Common menu bar links

Breadcrumb Trail

ARCHIVED - RPP 2006-2007

Office of the Superintendent of Financial Institutions Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

SECTION III - SUPPLEMENTARY INFORMATION

Management Representation Statement

I submit for tabling in Parliament, the 2006-2007 to 2008-2009 Report on Plans and Priorities (RPP) for the Office of the Superintendent of Financial Institutions Canada.

This document has been prepared based on the reporting principles contained in the Guide to the preparation of Part III of the 2006-2007 Estimates: Reports on Plans and Priorities and Departmental Performance Reports.

- It adheres to the specific reporting requirements outlined in the TBS guidance;

- It is based on OSFI's approved Program Activity Architecture (PAA) structure as reflected in its MRRS;

- It presents consistent, comprehensive, balanced and reliable information;

- It provides a basis of accountability for the results achieved with the resources and authorities entrusted to it; and

- It reports finances based on approved, planned spending numbers from the Treasury Board Secretariat in the RPP.

Nicholas Le Pan

Superintendent

Organizational Information

OSFI comprises three sectors (see organization chart below), each headed by an Assistant Superintendent. Each sector works interdependently to achieve OSFI's strategic outcomes. In addition, there is an independent Internal Audit and Consulting function that reports directly to the Superintendent. The Office of the Chief Actuary (OCA) was created within the organization as a separate unit to provide effective actuarial and other services to the Government of Canada and provincial governments that are Canada Pension Plan (CPP) stakeholders.

Workforce

As at December 31, 2005, OSFI employed 427 people in offices located in Ottawa, Montreal, Toronto and Vancouver.

OSFI's work requires the effort and attention of multidisciplinary teams. It requires a combination of broad perspective and in-depth expertise. OSFI builds excellence into its culture, and encourages continuous learning through teamwork, professional development and training opportunities, and the provision and support of advanced technologies.

OSFI's unique work environment benefits from a full spectrum of professional experience and expertise, drawing on the talents of recent graduates, as well as seasoned industry and regulatory experts.

Chart of Full-Time Equivalent Headcount

|

Sector |

As at March 31, 2005 |

% of total |

As at December 31, 2005 |

% of total |

|

Corporate Services* |

111 |

26% |

118 |

28% |

|

Supervision** |

165 |

39% |

159 |

37% |

|

Regulation** |

124 |

29% |

124 |

29% |

|

Office of the Chief Actuary |

26 |

6% |

26 |

6% |

|

TOTAL |

426 |

100% |

427 |

100% |

* The change in Corporate Services is in support of major technology initiatives; where appropriate, projects are staffed with term positions that coincide with the project's duration. Corporate Services includes employees in the Superintendent's Office and in Audit and Consulting Services.

** In August 2005, the Private Pension Plan Division became part of the Regulation Sector, whereas it had previously been part of the Supervision Sector. The March 31, 2005 figures have been restated to reflect this change.

Key Partners

OSFI works with a number of key partners in advancing its strategic outcomes. Together, these departments and agencies constitute Canada's network of financial regulation and supervision and provide a system of deposit insurance. On a federal level, partnering organizations include the Department of Finance (http://www.fin.gc.ca), the Bank of Canada (http://www.bank-banque-canada.ca), the Canada Deposit Insurance Corporation (http://www.cdic.ca), the Financial Consumer Agency of Canada (http://www.fcac-acfc.gc.ca), and the Financial Transactions and Reports Analysis Centre of Canada (http://www.fintrac.gc.ca), among others.

In addition, OSFI collaborates with certain provincial and territorial supervisory and regulatory agencies, as necessary, and with private-sector organizations and associations, particularly in rule making. OSFI plays a key role in the International Association of Insurance Supervisors (http://www.iaisweb.org) and international organizations such as the Basel Committee on Banking Supervision (http://www.bis.org/bcbs/index.htm).

Maintaining good relationships with these organizations is critical to OSFI's success. OSFI reviews, on an annual basis, its involvement with these organizations to ensure it is maximizing the effective use of resources.

Financial and Other Tables

This section presents a number of financial tables that detail OSFI's Expenditures and Revenues for the planning period. Tables 1 to 7 are provided in accordance with Treasury Board requirements. The remaining tables offer additional information on User Fees and Regulatory Initiatives.

Background

OSFI recovers its costs from several revenue sources. Costs for risk assessment and intervention (supervision), approvals and rule making are charged to the financial institutions and private pension plans that OSFI regulates and supervises.

The amount charged to individual institutions for OSFI's main activities of supervision, approvals and rule making is determined in several ways. In general, the system is designed to allocate costs based on the approximate amount of time spent supervising and regulating institutions. As a result, well-managed, lower-risk institutions and those with fewer approvals bear a smaller share of OSFI's costs.

Specific user fees cover costs for certain approvals. Problem (staged) institutions are assessed a surcharge approximating the extra supervision resources required.

OSFI also receives revenues for cost-recovered services. These include revenues from the Canadian International Development Agency (CIDA) for international assistance, revenues from provinces for whom OSFI does supervision on contract, and revenues from other federal agencies for whom OSFI provides administrative support. Cost-recovered services revenue also includes amounts charged separately to major banks for the implementation of the internal ratings-based approach of the New Basel Capital Accord.

The remainder of the costs of risk assessment and intervention, approvals and rule making are recovered through base assessments against institutions and private pension plans fees according to various formulae.

On April 1, 2002, OSFI began collecting late and erroneous filing penalties from financial institutions that submit late and/or erroneous financial and non-financial returns. On August 31, 2005, the Administrative Monetary Penalties (OSFI) Regulations came into force. These Regulations implement an administrative monetary penalties regime pursuant to which the Superintendent can impose penalties in respect of specific violations, as designated in the schedule to the Regulations. These Regulations incorporate the late and erroneous filing penalty regime and replace the Filing Penalties (OSFI) Regulations, which came into force on April 1, 2002. These penalties are billed quarterly, collected and remitted to the Consolidated Revenue Fund. By regulation, OSFI cannot use these funds, which are recorded as non-respendable revenue, to reduce the amount that it assesses the industry in respect of its operating costs.

The Office of the Chief Actuary is funded by fees charged for actuarial services and in part by an annual parliamentary appropriation for services to the Government of Canada related to public pensions. OSFI's financial statements are prepared using Generally Accepted Accounting Principles (GAAP), are audited annually by the Office of the Auditor General and are published in OSFI's Annual Report. OSFI's annual reports can be accessed at http://www.osfi-bsif.gc.ca/osfi/index-eng.aspx?DetailID=647.

Financial Tables

OSFI continues to re-evaluate its programs to ensure that they contribute to OSFI's mandate and are efficiently managed. In so doing, OSFI has been successful at minimizing ongoing operating cost increases and at judiciously managing its human resources in optimal ways. As a result, OSFI's human resources (average FTEs) remain flat over the planning period.

Total spending over the planning period is increasing at about 4% per year driven primarily by normal inflationary and merit adjustments and continued annual capital investments. These investments in enabling technologies, information management strategies, and information technology infrastructure are consistent with OSFI's priority on resources and infrastructure during the planning period.

The total planned spending for 2005-2006 is $755 thousand. The planned increase to $768 thousand in 2006-2008 and beyond is related to adjustments granted by the Treasury Board for collective agreements for the Office of the Chief Actuary.

OSFI's total planned spending and average full-time equivalent (FTE) complement over the three-year planning period are displayed in the following table.

Table 1:

OSFI Planned Spending and Full-Time Equivalents

|

($ thousands) |

Forecast Spending |

Planned Spending |

Planned Spending |

Planned Spending |

|

Regulation and supervision of federally regulated financial institutions |

70,359 |

73,177 |

76,342 |

79,640 |

|

Regulation and supervision of federally regulated private pension plans |

5,504 |

5,184 |

5,375 |

5,576 |

|

International Assistance |

1,746 |

1,958 |

2,007 |

2,058 |

|

Office of the Chief Actuary (OCA) |

4,620 |

4,714 |

4,912 |

5,119 |

|

Budgetary Main Estimates (gross) |

82,229 |

85,033 |

88,636 |

92,393 |

|

Non-Budgetary Main Estimates (gross) |

0 |

0 |

0 |

0 |

|

Less: Respendable revenue |

81,474 |

84,265 |

87,868 |

91,625 |

|

Total Main Estimates |

755 |

768 |

768 |

768 |

|

Adjustments: |

0 |

0 |

0 |

0 |

|

Total Adjustments |

0 |

0 |

0 |

0 |

|

Total Planned Spending |

755 |

768 |

768 |

768 |

|

Total Planned Spending |

755 |

768 |

768 |

768 |

|

Less: Non-respendable revenue |

430 |

425 |

425 |

425 |

|

Plus: Cost of services received without charge |

0 |

80 |

0 |

0 |

|

Net cost of Program |

325 |

423 |

343 |

343 |

|

Full-Time Equivalents |

439 |

459 |

459 |

459 |

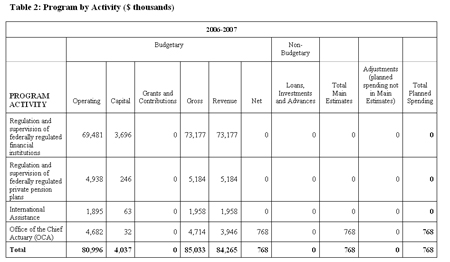

Table 2:

Program by Activity ($ thousands)

The next table outlines OSFI's 2006-2007 expenditures by Activity.

The expenditures of each activity in Table 2 include a share of OSFI's Corporate Services costs, which have been allocated in a consistent manner to accurately reflect the total cost of each activity; to support equitable billing; and to support the Treasury Board requirement to understand Government-Wide Corporate Services and fully-loaded program costs. OSFI's largest activity is the Regulation and Supervision of federally regulated financial institutions, which utilizes approximately 85% of OSFI's resources. The net cost of the Office of the Chief Actuary activity is funded by an annual parliamentary appropriation for actuarial services to the Government of Canada related to Public Pensions.

Note: Corporate Services costs are allocated across the activities based on direct human resources costs.

Table 3:

Summary of Capital Spending by Program Activity

As indicated in the commentary for Table 1, OSFI continues to develop cost-effective information management systems to maintain robust technology infrastructure necessary to support its supervisory and regulatory activities. The table below details OSFI's planned capital investments by program activity.

Summary of Capital Spending by Program Activity

|

($ thousands) |

Forecast Spending 2005-2006 |

Planned Spending 2006-2007 |

Planned Spending 2007-2008 |

Planned Spending 2008-2009 |

|

Office of the Superintendent of Financial Institutions |

||||

|

Regulation and supervision of federally regulated financial institutions |

3,712 |

3,696 |

4,196 |

4,696 |

|

Regulation and supervision of federally regulated private pension plans |

252 |

246 |

246 |

246 |

|

International Assistance |

57 |

63 |

63 |

63 |

|

Office of the Chief Actuary (OCA) |

0 |

32 |

32 |

32 |

|

Total |

4,021 |

4,037 |

4,537 |

5,037 |

Table 4 illustrates sources of respendable and non-respendable revenue presented on the cash basis, however OSFI recovers its costs through assessments and user fees billed on the accrual basis of accounting.1 On this basis, the expected assessment increase for 2006-2007 will be in the range of 5%.

The bulk of cost recovered services in Regulation and Supervision of Federally Regulated Financial Institutions in 2006-2007 and 2007-2008 relates to the Internal Ratings Based (IRB) implementation project that is charged directly to the major banks. The user fees and charges planned for 2006-2007 and beyond for this same program activity are based on regulations that were in effect at the time of preparation of the Main Estimates. However, effective April 1, 2006, these regulations will be amended to reduce the number and types of approvals that require user fees; as such, this will result in lower user fees than currently planned. The reduction in user fees will be recovered through base assessments. OSFI's 2007-2008 Annual Reference Level Update (ARLU) will take into account this change in regulations.

1 OSFI's financial statements are prepared using GAAP, are audited annually by the Office of the Auditor General and are published in OSFI's Annual Report. OSFI's annual reports can be accessed at http://www.osfi-bsif.gc.ca/osfi/index-eng.aspx?DetailID=647

Table 4:

Sources of Respendable and Non-Respendable Revenue

|

($ thousands) |

Forecast Revenue 2005-2006 |

Planned Revenue 2006-2007 |

Planned Revenue 2007-2008 |

Planned Revenue 2008-2009 |

|

Office of the Superintendent of Financial Institutions Regulation and supervision of federally regulated financial institutions Sources of respendable revenue |

||||

|

Base Assessments |

60,908 |

64,733 |

68,096 |

71,602 |

|

User Fees and Charges |

4,927 |

5,019 |

5,019 |

5,019 |

|

Cost Recovered Services |

4,524 |

3,425 |

3,227 |

3,020 |

|

70,359 |

73,177 |

76,342 |

79,641 |

|

|

Regulation and supervision of federally regulated private pension plans Source of respendable revenue |

||||

|

Pension Fees |

5,504 |

5,184 |

5,375 |

5,575 |

|

5,504 |

5,184 |

5,375 |

5,575 |

|

|

International Assistance Sources of respendable revenue |

||||

|

Base Assessments |

446 |

483 |

532 |

583 |

|

Cost Recovered Services |

1,300 |

1,475 |

1,475 |

1,475 |

|

1,746 |

1,958 |

2,007 |

2,058 |

|

|

Office of the Chief Actuary (OCA) Sources of respendable revenue |

||||

|

User Fees and Charges |

73 |

35 |

35 |

35 |

|

Cost Recovered Services |

3,792 |

3,911 |

4,109 |

4,316 |

|

3,865 |

3,946 |

4,144 |

4,351 |

|

|

Total Respendable Revenue |

81,474 |

84,265 |

87,868 |

91,625 |

Non-Respendable Revenue

|

($ thousands) |

Forecast Revenue 2005-2006 |

Planned Revenue 2006-2007 |

Planned Revenue 2007-2008 |

Planned Revenue 2008-2009 |

|

Office of the Superintendent of Financial Institutions Regulation and supervision of federally regulated financial institutions Source of non-respendable revenue |

||||

|

Filing Penalties |

430 |

425 |

425 |

425 |

|

Total Non-Respendable Revenue |

430 |

425 |

425 |

425 |

|

Total Respendable and Non-respendable Revenue |

81,904 |

84,690 |

88,293 |

92,050 |

Tables 5 and 6a provide additional information to illustrate total Government of Canada expenditures that are related to OSFI.

Table 5:

Net Cost of Agency for the Estimates Year 2006-2007

2006-2007 |

|||||

|

($ thousands) |

Regulation and supervision of federally regulated financial institutions |

Regulation and supervision of federally regulated private pension plans |

Inter-national Assistance |

Office of the Chief Actuary (OCA) |

Total |

|

Total Planned Spending |

0 |

0 |

0 |

768 |

768 |

|

Plus: |

|||||

|

Audit fees from the Office of the Auditor General |

80 |

80 |

|||

|

Less: |

425 |

425 |

|||

|

2006-2007 Net cost of Agency |

(345) |

0 |

0 |

768 |

423 |

Table 6a:

Voted Items Listed in Main Estimates

|

Vote Item |

($ thousands) |

2005-2006 |

2006-2007 |

|

35 |

Program expenditures |

755 |

768 |

|

Total Agency |

755 |

768 |

Table 6b:

Statutory Items Listed in Main Estimates

|

Statutory Item |

($ thousands) |

2005-2006 |

2006-2007 |

|

(S) |

Spending of revenues pursuant to subsection 17(2) of the Office of the Superintendent of |

0 |

0 |

|

Total Agency |

0 |

0 |

Table 7:

Resource Requirements by Sector

Table 7 provides a breakdown of OSFI's resources requirements by Sector. Consistent with the methodology for the Program Activity Architecture (PAA), the Corporate Services Sector resources are allocated across OSFI's other three sectors (Regulation, Supervision, and Office of the Chief Actuary).

Resource Requirements by Sector

2006-2007 |

|||||

|

($ millions) |

Regulation and supervision of federally regulated financial institutions |

Regulation and supervision of federally regulated private pension plans |

International Assistance |

Office of the Chief Actuary (OCA) |

Total Planned Spending |

|

Regulation |

$22.9 |

$5.2 |

$1.9 |

$30.0 |

|

|

Supervision |

50.3 |

50.3 |

|||

|

Office of the Chief Actuary |

4.7 |

4.7 |

|||

|

Total |

$73.2 |

$5.2 |

$1.9 |

$4.7 |

$85.0 |

Table 8:

User Fees

|

Fee Type: R A fee is either identified as "Regulatory" ("R") or "Other Products and Services" ("O"). A Regulatory fee relates to an activity undertaken by a department that is integral to the effectiveness of a program and successful achievement of the program mandate requires moderating, directing, testing, or approving the actions of external parties. |

||

|

Fee Setting Authority: OSFI Act |

||

|

Effective date of planned change to take effect Effective date of regulations - targeted for April 1, 2006 |

||

|

Description of Document or Service |

Reasons for Fee Introduction or Amendment |

Planned Consultation and Review Process |

|

Letters patent of amalgamation |

Regulations are being proposed that would eliminate all user fees except those that are paid by non-Federally Regulated Financial Institutions (FRFIs), such as new applicants, and those that are charged for rulings, accreditations, interpretations, capital quality confirmations, and copies of corporate documents, which can be time consuming to process and are outside OSFI's core businesses. The proposed regulations would reduce the number of service charges from 51 to 14. The proposed regulations eliminate the majority of user fees, recognizing that the fees currently do not significantly redistribute OSFI's costs amongst FRFIs and that the fees do not recover a meaningful percentage of OSFI's annual costs. User fees currently recover less than four percent of OSFI's total regulatory and supervisory costs charged to institutions. Eliminating the majority of service charges has little impact on the total amounts individual FRFIs pay. Furthermore, the administration associated with the system, such as tracking, verifying, and reporting on services charges, is resource intensive and costly. Charges to non-FRFIs (e.g., new applicants) and for rulings, accreditations, interpretations, capital quality confirmations, and copies of corporate documents are being retained on the basis that charging for these services, which are not part of OSFI's normal course of regulation and supervision and are often resource intensive to process, represents a more equitable approach to recovering OSFI's costs associated with those services than would charging these services directly to FRFIs through base assessments. |

Given that this policy will result in modest changes to the levels of assessments that some institutions will pay, selected FRFIs and industry associations were consulted. As well, each of the FRFIs that were consulted was provided with estimates of how the new policy would affect their institution. None of the industry associations and institutions expressed concerns with the proposal to reduce the number of service charges. The amended regulations were then published in the Canada Gazette to solicit further comments. No concerns were expressed at that time. The regulations will be published in final form upon approval by the Governor-in-Council. The original regulations and the amended regulations can be found on the Canada Gazette website at: Canada Gazette Part II, Vol. 136, No. 21, SOR/2002-337 and Canada Gazette Part II, Vol. 137, No. 18, SOR/2003-291 respectively. (These links are also available at: http://www.osfi-bsif.gc.ca/osfi/index-eng.aspx?DetailID=528.) |

|

Approval of an agreement respecting the sale of all or substantially all assets |

||

|

Approval of the acquisition or increase of a significant interest |

||

|

Approval of a purchase, reinsurance or transfer of policies, a reinsurance against risks undertaken by the company, or a sale of assets |

||

|

Approval of the acquisition of control of, or the acquisition or increase of a substantial investment in, an entity |

||

|

Approval to retain control of, or to continue to hold a substantial investment in, an entity for longer than 90 days |

||

|

Permission to retain control of, or to hold a substantial investment in, an entity for an indeterminate period |

||

|

Approval, for an indeterminate period, to retain control of, or to hold a substantial investment in, an entity that was acquired by way of a loan workout or realization of a security interest |

||

|

Order increasing the aggregate financial exposure limit |

||

|

Authorization for the release of assets in Canada |

||

|

Exemption from the requirement to maintain and process information or data in Canada |

||

|

Approval of a time period to do all things necessary to relinquish control of, or a substantial investment in, an entity or to relinquish an increase to a substantial investment in an entity |

||

|

Approval of a declaration of dividend in excess of net income |

||

|

Letters patent of dissolution |

||

|

Approval to return amounts transferred from segregated fund account |

||

|

Approval of transactions that are part of the restructuring of a bank holding company or of an insurance holding company or any entity controlled by such a company and to which self-dealing provisions will not apply |

||

|

Approval of asset transactions with a related party or of arrangements applying to such transactions |

||

|

Short-term exemption order |

||

|

Letters patent of, or approval of, continuance or amalgamation under any other Act of Parliament or any Act of the legislature of a province |

||

|

Consent for purchase or redemption of shares or membership shares |

||

|

Approval of special resolution for reduction of stated capital |

||

|

Approval of the making or acquisition of commercial loans, or the acquisition of control of an entity that holds commercial loans, if the total value of commercial loans held exceeds the specified limit |

||

|

Approval of amendment to by-laws to change name |

||

|

Variation of an order approving the commencement and carrying on of business of a body corporate or approving the insuring in Canada of risks by a foreign body corporate |

||

|

Approval for the issuance of shares or other securities in consideration for property |

||

|

Approval to amend an incorporating instrument |

||

|

Extension of the deadline to do all things necessary to relinquish control of, or a substantial investment in, an entity or to relinquish an increase to a substantial investment in an entity |

||

|

Approval of an acquisition or a transfer of assets in excess of 10% of the total value of assets |

||

|

Exemption from requirement to provide financial statements for non-bank affiliates |

||

|

Approval of an acquisition or a transfer of assets in excess of 5% of the total value of assets from a related party that is not a federal financial institution |

||

|

Approval to be reinsured by a related party that is not a company or foreign company |

||

|

Approval of a deposit agreement or of a trust deed to maintain assets in Canada |

||

|

Approval of an amendment to an approved asset-to-capital multiple or borrowing multiple |

||

|

Approval of the issuance of subordinated debt to a parent |

||

|

Consent for purchase or redemption of securities other than shares |

||

|

Approval of a reinsurance trust agreement or of an amendment to a reinsurance trust agreement |

||

|

Approval of a letter of credit in lieu of assets |

||

|

Fee Type: O A fee is either identified as "Regulatory" ("R") or "Other Products and Services" ("O"). A Regulatory fee relates to an activity undertaken by a department that is integral to the effectiveness of a program and successful achievement of the program mandate requires moderating, directing, testing, or approving the actions of external parties. |

||

|

Fee Setting Authority: OSFI Act |

||

|

Effective date of planned change to take effect Effective date of regulations - targeted for April 1, 2006 |

||

|

Description of Document or Service |

Reasons for Fee Introduction or Amendment |

Planned Consultation and Review Process |

|

Charge paid for actuarial services provided by the Chief Actuary in respect of requests for services ancillary to the mandate of the Chief Actuary |

The regulations currently set out an hourly charge payable for certain actuarial services provided by the Chief Actuary. The hourly charge is no longer adequate in light of an increase in overhead costs of the Office of the Chief Actuary. Regulations are being proposed that would eliminate this fixed charge. After the coming into effect of the proposed Regulations, the hourly charge for these services will be published on OSFI's website at the beginning of each fiscal year, so as to maintain sufficient transparency and services will be contracted on an individual basis. |

The proposal to repeal the set hourly charge was discussed during the Office of the Chief Actuary Consultation Committee meeting in March 2005. None of the stakeholders expressed concerns with this proposal. The amended regulations were then published in the Canada Gazette to solicit further comments. No concerns were expressed at that time. The regulations will be published in final form upon approval by the Governor-in-Council. |

Table 9:

Major Regulatory Initiatives

|

Legislative Acts and/or Regulations |

Purpose of regulatory initiative |

Expected results |

|

Order Amending |

The Schedule to the Insurance Companies Act is being revised to reduce the current number of insurance classes and to form the basis for federal class definitions to be harmonized with most provincial and territorial definitions. |

The number of insurance classes will be reduced from over 50 classes used by federal, provincial and territorial jurisdictions to 17 harmonized classes. Also, class definitions will be harmonized, which will reduce the administrative burden and cost to insurers. |

|

Regulations Amending the Charges for |

The amendments will eliminate all service charges except (i) charges paid by non-Federally Regulated Financial Institutions, (e.g., new applicants); and (ii) charges paid for rulings, accreditations, interpretations, capital quality confirmations, and copies of corporate documents. |

The Regulations will reduce the number of service charges from 52 to 14. |

|

Regulations Amending the Investment Limits Regulations |

The Regulations will be reviewed to determine (i) whether the investment limit for P & C companies adequately considers excess assets; and (ii) whether certain investments made by lifecos and DTIs for hedging purposes should be exempt from the equity investments limits. |

The amendments under consideration would provide increased flexibility in the investment limits regime. It would also level the playing field with those FRFIs that are currently exempt from the limit. |

|

Regulations Amending the Reinsurance (Canadian Companies) Regulations and |

The Regulations will be amended primarily to clarify how they apply to the accident and sickness business of life insurance companies. |

The key amendments under consideration will clarify that the Regulations apply to life insurance companies that write accident and sickness insurance and that all of the premium income (not only the accident and sickness premium income) should be included in the denominator for purposes of determining the reinsurance limit. |

|

Pension Benefits Standards Act, |

An amendment being considered would increase temporarily the amortization period for making-up solvency deficiencies in federal defined benefit pension plans, subject to certain terms and conditions. Also being considered in the context of the Department of Finance review of the framework for defined benefit pension plans are amendments to the Pension Benefits Standards Act, 1985 and the Regulations that would, among other things: (i) permit letters of credit with certain characteristics to be recognized as pension assets in solvency valuations; (ii) void amendments to a pension plan if the solvency ratio of the plan falls below the prescribed level; (iii) require employers to pay into the plan, upon termination of the plan, the amount necessary to fund the full benefits promised to plan members; and (iv) provide funding flexibility to pension plans whose sponsor is restructuring under the CCAA, BIA, or WURA. |

The amendments under consideration would provide more funding flexibility to plan sponsors and protect the interests of plan members and beneficiaries. |

Table 10:

Internal Audits and Evaluations

|

Internal Audit |

Estimated Start Date |

Date Published / Estimated Completion Date |

|

OSFI Contracting |

July 19, 2005 |

|

|

Website Reference: |

||

|

OSFI Travel & Hospitality |

July 19, 2005 |

|

|

Website Reference: |

||

|

Managing Core Supervision Workflow (CSWS) Contract Payments |

Sept. 9, 2005 |

|

|

Website Reference: |

||

|

Financial Conglomerates Group (FCG) |

March 2006 |

|

|

OSFI Training and Development |

April 2006 |

|

|

2006/07 Plan to be approved by Audit Committee |

||