Common menu bar links

Breadcrumb Trail

ARCHIVED - Department of Finance Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Section I: Overview

Minister's Message

|

Canada's economic fundamentals remain strong, earning wide respect internationally. Nevertheless, we are mindful of the increasingly

complex challenges that confront us. Canadians need to know what needs to be done to make our strong Canadian economy even stronger. The world economy is changing and Canada needs to adapt to it. It's abundantly clear that to sustain our Canadian advantage we must not just embrace change—we must lead it. |

Building on Budget 2006 and Advantage Canada, our long-term economic plan, we are making choices now to secure Canada's prosperity for the future. For example, Budget 2007 focussed on restoring fiscal balance in Canada, cutting taxes for working families, reducing the national debt, and investing in key priorities like improving health care and environmental protection.

Canada has an opportunity that few other countries have: to make broad-based tax reductions that will strengthen our economy and leave more money in the pockets of Canadian individuals, families, and businesses. With almost $60 billion of tax cuts announced in our October 2007 Economic Statement—including another one-percentage-point reduction in the Goods and Services Tax (GST)—the total actions taken by this government to date have provided nearly $200 billion in broad-based tax reductions for all Canadians, over 2007–08 and the following five fiscal years.

We live in a highly competitive global economy, and we can't take our economic fundamentals for granted. We are not immune to the global challenges just over the horizon.

This Report on Plans and Priorities highlights the Department of Finance Canada's key strategies and goals to bolster confidence and investment in Canada's economy and to improve the quality of life of all Canadians.

Management Representation Statement

I submit for tabling in Parliament the 2008–09 Report on Plans and Priorities (RPP) for the Department of Finance Canada.

This document has been prepared based on the reporting principles contained in the Guide to the Preparation of Part III of the 2008–09 Estimates: Reports on Plans and Priorities and Departmental Performance Reports.

- It adheres to the specific reporting requirements outlined in the Treasury Board of Canada Secretariat (the Secretariat) guidance.

- It is based on the Department's approved Program Activity Architecture (PAA) as reflected in its Management, Resources, and Results Structure.

- It presents consistent, comprehensive, balanced, and reliable information.

- It provides a basis of accountability for the results achieved with the resources and authorities entrusted to it.

- It reports finances based on approved planned spending numbers from the Secretariat.

The paper version was signed by

Rob Wright

Deputy Minister

Department of Finance Canada

Raison d'être

The Department is committed to making a difference for Canadians by helping the Government of Canada develop and implement strong and sustainable economic, fiscal, social, security, and financial-sector policies and programs. It plays an important role in ensuring that government spending is focussed on results and delivers value for taxpayer dollars. The Department interacts extensively with other federal departments and agencies and plays a pivotal role in the analysis and design of public policy across the widest range of issues affecting Canadians.

The Department of Finance Canada's responsibilities include the following:

- preparing the federal budget;

- developing tax and tariff policy and legislation;

- managing federal borrowing on financial markets;

- administering major transfers of federal funds to the provinces and territories;

- developing regulatory policy for the country's financial sector; and

- representing Canada within international financial institutions and groups.

The Department also plays an important role as a central agency working with other departments to ensure the government's agenda is carried out and ministers are supported with first-rate analysis and advice.

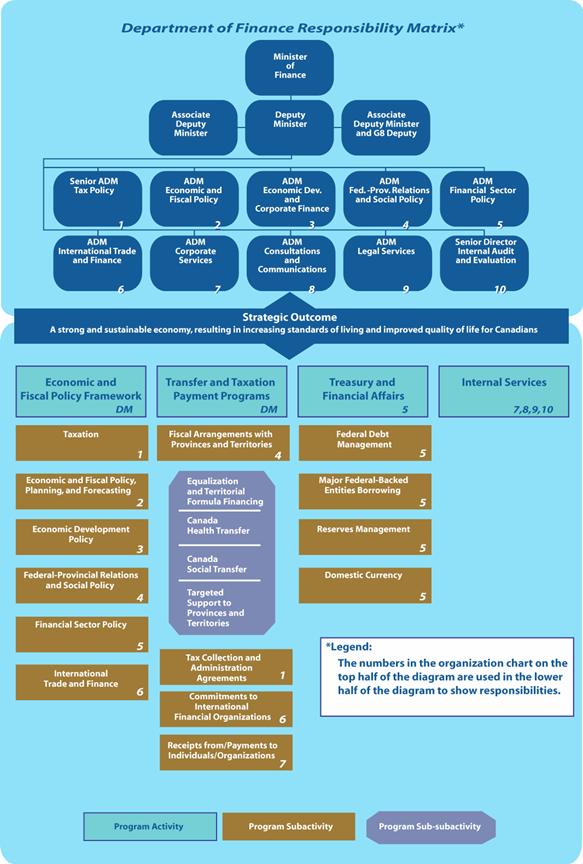

Organizational Information

The Department supports the Minister of Finance by providing the best possible analysis and policy advice on economic, fiscal, social, and financial issues; implementing government decisions in a timely and efficient manner; and communicating government decisions in the clearest way possible, within and outside government.

Program Activity Architecture (PAA) Crosswalk

In 2007, the Department revised its strategic outcome to better reflect focussed departmental efforts to improve the well-being of all Canadians. This revision will enable the Department to do a better job of reporting to Parliament on its priorities and strategic directions. It also facilitates the development of more appropriate performance measurement indicators directly related to the strategic outcome. At the same time, the Department revised its PAA, which is fully reflected for the first time in this 2008–09 RPP. The following table cross-references the earlier 2007–08 PAA with the new 2008–09 structure.

| ($ millions) | New Program Activities | ||||

| Economic and Fiscal Policy Framework | Transfer and Taxation Payment Programs | Treasury and Financial Affairs | Total | ||

| 2007 Program Activities | Tax Policy | 32.9 | 32.9 | ||

| Economic and Fiscal Policy | 15.5 | 15.5 | |||

| Financial Sector Policy | 19.6 | 19.6 | |||

| Economic Development and Corporate Finance | 8.5 | 8.5 | |||

| Federal-Provincial Relations and Social Policy | 12.7 | 12.7 | |||

| International Trade and Finance | 16.4 | 16.4 | |||

| Public Debt | 33,683.0 | 33,683.0 | |||

| Domestic Coinage | 147.0 | 147.0 | |||

| Transfer Payments | 45,327.7 | 45,327.7 | |||

| International Financial Organizations | 696.2 | 696.2 | |||

| Total Planned Spending | 105.8 | 46,023.8 | 33,830.0 | 79,959.6 | |

Voted and Statutory Items Displayed in the Main Estimates

| Voted and Statutory Item | Wording |

2008–09 Main Estimates |

2007–08 Main Estimates |

| ($ thousands) | |||

| 1 | Operating expenditures(1) | 89,793 | 89,343 |

| 5 | Grants and contributions(2) | 374,800 | 221,200 |

| (S) | Minister of Finance—salary and motor car allowance | 76 | 75 |

| (S) | Territorial Formula Financing (Part I—Federal-Provincial Fiscal Arrangements Act)(3) | 2,312,939 | 2,142,450 |

| (S) | Payments to International Development Association(4) | 318,280 | 318,269 |

| (S) | Contributions to employee benefits plan(5) | 11,910 | 12,344 |

| (S) | Purchase of domestic coinage(6) | 147,000 | 145,000 |

| (S) | Interest and other costs(7) | 33,683,000 | 34,697,000 |

| (S) | Statutory subsidies(Constitution Act, 1867; Constitution Act, 1982; and other statutory authorities) | 32,000 | 32,000 |

| (S) | Fiscal Equalization (Part I—Federal-Provincial Fiscal Arrangements Act)(8) | 13,619,924 | 11,676,353 |

| (S) | Canada Health Transfer (Part V.1—Federal-Provincial Fiscal Arrangements Act)(9) | 22,629,304 | 21,348,400 |

| (S) | Canada Social Transfer (Part V.1—Federal-Provincial Fiscal Arrangements Act)(10) | 10,557,729 | 8,800,000 |

| (S) | Payment to Ontario (Budget Implementation Act, 2007)(11) | 150,000 | — |

| (S) | Youth Allowances Recovery (Federal-Provincial Fiscal Revision Act, 1964)(12) | (717,374) | (661,000) |

| (S) | Alternative Payments for Standing Programs (Part VI—Federal-Provincial Fiscal Arrangements Act)(13) | (3,256,839) | (3,010,000) |

| Total budgetary | 79,952,542 | 75,811,434 | |

| (L10) | In accordance with the Bretton Woods and Related Agreements Act, the issuance and payment of non-interest bearing, non-negotiable demand notes in an amount not to exceed $318,280,000 to the International Development Association | — | — |

| (S) | Payments and encashment of notes issued to the European Bank for Reconstruction and Development—capital subscriptions(14) | 3,075 | 5,247 |

| Total non-budgetary | 3,075 | 5,247 | |

| Total Department | 79,955,617 | 75,816,681 | |

Notes:

1. The increase of $450,000 is attributable to an increase for collective agreements, implementation of the Federal Accountability Act evaluation function, and the internal audit initiative and offset primarily by security regulation review sunsetting funds and cost-efficiency reductions.

2. The increase of $153.6 million, or 69.4 per cent, in the grants and contributions vote is mainly due to a reprofile from 2007–08 to 2008–09 of certain grants and an updated estimate for the interest component of contribution payments.

3. The increase of $170.5 million in transfer payments for Territorial Formula Financing is a result of the new formula for Territorial Formula Financing that was announced in Budget 2007.

4. The increase of $11,000 is required to reflect the required amounts for the final note encashment of International Development Agency agreement No. 14. This note will be issued in January 2008 (fiscal year 2007–08) and encashed in 2008–09.

5. The decrease in the employee benefits plan (EBP) is primarily attributable to a reduction in the EBP rate from 18.5 per cent to 17.5 per cent. This decrease was slightly offset by the application of the rate to increases in the salary allotment for items such as collective bargaining.

6. The increase of $2 million or 1.4 per cent reflects the increased funding required to cover the cost to produce and distribute the domestic coinage to meet the needs of the economy.

7. Forecast of public debt charges have decreased by $1.014 billion or 2.9 per cent due mainly to a downward revision of the expected stock of interest-bearing debt.

8. The increase of $1.944 billion or 16.7 per cent in transfer payments for Equalization is a result of the new formula for Equalization that was announced in Budget 2007.

9. The increase of $1.281 billion in Canada Health Transfer funds reflects the 6-per-cent increase in funding commitment in the September 2004 10-Year Plan to Strengthen Health Care.

10. The increase of $1.758 billion or 20 per cent in Canada Social Transfer (CST) funds represents the legislated amount for the CST following new commitments set out in Budget 2007 that provide for a significant adjustment to the CST base and a 3-per-cent annual escalator.

11. Budget 2007 announced new funding to the Province of Ontario to assist the province in the transition to a single corporate tax administration.

12. The increase in the Youth Allowances Recovery of $56.4 million is related to an increase in the estimated value of personal income tax points.

13. The increased recovery of $246.8 million in the Alternative Payments for Standing Programs is attributable to an increase in the value of personal income tax points.

14. The decrease in the payments and encashment of notes to the European Bank for Reconstruction and Development (EBRD) of $2.2 million or 41.4 per cent reflects the agreed schedule of Canada's payments and encashments for the EBRD's 1998 capital subscription increase and effects of exchange rate changes.

Departmental Planned Spending and Full-time Equivalents (FTE)

| ($ millions) |

Forecast Spending 2007–08 |

Planned Spending 2008–09 |

Planned Spending 2009–10 |

Planned Spending 2010–11 |

| Economic and Fiscal Policy Framework | 102.2 | 102.2 | 102.2 | 101.9 |

| Transfer and Taxation Payment Programs | 40,867.7 | 46,020.8 | 47,464.1 | 49,721.7 |

| Treasury and Financial Affairs | 34,842.0 | 33,830.0 | 34,272.0 | 34,122.0 |

| Budgetary Main Estimates (gross)(1) | 75,811.8 | 79,952.9 | 81,838.3 | 83,945.6 |

|

Transfer and Taxation Payment Programs Non-budgetary Main Estimates (gross) |

5.2 | 3.1 | 1.7 | 0.0 |

| Less: Respendable revenue | 0.4 | 0.4 | 0.4 | 0.4 |

| Total Main Estimates | 75,816.7 | 79,955.6 | 81,839.6 | 83,945.2 |

| Adjustments: | ||||

| Supplementary Estimates A: | ||||

| Funding in support of the Federal Accountability Act to evaluate all ongoing grant and contribution programs every five years | 0.3 | |||

| Transfer from Human Resources and Skills Development Canada—for government advertising programs | 0.1 | |||

| Interest and other costs | (890.0) | |||

| Territorial Formula Financing | 78.8 | |||

| Fiscal Equalization | 1,248.3 | |||

| Canada Health Transfer | 118.0 | |||

| Canada Social Transfer | 794.6 | |||

| Youth Allowances Recovery | 7.0 | |||

| Alternative Payments for Standing Programs | 34.0 | |||

| Payment to British Columbia | 30.0 | |||

| Payment to Yukon | 3.5 | |||

| Payment to Northwest Territories | 54.4 | |||

| Payment to Ontario | 250.0 | |||

| Clean Air and Climate Change Trust Fund | 1,518.9 | |||

| Patient Wait Times Guarantee | 612.0 | |||

| Transitional payments | 614.0 | |||

| Child Care Spaces | 250.0 | |||

| Human Papillomavirus Immunization | 300.0 | |||

| Other Transfers from Treasury Board Central Votes: | ||||

| TB Vote 22 (Operating budget carry forward) | 4.7 | |||

| TB Vote 15 (Collective bargaining) | 1.6 | |||

| TB Vote 10 (Government-wide initiatives) | 0.5 | |||

| Other Statutory Items Not Listed in the Main Estimates:(2) | ||||

| Payment of liabilities previously transferred to revenue | 4.0 | 4.0 | 4.0 | 4.0 |

| Net loss on exchange | 0.2(3) | |||

| Vote 5—Reprofile of certain grants to 2008–09 | (123.0) | |||

| Total Adjustments | 4,911.9 | 4.0 | 4.0 | 4.0 |

| Total Planned Spending | 80,728.6 | 79,959.6 | 81,843.6 | 83,949.2 |

| Total planned spending | 80,728.6 | 79,959.6 | 81,843.6 | 83,949.2 |

| Less: Non-respendable revenue | 4,422.1 | 4,333.5 | 4,341.5 | 4,350.5 |

| Plus: Cost of services received without charge | 16.0 | 16.5 | 16.6 | 16.7 |

| Total Departmental Spending | 76,322.5 | 75,642.6 | 77,518.7 | 79,615.5 |

| Full-time Equivalents | 821 | 835 | 835 | 835 |

Notes:

1. The increase in Main Estimates over the next three years is mainly due to increases in the Transfer and Taxation Payment Programs attributable to the new formula and commitments announced in the Budget 2007 for transfer payments to provinces and territories, the reprofile from 2007–08 to 2008–09 of certain grants, and the updated estimate for the interest component of contribution payments. The variation under the Treasury and Financial Affairs program activity is due to revision of the forecast for interest and service costs related to the public debt.

2. Includes only items over $100,000.

3. Represents actual to end-of-December 2007. Amounts held for international currency reserve will fluctuate from year to year based on market conditions.

Summary Information

Financial Resources ($ millions)

| 2008–09 | 2009–10 | 2010–11 |

| 79,959.6 | 81,843.6 | 83,949.2 |

Human Resources (FTEs)

| 2008–09 | 2009–10 | 2010–11 |

| 835 | 835 | 835 |

Departmental Priorities

| Name | Type |

| 1. Sound Fiscal Management | Ongoing |

| 2. Sustainable Economic Growth | Ongoing |

| 3. Sound Social Policies | Ongoing |

| 4. Effective International Presence | Ongoing |

Program Activities by Strategic Outcome

| Strategic outcome: A strong and sustainable economy, resulting in increasing standards of living and improved quality of life for Canadians | |||||

| Planned Spending ($ millions) | |||||

| Program Activity | Expected Results | 2008–09 | 2009–10 | 2010–11 | Contributes to the Following Priority or Priorities |

| Economic and Fiscal Policy Framework | Effective management of the government's fiscal plan | 53.2 | 53.2 | 53.3 | Sound Fiscal Management; Sustainable Economic Growth; Sound Social Policies; Effective International Presence |

| Canada has a sound, efficient, and competitive financial sector | 19.6 | 20.2 | 19.7 | ||

| Canada has a competitive, efficient, and fair tax system | 32.9 | 32.4 | 32.5 | ||

| Transfer and Taxation Payment Programs | Payments to support Canadian provinces and territories in providing their residents with public services in areas of shared national priority; payments to international organizations to help the promotion of economic advancement of developing countries | 46,023.8 | 47,465.8 | 49,721.7 | Sound Fiscal Management; Sustainable Economic Growth; Sound Social Policies; Effective International Presence |

| Treasury and Financial Affairs | Prudent and cost-effective management of the government's treasury activities and financial affairs | 33,830.0 | 34,272.0 | 34,122.0 | Sound Fiscal Management |

| Total Department of Finance Canada | 79,959.6 | 81,843.6 | 83,949.2 | ||

Note: Due to rounding, figures may not add up to totals shown.

Departmental Plans and Priorities

Operating environment

If it has to do with the economy, it's the Department of Finance Canada's business. The Department serves as the government's primary source of analysis and advice on the economic, fiscal, and tax implications of key government priorities. The Department plans and prepares the federal government's budget, analyzes and designs tax policies and legislation, and develops rules and regulations for Canada's banks and other federal financial institutions. It administers the major fiscal arrangements that transfer federal funds to the provincial and territorial governments. It also negotiates tax collection agreements with the provinces and territories and tax administration agreements with Aboriginal governments. It develops policies on international finance and helps design Canada's tariff policies. It also monitors economic and financial developments in Canada and provides policy advice on a wide range of economic issues. In short, the Department helps manage the nation's bank account and provides advice to the government with the goal of creating a healthy economy for all Canadians.

In its Economic Summary of Canada 2006, the Organisation for Economic Co-operation and Development (OECD) noted that Canada's economy, one of the healthiest among G7 countries, has remained strong in spite of major and ongoing structural changes: increased inter-regional labour mobility, restructuring within the resource and manufacturing sectors, and the rise of the service sector. These developments have significantly changed the composition of employment over the past two decades and, hence, the drivers of the Canadian economy.

With Advantage Canada, the government laid out a long-term economic plan to create better-paying jobs and solid growth for Canadians. Steps have been taken to ensure that Canada has a modern infrastructure, an innovative and entrepreneurial business environment, and a tax system that rewards hard work—all based on a foundation of sound fiscal management. Designed to make Canada a true world economic leader, Advantage Canada is a blueprint for the future that is focussed on creating five Canadian advantages that will help improve Canadians' quality of life and Canada's success on the world stage:

- Canada's tax advantage will reduce taxes for all Canadians and establish the lowest tax rate on new business investment in the G7;

- Canada's fiscal advantage will eliminate Canada's total government net debt in less than a generation, creating a strong foundation on which to build sustainable prosperity;

- Canada's entrepreneurial advantage will reduce unnecessary regulation and red tape and lower taxes to unlock business investment. In a more competitive business environment, consumers will be able to buy goods at lower prices, and Canadian businesses will be better equipped for global success;

- Canada's knowledge advantage will create the best-educated, most skilled, and most flexible workforce in the world; and

- Canada's infrastructure advantage will create modern, world-class infrastructure to ensure the seamless flow of people, goods, and services across our roads and bridges, through our ports and gateways, and using our public transit.

The Speech from the Throne in October 2007 outlined five clear priorities for the Government of Canada: strengthening Canada's sovereignty and place in the world; building a stronger federation; providing effective economic leadership; continuing to tackle crime; and improving our environment. The Department of Finance Canada plays a direct role in leading two of those key priorities—building a stronger federation and providing effective economic leadership—and contributes significantly to the other priorities.

Management agenda

The working environment of the Department is characterized by a strong commitment to consultation, coordination, and collaboration with a wide range of partners and client groups and a dynamic engagement with a rapidly changing global economy.

An important component of the work conducted by the Department involves consultation and collaboration with partners in both the public and private sectors. Its primary partners and clients include Parliament and parliamentary committees; provincial, territorial, and Aboriginal governments; other departments and agencies; Crown corporations; Canadian interest groups; financial market participants; the international economic and finance community; the international trade community; and civil society more broadly. In 2008–09, the Department will work on strengthening its outreach to these partners through the following activities:

- regular meetings with and presentations to tax professionals such as the Tax Executives Institute; business groups such as the Canadian Federation of Independent Business; non-governmental organizations, including labour organizations such as the Canadian Labour Congress; international organizations such as the OECD; and not-for-profit groups; and

- regular meetings and ongoing contact with provincial and territorial counterparts (ministers, deputy ministers, and senior officials) and Aboriginal governments.

The Department's activities are undertaken in the context of a rapidly integrating, technology-driven global economy. Events that take place far from Canada can have a powerful effect, both adverse and beneficial, on Canada's economy. To support its work on international economic issues, including international trade negotiations and initiatives to enhance the competitiveness of Canadian industry through tariff relief measures, the Department holds domestic consultations not only within the federal government but also with provincial and territorial governments, the private sector, and the Canadian public. The Department plays a key role in promoting a strong multilateral system of global economic and financial governance, most importantly in supporting the Minister's participation in the G7, G8, and G20 processes.The Department also plays a lead role in managing the country's activities related to international financial institutions and organizations such as the International Monetary Fund (IMF), the World Bank, the European Bank for Reconstruction and Development, the Financial Stability Forum, and the Financial Action Task Force on Money Laundering (FATF).

In 2007, the Department of Finance Canada conducted an in-depth review of the funding, relevance, and performance of all its programs and spending to ensure results and value for money from programs that are a priority for Canadians. The results of this strategic review were submitted to Treasury Board last fall, for subsequent review by Cabinet. The results of this review will be reflected in future reporting to Parliament.

The Department also has a strong commitment to accountability and risk management in its day-to-day business. The Department has adopted an integrated corporate business planning and resource allocation framework that encompasses priority setting, business planning, work planning, and results and performance measurement applying to both financial and human resources (HR) requirements. A corporate risk profile has been developed to help guide priority setting and resource allocation activities. This integrated planning framework, coupled with the Department's risk-based audit plan, positions the Department to better report on and demonstrate accountability for results and resources to Parliament and to Canadians. It also allows the Department to more strategically integrate priority setting with performance measurement and HR planning.

In 2008–09, a three-year HR management plan will also be developed and implemented to support the government's HR priorities, which include addressing HR management gaps—including succession planning, recruitment, retention, diversity, and official languages—and responding to employee concerns. This initiative is very much in keeping with the Clerk of the Privy Council's call for a renewed public service that adapts to challenging new circumstances and responds in innovative ways to the evolving needs of Canadians, centred on strong, values-based leadership.

The Department will also continue to implement the requirements of the Federal Accountability Act. As part of this process, the Department's Internal Audit and Evaluation Division has been provided with ongoing incremental funding to implement the enhanced requirements of the 2006 Treasury Board Policy on Internal Audit. This funding was provided largely for the hiring of additional staff, training and development, creation of critical infrastructure, and costs associated with external audit committee members.

Challenges and opportunities

To date, the economy has shown resilience in its ability to cope with ongoing changes. Canada's recent performance has been strong, driven by solid fundamentals for both households and businesses. Challenges, however, lie ahead. Increased competition from low cost producers, together with the rise of the Canadian dollar and a slower U.S. economy, is leading to a sectoral adjustment in the Canadian economy. Output and employment have shifted away from manufacturing toward the service sector, while remaining strong overall. Further, the effects of recent instability in global financial markets, a declining U.S. housing market, and the Canadian dollar's gains continue to pose challenges. While the economic fundamentals of the country are strong, Canada is not immune from economic turbulence. The global uncertainties highlight the importance of putting in place sound structural policies that can help mitigate the potential downside risks to the economy, as well as securing long-term growth potential. Finally, an expected slowdown in the rate of growth of the working age population, coupled with the fiscal pressures on all levels of government created by an aging population, will require a boost in productivity growth to maintain the high growth in living standards that Canadians have come to enjoy.

Canada's economic and fiscal fundamentals are solid, yet the world economy is experiencing a degree of volatility and increased uncertainty. Canada's strong fiscal position provides Canada with an opportunity that few other countries have: to make broad-based tax reductions that will strengthen its economy, stimulate investment, and create more and better jobs. To that end, the government has recently introduced a long-term plan of broad-based tax relief for individuals, families, and businesses worth almost $60 billion over 2007–08 and the following five fiscal years. Combined with previous relief provided by the government, total tax relief over the same period is nearly $200 billion. Some of the key broad-based tax relief measures include the following:

- a new era in business taxation that will reduce the general federal corporate income tax rate to 15 per cent by 2012 from its 2007 rate of 22.1 per cent; this initiative will improve productivity, employment, and prosperity in an uncertain world;

- a reduction in the small business income tax rate to 11 per cent in 2008, one year earlier than scheduled;

- a further one-percentage-point reduction in the GST as of January 1, 2008, fulfilling the government's commitment to reduce the GST to 5 per cent; and

- a reduction in the lowest personal income tax rate to 15 per cent from 15.5 per cent, effective January 1, 2007, and an increase in the basic personal amount—the amount that all Canadians can earn tax-free—to $9,600 for 2007 and 2008 and to $10,100 for 2009.

Priorities

In recognition of the risks, challenges, and opportunities faced by the country, the Department has established four key priorities:

Priority 1: Sound Fiscal Management

A strong economy requires sensible, strong financial management and leadership. Canada's solid macroeconomic framework, which includes transparent fiscal management, underpins healthy economic growth and helps ensure the sustainability of Canada's social safety net. A sound fiscal structure also includes a competitive, efficient, and fair tax system to promote economic growth, create jobs, and boost living standards in a fiscally sustainable manner.

Solid macroeconomic fundamentals have placed Canadians in a good position to capitalize on both domestic and global economic opportunities. This position has allowed the government to reduce the public debt burden and, in turn, invest in important economic and social priorities, while also delivering significant broad-based tax relief to all Canadians.

The Department of Finance Canada will play a major role in keeping the government focussed on what it does best: improving services and helping build a climate for the overall economy to perform better. The Department will help ensure that spending is responsible, operations are efficient, and results are effective and accountable to taxpayers.

Priority 2: Sustainable Economic Growth

Government plays an important role in ensuring that Canadian individuals, businesses, and organizations have the advantages they need to succeed on a global scale. The Department therefore puts a key emphasis on sustainable economic growth by developing and implementing policies and programs that provide appropriate support for the drivers of productivity growth: business investments, public infrastructure, human capital, innovation, and financial market governance.

As the government's source of analysis and advice on economic and fiscal matters, the Department will continue to help ensure that policies and programs create the conditions necessary for sustainable long-term economic growth by supporting business investments and research and development (R&D) and by helping Canadians meet the demands of the global economy.

The Department will assist government partnerships with the provinces, territories, and the private sector in strategic areas that contribute to strong economies, including primary scientific research, a clean environment, and modern infrastructure.

Priority 3: Sound Social Policies

The Department contributes, through its analysis and advice, to the government's efforts to meet its objectives for the quality of Canada's communities, health care, education, and social safety net programs and equality of opportunity for all citizens.

The government supports social programs delivered by provinces and territories by means of transfers to provincial and territorial governments. The Canada Health Transfer (CHT) is the primary federal transfer in support of health care, and the Canada Social Transfer (CST) supports social programs, including social assistance, social services, post-secondary education, and programs for children. Equalization payments enable less prosperous provincial governments to provide their residents with public services that are reasonably comparable to those in other provinces at reasonably comparable levels of taxation. Finally, Territorial Formula Financing is the key transfer to the three territorial governments. The Department designs and administers these transfers and undertakes regular review and consultations with provinces and territories as well as with interested stakeholders, academics, and other experts.

Priority 4: Effective International Presence

Improving the living standards and quality of life of Canadians in an increasingly competitive and integrated global economy continues to be a key departmental objective. This objective comprises maintaining secure and open borders, working to strengthen global growth and stability, advancing Canada's trade and investment interests, helping to foster development aimed at reducing global poverty, and advancing international standards to prevent abuses to the international financial system, including anti-terrorist financing. The Department contributes to policies and measures designed to achieve these objectives by representing Canada in a wide range of international financial institutions and economic organizations.

The Department will assist the government in creating the Right economic conditions to encourage Canadian firms to invest and flourish and to be open to trade and foreign investment so goods, services, and technologies can flow freely into Canada, and Canadian firms can have ready access to foreign markets to compete with the world's best.