Common menu bar links

Breadcrumb Trail

ARCHIVED - Public Prosecution Service of Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Section III: Supplementary Information

3.1 Link to Government of Canada Outcome Areas

The Government of Canada's performance reporting framework consists of thirteen outcomes grouped under three spending areas: Economic, Social and International Affairs. In addition, the PPSC, like several government organizations, provides advice that supports other government departments and agencies. These services are aligned with a fourth spending area, Government Affairs. The table below illustrates how the PPSC's four program activities are linked to Canada's performance.

|

Strategic Outcome: Prosecute criminal offences under federal law in a manner that is independent of any improper influence and respects the public interest. |

||||

|

Actual Spending 2007-2008 |

Alignment to Government of Canada Outcome Area |

|||

|

Budgetary |

Non-budgetary |

Total |

||

|

Program Activity #1: Prosecution of drug, organized crime and Criminal Code offences |

85.9 |

N/A |

85.9 |

Social Affairs |

|

Program Activity #2: Prosecution of federal offences to protect the environment, natural resources, economic and social health |

18.8 |

N/A |

18.8 |

Economic Affairs |

|

Program Activity #3: Addressing criminal issues, in the context of prosecutions, to contribute to a safer world for Canada |

4.4 |

N/A |

4.4 |

International Affairs |

|

Program Activity #4: Promoting a fair and effective justice system that reflects Canadian values within a prosecutorial context |

0.8 |

N/A |

0.8 |

Social Affairs |

|

Total |

109.9 |

- |

109.9 |

|

(For more information about the Government of Canada's four broad Spending Areas and the corresponding 13 Outcomes, visit http://www.tbs-sct.gc.ca/ppg-cpr/Home-Accueil-eng.aspx.)

3.2 Partners

Department of Justice Canada

The PPSC continues to work closely and cooperatively with the Department of Justice Canada. Federal prosecutors benefit from consultations with Justice counsel in areas such as human rights law, constitutional law, Aboriginal law and criminal law policy. Both the PPSC and the Department provide legal advice to investigative agencies.

From an administrative perspective, the PPSC continues to rely on the Department for most transactional corporate services.

Investigative Agencies

The PPSC works with several investigative agencies, including the RCMP and other police forces. It also works with the enforcement arms of federal departments and agencies, including the Competition Bureau, the Canada Revenue Agency, the Canada Border Services Agency, Fisheries and Oceans Canada, Environment Canada, and Health Canada.

Investigations that target sophisticated organizations or that use techniques that have not received definitive judicial consideration usually require ongoing advice from prosecutors. The complexity of the law and the high costs of multi-year investigations make it increasingly important for police to know as early as possible the impact of their decisions on potential prosecutions. In an era where considerable time in a trial can be spent analyzing investigative decisions, the PPSC provides ongoing legal advice before a charge is laid.

As well, certain key evidence gathering orders require — or may benefit from — the involvement of PPSC counsel. This includes wiretap applications and orders to produce potential evidence. In this capacity, counsel ensures that the court has what it needs in order to decide whether the police should be empowered to do what they are asking.

The early and ongoing involvement of prosecutors both during major investigations and in the implementation of national enforcement programs helps ensure that the police and other investigative agencies benefit from legal advice to decide how best to enforce the law.

Provinces

Jurisdiction over prosecutions is shared between the federal and provincial governments. From this shared responsibility, the need arises for cooperation and coordination in the enforcement of criminal law. For example, the PPSC may prosecute Criminal Code offences which fall under the jurisdiction of provincial Attorneys General with their consent and on their behalf, where it is more efficient and cost-effective to do so. This generally occurs where the Criminal Code offences are related to some federal charge, such as firearms offences related to a drug charge.

Similarly, a provincial prosecution service may prosecute a drug charge where the charge is one of many offences and where the major offence is one within its jurisdiction. Such arrangements are called "major-minor" agreements, meaning that the prosecution service responsible for prosecuting the "major" charge will prosecute the "minor" one as well. On February 10, 2007, the Director was assigned the power to conduct prosecutions that the Attorney General of Canada is authorized to undertake under such agreements.

Major cases that involve serious Criminal Code and other federal offences are also increasingly being prosecuted by joint prosecution teams, particularly in organized crime files.

3.3 Supplementary Tables

Table 1: Comparison of Planned to Actual Spending (including FTEs)

|

2007-2008 |

||||||

|

($ millions) |

2005-2006 Actual |

2006-2007 Actual |

Main Estimates |

Planned Spending |

Total |

Actual |

|

Prosecution of drug, organized crime and Criminal Code offences |

N/A |

N/A |

75.7 |

99.2 |

94.4 |

85.9 |

|

Prosecution of federal offences to protect the environment, natural resources, economic and social health |

N/A |

N/A |

17.6 |

19.9 |

19.2 |

18.8 |

|

Addressing criminal issues to contribute to a safer word for Canada |

N/A |

N/A |

4.3 |

5.1 |

4.8 |

4.4 |

|

Promoting a fair and effective justice system that reflects Canadian values in a prosecutorial context. |

N/A |

N/A |

0.9 |

1.1 |

0.8 |

0.8 |

|

Total |

|

|

98.5 |

125.3 |

119.2 |

109.9 |

|

Less: Non-respendable revenue |

N/A |

N/A |

N/A |

N/A |

N/A |

1.2 |

|

Plus: Cost of services received without charge |

N/A |

N/A |

9.5 |

9.5 |

N/A |

11.6 |

|

Total Organizational Spending |

|

|

108.0 |

134.8 |

119.2 |

120.3 |

|

Full time equivalents |

N/A |

N/A |

674 |

724 |

- |

748 |

Table 2: Voted and Statutory Items

|

($ thousands) |

2007-2008 |

||||

|

Vote or Statutory Item |

Truncated Vote or Statutory Wording |

Main Estimates |

Planned Spending |

Total Authorities |

Actual |

|

Vote 35 |

Program expenditures |

86.3 |

112.1 |

109.1 |

99.8 |

|

- |

Capital expenditures |

N/A |

N/A |

N/A |

N/A |

|

- |

Grants and contributions |

N/A |

N/A |

N/A |

N/A |

|

- |

Minister - Salary and motor car allowance |

N/A |

N/A |

N/A |

N/A |

|

- |

Contributions to |

12.2 |

13.2 |

10.1 |

10.1 |

|

Total |

98.5 |

125.3 |

119.2 |

109.9 |

|

Table 3: Sources of Respendable and Non-Respendable Revenue

For supplementary information on the PPSC's sources of respendable and non respendable revenue please visit: http://www.tbs-sct.gc.ca/dpr-rmr/st-ts-eng.asp

Table 4: Reporting on Horizontal Initiatives

During 2007-2008, the PPSC participated in two horizontal initiatives: the Federal Tobacco Control Strategy led by Health Canada, and the Public Security and Anti-Terrorism (PSAT) initiative, led by Public Safety Canada.

Supplementary information on horizontal initiatives can be found at

http://www.tbs-sct.gc.ca/rma/eppi-ibdrp/hrdb-rhbd/profil_e.asp.

Table 5: Internal Audits and Evaluations

No internal audits or evaluations were conducted during 2007-2008.

Table 6: Travel Policies

The PPSC follows the Treasury Board of Canada Secretariat Special Travel Authorities and the Treasury Board of Canada Secretariat Travel Directive, Rates and Allowances.

Supplementary information on travel policies can be found at

http://publiservice.tbs-sct.gc.ca/pubs_pol/hrpubs/TBM_113/menu-travel-voyage_e.asp

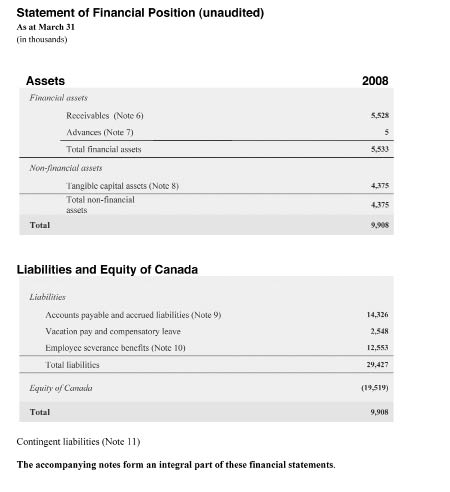

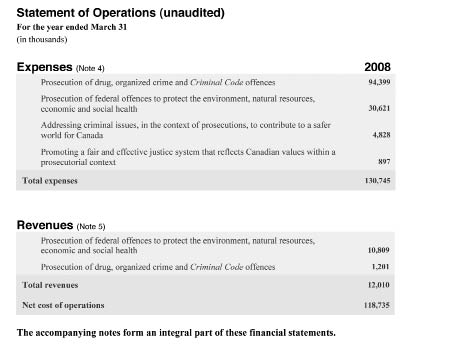

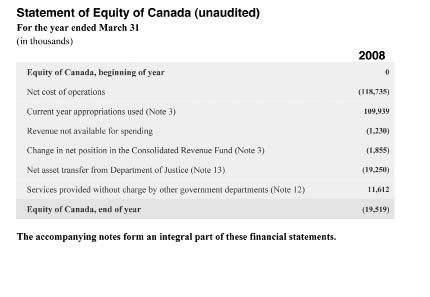

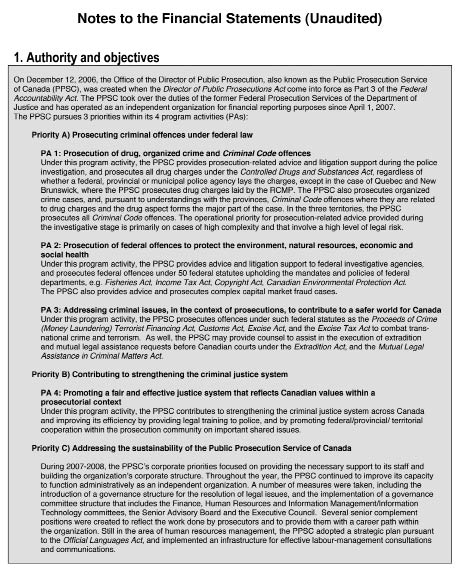

Table 7: Financial Statements

All federal government departments and agencies as defined in section 2 of the Financial Administration Act and departments with revolving funds are to include their financial statements in their Departmental Performance Report.

Financial Statements (Unaudited) - For the Year Ended March 31, 2008

Management Responsibility for Financial Statements

Responsibility for the integrity and objectivity of the accompanying financial statements for the year ended March 31, 2008 and all information contained in these statements rests with PPSC management. These financial statements have been prepared by management in accordance with Treasury Board accounting policies which are consistent with Canadian generally accepted accounting principles for the public sector.

Some of the information in the financial statements is based on management's best estimates and judgment and gives due consideration to materiality. To fulfill its accounting and reporting responsibilities, management maintains a set of accounts that provides a centralized record of the organization's financial transactions. The financial statements included in this Departmental Performance Report are consistent with financial information submitted to the Public Accounts of Canada.

Management maintains a system of financial management and internal control designed to provide reasonable assurance that financial information is reliable, that assets are safeguarded and that transactions are in accordance with the Financial Administration Act, are executed in accordance with prescribed regulations, within Parliamentary authorities, and are properly recorded to maintain accountability of Government funds. Management also seeks to ensure the objectivity and integrity of data in its financial statements by careful selection, training and development of qualified staff, by organizational arrangements that provide appropriate divisions of responsibility, and by communication programs aimed at ensuring that regulations, policies, standards and managerial authorities are understood throughout the organization.

The financial statements of the PPSC have not been audited.

| Brian Saunders | Lucie Bourcier |

| Director of Public Prosecution | Chief Financial Officer |

Ottawa, Canada

Date August 15, 2008