The 2012–2013 Scorecard Report: Implementing the Red Tape Reduction Action Plan

Archived information

Archived information is provided for reference, research or recordkeeping purposes. It is not subject à to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

� Her Majesty the Queen in Right of Canada,

represented by the President of the Treasury Board, 2014

Catalogue No. BT58-7/2014E-PDF

ISBN 978-1-100-23181-5

This document is available in alternative formats upon request.

Table of Contents

- Preface

- Message from the President of the Treasury Board

- The Regulatory Advisory Committee’s Advice to the President of the

Treasury Board on the 2012–2013 Annual Scorecard Report - List of Acronyms Used in the Annual Scorecard Report

- 1. Executive Summary

- 2. Federal Regulatory Management in Canada

- 3. The One-for-One Rule

- 4. The Small Business Lens

- 5. Forward regulatory plans

- 6. Service standards for high-volume regulatory authorizations

- 7. Conclusion

- Annex A: Summary of 2012–2013 Assessment Results by Portfolio/Entity

- Annex B: List of Final, GIC-Approved Regulatory Changes Subject to

the One-for-One Rule Published in the Canada Gazette, Part II, in 2012–2013

Preface

The Annual Scorecard Report demonstrates the Government’s commitment to transparency and accountability for implementation of the Red Tape Reduction Action Plan’s systemic reforms.

About the Annual Scorecard Report

On October 1, 2012, in response to recommendations made by the Red Tape Reduction Commission, the Government of Canada released the Red Tape Reduction Action Plan. In doing so, the Government launched an ambitious regulatory reform package, and made cutting regulatory red tape for Canadians and businesses a priority.

Through the Action Plan, the Government has committed to implement a comprehensive package of fundamental, systemic regulatory reforms that address many of the Commission’s recommendations. These systemic reforms

include:

- The One-for-One Rule;

- The Small Business Lens;

- Forward regulatory plans;

- Service standards for high-volume regulatory authorizations;

- Interpretation policies; and

- The Administrative Burden Baseline Initiative.

The Government also committed to releasing an annual Scorecard Report on the results achieved in implementing the systemic reforms as part of the Action Plan’s broader commitment to transparency and accountability.

Scorecard Methodology

The 2012–2013 Scorecard Report has been prepared as per the commitments made in the Red Tape Reduction Action Plan and has also been reviewed by an external Regulatory Advisory Committee.

The Treasury Board of Canada Secretariat has produced this Scorecard Report based on a review of progress made by departments and agencies in implementing the systemic reforms in the 2012–2013 Fiscal Year. Through these assessments, 22 regulatory portfolios See footnote [1] and portfolio entities received a rating summarizing their initial progress for each of the systemic reforms implemented this year (see Annex A). These assessments are intended to drive compliance with the requirements of the Cabinet Directive on Regulatory Management, which supports a fair, predictable, and transparent regulatory environment for Canadians and businesses.

Message from the President of the Treasury Board

I am pleased to present the first annual Scorecard Report on progress made in implementing the Red Tape Reduction Action Plan.

I am pleased to present the first annual Scorecard Report on progress made in implementing the Red Tape Reduction Action Plan.

Canada is internationally recognized as one of the best places in the world to do business. With a strong fiscal foundation, declining tax rates and a robust regulatory system, Canada has become a global leader by finding smarter ways to encourage investment and foster economic growth. However, in the current climate of economic uncertainty and intense global competition, this is not the time to rest on our record of success.

In January 2011, Prime Minister Stephen Harper launched the Red Tape Reduction Commission. The Commission was asked to identify irritants to business stemming from federal regulatory requirements and provide recommendations on how to reduce the regulatory burden. On October 1, 2012, the Government released the Red Tape Reduction Action Plan as a response to the Commission’s recommendations.

The Action Plan outlines an ambitious regulatory reform agenda that aims to reduce regulatory burden on Canadians and businesses, make it easier to do business with regulators, and improve service and predictability in the federal regulatory system. In doing so, the Action Plan commits to a comprehensive package of fundamental, systemic regulatory reforms that are being implemented under the oversight of the Treasury Board of Canada Secretariat.

The Annual Scorecard Report is part of the Government’s commitment to a transparent and accountable Action Plan implementation. This first edition provides a results-focused account of the progress made in implementing the systemic reforms in the 2012–2013 Fiscal Year. Overall, it shows that these reforms are off to a very promising start and have the potential to significantly benefit individuals and businesses all across the country.

I would like to thank the members of the Regulatory Advisory Committee who have reviewed this Scorecard Report. Their input has been very helpful in our efforts to ensure that the report fairly represents the Government’s progress in implementing the systemic reforms in 2012–2013. Their volunteering of their time and expertise is a testament to their exemplary commitment to public service and dedication to building a better country.

Business is the foundation of Canada’s economic strength. Removing unnecessary regulatory barriers and administrative burden allows businesses to focus their time and energy on creating jobs and seizing new opportunities for growth. Over the coming years, we will build on the successes already achieved and deliver the quality of services that Canadians and businesses expect and deserve from their Government.

(original signed by)

The Honourable Tony Clement

President of the Treasury Board

The Regulatory Advisory Committee’s Advice to the President of the Treasury Board on the 2012–2013 Annual Scorecard Report

Deliberations of Advisory Committee

The Regulatory Advisory Committee was established in September, 2013. Committee members who will serve an initial term of two years are: Vic Young, Corporate Director and Committee Chair; Eve-Lyne Biron, President and CEO of Biron Groupe Santé; Bruce Cran, President of the Consumers’ Association of Canada; David Fung, Chairman and CEO of ACDEG Group; and Laura Jones, Executive Vice President of the Canadian Federation of Independent Business.

The Committee held two meetings by teleconference on September 19th and November 25th. It also held three meetings in person on September 25th, December 9th and December 10th. All of the in-person meetings included in-camera sessions of Committee members only, in the absence of government officials. At its initial meeting, the Committee held a phone conversation with the President of the Treasury Board, Mr. Tony Clement to discuss their mandate and the desire of the Minister to receive unvarnished advice. On December 24th, the Chair of the Committee held a phone conversation with Minister Clement to discuss Committee progress and the timing of the final report.

Throughout the months of September to December there was continuous communication between the Chair and senior Treasury Board officials to discuss meeting agenda items and the ongoing information requirements of the Committee. The Committee was impressed with the presentations that it received and has no doubt about the personal commitment of Treasury Board officials to the success of the program.

Focus of Initial Report

In its initial report, the Committee did not perform nor was it mandated to perform an ‘audit-like’ review of the Scorecard. Rather the Committee has drawn on the expertise of government officials as well as the members’ business backgrounds and experience to arrive at a general opinion on the overall fairness and reliability of the Scorecard. The Committee focused on the implementation of (i) the One for One Rule, (ii) the Small Business Lens, (iii) Forward Regulatory Plans and (iv) Service Standards for high-volume regulatory authorizations.

The Committee’s role is limited to providing advice on red tape arising from regulation. Other potential sources of burden that business may experience in their interaction with government may include, for example (i) applying for grants and contributions programs; (ii) meeting government requirements to do business with government through contracts; (iii) requirements from government policy and (iv) lacklustre government customer service. These potential sources of red tape burden are not covered by our mandate. The Committee has been advised by Treasury Board officials that ‘regulatory red tape’ makes up a significant portion of the total red tape universe. However, it is important to note that the Committee spent considerable time trying to understand the government’s definition of ‘regulatory red tape’ and how it differs from the more comprehensive definition of red tape that is commonly used by the private sector. More clarity in this area is still needed in order to fully understand the potential impact of the reforms. While the mandate of the committee when commenting on the scorecard is limited to ‘regulatory red tape’, we recommend that the government not limit itself to this definition where it gets in the way of making a difference on the ground.

In our meetings and interactions with the Treasury Board Secretariat, the Committee has come to the conclusion that the Red Tape Reduction Action Plan is a significant initiative that is being undertaken with real commitment. It must, however, be viewed as a longer-term program. The Scorecard for 2012–2013 should be seen as an important first step in a three year program aimed at changing the regulation making process and halting the growth of red tape in the Government of Canada. The next two years will be critical to the objective of embedding the understanding of the importance of red tape reduction into the culture of government departments and agencies. This is no easy task and it would be premature to make any bold claims with respect to early and significant results. The most important thing at this stage is to retain the commitment to the completion of the three-year program; to reinforce political leadership and tone at the top related to the necessity of red tape reduction; and to ensure the appropriate resources are applied to the remaining projects associated with implementing these systemic reforms.

We believe that government is on a very significant journey that will require many more years of hard work. Therefore the key message is that the program is off to a good start and there is much work to be done and that red tape reduction remains a priority for government going forward. At this stage, we should not confuse significant early action with longer term results.

Focus of Future Reports

The Committee is keen to determine the extent to which Action Plan implementation is, in fact, resulting in lasting systemic change that makes a difference for business and other stakeholders. The Committee will monitor the work of TBS officials in 2014 aimed at developing meaningful metrics to better gauge the impact of the systemic reforms. The Committee did not undertake any stakeholder consultations on the progress reported in the initial Scorecard as it was considered too early to do so. It intends, however, to undertake such consultations in 2014 with a view to assessing the ‘on the ground’ response of stakeholders. Also in 2014 and 2015 respectively, the Committee will review the implementation of (i) Interpretation Policies and (ii) the Administrative Burden Baseline.

The most important advice we can provide at this time is that Treasury Board does everything possible to keep everyone’s feet to the fire to bring red tape reduction to fruition. Some of the key questions that need to be answered are: what does success look like; is the red tape reduction action plan making a difference; what, if any, culture change, is occurring in the manner government is dealing with red tape; and what is the ongoing impact on stakeholders? Going forward, measuring the success of the reforms in a manner which is comprehensive and provides clarity and consistency will lead to credibility with respect to how the program is being implemented. The Committee intends to monitor the critical elements associated with metric development and implementation credibility.

Advice to the President of the Treasury Board

As is required by its mandate, the Regulatory Advisory Committee to the President of the Treasury Board has reviewed the first Annual Scorecard Report related to the Government's Red Tape Reduction Action Plan. Based on the information provided, the nature of the initial review undertaken and, in the overall context of the related and pertinent issues described above, the Advisory Committee is of the view that the Scorecard and the statements made therein are reliable and fairly (i) represent progress to date and (ii) reflect the ongoing commitment of Government, between now and 2015, to establish a comprehensive process of regulatory red tape reform.

At the risk of being repetitive, the Committee wishes to reiterate that while there has been much progress to date much work remains to be done; meaningful performance metrics need to be developed; and stakeholder consultations need to be undertaken. These red tape reforms are being implemented over three years but are intended to set the rules for regulation making over the long term and will affect the regulatory system for years to come. Evaluating impact and making necessary adjustments where needed will be critical to making a positive difference in the lives of all Canadians. We look forward to providing ongoing advice during this critical period related to the implementation of the Red Tape Reduction Action Plan.

Signed,

(original signed by)

Vic Young

Corporate Director and Committee Chair

Eve-Lyne Biron

President and CEO, Biron Group Santé

David Fung

Chairman and CEO, ACDEG Group

Bruce Cran

President, Consumers’ Association of Canada

Laura Jones

Executive Vice President, Canadian Federation of Independent Business

List of Acronyms Used in the Annual Scorecard Report

- AAFC

-

Agriculture and Agri-Food Canada

- AANDC

-

Aboriginal Affairs and Northern Development Canada

- CDRM

-

Cabinet Directive on Regulatory Management

- CH

-

Canadian Heritage

- CIC

-

Citizenship and Immigration Canada

- CRA

-

Canada Revenue Agency

- CWB

-

Canadian Wheat Board

- DFATD

-

Foreign Affairs, Trade and Development Canada

- DFO

-

Fisheries and Oceans Canada

- EC

-

Environment Canada

- ESDC

-

Employment and Social Development Canada

- FIN

-

Department of Finance Canada

- FPCC

-

Farm Products Council of Canada

- GIC

-

Governor in Council

- HC

-

Health Canada

- IC

-

Industry Canada

- JUS

-

Department of Justice

- NRCAN

-

Natural Resources Canada

- PS

-

Public Safety Canada

- PWGSC

-

Public Works and Government Services Canada

- RIAS

-

Regulatory Impact and Analysis Statement

- TBS

-

Treasury Board of Canada Secretariat

- TC

-

Transport Canada

- TBS

-

Treasury Board of Canada Secretariat

- VAC

-

Veterans Affairs Canada

- VIN

-

Vehicle Identification Number

1. Executive Summary

In 2012–2013, 86% of all final, Governor in Council (GIC)-approved regulatory changes published in the Canada Gazette either reduced (7%) or did not impose any new (79%) administrative burden on business.

Source: Based on data published in Part II of the Canada Gazette

One of the Government of Canada’s top priorities is to create the right conditions to support jobs, economic growth, and long-term prosperity for all Canadians. A robust, effective and efficient federal regulatory system provides consistency, fairness, and transparency, and supports innovation, productivity, and competition.

Canadians and businesses across the country have identified a number of irritants that exist in the federal regulatory system, creating unnecessary delays, costs and bureaucracy. The Red Tape Reduction Action Plan, released in October 2012, outlines a package of fundamental, systemic reforms that the Government has committed to putting in place to reduce regulatory red tape and strengthen regulatory transparency and predictability.

This Scorecard Report captures the progress made in implementing the systemic reforms in the 2012–2013 Fiscal Year. Overall, it demonstrates that the reforms are being faithfully implemented and have traction and momentum within government. It also shows progress is clearly being made and, perhaps most importantly, that a solid foundation for sustained results achievement has been built.

The One-for-One Rule

Service standards help to create a more transparent and predictable federal regulatory system, making it easier for Canadians and businesses to know what to expect in terms of the timeliness of decision making.

On March 1, 2013, regulators posted new service standards for a wide range of high-volume regulatory authorizations and processes representing over 60,000 annual transactions with Canadians and businesses.

The One-for-One Rule, which came into effect on April 1, 2012, places strict controls on the growth of regulatory red tape on business. It requires regulators to offset any administrative burden from new regulatory changes with equal reductions from existing regulations. In addition, when brand new regulations are introduced that add administrative burden, an existing regulation must also be repealed.

During its first year of implementation, the Rule provided a successful, system-wide control on regulatory red tape impacting business. In fact, the Rule did more than control regulatory red tape – it reduced it by about $3 million and eliminated a net of six regulations from the government’s books in 2012–2013. It is estimated that application of the Rule in 2012–2013 will also save businesses 98,000 hours per year in time spent dealing with regulatory red tape. The above trend has continued well into 2013–2014. As of December 12, 2013, a total reduction in administrative burden of almost $20 million and a net reduction of 19 regulations had been achieved.

In 2012–2013, all portfolios that published final, GIC-approved regulatory changes in the Canada Gazette with administrative burden cost increases or decreases reduced the overall burden of their regulations. Burden relief was provided through a wide range of regulatory changes that eliminated unnecessary or redundant reporting requirements imposed on business.

The Small Business Lens

The Small Business Lens, which came into effect on February 1, 2012, requires that regulators consider small business realities and consult early with small businesses in designing regulations.

In 2012–2013, the Small Business Lens only applied to regulatory proposals under development that had yet to come forward to Cabinet for final approval. It is therefore too early to determine whether the Lens is having the intended impact. However, there were some early signs that regulators have become more sensitive to and transparent in describing the potential impact of their regulations on the small business community.

Forward regulatory plans

By introducing forward regulatory plans, the Government has taken a significant step to increase the transparency of the federal regulatory system for Canadians and businesses. These plans provide stakeholders with early notice of regulatory changes to be introduced by regulators within a 24-month period.

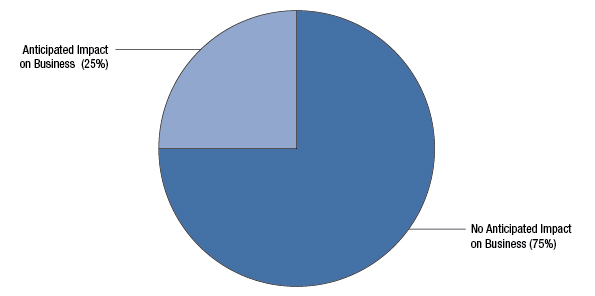

In spring 2013, regulators posted 32 forward regulatory plans on their Acts and Regulations Web pages. Collectively, regulators identified about 460 planned regulatory initiatives in these plans. These initiatives covered a wide range of sectors—from health and the environment, to security and trade. The vast majority of the identified initiatives (75%) were not expected to have any business impacts.

Service standards for high-volume regulatory authorizations

Service standards are a public commitment to a measurable level of performance that clients can expect under normal circumstances. The Government has committed to establishing and reporting annually on service standards for those high-volume regulatory authorizations where service standards either do not exist or are not publicly available.

In spring 2013, regulators posted service standards for 24 high-volume regulatory authorizations and processes on their Acts and Regulations Web pages. As a result, more than 60,000 annual transactions (or “touch points”) with businesses have been added to those already governed by a publicly available timeliness commitment, performance target and service feedback mechanism. This represents an important first step towards improving service performance across the federal regulatory system.

2. Federal Regulatory Management in Canada

“A robust and effective regulatory system provides consistency, fairness, and transparency, and supports innovation, productivity, and competition.”

- The Cabinet Directive on Regulatory Management

2.1 The role of federal regulation in Canada

The Government of Canada uses regulation as a key policy instrument to enable economic activity and protect the health, safety, security, and environment of Canadians.

Regulations are a form of law. They have a binding legal effect and set out rules that usually apply generally, rather than to specific persons or situations. Regulations are made by persons or bodies to which Parliament has delegated authority, such as the Governor in Council (GIC), See footnote [2] a minister, or an administrative agency.

An effective and streamlined regulatory system contributes significantly to a competitive and resilient economy. For example, in the economic sector, regulation establishes the rules for fair markets, reduces barriers to trade through alignment with trading partners, clarifies conditions for the use of new products, services, and technologies, and fosters new investment.

Despite the importance of regulation to maintaining a fair and competitive economy, Canadians and businesses from across the country have identified a number of regulatory irritants that add unnecessary delays, costs and bureaucracy. This has a direct and negative impact on their bottom lines. Cutting regulatory red tape and reducing barriers in the regulatory system will therefore free up businesses to expand and create jobs, while cementing Canada’s reputation as one of the best places in the world to do business.

2.2 The Cabinet Directive on Regulatory Management

The Cabinet Directive on Regulatory Management (CDRM), which came into effect on April 1, 2012, applies to all federal departments, agencies, and entities (herein referred to as “regulators”) over which Cabinet has either general or specific regulation-making authority.

The CDRM requires that the Government, when regulating, adheres to the following principles:

- to protect and advance the public interest;

- to advance the efficiency and effectiveness of regulation;

- to make decisions based on evidence;

- to promote a fair and competitive market economy;

- to monitor and control the administrative burden of regulation;

- to create accessible, understandable and responsive regulation; and

- to require timeliness, policy coherence and minimal duplication throughout the regulatory process.

“Red tape is like death by a thousand paper cuts. It’s a cost that leaves hundreds of thousands of small business owners frustrated. Every hour spent dealing with red tape is an hour not spent serving a customer or training an employee. It has a huge impact on all Canadians.”

Laura Jones, Senior Vice-President, Canadian Federation of Independent Business, Times and Transcript, January 14, 2012

2.3 The Government of Canada’s regulatory reform agenda

In January 2011, Prime Minister Stephen Harper launched the Red Tape Reduction Commission. The Commission was asked to identify irritants to business stemming from federal regulation and make specific and system-wide recommendations on how to reduce the regulatory burden.

The Commission canvassed business representatives from across the country with an emphasis on identifying regulatory irritants that have a clear detrimental effect on growth, competitiveness and innovation, particularly from a small business perspective. Through these consultations, business representatives voiced frustration over duplicative regulatory requirements, high administrative costs and a lack of a customer-service orientation within government in providing regulatory services.

Overall, business representatives felt that regulators have a poor understanding of industry realities and need to pay greater attention to timeliness, predictability and accountability.

Following the release of the Commission’s "What Was Heard" Report in September 2011, its Recommendations Report was released in January 2012. The Report outlined several “systemic” recommendations to address the root causes of regulatory red tape and 90 additional department-specific recommendations to reduce or eliminate regulatory irritants.

The Red Tape Reduction Action Plan, released in October 2012, is the Government’s response to the Commission's recommendations. The Action Plan underscores the Government’s commitment to breaking down barriers to doing business in Canada and building the foundations of long term prosperity.

The Action Plan details a package of fundamental, government-wide regulatory reforms that the Government is implementing to address the Commission’s “systemic” recommendations. These systemic reforms are:

- The One-for-One Rule, which targets and strictly controls the growth of administrative burden on business imposed by regulation. More information on the Rule can be found in Chapter 3.

- The Small Business Lens, which requires that regulators take into account the needs and realities of small business when they design or change regulations. More information on the Lens can be found in Chapter 4.

- Forward regulatory plans, which provide Canadians and businesses with an early warning of regulatory changes affecting them over a 24-month period. More information on these plans can be found in Chapter 5.

- Service standards for high-volume regulatory authorizations, which drive accountability for service improvement, particularly for those authorizations and processes that impact business. More information on service standards can be found in Chapter 6.

- Interpretation policies, which provide clarity on how regulators interpret their regulations and when they can be counted on to give answers in writing to questions or concerns from stakeholders. Interpretation policies are under development and will be publicly-released later this year.

- An Administrative Burden Baseline initiative, through which regulators will develop and maintain an inventory of requirements in regulation that impose administrative burden on business, thereby providing additional assurance of the Government’s commitment to monitoring and reporting on regulatory red tape. Once established, these inventories will help regulators manage their stock of regulatory requirements. Regulators will release their initial inventories of regulatory requirements by fall 2014, to be updated annually thereafter.

In addition, the Action Plan accepts all of the Commission’s 90 department-specific recommendations, the vast majority of which will be implemented by the applicable regulator(s) by the end of 2015–2016.

2.4 A transparent and accountable approach to reform implementation

The commitment to transparency and accountability is central to the implementation of the systemic regulatory reforms. For example, details on how the One-for-One Rule and the Small Business Lens have been applied to regulations are publicly available through the Canada Gazette. Furthermore, in spring 2013 regulators created 36 new Acts and Regulations Web pages. Although not called for in the Action Plan, these standardized Web pages are intended to make regulatory information easier to find and provide a more consistent user experience for Canadians and businesses. These Web pages also showcase a regulator’s forward regulatory plan, service standards for high-volume regulatory authorizations and other regulatory red tape reduction efforts.

The publication of an Annual Scorecard Report on the implementation of the systemic reforms further underscores the Government’s commitment to transparency and accountability. This edition of the Scorecard represents the Government’s first opportunity to report publicly on the overall results achieved so far.

3. The One-for-One Rule

“Our One-for-One Rule puts a permanent control on the size and cost of administrative burden on business.”

Tony Clement

President of the Treasury Board

April 24, 2013

3.1 Our commitment

Canada’s business community is concerned that without an effective way of controlling the growth of administrative burden stemming from regulation, this burden will steadily grow and will directly affect the cost of doing business in Canada.

In January 2012, the Government of Canada announced that it would implement a One-for-One Rule to target and control the growth of administrative burden (i.e., the time and resources spent by business to show compliance with government regulation) that regulations impose on business. Experience from other jurisdictions, such as the United Kingdom, strongly suggests that such a rule can be an effective way of freeing businesses from unnecessary and frustrating regulatory red tape.

The One-for-One Rule, which came into force on April 1, 2012, is imposing a new discipline across the federal regulatory system. Through the Rule, regulators are controlling administrative burden and eliminating outdated regulations in two ways:

- When a new or amended regulation increases the administrative burden on business (an “in”), regulators are required to offset—from their existing regulations—an equal amount of administrative burden cost on business (an “out”).

- Regulators must remove an old regulation every time they introduce a brand new regulation that imposes new administrative burden on business.

Under the Rule, regulators have two years to provide administrative burden relief that is at least equal to any new burden imposed through a regulatory change. The value of the administrative burden cost increases or decreases and the underlying cost assumptions are made public in the Regulatory Impact Analysis Statement (RIAS See footnote [3]) when the regulatory change is published in the Canada Gazette.

3.2 Summary of results: 2012–2013

Government-wide results

Administrative burden includes “planning, collecting, processing and reporting of information, and completing forms and retaining data required by the federal government to comply with a regulation.”

- TBS’s Guide for the One-for-One Rule

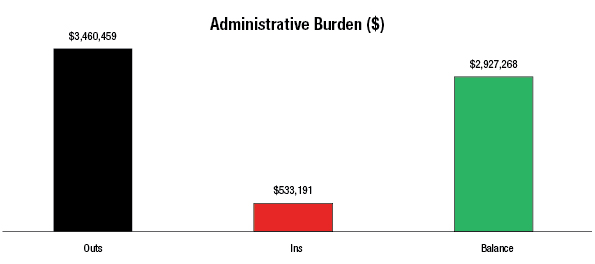

During its first year of implementation, the One-for- One Rule successfully controlled the growth of administrative burden on business imposed through regulation. A strong supporting infrastructure within government and a solid commitment to implement the Rule were key to this success. The Government even managed to reduce the overall regulatory burden by about $3 million (see Graph 3.1). It is also estimated that the application of the Rule will save businesses 98,000 hours annually in time spent dealing with regulatory red tape.

The Rule also provided an opportunity for regulators to reduce the number of outdated regulations currently on the books while continuing to preserve the health, safety, security, and environment of Canadians. For example, Public Safety Canada repealed regulations that impose outdated rules on individuals and businesses that sponsor or participate in gun shows. By the end of 2012–2013, a net of six regulations had been eliminated under the Rule.

It should be noted that progress under the Rule has continued in 2013–2014 with a cumulative reduction in administrative burden of almost $20 million and a net reduction of 19 regulations as of December 12, 2013.

Graph 3.1 – Government-wide balance under the One-for-One Rule as of March 31, 2013 See endnote 1 *

Graph 3.1 – Government-wide balance under the One-for-One Rule as of March 31, 2013 - Text version

Return to endnote reference 1 * Figures are based on estimates for increases or decreases in costs of administrative burden for all regulatory changes approved by the Governor in Council and published in the Canada Gazette between April 1, 2012, and March 31, 2013.

“Reducing the regulatory burden on businesses would free up time and money that business owners could use more efficiently, for example to buy new equipment, develop plans for business growth and explore new markets.”

Canadian Federation of Independent Business, Canada’s Red Tape Report with U.S. Comparisons, 2013

Portfolio-level results

The One-for-One Rule requires ministers to manage their balances of administrative burden on a portfolio basis. This means that ministers must offset regulatory changes that impose new administrative burden on business with other regulatory changes from within their portfolios that reduce it.

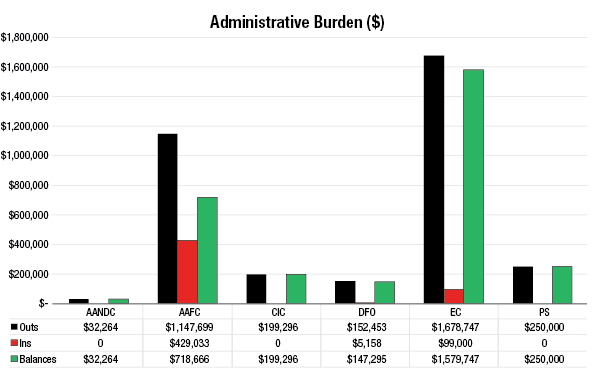

In the first year of implementation, all six portfolios that published final, GIC-approved regulatory changes with administrative burden implications See footnote [4] reduced the overall burden of their regulations (see Graph 3.2).

Graph 3.2 – Administrative burden balances by portfolio as of March 31, 2013 See endnote 2 *

Graph 3.2 – Administrative burden balances by portfolio as of March 31, 2013 - Text version

Return to endnote reference 2 * Figures are based on estimates for increases or decreases in costs of administrative burden for all regulatory changes approved by the Governor in Council and published in the Canada Gazette between April 1, 2012, and March 31, 2013.

Administrative burden relief was provided through regulatory changes that eliminated unnecessary or redundant reporting requirements imposed on business. For example:

- Through amendments to Environment Canada’s On-Road Vehicle and Engine Emission Regulations, $1.5 million of administrative burden on vehicle importers was reduced by eliminating the need for them to submit vehicle or engine identification numbers (VINs) and the dates they imported the vehicles as part of their declarations. Importers are now only required to submit one importation declaration to the Minister of Environment per year. A VIN number is a unique code that includes a serial number used by the automotive industry to identify individual motor vehicles.

- Under Agriculture and Agri-Food Canada’s new regulations supporting the Canadian Wheat Board (Interim Operations) Act, $1.1 million in administrative burden on Western Canadian wheat and barley farmers was reduced by eliminating the permit book system. Previously, only farmers with a delivery permit were legally authorized to sell wheat and barley to the Canadian Wheat Board (CWB), and all wheat and barley sales had to be recorded in the permit book. With the passage of these regulations, the permit book is no longer required as the CWB now operates as a voluntary (as opposed to mandatory) marketing organization.

- Through regulatory amendments made under the Fisheries Act, Fisheries and Oceans Canada provided fishers with $152,453 in administrative burden relief by eliminating rules that require fishers to identify their fishing gear and vessels using marking devices (e.g., tags) supplied by the department.

The Treasury Board Secretariat (TBS) assessed all final, GIC-approved regulatory changes with administrative burden cost increases or decreases published in the Canada Gazette to determine the extent to which regulators had met the costing and transparency requirements under the Rule. (For example, regulators were expected to clearly describe the assumptions underlying their estimates of administrative burden, as well as accurately reflect the feedback received from businesses on these estimates through consultations.) TBS communicated the results of these assessments to regulators to ensure improvements are made going forward.

In most cases, TBS observed a high level of compliance with these requirements. However, TBS did note that some regulators did not always provide the information necessary for stakeholders to challenge the assumptions underlying burden estimates in the RIAS.

4. The Small Business Lens

“This [the Small Business Lens] will enable small business owners to judge for themselves, and to comment upon, the government’s efforts to minimize regulatory burden.”

Government of Canada, Red Tape Reduction Action Plan, 2012

4.1 Our commitment

Small businesses account for 98% of all businesses in Canada See footnote [5]. They play a vital role in creating jobs and generating wealth in communities across the country. As such, the Government of Canada must be sensitive to their challenges in complying with regulation, which are magnified due to the fact that small businesses generally have fewer resources to dedicate towards achieving regulatory compliance.

The Small Business Lens, which officially came into effect on February 1, 2012, requires that regulators consider small business realities and consult early with small businesses in designing regulations. This is intended to hardwire increased sensitivity to small business impacts into the regulatory development process.

The Small Business Lens applies to regulatory proposals that impact small business and that have nationwide cost impacts of over $1 million annually. The Lens places the burden of proof on regulators to demonstrate that they have done what they can to minimize direct administrative and compliance costs on small business without compromising the health, safety and security of Canadians or the Canadian environment or economy.

A small business is defined as “any business, including its affiliates, that has fewer than 100 employees or generates between $30,000 and $5 million in annual gross revenue.”

Regulators must also include a summary of their analysis of small business impacts within the RIAS when the regulatory change is published in the Canada Gazette. This enables small businesses to judge for themselves and comment on the Government’s efforts to minimize their regulatory burden.

4.2 Summary of results: 2012–2013

In 2012–2013, the Small Business Lens only applied to regulatory proposals under development that had yet to come forward to Cabinet for final approval. This is due to the fact that regulations with significant business impacts can take many months or even years to design and implement due to the need to thoroughly analyze and consult with stakeholders on the underlying problems that these regulations are attempting to address.

Recognizing this, it is still too early to draw conclusions as to whether the Lens is having the intended effect. As more regulatory proposals are brought forward to Cabinet for approval, it is expected that a better picture of efforts to reduce the regulatory burden on small businesses will emerge.

However, there were some early signs that regulators were being more sensitive to small business impacts in designing their regulations in 2012–2013. For example:

- Under the Regulations Amending the Canadian Aviation Regulations, Transport Canada provided small businesses with more time to comply with the requirement to install an Enhanced Altitude Accuracy function in private turbine-powered aeroplanes.

- Under the Regulations Amending the Sulphur in Diesel Fuel Regulations, Environment Canada generated savings for small businesses in a number of ways. For example, the department reduced reporting requirements for importers of small volumes of diesel fuel into Canada and allowed for the electronic submission of information.

Regulators have also become more transparent in describing small business impacts when their regulations are published in the Canada Gazette. In 2012–2013, more than 40 final, GIC-approved regulatory changes included an analysis of these impacts in their published RIAS.

Did you know?

Management consulting firm Ernst and Young ranked Canada among the top five places in the world to start a business in their 2013 Entrepreneurship Barometer, a report that studies and compares conditions for business start-ups in G20 countries.

5. Forward regulatory plans

“These [forward regulatory] plans will give Canadians, business and trading partners greater opportunity to inform the development of regulations and to plan for the future.”

Government of Canada, Red Tape Reduction Action Plan, 2012

5.1 Our commitment

Canadians and businesses deserve a federal regulatory system that is transparent and predictable. They reasonably expect to have advance notice of the Government of Canada’s intention to regulate and to have a chance to comment on planned regulatory changes that will affect them and their bottom lines.

A transparent and predictable regulatory system enables Canadians and businesses to prepare and adjust their own plans and activities before new rules are made. It also allows stakeholders to make informed decisions about their future and encourages investment and innovation.

A regulatory initiative is a “planned or potential regulatory change such as a new regulation, an amendment to an existing regulation, or the removal of an existing regulation” contained within a forward regulatory plan.

- TBS’s Guide on Forward Planning

By introducing forward regulatory plans, the Government has taken a significant step toward increasing transparency in the federal regulatory system for Canadians and businesses. These plans provide stakeholders with early notice of regulatory changes to be introduced by regulators within a 24-month period.

The Government committed to releasing the first set of forward regulatory plans by March 1, 2013. Regulators were to make their plans public on their Acts and Regulations Web pages. Going forward, these plans are being updated on a semi-annual basis to reflect the changing operating realities of regulators.

5.2 Summary of results: 2012–2013

In spring 2013, regulators posted 32 forward regulatory plans on their respective Acts and Regulations Web pages. The overall scope and quality of these plans are a clear demonstration of the federal regulatory community’s collective resolve to implement the Government’s Red Tape Reduction Action Plan.

A government-wide list of forward regulatory plans was also published on TBS’s website to provide Canadians and businesses with easy access to these plans.

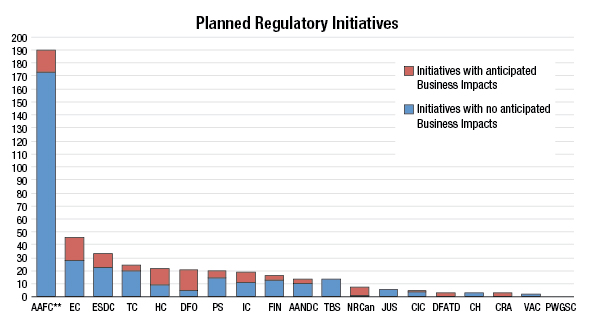

Overview of planned regulatory initiatives

Regulators collectively identified 460 planned regulatory initiatives to be implemented over the next two years in their forward regulatory plans (see Graph 5.1). These initiatives covered a wide range of sectors—from health and the environment, to security and trade. The vast majority of the identified initiatives (75%) were not expected to have any impacts on business (see Graph 5.2).

For each initiative, regulators were to provide basic information to help stakeholders understand what is being proposed and whether they will be affected, including:

- the title of the initiative;

- a description of the initiative;

- whether the initiative could have business impacts;

- an identification of public consultation opportunities; and

- a departmental point of contact for obtaining additional information.

TBS assessed all forward regulatory plans required by March 1, 2013, against these requirements. In addition, TBS communicated the results of these assessments to regulators so that they could make any necessary improvements to their plans.

Through these assessments, TBS noted that the overall compliance with the requirements for forward regulatory plans was generally high. However, TBS also observed that regulators need to make greater use of plain language in describing their regulatory initiatives and the associated objectives to ensure that Canadians and businesses are clear on whether they will be impacted. TBS also noted that, in some instances, regulators need to be more specific in describing their upcoming consultation opportunities so that stakeholders can be better prepared to participate in the regulatory development process.

Graph 5.1 – Distribution of Planned Regulatory Initiatives by Portfolio See endnote 3 *

Graph 5.1 – Distribution of Planned Regulatory Initiatives by Portfolio - Text version

Return to endnote reference 3 * Based on an analysis of the forward regulatory plans posted on departmental Acts and Regulations Web pages as of June 2013. The total number of planned regulatory initiatives analyzed (n = 448) differs from the initial posting (n = 460) as regulators update their plans on an ongoing basis.

** Over 80% of AAFC’s planned regulatory initiatives were from the Farm Products Council of Canada (FPCC). Of the FPCC’s initiatives, nearly 50% were proposals to repeal spent (i.e., obsolete) regulations with no anticipated business impacts. The remaining initiatives on the FPCC’s plan were routine items that are part of the FPCC’s supply management mandate and represent regularly-occurring interactions with the farm products industry.

Graph 5.2 - Anticipated Business Impacts of Planned Regulatory Initiatives See endnote 4 *

Graph 5.2 - Anticipated Business Impacts of Planned Regulatory Initiatives - Text version

Return to endnote reference 4 * Based on an analysis of the forward regulatory plans posted on departmental Acts and Regulations Web pages as of June 2013. The total number of planned regulatory initiatives analyzed (n = 448) differs from the initial posting (n = 460) as regulators update their plans on an ongoing basis.

6. Service standards for high-volume regulatory authorizations

“[The Government] will establish service standards and complaint processes for high-volume regulatory authorizations. This will give stakeholders a clear opportunity to provide feedback on the service they receive.”

Government of Canada, Red Tape Reduction Action Plan, 2012

6.1 Our commitment

Canadians and businesses expect quality and predictability in the services they receive from government. While regulation itself is not a service, it is legitimate to expect that regulatory activities be managed with a strong service orientation and a clear commitment to service performance. These activities are called regulatory authorizations. Through its regulatory authorizations, the Government of Canada grants an individual, business or regulated entity permission either to conduct a regulated activity or to be exempt from it. For businesses, clear and timely regulatory decisions can impact their ability to operate, grow and expand.

Service standards are a public commitment to provide a measurable level of service that clients can expect to receive under normal circumstances. They help clarify expectations for clients by indicating how long they should expect to wait once a service has been accessed. Through the Red Tape Reduction Action Plan, the Government committed to developing and reporting annually on service standards for all high-volume regulatory authorizations where service standards either do not exist or are not publicly available.

A high-volume regulatory authorization is defined as “one with 100 or more transactions per year.”

- TBS’s Guide on Improving Service Performance for Regulatory Authorizations

Regulators have until March 2016 to publicly release service standards for all of their high-volume regulatory authorizations that impact business. By March 1, 2013, regulators were required to publish their first set of service standards for all of their high-volume regulatory authorizations that have 2,000 or more transactions per year, or, if they do not have any of these, their next highest volume regulatory authorization. Regulators were to make these service standards public using their Acts and Regulations Web pages.

Starting in June 2014, regulators will be required to report performance against all of their publicly available service standards for high-volume regulatory authorizations on an annual basis.

6.2 Summary of results: 2012–2013

In spring 2013, regulators made clear progress toward filling the service standards gap. Overall, regulators posted service standards for 24 high-volume regulatory authorizations and processes on their Acts and Regulations Web pages, 19 of which had service standards posted that were either brand new or never before reported publicly. See footnote [6]

Overview of service standards for high-volume regulatory authorizations

The 19 newly available service standards cover a wide range of high-volume regulatory authorizations and processes that impact business, such as the issuance of:

- lands-related permits on Indian lands;

- radio operator certificates;

- overweight vehicle permits for certain designated national park areas; and

- permits for the import and export of controlled substances.

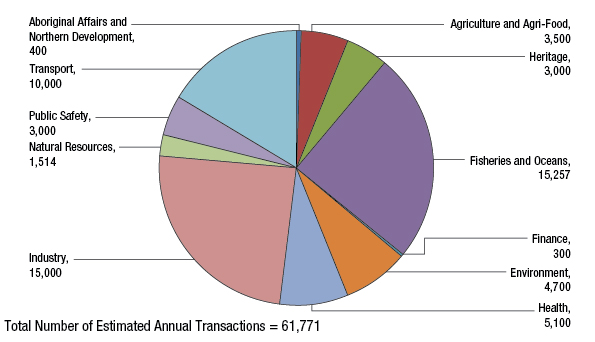

As a result of the federal regulatory community’s efforts in this area, more than 60,000 annual regulatory transactions (or “touch points”) with business have been added to those that are already governed by a publicly available timeliness commitment, performance target and service feedback mechanism (see Graph 6.1). This represents an important first step towards improving service performance within the federal regulatory system.

Graph 6.1: Estimated Number of Annual Transactions for High-Volume Regulatory Authorizations and Processes with Newly Available Service Standards by Portfolio See endnote 5 *

Return to endnote reference 5 * Based on departmental estimates of annual transactions for high-volume regulatory authorizations and processes with new service standards posted in spring 2013.

For each service standard (or the associated regulatory authorization), regulators must provide basic information to ensure a transparent and predictable service experience for stakeholders, including:

- how long an applicant should expect to wait to receive a decision for a regulatory authorization;

- the performance target for meeting service standards;

- the performance achieved against these targets (starting in June 2014);

- the information requirements and process that applicants must follow when applying for the authorization; and

- the service feedback mechanism for lodging a complaint if service expectations have not been met.

TBS assessed all newly available service standards for high-volume regulatory authorizations and processes required by March 1, 2013, against these requirements. In addition, TBS communicated the results of these assessments to regulators so that they could make any necessary improvements to their service standards.

Through these assessments, TBS observed that all regulators had met these requirements. Of note, three regulators (Canadian Heritage, the Canadian Nuclear Safety Commission and the Public Health Agency of Canada) published performance against their service standards for previous fiscal years. However, TBS also observed that, in some instances, regulators need to be clearer in describing the information requirements and processes associated with their regulatory authorizations. This will assist stakeholders (especially individuals and small businesses) when applying to conduct a regulated activity. It should also be noted that, as service performance is reported and experience builds, regulators will have the opportunity to revisit their service standards and performance targets to ensure continuous improvement in the delivery of their regulatory services.

7. Conclusion

“By reforming the regulatory system, the Government is freeing Canadian businesses from unnecessary red tape so they can focus on creating jobs for Canadian workers and expanding their enterprises. In this way, the red tape reduction reforms are helping to secure Canada’s long-term economic prosperity.”

Government of Canada, Canada’s Economic Action Plan, 2013

7.1 Summary of current progress

Reducing regulatory red tape helps support a flourishing and healthy business environment, which is the foundation for creating jobs and long-term prosperity.

As demonstrated through this first Annual Scorecard Report, the Government is off to a very promising start in implementing the systemic regulatory reforms, with clear evidence of momentum and encouraging progress achieved in 2012–2013. An effective mechanism to cap administrative burden on business has been built. Moreover, the regulatory system is now more transparent and predictable. Perhaps most important of all, a solid foundation for further, sustained progress has been established.

Since the One-for-One Rule came into effect in 2012, the Government has controlled, and even reduced, the administrative burden imposed by regulation on businesses.

In relation to the Small Business Lens, there are some early signs that regulators are becoming more sensitive to the challenges that small businesses face in complying with regulation. Regulators have also become more transparent in describing the small business impacts of their regulations when these are published in the Canada Gazette.

With 32 newly posted forward regulatory plans, Canadians and businesses now have access to details on 460 regulatory initiatives to come over the next two years. This information can now be used by businesses and Canadians to plan ahead and to participate in the regulatory development process.

In addition, regulators posted service standards for 24 high-volume regulatory authorizations and processes on their Acts and Regulations Web pages. These service standards help make the regulatory system more predictable for Canadians and businesses when applying to conduct a regulated activity, and can lead to a better overall service experience.

The Government has also gone beyond the Red Tape Reduction Action Plan’s commitments by requiring regulators to create standardized Acts and Regulations Web pages that make regulatory information easier to find and provide a more consistent user experience for Canadians and businesses.

7.2 Moving forward

The Government’s Red Tape Reduction Action Plan is one of the most ambitious regulatory red tape-cutting exercises in the world today. Moving forward, the Government will continue to stay the course in implementing the following Action Plan commitments:

- Through the Administrative Burden Baseline initiative, regulators will develop and maintain an inventory of requirements in regulation that impose administrative burden on business, thereby providing additional assurance of the Government’s commitment to monitoring and reporting on regulatory red tape. Once established, these inventories will help regulators manage their stock of regulatory requirements. This information will be posted on departmental Acts and Regulations Web pages by fall 2014 and updated annually thereafter.

- The Government will follow through on its commitment to legislate the One-for-One Rule. In doing so, Canada will be the first country to give such a rule the weight of legislation.

- Regulators will publish interpretation policies that clarify how they interpret regulations and when stakeholders can expect to receive answers to their questions in writing. These interpretation policies will be published on departmental Acts and Regulations Web pages later this year.

- Regulators will continue to implement the 90 department-specific actions recommended by the Red Tape Reduction Commission. The vast majority of these will be implemented by the applicable regulator(s) by the end of 2015–2016.

For those systemic reforms that were implemented in 2012–2013, the Government hopes to demonstrate even more promising results in the next Annual Scorecard Report.

Efforts to target and control the regulatory burden on business (particularly small businesses) will continue through the ongoing implementation of the One-for-One Rule and the Small Business Lens. It is expected that more evidence of the impact of the Lens will be demonstrated next year as more regulatory proposals come forward to Cabinet for final approval.

Ensuring greater transparency and predictability within the federal regulatory system will also remain a priority for the Government. In this regard, regulators will continue to update their forward regulatory plans on a semi-annual basis to ensure that Canadians and businesses are provided with current information on planned regulatory changes to be implemented over the next two years. Regulators will also continue to develop and release new service standards for their high-volume regulatory authorizations until all such processes are governed by a commitment to timely service delivery. Furthermore, starting in June 2014, regulators will report annually on their performance against all of their publicly available service standards for these authorizations.

The Government’s Red Tape Reduction Action Plan reinforces Canada’s reputation as one of the best places in the world to do business. Moving forward, the Government is committed to fostering even better conditions for doing business in Canada while continuing to protect the health and safety of Canadians through an effective and efficient regulatory system.

Annex A: Summary of 2012–2013 Assessment Results by Portfolio/Entity

Ratings are assigned by the Treasury Board of Canada Secretariat’s Regulatory Affairs Sector based upon an assessment of a portfolio’s level of compliance with guidance requirements for a given systemic reform (see Guidelines and Tools on TBS’s website). Portfolios are provided with an opportunity to implement corrective actions for a given systemic reform in advance of being assigned a final rating.

Reform Rating Explanation:

![]() = Full compliance demonstrated for most or all reform commitments and guidance requirements

= Full compliance demonstrated for most or all reform commitments and guidance requirements

![]() = Generally in compliance with reform commitments and guidance requirements; minor corrective actions are required

= Generally in compliance with reform commitments and guidance requirements; minor corrective actions are required

![]() = Some compliance demonstrated with reform commitments and guidance requirements; moderate corrective actions are required

= Some compliance demonstrated with reform commitments and guidance requirements; moderate corrective actions are required

![]() = Significant compliance issues evident with reform commitments and guidance requirements; major corrective actions are required

= Significant compliance issues evident with reform commitments and guidance requirements; major corrective actions are required

![]() = Inadequate compliance demonstrated with reform commitments and guidance requirements

= Inadequate compliance demonstrated with reform commitments and guidance requirements

Provided below are the 2012–2013 ratings assigned to portfolios for each applicable systemic reform (including Acts and Regulations Web pages):

| Portfolios for Assessment | Regulatory Reforms - Ratings | ||||

|---|---|---|---|---|---|

| "One-For-One" Rule | Small Business Lens | Forward Regulatory Plan | Service Standards | Acts & Regulations Web Page | |

| Aboriginal Affairs and Northern Development |  |

N/A |  |

|

|

| Agriculture and Agri-Food |  |

N/A |  |

|

|

| Canadian Heritage | N/A | N/A | N/A |  |

|

| Citizenship and Immigration |  |

N/A |  |

N/A |  |

| Employment and Social Development |  |

N/A |  |

N/A |  |

| Environment |  |

N/A |  |

|

|

| Finance | N/A | N/A |  |

|

|

| Fisheries and Oceans |  |

N/A |  |

|

|

| Foreign Affairs, Trade and Development | N/A | N/A |  |

N/A |  |

| Health | N/A | N/A |  |

|

|

| Industry | N/A | N/A |  |

|

|

| Justice | N/A | N/A |  |

N/A |  |

| National Revenue | N/A | N/A |  |

N/A |  |

| Natural Resources | N/A | N/A |  |

|

|

| Public Safety |  |

N/A |  |

|

|

| Public Works and Government Services | N/A | N/A | N/A | N/A |  |

| Transport | N/A | N/A |  |

|

|

| Treasury Board | N/A | N/A |  |

N/A |  |

| Veterans Affairs | N/A | N/A |  |

N/A |  |

The following portfolio entities were granted separate assessments and assigned separate ratings upon request from their Minister:

| Portfolio Entities Granted Separate Assessments (Portfolio) | Regulatory Reforms - Ratings | ||||

|---|---|---|---|---|---|

| "One-For-One" Rule | Small Business Lens | Forward Regulatory Plan | Service Standards | Acts & Regulations Web Page | |

| Canadian Environmental Assessment Agency (Environment) | N/A | N/A |  |

N/A |  |

| Canadian Transportation Agency (Transport) | N/A | N/A |  |

N/A |  |

| Parks Canada (Environment) | N/A | N/A |  |

|

|

Annex B: List of Final, GIC-Approved Regulatory Changes Subject to the One-for-One Rule Published in the Canada Gazette, Part II, in 2012–2013

Carve-Outs:

The One-for-One Rule applies to all regulatory changes that impose new administrative burden costs on business. There are, however, circumstances where the application of the Rule may be inappropriate or unworkable. On these occasions when a carve-out is required, the Rule provides flexibility for the Treasury Board of Canada to exempt certain regulations on a case-by-case basis.

Provided below are the regulations that were granted carve-outs in 2012–2013:

Footnotes

Return to footnote reference [1] The term “portfolio” refers to the federal departments, agencies and other entities for which a Cabinet Minister is assigned responsibility by the Prime Minister of Canada.

Return to footnote reference [2] The GIC is the Governor General of Canada acting on the advice of the Queen’s Privy Council (i.e., Cabinet). Treasury Board, as delegated by the Prime Minister, is the Cabinet Committee that exercises the authority to approve regulations.

Return to footnote reference [3] The RIAS is a public document that is published with a proposed regulation and describes the Government's regulatory action and its impact on the environment, health, safety, security, and social and economic well-being of Canadians.

Return to footnote reference [4] The complete list of final, GIC-approved regulatory changes subject to the Rule and published in the Canada Gazette in 2012–2013 is provided in Annex B.

Return to footnote reference [5] Industry Canada, Key Small Business Statistics, August 2013.

Return to footnote reference [6] The other five regulatory authorizations had existing service standards posted that were already reported publicly but were reformulated based on the new format prescribed in TBS guidance ahead of schedule (i.e., not due until November 2013).

- Date modified: