Treasury Board of Canada Secretariat - 2014–15 Report on Plans and Priorities

Archived information

Archived information is provided for reference, research or recordkeeping purposes. It is not subject à to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

ISSN 2292-6402

Table of Contents

- Preface: 2014-15 Report on Plans and Priorities

- President's Message

-

Section I: Organizational Expenditure Overview

-

Section II: Analysis of Programs by Strategic Outcome

- Strategic Outcome

-

Program 1.1: Management Frameworks

- Sub-program 1.1.1: Strategic Management and Governance

- Sub-program 1.1.2: Sound Management and Decision Making

- Sub-program 1.1.3: Service Modernization

- Sub-program 1.1.4: Information Management, Access and Privacy

- Sub-program 1.1.5: Management of Information Technology

- Sub-program 1.1.6: Government Security

- Sub-program 1.1.7: Communications and Corporate Identity

- Sub-program 1.1.8: Regulatory Management

- Program 1.2: People Management

- Program 1.3: Expenditure Management

- Program 1.4: Financial Management

- Program 1.5: Government-Wide Funds and Public Service Employer Payments

- Program 1.6: Internal Services

-

Program 1.1: Management Frameworks

- Strategic Outcome

-

Section III: Supplementary Information

-

Section IV: Organizational Contact Information

Preface: 2014-15 Report on Plans and Priorities

2014–15 Estimates

Part III – Departmental Expenditure Plans: Reports on Plans and Priorities

Purpose

Reports on Plans and Priorities (RPPs) are individual expenditure plans for each department and agency. These reports provide increased levels of detail over a three-year period on an organization’s main priorities by strategic outcome, program and planned/expected results, including links to related resource requirements presented in the Main Estimates. In conjunction with the Main Estimates, RPPs serve to inform members of Parliament on planned expenditures of departments and agencies, and support Parliament’s consideration of supply bills. The RPPs are typically tabled soon after the Main Estimates by the President of the Treasury Board.

Estimates documents

The Estimates are comprised of three parts:

Part I – Government Expenditure Plan: Provides an overview of the government’s requirements and changes in estimated expenditures from previous fiscal years.

Part II – Main Estimates: Supports the Appropriation Acts with detailed information on the estimated spending and authorities being sought by each federal organization requesting appropriations.

In accordance with Standing Orders of the House of Commons, Parts I and II must be tabled on or before March 1.

Part III – Departmental Expenditure Plans: Consists of two components:

- Report on Plans and Priorities (RPP)

- Departmental Performance Report (DPR)

DPRs are individual departmental and agency accounts of results achieved against planned performance expectations as set out in respective RPPs.

The DPRs for the most recently completed fiscal year are tabled in the fall by the President of the Treasury Board.

Supplementary Estimates support Appropriation Acts presented later in the fiscal year. Supplementary Estimates present information on spending requirements that were either not sufficiently developed in time for inclusion in the Main Estimates or have subsequently been refined to account for developments in particular programs and services. Supplementary Estimates also provide information on changes to expenditure forecasts of major statutory items as well as on such items as transfers of funds between votes, debt deletion, loan guarantees, and new or increased grants.

For more information on the Estimates, please consult the Treasury Board of Canada Secretariat website.

Links to the Estimates

As shown above, RPPs make up part of Part III of the Estimates documents. Whereas Part II emphasizes the financial aspect of the Estimates, Part III focuses on financial and non-financial performance information, both from a planning and priorities standpoint (RPP), and an achievements and results perspective (DPR).

The Management Resources and Results Structure (MRRS) establishes a structure for display of financial information in the Estimates and reporting to Parliament via RPPs and DPRs. When displaying planned spending, RPPs rely on the Estimates as a basic source of financial information.

Main Estimates expenditure figures are based on the Annual Reference Level Update, which is prepared in the fall. In comparison, planned spending found in RPPs includes the Estimates as well as any other amounts that have been approved through a Treasury Board submission up to February 1(see “Definitions” below). This readjusting of the financial figures allows for a more up-to-date portrait of planned spending by program.

Changes to the presentation of the Report on Plans and Priorities

Several changes have been made to the presentation of the RPPs, partially to respond to a number of requests (from the House of Commons Standing Committees on Public Accounts (PAC – Report 15), in 2010, and on Government and Operations Estimates (OGGO – Report 7), in 2012) to provide more detailed financial and non-financial performance information about programs within RPPs and DPRs, thus improving the ease of their study to support appropriations approval.

- In Section II, financial, human resources and performance information is now presented at the program and sub-program levels for more granularity.

- The report’s general format and terminology have been reviewed for clarity and consistency purposes.

- Other efforts aimed at making the report more intuitive and focused on Estimates information were made to strengthen alignment with the Main Estimates.

How to read this document

RPPs are divided into four sections:

Section I: Organizational Expenditure Overview

This Organizational Expenditure Overview allows the reader to get a general view of the organization. It provides a description of the organization’s purpose, as well as basic financial and human resources information. This section opens with a new subsection, “Organizational Profile,” which displays general information about the department, including the names of the minister and the deputy head, the ministerial portfolio, the year the department was established, and the main legislative authorities. This subsection is followed by another new subsection entitled “Organizational Context,” which includes the headings Raison d’être, Responsibilities, Strategic Outcomes and Program Alignment Architecture, Organizational Priorities and Risk Analysis. Section I ends with the subsections “Planned Expenditures,” “Alignment to Government of Canada Outcomes,” “Estimates by Votes” and “Contribution to the Federal Sustainable Development Strategy.” It should be noted that this section does not display any non-financial performance information related to programs (please see Section II).

Section II: Analysis of Program(s) by Strategic Outcome(s)

This section provides detailed financial and non-financial performance information for strategic outcomes, programs and sub-programs. This section allows the reader to learn more about programs and sub-programs by reading their respective descriptions and narratives entitled “Planning Highlights.” These narratives speak to key services or initiatives that support the plans and priorities presented in Section I; they also describe how performance information supports the department’s strategic outcome(s) or parent program(s).

Section III: Supplementary Information

This section provides supporting information related to departmental plans and priorities. In this section, the reader will find a future-oriented statement of operations and a link to supplementary information tables regarding transfer payments, as well as information related to greening government operations, internal audits and evaluations, horizontal initiatives, user fees, major Crown and transformational projects, and up-front multi-year funding, where applicable to individual organizations. The reader will also find a link to the Tax Expenditures and Evaluations publication, produced annually by the Minister of Finance, which provides estimates and projections of the revenue impacts of federal tax measures designed to support the economic and social priorities of the Government of Canada.

Section IV: Organizational Contact Information

In this last section, the reader will have access to organizational contact information.

Definitions

- Appropriation

Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

- Budgetary Vs. Non-Budgetary Expenditures

Budgetary expenditures: Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

Non-budgetary expenditures: Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

- Expected Result

An outcome that a program is designed to achieve.

- Full-Time Equivalent (FTE)

A measure of the extent to which an employee represents a full person-year charge against a departmental budget. FTEs are calculated as a ratio of assigned hours of work to scheduled hours of work. Scheduled hours of work are set out in collective agreements.

- Government of Canada Outcomes

A set of high-level objectives defined for the government as a whole.

- Management Resources and Results Structure (MRRS)

A common approach and structure to the collection, management and reporting of financial and non-financial performance information.

An MRRS provides detailed information on all departmental programs (e.g., program costs, program expected results and their associated targets, how they align to the government’s priorities and intended outcomes) and establishes the same structure for both internal decision making and external accountability.

- Planned Spending

For the purpose of the RPP, planned spending refers to those amounts for which a Treasury Board submission approval has been received by no later than February 1, 2014. This cut-off date differs from the Main Estimates process. Therefore, planned spending may include amounts incremental to planned expenditure levels presented in the 2014–15 Main Estimates.

- Program

A group of related resource inputs and activities that are managed to meet specific needs and achieve intended results, and that are treated as a budgetary unit.

- Program Alignment Architecture

A structured inventory of a department’s programs, where programs are arranged in a hierarchical manner to depict the logical relationship between each program and the strategic outcome(s) to which they contribute.

- Spending Areas

Government of Canada categories of expenditures. There are four spending areas (social affairs, economic affairs, international affairs and government affairs) each comprised of three to five Government of Canada outcomes.

- Strategic Outcome

A long-term and enduring benefit to Canadians that is linked to the department’s mandate, vision, and core functions.

- Sunset Program

A time-limited program that does not have ongoing funding or policy authority. When the program is set to expire, a decision must be made as to whether to continue the program. (In the case of a renewal, the decision specifies the scope, funding level and duration.)

- Whole-of-Government Framework

A map of the financial and non-financial contributions of federal organizations receiving appropriations that aligns their programs to a set of high-level outcome areas defined for the government as a whole.

President's Message

I am pleased to present the 2014–15 Report on Plans and Priorities of the Treasury Board of Canada Secretariat. This report details activities that demonstrate our commitment to transforming Government of Canada operations to further increase their efficiency and provide better services to the hard-working Canadian taxpayers.

Canadians need and deserve a public service that is equipped to deliver modern, cost effective and responsive programs and services. To achieve this, as President of the Treasury Board, I am taking steps to strengthen financial and expenditure management, reform human resources management, and streamline government operations.

To strengthen financial and expenditure management, we are implementing measures to improve value for money, contain the costs of administration, and achieve greater efficiency throughout the public service. We will establish a new Costing Centre of Expertise in the Secretariat to improve both the capacity to challenge costs and the quality of financial information provided for decision making. We will also be improving how we monitor and report on expenditures and measures such as the freeze on the federal operating budget, announced in last October's Speech from the Throne. These efforts are crucial to balancing the Government's overall budget by 2015.

The Secretariat is also leading efforts to modernize the management of human resources to ensure the public service is high performing and affordable. For example, we will oversee the implementation of the new Directive on Performance Management to recognize good work and encourage excellence. This will lead to a more dynamic and productive workforce, combat absenteeism, and ultimately provide better service for Canadians.

We are aiming to reform our disability and sick-leave system to place greater emphasis on employee wellness, improve case management and reduce the number of sick days lost to illness. A modernized disability and sick-leave management system, including the introduction of a formal short-term disability plan, will lead to a healthier and more productive federal workforce to serve Canadians. The Government looks forward to working with bargaining agents to make this happen.

Finally, we will continue to streamline government operations. This includes publishing Canada's second Action Plan on Open Government to foster greater transparency and accountability, and changing how we use information technology to achieve greater administrative efficiency and reduce back-office costs.

We will also continue to help reduce and contain red tape for Canadian businesses by enshrining in law the One-for-One Rule from our Red Tape Reduction Action Plan. The rule requires that for every regulation added that imposes a burden on business, another regulation must be removed.

These are just some of the ways we will ensure that the Government provides value for taxpayers' dollars while continuing to meet the needs of Canadians. I look forward to continuing our work toward these objectives, and invite all Canadians to read about the Secretariat's plans and priorities for 2014–2015.

The Honourable Tony Clement

President of the Treasury Board

Section I: Organizational Expenditure Overview

Organizational Profile

Minister: The Honourable Tony Clement

Deputy head: Yaprak Baltacioğlu

Ministerial portfolio: Treasury Board

Year established: 1966

Main legislative authorities:

- Access to Information Act

- Alternative Fuels Act

- Auditor General Act

- Canada School of Public Service Act

- Conflict of Interest Act

- Diplomatic Service (Special) Superannuation Act

- Employment Equity Act

- Federal Real Property and Federal Immovables Act

- Federal Accountability Act

- Financial Administration Act

- Government Services Act, 1999

- Lieutenant Governors Superannuation Act

- Lobbying Act

- Members of Parliament Retiring Allowances Act

- Official Languages Act

- Privacy Act

- Public Pensions Reporting Act

- Public Sector Compensation Act

- Public Sector Pension Investment Board Act

- Public Servants Disclosure Protection Act

- Public Service Employment Act

- Public Service Labour Relations Act

- Public Service Modernization Act

- Public Service Pension Adjustment Act

- Public Service Superannuation Act

- Special Retirement Arrangements Act

- Supplementary Retirement Benefits Act

- User Fees Act

Organizational Context

Raison d'être

The Treasury Board of Canada Secretariat (Secretariat) is the administrative arm of the Treasury Board, and the President of the Treasury Board is the Minister responsible for the Secretariat. This organization supports the Treasury Board by making recommendations and providing advice on program spending, regulations and management policies and directives, while respecting the primary responsibility of deputy heads in managing their organizations, and their roles as accounting officers before Parliament. In this way, the Secretariat strengthens the way government is managed and helps to ensure value for money in government spending and results for Canadians.

Responsibilities

The Secretariat supports the Treasury Board in each of its roles (see text box “Treasury Board Roles”).

Within the Secretariat, the Comptroller General of Canada provides government-wide leadership, direction, oversight and capacity building for financial management, internal audit and the management of assets and acquired services.

The Chief Human Resources Officer provides government-wide leadership on people management through policies, programs and strategic engagements and by centrally managing labour relations, compensation, pensions and benefits and contributing to the management of executives.

The Chief Information Officer provides government-wide leadership, direction, oversight and capacity building for information management, information technology, government security (including identity management), access to information, privacy, and internal and external service delivery.

The Treasury Board Portfolio consists of the Secretariat and the Canada School of Public Service. The Public Sector Pension Investment Board, the Office of the Commissioner of Lobbying of Canada and the Office of the Public Sector Integrity Commissioner of Canada are arm’s-length organizations that report to Parliament through the President of the Treasury Board.

When working with federal departments, agencies and Crown corporations, the Secretariat plays three central agency roles:

- A leadership role in driving and modeling excellence in public sector management and in identifying and launching government-wide horizontal initiatives that target administrative efficiencies;

- A challenge and oversight role that includes reporting on the government’s management and budgetary performance and developing government-wide management policies and standards; and

- A community enabling role to help organizations improve management performance.

Treasury Board Roles

The Treasury Board is a Cabinet committee of ministers established in 1867. It oversees the government’s financial, human resources and administrative responsibilities and establishes policies that govern each of these areas. In addition, the Prime Minister has designated the Treasury Board to act as the committee of the Queen’s Privy Council for the consideration and approval of regulations and most orders-in-council. The Treasury Board, as the Management Board for the government, has three principal roles:

- It acts as the government’s Management Office by promoting improved management performance. It also approves policies to support the prudent and effective management of the government’s assets and financial, information and technology resources.

- It acts as the government’s Budget Office by examining and approving the proposed spending plans of government departments and by reviewing the development of approved programs

- It acts as the human resources office and employer or People Management Office by managing compensation and labour relations for the core public administration. It also sets foundational values for the public sector and people management policies for the core public administration (including determining the terms and conditions of employment) to ensure coherence and consistency, where needed.

Strategic Outcome and Program Alignment Architecture (PAA)

The Secretariat’s Program Alignment Architecture (PAA) is made up of six programs that contribute to the achievement of the Secretariat’s strategic outcome. Detailed information about the Secretariat’s strategic outcome and about each of the programs and sub-programs in the PAA can be found in Section II: Analysis of Programs by Strategic Outcome.

2014–15 Program Alignment Architecture

-

1.1 Program: Management Frameworks

- 1.1.1 Sub-Program: Strategic Management and Governance

- 1.1.2 Sub-Program: Sound Management and Decision Making

- 1.1.3 Sub-Program: Service Modernization

- 1.1.4 Sub-Program: Information Management, Access and Privacy

- 1.1.5 Sub-Program: Management of Information Technology

- 1.1.6 Sub-Program: Government Security

- 1.1.7 Sub-Program: Communications and Corporate Identity

- 1.1.8 Sub-Program: Regulatory Management

-

1.2 Program: People Management

- 1.2.1 Sub-Program: Direction Setting

- 1.2.2 Sub-Program: Enabling Infrastructure

- 1.2.3 Sub-Program: Comprehensive Management of Compensation

-

1.3 Program: Expenditure Management

- 1.3.1 Sub-Program: Results-Based Expenditure Management

- 1.3.2 Sub-Program: Expenditure Management Advice and Reporting

- 1.3.3 Sub-Program: Compensation Expenditure Management

-

1.4 Program: Financial Management

- 1.4.1 Sub-Program: Financial Management, Oversight and Reporting

- 1.4.2 Sub-Program: Internal Audit

- 1.4.3 Sub-Program: Assets and Acquired Services

- 1.5 Program: Government-Wide Funds and Public Service Employer Payments

- 1.6 Program: Internal Services

Organizational Priorities

For the period 2014–17, the Secretariat will continue to focus on implementing key reforms aimed at increasing the efficiency and effectiveness of government and ensuring value for taxpayer dollars. This includes supporting greater fiscal discipline in the management of government expenditures; enhancing public service integrity, performance and productivity; leveraging information technology (IT) to improve service and reduce costs; and continuing to simplify government rules and administrative processes. Efforts will also continue to increase the Secretariat’s efficiency and effectiveness as an organization.

The Secretariat has identified five priority areas for 2014–15 that will contribute to the achievement of the Secretariat’s strategic outcome, “Government is well managed and accountable, and resources are allocated to achieve results.” These priorities will be supported by efforts within each of the Secretariat’s programs and sub-programs, including a number of key initiatives highlighted in the tables below. Additional information is provided in Section II: Analysis of Programs by Strategic Outcome.

| Type See footnote [1] | Programs |

|---|---|

| Ongoing |

|

| Description | |

|

Why is this a priority? As indicated in the 2013 federal budget and the Speech from the Throne, achieving leaner and more efficient government is a key part of the government’s plan to return to balanced budgets by 2015. To build on recent targeted measures (e.g., $5.2 billion in ongoing savings announced in Budget 2012), there is a need to reform how government spending is managed and ensure that limited resources are allocated efficiently to key priorities and results for Canadians. This reform includes a more rigorous examination of new spending proposals and a more systematic review of ongoing spending to ensure efficient design and delivery of federal government programs. It also includes efforts to modernize the way that government financial and performance data is captured and managed in order to support stronger management oversight and reduce administrative costs. What are the plans for meeting this priority?

|

|

| Type | Programs |

|---|---|

| Ongoing |

|

| Description | |

|

Why is this a priority? To contribute effectively, employees need to be supported with clear goals and opportunities to learn and innovate while they deliver the quality programs and services expected by Canadians. In this context, there is a need to modernize how the government manages performance, and how it supports employee wellness and productivity. At the same time, there is a need to manage compensation in a holistic and sustainable way that aligns with modern employment conditions and current fiscal and economic realities. What are the plans for meeting this priority?

|

|

| Type | Programs |

|---|---|

| Ongoing |

|

| Description | |

|

Why is this a priority? Adopting modern, consolidated systems based on standard business processes can reduce administrative or back office costs, enhance employee productivity and reduce overall government spending in internal services. The 2013 Fall Report of the Auditor General of Canada has highlighted that the government is falling behind citizens’ expectations for how government services are designed and delivered. The government must adopt new IT solutions to enable e-Services that integrate the customer experience across government programs and allow citizens and businesses to “tell us once,” securely and confidentially. The Open Government Partnership (OGP) the government endorsed in April 2012 responds to citizens’ demands for increased transparency and engagement, and commits Canada to a three-year action plan encompassing a number of departmental and government-wide horizontal initiatives. What are the plans for meeting this priority?

|

|

| Type | Programs |

|---|---|

| Ongoing |

|

| Description | |

|

Why is this a priority? Bureaucratic red tape can impose needless administrative costs on the operations of Canadian business and on government itself. Left unchecked, this can have a negative impact on productivity. Launched in October 2012, the Red Tape Reduction Action Plan is one of the most ambitious red tape–cutting initiatives in the world today. The plan sets out the government’s common-sense approach to cutting red tape so that entrepreneurs can focus on doing business and creating jobs. At the same time, there is an opportunity to review administrative rules within government, to increase administrative efficiency and to reduce costs. What are the plans for meeting this priority?

|

|

| Type | Programs |

|---|---|

| Ongoing |

|

| Description | |

|

Why is this a priority? The continued pressure on government resources and the heightened focus on cost-containment demand that the Secretariat improve its internal efficiency and effectiveness as an organization, including its work environment, processes and technologies. By 2017, the Secretariat’s four-year workplace renewal initiative will modernize and reduce the Secretariat’s office space by 33 per cent, streamline and automate internal operations, and leverage updated technology to enhance employee productivity and collaboration and increase efficiency in support of the Secretariat’s central agency responsibilities. What are the plans for meeting this priority?

|

|

Risk Analysis

The Secretariat actively monitors its operating environment in order to identify and manage risks that could affect progress toward its strategic outcome, organizational priorities and program expected results. Key risks are captured in the Secretariat’s Corporate Risk Profile (CRP), which is updated at least once per year. Through the most recent review of its CRP, the Secretariat identified four key risks, which are described in the table below. For each risk, a response strategy has been developed, including specific mitigation measures.

Key Risks

| Risk | Risk Response Strategy See footnote [2] | Link to Program Alignment Architecture |

|---|---|---|

|

1. Cyber-Security |

The Secretariat will work on a number of fronts to mitigate the risk of rapidly evolving cyber-threats, including:

|

Government Security (1.1.6) |

|

2. Back Office Transformation |

The Secretariat will provide leadership and oversight toward ensuring that government administrative reforms achieve their intended results, including:

|

Management of Information Technology (1.1.5 ) Enabling Infrastructure (1.2.2) Financial Management, Oversight, and Reporting (1.4.1) |

|

3. Expenditure Management |

The Secretariat will pursue initiatives to ensure that appropriate mechanisms and capacities are in place to support sound decision making on government expenditures, including:

|

Expenditure Management (1.3) Financial Management (1.4) |

|

4. High-Performing Public Service |

The Secretariat will advance a number of key reforms to ensure that government people management practices are aligned with current and future needs, including:

|

Management Frameworks (1.1) People Management (1.2) Financial Management (1.4) |

For 2014–17, the Secretariat will continue to operate in a dynamic environment, as it advances key reforms to achieve modern, efficient and high-performing government. This environment, described in the following paragraphs, provides the strategic and organizational context for the Secretariat’s management of the identified risks.

Reducing the cost of government and ensuring value for taxpayer dollars is a key ongoing priority. Significant savings and efficiencies have been achieved in recent years through targeted measures (e.g., $5.2 billion in savings identified in Budget 2012). Moving forward, cost-containment considerations need to continue to be embedded in federal expenditure management processes. Providing robust cost analysis of proposed new spending, as well as continuous review of existing spending, will ensure that limited government resources are aligned to current and future needs. As a central agency, the Secretariat remains focused on ensuring that government has the comprehensive, accurate and reliable information needed to support sound financial decision making.

As the government adapts to the realities of the 21st century, the Secretariat is providing leadership to modernize people management practices. This includes reviewing and updating the current people management policies and tools to support a high-performing workforce that has the skills to meet the needs of Canadians, now and for the future. The Secretariat is also advancing reforms that promote higher productivity and performance within the public service and that ensure that compensation and benefits are sustainable for the long term. In the next round of collective bargaining, which begins in 2014, a number of key issues will be under negotiation, including reforms to the current system of sick leave and disability management and the alignment of public sector compensation and benefits within the broader employment marketplace.

The government is continuing to leverage technology to increase efficiency and reduce the administrative costs associated with its back office functions (e.g., human resources, finance and records management). This is an ongoing and challenging area of work, which involves standardizing, consolidating and simplifying the administrative processes and systems that support the operations of federal departments and agencies. The Secretariat remains focused on facilitating a strategic and coordinated approach across government, to ensure that these reforms achieve their intended results.

Finally, while rapid technological change provides opportunities for greater efficiency, it also presents potential risks from a security perspective. Rapidly evolving cyber-threats are an ongoing consideration. As the government-wide lead on IT security policy and standards, the Secretariat has a responsibility to work with other departments, including Shared Services Canada, to support a coordinated and strategic approach to government cyber-security.

Planned Expenditures

| 2014–15 Main Estimates |

2014–15 Planned Spending |

2015–16 Planned Spending |

2016–17 Planned Spending |

|---|---|---|---|

| 7,364,924,114 | 7,364,924,114 | 6,884,471,022 | 6,567,126,038 |

| 2014–15 | 2015–16 | 2016–17 |

|---|---|---|

| 1891 | 1879 | 1823 |

| Program | 2011–12 Expenditures |

2012–13 Expenditures |

2013–14 Forecast Spending |

2014–15 Main Estimates |

2014–15 Planned Spending |

2015–16 Planned Spending |

2016–17 Planned Spending |

|---|---|---|---|---|---|---|---|

| Management Frameworks | 65,304,000 | 58,544,372 | 53,692,649 | 51,725,463 | 51,725,463 | 51,404,826 | 50,260,516 |

| People Management | 65,443,624 | 60,974,838 | 57,951,754 | 64,550,201 | 64,550,201 | 64,786,456 | 62,349,147 |

| Expenditure Management | 50,893,368 | 31,046,559 | 34,280,616 | 31,791,958 | 31,791,958 | 31,791,872 | 31,791,259 |

| Financial Management | 36,469,977 | 30,866,718 | 34,453,786 | 32,235,681 | 32,235,681 | 32,235,681 | 31,772,740 |

| Government-Wide Funds and Public Service Employer Payments | 2,192,868,914 | 2,500,372,809 | 2,711,199,661 | 7,106,195,208 | 7,106,195,208 | 6,646,263,604 | 6,333,254,397 |

| Subtotal | 2,410,979,883 | 2,681,805,296 | 2,891,578,466 | 6,836,498,511 | 6,836,498,511 | 6,826,482,439 | 6,509,428,059 |

| Internal Services | 2011–12 Expenditures |

2012–13 Expenditures |

2013–14 Forecast Spending |

2014–15 Main Estimates |

2014–15 Planned Spending |

2015–16 Planned Spending |

2016–17 Planned Spending |

|---|---|---|---|---|---|---|---|

| Subtotal | 93,528,245 | 80,220,720 | 78,295,105 | 78,425,603 | 78,425,603 | 57,988,583 | 57,697,978 |

| Program | 2011–12 Expenditures |

2012–13 Expenditures |

2013–14 Forecast Spending |

2014–15 Main Estimates |

2014–15 Planned Spending |

2015–16 Planned Spending |

2016–17 Planned Spending |

|---|---|---|---|---|---|---|---|

| Total | 2,504,508,128 | 2,762,026,016 | 2,969,873,571 | 7,364,924,114 | 7,364,924,114 | 6,884,471,022 | 6,567,126,038 |

The tables above outline actual spending for 2011–12 See footnote [3] and 2012–13; forecast spending for 2013–14; the 2014–15 Main Estimates figures; and planned spending for 2014–15 and two future years. See footnote [4] Additional details regarding planned spending are discussed in Section II: Analysis of Programs by Strategic Outcome.

Approximately 60 per cent of the planned spending for Program 1.5 Government-Wide Funds and Public Service Employer Payments is transferred to, and spent by, other departments and agencies for items such as operating and capital budget carry-forward, severance, parental benefits and compensation requirements (Votes 5, 10, 15, 25, 30 and 33). The Secretariat’s total authorities are therefore reduced accordingly. The most significant difference between the planned and the actual spending (on average $4.2 billion per year) relates to the amounts that were distributed from these votes to other departments and agencies (expenditures appear in their operating votes). The balance of funding within the program is for public service employer payments.

Actual spending for the Secretariat’s operations (Programs 1.1 to 1.4 and Program 1.6) decreased by $50 million from 2011–12 to 2012–13, largely as a result of the following:

- One-time expenditures related to professional services costs for external experts to support the review of departmental spending across government;

- Payouts to employees resulting from the revision of specific collective agreements;

- Reductions related to Economic Action Plan 2012 cost-containment measures;

- Project delays; and

- Deferral of staffing plans.

Forecast spending for the Secretariat’s operations shows a decrease of $3 million from 2012–13 actual spending to 2013–14 forecast spending due to the following:

- Payouts to employees resulting from the revision of specific collective agreements;

- Reductions related to Economic Action Plan 2012 cost-containment measures; and

- Transfers of funding to other departments.

The above decreases are offset by increases in new activities related to Workspace Renewal and the Workplace Wellness and Productivity Strategy.

An increase of $55 thousand from the 2013–14 forecast spending to the 2014–15 Main Estimates and 2014–15 planned spending is largely a result of increases in funding for Workspace Renewal. This is offset by reduced activities due to the Economic Action Plan 2012 cost-containment measures and the sunset of the Human Resources Modernization initiative and other programs.

Forecast spending for the Secretariat’s operations will decrease by $20.5 million from 2014–15 to 2016–17 due to the sunset of the Workspace Renewal initiative in 2015–16 and to the sunset of the Joint Learning and Federal Contaminated Sites programs (total $4.3 million in 2016–17).

The increase of $307.5 million to net public service employer payments from 2011–12 to 2012–13 largely resulted from a statutory payment for an actuarial adjustment made in virtue of the Public Service Superannuation Act, which was offset by a one-time payment in 2011–12 for long-term disability benefits provided under the Service Income Security Insurance Plan. The increase of $210.8 million from 2012–13 actual spending to the 2013–14 forecast includes a contingency for employee benefit plan expenses. The increase of $4.4 billion from 2013–14 to 2014–15 is due to the transfers to other departments and agencies.

The decrease of $459.9 million from 2014–15 to 2015–16 is due to a decrease of $450 million in government-wide paylist requirements (Vote 30) and to a decrease of $9.9 million in public service employer payments (Vote 20) from Strategic Review Reductions. Planned spending between 2015–16 and 2016–17 will decrease by $313 million due to a reduction of $400 million in government-wide paylist requirements (Vote 30) and will increase by $87 million as a result of expected increases in plan usage per member and unit costs, and employer contributions directly related to salaries.

Alignment to Government of Canada Outcomes

| Strategic Outcome | Program | Spending Area | Government of Canada Outcome | 2014–15 Planned Spending |

|---|---|---|---|---|

| Government is well managed and accountable, and resources are allocated to achieve results | 1.1 Management Frameworks | Government Affairs | Well-managed and efficient government operations | 51,725,463 |

| 1.2 People Management | Government Affairs | Well-managed and efficient government operations | 64,550,201 | |

| 1.3 Expenditure Management | Government Affairs | Well-managed and efficient government operations | 31,791,958 | |

| 1.4 Financial Management | Government Affairs | Well-managed and efficient government operations | 32,235,681 | |

| 1.5 Government-Wide Funds and Public Service Employer Payments | Government Affairs | Well-managed and efficient government operations | 7,106,195,208 | |

| 1.6 Internal Services | Government Affairs | Well-managed and efficient government operations | 78,425,603 |

| Spending Area | Total Planned Spending |

|---|---|

| Economic Affairs | N/A |

| Social Affairs | N/A |

| International Affairs | N/A |

| Government Affairs | 7,364,924,114 |

Departmental Spending Trend

Figure 1: Departmental Spending Trend Chart

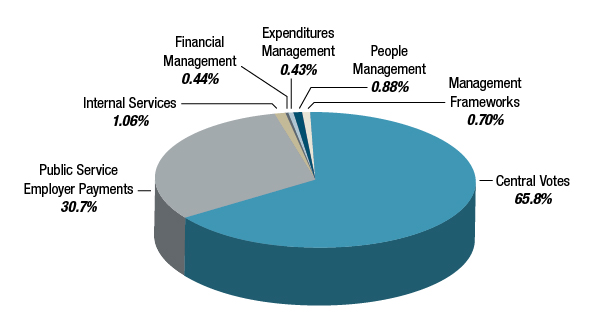

For fiscal year 2014–15, the Secretariat’s total planned spending is $7.36 billion. This includes $4.84 billion, or 65.8 per cent, in centrally managed funds used to supplement the appropriations of departments and agencies.

Most of the balance of planned spending, $2.52 billion, is related to the Secretariat’s role as employer of the core public administration ($2.26 billion). These funds are used for:

- Public service pension, benefits and insurance, including payment of the employer’s share of health, income maintenance and life insurance premiums;

- Payments in respect of provincial health insurance;

- Payments of provincial payroll taxes and Quebec sales tax on insurance premiums; and

- Return to certain employees of their share of the employment insurance premium reduction.

The remaining amount ($0.26 billion) is directly related to the operations of the Secretariat and its five other programs: Management Frameworks, People Management, Expenditure Management, Financial Management and Internal Services.

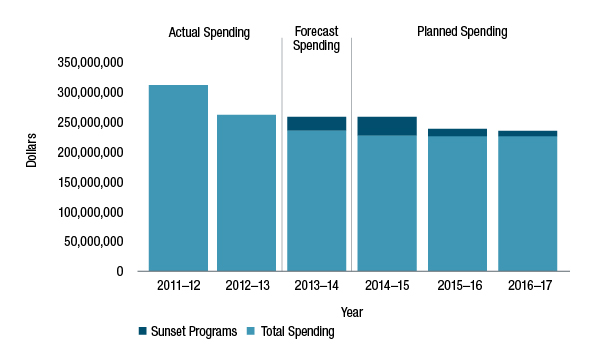

Figure 2: Departmental Spending Trend for Program Expenditures (Vote 1)

Figure 2: Departmental Spending Trend for Program Expenditures (Vote 1) - Text version

The Secretariat’s program expenditures include salaries, non-salary costs that support its operations, and contributions to employee benefit plans for its own employees, as well as other statutory payments.

The decrease in spending from 2011–12 to 2012–13 is largely due to one-time expenditures related to professional services costs for external experts to support the review of departmental spending across government, incurred in 2011–12, and to payouts to employees resulting from the revision of specific collective agreements.

Decreases from 2012–13 to 2016–17 are mostly a result of Strategic Review 2010 reductions, transfers to Shared Services Canada and Public Works and Government Services Canada, and Economic Action Plan 2012 cost-containment measures.

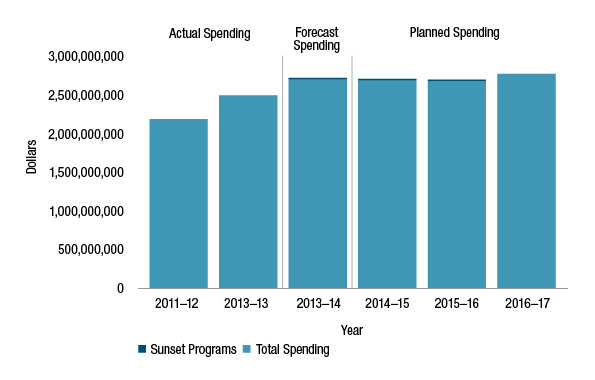

Figure 3: Spending Trend for Public Service Employer Payments (Vote 20)

Figure 3: Spending Trend for Public Service Employer Payments (Vote 20) - Text version

Expenditures for public service employer payments and statutory items include the payment of the employer’s share of contributions required under the various insurance plans sponsored by the Government of Canada. These amounts also include statutory items for payments under the Public Service Pension Adjustment Act; pay equity settlements, pursuant to section 30 of the Crown Liability and Proceedings Act; and employer contributions made under the Public Service Superannuation Act (PSSA), other retirement Acts and the Employment Insurance Act.

Public service employer payments increased by $307.5 million from 2011–12 to 2012–13, mostly as a result of a $443 million actuarial adjustment to employer contributions made under the PSSA. The actuarial adjustment was offset by a decrease of $112.4 million due to a one-time payment under the Service Income Security Insurance Plan and by savings in the Public Service Health Care Plan and payroll taxes. This actuarial adjustment is reflected in forecast and planned spending each year from 2013–14 to 2016–17.

Planned spending between 2015–16 and 2016–17 will increase by $87 million as a result of expected increases in plan usage per member and unit costs, and employer contributions directly related to salaries.

Estimates by Vote

For information on the Treasury Board of Canada Secretariat’s organizational appropriations, please see the 2014-15 Main Estimates publication.

Contribution to the Federal Sustainable Development Strategy (FSDS)

The 2013–16 Federal Sustainable Development Strategy (FSDS) tabled on November 4, 2013, guides the Government of Canada’s 2013–16 sustainable development activities. The FSDS articulates Canada’s federal sustainable development priorities for a period of three years, as required by the Federal Sustainable Development Act.

The Secretariat contributes to Theme IV, Shrinking the Environmental Footprint – Beginning with Government, as denoted by the visual identifier below.

This contribution is a component of the Internal Services program and is further explained under “Planning Highlights” for Program 1.6: Internal Services.

The Secretariat also ensures that its decision-making process includes consideration of FSDS goals and targets through strategic environmental assessment (SEA). An SEA for policy, plan or program proposals includes analysis of the impacts of the proposal on the environment, including on FSDS goals and targets. The results of SEAs are made public when an initiative is announced or approved, demonstrating that environmental factors were integrated into the decision-making process.

For additional details on the Secretariat’s activities to support sustainable development, please see Section II of this RPP and consult the Secretariat’s website under Contributing to the Federal Sustainable Development Strategy. For complete details on the FSDS, please see the Federal Sustainable Development Strategy web page.

Section II: Analysis of Programs by Strategic Outcome

Strategic Outcome

| Performance Indicator | Targets | Date to be Achieved |

|---|---|---|

| Canada’s ranking in the World Bank Worldwide Governance Indicators project for indicator three “Government Effectiveness” | Top ten among Organisation for Economic Co-operation and Development (OECD) member countries | Annually |

Results achieved in support of the Secretariat’s strategic outcome strengthen the effectiveness and efficiency of the federal government; support decision making by Parliament, the Treasury Board and Cabinet; and ensure that Canadians are well served by a government that is accountable and transparent. Effective government contributes to Canada’s competitive advantage, providing a strong foundation for security, stability and prosperity. The strategic outcome is supported by six programs:

- Management Frameworks;

- People Management;

- Expenditure Management;

- Financial Management;

- Government-Wide Funds and Public Service Employer Payments; and

- Internal Services.

This section describes each of the Secretariat’s programs and sub-programs and identifies their expected results, performance indicators and targets, in line with the Policy on Management, Resources and Results Structures. It presents the financial and human resources planned for each program and sub-program, and highlights a number of key planned initiatives for 2014–15.

The Secretariat’s 2014–15 Performance Alignment Architecture (PAA) provides the basis of reporting on planning in this report. The targets for some programs and sub-programs are currently under review as a result of changes to the 2014–15 Management Accountability Framework (MAF). Outcomes from that review process will be reflected in the Secretariat’s 2014–15 Departmental Performance Report.

Program 1.1: Management Frameworks

The Management Frameworks Program establishes principles for sound governance and management in the Government of Canada by helping ministers set government-wide policy direction in targeted areas. These areas include service and program modernization, information management, information technology, security, communications and regulatory management.

This program achieves its results by communicating clear expectations for deputy heads and by adopting principles-based approaches and risk-informed oversight. Working with departments, agencies and functional communities (e.g., regulation, information technology, security), the Secretariat provides leadership, oversight, assessment and guidance in areas related to management policy and regulatory development, compliance and performance reporting. This work also includes responding to emerging public sector management issues and promoting informed risk-taking, innovation, cost-effectiveness, efficiency, transparency and accountability.

This program is underpinned by a broad set of enabling legislation, including the Financial Administration Act and the Federal Accountability Act.

| 2014–15 Main Estimates |

2014–15 Planned Spending |

2015–16 Planned Spending |

2016–17 Planned Spending |

|---|---|---|---|

| 51,725,463 | 51,725,463 | 51,404,826 | 50,260,516 |

| 2014–15 | 2015–16 | 2016–17 |

|---|---|---|

| 382 | 382 | 382 |

| Expected Result | Performance Indicator | Target | Date to be Achieved |

|---|---|---|---|

| Sound governance and management in the Government of Canada | Percentage of departments and agencies that obtained a MAF rating of at least “Acceptable” for citizen-focused service, management of security, risk management, information management, and IT management | Under review See footnote [5] | Not applicable |

Planning Highlights

In addition to the expected results identified above, efforts under this program will contribute to meeting the Secretariat’s priorities described in the section “Organizational Priorities,” particularly Priorities 3 and 4.

In 2014–15, progress will be achieved on Canada’s Action Plan on Open Government, the design of an applications rationalization program for government, improvements to the Treasury Board policy suite and the MAF, and red tape reduction. These and other key initiatives are identified in the “Planning Highlights” sections of the appropriate sub-programs.

In advancing the work of this program, the Secretariat will also manage risks, particularly those related to modernizing and transforming the back office, managing the security and integrity of IT systems, and ensuring a high-performing public service (e.g., IM, IT, and security functions) as described in the “Risk Analysis” section.

Sub-program 1.1.1: Strategic Management and Governance

Through the Strategic Management and Governance sub-program, the Secretariat provides leadership across the Government of Canada to establish a broad management agenda and promote strategic approaches to crosscutting policy issues on public sector management. Policy centres and federal institutions receive advice and support to maintain the integrity of the suite of Treasury Board policies, to review and refine policy instruments to ensure they reflect government priorities, to achieve management goals, to appropriately manage risk and to impose minimal administrative burden.

Sub-program 1.1.1 also identifies new and emerging management and governance issues; promotes increased productivity and innovation in management practices; advances modern reporting; and develops efficient, cost-effective approaches to planning, risk management and oversight and to strengthening the government’s operating environment.

| 2014–15 Planned Spending |

2015–16 Planned Spending |

2016–17 Planned Spending |

|---|---|---|

| 3,922,779 | 3,925,335 | 3,925,335 |

| 2014–15 | 2015–16 | 2016–17 |

|---|---|---|

| 35 | 35 | 35 |

| Expected Result | Performance Indicator | Target | Date to be Achieved |

|---|---|---|---|

| Federal institutions are equipped with policy instruments to meet their accountabilities and achieve results | Percentage of active policy instruments that meet or exceed expected maturity milestones | 100% | March 2015 |

Planning Highlights

- Identify opportunities to strengthen and streamline the Treasury Board policy suite, to ensure that it responds to the government’s management priorities, mitigates significant risks and enhances management performance; and

- Refine Treasury Board policy reporting requirements to facilitate improved management of internal-to-government reporting.

Sub-program 1.1.2: Sound Management and Decision Making

Through the Sound Management and Decision Making sub-program, the Secretariat provides independent strategic advice, guidance and support to federal organizations for implementing and applying Treasury Board policies, government priorities, risk-management strategies and performance management in support of sound decision making.

Sub-program 1.1.2 includes the Secretariat’s advice and guidance on resource allocation, risks and policy compliance, provided to departments and agencies during the due diligence review of Treasury Board submissions.

It also includes the Secretariat’s MAF activities, which set out the Treasury Board’s expectations for good public service management. MAF is an integrated assessment tool that helps managers, deputy heads and central agencies assess progress and strengthen accountability for management results through clear indicators and measures that gauge performance over time. This sub-program captures the strategic direction and continuous evolution of MAF, which is informed by the management expectations set out in other sub-programs of the Secretariat’s PAA.

| 2014–15 Planned Spending |

2015–16 Planned Spending |

2016–17 Planned Spending |

|---|---|---|

| 14,067,476 | 14,079,102 | 14,079,102 |

| 2014–15 | 2015–16 | 2016–17 |

|---|---|---|

| 106 | 106 | 106 |

| Expected Result | Performance Indicators | Target | Date to be Achieved |

|---|---|---|---|

| Advice and direction provided to departments and agencies support sound management and decision making within departments and agencies | Percentage of a representative group of deputy heads in agreement that the advice and direction provided by the Secretariat supports sound management and decision making | 80% | March 2015 |

| Percentage of departments and agencies that obtained a MAF rating of at least “Acceptable” for use of information for decision making | Under review See footnote [6] | Not applicable |

Planning Highlights

- Implement a streamlined and enhanced MAF to reduce administrative burden and provide more useful information on management practices within departments and across government.

Sub-program 1.1.3: Service Modernization

Through the Service Modernization sub-program, the Secretariat provides direction and oversight to federal organizations to enhance internal and external service delivery efficiency and to improve service experiences and outcomes for individuals, businesses and employees.

Sub-program 1.1.3 works to promote client-centred service; build operational efficiency through a whole-of-government approach to service delivery; develop a culture of collaboration and service excellence; integrate multi-channel service delivery through effective use of modern technology; and enable the effective use of online technologies, including social media and collaborative technologies. This is accomplished through research, analysis, development and maintenance of policies and related policy instruments, community engagement, and leadership.

The authority for this sub-program is the Financial Administration Act.

| 2014–15 Planned Spending |

2015–16 Planned Spending |

2016–17 Planned Spending |

|---|---|---|

| 3,150,476 | 3,150,476 | 3,151,175 |

| 2014–15 | 2015–16 | 2016–17 |

|---|---|---|

| 31 | 31 | 31 |

| Expected Result | Performance Indicator | Target | Date to be Achieved |

|---|---|---|---|

| Departments and agencies are equipped with knowledge and guidance to implement sound service and Web 2.0 management practices | Percentage of planned policy activities completed | 80% | March 2015 |

Planning Highlights

- Develop and implement government-wide standards for social media channels and mobile applications to ensure a standard look and feel and a standard development platform.

- Advance work on pilot programs for business (Business Number Hub) and for citizens (Federated Identity Management) that will facilitate a “tell us once” approach; and

- Develop a government-wide service strategy and new policy instruments that will support enhanced digital self-service delivery.

Sub-program 1.1.4: Information Management, Access and Privacy

Through the Information Management, Access and Privacy sub-program, the Secretariat ensures the continual improvement of the management of information across the Government of Canada by providing strategic direction and leadership to federal institutions on record keeping, business intelligence, data management, web content management, access to information and privacy protection.

Sub-program 1.1.4 is focused on ensuring that information is safeguarded as a public trust and managed as a strategic asset. It further ensures that information is open to the public whenever possible, that Canadians can exercise their right to access and reuse information, and that personal information is protected against unauthorized collection, use and disclosure. The sub-program’s objectives are accomplished by developing and maintaining policy instruments, encouraging collaboration between government institutions, monitoring and overseeing activities, providing leadership and working with partners. This includes community development, learning and outreach activities.

The authority for this sub-program comes from the Financial Administration Act, the Access to Information Act and the Privacy Act.

| 2014–15 Planned Spending |

2015–16 Planned Spending |

2016–17 Planned Spending |

|---|---|---|

| 7,279,166 | 7,289,572 | 7,289,572 |

| 2014–15 | 2015–16 | 2016–17 |

|---|---|---|

| 58 | 58 | 58 |

| Expected Result | Performance Indicator | Target | Date to be Achieved |

|---|---|---|---|

| Institutions are equipped with knowledge and guidance to safeguard information as a public trust, and manage it as a strategic asset | Percentage of planned policy activities completed | 75% | March 2015 |

Planning Highlights

- Modernize administration of the Access to Information and Privacy Program (ATIP), including defining a whole-of-government management solution to reduce costs and support Canadians’ right of access; and

- Continue to lead the Open Government initiative by publishing Canada’s second Action Plan on Open Government, including a progress report on existing commitments and the identification of new commitments to foster greater engagement with citizens, consistent with the core principles of the Open Government Partnership.

Sub-program 1.1.5: Management of Information Technology

Through the Management of Information Technology sub-program, the Secretariat provides federal organizations with strategic direction and leadership on the management of information technology (IT). Its whole-of-government strategies focus on standardizing, consolidating and re-engineering IT systems to enable effective program and service delivery. The Secretariat also optimizes Government of Canada IT investments through effective management and governance of IT-enabled projects and supports Shared Services Canada, a centralized department that provides email, data centre and network services to the largest departments in the Government of Canada.

Sub-program 1.1.5 objectives are achieved through IT frameworks, policies, directives and standards, such as the Treasury Board Information Technology Standards (TBITS), that guide Government of Canada institutions in implementing specific technical issues. The Secretariat monitors departmental implementation of this sub-program through oversight, evaluation and reporting activities, including a challenge function that seeks to ensure best value in IT and web investments on behalf of taxpayers.

The authority for this program is the Financial Administration Act.

| 2014–15 Planned Spending |

2015–16 Planned Spending |

2016–17 Planned Spending |

|---|---|---|

| 5,997,281 | 6,005,700 | 6,004,691 |

| 2014–15 | 2015–16 | 2016–17 |

|---|---|---|

| 53 | 53 | 53 |

| Expected Results | Performance Indicators | Target | Date to be Achieved |

|---|---|---|---|

| Program roadmaps for back office IT applications are approved | Percentage of five-year program roadmaps approved | 50% | March 2015 |

| Departments and agencies are equipped to move toward standardization and consolidation of the Government of Canada’s web presence and IT solutions | Percentage of departmental IT plans that address Government of Canada IT modernization priority initiatives | 50% | March 2015 |

| Percentage of planned policy activities completed | 75% | March 2015 |

Planning Highlights

- Develop a government-wide applications rationalization program, including roadmaps for the rationalization of core back office IT applications (e.g., human resources, financial management, electronic documents records management), which will streamline and modernize internal systems, reduce costs, support enhanced business analytics and increase administrative efficiencies;

- Develop a Government of Canada integrated IT plan to ensure that major initiatives are aligned with both Shared Services Canada’s transformation of government IT infrastructure (email, data centres, end-user devices and telecommunications) and with departmental plans;

- Publish policy instruments and implement tools and processes for departmental IT investment planning, architecture reviews and applications portfolio management; and

- Develop the detailed plan for the migration of 1,500 individual websites to Canada.ca, the new web presence for the Government of Canada.

Sub-program 1.1.6: Government Security

Through the Government Security sub-program, the Secretariat contributes to improving the Government of Canada’s security posture by supporting departmental and government-wide security management to protect information, assets, individuals and services against internal and external threats. Sub-program 1.1.6 focuses on governance, departmental security management (including cyber-security), identity management, individual security screening, physical security, security of information and information technology, security in contracting, and the continuity of government operations and services. These activities enable effective and efficient management of security within departments and throughout government.

The objectives of this sub-program are accomplished through developing and maintaining policy instruments; enabling the security community by providing guidance and sharing best practices; encouraging collaboration between departments; monitoring and overseeing security activities; providing leadership and working with partners; developing a cyber-authentication renewal and federating identity program in support of service modernization; and supporting Government of Canada strategic security initiatives, including initiatives related to Canada’s Cyber Security Strategy.

The authority for this program derives from the Financial Administration Act.

| 2014–15 Planned Spending |

2015–16 Planned Spending |

2016–17 Planned Spending |

|---|---|---|

| 11,382,125 | 11,022,105 | 9,878,105 |

| 2014–15 | 2015–16 | 2016–17 |

|---|---|---|

| 56 | 56 | 56 |

| Expected Result | Performance Indicator | Target | Date to be Achieved |

|---|---|---|---|

| Departments and agencies are equipped with knowledge, direction and guidance to implement and evolve sound security management practices | Percentage of planned policy activities completed | 75% | March 2015 |

Planning Highlights

- Continue the five-year review of the Policy on Government Security and the renewal of related policy instruments to improve consistency of application and ensure continued effective delivery of services, including implementation of the revised Standard on Personnel Security Screening;

- Continue to develop the Identity Policy Architecture, including a new Guideline on Identity Assurance; and

- Complete work as planned on the Enterprise Security Architecture, in collaboration with Communications Security Establishment Canada and Shared Services Canada.

Sub-program 1.1.7: Communications and Corporate Identity

Through the Communications and Corporate Identity sub-program, the Secretariat helps Government of Canada departments and agencies effectively manage communications and corporate identity within their organizations. Sub-program 1.1.7 is necessary to ensure that federal organizations inform the public of government policies, programs, services and initiatives; consider the public’s views and needs in their development; and visually identify government assets and activities through the official symbols of the Government of Canada.

To meet these goals, the Secretariat proposes government-wide policy direction to Treasury Board ministers, implements approved policy instruments, examines the extent to which departments are in compliance with key policy requirements, and takes corrective measures to address compliance issues. To assist compliance with policy requirements, the Secretariat provides policy interpretation, advice and outreach to all government departments and agencies, in particular to communications staff.

The legislative authority for this program is section 7 of the Financial Administration Act.

| 2014–15 Planned Spending |

2015–16 Planned Spending |

2016–17 Planned Spending |

|---|---|---|

| 753,653 | 753,653 | 753,653 |

| 2014–15 | 2015–16 | 2016–17 |

|---|---|---|

| 9 | 9 | 9 |

| Expected Result | Performance Indicator | Target | Date to be Achieved |

|---|---|---|---|

|

Communications and corporate identity are effectively managed within departments in a manner consistent with the Communications Policy of the Government of Canada and the Federal Identity Program Policy. |

Percentage of departments in compliance with selected requirements of the Communications Policy of the Government of Canada and the Federal Identity Program Policy, and their related instruments. |

80% | Annually |

Planning Highlights

- Implement the new “Procedures for Publishing” to ensure responsible publishing practices within departments; and

- Implement new requirements for use of the Government of Canada avatar to identify official departmental social media accounts.

Sub-program 1.1.8: Regulatory Management

Through the Regulatory Management sub-program, the Secretariat supports the Treasury Board as a committee of ministers in considering Governor in Council regulations and orders. Regulation is one of the key instruments to advance the government’s policy agenda and to fulfill statutory responsibilities through a number of Acts to protect the health, safety and security of Canadians, their environment and economy. Regulations must be developed and implemented in a way that reduces burden on business, makes it easier to do business with regulators, and improves service and predictability for all stakeholders. Canada’s regulatory policy is the Cabinet Directive on Regulatory Management.

The Secretariat supports the Treasury Board for the continuum of regulatory development, implementation and monitoring through its three main business lines: 1) Challenge function—regulatory proposals are reviewed on a submission-by-submission basis to ensure quality design; 2) Policy leadership—guidelines and tools are developed to assist departments in complying with the directive when preparing regulatory submissions, including new requirements related to systemic regulatory reforms; and 3) Oversight—ongoing monitoring and reporting of regulatory system performance to support red tape reduction efforts.

| 2014–15 Planned Spending |

2015–16 Planned Spending |

2016–17 Planned Spending |

|---|---|---|

| 5,172,507 | 5,178,884 | 5,178,884 |

| 2014–15 | 2015–16 | 2016–17 |

|---|---|---|

| 34 | 34 | 34 |

| Expected Result | Performance Indicator | Target | Date to be Achieved |

|---|---|---|---|

| Regulations approved by the Governor in Council address risks and limit new administrative burden on business via application of the reconciliation requirement of the One-for-One Rule | Percentage of regulations approved by the Governor in Council that address risks while controlling administrative burden on business through the One for One Rule | 90% | March 2015 |

Planning Highlights

- Introduce legislation to enshrine the One-for-One Rule in law to ensure that for every regulation added, one must be removed; and

- Work with key federal regulators to review their business-related administrative requirements and information obligations (previously completed under the Paperwork Burden Reduction Initiative) to identify any requirements in federal regulation that impose administrative burden on business.

Program 1.2: People Management

The People Management Program supports activities of the Treasury Board in its role as the employer of the core public administration. The program’s primary objectives are to lead people management and promote leadership excellence, to support human resources infrastructure and to ensure the appropriate degree of consistency in people management across the public service. In certain instances, activities extend beyond the core public administration to separate agencies, members of the Royal Canadian Mounted Police and Canadian Forces, locally engaged staff, students and appropriation-dependent Crown corporations.

To support deputy heads and to provide Parliament and Canadians with a clear view of the overall state of people management, this program enables the development and implementation of direction-setting strategic frameworks and policies for classification, executive management, official languages, and values and ethics; the establishment of people management indicators, measures, oversight and monitoring; and the collection and analysis of reliable and consistent data regarding the public service. This program enables prudent fiscal management of resources in the areas of classification, total compensation (collective bargaining, wages and salaries, terms and conditions of employment, pensions and benefits) and labour relations, and supports departments to implement decisions by the Government of Canada regarding expenditures and programs.

Responsibilities in areas other than classification and labour relations are shared with the Expenditure Management program. The People Management program is underpinned by a number of pieces of legislation, which are identified in the Policy Framework for People Management and the Policy Framework for the Management of Compensation.

| 2014–15 Main Estimates |

2014–15 Planned Spending |

2015–16 Planned Spending |

2016–17 Planned Spending |

|---|---|---|---|

| 64,550,201 | 64,550,201 | 64,786,456 | 62,349,147 |

| 2014–15 | 2015–16 | 2016–17 |

|---|---|---|

| 545 | 545 | 486 |

| Expected Result | Performance Indicators | Target | Date to be Achieved |

|---|---|---|---|

| Effective people management in the Government of Canada | Percentage of assessed departments and agencies that obtained a MAF rating of at least “Acceptable” for people management | Under review See footnote [7] | Not applicable |

| Percentage of assessed departments and agencies that obtained a MAF rating of at least “Acceptable” for areas of weakness identified in the previous round of assessment of people management | Under review See footnote [8] | Not applicable |

Planning Highlights

In addition to the expected results identified above, efforts under this program will contribute to meeting the Secretariat’s priorities described in the section “Organizational Priorities,” particularly Priority 2.

In 2014–15, progress will be achieved in streamlining policies, managing compensation, and modernizing pension and benefits, including disability and sick leave, while continuing to ensure that the public service is affordable, modern and high performing. Progress in supporting and managing employee performance and in modernizing human resources systems for efficiency gains in service delivery will also be achieved. These and other key initiatives are identified in the “Planning Highlights” sections of the appropriate sub-programs.

In advancing the work of this program, the Secretariat will also manage risks, particularly those related to modernizing and transforming the back office and to ensuring a high-performing public service, as described in the “Risk Analysis” section.

Sub-program 1.2.1: Direction Setting

Through the Direction Setting sub-program, the Secretariat ensures that organizations of the core public administration receive high-quality advice, guidance and support for people management and related policy instruments.

Sub-program 1.2.1 includes developing and implementing strategic frameworks; establishing, assessing and monitoring performance expectations; and establishing risk-based policies in areas of employer responsibility.

This sub-program is supported by research, forecasting and business intelligence to enable evidence-based decision making.

| 2014–15 Planned Spending |

2015–16 Planned Spending |

2016–17 Planned Spending |

|---|---|---|

| 23,197,579 | 23,209,718 | 22,653,832 |

| 2014–15 | 2015–16 | 2016–17 |

|---|---|---|

| 185 | 185 | 179 |

| Expected Result | Performance Indicator | Target | Date to be Achieved |

|---|---|---|---|

| Federal organizations are equipped with the knowledge and guidance to address people management priorities | Percentage of the people management policy instruments that have been reviewed that comply with established review cycles | 80% | March 2017 |

Planning Highlights

- Strengthen deputy head accountability through a new policy on workforce excellence, which will replace 13 policy instruments and provide high-level guidance recognizing deputy heads’ authority for managing their people.

Sub-program 1.2.2: Enabling Infrastructure

Through the Enabling Infrastructure sub-program, the Secretariat guides and supports deputy heads’ collective responsibility for putting in place efficient and effective people management through common business processes, information systems, best practice tools and sound data.

The objectives of sub-program 1.2.2 are achieved by strengthening the existing governance of human resources management; championing the human resources functional community; and establishing a broad engagement strategy to facilitate a shift in human resources practices, behaviours and relationships, while leveraging Web 2.0 technology. Defining a common way to deliver human resources services throughout the Government of Canada will establish a comprehensive blueprint for deriving data architecture and definitions.

The Secretariat builds on this foundation by maximizing investments made in information technology solutions for modernizing human resources services and programs and by increasing its capacity to define, capture and measure business intelligence, and understand the perceptions and needs of public servants.

| 2014–15 Planned Spending |

2015–16 Planned Spending |

2016–17 Planned Spending |

|---|---|---|

| 21,708,539 | 21,915,271 | 20,626,697 |

| 2014–15 | 2015–16 | 2016–17 |

|---|---|---|

| 196 | 194 | 178 |

| Expected Result | Performance Indicator | Target | Date to be Achieved |

|---|---|---|---|

| Federal organizations are equipped with processes, tools, data or systems to continuously improve their people management practices | Percentage of organizations that have adopted standardized processes, tools, data or systems | 80% | March 2017 |

Planning Highlights

- Oversee public service–wide implementation of the new Directive on Performance Management, to ensure a consistent and deliberate approach to supporting and managing employee performance;

- Continue to modernize and consolidate human resources processes and systems, to reduce costs and provide consistent and improved levels of service to managers and employees across the public service; and

- Improve departmental access to enterprise-wide people management data on a self-service basis.

Sub-program 1.2.3: Comprehensive Management of Compensation

Through the Comprehensive Management of Compensation sub-program, the Secretariat provides advice to the Treasury Board, the Department of Finance Canada, the Privy Council Office and other federal organizations in support of the Treasury Board’s management office, employer and budget office roles.

Comprehensive compensation management encompasses wages and other cash compensation, including pay equity and equitable compensation. It involves establishing and maintaining public service pensions and benefits and other non-monetary forms of compensation, such as terms and conditions of employment and other related workplace policies.

The Secretariat develops plans and strategies related to total compensation through collective bargaining; external, independent advisory committees; and active stakeholder engagement with organizations, bargaining agents and separate agencies, the Canadian Forces and the Royal Canadian Mounted Police. This allows the Government of Canada to appropriately recruit and retain its workforce. To support consistency and results, the Secretariat performs an oversight and performance management function in applying its workforce policies to ensure program delivery standards for all employees, including executives.

| 2014–15 Planned Spending |

2015–16 Planned Spending |

2016–17 Planned Spending |

|---|---|---|

| 19,644,083 | 19,661,467 | 19,068,619 |

| 2014–15 | 2015–16 | 2016–17 |

|---|---|---|

| 164 | 166 | 129 |

| Expected Result | Performance Indicator | Target | Date to be Achieved |

|---|---|---|---|

| The comprehensive management of compensation helps the Government of Canada meet its objectives for sustainable recruitment and retention and fulfill its employer obligations | Percentage of Government of Canada objectives met in the areas of recruitment and retention or employer obligations See footnote [9] | 100% | March 2020 |

Planning Highlights