Common menu bar links

Breadcrumb Trail

ARCHIVED - Financial Transactions and Reports Analysis Centre of Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Director's Message

This is the first year that I have the honour of reporting on FINTRAC’s plans and priorities since being named the Centre’s director in March 2008.

The last year has brought change for FINTRAC. Most notably, it has been a year of legislative change with the continued effects of the 2006 Parliament’s amendments to the Proceeds of Crime (Money Laundering) and Terrorist Financing Act. Many of the amendments came into force in 2008, and the last will take effect in 2009. These changes, both legislative and operational, have strengthened the detection and deterrence of money laundering and terrorist activity financing in Canada. The number of organizations that are subject to compliance obligations under the Act has increased; the scope of the intelligence FINTRAC is able to provide its partners has also been expanded. As well, improvements were made to FINTRAC’s production and disclosure of financial intelligence. We are now more efficient and able to produce intelligence that is timelier and more relevant to our partners.

Even as we adapt to our new powers, the world is shifting and changing around us, which means that FINTRAC will need to shift and change as well. We will need to keep pace with the adaptations criminals make to conceal proceeds of crime and with the clandestine efforts of those engaged in terrorist activity financing.

The challenge in the year ahead is for FINTRAC to become more engaged with our partners whose investigative work can and does benefit from the product that we provide. FINTRAC needs to know more about how our intelligence is employed – when it is of most value, and what investigative leads we have brought to light. We will also keep an eye on where our partners are headed and what priorities they set for themselves, and we will recognize opportunities to help them succeed.

As we look ahead, I expect that FINTRAC will assist more investigations than in any year in our past. As an agency that works behind the scenes, the true measure of our success will always be the assistance that we are able to offer those investigating these serious crimes, helping them connect the money to the crime.

____________________________________

Jeanne M. Flemming

Director

SECTION I - OVERVIEW

Raison d'Être

The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC), Canada's financial intelligence unit, was created in 2000. It is an independent agency, reporting to the Minister of Finance, who is accountable to Parliament for the activities of the Centre. It was established and operates within the ambit of the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) and its Regulations.

The Centre's mandate is to facilitate the detection, prevention and deterrence of money laundering, terrorist activity financing and other threats to the security of Canada by collecting, analyzing, assessing and disclosing financial information.

FINTRAC is one of several domestic partners in Canada's Anti-Money Laundering and Anti-Terrorist Financing (AML/ATF) Initiative, which also includes the Department of Finance as the policy lead, the Royal Canadian Mounted Police (RCMP), the Canadian Security and Intelligence Service (CSIS), the Canada Revenue Agency (CRA), the Canada Border Services Agency (CBSA), the Office of the Superintendant of Financial Institutions (OSFI), the Public Prosecution Service of Canada, Communications Security Establishment Canada, the Department of Justice, Public Safety Canada and the private sector. FINTRAC is also part of the Egmont Group, an international network of financial intelligence units that collaborate to combat money laundering and terrorist activity financing.

FINTRAC's Responsibilities

FINTRAC is Canada's financial intelligence unit, and is a specialized agency created to collect, analyze and disclose financial information and intelligence on suspected money laundering, terrorist activity financing and other threats to the security of Canada.

FINTRAC's mandate is to facilitate the detection, prevention and deterrence of money laundering, terrorist activity financing and other threats to the security of Canada by gathering and analyzing information on suspect financial activities; ensuring those subject to the PCMLTFA comply with reporting, record keeping and other obligations; and making case disclosures of financial intelligence to the appropriate law enforcement agency, CSIS, or other agencies designated by legislation in support of investigations and prosecutions. FINTRAC's mandate also includes enhancing public awareness and understanding of matters related to money laundering. These activities are conducted while ensuring the protection of the personal information under FINTRAC's control.

FINTRAC's headquarters are located in Ottawa, and three regional offices in Montreal, Toronto and Vancouver have specific mandates related to compliance with the Act.

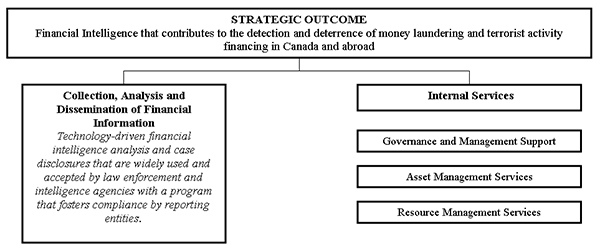

Strategic Outcome

To effectively pursue its mandate, FINTRAC aims to achieve the following strategic outcome:

Financial intelligence that contributes to the detection and deterrence of money laundering and terrorist activity financing in Canada and abroad.

Program Activity Architecture

Summary Information

|

2009-2010 |

2010-2011 |

2011-2012 |

|---|---|---|

|

50.2 |

48.5 |

31.7 |

For the years 2011-2012, a reinstatement of resources for $16.2M, which represent resources for FINTRAC's anti-money laundering / anti-terrorist activity financing initiative, is contingent upon approval of evaluation of the AML/ATF Regime.

More information on this horizontal initiative can be found at: http://www.tbs-sct.gc.ca/est-pre/estime.asp

|

2009-2010 |

2010-2011 |

2011-2012 |

|

313 |

315 |

315 |

For the years 2011-2012, the number of FTEs remains stable, contingent on the above-mentioned reinstatement of funds upon approval of the evaluation of the AML/ATF Regime.

|

Program Activity1 |

Forecast Spending |

Planned Spending |

|||

|---|---|---|---|---|---|

|

2010-2011 |

2011-2012 |

2012-2013 |

Alignment to Government |

||

|

Collection, Analysis and Dissemination of Financial Information2 |

50.2 |

48.5 |

31.7 |

31.7 |

Safe and Secure Communities |

|

Total: |

50.23 |

48.5 |

31.74 |

31.7 |

|

Departmental Plans and Priorities

In 2008-2009, FINTRAC developed a new three-year Strategic Plan (2009-2012) that takes into account the challenges inherent to its business lines, the recommendations stemming from the various reviews that have taken place in the previous fiscal years, the risks identified in its corporate risk profile and consultations with domestic partners, selected international counterparts and employees of the Centre. This exercise helped in shaping the Centre’s change agenda. FINTRAC, as a maturing organization, is now able to re-focus its activities to better align its products to the needs of its key domestic partners.

For 2009-2010, FINTRAC’s main activities remain unchanged as they continue to address the Centre’s commitments. New priorities will contribute to these activities, as FINTRAC finalizes the development and implementation of the initiatives that expand its program to meet the legislative requirements set out in the 2006 changes to the PCMLTFA.

FINTRAC is facing the challenge of integrating new regulatory and enforcement requirements into its program activities, which include the Money Services Businesses (MSB) Registry and the Administrative Monetary Penalties (AMPs) Program.

In 2007, FINTRAC completed the Treasury Board-mandated Strategic Review exercise. This exercise was aimed at identifying areas where resources can be streamlined in order to attain the best value for money. Following recommendations from the Review, FINTRAC will invest more effort in both the compliance and strategic financial intelligence activity areas in the planning period. Resources will be reallocated to the compliance activities, specifically to increase the number of compliance examinations that are conducted and to improve feedback to reporting entities with obligations under the PCMLTFA. More resources will also be directed to the strategic analysis function. This will better support tactical analysis and will assist in providing key partners and policy-makers with FINTRAC’s unique perspective on trends and typologies relating to money laundering and terrorist activity financing. Ultimately, investment in these functions will further enhance the quality of FINTRAC’s case disclosures to partners. FINTRAC will report on the efficiencies created by this reinvestment in its 2009-2010 Departmental Performance Report.

Priorities over the Next Three Years

|

Operational Priorities |

Type |

Links to Strategic Outcome(s) |

Description |

|---|---|---|---|

|

Align our financial intelligence products more closely with our key partners' needs and identify emerging money laundering and terrorist financing trends. |

New |

This priority contributes to FINTRAC's strategic outcome Financial intelligence that contributes to the detection and deterrence of money laundering and terrorist activity financing in Canada and abroad. |

Why this is a priority: FINTRAC provides financial intelligence to its partners. Investigations, prosecutions, and restraint and forfeiture of proceeds of crime are outside of FINTRAC's mandate, but constitute the desired end-result of the AML/ATF regime. More resources will be directed to the analysis function: this will better support tactical analysis and will assist in providing partners and policy-makers with FINTRAC's unique perspective on trends and typologies relating to money laundering and terrorist activity financing. Investment in these functions will further enhance the quality of FINTRAC's case disclosures to partners. Plans for meeting the priority:

|

|

Pursue policy and legislative opportunities to strengthen the AML/ATF regime. |

New |

This priority contributes to FINTRAC's strategic outcome Financial intelligence that contributes to the detection and deterrence of money laundering and terrorist activity financing in Canada and abroad. |

Why this is a priority: Identification of gaps and possible improvements to the regime will ensure FINTRAC's efficiency and effectiveness. Plans for meeting the priority:

|

|

Refine our risk-based compliance program and fully implement the new legislative requirements |

New |

This priority contributes to FINTRAC's strategic outcome Financial intelligence that contributes to the detection and deterrence of money laundering and terrorist activity financing in Canada and abroad. |

Why this is a priority: FINTRAC's compliance program plays a dual role in the AML/ATF regime. First, it ensures that FINTRAC receives the financial information it needs to analyze and disclose on cases of suspected money laundering and terrorist financing. The compliance program also serves as a deterrent for those who would attempt to use Canada's financial systems for money laundering or terrorism financing purposes. The risk-based compliance program and the implementation of the legislative requirements resulting from the 2006 changes to the PCMLTFA allow FITNRAC to better utilize its resources and be more efficient in its enforcement of compliance with the Act. Plans for meeting the priority:

|

|

Be innovative in our approach to operational processes to maximize our efficiency and effectiveness. |

New |

This priority contributes to FINTRAC's strategic outcome Financial intelligence that contributes to the detection and deterrence of money laundering and terrorist activity financing in Canada and abroad. |

Why this is a priority: The volume of reports received by FINTRAC calls for powerful IT tools to extract financial intelligence and identify cases of non-compliance. Automating key business processes will allow FINTRAC to make the best use of its resources and maximize its impact in the AML/ATF regime by producing more relevant and timely financial intelligence. Plans for meeting the priority:

|

|

Enhance collaboration within the organization and with our partners and stakeholders. |

New |

This priority contributes to FINTRAC's strategic outcome Financial intelligence that contributes to the detection and deterrence of money laundering and terrorist activity financing in Canada and abroad. |

Why this is a priority: After completing a review of its governance structure, the Centre will put a special emphasis on efforts to maximize the synergies amongst business units. FINTRAC will also turn its attention to its key partners and stakeholders in the AML/ATF regime to make sure its efforts are aligned with their needs, and are recognized for the value they add to the fight against money laundering, the financing of terrorist activities and other threats to the security of Canada. Plans for meeting the priority:

|

Management Priorities over the Next Three Years

|

Management Priorities |

Type |

Links to Strategic Outcome(s) |

Description |

|---|---|---|---|

|

Promote excellence in our workforce and strengthen our management and human resources framework. |

New |

This priority contributes to FINTRAC's strategic outcome Financial intelligence that contributes to the detection and deterrence of money laundering and terrorist activity financing in Canada and abroad. |

Why this is a priority: FINTRAC is a maturing organization, evolving and going through a period of change in its management and business processes. The Centre is focusing on human and resources management to ensure this growth is sustainable, and results in a strong organization that delivers on expected results. Plans for meeting the priority:

|

Risk Analysis

FINTRAC is a partner in Canada's Anti-Money Laundering/ Anti-Terrorist Financing Initiative led by the Department of Finance. The Centre is facing renewed challenges with regard to resources and the definition of its mandate.

The Centre's operating environment is shaped by a number of important considerations, notably the continuing implementation of new initiatives. Having received Royal Assent in December 2006, legislative amendments to the PCMLTFA will continue to have a significant impact on the Centre's operations. The expansion in the number of reporting entities, new reporting sectors and the addition of a new report type (the Casino Disbursement Report), the first full year of operation of a money services businesses (MSB) registry, and the implementation of an administrative monetary penalties (AMP) regime are shaping FINTRAC's activities and will offer new opportunities for the Centre to fulfill its mandate.

The feedback received about FINTRAC's financial intelligence products has shown that there is a need for such products. Law enforcement and security partners have confirmed that FINTRAC's products help in their investigations whether by identifying individuals or groups or individuals, known and often unknown to investigators, and by helping to link together money and suspected crimes. There is however a need to improve the link between the needs of investigators and the intelligence products that are offered to them. For the next planning period, FINTRAC's challenge is to better understand the needs of its key domestic and international partners, while remaining at arm's length from the agencies responsible for investigating crimes as is intended by its governing legislation.

New legislation is not the only driver of change. On a continuing basis, those that would launder money or finance terrorism are developing new methods and finding new venues for their activities and FINTRAC continues to work with its domestic and international partners to identify emerging trends. To meet this challenge, FINTRAC maintains a research and analysis capacity which is increasingly being supported by advanced technological tools in order to monitor the use of new technologies to launder money and finance terrorist activities and to assess their level of risk. The Centre continues to develop and roll out information technology advances to support its operations. Going forward, emphasis will continue to be placed on updating and refining tactical and strategic intelligence analytical tools, including a new focus on mining the data contained in FINTRAC's databases. These activities are conducted in a tightly contained environment, in line with FINTRAC's strong commitment to protect the information under its control against any type of unauthorized disclosure. To this effect, FINTRAC is fully cooperating with the Office of the Privacy Commissioner's first audit of FINTRAC's measures to safeguard information under its control, mandated by the 2006 changes to the Act.

FINTRAC is also restructuring its activities and its organizational structure. The result will be a more nimble entity, ready to face the challenge of its tenth year of existence. As FINTRAC grows and matures as an organization, good stewardship of it resources will enable it to continue meeting its goals with regard to the detection and deterrence of money laundering and terrorist activity financing, and to implement the new initiatives and programs that will allow the benefits it offers to Canadians to grow.

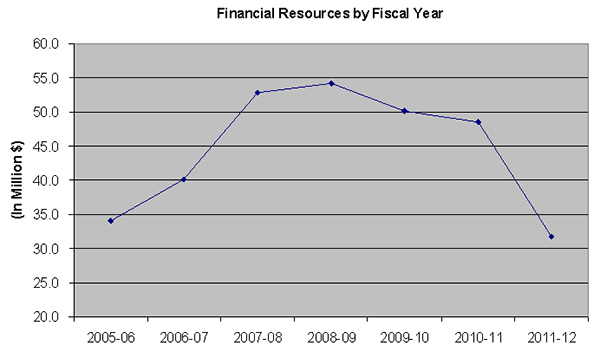

Expenditure Profile

Departmental Spending Trend

FINTRAC received funding for the new initiatives called for by the December 2006 amendments to the PCMLTFA; however, as the coming into force dates of these initiatives happened gradually over the following three fiscal years, important reprofiling of funds was prompted, which explains the apparent peak in resourcing for the years 2007-2008 and 2008-2009.

Actual Spending 2005-2006 to 2007-2008

From 2005-2006 to 2006-2007, the total resources available for FINTRAC increased from $34.0M to $40.3M. This additional funding allowed FINTRAC to respond to additional operational pressures (business continuity plan (BCP) – Disaster recovery site), asset replacement plan and workload pressures) related to the National Initiative to Combat Money Laundering (NICML, now AML/ATF regime), and to the development of new initiatives.

In 2007-2008, funding increased to $52.8M: additional resources were allowed towards the contribution for the establishment of the Egmont Group secretariat in Toronto, for FINTRAC's participation in the National Anti-Drug Strategy and for the implementation of the new initiatives.

Planned Spending 2008-2009 to 2010-2011

The resources available for spending in 2008-2009 were $54.2M, including an amount of $5.1M reprofiled from 2007-2008 for new initiatives.

Resources available in 2009-2010 are $50.2M, including a reprofiling of $1.25M for FINTRAC’s BCP – Disaster recovery site; ongoing resource levels planned for fiscal years 2010-2011 are $48.5M and $31.7M in 2011-2012. Please note that for 2011-2012, a reinstatement of resources for $16.2M, which represent resources for FINTRAC's anti-money laundering / anti-terrorist activity financing initiative, is contingent upon approval of evaluation of the AML/ATF Regime. This reinstatement of funds will bring the level of resources to $47.9M.

Voted and Statutory Items Displayed in the Main Estimates

This table illustrates the way in which Parliament approved FINTRAC resources, and shows the changes in resources derived from supplementary estimates and other authorities, as well as how funds were spent.

|

Vote or Statutory Item |

Truncated Vote or Statutory Wording |

2009-2010 |

2008-2009 |

|---|---|---|---|

|

25 |

Program expenditures |

43.7 |

49.4 |

|

(S) |

Contributions to employee benefit plans |

4.2 |

4.2 |

|

Total Agency |

47.9 |

53.6 |