Common menu bar links

Breadcrumb Trail

ARCHIVED - Human Resources and Skills Development - Report

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Minister's Message

Message from the Minister of Human Resources and Skills Development

I am pleased to present Human Resources and Skills Development Canada's Departmental Performance Report which identifies progress made on the priorities outlined in the 2010-2011 Report on Plans and Priorities.

In 2010–2011, our government continued to deliver key elements of the second phase of Canada’s Economic Action Plan, helping hundreds of thousands of Canadians, investing in the key drivers of economic growth – innovation, investment, education and training. Through the creation of jobs and support to families and communities, we are fostering an environment in which all Canadians can contribute to, and benefit from, our country’s continued economic recovery.

Human Resources and Skills Development Canada provided targeted help for those most adversely affected by these challenging economic times. Extended Employment Insurance benefits, including the Work-Sharing Program, and improvements to the Wage Earner Protection Program helped many Canadians during difficult times. Our partnerships with employers, the provinces and territories helped Canadian workers access information, skills and training to meet the changing demands for the jobs of tomorrow. For example, the Working in Canada tool provided more than two million people with regional and national labour market information to help them make decisions about their future.

At the same time investments provided opportunities for Canadians to upgrade their skills. In continuing to provide additional incentives for Canadians to participate in and complete apprenticeships, our government issued over 77,000 Apprenticeship Grants to apprentices completing their certification in the Red Seal trades. Education plays an important role in preparing for job opportunities, both now and in the future. In support of post-secondary education, we completed implementation of the Canada Student Grants Program and the Repayment Assistance Plan, broadening the financial assistance available to students.

Service excellence remained at the forefront for Service Canada with more than $87 billion in Employment Insurance, Canada Pension Plan and Old Age Security benefits delivered to Canadians. Despite the higher demand for services, processing improvements and other measures continued to allow Service Canada to meet the needs of Canadians in a timely and responsive manner. In addition, Canadians were encouraged to use direct deposit as a more reliable, secure, confidential, and sustainable way to receive benefits.

As Minister of Human Resources and Skills Development, I am proud of how we have helped give Canadians the tools they need to take advantage of the jobs of tomorrow, how we have supported Canadian families and communities, and how we have invested in innovation, education and training. Human Resources and Skills Development Canada will continue to support Canadians as the economy recovers.

__________________________________________________

The Honourable Diane Finley, P.C., M.P.

Minister of Human Resources and Skills Development

Message from the Minister of Labour

I am pleased to sign the 2010-2011 Departmental Performance Report, which presents the achievements of the Labour Program.

The Labour Program is a key player in supporting a strong Canadian economy. It works to protect Canadian workers and employers by strengthening labour-management relations, and by developing Canadian national occupational health and safety standards that reflect industry best practices in Canada and around the world. It also plays a leadership role in international labour affairs.

In 2010–2011, the Labour Program offered more preventive mediation services aimed at resolving workplace differences and improving labour relations. And we are pleased to note that 94% of collective bargaining disputes were settled without a work stoppage last year. Minimizing labour disruptions is crucial in bringing stability to these difficult economic times.

The Labour Program also played an important role in Canada's Economic Action Plan through the Wage Earner Protection Program, as significant and permanent changes were made to the Wage Earner Protection Program Act to include protection for employee severance and termination pay.

Additionally, we implemented the results of the Strategic Review, conducted in 2009, which confirmed very clearly the relevance of our mandate, while highlighting the need for us to be more effective and efficient in service delivery and resource management. Consequently, we developed and implemented an agenda aimed at modernizing our service delivery, ensuring efficiency and attaining service excellence through continuous improvement.

Moving forward, the Labour Program will continue to ensure that workplaces of the future are safe, fair and productive. In support of this aim, we will continue to conduct round-table discussions across the country. These round tables afford us an opportunity to hear from leaders representing all sides of an issue in an effort to assist in the formation of government policy and possible legislative/regulatory changes.

We will follow through on our international mandate. This means implementing labour cooperation agreements, representing Canada in multilateral forums and negotiating international labour standards that advance Canadian interests and values of respect for workers’ rights around the globe.

This year’s Departmental Performance Report demonstrates yet again the Labour Program’s commitment to help Canadians prosper and contribute to a productive work environment.

__________________________________________________

The Honourable Lisa Raitt, P.C., M.P.

Minister of Labour

Section I - Organizational Overview

1.1 Raison d'�tre

The mission of Human Resources and Skills Development Canada (HRSDC) is to build a stronger and more competitive Canada, to support Canadians in making choices that help them live productive and rewarding lives, and to improve Canadians' quality of life.

1.2 Responsibilities

To fulfill its mission, HRSDC is responsible for:

- supporting a flexible, national labour market;

- increasing participation in the labour force;

- removing barriers to post-secondary education attainment and skills development;

- overseeing federal labour responsibilities;

- providing income support to seniors, families with children and Employment Insurance beneficiaries; and

- delivering other Government of Canada programs and services.

Included in these core roles are responsibilities for the design and delivery of some of the Government of Canada's most well-known statutory programs and services, including:

- Old Age Security;

- the Canada Pension Plan;

- Employment Insurance;

- Canada Student Loans and Grants;

- Canada Education Savings Program;

- the National Child Benefit; and

- the Universal Child Care Benefit.

These direct benefits to Canadians are part of Canada's social safety net and represent almost 95% of the Department's expenditures.

Through Service Canada, HRSDC is the face of the Government of Canada for many Canadians, helping them access HRSDC programs and other Government of Canada programs and services at more than 600 points of service across the country. In addition to in-person services, the organization serves the needs of Canadians online at www.servicecanada.gc.ca, and by telephone through 1 800 O Canada and its integrated network of call centres.

The Department, through the Labour Program, also oversees federal labour responsibilities. This includes labour laws, occupational health and safety, labour relations and mediation services in federally regulated workplaces, representation of Canada in international labour organizations, and negotiation of labour cooperation agreements as part of free trade negotiations.

Finally, through grants and contributions, HRSDC provides funding to other levels of government, the voluntary and private sectors, employers, unions, educators, and community organizations to support projects that meet the labour market and social development needs of Canadians.

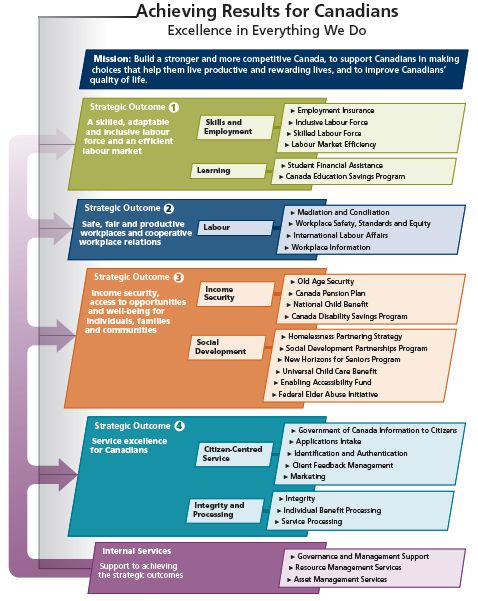

1.3 Strategic Outcomes and Program Activity Architecture

Human Resources and Skills Development Canada Program Activity Architecture

The HRSDC Program Activity Architecture (PAA) is a representation of the programs offered by HRSDC and the results (strategic outcomes) that the programs are designed to achieve for Canadians. The PAA also includes a program activity for services that are internal to the Department and are important in supporting the achievement of HRSDC's four strategic outcomes

Text description of Achieving Results for Canadians

The full HRSDC Program Activity Architecture is available at: http://www.hrsdc.gc.ca/eng/publications_resources/dpr/paa/paa.shtml

1.4 Organizational Priorities

HRSDC successfully met the objectives of all of its priorities outlined in the 2010-2011 Report on Plans and Priorities.

| Priority | Strategic Outcome(s) and/or Program Activity(ies) |

|---|---|

| Supporting the changing needs of Canadian workers and employers | Link to Strategic Outcomes Strategic Outcome 1: A skilled, adaptable and inclusive labour force and an efficient labour market |

| Status | |

| HRSDC assisted unemployed workers through enhancements to the Employment Insurance Act and the introduction of new active employment measures as part of the second year of Canada's Economic Action Plan (EAP). These measures assisted Canadians by providing targeted help to those adversely

affected by the recession, including Aboriginal people, youth and older workers. For full reporting on the EAP, visit www.actionplan.gc.ca. Strengthening of particular Employment Insurance (EI) measures helped Canadians during a period of high unemployment. As an example, Bill C-10 (Budget Implementation Act, 2009) extended the duration of EI regular benefits by five weeks for all claimants and Bill C-50 (An Act to amend the Employment Insurance Act and to increase benefits) provided up to 20 more weeks of regular benefits to long-tenured workers. In addition, vulnerable workers (including persons with disabilities, youth, Aboriginal people and recent immigrants) and workers in transition were supported in their efforts to find jobs and increase their participation in the labour market. A number of other key legislative and regulatory initiatives for the EI program were also implemented including Bill C-56 (Fairness for the Self-Employed Act) and Bill C-13 (Fairness for Military Families (Employment Insurance) Act). Additionally, extensions were also implemented to the Best 14 Weeks and the Working While on Claim EI pilot projects. The Department's partnerships with employers, the provinces and territories played a key role in improving the preparedness of Canadian workers to meet the evolving demand for skills in the labour market. For instance, in working with the provinces and territories, the Department was successful in implementing a framework for Foreign Credential Recognition (FCR), which took into consideration the gaps in practices and processes identified in target occupations. Revamping and consolidating Labour Market Information (LMI) tools, services and resources, including streamlining the delivery of e-products such as specialized information for FCR and the introduction of new audience-specific content, has improved access to LMI. As well, apprenticeship grants–part of a suite of federal supports to apprentices and the skilled trades–increased access to the skilled trades, encouraged progression within an apprenticeship program, and promoted completion and certification in the 52 Red Seal trades. The Department also successfully completed various activities to improve supports for individuals pursuing post-secondary education, including completing implementation of the Canada Student Grants Program, the Repayment Assistance Plan and the Repayment Assistance Plan for Borrowers with Permanent Disabilities. Work continued to implement the Service Delivery Vision for the Canada Student Loans Program, enabling the Department to put in place the first Master Student Financial Assistance Agreement in the province of British Columbia. Discussions with other interested provincial and territorial partners to pursue additional Service Delivery Vision initiatives are ongoing. |

|

| Priority | Strategic Outcome(s) and/or Program Activity(ies) |

|---|---|

| Helping Canadian workers and employers maintain workplace safety, fairness, and productivity, and cooperative workplace relations | Link to Strategic Outcomes Strategic Outcome 2: Safe, fair and productive workplaces and cooperative workplace relations |

| Status | |

| Supporting national economic growth and ensuring Canada succeeds in an increasingly competitive global economy is an important government priority. Meeting the needs of parties involved in resolving workplace disputes and mitigating the risk of work stoppages in key industries takes on increased importance in the current economic context. The Preventive Mediation Program is used by unions and management to assist them in building better relationships that translate into better relations at negotiation tables, helping to prevent costly work stoppages. The Labour Program endeavoured to deliver more preventive mediation sessions, thereby improving results and fostering better labour management relations. These efforts are expected to translate into fewer work stoppages and decreased productivity loss, bringing stability to a period of slow economic growth. As part of the EAP, changes were made to the Wage Earner Protection Program Act to include protection for employee severance and termination pay. On the international stage, the Labour Program led the negotiation and implementation of labour cooperation agreements, which are part of each free trade agreement and protect Canadian companies and workers from foreign competitors who may be tempted to gain unfair advantages by ignoring fundamental labour standards. The Labour Program also represented Canada in multilateral forums where labour matters were discussed, such as the International Labour Organization and the inter-American Conference of Ministers of Labour, and negotiated international labour standards that advanced Canadian interests and values abroad. |

|

| Priority | Strategic Outcome(s) and/or Program Activity(ies) |

|---|---|

| Providing income security, access to opportunities and support for the well-being of Canadians, their families and communities | Linked to Strategic Outcomes Strategic Outcome 3: Income security, access to opportunities and well-being for individuals, families and communities |

| Status | |

| In 2010-2011, the Department provided timely statutory benefits for millions of Canadians through the administration of Canada's national pension programs. Both the Canada Pension Plan (CPP) and Old Age Security (OAS) helped individuals and families by contributing to a

stable income for eligible recipients. The Department implemented Bill C-31 (Eliminating Entitlements for Prisoners Act) in December 2010. The new provisions of this bill placed limits on the payment of OAS benefits to beneficiaries by suspending their OAS benefits (pension, Guaranteed Income Supplement, Allowance and Allowance for the Survivor) while they are incarcerated in a federal penitentiary, generally serving a sentence of two years or more. Agreements are being pursued with the provinces and territories which would suspend payments to individuals who are incarcerated serving a term exceeding 90 days in a prison in that jurisdiction. HRSDC began implementing changes to the CPP in January 2011 as a result of Bill C-51 (Economic Recovery Act (stimulus)). The proposed changes to the CPP better reflect the way Canadians now live, work and retire, recognizing that retirement is often a process that occurs in stages, rather than a one-time event. The enhancements provide greater flexibility for older workers to combine pension and work income if they wish, modestly expand pension coverage, and improve fairness in the Plan's flexible retirement provisions. These changes ensure that the CPP will remain fair and sustainable as it responds to the evolving needs of Canada's aging population, the changing economy and the labour market. The Department continued to support programs for the homeless or those at risk of becoming homeless, as well as programs for children, families, seniors, communities, and people with disabilities. HRSDC provided these groups with the knowledge, information, and opportunities to move forward with their own solutions to social and economic challenges. |

|

| Priority | Strategic Outcome(s) and/or Program Activity(ies) |

|---|---|

| Sustaining the delivery of responsive, quality government information, programs and services | Link to Strategic Outcomes Strategic Outcome 1: A skilled, adaptable and inclusive labour force and an efficient labour market Strategic Outcome 2: Safe, fair and productive workplaces and cooperative workplace relations Strategic Outcome 3: Income security, access to opportunities and well-being for individuals, families and communities Strategic Outcome 4: Service excellence for Canadians |

| Status | |

| In 2010-2011 HRSDC managed close to 123.8 million citizen service contacts with clients, compared to approximately 118.5 million in 2009-2010. This included 13.8 million service requests made by clients at Service Canada in-person locations, 1.9 million calls answered by 1 800 O-Canada agents, 9.8 million calls answered by an EI, OAS, or CPP agent,

31.3 million calls resolved in the interactive voice response system of the call centre network, and 67 million visits to the Service Canada website. The delivery of temporary measures under the EAP remained a priority in 2010-2011, and more than $87 billion in EI, OAS and CPP benefits were delivered to Canadians. By year's end, a total of 2.9 million EI claims had been filed, 12.3% more than the number of claims recorded prior to the economic downturn. The Department achieved its EI speed of payment target for 19 consecutive months with a fiscal year average of 83.9% nationally. In 2010-2011, CPP and OAS issued over 112 million payments to beneficiaries. CPP delivered $31.6B in benefits to approximately 4.7 million beneficiaries while $35.7B in OAS benefits were delivered to more than 4.8 million beneficiaries. During the 2010-2011 fiscal year, more than 3.02 million CPP and OAS applications were processed. Service Canada mailed over 10 million forms and letters including CPP and OAS taxation slips, statements of contributions, notices of entitlement letters and applications for benefits. The speed of payment measures for both the CPP Retirement and OAS Basic pensions has been met or exceeded consistently every month since the 2004-2005 fiscal year. In addition, HRSDC was able to yield substantial savings for the federal government in 2010-2011 by identifying and subsequently discontinuing benefits that were issued as a result of suspected fraud or abuse of EI, CPP, and OAS programs. The Department's integrated approach to service delivery leverages the strengths of each individual service channel (Internet, telephone, in-person, and mail/fax). Focusing on a coordinated approach to service delivery enabled the Department to meet citizens' demands for responsive, quality government information, programs and services. This was particularly evident in the Department's delivery of its commitments under the EAP, its maintenance of a high level of performance over the short and medium term and the promotion of easy-to-access tools such as the Benefits Finder, Record of Employment Web, My Service Canada Account, Finding a Job, and the Canada Retirement Income Calculator. The Department remains attuned and responsive to the needs of citizens through regular research and analysis of citizen feedback. A service improvement initiative addressed the needs and demands of citizens by responding directly to feedback collected through various tools, such as comment cards, Web comment forms, and the Office for Client Satisfaction. Service Canada continues to look to ways to decrease the environmental impact within the processing operation. Active promotion of direct deposit as a more reliable, secure, confidential and environmentally sustainable way to receive payments is ongoing. Recent updates to the Tax Information Slips Online service will mean that CPP clients and agents on the phone will now be able to access amendment and duplicate tax slips online decreasing the demand for hard copy versions. In addition, the demand for Personal Access Codes required to access online systems, increased by 19.5% in 2010-2011 over the previous year. Internally, the Department invested in the design and delivery of training programs that strengthened the knowledge and skills of employees involved in the delivery of the Department's programs and service offerings. Front-line staff were also given the tools required to effectively meet the needs of Canadians during their first interaction with the Department. For example, these officers can now complete direct deposit requests from CPP/OAS clients and provide information on the status of their pension application. |

|

| Priority | Strategic Outcome(s) and/or Program Activity(ies) |

|---|---|

| Continuing to enhance departmental management excellence and accountability | Link to Strategic Outcomes Strategic Outcome 1: A skilled, adaptable and inclusive labour force and an efficient labour market Strategic Outcome 2: Safe, fair and productive workplaces and cooperative workplace relations Strategic Outcome 3: Income security, access to opportunities and well-being for individuals, families and communities Strategic Outcome 4: Service excellence for Canadians |

| Status | |

| Public Service Renewal is a key priority for the Department and was supported through the 2010-2011 Renewal Action Plan and three priorities: Creating a Healthy Workplace; Strengthening and Enabling Leadership; and Investing in Career Development. The Department completed a review of key corporate services in the areas of finance, human resources and informatics which will lead to the renewal of departmental systems and an integrated enterprise approach to internal service delivery. The various projects underway will achieve the goals of enhancing service delivery excellence, facilitating effective stewardship, and obtaining greater value for money in internal systems. Progress was achieved advancing departmental governance to oversee the effective management of assets and project investments. In addition, a departmental Information Technology (IT) Asset Plan was completed, establishing a profile of the Department's current IT assets in terms of operating costs, support for business needs, and operating risks. Information management was supported through the development of an action plan to address related departmental infrastructure, and the creation of an Information Management (IM) Strategy to promote a shared understanding of the importance and future direction for IM as well as providing employees with the necessary tools and resources. |

|

1.5 Risk Analysis

The Department identified and addressed three risk areas: employee demographics and skills, information technology infrastructure and service delivery.

Employee Demographics and Skills

The Department's workforce continued to be affected by the same demographic trends as the rest of the Canadian population. An aging workforce, combined with high levels of turnover, resulted in increased pressure to manage organizational renewal and change in a systematic manner. One of the ways the Department is addressing this risk is through its continued support for Public Service Renewal. The following initiatives have been put in place in order to support Public Service Renewal and build a healthy, enabled workplace and workforce with strong executive and managerial leadership:

Leadership

The first portfolio-wide executive leadership conference was held in May 2010, followed by discussion of future leadership requirements in an environment of greater fiscal restraint. To foster strong leadership in the Department, an executive integrated talent and performance management/succession planning process was developed. Human resource planning at the executive level is focused on the competencies required for an evolving work environment.

Effective people management is the cornerstone of building a healthy and enabled workforce. The development of people management dashboards and the development of a human resources policy framework lays the foundation for evidence-based decisions based on clear accountabilities, roles and responsibilities. Combined with the development of an integrated human resource staffing process, managers have the tools they need to develop integrated business and human resources plans, supporting improved performance in both people management and leadership.

Workplace

HRSDC has developed a Healthy and Enabling Workplace Strategy to provide a safe work environment that encourages performance and productivity through leadership that is grounded in core public service values. The Department has also developed a mentoring framework in order to build the organization's capacity to transfer knowledge and create a sense of community.

In conjunction with these efforts, the Department has established learning paths for employees and ensured curricula are aligned with new programs, services and work conditions to help sustain a multi-skilled and flexible workforce able to address current and future business priorities.

Workforce

As part of its efforts to ensure the Department has the right people in the right jobs, at the right time, a three-year post-secondary recruitment strategy was implemented, resulting in 178 post-secondary hires. In addition, a Student Bridging Inventory was launched and a multi-year diversity and employment equity plan was developed and approved. A Workforce Management Strategy has also been developed to support effective people management through the Department's coming transformation while demonstrating transparency and fairness to employees.

Information Technology Infrastructure

HRSDC's aging IT infrastructure limited the Department's capacity to implement new and innovative approaches to business processes. To address this, the Department has established a long-term funding strategy that will provide a sustainable, annual source of funds for the needed replacement of assets.

To address the reliance of the Department's key systems and applications on older technologies, monitoring of mission-critical systems has been improved in order to ensure business continuity and, in certain cases, upgrades have been made to hardware to enhance performance. Where possible, backups of critical applications have been made to speed disaster recovery, and plans have been developed to ensure that commercially available components (e.g. operating systems, hardware, and developer tools) are available on short notice from suppliers. Lastly, the Department began to consolidate and streamline the application portfolio so that similar business requirements can be addressed by common solutions while at-risk systems are being replaced with "off the shelf" solutions wherever possible.

Service Delivery

Although the economic recovery is progressing, the Department continued to experience high levels of demand for core services. Employment Insurance claim volumes were still significantly higher than volumes experienced prior to the economic downturn. Higher volumes of applications for Old Age Security and Canada Pension Plan were also evident in 2010-2011, highlighting the long-term demographic trend of an aging Canadian population.

The Department implemented a broad-based strategy to mitigate the risks created by these continuing demands on services. Through funding as part of EAP, the Department optimized its processing and service delivery operations across the country, extended hours of service for call centres, increased the number of staff, and improved Internet services to better enable citizen self-service.

EAP funding for meeting the increased demand in Employment Insurance claims wound down, as planned, on March 31, 2011. In the months leading up to this date, a strategy was developed to monitor potential risks and other key issues related to the winding down of investments. It was reviewed by departmental officials monthly, which allowed for early detection of issues and development of mitigation strategies.

1.6 Summary of Performance

2010-2011 Financial Resources ($ millions)

| Planned Spending | Total Authorities | Actual Spending |

|---|---|---|

| 102,134.6 | 101,686.6 | 101,467.2 |

2010-2011 Human Resources (FTEs)

| Planned | Actual | Difference |

|---|---|---|

| 27,457 | 24,388 | 3,069 |

| Performance Indicator | Target | 2010-2011 Performance |

|---|---|---|

| Employment ratio (Employed population as a percentage of the working-age population) Source: Labour Force Survey |

72.9% | Results: 2010-2011: 71.7% Historical results 2009-2010: 71.3% 2008-2009: 73.1% 2007-2008: 73.6% 2006-2007: 73.0% 2005-2006: 72.4% |

| Percentage of unemployed individuals eligible to receive benefits, among those who had a recent job separation that met EI program criteria Source: Employment Insurance Coverage Survey |

82.2% | Results: 2010: 83.9% Historical results: 2009: 86.2% 2008: 82.2% 2007: 82.3% 2006: 82.7% 2005: 83.4% |

| Percentage of the Canadian labour force (aged 25-64) that has attained a post-secondary education credential Source: Labour Force Survey |

65.5% | Results: 2010: 66.0% Historical results: 2009: 65.0% 2008: 64.3% 2007: 63.7% 2006: 62.8% 2005: 62.0% |

| Canada's OECD ranking for the percentage of its population with post-secondary education credentials Source: Organisation for Economic Co-operation and Development (OECD) |

1st place among OECD countries | Results: 2008 1st Historical results: 2007: 1st 2006: 1st 2005: 1st 2004: 1st 2003: 1st |

| Program Activity | 2009-2010 Actual Spending ($ millions) |

2010-2011 ($ millions) | Alignment to Government of Canada Outcomes | |||

|---|---|---|---|---|---|---|

| Main Estimates |

Planned Spending |

Total Authorities |

Actual Spending |

|||

| Skills and Employment | 23,765.6 | 2,317.3 | 24,794.4 | 25,225.0 | 25,034.7 | Income security and employment for Canadians |

| Learning | 2,466.7 | 2,486.3 | 2,493.5 | 2,928.5 | 2,921.1 | An innovative and knowledge-based economy |

| Total | 26,232.3 | 4,803.6 | 27,287.9 | 28,153.5 | 27,955.8 | |

| Performance Indicators | Target | 2010-2011 Performance |

|---|---|---|

| Percentage of collective bargaining disputes settled under Part I (Industrial Relations) of the Canada Labour Code without a work stoppage Source: Administrative Data |

90% | Result: 2010-2011: 94% Historical results: 2009-2010: 94% 2008-2009: 94% 2007-2008: 93% 2006-2007: 97% 2005-2006: 97% |

| Percentage of unjust dismissal complaints settled by inspectors under Part III (Labour Standards) of the Canada Labour Code Source: Administrative Data |

75% | Results: 2010-2011: 71% Historical results: 2009-2010: 71% 2008-2009: 73% 2007-2008: 76% 2006-2007: 74% 2005-2006: 74% |

| Percentage of money collected in relation to the amount found to be owed for complaints under Part III (Labour Standards) of the Canada Labour Code (excluding unjust dismissal complaints) Source: Administrative Data |

75% | Results: 2010-2011: 71.8% Historical results: 2009-2010: 72.1% 2008-2009: 78.6% 2007-2008: 66.4% 2006-2007: 75.1% 2005-2006: 77.7% |

| Percentage change, year over year, in the rate of lost time injuries and fatalities within the targeted higher risk federal jurisdiction industries Source: Administrative Data |

Decrease of 15% over a five year period (2009-2013) | Results: Not available until 2014 Historical results: 2005-2009: Decrease of 5.2% 2001-2005: Decrease of 20.5% Note: Disability Injury Incident Rate is measured over a fixed five-year period as it can fluctuate from year to year. |

| Program Activity | 2009-2010 Actual Spending ($ millions) |

2010-2011 ($ millions) | Alignment to Government of Canada Outcomes | |||

|---|---|---|---|---|---|---|

| Main Estimates |

Planned Spending |

Total Authorities |

Actual Spending |

|||

| Labour | 268.5 | 300.3 | 300.5 | 264.8 | 262.8 | A fair and secure marketplace |

| Total | 268.5 | 300.3 | 300.5 | 264.8 | 262.8 | |

| Performance Indicators | Targets | 2010-2011 Performance |

|---|---|---|

| Percentage of population able to purchase goods and services, which corresponds to a modest standard of living in Canada according to the Market Basket Measure (MBM)a Source: Survey of Labour and Income Dynamics, 2008 |

89.9% | Results: 2008: 90.5% Historical results: 2007: 89.9% 2006: 88.1% 2005: 87.6% 2004: 86.9% 2003: 86.8% Note: There is a three-year lag in the availability of data |

| a The MBM is a measure of low income based on the cost of a specified basket of goods and services. It measures the incidence, depth and persistence of low income nationally for all main age groups, and genders, as well as for the five groups at high risk of persistent low income (lone parents; unattached individuals aged 45-64; persons with work limiting disabilities; recent immigrants; and Aboriginal people in Canada living off reserve). | ||

| Program Activity | 2009-2010 Actual Spending ($ millions) |

2010-2011 ($ millions) | Alignment to Government of Canada Outcomes | |||

|---|---|---|---|---|---|---|

| Main Estimates |

Planned Spending |

Total Authorities |

Actual Spending |

|||

| Income Security | 65,199.8 | 36,917.5 | 68,843.1 | 67,434.1 | 67,430.8 | Income security and employment for Canadians |

| Social Development | 2,796.8 | 2,862.6 | 2,862.6 | 2,954.6 | 2,917.3 | A diverse society that promotes linguistic duality and social inclusion |

| Total | 67,996.6 | 39,780.1 | 71,705.7 | 70,388.7 | 70,348.1 | |

| Performance Indicators | Targets | 2010-2011 Performance |

|---|---|---|

| Percentage of clients whose service expectations were met Source: Administrative Data |

Baseline Year | Results: 2010-2011: 84% |

| Percentage of partner organizations whose service expectations were met Source: Administrative Data |

Baseline Year | Results: 2010-2011: Survey postponed Note: The survey for this indicator was postponed pending the re-alignment of the Department's service delivery model and its expected influence on our partnership agreements. |

| Program Activity | 2009-2010 Actual Spending ($ millions) |

2010-2011 ($ millions) | Alignment to Government of Canada Outcomes | |||

|---|---|---|---|---|---|---|

| Main Estimates |

Planned Spending |

Total Authorities |

Actual Spending |

|||

| Citizen-Centred Service | 531.1 | 495.2 | 556.0 | 536.1 | 520.9 | A transparent, accountable and responsive federal government |

| Integrity and Processing | 804.7 | 588.1 | 738.3 | 763.4 | 748.6 | A transparent, accountable and responsive federal government |

| Total | 1,335.8 | 1,083.3 | 1,294.3 | 1,299.5 | 1,269.5 | |

| (Financial Resources, [Gross], $ Millions) | 2009-2010 | ||||

|---|---|---|---|---|---|

| Actual Spending ($ millions) |

Main Estimates |

Planned Spending |

Total Authorities |

Actual Spending |

|

| Internal Services | 937.4 | 823.2 | 898.7 | 944.6 | 925.3 |

| Total | 937.4 | 823.2 | 898.7 | 944.6 | 925.3 |

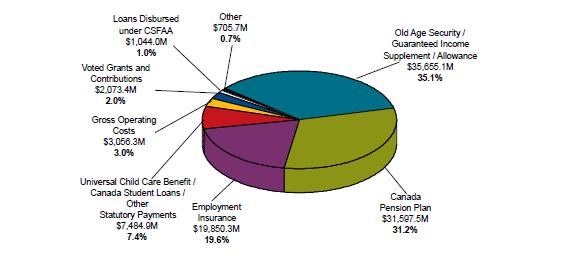

1.7 Expenditure Profile

HRSDC expenditures on programs and services total more than $101 billion, of which almost $96 billion, or almost 95%, directly benefits Canadians through EI, the CPP, OAS, the Universal Child Care Benefit, loans disbursed under the Canada Student Financial Assistance Act and other statutory transfer payment programs. Departmental expenditures were $2.1 billion in voted grants and contributions and $2.6 billion for EI Part II.

Consolidated Total: $101,467.2 Million

| Human Resources and Skills Development Canada - Gross Expenditures (millions of dollars) | Statutory Transfer Payments (millions of dollars) | ||||

|---|---|---|---|---|---|

| Budgetary | Grants and Contributions | ||||

| Net Operating Costs | 1,135.7 | Old Age Security | 27,213.5 | ||

| Add Recoveries in relation to: | Guaranteed Income Supplement | 7,901.1 | |||

| Canada Pension Plan | 296.6 | Allowances | 540.5 | ||

| Employment Insurance Operating Account | 1,490.9 | Other Statutory Payments: | |||

| Worker's Compensation | 121.4 | EI Benefit Enhancement Meassures | 2,900.0 | ||

| Other | 11.7 | 1,920.6 | Universal Child Care Benefit | 2,651.2 | |

| Gross Operating Costs | 3,056.3 | Canada Student Loans | 991.3 | ||

| Voted Grants and Contributions | 2,073.4 | Canada Education Savings Grant | 670.6 | ||

| Total Gross Expenditures | 5,129.7 | Canada Diability Savings Program | 128.3 | ||

| Canada Learning Bond | 66.8 | ||||

| Wage Earner Protection Program | 31.9 | ||||

| Other - Workers' Compensation and EI/CPP Charges and Recoveries |

705.7 | Pathways to Education | 2.0 | 7,442.1 | |

| Non-Budgetary | Sub-Total | 43,097.2 | |||

| Loans disbursed under Canada Student Financial Assistance Act (CSFAA) | 1,044.0 | Canada Pension Plan Benefits | 31,597.5 | ||

| Employment Insurance Benefits | |||||

| Part I | 17,244.9 | ||||

| Part II | 2,605.4 | 19,850.3 | |||

| Other Specified Purpose Accounts | 42.8a | ||||

| Total Statutory Transfer Payments | 94,587.8 | ||||

| a This amount includes payments related to the Government Annuities Account, the Civil Service Insurance Fund and the Canada Millennium Scholarship Foundation Excellence Awards Fund. | |||||

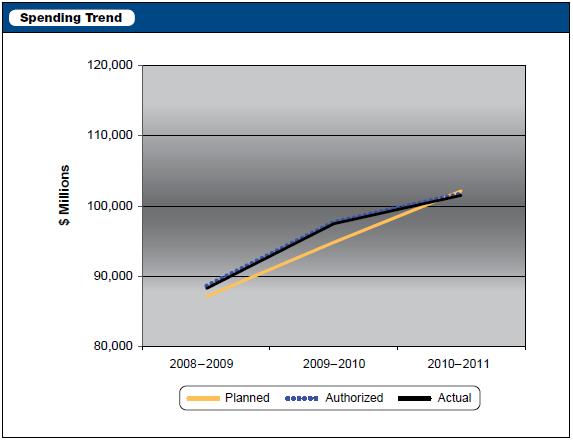

Departmental Spending Trend

The figure below illustrates HRSDC's spending trend from 2008-2009 to 2010-2011. In the 2010-2011 fiscal year, the Department spent $101.5 billion to contribute to achieving its expected results.

The 2008-2009 to 2010-2011 total authorized spending includes all parliamentary appropriation and revenue sources, Main Estimates and Supplementary Estimates. Planned spending corresponds to the forecasted planned spending presented in the Report on Plans and Priorities from each respective year.

In 2009-2010, actual expenditures were $9.1 billion (10.4%) higher than in 2008-2009. This increase can be mainly explained by a $3.6 billion increase in EI benefits and administrative costs due to the economic downturn, a $2.3 billion increase for initiatives announced in Canada's Economic Action Plan, a $1.4 billion increase in CPP benefits, and a $1.3 billion increase in OAS payments due to changes in the number of beneficiaries and the average monthly rate.

| EAPa | |||||

|---|---|---|---|---|---|

| 2008-2009 | 2009-2010a | 2010-2011a | 2009-2010 | 2010-2011 | |

| Planned | 87,125.7 | 94,719.8 | 102,134.6 | 2,037.5 | 2,525.7 |

| Authorized | 88,520.2 | 97,622.1 | 101,686.6 | 2,307.3 | 2,655.1 |

| Actual | 88,264.2 | 97,402.7 | 101,467.2 | 2,272.3 | 2,619.5 |

| a Canada's Economic Action Plan (EAP) initiaves are included with 2009-2010 and 2010-2011 figures. | |||||

In 2010-2011, actual expenditures were $4.1 billion, or 4.2% higher than in 2009-2010. This increase can be mainly explained by a payment of $2.9 billion for temporary EI benefit enhancement measures in accordance with the Budget Implementation Act 2009, a $1.2 billion increase in CPP benefits and a $1.0 billion increase in OAS payments due to the aging population and the increase in the monthly benefit amount. These increases are offset by a decrease of $1.7 billion to EI benefits mainly due to a decrease in the average unemployment rate from 8.4% in 2009-2010 to 7.9% in 2010-2011, resulting from the economic recovery.

1.8 Estimates by Vote

For information on our organizational votes and/or statutory expenditures, please see the 2010-2011 Public Accounts of Canada (Volume II). An electronic version of the Public Accounts is available at www.tpsgc-pwgsc.gc.ca/recgen/txt/72-eng.html