Common menu bar links

Breadcrumb Trail

ARCHIVED - Treasury Board of Canada Secretariat - Report

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Section II – Analysis of Program Activities by Strategic Outcome

Strategic outcome—Government is well managed and accountable, and resources are allocated to achieve results

Results under the Secretariat's strategic outcome strengthen the effectiveness and efficiency of the federal government, support Parliament and Cabinet decisions, and ensure that Canadians are well served by a government that is accountable, transparent, effective, and efficient. The strategic outcome rests on four distinct program activities.

Targets have been established throughout Section II to ensure compliance with the Policy on Management, Resources and Results Structures. There were challenges in establishing measurable targets for reporting purposes; as such, specific initiatives and activities have been used to demonstrate the Secretariat's progress. Significant improvement to the 2010–11 PMF was made during 2009–10, including measurable targets for future reporting.

Program Activity 1: Management Policy Development and Oversight

Through Program Activity 1, the Secretariat provides support to the Treasury Board in its role as the government's management board by promoting good management practices across government. This includes its role as employer of the core public administration. The Secretariat does this by developing policies, directives, and standards to guide good management across government; monitoring compliance and developing tools to measure and report on management performance; and providing advice and support to functional communities. To achieve its objectives under this program activity, the Secretariat works closely with its portfolio partner, the Canada School of Public Service.

| 2009–10 Financial Resources ($ thousands) |

2009–10 Human Resources (FTEs) |

||||

|---|---|---|---|---|---|

| Planned Spending |

Total Authorities |

Actual Spending |

Planned | Actual | Difference |

| 112,497 | 157,585 | 146,845 | 783 | 1,153 | 370 |

The increase of approximately $45 million between planned spending and total authorities can be attributed to the amalgamation of the CPSA with the Secretariat in 2009–10, support for new initiatives, funding provided for collective agreements, and paylist requirements. The amalgamation with the CPSA constituted the largest part of this increase, approximately $39 million. Actual spending was below total authorities due to a reduction in requirements for litigation support, delays in project funding, and slippage in anticipated contract activity.

The following table outlines the Secretariat's progress in meeting its established, expected results under Program Activity 1 as described in the RPP. Specific initiatives and activities have been used to help demonstrate the Secretariat's progress.

| Expected Results | Performance Indicators and Targets | Performance Status and Summary |

|---|---|---|

| Expectations are established to improve public service management. | Evolution of departmental MAF ratings and assessments over time (including those related to the employer role). |

Met all A five-year evaluation concluded that the MAF is achieving its objectives and continues to be successful and relevant. Results indicate that there has been an increase in the number of organizations performing well in overall MAF ratings. In the last five years, "attention required" and "opportunity for improvement" ratings decreased from 18% to 1% and from 31% to 15% respectively. "Acceptable" and "strong" ratings rose from 51% to 63% and from 0% to 21% respectively. To ensure continuous improvement of government management practices, the MAF process has been refined over the years to become more strategic and robust and, at the same time, less burdensome. |

| Functional communities are provided with the appropriate knowledge and tools to comply with Treasury Board policies. | Recruitment levels measured against the Secretariat's set targets. |

Mostly met Recruitment programs for chartered accountants, financial officers, internal auditors, computer systems analysts, and purchasing and supply specialists were completed, and identified targets for these communities were mostly met. These programs helped address shortage areas across government and strengthen development areas within functional communities. The Secretariat undertook targeted recruitment in 2009–10. For example, to enable departments and agencies to implement the new financial management policy suite, specific attention was given to hiring individuals with the necessary financial competencies. |

| Assessment of capacity in key management areas (internal audit, financial management, procurement, evaluation, IM and IT, labour relations, compensation, and occupational health and safety). |

Met all The Secretariat continually assesses capacity in the key management areas of internal audit, financial management, procurement, evaluation, IM and IT, labour relations, compensation, and occupational health and safety. It uses MAF's annual results to inform improvements in management practices and provide support to departments and agencies in strengthening capacity in these areas. Results from MAF Round V to VII showed that there was a measurable improvement in the quality of human resources planning in the internal audit community. The results of these assessments informed the Internal Audit Human Resources Management Framework. |

|

| Tools developed and used, and training delivered. |

Mostly met The Secretariat continued to engage functional communities in developing the implementation plan for specific policy instruments. This included identifying the tools and training needed to ensure a smooth transition in meeting new requirements. For example, through the Canada School of Public Service, seven new courses were developed to meet the needs of the procurement, materiel management and real property community. The Secretariat also provided training and written guidance on the use of assessment tools for organizational project management capacity and project risk and complexity to meet the requests of 18 departments and agencies. |

|

| Treasury Board policies and Secretariat advice are clear, relevant, and well communicated from the standpoint of departments and agencies.[5] | Quality of advice provided to departments and agencies. |

Met all The Secretariat works closely with client organizations and uses a single-window approach to simplify the process for organizations. The Secretariat continued to provide guidance on government policies and priorities and, as part of its challenge role, continued to review Treasury Board submissions, Memoranda to Cabinet, Estimates, MAF assessments, and strategic reviews. |

| Implementation of policies sequenced and phased in, depending on departmental capacity. |

Mostly met[6] The Secretariat continued to work with departments and agencies to coordinate the phased implementation of risk-based policies. Each policy area determined, in consultation with these organizations, an appropriate implementation plan for policy instruments. This implementation plan took into consideration several factors including deputies' accountability, governance structures, capacity, service to Canadians, impacts on internal and external stakeholders, and implementation risks. For instance, the Directive on Recordkeeping came into effect on June 1, 2009. Departments and agencies have five years to be fully compliant. As MAF results showed, federal organizations are beginning to put in place measures to ensure compliance. The Policy on Government Security was also introduced in 2009. Over the next three years, departments and agencies will progressively implement the new requirements related to departmental security planning. Current MAF ratings demonstrate that this is an area that needs improvement throughout government. |

As the performance summary demonstrates, the Secretariat effectively advanced management performance and the prudent use of resources for Program Activity 1 in 2009–10.

Performance Analysis

The Secretariat delivered most of the initiatives under Program Activity 1 in 2009–10, which resulted in significant progress in management policy development and oversight. Overall progress in this program activity is consistent with the policy direction on public service management taken by most other OECD countries. Most notably, the MAF has gained an international profile as a sophisticated management framework. The OECD has recognized the MAF as "an exceptional model for widening the framework of performance assessments beyond managerial results to include leadership, people management, and organizational environment."[7]

Policy in action: Economic Action Plan

In response to the global economic downturn, the government developed a targeted, timely, and responsible stimulus package through the EAP. A key priority for the Secretariat in implementing the EAP was to assist chief audit executives and chief financial officers in providing strategic and value-added advice to their departments and agencies. The Secretariat organized EAP-related risk assessment and mitigation sessions for audit executives, financial officers, and line management. It also assisted with the development of advice and timely, front-end, risk-targeted approaches and tools. Early identification of EAP risks allowed internal audit to work with management to determine appropriate mitigation strategies, define selection criteria, and document decisions.

Evaluation findings: Treasury Board submission process

One of the Secretariat's central roles is to work with departments and agencies on their Treasury Board submissions to seek spending and other authorities for programs and initiatives. An evaluation of the Treasury Board submission process concluded that the process is generally relevant and effective. The evaluation also identified opportunities for improvement in process management and professional development. In response, the Secretariat is strengthening its internal training and outreach to departments and agencies and is examining information management tools to see how they can be adjusted to improve internal processes.

Lessons learned: Policy suite renewal—people management

To implement the directions of the second and third reports of the Prime Minister's Advisory Committee on the Public Service, the Secretariat undertook a review of the 62 mandatory Treasury Board policy instruments in the area of people management. The objective is to streamline the policy suite to 41 instruments and make the policies more principles-based and risk-sensitive. Extensive consultation and analysis enabled the drafting of the Policy Framework for People Management, which connects the management of people and business. In addition, 6 policies were eliminated in 2009–10.

A 90-per-cent completion target for policy suite renewal was set at the beginning of the year. However, a large reorganization (resulting from the 2008–09 Human Resources Horizontal Strategic Review) and the complex collective bargaining environment delayed completion of policy suite renewal for people management in 2009–10. This work will be completed in 2010–11.

This experience suggests that implementing complex change takes time, and many variables have an impact on its speed and results. It is critical to build understanding of new directions among the key stakeholders in order to achieve the intended change.

In further support of Program Activity 1, the Secretariat focused on the following specific initiatives and made demonstrable progress.

| Expected Results | Performance Indicators and Targets | Performance Status and Summary |

|---|---|---|

| A streamlined Treasury Board policy suite that clarifies the responsibilities of deputy heads and supports other key management initiatives at the Secretariat. | 90% of policies have been streamlined. |

Mostly met Good progress has been made to streamline the Secretariat's suite of policies: to date 73% of policies have been streamlined; this includes elimination and renewal of policies. In 2009–10, 43 instruments were reviewed, which led to the elimination of 17 policies. More information is provided in the section "Lessons learned: Policy suite renewal—people management." The Foundation Framework for Treasury Board Policies was also approved. It provides general responsibilities, accountabilities, and expectations for ministers and deputy heads. |

| Departments and agencies implement good practices for corporate risk management, such as completing an annual Corporate Risk Profile. | A majority of federal organizations have updated their Corporate Risk Profile. |

Exceeded 86% of organizations updated their Corporate Risk Profile. |

| Departments and agencies develop quality PAAs and performance measurement information for use in decision making and reporting. | 80% of departmental PAAs rated as "acceptable" in accordance with the requirements of the Policy on Management, Resources and Results Structures. |

Met all 81% of departments and agencies had PAAs rated as "acceptable" or higher. |

| The quality of regulatory submissions improves in the areas of cost-benefit analysis, regulatory cooperation, consultation, and performance measurement, while the administrative burden is minimized. | By April 2010, the administrative burden is reduced, and 66% of the medium- and high-impact regulatory impact assessment statements (RIASs) that were assessed contain cost-benefit analysis, regulatory cooperation, consultation, and/or performance measurement. |

Mostly met In 2009–10, departments and agencies submitted 13 regulatory proposals to reduce the regulatory burden. The quality of regulatory submissions improved over the fiscal year. Specifically, 77% of medium- and high- impact RIASs included information on cost-benefit analysis, 71% had evidence of regulatory cooperation, 88% included information on consultation, and 65% of high-impact RIASs included performance measurement. Work will continue to ensure ongoing improvement in regulatory submissions. |

Benefits for Canadians

The Secretariat worked with other departments and agencies to reduce administrative delays, promote risk management, and enhance transparency—all of which improve the capacity of the public service to meet Canadians' expectations. For example, to continue to meet Canadians' expectations for improved public access to online government programs and services, the Secretariat is leading the Cyber Authentication Renewal Project, which will provide increased choice for Canadians to access online services and information (such as tax information). The Secretariat has also improved the government's management of public funds by clarifying accountability and management expectations and by strengthening financial and audit capacity across government. These efforts improved government's overall management performance and accountability, which is a benefit to all Canadians.

Program Activity 2: Expenditure Management and Financial Oversight

The Secretariat exercises its role as the budget office by undertaking the following key functions: providing advice to ministers regarding resource allocation and re allocation and the provision of expenditure authorities; undertaking government-wide expenditure and performance analysis and oversight of Estimates and government supply; and ensuring that accurate and timely financial and performance information from departments and agencies is available and reported to support the Public Accounts and budget office functions.

| 2009–10 Financial Resources ($ thousands) |

2009–10 Human Resources (FTEs) |

||||

|---|---|---|---|---|---|

| Planned Spending |

Total Authorities |

Actual Spending |

Planned | Actual | Difference |

| 37,027 | 43,464 | 37,081 | 283 | 289 | 6 |

In 2009–10, actual spending was less than total authorities due to delays in the ramping up of new projects and slippage in anticipated contract activity.

The following table outlines the Secretariat's progress in meeting its established, expected results under Program Activity 2, as described in the RPP. Specific initiatives and activities have been used to help demonstrate the Secretariat's progress.

| Expected Results | Performance Indicators and Targets | Performance Status and Summary |

|---|---|---|

| Resources are allocated to achieve results. | All direct program spending reviewed over four years by 2010–11. |

Met all Successfully completed the third year of the four-year strategic review process. In 2009–10, approximately $26 billion, or 23%, of all government program spending was reviewed. Reviews for all departments and agencies not yet reviewed will be completed in the fourth year of the strategic review process. |

| Funds reallocated from low to high priorities. |

Met all Funds have been reallocated each year as appropriate through the strategic review process. Reallocation savings, identified from 12 of the organizations that undertook a review in 2009, were $151.7 million for 2010–11, $247.5 million for 2011–12, and $286.9 million for 2012–13, as announced in Budget 2010. |

|

| Compensation aligned with approved Policy Framework for the Management of Compensation. |

Met all In general, compensation has been aligned with the principles of the Policy Framework for the Management of Compensation. Most core public administration groups reached agreements or tentative agreements that were consistent with the Expenditure Restraint Act. Additional information is provided in this DPR under Operational Priority 3 in Section I. |

|

| Results-based information increasingly informs expenditure management decisions. | Percentage of departments and agencies on track with MRRS policy implementation. |

Somewhat met 66% of federal organizations that possess a PAA rated as "acceptable" or higher (81% of departments and agencies possess that rating) have submitted a PMF to the Secretariat approved by their deputy head and chief financial officer. Alignment to the MRRS policy has been more difficult for departments and agencies than expected, often requiring adjustments to how business is organized and a cultural change around how programs and their results are defined. Capacity development has been a challenge. The Secretariat is continuing to work to build capacity and to support implementation through updated guidance material, training, and detailed feedback to departments and agencies. |

| Improvement of overall quality of evaluation reports. |

Mostly met 83% of assessed organizations received a minimum rating of "acceptable" for the quality of evaluation reports in MAF The percentage of departments and agencies receiving a minimum rating of "acceptable" declined slightly due to more stringent standards. However, these organizations have made progress in meeting the enhanced standards and are well positioned to ensure that the quality of evaluation continues to improve. Improvements to evaluation reports should continue as outlined in the Government Response to Chapter 1 of the 2009 Fall Report of the Auditor General of Canada. |

|

| Reporting to Parliament on government spending is accurate; financial performance and stewardship is complete and timely. |

Timely tabling of Estimates and Public Accounts. |

Met all All Estimates documents were tabled in accordance with the supply timetable established by the House of Commons. The Public Accounts were tabled in advance of the December 31, 2009, deadline. The government received an unqualified opinion from the Auditor General of Canada for the 11th consecutive year (Public Accounts of Canada, Volume 1, Section 2.4). |

| Assessment of the quality of financial and non-financial information. |

Exceeded Targeted increase in departmental performance reporting was exceeded. 96% of departments and agencies assessed received a minimum rating of "acceptable" for the quality of performance reporting. This surpasses the target of 50% for MAF Round VII and demonstrates an 18% increase from Round VI. |

|

| Extent to which public reports (e.g., DPRs, RPPs, and Public Accounts) are consistent and integrated. |

Mostly met The whole-of-government framework ensures consistency in information reported across a variety of public reports, including Canada's Performance, RPPs, DPRs, and other financial information reported by the government. Consistency of departmental reporting between RPPs and DPRs, as measured through the quality of performance reporting, increased in MAF Round VII. Work is ongoing with departments and agencies to improve the application of the whole-of-government framework. The Secretariat continues to improve the presentation of information in Canada's Performance to support the analysis of resource allocations across the Government of Canada. |

As the performance summary demonstrates, the Secretariat continues to align resources to results, uses reliable information to reach decisions, and reports transparently to Parliament as required.

Performance Analysis

The results of the Secretariat's efforts under Program Activity 2 include an improved Expenditure Management System which ensures that programs are focused on results, provides value for taxpayers' money, and is aligned with government priorities and responsibilities. Improvements in expenditure management will continue with the ongoing implementation of the renewed Policy on Evaluation. This will enhance the body of evidence that the government needs for informed decision making.

The Policy on Evaluation was renewed in April 2009 to emphasize the value for money of all ongoing direct program spending, to support decision making on policy, expenditure management, and program improvements, and to improve accountability to Parliament and Canadians. The Standard on Evaluation for the Government of Canada was established to set clear expectations for evaluation quality. In 2009–10, 83 per cent of all large organizations produced evaluations of "acceptable" or "strong" quality, as assessed by the Secretariat.

Lessons learned: Departmental reporting

Over the years, parliamentarians and the Office of the Auditor General have expressed the need for more concise, results-focused information to support their consideration of annual appropriations. In response to these concerns, the Secretariat launched a three-year action plan in 2007. The action plan implemented a pilot project for concise reporting with select departments and agencies for their 2008–09 RPPs and 2007–08 DPRs. The pilot was considered a success by all participants, and the concise reporting model was applied to all departments and agencies as a result.

In September 2009, representatives from the Library of Parliament and the Office of the Auditor General indicated that, while the new concise format was a step in the right direction, additional work was still required. This would include strengthening balanced reporting; using credible, evidence-based performance information; and providing electronic access to lower-level program details. In response, the Secretariat plans to strengthen its guidance and support to departments and agencies to ensure that reporting continues to meet the needs of parliamentarians and other end-users. The Secretariat also intends to explore the use of new Web-based technologies to further develop the electronic layer of performance reporting.

In further support of Program Activity 2, the Secretariat focused on the following specific initiatives and was successful in meeting all key objectives over the fiscal year.

| Expected Results | Performance Indicators and Targets | Performance Status and Summary |

|---|---|---|

| Clear, timely, and accurate Estimates information is tabled in Parliament to support annual appropriations from the Consolidated Revenue Fund in support of federal priorities. | Tabling of clear, timely, and accurate Main and Supplementary Estimates in accordance with the timeline set out in the parliamentary calendar. |

Met all All Estimates documents were tabled in accordance with the supply timetable. Improvements to RPP and DPR processes are highlighted in "Lessons learned: Departmental reporting." |

| Extending accrual accounting to departmental budgeting supports fiscal discipline through improved accountability, transparency, and financial management. | All departments and agencies participating in the pilot project table future-oriented financial statements in their RPPs. |

Met all All 10 pilot departments and agencies included a future-oriented statement of operations in their respective RPPs. Implementation will continue on schedule. |

Benefits for Canadians

The Expenditure Restraint Act received royal assent on March 12, 2009. The Act limits increases to the rates of pay of unionized and non-unionized employees in the federal public sector until 2010–11, while maintaining collective bargaining and established dispute resolution mechanisms (strike or arbitration). The Secretariat was responsible for negotiating collective agreements with a number of bargaining units now subject to the terms of the Expenditure Restraint Act. Twelve collective agreements were signed in 2009–10.

The Expenditure Management System is built on three pillars: managing for results, upfront discipline, and ongoing strategic reviews. This system ensures that the Secretariat is well equipped to perform the role of managing and overseeing the government's expenditures. For example, strategic reviews make sure that funding is allocated to programs that are a high priority for Canadians and that these programs produce results. This is sound management and demonstrates how the government continues to ensure value for money for Canadians and manage spending growth.

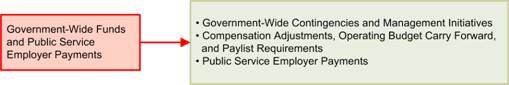

Program Activity 3: Government-Wide Funds and Public Service Employer Payments

Government-wide funds are held centrally to supplement other appropriations. The Secretariat is responsible for managing access to these government-wide funds and for administering payments and receipts on behalf of other federal government departments and agencies in a sound and efficient manner. The expected result is that these funds are administered in accordance with applicable legislation and Treasury Board policies and standards. The human resources associated with this program activity are included in other program sub-activities. However, the financial resources are shown separately in the PAA for visibility and reporting purposes. The results for these expenditures are found in the DPRs of recipient departments and agencies.

| 2009–10 Financial Resources ($ thousands) |

2009–10 Human Resources (FTEs) |

||||

|---|---|---|---|---|---|

| Planned Spending |

Total Authorities |

Actual Spending |

Planned | Actual | Difference |

| 2,103,064 | 4,259,474 | 2,068,107 | – | – | – |

Program Activity 3 involves the Secretariat's administration of centrally managed government-wide funds on behalf of other departments and agencies. As a result, variances between planned, total, and actual spending are not a reflection of the Secretariat's performance, and performance analysis is not required. For a description of the votes, refer to the Appendix A; for information on the variances, see the "Voted and Statutory Items" table in Section I.

| Expected Results | Performance Indicators and Targets | Performance Status and Summary |

|---|---|---|

| Payments and receipts, held centrally by the Secretariat, are made on behalf of other federal government departments and agencies in an administratively sound and efficient manner. | Payments are made appropriately and on time. |

Met all Payments were made during the fiscal year in accordance with established service level agreements and standards. |

Program Activity 4: Internal Services

Program Activity 4 includes functions that support the needs of programs and other corporate obligations and enable the efficient and effective delivery of all Secretariat priorities and programs. This program activity is an integral part of the PAA and encompasses the activities of Human Resources, Finance, IM, and IT. It also includes governance, strategic policy, planning, audit, communications, legal services, and the Minister's office.

During 2009–10, the Secretariat provided specific shared services to several federal organizations. In addition, the Secretariat continued to coordinate the tabling of the Estimates and the supply process for all federal organizations. The costs borne by the Secretariat for legal services include government-wide costs for the Treasury Board's role as the employer of the core public administration.

| 2009–10 Financial Resources ($ thousands) |

2009–10 Human Resources (FTEs) |

||||

|---|---|---|---|---|---|

| Planned Spending |

Total Authorities |

Actual Spending |

Planned | Actual | Difference |

| 62,640 | 94,310 | 89,524 | 648 | 737 | 89 |

The increase of approximately $31.7 million between planned spending and total authorities can be attributed to the amalgamation of the CPSA with the Secretariat in 2009–10 (approximately $17 million). The remaining increase of $14.7 million can be attributed to funding for litigation, collective agreements, and paylist requirements. Actual spending was below total authorities due to the reduction in requirements for litigation support, delays in the ramping up of new projects, and slippage in anticipated contract activity.

Performance analysis

Throughout 2009–10, the Secretariat addressed the priorities of the Public Service Renewal Action Plan, implemented the Secretariat's Change Agenda, and made adjustments to meet new policy expectations to improve internal management.

The Secretariat improved its integrated business planning process by revising its PAA, redeveloping its PMF, and building on best practices. Significant resources were also dedicated to advance business continuity planning and develop the Secretariat's H1N1 pandemic response.

All internal audits and evaluations are listed in the supplementary online tables. An audit of the Secretariat's Governance Framework was completed in February 2010. It found that this framework is well established and meets the department's needs for effective governance. The audit's comprehensive approach was recognized by the Government of Canada Audit Committee as a potential model for similar audits across government.

Although the Secretariat did not set specific targets for Program Activity 4 in the 2009–10 RPP, the Secretariat identified internal targets and tracked them during the year, as summarized below.

| Expected Results | Performance Indicators and Targets | Performance Status and Summary |

|---|---|---|

| The Secretariat's resources are more effectively aligned to priorities and program activities. | Implementation of the 2010–11 Integrated Business Plan by incorporating HR, finance, IM and IT, and accommodations functions to provide the necessary information for decision making and risk management. |

Mostly met The 2010–11 Integrated Business Plan process was implemented. The Secretariat continued its integration of finance, HR, and other enabling functions (e.g., IM/IT and accommodations) into the planning cycle to provide the required information for decisions on resource allocation. This was more complex in 2009–10 due to the organizational changes. Additional information is provided in "Lessons learned: Financial forecasting." |

| The integration of risk management best practices. | Build risk management practices into daily business. |

Mostly met The Secretariat identified "strengthen risk management capacity and adopted risk-based approaches in daily business" as one of two management priorities. A number of key initiatives incorporated risk-based approaches, such as the MAF, the Treasury Board submission process, and EAP implementation. A pilot training session was also developed and delivered. |

| The Government of Canada's Management Agenda and Treasury Board operations are supported by the Secretariat's Change Agenda. | Change-enabling strategies and associated initiatives are developed and implemented, targeting three distinct audiences across the Secretariat (senior management, executives, and all staff) and focusing on three key elements (employee engagement, capacity building, and updating processes to reinforce change-enabling strategies). |

Met all The Secretariat this year focused on integrating the role of enabler into how it conducts its business. This was achieved through a variety of mechanisms, including engaging staff to develop a new vision for the Secretariat, renewing the department's approach to employee orientation, providing tools and training for employees and managers to explain the role of enabler, and incorporating change-enabling behaviours into the performance agreements of executives. The Secretariat also continued its focus on embedding change-enabling approaches into the Secretariat's priorities (see Section I). |

| The Secretariat is a workplace of choice. | Implementation of the Human Resources Strategy 2008–11, focusing on senior management's commitment to developing and implementing a robust resourcing strategy, improving human resources infrastructure, supporting Secretariat employees through community management renewal strategies, and improving internal communications. |

Met all The Human Resources Strategy was broadly disseminated, and the development of a comprehensive resourcing strategy is underway. Staffing of critical positions for a dedicated Human Resources Directorate was completed. Capacity was strengthened in the Compensation and Benefits unit and the Classification unit. The Secretariat also continued to foster internal communities through special initiatives and development programs. The Secretariat's MAF results for values and ethics were "strong" and indicate a healthy work environment. |

| The new shared corporate services model effectively supports the Secretariat, as well as the Department of Finance Canada and other partners. | Implementation of a new shared corporate services model that helps clarify accountabilities, ensures better compliance with legislation and policy, and improves the Secretariat's ability to meet the specialized and operational needs of its clients, while managing the risks associated with providing ongoing shared services. |

Mostly met Approximately a year after the transition, a Steering Committee was established in February 2010 (jointly led by senior management in the Secretariat and the Department of Finance Canada) to ensure that the transition met its objectives, and to reflect on progress as part of good management practices. A few additional changes were implemented by April 1, 2010, and more changes are expected. Formal agreement documents are drafted and will be finalized in the new fiscal year. |

Lessons learned: Financial forecasting

The Secretariat did not spend all of the allotted funding in its Vote 1 appropriation due to planned litigation expenditures that were not required because of a negotiated settlement. The reduced spending also resulted from the focus on establishing the new Office of the Chief Human Resources Officer and other organizational changes. Steps will be taken to more effectively track the planned and actual rate of spending so that resources can be reallocated throughout the year to meet priorities and mandate requirements.

Benefits for Canadians

Efficient and effective internal services are essential in meeting the management and financial performance expectations that have been set for the Secretariat and all departments and agencies. By advancing integrated business planning, improving its internal management practices, and implementing human resources initiatives, the Secretariat is contributing to the ongoing renewal of the public service and is ensuring that it has the capacity to deliver its mandate. This increases the efficient and effective use of taxpayers' money, which is a benefit to all Canadians.