Common menu bar links

Breadcrumb Trail

ARCHIVED - Northern Pipeline Agency

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Section III � Supplementary Information

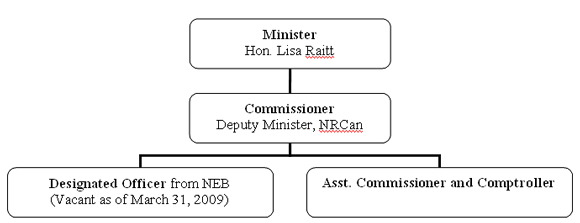

3.1 Organizational Information

The Northern Pipeline Agency has been designated as a department for the purposes of the Financial Administration Act. The NPA currently reports to Parliament through the Minister of Natural Resources Canada who is responsible for the management and direction of the NPA. The NPA has one senior officer, a Commissioner appointed by the Governor in Council. The Commissioner is currently the Deputy Minister of NRCan. Its organizational structure is defined by the Act. The Commissioner has appointed a full time Assistant Commissioner of the Agency.

The figure below provides a schematic of the reporting relationship of the key officers responsible for the NPA's program activity.

3.2 Financial Highlights

| Condensed Statement of Financial Position At End of Year (March 31) |

% Change | 2009 | 2008 |

|---|---|---|---|

| Financial Assets | -12% | 821,959 | 938,548 |

| Non Financial Assets | -40% | 4,106 | 6,894 |

| Total Assets | -13% | 826,065 | 945,442 |

| A/P and Accrued Liabilities | 645% | 33,127 | 4,444 |

| Deferred Revenue | -16% | 792,938 | 940,998 |

| Total Liabilities | -13% | 826,065 | 945,442 |

| Equity | 0% | 0 | 0 |

| Total Equity | 0% | 0 | 0 |

| Total liabilities and equity | -13% | 826,065 | 945,442 |

| Condensed Statement of Operations For the Year Ended March 31 |

% Change | 2009 | 2008 |

|---|---|---|---|

| Regulatory Revenue | 8% | 148,060 | 137,451 |

| Total Revenues | 8% | 148,060 | 137,451 |

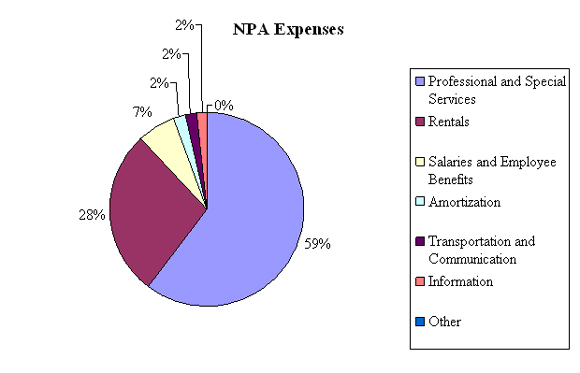

| Professional and Special Services | 0% | 89,095 | 88,965 |

| Rentals | 51% | 41,180 | 27,337 |

| Salaries and Employee Benefits | 25% | 9,629 | 7,708 |

| Amortization | -45% | 2,788 | 5,069 |

| Transportation and Communication | -64% | 2,751 | 7,607 |

| Information | 264% | 2,603 | 716 |

| Other | -71% | 14 | 49 |

| Total Recoverable Expenses | 8% | 148,060 | 137,451 |

| Non-Recoverable Services | 15% | 56,385 | 48,888 |

| Total Non-Recoverable Expenses | 15% | 56,385 | 48,888 |

| Net Cost of Operations | 15% | 56,385 | 48,888 |

3.3 Financial Highlights Chart

Most of the Northern Pipeline Agency's expenses are cost recoverable. The largest single expense is that of a service agreement with NRCan's Shared Service Office to provide administrative, financial and technical services.

3.4 Contacts for Further Information

Northern Pipeline Agency

615 Booth Street

Ottawa, Ontario K1A 0E4

Telephone: (613) 992-9612

Fax: (613) 995-1913

3.5 Financial Statements

The Northern Pipeline Agency's audited financial statements are included in the following pages.

Statement of Management Responsibility

Responsibility for the integrity and objectivity of the accompanying financial statements for the year ended March 31, 2009 and all information contained in these statements rests with the Agency's management. These financial statements have been prepared by management in accordance with Treasury Board accounting policies which are consistent with Canadian generally accepted accounting principles for the public sector.

Management is responsible for the integrity and objectivity of the information in these financial statements. Some of the information in the financial statements is based on management's best estimates and judgment and gives due consideration to materiality. To fulfil its accounting and reporting responsibilities, management maintains a set of accounts that provides a centralized record of the Agency's financial transactions. Financial information submitted to the Public Accounts of Canada and included in the Agency's Departmental Performance Report and Annual Report is consistent with these financial statements.

Management maintains a system of financial management and internal control designed to provide reasonable assurance that financial information is reliable, that assets are safeguarded and that transactions are in accordance with the Financial Administration Act, are executed in accordance with prescribed regulations, within Parliamentary authorities, and are properly recorded to maintain accountability of Government funds. Management also seeks to ensure the objectivity and integrity of data in its financial statements by careful selection, training and development of qualified staff, by organizational arrangements that provide appropriate divisions of responsibility, and by communication programs aimed at ensuring that regulations, policies, standards and managerial authorities are understood throughout the Agency.

The financial statements of the Agency have been audited by the Auditor General of Canada, the independent auditor for the Government of Canada.

| Cassie J. Doyle Commissioner |

Christopher Cuddy |

Ottawa, Canada

August 14, 2009

AUDITOR'S REPORT

To the Minister of Natural Resources

I have audited the statement of financial position of the Northern Pipeline Agency as at March 31, 2009 and the statements of operations, equity of Canada and cash flow for the year then ended. These financial statements are the responsibility of the Agency's management. My responsibility is to express an opinion on these financial statements based on my audit.

I conducted my audit in accordance with Canadian generally accepted auditing standards. Those standards require that I plan and perform an audit to obtain reasonable assurance whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation.

In my opinion, these financial statements present fairly, in all material respects, the financial position of the Agency as at March 31, 2009 and the results of its operations and its cash flows for the year then ended in accordance with Canadian generally accepted accounting principles.

Further, in my opinion, the transactions of the Agency that have come to my notice during my audit of the financial statements have, in all significant respects, been in accordance with the Financial Administration Act and regulations, the Northern Pipeline Act and regulations, the National Energy Board Cost Recovery Regulations and the by-laws of the Agency.

Crystal Pace, CA

Principal

for the Auditor General of Canada

Ottawa, Canada

August 14, 2009

| 2009 | 2008 | |

|---|---|---|

| ASSETS | ||

| Financial assets | ||

| Due from Consolidated Revenue Fund | $801,402 | $911,763 |

| Accounts receivable and advances (Note 7) | 20,557 | 26,785 |

| 821,959 |

938,548 |

|

| Non-financial assets | ||

| Tangible capital assets (Note 6) | 4,106 | 6,894 |

| TOTAL ASSETS | $826,065 |

$945,442 |

LIABILITIES |

||

| Accounts payable and accrued liabilities (Note 7) | $33,127 | $4,444 |

| Deferred revenue (Note 4) | 792,938 | 940,998 |

| TOTAL LIABILITIES | $826,065 | $945,442 |

Equity of Canada |

- | - |

TOTAL LIABILITIES AND EQUITY OF CANADA |

$826,065 | $945,442 |

Contractual obligations (Note 8)

The accompanying notes form an integral part of the financial statements.

Approved by:

| Cassie J. Doyle Commissioner |

Christopher Cuddy Assistant Commissioner |

| 2009 | 2008 | |

|---|---|---|

| REVENUE | ||

| Regulatory revenue | $148,060 | $137,451 |

OPERATING EXPENSES |

||

| Professional and special services | $89,095 | $88,965 |

| Rentals | 41,180 | 27,337 |

| Salaries and employee benefits | 9,629 | 7,708 |

| Amortization | 2,788 | 5,069 |

| Transportation and communication | 2,751 | 7,607 |

| Information | 2,603 | 716 |

| Other | 14 | 49 |

TOTAL RECOVERABLE EXPENSES |

$148,060 | $137,451 |

NON-RECOVERABLE SERVICES PROVIDED WITHOUT CHARGE (Note 7) |

56,385 | 48,888 |

NET COST OF OPERATIONS |

$56,385 | $48,888 |

| 2009 | 2008 | |

|---|---|---|

| Equity of Canada, beginning of the year | $- | $- |

| Net cost of operations | (56,385) | (48,888) |

| Change in due from Consolidated Revenue Fund | (110,361) | (79,778) |

| Non-recoverable services received without charge | 56,385 | 48,888 |

| Net cash provided by Government | 110,361 | 79,778 |

| Equity of Canada, end of the year | $- | $- |

The accompanying notes form an integral part of the financial statements.

| 2009 | 2008 | |

|---|---|---|

| Operating Activities | ||

| Net cost of operations | $56,385 | $48,888 |

| Adjustment for non-cash items | ||

| Services received without charge (Note 7) | (56,385) | (48,888) |

| Amortization of tangible capital assets | (2,788) | (5,069) |

| (2,788) | (5,069) | |

| Variations in the Statement of Financial Position | ||

| (Decrease) in accounts receivable and advances | (6,228) | (55,609) |

| (Increase) decrease in accounts payable and accrued liabilities | (28,683) | 3,005 |

| Decrease in deferred revenue | 148,060 | 137,451 |

| Cash used by operating activities | 110,361 | 79,778 |

Financing Activities |

||

| Net cash provided by Government of Canada | $(110,361) | $(79,778) |

The accompanying notes form an integral part of the financial statements.

Northern Pipeline Agency

Notes to the Financial Statements

Year ended 31 March 2009

- Authority, Objectives and Operations

In 1978, Parliament enacted the Northern Pipeline Act to:

- give effect to an Agreement on Principles Applicable to a Northern Natural Gas Pipeline (the Agreement) between the Governments of Canada and the United States of America;

- establish the Northern Pipeline Agency (the Agency) to oversee the planning and construction of the Canadian portion of the project.

The Agency is designated as a department and named under Schedule I.1of the Financial Administration Act, reporting to Parliament through the Minister of Natural Resources.

The objectives of the Agency are to:

- carry out and give effect to the Agreement of September 20, 1977 between Canada and the United States underpinning

the project;

- carry out, through the Agency, federal responsibilities in relation to the pipeline;

- facilitate the efficient and expeditious planning and construction of the pipeline, taking into account local

and regional interests;

- facilitate consultation and coordination with the governments of the provinces and the territories traversed

by the pipeline;

- maximize the social and economic benefits of the pipeline while minimizing any adverse social and environmental

effects; and

- advance national economic and energy interests and to maximize related industrial benefits by ensuring the highest possible degree of Canadian participation.

In 1982, the sponsors of the Pipeline announced that the target date for completion had been set back until further notice and all parties scaled down their activities. Work continues to prepare the Agency to meet commitments set out in the Northern Pipeline Act should Foothills Pipe Lines Ltd. decide to proceed with the second stage of the Alaskan Natural Gas Transportation System.

In accordance with Section 29 of the Northern Pipeline Act and with the National Energy Board Cost Recovery Regulations, the Agency is required to recover all of its annual operating costs from the companies holding certificates of public convenience and necessity issued by the Agency. Currently, Foothills is the sole holder of such certificates. The Government of Canada provides funds for working capital through an annual Parliamentary appropriation.

- Significant Accounting Policies

These financial statements have been prepared in accordance with Treasury Board accounting policies and year-end instructions issued by the Office of the Comptroller General, which are consistent with Canadian generally accepted accounting principles for the public sector.

- Parliamentary appropriations:

The Agency is financed by the Government of Canada through Parliamentary appropriations. Appropriations provided to the Agency do not parallel financial reporting according to generally accepted accounting principles since appropriations are primarily based on cash flow requirements. Consequently, items recognized in the statement of operations and the statement of financial position are not necessarily the same as those provided through appropriations from Parliament. Note 3 provides a high-level reconciliation between the bases of reporting.

- Net cash provided by Government:

The Agency operates within the Consolidated Revenue Fund (CRF), which is administered by the Receiver General for Canada. All cash received by the Agency is deposited to the CRF and all cash disbursements made by the Agency are paid from the CRF. The net cash provided by the Government is the difference between all cash receipts and all cash disbursements including transactions between the Agency and departments of the federal government.

- Due from the Consolidated Revenue Fund:

Due from the Consolidated Revenue Fund (CRF) represents the amount of cash that the Agency is entitled to draw from the Consolidated Revenue Fund without further appropriations, in order to discharge its liabilities.

- Revenue/Deferred revenue:

Revenues from regulatory fees recovered from Foothills are recognized in the accounts based on the services provided in the year.

Revenues that have been received but not yet earned are recorded as deferred revenues. Deferred revenues represent the accumulation of excess billings over the actual expenses for the last two fiscal years.

- Expenses:

Expenses are recorded on the accrual basis.

Vacation pay and compensatory leave are expensed as the benefits accrue to employees under their respective terms of employment.

Services received without charge from other government departments are recorded as operating expenses at their estimated cost.

- Accounts receivable:

Receivables are stated at amounts expected to be ultimately realized. A provision is made for receivables where recovery is considered uncertain.

- Employee future benefits:

Future benefits for employees, including pension benefits, providing services to the Agency are funded by the employee's home-base department. Estimated costs are included in the employee benefits charged to the Agency.

- Tangible capital assets:

All tangible capital assets and leasehold improvements having an initial cost of $1,000 or more are recorded at their acquisition cost. Tangible capital assets owned by the Agency are valued at cost, net of accumulated amortization. Amortization is calculated using the straight-line method, over the estimated useful life of the assets as follows:

- Office furniture and equipment 10 years

- Informatics hardware 4 years

- Measurement uncertainty:

The preparation of these financial statements in accordance with Treasury Board accounting policies and year-end instructions issued by the Office of the Comptroller General, which are consistent with Canadian generally accepted accounting principles for the public sector, requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses reported in the financial statements. At the time of preparation of these statements, management believes the estimates and assumptions to be reasonable. Deferred revenue, salaries and employee benefits are the most significant items where estimates are used. Actual amounts could differ significantly from those estimated. These estimates are reviewed annually and as adjustments become necessary, they are recognized in the financial statements in the year in which they become known.

- Parliamentary appropriations:

- Parliamentary Appropriations

The Government of Canada funds the expenses of the Agency through Parliamentary appropriations. Items recognized in the statement of operations and the statement of financial position in one year may be funded through Parliamentary appropriations in prior, current or future years. Accordingly, the Agency has different net results of operations for the year on a government funding basis than on an accrual accounting basis. The differences are reconciled as follows:

- Reconciliation of net cost of operations to current year parliamentary appropriations used:

2009 2008 Net cost of operations $56,385 $48,888 Adjustments for items affecting net cost of operations but not affecting appropriations: Add (Less): Services received without charge (56,385) (48,888) Amortization of tangible capital assets (2,788) (5,069) Revenue not available for spending 148,060 137,451 Other (5,554) 4,085 139,718

136,467

Current year appropriations used $139,718 $136,467

- Appropriations provided and used:

2009 2008 Vote 35 - Program expenditures $256,200 $287,500 Statutory amounts 1,011 1,857 Lapsed appropriations (117,493) (152,890) Current year appropriations used $139,718 $136,467

- Reconciliation of net cash provided by Government to Parliamentary appropriations used:

2009 2008 Net cash provided by Government $110,361 $79,778 Revenue not available for spending 148,060 137,451 Change in net position in the Consolidated Revenue Fund: Variation in accounts receivable & advances 6,228 55,609 Variation in accounts payable & accrued liabilities 28,683 (3,005) Variation in deferred revenue / other liabilities (148,060) (137,451) Other (5,554) 4,085 Current year appropriations used $139,718 $136,467

- Reconciliation of net cost of operations to current year parliamentary appropriations used:

- Deferred Revenue

Deferred revenue consists of:

2009 2008 Opening Balance $940,998 $1,078,449 Recoverable expenses of current fiscal year (148,060) (137,451) Deferred Revenue $792,938 $940,998

- Easement Fee

In 1983, the Government of Canada, pursuant to Subsection 37(3) of the Northern Pipeline Act, granted Foothills Pipe Lines Ltd. a twenty-five year easement upon and under lands in the Yukon Territory. For the right of easement, Foothills Pipe Lines Ltd. is to pay the Agency an annual amount of $30,400; of this annual amount, $2,806 (2008 - $2,806) is collected on behalf of and forwarded directly to the Government of the Yukon Territory. The balance of $27,594 (2008 - $27,594) was remitted to the Government of Canada by the Agency. This fee is not accounted for in these financial statements.

- Tangible Capital Assets

There were no acquisitions or disposals of tangible capital assets in 2009.

Cost Accumulated Amortization Net book value 2009 Net book value 2008 Office furniture and equipment $7,527 $3,421 $4,106 $4,859 Informatics hardware 17,266 17,266 - 2,035 Total $24,793 $20,687 $4,106 $6,894

Amortization expense for the year ended March 31, 2009 is $2,788 (2008 - $5,069)

- Related Party Transactions

The Agency is related as a result of common ownership to all Government of Canada departments, agencies and Crown corporations. The Agency enters into transactions with these entities in the normal course of business and on normal trade terms applicable to all individuals and enterprises except that certain services, as defined previously, are provided without charge.

- Services provided without charge:

These services without charge have been recognized in the Agency's Statement of Operations as follows:

2009 2008 Audit services provided by the Office of the Auditor General of Canada $55,284 $43,509 Management services provided by Natural Resources Canada $1,101 $5,379 Total $56,385 $48,888

- Receivables and payables outstanding at year-end with related parties:

2009 2008 Accounts receivable with other government departments and agencies $19,989 $26,385 Accounts payable to other government departments and agencies $30,089 -

- Services provided without charge:

- Contractual Obligations

The nature of the Agency's activities can result in some large multi-year contracts and obligations whereby the Agency will be obligated to make future payments when the services/goods are received. Significant contractual obligations that can be reasonably estimated are summarized as follows:

2010 2011 2012

and thereafterTotal Operating leases $18,406 $18,406 $1,214 $38,026

- Comparative Figures

Comparative figures have been reclassified to conform to the current year's presentation.