Common menu bar links

Breadcrumb Trail

ARCHIVED - Agriculture and Agri-Food Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Minister's Message

Agriculture is the backbone of Canada's economy, driving jobs and prosperity for Canadians. As Canada positions itself for future growth, agriculture will continue to be a leading priority for the federal government.

It all starts with the farmer. A profitable farm gate is critical to the success of the sector, and that is why this Government continues to put Farmers First in all of our policies and programs.

Farmers tell me time and again they want governments to help them compete in an innovative and environmentally sustainable sector, supported by programs that are responsive, predictable and bankable.

We listened and we're delivering.

Growing Forward, the five-year, federal-provincial-territorial framework for agriculture, is delivering flexible and responsive programs that provinces and territories can tailor to meet the unique needs of their producers and processors. Over the five years, the federal government is contributing to the $1.3 billion in cost-shared, non-business risk management programs. It will provide an additional $1 billion in federal-only programming.

Canada's Economic Action Plan is helping farmers and food processors proactively capture new market opportunities, through the $500-million Agricultural Flexibility Fund, $50 million to strengthen red meat processing operations, and the new Canadian Agricultural Loans Act, which will deliver about $1 billion in government-guaranteed loans over five years to help producers, including new producers, build their businesses.

With almost half of Canada's total agricultural production exported, much of the potential for growth lies in our ability to expand our markets abroad. That is why I have made market access a central focus of my mandate. Side by side with industry and our provincial and territorial colleagues, we have delivered results for producers in key global markets.

Here at home, we are working with producers to respond to immediate pressures, through our new suite of business risk management programs, and investments to help Canada's pork producers weather the financial storm and transition to new market realities.

Over the next three years, we will work through Growing Forward and other programs to deliver real results for the sector and Canadians in three key priority areas - innovation, the environment, and a competitive sector that proactively manages business risks.

We will continue to help farmers take action on the environment and food safety systems, while ensuring programs reflect their changing needs and support innovation so the sector can meet - and beat - the competition.

Since coming to office, this Government has worked hard with our partners in the provinces and territories and in industry on behalf of our nation's farmers. I use the word partners very consciously. Working side by side with the sector and other governments will always be the soundest approach to addressing current and emerging challenges while building on our strengths.

There is another solid partnership striving to advance the interests of our farmers. The seven organizations in my Agriculture and Agri-Food Portfolio each have their own particular mandates and pursue their own activities. At the same time, these organizations share certain responsibilities, serve many of the same clients and all have the same overarching mandate to support Canada's agriculture and agri-food industry. Their employees perform their duties with the professionalism, dedication and energy that Canadians expect and deserve.

As Minister, I will continue to depend on the hard work and expertise of the portfolio organizations as, together, we help industry realize the promise of its future.

The Honourable Gerry Ritz

Minister of Agriculture and Agri-Food and Minister for the Canadian Wheat Board

Section I - Overview

Summary Information

Raison d'être

Agriculture and Agri-Food Canada (AAFC) was created in 1868 - one year after Confederation - because of the importance of agriculture to the economic, social and cultural development of Canada. Today, the department provides information, research and technology, and policies and programs to help ensure the agriculture, agri-food and agri-based products industries can compete in domestic and international markets, deriving economic returns to the sector and the Canadian economy as a whole. Through its work, the department strives to help the sector maximize its long-term profitability and competitiveness, while respecting the environment and the safety and security of Canada's food supply.

Responsibilities

AAFC provides information, research and technology, and policies and programs to help Canada's agriculture, agri-food and agri-based products sector increase its environmental sustainability, compete in markets at home and abroad, manage risk, and embrace innovation. The activities of the department extend from the farmer to the consumer, from the farm to global markets, through all phases of production, processing and marketing of agriculture and agri-food products.

AAFC derives its mandate from the Department of Agriculture and Agri-Food Act. The Minister is also responsible for the administration of several other Acts, such as the Canadian Agricultural Loans Act. A list of these Acts is available at: http://www.agr.gc.ca/acts.

The department is responsible for ensuring collaboration among the organizations within the Agriculture and Agri-Food Portfolio; this ensures coherent policy and program development and effective cooperation in meeting challenges on cross-portfolio issues. The other portfolio organizations are: the Canadian Dairy Commission; the Canadian Food Inspection Agency; the Canadian Grain Commission; Farm Credit Canada; the Canada Agricultural Review Tribunal; and the Farm Products Council of Canada. For more information on these portfolio organizations, visit www.agr.gc.ca/portfolio. AAFC also includes the Canadian Pari-Mutuel Agency, a special operating agency that regulates and supervises pari-mutuel betting on horse racing at racetracks across Canada.

AAFC provides the overall leadership and coordination on federal rural policies and programs through Canada's Rural Partnership, and supports co-operatives to promote economic growth and social development of Canadian society. Through the Rural and Co-operatives Development program, AAFC coordinates the Government's policies towards the goal of economic and social development and renewal of rural Canada. The program also facilitates the development of co-operatives which help Canadians and communities capture economic opportunities.

The department also supports the Minister in his role as Minister for the Canadian Wheat Board.

Strategic Outcomes

To effectively pursue its mandate and make a difference to Canadians, AAFC's policies and programs are designed to achieve the following three Strategic Outcomes (SO):

The department's Prairie Shelterbelt Program is one of the longest running Government of Canada programs. Since 1901, 600 million tree seedlings have been produced and distributed to 700,000 Western Canada farm clients. That is enough trees, at two-metre spacing, to encircle the planet 30 times! In 2010, over 5000 farmers will receive tree seedlings to help plant over 150 km of trees to protect water sources and habitats. Visit: http://www.agr.gc.ca/agroforestry.

AAFC supports an economically and environmentally sustainable agriculture, agri-food and agri-based products sector that ensures proper management of available natural resources and adaptability to changing environmental conditions. Addressing key environmental challenges in Canada including agriculture's impact on water quality and water use, adaptation to the impact of climate change, mitigation of agriculture's greenhouse gas emissions and the exploration of new economic opportunities contribute to a cleaner environment and healthier living conditions for the Canadian public, while enabling the sector to becomemore profitable.

Canada is one of the largest exporters of agri-food and seafood in the world. Over 47 per cent of all agri-food products are exported to 196 countries around the globe. These exports are crucial to the profitability of the Canadian agriculture and agri-food sector. AAFC will continue to support the exporting process through various activities from negotiating trade agreements, resolving trade disputes, organizing overseas trade missions and market development activities, to developing and promoting the Canada Brand. Visit: http://www.ats-sea.agr.gc.ca

SO 2 A competitive agriculture, agri-food and agri-based products sector that proactively manages risk

Canada's capacity to produce, process and distribute safe, healthy, high-quality and viable agriculture, agri-food and agri-based products is dependent on its ability to proactively manage and minimize risks and to expand domestic and global markets for the sector by meeting and exceeding consumer demands and expectations. Proactive risk management to ensure food safety, market development and responsiveness, and improved regulatory environment contribute directly to the economic stability and prosperity of Canadian farmers and provide greater security for the Canadian public regarding the sector.

Nanotechnology, the science of the really, really small, has tremendous potential in the food science world, opening the door to advances in the way food is grown, processed and packaged. AAFC scientists at the Food Research and Development Centre in St-Hyacinthe, Quebec, are working on three projects focused on this novel technological breakthrough.

SO 3 An innovative agriculture, agri-food and agri-based products sector

Sector innovation includes the development and commercialization of value-added agricultural-based products, knowledge-based production systems, processes and technologies, and equipping the sector with improved business and management skills and strategies to capture opportunities and to manage change. Such innovation is vital for ongoing growth and improvement in the productivity, profitability, competitiveness and sustainability of Canada's agriculture, agri-food and agri-based products sector and its rural communities.

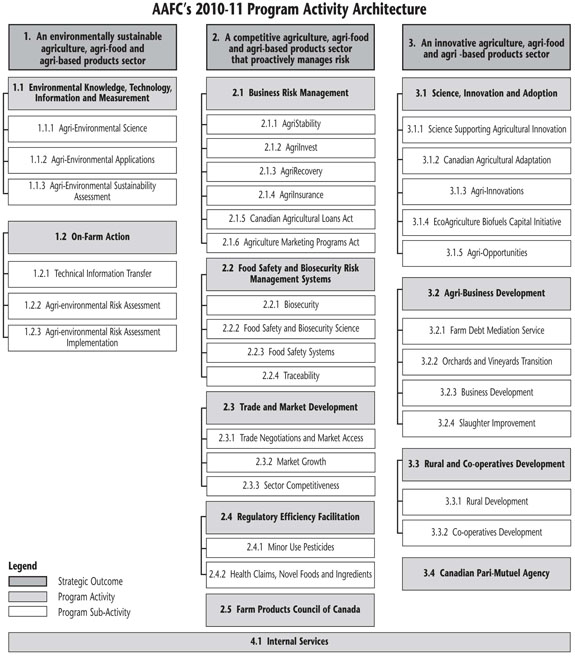

Program Activity Architecture

The graphic below displays AAFC's Program Activities and Program Sub-Activities that comprise its Program Activity Architecture (PAA). This PAA reflects how the department allocates and manages its resources and makes progress toward its strategic outcomes.

Planning Summary

Financial Resources (Total Net Planned Spending)

The following table provides a summary of the total planned spending for AAFC for the next three fiscal years. For an explanation of the annual variation in spending displayed in this table, please refer to the discussion of the departmental spending trend in the Expenditure Profile subsection.

| 2010-11 | 2011-12 | 2012-13 |

|---|---|---|

| 3,331.3 | 2,997.1 | 1,947.1 |

The following table provides a summary of the total planned human resources for AAFC for the next three fiscal years, which is based on the department's existing workforce.

| 2010-11 | 2011-12 | 2012-13 |

|---|---|---|

| 6,086 | 6,086 | 6,086 |

* These FTEs do not include students or staff funded through respendable revenue sources. For example, in 2009-2010, there were 69 FTEs employed by AAFC funded by respendable revenue sources from collaborative research projects with industry and other activities not funded through AAFC appropriations. Also, 458 FTEs were employed as students.

Planning Summary by Strategic Outcome

The following tables provide a summary of planned performance and spending for each of AAFC's three Strategic Outcomes.

| Strategic Outcome 1: An environmentally sustainable agriculture, agri-food and agri-based products sector | |

|---|---|

| Performance Indicators | Targets |

| Soil Quality Agri-Environmental Index* | 81 by March 31, 2030 |

| Water Quality Agri-Environmental Index* | 81 by March 31, 2030 |

| Air Quality Agri-Environmental Index* | 81 by March 31, 2030 |

| Biodiversity Quality Agri-Environmental Index* | 81 by March 31, 2030 |

| Program Activity | Forecast Spending (net)1 2009-10 ($ millions) |

Planned Spending (net)2 ($ millions) |

Alignment to Government of Canada Outcomes | ||

|---|---|---|---|---|---|

| 2010-11 | 2012-12 | 2012-13 | |||

| Environmental Knowledge, Technology, Information and Measurement | 72.3 | 59.6 | 59.8 | 57.1 | A Clean and Healthy Environment |

| On-Farm Action | 141.0 | 152.5 | 147.2 | 138.7 | A Clean and Healthy Environment |

| Total for SO 1 | 213.3 | 212.1 | 206.9 | 195.8 | |

* The indices listed measure agri-environmental progress in each of the four key areas of soil, water, air, and biodiversity. The scale for these indices is: 0-20 = Unacceptable; 21-40 = Poor; 41-60 = Average; 61-80 = Good; and 81-100 = Desired. A target of 81-100, with a stable or improving trend, represents the desired value for the sector's performance.

| Strategic Outcome 2: A competitive agriculture, agri-food and agri-based products sector that proactively manages risk | |

|---|---|

| Performance Indicators | Targets |

| Increase in agriculture and agri-food (includes seafood processing) Gross Domestic Product (GDP), in constant dollars (1997 dollars) | 10 per cent by March 31, 2013 |

| Program Activity | Forecast Spending (net)1 2009-10 ($ millions) |

Planned Spending (net)2 ($ millions) |

Alignment to Government of Canada Outcomes | ||

|---|---|---|---|---|---|

| 2010-11 | 2012-12 | 2012-13 | |||

| Business Risk Management | 2,235.0 | 1,996.2 | 1,873.6 | 843.6 | Strong Economic Growth |

| Food Safety and Biosecurity Risk Management Systems | 145.8 | 154.8 | 97.8 | 90.0 | Strong Economic Growth |

| Trade and Market Development | 126.2 | 116.3 | 116.6 | 117.2 | Strong Economic Growth |

| Regulatory Efficiency Facilitation | 26.8 | 35.9 | 35.8 | 36.0 | Strong Economic Growth |

| Farm Products Council of Canada | 2.8 | 2.8 | 2.8 | 2.8 | Strong Economic Growth |

| Total for SO 2 | 2,536.6 | 2,306.0 | 2,126.6 | 1,089.6 | |

| Strategic Outcome 3: An innovative agriculture, agri-food and agri-based products sector | |

|---|---|

| Performance Indicators | Targets |

| Percentage increase in the development of food and other agriculture-derived products and services as measured by 1) revenues from bio-products and 2) percentage increase in private industry's Research and Development (R&D) expenditures in the agri-food sector as measured by the food processing and bio-products sectors (Percentage reflects a real increase, after adjustments for inflation) | 10 per cent by March 31, 2014 |

| Increase in agriculture Net Value-Added (Value-Added is a Statistics Canada measure of Canadian value-added GDP) | 7 per cent by March 31, 2014 |

| Program Activity |

Forecast Spending (net)1 2009-10 ($ millions) |

Planned Spending (net)2 ($ millions) |

Alignment to Government of Canada Outcomes |

||

|---|---|---|---|---|---|

| 2010-11 | 2012-12 | 2012-13 | |||

| Science, Innovation and Adoption | 355.1 | 408.8 | 286.7 | 306.7 | An Innovative and Knowledge-based Economy |

| Agri-Business Development | 63.1 | 72.9 | 52.3 | 36.8 | An Innovative and Knowledge-based Economy |

| Rural and Co-operatives Development | 25.7 | 25.1 | 25.1 | 20.2 | An Innovative and Knowledge-based Economy |

| Canadian Pari-Mutuel Agency | 0.5 | 0.4 | (0.0) | (0.3) | A Fair and Secure Marketplace |

| Total Planned Spending | 444.4 | 507.2 | 364.1 | 363.5 | |

| PA 4.1: Internal Services | |||||

|---|---|---|---|---|---|

| Program Activity | Forecast Spending (net)1 2009-10 ($ millions) |

Planned Spending (net)2 ($ millions) |

Alignment to Government of Canada Outcomes |

||

| 2010-11 | 2011-12 | 2012-13 | |||

| Total for PA 4.1 | 360.2 | 306.0 | 299.4 | 298.3 | Supports all Strategic Outcomes |

| Total Department3 | |||||

|---|---|---|---|---|---|

| Program Activity | Forecast Spending (net)1 2009-10 ($ millions) |

Planned Spending (net)2 ($ millions) |

Alignment to Government of Canada Outcomes |

||

| 2010-11 | 2011-12 | 2012-13 | |||

| All Program Activities | 3,554.5 | 3,331.3 | 2,997.1 | 1,947.1 | Supports all Strategic Outcomes |

1Forecast spending 2009-10 reflects the authorized funding levels to the end of the fiscal year 2009-10 (not necessarily forecast expenditures).

2Planned spending reflects funds already brought into the department's reference levels as well as amounts to be authorized through the Estimates process (for the 2010-11 through to 2012-13 planning years) as presented in the Annual Reference Level Update. It also includes adjustments in future years for funding approved in the government fiscal plan, but yet to be brought into the department's reference levels. Planned spending has not been adjusted to include new information contained in Budget 2010. More information will be provided in the 2010-11 Supplementary Estimates.

3For an explanation of the annual variation in spending displayed in the above table, please refer to the discussion of the departmental spending trend in the Expenditure Profile subsection.

The figures in the above have been rounded. Figures that cannot be listed in millions of dollars are shown as 0.0. Due to rounding, figures may not add to the totals shown.

Contribution of Priorities to Strategic Outcomes

As noted in Canada's Economic Action Plan (Budget 2009), Canada's farmers continue to strive to develop innovative, high-quality food products for Canada's families and markets abroad, providing a strong economic foundation for many rural communities. Despite strong income gains in some sectors over the past few years, Canada's farm sector was not isolated from the recent economic downturn.

AAFC's operational priorities reflect the importance of competitiveness, innovation, environmental sustainability and proactive risk management to ensure the sector's long-term profitability. There is a need for continuous investment in scientific research, the development and adoption of leading-edge products and technologies, business skills, risk management and market intelligence to enable producers and enterprises to achieve a sustainable competitive advantage.

Domestic and international market demands for agricultural and agri-food products continue to evolve, and the Canadian sector must continually adapt and become more competitive and innovative to meet the challenges of a globalized market. In support of this, governments provide information to help the sector identify and respond to emerging trends ahead of Canada's competitors, as well as the tools necessary to encourage adaptation that enables the sector to achieve lower costs and penetrate higher-value markets. In addition, given the sector's heavy reliance on export markets, the Government works actively to ensure continued access to existing markets and to gain access to new ones. Finally, the Government will continue to work toward addressing market demands for assurances that governments and the sector are working to protect Canada's environmental resources.

Given that agriculture is a shared federal-provincial-territorial (FPT) jurisdiction, AAFC works in partnership with provincial and territorial governments. To this end, the department is currently working with provincial and territorial partners to implement the Growing Forward policy framework, which forms the basis for FPT cooperation in supporting the sector. Growing Forward includes a comprehensive suite of Business Risk Management (BRM) programs and a suite of non-BRM programs that focus on innovation, business development, environmental performance, regulatory issues, international markets, food safety, biosecurity, and traceability.

Building on Growing Forward, in 2010-11 AAFC will implement new and ongoing initiatives to help improve the overall competitiveness of the sector. Discussions have already begun with government partners on the next generation of agricultural policies that will succeed Growing Forward. AAFC, together with provincial and territorial governments, will continue a strategic review of BRM programming to ensure that the current suite of programs is achieving its objectives and also to guide work on future programs and policies beyond the Growing Forward framework. The Government will also continue to make significant investments in scientific research, which is a key component to ensuring continued innovation in the agricultural sector.

In addition, as the sector and Canada's economy move into recovery from the economic downturn, AAFC will continue to implement the important initiatives launched under Canada's Economic Action Plan. These initiatives, which include the Agricultural Flexibility Fund, the Slaughter Improvement Program, and the Canadian Agricultural Loans Act, will help the sector build towards the future.

In regards to Management Priorities, AAFC is committed to management excellence to deliver its programs and services and achieve its Strategic Outcomes efficiently and effectively.

Additional information on Operational and Management Priorities is provided in the following table.

| Operational Priorities | Type | Links to Strategic Outcomes | Description |

|---|---|---|---|

| Ensure current suite of Business Risk Management programs is achieving its objective through the BRM Strategic Review with Provinces and Territories | Previously committed to | SO 2 | As the key mechanism through which financial support is provided to the sector, BRM programs must be reviewed to ensure they best position the sector to be competitive while also ensuring producers are proactive in managing risks. An FPT working group will focus on long-term policy direction for BRM programming. This process will include industry engagement, which will be important in developing improved policies and programs that will be presented to Ministers. The department will aim to implement identified improvements in the next policy framework. |

Secure and enhance market access for Canadian agricultural and agri-food products |

Ongoing |

SO 2 | Intense global competition, an increasingly complex international marketplace, and numerous non-tariff barriers to trade have created a difficult business environment for Canadian farmers and food processors. AAFC is developing partnerships across other government departments, including Industry Canada and Foreign Affairs and International Trade Canada, to encourage industry-led dialogue to develop and implement industry-led strategies for competitiveness and innovation, as well as identify barriers to achieving strategic outcomes. To improve access to international markets, AAFC will provide timely market information and competitive intelligence that allow Canadian companies to respond to new market opportunities. The department's new Market Access Secretariat, created in 2009, will support a higher level of co-ordination among all levels of government and industry to address urgent competitiveness issues and enhance market access capabilities. AAFC, with support from the Canadian Food Inspection Agency and other federal departments, will strive to influence international rules and standards to ensure they do not constitute technical trade barriers for Canada's agriculture and agri-food industry. AAFC will ensure Canada's international trade obligations are taken into account in domestic programs and policies affecting agriculture and agri-food. |

| Support science and innovation, keys to the sector's competitiveness | Ongoing | SO 1 SO 2 SO 3 |

Science generates knowledge on which the agriculture, agri-food and agri-based products sector can leverage innovation to enhance competitiveness and sustained profitability. AAFC will continue to lead and participate in scientific discovery and innovations which will improve the competitiveness of the agriculture, agri-food and agri-based products sector and enhance the lives of Canadians. The department will specifically focus on:

AAFC provides scientific knowledge adapted to the Canadian context. The conduct of long-term, high-risk, transformational and applied research is fundamental to its mandate. Innovation programming will help the agricultural, agri-food and agri-products sector build its capacity to engage in scientific research and develop the tools and technologies needed to foster enhanced competitiveness. A multi-faceted approach involving federal and provincial governments, universities, producers, and the private sector is required to address effectively the complex issues facing the sector. No one player within the Canadian agri-innovation system has the capacity, resources, mandate, or perspective to do this alone. In this context, innovative and flexible models of cooperation must be developed. While AAFC will continue to be a major provider of science and innovation activities, it will also increasingly act as a catalyst within the system to bring together the knowledge and capacity of the entire agri-innovation system in a cohesive manner. As it plays this catalyst role, AAFC will continue to enhance its management tools for science and innovation, ensuring that its strategic action plan and its human resource, communications and investment plans are fully developed. |

| Improve the sector's environmental performance in support of Canada's environmental agenda | Ongoing | SO 1 SO 2 SO 3 |

Addressing key agri-environmental challenges not only contributes to a cleaner environment for Canadians, but also maintains or enhances profitability for producers. Two key agri-environmental challenges are climate change and water. AAFC will support the sector in two key ways: through initiatives that enable sound environmental decisions including improving scientific understanding, developing and validating environmental and economic performance, and enhancing indicators and accounting systems; and with on-farm programs that identify environmental risks and opportunities and promote stewardship. |

| Management Priorities | Type | Links to Strategic Outcome(s) | Description |

|---|---|---|---|

| Management Excellence | Ongoing | SO 1 SO 2 SO 3 |

Sound management practices, processes and systems, particularly in areas such as human resources and service delivery, are essential to AAFC's ability to deliver its programs and services and achieve its strategic outcomes efficiently and effectively. Following are highlights of key areas: The Service Policy and Transformation Directorate will help implement AAFC's Service Excellence agenda and work to develop and adapt common business processes to better serve clients. AAFC will further develop and implement people management strategies, through the department's 2009-2012 Integrated Human Resources Plan, to meet its business objectives in support of Government priorities. This Integrated Plan establishes the foundation for fostering a work environment that values professional excellence, diversity, linguistic duality, continuous learning, and mutual respect. AAFC is developing a five-year Investment Plan (2010-2015) in accordance with Treasury Board's Policy on Investment Planning - Assets and Acquired Services. Effective investment planning ensures resources clearly support program outcomes and government priorities. |

AAFC's three-year Integrated Human Resources Plan is a key component of the department's integrated planning approach and is aimed at supporting departmental Strategic Outcomes and the priorities described above. The Integrated Human Resources Plan takes into account existing elements of the business planning process and corporate accountabilities for business delivery. It identifies the key human resources issues facing the department over the next three years and sets out strategies to address them. These key issues include:

- projected gaps due to retirement rates;

- shortages of skills and knowledge in key areas; and

- a workplace where the use of both official languages is encouraged and supported.

Strategies to achieve the department's goals in these areas include:

- an effective values-based staffing system that attracts, develops and retains employees at all levels;

- enhanced opportunities for career and skill development and continuous learning; and

- a more strategic investment of language training funds.

Risk Analysis

Canada's agriculture, agri-food and agri-based product sector is an export-oriented industry that operates in a highly competitive environment. Changing world supply and demand conditions, which continue to impact global agriculture and food markets, pose significant challenges as well as opportunities for Canadian producers.

Although grains and oilseeds prices recently spiked upwards after years of low prices and declining stocks, the future path of commodity prices is uncertain due to volatility in variables such as the price of energy, cost of fertilizer and other inputs, weather and climatic conditions, and fluctuations in exchange rates. There is severe pressure on profit margins in Canada's red meat industry, particularly pork, which is facing challenges such as increased competition from other major exporters and reduced market access in key markets such as the U.S., the primary destination for Canada's agriculture and agri-food products. On the other hand, global demand, particularly for higher value food items, is being driven upward by increasing income and populations in emerging economies and developing countries. The evolving global food systems, including growth, restructuring and consolidation in retail supermarkets, food processors and supply chain networks, present both opportunities and new requirements leading to fundamental shifts in food demand and supply relationships worldwide.

In the years ahead, agriculture production will be sensitive to technological change that enhances yields, since future growth due to area expansion is estimated to be small. Successful agricultural nations will be those that make optimum use of their productive resource capacity and invest in new technologies and practices that reduce production risks. Technological advances in agriculture, such as precision farming and new crop varieties, can lead to lower production costs and increased productivity. Innovation and growth in productivity are also essential to maintaining competitiveness in food and beverage processing, a key market for Canadian primary agricultural products. Investments in public and private research and development will be required to maintain the cost competitiveness and productivity of Canada's agricultural, agri-food and agri-products industry.

Canada's agriculture, agri-food and agri-based product sector is dynamic and in a constant state of transition as it adapts to changing economic conditions and consumer preferences in an effort to remain competitive and profitable. To provide relevant and effective support, AAFC must be similarly adaptive. AAFC will need to transition to a revised funding base post Canada's Economic Action Plan.

AAFC is committed to putting in place the foundation for sound business practices where integrated risk and opportunity management is systematically and explicitly applied in the pursuit of strategic and operational objectives. Policy and program decisions are made based on the examination of the department's operating environment, strategic priorities, branch priorities, resource capacity, and existing or emerging key corporate risks. Ongoing assessment of potential risks and opportunities fosters an environment where risks and opportunities are not only identified, but they are managed and mitigated or pursued. Effective risk management helps AAFC's commitment to continuous improvement and learning, to foster innovation and risk management in support of the sector.

Risk management practices, tools and guides such as AAFC's Corporate Risk Profile and Guide to Risk Management in Integrated Business Planning contribute to a consistent approach to implementing integrated risk management. The AAFC Corporate Risk Profile is regularly updated and associated risk mitigation strategies are assessed to determine residual risk that could impact the achievement of the department's strategic outcomes. Departmental priority setting integrates the current Corporate Risk Profile information.

The following chart provides an overview of the most significant risks and the corresponding mitigation strategies identified in AAFC's Corporate Risk Profile.

| Risk | Mitigation Strategies |

|---|---|

| Catastrophic Crisis A large-scale event could present a severe risk to the sector and/or Canadians at large. |

Mitigation strategies include:

|

| Information Management Compromised information, information management or information systems could impact the department's ability to make effective policy and program decisions, and subsequently affect reporting. |

Mitigation strategies include:

|

| Program Risk AAFC's highly complex programs and broad range of clients present risks for potential errors, or risks that management processes and tools are inadequate to provide sufficient program control frameworks. |

Mitigation strategies include establishing the Centre of Program Excellence to systemically increase the department's risk management capacity through training, establishment and promulgation of best practises, centralization of shared programming with provinces, and independent recipient risk audit. In addition, the Service Transformation Directorate has been established to streamline, standardize and improve program delivery models and systems to enhance risk-based controls while improving the client experience. Specific initiatives include:

|

| Infrastructure Aging infrastructure and assets could impair AAFC's significant moveable assets and physical infrastructure holdings, impeding achievement of strategic outcomes. |

Mitigation strategies include:

|

| People Work Environment AAFC's capacity to maintain a talented, principled and representative workforce in an environment that is fair, ethical, supportive and safe could impact on achievement of strategic outcomes. |

Mitigation strategies include:

|

| System/Technology Sufficiency Evolving business priorities and processes may not be adequately supported if applications investments are not made in a strategic manner using modern application development tools. This could result in infrastructure failure or incapacity to integrate information to facilitate decision making. |

Mitigation strategies include:

|

Expenditure Profile

AAFC departmental spending varies from year to year in response to the circumstances in the agriculture and agri-food industry in any given year. Programming within AAFC is in direct response to industry and economic factors which necessitate support to this vital part of the economy. Much of AAFC's programming is statutory (ie. for programs approved by Parliament through enabling legislation) and the associated payments fluctuate according to the demands and requirements of agriculture producers.

Canada's Economic Action Plan

AAFC's spending plans have been augmented through initiatives under Canada's Economic Action Plan (CEAP) that recognize agriculture and agri-food as a vital sector of the Canadian economy. Key investments are also being made to help Canadian farmers maximize market opportunities and derive benefits as soon as possible, on the understanding that they have an important role in helping Canada recover from the global recession.

Progress has been achieved on the CEAP initiatives in support of Canada's farm and agricultural businesses as the Government continues to make funding available to the sector. In implementing these investments, AAFC has ensured that they are complementary and integrated with Growing Forward programs.

Under CEAP, there are four initiatives specific to agriculture and agri-food. The Canadian Agricultural Loans Act program guarantees an estimated $1 billion in loans over the next five years to help Canadian farm families and cooperatives obtain the credit they need in light of tighter global credit markets. AAFC is working with farmers, industry, and provincial and territorial governments to continue to implement the Agricultural Flexibility Fund to deliver $500 million, over five years, to help the sector adapt to pressures and improve its competitiveness. The Slaughter Improvement Program is a three-year, $50 million initiative that supports investments and improves operations in meat slaughter and processing plants. Finally, the transfer of responsibility for delivering the AgriStability program to interested provinces will allow for integration and alignment with business risk management programs that are delivered by provinces and the streamlining of services to producers.

AAFC is also participating in two government-wide CEAP initiatives. Under the Modernizing Federal Laboratories program to build infrastructure, $25.9 million will be invested to update eight departmental laboratories across the country. Moreover, with additional funding under CEAP's Accelerating Federal Contaminated Sites Action Plan, AAFC will address priority sites more quickly, benefiting the environment and providing employment opportunities throughout the country.

More detailed information regarding CEAP initiatives can be found in Section II.

Departmental Spending Trend

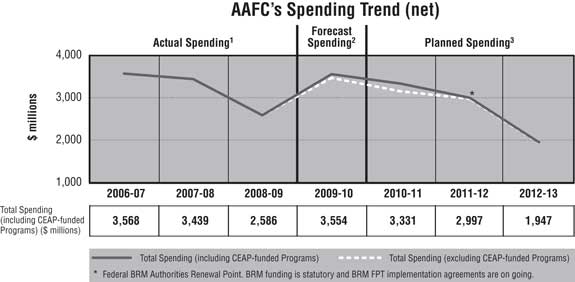

The figure below illustrates AAFC's spending trend from 2006-2007 to 2012-2013, including CEAP initiatives.

Notes:

1Actual spending represents the actual expenditures incurred during the respective fiscal year, as reported in

Public Accounts.

2Forecast spending reflects the authorized funding levels to the end of the fiscal year (not necessarily forecast expenditures).

3Planned spending reflects funds already brought into the department's reference levels as well as amounts to be authorized through the Estimates process as presented in the Annual Reference Level Update. It also includes adjustments in future years for funding approved in the government fiscal plan, but yet to be brought into the department's reference levels. Planned spending has not been adjusted to include new information contained in Budget 2010. More information will be provided in the 2010-11 Supplementary Estimates.

Over the period 2006-07 to 2012-13, actual and planned spending varies between $3.6 billion in 2006-07 and $1.9 billion currently planned for 2012-13. This variability is the result of a number of factors outlined below.

AAFC's overall spending in 2006-07 was relatively higher than other years primarily as a result of a significant new funding commitment in the 2006 Federal Budget which announced $1.5 billion to support a more prosperous future for farmers. This included funding for ongoing programs (developed on a five-year basis) as well as one-time spending of $1 billion to assist in the transition to more effective farm income stabilization programming.

For 2007-08, spending included Budget 2007 funding of $1 billion for the Cost of Production and AgriInvest Kickstart programs (one-year programs). Following the delivery of these one-year programs for 2007-2008, spending for 2008-09 returned to levels required to support the industry. In addition, there was a reduction in the requirement for Business Risk Management programming in 2008-2009 as a result of a strong rise in crop receipts, mainly in the grains and oilseeds sector for 2008 over 2007.

The increase in forecast spending in 2009-10 is largely the result of funding provided to the pork industry to support an orderly transition of this sector in view of the new market challenges. In addition, BRM spending is forecasted to increase above 2008-09 levels. Also reflected in forecast spending for 2009-10, and in planned spending for 2010-11 and future years, are investments under Canada's Economic Action Plan to assist in the recovery from the global economic recession.

The decrease in planned spending from 2010-11 to 2011-12 is due primarily to the fact that 2010-11 planned spending includes funding that was carried over from previous years. Furthermore, program authorities for the Pork Industry Initiative and the authorities for emergency advances for livestock under the Advance Payments Program are currently set to expire at the end of 2010-11.

The further reduction in planned spending from 2011-12 to 2012-13 reflects the federal authorities renewal point associated with the current suite of statutory BRM programs. BRM funding is statutory and BRM FPT implementation agreements are ongoing. AAFC, in consultation with provinces and territories, continues to work on the strategic review of the BRM suite of programs and the development of an industry engagement strategy, which will guide the next phase of BRM programming to meet evolving needs.

Voted and Statutory Items

| Vote # or Statutory Item (S) | Truncated Vote or Statutory Wording | 2009-10 Main Estimates |

2010-11 Main Estimates |

|---|---|---|---|

| 1 | Operating Expenditures | 657.9 | 742.4 |

| 5 | Capital Expenditures | 34.0 | 50.0 |

| 10 | Grants and Contributions | 417.0 | 551.2 |

| 15 | Pursuant to Section 29 of the Financial Administration Act, to authorize the Minister of Agriculture and Agri-Food, on behalf of Her Majesty in right of Canada, in accordance with terms and conditions approved by the Minister of Finance, to guarantee payments of amounts not exceeding, at any time, in aggregate, the sum of $140,000,000 payable in respect of Line of Credit Agreements to be entered into by the Farm Credit Canada for the purpose of the renewed (2003) National Biomass Ethanol Program | 0.0 | 0.0 |

| 20 | Canadian Pari-Mutuel Agency | - | 0.3 |

| (S) | Contribution Payments for the AgriStability Program | 369.2 | 500.0 |

| (S) | Contributions Payments for the AgriInsurance Program | 440.6 | 452.0 |

| (S) | Payments in connection with the Agricultural Marketing Programs Act | 165.0 | 184.0 |

| (S) | Grant Payments for the AgriInvest Program | 139.4 | 155.8 |

| (S) | Grant Payments for the AgriStability Program | 225.1 | 95.3 |

| (S) | Grant Payments for the Agricultural Disaster Relief Program / AgriRecovery | 54.2 | 54.2 |

| (S) | Contribution Payments for the Agricultural Disaster Relief Program / AgriRecovery | 54.2 | 54.2 |

| (S) | Contributions in support of the Assistance to the Pork Industry Initiative | - | 39.1 |

| (S) | Contribution Payments for the AgriInvest Program | 20.1 | 19.0 |

| (S) | Canadian Cattlemen's Association Legacy Fund | 5.0 | 5.0 |

| (S) | Loan guarantees under the Canadian Agricultural Loans Act | - | 4.0 |

| (S) | Grants to agencies established under the Farm Products Agencies Act | 0.2 | 0.2 |

| (S) | Contributions to employee benefit plans | 63.7 | 83.3 |

| (S) | Minister of Agriculture and Agri-Food - Salary and motor car allowance | 0.1 | 0.1 |

| (S) | Canadian Pari-Mutuel Agency Revolving Fund | (0.0) | - |

| Appropriations not required | |||

| - | Pursuant to Section 29 of the Financial Administration Act, to authorize the Minister of Agriculture and Agri-Food, on behalf of Her Majesty in right of Canada, in accordance with terms and conditions approved by the Minister of Finance, to guarantee payments of an amount not exceeding, at any one time, in aggregate, the sum of $1,500,000,000 payable in respect of cash advances provided by producer organizations, the Canadian Wheat Board and other lenders under the Spring Credit Advance Program and $1,500,000,000 payable in respect of cash advances provided by producer organizations, the Canadian Wheat Board and other lenders under the Enhanced Spring Credit Advance Program. | 0.0 | - |

| - | Loan guarantees under the Farm Improvement and Marketing Cooperatives Loans Act | 4.0 | - |

| TOTAL DEPARTMENT | 2,649.6 | 2,990.1 | |

The Main Estimates for 2010-11 are $2,990.1 million compared to $2,649.6 million for 2009-10, an increase of $340.5 million. The increase is mainly attributable to funding for the Agricultural Flexibility Fund, increased funding in support of the BRM Suite of Programs, and funding for the assistance to the Pork Industry Initiative, offset by reductions due to the 2008 Strategic Review exercise.

The figures have been rounded. Figures that cannot be listed in millions of dollars are shown as 0.0. Due to rounding, figures may not add to the totals shown.