ARCHIVED - Financial Transactions and Reports Analysis Centre of Canada - Report

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

2012-13

Report on Plans and Priorities

Financial Transactions and Reports Analysis Centre of Canada

The original version was signed by

The Honourable James M. Flaherty

Minister of Finance

Table of Contents

Section I: Organizational Overview

- Raison d'être

- Responsibilities

- Strategic Outcome and Program Activity Architecture (PAA)

- Organizational Priorities

- Risk Analysis

- Planning Summary

- Expenditure Profile

- Estimates by Vote

Section II: Analysis of Program Activities by Strategic Outcome

- Strategic Outcome: A Canadian financial system resistant to money laundering and terrorist financing

- Program Activity: Financial Intelligence Program

- Program Activity: Compliance Program

- Program Activity: Internal Services

Section III: Supplementary Information

Section IV: Other Items of Interest

Director's Message

I am pleased to present the Financial Transactions and Reports Analysis Centre of Canada's (FINTRAC's) 2012-13 Report on Plans and Priorities, an outline of the Centre's corporate direction for the coming year.

The role of FINTRAC as Canada's financial intelligence agency is critical to combatting money laundering and terrorist financing. We support police, the Canadian Security Intelligence Service, the Canada Revenue Agency, the Canada Border Services Agency, the Communications Security Establishment and federal public safety policy makers by providing strategic and tactical intelligence that sheds light on their investigations and informs their decisions.

FINTRAC also has responsibility for ensuring compliance with Part 1 of the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA). FINTRAC's ability to produce valuable financial intelligence is linked to a sound compliance program, which relies foremost on the information we obtain from reporting entities. We do this by working with the many businesses and individuals who have reporting, record keeping and client identification obligations set out in the Act. By improving compliance with the PCMLTFA, FINTRAC and the many business sectors will strengthen the defences against those who would abuse the Canadian financial system and ensure that the Centre continues to receive the transaction reports necessary to produce high quality financial intelligence.

In the planning period ahead, we look forward to the conclusion of the second Parliamentary Review of the PCMLTFA. The first review in 2006 resulted in significant improvements to the legislation. Those changes helped make FINTRAC a stronger and more effective agency that is able to make a significant contribution to the detection, deterrence and prevention of money laundering and terrorist financing. We anticipate that similar advancements will come from the current Parliamentary Review.

At FINTRAC, our success is measured by the quality of the financial intelligence we provide and the assistance we are able to offer to our partners. I am pleased to say that, by those measures, we are delivering a valued product that is making a significant contribution to the public safety of Canadians and to the protection of the integrity of Canada's financial system.

Darlene Boileau

Acting Director

Section I: Organizational Overview

Raison d'être

The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) is Canada's financial intelligence unit (FIU). The Centre exists to assist in the detection, prevention and deterrence of money laundering and the financing of terrorist activities. FINTRAC's 'value-added' financial intelligence products and compliance functions are a unique contribution to the public safety of Canadians and to the protection of the integrity of Canada's financial system.

FINTRAC is an independent agency that operates at arm's length from the law enforcement agencies and other entities to which it is authorized to disclose financial intelligence. It reports to the Minister of Finance, who is in turn accountable to Parliament for the activities of the Centre. FINTRAC was established and operates within the ambit of the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) and its regulations.

FINTRAC's Mission

To contribute to the public safety of Canadians and help protect the integrity of Canada's financial system through the detection and deterrence of money laundering and terrorist financing.

FINTRAC's Vision

To be recognized as a world class financial intelligence unit in the global fight against money laundering and terrorist financing.

Responsibilities

FINTRAC is one of several domestic partners in Canada's Anti-Money Laundering and Anti-Terrorist Financing (AML/ATF) Regime, which also includes the Department of Finance as the policy lead, the Royal Canadian Mounted Police (RCMP), the Canadian Security Intelligence Service (CSIS), the Canada Revenue Agency (CRA), the Canada Border Services Agency (CBSA), the Office of the Superintendent of Financial Institutions (OSFI), the Public Prosecution Service of Canada, the Department of Justice, and Public Safety Canada. FINTRAC is also part of the Egmont Group, an international network of financial intelligence units that collaborate to combat money laundering and terrorist activity financing.

FINTRAC's role is to facilitate the detection, prevention and deterrence of money laundering, and terrorist activity financing by engaging in the following activities:

- Receiving, collecting and analyzing information on suspect financial activities;

- Disclosing tactical financial intelligence to the appropriate police service, CSIS, or other agencies designated by legislation;

- Producing and disseminating strategic financial intelligence to inform government partners and decision makers, as well as reporting entities about money laundering and terrorist financing trends, methods and issues;

- Ensuring compliance of reporting, record keeping and other obligations by those subject to the PCMLTFA; and

- Enhancing public awareness and understanding of matters related to money laundering.

FINTRAC's headquarters are located in Ottawa, with three regional offices in Montreal, Toronto and Vancouver having specific mandates related to compliance with the PCMLTFA.

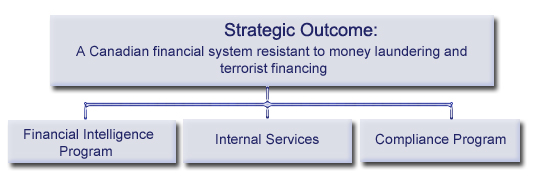

Strategic Outcome and Program Activity Architecture (PAA)

To effectively pursue its mandate, FINTRAC aims to achieve a single Strategic Outcome supported by the Program Activity Architecture (PAA) summarized below.

[ View the text equivalent for Strategic Outcome and Program Activity Architecture (PAA)]

Protecting Privacy

The protection of the personal information that FINTRAC receives is an integral part of the Centre's mandate. The PCMLTFA establishes stringent rules that govern both the management and disclosure of the personal information contained in the Centre's transaction reports and other records. All facets of FINTRAC's operations are subject to rigorous security measures that ensure the safeguarding of the Centre's physical premises and IT systems, and include the handling, storage and retention of all personal and other sensitive information under its control.

As required pursuant to the PCMLTFA, the Office of the Privacy Commissioner reviews FINTRAC's information protection measures every two years. The second review was initiated in 2011-12. FINTRAC looks forward to the final report, and to responding to any recommendations that will help to further strengthen the Centre's measures to protect information.

Organizational Priorities

For the planning period, FINTRAC's activities will be guided and shaped by the organizational priorities described below. The Centre has updated its organizational priorities for the period 2012-14 to better support the achievement of its Strategic Outcome and to assist in the delivery of the expected results identified within each of the Centre's program activities.

| Priority | Type | Program Activity |

|---|---|---|

| Produce quality financial intelligence products that are aligned with our partners' priorities and identify trends related to money laundering and terrorist financing. | New |

|

| Description | ||

|

Why is this a priority?

Plans for meeting the priority

|

||

| Priority | Type | Program Activity |

|---|---|---|

| Deliver an effective national risk-based compliance program | New |

|

| Description | ||

|

Why is this a priority?

Plans for meeting the priority

|

||

| Priority | Type | Program Activities |

|---|---|---|

| Pursue policy and legislative opportunities to strengthen the anti-money laundering and anti-terrorist financing (AML /ATF) Regime | Ongoing |

|

| Description | ||

|

Why is this a priority?

Plans for meeting the priority

|

||

| Priority | Type | Program Activities |

|---|---|---|

| Be innovative and collaborative in our approach to operationalizing processes to maximize efficiency and effectiveness. | New |

|

| Description | ||

|

Why is this a priority?

Plans for meeting the priority

|

||

| Priority | Type | Program Activities |

|---|---|---|

| Promote excellence in our workforce and strengthen our business and people management frameworks. | New |

|

| Description | ||

|

Why is this a priority?

Plans for meeting the priority

|

||

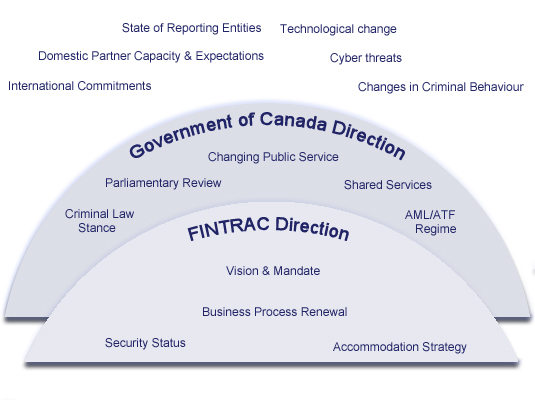

Risk Analysis

FINTRAC operates within a dynamic and constantly changing operating environment. In seeking to be proactive in identifying risks and opportunities, the Centre must anticipate and assess both internal and external risk factors that can affect the design and delivery of its programs and the achievement of its strategic outcome.

FINTRAC's Operating Environment

[View the text equivalent for FINTRAC's Operating Environment]

As part of its risk management approach, FINTRAC integrates risk information into its key decision-making and planning activities by utilizing a Corporate Risk Profile (CRP). As a primary component of FINTRAC's risk management strategy an annual update of the CRP helps FINTRAC to identify both internal and external risks and opportunities. It includes a detailed discussion of the likelihood and impact for each of the risks, risk rankings, risk responses/mitigation measures, and identifies who is responsible for monitoring and mitigating the risk from within the Centre.

The top corporate risks and opportunities from the CRP are approved by FINTRAC's Executive Committee and are monitored regularly to ensure implementation of mitigation measures when appropriate. The top corporate risks identified in FINTRAC's most recent CRP are discussed in the following table.

| Key Risk | Risk Summary and Mitigation Measures |

Program Activities |

|---|---|---|

|

Protection of Information There is a risk that the information entrusted to FINTRAC may be improperly accessed, used and/or disclosed. |

FINTRAC has access to sensitive financial information and is responsible for protecting its confidentiality. To ensure the continued protection of personal and other sensitive information, FINTRAC employs a number of safeguards including: incident monitoring; information security awareness training for all staff; access controls through IM/IT protocols; a strong information management program; and criminal penalties for those who deliberately intend to bypass the legal requirements set out in the PCMLTFA and other legislation. These measures are led by the Centre's Chief Privacy Officer, a member of FINTRAC's Executive Committee, with responsibility to provide strategic privacy leadership, and to coordinate and oversee privacy related activities for the Centre. FINTRAC's information protection measures are also assessed by audits conducted every two years by the Office of the Privacy Commissioner. |

|

|

Compliance Program There is a risk that FINTRAC may not have a strong enough compliance program to assist in the detection, prevention and deterrence of money laundering, the financing of terrorist activities and other threats to the security of Canada. |

The quality of FINTRAC's financial intelligence stems directly from the quality and quantity of the financial information received by the Centre from those with obligations under the PCMLTFA. Given the large number of entities and individuals that could be conducting financial transactions in the course of their activities that fall within the ambit of the PCMLTFA and its regulations, FINTRAC utilizes a risk-based approach to deliver enforcement, relations and support activities that help ensure compliance with legislative and regulatory obligations. The Centre employs a stratification framework to tailor its compliance activities in accordance with the risk of non-compliance by individuals and entities, thereby ensuring that the level of compliance activity undertaken is commensurate with the risk of non-compliance. |

|

|

Emergency Planning and Business Continuity Plans There is a risk that FINTRAC emergency planning and Business Continuity Plans may not be robust enough to ensure continuous operation in the event of an incident. |

Canada is not immune to terrorist events or to natural disasters such as fire, flooding or earthquakes. In the event that an incident does occur that impacts its normal operations, FINTRAC must be prepared to respond quickly and effectively. The Centre has, and will continue to develop and implement, strategies and action plans to help mitigate the impact of any incident and to resume its operations in a reasonable amount of time. This will include maintaining an up-to-date Business Continuity Plan and enhancing its incident monitoring and response procedures. |

|

Planning Summary

| 2012-13 | 2013-14 | 2014-15 |

|---|---|---|

| 55.1 | 52.8 | 50.8 |

FINTRAC's Budget 2010 funding will increase from $8.0M in 2011-12 to $10.5M in 2012-13, to $10.0M in 2013-14, and stabilize at $8.0M in 2014-15 and on-going to enhance the Centre's ability to ensure compliance with PCMLTFA and meet its responsibilities related to tax evasion becoming a predicate offence to money laundering. Beginning in 2012-13 and on-going, FINTRAC's financial resources will be reduced by $6.3M due to the transfer of authorities related to functions adopted by Shared Services Canada ($5.6M) and the sunset of funding for the National Anti-Drug Strategy ($0.7M). Planned spending for all three years includes an estimate of TB Vote 30 - Paylist Requirements. Planned spending for 2012-13 also includes an estimated operating budget carry forward of $1.8M.

| 2012-13 | 2013-14 | 2014-15 |

|---|---|---|

| 345 | 345 | 345 |

In 2012-13 and on-going, FINTRAC's FTEs are expected to decrease by 22 over the previous fiscal year due to the transfer of IT functions adopted by Shared Services Canada.

| Performance Indicators | Targets |

|---|---|

| Percentage of FINTRAC disclosures of Financial Intelligence that are considered relevant to key partners | 80% of disclosures are relevant to key partners |

| Total number of publications on money laundering and terrorist financing methods and risks presented to reporting entities and investigative partners. | Increasing number of various strategic financial intelligence products which meet the needs of diverse partners and reporting entity sectors and further their understanding of money laundering and terrorist financing methods and risks. |

| Percentage of reporting entities with strengthened compliance regimes | Upward trend. Methodology to be set in 2012-13 |

| Program Activity | Forecast Spending 2011-12 |

Planned Spending | Alignment to Government of Canada Outcomes | ||

|---|---|---|---|---|---|

| 2012-13 | 2013-14 | 2014-15 | |||

| Financial Intelligence Program | N/A 1 | 23.4 | 22.4 | 21.6 |

A Safe and Secure Canada |

| Compliance Program | N/A 1 | 23.4 | 22.4 | 21.6 | A Safe and Secure Canada |

| Detection and deterrence of money laundering and terrorist financing 2 | 49.0 | N/A 2 | N/A 2 | N/A 2 | A Safe and Secure Canada |

| Total Planned Spending 3 | 46.8 | 44.9 | 43.2 | ||

| Program Activity | Forecast Spending 2011-12 |

Planned Spending | ||

|---|---|---|---|---|

| 2012-13 | 2013-14 | 2014-15 | ||

| Internal Services | 8.6 | 8.3 | 7.9 | 7.6 |

| Total Planned Spending | 8.3 | 7.9 | 7.6 | |

Expenditure Profile

Departmental Spending Trend

[View the text equivalent for Spending Trend by Fiscal Year]

Actual Spending (2008-09 to 2010-11)

The resources available for spending in 2008-09 and 2009-10 were $56.8M and $53.7M, respectively. Actual Spending for 2008-09 was $50.6M and 2009-10 was $49.9M.

In 2010-11, resources available for spending increased to $56.2M. The primary reason for the increase in available resources was the $3.5M in funding received from Budget 2010. FINTRAC is utilizing these funds to invest in technologies to enhance key business functions essential to ensure compliance with PCMLTFA, and additional capacity to meet responsibilities related to tax evasion becoming a predicate offence to money laundering. Also of note, the Government of Canada, via FINTRAC, concluded its start-up funding of $5.0M over 5 years for the establishment of the Egmont Group Secretariat in Toronto. Actual Spending for 2010-11 was $50.9M.

Forecast Spending (2011-12)

Forecast spending for 2011-12 is $57.6M, with the increase over 2010-11 mainly attributable to an increase in the Budget 2010 funding profile from $3.5M in 2010-11 to $8.0M in 2011-12. Another major factor includes the high percentage of FINTRAC employees opting to liquidate payments of their accumulated severance benefits in 2011-12, estimated to be $3.9M. While this is a cost for FINTRAC, severance liquidation payments are reimbursed by Treasury Board, and therefore FINTRAC's available resources will increase by an equivalent amount.

In an effort to streamline and reduce duplication of the government's IT services, FINTRAC transferred authorities, functions, and resources in the amount of $2.7M to the newly established Shared Services Canada, as of the Order-in-council date of November 15, 2011. FINTRAC is expecting to carry forward $1.8M of its Operating Budget to 2012-13, and this has been reflected in the forecasted/planned spending figures.

Planned Spending (2012-13 to 2014-15)

Planned spending is expected to be $55.1M in 2012-13, $52.8M in 2013-14, and $50.8M in 2014-15. This trend can largely be attributable to FINTRAC's Budget 2010 funding, which will increase from $8.0M in 2011-12 to $10.5M in 2012-13, $10.0M in 2013-14, and stabilize at $8.0M in 2014-15 and on-going to enhance the Centre's ability to ensure compliance with PCMLTFA and meet new responsibilities related to tax evasion becoming a predicate offence to money laundering. Beginning in 2012-13 and on-going, FINTRAC's financial resources will be reduced by $6.3M due to the transfer of authorities related to functions adopted by Shared Services Canada ($5.6M) and the sunset of funding for the National Anti-Drug Strategy ($0.7M).

Estimates by Vote

For information on our organizational appropriations, please see the 2012-13 Main Estimates publication.

Section II - Analysis of Program Activities by Strategic Outcome

Strategic Outcome: A Canadian financial system resistant to money laundering and terrorist financing

FINTRAC's role of assisting in the detection, prevention and deterrence of the laundering of criminal proceeds and the financing of terrorist activities is a vital component of Canada's Anti-Money Laundering and Anti-Terrorist Financing (AML/ATF) Regime and supports the achievement of the Centre's strategic outcome of a Canadian financial system resistant to money laundering and terrorist financing.

The following section describes FINTRAC's program activities and identifies the expected results, performance indicators and targets for each of them. This section also contains a discussion of plans surrounding FINTRAC'S program activities, explains how FINTRAC plans on meeting the expected results and presents the financial and non-financial resources that will be dedicated to each program activity.Program Activity: Financial Intelligence Program

Program Activity Description

FINTRAC's Financial Intelligence Program, mandated by the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA), is a component of the broader national security and anti-crime agenda. The program contributes to the public safety of Canadians and strives to disrupt the ability of criminals and terrorist groups that seek to abuse Canada's financial system while reducing the profit incentive of organized crime. The main methods of intervention used by the program include receiving and analyzing reported financial transactions and other information the Centre is authorized to collect under the PCMLTFA. The program produces trusted and valued financial intelligence products including tactical case disclosures on suspected money laundering, terrorist activity financing and other threats to the security of Canada, as well as strategic intelligence such as money laundering and terrorist financing trends reports, country and group based financial intelligence assessments, and vulnerability assessments of emerging financial technologies or services. The program's products are relied upon and sought after by Canadian law enforcement at the federal, provincial and municipal levels, by counterpart agencies and domestic and international intelligence bodies, and by policy and decision makers working to identify emerging issues and vulnerabilities in the Anti-Money Laundering and Anti-Terrorist Financing Regime.

| 2012-13 | 2013-14 | 2014-15 |

|---|---|---|

| 23.4 | 22.4 | 21.6 |

| 2012-13 | 2013-14 | 2014-15 |

|---|---|---|

| 147 | 147 | 147 |

| Program Activity Expected Results | Performance Indicators | Targets |

|---|---|---|

| Disclosures of financial intelligence make an important contribution to investigations of money laundering and terrorist financing | Percentage of feedback forms indicating that a disclosure was useful in support of key partner priority investigations. | 70% |

| Percentage of feedback forms indicating that a proactive disclosure was useful in intelligence and investigative efforts of key partners. | 50% | |

| Strategic financial intelligence products align with the priorities of investigators, intelligence analysts, policy and decision makers | Percentage of strategic intelligence produced in support of a partner priority or a request. | 70% |

Planning Highlights

This program activity encompasses all of FINTRAC's financial intelligence activities. These activities are complemented by research, partnership and government relationship activities, both domestically and internationally. In order to achieve the expected results, FINTRAC plans to undertake the following activities during the 2012-13 fiscal year:

- Continue to ensure that partners receive quality financial intelligence products that address their needs and priorities.

- Identify and communicate money laundering and terrorist financing trends, methods and issues.

- Collaborate with partners and stakeholders to evaluate product effectiveness.

- Seek opportunities to develop new relationships, both domestically and internationally, to strengthen FINTRAC's role in combating money laundering and terrorist financing.

Program Activity: Compliance Program

Program Activity Description

FINTRAC's Compliance Program is responsible for ensuring compliance with Part 1 of the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) and associated regulations. The compliance program utilizes a risk based approach to deliver enforcement, relations and support activities that help ensure compliance with legislative and regulatory obligations that apply to individuals and entities operating in Canada’s financial system.

| 2012-13 | 2013-14 | 2014-15 |

|---|---|---|

| 23.4 | 22.4 | 21.6 |

| 2012-13 | 2013-14 | 2014-15 |

|---|---|---|

| 147 | 147 | 147 |

| Program Activity Expected Results | Performance Indicators | Targets |

|---|---|---|

| Non-compliance among reporting entities is detected and addressed | Percentage of cases where compliance behaviour is improved | Upward trend. Methodology to be set in 2012-13 |

| Entities have access to timely and accurate information | Percentage of general inquiries answered within established timeframes | 90% |

Planning Highlights

FINTRAC's compliance program is made up of numerous activities, of which the most prominent are: undertaking awareness activities to ensure understanding among reporting entities of their legal obligations under the PCMLTFA; providing technical support to facilitate reporting; building relations with regulators and key stakeholders; taking responsible enforcement actions, which include reports monitoring and compliance assessment functions; maintaining a money services business (MSB) registry; and taking appropriate remedial action when non-compliance is detected, which may result in administrative penalties, or disclosure of non-compliance to law enforcement.

During the planning period, FINTRAC will undertake the following activities to support the Centre's compliance priorities:

- Raise awareness among reporting entities of their legislative obligations under the PCMLTFA;

- Provide timely technical support to reporting entities to facilitate reporting;

- Enhance relations with regulators and key stakeholders;

- Provide feedback to reporting entities on the quality of prescribed financial transaction reports; and

- Expand enforcement and reports monitoring activities across sectors and take appropriate remedial action when non-compliance is detected, which may include administrative monetary penalties or non-compliance disclosures.

Program Activity: Internal Services

| 2012-13 | 2013-14 | 2014-15 |

|---|---|---|

| 8.3 | 7.9 | 7.6 |

| 2012-13 | 2013-14 | 2014-15 |

|---|---|---|

| 51 | 51 | 51 |

Planning Highlights

The priority for internal services over the planning period will be to focus on promoting excellence in the Centre's workforce and to strengthen business and people management frameworks. To realize these objectives, FINTRAC will undertake the following activities:

- Maintain a reputation as an "employer of excellence" with employee recruitment and engagement initiatives that strengthen the Centre's expertise in alignment with business priorities.

- Promote awareness of organizational expectations and improve people management by focusing corporate learning, recruitment, retention, performance management and recognition initiatives on the Centre's core leadership competencies.

- Review and update corporate policies and practices in support of FINTRAC business priorities and Government of Canada policies and legislation.

- Enhance corporate information and reporting systems to strengthen alignment of resources with business priorities and support executive decision-making.

- Develop an Investment Management Framework to strengthen the Centre's oversight capacity and ensure sound stewardship of financial resources.

- Continue to develop, refine and implement business continuity and emergency management frameworks to mitigate the impact of service disruptions for the Centre.

- Continue to develop the integrated security program to ensure protection of the Centre's information, assets and resources.

- Enhance operational effectiveness and improve the Centre's security posture by consolidating its headquarters operations to a single location. To complete the relocation, construction and fit-up projects are being managed by PWGSC. The sub-project which consists of the procurement, acquisition and installation of equipment, as well as the physical move of FINTRAC employees, will be managed by FINTRAC.

Section III - Supplementary Information

Financial Highlights

The future-oriented financial highlights presented within this RPP are intended to serve as a general overview of FINTRAC's financial position and operations. These statements have been prepared on an accrual basis to strengthen accountability and improve transparency and financial management.

| % Change | Future-Oriented 2012-13 |

Future-Oriented 2011-12 |

|

|---|---|---|---|

| Total Expenses | 1% | 61.0 | 60.4 |

| Total Revenues | N/A | N/A | 0.1 |

| Net Cost of Operations | 1% | 61.0 | 60.3 |

| % Change | Future-Oriented 2012-13 |

Future-Oriented 2011-12 |

|

|---|---|---|---|

| Total assets | -19% | 12.5 | 15.5 |

| Total liabilities | -9% | 8.6 | 9.5 |

| Equity | -37% | 3.8 | 6.0 |

| Total 4 | -19% | 12.5 | 15.5 |

Consistent with prior years, FINTRAC does not plan the issuance of Administrative Monetary Penalties (AMPs) and is therefore unable to forecast future revenues in 2012-13.

Pursuant to s. 31.1 of the Financial Administration Act and Order-in-Council (OIC) P.C. 2011-1297 effective November 15, 2011, FINTRAC transferred to Shared Services Canada (SSC) the control and supervision of portions of its IT services (e.g. e-mail, data centers, and network services/support). As a result, SSC-related expenditures from November 15, 2011, onwards have not been reflected in these future-oriented financial statements. Furthermore, the net effect of assets and liabilities transferred to SSC as of the OIC date has been accounted for as an adjustment to equity.

Future-Oriented Financial Statements

The financial highlights presented above are intended to serve as a general overview of FINTRAC's operations reported in the Department's future-oriented financial statements.

List of Supplementary Information Tables

All electronic supplementary information tables found in the 2012-13 Report on Plans and Priorities can be found on the Treasury Board of Canada Secretariat's web site:

- Greening Government Operations;

- Sources of Respendable and Non-Respendable Revenue;

- Summary of Capital Spending by Program Activity; and

- Upcoming Internal Audits and Evaluations over the next three fiscal years;

Section IV - Other Items of Interest

Organizational Contact Information

Mail

Financial Transactions and Reports Analysis Centre of Canada (FINTRAC)

24th Floor, 234 Laurier Avenue West

Ottawa, Ontario

K1P 1H7

Canada

Email

guidelines-lignesdirectrices@fintrac-canafe.gc.ca

Telephone

1-866-346-8722 (toll free)

Facsimile

613-943-7931

Footnotes

1 FINTRAC's Strategic Outcome and Program Activity Architecture elements were amended for display in the 2012-13 and future year Estimates and Public Accounts.

2 This 2011-12 Program Activity element has been removed from display in the 2012-13 and future year Estimates and Public Accounts.

3 Totals may not add due to rounding.

4 Totals may not add due to rounding.