Common menu bar links

Breadcrumb Trail

ARCHIVED - Agriculture and Agri-Food Canada - Report

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Section III - Supplementary Information

Financial Highlights

Future-Oriented Financial Statements

Future-oriented financial statements provide forecast information on assets and liabilities, revenues, and expenses, prepared on an accrual accounting basis to strengthen accountability and improve transparency and financial management. The financial highlights presented in this section are intended to serve as a general overview of AAFC's operations reported in the Department's future-oriented financial statements, which can be found on AAFC's website.

Since future oriented financial statements are prepared on an accrual accounting basis, there are differences between the figures below and the planned spending amounts presented in other sections of the RPP, which reflect the cash accounting basis used to recognize transactions affecting parliamentary appropriations. The differences are related to such items as provisions for loan guarantees, repayable contributions, non-respendable revenues, services without charge received from other government departments, amortization, and severance and vacation pay liability adjustments. For more information, refer to Note 5 in the full 2012-13 Future-oriented Statement of Operations found on the Department's website.

| $ Change | Future-Oriented 2012-13 |

Future-Oriented 2011-12 |

|

|---|---|---|---|

| Total Expenses | 129 | 3,114 | 2,985 |

| Total Revenues | 135 | 135 | |

| Net Cost of Operations | 129 | 2,979 | 2,850 |

| $ Change | Future-Oriented 2012-13 |

Future-Oriented 2011-12 |

|

|---|---|---|---|

| Total assets | (95) | 2,563 | 2,658 |

| Total liabilities | (194) | 1,967 | 2,161 |

| Equity | 99 | 596 | 497 |

| Total | (95) | 2,563 | 2,658 |

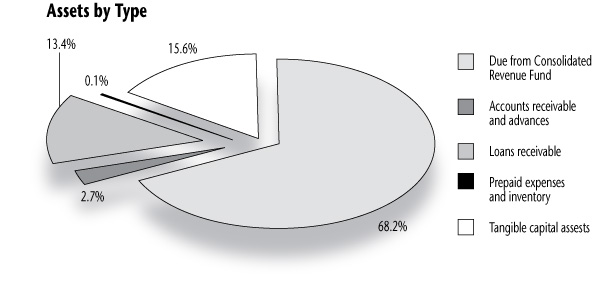

Assets

Total assets are projected to be $2.6 billion at the end of 2012-13. The majority of the assets is related to the Due from Consolidated Revenue Fund (68.2% or $1.7 billion). The remaining balance of the assets is made up of accounts receivable and advances (2.7% or $70.3 million), loans receivable (13.4% or $343.2 million), prepaid expenses and inventory (0.1% or $1.6 million) and tangible capital assets (15.6% or $398.7 million).

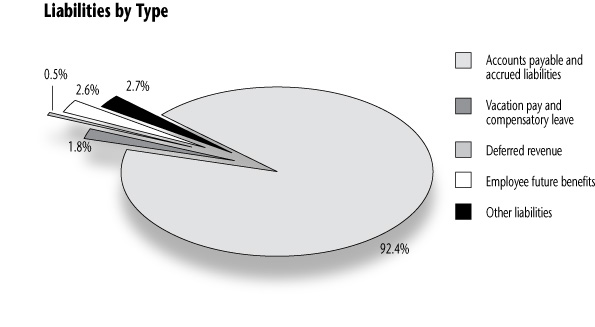

Liabilities

Liabilities arising from departmental activities consist primarily of accounts payable and accrued liabilties, the majority of which are related to accruals in support of programs such as AgriStability and AgriInvest.

Total liabilities are projected to be $2.0 billion at the end of 2012-13. The majority of the liabilities are related to accounts payable and accrued liabilities (92.4% or $1.8 billion). The remaining balance of the liabilities is made up of vacation pay and compensation leave (1.8% or $34.7 million), deferred revenue (0.5% or $10.2 million), employee future benefits (2.6% or $50.6 million) and other liabilities (2.7% or $52.4 million).

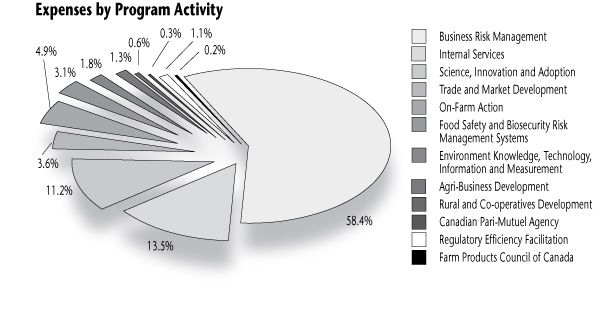

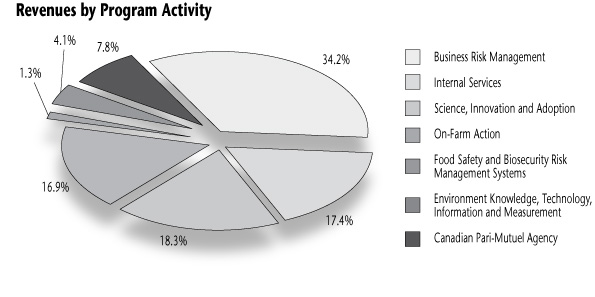

Expenses and Revenues

Expenses incurred and revenues earned, which support AAFC's programs and services that benefit Canadians, are detailed in the following charts.

Total expenses are projected to be $3.1 billion in 2012-13. The majority of these expenses are in the form of transfer payments for Business Risk Management (58.4% or $1.8 billion) related to departmental programs discussed in Section II of this report.

Total revenues are projected to be $134.9 million for fiscal year 2012-13. The majority of these revenues are from Business Risk Management (34.2% or $46.0 million) for Crop Re-insurance premiums. Other revenues include collaborative research agreement funding, Canadian Pari-Mutuel Agency fees, grazing fees from the community pastures program and services provided to other government departments.

List of Supplementary Information Tables

All electronic supplementary information tables found in the 2012-13 Report on Plans and Priorities can be found on the Treasury Board of Canada Secretariat's website:

- Details on Transfer Payment Programs (TPPs)

- Greening Government Operations (GGO)

- Horizontal Initiatives

- Sources of Respendable and Non-Respendable Revenue

- Status Report on Transformational and Major Crown Projects

- Summary of Capital Spending by Program Activity

- Up-Front Multi-Year Funding

- Upcoming Internal Audits and Evaluations over the next three fiscal years

- User Fees

Section IV - Other Items of Interest

Organizational Contact Information

Public Information Requests Services

Agriculture and Agri-Food Canada

1341 Baseline Road

Ottawa, Ontario K1A 0C5

Telephone: 613-773-1000

Toll-free: 1-855-773-0241

Fax: 613-773-2772

TDD/TTY: 613-773-2600

Email: info@agr.gc.ca

Additional contact information can be found online.