Common menu bar links

Breadcrumb Trail

ARCHIVED - Department of Finance Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Section I: Overview

Minister's message

The Department of Finance Canada plays a vital role in helping the Government of Canada develop social and economic policies to continue improving the standard of living and quality of life of Canadians, their families, and their communities in the years to come.

Over the last year, the Department has continued building on Advantage Canada, the Government's long-term economic plan, and the foundation on which we base new policy ideas.

For example, last fall's Economic Statement introduced broad-based tax reductions for individuals, families, and businesses of $60 billion over 2007–08 and the following five fiscal years. The broad-based tax reductions included acceleration and deepening of the Government's previously announced corporate income tax (CIT) reductions, bringing the federal CIT rate to 15 per cent by 2012. The Statement also included an additional one-percentage-point reduction in the GST, effective January 1, 2008, fulfilling the Government's commitment to reduce the GST to 5 per cent.By moving early to stimulate the Canadian economy, we anticipated the global economic slowdown and helped cushion its effects on our country's future economic and fiscal health. This decisive action was further enhanced in Budget 2008, a balanced, focussed, and prudent plan to strengthen Canada amid deepening global economic uncertainty.

Budget 2008 contained provisions for reducing debt and taxes, focussing government spending, and providing additional support for sectors of the economy in most need. It also introduced the Tax-Free Savings Account, a general-purpose account that will allow Canadians to watch their savings—including interest income, dividend payments, and capital gains—grow tax-free.

Though we have a bright and promising future, Canada is not an island. Many challenges are still to be met. Nevertheless, as a result of our strong economic fundamentals, we are in a good position to weather the current economic storm.

By focussing on four key priorities—ensuring sound fiscal management, promoting sustainable economic growth, fostering a sound social policy framework, and providing effective international influence—the Department of Finance Canada has demonstrated vision, commitment, and leadership for the benefit of all Canadians.

This Departmental Performance Report highlights the department's many successes in strengthening our economic fundamentals and better positioning Canada to compete in the highly competitive global economy.

Management representation statement

I submit for tabling in Parliament the Department of Finance Canada 2007–08 Departmental Performance Report (DPR).

This document has been prepared based on the reporting principles contained in the Guide to the Preparation of Part III of the 2007–08 Estimates: Reports on Plans and Priorities and Departmental Performance Reports:

- It adheres to the specific reporting requirements outlined in the Treasury Board of Canada Secretariat guidance;

- It is based on the department's approved strategic outcome and Program Activity Architecture (PAA) that were approved by the Treasury Board;

- It presents consistent, comprehensive, balanced, and reliable information;

- It provides a basis of accountability for the results achieved with the resources and authorities entrusted to the Department; and

- It reports finances based on approved numbers from the Estimates and the Public Accounts of Canada.

The paper version was signed by

Rob Wright

Deputy Minister

Summary information

Department's raison d'�tre

The Department is committed to making a difference for Canadians by helping the Government of Canada develop and implement strong and sustainable economic, fiscal, tax, social, security, and financial-sector policies and programs. It plays an important role in ensuring that government spending is focussed on results and delivers value for taxpayer dollars. The Department interacts extensively with other federal departments and agencies and plays a pivotal role in the analysis and design of public policy across the widest range of issues affecting Canadians.

The Department of Finance Canada's responsibilities include the following:

- preparing the federal budget;

- developing tax and tariff policy and legislation;

- managing federal borrowing on financial markets;

- administering major transfers of federal funds to the provinces and territories;

- developing regulatory policy for the country's financial sector; and

- representing Canada within international financial institutions and groups.

The Department also plays an important role as a central agency working with other departments to ensure that the government's agenda is carried out and ministers are supported with first-rate analysis and advice.

Financial Resources ($ thousands)

| 2007–08 | ||

| Planned Spending | Total Authorities | Actual Spending |

| 75,817,194 | 86,583,644 | 86,379,638 |

Human Resources (Full-Time Equivalents—FTEs)

| 2007–08 | ||

| Planned | Actual | Difference |

| 798 | 790 | 8 |

Program Activity Architecture

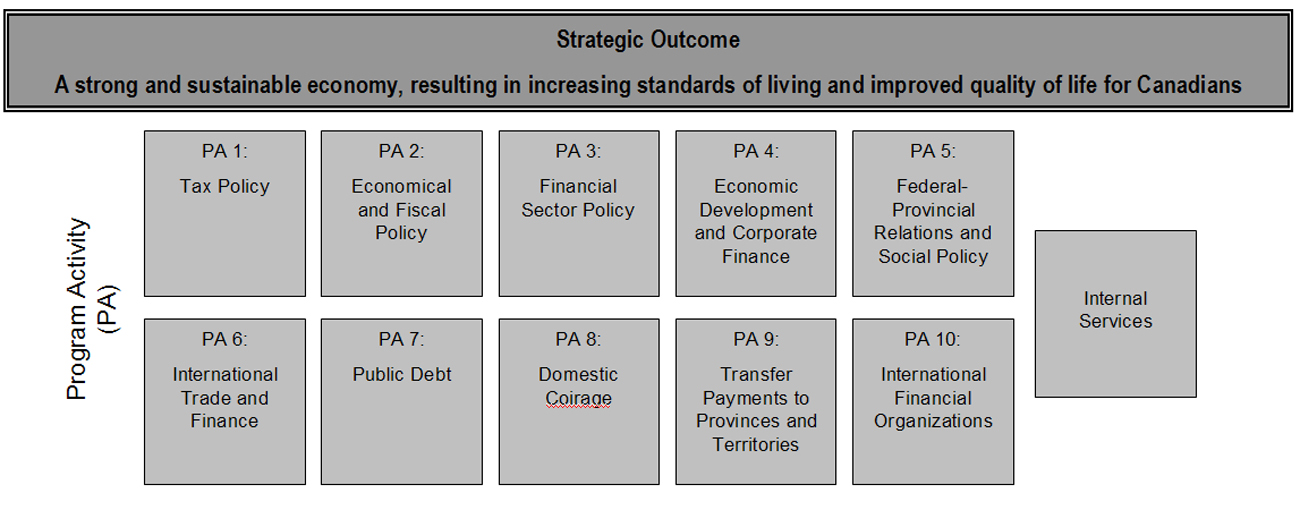

The Department of Finance Canada's PAA, used as the basis for the 2007–08 Report on Plans and Priorities, includes ten program activities (plus internal services) supporting the achievement of one strategic outcome, as follows:

In 2007, the Department revised its PAA to focus on three main activities: economic and fiscal policy making; transfer payments to provinces, territories, and international organizations; and the management of Government of Canada debt. The Department also developed a performance measurement framework that will help improve reporting to Parliament. This revision was reflected for the first time in the 2008–09 Report on Plans and Priorities.

However, to ensure consistency with performance expectations set out in the 2007–08 Report on Plans and Priorities and to maintain good links between performance and plans, performance information in this year's DPR is presented using the earlier PAA.

Summary of departmental performance

The following provides an overview of the strategic outcome, priorities, and program activities of the Department of Finance Canada and associated results, resources, and performance status for 2007–08.

Departmental Priorities

| Name | Type | Performance Status |

| Priority 1: Sound Fiscal Management | Ongoing | Successfully met |

| Priority 2: Sustainable Economic Growth | Ongoing | Successfully met |

| Priority 3: Sound Social Policy Framework | Ongoing | Successfully met |

| Priority 4: Effective International Influence | Ongoing | Successfully met |

Program Activities by Strategic Outcome

| Program Activity and Expected Results |

Performance Status | 2007–08 ($ thousands) | Contributes to the Following Priority | |

| Planned Spending | Actual Spending[1] |

|||

| Strategic Outcome: A strong and sustainable economy, resulting in increasing standards of living and improved quality of life for Canadians |

||||

| Program Activity 1: Tax Policy | ||||

| Improving the fairness, efficiency, and competitiveness of the personal, corporate, sales, and excise tax systems while raising the required amount of tax revenue | Successfully met | 30,400 | 31,123 | 1, 2, 3 |

| Sound fiscal relationships with provinces, Aboriginal governments, and other countries | Successfully met | 2,288 | 2,343 | 1, 2, 3 |

| Program Activity 2: Economic and Fiscal Policy | ||||

| Transparent fiscal planning and sustainable fiscal policy | Successfully met | 6,229 | 6,404 | 1 |

| Effective analysis of economic performance | Successfully met | 8,778 | 8,843 | 2 |

| Program Activity 3: Financial Sector Policy | ||||

| Prudent and cost-effective treasury management of the borrowing activities of Crown corporations and the government's investment portfolios | Successfully met | 3,370 | 904,770 | 1 |

| A regulatory framework that promotes a sound, efficient, and competitive Canadian financial sector that serves the needs of individuals, businesses, and the economy | Successfully met | 10,599 | 2,845,649 | 2 |

| A legislative and regulatory framework that ensures the security and viability of federally regulated defined benefit pension plans | Successfully met | 971 | 262,675 | 3 |

| An effective anti-money laundering and anti-terrorist financing framework | Successfully met | 3,172 | 851,262 | 4 |

| Program Activity 4: Economic Development and Corporate Finance | ||||

| Sound advice to the Minister on economic, funding, and policy proposals | Successfully met | 8,289 | 7,995 | 1, 2, 3 |

| Program Activity 5: Federal-Provincial Relations and Social Policy | ||||

| A principled framework to restore fiscal balance in Canada | Successfully met | 7,032 | 7,237 | 1 |

| Sound advice to the Minister on government social policy priorities | Successfully met | 5,265 | 5,460 | 3 |

| Program Activity 6: International Trade and Finance | ||||

| Secure access to key markets for Canadian exporters and investors | Successfully met | 6,445 | 6,570 | 2 |

| Canadian leadership and influence in the international forums on international economic, financial, development, and trade finance issues | Successfully met | 9,433 | 9,454 | 4 |

| Program Activity 7: Public Debt | ||||

| Stable low-cost financing for the Government of Canada | Successfully met | 34,597,000 | 33,116,651 | 1 |

| A well-functioning market in Government of Canada securities | Successfully met | 100,000 | 95,721 | 1 |

| Program Activity 8: Domestic Coinage | ||||

| A supply of coinage at a reasonable cost | Successfully met | 145,000 | 182,736 | 1 |

| Program Activity 9: Transfer Payments to Provinces and Territories | ||||

| Administration of federal transfers to the provinces and territories including Equalization, Territorial Formula Financing, Canada Health Transfer, and Canada Social Transfer | Successfully met | 40,328,203 | 47,211,456 | 3 |

| Program Activity 10: International Financial Organizations | ||||

| Payments to international organizations and Canadian creditors consistent with our commitments | Successfully met | 544,717 | 823,289 | 4 |

Operating environment and context

The Department of Finance Canada is dedicated to the creation of a strong and sustainable economy, resulting in increasing standards of living and improved quality of life for Canadians. To that end, the Department continues to work to maintain a balanced approach that will ensure a sustainable fiscal structure and encourage a more productive, competitive, and dynamic Canada while, at the same time, supporting and sustaining Canadian society.

Departmental priorities

The Department of Finance Canada's plan of action for 2007–08 was guided by four ongoing priorities: ensuring sound fiscal management; promoting sustainable economic growth; fostering a sound social policy framework; and providing effective international influence.

Priority 1: Sound Fiscal Management

A strong economy requires sensible, strong financial management and leadership. Canada's solid macroeconomic framework underpins economic growth and helps ensure the sustainability of Canada's social safety net. A sound fiscal structure also includes a competitive, efficient, and fair tax system to promote economic growth, create jobs, and boost living standards in a fiscally sustainable manner. The Department of Finance Canada plays a major role in sound fiscal management by keeping the government focussed on what it does best: improving services, helping to build a climate for the overall economy to perform better, and ensuring responsible spending, efficient operations, and effective results for taxpayers.

Priority 2: Sustainable Economic Growth

Promoting the competitiveness, efficiency, safety, and soundness of Canada's financial sector and ensuring that domestic financial markets function well are necessary conditions for achieving sustainable growth in the Canadian economy. As the government's source of analysis and advice on economic and fiscal matters, the Department helps to ensure that policies and programs create the conditions necessary for sustainable long-term economic growth by supporting business investments and research and development (R&D) and by helping Canadians meet the demands of the global economy. The Department also assists government partnerships with the provinces, territories, and the private sector in strategic areas that contribute to strong economies, including primary scientific research, a clean environment, and modern infrastructure.

Priority 3: Sound Social Policy Framework

Long-term, predictable, stable, formula-based transfer support for provinces and territories and improvements to the social policy framework contribute to improved public services for Canadians. The Department plays a key role in this regard by designing and administering transfers to provincial and territorial governments that assist provinces and territories in providing important programs and services for Canadians, including health care, education, social programs, and infrastructure. Through its analysis and advice, the Department also helps advance government objectives supporting the quality of Canada's communities, health care, education, social safety net programs, and equality of opportunity for all citizens.

Priority 4: Effective International Influence

In an increasingly competitive and integrated global economy, Canada must work to maintain secure and open borders, strengthen global growth and stability, advance the country's trade and investment interests, help foster development aimed at reducing global poverty, and advance international standards to prevent abuses to the international financial system, including anti-terrorist financing measures. The Department contributes to policies and measures designed to achieve these objectives by representing Canada in a wide range of international financial institutions and economic organizations. It also assists the government in creating the right economic conditions to encourage Canadian firms to invest and flourish and to be open to trade and foreign investment. As a result, goods, services and technologies can flow freely into Canada, and Canadian firms can have ready access to foreign markets to compete with the world's best.

Key partners and clients

The working environment of the Department is characterized by a strong commitment to consultation, coordination, and collaboration with a wide range of partners and client groups and a dynamic engagement with a rapidly changing global economy. An important component of the work conducted by the Department involves consultation and collaboration with partners in both the public and private sectors. This keeps the Department attuned to the interests and pressures faced by other government departments and stakeholders. Its primary partners and clients include Parliament and parliamentary committees; provincial, territorial, and Aboriginal governments; other departments and agencies; Crown corporations; Canadian interest groups; tax professionals; financial market participants; the international economic and finance community; the international trade community; and civil society more broadly.

The Department's activities are also undertaken in the context of a rapidly integrating, technology-driven global economy. Events that take place far from Canada can have a powerful effect, both adverse and beneficial, on Canada's economy. To support its work on international economic issues, including international trade negotiations and initiatives to enhance the competitiveness of Canadian industry through tariff relief measures, the Department holds domestic consultations not only within the federal government but also with provincial and territorial governments, the private sector, and the Canadian public.

The Department also plays a key role in promoting a strong multilateral system of global economic and financial governance, most importantly in supporting the Minister's participation in the G7, G8, and G20 processes. It also plays a lead role in managing the country's activities related to international financial institutions and organizations, such as the International Monetary Fund (IMF), the World Bank, the European Bank for Reconstruction and Development (EBRD), the Financial Stability Forum, and the Financial Action Task Force on Money Laundering.

Challenges and opportunities

The Canadian economy has experienced solid growth for 16 consecutive years, and its economic fundamentals are strong:

- The budget is balanced;

- Unemployment is near its lowest point in a generation;

- Interest rates are low;

- Inflation remains low, stable, and predictable;

- Business and household finances are strong, and the federal, provincial, and territorial governments also remain in a strong fiscal position;

- Canada is one of the few countries in the world with sound public pension plans; and

- Canada is on the best fiscal footing of the major Western industrialized countries, with the largest budgetary surplus as a share of gross domestic product (GDP) and the lowest debt burden in the G7.

The Canadian economy successfully dealt with a number of challenges in 2007–08, including a weakening U.S. economy and increased volatility in global financial markets. The higher Canadian dollar continues to present a challenge to export-intensive sectors, most notably manufacturing and forestry. In addition, Canada's population is aging, putting pressure on government programs and services, and a shortage of skilled workers in a number of sectors is already apparent.

The government's long-term economic plan, entitled Advantage Canada,aims to foster conditions in which all Canadians can reach their full potential. It is creating an environment that welcomes investment and encourages businesses to flourish.

Advantage Canada is the prism through which the government analyzes policies—whether they are fiscal ideas; entrepreneurial ideas; ideas related to post-secondary education, research, and development; or tax ideas—and determines whether these are policies or strategies that Canada should be adopting.

The Department worked extensively in 2007–08 to implement the priorities set out in Advantage Canada, including releasing Mobilizing Science and Technology to Canada's Advantage (also known as Canada's science and technology strategy), helping to increase the use of public-private partnerships, and leveraging investment in infrastructure through the establishment of a new Crown corporation, PPP Canada Inc.

The government's ambitious policy agenda, which has resulted in almost 150 tax measures' being announced since Budget 2006, together with the increased activity associated with a minority Parliament, have caused a substantial increase in the demand for advice from the Department of Finance Canada. In particular, private members' bills have resulted in a realignment of departmental priorities and resources, given the risk these bills pose to the government's fiscal position.

As well, the Government has made restoring fiscal balance a key priority, which includes renewing and strengthening major federal transfers and ensuring greater accountability of government through the clarification of roles and responsibilities. This priority has major implications for the work of the Department, particularly given its responsibilities with respect to fiscal arrangements and federal-provincial-territorial relations more broadly. For example, the analysis and advice supporting significant changes to major transfers created considerable ongoing workload pressures to ensure that legislation and regulations were updated to reflect the new program commitments, that internal data collection and calculation methodologies were established and tested, and that provincial and territorial colleagues were kept up to date with respect to the new transfer arrangements.

As a result of the Strategic Review conducted in 2007–08, the Department of Finance Canada is improving the efficiency of its operations and general administration—for example, by refocussing long-term tax policy research, reassigning tax policy analysis responsibilities, and investigating the use of new database software to allow for more robust modelling capacity as well as more powerful storage and backup capacity. The Department is also re-examining and adjusting its plans to ensure ongoing support for highest-priority activities, for example, timely, accurate payment of major transfers and provision of analysis and advice.

Additionally, due to competitive labour markets, the Department faced challenges in 2007–08 in recruiting and retaining the talent needed to meet the increasing demands of a changing economy. To this end, the Department actively participated in recruitment efforts, which include its university recruitment program, as well as succession planning to ensure a full complement of economists, analysts, taxation specialists, and managers to deliver on the Department's challenging mandate.

Overall departmental performance

Over the course of 2007–08 the government has reduced the public debt burden, delivered significant tax relief to all Canadians, and invested in important economic and social priorities.

Recent government initiatives have helped to create an environment that enhances productivity through broad-based personal income tax cuts, corporate tax cuts, a new Tax-Free Savings Account to help Canadians save for their future, investments in infrastructure and skills training, and one of the most generous tax regimes in the world in support of research and development.

The government has also made it clear that it wishes to work with the provinces to help them contribute to the creation of a more competitive tax system. These initiatives will help Canada successfully compete in the increasingly competitive and volatile global marketplace.

Building on a sound economic and fiscal policy framework

Canada's solid macroeconomic framework, which includes transparent fiscal management and a competitive, efficient, and fair tax system, has placed Canadians in a good position to weather both domestic and global economic uncertainties. A key focus for the Department in 2007–08 was to monitor and assess the implications for the Canadian economy of the U.S. economic slowdown and financial market turbulence, as well as the continuing adjustment of the domestic economy to the higher Canadian dollar. The Canadian economy continued to grow at a relatively robust pace of 2.7 per cent in 2007, second only to the U.S. among G7 countries.

The Department contributed to the development and implementation of the October 2007 Economic Statement and Budget 2008. Both documents put in place important measures to support the economy, providing broad-based tax reductions for individuals, families, and businesses worth $60 billion over 2007–08 and the following five fiscal years. Since Budget 2006, total tax relief over the same period is close to $200 billion.

In addition, Budget 2008 built on the government's strong record by doing the following:

- keeping the federal debt-to-GDP ratio on a sustainable downward trajectory by working to reduce the ratio to 25 per cent by 2011–12;

- delivering the benefits of lower debt to Canadians through the Tax Back Guarantee—by 2009–10, $2 billion in annual interest savings will be dedicated to ongoing personal income tax relief;

- keeping spending focussed and disciplined by requiring federal organizations to conduct regular Strategic Reviews of their programs and spending—as a result, some $386 million in annual savings were identified and reallocated to higher priorities in Budget 2008; and

- providing more long-term and predictable funding for infrastructure, making gas tax funding for municipalities permanent, and providing additional funding for public transit.

The Department also worked with governments in other countries to review, improve, and expand Canada's network of international tax treaties and to obtain tax information exchange agreements with non–tax treaty jurisdictions. Tax treaty negotiations with Spain, Greece, and Colombia were announced during 2007–08.

A fifth set of changes to the Canada–U.S. Income Tax Convention—known as the Fifth Protocol—was signed in September 2007 and enacted into Canadian law in December. The Protocol, which is a major updating of the treaty, will enter into force once it is ratified by the U.S. In addition, an updated tax treaty with Mexico entered into force on April 12, 2007.

Following commitments made in Budget 2007 in support of financial stability, the Department further implemented legislation and regulations to ensure greater certainty in the treatment of eligible financial contracts in insolvency, and it provided certain immunities to the Bank for International Settlements in recognition of its role in enhancing global stability.

On March 29, 2007, Bill C-37, An Act to amend the law governing financial institutions and to provide for related and consequential matters, came into force, and the first package of regulations to implement the legislation came into force on March 8, 2008. During 2007–08, the Department of Finance Canada also worked on the development of regulations associated with Bill C-57, An Act to amend certain Acts in relation to financial institutions, which modernized the governance framework for federal financial institutions and updated certain governance standards that are unique to financial institutions.

The Department of Finance Canada also continued to take the lead role in Canada's Anti-Money Laundering and Anti-Terrorist Financing Regime, which combats money laundering and terrorism financing by providing appropriate tools to law enforcement while respecting the privacy of Canadians and conforming to international standards. For example, the majority of regulations required to implement Bill C-25, An Act to amend the Proceeds of Crime (Money Laundering) and Terrorist Financing Act and the Income Tax Act and to make a consequential amendment to another Act, were finalized in 2007–08 and are expected to come into force in 2008–09.

Budget 2008 announced reinvestments over the next two years to strengthen Canada's international network and extend its reach to new markets. The Department worked on a number of tariff relief initiatives to enhance the competitiveness of Canadian industry, which provided relief of some $170 million in payment of customs duties on current and future importations.

In 2007–08, the Department worked with other government departments to advance work under the Security and Prosperity Partnership of North America (SPP), which included steps to fund initiatives based on commitments made at the North American Leaders' Summit in Montebello, Quebec, in August 2007.

The Department also worked closely with other government departments to ensure that the border is secure and conducive to trade. To this end, Budget 2008 announced significant funding over two years for initiatives to ensure that the Canada Border Services Agency has the resources needed to effectively manage the border, implement a higher-security 10-year electronic passport by 2011, expand the joint Canada–United States New Exporters to U.S. South (NEXUS) program for low-risk frequent travellers across the border, and support provinces and territories that are planning to introduce an enhanced driver's licence.

Fulfilling obligations with respect to transfer programs

The Department administers transfer programs to provinces and territories in support of the quality of Canada's communities, health care, education, and social safety net, as well as efforts to enhance the equality of opportunity for all citizens.

In 2007–08, the Department restructured the Equalization and Territorial Formula Financing (TFF) programs, consistent with Budget 2007. Equalization returned to a formula basis, using a higher 10-province standard, a new approach to the treatment of natural resource revenues, and a fiscal capacity cap. Combined, these measures strengthened the program to bring it in line with the Constitutional commitment to provide payments to ensure reasonably comparable services at reasonably comparable levels of taxation. The new formulas were used to determine payments for 2007–08.

Over the course of 2007–08, Canada Health Transfer (CHT) and Canada Social Transfer (CST) estimates of payments were calculated and released on a semi-annual basis. The CST was also renewed and strengthened, with the addition of $687 million to support the move to equal per capita cash, an additional $250 million annually for child care, as well as $800 million annually for post-secondary education. The funding is now legislated to 2013–14 with annual growth of three per cent, to ensure stable, predictable, and growing federal support for a range of social programs.

In 2007–08, the Department also provided timely payments to a wide range of international financial organizations and Canadian creditors, consistent with the Department's commitments, which play an important role in mobilizing resources for poverty reduction in low-income and least-developed countries. For example, in December 2007, Canada committed $1.3 billion to the International Development Association (IDA) of the World Bank to support poverty reduction programs and projects in the world's poorest countries.

Canada's participation in both bilateral and multilateral debt relief initiatives has also helped recipient countries redirect freed-up resources to poverty reduction initiatives to improve the lives of their citizens and reach their long-term development goals. For example, Canada contributed $44 million to clear Liberia's payments in arrears to international financial institutions, which, along with contributions from other G8 countries, cleared the way for Liberia to become eligible for $3 billion in debt relief.

Providing critical treasury and financial affairs operations

The Government is committed to ongoing, measured debt reduction, planning debt reduction of $10.2 billion for 2007–08, $2.3 billion for 2008–09, $1.3 billion for 2009–10, and $3 billion per year for 2010–11 to 2012–13. This will allow the Government to meet its commitment to reduce the debt-to-GDP ratio to 25 per cent by 2011–12, three years ahead of the original target date. To underscore the importance of these measures, with the $10.2 billion in planned debt reduction for 2007–08, the national debt will have been reduced by more than $1,500 for every man, woman, and child in Canada since the Government came to power in January 2006.

A realignment of organizational responsibilities for the retail debt program, involving the closure of the Canada Investment and Savings Agency and the transfer of responsibilities to the Bank of Canada and the Department of Finance Canada, was also successfully completed in 2007–08.

Advancing the management agenda

The Department is renewing and strengthening its commitment to values and ethics in order to ensure that departmental personnel continue to observe the highest standards of professional ethics and conduct. To that end, a new position of Director of Values and Ethics has been created and is anticipated to be filled in summer 2008. Among other duties, the Director will ensure that all persons working in the Department comply with the Values and Ethics Code for the Public Service and with the Department's conflict of interest code. The Department also adopted new policies and procedures mandated by the coming into force of the Public Servants Disclosure Protection Act in April 2007.

The decision to focus on the conflict of interest code followed senior management's identification of conflict of interest as an important risk for the department to manage. Risk management—a key building block for good governance and accountability—is also well ingrained in the decision-making and resource allocation processes of the Department. In November 2007, the Department's senior management approved a corporate risk profile, identifying key corporate risks and mitigation strategies. The profile also established a risk management framework for the Department to help guide its management decisions as part of its business planning activities, priority setting activities, and resource allocation choices.

The Department has a strong commitment to accountability and risk management in its day-to-day business. To this end, the Department has adopted an integrated corporate business planning and resource allocation framework that encompasses priority setting, business planning, work planning, and results and performance measurement applying to both financial and human resources (HR) requirements. This framework, coupled with the Department's risk-based audit and evaluation plans, positions the Department to better report on and demonstrate accountability for results and resources to Parliament and to Canadians. It also allows the Department to more strategically integrate priority setting with performance measurement and HR planning.

In 2007–08, the Department's Internal Audit and Evaluation Division built a solid foundation for a professional and independent internal audit and evaluation function. Significant progress was made to implement requirements of the 2006 Treasury Board Policy on Internal Audit by hiring additional professional auditors, providing training and development for professional accreditations, and developing key infrastructure elements including a three-year audit plan and internal procedures, protocols, and approaches. For the evaluation function, the focus in 2007–08 was on building and strengthening capacity and meeting expectations of the Management Accountability Framework and the Federal Accountability Act. With the implementation of a new Treasury Board evaluation policyanticipated in 2008–09, considerable efforts were also made to begin the development of the evaluation infrastructure. A needs assessment was conducted and a one-year evaluation plan approved in the fall of 2007.

The Standing Committee on the Status of Women presented reports on gender-based analysis (GBA) to the House of Commons in April 2005 and in May 2006. In July 2005, in response to the April 2005 report, the Department of Finance Canada committed to appoint a GBA champion, conduct a pilot project in the Tax Policy Branch to train analysts and managers in GBA, and hold pre-budget consultations with various groups. The Department has fulfilled all three commitments.

The Department responded in August 2006 to the May 2006 report and committed to post good examples of GBA on the Department's internal website, provide GBA training workshops to branches in addition to the Tax Policy Branch, include GBA in the training curriculum for new employees, and report on progress made in its 2007–08 DPR. Over the last year, the Department has continued to work to fulfill its commitments by offering GBA training to officers and managers from all branches of the Department, including GBA in its training curriculum for new employees, reporting on GBA in the Department's DPRs, and preparing good examples of GBA to be posted on the Department's internal website.