Common menu bar links

Breadcrumb Trail

ARCHIVED - Human Resources and Social Development Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Ministers' Messages

Message from the Minister of Human Resources and Social Development

I am pleased to present to Parliament the 2008-2009 Report on Plans and Priorities for the Department of Human Resources and Social Development Canada (HRSDC).

HRSDC supports Canadians in meeting the challenges they face by putting in place policies, programs and services that are flexible, that create opportunities in today's labour market and that provide choice.

As Minister, I have had the opportunity to see first hand how the portfolio positively impacts on the lives of Canadians. Whether it is through support for families with the Universal Child Care Benefit, bridging the skills and learning gap with the Apprenticeship Incentive Grant or the Canada Education Savings Grant, or effective and sustainable solutions to prevent and reduce homelessness through the Homelessness Partnering Strategy, we are taking action to improve the quality of life for all Canadians.

Looking forward, we will build on those accomplishments by continuing to support children, families and vulnerable Canadians seeking to break free from poverty. We'll focus on addressing accessibility issues for persons with disabilities by implementing the Registered Disability Savings Plan and Enabling Accessibility Fund. Emphasis will also be placed on supporting low-income seniors and preventing elder abuse.

Building a knowledge advantage will be a primary focus to address labour market challenges and opportunities and the needs of workers in vulnerable communities. The actual results we expect from a well-functioning labour market are more than statistics. In fact, our objective in addressing labour market challenges is to have healthy and strong families, fewer people in poverty and more self-sufficient and self-reliant adults. Keeping that in mind, we will improve the governance and management of the EI account through the establishment of the Canada Employment Insurance Financing Board, an independent Crown corporation. We are also significantly improving student financial assistance by creating the Canada Student Grant Program. And we continue to negotiate and implement labour market agreements to increase the participation of individual Canadians in the workforce who are not fully active in the labour market. Integration of foreign-trained workers and entry of temporary foreign workers will also be at the heart of our commitments.

We are equally committed as a portfolio to providing the highest level of services to Canadians. Service Canada delivers a number of services and benefits on behalf of federal departments and agencies as well as provides Canadians with increased choice, quicker results and easier access. The success of this approach will require ongoing collaboration with federal departments as well as with provinces, territories and partners in the public and private sectors.

Canada was built through the skills, the imagination and dedication of all Canadians. HRSDC will continue this momentum by demonstrating excellence in policy, program and service delivery and by helping all Canadians reach their full potential.

The Honourable Monte Solberg, P.C., M.P.

Minister of Human Resources and Social Development

Message from the Minister of Labour

The Government of Canada is dedicated to promoting a healthy society and a productive and prosperous economy. The work done by the Labour Program to support fair, safe, healthy, cooperative and productive workplaces is crucial in promoting these goals.

In 2008-2009 the Labour Program will have an exciting and challenging agenda that includes four key priorities: implementing the Wage Earner Protection Program (WEPP), supporting the reintegration of reservists into civilian life, engaging internationally in labour issues, and identifying options for reducing the frequency and duration of work stoppages.

Legislation to create the WEPP has received Royal Assent. The new program will provide workers with unpaid wages and vacation pay when their employers are bankrupt or subject to receivership. Implementing the program will be the responsibility of the Labour Program, Service Canada and other partners.

Members of the reserve force, who volunteer their time and often risk their lives to serve our country, should not have to worry if their jobs or enrolment in universities and colleges will be protected while they are away. The government is acting to make sure that the needs of reservists are met.

Internationally, Canada is committed to negotiating and implementing strong Labour Cooperation Agreements in order to achieve decent working conditions for workers and a level playing field for business with its trade partners in the Americas and beyond. The Government is also committed to working with the provinces, territories, unions and employers to strengthen the International Labour Organization's ability to advance core labour standards globally.

Finally, the number of days lost to work stoppages in Canada is high in comparison with other members of the Organization of Economic Co-operation Development. We will be exploring the causes and impacts of work stoppages, and options for reducing their risk, frequency and duration in federally regulated industries.

The Labour Program is working to help employers and workers succeed in a dynamic global economy by meeting the challenges and taking advantage of the opportunities of changing workplaces.

The Honourable Jean-Pierre Blackburn, P.C., M.P.

Minister of Labour and Minister of the Economic Development Agency of Canada for the Regions of Quebec

Management Representation Statements

Human Resources and Social Development

I submit for tabling in Parliament, the 2008-2009 Report on Plans and Priorities (RPP) for Human Resources and Social Development Canada.

This document has been prepared based on the reporting principles contained in Guide for the Preparation of Part III of the 2008-2009 Estimates: Reports on Plans and Priorities and Departmental Performance Reports:

- It adheres to the specific reporting requirements outlined in the Treasury Board of Canada Secretariat guidance;

- It is based on the department's strategic outcomes and Program Activity Architecture that were approved by the Treasury Board;

- It presents consistent, comprehensive, balanced and reliable information;

- It provides a basis of accountability for the results achieved with the resources and authorities entrusted to it; and

- It reports finances based on approved planned spending numbers from the Treasury Board of Canada Secretariat.

Janice Charette

Deputy Minister Human Resources and Social Development

Labour

The plans, priorities, planned spending and performance measures in support of the Labour Program are accurately presented in the 2008 - 2009 Report on Plans and Priorities for Human Resources and Social Development Canada.

Munir A. Sheikh

Deputy Minister of Labour and Associate Deputy Minister of Human Resources and Social Development

Service Canada

The plans, priorities, planned spending and performance measures in support of Service Canada are accurately presented in the 2007 - 2008 Report on Plans and Priorities for Human Resources and Social Development Canada.

Hélène Gosselin

Deputy Head of Service Canada and Associate Deputy Minister of Human Resources and Social Development

Budget 2008 Announcements

The Government of Canada tabled the 2008 Budget on February 26, 2008, outlining its priorities for Canadians for the upcoming years. The following Budget announcements affect Human Resources and Social Development Canada and support the labour market, social development and service to Canadians priorities outlined in this Report.

Investing in People

Improving Canada's competitive position means developing the best-educated, most-skilled and most flexible workforce in the world.

The Government committed to supporting Canadian students with a $350-million investment in 2009-2010, rising to $430 million by 2012-2013, in a new, consolidated Canada Student Grant Program that will reach 245,000 college and undergraduate students per year when it takes effect in the fall of 2009. The Government will phase out the Canada Millenium Scholarship Foundation in 2009. A total of $123 million will be invested over four years, starting in 2009-2010, to streamline and modernize the Canada Student Loans Program. The flexibility of Registered Education Savings Plans will be enhanced by increasing the time they may remain open to 35 years from 25 years, and by extending the maximum contribution period by 10 years.

The Government will reduce disincentives to work for seniors by raising the current Guaranteed Income Supplement earned income exemption to $3,500 from its current maximum exemption level of $500.

Supporting the Vulnerable

Budget 2008 provided an additional $90 million over three years to extend the Targeted Initiative for Older Workers until March 2012 to help more older workers remain active and productive participants in the labour market.

It also provided $13 million over three years to help seniors and others recognize the signs and symptoms of elder abuse, building on the $10 million per year provided in Budget 2007 to expand the New Horizons for Seniors Program.

Strengthening Partnerships with Aboriginal Canadians

Advantage Canada recognized that the most effective way to address the gap in socio-economic conditions faced by Aboriginal Canadians remains increasing their participation in the Canadian economy. The Government is committed to fostering partnerships involving the private and public sectors that help Aboriginal people get the skills and training they need to take advantage of the opportunities in the North and across Canada. Budget 2008 takes another important step to help Aboriginal people make the most of these opportunities by committing to establish a new framework for Aboriginal economic development by the end of 2008.

The Government will continue to engage Aboriginal groups and other stakeholders on a successor approach to the Aboriginal Human Resources Development Strategy, expected in 2009. The new approach will better place the skills and training available for individuals in the context of employer and labour market demands.

Improved Management and Governance of Employment Insurance

The Government committed to improving the management and governance of the Employment Insurance (EI) Account and ensure that premiums will be no higher than required to pay for benefits over time. To enhance the independence of premium rate setting and to ensure that EI premiums are used exclusively for the EI program, the Government is creating a new, independent Crown corporation, the Canada Employment Insurance Financing Board that will report to the Minister of Human Resources and Social Development. It will have the following key responsibilities: managing a separate bank account; implementing an improved EI premium rate-setting mechanism to ensure that EI revenues and expenditures break even over time; and maintaining a cash reserve of $2 billion to establish a reserve that can be used in the event of an economic downturn.

Note: These recent announcements are not in the narrative of the Report on Plans and Priorities, however, the department is committed to moving forward on these priorities and will report on them in its 2008-2009 Departmental Performance Report. The Budget announcements are not included in the planned spending figures for the department.

Section I - Overview

Human Resources and Social Development Canada

Departmental Overview

Introduction

This Report presents the plans and priorities for Human Resources and Social Development Canada HRSDC for 2008-2009 and planned spending for the next three years. Information is presented in four main sections: Section I sets the context, overall priorities for the Department and lays out the Performance Measurement Framework; Section II presents key plans by Strategic Outcome at the Program Activity level including financial information; Section III includes detailed information, such as financial data relating to specified purpose accounts, evaluation information, sustainable development, etc.; and, Section IV outlines program descriptions and provides web links to the Department's programs and services.

Raison d'être

HRSDC's vision is to build a stronger and more competitive Canada, to support Canadians in making choices that help them live productive and rewarding lives, and to improve Canadians' quality of life.

HRSDC develops, manages and delivers some $87B in programs and services that provide Canadians with income support, skill development opportunities, labour market and other information, as well as many other tools that help Canadians to thrive economically and socially. The programs and services offered by the Department affect the lives of millions of Canadians. This includes income support to Canadians through benefits that Parliament has legislated, such as Old Age Security and the Canada Pension Plan. Through Employment Insurance, temporary income support and access to employment programs and services are provided to unemployed Canadians to help them prepare for, find and retain employment. By encouraging skills development in Canadian workplaces and by developing and disseminating information about the labour market, the Department helps Canadian businesses and workers connect. HRSDC also invests in learning by facilitating access to post-secondary education and adult learning opportunities.

HRSDC's social policies and programs help to ensure that children and families, seniors, people with disabilities, homeless people and those at risk of homelessness, and others facing barriers have the support and information they need to improve their well-being. HRSDC is responsible for a number of key initiatives that contribute to these objectives including the Universal Child Care Benefit, the Homelessness Partnership Initiative, the Opportunities Fund for Persons with Disabilities, the Social Development Partnerships Program and the New Horizons for Seniors Program.

Promoting socio-economic well-being also involves working with and building on the strengths and capacity of a multitude of players, including provinces, territories, employers and non-governmental organizations. The Department strives to ensure clear roles and responsibilities between orders of government to develop integrated and complementary programs and services for the benefit of Canadians. It is also working hard to engage partners, such as the profit and non-profit sectors, learning organizations and community groups, including official language minority communities across the country, and foster their contribution.

Through the Labour Program the Department promotes and sustains stable industrial relations and healthy, fair, productive workplaces within the federal jurisdiction. In support of these goals, the Labour program mediates labour disputes, works to keep compliance operations modern and responsive, negotiates and implements international labour standards and agreements, collaborates closely with provincial and territorial ministries of Labour, and carries out labour-related research and analysis.

High quality service delivery is vital to meeting the needs of Canadians. Through Service Canada, citizens are provided with a single point of access to HRSDC's services. Service Canada has been delivering a growing number of services and benefits on behalf of this and other federal departments and agencies and providing Canadians with increased choice and access. Today, the Service Canada delivery network brings together: more than 600 points of service in communities throughout Canada; a national 1 800 O-Canada telephone service providing Canadians with information about all federal government services; and, a range of on-line services at www.servicecanada.gc.ca.

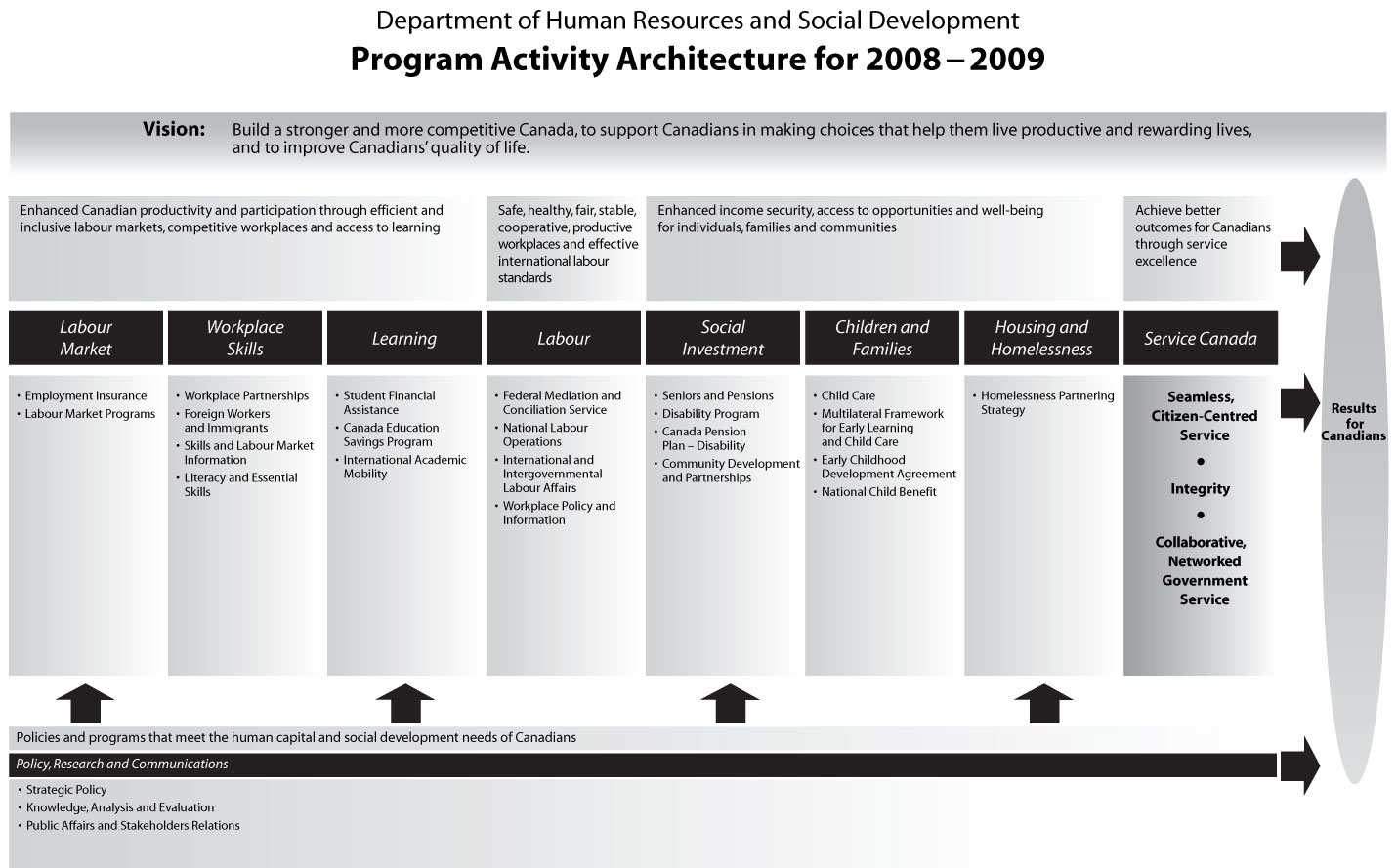

The Departments programs and services are designed to contribute to the following five strategic outcomes:

- Policies and programs that meet the human capital and social development needs of Canadians;

- Enhanced Canadian productivity and participation through efficient and inclusive labour markets, competitive workplaces and access to learning;

- Safe, healthy, fair, stable, cooperative, productive workplaces and effective international labour standards;

- Enhanced income security, access to opportunities and well-being for individuals, families and communities;

- Achieve better outcomes for Canadians through service excellence.

Deparment of Human Resources and Social Development - Program Activity Architecture for 2008-2009

Organizational Information

Mandate

On February 6, 2006, Human Resources and Skills Development Canada and the former Social Development Canada were consolidated into the Department of Human Resources and Skills Development to be styled Human Resources and Social Development. The powers, duties and functions of the Minister of Social Development were transferred to the Minister of Human Resources and Skills Development, and the Minister was styled as Minister of Human Resources and Social Development. The Minister was also made responsible for the Canada Mortgage and Housing Corporation. Further, a Secretary of State for Seniors was appointed on January 4, 2007 to ensure seniors' issues are adequately addressed.

Until new legislation is enacted, the Minister will rely on the provisions of the Department of Human Resources and Skills Development Act and the Department of Social Development Act for specific authorities.

The Department of Human Resources and Skills Development Act defines the powers, duties and functions of the Minister of Human Resources and Skills Development, the Minister of Labour, and of the Canada Employment Insurance Commission. The legislative mandate of Human Resources and Skills Development is to improve the standard of living and quality of life of all Canadians by promoting a highly skilled and mobile labour force and an efficient and inclusive labour market. The Minister of Human Resources and Skills Development has overall responsibility for the employment insurance system, while the administration of the Employment Insurance Act is the responsibility of the Canada Employment Insurance Commission.

The Department of Human Resources and Skills Development Act provides for the appointment of a Minister of Labour who is responsible for the Canada Labour Code and the Employment Equity Act, as well as other legislation on wages and working conditions. The departmental statute provides that the Minister of Labour make use of the services and facilities of the Department. The Act also sets out the mandate of the Minister of Labour to promote safe, healthy, fair, stable, cooperative and productive workplaces.

The Department of Social Development Canada Act defines the powers, duties and functions of the Minister of Social Development. The mandate of Social Development Canada is to promote social well-being and security. In exercising the power and performing the duties and functions assigned by this Act, the Minister is responsible for the administration of the Canada Pension Plan, the Old Age Security Act, and the National Council of Welfare, and the Universal Child Care Benefit Act.

Service Canada operates within the legislative mandate and framework of the current departmental legislation (Department of Human Resources and Skills Development Act and the Department of Social Development Act). Its mandate is to work in collaboration with federal departments, other levels of government and community service providers to bring services and benefits together in a single service delivery network.

On June 1, 2006, the Policy Research Initiative was transferred from the Privy Council Office to the Department. It leads horizontal research projects in support of the medium-term policy agenda of the Government of Canada and identifies data needs and priorities for future policy development.

2008-2009 Planned Expenditure Profile

Human Resources and Social Development Canada (HRSDC) has planned expenditures on programs and services of more than $87 billion, of which almost $82 billion, or more than 94%, directly benefits Canadians through Employment Insurance, the Canada Pension Plan, Universal Child Care Benefit, Old Age Security, loans disbursed under the Canada Student Financial Assistance Act and other statutory transfer payments. The Department has planned spending of $1.7 billion in voted grants and contributions, $37.2 billion in statutory grants and contributions and $2.1 billion for Employment Insurance Part II.

The financial strategy for Service Canada establishes that statutory funds, including Employment Insurance, Canada Pension Plan, Old Age Security and voted grants and contributions related to the delivery of specified programs, is allocated annually by HRSDC.

Consolidated Total $ 87,125.7 M

| Budgetary | ||

| Net Operating Costs | 989.0 | |

| Add Recoveries in relation to: | ||

| Canada Pension Plan | 246.9 | |

| Employment Insurance (EI) Account | 1,277.9 | |

| Workers' Compensation | 94.4 | |

| Other Government Departments | 5.0 | 1,624.2 |

| Gross Operating Costs | 2,613.2 | |

| Voted Grants and Contributions | 1,736.8 | |

| Total Gross Expenditures | 4,350.0 | |

| Other - Workers' Compensation and EI/CPP Charges and Recoveries | 526.4 | |

| Non-Budgetary | ||

| Loans disbursed under Canada Student Financial Assistance Act (CSFAA) | 906.3 | |

| Statutory Transfer Payments (in millions of dollars) | ||

| Grants and Contributions | ||

| Old Age Security | 25,321.0 | |

| Guaranteed Income Supplement | 7,696.0 | |

| Allowance | 573.0 | |

| Other Statutory Payments: | ||

| Universal Child Care Benefit | 2,470.0 | |

| Canada Student Loans | 403.2 | |

| Canada Education Savings Grant | 588.0 | |

| Canada Learning Bond | 34.0 | |

| Registered Disability Savings Plan | 115.0 | |

| Wage Earner Protection Program | 31.2 | |

| Others | 0.1 | 3,641.5 |

| Sub-Total | 37,231.5 | |

| Canada Pension Plan benefits | 29,105.9 | |

| Employment Insurance benefits | ||

| Part I | 12,827.0 | |

| Part II | 2,136.3 | 14,963.3 |

| Other Specified Purpose Accounts | 42.3a | |

| Total Statutory Transfer Payments | 81,343.0 | |

| a This amount includes payments related to Government Annuities Account and the Civil Service Insurance Fund. | ||

Financial Highlights

Main Estimates

The 2008-2009 Main Estimates total of $40,647.5 million for Human Resources and Social Development Canada (HRSDC) represents a net increase of $186.5 million over the 2007-2008 Main Estimates amount of $40,461.0 million. The major changes are as follows:

- A decrease of $1,902.8 million in net operating expenditures mainly due to:

- Offsets related to reduction in funding such as:

- A decrease of $1,926.9 million for Service Canada related to a trust account established in 2007-2008 for the recognition of the experience of residing at an Indian Residential School and its impact. (Common Experience Payments);

- A decrease of $12.5 million related to Phase I of the Workplace Skills Strategy to support employers and working Canadians in sustained and responsive skills development, addressing real and anticipated gaps, since three year funding is ending in 2007-2008; and

- A decrease of $3.7 million for Expenditure Review Committee procurement reduction. Further to Budget 2007, across-the-board reductions were applied to departments to implement Cabinet decision to seek cost efficiency savings to offset a portion of the fiscal impact of slower than expected realization of savings from procurement reform.

- new funding for administration of programs such as:

- An increase of $19.5 million for Temporary Foreign Worker Program. As per Budget 2007, $118.0 million over 5 years from 2007-2008 to 2011-2012 and $28.0 million on-going for improvements to the Temporary Foreign Worker Program to help employers meet immediate labour and skills shortages and strengthen Program integrity;

- An increase of $16.1 million related to a transfer from Public Works and Government Services for Public Access Programs Sector. This transfer is for customized info services provided by Public Access Programs Sector on behalf of other departments; and

- An increase of $3.5 million for the implementation of the EcoAuto Rebate Program to pursue incentives to encourage the purchase of more fuel efficient personal vehicles;

- As well as an increase of $1.2 million related to the collective agreements.

- Offsets related to reduction in funding such as:

- An increase of $519.5 million in voted grants and contributions mainly due to:

- New funding for programs such as:

- An increase of $500.0 million for Labour Market Strategy for the implementation of the new Labour Market Architecture to enhance the labour market participation among under-represented groups and low-skilled workers;

- An increase of $18.7 million for Aboriginal Skills and Employment Partnership. As per Budget 2007, new funding to build on the Aboriginal Skills and Employment Partnership Program in order to help Aboriginal people who have been traditionally under-represented in the workplace and who face unique challenges to participating in the workplace;

- An increase of $14.5 million for Homelessness Partnership Strategy related to a reprofile of funds from 2007-2008 to 2008-2009 of $17.5 million and a transfer to Public Works and Government Services for the Surplus Federal Real Property Initiative of $3.0 million;

- An increase of $8.0 million for Apprenticeship Incentive Grant. As per Budget 2006, new funding to encourage more Canadians to pursue apprenticeships and reward progression by providing $1,000 per year to apprentices successfully completing their first or second year of an apprenticeship program in a Red Seal Trade; and

- An increase of $6.9 million for New Horizons for Seniors Program. As per Budget 2007, new funding for the expansion of New Horizons for Seniors Program.

- The preceding increases are offset by the following reductions:

- A decrease of $17.7 million to the National Literacy Program since the program has now migrated to the new Adult Learning, Literacy and Essential Skills Program. This integrated program provides a better targeted and more focus approach to help reduce non-financial barriers to adult learning and enhance the development of literacy and essential skills; and

- A decrease of $12.0 million to the Enabling Fund for Official Language Minority Communities, an initiative that supports the activities of two Official Language Minority Communities networks linked to a total of 25 community organizations, since the initiative received a three year funding ending in 2007-2008. This initiative forms part of the overall Government of Canada Action Plan on Official Languages.

- New funding for programs such as:

- An increase of $1,519.2 million in statutory program payments, mainly due to:

- An increase of $1,531.0 million for Elderly Benefits which includes Old Age Security, Guaranteed Income Supplement and Allowance. This increase is explained from changes in the forecasted average rates of payment and in the population. In general, changes in the average Old Age Security, Guaranteed Income Supplement and Allowance benefit rates can be partially

attributed to changes in the Consumer Price Index. Elderly benefits are fully indexed quarterly to any rise in the cost of living. Legislation ensures that Elderly benefits will never decrease if the cost of living goes down.

- Old Age Security - Increase of $1,228.0 million. The forecasted average monthly rate has increased from $477.35 to $489.82, which accounts for $664.5 million. There is also an anticipated increase in the estimated number of beneficiaries from 4,382,379 to 4,505,101 which accounts for an increase of $712.5 million and there is an anticipated increase in the Old Age Security benefit repayment which will reduce the Old Age Security benefit payments by $149.0 million.

- Guaranteed Income Supplement - Increase of $283.0 million. The forecasted average monthly rate has increased from $378.03 to $396.06 resulting in an increase of $349.6 million. The estimated number of beneficiaries has decreased from 1,634,112 to 1,619,274 accounting for a decrease of $66.6 million. The number of GIS recipients constantly fluctuates from year to year based on a number of factors, including fluctuations in a client's income, the death of the client, or a change in the client's residence status.

- Allowance Payments - Increase of $20.0 million. The average forecast monthly rate has increased from $449.32 to $473.67, accounting for an increase of $29.2 million. The estimated number of beneficiaries decreased from 102,563 to 100,808, accounting for a decrease of $9.2 million. Like Guaranteed Income Supplement, the number of Allowance recipients constantly fluctuates from year to year based on a number of factors, including fluctuations in a client's income, the death of the client, or a change in the client's residence status.

- An increase of $48.0 million for Canada Education Savings Grants as result of the changes to Canada Education Savings Grants and contribution limits announced in Budget 2007.

- An increase of $10.0 million for Universal Child Care Benefit. The increase in expected benefits paid is due to an increase in the projected number of recipients and an increase in take-up rates.

- An increase of $9.0 million for Canada Learning Bond. As per revised forecast, the participation rate for the Canada Learning Bond is steadily increasing. Better than expected performance in 2006-2007 has continued into 2007-2008, promotional activities seem to be having a positive response.

- An increase of $0.1 million related to other items.

- A decrease of $61.9 million in Canada Student Loans Program as a result of:

- A decrease of $38.5 million is related to Direct Financing under the Canada Student Financial Assistance Act mainly due to a reduction in program costs which has led to a reduction in alternative payments;

- A decrease of $28.8 million in the provision of funds for interest and other payments as a result of a reduction in the projection of the loans in study portfolio as well as a reduction of the assumption regarding the proportion of loans going into debt reduction in order to align projection with actual results;

- A decrease of $1.4 million related to liability under the Canada Student Loans Act. The reduction in expenditures is linked to the overall decrease in the value of the guaranteed loans' portfolio; and

- An increase of $6.7 million for Canada Study Grants mainly due to the fact that the Canada Student Loans Program is still experiencing higher than expected take-up of the Canada Access Grant program. There is also a greater utilization of Low Income and Permanent Disability Access grants than originally forecasted.

- A decrease of $16.0 million is related to Workers' Compensation Payments. The variance is mainly due to projected increases in recoveries based on previous year trend analysis as well as increased costs due to a Chronic Pain Decision rendered by the Nova Scotia Workers' Compensation Board.

- A decrease of $1.0 million in contribution to the employee benefit plans.

- An increase of $1,531.0 million for Elderly Benefits which includes Old Age Security, Guaranteed Income Supplement and Allowance. This increase is explained from changes in the forecasted average rates of payment and in the population. In general, changes in the average Old Age Security, Guaranteed Income Supplement and Allowance benefit rates can be partially

attributed to changes in the Consumer Price Index. Elderly benefits are fully indexed quarterly to any rise in the cost of living. Legislation ensures that Elderly benefits will never decrease if the cost of living goes down.

- An increase of $50.6 million in non-budgetary payments related to the loans negotiated under the Canada Student Financial Assistance Act, from $855.7 million to $906.3 million as a result of a $29.4 million increase in loans disbursed due to higher than forecasted uptake on Budget 2004 measures intended to ease the transition to post-secondary education and by a $21.2 million decrease in loan repayments due to higher utilization of debt management measures through which students are not required to repay their student loans.

Forecasts 2007-2008 to Planned Spending 2008-2009

Consolidated spending under Human Resources and Social Development authorities is expected to be $87,125.7 million in 2008-2009. This represents an increase of $2,412.8 million over the 2007-2008 forecasts of $84,712.9 million. The variance is mainly due to:

- a decrease of $1,896.7 million in net operating expenditures mainly due to:

- Offsets related to reduction in funding such as:

- a decrease of $1,844.3 million for Service Canada related to a trust account established in 2007-2008 for the recognition of the experience of residing at an Indian Residential School and its impact. (Common Experience Payments);

- a decrease of $27.8 million related to operating budget carry forward funding in 2007-2008;

- a decrease of $12.7 million related to reduced funding of the Government Advertising Plan;

- a decrease of $12.5 million related to Phase I of the Workplace Skills Strategy to support employers and working Canadians in sustained and responsive skills development, addressing real and anticipated gaps, since three year funding is ending in 2007-2008; and

- offset by an increase of $0.6 million for other items.

- Offsets related to reduction in funding such as:

- a decrease of $0.4 million for write-off of debt due to the Crown for Canada Student Loans Direct financing in 2007-2008.

- an increase $558.3 million in voted grants and contributions due to the following:

- new funding for programs such as:

- $500.0 million for Labour Market Strategy for the implementation of the new Labour Market Architecture to enhance the labour market participation among under-represented groups and low-skilled workers;

- $17.3 million for Aboriginal Skills Employment Partnering Program. As per Budget 2007, new funding to build on the Aboriginal Skills and Employment Partnership Program in order to help Aboriginal people who have been traditionally under-represented in the workplace and who face unique challenges to participating in the workplace;

- $9.9 million for the Homelessness Partnering Strategy related to reprofiles from previous years;

- $8.0 million for the Apprenticeship Incentive Grant. As per Budget 2006, new funding to encourage more Canadians to pursue apprenticeships and reward progression by providing $1,000 per year to apprentices successfully completing their first or second year of an apprenticeship program in a Red Seal Trade;

- $8.0 million for the Enabling Accessibility Fund to support community-based projects across Canada that improve accessibility and enable Canadians, regardless of physical ability, to participate in and contribute to their community and the economy; and

- $15.1 million for other programs.

- new funding for programs such as:

- An increase of $1,669.8 million in statutory program payments, mainly due to:

- an increase of $1,559.0 million for Elderly benefits which includes Old Age Security (increase of $1,280.0 million), Guaranteed Income Supplement (increase of $247.0 million) and Allowance (increase of $32.0 million). This increase is explained from changes in the forecasted average rates of payment and in the population. In general, changes in the average Old Age Security, Guaranteed Income Supplement and Allowance benefit rates can be partially attributed to changes in the Consumer Price Index. Elderly benefits are fully indexed quarterly to any rise in the cost of living. Legislation ensures that Elderly benefits will never decrease if the cost of living goes down.

- an increase of $115.0 million for Registered Disability Savings Plan announced in Budget 2007. This new plan will help parents to save for ensuring the long-term financial security of a child with a severe disability.

- an increase of $31.2 million related to the Wage Earner Protection Program, which is designed to pay certain employees of bankrupt companies their unpaid wages and vacation pay up to $3,000.

- increased funding of $10.0 million for Universal Child Care Benefits. The increase in expected benefits paid is due to an increase in the projected number of recipients and an increase in take-up rates.

- an increase of $6.0 million to the Canada Education Savings Grant.

- an increase of $6.0 million to the Canada Learning Bond. As per revised forecast, the participation rate for the Canada Learning Bond is steadily increasing.

- a decrease of $36.2 million in Canada Student Loans Program as a result of:

- a decrease of $3.1 million related to Direct Financing under the Canada Student Financial Assistance Act due to a reduction in program costs which has led to a reduction in alternative payments;

- a decrease of $1.8 million in liabilities under the Canada Student Loans Act. The reduction in expenditures is linked to the overall decrease in the value of the guaranteed loans' portfolio;

- a decrease of $20.4 million in the provision of funds for interests and other payments under the Canada Student Financial Assistance Act as a result of a reduction in the projection of the loans in study portfolio as well as a reduction of the assumption regarding the proportion of loans going into debt reduction in order to align projection with actual results; and

- a decrease of $10.9 million of the Canada Study Grant;

- a decrease of $16.0 million in Workers' Compensation. The variance is mainly due to projected increases in recoveries based on previous year trend analysis as well as increased costs due to a Chronic Pain Decision rendered by the Nova Scotia Workers' Compensation Board.

- a decrease of $5.2 million in contribution to the employee benefit plans.

- a net decrease of $27.8 million in non-budgetary payments for loans disbursed under the Canada Student Financial Assistance Act.

- an increase of $523.8 million for planned Employment Insurance Account mainly due to an increase in forecasted Employment Insurance Part I benefits.

- an increase of $1,588.6 million to the Canada Pension Plan. The increase is mainly due to increases in benefits, which reflect forecasts of client population and average benefit payments.

- a decrease of $2.8 million to other specified purpose accounts (Government Annuities Account and Civil Service Insurance Fund).

Planned Spending 2008-2009 to Planned Spending 2009-2010

For 2009-2010, the department's consolidated planned spending is anticipated to be $90,447.7 million, which represents an increase of $3,322.0 million from the 2008-2009 planned spending. The major changes are as follows:

- a net decrease of $48.2 million in operating expenditures, mainly due to reductions in funding for the following initiatives:

- $22.2 million for the Homelessness Partnering Strategy which was approved for two years;

- $6.3 million for surveys for which contractual requirements are reduced in 2009-2010;

- $3.6 million for Understanding the Early Years;

- $3.3 million related to the EcoAuto Rebate Program;

- $2.6 million in Trades and Apprenticeship Strategy;

- $2.5 million in Aboriginal Human Resources Development Strategy; and

- $7.7 million for other items.

- a decrease of $225.7 million in voted grants and contributions, mainly due to decreases related to the multi-year funding profile for the following initiatives:

- $123.8 million for the Homelessness Partnering Strategy, which was approved for two years;

- $37.3 million in Targeted Initiative for Older Workers;

- $22.5 million in Aboriginal Human Resources Development Strategy;

- $12.0 million in Enabling Fund for Official Language Minority Communities;

- $9.2 million in Aboriginal Skills Employment Partnership;

- $9.1 million in Workplace Skills Initiative;

- $8.9 million in Foreign Credential Referral Office; and

- $2.9 million for other items.

- an increase of $1,551.7 million in statutory payments mainly related to:

- $1,500.0 million for Elderly benefits which include Old Age Security (increase of $1,198.0 million), Guaranteed Income Supplement (increase of $278.0 million) and Allowances (increase of $24.0 million);

- $50.0 million for the Registered Disability Savings Plan;

- $10.0 million for the Universal Child Care Benefits;

- $7.0 million for the Canada Learning Bond;

- $3.0 million for the Canada Education Savings Grant;

- $1.0 million for Federal Workers' Compensation;

- offset by decreases of $16.0 million in Canada Student Loans Program and of $3.3 million in contribution to employee benefit plans.

- a net decrease of $173.1 million in non budgetary payments for loans disbursed under the Canada Student Financial Assistance Act which is primarily due to the impact of loan reimbursements from borrowers in the loan portfolio;

- an increase of $594.7 million for the Employment Insurance Account mainly due to an increase in forecasted EI Part I benefits;

- an increase of $1,625.2 million to the Canada Pension Plan mainly due to an increase in forecasted Canada Pension Plan benefits of $1,622.1 million; and

- a decrease of $2.6 million in the payments and other charges related to the Government Annuities Account.

Planned Spending 2009-2010 to Planned Spending 2010-2011

For 2010-2011, the department's consolidated planned spending is anticipated to be $94,151.8 million, which represents an increase of $3,704.1 million from the 2009-2010 planned spending. The major changes are as follows:

- a net decrease of $1.6 million in operating expenditures;

- a decrease of $49.2 million in voted grants and contributions, mainly due to decreases related to the multi-year funding profile for the following initiatives:

- $20.9 million for Workplace Skills Initiative;

- $13.5 million for the Enabling Accessibility Fund;

- $9.9 million in Aboriginal Human Resources Development Strategy;

- $4.1 million for Kativik Regional Government; and

- $0.8 million for other items.

- an increase of $1,645.4 million in statutory payments mainly related to:

- $1,592.0 million for Elderly benefits which include Old Age Security (increase of $1,279.0 million), Guaranteed Income Supplement (increase of $290.0 million) and Allowances (increase of $23.0 million);

- $45.0 million for the Registered Disability Savings Plan;

- $7.0 million for the Canada Learning Bond; and

- $5.0 million for the Universal Child Care Benefits;

- $2.0 million for the Canada Education Savings Grant;

- $2.0 million for the Federal Workers' Compensation;

- offset by a decrease of $7.6 million in the Canada Student Loans Program.

- a net decrease of $115.6 million in non budgetary payments for loans disbursed under the Canada Student Financial Assistance Act which is primarily due to the impact of loan reimbursements from borrowers in the loan portfolio;

- an increase of $487.9 million for the Employment Insurance Account mainly due to an increase in forecasted Employment Insurance Part I benefits of $480.0 million;

- an increase of $1,739.6 million to the Canada Pension Plan mainly due to an increase in forecasted Canada Pension Plan benefits of $1,738.1 million; and

- a decrease of $2.4 million in the payments and other charges related to the Government Annuities Account.

| Program Activities by Strategic Outcome Summary Information | |||

| Planned Spending (in millions of dollars) | |||

| 2008 - 2009 | 2009 - 2010 | 2010 - 2011 | |

| Strategic Outcome: Policies and programs that meet the humain capital and social development needs of Canadians | |||

|

185.2 | 168.3 | 168.3 |

| Strategic Outcome: Enhanced Canadian productivity and participation through efficient and inclusive labour markets, competitive workplaces and access to learning | |||

|

16,375.7 | 16,899.5 | 17,361.9 |

|

273.8 | 259.8 | 240.3 |

|

2,096.6 | 1,921.5 | 1,808.4 |

| Sub-Total | 18,746.1 | 19,080.8 | 19,410.6 |

| Strategic Outcome: Safe, healthy, fair, stable, cooperative, productive workplaces and effective international labour standards | |||

|

271.4 | 280.9 | 285.1 |

| Strategic Outcome: Enhanced income security, access to opportunities and well-being for individuals, families and communities | |||

|

63,028.0 | 66,193.8 | 69,549.9 |

|

2,488.2 | 2,499.1 | 2,504.3 |

|

165.6 | 1.2 | 1.2 |

| Sub-Total | 65,681.8 | 68,694.1 | 72,055.4 |

| Strategic Outcome: Achieve better outcomes for Canadians through service excellence (Service Canada) | |||

|

602.2 | 595.9 | 598.2 |

|

880.2 | 876.2 | 876.0 |

|

232.4 | 232.7 | 232.8 |

| Sub-Total | 1,714.8 | 1,704.8 | 1,707.0 |

| TOTAL | 86,599.3 | 89,928.9 | 93,626.4 |

| aA new program, the Homelessness Partnering Strategy, was announced in December 2006 and is funded for two years (2007 - 2008 and 2008 - 2009). bWithin the portfolio, Human Resources and Social Development Canada focuses on Homelessness and Canada Mortgage and Housing Corporation focuses on housing. The Program Activity Architecture will be updated at the earliest opportunity to reflect this. |

|||

2008-2009 Departmental Priorities

The priorities of HRSDC for 2008-2009 are grouped under three main categories.

- Policy and programs

- Service delivery

- Management priorities

The focus of these priorities is a result of an ongoing assessment of the economic, social, policy and operating environment in which the department operates.

Policy and Programs

HRSDC has an important role to play in ensuring Canadians are provided the flexibility and opportunity to reach their full potential and participate to their fullest in a competitive and productive economy. It also has a role to play in supporting the most vulnerable Canadians that cannot work.

Over the past decade and a half, Canada has experienced sustained and widespread economic growth, which has resulted in overall strong job creation. This continued strength in the Canadian economy has provided opportunity to Canadians, increased employment rates and contributed to significant declines in poverty rates.

However, major factors on the economic landscape, such as increasing global competition and the accelerated pace of technological change, as well as social changes including the aging and increased diversity of the Canadian population and changes in form and roles of families are creating significant challenges that continue to drive the priorities of the department.

Context

A rising global demand for many of the industrial materials that Canada exports, especially energy, has pushed the prices for these goods higher, increased income and spurred major new investments in Canada's resource sector. The shift of manufacturing to low-cost economies, China in particular, has driven down prices and increased real purchasing power. The significant and rapid appreciation of the Canadian dollar compared to its American counterpart contributed to further lowering the prices of consumer goods for Canadians and improving purchasing power. Furthermore, this appreciation has allowed Canadian businesses to import productivity-enhancing business machinery and equipment at lower prices. The emergence of China (and, to a lesser degree, India) has also opened up large markets for Canadian goods and created new business opportunities for Canadian firms.

Strong job creation has led to the lowest national unemployment rate in over 30 years. This fuels further income and expenditure growth by Canadians. However, the pace of job creation has started to test the limits of the Canadian population to provide the necessary workers. An increasing number of firms are reporting that they are unable to find all the workers they need, and not just high-skilled workers, in spite of the fact that labour force participation is near an all-time high.

This rising tide of growth and job creation since the mid-1990s has benefited younger and older workers in particular, who were among the hardest hit by the economic slowdown of the early 1990s. Vulnerable groups such as Aboriginal peoples, people with disabilities, lone parents and immigrants, have nevertheless also seen their employment prospects improve since the mid-1990s despite the fact that labour force participation and employment rates remain lower than the national average.

It is important to note that there were uneven regional and sectoral impacts reflecting the country's diverse regional economic structures and that the benefits of a strong economy have not been equally shared by Canadians of varying backgrounds. On the one hand, most sectors in the West have been booming, as a result of soaring energy prices, and strong business investment in new sources of supply. On the other hand, certain sectors located chiefly in central Canada and in rural regions in British Columbia, have suffered from the appreciation of the Canadian dollar and higher energy costs. For example, the Canadian manufacturing sector continues to shed jobs as a result of the rising dollar and falling international prices for manufactured goods. Forestry has also been adversely affected by the higher Canadian dollar and by the burgeoning troubles in the U.S. housing market.

As a result, strong growth has led to increases of per-capita personal disposable income but increases in hourly wage rates have grown at a much slower pace. Particularly worrisome is the fact that real average annual earnings of the bottom 50 per cent of earners have remained virtually unchanged since 1976.

Some families have made gains, in large measure, through rising employment opportunities. The continued increase of family work effort in paid employment that stems from the increased labour force participation of women and the commensurate increase in dual-earner families have resulted in modest income gains. Gains were made even among the bottom 50 per cent of families, which has contributed to reducing the rate of low-income among children. Despite these gains, many Canadians have not managed to break free from poverty. In fact, many Canadians remain vulnerable, among them adults with disabilities, recent immigrants, Aboriginal peoples, and lone parents. And they are not alone. A significant number of Canadians continue to experience poverty despite considerable work effort and consistent attachment to the labour force.

In the face of an aging society, increasing pressure will also be placed on families to meet their caregiving responsibilities. In this context, attention will need to be given to supporting Canadians who are engaged in these activities to ensure that they can adequately balance these responsibilities while maintaining their capacity to fully participate in the economic and social fabric of Canadian society.

Going forward, improving the opportunities for all Canadians by helping them to acquire the skills and knowledge that they require will not only raise the overall productivity of the workforce but also ensure that they can seize opportunities, share in Canada's future prosperity and become more self sufficient. Additionally, increasing choice through supports for Canadians and their families that help relieve some of the time and financial pressures Canadians face will build resiliency and increase independence.

Aboriginal people often face multiple barriers to their successful labour market participation - including low literacy and essential skills and access to training or education required by employers. The Aboriginal population is also young and growing at a much faster rate than the general Canadian population (a 22% increase between 1996 and 2001), particularly in the North and West, with a large majority living in Western Canada. 1 The population growth is most rapid among the age group seeking work skills, post-secondary education and first jobs. It is estimated that about half of all Aboriginal people are under the age of 25 and that over the next twenty years about 400,000 Aboriginal people will be ready to enter the workforce.

In Canada there are 3.6 million Canadians or 12.4% of the population that have a disability. 2 This includes 181,000 children, 1.5 million seniors and 1.9 million working-age adults. These numbers are expected to increase as the population ages. Canada is not fully benefiting from the employment potential, skills and talents of people with disabilities, and people with disabilities in Canada are not living to their fullest potential: 44% of people with disabilities were participating in the labour market, compared with 74% of people without disabilities. Another concern is that many people with disabilities live in poverty (23% of people aged 16-64 with disabilities lived in low income, compared to 14% of people without disabilities in 2001).

Strong economic growth and job creation have been accompanied by significant changes in the workplace. These changes are rooted in a number of factors. First, globalization has produced competitive pressures but also great opportunities. These pressures lead employers to seek flexibility to adjust their workforce size in response to shifting conditions and cause employees to seek increased job security. And both Canadian employers and workers want protection from undercutting by companies in other countries that may be tempted to gain a competitive edge by violating their own workers' labour rights.

Second, demographic changes - notably the growth in dual-income families, Canada's rising diversity as a result of immigration, the aging population and tight labour market, and growing elder care responsibilities - have increased worker demands for flexible work arrangements, a workplace that accommodates diversity, and work-life balance. At the same time, these changes have contributed to employer concerns about recruiting and retaining a qualified and motivated workforce.

Third, technological advancements have facilitated responses to employers' needs with respect to productivity and worker needs for flexibility - by allowing employees to produce more quickly and, sometimes, from a larger number of locations - but have also been perceived as aggravating pressures on work-life balance.

One result of such factors is growth in non-standard employment. Self-employed, part-time, and temporary workers now account for about 32 percent of the Canadian workforce. A disproportionate share of these workers has low earnings and limited or no access to non-wage benefits, and many may not be covered by labour legislation, even though they may be similar to regular employees in that they are economically dependent on a single client. Another impact has been an increased emphasis in Canadian workplaces on strategies that help attract and integrate individuals from a wide range of backgrounds and with a variety of needs; examples include policies related to work-life balance, employment equity, and disability management/return-to-work.

Another consequence of these factors has been the need for employers, unions, and employees to work together to ensure that Canadian workplaces are able to respond to a rapidly-changing environment in ways that provide flexibility to employers while protecting the rights and working conditions of employees. This, in turn, requires heightened emphasis, attention, and skills in negotiations and problem-solving. A final effect has been increased attention, in the context of trade liberalization, to the importance of enhancing respect for, and application of, core international labour standards.

Canada's ability to attract new immigrants in the past has been a strong mitigating force to counterbalance slowing labour force growth. For some time now, immigrants have been an important source of labour force growth. Canada is now facing increased competition for skilled labour from a growing number of countries including China and India and is also facing challenges in retaining skilled immigrants who are already established in Canada. It is expected that due to a smaller labour pool in coming years, employers will face increasing competition to hire and retain workers, particularly those considered skilled workers.

In this context, it is important to note that too many immigrants continue to face challenges in adapting to the Canadian setting, and many immigrants have difficulties integrating into the Canadian workforce. Their employment rates are still below those of other Canadians, and their relative earnings, particularly for the university-educated, are lower. Credential recognition is an important component to immigrants' ability to find rewarding work and to integrate into Canadian society. A lack of adequate literacy skills in Canada's official languages also represents a significant challenge for many immigrants entering the Canadian labour market.

Although Canada's productivity performance has improved somewhat since 1997, productivity growth and level still lag considerably behind that of the United States and most other G7 countries. Productivity growth requires a continued investment in a highly skilled and adaptable workforce. Economies endowed with a skilled labour force are better able to create and make effective use of new technologies. Despite having one of the most highly educated workforces and the highest share of post-secondary degree holders in all of the OECD, other countries are quickly catching up and some countries already perform better in certain categories.

In addition, the educational attainment of certain sub-groups of the population is still lagging. High school completion rates among Aboriginal people, for example, are quite low and this constitutes a major barrier to their success in society and in labour markets. A substantial portion of Canada's adult population does not have the literacy and numeracy skills to cope with the demands of everyday life and work in an advanced society. Some of these individuals are older, less educated people who will be approaching retirement age. Others are younger and better educated, but in need of skills upgrading. Another group facing challenges with regard to skills is highly-educated recent immigrants who display low levels of official language skills.

Too many families, particularly those headed by lone-parents, are increasingly relying on the shelter system and an estimated 65,000 youth are homeless. For many, homelessness is the result of a combination of serious financial problems, unemployment and family instability or abuse. Some, particularly among the chronically homeless, suffer from mental health or substance abuse problems.

Associated Risks

The growing and diverse range of funding instruments and service delivery partners poses a risk to the Department's ability to enhance delivery of responsive policies, programs and services to Canadians.

The Department is responsible for the administration and delivery of a wide range of statutory programs and services across a broad mandate, in addition to providing Canadians with access to a full range of government services and benefits. Public expectations for increased accountability, effective programs and efficient service continue to rise and require effective dialogue, consultation and outreach.

Grant and contribution programs are an important instrument for the Department to achieve its objectives. As a result of the Blue Ribbon Panel and other review mechanisms, efforts continue to determine the optimal model to create a modern and coherent department-wide strategic approach to assessing, managing and mitigating grant and contribution program risks, balanced with program effectiveness and accountability.

Challenges remain in ensuring communication and flow of information between the policy development, program design and service delivery dimensions of the Department's activities. HRSDC's relations with provinces and territories will be influenced by the federal government's new approach to provinces and territories for post-secondary education and training, new labour market agreements and other social policy priority areas. The infrastructure capacity of provinces and territories, and the sustained engagement to ensure a flow of information in support of program outcomes and accountability, could affect the Department's ability to implement effective policies and meet Canadians' expectations.

To respond to these challenges effectively, the Department establishes and maintains productive partnerships to ensure greater coherence of the national labour market and social development agenda and to effectively deliver on government priorities.

Service Canada is also working to develop and implement client driven service strategies to improve and ensure uninterrupted delivery of core services such as Employment Insurance, Canada Pension Plan, and Old Age Security, as well as increase the performance of its service delivery channels, supported by better information management and the use of technology. Finally, HRSD continues to review its performance measurement framework to support effective accountability and public reporting.

Priorities for 2008-2009

In this complex environment, HRSDC plays an important role in ensuring that Canada's economy remains competitive and productive, and that Canadians can participate in the economy and society. In 2008-2009, the Department will focus its efforts on: strengthening the knowledge advantage that will drive economic growth in years to come; and ensuring measures are in place to support children, families and those who are most vulnerable in society.

Building the Knowledge Advantage

In 2006, the Government launched Advantage Canada: Building a Strong Economy for Canadians, a long-term, economic plan for Canada. HRSDC is contributing to this plan through the implementation of the Knowledge Advantage agenda, which sets a goal for Canada to achieve the best-educated, most-skilled and most flexible workforce in the world. The Department will contribute to this by facilitating increased participation of Canadians and new immigrants in the labour market, continuing to achieve a higher quality and more productive workforce through better access to skills development and education, and by facilitating labour market adjustments through mobility, as well as providing Canadians with access to timely and accurate labour market information.

The Department recognizes that it cannot achieve its objectives by working alone. It must continue to work in collaboration with provinces, territories, partners and key stakeholders building on each others' strengths and capacity to deliver results for Canadians. As set out in Budget 2007, a key feature of this approach is the implementation of a new labour market training architecture with provinces and territories, which recognizes that provinces and territories are best placed to design and deliver labour market training to most Canadians. Accordingly, the Department is pursuing a three part approach: working towards the full transfer of EI Part II programming to provinces and territories; negotiating new labour market agreements; and exploring the feasibility of transferring existing federal labour market programs to provinces and territories.

Further, HRSDC will support government commitments to improve the governance and management of the Employment Insurance (EI) Account, ensuring the Program continues to help Canadian workers to adjust to changing labour market conditions, as well as operate in an effective and efficient manner.

The Department will support workplace training for Canadians by working with provinces, territories and the private sector to make training and skills development more widely available to Canadian workers and better aligned with the needs of the economy. HRSDC will continue to encourage skills development and training in Canadian workplaces and to invest in the development of tools and other support mechanisms to raise literacy and essential skills of Canadians.

The Department will continue to work closely with other federal departments and industry stakeholders to develop strategies to adjust to changing circumstances, including in traditional industries and helping communities take advantage of existing and emerging opportunities. It will also improve the quality of industry-driven approaches with regard to workplace skills by supporting sectoral initiatives and developing the next phase of the Trades and Apprenticeship Strategy.

Enhancing skills of Aboriginal people will also be a focus for HRSDC. The department will strengthen partnerships which help Aboriginal people obtain the skills and training they require thereby enabling them to take advantage of job prospects in the North and across Canada. It will also develop options for a new Aboriginal labour market strategy for implementation in April, 2009.

In order to address the new realities of the changing labour market, including the potential need for improved training and enhanced income support, the Expert Panel on Older Workers was asked to examine potential measures to help older workers. To this end, the Department will respond to the Report from the Expert Panel.

Given the slow labour force growth that is anticipated in the future, HRSDC will respond to industry's growing demand for skilled labour by further exploring ways to facilitate the labour market integration of foreign-trained workers, facilitating the entry of temporary foreign workers while improving our capacity to monitor compliance with regulatory requirements, reducing barriers to mobility (including skilled trades), and helping Aboriginal people to obtain the skills and training they require.

The department's work will also continue to promote access to higher education. To this end, the Department will complete its review of the Canada Student Loans Program (CSLP) and develop proposals to improve the delivery of financial assistance to students. The review seeks to simplify CSLP instruments, make them more effective, and ensure integrated administration and efficient delivery. In addition to this work, a number of reviews have been undertaken to assess the Canada Millennium Scholarship Foundation's performance, effectiveness and success in achieving its mandate.

To further support learners, Budget 2007 increased Canada Social Transfer funding to provinces and territories, starting in 2008-2009, to strengthen the quality and competitiveness of Canada's post-secondary education system. The Department recognizes that parents across this country face challenges paying for post-secondary education. It will therefore take measures to implement improvements, announced by the government, to Registered Education Savings Plans in order to encourage parents to save.

The Department also supports Canada in international trade. It is widely recognized that labour issues lie at the centre of the debate over international economic integration. Progress on the international trade agenda is increasingly tied to developing meaningful international criteria to improve compliance with internationally recognized labour standards. The Labour Program will work to ensure that labour policy and programs respond to evolving worker-employer relations and workplace and economic realities. In this regard, expert advice will be sought on the causes and impacts of work stoppages and options for reducing their frequency and duration. Robust Labour Cooperation Agreements will be negotiated and implemented in the context of free trade accords, to protect workers' fundamental rights and ensure a level playing field for Canadian companies.

Supporting Children, Families and Vulnerable Canadians

Key to Canada's increasing prosperity are the hard-working Canadians that fuel the strong economic growth that the country has experienced. The Department plays a central role in supporting Canadians and their families, especially vulnerable families, and families under financial and time pressures. Enabling Canadians by providing effective tools and support helps them to make the best choices for themselves and their families.

As such, a significant portion of departmental resources are invested in providing Canadians with the opportunities and supports they need. HRSDC and Service Canada work together to deliver a broad range of programs and services to support the Government's commitment to invest in families and to help those seeking to break free from the cycles of homelessness and poverty.

As families are the building blocks of society, HRSDC will continue to provide support to families through the Universal Child Care Benefit to allow Canadians choice in child care and provide families with direct financial assistance regardless of family income or place of residence. These investments are complemented by the Government's decision to provide funding to provinces and territories through the Canada Social Transfer to create child care spaces, as outlined in Budget 2007. Recognizing the important multiple roles families play in providing for one another, the Department will also look at ways of providing better support to Canadians that care for seniors or disabled family members.

A key objective of the government is to ensure all Canadians benefit from positive economic conditions and enjoy a high standard of living. To this end, the Department will continue to work on the development of a Canadians with Disabilities Act. Activities to implement other Budget 2007 commitments for persons with disabilities will continue, including the development of a Registered Disability Savings Plan, Canada Disability Savings Grant, Canada Disability Savings Bond, as well as establishing the Enabling Accessibility Fund.

Significant efforts will also be made to explore long-term solutions to homelessness in Canada. Through the Homelessness Partnering Strategy, the department will put in place measures to create transitional and supportive housing and to improve programs and services to help homeless people become self-sufficient. Under this Strategy, the federal government offers the provinces and territories the opportunity to enter into bilateral arrangements to improve collaboration between the two levels of government. An amount of $269.6 million will be invested over 2 years to deliver on this commitment.

Finally, seniors represent a growing proportion of the Canadian population. Over the next year, HRSDC will work with Health Canada and the Secretary of State for Seniors to support the National Seniors Council in their work on all matters related to the well-being and quality of life of seniors, including the opportunities and challenges arising from a rapidly growing and increasingly diverse aging population. The Department will also lead on the development and implementation of new measures to address the growing problem of elder abuse in Canadian communities.

HRSDC will continue to work collaboratively with its partners to deliver an expanded New Horizons for Seniors Program which provides funding to support projects across Canada that help ensure seniors are able to benefit from, and contribute to, the quality of life in their community through their social participation and active living. The Program accomplishes its' objectives through three separate streams: Community Participation and Leadership, Capital Assistance funding, and Elder Abuse Awareness funding.

The Department will implement measures to protect reservists' employment in federally-regulated workplaces and provide relief from Student Loan payments for student reservists while they are serving in the military. The Wage Earners Protection Program, which provides workers with wages owed to them when their employers go bankrupt or subject to receivership, will also be implemented.

Service Delivery

Context

Service Canada is responsible for the delivery of significant government programs or support for Canadians such as Employment Insurance, Canada Pension Plan and Old Age Security - which includes Guaranteed Income Supplements, as well as a broad range of smaller programs and services for HRSDC and other government departments such as Passport Canada and Indian Residential Schools Resolution Canada.

The Department's service environment is largely influenced by Canadians' values and expectations. Service matters to Canadians - overall quality affects citizens' satisfaction and the level of confidence they have in governments and in public services. Recognizing this, Service Canada will continue to implement a one-stop, integrated government services approach.

In terms of accessing information and services through various channels - in person, by phone, by mail and via the Internet - Canadians expect to be able to choose alternate service delivery channels to suit their needs. Also, recent efforts to reach out to rural and remote communities have proven popular with Canadians, based on the 2006 Service Canada Awareness Baseline study, 89% of Canadians surveyed support this direction.

Canadians also have increasingly strong expectations about the government's ability to deliver improved services. Canadians value accuracy, understanding and reliability as the most important features of service quality. Staff and information quality, access and speed of service, as well as new and innovative ways to provide information to citizens also appear to be among the top satisfaction drivers.

Although the Government of Canada has made great strides in improving service quality and in delivering programs and services more efficiently, further improvements in these areas remain a key priority.

Associated Risk

The important role that IT plays in supporting departmental priorities means that the Department must manage the risk that the existing information technology infrastructure and recovery capability might not be adequate to ensure continued quality front-line service delivery to all Canadian citizens.

The Department is committed to deliver its programs and services more efficiently through the use of information technology. In collaboration with its service partners, Service Canada provides Canadians with access to more than 60 government programs and services across multiple service delivery channels, while ensuring the privacy and protection of sensitive information, including securing information technology (IT) channels and equipment. The Department's aging IT infrastructure could affect the ability to meet client expectations for high level service delivery.

The Department will finalize the information technology plan aligned to strategic plans and priorities and ensure effective management of IT investments. The Department will also ensure that business resumption and recovery capabilities are sufficient to mitigate the potential risk of systems problems. Service Canada will develop and execute a renewal road map in order to modernize its technology infrastructure and associated software applications.

To achieve a more effective, efficient, and streamlined state of processing and payment services to citizens, Service Canada is implementing greater automation in its information systems for payment and service delivery processes. Better risk management and information sharing with partners will also ensure that Canadians have trust in the security and confidentiality of the information used in delivering programs.

Priorities for 2008-2009

Providing the highest level of services to Canadians

Canadians benefit from programs and services that are easy to find, deal with and access. Service Canada is committed to improving service to Canadians by putting the citizen at the centre of how government delivers services and by providing service in the official language of their choice.

Service Canada is dedicated to improving the delivery of services to Canadians. This includes enhancing the quality of service delivery, while improving the cost-effectiveness of operations. Service Canada will continue to focus on improving the delivery of Employment Insurance, Canada Pension Plan and Old Age Security through the on-going simplification and standardization of automated processes, in order to transform into a world-class service delivery organization with a national and virtual processing network. This work will be supported by stronger information management practices and the use of technology. Further, better risk management and secure information sharing with partners will ensure that Canadians have trust in the security and confidentiality of the information used in delivering programs.

Finally, the Labour Program's delivery of services across Canada related to occupational health and safety, labour standards, employment and pay equity, fire safety, and injury compensation will be enhanced through full implementation of a reorganization that creates a dedicated senior official responsible for directing those activities and through efforts to modernize compliance strategies.

Management - Stewardship and Accountability

Context