Common menu bar links

Breadcrumb Trail

ARCHIVED - Industry Canada - Report

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

How to read this report

The 2009–10 Departmental Performance Report (DPR) presents the results of Industry Canada’s program activities during the 2009–10 fiscal year, compared with the commitments stated in the Department’s 2009–10 Report on Plans and Priorities (RPP). The report contains an introductory message from the Minister summarizing the Department’s performance, followed by a message from the Minister of State (Science and Technology) (Federal Economic Development Agency for Southern Ontario) summarizing the performance of the Federal Economic Development Agency for Southern Ontario (FedDev Ontario). This DPR is composed of the following three sections, detailed below:

Section 1: Departmental Overview

- summary information on the Department, starting with Industry Canada’s raison d’être, responsibilities and Program Activity Architecture

- performance summary information, including tables by strategic outcomes

- contribution of operational and management priorities to strategic outcomes

- information on Industry Canada’s operating environment

- departmental expenditure profile, including the total financial and human resources managed by the Department

- a summary of Industry Canada items related to Canada’s Economic Action Plan and of programs transferred to FedDev Ontario

- a list of voted and statutory items

Section 2: Analysis of Program Activities by Strategic Outcome

This section includes detailed analyses of Industry Canada’s performance at the program activity level and by strategic outcome. Variance analysis is also provided at the program activity level between Planned and Actual financial resources and human resources, when there is a difference of 10% or more. For the 2009–10 fiscal year, Industry Canada has also included results achieved under Canada’s Economic Action Plan (EAP). Sections specific to the EAP have been added under each program activity in which performance results were achieved in 2009–10. At the end of Section 2, the document reports on results achieved by FedDev Ontario. With its creation on August 13, 2009, FedDev Ontario became fully accountable for its decisions and financial delegated authorities, but until the end of the 2009–10 fiscal year, given that FedDev Ontario will continue to be included in Industry Canada appropriations and in Industry Canada Public Accounts and Financial Statements, Industry Canada will be obliged to perform an oversight role. In future parliamentary reports, FedDev Ontario will report on its results independently of Industry Canada.

The 2009–10 DPR is the first for Industry Canada to report on targets from the Department’s approved Management, Resources and Results Structure at the program activity level. To assign performance status, we have used the following guide, in accordance with instructions from the Treasury Board of Canada Secretariat:

- Exceeded: More than 100% of the expected level of performance was achieved.

- Met all: 100% of the expected level of performance was achieved.

- Mostly met: 80% to 99% of the expected level of performance was achieved.

- Somewhat met: 60% to 79% of the expected level of performance was achieved.

- Not met: Less than 60% of the expected level of performance was achieved.

Fiscal year 2009–10 will represent Industry Canada’s baseline year for reporting on targets. Trend analyses continue to be provided, when possible and when historical data are available, to help readers establish year-over-year continuity and better understand how Industry Canada achieves its strategic outcomes and contributes to whole-of-government outcomes. Industry Canada documents data sources and reference material for performance information and results for future reference.

Section 3: Supplementary Information

This section includes information on the Department’s financial highlights and provides links to the Department’s financial statements and electronic resources for further information.

In our continuing effort to provide Canadians with online access to information and services, we are including web links to more information and highlights. We are committed to continuous improvement in our reporting. We welcome your comments on this report by email to info@ic.gc.ca, by fax to 613-957-6543 or by mail to:

Planning, Performance and Reporting Group

Comptrollership and Administration Sector

Industry Canada

2nd Floor, East Tower

235 Queen Street

Ottawa ON K1A 0H5

Minister’s Message

Last year, Canada was the last country to fall into the global recession. Today, our economy is beginning to emerge in the strongest position of any advanced country in the world. Investment and key stimulus measures, part of year one of Canada’s Economic Action Plan, provided continued results and helped set Canada apart from its G8 counterparts in terms of economic strength.

In 2009–10, the Department worked quickly with the Industry Portfolio to deliver timely and targeted stimulus initiatives. Composed of Industry Canada and 10 other agencies, Crown corporations and quasi-judicial bodies, the Portfolio helps the Department to build a more productive and competitive economy.

Even though Industry Canada focused largely on Economic Action Plan initiatives, the Department remained steadfast in its commitment to promote long-term economic growth through our three strategic outcomes:

- the Canadian marketplace is efficient and competitive;

- science and technology, and knowledge and innovation are effective drivers of a strong Canadian economy; and

- competitive businesses are drivers of sustainable wealth creation.

In addition to Industry Canada’s work to foster a growing, competitive, knowledge-based economy, the Department took measured steps to overcome the economic crisis by:

- supporting innovation and scientific excellence by providing $2 billion over two years for the Knowledge Infrastructure Program to revitalize research infrastructure at post-secondary institutions;

- ensuring a viable and sustainable North American automotive industry by supporting the restructuring efforts of Chrysler Canada Inc. and General Motors of Canada Limited;

- strengthening communities by investing $225 million over three years to develop and implement a strategy to extend broadband Internet coverage to unserved and underserved areas, which includes the Broadband Canada: Connecting Rural Canadians initiative;

- helping consumers and businesses experiencing financial difficulty by introducing regulatory amendments to the Bankruptcy and Insolvency Act and the Companies’ Creditors Arrangement Act, which include provisions that make alternatives to bankruptcy more available to Canadians;

- enhancing economic development in southern Ontario by establishing the Federal Economic Development Agency for Southern Ontario, which provides funding to targeted sectors impacted by the economic downturn; and,

- supporting the next generation of small business leaders in Canada by investing $10 million in the Canadian Youth Business Foundation.

Moving forward, the Department will continue to ensure that the jobs and industries of the future are created right here in Canada. We will follow through on delivering existing stimulus plans and continue supporting government priorities. This means ensuring that we have the right conditions and regulatory frameworks in place to encourage investment in Canada, increasing support for research and development to improve Canada’s long-term competitiveness and developing a digital economy.

I will work with my colleagues, the private sector and other governments to enhance Canada’s productivity and create the foundation for strong, sustainable and balanced growth.

It is my pleasure to present this year’s Departmental Performance Report for Industry Canada.

Tony Clement

Minister of Industry

Minister of State’s Message

As Canada emerges from the global recession, the Government of Canada remains committed to supporting communities and helping them return to a cycle of prosperity and growth. The economic downturn hit Ontario’s manufacturing sector particularly hard, forcing plant closures and widespread layoffs.

Through Canada’s Economic Action Plan, our government provided more than $1 billion over five years for the creation of the Federal Economic Development Agency for Southern Ontario (FedDev Ontario) to address the unique needs and priorities of workers, businesses and communities in southern Ontario.

With the launch of this Agency in August 2009, our initial priority was to invest immediately — through strategic partnerships and programs — to provide short-term stimulus to maintain and generate jobs throughout the region. Funding was committed to existing programs being delivered by the Business Development Bank of Canada, National Research Council Canada, the Ontario Chamber of Commerce, Canadian Manufacturers & Exporters and the Yves Landry Foundation. FedDev Ontario also provided a boost to communities and businesses across Southern Ontario through the Community Adjustment Fund, the Recreational Infrastructure Canada Program in Ontario and the Southern Ontario Development Program.

Over the past year, I participated in many consultations with key stakeholders, including provincial and municipal leaders, businesses, not-for-profit organizations, research and academic institutions. These consultations helped me to learn more about the challenges our region faces.

I am committed to working with our partners to create conditions under which ideas can be nurtured and realized, high-quality jobs created and economic growth achieved.

I am proud of our government’s achievements to date in putting this region on the path to economic recovery. I am also confident that the new Federal Economic Development Agency for Southern Ontario will play a key role in ensuring a competitive and diversified Southern Ontario economy.

Gary Goodyear

Minister of State (Science and Technology)

(Federal Economic Development Agency for Southern Ontario)

Section 1: Departmental Overview

1.1 Raison d’être and Responsibilities

Mission

Industry Canada’s mission is to foster a growing, competitive, knowledge-based Canadian economy. The Department works with Canadians throughout the economy, and in all parts of the country, to improve conditions for investment, improve Canada’s innovation performance, increase Canada’s share of global trade and build an efficient and competitive marketplace.

Mandate

Industry Canada’s mandate is to help make Canadian industry more productive and competitive in the global economy, thus improving the economic and social well-being of Canadians.

The many and varied activities Industry Canada carries out to deliver on its mandate are organized around three interdependent and mutually reinforcing strategic outcomes, each linked to a separate key strategy.

The Canadian Marketplace is Efficient and Competitive

Advancing the marketplace

Industry Canada fosters competitiveness by developing and administering economic framework policies that promote competition and innovation;support investment and entrepreneurial activity; and instill consumer, investor and business confidence.

Science and Technology, Knowledge, and Innovation are Effective Drivers of a Strong Canadian Economy

Fostering the knowledge-based economy

Industry Canada invests in science and technology to generate knowledge and equip Canadians with the skills and training they need to compete in the global, knowledge-based economy. These investments help ensure that discoveries and breakthroughs happen here in Canada and that Canadians can realize their social and economic benefits.

Competitive Businesses are Drivers of Sustainable Wealth Creation

Supporting business

Industry Canada encourages business innovation and productivity because businesses are the organizations that generate jobs and wealth. Promoting economic development in communities encourages the development of skills, ideas and opportunities across the country.

Responsibilities

Industry Canada is the Government of Canada’s centre of microeconomic policy expertise. The Department’s founding legislation, the Department of Industry Act, established the Department to foster a growing, competitive and knowledge-based Canadian economy.

Industry Canada is a department with many entities that have distinct mandates, with program activities that are widely diverse and highly dependent on partnerships. Industry Canada works on a broad range of matters related to industry and technology, trade and commerce, science, consumer affairs, corporations and corporate securities, competition and restraint of trade, weights and measures, bankruptcy and insolvency, patents and copyright, investment, small business and tourism.

1.2 Program Activity Architecture

This DPR reflects the Program Activity Architecture (PAA) in the 2009–10 RPP, which is aligned with Industry Canada’s Management, Resources and Results Structure (MRRS) for 2009–10. The MRRS provides a standard basis for reporting to parliamentarians and Canadians on the alignment of resources, program activities and results.

Industry Canada’s strategic outcomes are long-term and enduring benefits to the lives of Canadians that reflect our mandate and vision and are linked to Government of Canada priorities and intended results.

The Department’s PAA is an inventory of all programs and activities undertaken. The PAA depicts them in a logical and hierarchical relationship to each other and to the strategic outcome to which they contribute. They also clearly link financial and non-financial resources.

Starting in the 2009–10 Estimates cycle, the resources for the Internal Services program activity are to be displayed separately and no longer allocated among the remaining program activities as in previous fiscal years. To increase comparability between fiscal years, 2008–09 Actuals have been realigned or remapped to apply this change to the 2009–10 reporting structure.

Given the significant changes to Industry Canada’s PAA structure in 2009–10, as well as changes in the methodology used in assigning FTEs to specific program activities, there is a variance between Planned and Actual values for FTEs in certain program activities. Measures have been taken to ensure future FTE numbers are accounted for in a consistent manner.

Organizational Changes within Industry Canada

The Automotive Innovation Fund, Bombardier CSeries Program, Ontario Potable Water Program and Brantford Greenwich–Mohawk Remediation Project were created in 2009–10 at the program sub-activities level. These programs were not included in the 2009–10 PAA because they were added after the PAA review exercise.

The Automotive Innovative Fund and Bombardier CSeries Program were approved by the Treasury Board of Canada Secretariat (TBS) subsequent to the approval of the 2009–10 PAA. Both programs, along with their planned spending, are under Knowledge Advantage in Targeted Canadian Industries.

The funding for the Ontario Potable Water Program and the Brantford Greenwich–Mohawk Remediation Project was reprofiled under Community, Economic and Regional Development, increasing their funding threshold for 2009–10.

The Mackenzie Gas Project program activity, appearing in the 2009–10 PAA, was transferred from Industry Canada to Environment Canada on October 30, 2008, through an Order-in-Council (P.C. 2008–1730).

Budget 2009 — Canada’s Economic Action Plan

In Budget 2009, tabled in Parliament on January 27, 2009, the Government of Canada announced a set of initiatives aimed at providing a quick recovery from the economic downturn and improving access to financing, supporting small businesses, helping municipalities build stronger communities through investments in infrastructure, and providing short-term support for key industrial and commercial sectors.

Industry Canada also promoted economic recovery with initiatives aimed at specific economic sectors, such as science and innovation, tourism, supporting small businesses and community economic development, and encouraging the development of broadband infrastructure in previously underserved or unserved areas across Canada. Industry Canada’s initiatives under the EAP include:

- Improving Canada’s Competition and Investment Frameworks

- Knowledge Infrastructure Program

- Institute for Quantum Computing

- Canada Foundation for Innovation

- Modernizing Federal Laboratories

- Canada Small Business Financing Program

- Canada Business Network

- Canadian Youth Business Foundation

- Marquee Tourism Events Program

- Federal Tourism Strategy

- Targeted Assistance for the Automotive Sector

- Community Adjustment Fund in Northern Ontario

- Broadband Canada: Connecting Rural Canadians

Funding for these had not originally been planned. Throughout this report, the reader will notice large funding increases in financial tables’ “Total Authorities”; these increases are usually due to the addition of EAP initiatives. Details of Industry Canada’s EAP initiative accomplishments are provided in sections 2 and 3 of this document at the program activity level, when appropriate, and in the Online Supplementary Information Tables.

Machinery of Government Changes

In 2009–10 the following machinery of government changes affected Industry Canada:

The Federal Economic Development Agency for Southern Ontario (FedDev Ontario)

FedDev Ontario was created in August 2009 as a result of the EAP. The following programs were subsequently transferred from Industry Canada to FedDev Ontario:

- Eastern Ontario Development Program

- Canada–Ontario Infrastructure Program

- Canada–Ontario Municipal Rural Infrastructure Fund

- Municipal Rural Infrastructure Top-Up Fund

- Brantford Greenwich–Mohawk Remediation Project

- Canada Strategic Infrastructure Program

- Building Canada Fund

- Ontario Potable Water Program

The following programs were split between Industry Canada and FedDev Ontario as a result of the EAP. Industry Canada serves Northern Ontario, and FedDev Ontario serves Southern Ontario:

- Community Futures Program

- Economic Development Initiative — Official Language Minority Communities Development Program

In addition, FedDev Ontario administers the following programs that are part of Canada’s EAP:

- Recreational Infrastructure Canada Program

- Southern Ontario Development Program (FedDev Ontario’s core program)

- Community Adjustment Fund for Southern Ontario

This DPR will cover achievements for all EAP initiatives, including a section focusing specifically on FedDev Ontario. In future parliamentary reporting documents, FedDev Ontario will report on its achievements independently of Industry Canada.

Program Activity Architecture

This section illustrates Industry Canada’s complete framework of program activities and program sub-activities, which roll up and contribute to progress toward the Department’s three strategic outcomes.

Strategic Outcome: The Canadian Marketplace is Efficient and Competitive

Program Activity: Marketplace Frameworks and Regulations

Sub-Activities

- Measurement Canada

- Office of the Superintendent of Bankruptcy

- Corporations Canada

- Regulation of Small and Medium-Sized Businesses (including Paperwork Burden Reduction)

- Investment Review

- Canadian Intellectual Property Office

Program Activity: Marketplace Frameworks and Regulations for Spectrum, Telecommunications and the Online Economy

Sub-Activities

- Spectrum/Telecommunications Program (Operations and Engineering)

Sub-Sub-Activities- International Telecommunication Union

- Spectrum/Telecommunications Management and Regulations

- Regional Operations — Spectrum

- Electronic Commerce

Program Activity: Consumer Affairs Program

Sub-Activities

- Consumer Information

- Consumer Policy

Program Activity: Competition Law Enforcement and Advocacy

Sub-Activities

- Competition Law Enforcement

- Advocacy in Favour of Market Forces

Strategic Outcome: Science and Technology, Knowledge, and Innovation are Effective Drivers of a Strong Canadian Economy

Program Activity: Canada’s Research and Innovation Capacity

Sub-Activities

- Government Science and Technology Policy Agenda in Partnership with Key Stakeholders

- Science, Technology and Innovation Council Secretariat

Program Activity: Communications Research Centre Canada

Sub-Activities

- Information and Communications Technologies Regulations and Standards

- Information and Communications Technologies for Other Federal Departments

- Innovation and Technology Transfer

Program Activity: Knowledge Advantage in Targeted Canadian Industries

Sub-Activities

- Knowledge Advantage in Aerospace, Defence and Marine Industries

- Knowledge Advantage in Automotive and Transportation Industrie

- Knowledge Advantage in Life Science Industries

- Knowledge Advantage in Resource Processing Industries

- Knowledge Advantage in Service and Consumer Products Industries

Program Activity: Industrial Technologies Office — Special Operating Agency

Sub-Activities

- Strategic Aerospace and Defence Initiative

- Program for Strategic Industrial Projects

- Technology Partnerships Canada — Research and Development Program

Strategic Outcome: Competitive Businesses are Drivers of Sustainable Wealth Creation

Program Activity: Entrepreneurial Economy

Sub-Activities

- Canada Small Business Financing Program

- Service to Business (Canada Business Network)

- BizPaL

- Student Connections

- Small Business Growth and Prosperity

- Canadian Youth Business Foundation

Program Activity: Global Reach and Agility in Targeted Canadian Industries

Sub-Activities

- Global Reach and Agility in Aerospace, Defence and Marine Industries

- Structured Financing Facility — Shipbuilding and Industrial Marine Framework

- Global Reach and Agility in Automotive and Transportation Industries

- Global Reach and Agility in Life Science Industries

- Global Reach and Agility in Resource Processing Industries

- Global Reach and Agility in Service and Consumer Products Industries

- Canadian Apparel and Textile Industries Program

- Global Reach and Agility in Information and Communications Technologies Industries

- Industrial and Regional Benefits

Program Activity: Community, Economic and Regional Development

Sub-Activities

- Federal Economic Development Initiative for Northern Ontario (FedNor)

Sub-Sub-Activities- Community Futures Program

- Northern Ontario Development Program

- Eastern Ontario Development Program

- Section 41 — Official Languages Act

- Canada–Ontario Municipal Rural Infrastructure Program

- Ontario Municipal Rural Infrastructure Top–Up Program

- Computers for Schools

- Community Access Program

Program Activity: Security and Prosperity Partnership of North America — Canadian Secretariat

Program Activity: Mackenzie Gas Project

Internal Services

Program Activity Architecture Crosswalk

This chart illustrates Industry Canada’s complete framework of program activities and program sub-activities as displayed in the 2009–10 RPP, with the addition of temporary programs resulting from the EAP, which roll up and contribute to progress toward the Department’s three strategic outcomes.

Strategic Outcome: The Canadian Marketplace is Efficient and Competitive

Program Activity: Marketplace Frameworks and Regulations

Sub-Activities

- Measurement Canada

- Office of the Superintendent of Bankruptcy

- Corporations Canada

- Regulation of Small and Medium-Sized Businesses (including Paperwork Burden Reduction)

- Investment Review

- Canadian Intellectual Property Office

- 2Improving Canada’s Competition and Investment Frameworks

Program Activity: Marketplace Frameworks and Regulations for Spectrum, Telecommunications and the Online Economy

Sub-Activities

- Spectrum/Telecommunications Program (Operations and Engineering)

Sub-Sub-Activities- International Telecommunication Union

- Spectrum/Telecommunications Management and Regulations

- Regional Operations — Spectrum

- Electronic Commerce

Program Activity: Consumer Affairs Program

Sub-Activities

- Consumer Information

- Consumer Policy

Program Activity: Competition Law Enforcement and Advocacy

Sub-Activities

- Competition Law Enforcement

- Advocacy in Favour of Market Forces

Strategic Outcome: Science and Technology, Knowledge, and Innovation are Effective Drivers of a Strong Canadian Economy

Program Activity: Canada’s Research and Innovation Capacity

Sub-Activities

- Government Science and Technology Policy Agenda in Partnership with Key Stakeholders

- Science, Technology and Innovation Council Secretariat

- 1Knowledge Infrastructure Program

- 1Institute for Quantum Computing

- 3Canada Foundation for Innovation

Program Activity: Communications Research Centre Canada

Sub-Activities

- Information and Communications Technologies Regulations and Standards

- Information and Communications Technologies for Other Federal Departments

- Innovation and Technology Transfer

- 1Modernizing Federal Laboratories

Program Activity: Knowledge Advantage in Targeted Canadian Industries

Sub-Activities

- Knowledge Advantage in Aerospace, Defence and Marine Industries

- Knowledge Advantage in Automotive and Transportation Industrie

- Knowledge Advantage in Life Science Industries

- Knowledge Advantage in Resource Processing Industries

- Knowledge Advantage in Service and Consumer Products Industries

Program Activity: Industrial Technologies Office — Special Operating Agency

Sub-Activities

- Strategic Aerospace and Defence Initiative

- Program for Strategic Industrial Projects

- Technology Partnerships Canada — Research and Development Program

Strategic Outcome: Competitive Businesses are Drivers of Sustainable Wealth Creation

Program Activity: Entrepreneurial Economy

Sub-Activities

- 4Canada Small Business Financing Program

- 3Service to Business (Canada Business Network)8

- BizPaL

- Student Connections

- Small Business Growth and Prosperity

- 3Canadian Youth Business Foundation

Program Activity: Global Reach and Agility in Targeted Canadian Industries

Sub-Activities

- Global Reach and Agility in Aerospace, Defence and Marine Industries

- Structured Financing Facility — Shipbuilding and Industrial Marine Framework

- Global Reach and Agility in Automotive and Transportation Industries

- Global Reach and Agility in Life Science Industries

- Global Reach and Agility in Resource Processing Industries

- Global Reach and Agility in Service and Consumer Products Industries

- Canadian Apparel and Textile Industries Program

- Global Reach and Agility in Information and Communications Technologies Industries

- Industrial and Regional Benefits

- 1Marquee Tourism Events Program

- 2Federal Tourism Strategy

- 1aTargeted Assistance for the Automotive Sector

Program Activity: Community, Economic and Regional Development

Sub-Activities

- Federal Economic Development Initiative for Northern Ontario (FedNor)

Sub-Sub-Activities - Economic Development Initiative — Official Language Minority Communities Development Program

- Computers for Schools

- Community Access Program

- 1Community Adjustment Fund in Northern Ontario

- 1Broadband Canada: Connecting Rural Canadians

- 1,5Federal Economic Development Agency for Southern Ontario

- 5Canada–Ontario Infrastructure Program

- 5Canada–Ontario Municipal Rural Infrastructure Fund

- 5Municipal Rural Infrastructure Top-Up Fund

- 5Building Canada Fund

- 5Canada Strategic Infrastructure Fund

- 1,5Recreational Infrastructure Canada Program

- 7Southern Ontario Development Program

- 1,5Community Adjustment Fund for Southern Ontario

Program Activity: Security and Prosperity Partnership of North America - Canadian Secretariat

Internal Services

1. Designates new EAP items with new funding

2. Designates new EAP items without funding

3. Designates EAP items that further funded existing Industry Canada work

4. Designates EAP items without funding that affected existing Industry Canada program activities

7. Designates programs that were never part of Industry Canada but were created by FedDev Ontario

8. The corresponding EAP title for this program is Canada Business Network.

1.3 Performance Summary

Industry Canada’s Financial and Human Resources

These two tables present Industry Canada’s financial and human resources for 2009–10.

| Planned Spending | Total Authorities | Actual Spending |

|---|---|---|

| 1,214.1 | 3,223.6* | 2,567.6 |

| Planned | Actual | Difference |

|---|---|---|

| 5,273** | 5,682 | 409*** |

Performance Summary Tables by Strategic Outcome

| Performance Indicators | Target and Performance Status | Results and Performance Summary | Trend |

|---|---|---|---|

| Barriers to competition (Organisation for Economic Co-operation and Development [OECD] assessment of accessibility to Canadian market) |

Maintain or improve 6th-place ranking* Status: Mostly met |

Based on 2008 measure of the OECD Product Market Regulation indicators (PMR), Canada is ranked 5th on the list of most inaccessible markets among OECD countries. In the 2003 PMR report, Canada ranked 11th.1 The Barriers to Competition ranking is based on legal barriers, antitrust exemptions, barrier to entry in network sectors, and barrier to entry in services. | Declining (raw score in 1998: 1.85; in 2003: 2.00; and in 2008: 2.09. The decline is in 3 out of 4 areas of barriers to competition: legal barriers, barrier to entry in network sectors, and barrier to entry in services.) |

| Number of days taken to register a new company |

3 days Status: Somewhat met |

The process of registering a new company in Canada takes 5 days. The number of days taken increased from 3 (2004–08) to 5 (2009–10).2 | Declining (due to change in procedures related to business registration) |

| Program Activity | 2008-09 Actual Spending |

2009-10 | Alignment to Government of Canada Outcomes | |||

|---|---|---|---|---|---|---|

| Main Estimates |

Planned Spending |

Total Authorities |

Actual Spending |

|||

| Marketplace Frameworks and Regulations | 32.1 | 46.9 | 46.9 | 209.2** | 43.2 | Economic Affairs: A Fair and Secure Marketplace |

| Marketplace Frameworks and Regulations for Spectrum, Telecommunications and the Online Economy | 86.6 | 82.8 | 87.2 | 115.4 | 110.4 | |

| Consumer Affairs Program | 5.3 | 4.5 | 4.5 | 5.2 | 5.1 | |

| Competition Law Enforcement and Advocacy | 45.3 | 42.6 | 42.6 | 49.6 | 47.7 | |

| Total | 169.3 | 176.9 | 181.3 | 379.5 | 206.5 | |

| Performance Indicators | Target and Performance Status | Results and Performance Summary | Trend |

|---|---|---|---|

| Innovation Index (measure of the adoption of new technology, and the interaction between the business and science sectors) |

Maintain or improve 12th-place ranking Status: Met all |

Canada has maintained its 12th-place ranking in innovation out of 133 countries.3 The Innovation Index includes capacity for innovation; quality of scientific research institutions; company spending on research and development (R&D); university–industry collaboration in R&D; government procurement of advanced technology products; availability of scientists and engineers; and utility patents. | No change |

| International ranking of Canada in university– industry collaboration in R&D |

Maintain 2nd-place ranking4 Status: Mostly met |

Canada ranks 3rd out of 10 comparator countries in university–industry collaboration in R&D.5 | No change (Canada ranked 2nd from 2003 to 2006. Since 2007 Canada has ranked 3rd.) |

| Number of people working in R&D of total employment numbers* |

8 per 1,000 Status: Exceeded |

The latest results show that in 2005, Canada had 8.3 researchers per 1,000 of the population. This is up from 8.1/1,000 in 2004.*6 | Improving |

| Program Activity | 2008-09 Actual Spending |

2009-10 | Alignment to Government of Canada Outcomes | |||

|---|---|---|---|---|---|---|

| Main Estimates |

Planned Spending |

Total Authorities |

Actual Spending |

|||

| Canada’s Research and Innovation Capacity | 116.3 | 264.3 | 264.3 | 1,272.4^ | 1,271.1 | Economic Affairs: An Innovative and Knowledge-based Economy |

| Communications Research Centre Canada | 45.6 | 35.4 | 35.4 | 49.3 | 48.7 | |

| Knowledge Advantage in Targeted Canadian Industries** | 87.7 | 61.0 | 131.0 | 137.0^^ | 58.9 | |

| Industrial Technologies Office — Special Operating Agency | 289.8 | 221.4 | 221.4 | 346.3^^^ | 218.8 | |

| Total | 539.4 | 582.2 | 652.1 | 1,805.0 | 1,597.6 | |

| Performance Indicators | Target and Performance Status | Results and Performance Summary | Trend |

|---|---|---|---|

| Percentage of gross domestic product (GDP) contributed by small and medium-sized businesses |

Maintain or improve current percentage (26%) Status: Exceeded |

Canadian small businesses accounted for 29% of GDP for 2008–09.*7 This is up from 26% in 2007–08.8 In Canada, 97.8% of all business establishments are small businesses.**9 | Improving |

| Ratio of small and medium-sized businesses in rural vs. urban areas (defined by census subdivisions) |

1:3 Status: Somewhat met |

The ratio of rural to urban small and medium-sized enterprises (SMEs) in Canada is 1:5.6. Rural SMEs account for 15.2% of total SME business activity, compared with the 84.8% contribution by urban SMEs.10 | Declining |

| Program Activity | 2008-09 Actual Spending |

2009-10 | Alignment to Government of Canada Outcomes | |||

|---|---|---|---|---|---|---|

| Main Estimates |

Planned Spending |

Total Authorities |

Actual Spending |

|||

| Entrepreneurial Economy | 123.2 | 95.7 | 95.7 | 146.8 | 140.9 | Economic Affairs: A Fair and Secure Marketplace |

| Global Reach and Agility in Targeted Canadian Industries | 72.2 | 139.4 | 61.4 | 126.4 | 108.1 | |

| Community, Economic and Regional Development*** | 159.5 | 110.6 | 138.5 | 585.4 | 335.7 | |

| Security and Prosperity Partnership of North America — Canadian Secretariat | 2.7 | 2.2 | 2.2 | 1.6 | 1.1 | International Affairs: A Strong and Mutually Beneficial North American Partnership |

| MacKenzie Gas Project | 5.0 | 0.0 | 0.0 | 0.0 | 0.0 | Economic Affairs: Strong Economic Growth |

| Total | 362.6 | 347.9 | 297.8 | 860.1 | 585.8 | |

| Program Activity | 2008-09 Actual Spending ($ millions) |

2009-10 ($ millions) | Alignment to Government of Canada Outcomes | |||

|---|---|---|---|---|---|---|

| Main Estimates |

Planned Spending |

Total Authorities |

Actual Spending |

|||

| Internal Services | 157.3 | 81.9 | 82.9 | 179.0* | 177.8 | Not applicable |

| Total | 157.3 | 81.9 | 82.9 | 179.0 | 177.8 | |

Contribution of Priorities to Strategic Outcome(s)

Operational Priorities

| Operational Priority: Ensure marketplace policies help promote competitive markets and instill consumer confidence |

Type: Previously committed to |

Strategic Outcome(s): The Canadian Marketplace is Efficient and Competitive |

|---|---|---|

|

Status: Successfully met

|

||

| Operational Priority: Foster business innovation |

Type: Previously committed to |

Strategic Outcome(s): Science and Technology, Knowledge, and Innovation are Effective Drivers of a Strong Canadian Economy |

|---|---|---|

|

Status: Successfully met

|

||

| Operational Priority: Invest in S&T to enhance the generation and commercialization of knowledge |

Type: Previously committed to |

Strategic Outcome(s): Science and Technology, Knowledge, and Innovation are Effective Drivers of a Strong Canadian Economy |

|---|---|---|

|

Status: Successfully met

|

||

| Operational Priority: Foster internationally competitive businesses and industries |

Type: Ongoing |

Strategic Outcome(s): Competitive Businesses are Drivers of Sustainable Wealth Creation |

|---|---|---|

|

Status: Mostly met

|

||

| Operational Priority: Promote entrepreneurship, community development and sustainable development |

Type: Ongoing |

Strategic Outcome(s): Competitive Businesses are Drivers of Sustainable Wealth Creation |

|---|---|---|

|

Status: Successfully met

|

||

Management Priorities

| Management Priority: Corporate Performance Framework |

Type: Previously committed to |

Strategic Outcome(s): All strategic outcomes |

|---|---|---|

|

Status: Ongoing In 2009–10, Industry Canada continued its efforts to improve its PAA and Performance Measurement Framework for 2010–11 to reflect program changes and improve compliance with the guidelines produced by TBS. A number of sub-activities have been restructured for the 2010–11 PAA to improve the alignment of resources to results and to group programs with similar goals. Industry Canada’s goal is to better identify and measure the objectives of each program and improve the alignment of resources to results in the years to come. |

||

| Management Priority: Integrated Risk Management |

Type: Previously committed to |

Strategic Outcome(s): All strategic outcomes |

|---|---|---|

|

Status: Mostly met The Department’s Integrated Risk Management Framework was updated in 2009–10 to reflect the current governance and roles and responsibilities exercised by various committees and employees at all levels with respect to risk management. Risk management was further integrated into business planning and reporting processes through the 2010–11 Integrated Planning process, which identified key sector risks at the program activity level. Throughout 2009–10, mitigation plans were updated for the Department’s Corporate Risk Profile and risk identification, mitigation and reporting processes were put in place for risks related to the implementation of Industry Canada’s EAP initiatives. Work continues to integrate risk more fully into departmental business plans. |

||

| Management Priority: Human Resources Modernization Initiatives |

Type: Previously committed to |

Strategic Outcome(s): All strategic outcomes |

|---|---|---|

|

Status: Successfully Met Developed and implemented the year one Action Plan of the 3-year People Management Strategy for Renewal and Results (PMSRR). Significant progress was made in year one in all 4 priority areas.

|

||

| Management Priority: Information Management |

Type: New |

Strategic Outcome(s): All strategic outcomes |

|---|---|---|

|

Status: Successfully met

|

||

| Management Priority: Real Property Management |

Type: New |

Strategic Outcome(s): All strategic outcomes |

|---|---|---|

|

Status: Successfully met

|

||

1.4 Operating Environment and Risk Analysis

In the 2009–10 RPP, Integrated Risk Management was identified as a management priority. During fiscal year 2009–10, Industry Canada continued to further integrate risk management into departmental planning and reporting through its integrated business planning processes. As part of this process, the Department conducted environmental scans to identify potential key risks and challenges. Industry Canada also maintained a robust set of risk management tools and frameworks, such as the Industry Canada Integrated Risk Management Framework, which was recently updated to conform to new Treasury Board guidelines.

An important element of the Department’s Integrated Risk Management Framework is the Corporate Risk Profile (CRP). The 2008–09 CRP identified several key corporate risks, including people — recruitment, development and retention; grants and contributions programs; performance measurement, monitoring and reporting; IM; and the Real Property Management Framework. In 2009–10, action plans were updated to effectively mitigate the corporate risks and ensure there was appropriate focus to address these management and program challenges. In particular, the Department implemented a new PMSRR and approved an IM Governance and Accountability Framework. Throughout the year, the action plans for all the corporate risks were monitored, reported on, and updated on a regular basis. In terms of risk management, a key lesson learned by Industry Canada is the need to identify more program-based corporate risks. The process and approach for the development of the Department’s 2010–11 CRP was adjusted to bring a greater focus on program-based risks and a fuller identification and rating of the corporate risks.

Canada’s Economic Action Plan

Industry Canada took a proactive approach to identifying and managing the risks associated with the EAP, a government-wide and departmental priority. The nature of the EAP initiatives — high-profile programs with large expenditures in tight time frames — increased the potential impact of the risks on program delivery. To address these risks, Industry Canada established and implemented effective stewardship measures such as robust management and financial control frameworks; the ongoing monitoring, review and oversight of initiatives through established and ad hoc governance bodies; the adoption of a comprehensive approach to securing program authorities and funding; and third-party due diligence reviews. The stewardship measures also incorporated additional integrated risk management processes. EAP risks have been, and continue to be, monitored on an ongoing basis. Mitigation plans were developed and regular status reports were made to senior management and the Departmental Audit Committee.

Science and Technology

Canada’s record in business expenditure on R&D in Business Enterprise Research and Development (BERD) and in commercializing university research is lower than the global average. The Council of Canadian Academies’ June 2009 report entitled Innovation and Business Strategy: Why Canada Falls Short, concluded that Canada’s weak productivity performance relative to other countries over the past two decades is likely rooted in weak business innovation, of which BERD intensity is the most often-used indicator.

A strong government S&T policy agenda is essential to help bridge this productivity gap, advance leading-edge R&D, and provide value-added knowledge and expertise to enhance conditions for commercialization and innovation in Canadian industry. The Department has committed to work with the private sector, industry associations, academia and all levels of government to foster an environment that is conducive to innovation and that promotes scientific excellence and industrial competitiveness.

To ensure that federal funding is yielding maximum benefits for Canadians, a comprehensive review of federal support for R&D was announced in Budget 2010. The review will be conducted in close consultation with business leaders from all sectors and our provincial partners, and the results will be used to strengthen federal S&T and innovation policies and programs.

Information and Communications Technology

Industry Canada, through the CRC, launched program reviews to periodically evaluate the relevance and excellence of its research programs. As a result of the CRC review, we have committed to completing one program review per year, starting with photonics. The review is made up of a panel of national and international industry experts in the Information and Communications Technology (ICT) sector. Results are expected in 2010–11.

Consumer Interests

There is a constant change in where Canadian consumers shop, what they buy and how they pay for it. This change arises from globalizing supply chains and the emergence of new technologies, new products and new marketing techniques, as well as from changes in overall economic performance. To ensure that policy-makers would continue to have access to high-quality, independent and timely research on consumer issues, Industry Canada’s Office of Consumer Affairs completed a final evaluation of one of its most important policy tools, the Contributions Program for Non-profit Consumer and Voluntary Organizations. This program funds research by consumer and related organizations on public policy issues. The evaluation concluded that the Program supports the role of the federal government in the promotion of consumer interests by encouraging effective, evidence-based engagement by consumer organizations in the development of marketplace policies.

International Competitiveness

Industry Canada's strengths stem from its in-depth knowledge of Canadian industry and the specific issues that impact its ability to capitalize on international opportunities. The challenge for Industry Canada is to ensure that industry interests are represented in government policy and regulatory program decisions and to efficiently convey federal sectoral policy perspectives back to industry.

To mitigate operating risks, Industry Canada builds strategic partnerships with other government departments, other national governments, provincial and territorial governments, international organizations and industry stakeholders. The Department’s extensive industry and government network and reputation as a respected leader and contributor to the development of policies, programs and information products increase the knowledge advantage of targeted Canadian industries.

In 2009–10, Canadian industries were affected by the global recession. The Department was responsible for monitoring and assisting companies in crisis, and led the analysis of the GM and Chrysler restructuring agreements during the automotive crisis.

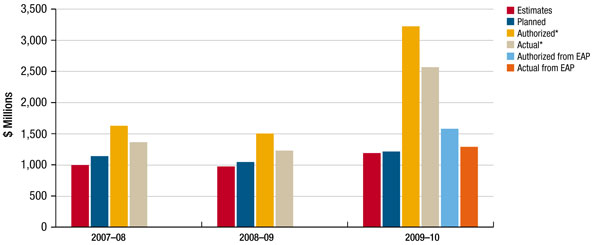

1.5 Expenditure Profile

Industry Canada’s total actual spending for 2009–10 was $2.56 billion, twice as much as 2008–09’s actual spending of $1.23 billion. Industry Canada also increased its operating budget by 8.4% in 2009–10 to a total of $459.2 million from $423.5 million in 2008–09. These increases were provided to the Department so that it would have the capacity to deliver the EAP with appropriate governance and oversight.

Departmental Spending Trends

* Authorized and Actual Spending from the EAP area also included within Authorized and Actual Spending from Industry Canada for 2009–10.

Canada’s Economic Action Plan

Industry Canada’s role in the EAP has resulted in a dramatic temporary increase of $1.5 billion in the Department’s planned spending for fiscal year 2009–10. A significant portion of those resources were used to support S&T, knowledge and innovation, which have provided short-term stimulus and will position the Canadian economy to excel in the future. This investment was channelled through initiatives such as KIP, the Institute for Quantum Computing, the Canada Foundation for Innovation, and the modernization of the laboratory facilities at Industry Canada’s CRC.

The following table highlights EAP initiatives, including their planned and actual spending, for the full year 2009–10.^

| EAP Initiatives | Total Budget | Actual Spending |

|---|---|---|

| Knowledge Infrastructure Program | 999.5 | 991.0 |

| Institute for Quantum Computing | 16.5 | 16.5 |

| Modernizing Federal Laboratories | 3.1 | 2.8 |

| Marquee Tourism Events Program | 49.6 | 48.3 |

| Community Adjustment Fund in Northern Ontario | 16.2 | 11.2 |

| Broadband Canada: Connecting Rural Canadians | 84.3 | 3.6 |

| Recreational Infrastructure Canada Program | 97.3 | 30.2 |

| Southern Ontario Development Program and Eastern Ontario Development Program | 139.7 | 58.7 |

| Canadian Youth Business Foundation | 10.0 | 10.0 |

| Canada Business Network | 5.8 | 5.7 |

| Community Adjustment Fund for Southern Ontario | 156.3 | 110.4 |

| Ivey Centre for Health Innovation and Leadership | 1.0 | 0.5 |

The following programs were EAP initiatives but did not require a formal spending authority:

- Canada Small Business Financing Program

- Federal Tourism Strategy

- Improving Canada’s Competition and Investment Frameworks

- Targeted Assistance for the Automotive Sector

Voted and Statutory Items

This table illustrates the way in which Parliament approved Industry Canada’s resources, the changes in resources derived from Supplementary Estimates and other authorities, and how funds were spent.

| Vote # or Statutory Item (S) | Truncated Vote or Statutory Wording | 2009–10 ($ millions) | |||

|---|---|---|---|---|---|

| Main Estimates |

Planned Spending |

Total Authorities^ | Actual Spending |

||

| 1 | Operating Expenditures | 320.1 | 323.8 | 497.3** | 459.2 |

| 5 | Capital Expenditures | 9.4 | 12.5 | 24.3 | 19.1 |

| 10 | Grants and Contributions | 597.0 | 615.4 | 1,621.9** | 1,165.9 |

| (S) | Minister of Industry — Salary and Motor Car Allowance | 0.1 | 0.1 | 0.1 | 0.1 |

| (S) | Canadian Intellectual Property Office Revolving Fund | (1.2) | (1.2) | 152.4 | (1.3)* |

| (S) | Liabilities under the Small Business Loans Act | 1.7 | 1.7 | 0.2 | 0.2 |

| (S) | Liabilities under the Canada Small Business Financing Act | 83.9 | 83.9 | 116.5 | 116.5 |

| (S) | Knowledge Infrastructure Program | 0.0 | 0.0 | 500.0** | 500.0 |

| (S) | Community Adjustment Fund | 0.0 | 0.0 | 116.0** | 116.0 |

| (S) | Grant to CANARIE Inc. to operate and develop the next generation of Canada’s Advanced Research Network (CAnet5) | 29.0 | 29.0 | 28.0 | 28.0 |

| (S) | Contributions to employee benefit plans | 49.4 | 49.4 | 65.5 | 65.5 |

| (S) | Spending of proceeds from the disposal of surplus Crown assets | 0.0 | 0.0 | 0.4 | 0.1 |

| (S) | Refunds of amounts credited to revenues in previous years | 0.0 | 0.0 | 0.4 | 0.4 |

| (S) | Grant to Genome Canada | 88.8 | 88.8 | 82.9 | 82.9 |

| (S) | Grant to Perimeter Institute for Theoretical Physics | 10.0 | 10.0 | 15.0 | 15.0 |

| Total Budgetary | 1,188.0 | 1,213.3 | 3,220.9 | 2,567.6 | |

| L15 | Payments pursuant to subsection 14(2) of the Department of Industry Act | 0.3 | 0.3 | 0.3 | 0.0 |

| L20 | Loans pursuant to paragraph 14(1)(a) of the Department of Industry Act | 0.5 | 0.5 | 0.5 | 0.0 |

| L97b | Advances to regional offices and employees posted abroad. Appropriation Act No. 1 1970. Limit $1.95 million (net) | 0.0 | 0.0 | 2.0 | 0.0 |

| Total Non-Budgetary | 0.8 | 0.8 | 2.8 | 0.0 | |

| Total Department | 1,188.8 | 1,214.1 | 3,223.6 | 2,567.6 | |