The 2012–2013 Scorecard Report: Implementing the Red Tape Reduction Action Plan

Archived information

Archived information is provided for reference, research or recordkeeping purposes. It is not subject à to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

3. The One-for-One Rule

“Our One-for-One Rule puts a permanent control on the size and cost of administrative burden on business.”

Tony Clement

President of the Treasury Board

April 24, 2013

3.1 Our commitment

Canada’s business community is concerned that without an effective way of controlling the growth of administrative burden stemming from regulation, this burden will steadily grow and will directly affect the cost of doing business in Canada.

In January 2012, the Government of Canada announced that it would implement a One-for-One Rule to target and control the growth of administrative burden (i.e., the time and resources spent by business to show compliance with government regulation) that regulations impose on business. Experience from other jurisdictions, such as the United Kingdom, strongly suggests that such a rule can be an effective way of freeing businesses from unnecessary and frustrating regulatory red tape.

The One-for-One Rule, which came into force on April 1, 2012, is imposing a new discipline across the federal regulatory system. Through the Rule, regulators are controlling administrative burden and eliminating outdated regulations in two ways:

- When a new or amended regulation increases the administrative burden on business (an “in”), regulators are required to offset—from their existing regulations—an equal amount of administrative burden cost on business (an “out”).

- Regulators must remove an old regulation every time they introduce a brand new regulation that imposes new administrative burden on business.

Under the Rule, regulators have two years to provide administrative burden relief that is at least equal to any new burden imposed through a regulatory change. The value of the administrative burden cost increases or decreases and the underlying cost assumptions are made public in the Regulatory Impact Analysis Statement (RIAS See footnote [3]) when the regulatory change is published in the Canada Gazette.

3.2 Summary of results: 2012–2013

Government-wide results

Administrative burden includes “planning, collecting, processing and reporting of information, and completing forms and retaining data required by the federal government to comply with a regulation.”

- TBS’s Guide for the One-for-One Rule

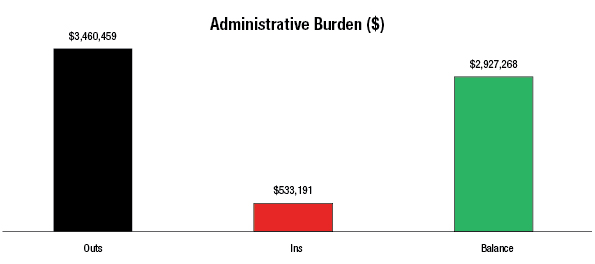

During its first year of implementation, the One-for- One Rule successfully controlled the growth of administrative burden on business imposed through regulation. A strong supporting infrastructure within government and a solid commitment to implement the Rule were key to this success. The Government even managed to reduce the overall regulatory burden by about $3 million (see Graph 3.1). It is also estimated that the application of the Rule will save businesses 98,000 hours annually in time spent dealing with regulatory red tape.

The Rule also provided an opportunity for regulators to reduce the number of outdated regulations currently on the books while continuing to preserve the health, safety, security, and environment of Canadians. For example, Public Safety Canada repealed regulations that impose outdated rules on individuals and businesses that sponsor or participate in gun shows. By the end of 2012–2013, a net of six regulations had been eliminated under the Rule.

It should be noted that progress under the Rule has continued in 2013–2014 with a cumulative reduction in administrative burden of almost $20 million and a net reduction of 19 regulations as of December 12, 2013.

Graph 3.1 – Government-wide balance under the One-for-One Rule as of March 31, 2013 See endnote 1 *

Graph 3.1 – Government-wide balance under the One-for-One Rule as of March 31, 2013 - Text version

Return to endnote reference 1 * Figures are based on estimates for increases or decreases in costs of administrative burden for all regulatory changes approved by the Governor in Council and published in the Canada Gazette between April 1, 2012, and March 31, 2013.

“Reducing the regulatory burden on businesses would free up time and money that business owners could use more efficiently, for example to buy new equipment, develop plans for business growth and explore new markets.”

Canadian Federation of Independent Business, Canada’s Red Tape Report with U.S. Comparisons, 2013

Portfolio-level results

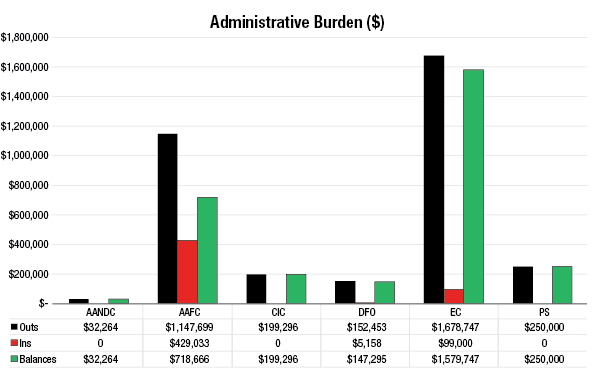

The One-for-One Rule requires ministers to manage their balances of administrative burden on a portfolio basis. This means that ministers must offset regulatory changes that impose new administrative burden on business with other regulatory changes from within their portfolios that reduce it.

In the first year of implementation, all six portfolios that published final, GIC-approved regulatory changes with administrative burden implications See footnote [4] reduced the overall burden of their regulations (see Graph 3.2).

Graph 3.2 – Administrative burden balances by portfolio as of March 31, 2013 See endnote 2 *

Graph 3.2 – Administrative burden balances by portfolio as of March 31, 2013 - Text version

Return to endnote reference 2 * Figures are based on estimates for increases or decreases in costs of administrative burden for all regulatory changes approved by the Governor in Council and published in the Canada Gazette between April 1, 2012, and March 31, 2013.

Administrative burden relief was provided through regulatory changes that eliminated unnecessary or redundant reporting requirements imposed on business. For example:

- Through amendments to Environment Canada’s On-Road Vehicle and Engine Emission Regulations, $1.5 million of administrative burden on vehicle importers was reduced by eliminating the need for them to submit vehicle or engine identification numbers (VINs) and the dates they imported the vehicles as part of their declarations. Importers are now only required to submit one importation declaration to the Minister of Environment per year. A VIN number is a unique code that includes a serial number used by the automotive industry to identify individual motor vehicles.

- Under Agriculture and Agri-Food Canada’s new regulations supporting the Canadian Wheat Board (Interim Operations) Act, $1.1 million in administrative burden on Western Canadian wheat and barley farmers was reduced by eliminating the permit book system. Previously, only farmers with a delivery permit were legally authorized to sell wheat and barley to the Canadian Wheat Board (CWB), and all wheat and barley sales had to be recorded in the permit book. With the passage of these regulations, the permit book is no longer required as the CWB now operates as a voluntary (as opposed to mandatory) marketing organization.

- Through regulatory amendments made under the Fisheries Act, Fisheries and Oceans Canada provided fishers with $152,453 in administrative burden relief by eliminating rules that require fishers to identify their fishing gear and vessels using marking devices (e.g., tags) supplied by the department.

The Treasury Board Secretariat (TBS) assessed all final, GIC-approved regulatory changes with administrative burden cost increases or decreases published in the Canada Gazette to determine the extent to which regulators had met the costing and transparency requirements under the Rule. (For example, regulators were expected to clearly describe the assumptions underlying their estimates of administrative burden, as well as accurately reflect the feedback received from businesses on these estimates through consultations.) TBS communicated the results of these assessments to regulators to ensure improvements are made going forward.

In most cases, TBS observed a high level of compliance with these requirements. However, TBS did note that some regulators did not always provide the information necessary for stakeholders to challenge the assumptions underlying burden estimates in the RIAS.

- Date modified: