Common menu bar links

Breadcrumb Trail

ARCHIVED - Border Services (FB) - Archived

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Part IV: Leave Provisions

Article 33

Leave - General

33.01

- When an employee becomes subject to this Agreement, his or her earned daily leave credits shall be converted into hours. When an employee ceases to be subject to this Agreement, his or her earned hourly leave credits shall be reconverted into days, with one day being equal to seven decimal five (7.5) hours.

- Earned leave credits or other leave entitlements shall be equal to seven decimal five (7.5) hours per day.

- When leave is granted, it will be granted on an hourly basis and the number of hours debited for each day of leave shall be equal to the number of hours of work scheduled for the employee for the day in question.

- Notwithstanding the above, in Article 46, Bereavement Leave With Pay, a "day" will mean a calendar day.

33.02 Except as otherwise specified in this Agreement:

- where leave without pay for a period in excess of three (3) months is granted to an employee for reasons other than illness, the total period of leave granted shall be deducted from "continuous employment" for the purpose of calculating severance pay and from "service" for the purpose of calculating vacation leave;

- time spent on such leave which is for a period of more than three (3) months shall not be counted for pay increment purposes.

33.03 An employee is entitled, once in each fiscal year, to be informed, upon request, of the balance of his or her vacation and sick leave credits.

33.04 The amount of earned but unused leave with pay credited to an employee by the Employer at the time when this Agreement is signed, or at the time when the employee becomes subject to this Agreement shall be retained by the employee.

33.05 An employee shall not be granted two (2) different types of leave with pay or monetary remuneration in lieu of leave in respect of the same period of time.

33.06 An employee who, on the day that this Agreement is signed, is entitled to receive furlough leave, that is, five (5) weeks' leave with pay upon completing twenty (20) years of continuous employment, retains his or her entitlement to furlough leave, subject to the conditions respecting the granting of such leave that are in force on the day that this Agreement is signed.

33.07 An employee is not entitled to leave with pay during periods he or she is on leave without pay or under suspension.

33.08 In the event of termination of employment for reasons other than incapacity, death or lay-off, the Employer shall recover from any monies owed the employee an amount equivalent to unearned vacation and sick leave taken by the employee, as calculated from the classification prescribed in the employee's certificate of appointment on the date of the termination of the employee's employment.

33.09 An employee shall not earn leave credits under this Agreement in any month for which leave has already been credited to him or her under the terms of any other collective agreement to which the Employer is a party or under other rules or regulations of the Employer.

33.10 When an employee who is in receipt of a special duty allowance or an extra duty allowance is granted leave with pay, the employee is entitled during the employee's period of leave to receive the allowance if the special or extra duties in respect of which the employee is paid the allowance were assigned to the employee on a continuing basis, or for a period of two (2) or more months prior to the period of leave.

Article 34

Vacation Leave With Pay

34.01 The vacation year shall be from April 1 to March 31 inclusive of the following calendar year.

Accumulation of Vacation Leave Credits

**

34.02 For each calendar month in which an employee has earned at least seventy-five (75) hours' pay, the employee shall earn vacation leave credits at the rate of:

- nine decimal three seven five (9.375) hours until the month in which the anniversary of the employee's eighth (8th) year of service occurs;

- twelve decimal five (12.5) hours commencing with the month in which the employee's eighth (8th) anniversary of service occurs;

- thirteen decimal seven five (13.75) hours commencing with the month in which the employee's sixteenth (16th) anniversary of service occurs;

- fourteen decimal four (14.4) hours commencing with the month in which the employee's seventeenth (17th) anniversary of service occurs;

- fifteen decimal six two five (15.625) hours commencing with the month in which the employee's eighteenth (18th) anniversary of service occurs;

- sixteen decimal eight seven five (16.875) hours commencing with the month in which the employee's twenty-seventh (27th) anniversary of service occurs;

- eighteen decimal seven five (18.75) hours commencing with the month in which the employee's twenty-eighth (28th) anniversary of service occurs.

34.03

- For the purpose of clause 34.02 only, all service within the public service, whether continuous or discontinuous, shall count toward vacation leave except where a person who, on leaving the public service, takes or has taken severance pay. However, the above exception shall not apply to an employee who receives severance pay on lay-off and is reappointed to the public service within one year following the date of lay-off.

- Notwithstanding paragraph (a) above, an employee who was a member of one of the bargaining units listed below on the date of signing of the relevant collective agreement or an employee who became a member of those bargaining units between the date of signing of the relevant collective agreement and May 31, 1990 shall retain, for the purposes of "service" and of establishing his or her vacation entitlement pursuant to this clause, those periods of former service which had previously qualified for counting as continuous employment, until such time as his or her employment in the public service is terminated.

| Bargaining Units | Dates of Signing |

|---|---|

| AS, IS, PM | May 17, 1989 |

| CM, CR, DA, OE, ST | May 19, 1989 |

| WP | November 24, 1989 |

34.04 An employee is entitled to vacation leave with pay to the extent of the employee's earned credits, but an employee who has completed six (6) months of continuous employment is entitled to receive an advance of credits equivalent to the anticipated credits for the current vacation year.

Scheduling of Vacation Leave With Pay

34.05

- Employees are expected to take all their vacation leave during the vacation year in which it is earned.

- Subject to the following subparagraphs,

the Employer reserves the right to schedule an employee's vacation leave but

shall make every reasonable effort:

- to provide an employee's vacation leave in an amount and at such time as the employee may request;

- not to recall an employee to duty after the employee has proceeded on vacation leave;

- not to cancel or alter a period of vacation or furlough leave which has been previously approved in writing.

34.06 The Employer shall give an employee as much notice as is practicable and reasonable of approval, denial, alteration or cancellation of a request for vacation or furlough leave. In the case of denial, alteration or cancellation of such leave, the Employer shall give the reason therefor in writing, upon written request from the employee.

34.07 Where, in respect of any period of vacation leave, an employee:

- is granted bereavement leave,

or - is granted leave with pay because of

illness in the immediate family,

or - is granted sick leave on production of a medical certificate,

the period of vacation leave so displaced shall either be added to the vacation period, if requested by the employee and approved by the Employer, or reinstated for use at a later date.

34.08 Advance Payments

- The Employer agrees to issue advance payments of estimated net salary for vacation periods of two (2) or more complete weeks, provided a written request for such advance payment is received from the employee at least six (6) weeks prior to the last payday before the employee's vacation period commences.

- Provided the employee has been authorized to proceed on vacation leave for the period concerned, pay in advance of going on vacation shall be made prior to the commencement of leave. Any overpayment in respect of such pay advances shall be an immediate first charge against any subsequent pay entitlements and shall be recovered in full prior to any further payment of salary.

34.09 Recall From Vacation Leave

- Where an employee is recalled to duty

during any period of vacation or furlough leave, the employee shall be

reimbursed for reasonable expenses that the employee incurs:

- in

proceeding to the employee's place of duty,

and - in returning to the place from which the employee was recalled if the employee immediately resumes vacation upon completing the assignment for which the employee was recalled,

- in

proceeding to the employee's place of duty,

- The employee shall not be considered as being on vacation leave or furlough leave during any period in respect of which the employee is entitled under paragraph (a) to be reimbursed for reasonable expenses incurred by the employee.

34.10 Cancellation or Alteration of Vacation Leave

When the Employer cancels or alters a period of vacation or furlough leave which it has previously approved in writing, the Employer shall reimburse the employee for the non-returnable portion of vacation contracts and reservations made by the employee in respect of that period, subject to the presentation of such documentation as the Employer may require. The employee must make every reasonable attempt to mitigate such losses.

Carry-Over and/or Liquidation of Vacation Leave

34.11

- Where, in any vacation year, an employee has not been granted all of the vacation leave credited to him or her, the unused portion of his or her vacation leave, to a maximum of two hundred and sixty-two decimal five (262.5) hours of credits, shall be carried over into the following vacation year. All vacation leave credits in excess of two hundred and sixty-two decimal five (262.5) hours shall be automatically paid in cash at his or her daily rate of pay, as calculated from the classification prescribed in his or her certificate of appointment of his or her substantive position on the last day of the vacation year.

- Notwithstanding paragraph (a), if, on March 31, 1999, or on the date an employee becomes subject to this Agreement after March 31, 1999, an employee has more than two hundred and sixty-two decimal five (262.5) hours of unused vacation leave credits, a minimum of seventy-five (75) per year shall be granted or paid in cash by March 31 of each year, commencing on March 31, 2000, until all vacation leave credits in excess of two hundred and sixty-two decimal five (262.5) hours have been liquidated. Payment shall be in one instalment per year and shall be at the employee's daily rate of pay, as calculated from the classification prescribed in his or her certificate of appointment of his or her substantive position on March 31 of the applicable previous vacation year.

34.12 During any vacation year, upon application by the employee and at the discretion of the Employer, earned but unused vacation leave credits in excess of one hundred and twelve decimal five (112.5) hours may be paid in cash at the employee's daily rate of pay, as calculated from the classification prescribed in the certificate of appointment of the employee's substantive position on March 31 of the previous vacation year.

Leave to Employee's Credit When Employment Terminates

34.13 When an employee dies or otherwise ceases to be employed, the employee's estate or the employee shall be paid an amount equal to the product obtained by multiplying the number of days of earned but unused vacation and furlough leave to the employee's credit by the daily rate of pay, as calculated from the classification prescribed in the certificate of appointment on the date of the termination of employment.

34.14 Notwithstanding clause 34.13, an employee whose employment is terminated for cause pursuant to paragraph 12(1)(e) of the Financial Administration Act by reason of abandonment of his or her position is entitled to receive the payment referred to in clause 34.13, if he or she requests it within six (6) months following the date upon which his or her employment is terminated.

34.15 Where the employee requests, the Employer shall grant the employee his or her unused vacation leave credits prior to termination of employment if this will enable the employee, for purposes of severance pay, to complete the first (1st) year of continuous employment in the case of lay-off, and the tenth (10th) year of continuous employment in the case of resignation.

34.16 Appointment to a Separate Agency

Notwithstanding clause 34.13, an employee who resigns to accept an appointment with an organization listed Schedule V of the Financial Administration Act may choose not to be paid for unused vacation and furlough leave credits, provided that the appointing organization will accept such credits.

34.17 Appointment From a Separate Agency

The Employer agrees to accept the unused vacation and furlough leave credits, up to a maximum of two hundred and sixty-two decimal five (262.5) hours, of an employee who resigns from an organization listed in Schedule V of the Financial Administration Act in order to take a position with the Employer if the transferring employee is eligible and has chosen to have these credits transferred.

**

34.18

- An employee shall be credited a one-time entitlement of thirty-seven decimal five (37.5) hours of vacation leave with pay on the first (1st) day of the month following the employee's second (2nd) anniversary of service, as defined in clause 34.03.

- The vacation leave credits provided in paragraph 34.18(a) above shall be excluded from the application of paragraph 34.11, dealing with the Carry-Over and/or Liquidation of Vacation Leave.

Article

35

Sick Leave With Pay

Credits

35.01

- An employee shall earn sick leave credits at the rate of nine decimal three seven five (9.375) hours for each calendar month for which the employee receives pay for at least seventy-five (75) hours.

- A shift worker shall earn additional sick leave credits at the rate of one decimal two five (1.25) hours for each calendar month during which he or she works shifts and he or she receives pay for at least seventy-five (75) hours. Such credits shall not be carried over in the next fiscal year and are available only if the employee has already used one hundred and twelve decimal five (112.5) hours of sick leave credits during the current fiscal year.

Granting of Sick Leave

35.02 An employee shall be granted sick leave with pay when he or she is unable to perform his or her duties because of illness or injury provided that:

- he or she satisfies the Employer of this condition in such manner and at such

time as may be determined by the Employer;

and - he or she has the necessary sick leave credits.

35.03 Unless otherwise informed by the Employer, a statement signed by the employee stating that, because of illness or injury, he or she was unable to perform his or her duties, shall, when delivered to the Employer, be considered as meeting the requirements of paragraph 35.02(a).

35.04 When an employee has insufficient or no credits to cover the granting of sick leave with pay under the provisions of clause 35.02, sick leave with pay may, at the discretion of the Employer, be granted to the employee for a period of up to one hundred and eighty-seven decimal five (187.5) hours, subject to the deduction of such advanced leave from any sick leave credits subsequently earned.

35.05 When an employee is granted sick leave with pay, and injury-on-duty leave is subsequently approved for the same period, it shall be considered, for the purpose of the record of sick leave credits, that the employee was not granted sick leave with pay.

35.06 Where, in respect of any period of compensatory leave, an employee is granted sick leave with pay on production of a medical certificate, the period of compensatory leave so displaced shall either be added to the compensatory leave period if requested by the employee and approved by the Employer, or reinstated for use at a later date.

35.07 Sick leave credits earned but unused by an employee during a previous period of employment in the public service shall be restored to an employee whose employment was terminated by reason of lay-off and who is reappointed in the public service within two (2) years from the date of lay-off.

35.08 The Employer agrees that an employee shall not be terminated for cause for reasons of incapacity pursuant to paragraph 12(1)(e) of the Financial Administration Act at a date earlier than the date at which the employee will have used his or her accumulated sick leave credits except where the incapacity is the result of an injury or illness for which injury-on-duty leave has been granted pursuant to Article 37.

Article 36

Medical Appointment for Pregnant Employees

36.01 Up to three decimal seven five (3.75) hours of reasonable time off with pay will be granted to pregnant employees for the purpose of attending routine medical appointments.

36.02 Where a series of continuing appointments is necessary for the treatment of a particular condition relating to the pregnancy, absences shall be charged to sick leave.

Article

37

Injury-on-Duty Leave

37.01 An employee shall be granted injury-on-duty leave with pay for such period as may be reasonably determined by the Employer when a claim has been made pursuant to the Government Employees Compensation Act and a Workers' Compensation authority has notified the Employer that it has certified that the employee is unable to work because of:

- personal injury accidentally received in

the performance of his or her duties and not caused by the employee's willful

misconduct,

or - an industrial illness or a disease arising out of and in the course of the employee's employment,

if the employee agrees to remit to the Receiver General for Canada any amount received by him or her in compensation for loss of pay resulting from or in respect of such injury, illness or disease, provided, however, that such amount does not stem from a personal disability policy for which the employee or the employee's agent has paid the premium.

**Article 38

Maternity Leave Without Pay

38.01 Maternity Leave Without Pay

- An employee who becomes pregnant shall, upon request, be granted maternity leave without pay for a period beginning before, on or after the termination date of pregnancy and ending not later than eighteen (18) weeks after the termination date of pregnancy.

- Notwithstanding paragraph (a):

- where the employee has not yet proceeded on

maternity leave without pay and her newborn child is hospitalized,

or - where the employee has proceeded on maternity leave without pay and then returns to work for all or part of the period during which her newborn child is hospitalized,

- where the employee has not yet proceeded on

maternity leave without pay and her newborn child is hospitalized,

- The extension described in paragraph (b) shall end not later than fifty-two (52) weeks after the termination date of pregnancy.

- The Employer may require an employee to submit a medical certificate certifying pregnancy.

- An employee who has not commenced maternity leave without pay may elect to:

- use earned vacation and compensatory leave credits up to and beyond the date that her pregnancy terminates;

- use her sick leave credits up to and beyond the date that her pregnancy terminates, subject to the provisions set out in Article 35, Sick Leave With Pay. For purposes of this subparagraph, the terms "illness" or "injury" used in Article 35, Sick Leave With Pay, shall include medical disability related to pregnancy.

- An employee shall inform the Employer in writing of her plans for taking leave with and without pay to cover her absence from work due to the pregnancy at least four (4) weeks in advance of the initial date of continuous leave of absence during which termination of pregnancy is expected to occur unless there is a valid reason why the notice cannot be given.

- Leave granted under this clause shall be counted for the calculation of "continuous employment" for the purpose of calculating severance pay and "service" for the purpose of calculating vacation leave. Time spent on such leave shall be counted for pay increment purposes.

38.02 Maternity Allowance

- An employee who has been granted maternity leave without pay shall be paid a

maternity allowance in accordance with the terms of the Supplemental

Unemployment Benefit (SUB) Plan described in paragraphs (c) to (i), provided

that she:

- has completed six (6) months of continuous employment before the commencement of her maternity leave without pay,

- provides the Employer with proof that she

has applied for and is in receipt of maternity benefits under the Employment

Insurance or the Québec Parental Insurance Plan in respect of insurable

employment with the Employer,

and - has signed an agreement with the Employer

stating that:

- she will return to work on the expiry date of her maternity leave without pay unless the return to work date is modified by the approval of another form of leave;

- following her return to work, as described in section (A), she will work for a period equal to the period she was in receipt of maternity allowance;

- should she

fail to return to work for the Employer, Parks Canada, the Canada Revenue

Agency or the Canadian Food Inspection Agency in accordance with section (A),

or should she return to work but fail to work for the total period specified in

section (B), for reasons other than death, lay-off, early termination due to

lack of work or discontinuance of a function of a specified period of employment

that would have been sufficient to meet the obligations specified in section (B), or having become disabled as defined in the Public Service Superannuation Act,

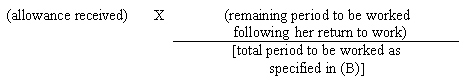

she will be indebted to the Employer for an amount determined as follows:

however, an employee whose specified period of

employment expired and who is rehired in any portion of the Core Public

Administration as specified in the Public Service Labour Relations Act

or Parks Canada, the Canada Revenue Agency or the Canadian Food Inspection

Agency within a period of ninety (90) days or less is not indebted for the

amount if her new period of employment is sufficient to meet the obligations

specified in section (B).

however, an employee whose specified period of

employment expired and who is rehired in any portion of the Core Public

Administration as specified in the Public Service Labour Relations Act

or Parks Canada, the Canada Revenue Agency or the Canadian Food Inspection

Agency within a period of ninety (90) days or less is not indebted for the

amount if her new period of employment is sufficient to meet the obligations

specified in section (B).

- For the purpose of sections (a)(iii)(B), and (C), periods of leave with pay shall count as time worked. Periods of leave without pay during the employee's return to work will not be counted as time worked but shall interrupt the period referred to in section (a)(iii)(B), without activating the recovery provisions described in section (a)(iii)(C).

- Maternity allowance payments made in accordance with the SUB Plan will consist

of the following:

- where an employee is subject to a waiting

period of two (2) weeks before receiving Employment Insurance maternity benefits,

ninety-three per cent (93%) of her weekly rate of pay for each week of the

waiting period, less any other monies earned during this period,

and - for each week that the employee receives a maternity benefit under the Employment Insurance or the Québec Parental Insurance plan, she is eligible to receive the difference between ninety-three per cent (93%) of her weekly rate and the maternity benefit, less any other monies earned during this period which may result in a decrease in her maternity benefit to which she would have been eligible if no extra monies had been earned during this period.

- where an employee is subject to a waiting

period of two (2) weeks before receiving Employment Insurance maternity benefits,

ninety-three per cent (93%) of her weekly rate of pay for each week of the

waiting period, less any other monies earned during this period,

- At the employee's request, the payment referred to in subparagraph 38.02(c)(i) will be estimated and advanced to the employee. Adjustments will be made once the employee provides proof of receipt of Employment Insurance or Québec Parental Insurance Plan maternity benefits.

- The maternity allowance to which an employee is entitled is limited to that provided in paragraph (c) and an employee will not be reimbursed for any amount that she may be required to repay pursuant to the Employment Insurance Act or the Parental Insurance Act in Québec.

- The weekly rate of pay referred to in paragraph (c) shall be:

- for a full-time employee, the employee's weekly rate of pay on the day immediately preceding the commencement of maternity leave without pay,

- for an employee who has been employed on a part-time or on a combined full-time and part-time basis during the six (6) month period preceding the commencement of maternity leave, the rate obtained by multiplying the weekly rate of pay in subparagraph (i) by the fraction obtained by dividing the employee's straight time earnings by the straight time earnings the employee would have earned working full-time during such period.

- The weekly rate of pay referred to in paragraph (f) shall be the rate to which the employee is entitled for her substantive level to which she is appointed.

- Notwithstanding paragraph (g), and subject to subparagraph (f)(ii), if on the day immediately preceding the commencement of maternity leave without pay an employee has been on an acting assignment for at least four (4) months, the weekly rate shall be the rate she was being paid on that day.

- Where an employee becomes eligible for a pay increment or pay revision that would increase the maternity allowance while in receipt of the maternity allowance, the allowance shall be adjusted accordingly.

- Maternity allowance payments made under the SUB Plan will neither reduce nor increase an employee's deferred remuneration or severance pay.

38.03 Special Maternity Allowance for Totally Disabled Employees

- An employee who:

- fails

to satisfy the eligibility requirement specified in subparagraph 38.02(a)(ii)

solely because a concurrent entitlement to benefits under the Disability

Insurance (DI) Plan, the Longterm Disability (LTD) Insurance portion of the

Public Service Management Insurance Plan (PSMIP) or the Government

Employees Compensation Act prevents her from receiving Employment

Insurance or Québec Parental Insurance Plan maternity benefits,

and - has satisfied all of the other eligibility criteria specified in paragraph 38.02(a), other than those specified in sections (A) and (B) of subparagraph 38.02(a)(iii),

- fails

to satisfy the eligibility requirement specified in subparagraph 38.02(a)(ii)

solely because a concurrent entitlement to benefits under the Disability

Insurance (DI) Plan, the Longterm Disability (LTD) Insurance portion of the

Public Service Management Insurance Plan (PSMIP) or the Government

Employees Compensation Act prevents her from receiving Employment

Insurance or Québec Parental Insurance Plan maternity benefits,

- An employee shall be paid an allowance under this clause and under clause 38.02 for a combined period of no more than the number of weeks during which she would have been eligible for maternity benefits under the Employment Insurance or the Québec Parental Insurance Plan had she not been disqualified from Employment Insurance or Québec Parental Insurance Plan maternity benefits for the reasons described in subparagraph (a)(i).

Article 39

Maternity-Related Reassignment or Leave

39.01 An employee who is pregnant or nursing may, during the period from the beginning of pregnancy to the end of the twenty-fourth (24th) week following the birth, request that the Employer modify her job functions or reassign her to another job if, by reason of the pregnancy or nursing, continuing any of her current functions may pose a risk to her health or the health of the foetus or child. On being informed of the cessation, the Employer, with the written consent of the employee, shall notify the appropriate workplace committee or the health and safety representative.

39.02 An employee's request under clause 39.01 must be accompanied or followed as soon as possible by a medical certificate indicating the expected duration of the potential risk and the activities or conditions to be avoided in order to eliminate the risk. Depending on the particular circumstances of the request, the Employer may obtain an independent medical opinion.

39.03 An employee who has made a request under clause 39.01 is entitled to continue in her current job while the Employer examines her request but, if the risk posed by continuing any of her job functions so requires, she is entitled to be immediately assigned alternative duties until such time as the Employer:

- modifies her job functions or reassigns

her;

or - informs her in writing that it is not reasonably practicable to modify her job functions or reassign her.

39.04 Where reasonably practicable, the Employer shall modify the employee's job functions or reassign her.

39.05 Where the Employer concludes that a modification of job functions or a reassignment that would avoid the activities or conditions indicated in the medical certificate is not reasonably practicable, the Employer shall so inform the employee in writing and shall grant leave of absence without pay to the employee for the duration of the risk as indicated in the medical certificate. However, such leave shall end no later than twenty-four (24) weeks after the birth.

39.06 An employee whose job functions have been modified, who has been reassigned or who is on leave of absence shall give at least two (2) weeks' notice in writing to the Employer of any change in duration of the risk or the inability as indicated in the medical certificate unless there is a valid reason why that notice cannot be given. Such notice must be accompanied by a new medical certificate.

**Article 40

Parental Leave Without Pay

40.01 Parental Leave Without Pay

- Where an employee has or will have the actual care and custody of a new-born child (including the new-born child of a common-law partner), the employee shall, upon request, be granted parental leave without pay for a single period of up to thirty-seven (37) consecutive weeks in the fifty-two (52) week period beginning on the day on which the child is born or the day on which the child comes into the employee's care.

- Where an employee commences legal proceedings under the laws of a province to adopt a child or obtains an order under the laws of a province for the adoption of a child, the employee shall, upon request, be granted parental leave without pay for a single period of up to thirty-seven (37) consecutive weeks in the fifty-two week (52) period beginning on the day on which the child comes into the employee's care.

- Notwithstanding paragraphs (a) and (b) above, at the request of an employee and at the discretion of the Employer, the leave referred to in the paragraphs (a) and (b) above may be taken in two periods.

- Notwithstanding paragraphs (a) and (b):

-

where

the employee's child is hospitalized within the period defined in the above

paragraphs, and the employee has not yet proceeded on parental leave without

pay,

or - where the employee has proceeded on parental leave without pay and then returns to work for all or part of the period during which his or her child is hospitalized,

-

where

the employee's child is hospitalized within the period defined in the above

paragraphs, and the employee has not yet proceeded on parental leave without

pay,

- An employee who intends to request parental leave without pay shall notify the Employer at least four (4) weeks in advance of the commencement date of such leave.

- The Employer may:

- defer the commencement of parental leave without pay at the request of the employee;

- grant the employee parental leave without pay with less than four (4) weeks' notice;

- require an employee to submit a birth certificate or proof of adoption of the child.

- Leave granted under this clause shall count for the calculation of "continuous employment" for the purpose of calculating severance pay and "service" for the purpose of calculating vacation leave. Time spent on such leave shall count for pay increment purposes.

40.02 Parental Allowance

- An employee who has been granted

parental leave without pay, shall be paid a parental allowance in accordance

with the terms of the Supplemental Unemployment Benefit (SUB) Plan described in

paragraphs (c) to (i), providing he or she:

- has completed six (6) months of continuous employment before the commencement of parental leave without pay,

- provides

the Employer with proof that he or she has applied for and is in receipt of

parental, paternity or adoption benefits under the Employment Insurance or

the Québec Parental Insurance Plan in respect of insurable

employment with the Employer,

and - has

signed an agreement with the Employer stating that:

- the employee will return to work on the expiry date of his/her parental leave without pay, unless the return to work date is modified by the approval of another form of leave;

- Following his or her return to work, as described in section (A), the employee will work for a period equal to the period the employee was in receipt of the parental allowance, in addition to the period of time referred to in section 38.02(a)(iii)(B), if applicable;

- should he or she fail to return to work for

the Employer, Parks Canada, the Canada Revenue Agency or the Canadian Food

Inspection Agency in accordance with section (A) or should he or she return to

work but fail to work the total period specified in section (B), for reasons

other than death, lay-off, early termination due to lack of work or

discontinuance of a function of a specified period of employment that would

have been sufficient to meet the obligations specified in section (B), or

having become disabled as defined in the Public Service Superannuation Act,

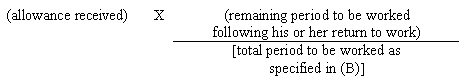

he or she will be indebted to the Employer for an amount determined as follows:

however,

an employee whose specified period of employment expired and who is rehired in

any portion of the Core Public Administration as specified in the Public

Service Labour Relations Act or Parks Canada, the Canada Revenue Agency or

the Canadian Food Inspection Agency within a period of ninety (90) days or less

is not indebted for the amount if his or her new period of employment is

sufficient to meet the obligations specified in section (B).

however,

an employee whose specified period of employment expired and who is rehired in

any portion of the Core Public Administration as specified in the Public

Service Labour Relations Act or Parks Canada, the Canada Revenue Agency or

the Canadian Food Inspection Agency within a period of ninety (90) days or less

is not indebted for the amount if his or her new period of employment is

sufficient to meet the obligations specified in section (B).

- For the purpose of sections (a)(iii)(B), and (C), periods of leave with pay shall count as time worked. Periods of leave without pay during the employee's return to work will not be counted as time worked but shall interrupt the period referred to in section (a)(iii)(B), without activating the recovery provisions described in section (a)(iii)(C).

- Parental Allowance payments made in

accordance with the SUB Plan will consist of the following:

- where an employee is subject to a waiting period of two (2) weeks before receiving Employment Insurance parental benefits, ninety-three per cent (93%) of his/her weekly rate of pay for each week of the waiting period, less any other monies earned during this period;

- for each week the employee receives parental, adoption or paternity benefit under the Employment Insurance or the Québec Parental Insurance Plan, he/she is eligible to receive the difference between ninety-three per cent (93%) of his or her weekly rate and the parental, adoption or paternity benefit, less any other monies earned during this period which may result in a decrease in his/her parental, adoption or paternity benefit to which he/she would have been eligible if no extra monies had been earned during this period.

- where an employee has received the full eighteen (18) weeks of maternity benefit and the full thirty-two (32) weeks of parental benefit under the Québec Parental Insurance Plan and thereafter remains on parental leave without pay, she is eligible to receive a further parental allowance for a period of two (2) weeks, ninety-three per cent (93%) of her weekly rate of pay for each week, less any other monies earned during this period.

- At the employee's request, the payment referred to in subparagraph 40.02(c)(i) will be estimated and advanced to the employee. Adjustments will be made once the employee provides proof of receipt of Employment Insurance or Québec Parental Insurance Plan parental benefits.

- The parental allowance to which an employee is entitled is limited to that provided in paragraph (c) and an employee will not be reimbursed for any amount that he or she is required to repay pursuant to the Employment Insurance Act or the Parental Insurance Act in Quebec.

- The weekly rate of pay referred to in

paragraph (c) shall be:

- for a full-time employee, the employee's weekly rate of pay on the day immediately preceding the commencement of maternity or parental leave without pay;

- for an employee who has been employed on a part-time or on a combined full-time and part-time basis during the six (6) month period preceding the commencement of maternity or parental leave without pay, the rate obtained by multiplying the weekly rate of pay in subparagraph (i) by the fraction obtained by dividing the employee's straight time earnings by the straight time earnings the employee would have earned working full-time during such period.

- The weekly rate of pay referred to in paragraph (f) shall be the rate to which the employee is entitled for the substantive level to which she or he is appointed.

- Notwithstanding paragraph (g), and subject to subparagraph (f)(ii), if on the day immediately preceding the commencement of parental leave without pay an employee is performing an acting assignment for at least four (4) months, the weekly rate shall be the rate the employee was being paid on that day.

- Where an employee becomes eligible for a pay increment or pay revision that would increase the parental allowance while in receipt of parental allowance, the allowance shall be adjusted accordingly.

- Parental allowance payments made under the SUB Plan will neither reduce nor increase an employee's deferred remuneration or severance pay.

- The maximum combined, shared maternity and parental allowances payable under this collective agreement shall not exceed fifty-two (52) weeks for each combined maternity and parental leave without pay.

40.03 Special Parental Allowance for Totally Disabled Employees

- An employee who:

- fails

to satisfy the eligibility requirement specified in subparagraph 40.02(a)(ii)

solely because a concurrent entitlement to benefits under the Disability

Insurance (DI) Plan, the Long-term Disability (LTD) Insurance portion of the

Public Service Management Insurance Plan (PSMIP) or via the Government

Employees Compensation Act prevents the employee from receiving Employment

Insurance or Québec Parental Insurance Plan benefits,

and - has satisfied all of the other eligibility criteria specified in paragraph 40.02(a), other than those specified in sections (A) and (B) of subparagraph 40.02(a)(iii), shall be paid, in respect of each week of benefits under the parental allowance not received for the reason described in subparagraph (i), the difference between ninety-three per cent (93%) of the employee's rate of pay and the gross amount of his or her weekly disability benefit under the DI Plan, the LTD Plan or via the Government Employees Compensation Act.

- fails

to satisfy the eligibility requirement specified in subparagraph 40.02(a)(ii)

solely because a concurrent entitlement to benefits under the Disability

Insurance (DI) Plan, the Long-term Disability (LTD) Insurance portion of the

Public Service Management Insurance Plan (PSMIP) or via the Government

Employees Compensation Act prevents the employee from receiving Employment

Insurance or Québec Parental Insurance Plan benefits,

- An employee shall be paid an allowance under this clause and under clause 40.02 for a combined period of no more than the number of weeks during which the employee would have been eligible for parental, paternity or adoption benefits under the Employment Insurance or the Québec Parental Insurance Plan, had the employee not been disqualified from Employment Insurance or Québec Parental Insurance Plan benefits for the reasons described in subparagraph (a)(i).

**Article

41

Leave Without Pay for the Care of Family

41.01 Both parties recognize the importance of access to leave for the purpose of the care of family.

41.02 An employee shall be granted leave without pay for the care of family in accordance with the following conditions:

- an employee shall notify the Employer in writing as far in advance as possible but not less than four (4) weeks in advance of the commencement date of such leave unless, because of urgent or unforeseeable circumstances, such notice cannot be given;

- leave granted under this Article shall be for a minimum period of three (3) weeks;

- the total leave granted under this Article shall not exceed five (5) years during an employee's total period of employment in the public service;

- leave granted for a period of one (1) year or less shall be scheduled in a manner which ensures continued service delivery.

- Compassionate Care

Leave

- Notwithstanding the definition of "family" found in clause 2.01 and notwithstanding paragraphs 41.02(b) and (d) above, an employee who provides the Employer with proof that he or she is in receipt of or awaiting Employment Insurance (EI) Compassionate Care Benefits may be granted leave for periods of less than three (3) weeks while in receipt of or awaiting these benefits.

- Leave granted under this clause may exceed the five (5) year maximum provided in paragraph (c) above only for the periods where the employee provides the Employer with proof that he or she is in receipt of or awaiting Employment Insurance (EI) Compassionate Care Benefits.

- When notified, an employee who was awaiting benefits must provide the Employer with proof that the request for Employment Insurance (EI) Compassionate Care Benefits has been accepted.

- When an employee is notified that their request for Employment Insurance (EI) Compassionate Care Benefits has been denied, paragraphs (i) and (ii) above cease to apply.

41.03 An employee who has proceeded on leave without pay may change his or her return-to-work date if such change does not result in additional costs to the Employer.

41.04 All leave granted under Leave Without Pay for the Long-Term Care of a Parent or Leave Without Pay for the Care and Nurturing of Pre-School Age Children provisions of previous Program and Administrative Services collective agreements or other agreements will not count towards the calculation of the maximum amount of time allowed for care of family during an employee's total period of employment in the public service.

Article

42

Volunteer Leave

42.01 Subject to operational requirements as determined by the Employer and with an advance notice of at least five (5) working days, the employee shall be granted, in each fiscal year, a single period of up to seven decimal five (7.5) hours of leave with pay to work as a volunteer for a charitable or community organization or activity, other than for activities related to the Government of Canada Workplace Charitable Campaign.

The leave will be scheduled at times convenient both to the employee and the Employer. Nevertheless, the Employer shall make every reasonable effort to grant the leave at such times as the employee may request.

Article 43

Leave With Pay for Family-Related Responsibilities

43.01 For the purpose of this Article, family is defined as spouse (or common-law partner resident with the employee), children (including foster children or children of the spouse or common-law partner), parents (including stepparents or foster parents), or any relative permanently residing in the employee's household or with whom the employee permanently resides.

43.02 The total leave with pay which may be granted under this Article shall not exceed thirty-seven decimal five (37.5) hours in a fiscal year.

43.03 Subject to clause 43.02, the Employer shall grant the employee leave with pay under the following circumstances:

- to take a family member for medical or dental appointments, or for appointments with school authorities or adoption agencies, if the supervisor was notified of the appointment as far in advance as possible;

- to provide for the immediate and temporary care of a sick member of the employee's family and to provide the employee with time to make alternative care arrangements where the illness is of a longer duration;

- to provide for the immediate and temporary care of an elderly member of the employee's family;

- for needs directly related to the birth or the adoption of the employee's child.

43.04 Where, in respect of any period of compensatory leave, an employee is granted leave with pay for illness in the family under paragraph 43.03(b) above, on production of a medical certificate, the period of compensatory leave so displaced shall either be added to the compensatory leave period, if requested by the employee and approved by the Employer, or reinstated for use at a later date.

Article 44

Leave Without Pay for Personal Needs

44.01 Leave without pay will be granted for personal needs in the following manner:

- subject to operational requirements, leave without pay for a period of up to three (3) months will be granted to an employee for personal needs;

- subject to operational requirements, leave without pay for more than three (3) months but not exceeding one (1) year will be granted to an employee for personal needs;

- an employee is entitled to leave without pay for personal needs only once under each of paragraphs (a) and (b) during the employee's total period of employment in the public service. Leave without pay granted under this clause may not be used in combination with maternity or parental leave without the consent of the Employer.

Article 45

Leave Without Pay for Relocation of Spouse

45.01 At the request of an employee, leave without pay for a period of up to one (1) year shall be granted to an employee whose spouse or common-law partner is permanently relocated and up to five (5) years to an employee whose spouse or common-law partner is temporarily relocated.

Article

46

Bereavement Leave With Pay

**

46.01 When a member of the employee's family dies, an employee shall be entitled to a bereavement period of five (5) consecutive calendar days. Such bereavement period, as determined by the employee, must include the day of the memorial commemorating the deceased, or must begin within two (2) days following the death. During such period, the employee shall be paid for those days which are not regularly scheduled days of rest for the employee. In addition, the employee may be granted up to three (3) days' leave with pay for the purpose of travel related to the death.

46.02 An employee is entitled to one (1) day's bereavement leave with pay for a purpose related to the death of his or her son-in-law, daughter-in-law, brother-in-law or sister-in-law.

46.03 If, during a period of sick leave, vacation leave or compensatory leave, an employee is bereaved in circumstances under which he or she would have been eligible for bereavement leave with pay under clauses 46.01 and 46.02, the employee shall be granted bereavement leave with pay and his or her paid leave credits shall be restored to the extent of any concurrent bereavement leave with pay granted.

46.04 It is recognized by the parties that circumstances which call for leave in respect of bereavement are based on individual circumstances. On request, the deputy head of a department may, after considering the particular circumstances involved, grant leave with pay for a period greater than and/or in a manner different than that provided for in clauses 46.01 and 46.02.

Article 47

Court Leave

47.01 The Employer shall grant leave with pay to an employee for the period of time he or she is compelled:

- to be available for jury selection;

- to serve on a jury;

- by subpoena, summons or other legal instrument, to attend as a witness in any

proceeding held:

- in or under the authority of a court of justice or before a grand jury;

- before a court, judge, justice, magistrate or coroner;

- before the Senate or House of Commons of Canada or a committee of the Senate or House of Commons otherwise than in the performance of the duties of the employee's position;

- before a legislative council, legislative

assembly or house of assembly or any committee thereof that is authorized by

law to compel the attendance of witnesses before it;

or - before an arbitrator or umpire or a person or body of persons authorized by law to make an inquiry and to compel the attendance of witnesses before it.

Article 48

Personnel Selection Leave

48.01 Where an employee participates in a personnel selection process, including the appeal process where applicable, for a position in the public service as defined in the Public Service Labour Relations Act, the employee is entitled to leave with pay for the period during which the employee's presence is required for purposes of the selection process and for such further period as the Employer considers reasonable for the employee to travel to and from the place where his or her presence is so required.

Article 49

Education Leave Without Pay

49.01 The Employer recognizes the usefulness of education leave. Upon written application by the employee and with the approval of the Employer, an employee may be granted education leave without pay for varying periods of up to one (1) year, which can be renewed by mutual agreement, to attend a recognized institution for studies in some field of education in which preparation is needed to fill the employee's present role more adequately or to undertake studies in some field in order to provide a service which the Employer requires or is planning to provide.

49.02 At the Employer's discretion, an employee on education leave without pay under this Article may receive an allowance in lieu of salary of up to one hundred per cent (100%) of the employee's annual rate of pay, depending on the degree to which the education leave is deemed by the Employer to be relevant to organizational requirements. Where the employee receives a grant, bursary or scholarship, the education leave allowance may be reduced. In such cases, the amount of the reduction shall not exceed the amount of the grant, bursary or scholarship.

49.03 Allowances already being received by the employee may, at the discretion of the Employer, be continued during the period of the education leave. The employee shall be notified when the leave is approved as to whether such allowances are to be continued in whole or in part.

49.04

- As a condition of the granting of education leave without pay, an employee shall, if required, give a written undertaking prior to the commencement of the leave to return to the service of the Employer for a period of not less than the period of the leave granted.

- If the employee:

- fails to complete the course,

- does

not resume employment with the Employer on completion of the course,

or - ceases to be employed except by reason of death or lay-off before termination of the period he or she has undertaken to serve after completion of the course,

the employee shall repay the Employer all allowances paid to him or her under this Article during the education leave or such lesser sum as shall be determined by the Employer.

Article 50

Career Development Leave

50.01 Career development refers to an activity which in the opinion of the Employer, is likely to be of assistance to the individual in furthering his or her career development and to the organization in achieving its goals. The following activities shall be deemed to be part of career development:

- a course given by the Employer;

- a course offered by a recognized academic institution;

- a seminar, convention or study session in a specialized field directly related to the employee's work.

50.02 Upon written application by the employee and with the approval of the Employer, career development leave with pay may be given for any one of the activities described in clause 50.01. The employee shall receive no compensation under Article 28, Overtime, or Article 32, Travelling Time, during time spent on career development leave provided for in this Article.

50.03 Employees on career development leave shall be reimbursed for all reasonable travel and other expenses incurred by them which the Employer may deem appropriate.

Article

51

Examination Leave With Pay

51.01 At the Employer's discretion, examination leave with pay may be granted to an employee for the purpose of writing an examination which takes place during the employee's scheduled hours of work.

Article 52

Leave With or Without Pay for Other Reasons

52.01 At its discretion, the Employer may grant:

- leave with pay when circumstances not directly attributable to the employee prevent his or her reporting for duty; such leave shall not be unreasonably withheld;

- leave with or without pay for purposes other than those specified in this Agreement.

52.02 Personal Leave

Subject to operational requirements as determined by the Employer and with an advance notice of at least five (5) working days, the employee shall be granted, in each fiscal year, a single period of up to seven decimal five (7.5) hours of leave with pay for reasons of a personal nature.

The leave will be scheduled at times convenient to both the employee and the Employer. Nevertheless, the Employer shall make every reasonable effort to grant the leaves at such times as the employee may request.