Common menu bar links

Breadcrumb Trail

ARCHIVED - Department of Finance Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Section II: Analysis of Program Activities by Strategic Outcome

Program Activity 1.1: Economic and Fiscal Policy Framework

This program activity is the primary source of advice and recommendations to the Minister of Finance regarding issues, policies, and programs of the Government of Canada in the areas of economic, fiscal, and social policy; federal-provincial-territorial relations; financial affairs; taxation; and international trade and finance. The work conducted in this program area involves extensive research, analysis, and consultation and collaboration with partners in both the public and private sectors. In addition, it involves the negotiation of agreements and drafting of legislation. To help develop first-rate policy and advice to ministers, the Department of Finance Canada works with the public and Canadian interest groups; departments, agencies, and Crown corporations; provincial, territorial, and Aboriginal governments; financial market participants; the international economic and finance community; and the international trade community. The aim of this program area is to support the fiscal and economic framework that generates revenue for expenditures in line with the budget plan as well as for the financial operations of the Government of Canada.

|

2008-09 Financial Resources ($ millions) |

2008-09 Human Resources (FTEs) |

||||

|---|---|---|---|---|---|

| Planned Spending |

Total Authorities |

Actual Spending |

Planned | Actual | Difference |

| 105.8 | 135.0 | 122.7 | 806 | 812 | -6 |

|

Expected Results |

Performance Indicators |

Targets |

Performance Status |

Performance Summary |

|

| Effective management of the government's fiscal plan | Annual debt reduction | Annual debt reduction of $3 billion | Target to be revised due to global economic situation | In Canada's Economic Action Plan: Budget 2009, the Government of Canada announced a set of stimulus measures designed to protect the economy from the threat of global recession. The Department took a large number of actions to support the implementation of the Action Plan, which the IMF has praised as being "appropriately large, timely, well diversified, and structured for maximum effectiveness."[6] Thanks to a strong fiscal position heading into the recession, the IMF also expects Canada's position to remain the strongest in the G8 for 2008 and 2009. | |

| Debt-to-GDP ratio | Reduce the federal debt-to-GDP ratio to 25 per cent by 2011–12 | Target to be revised due to global economic situation | |||

| Nominal growth in government program spending | Below the nominal growth in the economy on average | Target to be revised due to global economic situation | |||

| Canada has a sound, efficient, and competitive financial sector | Soundness, efficiency, and competitiveness of Canada's financial sector | Healthy, growing financial sector that serves the needs of Canadians | Met all | While the financial sector environment changed dramatically since the 2008–09 RPP and commitments originally made were overtaken by global events, the World Economic Forum recognizes the Canadian banking system as the strongest in the world. | |

| Canada has a competitive, efficient, and fair tax system | Competitiveness, efficiency, and fairness of Canada's tax system | Tax system that raises the required revenue in a manner that compares favourably to other G7 countries | Met all |

Actions taken since 2006 will reduce taxes by $220 billion

over 2008–09 and the following five fiscal years. These

actions include federal corporate income tax reductions that

will allow Canada to reach the goal of the lowest overall tax

rate on new business investment (marginal effective tax rate

or METR) in the G7 by 2010 and to have the lowest statutory

corporate income tax rate in the G7 by 2012.

For a full description of further actions taken, please see "Supporting tax relief and prudent fiscal management" below. |

|

Benefits for Canadians

A sound economic and fiscal policy framework enables the Canadian economy to perform well despite economic shocks and challenges. Moreover, sound fiscal planning is essential to the country's long-term prosperity. As a result of the severe economic downturn and the recession in the Canadian economy, there has been a significant downward revision to projected revenues and an upward revision to program expenses, particularly to Employment Insurance benefits. In response to these extraordinary events, Budget 2009 included a broad set of stimulus measures designed to protect the economy from the immediate threat of the global downturn.

Performance Analysis

Key initiatives identified in the Department of Finance Canada's 2008–09 RPP included:

Supporting prudent fiscal management and tax relief

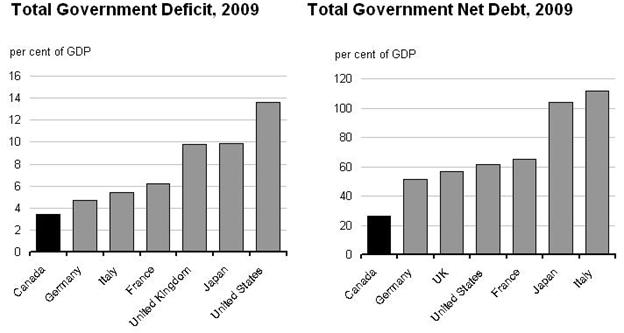

In light of the exceptional global economic circumstances, the Government of Canada is focussing on stabilizing the economy through the implementation of Budget 2009. The Government of Canada remains committed to strong fiscal management and will dedicate any surpluses to repaying the deficits that are expected over the coming years. This will help to secure Canada's solid fiscal position, which the IMF notes is the strongest among all G7 nations (see Figure 1)

Figure 1

Note: For Canada, figures include the

federal, provincial-territorial and local government sectors, as

well as the Canada Pension Plan and Qu�bec Pension Plan.

Source: IMF

To ensure that spending is sustainable in the long term, the Government of Canada committed to keeping the rate of program spending growth, on average, below the rate of growth of the economy. This was achieved for the period from 2005–06 to 2008–09, when program spending growth averaged 4.2 per cent, well below the nominal GDP growth of 5.6 per cent. In order to ensure that the government's fiscal position remains structurally sound, most new spending being undertaken in response to the economic crisis will end in 2011–12.

In 2008–09, the Department developed and provided advice and guidance to the government related to the tax measures included in Budget 2009. The tax reductions introduced in Budget 2009 are an essential part of the government's effort to stimulate the economy and to create and maintain jobs. Lower taxes help ease the financial pressure on individuals, families, and businesses and help build a solid foundation for future economic growth. The tax reductions in Budget 2009 are helping to improve the competitiveness and efficiency of the tax system, raise standards of living, and fuel job creation and investment in Canada.

Budget 2009 includes the following measures that will reduce the tax burden for Canadian families and businesses by over $20 billion in 2008–09 and the next five fiscal years:

- general personal income tax relief to allow Canadians to earn more income before paying federal income tax or being subject to higher tax rates;

- enhancements to the Working Income Tax Benefit (WITB), which effectively doubled the tax relief provided through the WITB and will further reduce the welfare wall and help ensure that low-income Canadians are financially better off as a result of getting a job;

- an increase of the Age Credit amount by $1,000 to provide tax savings to about 2.2 million seniors;

- permanent and temporary measures to help stimulate Canadian businesses, including the commitment to move ahead with the broad-based tax reductions in the federal general corporate income tax rate, the increase in the small business income limit to $500,000, the temporary 100-per-cent capital cost allowance (CCA) rate for investments in computers, and the one-year extension of the Mineral Exploration Tax Credit; and

- a temporary Home Renovation Tax Credit that will help stimulate economic activity, boost the value of Canada's housing stock, and increase energy-efficiency. Other measures to support home ownership were also introduced.

Significant progress toward a more competitive and efficient tax system was also supported by the signing in March 2009 of a Memorandum of Agreement with the Government of Ontario to harmonize the Ontario retail sales tax with the goods and services tax (GST). This agreement will assist Canadian businesses by increasing the proportion of business inputs in Canada that will no longer be subject to sales tax. During 2008–09, an amendment to the Canada–Ontario Tax Collection Agreement (TCA) was also signed to allow for the federal government to collect Ontario corporate taxes, commencing with taxation years ending after December 31, 2008. This will reduce compliance costs for businesses by allowing for a single annual tax return for both federal and Ontario corporate taxes, a single tax collector, and one set of income tax rules. Under TCAs, the Canada Revenue Agency now collects personal income taxes for all provinces and territories except Quebec and corporate income taxes for all provinces and territories except Quebec and Alberta.

The Department played a central role in ensuring the timely implementation of the Tax-Free Savings Account (TFSA) announced in Budget 2008. The TFSA allows Canadians to set money aside in eligible investment vehicles and watch those savings grow tax-free throughout their lifetimes.

The Department also assisted in the implementation of the Registered Disability Savings Plan (RDSP), which became available to Canadians in December 2008. The 2008 contribution period for RDSPs was extended to March 2, 2009, to allow more Canadians with disabilities to take advantage of the grants and bonds associated with the RDSP for 2008.

The Department continued the expansion and modernization of Canada's income tax treaty network. During the reporting period, new treaties were signed with Columbia and Greece, Canadian government approval was secured for the signature of a number of other treaties, and negotiations were held with a number of other countries on new or revised income tax treaties.[7] Finally, Canada's goal of entering into international Tax Information Exchange Agreements was advanced with formal negotiations being held with a number of jurisdictions, and informal discussions with a number of others.

Supporting provinces and territories

In response to unsustainable growth in the Equalization Program, the Government of Canada took action to bring the program in line with a three-year moving average of nominal GDP growth. This will help to ensure stability and predictability for both orders of government while still being responsive to changes in economic conditions. Changes to the program were announced in November 2008 to provide certainty to provinces[8] and were included in Budget 2009.[9] These changes will be reflected in payments for 2009–10.

The Budget Implementation Act, 2009 also included action to ensure fairness for all provinces under the CHT by ensuring that all Equalization-receiving provinces, including Ontario, would receive equal per capita cash support, thereby addressing a technical anomaly in the calculation of the CHT. Equal per capita cash support was legislated for 2009–10 and 2010–11 through a special payment to Ontario, after which the fairness provision will be addressed within the CHT funding envelope. Overall support for the CHT and the Canada Social Transfer (CST) will continue to grow at 6 per cent and 3 per cent respectively, as per commitments made under the 10-Year Plan to Strengthen Health Care and Budget 2007. (See also Program Activity 1.2.)

In preparation for the next renewal of the fiscal arrangements, which are currently legislated until 2013–14, focus has been put on enhancing research capacity and working with provinces and territories on technical issues aimed at improving the efficiency, equity, accuracy, and transparency of major federal transfers.

In addition to the ongoing, sound administration of Territorial Formula Financing, the Department is also supporting the government's Northern Strategy[10] and supporting and advising on mechanisms to facilitate the negotiation and implementation of Aboriginal specific claims agreements.

Supporting work, innovation, and skills

The Department worked closely with other departments to help ensure the timely and effective implementation of Budget 2008 initiatives such as the modernization of the system of student financial assistance, the rollout of the new labour market training program, improvements to the immigration system and the Temporary Foreign Worker Program and those promoting the labour market participation of older workers.

Significant investments to support workers affected by the global slowdown and to create opportunities for workers through skills development were also made through Budget 2009. Specifically, the Canada Skills and Transition Strategy includes $6.3 billion over two years to strengthen benefits for Canadian workers, enhance the availability of training and maintain low Employment Insurance premium rates. These measures reflect a balance between the need to provide immediate assistance to support workers affected by the economic slowdown and to ensure that they are able to take advantage of the emerging economic opportunities over the longer term.

Finally, the Department will continue to work with Industry Canada on implementing Canada's science and technology strategy, Mobilizing Science and Technology to Canada's Advantage. Additional resources were provided in Budget 2009 in support of knowledge infrastructure, research, people, and commercialization.

Supporting the financial system

Since the 2008–09 RPP was issued, the financial sector environment changed dramatically. The initial departmental plan primarily was to review the causes of the credit market turbulence that started in 2007 and to extend initiatives from the government's Capital Markets Plan announced a year earlier. This plan was entirely overtaken by events occurring during 2008–09.

In light of the financial market turbulence that was experienced in 2007–08, the Department supported initial action by the government in mid-2008 to modernize the authorities of the Bank of Canada and to implement new rules for government-guaranteed mortgages aimed at protecting and strengthening the Canadian housing market. Following the dramatic worsening of the crisis in the fall and winter of 2008–09, the Department, in conjunction with a large group of partner federal organizations,[11] supported significant action by the government to improve access to financing and reinforce Canada's financial system. These measures were contained in the Fall 2008 Economic and Fiscal Statement[12] and Budget 2009.[13]

Action taken in the fall of 2008 on access to financing was focussed on supporting Canada's financial institutions, most notably through creation of the Insured Mortgage Purchase Program (IMPP). The IMPP, managed by the Canada Mortgage and Housing Corporation, provided over $55 billion in term financing to banks by the end of 2008–09 supporting their ongoing lending activity. This was done at no additional risk to the taxpayer and generated a positive financial return for the government. In addition, the Canadian Lenders Assurance Facility (CLAF) and the Canadian Life Insurers Assurance Facility (CLIAF) were launched to provide insurance on the wholesale term borrowing of federally regulated deposit-taking institutions and life insurers. The CLAF and CLIAF was not used in 2008–09 but nonetheless provided confidence that domestic financial institutions could, if needed, access global credit markets on a competitive basis with government-supported foreign financial institutions.

For Budget 2009, the Department developed the $200 billion Extraordinary Financing Framework (EFF),[14] which embraced new and existing initiatives supporting access to financing for Canadian households and businesses and provided an immediate and effective response to alleviate the impact of the global financial market turmoil on Canada. The EFF increased the availability of financing support for businesses and addressed disruptions in securitization markets. To help manage the EFF, the Department helped to establish and support an external Advisory Committee on Financing.

The Budget Implementation Act passed in March 2009 contained legislative initiatives to strengthen Canada's financial system and modernize the regulatory framework going forward. To reinforce financial stability, the Canada Deposit Insurance Corporation (CDIC) was provided with more flexible and up-to-date regulatory tools for dealing with weak or failing institutions in Canada, the authority of the Minister of Finance was broadened to promote financial stability and maintain efficient and well-functioning markets, and the government was provided with standby authority to inject capital into federally regulated financial institutions to support financial stability. To modernize the regulatory framework, the Department took steps in 2008–09 to develop transparency-enhancing measures for credit cards and mortgage insurance.

Throughout the winter of 2009, the Department played a key role in international efforts to address the financial crisis by taking on a leadership role in the G20, including co-chairing the Working Group on Enhancing Sound Regulation and Strengthening Transparency. Recommendations for financial sector reform developed by this working group were broadly supported by G20 leaders at the London Summit in April 2009.

For federally regulated pension plans, the Department supported temporary solvency funding relief in respect of serious solvency deficiencies that emerged as a result of the financial market turmoil in 2008. The relief, announced in the 2008 Economic and Fiscal Statement, allowed plans to extend their solvency amortization period to 10 years from 5, subject to certain conditions. In order to assist the Office of the Superintendent of Financial Institutions (OSFI) in providing further pension funding flexibility, in Budget 2009, the Department supported plan member protection by taking steps to make the amount of any deferral of funding that results from use of an asset valued in excess of 110 per cent, as allowed by OSFI, subject to a deemed trust. In addition, in January 2009, the Department initiated public consultations on the legislative and regulatory framework for pension plans subject to the Pension Benefits Standards Act, 1985.

In the area of anti-money laundering and anti-terrorist financing, the Department continued to take steps to address deficiencies identified in the Financial Action Task Force's (FATF) mutual evaluation report on Canada and to address areas of domestic risk. This included the coming into force of new legislative and regulatory measures, greater collaboration and development of innovative solutions with public and private sector partners, and new tools to enhance the policy development process. Canada reported on these measures at the FATF meeting in February 2009 and continued to actively contribute to the work of the FATF in strengthening its standards and their global implementation, including at FATF-style regional bodies such as the Asia/Pacific Group on Money Laundering and the Caribbean Financial Action Task Force.

Supporting business competition, trade, and foreign investment

The Department worked to develop measures to maintain access to affordable credit for Canadian businesses. For example, the 2008 Economic and Fiscal Statement[15] included additional resources for the Business Development Bank of Canada to increase its term lending and develop a new time-limited guarantee facility for financial institutions for their lines of credit for viable small- and medium-sized firms. Also, the Department worked to expand the mandate of Export Development Canada (EDC) to allow it to provide financing and insurance in the domestic market. EDC's domestic activities will be available in collaboration with other financial institutions to creditworthy companies. EDC's new powers in the domestic market will be in place for two years.

The global crisis created a severe shortage in the availability of trade financing in developing economies. The Department responded by working with World Bank officials by participating in the Global Trade Liquidity Program (GTLP)—a new facility aimed at increasing the amount of liquidity available for trade financing in developing countries.[16] Preparatory work at the end of 2008–09 culminated with an announcement on April 2, 2009, that Canada would contribute US$200 million to the GTLP. This in turn is expected to generate up to US$2 billion in trade financing over two years.

In support of Canada's trade liberalization strategy, the Department led the negotiations that concluded free trade agreements with Colombia and Peru and developed implementing legislation for the Canada–European Free Trade Association Trade Agreement.

Domestically, the Department contributed to the elimination of tariffs on a range of machinery and equipment in Budget 2009, which will lower costs for Canadian businesses importing specialized equipment from overseas to modernize their operations. The Department also continued to provide tariff relief in support of Canadian industry through statutory authorities under the Customs Tariff and the approval of seven orders-in-council providing duty relief to Canadian companies.

The Department also contributed to the efforts of the G7, the G20, and the WTO in establishing international commitments to resist protectionist actions that could hinder global economic recovery. In the same vein, the Department supported the initiatives of a number of international bodies (including the WTO and the Organization for Economic Co-operation and Development) to monitor and report on trade measures during the economic downturn.

In 2008–09, the Department contributed to a number of measures in support of debt management capacity building in low-income countries. This is an area of systemic weakness in many poor debtor countries, and over 70 per cent of these countries face a medium or high risk of debt distress. As a result of Canada's advocacy of the importance of building debt management capacity to groups such as the G7, G20, IMF, and the World Bank, the World Bank initiated talks with Canada on establishing a new Debt Management Facility (DMF) for Low-Income Countries.[17]

The DMF, officially launched in November 2008, will assess debtor countries' current level of capacity, create a technical assistance program to address any weaknesses highlighted in the assessment, and help the debtor countries formulate and implement a medium-term debt strategy. Canada has played a strong leadership role in guiding the DMF's creation and implementation and will hold a seat on its Steering Committee for the next two years. This will help to ensure that priority issues of the Government of Canada are addressed, such as ensuring that countries that have benefited from substantial debt relief have the means necessary to maintain their debt levels at sustainable levels.

Implementation of improvements to Canada's competition and investment laws and policies were included in Budget 2009. These changes, which were based on the recommendations of the Competition Policy Review Panel, will help to better protect consumers and encourage new foreign investments while ensuring these investments do not jeopardize national security.

Budget 2009 included targeted support for traditional industries such as automobile manufacturing, forestry, shipbuilding, and tourism to help these industries invest in their long-term success and create new opportunities and jobs for Canadians in all areas of the country.

In 2008–09, the Department continued to contribute to the government-wide Paperwork Burden Reduction Initiative.[18] On March 20, 2009, the Government of Canada announced that the goal of a 20 per cent reduction in the federal paperwork burden on Canadian small businesses had been successfully met.

Environment and infrastructure

Budget 2009 contained a number of funding initiatives in support of the environment and infrastructure, including the following:

- green infrastructure projects, energy-saving home retrofits, and the remediation of federal contaminated sites;

- a new Clean Energy Fund that supports clean energy research, development, and demonstration projects;

- resources to accelerate and enhance infrastructure projects that support the government's long-term infrastructure agenda and provide a stimulus to the Canadian economy;

- the establishment of PPP Canada Inc., a Crown corporation that will spearhead federal efforts to promote the use of public-private partnerships in Canada; and

- the Home Renovation Tax Credit that is providing temporary support for eligible home renovation expenditures, including those that increase energy efficiency.

In 2008–09, pursuant to a commitment in Budget 2009, the Department launched consultations on the potential extension of accelerated capital cost allowance to assets used in carbon capture and storage.

Provide support for advisory panels

Throughout 2008, the Department supported to the work of the Advisory Panel on Canada's System of International Taxation, including administrative support to ensure the effective functioning of the Panel and its secretariat, and responded to requests from the Panel for information. The Panel released its final report on December 10, 2008. In Budget 2009, the government indicated that it would study and respond to the Panel's report in due course and determine which consultations would be held. At the same time, the government took action to address certain issues that arose in the context of the Advisory Panel's report and merited a more immediate response.

An agreement was reached between the federal government and the Government of Nova Scotia to work together to implement the recommendations of the independent Crown Share Panel for past Crown Share Adjustment Payments, which would enable the calculation of Crown Share Adjustment Payments for future years. To this end, the government provided Nova Scotia with a payment of $234.4 million covering the period up to the end of 2007–08, and the Department is working with Natural Resources Canada and officials from the Government of Nova Scotia to develop regulations with respect to the Crown Share Adjustment Payments.[19]

On January 12, 2009, the Expert Panel on Securities Regulation released its final report, Creating an Advantage in Global Capital Markets, and a draft securities act. In Budget 2009, the government committed to move forward quickly with willing provinces and territories on a Canadian Securities Regulator on the basis of the Expert Panel's report. The Department supported this commitment by preparing for the establishment of the Transition Office,[20] which will be responsible for developing a transition plan and leading the transition to a Canadian Securities Regulator. The Budget Implementation Act provided the legal authority and mandate to set up the Transition Office.

Tax treatment agreements and treaties with Aboriginal governments

The Department works with Aboriginal governments to negotiate tax treatment agreements and the tax-related content of land claim, self-government, and modern treaty agreements. During 2008–09, negotiations were completed for treaty agreements and tax treatment agreements with two Aboriginal governments in British Columbia.[21]

Lessons Learned

Uncertainty of forecasting

To ensure objectivity and transparency, the economic forecast used to develop the Government of Canada's fiscal projections is based on an average of private sector economic forecasts. This process has been followed for over a decade, and the government continues to maintain this approach. However, given the considerable uncertainty about the future course of the economy, compounded by uncertainty about commodity prices and how they affect nominal income growth in Canada, Budget 2009 adjusted downward the private sector forecast for nominal GDP for budget planning assumptions. Further, in the June 2009 Report to Canadians,[22] the government, following a new survey of private sector economists, revised down the projections of nominal income growth. The government will continue to monitor economic developments with a view to providing an update to Canadians in the fall.

Sound structural policies

The severe financial market turmoil has taught important lessons to governments around the world about the composition, behaviour, and regulation of the financial sector. While the Canadian financial system has been among the most resilient in the world, there are a number of important areas where further action is warranted. The agenda for action is expected to require significant departmental resource commitments over at least the next two years.

Given the scale of the disruption and the economic consequence, measures taken to support access to financing will need to be sustained for a period of time in 2009–10, after which time the Department will need to work with the private sector to redevelop well-functioning markets and identify effective exit strategies.

A key role for the Department going forward will be to continue supporting the development and legislative implementation of a Canadian Securities Regulator, which will help to address financial stability risks. In addition, departmental action needs to be taken, in conjunction with partner agencies, to review the regulatory framework to better monitor and address systemic risks; to ensure the degree of oversight—for systemically important institutions and markets or instruments—is sufficient and the type of regulation applied is appropriate; and to strengthen other regulatory standards. This work will likely require legislative and regulatory initiatives by the Department to ensure the framework and regulatory tools in Canada remain at the leading edge of global practices.

Evidently, international coordination and surveillance were inadequate and did not provide an effective defence against excessive risk taking by financial institutions; therefore, there is a need for the Department to continue to play a leadership role in coordinated international efforts to help prevent future crises.

Based on input received from recently completed consultations, the Department plans to propose changes to the regulatory framework in 2009–10 to address the ongoing challenges facing federally regulated pension plans.

Supporting business competition, trade, and foreign investment

The urgency to quickly address the needs of business to access financing, new markets, and tariff relief on inputs was accentuated by following the global economic crisis.

Transfer payment programs

Transparency continues to be a priority to ensure accountability with respect to the transfer payment programs. The expectations of provinces, territories, and other parties (including academics) for more extensive consultations were not always met. Enhanced transparency, consultation, and engagement with respect to federal transfers are areas of focus for the Department in 2009–10. (See also PA 1.2 for additional information on transfer payments.)

Importance of setting objectives for tax policy

Establishing and communicating objectives for tax policy, to encourage collaboration and consensus among the different parties involved, is an important goal.

For example, to strengthen Canada's business tax advantage, in recent years the federal government has proposed the general elimination of capital taxes at both the federal and provincial levels of government—a move toward the goal of a 25-per-cent combined federal-provincial corporate statutory income tax rate and the creation of a fully modernized and efficient consumption tax system in Canada. Leadership in the setting of these national tax policy objectives has encouraged and facilitated discussions and collaboration among tax authorities across Canada, which are helping to improve Canada's overall tax efficiency, international competitiveness, and economic growth. This recent experience shows the importance of setting policy objectives for fostering collaboration among governments, with the ultimate goal of improving Canadians' living standards.

Managing ongoing workload arising from new policy initiatives

In 2008–09, the Department invested significant resources to design and implement new tax measures, such as the Registered Disability Savings Plan (RDSP), and to negotiate Tax Information Exchange Agreements with other countries. In addition, Budget 2009 contains several major initiatives under the Extraordinary Financing Framework (EFF) that give rise to substantial financial positions or contingent liabilities for the government that must be prudently managed and accounted for.

While the Department has managed to re-prioritize workload to ensure the initial policy development and design work is completed, these initiatives also generate ongoing workload, which has increased with the volume of new measures, particularly in the area of taxation. This will require the dedication of increased resources over the coming year.

Looking forward, other new initiatives may need to be developed to respond to the evolving financial market circumstances and to possible decisions by additional provinces to harmonize their retail sales taxes with the GST, which will also require additional resources. This includes further engagement in coordinated international efforts to address the financial crisis and help prevent future crises as well as various legislative and regulatory initiatives to ensure the framework and regulatory tools in Canada remain at the leading edge of global practices.

Program Activity 1.2: Transfer and

Taxation

Payment Programs

This program activity administers transfer and taxation payments to provinces, territories, and Aboriginal governments. Payments are made in accordance with legislation and negotiated agreements to enable Canadian provinces and territories to provide their residents with public services and to support Aboriginal self-government. This program activity also covers commitments and agreements with international financial institutions aimed at aiding the economic advancement of developing countries. These commitments can result in payments, generally statutory transfer payments, to a variety of recipients, including individuals, organizations, and other levels of government.

|

2008-09 Financial Resources ($ millions) |

2008-09 Human Resources (FTEs) |

||||

|---|---|---|---|---|---|

| Planned Spending |

Total Authorities |

Actual Spending |

Planned | Actual | Difference |

| 46,023.8 | 48,758.3 | 48,601.5 | 0 | 0 | 0 |

|

Expected Results |

Performance Indicators |

Targets |

Performance Status |

Performance Summary |

|

| Payments to support Canadian provinces and territories in providing their residents with public services in areas of shared national priority and payments to international organizations to help promote of economic advancement of developing countries | Payments are made on time and according to levels and formulas set out in legislation and are audited by the Office of the Auditor General of Canada (OAG). | 100 per cent | Met all |

The transfer and taxation payments to Canadian provinces,

territories, and Aboriginal governments were all made on time

and according to levels and formulas set out in legislation

or tax agreements.

The OAG conducted a preliminary audit in March 2009 and did not report fault with the transfer payments system. The OAG annually audits the tax payments and did not report any material errors. |

|

Benefits for Canadians

The Department's work in 2008–09 to ensure the continued delivery of timely transfer payments to the provinces and territories—such as Equalization, Territorial Formula Financing, the Canada Health Transfer (CHT), and the Canada Social Transfer—helped to support the provision of public services, universally accessible health care services, post-secondary education, social programs, and other targeted areas.

During 2008–09, the Department effectively administered tax collection agreements with the provinces and territories, and tax administration agreements with Aboriginal governments, making accurate and timely payments. Tax collection agreements with provinces and territories allow the federal government to streamline service and reduce administrative costs by having a single tax form and a single tax collector. To support Aboriginal self-government, tax administration agreements with Aboriginal governments allow the federal government to vacate a negotiated portion of its GST and personal income tax room, to share it with Aboriginal governments, and to administer Aboriginal tax regimes.

Performance Analysis

Key initiatives identified in the Department of Finance Canada's 2008–09 RPP included:

Implementation of new fiscal arrangements

In 2008–09, the Department focussed on implementing the new fiscal arrangements flowing from Budget 2007 through the adoption of the required regulatory amendments, ensuring timely and accurate payments to provincial and territorial governments, consistent with the government's commitments and policy objectives. Adjustments were made to the formula for the CHT and for Equalization to ensure fairness for all provinces involved in the CHT and the continued sustainability and affordability of the Equalization program. These new arrangements were included in the Budget Implementation Act, 2009.

Tax collection agreements with provincial and territorial governments

The Department administers tax collection agreements for personal income tax with all provinces and territories (except Quebec) and for corporate income tax with all provinces and territories (except Alberta and Quebec). During 2008–09, an amendment to the Canada–Ontario TCA was signed to allow for the federal government to collect Ontario corporate taxes.

In addition to making timely and accurate payments to provinces and territories under the tax collection agreements, the Department reviewed provincial income tax changes for the purposes of federal administration under the agreements.

Comprehensive Integrated Tax Co-ordination Agreements with provincial governments

The Department also continued to effectively manage the terms of the Comprehensive Integrated Tax Co-ordination Agreements with Newfoundland and Labrador, Nova Scotia, and New Brunswick, including the provision of the estimates under Annex A of the agreements, which ensures that each province receives its share of the revenues assessed under the GST/Harmonized Sales Tax (HST).

Tax administration agreements with Aboriginal governments

During 2008–09, new administration agreements for the First Nations goods and services tax (FNGST) were concluded and signed with four Aboriginal governments in western Canada.[23]

Revenue Allocation Framework under the Comprehensive Integrated Tax Co-ordination Agreements

In 2008–09, the Department continued to work with officials in the three Atlantic provinces covered by the Revenue Allocation Framework to ensure that all parties to the agreements receive their revenue from the HST in an efficient and effective manner.

Payments to provincial and territorial governments, international financial organizations, and Canadian creditors

In 2008–09, Canada made all transfer payments to provincial and territorial governments on time. It also made debt-relief payments on time. These payments help poor countries achieve debt sustainability. The Department also provided timely payments to a number of international financial organizations. For instance, Canada proceeded with the scheduled encashment of promissory notes for the European Bank for Reconstruction and Development (EBRD) under the institution's last capital increase in 1998. This additional capital helps the EBRD better respond to the significant financing needs of its regional countries during the global economic crisis.

The Department's efforts in administering Canada's international financial commitments and various related transfer payments helped to reduce the debt load of developing countries, provide grants to the world's poorest countries to support poverty reduction and economic growth, and foster a transition toward open, market-oriented economies.

Lessons Learned

Transfer payment programs

Because many of the major transfer programs to provinces and territories use economic and fiscal data in their formulas, transfer programs are not immune to the impact of global and national economic volatility. In this context, the Department's initiative to provide Equalization payment information for 2009–10 well in advance of the legislated release date allowed for provinces to better plan their 2009–10 budgets. In the coming years, in addition to work to improve transparency and provincial-territorial engagement (see PA 1.1), the Department will work to ensure the accuracy, efficiency, and predictability of federal transfers in preparation for the next renewal of the fiscal arrangements (currently legislated until 2013–14).

The Department will continue to strive to maintain its target of 100 per cent in terms of accurate and on-time transfer of funds to provinces and territories. It will also work to improve the models used in the computation of transfer payments to respond to information requests in a more timely and transparent manner.

Equalization payments

Changes to the transfer programs announced in Budget 2007 as well as the changes to the Equalization program announced in 2008–09 may have simplified the calculation of payments in many respects but have added a layer of complexity to the computation of some of the transfer payment programs. The Department will continue to strive to maintain its target of 100 per cent in terms of the accuracy and timeliness of the transfer of funds to provinces and territories and will work to improve models to allow the Department to be able to respond to information requests on the computation of transfer payments in a more timely and transparent manner.

Multilateral Debt Relief Initiative

Canada makes payments to the International Development Association (IDA) of the World Bank and the African Development Fund (AfDF) to cover its share of the Multilateral Debt Relief Initiative (MDRI). To further strengthen the commitment to IDA and the AfDF, Canada resubmitted new Instruments of Commitment to the institutions with an accelerated payment schedule and accordingly made a payment of $107.84 million to the AfDF and $41.44 million to IDA to cover our share of the costs of the MDRI.

The current payment vehicle for Canada's MDRI contributions is not conducive for this type of payment as it does not effectively secure funds for this Initiative. Going forward, the Department will examine ways to make the payment vehicle better suited to the specific parameters governing Canada's commitment to the MDRI.

Debt payments to Canadian creditors (bilateral debt relief)

Slight variations between planned and actual spending are attributable almost exclusively to certain countries failing to meet the requirements of their IMF programs, which led to a delay in debt forgiveness for these countries. A small amount of the variance is due to interest rate and currency fluctuations, which could not be anticipated.

Program Activity 1.3: Treasury and Financial Affairs

Canada's debt and reserves management activities include the funding of government operations, which involves the payment of debt service costs and investments in financial assets that are needed to maintain a prudent liquidity position. This program activity supports the ongoing refinancing of government debt coming to maturity, the execution of the budget plan, and other financial operations of the government, including governance of the borrowing activities of major government-backed entities such as Crown corporations. The program area also includes oversight of the system of circulating Canadian currency (banknotes and coins) to meet the needs of the economy.

|

2008-09 Financial Resources ($ millions) |

2008-09 Human Resources (FTEs) |

||||

|---|---|---|---|---|---|

| Planned Spending |

Total Authorities |

Actual Spending |

Planned | Actual | Difference |

| 33,830.0 | 162,075.8 | 162,075.8 | 29 | 24 | 5 |

|

Expected Results |

Performance Indicators |

Targets |

Performance Status |

PerformanceSummary | |

| Prudent and cost-effective management of the government's treasury activities and financial affairs | Public debt structure | 60 per cent fixed-rate debt | Met all | As a result of the rapid increase in issuance levels stemming from the need to fund the Insured Mortgage Purchase Program and other measures—planned to be achieved through a relatively higher proportion of short-term debt—the fixed-rate share of the debt fell to 57 per cent in 2008–09. | |

| Measures of market performance | Well-bid and well-covered auctions | Met all | All bill and bond operations were fully covered and raised their allocated amount of funding. | ||

| Market consultation | Positive feedback from market participants on initiatives | Met all | A series of consultations were undertaken. Views expressed by market participants were taken into consideration in the development of the debt management strategy. | ||

Benefits for Canadians

Managing public debt effectively helps keep public debt costs low and financial markets functioning well. Fiscal savings from debt management better positions Canada to weather economic storms and improves intergenerational equity by ensuring that future generations do not have to pay for the benefits received by their predecessors. In 2008–09, fiscal savings from previous years helped to fund the stimulus initiatives contained in Budget 2009.

Performance Analysis

The general objectives of meeting the operational needs of the government and the Crowns operational needs, maintaining a prudent financial position, conducting effective operations, and sustaining a well-functioning Government of Canada securities market were maintained in 2008–09. However, as a result of the dramatic changes in the economic outlook and fiscal plan during the year, the Department was required to address major strategic and operational challenges in managing the Treasury and Financial Affairs program activity.

To meet the fiscal needs stemming from measures to support access to credit and from higher government spending, the Department, in conjunction with the Bank of Canada, substantially increased the size of the federal borrowing program. The bond program was increased by 114 per cent, from $35 billion in 2007–08 to $75 billion in 2008–09, while the Treasury bill stock was increased by $79 billion to $196 billion. Despite the increase, all operations were conducted successfully, with strong bidding at auctions. The Department also worked closely with the Crown corporations that supported EFF initiatives to ensure that their funding requirements were effectively met.[24]

The Department provided advice to the Minister on his responsibilities for the effective functioning of the domestic currency system, which primarily involve the production of counterfeit-resistant banknotes by the Bank of Canada and the cost-efficient production of circulating coinage by the Royal Canadian Mint. In 2008–09, new banknote designs were reviewed and further analysis was undertaken on the coinage system.

Lessons Learned

The strategic and operational challenges faced in 2008–09 underlined the value of the Department's past efforts to maintain diversified, flexible borrowing programs and consolidate the borrowings of most of the financial Crown corporations.

Looking forward, the measures in Budget 2009 will require a continued increase in federal borrowing in 2009–10. This increase is planned to be met through measures announced in Budget 2009 under Annex 4 "Debt Management Strategy 2009–2010."[25] However, the timing and amount of financial requirements is expected to be variable and depend in part on the degree and pace of private market recovery. To support a well-functioning market in Government of Canada securities through transparency and predictability regarding borrowing operations, updates to the Debt Strategy will be published periodically and consultations with market participants will be undertaken as required.

More generally, the Department will also need to continue to advise the Minister on prudent and cost-effective management of a growing debt stock, the management of the foreign reserve portfolio, and means to enhance the currency system.