Common menu bar links

Breadcrumb Trail

ARCHIVED - Department of Finance Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Section II: Analysis of Program Activities by Strategic Outcome

Strategic outcome

The Department of Finance Canada provides effective economic leadership with a clear focus on one strategic outcome:

All program activities support the Department's strategic outcome.

Program Activity 1: Tax Policy

The Tax Policy program activity develops and evaluates federal taxation policies and legislation, negotiates international tax treaties and tax information exchange agreements as well as tax elements of comprehensive land claim and self-government agreements with Aboriginal governments, and provides advice and recommendations for changes aimed at improving the tax system while raising the required amount of revenue to finance government priorities. It focusses on the following areas: personal income tax, business income tax, Aboriginal tax policy, and sales and excise taxes. It is also involved with federal-provincial tax coordination, federal-provincial tax collection and reciprocal agreements, federal-Aboriginal tax administration agreements, and tax policy research and evaluation.

Financial Resources ($ thousands)

| Planned Spending | Authorities | Actual Spending |

| 32,689 | 35,797 | 33,466 |

Human Resources (Full-Time Equivalents—FTEs)

| Planned | Actual | Difference |

| 244 | 247 | –3 |

The Tax Policy program activity supports and contributes to the Department's strategic outcome and priorities by ensuring that the tax system raises sufficient revenues in an economically efficient and fair manner to pay for public services, including social programs (e.g. universal health care and public safety and security), and strategic investments in areas that promote a more competitive and productive Canadian economy (e.g. education and training, basic scientific research, and infrastructure). Regardless of their objective, proposed policies are reviewed for gender and environmental impacts.

Why is this important? Improvements to the competitiveness, efficiency, and fairness of Canada's tax system increase incentives to work, increase standards of living, fuel growth in the economy, encourage investment in Canada, and further strengthen Canadians' confidence in the tax system.

Expected result: Improving the fairness, efficiency, and competitiveness of the personal, corporate, sales, and excise tax systems while raising the required amount of tax revenue

Performance indicators

- Proposals and research to improve the competitiveness, efficiency, and fairness of the personal, corporate, sales, and excise tax systems

- Amount of tax revenue raised

Data sources

- The federal budgets, legislation, regulations, press releases, tax treaties, the Department's marginal effective tax rate models, Public Accounts of Canada, tax evaluations, working and research papers, and tax expenditure reports

Targets

- Proposals in the budget and throughout the year, as required, to implement the government's tax policy agenda and maintain a competitive, effective, and fair tax system

- Collection of sufficient tax revenues to pay for public services

- Publication of the tax expenditures and evaluations report

- Two published evaluations per year

Status

- Successfully met

The Tax Policy program activity carried out a number of tax initiatives during 2007–08 aimed at improving the competitiveness, efficiency, and fairness of the personal, corporate, sales, and excise tax systems in a fiscally sustainable manner. Many of these measures were developed to support implementation of Advantage Canada—the government's strategic long-term economic plan.

In particular, Tax Policy program staff provided sound and timely advice and recommendations to the Minister of Finance and senior officials in preparation for the October 2007 Economic Statement and Budget 2008. This work contributed to the development of measures such as broad-based tax reductions for individuals, families, and businesses worth $60 billion over 2007–08 and the following five fiscal years, bringing total tax relief since Budget 2006 over this same period to almost $200 billion.

Some measures of direct benefit to individuals included the following:

- reducing the goods and services tax (GST) rate by an additional percentage point as of January 1, 2008, fulfilling the Government's commitment to reduce the GST to 5 per cent;

- reducing the lowest personal income tax rate to 15 per cent from 15.5 per cent and increasing the basic amount that all individuals can earn tax-free; and

- introducing a new Tax-Free Savings Account to help Canadians save for the future.

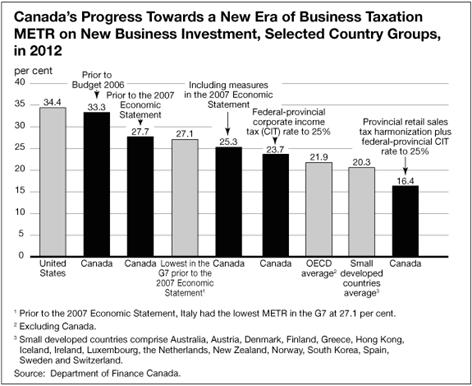

Key measures introduced during 2007–08 to improve the competitiveness, efficiency, and fairness of Canada's business tax system included the following:

- historic tax reductions that will encourage new business investment, improve productivity and job creation, and bolster confidence in the Canadian economy on a long-term basis—these broad-based corporate tax reductions will reduce the federal corporate income tax rate to 15 per cent by 2012 from 22.12 per cent (including the corporate surtax) in 2007;

- further assistance to Canada's manufacturing and processing sector by extending accelerated capital cost allowance (CCA) treatment for investment in machinery and equipment by three additional years;

- expansion of the accelerated CCA for clean-energy generation equipment to additional applications involving ground-source heat pump and waste-to-energy systems;

- improvements to the scientific research and experimental development (SR&ED) tax incentive program to enhance support for small-and medium-sized businesses and to provide investment tax credits for certain SR&ED activities carried out outside of Canada;

- alignment of CCA rates with the useful life of assets for railway locomotives and carbon dioxide pipelines (a key component of carbon capture and storage systems); and

- introduction of the Anti-Tax Haven Initiative and creation of the Advisory Panel on Canada's System of International Taxation, to improve the fairness and competitiveness of Canada's system of international taxation.

The Tax Policy program also published a research report on the effect of corporate income tax rate reductions on business investment in the 2007 Tax Expenditures and Evaluations report available at http://www.fin.gc.ca/taxexp/2007/taxexp07_4e.html#part2.

Expected result: Sound fiscal relationships with provinces, Aboriginal governments, and other countries

Performance indicators

- Active negotiation of additional tax administration agreements with provincial and Aboriginal governments

- Effective network of tax treaties with other countries

- Effective meetings of the Federal-Provincial Tax Committee

Data sources

- Federal-provincial agreements, federal-provincial meetings, federal-Aboriginal agreements, and federal-Aboriginal negotiations

Target

- Increased number of tax agreements and tax treaties signed

Status

- Successfully met

The Tax Policy program activity contributed to the expected result of improving the coordination of the federal tax system with those of the provinces, territories, Aboriginal governments, and other countries during 2007–08.

To promote a more competitive tax system, the federal government continued to encourage provinces that have retail sales taxes to facilitate a transition to a provincial value-added tax harmonized with the GST.

The Tax Policy program regularly works with Aboriginal groups and governments to manage the First Nations sales tax (FNST), the First Nations goods and services tax (FNGST), and the First Nations personal income tax (FNPIT) administration agreements. During 2007–08 Tax Policy program staff negotiated tax elements related to 20 agreements in principle and to 4 final comprehensive land claim agreements and self-governing agreements with Aboriginal peoples.

The Tax Policy program also works with governments of other countries to review, improve,

and expand Canada's network of international tax treaties and tax information exchange agreements (TIEA) with non–tax treaty jurisdictions. Tax treaty negotiations with the following countries were announced during 2007–08: Spain, Greece, and Colombia. A fifth set of changes to the existing Canada–U.S. Income Tax Convention—known as the Fifth Protocol—was

signed in September 2007 and enacted into Canadian law in December. The Protocol, which is a major updating of the treaty, will enter into force once it is ratified by the U.S. In addition, an updated tax treaty with Mexico entered into force on April 12, 2007.

These and other treaty-related developments can be found on the Department of Finance Canada's website at http://www.fin.gc.ca/treaties/treatystatus_e.html.

Program Activity 2: Economic and Fiscal Policy

This program area analyzes Canada's economic and fiscal situation and advises on the government's economic policy framework, budget planning framework, and spending priorities. It is responsible for monitoring and preparing forecasts of Canada's economic and fiscal position and plays a lead role in the management of the government's fiscal framework. The program also provides analytical support on a wide range of economic and financial issues related to the government's macroeconomic and structural policies.

Financial Resources ($ thousands)

| Planned Spending | Authorities | Actual Spending |

| 15,007 | 16,186 | 15,247 |

Human Resources (Full-Time Equivalents—FTEs)

| Planned | Actual | Difference |

| 121 | 118 | 3 |

The work under this program activity contributes to the Department's strategic outcome and priorities by helping to ensure that fiscal planning in the Government of Canada is transparent and supports long-term fiscal sustainability. It also helps to ensure that the government understands the strengths and weaknesses of the Canadian economy now and in the future in order to develop economic policies that lead to sustained economic growth.

Why is this important? Sound economic and fiscal policies enable the Canadian economy to perform well. Moreover, sound fiscal planning and lowering the public debt are essential to the country's long-term prosperity. Lower debt helps keep interest rates low and frees up funds for more productive uses, such as lower personal income taxes. Lower debt levels also strengthen the government's ability to deal with challenges—such as an aging population—and help to reduce the overall level of interest rates, leading to more private sector investment and a more productive economy.

Expected result: Transparent fiscal planning and sustainable fiscal policy

Performance indicators

- Publication of fiscal projections

- Federal debt as a share of the GDP

Data sources

- The federal budget and the Economic and Fiscal Update

- Annual Financial Report of the Government of Canada

Targets

- Publish two-year and five-year fiscal projections

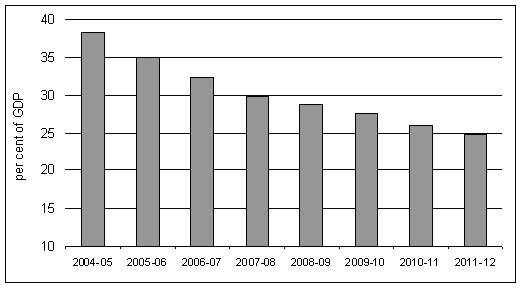

- Reduce the federal debt-to-GDP ratio to 25 per cent by 2011–12

Status

- Successfully met

The government has taken significant steps to ensure that fiscal planning is transparent and enhances accountability and that fiscal policy remains sustainable. In 2007–08, the Department continued to monitor and assess the government's fiscal position and to update fiscal projections through the Economic Statement, the Budget Plan, and the monthly Fiscal Monitor. The Department also provided quarterly updates of the fiscal outlook for the year in progress, as committed to in the Federal Accountability Action Plan. Further information on the government's fiscal performance can be found in the Annual Financial Report of the Government of Canada at http://www.fin.gc.ca/purl/afr-e.html.

In light of global economic uncertainty, the Department updated and presented the five-year budget balance projections initially presented in the October 2007 Economic Statement in Budget 2008. The federal budget will continue to focus on a two-year planning horizon.

The government is committed to ongoing, measured debt reduction, planning debt reduction of $10.2 billion for 2007–08, $2.3 billion for 2008–09, $1.3 billion for 2009–10, and $3 billion per year for 2010–11 to 2012–13. This will allow the government to meet its commitment to reduce the debt-to-GDP ratio to 25 per cent by 2011–12, three years ahead of the original target date. The chart below shows the Budget 2008 projection of the federal debt-to-GDP ratio.

Federal Debt-to-GDP Ratio (Projections for 2007–08 Onward)

The Tax Back Guarantee was legislated in Budget 2007. Under the guarantee, the government dedicates the effective interest savings from federal debt reduction each year to permanent and sustainable personal income tax reductions. As of 2009–10, tax reductions provided under the Guarantee will amount to $2 billion. This accounts for nearly 40 per cent of the personal tax relief provided since Budget 2006.

To ensure that spending is sustainable for the long term, the Government is committed to keeping the rate of growth of program spending, on average, below the rate of growth of the economy. In Budget 2008, program spending as a share of GDP in 2007–08 and 2008–09 is below the track set out in Budget 2007, and program spending is projected to decline as a share of GDP over the next five years.

Expected result: Effective analysis of economic performance

Performance indicators

- Canada's GDP growth relative to the G6 (G7 less Canada)

Data sources

- IMF World Economic Outlook

Target

- Above-G6 average for annual GDP growth rate

Status

- Successfully met

The Department continued to provide effective analysis of economic activity in Canada, the U.S., and abroad. This information includes, among other things, chapters on economic developments and outlook in the Economic Statement and the Budget Plan. For example, Budget 2008 presented an analysis of some key structural factors underlying Canada's economic performance, including the following:

- the improvement in Canada's terms of trade due to higher commodity prices and its positive effect on the increase in Canadians' living standards;

- the changes in the composition of the labour market following the continuing adjustment to the higher Canadian dollar in the manufacturing and forestry sectors; and

- federal debt reduction's role in helping lower the overall level of private sector borrowing interest rates and in freeing up financial resources for more productive uses in the economy.

Regular consultations with and participation in meetings of the Organisation for Economic Co-operation and Development (OECD) and the IMF enabled the Department to monitor global economic developments and, given the openness of the Canadian economy, promote the growth potential of Canada.

A key focus for 2007–08 was to monitor and assess the implications for the Canadian economy of the U.S. economic slowdown and financial market turbulence, as well as the continuing adjustment of the domestic economy to the higher Canadian dollar. These implications were presented in Budget 2008, in conjunction with the Department's survey of private sector forecasters regarding their outlook on the Canadian economy and a thorough examination of the risks and uncertainties in that outlook.

Program Activity 3: Financial Sector Policy

This program area ensures the soundness, efficiency, and competitiveness of Canada's financial sector in support of strong, sustainable growth in the Canadian economy. This program provides analysis of Canada's financial services sector and financial markets, and it develops the legislative and regulatory framework governing federally regulated financial institutions (banks, trust and loan companies, insurance companies, and co-operative credit associations) and federally regulated defined benefit pension plans. This program activity also spearheads the federal strategy to combat money laundering and terrorist financing. It plays a lead role in conducting Canada's relations and negotiating Canada's commitments with foreign governments in the area of trade in financial services.

Financial Resources ($ thousands)

| Planned Spending | Authorities | Actual Spending |

| 18,113 | 4,934,982 | 4,864,357[2] |

Human Resources (Full-Time Equivalents—FTEs)

| Planned | Actual | Difference |

| 129 | 130 | –1 |

The Financial Sector Policy program supports and contributes to the Department's strategic outcome and priorities by ensuring that Canada's financial sector and domestic financial markets function well—conditions necessary to achieve sustainable growth in the Canadian economy.

Why is this important? A sound, efficient, and competitive Canadian financial sector is necessary to support the savings and investment needs of individuals, businesses, and the economy as a whole.

Expected result: Prudent and cost-effective treasury management of the borrowing activities of Crown corporations and the government's investment portfolios[3]

Performance indicators

- Crown borrowing costs

- Net returns on liquid asset portfolios

- Amount of exposure to financial risk

- Administrative costs of treasury functions

Data sources

- Crown annual reports and corporate plans

- Public Accounts of Canada

- Debt Management Report and Report on the Management of Canada's Official International Reserves

- Bank of Canada annual reports

Targets

- Low and stable risk-adjusted costs of borrowing and investing funds

- Positive returns on investment portfolios, net of costs

- Exposure to financial risks within Minister-approved limits

- Overhead costs in line with comparable entities

Status

- Successfully met

Treasury management operations and initiatives for the management of the Government of Canada's financial assets and liabilities continued to focus on lowering financing costs and generating positive investment returns while prudently managing investment risks within approved ministerial limits. Low and stable risk-adjusted costs of borrowing by the federal government on behalf of borrowing agent Crown corporations support a well-functioning market in an environment of declining borrowing needs. The administrative costs of treasury borrowing and investing activities are in line with those of other sovereigns.

The Minister of Finance approves all Crown borrowing within the context of annual corporate plan approvals. Crown results are available in their annual reports. Information about the plans, actions, and outcomes associated with financial asset and debt management can be found in the Report on the Management of Canada's Official International Reserves: April 1, 2006–March 31, 2007, as well as in the Debt Management Report 2007–2008, both of which will be published in the fall of 2008, following tabling of the Public Accounts of Canada for 2007–08.

Related to pursuing improvements to the borrowing framework for major government-backed entities, the borrowings of the Business Development Bank of Canada (BDC), the Canada Mortgage and Housing Corporation (CMHC), and Farm Credit Canada (FCC) were consolidated with the Government of Canada borrowing program. This allowed the Department to deliver on a related commitment fromBudget 2007, reduce Crown borrowing costs, and enhance the liquidity of the Government of Canada debt market. The BDC, the CMHC, and the FCC were granted limited early access for short-term borrowings in December 2007, which helped to reduce their borrowing costs during a period of widening credit spreads.

The Department provided analysis and advice on cash and reserves investment policy in collaboration with the Bank of Canada. This analysis and advice helped maintain prudential liquidity for the government while maintaining the government's exposure to financial risk within approved limits.

In 2007–08, recommendations received through an external evaluation of cash management activities were considered, and an external evaluation of the treasury management risk framework was completed. The completed external evaluations are posted on the Treasury Evaluation Program section of the Department's website at http://www.fin.gc.ca/access/fininste.html#Treasury.

Expected result: A regulatory framework that promotes a sound, efficient, and competitive Canadian financial sector that serves the needs of individuals, businesses, and the economy

Performance indicators

- Policy, legislative, and regulatory initiatives

Data sources

- Legislation, regulations, and publications

Targets

- Implement and draft regulations for Bill C-37

- Develop Bill C-57 regulations

- Complete the IMF Financial Sector Assessment Program (FSAP) update

- Develop policies for the review of the mortgage insurance framework

Status

- Successfully met

In 2007–08, the Department conducted analysis and provided advice on a broad range of financial issues and identified potential areas of policy change needed to support a leading-edge financial services sector and domestic capital market to achieve a more productive, competitive, and dynamic economy.

Following commitments made in Budget 2007 in support of financial stability and the efficiency of Canada's capital markets, the Department implemented legislation and regulations to provide greater certainty in the treatment of eligible financial contracts in insolvency and provided certain immunities to the Bank for International Settlements in recognition of its role in enhancing global stability. The Department closely monitored financial markets and institutions domestically and internationally and worked with other government and non-governmental organizations to analyze and develop recommendations to improve resiliency in the financial sector.

The fiscal year 2007–08 has been a very challenging one for the financial system. With the onset of the global credit turmoil in the summer of 2007, the Department increased its monitoring and analysis of Canadian credit markets, notably developments in the Canadian non-bank sponsored asset-backed commercial paper (ABCP) market, which froze in August 2007. On August 16, 2007, a group representing major investors in non-bank sponsored ABCP and the main international bank asset providers agreed to a standstill under the Montr�al Accord, providing the basis for a restructuring of the affected paper. Since the standstill began, the Department, along with the Bank of Canada, encouraged all of the parties to work constructively toward an orderly resolution. The Minister of Finance issued statements supporting the restructuring process at key milestones, and on June 5, 2008, the Superior Court of Justice of Ontario approved the plan for restructuring ABCP developed by the Pan-Canadian Investors Committee.

In response to the global turmoil, G7 finance ministers and central bank governors tasked the Financial Stability Forum (FSF) in October 2007 with assessing the causes and making recommendations to enhance market and institutional resilience. The Department is an active member of the FSF, along with the Office of the Superintendent of Financial Institutions and the Bank of Canada. The Department is fully engaged in international efforts and is working collaboratively with other federal and provincial regulators to improve market resiliency and ensure that regulatory agencies have a range of flexible and up-to-date regulatory tools. The Department continues to closely monitor financial markets and institutions domestically and internationally.

On March 29, 2007, Bill C-37, An Act to amend the law governing financial institutions and to provide for related and consequential matters, received Royal Assent, and the first package of regulations to implement the legislation came into force on March 8, 2008. The regulations can be found on the Canada Gazette website at http://gazetteducanada.gc.ca/partII/2008/20080319/html/index-e.html. Bill C-37 is aimed at enhancing the interests of consumers and increasing legislative and regulatory efficiency, while also making a number of technical amendments. The Department continues to work on the development of the remaining regulations required to fully implement the Bill.

During 2007–08, the Department of Finance Canada also worked toward completing the outstanding regulations associated with Bill C-57, An Act to amend certain Acts in relation to financial institutions. Once completed, these regulations will allow the remaining provisions of the legislation to be brought into force. Bill C-57 brings the governance standards in the financial institutions statutes up to the standards adopted in 2001 for business corporations in the Canada Business Corporations Act and general co-operatives in the Canada Cooperatives Act. As an integrated package, the amendments clarify the roles of directors, enhance the rights of shareholders, modernize governance practices, strengthen the governance elements of the regulatory framework, and increase disclosure of information in respect of participating and adjustable life insurance policies.

In 2007–08, the Department also coordinated and completed the FSAP Update offered by the IMF. An FSAP Update report was published by the IMF on February 13, 2008, and concluded that the Canadian financial sector is mature, sophisticated, and well-managed, with many examples of best practice. The report is available online at http://www.imf.org/external/pubs/cat/longres.cfm?sk=21710.0.

At a June 2007 meeting with provincial and territorial ministers responsible for securities regulation, the Minister of Finance committed to form the third-party Expert Panel on Securities Regulation (http://www.expertpanel.ca) to advise ministers on the best way forward. The government appointed the panel of experts in February 2008. This Panel will examine how to enhance, in practical ways, the effectiveness, content, and structure of capital markets regulation, in particular by improving enforcement and by favouring proportionate, more principles-based regulation. The panel will build on the work accomplished by pre-existing private sector groups. It will provide a concrete proposal, a transition path, and a common model act based on advice from recognized experts. The Panel will report to the Minister of Finance and to provincial and territorial ministers responsible for securities by the end of 2008.

During 2007–08, the Department consulted with industry stakeholders and relevant federal and provincial regulators on the mortgage insurance framework. The Department has also reviewed market developments and examined the approaches taken in comparable jurisdictions. It is anticipated that an updated mortgage insurance framework will be introduced by the end of 2008.

Expected result: A legislative and regulatory framework that ensures the security and viability of federally regulated defined benefit pension plans

Performance indicators

- Policy, legislative, and regulatory initiatives

Data sources

- Legislation and regulations

Target

- Develop legislation and regulations as needed

Status

- Successfully met

In 2007–08, the Department continued to review and assess means to strengthen the legislative and regulatory framework for federally registered defined benefit pension plans in order to improve the security of pension benefits and ensure the viability of defined benefit pension plans. A properly designed private pension system, with appropriate incentives for both employers and employees, can contribute to the security and prosperity of Canadian workers and retirees and support increases in living standards. In addition, departmental officials worked to provide technical advice on measures pertaining to phased retirement and life income funds. Developments at the provincial level were also monitored, including the reviews undertaken in Alberta, British Columbia, Ontario, and Nova Scotia and the effect of several court cases involving private pensions.

Expected result: An effective anti-money laundering (AML) and anti-terrorist financing (ATF) framework

Performance indicators

- Regulations

- International standards and evaluation reports

- Canadian presidency of the Financial Action Task Force on Money Laundering (FATF)

- Establishment of the Egmont Secretariat

Data sources

- Legislation, regulations

- FATF mutual evaluation report

- Report from the outgoing president of FATF

- Official announcement of the Egmont Secretariat

Targets

- Develop regulations for the Proceeds of Crime (Money Laundering) and Terrorist Financing Act

- Comply with international standards and the recommendation of the Auditor General of Canada and Treasury Board–mandated evaluation reports

- Deliver the FATF president's work program

- Operationalization of the Egmont Secretariat

Status

- Successfully met

The goal of Canada's AML and ATF Regime is to combat money laundering and terrorism financing by providing appropriate tools to law enforcement, while respecting the privacy of Canadians and conforming to international standards. The Department of Finance Canada continues to take the lead role in regard to the Regime, ensuring that ongoing work is undertaken in coordination with federal partners, such as the Financial Transactions Reports Analysis Centre of Canada (FINTRAC), and leading to prudent policy advice and implementation. A public-private sector advisory committee was struck in November 2007 to facilitate working more closely with private sector partners with the goal of ensuring that policy development remains current and effective.

The majority of regulations required to implement Bill C-25, An Act to amend the Proceeds of Crime (Money Laundering) and Terrorist Financing Act and the Income Tax Act and to make a consequential amendment to another Act, were finalized in 2007–08 and are expected to come into force in 2008–09. The amendments include enhancing customer due diligence measures, extending the Regime to include three new reporting sectors, creating a registration regime for money service businesses, and creating an administrative and monetary penalties regime.

In February 2008, the FATF released its findings on its evaluation of Canada's AML and ATF Regime (http://www.fatf-gafi.org/dataoecd/5/3/40323928.pdf). The report found that Canada's Regime is solid in terms of its legal structure, law enforcement powers, international cooperation, and ATF standards, even though the report only took into account measures that were in place as of June 2007. Canada will be compliant with virtually all of the FATF's recommendations when the remainder of the regulations are implemented over the course of 2008–09. These measures also address the recommendations of the Auditor General of Canada and Treasury Board–mandated evaluation reports.

June 2007 marked the end to a successful Canadian presidency of the FATF. During the Canadian presidency, six countries underwent assessments of their AML and ATF regimes; the FATF strengthened its cooperation with the World Bank, the IMF, and the United Nations to promote its 40 and 9 Special Recommendations; and it improved its relationship with FATF-style regional bodies. FATF membership grew during the Canadian presidency to include China as a member and South Korea and India as observers. Canada initiated a two-year process to define a strategic direction for the FATF mid-term review in 2007–08. Finally, the Canada president was very active in engaging private sector stakeholders.

On February 15, 2008, the Minister of Finance officially opened the permanent home of the Egmont Secretariat in Toronto. The Egmont Secretariat coordinates the exchange of information, provides training, and shares expertise among its 101 financial intelligence unit members worldwide.

Program Activity 4: Economic Development and Corporate Finance

This program area is responsible for fulfilling the challenge function of the Department of Finance Canada by monitoring major economic policy issues and proposals under development in the economic departments and from outside of government. It provides advice to the Minister regarding the financial and policy implications of existing and new policies and programs. The program provides policy analysis and recommendations in the areas of traditional and knowledge-based sectors, defence, transportation, public infrastructure, environment, energy and resources, agriculture, fisheries, regional development, and privatization. It also plays a lead role in advising on corporate restructuring affecting Crown corporations and other corporate holdings.

Financial Resources ($ thousands)

| Planned Spending | Authorities | Actual Spending |

| 8,289 | 8,836 | 7,995 |

Human Resources (Full-Time Equivalents—FTEs)

| Planned | Actual | Difference |

| 67 | 63 | 4 |

The program contributes to the Department's strategic outcomes and priorities by recommending policies that contribute to higher productivity and a more competitive and dynamic Canada.

Why is this important? The Department implements the government's economic and broader policy agenda through the development of the annual budget and the Economic and Fiscal Update. To do so, the Department needs to assess and make recommendations on numerous proposals for new program spending that emanate from federal departments, other levels of government, and the Canadian public. This activity is critical if the government is to establish policy and funding priorities that contribute to sound fiscal management and sustainable economic growth.

Expected result: Sound advice to the Minister on economic, funding, and policy proposals

Performance indicators

- Announcement of measures that advance productivity and economic growth

Data sources

- The federal budget and the Economic and Fiscal Update

Target

- Implementation of the government's microeconomic policy priorities through the budget and the Economic and Fiscal Update

Status

- Successfully met

The Department fulfills a challenge function by helping to manage the funding demands of other departments and agencies, contributing to sound decisions consistent with the government's public policy agenda and a responsible use of taxpayers' money. Operating and capital budgets of economic development proposals were successfully assessed, while economic and financial advice and policy analysis were provided to the Minister on issues for consideration at Cabinet and its committees and for the annual budget and the Economic and Fiscal Update, as required.

Through its analysis and advice, the program activity continued to shape regional development and policies for key sectors such as agriculture, fisheries, aerospace, environment, and automotive.

In 2007–08, the Economic Development and Corporate Finance activity area focussed on delivering some key elements of the government's economic agenda, including the following:

- additional resources in Budget 2008 for post-secondary education, research, and commercialization to support the implementation of the government's science and technology strategy, Mobilizing Science and Technology to Canada's Advantage;

- more long-term and predictable funding in Budget 2008 for infrastructure, gas tax funding for municipalities, and permanent additional funding for public transit in order to contribute to economic growth, achieve Canada's environmental goals, and build stronger, more competitive communities;

- the establishment of PPP Canada Inc., a new Crown corporation that will spearhead federal efforts to promote the use of public-private partnerships in Canada;

- additional funding in Budget 2008 to implement regulations that will lead to significant reductions in greenhouse gas emissions and improvements in air quality; and

- an inventory of administrative requirements and a reduction strategy in support of the government's Paperwork Burden Reduction Initiative—the inventory provides a benchmark against which future burden reductions will be made.

The Department also contributed to sound fiscal management by providing advice on expenditures and priorities in the Strategic Review of departments and agencies within its portfolio responsibilities.

Program Activity 5: Federal-Provincial Relations and Social Policy

This program area is responsible for administering a system of fiscal arrangements between Canada and the provinces and territories that will enable the funding of national priorities and redistribution of support to less prosperous regions in order to ensure reasonably comparable services at reasonably comparable levels of taxation. The program area is also responsible for policy

development and strategic advice with respect to fiscal arrangements and federal-

provincial-territorial relations more broadly.

In addition, the program area fulfills the challenge function of the Department by providing policy advice to the Minister regarding the fiscal and economic implications of the government's social policies and programs related to health care, immigration, employment insurance and pensions, post-secondary education, Aboriginal and cultural programs, and benefits, as well as programs for seniors, disabled persons, and children. The program area conducts research and provides analysis and advice to the Minister and senior government officials to assist in preparation for meetings of Cabinet and its committees, the annual budget, the Economic and Fiscal Update, and responsibilities with respect to Canada Pension Plan (CPP) legislation. The program is also responsible for preparing legislation and regulatory changes related to its mandate, particularly fiscal arrangements and CPP.

Financial Resources ($ thousands)

| Planned Spending | Authorities | Actual Spending |

| 12,298 | 13,335 | 12,697 |

Human Resources (Full-Time Equivalents—FTEs)

| Planned | Actual | Difference |

| 92 | 89 | 3 |

The work under this program activity supports the Department's strategic outcome and

priorities by contributing to the government's efforts to meet its objectives regarding the

quality of Canada's communities, health care, education, and social safety net programs and

the commitment to equality of opportunity for all citizens. It also ensures that federal-provincial-

territorial fiscal arrangements are consistent with the principles of efficiency and equity underlying the government's broad social and economic agenda, and that they allow for the redistribution of wealth across regions of the country through the provision of transfer payments consistent with the government's commitments.

Why is this important? Long-term, predictable, stable, formula-based transfer support for provinces and territories and improvements to the social policy framework contribute to improved, efficient, equitable public services for Canadians and support the quality of Canada's communities, health care, education, and social safety net programs and equality of opportunity for all citizens.

Expected result: A principled framework to restore fiscal balance in Canada

Performance indicators

- Implementation of a principles-based transfer system

Data sources

- Transfer agreements

Targets

- Timely, accurate implementation of legislative and regulatory changes

- New arrangements for Equalization, TFF, and the CST

- Enhanced accountability and transparency of fiscal arrangements for citizens

Status

- Successfully met

Canada's government is committed to restoring fiscal balance, in part through the development of a principles-based transfer system, with clearer responsibilities among different orders of government and with greater overall efficiency for governments and enhanced accountability for citizens. Analysis and advice led to the introduction in Budget 2007 of new, principles-based transfer programs reflecting the recommendations of the Expert Panel on Equalization and Territorial Formula Financing (TFF) and the advice received through consultations with provinces and territories, academics, stakeholders, and the Canadian public. After tabling of the budget, ongoing consultations and meetings with provincial and territorial officials were held to support information sharing and communications regarding changes to federal-provincial-territorial fiscal arrangements.

In 2007–08, the Department restructured the Equalization and TFF programs, consistent with Budget 2007. Equalization returned to a formula basis, using a higher 10-province standard, a new approach to the treatment of natural resource revenues, and a fiscal capacity cap. Combined, these measures strengthened the program to bring it in line with the Constitutional commitment to provide payments to ensure reasonably comparable services at reasonably comparable levels of taxation. The new formulas were used to determine payments for 2007–08.

The CST was also renewed and strengthened, with the addition of $687 million to support the move to equal per capita cash, an additional $250 million annually for child care, and $800 million annually for post-secondary education. The funding is now legislated to 2013–14 with annual growth of three per cent, to ensure stable, predictable, and growing federal support for a range of social programs. Material was developed to communicate these changes and ensure greater transparency of federal support, including new online material, an improved transfer booklet, and updated media material. As well, provinces and territories were encouraged to make more transparent the support received from the Government of Canada for national priorities, including child care and post-secondary funding, as well as targeted funding provided through third-party trusts.

More information about federal transfers to the provinces and territories can be found at http://www.fin.gc.ca/access/fedprove.html.

Expected result: Sound advice to the Minister on government social policy priorities

Performance indicators

- Announcement of measures and related funding that advance social policy priorities

Data sources

- The federal budget and the Economic and Fiscal Update

Target

- Timely implementation of social policy priorities in the government's agenda

Status

- Successfully met

In 2007–08, the Department contributed to the government's social policy priorities by providing analysis and advice to the Minister of Finance and senior government officials on a wide range of social policy issues in preparation for meetings of Cabinet and its committees, the annual budget, and the Economic and Fiscal Update. The Department worked extensively with other departments to implement the commitments made in Advantage Canada to create a Knowledge Advantage. It worked with other government departments to deliver on measures aimed at helping people with disabilities, Aboriginal peoples in Canada, and seniors, as well as modernizing Canada's health care system. The Department also contributed to the development of several measures aimed at enhancing the security of Canadians. The work of the Department led to the inclusion in the 2007 Economic and Fiscal Update and the 2008 Budget of a series of significant measures including the new Canada Student Grant Program, improvements to the immigration program (including legislative changes), and funding for strengthened partnerships with Aboriginal peoples in Canada.

The Department worked with colleagues across government and consulted external stakeholders and academic research in developing advice on providing long-term and predictable support for post-secondary education and training. In follow-up to Budget 2007, work ensued to implement changes made to the CST to increase support for post-secondary education by $800 million, growing at three per cent annually. The Department also worked with other government departments to implement changes to the Canada Student Loans Program, following a review of the program, which resulted in the announcement in Budget 2008 of the new Canada Student Grant Program.

The Department also worked with central agencies, government departments, and external stakeholders to ensure timely decisions with respect to and the implementation of the Budget 2008 announcement to modernize the immigration system, notably through the introduction of changes to the Immigration and Refugee Protection Act in the Budget Implementation Act, 2008.

The Department also worked with central agencies, other government departments, and external stakeholders to ensure timely analysis and decision making with respect to initiatives and related funding in other areas of social policy identified by the government as priorities in the lead-up to Budget 2008, notably the creation of the Canada Employment Insurance Financing Board.

These initiatives will ensure the independence of the employment insurance (EI) premium rate setting and that these premiums are used exclusively for the EI program. The new Canada Student Grant Program will provide more effective support to students and their families, improving access to post-secondary education. The changes to the immigration program will help maintain Canada's capacity to compete globally to attract immigrants who can contribute to Canada's prosperity. Finally, the strengthened partnerships with Aboriginal peoples in Canada will contribute to improved social outcomes, notably in health, education, and child services, as well as better opportunities for economic development.

Program Activity 6: International Trade and Finance

One of the aims of this program area is to secure access to key markets for Canadian exporters and investors and to reduce tariffs where possible in order to enhance the competitiveness of domestic industries and expand their commercial opportunities. In this respect, the Department plays a key role in international trade negotiations and the development of trade policy and is responsible for the administration of tariff and other trade-related measures. This program also manages the Department's participation in international financial institutions, such as the IMF, the World Bank, and the EBRD, and international economic coordination groups such as the G7, G20, and the Asia-Pacific Economic Cooperation forum.

Financial Resources ($ thousands)

| Planned Spending | Authorities | Actual Spending |

| 15,879 | 16,833 | 16,024 |

Human Resources (Full-time Equivalents—FTEs)

| Planned | Actual | Difference |

| 118 | 118 | 0 |

The work under this program activity contributes to the departmental strategic outcome and priorities by improving Canada's overall economic performance through a stronger international trade and investment system that opens markets, enhances the competitiveness of domestic industries, and expands access to key markets for Canadian exports and investment in major foreign markets. In addition, the Department contributes to international initiatives to improve outcomes in developing economies through the effective use of international assistance, debt relief, and other means and the provision of payments consistent with the Department's commitments.

Why is this important? Canada's economic performance and future prosperity depend on a strong and stable global economy, as well as trade and investment flows supported by high standards of multilateral, regional, and bilateral trade and investment agreements. Canadian leadership and influence on international economic, financial, development, and trade issues help to promote financial and economic stability.

Expected result: Secure access to key markets for Canadian exporters and investors

Performance indicators

- Progress will be measured through various domestic, regional, and multilateral trade and investment negotiations and initiatives

Data sources

- Trade and investment negotiations and agreements

Target

- Completed negotiations and agreements

Status

- Successfully met

To secure access to key markets and expand commercial opportunities for Canadian exporters and investors, the Department worked in partnership with other government departments, most notably Foreign Affairs and International Trade Canada (DFAIT), to advance or conclude a number of international trade and investment negotiations. The Department also remained actively engaged in the current World Trade Organization (WTO) negotiations, especially in areas of Department of Finance Canada responsibility (such as non-agricultural market access and trade rules negotiations). For further information on WTO and free trade agreement negotiations, please see http://www.international.gc.ca/trade-agreements-accords-commerciaux/agr-acc/index.aspx?menu_id=15&menu.

The Department also meets its ongoing commitments by providing policy advice on the operations and policies of other government departments with an international mandate. In 2007–08, the Department worked with DFAIT, in the context of the government's Strategic Review initiative, to enhance the effectiveness of Canadian diplomacy, better assist Canadian business participation in global market opportunities, and improve the delivery of core services in Canada and vital consular services abroad. This led to the Budget 2008 announcement of reinvestments over the next two years to strengthen international network and extend Canada's reach to new markets.

In meeting its key commitments for 2007–08, the Department played a major role in concluding the negotiations of a free trade agreement with Peru and continued its role in the trade negotiations with Colombia, which concluded in June 2008. For further information, please see the announcement on theCanada-Peru Free Trade Agreementat http://w01.international.gc.ca/MinPub/Publication.aspx?isRedirect=True&Language=E&publication_id=385802&docnumber=21.

The Department also worked on a number of tariff relief initiatives to enhance the competitiveness of Canadian industry, which provided relief of some $170 million in payment of customs duties on current and future importations. Moreover, the Department has worked with stakeholders in advancing other tariff relief measures to assist industry, including the development of an outward processing initiative concerning textile and apparel products.

In 2007–08, the Department worked with other government departments to advance work under the Security and Prosperity Partnership of North America (SPP), which included steps to fund initiatives based on commitments made at the North American Leaders' Summit in Montebello, Quebec, in August 2007. For further information on the priorities set at the August 2007 North American Leaders' Summit in Montebello, please see http://www.spp-psp.gc.ca/overview/priorities-en.aspx.

The Department also worked closely with other government departments to ensure that the border is secure and conducive to trade. To this end, Budget 2008 announced significant funding over two years for initiatives to ensure that the Canada Border Services Agency has the resources needed to effectively manage the border, implement a higher-security 10-year electronic passport by 2011, expand the joint Canada–United States New Exporters to U.S. South (NEXUS) program for low-risk frequent travellers across the border, and support provinces and territories planning to introduce an enhanced driver's licence.

Expected result: Canadian leadership and influence in the international forums on international economic, financial, development, and trade finance issues

Performance indicators

- Outcomes of international forums and policy decisions

Data sources

- Results (and communiqu�s) and agreements from international meetings and negotiations

Target

- Canadian policy positions and interests are reflected at international meetings and negotiations

Status

- Successfully met

In 2007–08, the Department promoted Canadian prosperity and economic security by working with its international partners to minimize international financial and economic instability. It did so by providing leadership in international forums, such as the G7 and G20, and by providing policy direction to international financial institutions consistent with Canadian interests and policy objectives. These efforts included contributing to economic and social progress in developing economies and the development and promotion of trade finance initiatives.

In addition, the Department participated in discussions at the executive boards of the IMF and the World Bank on country issues, thematic issues, and the global economic outlook to support a strong multilateral system of global economic and financial governance. The Department also monitored major industrialized economies and emerging markets and conducted research projects that focussed on current and emerging issues of importance to Canada, such as the economic effects of China's exchange rate regime on industrialized countries. Annual reports on Canada's participation in the IMF, the World Bank, and the EBRD can be found at http://www.fin.gc.ca/news08/08-031e.html.

In meeting its key commitments related to international assistance, in 2007–08, the Department participated in discussions that led to enhancements of the World Bank's International Development Association (IDA) operations in several areas, including Canadian priority areas of fragile states, debt sustainability, and aid effectiveness, and a strong increase in Canada's financial contributions to the IDA over the next three fiscal years. For further information on the Government of Canada's pledge of $1.3 billion to the IDA, please see http://www.fin.gc.ca/news07/07-099e.html.

The Department also initiated a Development Innovation Fund, announced in Budget 2008, to fund the world's best scientists to produce breakthrough knowledge with the potential to fundamentally change conditions in developing countries. Further, Canada contributed a total of $44 million to an effort by G8 countries to clear Liberia's $1.5 billion in arrears to international financial institutions, and in March 2008 Liberia's arrears were officially cleared, making the country eligible for a total of $3 billion in debt relief.

Regarding initiatives related to government support for trade finance, the Department successfully led the Canadian delegation in negotiating the revised OECD Aircraft Sector Understanding on Export Credits for Civil Aircraft, which was announced in July 2007. This agreement levels the playing field in official support for aircraft sales financing, and as a result Canadian aircraft manufacturers will be in an even stronger competitive position to continue building on their global success. For further information, please see the announcement of the OECD Aircraft Sector Understanding at http://www.fin.gc.ca/news07/07-063e.html.

In 2007–08, the Department also provided international leadership on the IMF governance reform agenda, in particular on quota (voting) and economic surveillance reforms. These reforms will help ensure that the IMF remains a relevant, effective, and representative institution able to promote international financial stability.

Program Activity 7: Public Debt

Canada's fund management activities encompass issuance of debt, management of liquidity, and investment of financial assets. The public debt program supports the ongoing refinancing of government debt that is coming to maturity, the fulfillment of the budget plan, and other financial operations of the government, including supporting the lending activities of major government-backed entities, such as Crown corporations.

Financial Resources ($ thousands)

| Planned Spending | Authorities | Actual Spending |

| 34,697,000 | 33,212,372 | 33,212,372 |

Human Resources (Full-Time Equivalents—FTEs)

| Planned | Actual | Difference |

| 28 | 25 | 3 |

This program activity supports the Department's strategic outcome and priorities by ensuring that debt costs are kept low and stable over time. As debt service is a large component of the spending of the federal government, the prudent and effective management of the government's debt continues to be an important element of the Department's strategy for sound fiscal management.

Why is this important? One of the keys to creating a strong economy is lifting the excessive debt burden. Reducing public debt helps keep interest rates down; it better positions Canada to weather economic storms; and it improves intergenerational equity by ensuring that future generations do not have to pay for the benefits received by their predecessors.

Reducing Public Debt

Expected result: Stable low-cost financing for the Government of Canada[4]

Performance indicators

- Measures of operational performance (e.g. auction statistics)

- Public debt structure

Data sources

- The Fiscal Monitor

- Debt Management Report

- Annual Financial Report of the Government of Canada

Targets

- Well-contested auctions and operations

- Progression of the debt structure target toward 60 per cent fixed-rate debt

Status

- Successfully met

Detailed information on plans, programs, and outcomes will be available in the Debt Management Report 2007–2008, which will be published in the fall of 2008, after the Public Accounts of Canada for 2007–08 have been tabled.

Changes in the external environment and in the government's fiscal needs pose strategic and operational challenges for debt and cash management. These challenges are addressed through the maintenance of diversified, flexible borrowing programs.

In 2007–08, all borrowing and investment operations were successfully conducted as planned. Gross domestic bond issuance was $34 billion, and $7 billion of outstanding bonds were repurchased over 46 operations (25 auctions and switches, and 21 buybacks and switches). The total biweekly Treasury bill issuance for the year amounted to $224 billion. There were 32 cash management bill operations, amounting to $64 billion.

The debt structure objective was adjusted to reflect fiscal trends and the beginning of a period of financial turmoil, specifically through a reduction in planned Treasury bill issuance. The reduced level of borrowing for the government's own needs was offset by roughly $4 billion through the initiation of borrowing by the federal government on behalf of Crown corporations.

Planned versus actual key debt management measures, as of March 31, 2008

| Broad measure | Plan | Actual |

| Fixed-rate share (%) | 61.5 | 63.9 |

| Treasury bill stock ($ billions) | 138 | 117 |

| Treasury bill stock—net of Crowns ($ billions) | –– | 112 |

| Bond stock ($ billions) | 254 | 254 |

A realignment of organizational responsibilities for the retail debt program, involving the closure of the Canada Investment and Savings Agency and the transfer of responsibilities to the Bank of Canada and the Department of Finance Canada, was successfully completed in 2007–08. Retail debt product offerings and service levels were maintained, and modest administrative savings were achieved through efficiencies within the context of the new administrative structure.

Expected result: A well-functioning market in Government of Canada securities[5]

Performance indicator

- Measures of market performance (e.g. turnover, trading spreads)

Data sources

- Debt Management Report

Target

- Operational measures, in particular operational results reporting times, and secondary market indicators, such as volumes and trading spreads, that are in line with or better than previous years

Status

- Successfully met

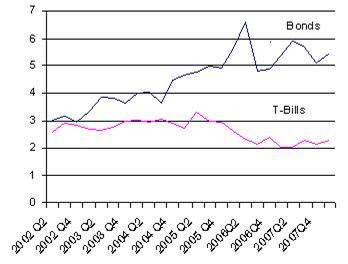

The financial market turmoil that began in August 2007 generally had a limited impact on federal debt management. The most notable effect was a general reduction in financing costs associated with the effect of flight to quality, accompanied by the reduction of interest rates by the Bank of Canada. The government also benefited from a shift to a positive return on carrying cash balances.

In 2007–08, a well-functioning market was maintained in Government of Canada securities, as demonstrated by turn-around times on security operations and turnover volumes. For the fiscal year, the average turn-around time was 1.89 minutes for bond and Treasury bill auctions and 2.98 minutes for repurchases and switches, which is well below the maximum turn-around time of 5 minutes for auctions and 10 minutes for repurchases and switches.

High turnover implies that a large number of securities changes hands over a given period of time, a hallmark of a liquid and efficient securities market. In 2007, turnover ratios for Government of Canada securities dipped slightly as a result of the financial market turmoil (i.e. investors tend to hold on to Government of Canada securities, or trade less, during periods of market uncertainty).

Quarterly Turnover Ratios

The continued transparency of and public engagement with the debt program were promoted through the following:

- an enhanced borrowing authority framework;

- consultations with market participants as part of the process of developing the debt strategy;

- departmental publications on debt management (http://www.fin.gc.ca/purl/dmr-e.html and http://www.fin.gc.ca/purl/dms-e.html); and

- other supporting documentation and notices on the Bank of Canada's website (http://www.bankofcanada.ca/en/markets/markets_auct.html).

Detailed information on adjustments and measures of market function will be available in the Debt Management Report 2007–2008, which will be published in the fall of 2008, after the Public Accounts of Canada for 2007–08 have been tabled.

A number of specific initiatives were taken that supported a well-functioning market, including the decision to consolidate Crown corporation borrowings and provide early access to funds, a continued reduction of operational turn-around times that lowered risk for auction participants, and an increase in gross issuance in 30-year nominal and real return bonds in recognition of high demand for long-dated securities.

Program Activity 8: Domestic Coinage

This program activity is responsible for the system of circulating coinage to meet the needs of the economy. The Department provides advice to the Minister on the currency system, which involves the production of banknotes by the Bank of Canada and the circulation of coinage by the Royal Canadian Mint. This partly entails the negotiation and oversight of the payment of production and distribution costs in the domain of domestic circulating coinage.

Financial Resources ($ thousands)

| Planned Spending | Authorities | Actual Spending |

| 145,000 | 182,736 | 182,736[6] |

Human Resources (Full-time Equivalents—FTEs)

| Planned | Actual | Difference |

| N/A | N/A | N/A |

This program activity supports the sound fiscal management priority of the Department by ensuring that domestic circulating coinage continues to be supplied to meet the needs of the economy at a reasonable cost.

Why is this important? An effective system of circulating coinage ensures efficient trade and commerce across Canada.

Expected result: A supply of coinage at a reasonable cost

Performance indicators

- Production and demand for coinage

- Seigniorage earned by the government

Data sources

- Royal Canadian Mint annual report

- Public Accounts of Canada

Targets

- Produce coinage sufficient to meet the demand of the economy

- Reduce costs and increase the amount of seigniorage earned by the government

Status

- Successfully met

The Department of Finance Canada buys domestic circulating coinage from the Royal Canadian Mint and resells it to financial institutions. In 2007–08, owing to lower demand for coins in the economy and increased coin recycling, the volume of coin production was lower than in 2006–07 but remained higher than in previous years. Details on the volume of coin production in 2007 can be found at http://www.mint.ca/royalcanadianmintpublic/index.aspx?RequestedPath=/en-ca/theroyalcanadianmint/annualreport/default.htm.

The Department works together with the Mint to ensure that the supply of coinage meets the needs of Canada's economy. In 2007–08, the Department and the Mint reviewed and amended an ongoing memorandum of understanding (MOU) that provides the Mint with incentives to enhance productivity and efficiency with respect to the production and distribution of circulation coins. In 2007–08, the Mint was able to contain fixed costs under the MOU at a level in line with prior years. The MOU is revisited on an annual basis to identify further efficiency gains and to adjust reimbursement for input costs.

During the year, the Mint also produced commemorative coins for the 2010 Vancouver Olympics that were well received by Canadians. The demand for these coins from collectors increased the amount of seigniorage earned by the Government of Canada. Seigniorage is the net revenue derived from the issuance of currency and is the difference between the face value of coins produced and the cost of producing and distributing them. Seigniorage on all circulating coinage is estimated to be $91 million in 2007–08. This is down $2 million from 2006–07 as a result of a number of factors, including less overall revenue from coins sales to financial institutions, lower production of high-value coins, and rising metal costs.

Program Activity 9: Transfer Payments to Provinces and Territories

In accordance with the Federal-Provincial Fiscal Arrangements Act (FPFAA), related regulations, and negotiated agreements, this program activity administers transfer payments to provinces and territories as set out in legislation and negotiated agreements to provide for Fiscal Equalization and support for health and social programs as well as targeted support to the provinces and territories in areas of shared priority, including health, social, and other sectors, through the Canada Health Transfer (CHT) and the Canada Social Transfer (CST).

Through its transfer payment programs, the government has provided support for a variety of initiatives, including the development and implementation of the Patient Wait Times Guarantee and a program of vaccination against human papilloma virus (HPV) to protect against cervical cancer. The payments are made in accordance with the terms and conditions established in associated legislation and regulations. More information on transfer payments can be found online at http://www.fin.gc.ca/access/fedprove.html.

Financial Resources ($ thousands)

| Planned Spending | Authorities | Actual Spending |

| 40,328,203 | 47,211,456 | 47,211,456[7] |

Human Resources (Full-time Equivalents—FTEs)

| Planned | Actual | Difference |

| N/A | N/A | N/A |

This program activity supports the Department's strategic outcome and priorities by administering transfer and taxation payments to provinces and territories, in accordance with legislation and negotiated agreements. The FPFAA and regulations clearly outline calculation and payment schedules and mandate the Department to ensure accurate and timely payments.

Why is this important? Major transfers represent significant support to provincial and territorial governments, ranging from less than 10 per cent of gross general revenues for some provinces to over 85 per cent for some territories. This support assists provinces and territories in providing important programs and services for Canadians, including health care, education, social programs, and infrastructure. Further, the government-wide priority to restore the fiscal balance is addressed through the enhancement to the transfer programs set out in Budget 2007.

Expected result: Administration of federal transfers to the provinces and territories including Equalization, Territorial Formula Financing, the Canada Health Transfer, and the Canada Social Transfer

Performance indicators

- Timely and accurate administration of transfer payments

Data sources

- Public Accounts of Canada and the departmental financial reporting system

Target

- Payments made according to levels and formulas set out in legislation and agreements

Status

- Successfully met

The FPFAA and related regulations establish Equalization and TFF payment amounts for 2007–08 and require that the Department issue two re-estimations of CHT and CST payments each year of all open years, incorporating more up-to-date data as available. In addition, the legislation specifies that payments to provinces and territories for major transfers be made monthly. Over the course of 2007–08, CHT and CST estimates of payments were calculated and released on a semi-annual basis, in the spring and fall. Updated information was provided to provinces and territories, as well as to Parliament, the media, and the public.

The Department also administered loans and deferral arrangements and a number of existing trust funds and established trusts supporting the improvement of patient wait times, clean air and climate change initiatives, and HPV immunization, as committed in Budget 2007, as well as the Community Development Trust announced in January 2008 (see Table 6 for further details).

Program Activity 10: International Financial Organizations

This program activity is responsible for administering Canada's international financial commitments, which are aimed at improving outcomes in developing economies. It administers transfer payments, in cooperation with Export Development Canada and the Canadian Wheat Board, to provide debt relief to developing countries as negotiated by the Paris Club. It also administers the issuance and encashment of demand notes and capital subscriptions for Canada's commitments to international financial institutions, such as the IDA, the IMF, and the EBRD, to provide international assistance to developing countries.

Financial Resources ($ thousands)

| Planned Spending | Authorities | Actual Spending |

| 544,717 | 951,112 | 823,289[8] |

Human Resources (Full-Time Equivalents—FTEs)

| Planned | Actual | Difference |

| N/A | N/A | N/A |

This program activity contributes to the Department's strategic outcome and priorities by meeting commitments and agreements with international financial institutions aimed at aiding in the economic advancement of developing countries. These commitments can result in payments, generally statutory transfer payments, to a variety of recipients including individuals, organizations, and other levels of government.

Why is this important? Canada is committed to finding coordinated and sustainable solutions to the payment difficulties experienced by debtor nations. Canada is also strongly committed to reducing the debt burdens of the most heavily indebted poor countries to sustainable levels.

Expected result: Payments to international organizations and Canadian creditors consistent with the Department’s commitments

Performance indicators

- Timely and accurate payments

Data sources

- Public Accounts of Canada and the departmental financial reporting system

Target

- Payments made in accordance with agreements and predetermined schedules or within 30 days of the invoice's being received

Status

- Successfully met

In 2007–08, the Department provided timely payments, as required, to a wide range of international financial organizations and Canadian creditors. These groups play an important role in mobilizing resources for poverty reduction in low-income and least-developed countries.

Canada's participation in both bilateral and multilateral debt relief initiatives has helped recipient countries redirect freed-up resources to poverty reduction initiatives to improve the lives of their citizens and reach their long-term development goals.

Additionally, international financial institutions are important partners for advancing Canada's own foreign and development policy interests and promoting Canadian core values of freedom, democracy, and the rule of law. Participation in these important global organizations, such as the World Bank, the IMF, and the EBRD,extends Canada's reach and influence throughout the world by providing Canada with a strong voice as a member of and leading donor to these institutions.

As part of the fiscal year 2005–06 risk-based audit plan, the Department of Finance Canada's Internal Audit and Evaluation Division conducted a review of administrative controls over international obligations and subscription payments under this program activity, the results of which were presented to the Audit and Evaluation Committee in September 2007. The work undertaken during the review found the following:

- The management framework of the administration of international obligations and subscriptions is effective in meeting the business requirements of the Department;

- Payment schedules and transaction types were compliant with the terms specified in the respective legislative acts and agreements;

- Program officials were experienced in the undertaking of their administrative responsibilities;

- Funding instruments respect the need for accountability to Parliament, while balancing the principles of cost-benefit, risk management, and policy objectives; and

- Departmental reporting demonstrated a good knowledge of program activities and performance.