Common menu bar links

Breadcrumb Trail

ARCHIVED - Financial Management

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

PART VI - PAY AND DURATION

ARTICLE

54

PAY ADMINISTRATION

54.01 Except as provided in this Article, the terms and conditions governing the application of pay to employees are not affected by this Agreement.

54.02 An employee is entitled to be paid for services rendered at:

(a) the pay specified in Appendix "A", for the classification of the position to which he/she is appointed, if the classification coincides with that prescribed in his/her certificate of appointment;

or

(b) the pay specified in Appendix "A", for the classification prescribed in his/her certificate of appointment, if that classification and the classification of the position to which his/her is appointed do not coincide.

54.03

(a) The rates of pay set forth in Appendix "A" shall become effective on the dates specified therein.

(b) Paragraph (c) supersedes the Retroactive Remuneration Directives.

**

(c) Where the rates of pay set forth in Appendix "A" have an effective date prior to the date of signing of this Agreement the following shall apply:

(i) "retroactive period" for the purpose of subparagraphs (ii) to (v) means the period from the effective date of the revision up to and including the day before the collective agreement is signed or when an arbitral award is rendered therefore;

(ii) a retroactive upward revision in rates of pay shall apply to employees, former employees or in the case of death, the estates of former employees who were employees in this bargaining unit during the retroactive period;

(iii) for initial appointments made during the retroactive period, the rate of pay selected in the revised rates of pay is the rate which is shown immediately below the rate of pay being received prior to the revisions;

(iv) for promotions, demotions, deployments, transfers or acting situations effective during the retroactive period, the rate of pay shall be recalculated, in accordance with the Public Service Terms and Conditions of Employment Regulations, using the revised rates of pay. If the recalculated rate of pay is less than the rate of pay the employee was previously receiving, the revised rate of pay shall be the rate, which is nearest to, but not less than the rate of pay being received prior to the revision. However, where the recalculated rate is at a lower step in the range, the new rate shall be the rate of pay shown immediately below the rate of pay being received prior to the revisions;

(v) no payment or no notification shall be made pursuant to paragraph (c) for one dollar ($1) or less.

54.04 Where a pay increment and a pay revision are effected on the same date, the pay increment shall be applied first (1st) and the resulting rate shall be revised in accordance with the pay revision.

54.05 If, during the term of this Agreement, a new classification standard for this group is established and implemented by the Employer, the Employer shall, before applying rates of pay to new levels resulting from the application of the standard, negotiate with the Association the rates of pay and the rules affecting the pay of employees on their movement to the new levels.

54.06 When the regular pay day for an employee falls on his/her day of rest, every effort shall be made to issue his/her cheque on his/her last working day, provided it is available at his/her regular place of work.

ARTICLE

55

ACTING PAY

55.01

(a) When an employee is required by the Employer to substantially perform the duties of a higher classification level in an acting capacity and performs those duties for at least three (3) consecutive working days, he/she shall be paid acting pay calculated from the date on which he/she commenced to act as if he/she had been appointed to that higher classification level for the period in which he/she acts.

(b) When a day designated as a paid holiday occurs during the qualifying period the holiday shall be considered as a day worked for purposes of the qualifying period.

ARTICLE

56

AGREEMENT RE-OPENER CLAUSE

56.01 This Agreement may be amended by mutual consent.

ARTICLE

57

DURATION

**

57.01 The duration of this Agreement shall be from the date it is signed to November 6, 2007.

57.02 Unless otherwise expressly stipulated, the provisions of this Agreement shall become effective on the date it is signed.

**

57.03 The provisions of this Agreement shall be implemented by the parties within a period of ninety (90) days from the date of signing.

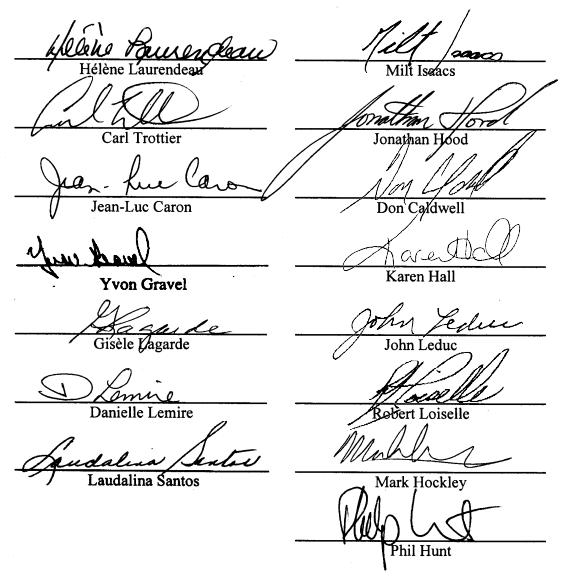

SIGNED AT OTTAWA, this 22nd day of the month of December 2006.

|

THE TREASURY BOARD |

|

THE ASSOCIATION OF |

**APPENDIX "A"

FI - FINANCIAL

MANAGEMENT

ANNUAL RATES OF PAY

(in dollars)

A) Effective November 7, 2004

B) Effective November 7, 2005

C) Effective November 7, 2006

|

FI - DEVELOPMENT |

||||||

|

From: |

$ |

22379 |

to |

41141 |

|

|

|

To: |

A |

22883 |

to |

42067 |

|

|

|

B |

23432 |

to |

43077 |

|

|

|

|

C |

24018 |

to |

44154 |

|

|

|

|

FI-1 |

||||||

|

From: |

$ |

41854 |

43788 |

45725 |

47662 |

49594 |

|

To: |

A |

42796 |

44773 |

46754 |

48734 |

50710 |

|

B |

43823 |

45848 |

47876 |

49904 |

51927 |

|

|

C |

44919 |

46994 |

49073 |

51152 |

53225 |

|

|

|

|

|

|

|

|

|

|

From: |

$ |

51534 |

53469 |

55404 |

57561 |

|

|

To: |

A |

52694 |

54672 |

56651 |

58856 |

|

|

B |

53959 |

55984 |

58011 |

60269 |

|

|

|

C |

55308 |

57384 |

59461 |

61776 |

|

|

|

FI-2 |

||||||

|

From: |

$ |

50947 |

53311 |

55674 |

58039 |

60404 |

|

To: |

A |

52093 |

54510 |

56927 |

59345 |

61763 |

|

B |

53343 |

55818 |

58293 |

60769 |

63245 |

|

|

C |

54677 |

57213 |

59750 |

62288 |

64826 |

|

|

|

|

|

|

|

|

|

|

From: |

$ |

62768 |

65130 |

67757 |

|

|

|

To: |

A |

64180 |

66595 |

69282 |

|

|

|

B |

65720 |

68193 |

70945 |

|

|

|

|

C |

67363 |

69898 |

72719 |

|

|

|

|

FI-3 |

||||||

|

From: |

$ |

64466 |

67180 |

69896 |

72609 |

75325 |

|

To: |

A |

65916 |

68692 |

71469 |

74243 |

77020 |

|

B |

67498 |

70341 |

73184 |

76025 |

78868 |

|

|

C |

69185 |

72100 |

75014 |

77926 |

80840 |

|

|

|

|

|

|

|

|

|

|

From: |

$ |

78341 |

81475 |

|

|

|

|

To: |

A |

80104 |

83308 |

|

|

|

|

B |

82026 |

85307 |

|

|

|

|

|

C |

84077 |

87440 |

|

|

|

|

|

FI-4 |

||||||

|

From: |

$ |

71997 |

75049 |

78108 |

81167 |

84225 |

|

To: |

A |

73617 |

76738 |

79865 |

82993 |

86120 |

|

B |

75384 |

78580 |

81782 |

84985 |

88187 |

|

|

C |

77269 |

80545 |

83827 |

87110 |

90392 |

|

|

|

|

|

|

|

|

|

|

From: |

$ |

87619 |

91124 |

|

|

|

|

To: |

A |

89590 |

93174 |

|

|

|

|

B |

91740 |

95410 |

|

|

|

|

|

C |

94034 |

97795 |

|

|

|

|

PAY NOTES

Pay Increment

(1)

(a) The pay increment period for an employee in the FI Development level is twenty-six (26) weeks and for employees at levels FI-1 to FI-4 is fifty-two (52) weeks.

(i) Employees at levels FI-1 to FI-4, a pay increment shall be the next rate in the scale of rates.

(ii) For employees in the Financial Management Development range, an increase at the end of an increment period shall be to a rate in the pay range which is four hundred dollars ($400) higher than the rate at which the employee is being paid or, if there is no such rate, to the maximum of the pay range.

(b) The pay increment date for an employee, appointed to a position in the bargaining unit on promotion, demotion or from outside the Public Service after April 15, 1986, shall be the anniversary date of such appointment. The anniversary date for an employee who was appointed to a position in the bargaining unit prior to April 15, 1986, remains unchanged.

**

Pay Adjustment (FI-DEV.)

(2) An employee being paid in the Financial Management Development range shall have his/her rate of pay increased on:

(a) November 7, 2004, to a pay rate within the "A" range which is two point twenty-five percent (2.25%) higher than his/her former rate of pay,

(b) November 7, 2005, to a pay rate within the "B" range which is two point four percent (2.4%) higher than his/her former rate of pay,

(c) November 7, 2006, to a pay rate within the "C" range which is two point five percent (2.5%) higher than his/her former rate of pay.

**

CANADA BORDER SERVICES AGENCY (CBSA) EMPLOYEES

(i) For employees that transferred on December 12, 2003 or April 1, 2004, the new rate of pay on that date shall be the step in the TB salary scale for the applicable group and level, which is closest to but not less than the CCRA rate the employee was receiving on date of transfer.

(ii) Should there be no such rate, the employee's CCRA rate of pay shall be maintained until such time as the CCRA rate can be integrated into the TB salary scale.

(iii) Effective November 7, 2004, for employees subject to (ii) above, the employee's new rate of pay shall be the rate in the TB salary scale which is closest to but not less than the maintained CCRA rate the employee was receiving, and the employee will receive a lump sum equal to the difference between the value of the economic increase and the actual increase in salary.

(iv) Effective November 7, 2004, where the CCRA rate of pay cannot be integrated into the revised TB salary scale as per (iii) above, the employee shall receive a lump sum equal to the value of the economic increase and the CCRA rate shall be maintained.

(v) Effective November 7, 2005, for employees subject to (iv) above, the employee's new rate of pay shall be the rate in the TB salary scale which is closest to but not less than the maintained CCRA rate the employee was receiving, and the employee will receive a lump sum equal to the difference between the value of the economic increase and the actual increase in salary.

(vi) Effective November 7, 2005, where the CCRA rate of pay cannot be integrated into the revised TB salary scale as per (v) above, the employee shall receive a lump sum equal to the value of the economic increase and the CCRA rate shall be maintained.

(vii) Effective November 7, 2006, for employees subject to (vi) above, the employee's new rate of pay shall be the rate in the TB salary scale which is closest to but not less than the maintained CCRA rate the employee was receiving, and the employee will receive a lump sum equal to the difference between the value of the economic increase and the actual increase in salary.

(viii) Effective November 7, 2006, where the CCRA rate of pay cannot be integrated into the revised TB salary scale as per (vii) above, the employee shall receive a lump sum equal to the value of the economic increase and the CCRA rate shall be maintained.

**APPENDIX "B"

MEMORANDUM

OF UNDERSTANDING

BETWEEN THE

TREASURY BOARD

(HEREINAFTER CALLED THE EMPLOYER)

AND

THE ASSOCIATION OF CANADIAN FINANCIAL OFFICERS

(HEREINAFTER CALLED THE ASSOCIATION)

IN RESPECT OF

THE FINANCIAL MANAGEMENT GROUP

Preamble

In order to compensate for specific responsibilities associated with the implementation of the Chief Financial Officer (CFO) Model during the period of transition, the Employer will provide a CFO Transitional Allowance to incumbents of positions at the FI-01 through FI-04 levels for the performance of duties in the Financial Management Group.

Application

1. The parties agree that incumbents of positions identified above shall be eligible to receive a "Chief Financial Officer (CFO) Transitional Allowance" as specified in 1(a) subject to the following conditions:

(a) Effective November 7, 2005, a Transitional Allowance is to be paid to employees at the maximum of each level in accordance with the following grid:

|

Chief Financial Officer (CFO) Transitional Allowance |

|

|

|

% of Level Maximum |

|

FI-1 |

2% |

|

FI-2 |

2% |

|

FI-3 |

3% |

|

FI-4 |

4% |

(b) The Chief Financial Officer (CFO) Transitional Allowance specified above does not form part of an employee's salary.

(c) An employee shall be paid the Chief Financial Officer (CFO) Transitional Allowance for each calendar month for which the employee receives at least ten (10) days' pay.

(d) The Allowance shall not be paid to or in respect of a person who ceased to be a member of the bargaining unit prior to the date of signing of this Agreement.

(e) The value of the Chief Financial Officer (CFO) Transitional Allowance payable is at the value specified in 1(a) for the level prescribed in the certificate of appointment of the employee's substantive position.

(f) When an employee is required by the Employer to perform the duties of a higher classification level within the FI bargaining unit, and performs these duties at the maximum rate of pay, the Transitional Allowance payable shall be proportionate to the time at each level.

2. Part-time employees shall be entitled to the Allowance on a pro rata basis.

3. The parties agree that disputes arising from the application of this Memorandum of Understanding may be subject to consultation.

4. This Memorandum of Understanding expires on November 6, 2007.