Common menu bar links

Breadcrumb Trail

ARCHIVED - Financial Transactions and Reports Analysis Centre of Canada - Report

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Director's Message

I am pleased to present the Financial Transactions and Reports Analysis Centre of Canada's (FINTRAC's) 2012-13 Report on Plans and Priorities, an outline of the Centre's corporate direction for the coming year.

The role of FINTRAC as Canada's financial intelligence agency is critical to combatting money laundering and terrorist financing. We support police, the Canadian Security Intelligence Service, the Canada Revenue Agency, the Canada Border Services Agency, the Communications Security Establishment and federal public safety policy makers by providing strategic and tactical intelligence that sheds light on their investigations and informs their decisions.

FINTRAC also has responsibility for ensuring compliance with Part 1 of the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA). FINTRAC's ability to produce valuable financial intelligence is linked to a sound compliance program, which relies foremost on the information we obtain from reporting entities. We do this by working with the many businesses and individuals who have reporting, record keeping and client identification obligations set out in the Act. By improving compliance with the PCMLTFA, FINTRAC and the many business sectors will strengthen the defences against those who would abuse the Canadian financial system and ensure that the Centre continues to receive the transaction reports necessary to produce high quality financial intelligence.

In the planning period ahead, we look forward to the conclusion of the second Parliamentary Review of the PCMLTFA. The first review in 2006 resulted in significant improvements to the legislation. Those changes helped make FINTRAC a stronger and more effective agency that is able to make a significant contribution to the detection, deterrence and prevention of money laundering and terrorist financing. We anticipate that similar advancements will come from the current Parliamentary Review.

At FINTRAC, our success is measured by the quality of the financial intelligence we provide and the assistance we are able to offer to our partners. I am pleased to say that, by those measures, we are delivering a valued product that is making a significant contribution to the public safety of Canadians and to the protection of the integrity of Canada's financial system.

Darlene Boileau

Acting Director

Section I: Organizational Overview

Raison d'être

The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) is Canada's financial intelligence unit (FIU). The Centre exists to assist in the detection, prevention and deterrence of money laundering and the financing of terrorist activities. FINTRAC's 'value-added' financial intelligence products and compliance functions are a unique contribution to the public safety of Canadians and to the protection of the integrity of Canada's financial system.

FINTRAC is an independent agency that operates at arm's length from the law enforcement agencies and other entities to which it is authorized to disclose financial intelligence. It reports to the Minister of Finance, who is in turn accountable to Parliament for the activities of the Centre. FINTRAC was established and operates within the ambit of the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) and its regulations.

FINTRAC's Mission

To contribute to the public safety of Canadians and help protect the integrity of Canada's financial system through the detection and deterrence of money laundering and terrorist financing.

FINTRAC's Vision

To be recognized as a world class financial intelligence unit in the global fight against money laundering and terrorist financing.

Responsibilities

FINTRAC is one of several domestic partners in Canada's Anti-Money Laundering and Anti-Terrorist Financing (AML/ATF) Regime, which also includes the Department of Finance as the policy lead, the Royal Canadian Mounted Police (RCMP), the Canadian Security Intelligence Service (CSIS), the Canada Revenue Agency (CRA), the Canada Border Services Agency (CBSA), the Office of the Superintendent of Financial Institutions (OSFI), the Public Prosecution Service of Canada, the Department of Justice, and Public Safety Canada. FINTRAC is also part of the Egmont Group, an international network of financial intelligence units that collaborate to combat money laundering and terrorist activity financing.

FINTRAC's role is to facilitate the detection, prevention and deterrence of money laundering, and terrorist activity financing by engaging in the following activities:

- Receiving, collecting and analyzing information on suspect financial activities;

- Disclosing tactical financial intelligence to the appropriate police service, CSIS, or other agencies designated by legislation;

- Producing and disseminating strategic financial intelligence to inform government partners and decision makers, as well as reporting entities about money laundering and terrorist financing trends, methods and issues;

- Ensuring compliance of reporting, record keeping and other obligations by those subject to the PCMLTFA; and

- Enhancing public awareness and understanding of matters related to money laundering.

FINTRAC's headquarters are located in Ottawa, with three regional offices in Montreal, Toronto and Vancouver having specific mandates related to compliance with the PCMLTFA.

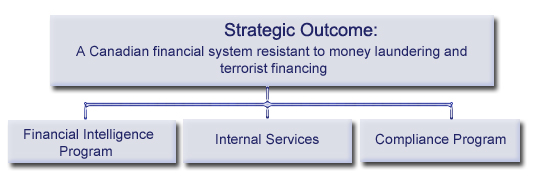

Strategic Outcome and Program Activity Architecture (PAA)

To effectively pursue its mandate, FINTRAC aims to achieve a single Strategic Outcome supported by the Program Activity Architecture (PAA) summarized below.

[ View the text equivalent for Strategic Outcome and Program Activity Architecture (PAA)]

Protecting Privacy

The protection of the personal information that FINTRAC receives is an integral part of the Centre's mandate. The PCMLTFA establishes stringent rules that govern both the management and disclosure of the personal information contained in the Centre's transaction reports and other records. All facets of FINTRAC's operations are subject to rigorous security measures that ensure the safeguarding of the Centre's physical premises and IT systems, and include the handling, storage and retention of all personal and other sensitive information under its control.

As required pursuant to the PCMLTFA, the Office of the Privacy Commissioner reviews FINTRAC's information protection measures every two years. The second review was initiated in 2011-12. FINTRAC looks forward to the final report, and to responding to any recommendations that will help to further strengthen the Centre's measures to protect information.

Organizational Priorities

For the planning period, FINTRAC's activities will be guided and shaped by the organizational priorities described below. The Centre has updated its organizational priorities for the period 2012-14 to better support the achievement of its Strategic Outcome and to assist in the delivery of the expected results identified within each of the Centre's program activities.

| Priority | Type | Program Activity |

|---|---|---|

| Produce quality financial intelligence products that are aligned with our partners' priorities and identify trends related to money laundering and terrorist financing. | New |

|

| Description | ||

|

Why is this a priority?

Plans for meeting the priority

|

||

| Priority | Type | Program Activity |

|---|---|---|

| Deliver an effective national risk-based compliance program | New |

|

| Description | ||

|

Why is this a priority?

Plans for meeting the priority

|

||

| Priority | Type | Program Activities |

|---|---|---|

| Pursue policy and legislative opportunities to strengthen the anti-money laundering and anti-terrorist financing (AML /ATF) Regime | Ongoing |

|

| Description | ||

|

Why is this a priority?

Plans for meeting the priority

|

||

| Priority | Type | Program Activities |

|---|---|---|

| Be innovative and collaborative in our approach to operationalizing processes to maximize efficiency and effectiveness. | New |

|

| Description | ||

|

Why is this a priority?

Plans for meeting the priority

|

||

| Priority | Type | Program Activities |

|---|---|---|

| Promote excellence in our workforce and strengthen our business and people management frameworks. | New |

|

| Description | ||

|

Why is this a priority?

Plans for meeting the priority

|

||

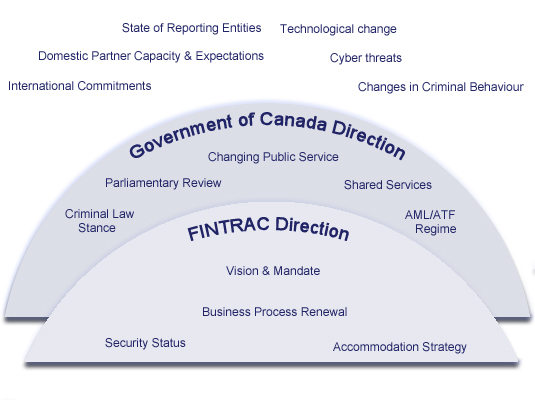

Risk Analysis

FINTRAC operates within a dynamic and constantly changing operating environment. In seeking to be proactive in identifying risks and opportunities, the Centre must anticipate and assess both internal and external risk factors that can affect the design and delivery of its programs and the achievement of its strategic outcome.

FINTRAC's Operating Environment

[View the text equivalent for FINTRAC's Operating Environment]

As part of its risk management approach, FINTRAC integrates risk information into its key decision-making and planning activities by utilizing a Corporate Risk Profile (CRP). As a primary component of FINTRAC's risk management strategy an annual update of the CRP helps FINTRAC to identify both internal and external risks and opportunities. It includes a detailed discussion of the likelihood and impact for each of the risks, risk rankings, risk responses/mitigation measures, and identifies who is responsible for monitoring and mitigating the risk from within the Centre.

The top corporate risks and opportunities from the CRP are approved by FINTRAC's Executive Committee and are monitored regularly to ensure implementation of mitigation measures when appropriate. The top corporate risks identified in FINTRAC's most recent CRP are discussed in the following table.

| Key Risk | Risk Summary and Mitigation Measures |

Program Activities |

|---|---|---|

|

Protection of Information There is a risk that the information entrusted to FINTRAC may be improperly accessed, used and/or disclosed. |

FINTRAC has access to sensitive financial information and is responsible for protecting its confidentiality. To ensure the continued protection of personal and other sensitive information, FINTRAC employs a number of safeguards including: incident monitoring; information security awareness training for all staff; access controls through IM/IT protocols; a strong information management program; and criminal penalties for those who deliberately intend to bypass the legal requirements set out in the PCMLTFA and other legislation. These measures are led by the Centre's Chief Privacy Officer, a member of FINTRAC's Executive Committee, with responsibility to provide strategic privacy leadership, and to coordinate and oversee privacy related activities for the Centre. FINTRAC's information protection measures are also assessed by audits conducted every two years by the Office of the Privacy Commissioner. |

|

|

Compliance Program There is a risk that FINTRAC may not have a strong enough compliance program to assist in the detection, prevention and deterrence of money laundering, the financing of terrorist activities and other threats to the security of Canada. |

The quality of FINTRAC's financial intelligence stems directly from the quality and quantity of the financial information received by the Centre from those with obligations under the PCMLTFA. Given the large number of entities and individuals that could be conducting financial transactions in the course of their activities that fall within the ambit of the PCMLTFA and its regulations, FINTRAC utilizes a risk-based approach to deliver enforcement, relations and support activities that help ensure compliance with legislative and regulatory obligations. The Centre employs a stratification framework to tailor its compliance activities in accordance with the risk of non-compliance by individuals and entities, thereby ensuring that the level of compliance activity undertaken is commensurate with the risk of non-compliance. |

|

|

Emergency Planning and Business Continuity Plans There is a risk that FINTRAC emergency planning and Business Continuity Plans may not be robust enough to ensure continuous operation in the event of an incident. |

Canada is not immune to terrorist events or to natural disasters such as fire, flooding or earthquakes. In the event that an incident does occur that impacts its normal operations, FINTRAC must be prepared to respond quickly and effectively. The Centre has, and will continue to develop and implement, strategies and action plans to help mitigate the impact of any incident and to resume its operations in a reasonable amount of time. This will include maintaining an up-to-date Business Continuity Plan and enhancing its incident monitoring and response procedures. |

|

Planning Summary

| 2012-13 | 2013-14 | 2014-15 |

|---|---|---|

| 55.1 | 52.8 | 50.8 |

FINTRAC's Budget 2010 funding will increase from $8.0M in 2011-12 to $10.5M in 2012-13, to $10.0M in 2013-14, and stabilize at $8.0M in 2014-15 and on-going to enhance the Centre's ability to ensure compliance with PCMLTFA and meet its responsibilities related to tax evasion becoming a predicate offence to money laundering. Beginning in 2012-13 and on-going, FINTRAC's financial resources will be reduced by $6.3M due to the transfer of authorities related to functions adopted by Shared Services Canada ($5.6M) and the sunset of funding for the National Anti-Drug Strategy ($0.7M). Planned spending for all three years includes an estimate of TB Vote 30 - Paylist Requirements. Planned spending for 2012-13 also includes an estimated operating budget carry forward of $1.8M.

| 2012-13 | 2013-14 | 2014-15 |

|---|---|---|

| 345 | 345 | 345 |

In 2012-13 and on-going, FINTRAC's FTEs are expected to decrease by 22 over the previous fiscal year due to the transfer of IT functions adopted by Shared Services Canada.

| Performance Indicators | Targets |

|---|---|

| Percentage of FINTRAC disclosures of Financial Intelligence that are considered relevant to key partners | 80% of disclosures are relevant to key partners |

| Total number of publications on money laundering and terrorist financing methods and risks presented to reporting entities and investigative partners. | Increasing number of various strategic financial intelligence products which meet the needs of diverse partners and reporting entity sectors and further their understanding of money laundering and terrorist financing methods and risks. |

| Percentage of reporting entities with strengthened compliance regimes | Upward trend. Methodology to be set in 2012-13 |

| Program Activity | Forecast Spending 2011-12 |

Planned Spending | Alignment to Government of Canada Outcomes | ||

|---|---|---|---|---|---|

| 2012-13 | 2013-14 | 2014-15 | |||

| Financial Intelligence Program | N/A 1 | 23.4 | 22.4 | 21.6 |

A Safe and Secure Canada |

| Compliance Program | N/A 1 | 23.4 | 22.4 | 21.6 | A Safe and Secure Canada |

| Detection and deterrence of money laundering and terrorist financing 2 | 49.0 | N/A 2 | N/A 2 | N/A 2 | A Safe and Secure Canada |

| Total Planned Spending 3 | 46.8 | 44.9 | 43.2 | ||

| Program Activity | Forecast Spending 2011-12 |

Planned Spending | ||

|---|---|---|---|---|

| 2012-13 | 2013-14 | 2014-15 | ||

| Internal Services | 8.6 | 8.3 | 7.9 | 7.6 |

| Total Planned Spending | 8.3 | 7.9 | 7.6 | |

Expenditure Profile

Departmental Spending Trend

[View the text equivalent for Spending Trend by Fiscal Year]

Actual Spending (2008-09 to 2010-11)

The resources available for spending in 2008-09 and 2009-10 were $56.8M and $53.7M, respectively. Actual Spending for 2008-09 was $50.6M and 2009-10 was $49.9M.

In 2010-11, resources available for spending increased to $56.2M. The primary reason for the increase in available resources was the $3.5M in funding received from Budget 2010. FINTRAC is utilizing these funds to invest in technologies to enhance key business functions essential to ensure compliance with PCMLTFA, and additional capacity to meet responsibilities related to tax evasion becoming a predicate offence to money laundering. Also of note, the Government of Canada, via FINTRAC, concluded its start-up funding of $5.0M over 5 years for the establishment of the Egmont Group Secretariat in Toronto. Actual Spending for 2010-11 was $50.9M.

Forecast Spending (2011-12)

Forecast spending for 2011-12 is $57.6M, with the increase over 2010-11 mainly attributable to an increase in the Budget 2010 funding profile from $3.5M in 2010-11 to $8.0M in 2011-12. Another major factor includes the high percentage of FINTRAC employees opting to liquidate payments of their accumulated severance benefits in 2011-12, estimated to be $3.9M. While this is a cost for FINTRAC, severance liquidation payments are reimbursed by Treasury Board, and therefore FINTRAC's available resources will increase by an equivalent amount.

In an effort to streamline and reduce duplication of the government's IT services, FINTRAC transferred authorities, functions, and resources in the amount of $2.7M to the newly established Shared Services Canada, as of the Order-in-council date of November 15, 2011. FINTRAC is expecting to carry forward $1.8M of its Operating Budget to 2012-13, and this has been reflected in the forecasted/planned spending figures.

Planned Spending (2012-13 to 2014-15)

Planned spending is expected to be $55.1M in 2012-13, $52.8M in 2013-14, and $50.8M in 2014-15. This trend can largely be attributable to FINTRAC's Budget 2010 funding, which will increase from $8.0M in 2011-12 to $10.5M in 2012-13, $10.0M in 2013-14, and stabilize at $8.0M in 2014-15 and on-going to enhance the Centre's ability to ensure compliance with PCMLTFA and meet new responsibilities related to tax evasion becoming a predicate offence to money laundering. Beginning in 2012-13 and on-going, FINTRAC's financial resources will be reduced by $6.3M due to the transfer of authorities related to functions adopted by Shared Services Canada ($5.6M) and the sunset of funding for the National Anti-Drug Strategy ($0.7M).

Estimates by Vote

For information on our organizational appropriations, please see the 2012-13 Main Estimates publication.