ARCHIVED - RPP 2007-2008

National Research Council Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

The Honourable Maxime Bernier

Minister of Industry

Section II: Analysis of Program Activities

- Priority 1: R&D in Key Sectors and Areas Critical to Canada’s Future

- Priority 2: Community Technology Clustering Initiatives

- Priority 3: Integrated Industry Support that Engages Key Players

- Priority 4: Program Management for a Sustainable Organization

Section III: Supplementary Information

Section IV – Other Items of Interest

Acronyms and Abbreviations

|

ACURA |

Association of Canadian Universities for Research in Astronomy |

|

AIP |

Atlantic Investment Partnership |

|

ALMA |

Atacama Large Millimeter Array |

|

CBRN |

Chemical, Biological, Radiation and Nuclear |

|

cGMP |

Current Good Manufacturing Practices |

|

CFHT |

Canada-France-Hawaii Telescope |

|

CNCB |

Canadian Neutron Beam Centre |

|

CRTI |

CBRN Research and Technology Initiative |

|

CTI |

Competitive Technology Intelligence |

|

DRDC |

Defence Research and Development Canada |

|

FCHP |

Fuel Cell and Hydrogen Program |

|

FTE |

Full-Time Equivalent |

|

GHI |

Genomics and Health Initiative |

|

HRM |

Human Resources Management |

|

ICT |

Information and Communications Technologies |

|

IP |

Intellectual Property |

|

IPF |

Industry Partnership Facility |

|

JCMT |

James Clerk Maxwell Telescope |

|

LRP |

Long Range Plan for Astronomy and Astrophysics |

|

LTRC |

Language Technologies Research Center |

|

MSE |

Medium-Sized Enterprise |

|

NIC |

NRC Information Centre (NRC-CISTI) |

|

NINT |

National Institute for Nanotechnology |

|

NMI |

National Metrology Institute |

|

NRC |

National Research Council Canada |

|

NRC-AMTC |

Aerospace Manufacturing Technology Centre |

|

NRC-ATC |

Aluminium Technology Centre |

|

NRC-BRI |

Biotechnology Research Institute |

|

NRC-CB |

Commercialization Branch |

|

NRC-CHC |

Canadian Hydraulics Centre |

|

NRC-CISTI |

Canada Institute for Scientific and Technical Information |

|

NRC-CPFC |

Canadian Photonics Fabrication Centre |

|

NRC-CSIR |

Centre for Sustainable Infrastructure Research |

|

NRC-CSTT |

Centre for Surface Transportation Technology |

|

NRC-GTL |

Gas Turbine Laboratory |

|

NRC-HIA |

Herzberg Institute of Astrophysics |

|

NRC-IAR |

Institute for Aerospace Research |

|

NRC-IBD |

Institute for Biodiagnostics |

|

NRC-IBS |

Institute for Biological Sciences |

|

NRC-ICPET |

Institute for Chemical Process and Environmental Technology |

|

NRC-IFCI |

Institute for Fuel Cell Innovation |

|

NRC-IIT |

Institute for Information Technology |

|

NRC-IMB |

Institute for Marine Biosciences |

|

NRC-IMI |

Industrial Materials Institute |

|

NRC-IMS |

Institute for Microstructural Sciences |

|

NRC-IMTI |

Integrated Manufacturing Technologies Institute |

|

NRC-INMS |

Institute for National Measurement Standards |

|

NRC-INH |

Institute for Nutrisciences and Health |

|

NRC-IOT |

Institute for Ocean Technology |

|

NRC-IRAP |

Industrial Research Assistance Program |

|

NRC-IRC |

Institute for Research in Construction |

|

NRC-PBI |

Plant Biotechnology Institute |

|

NRC-SIMS |

Steacie Institute for Molecular Sciences |

|

NSERC |

Natural Sciences and Engineering Research Council of Canada |

|

OAG |

Office of the Auditor General of Canada |

|

OAP |

Oceans Action Plan |

|

OECD |

Organisation for Economic Co-operation and Development |

|

OTEC |

Ocean Technology Enterprise Centre |

|

PEMFC |

Polymer Electrolyte Membrane Fuel Cells |

|

R&D |

Research and Development |

|

S&T |

Science and Technology |

|

SMEs |

Small and Medium-sized Enterprises |

|

STM |

Scientific, Technical and Medical |

|

TBS |

Treasury Board of Canada Secretariat |

|

TIS |

Technology and Industry Support |

|

TRIUMF |

Tri-University Meson Facility |

Section I – Agency Overview

Minister’s Message

Canada’s New Government is committed to fostering a strong, competitive economy that benefits Canada and all Canadians. To achieve this goal, I firmly believe that our government must create an environment that encourages and rewards people who work hard, that stimulates innovation, and that avoids unnecessary regulatory burden. By modernizing and improving Canada’s marketplace frameworks, we will ensure stability and fairness while creating new opportunities and choices for businesses, consumers and all Canadians.

Over the past year, our government has taken significant steps to improve Canada’s economy. Early in our mandate we presented Budget 2006, which contained measures aimed at improving our quality of life by building a strong economy that is equipped to lead in the 21st century. These measures focused on making Canada’s tax system more competitive internationally, and outlined our commitments to reduce paper burden on businesses and to continue to support science and technology in Canada.

Last fall, we presented a long-term economic plan in the Economic and Fiscal Update. Advantage

The Industry Portfolio consists of:

|

Canada: Building a Strong Economy for Canadians focused on creating five Canadian advantages that will give incentives for people and businesses to excel and to make Canada a world leader.

One of these proposed advantages, called the “Tax Advantage,”will create conditions more favourable to business in Canada by effectively establishing the lowest tax rate on new business investment in the G7. As well, the “Entrepreneurial Advantage”will ease the regulatory and paperwork burden imposed on business by ensuring that regulations meet their intended goals at the least possible cost.

Through Advantage Canada, our government committed to supporting science and technology in Canada, and underscored some of the elements of a science and technology strategy that will sustain research excellence in Canada and increase the competitiveness of the Canadian economy.

Canada’s New Government has repeatedly demonstrated that we are committed to getting things done for all Canadians. As we move forward, we will work more closely than ever with our stakeholders and the provincial and territorial governments, and we will continue to foster an environment where the marketplace functions as efficiently as possible, and keep encouraging investment in Canadian innovation and in research and development.

It gives me great pleasure to present the annual Report on Plans and Priorities for the National Research Council Canada, outlining their main initiatives, priorities, and expected outcomes for the upcoming year.

Maxime Bernier

Minister of IndustryManagement Representation Statement

|

I submit for tabling in Parliament, the 2007-2008 Report on Plans and Priorities (RPP) for the National Research Council Canada. This document has been prepared based on the reporting principles contained in the Guide to the Preparation of Part III of the 2007-08 Estimates: Reports on Plans and Priorities and Departmental Performance Reports:

Name: Dr. Pierre Coulombe Title: President |

Summary Information

Raison d’être

NRC is the Government of Canada’s leading resource for science and technology (S&T) and innovation with a business focus on:

- Improving the social and economic well-being of Canadians;

- Fostering industrial and community innovation and growth through technology and industry support; and

- Supplying excellence and leadership in research and development (R&D).

Table 1-1: Financial Resources ($ millions)

| 2007-2008 | 2008-2009 | 2009-2010 |

| 712.4 | 693.8 | 692.3 |

Table 1-2: Human Resources

| 2007-2008 | 2008-2009 | 2009-2010 |

| 4,044 | 4,076 | 4,127 |

Table 1-3: Departmental Priorities

| Name | Type |

| 1. R&D in Key Sectors and Areas Critical to Canada’s Future | Ongoing |

| 2. Community Technology Clustering Initiatives | Previously committed |

| 3. Integrated Industry Support that Engages Key Players | Ongoing |

| 4. Program Management for a Sustainable Organization | Ongoing |

Table 1-4: Program Activities by Strategic Outcome

|

Strategic Outcome: |

Planned spending |

Contributes to the following priority |

|||

|

|

Expected results |

2007-2008 |

2008-2009 |

2009-2010 |

|

|

Research and Development |

|

413.88 |

399.30 |

402.80 |

Priority 1 |

|

Technology Clusters |

|

30.04 |

22.00 |

22.00 |

Priority 2 |

|

Technology and Industry Support |

|

194.00 |

199.05 |

194.06 |

Priority 3 |

|

Internal Services* |

|

74.51 |

73.46 |

73.46 |

Priority 4 |

NRC’s Link to the Government of Canada Outcome Areas

NRC has a long history of making valuable scientific discoveries that strengthen Canadian industry and contribute to the well being of Canadians and others worldwide. NRC’s priorities for 2007-2008 support two main Government of Canada priorities as outlined below.

A Sustainable Economy

Global leadership in science and technology, education and commercialization are the cornerstones to achieving a sustainable economy. Through its dedication to excellence in research and development and its focus on technology cluster growth, knowledge transfer and the development of outstanding people through education and training, NRC is a key contributor to a

sustainable, innovative and prosperous economy.

Canada’s Place in the World

Canada seeks to play a major role in meeting the economic, health, environmental and security challenges facing the world. NRC supports all of these goals –combining leading-edge research in key areas such as genomics, health, sustainable technologies and the environment with a strong focus on global reach and international research collaborations. The

aim is to develop scientific and technological advances needed to enhance the quality of life of Canadians and others around the globe.

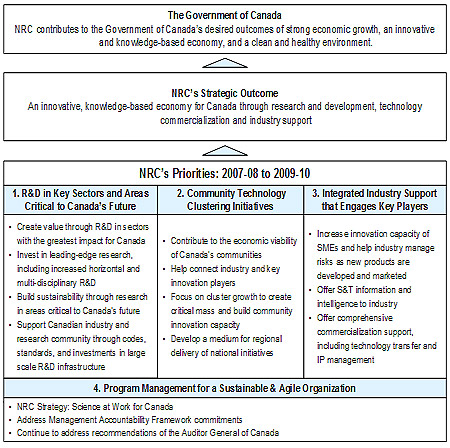

Figure 1-1: NRC Benefits to Canadians

Plans and Priorities

Operating Environment

NRC has unique attributes that shape its operating environment, including:

- A national S&T infrastructure positioned to improve Canada’s innovation capacity in existing and emerging fields of research builds networks for researchers and businesses, trains highly qualified personnel, creates new technology-based companies and jobs, and transfers knowledge and technology to Canadian companies.

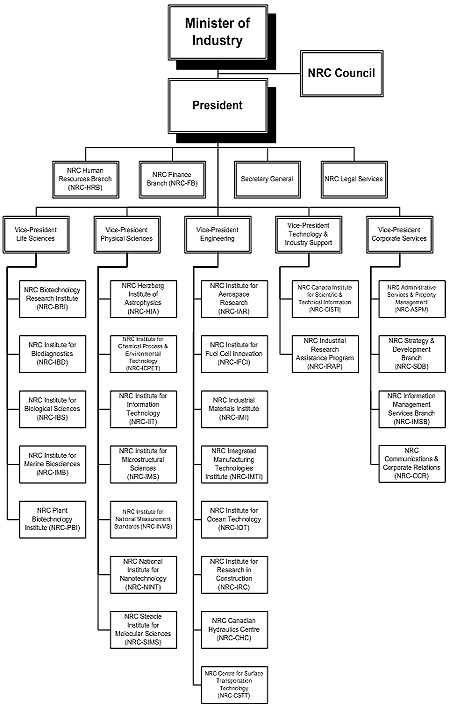

- A core strength of over 4,000 talented and dedicated people, 19 research institutes, 16 industrial partnership facilities, the Industrial Research Assistance Program (NRC-IRAP), the Canada Institute for Scientific and Technical Information (NRC-CISTI) and two technology centres.

- The ability to help companies move from discoveries in the laboratory to the development, prototyping, and commercialization of these ideas and technologies for the global marketplace.

- The capacity to adopt an integrated approach that brings research, technologies and industrial links together in delivering its mandate to provide access to international S&T infrastructures.

- The skills to manage research projects towards specific outcomes as well as long-term goals.

- The capability to bring together multi-disciplinary research teams to tackle issues of national importance.

- The ability to put together national programs for delivery in regions across the country.

- The capacity to manage its own highly technical and complex operations - 175 buildings totalling approximately 517,406 square metres of space.

NRC Strategic Direction: Building a Roadmap for Future Sustainability

NRC’s Strategy, Science at Work for Canada, will guide the organization through 2011. It positions NRC to anticipate and respond to important national priorities by engaging innovation system participants in multi-stakeholder collaborations and developing key competencies that will ready NRC to support Canada’s current and future S&T priorities. Recognizing that multi-stakeholder partnerships and horizontal initiatives are increasingly necessary to marshal effective responses to government priorities, NRC will continue to work closely with other science-based departments and agencies.

From an operational perspective, NRC will continue to explore ways to sustain its asset base in the face of annual inflationary pressures, aging buildings and equipment and a static core budget. The organization will also focus on strengthening its management systems and financial base for future sustainability. This will include continuing to address recommendations made by the Office of the Auditor General of Canada (OAG). NRC prides itself on being an adaptable, flexible organization. These attributes will be particularly important in the years ahead as NRC strives to deliver the best results possible for Canadians.

Priority 1: R&D in Key Sectors and Areas Critical to Canada’s Future |

Research and innovation are critical to Canada’s future economic growth and an improved quality of life for Canadians. As Canada’s foremost R&D agency, NRC concentrates its efforts on two vital elements of R&D excellence: quality and relevance. For the planning period, NRC will play a key role in helping Canada reach its full potential by performing research in fields that are of current and future importance to the Canadian economy and that address important public and Government priorities. To achieve this, NRC will work in collaboration with industry, university and government partners in Canada and abroad. Creating value from knowledge, providing a national S&T infrastructure, maintaining and fostering international alliances and supporting the commercialization of federal R&D are integral parts of NRC’s business.

Planned Strategies

Over the planning period, NRC will:

- Create value through R&D in sectors with the greatest economic impact for Canada

- Invest in leading-edge research including increased horizontal and multi-disciplinary R&D

- Build sustainability through research in areas critical to Canada’s future

- Support Canadian industry and the research community through codes, standards, and investments in large scale R&D infrastructure

Key Influencing Factors

|

Aerospace, Manufacturing and Information and Communications Technologies (ICT) are important economic engines for Canada - Aerospace remains one of Canada’s most important advanced technology sectors, investing $1.2B in R&D on total revenues of $21.8B in 2005. Both of these figures show growth, for the first time since early 2000. Over 80% of this revenue is from the civil aviation sector, and primarily in export, with 85% of total revenues obtained from foreign customers. The Canadian Aerospace Industry faces tough global competition. Economic trends, including further appreciation of the Canadian dollar relative to the US dollar, also present challenges to the Canadian industry. These pressures highlight the importance of continued innovation. In 2006, Canada’s manufacturing sector contributed 15% of GDP, 71% of total exports and represented 59% of private industrial R&D. Canada is a significant player in the global ICT industry, with 32,000 ICT companies employing almost 590,000 skilled Canadian workers and generating over $136B in revenues. The communication equipment-manufacturing sector alone is the largest R&D spending industry, representing 10% of total R&D spending in Canada. Nanotechnology is a strategically important area of research for Canada with substantial potential application and economic value for Canadians – The rich diversity of invention enabled by nanotechnology could allow for revolutionary developments in medicine, materials, pharmaceuticals, and electronics. The economic and social impact of nanotechnology has the potential to be profound: discoveries and applications of nanotechnology could lead to a new industrial revolution in the coming century, and to commercial markets as large as $1.5 trillion per year within 10-15 years. Nanotechnology is a fast-growing and revolutionary field in which Canada needs to build and sustain world leadership. NRC will continue to help Canada stake its place in nanotechnology through its research in applications for medical devices, electronics, fuel cells and construction materials, and through the development of its new National Institute for Nanotechnology (NINT) – a partnership with the University of Alberta and the Province of Alberta.Life Sciences, Genomics and Health research are fundamental to addressing critical public concerns such as health and wellness, dealing with chronic and infectious diseases, and developing more effective drug therapies, diagnostic tools and equipment – The global market for life sciences is estimated at $500 billion and is growing at 20% annually [1]. NRC has had significant success in this research area, providing important value to Canada and the world, including a number of world-firsts such as a non-invasive test for colon cancer and a new vaccine against meningitis C, and is continuing to provide the necessary R&D to develop a thriving Canadian nutraceutical industry. Future energy sources and the environment continue to be major national issues – Elimination of toxins from the environment and the production and use of cleaner and more efficient energy sources are also issues of concern. A number of NRC research programs (e.g. ocean science, biotechnology, manufacturing, construction, aerospace, fuel cell and alternative energy technologies, chemical processes and environmental technology) focus on the physical environment and ways to reduce and reverse industrial and urban environmental impacts, as well as ways to accommodate changes in environmental loads resulting from climate variations on the built environment. The Institute for Aerospace Research (NRC-IAR) applies its research programs in partnership with Canadian industry on the development of more fuel-efficient air and road transportation and in the development of more environmentally friendly propulsion systems. The disruption of ocean currents and weather patterns threaten habitats and coastal regions. Ocean technology has a major role to play in ocean observation systems that support modeling and forecasting of ocean-climate systems. Ocean technology supports environmentally sensitive exploitation of hydrocarbons beneath the ocean floor. There is also a new focus on energy derived from renewable sources such as ocean waves, tides and currents. Over the coming year, the Minister of Industry will be unveiling a science and technology strategy, in collaboration with the Minister of Finance, that will encompass a broad range of government support for research, including knowledge infrastructure. NRC is focusing on expanding horizontal and multi-disciplinary R&D across the organization and with other federal S&T organizations to support the new federal S&T strategy – Over the planning period, NRC will continue its efforts to dismantle longstanding barriers between many different research domains (e.g., life sciences and information technology) to create powerful new technology platforms and partnerships to serve the interests of Canadian society and businesses. NRC will also continue to work actively with other science-based departments and agencies to address horizontal management issues related to federal S&T collaborations and infrastructure renewal. NRC is participating with other government organizations to combine efforts to better meet federal priorities such as the Oceans Action Plan, the Chemical, Biological, Radiation and Nuclear Research and Technology Initiative, and others. The globalization of trade and emerging technology commercialization opportunities in areas such as biotechnology and nanotechnology continue to generate a need for new metrology and standards to assist Canadian manufacturers in transforming technologies into product applications so they can remain competitive in world markets. |

PLANNING HIGHLIGHTS

|

Strategy: Create value through R&D in sectors with the greatest economic impact for Canada |

Facilitate technology advantage for next generation aerospace industry – NRC-IAR’s Aerospace Manufacturing Technology Centre was designed to support the complete aerospace manufacturing supply chain, from Small and Medium-sized Enterprises (SME) to Aerospace Primes, in the development and implementation of modern manufacturing methods with the potential of cost savings. The Centre has completed its first year of operation with increased partner participation, as evidenced by $1M in partner funding for its research and community recognition in the number of partnerships. The NRC-IAR-Gas Turbine Laboratory (GTL) continues a half-century of advanced industry-focused support and has been awarded Pratt & Whitney Canada’s largest external collaborative research contract. Rounding out the key research programs in early 2008, the GTL will be the only facility in the world capable of mixed phase icing certification, an area of extreme interest for aircraft engine development and certification in the international community.

Integrate nanotechnology research and innovation – NRC's nanotechnology research is targeted at three main application areas that directly impact Canadian competitiveness: new materials and coatings; quantum devices for next generation computing and communications; and novel nanostructure devices for photonic, sensing, and biological applications. This research spans twelve NRC research institutes and combines a spectrum of competencies ranging from fundamental understanding of the properties of nanostructures, through manufacturing of nanomaterials and nanodevices, to collaborative efforts aiming at their applications in aerospace, construction, communication and health related industries. For example, the NRC Steacie Institute for Molecular Sciences (NRC-SIMS) will continue to collaborate with NRC-IRC and NRC-IAR in the development of new nanotechnology-based composite materials offering significant improvements in applications for their respective industries.

To build its competencies and leverage its resources and knowledge, NRC is developing a horizontal nanotechnology program that will increase the integration of expertise across NRC as well as facilitate collaborations with external partners, including other government departments, universities, industry, and international research centers. The program will be linked to a nascent nanotechnology network growing around NINT in which specialized nano centres across Canada are working together to share information and enable collaborative ventures. It is expected that the program will not only increase Canadian capacity in nanotechnology, but will also prove to be a training ground for young researchers entering this important new sector. The program is intended to grow over a five-year period and will feature a limited number of focused cross-disciplinary and multi-partner collaborative projects that will support the priority areas delineated in NRC’s Strategy, Science at Work for Canada.Position Canadian industry as a key player in advanced manufacturing – Collaboration with industrial, university and government partners in virtual and reconfigurable manufacturing and precision and freeform fabrication will continue to be part of the Integrated Manufacturing Technologies Institute (NRC-IMTI) portfolio. These efforts are designed to help Canadian firms develop and market new leading-edge manufacturing systems and integrated technologies worldwide for application in the automotive, aerospace, medical and electronics, machinery and equipment sectors. The Institute for Chemical Process and Environmental Technology (NRC-ICPET) will continue to focus on two major research thrusts: energy-oriented processes and solution-driven materials, targeting applications in the oil sands, fuel cell, and bioproducts industries. The Institute for Fuel Cell Innovation (NRC-IFCI) will continue to focus on clean energy-oriented processes and solution driven novel materials, sensors and architectures, targeting applications in fuel cells and hydrogen and linking those to end users such as car manufactures, utilities, oil industries, pulp and paper, mining, and forestry-bio fuels. The Industrial Materials Institute (NRC-IMI) will continue to focus on the materials processing and forming industry, performing R&D and providing open laboratories and partnership opportunities to innovative companies. NRC-IAR’s success in the area of aerospace manufacturing technology has led to a transition of these new technologies into the non-aerospace manufacturing sector.

Reduce industry risks and costs of working on next generation information and communications technology – The Institute for Microstructural Sciences (NRC-IMS) will continue to anticipate the future needs of Canadian industry by developing functional materials and quantum devices that will fuel the information revolution of the next decade. NRC-IMS is making significant advances in the development of nanomaterials and quantum devices that will help deliver solutions to diverse application areas such as biosensors, chemical sensing, and quantum computing. On the software side, the Institute for Information Technology (NRC-IIT) is developing technologies that facilitate the extraction of knowledge from data, enable people oriented systems, and advance e-business protocols. A key initiative, Social Networking Applied to Privacy, will see the development of automated methods that will assist companies in complying with privacy laws and obligations with respect to the handling of private information. Worldwide, compliance with privacy and fiduciary reporting requirements is one of the biggest challenges facing all organizations. This project was launched in April 2006 and is expected to be completed in the 2010-2011 timeframe.

The Language Technologies Research Centre (LTRC), a collaboration among NRC-IIT, the Université de Québec en Outaouais, Canada Economic Development for Quebec Regions and the Translation Bureau, officially opened its premises in May 2006. The Centre’s focus will be on developing new technologies related to translation, multilingual content management, language training, and speech processing. A key activity continues to be the PORTAGE project, which aims to develop state-of-the-art software to permit computer translations from one human language to another. The PORTAGE technology's international visibility has been heightened by participation in the multimillion-dollar Global Autonomous Language Exploitation (GALE) project sponsored by the US Defence Advanced Research Projects Agency (DARPA). As a member of the Nightingale Consortium, one of the three consortia participating in GALE, NRC’s role is to supply machine translation technology.Working to ensure vaccines and pharmaceuticals can be produced in Canada – The Biotechnology Research Institute (NRC-BRI) will continue to pursue research opportunities that support domestic production of vaccines. In 2006, technology transfer and several 1500 L-production runs were completed as part of a significant contract with Sanofi Pasteur Ltd. The contract involved the scale-up, production, and purification of a bacterial protein for the development of a new vaccine. The success of this work resulted in a Sanofi Pasteur senior executive recognizing Canada, in addition to Europe and the U.S., as a viable location for production work.

The Institute for Biological Sciences (NRC-IBS) is also engaged in work to support this strategy, including:

- Transformative Vaccine Formulation and Delivery: Researchers at NRC-IBS have discovered that Archaea, one of the world’s toughest microbes, can lead to promising new generation of vaccines for cancer and intracellular pathogens. Through a licensing deal with Nicholas Piramal India Limited, one of India’s largest health care companies, the promising archaeosome technology will move into clinical trials, with the aim of leading to the marketplace. The NRC archaeosome technology has the potential to revolutionize the global vaccine industry, and could lead to protective vaccines against grave diseases such as Tuberculosis (TB) and Acquired Immune Deficiency Syndrome (AIDS), which currently kill millions of people each year.

- New Cancer Therapies: NRC-IBS’ groundbreaking work on single domain antibody techniques has led to licensing agreements with Canadian companies Helix Biopharma Corp. and Protox Therapeutis Inc. to develop unique and specific antibody-based cancer therapies.

- Group B meningitis: There is currently no approved vaccine against Group B meningitis, a major cause of illness and death in the developed world. Through a research collaboration with a leading multinational vaccine company and a University in the UK, NRC obtained proof of principle for a lipopolysacharide-based vaccine strategy against Group B meningitis. The LPS-based platform holds great promise in developing a vaccine to protect infants against all groups of this deadly pathogen.

|

Strategy: Invest in leading-edge research including increased horizontal and multi-disciplinary R&D |

Supporting Canada’s leadership in Fuel Cells - The Fuel Cell and Hydrogen Program mobilizes fuel cell expertise and research strength from a network of NRC research institutes across Canada. A total of $6.2M over five years from 2003-04 through 2007-08 has been allocated to NRC and will be applied to its Fuel Cell and Hydrogen Program – a key horizontal initiative. By linking these institutes through a coordinated national program, NRC will help build a strong Canadian fuel cell industry. Linked through a horizontal program, each participating institute will also work with regional R&D providers, universities, government agencies, and local industry to support the development of regional fuel cell clusters. Transfer of fundamental research results from the current program to companies is already underway. Signed collaborative projects between NRC and Canada’s top three fuel cell companies (Ballard, Hydrogenics, and Tekion) all stem from research developed in the program.

As noted, the horizontal program is just part of the integrated fuel cell and hydrogen research work across NRC, which includes additional activities in Vancouver and Ottawa. In British Columbia, NRC-IFCI’s Technology Centre and its Incubation/Acceleration and Networking Facility will provide a focus for SMEs’ technology acceleration, integrated technology demonstrations, and industry-university-government partnerships. NRC-ICPET’s activities are helping to build significant fuel cell activity in Ontario through participation with the Kingston-based Fuel Cell Research Centre (FCRC), which brings together researchers at Queen’s and other Ontario universities and Ontario firms such as DuPont and Hydrogenics.

Overall NRC will play a key role in fuel cell and hydrogen research through the development of next generation Polymer Electrolyte Membrane Fuel Cells (PEMFC) and Solid Oxide Fuel Cells (SOFC) aimed at reducing fuel cell costs and improving reliability and durability. Projects will focus on polymeric and ceramic materials for fuel cell applications, virtual engineering of fuel cells, novel fuel cell stack architecture, embedded sensors and supporting diagnostics, advanced nano-materials research for an intermediate temperature SOFC, high temperature PEMFC (both polymer and ceramic proton conducting) and electrocatalysis. Collaborations with NRC’s Centre for Surface Transportation Technology will begin developing opportunities for the commercial application of fuel cells to military vehicles to meet the needs of the Canadian Armed Forces.

During the planning period, workshops with NRC scientists and experts from other departments, industry, and universities will allow for detailed discussions on research activities and focus areas to allow NRC to continually evaluate the relevance of its research and plan for future activities in the program. With its long affiliation with fuel cells and hydrogen, Natural Resources Canada (NRCan) will be a key partner in these discussions.

NRC Genomics and Health Initiative – The National Research Council's Genomics and Health Initiative (NRC-GHI) will continue to invest in large-scale horizontal research programs focused on bringing the benefits of rapid advances in the genome sciences and health research to a variety of Canadian industrial sectors. The program will invest $22M in 2007-08, involving a total of ten different NRC institutes, other government departments, universities, industry and organizations such as Genome Canada and CIHR. The primary goal of NRC-GHI is to advance the frontiers of scientific and technical knowledge within the areas of genome sciences and health-related research to create a knowledge base that will contribute to Canada’s competitiveness. Current research programs are in the development of personalized approaches to cancer diagnostics and treatment, management of chronic cardiovascular disease, development of pathogen detection technologies, the study of functional genomics of Brassica (Canola) seed development and metabolism, and vaccine development against pathogens affecting aquacultured fish.

Support horizontal and multi-disciplinary collaborations – The McGill University Health Centre (MUHC) and its affiliated institutions and collaborators signed an agreement with NRC-BRI to create and expand the existing model of the NRC-BRI Accelerator Project. This joint collaboration between NRC-BRI and MUHC, which takes advantage of the combination of clinical research and R&D conducted at NRC-BRI, will funnel external funding to support the valuation and transfer process; identify and prioritize the best potential innovations from both BRI and MUHC; offer project management for selected technologies; incubate and accelerate the development of technologies; and ultimately facilitate the transfer of technologies to the private sector or create spin-off companies to exploit such Intellectual Property (IP). This project will speed the translation of innovation from bench to bedside to business and thus accelerate value creation from excellence of the research conducted in both institutions.Support National Security – Funded by CRTI, NRC-INMS is participating in an ongoing collaboration with the Canadian Food Inspection Agency (CFIA), DRDC and Ionalytics Corporation to develop analytical methodology for the rapid and highly sensitive detection of chemical warfare agents, toxic agrochemicals and toxins. The combination of instrumentation and procedures will provide Canada with unique capability and capacity to address chemical terrorist threats. It is anticipated that these leading edge procedures will be rapidly adopted internationally. The project will be completed in 2009.

Speech Security Projects - NRC-IRC is collaborating in several projects with the RCMP and PWGSC concerning the design and assessment of the speech security of meeting rooms. The idea is to determine whether an eavesdropper can hear or understand speech from an adjacent meeting room where confidential material is being discussed. The work involves both physical measurements and subjective listening tests. New procedures have been developed to predict the likelihood of a security lapse from measurements or predictions of the acoustical characteristics of the meeting rooms. A better understanding of the factors influencing people’s ability to understand low levels of speech in noise has been achieved and work is underway to have the new procedures adopted into measurement standards.

| Strategy: Build sustainability through research in areas critical to Canada’s Future |

Continue to support Canada’s commitment to reduce green house gas emissions and improve the environment – A number of NRC research institutes and programs are applying their knowledge and competencies to climate change, energy, the environment, and sustainable development. These research efforts include: NRC’s Fuel Cell and Hydrogen Program, involving NRC-IFCI and five other institutes; work on advanced materials and energy-efficient processes for manufacturing; NRC-IRC’s development of new materials for buildings and construction and codes for sustainable municipal infrastructure; the application of biotechnology to the remediation of contaminated lands and water; and development of new infrastructure in support of the aerospace sector.

NRC will continue to participate in the Program for Energy Research and Development and the Climate Change Technology and Innovation. It will also contribute to the federal energy S&T strategy led by NRCan to ensure that its planned activities are aligned with federal priorities.

Positively influence indoor conditions - NRC’s Institute for Research in Construction (NRC-IRC) will continue to focus on three activities to positively influence indoor conditions. One research activity, together with other government departments and the private sector, focuses on improving indoor air quality, including better selection of low-emitting, non-toxic building materials, and improved ventilation/heating regimes. A second activity focuses on establishing the necessary daily light dose in buildings for good physical and mental health. The third activity is the development of the Building and Health Science Network, a community of Canadian researchers whose work touches on the effects of indoor environmental conditions on health and well-being. Results will be shared with the Canadian construction industry, health community, and Provincial/Territorial authorities to promote indoor health through design, construction, and operation of buildings.Build sustainability through oceans science – Canada’s oceans are a strategic resource of prime importance to humanity, the environment, and industry. The NRC’s Institute for Ocean Technology (NRC-IOT) integrates advanced technologies to achieve innovative solutions to meet the challenges relating to safe and effective transportation, food production, energy development, recreation and information gathering on the oceans. In 2005, NRC-IRAP received two-year funding under the umbrella of the Oceans Action Plan (OAP) to contribute to networking efforts that promote oceans science and technology. This has led to the creation of the Ocean Science and Technology Partnership Organization (OPO), a federally incorporated not-for-profit entity that will encourage national linkages between regional oceans networks. Properly supported, these relationships will lead to increased and timely information sharing, awareness building and new technology demonstrations, partnerships and joint ventures.

Natural health products and nutraceuticals – At its Plant Biotechnology Institute (NRC-PBI), NRC is working to enhance the innovative capacity and competitiveness of the Canadian plant-based natural health products industry for the health and wellness of Canadians by leading efforts to create a world recognized plant-based natural health products industry in functional foods, natural health products, and nutraceuticals. Scientists at the National Research Council Institute for Nutrisciences and Health (NRC-INH) are also involved in identifying how bioactive compounds found in nature can be used to improve human and animal health. Research focuses on the role natural compounds play in three key areas: neurological disorders (such as Alzheimer's disease); obesity-related disorders (such as Diabetes); and infection and immunity (such as viral infections). Focusing on plant product development and commercialization for health and wellness will serve to address important Canadian economic and social issues associated with the wellness of Canadians and the health system. By helping to build a natural health products industry, NRC is contributing to the global competitiveness of an emerging and important Canadian industry.

Make breast cancer diagnosis less invasive - With their improved magnetic resonance imaging (MRI) methods for diagnosing all types of breast cancers, NRC-IBD researchers hope that non-invasive examinations will become the norm for detecting breast cancer, rather than invasive biopsies. Biopsies can vary, but these medical procedures can involve a needle or surgery to remove human tissue, cells or fluids from a breast lump. Then the samples are examined for evidence of cancer. Scientists at IBD hope to reduce the number of unnecessary invasive procedures by observing biochemical changes in cancerous tissues.

Neurochip for drug screening and testing — NRC scientists have pioneered the development of a neurochip - a complex interface of living neurons or brain tissue with patterned materials and multi-electrode arrays that can potentially be used in drug screening and diagnostic testing. NRC is working to create a Neurochip Consortium to promote the future development and commercialization of this technology.

Revealing the secrets of brain adaptation and regeneration — NRC scientists have discovered the molecules that could help reduce the burden of Alzheimer’s disease or enhance brain recovery (angiogenesis-modulating peptides) after stroke-induced damage. These discoveries have resulted in two patent applications, publications and the award of a Heart and Stroke Foundation grant exceeding $200,000 for further research and development.

| Strategy: Support Canadian industry and the research community through codes, standards, and investments in large scale R&D infrastructure |

Support Canada’s long term competitiveness through the adoption and mutual recognition of international standards – NRC’s Institute for National Measurement Standards (NRC-INMS) is Canada’s National Metrology Institute (NMI), determining standards and methods of measurement that impact directly on the ability of Canadian firms to trade internationally. The increasing globalization of trade over the last two decades, including regional trade agreements and organizations such as the World Trade Organization, has made metrology and the establishment of national measurement standards a key element for export dependent economies, such as Canada. Over 35% of Canadian GDP is directly dependent on exports, four times the level of the United States. NRC-INMS plays a vital role in assuring global market access to Canadian industry by reducing non-tariff trade barriers. NRC-INMS will continue to work internationally, particularly with the Security and Prosperity Partnership with Mexico and the U.S., toward establishing mutual recognition of standards for testing and measurement in the automotive and chemical sectors, as well as the development of regulatory standards for nanotechnology and other emerging technologies. Canada’s participation in establishing the initial standards for emerging technologies will provide a competitive edge to innovative Canadian firms, providing them with early access to state of the art international standards for effective participation in global markets.

The demand for advanced measurement standards for Canada’s key industrial sectors and emerging sectors, such as biotechnology and nanotechnology, is increasing at a previously unseen pace. For example, several International NMIs have stated that metrology has to advance in parallel to nanotechnology research for the technology to gain acceptance and be transformed into product applications. Over the planning period, NRC will be preparing a proposal for the renewal of the Canadian strategic measurement innovation infrastructure in support of industrial innovation and the export of high technology products.

Leverage "Big Science" partnerships – TRIUMF (Tri-University Meson Facility) is one of the country's key investments in "Big Science" infrastructure. It provides world-class facilities for research in sub-atomic physics, nuclear physics, nuclear astrophysics, life sciences and condensed matter and encourages the transfer of technology developed at the laboratory to the marketplace. NRC provides funding for the facility on behalf of the Government of Canada via a contribution agreement. TRIUMF has a 2005-2010 Plan, with five-year funding totalling $222 million.

Facilitate the implementation of Canada’s Long Range Plan for Astronomy and Astrophysics

(LRP). The Herzberg Institute of Astrophysics (NRC-HIA) plays a unique role in implementing the LRP. It is within NRC’s mandate to manage national astronomy observatories and to facilitate Canadian academic access to international facilities

including the Canada-France-Hawaii Telescope (CFHT), the James Clerk Maxwell Telescope (JCMT) and the Gemini Telescopes. NRC-HIA also provides data management and processing support that allows astronomers worldwide to work with the latest information. Canada ranks among the world leaders for excellence in astronomy research and for economic-industrial benefits

accruing from activities in astronomy. Canadian industry is the world leader in observatory construction, which is directly related to the integrative approach promoted by NRC-HIA. NRC brings research, technologies and industrial links together in delivering its mandate to provide access to international S&T infrastructures to the Canadian Astronomy

Research Community.

Astronomy represents significant value to Canada. Research and knowledge transfer from astronomy and astrophysics provides social and economic benefits in far-ranging areas, from medical resonance imaging in the health sector, to remote sensing, to advances in telecommunications. LRP is a ten-year strategy to maintain Canada’s position as a world leader

in both the scientific and industrial development aspects of astronomy and astrophysics. Working closely with Canadian universities, Natural Sciences and Engineering Research Council (NSERC), the Canadian Space Agency and the Association of Canadian Universities for Research in Astronomy (ACURA), as well as industry partners, NRC-HIA has had a major role in

delivering a number of projects under the LRP. Currently, the Atacama Large Millimeter Array (ALMA), a World Observatory now under construction in Chile, is the only new international project in the LRP to which NRC is committed. Early phase work is also underway for the two longer-term priorities of the LRP, the Thirty Metre Telescope project and the Square

Kilometre Array. While the government has provided incremental funding and other support to the LRP through organizations such as NRC, to continue to meet its obligations to international partners, NRC will need new investments beginning in 2007, when funding for NRC’s share of LRP projects ends. In addition, there are three LRP next-generation ground

based telescopes, which are international projects that will require a considerable investment of resources if Canada is to continue to participate in a significant way. Over the planning period, NRC will continue to coordinate discussions with key stakeholders and will be seeking a policy decision on Canada’s national programs in astronomy and astrophysics, as

well as additional funding for its share of future LRP projects.

Work with partners in industry and academia to enable leading edge research – The Canadian Neutron Beam Centre (CNBC), part of the NRC-SIMS, enables neutron beam experiments to be undertaken on behalf of universities, industry and government researchers across Canada and internationally. It is a facility for developing new experimental methods, for exchanging knowledge among visiting scientists and staff, and for enabling the convergence of ideas, theories, and experiments to address problems of relevance to Canada and the world. The Centre is one of about 20 similar neutron scattering facilities worldwide and a key part of Canada’s science infrastructure. Neutron beams are a unique source of very valuable data about materials and contribute to advances in physics, chemistry, life sciences, materials research, and engineering. Research undertaken at the CNBC has resulted in many benefits to Canadians including health and the economy (Canada is a leader in producing medical isotopes for cancer treatment); industrial competitiveness (product improvements in jet aircraft, plastics, gas pipelines, metals and ceramics, etc) and in supporting Canada's nuclear energy industry (ensuring the safety and longevity of nuclear reactors in Canada). Over the planning period, CNBC will be focusing on applying new neutron beam methods to soft materials and nanostructures. In addition, a new , specialized spectrometer being installed this year promises to make significant contributions to hydrogen research by enabling the study of new hydrogen storage materials.

Priority 2: Community Technology Clustering Initiatives |

Canada’s private sector is dominated by SMEs, of which 98% have fewer than 100 employees. Within this context, Canadian SMEs often lack the capacity to invest in innovation to take full advantage of the outsourcing and off shoring realities of globalization, and realize the opportunity that would make them key players internationally. Canada needs to develop a dynamic environment that boosts the growth of its companies – from energetic and aggressive SMEs to large, globally competitive firms. Clusters are broadly based community partnerships that focus on achieving competitiveness for Canadian industry and, as such, are an appropriate mechanism to encourage SMEs to invest together and share risks in pre-competitive R&D.

Nations around the world have recognized the central role of science and technology in addressing the challenge to competitiveness and productivity caused by the advent of globalization. Many countries have recognized the importance and potential of technology clusters. Technology clusters are broadly based community partnerships focused on building competitive advantage through research and innovation. Business, academia, and governments form partnerships. Typically, the partners jointly develop a technology roadmap to identify critical research and technology domains important to the community. This is the basis for coordinated and integrated action. Clusters are recognized as requiring 10-20 years to mature before full results are achieved.

A cluster’s lifecycle can be broken down into several phases. Phase 1 - the first five years - focuses on augmenting the research and innovation capacity in communities. Phase 2 - the next five years - focuses on attracting additional private sector partners, a more comprehensive integration of community players, the operation of infrastructure and technology transfer and commercialization. Almost three quarters of NRC’s cluster initiatives are in, or are approaching, Phase 2 of their development lifecycle. Future phases of NRC’s cluster initiatives will need to be tailored to individual circumstances and progress. That being said, commercialization is the central theme in all-later phases.

In response to the economic challenges noted above, the Government of Canada has injected staggered investments of $480 million in NRC’s 11 cluster initiatives since 1999/2000. To date, NRC has received two investments from the Government of Canada for its Atlantic Canada cluster initiatives (Round I funding). It is currently seeking to renew investments in Central and Western Canada technology cluster initiatives (Round II funding), and, in 2007-2008, NRC will be approaching the Government of Canada to seek reinvestment in its Charlottetown, PEI and Regina, Saskatchewan cluster initiatives (Round III funding). Table 1-5 provides a list of NRC’s cluster initiatives, their funding cycles and financial resource allocations that have been made to date.

Table 1-5: Allocation of Resources for NRC Technology Cluster Development

|

Location |

Focus |

Resources |

|

|

2005-2006 to 2009-2010 |

|||

|

Halifax, NS |

Life Sciences (NRC-IMB and NRC-IBD) |

$19.5 million |

|

|

Fredericton and Moncton, NB |

Information Technology and e-Business |

$48.0 million |

|

|

St. John’s, NF |

Ocean Technologies |

$16.0 million |

|

|

Atlantic Canada |

Coordination, administration, special studies, innovation assistance, S&T knowledge,/ information dissemination |

$26.5 million |

|

|

2002-2003 to 2006-2007 |

|||

|

Saguenay-Lac-Saint-Jean, QC |

Aluminium Transformation |

$27.0 million 1,2 |

|

|

Ottawa, ON |

Photonics |

$30.0 million |

|

|

Winnipeg, MB |

Biomedical Technologies |

$10.0 million |

|

|

Saskatoon, SK |

Plants for Health and Wellness |

$10.0 million |

|

|

Edmonton, AB |

Nanotechnology |

$60.0 million1,3 |

|

|

Vancouver, BC |

Fuel Cells and Hydrogen Technologies |

$20.0 million |

|

|

2003-2004 to 2007-2008 |

|||

|

Charlottetown, PEI |

Nutrisciences and Health |

$ 20.0 million |

|

|

Regina, SK |

Sustainable Urban Infrastructure |

$ 10.0 million |

|

|

1: An additional $5 million was received in 2001-2002 |

3: The Province of Alberta also contributed $60 million |

||

Planned Strategies

Over the planning period, NRC will:

- Contribute to the economic viability of Canada’s communities

- Help connect industry and key innovation players

- Focus on cluster growth to create critical mass and build community innovation capacity

- Develop a medium for regional delivery of national initiatives

Key Influencing Factors

|

NRC is actively supporting the Government of Canada’s commitment to improving Canada’s productivity and competitiveness through community-based technology cluster initiatives – NRC’s technology clustering activities build on existing local strengths by: undertaking R&D that responds to cluster needs; collaborating with partners (particularly firms); fostering networking; and providing industry with access to pre-commercialization assistance, such as incubation opportunities and financial and technical advisory services. Development of sustainable technology clusters requires attraction and retention of sustained resources from key cluster stakeholders – Dynamic technology clusters require specialized infrastructure, highly-qualified people, risk capital, and the ongoing and active support of local stakeholders to sustain growth and generate economic and social benefits for Canadian communities. NRC is implementing new tools and approaches to track the growth of its investment in regional clusters – NRC has developed a unique cluster measurement approach that collects comprehensive data on cluster development and the role of NRC. This cluster measurement approach will be used as part of the evaluation of NRC’s Round II and III Clusters and will enable NRC and its partners to track cluster growth over time and identify areas for concerted action. |

PLANNING HIGHLIGHTS

|

Strategy: Contribute to the economic viability of Canada’s communities |

Engage and link community groups through horizontal support (NRC-IRAP and NRC-CISTI)

NRC’s Industrial Research Assistance Program (NRC-IRAP) continues to engage and link regional groups as part of developing the technical, financial and business networks vital to cluster development. NRC-IRAP builds innovation support capacity that benefits all SMEs by providing expertise, advice and financial assistance to organizations. To foster

specific cluster development, NRC-IRAP will take on a leadership role in collaborating and developing integration between regional players in order to strengthen the required integrated regional innovation infrastructure. NRC-IRAP will also directly impact firm growth within the cluster by providing non-repayable contributions on a cost-sharing basis for their

technological research projects.

In various clusters, NRC-CISTI has established NRC Information Centres (NIC), co-located at NRC institutes. NICs offer scientific, technical, medical, and business-related information and analysis services to NRC researchers, companies located onsite, and external clients in the region. NRC-CISTI will partner with institute outreach activities to promote and deliver an integrated package of services to regional clientele.

|

Strategy: Help connect industry and key innovation players |

Expand network of Industrial Partnership Facilities (IPFs) – In support of its cluster development activities, NRC will continue to develop, build, and operate Industry Partnership Facilities across Canada. These unique facilities are workplaces for collaborative research and the incubation of new firms and NRC spin-offs. They also serve as community resources for access to mentoring, innovation financing and competitive technical intelligence for new enterprises. In 2006-2007, NRC had 16 IPF locations across the country with a complement of 116 incubating firms. With the addition of two new facilities (Edmonton and Charlottetown) in 2006-2007, this brings the total space available in IPFs to 29,989 square metres.

Enhance collaborative partnerships – The full development of NRC cluster initiatives is expected to be a long-term commitment, with a cluster taking at least 10 to 20 years to reach full maturation. NRC will increase its efforts to develop collaborations and partnerships with industry and engage stakeholders to contribute to the development of clusters across Canada. NRC-IRAP’s involvement will increase significantly in Phase 2 of a cluster’s lifecycle. NRC-IRAP will become a key integrator and attractor, and will bring synergy to the clusters. NRC-IRAP’s approach to building and supporting technology clusters differs from, and builds on, its usual method of reacting to a specific firm need. Its cluster approach is community, not firm-based; proactive, not reactive; benefits are intended to accrue to all players within the cluster supply chain, not just one firm; and support is targeted to the specific needs of the cluster’s stage of development, not on one organization’s readiness.

|

Strategy: Focus on cluster growth to create critical mass and build community innovation capacity |

The successful growth of dynamic technology clusters will not be the result of a single organization – clustering is a collaborative and iterative process that requires active commitment from all stakeholders. NRC is uniquely positioned to contribute to the growth of Canadian technology clusters by:

- Bringing the leadership needed to gather stakeholders together to define a collective vision

- Building trust within a cluster by fostering networking and collaborative R&D between firms

- Motivating other levels of government to share in the vision

- Maximizing the use of scarce resources by leveraging funds (e.g. investing in much-needed scientific infrastructure, sharing experts between universities and NRC labs)

- Establishing a focal point for the cluster by acting as a neutral ground for the private sector to meet and attract in outside investment

- Identifying bottlenecks to SME growth, and creating targeted solutions for technology transfer and commercialization

- Connecting firms and researchers across the country and around the world through its national mandate and international reputation

The following are examples of early-stage cluster initiatives that NRC intends to move forward:

Nanotechnology (Alberta) – NRC is helping Canada stake its place in nanotechnology through its role in NINT. Established in 2001 with five year funding, NINT is a multi-disciplinary institution funded by the federal government, the University of Alberta and the Government of Alberta. NINT’s goal is to deliver nanotechnology applications in areas that can create and grow a sustained cluster of high technology industries that deliver social and economic benefits to Alberta and to Canada.

The main focus of NINT’s research is the integration of nano-scale devices and materials into complex nanosystems that are connected to the outside world. The long-term objective is to discover “design rules” for nanotechnology, and to develop platforms for building nanosystems and materials that can be constructed for specific applications. NINT will be a key participant in the planned NRC cross-council program on nanotechnology, and in particular, will work with NRC-INMS on measurement science in support of nanometrology. NINT will continue to work with nanoMEMS Edmonton and Tec Edmonton to bring together local proponents, and accelerate the growth of nanotechnology by attracting firms and investment to the region. The NINT building includes incubation space for companies, and NINT expects to have two companies in residence by the end of 2007/2008. Capacity in packaging and assembly, and market-facing product development was identified as a critical need for the region, and both NINT and NRC-IRAP will continue to be involved in the development of the proposal for the Alberta Centre for Advanced MicroNanoTechnology Products (ACAMP).

Biosciences (PEI) – Since 2003, in working closely with the PEI biosciences cluster, the Institute for Nutrisciences and Health (NRC-INH) has helped to double the number of biotechnology companies in PEI (20 to 40). The numbers of biotechnology jobs have grown by approximately 55% (from approximately 450 to 700 FTEs) and sector revenues by 50% ($41M to $62M). NRC-INH has been involved in three successful Atlantic Canada Innovation files (Chemaphor, Phycobiologics and ACBV), which helped secure three new companies into the cluster and over $13M in additional funding over a 5-year period. NRC will continue supporting this cluster through its stages of development.

|

Strategy: Develop a medium for regional delivery of national initiatives |

Clusters offer NRC a tool for better understanding regional economies, R&D needs and commercialization gaps. By pulling key industry stakeholders together (in the form of cluster initiatives) to address common innovation-related problems and challenges, NRC is better able to tailor its national network of R&D resources to meet the needs of innovative communities across Canada.

By establishing regional networks of clusters of firms and other community stakeholders, NRC is ensuring that its national R&D and commercialization support programs are accessible and remain regionally relevant. Overall, NRC’s cluster initiatives give Canada’s national R&D organization the capacity to:

- better understand the innovation needs of regions

- engage regional industry leaders to determine how best to deliver nationally-driven services and support

- physically deliver regionally tailored R&D and commercialization services and support that meet the needs of private industry

Build on successes from NRC’s Atlantic Initiatives, Phase I – NRC will continue to nurture the growth of its Atlantic cluster initiatives by maintaining leading-edge research capabilities (infrastructure and human capital), developing research collaborations with cluster firms, fostering increased networking and knowledge-sharing, and supporting the involvement of firms and other partners in the cluster.

- Information Technology (New Brunswick) – NRC-IIT is continuing to be a key provider of innovation infrastructure and programs to bridge R&D to innovative New Brunswick products. One key initiative is the Cancer Populomix Institute, a collaboration among UNB, Université de Moncton, the New Brunswick Innovation Foundation, the Beauséjour Medical Research Institute, Dalhousie University, and NRC-IIT. The aim of this collaborative group is to advance research for the prevention and early detection of cancer. NRC-IIT is contributing to the undertaking through the development of tools that will assist in the analysis of DNA microarray data. This technique for tumour classification and analysis may lead to dramatic improvements in cancer detection and treatment regimes, and shows potential for application across a spectrum of disease issues.

- Ocean Technologies (Newfoundland and Labrador) – NRC-IOT will continue to lead the ocean technology cluster-building process by working with industry, government and academia. Building on Atlantic Investment Partnership (AIP) funding, NRC-IOT has opened the Ocean Technology Enterprise Centre (OTEC), a hub designed to bring together key services (SME partners, IRAP, CISTI and cluster initiatives) to produce new economic development endeavours and support ocean technology company growth. NRC-IOT will also work with Ocean Advance to develop and implement a community-wide action plan.

- Life Sciences (Nova Scotia) – In 2005-2006 the Institute for Marine Biosciences (NRC-IMB) partnered with BioNova, the Nova Scotia biotechnology industry association, InnovaCorp (a provincial economic development organization), Nova Scotia Office of Economic Development, Atlantic Canada Opportunities Agency, and Nova Scotia Business Inc. to

facilitate the development of a roadmap for the revitalization of the cluster. Stage one of the process, the Asset Map, has been completed and the request for proposal for stage two is in preparation. The Atlantic Commercialization Centre (ACC), located in the IPF, currently houses the Business Development Officer for the Institute, a Senior Life Sciences

Development Officer dedicated to working with the Life Sciences Community, an NRC-IRAP Industrial Technology Advisor, and a Cluster Administrative Assistant, thus providing an integrated approach to NRC’s presence in the community. Through ACC programs, a new collaboration with the only local public life sciences company, MedMira, has been initiated and is

geared towards discovery and commercialization of breast cancer biomarkers. The Industry Partnership Facility currently houses eight organizations.

A large new laboratory for NRC’s Institute for Biodiagnostics (NRC-IBD) -Atlantic and its partners has just been completed at the IWK Hospital in Halifax. It will house a 3 Tesla MRI for animal studies, as well as a vertical bore 7T instrument for solution studies. The 3T system has been donated by NRC-IBD, and the 7T system by NRC-IMB. Collaborations will be with a wide variety of organizations, including Dalhousie University. When all instruments are operating, Halifax will have one of the best MR imaging laboratories in Canada. NRC-IBD Atlantic's 4 Tesla MRI at the QE II hospital is outperforming its specifications and running many human protocols. It was built and commissioned by the NRC-IBD spin off company IMRIS.

Encourage more involvement / commitment of cluster partners – During the planning period, NRC will follow up on lessons learned from the evaluation of its Atlantic Canada cluster initiatives, and will build upon existing successes, such as:

- Manitoba Cluster - The rapidly growing NRC-IBD spin-off company IMRIS is but one example of a success in Manitoba’s biomedical cluster. It has moved into new quarters in Winnipeg to accommodate its 70 employees and several demonstration systems. The company has recently been valued at $60M, demonstrating some of the economic benefits of NRC activities. It has successfully penetrated the US market and has an impressive order book. Several US hospitals with the IMRIS equipment have been advertising the value of the instrument very aggressively, including a live web cast of a neurosurgery using the device at the Boston Children's hospital.

- Canadian Photonics Fabrication Centre (Ontario) – CPFC, a partnership among NRC, the Province of Ontario, and Carleton University was officially opened in 2005, filling an important gap in the photonics community by providing not only fabrication and prototyping services, but also expertise and advice through the NRC-IMS. CPFC is the only industrial fabrication facility for photonics components in Canada, and one of the few in the world. CPFC not only extends its services to the local SMEs that have emerged in the wake of lab closures at JDS Uniphase and Nortel Networks, but to firms and photonics clusters across Canada. CPFC’s services substantially reduce start-up and production development costs, helping to reduce technology risk for Canadian firms, and mitigating investment risk to support venture capital investment. A technology roadmapping exercise is planned with clients and partners to determine which other platforms should be selected for CPFC’s future directions.

Priority 3: Integrated Industry Support that Engages Key Players |

The forces of globalization are placing increasing pressure on Canada’s competitiveness – making innovation an imperative for economic survival. In 2004, Canada’s ratio of Gross Expenditures in Research and Development (GERD) to Gross Domestic Product (GDP) (1.91%) fell short of the Organisation for Economic Co-operation and Development (OECD) average of 2.24%[2]. While Canada’s Industrial Research and Development spending rose 1.6% to $13.8 billion in 2005[3], it remains 3.3% below the peak level of $14.3 billion observed in 2001.

In Canada, 98% of firms have fewer than 100 employees, the majority of which do not have the resources or the capacity to either develop their own or contract out significant R&D projects. With its industrially-focused technology support, NRC’s role becomes even more important. For the planning period, NRC will build upon its critical mass and expertise in key technologies, knowledge transfer mechanisms, business support facilities and services across Canada to strengthen innovation and growth in Canadian businesses. It will also continue to develop strategic initiatives to help Canadian businesses better compete in the global marketplace.

Planned Strategies

Over the planning period, NRC will:

- Increase the innovation capacity of small and medium-sized enterprises (SMEs)

- Help industry manage risks as new products are developed and marketed

- Offer S&T information and intelligence to industry

- Offer comprehensive commercialization support, including technology transfer and IP management

Key Influencing Factors

| Innovation plays a key role in economic progress and raising living standards, and SMEs are a key source of innovation for Canada but challenges still exist: SMEs account for over 95% of manufacturing enterprises and an even higher share in many service industries[4]. However, SMEs are struggling to survive and grow as approximately 20% exit in the first year and many more leave the market during the second year[5]. Interestingly, high-knowledge firms experience faster growth and tend to have a survival rate higher than low-knowledge firms[6]. There is now a fundamental shift in how firms generate new ideas and bring them to market. In today’s connected world, the commercialization challenge is not simply one of producing the best product. Entrepreneurs and innovative firms require certain business expertise, and experience to complement their knowledge, intelligence, and skills, sometimes even before they recognize their importance. Continued support of SMEs is essential to building Canadian industrial innovation and growth. |

PLANNING HIGHLIGHTS

|

Strategy: Increase the innovation capacity of small and medium-sized enterprises (SMEs) and help industry manage risks as new products are developed and marketed |

Build innovation capacity within SMEs – NRC-IRAP is the agency’s innovation and technology assistance program in support of Canadian SMEs. Since its inception close to 60 years ago, the program has broadened its strategic purpose from a limited focus on technology transfer to its current strategic objective of increasing the innovative capabilities of Canadian SMEs. Today, NRC-IRAP provides comprehensive innovation assistance to technology-based SMEs in almost every industrial sector of importance to Canada’s current and future economic development. SMEs engaging in high-risk, technologically sophisticated R&D face increasingly complex challenges. NRC-IRAP will support these technology-based SMEs in growing and becoming more competitive by focusing on: increasing the rate of growth of SMEs; expanding the number of SMEs that successfully commercialize their products, services and processes; assisting with potential international collaborations on technology development projects; and providing international opportunities to clients looking to gain knowledge to advance their R&D projects.

Build on the success of the Competitive Technical Intelligence (CTI) program: NRC-IRAP and NRC-CISTI will continue to develop CTI services in order to provide best-in-class strategic advice to Atlantic cluster participants and optimize NRC investments. For example, NRC-IRAP and NRC-CISTI have added a Technical Business Analyst presence in St. John's NL and are integrating CTI advice into NRC-IRAP's portfolio of services to Atlantic and Nunavut firms. NRC-CISTI and NRC-IRAP are also working together to provide CTI to SMEs in other parts of Canada, including Montreal, Winnipeg and Edmonton. NRC-IRAP has developed an in-house capability to capture CTI, and as a next step, will integrate this information into the strategic planning and business strategies of client firms.

|

Strategy: Offer S&T information and intelligence to industry |

Scientific and Technical Information – The Canada Institute for Scientific and Technical Information (NRC-CISTI) is Canada’s national science library, and the largest comprehensive source of scientific, technical and medical (STM) information in North America. Through its publishing arm, NRC Research Press, NRC-CISTI is also Canada’s foremost scientific publisher. NRC-CISTI's information specialists, technical business analysts and technical information analysts provide value-added information services and competitive technical intelligence reports to NRC-IRAP SMEs, NRC researchers, and other clients through the NRC Information Centers co-located with NRC institutes across Canada.

NRC-CISTI’s Strategic Plan 2005-2010 sets out its vision: to be a leader in driving the exploitation of scientific information to create value for Canadians. Its mission is to advance research and innovation through high-value information and publishing services in science, technology and medicine.

NRC-CISTI will create value for Canadians by improving the flow of scientific information in three ways:

- An integrated “infostructure:” storage of and access to electronic scientific information, using intelligent search and analysis tools. Partnerships will be key to developing this system.

- Scientific publishing infrastructure, using online peer review, editing and publishing tools that will shorten the time between discovery and publication without sacrificing quality.

- Services to support commercialization and SMEs, such as Competitive Technical Intelligence and patent information analysis – “actionable” information.

Companies in NRC industrial partnership facilities are key clients and will be offered enhanced services to support their research and development activities.

|

Strategy: Offer comprehensive commercialization support, including technology transfer and intellectual property management |

During 2006-07, NRC undertook an in-depth examination of all its industry support programs, policies and practices as part of a project called Business Review. This Business Review project was launched to ensure NRC was well-equipped and well-positioned to carry out client based activities described in NRC’s Strategy, Science at Work for Canada. Recommendations from the Business Review project include: working increasingly on an industry-sector basis; increasing NRC’s capacity to develop industrially relevant technologies and their commercialization; and ensuring NRC’s internal operations make it easier for our Institutes and Programs to serve clients. In early 2007, NRC senior executives are expected to prioritize Business Review recommendations for implementation over the five-year period covered by the Strategy.

Improve NRC’s Intellectual Property Management: Guided both by a 2003 benchmarking study of best practices in Intellectual Property (IP) management, and the results of the Business Review project (described above), NRC will continue to strengthen its IP management. Specific activities will include: increased focus on high value IP; increased use of technology assessments; increased market research tools; and adoption of the world’s best practices and tools. As well, NRC’s corporate business office will undertake an innovative invention disclosure review process that promises to provide better guidance to institutes. This process will also engage the breadth of NRC’s Technology and Industry Support expertise and seek opportunities for technology bundling and convergence.

Priority 4: Program Management for a Sustainable Organization |