ARCHIVED - Department of Finance Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

2007-08

Departmental Performance Report

Department of Finance Canada

The original version was signed by

The Honourable James M. Flaherty

Minister of Finance

Table of Contents

Management representation statement

Summary of departmental performance

Operating environment and context

Overall departmental performance

Building on a sound economic and fiscal policy framework

Fulfilling obligations with respect to transfer programs

Providing critical treasury and financial affairs operations

Section II: Analysis of Program Activities by Strategic Outcome

Program Activity 1: Tax Policy

Program Activity 2: Economic and Fiscal PolicyProgram Activity 3: Financial Sector Policy

Program Activity 4: Economic Development and Corporate Finance

Program Activity 5: Federal-Provincial Relations and Social Policy

Program Activity 6: International Trade and Finance

Program Activity 7: Public Debt

Program Activity 8: Domestic Coinage

Program Activity 9: Transfer Payments to Provinces and Territories

Section III: Supplementary Information

Alignment with Government of Canada outcome areas

Table 1: Comparison of Planned to Actual Spending (Including FTEs)

Table 2: Voted and Statutory Items

Section IV: Other Items of Interest

Section I: Overview

Minister's message

The Department of Finance Canada plays a vital role in helping the Government of Canada develop social and economic policies to continue improving the standard of living and quality of life of Canadians, their families, and their communities in the years to come.

Over the last year, the Department has continued building on Advantage Canada, the Government's long-term economic plan, and the foundation on which we base new policy ideas.

For example, last fall's Economic Statement introduced broad-based tax reductions for individuals, families, and businesses of $60 billion over 2007–08 and the following five fiscal years. The broad-based tax reductions included acceleration and deepening of the Government's previously announced corporate income tax (CIT) reductions, bringing the federal CIT rate to 15 per cent by 2012. The Statement also included an additional one-percentage-point reduction in the GST, effective January 1, 2008, fulfilling the Government's commitment to reduce the GST to 5 per cent.By moving early to stimulate the Canadian economy, we anticipated the global economic slowdown and helped cushion its effects on our country's future economic and fiscal health. This decisive action was further enhanced in Budget 2008, a balanced, focussed, and prudent plan to strengthen Canada amid deepening global economic uncertainty.

Budget 2008 contained provisions for reducing debt and taxes, focussing government spending, and providing additional support for sectors of the economy in most need. It also introduced the Tax-Free Savings Account, a general-purpose account that will allow Canadians to watch their savings—including interest income, dividend payments, and capital gains—grow tax-free.

Though we have a bright and promising future, Canada is not an island. Many challenges are still to be met. Nevertheless, as a result of our strong economic fundamentals, we are in a good position to weather the current economic storm.

By focussing on four key priorities—ensuring sound fiscal management, promoting sustainable economic growth, fostering a sound social policy framework, and providing effective international influence—the Department of Finance Canada has demonstrated vision, commitment, and leadership for the benefit of all Canadians.

This Departmental Performance Report highlights the department's many successes in strengthening our economic fundamentals and better positioning Canada to compete in the highly competitive global economy.

Management representation statement

I submit for tabling in Parliament the Department of Finance Canada 2007–08 Departmental Performance Report (DPR).

This document has been prepared based on the reporting principles contained in the Guide to the Preparation of Part III of the 2007–08 Estimates: Reports on Plans and Priorities and Departmental Performance Reports:

- It adheres to the specific reporting requirements outlined in the Treasury Board of Canada Secretariat guidance;

- It is based on the department's approved strategic outcome and Program Activity Architecture (PAA) that were approved by the Treasury Board;

- It presents consistent, comprehensive, balanced, and reliable information;

- It provides a basis of accountability for the results achieved with the resources and authorities entrusted to the Department; and

- It reports finances based on approved numbers from the Estimates and the Public Accounts of Canada.

The paper version was signed by

Rob Wright

Deputy Minister

Summary information

Department's raison d'être

The Department is committed to making a difference for Canadians by helping the Government of Canada develop and implement strong and sustainable economic, fiscal, tax, social, security, and financial-sector policies and programs. It plays an important role in ensuring that government spending is focussed on results and delivers value for taxpayer dollars. The Department interacts extensively with other federal departments and agencies and plays a pivotal role in the analysis and design of public policy across the widest range of issues affecting Canadians.

The Department of Finance Canada's responsibilities include the following:

- preparing the federal budget;

- developing tax and tariff policy and legislation;

- managing federal borrowing on financial markets;

- administering major transfers of federal funds to the provinces and territories;

- developing regulatory policy for the country's financial sector; and

- representing Canada within international financial institutions and groups.

The Department also plays an important role as a central agency working with other departments to ensure that the government's agenda is carried out and ministers are supported with first-rate analysis and advice.

Financial Resources ($ thousands)

| 2007–08 | ||

| Planned Spending | Total Authorities | Actual Spending |

| 75,817,194 | 86,583,644 | 86,379,638 |

Human Resources (Full-Time Equivalents—FTEs)

| 2007–08 | ||

| Planned | Actual | Difference |

| 798 | 790 | 8 |

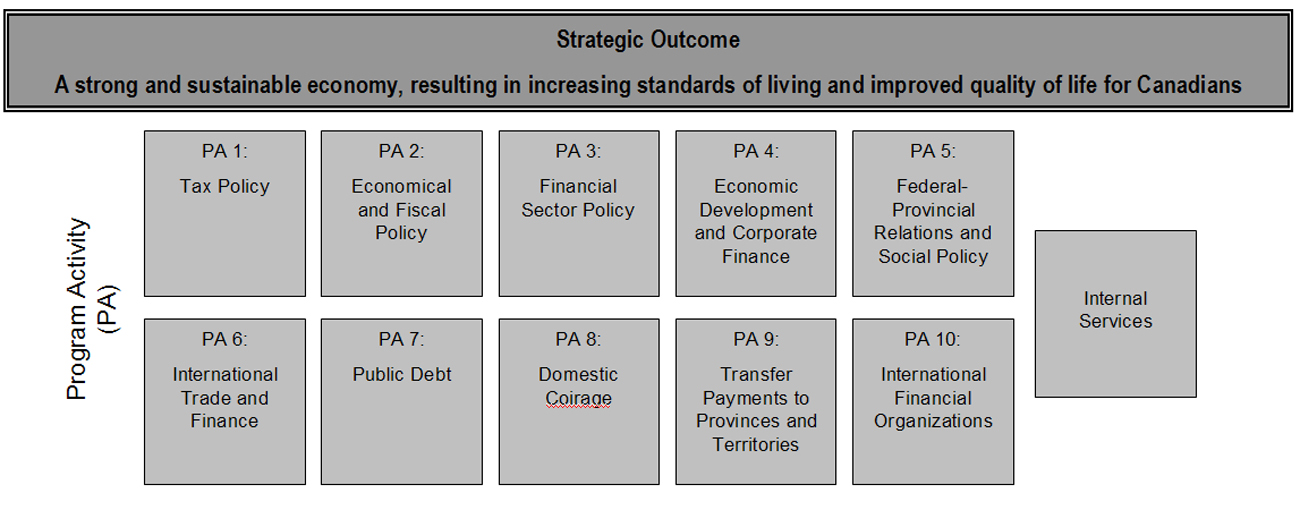

Program Activity Architecture

The Department of Finance Canada's PAA, used as the basis for the 2007–08 Report on Plans and Priorities, includes ten program activities (plus internal services) supporting the achievement of one strategic outcome, as follows:

In 2007, the Department revised its PAA to focus on three main activities: economic and fiscal policy making; transfer payments to provinces, territories, and international organizations; and the management of Government of Canada debt. The Department also developed a performance measurement framework that will help improve reporting to Parliament. This revision was reflected for the first time in the 2008–09 Report on Plans and Priorities.

However, to ensure consistency with performance expectations set out in the 2007–08 Report on Plans and Priorities and to maintain good links between performance and plans, performance information in this year's DPR is presented using the earlier PAA.

Summary of departmental performance

The following provides an overview of the strategic outcome, priorities, and program activities of the Department of Finance Canada and associated results, resources, and performance status for 2007–08.

Departmental Priorities

| Name | Type | Performance Status |

| Priority 1: Sound Fiscal Management | Ongoing | Successfully met |

| Priority 2: Sustainable Economic Growth | Ongoing | Successfully met |

| Priority 3: Sound Social Policy Framework | Ongoing | Successfully met |

| Priority 4: Effective International Influence | Ongoing | Successfully met |

Program Activities by Strategic Outcome

| Program Activity and Expected Results |

Performance Status | 2007–08 ($ thousands) | Contributes to the Following Priority | |

| Planned Spending | Actual Spending[1] |

|||

| Strategic Outcome: A strong and sustainable economy, resulting in increasing standards of living and improved quality of life for Canadians |

||||

| Program Activity 1: Tax Policy | ||||

| Improving the fairness, efficiency, and competitiveness of the personal, corporate, sales, and excise tax systems while raising the required amount of tax revenue | Successfully met | 30,400 | 31,123 | 1, 2, 3 |

| Sound fiscal relationships with provinces, Aboriginal governments, and other countries | Successfully met | 2,288 | 2,343 | 1, 2, 3 |

| Program Activity 2: Economic and Fiscal Policy | ||||

| Transparent fiscal planning and sustainable fiscal policy | Successfully met | 6,229 | 6,404 | 1 |

| Effective analysis of economic performance | Successfully met | 8,778 | 8,843 | 2 |

| Program Activity 3: Financial Sector Policy | ||||

| Prudent and cost-effective treasury management of the borrowing activities of Crown corporations and the government's investment portfolios | Successfully met | 3,370 | 904,770 | 1 |

| A regulatory framework that promotes a sound, efficient, and competitive Canadian financial sector that serves the needs of individuals, businesses, and the economy | Successfully met | 10,599 | 2,845,649 | 2 |

| A legislative and regulatory framework that ensures the security and viability of federally regulated defined benefit pension plans | Successfully met | 971 | 262,675 | 3 |

| An effective anti-money laundering and anti-terrorist financing framework | Successfully met | 3,172 | 851,262 | 4 |

| Program Activity 4: Economic Development and Corporate Finance | ||||

| Sound advice to the Minister on economic, funding, and policy proposals | Successfully met | 8,289 | 7,995 | 1, 2, 3 |

| Program Activity 5: Federal-Provincial Relations and Social Policy | ||||

| A principled framework to restore fiscal balance in Canada | Successfully met | 7,032 | 7,237 | 1 |

| Sound advice to the Minister on government social policy priorities | Successfully met | 5,265 | 5,460 | 3 |

| Program Activity 6: International Trade and Finance | ||||

| Secure access to key markets for Canadian exporters and investors | Successfully met | 6,445 | 6,570 | 2 |

| Canadian leadership and influence in the international forums on international economic, financial, development, and trade finance issues | Successfully met | 9,433 | 9,454 | 4 |

| Program Activity 7: Public Debt | ||||

| Stable low-cost financing for the Government of Canada | Successfully met | 34,597,000 | 33,116,651 | 1 |

| A well-functioning market in Government of Canada securities | Successfully met | 100,000 | 95,721 | 1 |

| Program Activity 8: Domestic Coinage | ||||

| A supply of coinage at a reasonable cost | Successfully met | 145,000 | 182,736 | 1 |

| Program Activity 9: Transfer Payments to Provinces and Territories | ||||

| Administration of federal transfers to the provinces and territories including Equalization, Territorial Formula Financing, Canada Health Transfer, and Canada Social Transfer | Successfully met | 40,328,203 | 47,211,456 | 3 |

| Program Activity 10: International Financial Organizations | ||||

| Payments to international organizations and Canadian creditors consistent with our commitments | Successfully met | 544,717 | 823,289 | 4 |

Operating environment and context

The Department of Finance Canada is dedicated to the creation of a strong and sustainable economy, resulting in increasing standards of living and improved quality of life for Canadians. To that end, the Department continues to work to maintain a balanced approach that will ensure a sustainable fiscal structure and encourage a more productive, competitive, and dynamic Canada while, at the same time, supporting and sustaining Canadian society.

Departmental priorities

The Department of Finance Canada's plan of action for 2007–08 was guided by four ongoing priorities: ensuring sound fiscal management; promoting sustainable economic growth; fostering a sound social policy framework; and providing effective international influence.

Priority 1: Sound Fiscal Management

A strong economy requires sensible, strong financial management and leadership. Canada's solid macroeconomic framework underpins economic growth and helps ensure the sustainability of Canada's social safety net. A sound fiscal structure also includes a competitive, efficient, and fair tax system to promote economic growth, create jobs, and boost living standards in a fiscally sustainable manner. The Department of Finance Canada plays a major role in sound fiscal management by keeping the government focussed on what it does best: improving services, helping to build a climate for the overall economy to perform better, and ensuring responsible spending, efficient operations, and effective results for taxpayers.

Priority 2: Sustainable Economic Growth

Promoting the competitiveness, efficiency, safety, and soundness of Canada's financial sector and ensuring that domestic financial markets function well are necessary conditions for achieving sustainable growth in the Canadian economy. As the government's source of analysis and advice on economic and fiscal matters, the Department helps to ensure that policies and programs create the conditions necessary for sustainable long-term economic growth by supporting business investments and research and development (R&D) and by helping Canadians meet the demands of the global economy. The Department also assists government partnerships with the provinces, territories, and the private sector in strategic areas that contribute to strong economies, including primary scientific research, a clean environment, and modern infrastructure.

Priority 3: Sound Social Policy Framework

Long-term, predictable, stable, formula-based transfer support for provinces and territories and improvements to the social policy framework contribute to improved public services for Canadians. The Department plays a key role in this regard by designing and administering transfers to provincial and territorial governments that assist provinces and territories in providing important programs and services for Canadians, including health care, education, social programs, and infrastructure. Through its analysis and advice, the Department also helps advance government objectives supporting the quality of Canada's communities, health care, education, social safety net programs, and equality of opportunity for all citizens.

Priority 4: Effective International Influence

In an increasingly competitive and integrated global economy, Canada must work to maintain secure and open borders, strengthen global growth and stability, advance the country's trade and investment interests, help foster development aimed at reducing global poverty, and advance international standards to prevent abuses to the international financial system, including anti-terrorist financing measures. The Department contributes to policies and measures designed to achieve these objectives by representing Canada in a wide range of international financial institutions and economic organizations. It also assists the government in creating the right economic conditions to encourage Canadian firms to invest and flourish and to be open to trade and foreign investment. As a result, goods, services and technologies can flow freely into Canada, and Canadian firms can have ready access to foreign markets to compete with the world's best.

Key partners and clients

The working environment of the Department is characterized by a strong commitment to consultation, coordination, and collaboration with a wide range of partners and client groups and a dynamic engagement with a rapidly changing global economy. An important component of the work conducted by the Department involves consultation and collaboration with partners in both the public and private sectors. This keeps the Department attuned to the interests and pressures faced by other government departments and stakeholders. Its primary partners and clients include Parliament and parliamentary committees; provincial, territorial, and Aboriginal governments; other departments and agencies; Crown corporations; Canadian interest groups; tax professionals; financial market participants; the international economic and finance community; the international trade community; and civil society more broadly.

The Department's activities are also undertaken in the context of a rapidly integrating, technology-driven global economy. Events that take place far from Canada can have a powerful effect, both adverse and beneficial, on Canada's economy. To support its work on international economic issues, including international trade negotiations and initiatives to enhance the competitiveness of Canadian industry through tariff relief measures, the Department holds domestic consultations not only within the federal government but also with provincial and territorial governments, the private sector, and the Canadian public.

The Department also plays a key role in promoting a strong multilateral system of global economic and financial governance, most importantly in supporting the Minister's participation in the G7, G8, and G20 processes. It also plays a lead role in managing the country's activities related to international financial institutions and organizations, such as the International Monetary Fund (IMF), the World Bank, the European Bank for Reconstruction and Development (EBRD), the Financial Stability Forum, and the Financial Action Task Force on Money Laundering.

Challenges and opportunities

The Canadian economy has experienced solid growth for 16 consecutive years, and its economic fundamentals are strong:

- The budget is balanced;

- Unemployment is near its lowest point in a generation;

- Interest rates are low;

- Inflation remains low, stable, and predictable;

- Business and household finances are strong, and the federal, provincial, and territorial governments also remain in a strong fiscal position;

- Canada is one of the few countries in the world with sound public pension plans; and

- Canada is on the best fiscal footing of the major Western industrialized countries, with the largest budgetary surplus as a share of gross domestic product (GDP) and the lowest debt burden in the G7.

The Canadian economy successfully dealt with a number of challenges in 2007–08, including a weakening U.S. economy and increased volatility in global financial markets. The higher Canadian dollar continues to present a challenge to export-intensive sectors, most notably manufacturing and forestry. In addition, Canada's population is aging, putting pressure on government programs and services, and a shortage of skilled workers in a number of sectors is already apparent.

The government's long-term economic plan, entitled Advantage Canada,aims to foster conditions in which all Canadians can reach their full potential. It is creating an environment that welcomes investment and encourages businesses to flourish.

Advantage Canada is the prism through which the government analyzes policies—whether they are fiscal ideas; entrepreneurial ideas; ideas related to post-secondary education, research, and development; or tax ideas—and determines whether these are policies or strategies that Canada should be adopting.

The Department worked extensively in 2007–08 to implement the priorities set out in Advantage Canada, including releasing Mobilizing Science and Technology to Canada's Advantage (also known as Canada's science and technology strategy), helping to increase the use of public-private partnerships, and leveraging investment in infrastructure through the establishment of a new Crown corporation, PPP Canada Inc.

The government's ambitious policy agenda, which has resulted in almost 150 tax measures' being announced since Budget 2006, together with the increased activity associated with a minority Parliament, have caused a substantial increase in the demand for advice from the Department of Finance Canada. In particular, private members' bills have resulted in a realignment of departmental priorities and resources, given the risk these bills pose to the government's fiscal position.

As well, the Government has made restoring fiscal balance a key priority, which includes renewing and strengthening major federal transfers and ensuring greater accountability of government through the clarification of roles and responsibilities. This priority has major implications for the work of the Department, particularly given its responsibilities with respect to fiscal arrangements and federal-provincial-territorial relations more broadly. For example, the analysis and advice supporting significant changes to major transfers created considerable ongoing workload pressures to ensure that legislation and regulations were updated to reflect the new program commitments, that internal data collection and calculation methodologies were established and tested, and that provincial and territorial colleagues were kept up to date with respect to the new transfer arrangements.

As a result of the Strategic Review conducted in 2007–08, the Department of Finance Canada is improving the efficiency of its operations and general administration—for example, by refocussing long-term tax policy research, reassigning tax policy analysis responsibilities, and investigating the use of new database software to allow for more robust modelling capacity as well as more powerful storage and backup capacity. The Department is also re-examining and adjusting its plans to ensure ongoing support for highest-priority activities, for example, timely, accurate payment of major transfers and provision of analysis and advice.

Additionally, due to competitive labour markets, the Department faced challenges in 2007–08 in recruiting and retaining the talent needed to meet the increasing demands of a changing economy. To this end, the Department actively participated in recruitment efforts, which include its university recruitment program, as well as succession planning to ensure a full complement of economists, analysts, taxation specialists, and managers to deliver on the Department's challenging mandate.

Overall departmental performance

Over the course of 2007–08 the government has reduced the public debt burden, delivered significant tax relief to all Canadians, and invested in important economic and social priorities.

Recent government initiatives have helped to create an environment that enhances productivity through broad-based personal income tax cuts, corporate tax cuts, a new Tax-Free Savings Account to help Canadians save for their future, investments in infrastructure and skills training, and one of the most generous tax regimes in the world in support of research and development.

The government has also made it clear that it wishes to work with the provinces to help them contribute to the creation of a more competitive tax system. These initiatives will help Canada successfully compete in the increasingly competitive and volatile global marketplace.

Building on a sound economic and fiscal policy framework

Canada's solid macroeconomic framework, which includes transparent fiscal management and a competitive, efficient, and fair tax system, has placed Canadians in a good position to weather both domestic and global economic uncertainties. A key focus for the Department in 2007–08 was to monitor and assess the implications for the Canadian economy of the U.S. economic slowdown and financial market turbulence, as well as the continuing adjustment of the domestic economy to the higher Canadian dollar. The Canadian economy continued to grow at a relatively robust pace of 2.7 per cent in 2007, second only to the U.S. among G7 countries.

The Department contributed to the development and implementation of the October 2007 Economic Statement and Budget 2008. Both documents put in place important measures to support the economy, providing broad-based tax reductions for individuals, families, and businesses worth $60 billion over 2007–08 and the following five fiscal years. Since Budget 2006, total tax relief over the same period is close to $200 billion.

In addition, Budget 2008 built on the government's strong record by doing the following:

- keeping the federal debt-to-GDP ratio on a sustainable downward trajectory by working to reduce the ratio to 25 per cent by 2011–12;

- delivering the benefits of lower debt to Canadians through the Tax Back Guarantee—by 2009–10, $2 billion in annual interest savings will be dedicated to ongoing personal income tax relief;

- keeping spending focussed and disciplined by requiring federal organizations to conduct regular Strategic Reviews of their programs and spending—as a result, some $386 million in annual savings were identified and reallocated to higher priorities in Budget 2008; and

- providing more long-term and predictable funding for infrastructure, making gas tax funding for municipalities permanent, and providing additional funding for public transit.

The Department also worked with governments in other countries to review, improve, and expand Canada's network of international tax treaties and to obtain tax information exchange agreements with non–tax treaty jurisdictions. Tax treaty negotiations with Spain, Greece, and Colombia were announced during 2007–08.

A fifth set of changes to the Canada–U.S. Income Tax Convention—known as the Fifth Protocol—was signed in September 2007 and enacted into Canadian law in December. The Protocol, which is a major updating of the treaty, will enter into force once it is ratified by the U.S. In addition, an updated tax treaty with Mexico entered into force on April 12, 2007.

Following commitments made in Budget 2007 in support of financial stability, the Department further implemented legislation and regulations to ensure greater certainty in the treatment of eligible financial contracts in insolvency, and it provided certain immunities to the Bank for International Settlements in recognition of its role in enhancing global stability.

On March 29, 2007, Bill C-37, An Act to amend the law governing financial institutions and to provide for related and consequential matters, came into force, and the first package of regulations to implement the legislation came into force on March 8, 2008. During 2007–08, the Department of Finance Canada also worked on the development of regulations associated with Bill C-57, An Act to amend certain Acts in relation to financial institutions, which modernized the governance framework for federal financial institutions and updated certain governance standards that are unique to financial institutions.

The Department of Finance Canada also continued to take the lead role in Canada's Anti-Money Laundering and Anti-Terrorist Financing Regime, which combats money laundering and terrorism financing by providing appropriate tools to law enforcement while respecting the privacy of Canadians and conforming to international standards. For example, the majority of regulations required to implement Bill C-25, An Act to amend the Proceeds of Crime (Money Laundering) and Terrorist Financing Act and the Income Tax Act and to make a consequential amendment to another Act, were finalized in 2007–08 and are expected to come into force in 2008–09.

Budget 2008 announced reinvestments over the next two years to strengthen Canada's international network and extend its reach to new markets. The Department worked on a number of tariff relief initiatives to enhance the competitiveness of Canadian industry, which provided relief of some $170 million in payment of customs duties on current and future importations.

In 2007–08, the Department worked with other government departments to advance work under the Security and Prosperity Partnership of North America (SPP), which included steps to fund initiatives based on commitments made at the North American Leaders' Summit in Montebello, Quebec, in August 2007.

The Department also worked closely with other government departments to ensure that the border is secure and conducive to trade. To this end, Budget 2008 announced significant funding over two years for initiatives to ensure that the Canada Border Services Agency has the resources needed to effectively manage the border, implement a higher-security 10-year electronic passport by 2011, expand the joint Canada–United States New Exporters to U.S. South (NEXUS) program for low-risk frequent travellers across the border, and support provinces and territories that are planning to introduce an enhanced driver's licence.

Fulfilling obligations with respect to transfer programs

The Department administers transfer programs to provinces and territories in support of the quality of Canada's communities, health care, education, and social safety net, as well as efforts to enhance the equality of opportunity for all citizens.

In 2007–08, the Department restructured the Equalization and Territorial Formula Financing (TFF) programs, consistent with Budget 2007. Equalization returned to a formula basis, using a higher 10-province standard, a new approach to the treatment of natural resource revenues, and a fiscal capacity cap. Combined, these measures strengthened the program to bring it in line with the Constitutional commitment to provide payments to ensure reasonably comparable services at reasonably comparable levels of taxation. The new formulas were used to determine payments for 2007–08.

Over the course of 2007–08, Canada Health Transfer (CHT) and Canada Social Transfer (CST) estimates of payments were calculated and released on a semi-annual basis. The CST was also renewed and strengthened, with the addition of $687 million to support the move to equal per capita cash, an additional $250 million annually for child care, as well as $800 million annually for post-secondary education. The funding is now legislated to 2013–14 with annual growth of three per cent, to ensure stable, predictable, and growing federal support for a range of social programs.

In 2007–08, the Department also provided timely payments to a wide range of international financial organizations and Canadian creditors, consistent with the Department's commitments, which play an important role in mobilizing resources for poverty reduction in low-income and least-developed countries. For example, in December 2007, Canada committed $1.3 billion to the International Development Association (IDA) of the World Bank to support poverty reduction programs and projects in the world's poorest countries.

Canada's participation in both bilateral and multilateral debt relief initiatives has also helped recipient countries redirect freed-up resources to poverty reduction initiatives to improve the lives of their citizens and reach their long-term development goals. For example, Canada contributed $44 million to clear Liberia's payments in arrears to international financial institutions, which, along with contributions from other G8 countries, cleared the way for Liberia to become eligible for $3 billion in debt relief.

Providing critical treasury and financial affairs operations

The Government is committed to ongoing, measured debt reduction, planning debt reduction of $10.2 billion for 2007–08, $2.3 billion for 2008–09, $1.3 billion for 2009–10, and $3 billion per year for 2010–11 to 2012–13. This will allow the Government to meet its commitment to reduce the debt-to-GDP ratio to 25 per cent by 2011–12, three years ahead of the original target date. To underscore the importance of these measures, with the $10.2 billion in planned debt reduction for 2007–08, the national debt will have been reduced by more than $1,500 for every man, woman, and child in Canada since the Government came to power in January 2006.

A realignment of organizational responsibilities for the retail debt program, involving the closure of the Canada Investment and Savings Agency and the transfer of responsibilities to the Bank of Canada and the Department of Finance Canada, was also successfully completed in 2007–08.

Advancing the management agenda

The Department is renewing and strengthening its commitment to values and ethics in order to ensure that departmental personnel continue to observe the highest standards of professional ethics and conduct. To that end, a new position of Director of Values and Ethics has been created and is anticipated to be filled in summer 2008. Among other duties, the Director will ensure that all persons working in the Department comply with the Values and Ethics Code for the Public Service and with the Department's conflict of interest code. The Department also adopted new policies and procedures mandated by the coming into force of the Public Servants Disclosure Protection Act in April 2007.

The decision to focus on the conflict of interest code followed senior management's identification of conflict of interest as an important risk for the department to manage. Risk management—a key building block for good governance and accountability—is also well ingrained in the decision-making and resource allocation processes of the Department. In November 2007, the Department's senior management approved a corporate risk profile, identifying key corporate risks and mitigation strategies. The profile also established a risk management framework for the Department to help guide its management decisions as part of its business planning activities, priority setting activities, and resource allocation choices.

The Department has a strong commitment to accountability and risk management in its day-to-day business. To this end, the Department has adopted an integrated corporate business planning and resource allocation framework that encompasses priority setting, business planning, work planning, and results and performance measurement applying to both financial and human resources (HR) requirements. This framework, coupled with the Department's risk-based audit and evaluation plans, positions the Department to better report on and demonstrate accountability for results and resources to Parliament and to Canadians. It also allows the Department to more strategically integrate priority setting with performance measurement and HR planning.

In 2007–08, the Department's Internal Audit and Evaluation Division built a solid foundation for a professional and independent internal audit and evaluation function. Significant progress was made to implement requirements of the 2006 Treasury Board Policy on Internal Audit by hiring additional professional auditors, providing training and development for professional accreditations, and developing key infrastructure elements including a three-year audit plan and internal procedures, protocols, and approaches. For the evaluation function, the focus in 2007–08 was on building and strengthening capacity and meeting expectations of the Management Accountability Framework and the Federal Accountability Act. With the implementation of a new Treasury Board evaluation policyanticipated in 2008–09, considerable efforts were also made to begin the development of the evaluation infrastructure. A needs assessment was conducted and a one-year evaluation plan approved in the fall of 2007.

The Standing Committee on the Status of Women presented reports on gender-based analysis (GBA) to the House of Commons in April 2005 and in May 2006. In July 2005, in response to the April 2005 report, the Department of Finance Canada committed to appoint a GBA champion, conduct a pilot project in the Tax Policy Branch to train analysts and managers in GBA, and hold pre-budget consultations with various groups. The Department has fulfilled all three commitments.

The Department responded in August 2006 to the May 2006 report and committed to post good examples of GBA on the Department's internal website, provide GBA training workshops to branches in addition to the Tax Policy Branch, include GBA in the training curriculum for new employees, and report on progress made in its 2007–08 DPR. Over the last year, the Department has continued to work to fulfill its commitments by offering GBA training to officers and managers from all branches of the Department, including GBA in its training curriculum for new employees, reporting on GBA in the Department's DPRs, and preparing good examples of GBA to be posted on the Department's internal website.

Section II: Analysis of Program Activities by Strategic Outcome

Strategic outcome

The Department of Finance Canada provides effective economic leadership with a clear focus on one strategic outcome:

All program activities support the Department's strategic outcome.

Program Activity 1: Tax Policy

The Tax Policy program activity develops and evaluates federal taxation policies and legislation, negotiates international tax treaties and tax information exchange agreements as well as tax elements of comprehensive land claim and self-government agreements with Aboriginal governments, and provides advice and recommendations for changes aimed at improving the tax system while raising the required amount of revenue to finance government priorities. It focusses on the following areas: personal income tax, business income tax, Aboriginal tax policy, and sales and excise taxes. It is also involved with federal-provincial tax coordination, federal-provincial tax collection and reciprocal agreements, federal-Aboriginal tax administration agreements, and tax policy research and evaluation.

Financial Resources ($ thousands)

| Planned Spending | Authorities | Actual Spending |

| 32,689 | 35,797 | 33,466 |

Human Resources (Full-Time Equivalents—FTEs)

| Planned | Actual | Difference |

| 244 | 247 | –3 |

The Tax Policy program activity supports and contributes to the Department's strategic outcome and priorities by ensuring that the tax system raises sufficient revenues in an economically efficient and fair manner to pay for public services, including social programs (e.g. universal health care and public safety and security), and strategic investments in areas that promote a more competitive and productive Canadian economy (e.g. education and training, basic scientific research, and infrastructure). Regardless of their objective, proposed policies are reviewed for gender and environmental impacts.

Why is this important? Improvements to the competitiveness, efficiency, and fairness of Canada's tax system increase incentives to work, increase standards of living, fuel growth in the economy, encourage investment in Canada, and further strengthen Canadians' confidence in the tax system.

Expected result: Improving the fairness, efficiency, and competitiveness of the personal, corporate, sales, and excise tax systems while raising the required amount of tax revenue

Performance indicators

- Proposals and research to improve the competitiveness, efficiency, and fairness of the personal, corporate, sales, and excise tax systems

- Amount of tax revenue raised

Data sources

- The federal budgets, legislation, regulations, press releases, tax treaties, the Department's marginal effective tax rate models, Public Accounts of Canada, tax evaluations, working and research papers, and tax expenditure reports

Targets

- Proposals in the budget and throughout the year, as required, to implement the government's tax policy agenda and maintain a competitive, effective, and fair tax system

- Collection of sufficient tax revenues to pay for public services

- Publication of the tax expenditures and evaluations report

- Two published evaluations per year

Status

- Successfully met

The Tax Policy program activity carried out a number of tax initiatives during 2007–08 aimed at improving the competitiveness, efficiency, and fairness of the personal, corporate, sales, and excise tax systems in a fiscally sustainable manner. Many of these measures were developed to support implementation of Advantage Canada—the government's strategic long-term economic plan.

In particular, Tax Policy program staff provided sound and timely advice and recommendations to the Minister of Finance and senior officials in preparation for the October 2007 Economic Statement and Budget 2008. This work contributed to the development of measures such as broad-based tax reductions for individuals, families, and businesses worth $60 billion over 2007–08 and the following five fiscal years, bringing total tax relief since Budget 2006 over this same period to almost $200 billion.

Some measures of direct benefit to individuals included the following:

- reducing the goods and services tax (GST) rate by an additional percentage point as of January 1, 2008, fulfilling the Government's commitment to reduce the GST to 5 per cent;

- reducing the lowest personal income tax rate to 15 per cent from 15.5 per cent and increasing the basic amount that all individuals can earn tax-free; and

- introducing a new Tax-Free Savings Account to help Canadians save for the future.

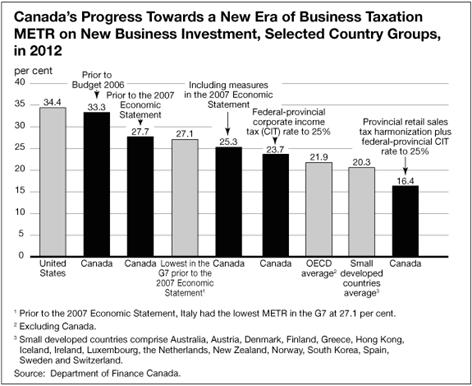

Key measures introduced during 2007–08 to improve the competitiveness, efficiency, and fairness of Canada's business tax system included the following:

- historic tax reductions that will encourage new business investment, improve productivity and job creation, and bolster confidence in the Canadian economy on a long-term basis—these broad-based corporate tax reductions will reduce the federal corporate income tax rate to 15 per cent by 2012 from 22.12 per cent (including the corporate surtax) in 2007;

- further assistance to Canada's manufacturing and processing sector by extending accelerated capital cost allowance (CCA) treatment for investment in machinery and equipment by three additional years;

- expansion of the accelerated CCA for clean-energy generation equipment to additional applications involving ground-source heat pump and waste-to-energy systems;

- improvements to the scientific research and experimental development (SR&ED) tax incentive program to enhance support for small-and medium-sized businesses and to provide investment tax credits for certain SR&ED activities carried out outside of Canada;

- alignment of CCA rates with the useful life of assets for railway locomotives and carbon dioxide pipelines (a key component of carbon capture and storage systems); and

- introduction of the Anti-Tax Haven Initiative and creation of the Advisory Panel on Canada's System of International Taxation, to improve the fairness and competitiveness of Canada's system of international taxation.

The Tax Policy program also published a research report on the effect of corporate income tax rate reductions on business investment in the 2007 Tax Expenditures and Evaluations report available at http://www.fin.gc.ca/taxexp/2007/taxexp07_4e.html#part2.

Expected result: Sound fiscal relationships with provinces, Aboriginal governments, and other countries

Performance indicators

- Active negotiation of additional tax administration agreements with provincial and Aboriginal governments

- Effective network of tax treaties with other countries

- Effective meetings of the Federal-Provincial Tax Committee

Data sources

- Federal-provincial agreements, federal-provincial meetings, federal-Aboriginal agreements, and federal-Aboriginal negotiations

Target

- Increased number of tax agreements and tax treaties signed

Status

- Successfully met

The Tax Policy program activity contributed to the expected result of improving the coordination of the federal tax system with those of the provinces, territories, Aboriginal governments, and other countries during 2007–08.

To promote a more competitive tax system, the federal government continued to encourage provinces that have retail sales taxes to facilitate a transition to a provincial value-added tax harmonized with the GST.

The Tax Policy program regularly works with Aboriginal groups and governments to manage the First Nations sales tax (FNST), the First Nations goods and services tax (FNGST), and the First Nations personal income tax (FNPIT) administration agreements. During 2007–08 Tax Policy program staff negotiated tax elements related to 20 agreements in principle and to 4 final comprehensive land claim agreements and self-governing agreements with Aboriginal peoples.

The Tax Policy program also works with governments of other countries to review, improve,

and expand Canada's network of international tax treaties and tax information exchange agreements (TIEA) with non–tax treaty jurisdictions. Tax treaty negotiations with the following countries were announced during 2007–08: Spain, Greece, and Colombia. A fifth set of changes to the existing Canada–U.S. Income Tax Convention—known as the Fifth Protocol—was

signed in September 2007 and enacted into Canadian law in December. The Protocol, which is a major updating of the treaty, will enter into force once it is ratified by the U.S. In addition, an updated tax treaty with Mexico entered into force on April 12, 2007.

These and other treaty-related developments can be found on the Department of Finance Canada's website at http://www.fin.gc.ca/treaties/treatystatus_e.html.

Program Activity 2: Economic and Fiscal Policy

This program area analyzes Canada's economic and fiscal situation and advises on the government's economic policy framework, budget planning framework, and spending priorities. It is responsible for monitoring and preparing forecasts of Canada's economic and fiscal position and plays a lead role in the management of the government's fiscal framework. The program also provides analytical support on a wide range of economic and financial issues related to the government's macroeconomic and structural policies.

Financial Resources ($ thousands)

| Planned Spending | Authorities | Actual Spending |

| 15,007 | 16,186 | 15,247 |

Human Resources (Full-Time Equivalents—FTEs)

| Planned | Actual | Difference |

| 121 | 118 | 3 |

The work under this program activity contributes to the Department's strategic outcome and priorities by helping to ensure that fiscal planning in the Government of Canada is transparent and supports long-term fiscal sustainability. It also helps to ensure that the government understands the strengths and weaknesses of the Canadian economy now and in the future in order to develop economic policies that lead to sustained economic growth.

Why is this important? Sound economic and fiscal policies enable the Canadian economy to perform well. Moreover, sound fiscal planning and lowering the public debt are essential to the country's long-term prosperity. Lower debt helps keep interest rates low and frees up funds for more productive uses, such as lower personal income taxes. Lower debt levels also strengthen the government's ability to deal with challenges—such as an aging population—and help to reduce the overall level of interest rates, leading to more private sector investment and a more productive economy.

Expected result: Transparent fiscal planning and sustainable fiscal policy

Performance indicators

- Publication of fiscal projections

- Federal debt as a share of the GDP

Data sources

- The federal budget and the Economic and Fiscal Update

- Annual Financial Report of the Government of Canada

Targets

- Publish two-year and five-year fiscal projections

- Reduce the federal debt-to-GDP ratio to 25 per cent by 2011–12

Status

- Successfully met

The government has taken significant steps to ensure that fiscal planning is transparent and enhances accountability and that fiscal policy remains sustainable. In 2007–08, the Department continued to monitor and assess the government's fiscal position and to update fiscal projections through the Economic Statement, the Budget Plan, and the monthly Fiscal Monitor. The Department also provided quarterly updates of the fiscal outlook for the year in progress, as committed to in the Federal Accountability Action Plan. Further information on the government's fiscal performance can be found in the Annual Financial Report of the Government of Canada at http://www.fin.gc.ca/purl/afr-e.html.

In light of global economic uncertainty, the Department updated and presented the five-year budget balance projections initially presented in the October 2007 Economic Statement in Budget 2008. The federal budget will continue to focus on a two-year planning horizon.

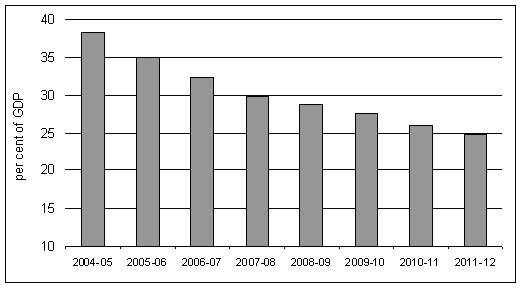

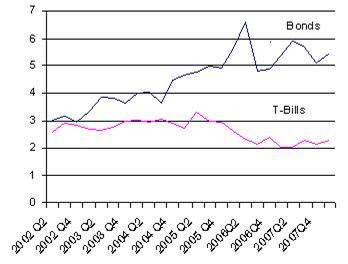

The government is committed to ongoing, measured debt reduction, planning debt reduction of $10.2 billion for 2007–08, $2.3 billion for 2008–09, $1.3 billion for 2009–10, and $3 billion per year for 2010–11 to 2012–13. This will allow the government to meet its commitment to reduce the debt-to-GDP ratio to 25 per cent by 2011–12, three years ahead of the original target date. The chart below shows the Budget 2008 projection of the federal debt-to-GDP ratio.

Federal Debt-to-GDP Ratio (Projections for 2007–08 Onward)

The Tax Back Guarantee was legislated in Budget 2007. Under the guarantee, the government dedicates the effective interest savings from federal debt reduction each year to permanent and sustainable personal income tax reductions. As of 2009–10, tax reductions provided under the Guarantee will amount to $2 billion. This accounts for nearly 40 per cent of the personal tax relief provided since Budget 2006.

To ensure that spending is sustainable for the long term, the Government is committed to keeping the rate of growth of program spending, on average, below the rate of growth of the economy. In Budget 2008, program spending as a share of GDP in 2007–08 and 2008–09 is below the track set out in Budget 2007, and program spending is projected to decline as a share of GDP over the next five years.

Expected result: Effective analysis of economic performance

Performance indicators

- Canada's GDP growth relative to the G6 (G7 less Canada)

Data sources

- IMF World Economic Outlook

Target

- Above-G6 average for annual GDP growth rate

Status

- Successfully met

The Department continued to provide effective analysis of economic activity in Canada, the U.S., and abroad. This information includes, among other things, chapters on economic developments and outlook in the Economic Statement and the Budget Plan. For example, Budget 2008 presented an analysis of some key structural factors underlying Canada's economic performance, including the following:

- the improvement in Canada's terms of trade due to higher commodity prices and its positive effect on the increase in Canadians' living standards;

- the changes in the composition of the labour market following the continuing adjustment to the higher Canadian dollar in the manufacturing and forestry sectors; and

- federal debt reduction's role in helping lower the overall level of private sector borrowing interest rates and in freeing up financial resources for more productive uses in the economy.

Regular consultations with and participation in meetings of the Organisation for Economic Co-operation and Development (OECD) and the IMF enabled the Department to monitor global economic developments and, given the openness of the Canadian economy, promote the growth potential of Canada.

A key focus for 2007–08 was to monitor and assess the implications for the Canadian economy of the U.S. economic slowdown and financial market turbulence, as well as the continuing adjustment of the domestic economy to the higher Canadian dollar. These implications were presented in Budget 2008, in conjunction with the Department's survey of private sector forecasters regarding their outlook on the Canadian economy and a thorough examination of the risks and uncertainties in that outlook.

Program Activity 3: Financial Sector Policy

This program area ensures the soundness, efficiency, and competitiveness of Canada's financial sector in support of strong, sustainable growth in the Canadian economy. This program provides analysis of Canada's financial services sector and financial markets, and it develops the legislative and regulatory framework governing federally regulated financial institutions (banks, trust and loan companies, insurance companies, and co-operative credit associations) and federally regulated defined benefit pension plans. This program activity also spearheads the federal strategy to combat money laundering and terrorist financing. It plays a lead role in conducting Canada's relations and negotiating Canada's commitments with foreign governments in the area of trade in financial services.

Financial Resources ($ thousands)

| Planned Spending | Authorities | Actual Spending |

| 18,113 | 4,934,982 | 4,864,357[2] |

Human Resources (Full-Time Equivalents—FTEs)

| Planned | Actual | Difference |

| 129 | 130 | –1 |

The Financial Sector Policy program supports and contributes to the Department's strategic outcome and priorities by ensuring that Canada's financial sector and domestic financial markets function well—conditions necessary to achieve sustainable growth in the Canadian economy.

Why is this important? A sound, efficient, and competitive Canadian financial sector is necessary to support the savings and investment needs of individuals, businesses, and the economy as a whole.

Expected result: Prudent and cost-effective treasury management of the borrowing activities of Crown corporations and the government's investment portfolios[3]

Performance indicators

- Crown borrowing costs

- Net returns on liquid asset portfolios

- Amount of exposure to financial risk

- Administrative costs of treasury functions

Data sources

- Crown annual reports and corporate plans

- Public Accounts of Canada

- Debt Management Report and Report on the Management of Canada's Official International Reserves

- Bank of Canada annual reports

Targets

- Low and stable risk-adjusted costs of borrowing and investing funds

- Positive returns on investment portfolios, net of costs

- Exposure to financial risks within Minister-approved limits

- Overhead costs in line with comparable entities

Status

- Successfully met

Treasury management operations and initiatives for the management of the Government of Canada's financial assets and liabilities continued to focus on lowering financing costs and generating positive investment returns while prudently managing investment risks within approved ministerial limits. Low and stable risk-adjusted costs of borrowing by the federal government on behalf of borrowing agent Crown corporations support a well-functioning market in an environment of declining borrowing needs. The administrative costs of treasury borrowing and investing activities are in line with those of other sovereigns.

The Minister of Finance approves all Crown borrowing within the context of annual corporate plan approvals. Crown results are available in their annual reports. Information about the plans, actions, and outcomes associated with financial asset and debt management can be found in the Report on the Management of Canada's Official International Reserves: April 1, 2006–March 31, 2007, as well as in the Debt Management Report 2007–2008, both of which will be published in the fall of 2008, following tabling of the Public Accounts of Canada for 2007–08.

Related to pursuing improvements to the borrowing framework for major government-backed entities, the borrowings of the Business Development Bank of Canada (BDC), the Canada Mortgage and Housing Corporation (CMHC), and Farm Credit Canada (FCC) were consolidated with the Government of Canada borrowing program. This allowed the Department to deliver on a related commitment fromBudget 2007, reduce Crown borrowing costs, and enhance the liquidity of the Government of Canada debt market. The BDC, the CMHC, and the FCC were granted limited early access for short-term borrowings in December 2007, which helped to reduce their borrowing costs during a period of widening credit spreads.

The Department provided analysis and advice on cash and reserves investment policy in collaboration with the Bank of Canada. This analysis and advice helped maintain prudential liquidity for the government while maintaining the government's exposure to financial risk within approved limits.

In 2007–08, recommendations received through an external evaluation of cash management activities were considered, and an external evaluation of the treasury management risk framework was completed. The completed external evaluations are posted on the Treasury Evaluation Program section of the Department's website at http://www.fin.gc.ca/access/fininste.html#Treasury.

Expected result: A regulatory framework that promotes a sound, efficient, and competitive Canadian financial sector that serves the needs of individuals, businesses, and the economy

Performance indicators

- Policy, legislative, and regulatory initiatives

Data sources

- Legislation, regulations, and publications

Targets

- Implement and draft regulations for Bill C-37

- Develop Bill C-57 regulations

- Complete the IMF Financial Sector Assessment Program (FSAP) update

- Develop policies for the review of the mortgage insurance framework

Status

- Successfully met

In 2007–08, the Department conducted analysis and provided advice on a broad range of financial issues and identified potential areas of policy change needed to support a leading-edge financial services sector and domestic capital market to achieve a more productive, competitive, and dynamic economy.

Following commitments made in Budget 2007 in support of financial stability and the efficiency of Canada's capital markets, the Department implemented legislation and regulations to provide greater certainty in the treatment of eligible financial contracts in insolvency and provided certain immunities to the Bank for International Settlements in recognition of its role in enhancing global stability. The Department closely monitored financial markets and institutions domestically and internationally and worked with other government and non-governmental organizations to analyze and develop recommendations to improve resiliency in the financial sector.

The fiscal year 2007–08 has been a very challenging one for the financial system. With the onset of the global credit turmoil in the summer of 2007, the Department increased its monitoring and analysis of Canadian credit markets, notably developments in the Canadian non-bank sponsored asset-backed commercial paper (ABCP) market, which froze in August 2007. On August 16, 2007, a group representing major investors in non-bank sponsored ABCP and the main international bank asset providers agreed to a standstill under the Montréal Accord, providing the basis for a restructuring of the affected paper. Since the standstill began, the Department, along with the Bank of Canada, encouraged all of the parties to work constructively toward an orderly resolution. The Minister of Finance issued statements supporting the restructuring process at key milestones, and on June 5, 2008, the Superior Court of Justice of Ontario approved the plan for restructuring ABCP developed by the Pan-Canadian Investors Committee.

In response to the global turmoil, G7 finance ministers and central bank governors tasked the Financial Stability Forum (FSF) in October 2007 with assessing the causes and making recommendations to enhance market and institutional resilience. The Department is an active member of the FSF, along with the Office of the Superintendent of Financial Institutions and the Bank of Canada. The Department is fully engaged in international efforts and is working collaboratively with other federal and provincial regulators to improve market resiliency and ensure that regulatory agencies have a range of flexible and up-to-date regulatory tools. The Department continues to closely monitor financial markets and institutions domestically and internationally.

On March 29, 2007, Bill C-37, An Act to amend the law governing financial institutions and to provide for related and consequential matters, received Royal Assent, and the first package of regulations to implement the legislation came into force on March 8, 2008. The regulations can be found on the Canada Gazette website at http://gazetteducanada.gc.ca/partII/2008/20080319/html/index-e.html. Bill C-37 is aimed at enhancing the interests of consumers and increasing legislative and regulatory efficiency, while also making a number of technical amendments. The Department continues to work on the development of the remaining regulations required to fully implement the Bill.

During 2007–08, the Department of Finance Canada also worked toward completing the outstanding regulations associated with Bill C-57, An Act to amend certain Acts in relation to financial institutions. Once completed, these regulations will allow the remaining provisions of the legislation to be brought into force. Bill C-57 brings the governance standards in the financial institutions statutes up to the standards adopted in 2001 for business corporations in the Canada Business Corporations Act and general co-operatives in the Canada Cooperatives Act. As an integrated package, the amendments clarify the roles of directors, enhance the rights of shareholders, modernize governance practices, strengthen the governance elements of the regulatory framework, and increase disclosure of information in respect of participating and adjustable life insurance policies.

In 2007–08, the Department also coordinated and completed the FSAP Update offered by the IMF. An FSAP Update report was published by the IMF on February 13, 2008, and concluded that the Canadian financial sector is mature, sophisticated, and well-managed, with many examples of best practice. The report is available online at http://www.imf.org/external/pubs/cat/longres.cfm?sk=21710.0.

At a June 2007 meeting with provincial and territorial ministers responsible for securities regulation, the Minister of Finance committed to form the third-party Expert Panel on Securities Regulation (http://www.expertpanel.ca) to advise ministers on the best way forward. The government appointed the panel of experts in February 2008. This Panel will examine how to enhance, in practical ways, the effectiveness, content, and structure of capital markets regulation, in particular by improving enforcement and by favouring proportionate, more principles-based regulation. The panel will build on the work accomplished by pre-existing private sector groups. It will provide a concrete proposal, a transition path, and a common model act based on advice from recognized experts. The Panel will report to the Minister of Finance and to provincial and territorial ministers responsible for securities by the end of 2008.

During 2007–08, the Department consulted with industry stakeholders and relevant federal and provincial regulators on the mortgage insurance framework. The Department has also reviewed market developments and examined the approaches taken in comparable jurisdictions. It is anticipated that an updated mortgage insurance framework will be introduced by the end of 2008.

Expected result: A legislative and regulatory framework that ensures the security and viability of federally regulated defined benefit pension plans

Performance indicators

- Policy, legislative, and regulatory initiatives

Data sources

- Legislation and regulations

Target

- Develop legislation and regulations as needed

Status

- Successfully met

In 2007–08, the Department continued to review and assess means to strengthen the legislative and regulatory framework for federally registered defined benefit pension plans in order to improve the security of pension benefits and ensure the viability of defined benefit pension plans. A properly designed private pension system, with appropriate incentives for both employers and employees, can contribute to the security and prosperity of Canadian workers and retirees and support increases in living standards. In addition, departmental officials worked to provide technical advice on measures pertaining to phased retirement and life income funds. Developments at the provincial level were also monitored, including the reviews undertaken in Alberta, British Columbia, Ontario, and Nova Scotia and the effect of several court cases involving private pensions.

Expected result: An effective anti-money laundering (AML) and anti-terrorist financing (ATF) framework

Performance indicators

- Regulations

- International standards and evaluation reports

- Canadian presidency of the Financial Action Task Force on Money Laundering (FATF)

- Establishment of the Egmont Secretariat

Data sources

- Legislation, regulations

- FATF mutual evaluation report

- Report from the outgoing president of FATF

- Official announcement of the Egmont Secretariat

Targets

- Develop regulations for the Proceeds of Crime (Money Laundering) and Terrorist Financing Act

- Comply with international standards and the recommendation of the Auditor General of Canada and Treasury Board–mandated evaluation reports

- Deliver the FATF president's work program

- Operationalization of the Egmont Secretariat

Status

- Successfully met

The goal of Canada's AML and ATF Regime is to combat money laundering and terrorism financing by providing appropriate tools to law enforcement, while respecting the privacy of Canadians and conforming to international standards. The Department of Finance Canada continues to take the lead role in regard to the Regime, ensuring that ongoing work is undertaken in coordination with federal partners, such as the Financial Transactions Reports Analysis Centre of Canada (FINTRAC), and leading to prudent policy advice and implementation. A public-private sector advisory committee was struck in November 2007 to facilitate working more closely with private sector partners with the goal of ensuring that policy development remains current and effective.

The majority of regulations required to implement Bill C-25, An Act to amend the Proceeds of Crime (Money Laundering) and Terrorist Financing Act and the Income Tax Act and to make a consequential amendment to another Act, were finalized in 2007–08 and are expected to come into force in 2008–09. The amendments include enhancing customer due diligence measures, extending the Regime to include three new reporting sectors, creating a registration regime for money service businesses, and creating an administrative and monetary penalties regime.

In February 2008, the FATF released its findings on its evaluation of Canada's AML and ATF Regime (http://www.fatf-gafi.org/dataoecd/5/3/40323928.pdf). The report found that Canada's Regime is solid in terms of its legal structure, law enforcement powers, international cooperation, and ATF standards, even though the report only took into account measures that were in place as of June 2007. Canada will be compliant with virtually all of the FATF's recommendations when the remainder of the regulations are implemented over the course of 2008–09. These measures also address the recommendations of the Auditor General of Canada and Treasury Board–mandated evaluation reports.

June 2007 marked the end to a successful Canadian presidency of the FATF. During the Canadian presidency, six countries underwent assessments of their AML and ATF regimes; the FATF strengthened its cooperation with the World Bank, the IMF, and the United Nations to promote its 40 and 9 Special Recommendations; and it improved its relationship with FATF-style regional bodies. FATF membership grew during the Canadian presidency to include China as a member and South Korea and India as observers. Canada initiated a two-year process to define a strategic direction for the FATF mid-term review in 2007–08. Finally, the Canada president was very active in engaging private sector stakeholders.

On February 15, 2008, the Minister of Finance officially opened the permanent home of the Egmont Secretariat in Toronto. The Egmont Secretariat coordinates the exchange of information, provides training, and shares expertise among its 101 financial intelligence unit members worldwide.

Program Activity 4: Economic Development and Corporate Finance

This program area is responsible for fulfilling the challenge function of the Department of Finance Canada by monitoring major economic policy issues and proposals under development in the economic departments and from outside of government. It provides advice to the Minister regarding the financial and policy implications of existing and new policies and programs. The program provides policy analysis and recommendations in the areas of traditional and knowledge-based sectors, defence, transportation, public infrastructure, environment, energy and resources, agriculture, fisheries, regional development, and privatization. It also plays a lead role in advising on corporate restructuring affecting Crown corporations and other corporate holdings.

Financial Resources ($ thousands)

| Planned Spending | Authorities | Actual Spending |

| 8,289 | 8,836 | 7,995 |

Human Resources (Full-Time Equivalents—FTEs)

| Planned | Actual | Difference |

| 67 | 63 | 4 |

The program contributes to the Department's strategic outcomes and priorities by recommending policies that contribute to higher productivity and a more competitive and dynamic Canada.

Why is this important? The Department implements the government's economic and broader policy agenda through the development of the annual budget and the Economic and Fiscal Update. To do so, the Department needs to assess and make recommendations on numerous proposals for new program spending that emanate from federal departments, other levels of government, and the Canadian public. This activity is critical if the government is to establish policy and funding priorities that contribute to sound fiscal management and sustainable economic growth.

Expected result: Sound advice to the Minister on economic, funding, and policy proposals

Performance indicators

- Announcement of measures that advance productivity and economic growth

Data sources

- The federal budget and the Economic and Fiscal Update

Target

- Implementation of the government's microeconomic policy priorities through the budget and the Economic and Fiscal Update

Status

- Successfully met

The Department fulfills a challenge function by helping to manage the funding demands of other departments and agencies, contributing to sound decisions consistent with the government's public policy agenda and a responsible use of taxpayers' money. Operating and capital budgets of economic development proposals were successfully assessed, while economic and financial advice and policy analysis were provided to the Minister on issues for consideration at Cabinet and its committees and for the annual budget and the Economic and Fiscal Update, as required.

Through its analysis and advice, the program activity continued to shape regional development and policies for key sectors such as agriculture, fisheries, aerospace, environment, and automotive.

In 2007–08, the Economic Development and Corporate Finance activity area focussed on delivering some key elements of the government's economic agenda, including the following:

- additional resources in Budget 2008 for post-secondary education, research, and commercialization to support the implementation of the government's science and technology strategy, Mobilizing Science and Technology to Canada's Advantage;

- more long-term and predictable funding in Budget 2008 for infrastructure, gas tax funding for municipalities, and permanent additional funding for public transit in order to contribute to economic growth, achieve Canada's environmental goals, and build stronger, more competitive communities;

- the establishment of PPP Canada Inc., a new Crown corporation that will spearhead federal efforts to promote the use of public-private partnerships in Canada;

- additional funding in Budget 2008 to implement regulations that will lead to significant reductions in greenhouse gas emissions and improvements in air quality; and

- an inventory of administrative requirements and a reduction strategy in support of the government's Paperwork Burden Reduction Initiative—the inventory provides a benchmark against which future burden reductions will be made.

The Department also contributed to sound fiscal management by providing advice on expenditures and priorities in the Strategic Review of departments and agencies within its portfolio responsibilities.

Program Activity 5: Federal-Provincial Relations and Social Policy

This program area is responsible for administering a system of fiscal arrangements between Canada and the provinces and territories that will enable the funding of national priorities and redistribution of support to less prosperous regions in order to ensure reasonably comparable services at reasonably comparable levels of taxation. The program area is also responsible for policy

development and strategic advice with respect to fiscal arrangements and federal-

provincial-territorial relations more broadly.

In addition, the program area fulfills the challenge function of the Department by providing policy advice to the Minister regarding the fiscal and economic implications of the government's social policies and programs related to health care, immigration, employment insurance and pensions, post-secondary education, Aboriginal and cultural programs, and benefits, as well as programs for seniors, disabled persons, and children. The program area conducts research and provides analysis and advice to the Minister and senior government officials to assist in preparation for meetings of Cabinet and its committees, the annual budget, the Economic and Fiscal Update, and responsibilities with respect to Canada Pension Plan (CPP) legislation. The program is also responsible for preparing legislation and regulatory changes related to its mandate, particularly fiscal arrangements and CPP.

Financial Resources ($ thousands)

| Planned Spending | Authorities | Actual Spending |

| 12,298 | 13,335 | 12,697 |

Human Resources (Full-Time Equivalents—FTEs)

| Planned | Actual | Difference |

| 92 | 89 | 3 |

The work under this program activity supports the Department's strategic outcome and

priorities by contributing to the government's efforts to meet its objectives regarding the

quality of Canada's communities, health care, education, and social safety net programs and

the commitment to equality of opportunity for all citizens. It also ensures that federal-provincial-

territorial fiscal arrangements are consistent with the principles of efficiency and equity underlying the government's broad social and economic agenda, and that they allow for the redistribution of wealth across regions of the country through the provision of transfer payments consistent with the government's commitments.

Why is this important? Long-term, predictable, stable, formula-based transfer support for provinces and territories and improvements to the social policy framework contribute to improved, efficient, equitable public services for Canadians and support the quality of Canada's communities, health care, education, and social safety net programs and equality of opportunity for all citizens.

Expected result: A principled framework to restore fiscal balance in Canada

Performance indicators

- Implementation of a principles-based transfer system

Data sources

- Transfer agreements

Targets

- Timely, accurate implementation of legislative and regulatory changes

- New arrangements for Equalization, TFF, and the CST

- Enhanced accountability and transparency of fiscal arrangements for citizens

Status

- Successfully met

Canada's government is committed to restoring fiscal balance, in part through the development of a principles-based transfer system, with clearer responsibilities among different orders of government and with greater overall efficiency for governments and enhanced accountability for citizens. Analysis and advice led to the introduction in Budget 2007 of new, principles-based transfer programs reflecting the recommendations of the Expert Panel on Equalization and Territorial Formula Financing (TFF) and the advice received through consultations with provinces and territories, academics, stakeholders, and the Canadian public. After tabling of the budget, ongoing consultations and meetings with provincial and territorial officials were held to support information sharing and communications regarding changes to federal-provincial-territorial fiscal arrangements.