including Crown corporations under the Minister's responsibility, real property, and other holdings.

Supporting sound social policy and the renewal of major transfer programs

Incollaboration with other departments and central agencies, the Department will continue to develop policy proposals that are consistent with, and deliver on, the government's priorities in areas such as labour markets, Aboriginal issues, justice, public safety, and income security. As per the commitments made at the Crown-First Nations Gathering on January 24, 2012, a working group with First Nations, Aboriginal Affairs and Northern Development Canada, Finance Canada and other relevant departments will be established to review the structure of financial arrangements between the federal government and First Nations.

Furthermore, the Department will work with provinces and territories to ensure the ongoing sustainability of the Canada Pension Plan.

The Department will continue discussions with the provinces and territories in preparation for the 2014–15 renewal of federal transfer payment programs. The focus is on reviewing the technical aspects of the Equalization and Territorial Formula Financing programs.

Promoting a stable, efficient and competitive financial sector

With the November 2011 Update of Economic and Fiscal Projections and the 2011 and 2012 budget announcements, the Department will continue to assess the economic outlook and employ the appropriate policy instruments to support stronger financial systems and economic recovery at home.

At the international level, the Department will work with the Financial Stability Board as well as its member jurisdictions and international standard-setting organizations to pursue the G20 financial sector reform agenda, with the objective of ensuring the resilience of the global financial system.

In light of refining the existing financial sector frameworks, the Department will continue to review the legislative frameworks governing federally regulated financial institutions to ensure that they reflect current conditions. Work in this area will include:

- The development of a demutualization framework for property and casualty insurance companies;

- The development of a legislative framework to promote a robust covered bond market; and

- The development of a national financial literacy strategy and enhancements to the financial consumer protection framework.

The Department will continue to promote the effective and efficient provision of financial services in Canada. It will continue to work with the provinces and territories to implement the framework for Pooled Registered Pension Plans across Canada and will assess the effectiveness of Canada's anti-money laundering and anti-terrorist financing regime and recommend enhancements as needed. With respect to the recommendations of the Task Force for the Payments System Review, the Department will provide advice and recommendations on options for the future of Canada's payments system framework. It will also work to provide advice and recommendations on implementation of our G20 commitments on financial sector regulation, in areas such as over-the-counter derivatives and financial institution resolution. The Department will continue to work with provinces and territories on enhancing securities regulation taking into account the Supreme Court of Canada's decision on the proposed Securities Act (Reference re Securities Act).

Supporting global finance and trade

As the global economic recovery continues to face challenges and uncertainties, the Department will continue to provide high-quality advice and demonstrate international leadership by co-chairing the working group responsible for steering the G20's Framework for strong, sustainable and balanced growth. In the same way, the Department will provide advice and support Canada's engagement on international economic cooperation matters arising from G7 and G20 forums, the International Monetary Fund, the World Bank, and the Organisation for Economic Co-operation and Development.

Additionally, the Department will advance innovative financing tools in the international community that balance fiscal restraint with Canada's support for global development goals. Furthermore, the Department will continue to advance Canada's trade policy framework in a manner that encourages trade growth, including supporting trade negotiations, both multilaterally under the World Trade Organization, and bilaterally/regionally with priority countries.

Program Activity 1.2: Transfer and Taxation Payment Programs

Program Activity Description

This program activity includes the administration of transfer and taxation payments to provinces and territories as well as taxation payments to Aboriginal governments in accordance with legislation and negotiated agreements. Also included in this program activity are commitments and agreements with international financial organizations aimed at supporting the economic advancement of developing countries. In addition, from time to time, the government will enter into agreements or enact legislation to respond to unforeseen pressures. These commitments can result in payments, generally statutory transfer payments, to a variety of recipients, including individuals, organizations, and other levels of government.

Financial Resources ($ thousands)

| 2012–13 | 2013–14 | 2014–15 |

|---|---|---|

| 57,042,204.2 | 60,124,289.6 | 61,199,894.6 |

Human Resources (Full-Time Equivalent—FTE)

| 2012–13 | 2013–14 | 2014–15 |

|---|---|---|

| — | — | — |

| Program Activity Expected Results | Performance Indicators | Targets |

|---|---|---|

| Design and administration of the provision of payments to Canadian provinces and territories in support of providing their residents with public services, and to international organizations to help promote the economic advancement of developing countries | Regulations amended to reflect changes made to the Equalization program in Budget legislation | According to statutory requirements, or as determined by environment |

| Timely provision of information for Government of Canada reports | No target, as materials are generated on an as-needed basis according to environment | |

| Percentage of reporting requirements met, including reporting to Parliament, the Office of the Auditor General of Canada, internal auditors, the International Monetary Fund and the Organisation for Economic Co-operation and Development, etc. | 100 per cent of requests fulfilled on time and in an accurate manner |

Planning Highlights

Planning Highlights

Supporting fiscal arrangements with provinces and territories

In the context of an aging population and slowing labour force growth, and ongoing uncertainty surrounding the global and domestic outlooks, it is important that federal transfers and social programs be sustainable and effective for Canadians.

To support fiscal arrangements with provinces and territories, the Department will continue to update regulations and legislation related to major transfer payment programs and other legislative requirements under the responsibility of the Minister of Finance, where required, to ensure that the administration of these programs remains timely, accurate and transparent. In this context, the Department will continue to improve modeling capacity where possible, and undertake further refinements of the data used in calculating major transfer entitlements to support the effective management of transfer payment programs.

The Department will also improve the transparency of the federal transfer payment system and continue to engage with the provinces and territories on technical issues in preparation for the 2014–15 renewal of major transfer payment programs.

Ensuring that tax agreements with provinces, territories and Aboriginal governments meet policy and administrative objectives

The Department will continue to work to improve and enhance the application and administration of its tax agreements with provinces, territories and Aboriginal governments. This will include continuing to align the payments made with the terms and conditions of the existing agreements to ensure accurate and timely payments.

The Department will also participate in negotiations with Aboriginal governments for new tax administration agreements, and work with provinces and territories to facilitate similar arrangements between them and Indian bands.

Supporting international development and global financial stability

The Department will deliver on the Government of Canada's commitments to support international financial institutions and multilateral development banks in fulfilling their renewed mandates in line with Canadian objectives. These objectives include strengthening governance and accountability, helping to ensure sustainable global growth and supporting the economic advancement of developing countries.

Supporting sustainable urban development and infrastructure renewal

With respect to the Toronto Waterfront Revitalization Initiative (TWRI), the Department will oversee the completion of federally funded projects and the administrative wind-down of the TWRI program, to be terminated by March 31, 2014. Also, the Department will manage the Harbourfront Centre Funding Program, which has been renewed for five years until 2016, in order to support the economic, social and cultural development of the Toronto waterfront.Program Activity 1.3: Treasury and Financial Affairs

Program Activity Description

This program activity provides direction for Canada's debt management activities, including the funding of interest costs for the debt and service costs for new borrowings. In addition, the program manages investments in financial assets needed to establish a prudent liquidity position. This program supports the ongoing refinancing of government debt coming to maturity, the execution of the budget plan, and other financial operations of the government, including governance of the borrowing activities of major government-backed entities, such as Crown corporations. This program activity is also responsible for the system of circulating Canadian currency (bank notes and coins) to meet the needs of the economy.

Financial Resources ($ thousands)

| 2012–13 | 2013–14 | 2014–15 |

|---|---|---|

| 28,982,000.0 | 30,015,339.2 | 31,509,006.2 |

Human Resources (Full-Time Equivalent—FTE)

| 2012–13 | 2013–14 | 2014–15 |

|---|---|---|

| 25 | 25 | 25 |

| Program Activity Expected Results | Performance Indicators | Targets |

|---|---|---|

| Prudent and cost-effective management of the government's treasury activities and financial affairs | Percentage of program line targets achieved | 100 per cent of program line targets achieved |

| Alignment of contingency plans to potential financial and operational risk events | 100 per cent alignment |

Planning Highlights

Managing Treasury and Financial Affairs

In 2012–13, the Department will take actions to ensure sufficient funding from government debt management operations while providing appropriate flexibility to adapt to changing circumstances, and ensure timely, cost-effective and well-managed funding for Crown corporations.

In the area of debt and reserve portfolio management, the Department will continue to implement the medium-term debt strategy announced in Budget 2011, involving the introduction of new benchmark maturity dates and other actions to reduce refinancing risk, increased holdings of prudential liquidity, as well as improved metrics to measure progress. With long-term interest rates at historically low levels, the Government plans to increase issuance of 10-year bonds and reduce the stock of treasury bills and issuance of short-term bonds compared to 2011–12. Together, these actions will help achieve the government's objective of raising stable, low-cost funding while preserving a well-functioning Government of Canada securities market. The Department will continue to implement the funding and investment plan to increase the government's liquidity position under the new prudential liquidity plan. The objective of the prudential liquidity plan is to safeguard the government's ability to meet payment obligations in situations where normal access to funding markets may be disrupted or delayed.

With respect to circulating currency, the Department will continue to support the introduction of a new bank note series by the Bank of Canada and strong enforcement measures to reduce the incidence of counterfeiting, and work with the Royal Canadian Mint to enhance the efficiency of the circulating coinage system.Program Activity 1.4: Internal Services

Program Activity Description

Internal Services are activities and resources that are administered to support the needs of programs and other corporate obligations of an organization. The Internal Services categories are Management and Oversight Services, Communications and Consultations Services, Legal Services, Human Resources Management Services, Financial Management Services, Information Management Services, Information Technology Services, Real Property Services, Materiel Services, Acquisition Services, and Travel and Other Administrative Services. Internal Services include only those activities and resources that apply across an organization and not those provided specifically to a program.

Financial Resources ($ thousands)

| 2012–13 | 2013–14 | 2014–15 |

|---|---|---|

| 42,071.0 | 52,165.0 | 55,032.0 |

Human Resources (Full-Time Equivalent—FTE)

| 2012–13 | 2013–14 | 2014–15 |

|---|---|---|

| 236 | 236 | 236 |

Planning Highlights

Planning Highlights

Sound financial and human resources management in an environment of budgetary restraint

To support strategic recruitment initiatives as well as retention and employee development strategies, and building on its solid integrated business planning process, the Department will continue to strengthen performance monitoring and reporting on its corporate Human Resources Plan. In doing so, it will follow through on the recommendation of an internal audit on human resources planning by establishing a well-defined performance measurement framework, including specific, measurable, attainable and time-oriented targets. In support of a high-performing workforce and the management of emerging talents, the Department will continue to implement its recently modernized performance management program for non-EX employees, which provides for a strengthened performance appraisal process.

The Department will also continue to strengthen the well-being of employees, notably by reviewing and acting on the results of the 2011 Public Service Employee Survey.

To meet internal representation targets established in the corporate Human Resources Plan, the Department will work to increase the representation of designated groups, particularly Aboriginal peoples and persons with disabilities. The cornerstone of this strategy will be the launch and the implementation of a three-year employment equity and diversity action plan to ensure full compliance with the Employment Equity Act.

In the area of financial management, the Department will continue to implement new government-wide policies to improve procurement and investment planning, quarterly financial reporting, and will continue to provide future-oriented financial statements.

Ensuring the availability of IM and IT services, aligned with the plans and priorities of the Department

The Department will continue to improve its information management and information technology (IM/IT) infrastructure and services to manage security concerns in a manner that addresses both security and work environment requirements. Key projects include continued improvements to the new secure IT network environment and managing service delivery from the newly created Shared Services Canada. Also, the Department will implement its IM/IT strategic plan for 2011–14 and work toward full compliance with the Treasury Board Directive on Recordkeeping.

Supporting Departmental initiatives

Through effective communications services and products, the Department will support Economic Action Plan 2012 and other medium and long-term economic initiatives.

The Department will continue the implementation of the Treasury Board Policy on Internal Audit and the Policy on Evaluation by updating and implementing the risk-based audit plan and the evaluation plan. This will continue to be done with a value-added focus and in support of departmental initiatives.

The Department's legal officers will continue to provide quality legal advice, litigation support and drafting services in support of key government priorities. Attention will be focused on matters such as the management of the national debt, the integrity of the fiscal framework, the federal regulatory framework for financial institutions, the path forward with respect to enhancing the regulation of capital markets and maintaining a fair and efficient tax system, and issues relating to sales tax harmonization.

The Department will continue to exercise sound management and decision making in responding to requests under the Access to Information Act and the Privacy Act and will also implement a Departmental Code of Conduct consistent with the provisions of the Values and Ethics Code for the Public Sector.

The Department participates in the Federal Sustainable Development Strategy and contributes to the targets for Greening Government Operations through the Internal Services program activity. The Department contributes to the following target areas of Theme IV: Shrinking the Environmental Footprint – Beginning with Government:

- Green Procurement;

- E-waste;

- Printing Units;

- Paper Consumption; and

- Green Meetings.