Common menu bar links

Breadcrumb Trail

ARCHIVED - Agriculture and Agri-Food Canada - Report

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Minister's Message

The future is bright for Canada's innovative farmers and food processors. Our rich resource base and skilled, hardworking, entrepreneurial producers position Canada to take a lead in delivering world-class food to a global marketplace that is ripe with opportunity.

The image some have of agriculture as a traditional sector rooted in the past, reliant on historical production processes, couldn't be further from the truth. In reality, the Canadian agriculture and agri-food sector today is a strong contributor to the Canadian economy, employing over 2.1 million Canadians, contributing more than $100.3 billion to our Gross Domestic Product and generating more than $35 billion in exports.

While increasing global food demand and rising incomes are good news for our farmers, our competitors, especially those in emerging markets, are not standing still. Our Government will continue to work with the provinces, territories and industry to help the Canadian agriculture sector thrive in this competitive environment.

On the international front, we will build on our past achievements, opening new markets, forging free trade agreements and ensuring our pathways to trade are built on fair rules and sound science.

The Canadian agricultural sector's culture of innovation, and our science-based regulatory framework, will help our farmers capture domestic and global markets and meet increasing and evolving consumer product demand. Canadian farmers have always been great innovators, and our Government will continue to support them in this regard. For example, we recently launched the $50-million Agricultural Innovation Program to improve the productivity and competitiveness of the Canadian agricultural sector. We are also opening up new opportunities for Western Canadian grain farmers through the Marketing Freedom for Grain Farmers Act.

Challenges will always remain in agriculture. To turn them into opportunities and help the industry succeed in new and emerging markets, Canada's agriculture industry needs to anticipate change and not only react to it.

Over the coming year I will be working hard with industry, and my provincial and territorial colleagues on a new framework for agriculture to give the industry the tools it needs to stay ahead of the curve and compete and prosper in the global marketplace.

I'm excited about the prospects that lie ahead. With strong collaboration between government, industry and farmers, and the scientific community we can position the sector for strong growth into the future. Working with the entire portfolio, and supported by science, business skills and strategic investments, we have a tremendous opportunity to rethink and reshape Canadian agriculture. I can't imagine a more rewarding challenge.

Honourable Gerry Ritz, P.C., M.P.,

Minister of Agriculture and Agri-Food and

Minister of the Canadian Wheat Board

Section I: Organizational Overview

Raison d'être

Our Vision

Driving innovation and ingenuity to build a world leading agricultural and food economy for the benefit of all Canadians.

Our Mission

AAFC provides leadership in the growth and development of a competitive, innovative and sustainable Canadian agriculture and agri-food sector.

The Department of Agriculture and Agri-Food Canada (AAFC) was created in 1868 — one year after Confederation — because of the importance of agriculture to the economic, social and cultural development of Canada. Today, the Department helps ensure the agriculture, agri-food and agri-based products industries can compete in domestic and international markets, deriving economic returns to the sector and the Canadian economy as a whole. Through its work, the Department strives to help the sector maximize its long-term profitability and competitiveness, while respecting the environment and the safety and security of Canada's food supply.

Responsibilities

AAFC provides information, research and technology, and policies and programs to help Canada's agriculture, agri-food and agri-based products sector increase its environmental sustainability, compete in markets at home and abroad, manage risk, and embrace innovation. The activities of the Department extend from the farmer to the consumer, from the farm to global markets, through all phases of producing, processing and marketing of agriculture and agri-food products. In this regard, and in recognition that agriculture is a shared jurisdiction, AAFC works closely with provincial and territorial governments.

The Department is responsible for ensuring collaboration among the organizations within the Agriculture and Agri-Food Portfolio; this means coherent policy and program development and effective cooperation in meeting challenges on cross-portfolio issues. The portfolio organizations consist of: the Canadian Food Inspection Agency; Farm Credit Canada; the Canadian Grain Commission; the Canadian Dairy Commission; the Farm Products Council of Canada; and the Canada Agricultural Review Tribunal. The Department also supports the Minister in his role as Minister for the Canadian Wheat Board.

AAFC's mandate is based upon the Department of Agriculture and Agri-Food Act. The Minister is also responsible for the administration of several other Acts, such as the Canadian Agricultural Loans Act.

Strategic Outcomes (SO) and Program Activity Architecture (PAA)

SO 1

An environmentally sustainable agriculture, agri-food

and agri-based products sector

AAFC supports an economically and environmentally sustainable agriculture, agri-food and agri-based products sector that ensures proper management of available natural resources and adaptability to changing environmental conditions. Addressing key environmental challenges in Canada including agriculture's impact on water quality and water use, adaptation to the impact of climate change, mitigation of agriculture's greenhouse gas emissions and the exploration of new economic opportunities contribute to a cleaner environment and healthier living conditions for the Canadian public, while enabling the sector to become more profitable.

SO 2 A competitive agriculture, agri-food and agri-based

products sector that proactively manages risk

Canada's capacity to produce, process and distribute safe, healthy, high-quality and viable agriculture, agri-food and agri-based products is dependent on its ability to proactively manage and minimize risks and to expand domestic and global markets for the sector by meeting and exceeding consumer demands and expectations. Proactive risk management to ensure food safety, market development and responsiveness, and improved regulatory processes contribute directly to the economic stability and prosperity of Canadian farmers and provide greater security for the Canadian public regarding the sector.

SO 3 An innovative agriculture, agri-food and agri-based

products sector

Sector innovation includes the development and commercialization of value-added agricultural-based products, knowledge-based production systems, processes and technologies, and equipping the sector with improved business and management skills and strategies to capture opportunities and to manage change. Such innovation is vital for ongoing growth and improvement in the productivity, profitability, competitiveness and sustainability of Canada's agriculture, agri-food and agri-based products sector and its rural communities.

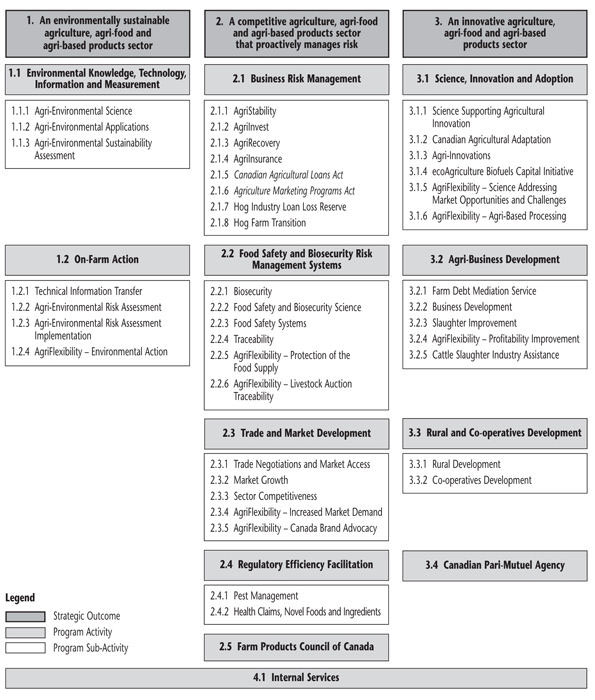

The graphic below displays AAFC's Program Activities and Program Sub-Activities that comprise its PAA. It reflects how the Department allocates and manages its resources and makes progress toward its Strategic Outcomes.

Agriculture and Agri-Food Canada's 2012-13 Program Activity Architecture

Organizational Priorities

Today's agriculture and agri-food sector is an advanced engine of growth and strong contributor to the Canadian economy. While primary agriculture remains a significant part of Canada's agri-food system, food processing is also growing as an important segment of the sector and an important employer in most provinces. With a strong resource base in Canada, a skillful workforce and positive investment climate along with rising demand at home and abroad for Canadian products, the long-term prospects for the sector are bright.

The global trade environment, in which Canadian producers and processors operate, is complex and rapidly evolving. Going forward, competition will be fierce in both export and domestic markets. Consequently, AAFC priorities and initiatives will continue to focus on supporting competitiveness and profitability of the sector over the long term. Success for the sector will depend on understanding and adapting to the marketplace, and innovating to keep pace with competitors and better respond to market demands.

In 2008, federal, provincial and territorial governments (FPT) launched the Growing Forward policy framework (2008-09 to 2012-13). It built on the previous approach of a common vision for a profitable, innovative, competitive, and market-oriented agriculture sector that proactively manages risks, and contributes to society's priorities. Investments are focused in several areas including science and innovation, food safety systems, business and skills development, and risk management programming.

FPT governments are in the process of developing Growing Forward 2, the next FPT agricultural policy framework, to position the industry to meet the challenges in the decade ahead. Policy frameworks are the cornerstone of the FPT relationship for agriculture and agri-food and ensure that governments work collaboratively towards common goals that addresses the challenges and opportunities facing the sector. On many other priority issues, such as Business Risk Management, food safety modernization, and a national traceability system, achieving consensus with provinces and territories is also crucial. The tradition of collaboration with provincial and territorial partners in agriculture remains essential.

The Growing Forward 2 framework and progress on other priorities in the Government's agenda will allow AAFC to continue creating the conditions and fostering the type of business environment that will allow agricultural producers and processors to compete successfully in an expanding global market place. The Government has placed a high priority on advancing the objectives and priorities of Canadian agricultural producers on the world stage. The Department is coordinating initiatives between governments and stakeholders on an ambitious trade agenda, targeting priority markets, and securing export opportunities in both emerging and established markets for Canadian agriculture and agri-food producers and processors.

Furthermore, the Department is also investing in innovation, both within the Growing Forward framework and federally, as well as leading and participating in applied scientific discovery, research and knowledge transfer to support the development of innovative products and processes which will improve the competitiveness and profitability of the sector. This will be further enhanced by the modernization of the federal regulatory framework on food safety, in collaboration with the Canadian Food Inspection Agency. In addition, the Government is creating new opportunities for the western grain sector by moving forward with marketing freedom for wheat and barley, improved rail freight service, and changes to the Canada Grains Act and the operations of the Canadian Grain Commission. These initiatives will complement an increased focus on trade and market access and stimulate greater efficiencies in the sector, promote faster adoption of leading-edge technologies and practices, improve regulatory performance, and create a more attractive investment climate.

AAFC will continue to focus on excellence in service to Canadians by acting on opportunities to strengthen its management capacity and practices. This means embracing the transformation and renewal of departmental activities to deliver policies and programs efficiently and effectively. In doing so, the Department will engage its employees in the excellence agenda, while maintaining a positive, collaborative and inclusive work environment, to provide the support required for a world-leading agricultural economy that benefits all Canadians.

Additional information on departmental priorities is provided in the following tables.

| Priority | Type | Strategic Outcomes and/or Program Activities |

|---|---|---|

| Develop the Federal-Provincial-Territorial (FPT) policy framework agreement (Growing Forward 2) and bilateral agreements, and prepare for implementation of federal activities | Previously committed to | SO1 - An environmentally sustainable sector SO2 - A competitive sector that proactively manages risk SO3 - An innovative sector |

| Description | ||

|

Why is this a priority?

Plans for meeting the priority

|

||

| Priority | Type | Strategic Outcomes and/or Program Activities |

|---|---|---|

| Advance trade and market interests both domestically and internationally | Ongoing | SO2 - A competitive sector that proactively manages risk Program Activity (PA) 2.3 Trade and Market Development |

| Description | ||

|

Why is this a priority?

Plans for meeting the priority

|

||

| Priority | Type | Strategic Outcomes and/or Program Activities |

|---|---|---|

Support activities that advance knowledge creation and transfer, improve products, processes or practices, and increase their adoption and commercialization to add value to farms, firms or the sector |

Ongoing |

SO1 - An environmentally sustainable sector SO2 - A competitive sector that proactively manages risk SO3 - An innovative sector Activities related to knowledge creation and transfer contribute to achieving AAFC's three Strategic Outcomes, whereas adoption and commercialization contributes mostly to SO3 (PA 3.1 Science, Innovation and Adoption) |

| Description | ||

|

Why is this a priority?

Plans for meeting the priority

|

||

| Priority | Type | Strategic Outcomes and/or Program Activities |

|---|---|---|

| Improve the sector's performance in support of Canada's environmental sustainability agenda | Ongoing | SO1 - An environmentally sustainable sector |

| Description | ||

|

Why is this a priority?

Plans for meeting the priority

|

||

| Priority | Type | Strategic Outcomes and/or Program Activities |

|---|---|---|

| Transform AAFC's business practices improving the efficiency and effectiveness of programs, services, and operations to meet the challenges of the future | Previously committed to | SO1 - An environmentally sustainable sector SO2 - A competitive sector that proactively manages risk SO3 - An innovative sector |

| Description | ||

|

Why is this a priority?

Plans for meeting the priority

|

||

| Priority | Type | Strategic Outcomes and/or Program Activities |

|---|---|---|

| Advance Public Service Renewal | Ongoing | SO1 - An environmentally sustainable sector SO2 - A competitive sector that proactively manages risk SO3 - An innovative sector |

| Description | ||

|

Why is this a priority?

Plans for meeting the priority

|

||

Risk Analysis

Perceptions persist among some that very little has changed in agriculture. Nothing is further from the truth. Canadian agriculture is driven by tens of thousands of highly skilled entrepreneurs and risk-takers. It is a strong contributor to the Canadian economy, providing jobs and opportunities across the country. With a strong resource base in Canada and rising demand at home and abroad for Canadian agriculture and agri-food products, long-term prospects for the sector are bright.

Technology and innovation are critical to the Canadian agriculture and agri-food industry's competitive advantage; some of today's major crops that are now important Canadian exports, such as canola, did not even exist 30 years ago. Markets are global, consumer demand is volatile and sophisticated, and retailers and processors are extremely demanding when it comes to quality, safety and commodity attributes.

The supply chain is complex yet manages to deliver consistently high quality food to the tables of Canadians and consumers around the world. The agriculture and agri-food system (including inputs, primary production, processing, retail, and food-services) is a large component of Canada's economy, contributing over $100.3 billion to Canada's GDP (8.1%) in 2010 and employing over 2.1 million Canadians across this value chain.

The performance of the agriculture and agri-food system continues to be influenced by global economic factors. Over the past two to three years, crude oil and many commodity prices rose sharply to record levels in 2008 and 2010. While they have levelled from these peaks, many commodity prices are projected to remain at higher than historical rates.

Recent economic developments in global markets continue to temper growth expectations, particularly in the European Union and the U.S. where the debt situations threaten economic recovery. Even with higher commodity prices, price and exchange rate volatility adds to the uncertainty associated with marketing agriculture and agri-food products in Canada and around the world. Given the increasing importance of export opportunities to the Canadian agriculture and agri-food industry, it is relatively robust economic growth in developing markets and the ability to access those markets that will be a key factor underpinning Canadian export expansion.

At the same time, the emergence of major competitors in growth economies has added to the challenges and opportunities of competing in global markets. Global supply and demand conditions are changing and these are creating new opportunities through:

- increasing global food demand from population growth;

- rising incomes in emerging markets;

- evolving consumer demands regarding the growing, processing, and content of their food;

- significant responses by processors and retailers who are demanding higher standards on how food is grown and processed; and

- vast new opportunities in the fast emerging bio-economy, creating other non-food markets for agricultural production.

Challenges remain, like rising input costs, the impacts of climate variability on productivity and yields, and, notably, the emergence of new competitors. While Canada benefits from several natural resource advantages, this, by itself, does not guarantee success. The sector requires a government partner to foster a culture of innovation and a supportive business environment to prosper. This will be emphasized in light of ongoing reforms of Canada's commodity marketing institutions, which will test the sector's ability to respond to market forces.

The development of Growing Forward 2, the next FPT policy framework for agriculture and agri-food, will occupy much of the Department's time and resources in 2012-13. This work involves extensive negotiations at the multilateral and bilateral level, as well as extensive program design and other policy development work, including stakeholder engagement.

Also in 2012-13, AAFC will move forward with the Government's agenda to secure Canada's economic recovery and return to fiscal balance. Budget 2011 launched a strategic and operating review of direct program spending across all of government in 2011-12, with emphasis on generating savings from operating expenses and improving productivity, while also examining the relevance and effectiveness of programs.

AAFC strives to fulfill its mandate and responsibilities by balancing both risks and opportunities when designing its policies, programs and services. AAFC's implementation of integrated risk and opportunity management supports informed decision-making and continuous improvement.

Through the annual Corporate Risk Profile exercise and other various management practices, tools, and guides, AAFC is fostering a responsible, risk-smart and opportunity-driven culture that focuses on informed decision-making, integrated business planning, and strategic resource allocation, all of which help the Department achieve its strategic objectives.

AAFC recognizes that continuous improvement and maturity of practices are required so that its risk management approach remains effective and relevant. Thus, AAFC has renewed its integrated risk and opportunity management process and tools to reflect leading best practices.

The following table provides an overview of the most significant, overarching corporate risks and their corresponding response strategies identified in the 2012-13 Corporate Risk Profile. Given the converging nature of the Department's corporate risks, to a certain extent, they are directly linked to all strategic outcomes and program level activities.

| 2012-13 Corporate Risks* | Key Response Strategies Include |

|---|---|

| *Shown alphabetically. | |

Catastrophic Crisis There is a risk that the Department does not have the capacity required to contribute fully to the broader federal effort to respond to wide-scale emergencies, which potentially present severe consequences to the agriculture, agri-based and agri-food sector and/or to Canadians at large. |

Continue to participate in and contribute to emergency management and governance procedures, industry emergency preparedness activities (e.g., flood), preparation for animal disease outbreaks (i.e., Livestock Market Interruption Strategy), and emergency preparedness activities in support of the agriculture and agri-food sector. |

Information Management/Information Technology (IM/IT) Disaster Recovery Readiness There is the risk that AAFC's ability to deliver essential services to the public would be severely impeded in the event of a loss of any data centre location (National Headquarters Complex for the Agriculture Portfolio, Winnipeg and Regina). This event could result in the loss of business capacity with serious financial or economic consequences, or could compromise safety to Canadians (e.g., food safety information to Canadians from the Canadian Food Inspection Agency). |

Continue to develop and test disaster recovery plans for IM/IT systems for AAFC's critical services and functions: develop plan for disaster recovery of IM/IT systems in support of remaining priority AAFC services and functions; document disaster recovery plan requirements and high-level plan for AAFC shared-services partners and clients; and review and update MOUs with partners and clients. Note: Some of AAFC's IM/IT infrastructure responsibility was transferred to Shared Services Canada (SSC) by the Order-In-Council dated November 15, 2011; full responsibility to SSC is effective April 1, 2012. |

Infrastructure There is a risk that the Department's aging infrastructure cannot support its work and priorities. |

Management of the Department's infrastructure through its Investment Plan and related governance to support ongoing operations and priorities; and continue rejuvenation of a dam safety management system. |

Knowledge and Information Management There is a risk that if AAFC is not able to transition to an organization where knowledge and information is managed, transferred, shared and preserved as a corporate resource, there will be a decrease in productivity and effective decision making. This risk is compounded by the loss of key expertise due to employee departures, the exponentially increasing volume of information, as well as privacy and security threats. |

Implementation of the Departmental Knowledge, Information and Collaboration Support Strategy, inclusive of Knowledge Workspace initiative; continuation of AAFC's National Mentoring Program; staff engagement; and continued adoption and use of appropriate social media tools. |

People Work Environment There is a risk that AAFC will not be able to achieve one or more of its business priorities as a result of ineffective development, alignment and retention of its people resources and/or the delayed targeted recruitment to fill key positions. |

Develop the 2012-15 Corporate Human Resources Plan and associated Staffing and Recruitment Strategy. Implement employee development programs including the Management and Leadership Development Program, National Mentoring Program and Leadership Development program for research scientists. Implement the Values and Ethics Code for AAFC including a Policy on Conflict of Interest and Post-Employment. |

Program Risk There is a risk that program design or delivery practices do not support the achievement of desired policy results. Opportunities exist to re-engineer program delivery functions and to increase client awareness and improve accessibility to programs |

Application of corporate approvals, oversight boards and cross-functional "tiger teams"/working groups; client stakeholder feedback; monitoring of the implementation of department-wide Grants and Contributions Delivery System; and expansion of AgPal, a web-based discovery tool that will help clients find programs and services that apply to them. |

AAFC continues to support a foundation for sound business practices where integrated risk and opportunity management is imbedded in its planning, decision-making and management practices in the pursuit of strategic objectives.

Planning Summary

Budget 2010 outlined the federal government's plan to restore balance to public finances over the next five years. One of the key measures of the plan is to freeze departments' and agencies' operating budgets in order to slow the growth of operating expenditures and improve efficiency. As a result, 2012-13 operating budgets, as appropriated by Parliament, will be frozen at 2010-11 reference levels. Management is reviewing various options to adjust to this constraint in funding. To do so, AAFC is building on its oversight practices to monitor program funding and expenditures.

Financial Resources ($ millions - net)

The following table provides a summary of total planned spending for AAFC over the next three fiscal years. For an explanation of the annual variation in spending, please refer to the discussion of the departmental spending trend in the Expenditures Profile subsection.

| 2012-13 | 2013-14 | 2014-15 |

|---|---|---|

| 3,012.6 | 2,485.1 | 2,410.4 |

Human Resources (Full-Time Equivalents - FTEs)1

The following table provides a summary of the total planned human resources for AAFC over the next three fiscal years, which is based on the Department's existing workforce.

| 2012-13 | 2013-14 | 2014-15 |

|---|---|---|

| 6,117 | 6,117 | 6,117 |

Planning Summary Tables

The following tables present: performance indicators and targets for each of AAFC's three strategic outcomes; forecasted spending for 2011-12 and planned spending for the next three fiscal years, by program activity in support of each strategic outcome; and total departmental spending for all program activities, forecasted for 2011-12 and planned for the next three fiscal years. Due to the sunsetting in 2012-13 of the non-Business Risk Management Growing Forward program, many program activities show a reduction in planned spending. The development of the successor Growing Forward policy framework is currently underway and, once in effect, will increase planned spending.

| Performance Indicators | Targets |

|---|---|

| * The indices listed measure agri-environmental progress in each of the four key areas of soil, water, air, and biodiversity. The scale for these indices is: 0-20 = Unacceptable; 21-40 = Poor; 41-60 = Average; 61-80 = Good; and 81-100 = Desired. A target of 81-100, with a stable or improving trend, represents the desired value for the sector's performance. | |

| Soil Quality Agri-Environmental Index* | 81 by March 31, 2030 (Index was within the good range in 2010-11 and showed an improving trend) |

| Water Quality Agri-Environmental Index* | 81 by March 31, 2030 (Index was within the good range in 2010-11 and showed a deteriorating trend) |

| Air Quality Agri-Environmental Index* | 81 by March 31, 2030 (Index was within the good range in 2010-11 and showed an improving trend) |

| Biodiversity Quality Agri-Environmental Index* | 81 by March 31, 2030 (Index was within average range in 2010-11 and showed a stable trend) |

| Program Activity | Forecast Spending 2011-122 |

Planned Spending3 | Alignment to Government of Canada Outcomes | ||

|---|---|---|---|---|---|

| 2012-13 | 2013-14 | 2014-15 | |||

| 1.1 Environmental Knowledge, Technology, Information and Measurement | 64.3 | 53.7 | 28.4 | 27.1 | A Clean and Healthy Environment |

| 1.2 On-Farm Action | 155.3 | 130.9 | 59.3 | 44.3 | |

| Total for Strategic Outcome 1 | 219.6 | 184.7 | 87.7 | 71.4 | |

| Performance Indicators | Targets |

|---|---|

| GDP in constant dollars (2002) of the agriculture and agri-food sector (includes seafood processing) | $46.9 billion by March 31, 2013. This represents a 10% increase from the 2009 GDP. |

| Program Activity | Forecast Spending 2011-122 |

Planned Spending3 | Alignment to Government of Canada Outcomes | ||

|---|---|---|---|---|---|

| 2012-13 | 2013-14 | 2014-15 | |||

| 2.1 Business Risk Management | 1,724.2 | 1,859.4 | 1,859.9 | 1,858.3 | Strong Economic Growth |

| 2.2 Food Safety and Biosecurity Risk Management Systems | 120.1 | 97.6 | 22.0 | 12.3 | |

| 2.3 Trade and Market Development | 113.0 | 114.3 | 62.6 | 44.2 | |

| 2.4 Regulatory Efficiency Facilitation | 27.0 | 35.7 | 12.6 | 12.6 | |

| 2.5 Farm Products Council of Canada | 3.2 | 2.7 | 2.7 | 2.7 | |

| Total for Strategic Outcome 2 | 1,987.5 | 2,109.7 | 1,959.9 | 1,930.2 | |

| Performance Indicators | Targets |

|---|---|

| Total R&D expenditures by Business Enterprises in food manufacturing | $172.7 million by March 31, 2014 |

| Percentage increase in the development of food and other agriculture derived products and services as measured by revenues from bioproducts | $1.934 million by March 31, 2014 Note: Baseline is $1.758 million in bioproduct revenue in 2006. Target represents a 10% increase. |

| Program Activity | Forecast Spending 2011-122 |

Planned Spending3 | Alignment to Government of Canada Outcomes | ||

|---|---|---|---|---|---|

| 2012-13 | 2013-14 | 2014-15 | |||

| 3.1 Science, Innovation and Adoption | 299.6 | 339.4 | 147.8 | 123.7 | An Innovative and Knowledge-Based Economy |

| 3.2 Agri-Business Development | 102.3 | 56.0 | 12.8 | 11.5 | |

| 3.3 Rural and Co-operatives Development | 25.9 | 20.0 | 5.2 | 5.2 | |

| 3.4 Canadian Pari-Mutuel Agency | 0.0 | (0.0) | (0.2) | (0.3) | A Fair and Secure Marketplace |

| Total for Strategic Outcome 3 | 427.8 | 415.4 | 165.6 | 140.1 | |

Internal Services

The Internal Services program activity supports all three of the above strategic outcomes.

| Program Activity | Forecast Spending 2011-122 |

Planned Spending3 | ||

|---|---|---|---|---|

| 2012-13 | 2013-14 | 2014-15 | ||

| Internal Services | 338.6 | 302.8 | 272.0 | 268.7 |

Total Departmental Spending

| All Program Activities | Forecast Spending 2011-122 |

Planned Spending3 | ||

|---|---|---|---|---|

| 2012-13 | 2013-14 | 2014-15 | ||

| Total Departmental Spending | 2,973.5 | 3,012.6 | 2,485.1 | 2,410.4 |

1 The FTEs do not include students or staff funded through respendable revenue sources. For example, in 2011-12, there were 23 FTEs employed by AAFC funded by respendable revenue sources from collaborative research projects with industry, and other activities not funded through AAFC appropriations. Also, 453 FTEs were employed as students.

2 Forecast spending for 2011-12 reflects the authorized funding levels to the end of the fiscal year 2011-12 (not necessarily forecast expenditures).

3 Planned spending reflects funds already brought into the Department's reference levels as well as amounts to be authorized through the Estimates process (for the 2012-13 through to 2014-15 planning years) as presented in the Annual Reference Level Update. It also includes adjustments in future years for funding approved in the government fiscal plan, but yet to be brought into the Department's reference levels. Planned spending has not been adjusted to include new information contained in Budget 2012. More information will be provided in the 2012-13 Supplementary Estimates.

For an explanation of the annual variation in planned spending displayed in the above tables, please refer to the discussion of the departmental spending trend in the Expenditure Profile subsection.

The figures in the above tables have been rounded. Figures that cannot be listed in millions of dollars are shown as 0.0. Due to rounding, figures may not add to the totals shown.

Contribution to the Federal Sustainable Development Strategy

AAFC is a participant in the Federal Sustainable Development Strategy (FSDS), which outlines the Government of Canada's commitment to improving the transparency of environmental decision-making by articulating its key strategic environmental goals and targets. FSDS goals and targets are considered in the Department's decision-making processes. Where applicable, AAFC analyzes the impact of new policy or program initiatives on attaining relevant FSDS goals and targets, through the Strategic Environmental Assessment process in accordance with the Guidelines for Implementing the Cabinet Directive on the Environmental Assessment of Policy, Plan and Program Proposals.

The Department contributes to Themes I - Addressing Climate Change and Air Quality; II - Maintaining Water Quality and Availability; III - Protecting Nature; and IV - Shrinking the Environmental Footprint - Beginning with Government, as denoted by the following visual identifiers:

Theme I: Addressing Climate Change and Air Quality

Theme I: Addressing Climate Change and Air Quality

Theme II: Maintaining Water Quality and Availability

Theme II: Maintaining Water Quality and Availability

Theme III: Protecting Nature

Theme III: Protecting Nature

Theme IV: Shrinking the Environmental Footprint - Beginning with Government

Theme IV: Shrinking the Environmental Footprint - Beginning with Government

AAFC's contributions are components of the following Program Activities and are further explained in Section II of this RPP:

- Program Activity 1.1: Environmental Knowledge, Technology, Information and Measurement

- Program Activity 1.2: On-Farm Action

- Program Activity 4.1: Internal Services (AAFC's contribution to Greening Government Operations (GGO), the goal of Theme IV)

For additional information on the Department's activities in support of sustainable development, please see Section II of this RPP, details of AAFC's Departmental Sustainable Development Strategy on the Department's website and the Supplementary Information Table on Greening Government Operations, which is listed in Section III of this RPP and housed on the Treasury Board of Canada Secretariat's website. For complete details on the Federal Sustainable Development Strategy, please see the Environment Canada's website.

Expenditure Profile

AAFC departmental spending varies from year to year in response to the circumstances in the agriculture, agri-food and agri-based products sector in any given period. Programming within AAFC is in direct response to industry and economic factors which necessitate support to this vital part of the economy. Much of AAFC's programming is statutory (i.e. for programs approved by Parliament through enabling legislation) and the associated payments fluctuate according to the demands and requirements of the sector.

Departmental Spending Trend

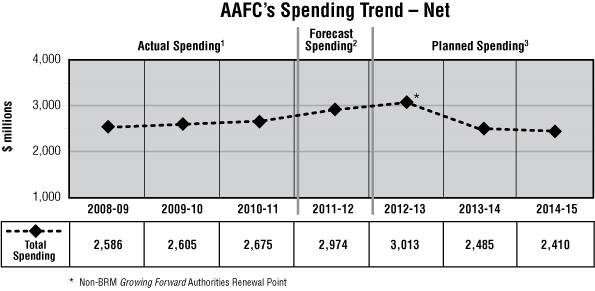

The figure below illustrates AAFC's spending trend from 2008-09 to 2014-15.

1Actual spending represents the actual expenditures incurred during the respective fiscal year, as reported in Public Accounts.

2 Forecast spending reflects the authorized funding levels to the end of the fiscal year (not necessarily forecast expenditures).

3 Planned spending reflects funds already brought into the Department's reference levels as well as amounts to be authorized through the Estimates process as presented in the Annual Reference Level Update. It also includes funding approved in the government fiscal plan, but yet to be brought into the Department's reference levels. Planned spending has not been adjusted to include new information contained in Budget 2012. More information will be provided in the 2012-13 Supplementary Estimates.

Over the period 2008-09 to 2014-15, actual, forecast and planned spending varies from a high of $3.0 billion in 2012-13 to a low of $2.4 billion currently planned for 2014-15. This variability is the result of a number of factors outlined below.

Although the actual spending trend depicted above is generally consistent across the years, the programs and initiatives vary from year to year in response to changes affecting the agriculture, agri-food and agri-based products sector.

2009-10 included support under the Hog Farm Transition Program for an orderly transition of the pork sector in view of new market challenges by providing funding to successful bidders who agreed to empty barns and cease production for three years. Spending for 2010-11 reflects support under the Prairie Excess Moisture Initiative, which provided emergency assistance to producers affected by flooding conditions from the spring and summer of 2010. Both 2009-10 and 2010-11 included investments under Canada's Economic Action Plan to assist in the recovery from the global economic recession.

The requirement for Business Risk Management (BRM) program funding over the recent years has been lower than in the past as a result of stronger commodity prices.

The increase in forecast spending in 2011-12 is largely the result of emergency assistance provided to producers affected by flooding conditions in Alberta, Saskatchewan, Manitoba and Quebec.

2012-13's planned spending appears in line with 2011-12's forecast spending as 2012-13's amount includes the full BRM programming envelope. Funding is brought into the Department's reference level as demand under the associated statutory programs requires it.

The reduction in planned spending from 2012-13 to 2014-15 reflects the sunsetting of the current non-BRM Growing Forward program at the end of 2012-13. AAFC, in consultation with provinces and territories, continues to work on developing a successor Growing Forward policy framework to position the industry to meet challenges in the decade ahead.

Estimates by Vote

For information on our organizational appropriations, please see the 2012-13 Main Estimates publication.