Common menu bar links

Breadcrumb Trail

ARCHIVED - RPP 2007-2008

Department of Finance Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Section III: Supplementary Information

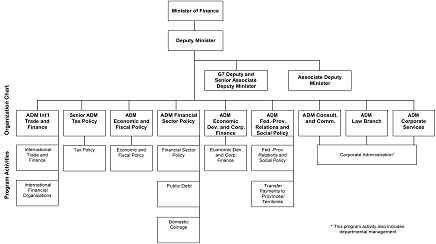

Organization Chart and Program Activity Architecture

Departmental Links to the Government of Canada Outcomes (for RPPs)

| 2007–08 | |||||

| Budgetary | |||||

| Operating | Grants | Contributions and Other Transfer Payments |

Gross | Respendable Revenue |

|

| ($ thousands) | |||||

| Strategic Outcome: To create a fiscal, economic, social, and global advantage for Canada by providing appropriate policies and sound advice with respect to economic, social, and financial conditions and to the government's overall agenda. | |||||

|

Tax Policy1 |

32,653 | 32,653 | (128) | ||

|

Economic and |

14,991 | 14,991 | (59) | ||

|

Financial Sector |

18,093 | 18,093 | (71) | ||

|

Economic |

8,280 | 8,280 | (32) | ||

|

Federal- |

12,284 | 12,284 | (48) | ||

|

International |

15,861 | 15,861 | (62) | ||

|

Public Debt7 |

34,697,000 | 34,697,000 | |||

|

Domestic |

145,000 | 145,000 | |||

|

Transfer |

40,328,203 | 40,328,203 | |||

|

International |

176,200 | 363,269 | 539,469 | ||

|

Total |

34,944,162 | 176,200 | 40,691,472 | 75,811,834 | (400) |

Departmental Links to the Government of Canada Outcomes (for RPPs) (Cont'd)

| 2007–08 | |||||

|

Budgetary

|

Non-budgetary

Loans, |

Total Main Estimates |

Adjustments (planned spending not in Main Estimates) |

Total Planned Spending |

|

| ($ thousands) | |||||

| Strategic Outcome: To create a fiscal, economic, social, and global advantage for Canada by providing appropriate policies and sound advice with respect to economic, social, and financial conditions and to the government's overall agenda. | |||||

|

Tax Policy1 |

32,525 | 32,525 | 164 | 32,689 | |

|

Economic and |

14,932 | 14,932 | 75 | 15,007 | |

|

Financial Sector |

18,022 | 18,022 | 91 | 18,113 | |

|

Economic |

8,248 | 8,248 | 41 | 8,289 | |

|

Federal- |

12,236 | 12,236 | 62 | 12,298 | |

|

International |

15,799 | 15,799 | 80 | 15,879 | |

|

Public Debt7 |

34,697,000 | 34,697,000 | 34,697,000 | ||

|

Domestic |

145,000 | 145,000 | 145,000 | ||

|

Transfer |

40,328,203 | 40,328,203 | 40,328,203 | ||

|

International |

539,469 | 5,247 | 544,716 | 1 | 544,717 |

|

Total |

75,811,434 | 5,247 | 75,816,681 | 512 | 75,817,194 |

1. The program activity Tax Policy contributes to the achievement of all Government of Canada outcomes.

2. The program activity Economic and Fiscal Policy contributes to the achievement of the Government of Canada's "Strong economic growth" outcome.

3. The program activity Financial Sector Policy contributes to the achievement of the Government of Canada's "A fair and secure marketplace" outcome.

4. The program activity Economic Development and Corporate Finance contributes to the achievement of the Government of Canada's "Strong economic growth" outcome.

5. The program activity Federal-Provincial Relations and Social Policy contributes to the achievement of the Government of Canada's "A diverse society that promotes linguistic duality and social inclusion" outcome.

6. The program activity International Trade and Finance contributes to the achievement of the Government of Canada's "A prosperous Canada through global commerce" outcome.

7. The program activity Public Debt contributes to the achievement of all Government of Canada outcomes.

8. The program activity Domestic Coinage contributes to the achievement of all Government of Canada outcomes.

9. The program activity Transfer Payments to Provinces and Territories contributes to the achievement of several of the Government of Canada's outcomes, including the outcomes of "Strong economic growth" and "Healthy Canadians."

10. The program activity International Financial Organizations contributes to the achievement of the Government of Canada's "Global poverty reduction through sustainable development" outcome.

Table 1: Departmental Planned Spending and Full-time Equivalents

| Forecast Spending 2006–07 |

Planned Spending 2007–08 |

Planned Spending 2008–09 |

Planned Spending 2009–10 |

|

|

($ thousands) |

||||

|

Tax Policy |

30,865 | 32,653 | 32,945 | 32,438 |

|

Economic and Fiscal Policy |

14,559 | 14,991 | 15,125 | 15,124 |

|

Financial Sector Policy1 |

20,521 | 18,093 | 16,030 | 16,549 |

|

Economic Development and Corporate Finance |

7,784 | 8,280 | 8,354 | 8,354 |

|

Federal-Provincial Relations and Social Policy2 |

16,753 | 12,284 | 12,394 | 12,393 |

|

International Trade and Finance |

15,555 | 15,861 | 16,003 | 16,002 |

|

Public Debt3 |

34,395,000 | 34,697,000 | 34,645,000 | 34,685,000 |

|

Domestic Coinage4 |

83,100 | 145,000 | 147,000 | 149,000 |

|

Transfer Payments to Provinces and Territories5 |

38,330,000 | 40,328,203 | 41,903,765 | 43,817,109 |

|

International Financial Organizations6 |

725,869 | 539,469 | 537,469 | 508,469 |

|

|

||||

|

Budgetary Main Estimates (gross) |

73,640,006 | 75,811,834 | 77,334,085 | 79,260,438 |

|

International Financial Organizations7 |

7,471 | 5,247 | 3,498 | 1,749 |

|

|

||||

|

Non-budgetary Main Estimates (gross) |

7,471 | 5,247 | 3,498 | 1,749 |

|

Less: Respendable revenue |

400 | 400 | 400 | 400 |

|

|

||||

|

Total Main Estimates |

73,647,077 | 75,816,681 | 77,337,183 | 79,261,787 |

|

|

||||

|

Adjustments |

||||

|

Procurement Savings |

||||

|

Tax Policy |

(207) | |||

| Economic and Fiscal Policy | (97) | |||

| Financial Sector Policy | (137) | |||

| Economic Development and Corporate Finance | (52) | |||

| Federal-Provincial Relations and Social Policy | (112) | |||

| International Trade and Finance | (104) | |||

|

Supplementary Estimates |

||||

|

Operating Budget Carry Forward |

4,233 | |||

|

Advertising campaigns |

4,100 | |||

|

Cost of New Ministry—Regional Responsibilities |

25 | |||

|

Transfer to Foreign Affairs and International Trade Canada for Beijing Councillor Position |

(393) | |||

|

Transfer to the Canadian International Development Agency for Multilateral Debt Initiative8 |

(5,595) | |||

|

Public Debt—Interest and Other Costs9 |

209,000 | |||

|

Equalization and Territorial Formula Financing10 |

255,464 | |||

|

Payments to territories (Data Revisions) |

46,035 | |||

|

Youth Allowances Recovery11 |

69,000 | |||

|

Alternative Payments for Standing Programs12 |

125,000 | |||

|

Domestic Coinage13 |

42,900 | |||

|

Increase to International Development Association |

1 | |||

|

Other |

||||

|

Treasury Board Vote 15 (Collective Bargaining) |

2,186 | |||

|

Employee Benefit Plan (EBP) |

437 | |||

|

Payments to International Development Association14 |

1 | |||

|

Internal Audit15 |

512 | 11 | 11 | |

|

|

||||

|

Total Adjustments |

751,683 | 513 | 11 | 11 |

|

|

||||

|

Total Planned Spending |

74,398,760 | 75,817,194 | 77,337,194 | 79,261,798 |

|

|

||||

|

Total Planned Spending |

74,398,760 | 75,817,194 | 77,337,194 | 79,261,798 |

|

Less: Non-respendable revenue |

217,840 | 233,517 | 248,766 | 257,518 |

|

Plus: Cost of Services Received Without Charge |

14,645 | 15,386 | 15,488 | 15,637 |

|

Total Departmental Spending |

74,195,566 | 75,599,063 | 77,103,916 | 79,019,917 |

|

|

||||

|

Full-time Equivalents16 |

811 | 798 | 789 | 789 |

Notes

1. The decrease of $2.4 million in 2007–08 is due to the sunsetting of $1.07 million in funding for the Financial Action Task Force on Money Laundering (FATF) presidency and a decrease of $1.3 million in the redistribution of corporate administration costs.

2. The decrease of $4.5 million in 2007–08 is due to the sunsettting of the Expert Panel on Equalization and Territorial Formula Financing (TFF) of $3 million and a decrease of $1.5 million in the redistribution of corporate administration costs.

3. The change in the public debt charges is due to an increase in forecast short-term interest rates.

4. The increase in Domestic Coinage reflects the increased funding required for the cost to produce and distribute the augmented volume of domestic coinage due to higher demand for coinage from the economy.

5. The increase in the amount of transfer payments is the result of increased transfer payments to provinces and territories, including Fiscal Equalization, TFF, the Canada Health Transfer, and the Canada Social Transfer.

6. The decrease in 2007–08 in the budgetary amount of the International Financial Organizations program activity is due largely to a significant payment for debt for Cameroon, part of the Heavily Indebted Poor Countries process, which was made in 2006–07, but which will not be repeated in 2007–08.

7. The decrease in the non-budgetary amounts for the International Financial Organizations program activity is consistent with the agreed upon schedule of Canada's payments and encashment for the capital subscription of the European Bank for Reconstruction and Development (EBRD).

8. $5.6 million transferred from the Department of Finance Canada's reference level to the Canadian International Development Agency for 2006–07. This represents surplus funds from lower than expected payments under the Multilateral Debt Relief Initiative for 2006–07. The International Assistance Envelope's (IAE)'s management framework supports inter-pool flexibility to ensure that any surplus resources are reallocated to areas of need.

9. Forecasts of public debt charges for 2006–07 increased by $393 million due to an increase in expected short-term interest rates.

10. Budget 2006 provided additional funding to compensate certain provinces and territories for losses, based on updated data.

11. This is a recovery based on tax abatements for the Province of Quebec. The amount of $69 million represents a decrease in the amount to be recovered from Quebec. This decrease is related to a decrease in the value of personal income tax points compared with the data used for Main Estimates 2006–07.

12. This is a recovery from the Province of Quebec for the additional tax point transfers above and beyond the Canada Health Transfer and Canada Social Transfer tax point transfers. The decrease is related to a decrease in the value of personal income tax points compared with the data used for Main Estimates 2006–07.

13. The revised estimate for domestic coinage reflects an increase in private sector demand for coinage.

14. The adjustment is due to a discrepancy with the 2006–07 Main Estimates due to a revised forecast for payments to the International Development Association.

15. The increased funding of $512,000 for internal audit is for the creation of an internal audit committee, as well as for additional personnel and related training to assist in carrying out new requirements flowing from the new Policy on Internal Audit.

16. The decrease in FTEs is largely due to the September 2006 decision to wind down the Canada Investment and Savings Agency (a special operating agency of the Department of Finance Canada).

Table 2: Voted and Statutory Items Listed in Main Estimates

|

Vote or Statutory Item |

Truncated Vote or Statutory Wording |

2007–08 |

2006–07 |

|

($ thousands) |

|||

|

1 |

Operating expenditures1 |

89,343 | 93,135 |

|

5 |

Grants and Contributions2 |

221,200 | 404,200 |

|

(S) |

Minister of Finance—Salary and motor car allowance |

75 | 73 |

|

(S) |

Territorial Formula Financing (Part I.1—Federal-Provincial Fiscal Arrangements Act)3 |

2,142,450 | 2,070,000 |

|

(S) |

Payments to the International Development Association |

318,269 | 318,269 |

|

(S) |

Contributions to employee benefit plans |

12,344 | 12,429 |

|

(S) |

Purchase of Domestic Coinage4 |

145,000 | 83,100 |

|

(S) |

Interest and Other Costs5 |

34,697,000 | 34,395,000 |

|

(S) |

Statutory Subsidies (Constitution Act, 1867-1982, and Other Statutory Authorities) |

32,000 | 32,000 |

|

(S) |

Fiscal Equalization (Part I—Federal-Provincial Fiscal Arrangements Act)6 |

11,676,353 | 11,282,000 |

|

(S) |

Canada Health Transfer (Part V.1—Federal-Provincial Fiscal Arrangements Act)7 |

21,348,400 | 20,140,000 |

|

(S) |

Canada Social Transfer (Part V.1—Federal-Provincial Fiscal Arrangements Act)8 |

8,800,000 | 8,500,000 |

|

(S) |

Youth Allowances Recovery (Federal-Provincial Fiscal Revision Act, 1964)9 |

(661,000) | (699,000) |

|

(S) |

Alternative Payments for Standing Programs (Part VI—Federal-Provincial Fiscal Arrangements Act)10 |

(3,010,000) | (2,995,000) |

| Appropriations not required | |||

| - | Pursuant to section 29 of the Financial Administration Act, to authorize the Minister on behalf of Her Majesty in Right of Canada to guarantee payment to the holders of mortgages insured by private insurers approved by the Superintendent of Financial Institutions to sell mortgage insurance in Canada of not more than 90% of the net claims of the holders of the insured mortgages in the event of the insolvency or liquidation of the private insurer, subject to the limitation that the aggregate outstanding principal amount of all mortgages covered by the guarantee shall not exceed $100,000,000,000 at any time; and to repeal Vote 16b, Appropriation Act No. 4, 2003-2004 | - | - |

| Items not required | |||

| - | Payments to International Monetary Fund's Poverty Reduction and Growth Facility11 | - | 3,400 |

| Total budgetary | 75,811,434 | 73,639,606 | |

|

L10 |

Issuance and payment of demand notes to the |

- | - |

|

(S) |

Payments and encashment of notes issued to the European Bank for Reconstruction and Development—Capital Subscriptions12 |

5,247 | 7,471 |

| Total non-budgetary | 5,247 | 7,471 | |

|

Total Department |

75,816,681 | 73,647,077 | |

Notes

1. The decrease of $3.8 million, or 4.1%, in the operating expenditures vote is largely due to the transfer of $391,000 to Foreign Affairs and International Trade Canada for the Finance Councillor Position in Beijing, procurement savings of $710,000, the sunset of $1.07 million in funding for the Financial Action Task Force on Money Laundering (FATF) presidency and $3 million for the Expert Panel on Equalization and Territorial Formula Financing. The Department also received $1.3 million in funding in 2007–08 for compensation for collective bargaining.

2. The decrease of $183 million, or 45.3%, in the grants and contributions vote is due largely to a significant payment for debt for Cameroon, part of the Heavily Indebted Poor Countries process, which was made in 2006–07, but which will not be repeated in 2007–08. Grants and contributions amounts can fluctuate appreciably from year to year for two reasons. First, the amounts of debt relief vary from country to country so corresponding payments made on behalf of these countries will change accordingly. Second, the timing of debt treatment can change, as the schedule for debt treatment of a country benefiting from debt relief may change for reasons internal to that country.

3. The increase of $72.5 million, or 3.5%, in the Territorial Formula Financing (TFF) is a result of the October 26, 2004, New Framework for Equalization and the Territorial Formula Financing Program. The New Framework established a level of TFF for 2005–06 of $2 billion and annual increase of 3.5% until 2013–14.

4. The increase of $61.9 million, or 74.5%, in Domestic Coinage reflects the increased funding required for the cost to produce and distribute the augmented volume of domestic coinage due to higher demand for coinage from the economy.

5. Public Debt charges have increased by $302 million, or 0.9%, due to an increase in forecast short-term interest rates.

6. The increase of $394 million, or $3.5%, in transfer payments for Fiscal Equalization is a result of the October 26, 2004, New Framework for Equalization and the Territorial Formula Financing Program. The New Framework established a level for Equalization for 2005–06 of $10.9 billion and an annual increase of 3.5% until 2013–14.

7. The increase of $1.2 billion, or 6%, in the Canada Health Transfer represents the legislated amount for health transfers as per Budget 2003 and the additional funding announced in the September 2004 10-Year Plan to Strengthen Health Care.

8. The increase of $300 million, or 3.5%, in the Canada Social Transfer represents the legislated amount for social transfer. Additional funding was committed for this transfer in Budget 2003 and March 2003.

9. The decrease in the Youth Allowances Recovery of $38 million, or 5.5%, is due to a decrease in the amount to be recovered from Quebec. This decrease is related to a decrease in the value of personal income tax points compared with the data used for the 2006–07 Main Estimates.

10. The increased recovery of $15 million, or 0.5%, in the Alternative Payments for Standing Programs is attributable to an increase in the amount to be received from Quebec. This increase is related to a increase in the value of personal income tax points compared with the data used for the 2006–07 Main Estimates.

11. The decrease of $3.4 million, or 100%, to the payment to the International Monetary Fund's (IMF) Poverty Reduction and Growth Facility (PRGF) is due to lower obligations to fund the IMF's PRGF.

12. The decrease in the payments and encashment of notes to the ERBD of $2.2 million, or 30%, is consistent with the agreed upon schedule of Canada's payments and encashment for the capital subscription of the EBRD.

Table 3: Services Received Without Charge

| 2007–08 | |

| ($ thousands) | |

|

Accommodation provided by Public Works and Government Services Canada |

7,284 |

|

Contributions covering the employer's share of employees' insurance premiums and expenditures paid by the Treasury Board of Canada Secretariat (excluding revolving funds) |

4,669 |

|

Salary and associated expenditures of legal services provided by the Department of Justice Canada |

3,432 |

|

Total 2007–08 Services Received Without Charge |

15,386 |

Table 4: Loans, Investments, and Advances (Non-budgetary)

|

Forecast Spending 2006–07 |

Planned Spending 2007–08 |

Planned Spending 2008–09 |

Planned Spending 2009–10 |

|

|

($ thousands) |

||||

|

International Financial Organizations |

|

|

|

|

|

Issuance and Payment of demand notes to the International Development Association (IDA)1 |

- |

- |

- |

- |

|

Issuance of demand notes to the European Bank for Reconstruction and Development (EBRD)—Capital Subscriptions1 |

- |

- |

- |

- |

|

Payments and encashment of notes issued to the EBRD—Capital Subscriptions2 |

7,471 |

5,247 |

3,498 |

1,749 |

|

Issuance of loans to the International Monetary Fund's (IMF) Poverty Reduction and Growth Facility (PRGF)1 |

- |

- |

- |

- |

|

Total |

7,471 |

5,247 |

3,498 |

1,749 |

Notes

1. Zero dollar appropriations are required for parliamentary approval in the Main Estimates of the L15 Vote for the issuance of demand notes to the IDA, and as notification of the statutory issuance of demand notes for the EBRD Capital Subscription and loan to the IMF's PRGF. The encashment of each of these notes is covered under separate statutory payments in the Main Estimates.

2. The decrease in the payments and encashment of notes to the ERBD is consistent with the agreed upon schedule of Canada's payments and encashment for the capital subscription of the EBRD.

Table 5: Sources of Respendable and Non-respendable Revenue

Respendable Revenue

|

Forecast Revenue |

Planned |

Planned Revenue |

Planned |

|

|

($ thousands) |

||||

|

Tax Policy |

|

|

|

|

|

Sale of Departmental Documents |

117 |

128 |

131 |

130 |

|

Economic and Fiscal Policy |

|

|

|

|

|

Sale of Departmental Documents |

55 |

59 |

60 |

60 |

|

Financial Sector Policy |

|

|

|

|

|

Sale of Departmental Documents |

77 |

71 |

64 |

65 |

|

Economic Development and Corporate Finance |

|

|

|

|

|

Sale of Departmental Documents |

29 |

32 |

33 |

33 |

|

Federal-Provincial Relations and Social Policy |

|

|

|

|

|

Sale of Departmental Documents |

63 |

48 |

49 |

49 |

|

International Trade and Finance |

|

|

|

|

|

Sale of Departmental Documents |

59 |

62 |

63 |

63 |

|

Total Respendable Revenue |

400 |

400 |

400 |

400 |

Non-respendable Revenue

|

Forecast Revenue |

Planned Revenue |

Planned Revenue |

Planned Revenue |

|

|

($ thousands) |

||||

|

Domestic Coinage |

||||

|

Domestic Coinage1 |

217,840 |

233,517 |

248,766 |

257,518 |

|

Total Non-respendable Revenue |

217,840 |

233,517 |

248,766 |

257,518 |

|

Total Respendable and |

218,240 |

233,917 |

249,166 |

257,918 |

Note

1. The Domestic Coinage non-respendable revenue represents the face value of the forecast volume of coins that will be sold to financial institutions to meet trade and commerce requirements. The increase in the forecast volume of coins is due to a strong Canadian economy, a strong retail sector, and the inclusion of the Olympic program.

Table 6: Resource Requirement by Branch

| 2007-08 | ||||||

|

Tax Policy |

Economic and Fiscal Policy |

Financial Sector Policy |

Economic Development and Corporate Finance |

Federal- Provincial Relations and Social Policy |

International Trade and Finance |

|

| ($ thousands) | ||||||

|

Tax Policy |

32,689 | |||||

|

Economic and Fiscal Policy |

15,007 | |||||

|

Financial Sector Policy |

18,113 | |||||

|

Economic Development and Corporate Finance |

8,289 | |||||

|

Federal-Provincial Relations and Social Policy |

12,298 | |||||

|

International Trade and Finance |

15,879 | |||||

| Total | 32,689 | 15,007 | 18,113 | 8,289 | 12,298 | 15,879 |

Table 6: Resource Requirement by Branch (Cont'd)

| 2007-08 | |||||

|

Public Debt |

Domestic Coinage |

Transfer Payments to Provinces and Territories |

International Financial Organizations |

Total Planned Spending |

|

| ($ thousands) | |||||

|

Tax Policy |

32,689 | ||||

|

Economic and Fiscal Policy |

15,007 | ||||

|

Financial Sector Policy |

34,697,000 | 145,000 | 34,860,113 | ||

|

Economic Development and Corporate Finance |

8,289 | ||||

|

Federal-Provincial Relations and Social Policy |

40,328,203 | 40,340,501 | |||

|

International Trade and Finance |

544,717 | 560,596 | |||

|

Total |

34,697,000 | 145,000 | 40,328,203 | 544,717 | 75,817,194 |

Table 7: Regulatory Initiatives

|

Regulations |

Expected Results |

|

Support consideration by Parliament of Bill C-37, An Act to amend the law governing financial institutions and to provide for related and consequential matters, with a view to passage before sunset in April 2007. Associated regulations will also be brought forward to bring the legislation into force. |

Legislation adopted before sunset of existing legislation in April 2007 and regulations developed to update the financial institutions statutes and ensure the efficiency of the regulatory framework that allows for a sound, efficient, and competitive financial sector. |

|

Regulations are being introduced pursuant to the passage of Bill C-57, which updated the corporate governance provisions in the financial institutions statutes. |

Develop regulations to implement the new corporate governance provisions in the financial institutions statutes. |

|

Amendments may be made to regulations under Part IX of the Excise Tax Act (GST/HST)—Part IX of the Excise Tax Act contains a number of provisions that give regulatory powers to deal with GST/HST issues. |

Through the use of regulations, the government may propose changes to address some issues in the GST/HST tax system. Amendments to the regulations are required from time to time to respond to emerging policy and technical issues, including budget-related measures. |

|

Customs Tariff—The Tariff contains a number of provisions that allow the government to respond to the competitive needs of Canadian industry and to enforce Canada's rights and meet its obligations under international agreements and arrangements to which Canada is a party. |

Through the use of orders and regulations, the government will continue to respond to the competitive needs of Canadian industry and will enforce Canada's rights and meet its obligations under international agreements and arrangements. |

|

Income Tax Act and related regulations—The Income Tax Act contains a number of provisions that give regulatory powers to deal with income tax issues. |

Through the use of regulations, the government may propose changes to address some issues in the income tax system. Amendments to the Regulations are required from time to time to address emerging policy or technical issues, including budget-related measures. |

|

Orders in Council for the Equalization and the Territorial Formula Financing Program—Federal-Provincial Fiscal Arrangements Act. |

Under current legislation, an Order in Council must be prepared in order to establish payment levels until superseded by Budget 2007 commitments. |

|

Legislative changes expected as a result of policy changes in Budget 2007 regarding fiscal balance. |

Legislation and regulatory changes will be introduced to implement a principled framework for major federal transfers, reflecting the proposals to restore fiscal balance included in Budget 2007. |

|

Regulations to establish guidelines for the chief actuary of the Canada Pension Plan (CPP) to calculate the full cost of benefit enrichments or new benefits to the CPP, upon Royal Assent of Bill C-36, which provides for this regulation-making authority. |

This would deliver on a federal-provincial-territorial agreement reached in June 2006 as part of the conclusion of the CPP's triennial review. |

|

Amend existing regulations relating to the calculation of the default contribution rate to the CPP that provide for rounding of this rate to the nearest cent. This requires a consequential change to Bill C-36. |

This would deliver on a federal-provincial-territorial agreement reached in June 2006 as part of the conclusion of the CPP's triennial review. |

|

Budget 2005 proposed to amend regulations made under the Pension Benefits Standards Act, 1985 to remove the requirement that life income funds be used to purchase an annuity when the beneficiary reaches age 80. |

Legislation and/or regulations will be introduced to repeal the requirement to purchase an annuity at age 80. |

|

Amendments to the regulations made pursuant to the Proceeds of Crime (Money Laundering) and Terrorist Financing Act. |

Regulations will be introduced or amended to respond to the revised Financial Action Task Force recommendations and to respond to the recommendations of the Auditor General of Canada and the Treasury Board-mandated evaluation. |

Table 8: Details of Transfer Payment Programs

Over the next three years, the Department of Finance Canada will manage the following transfer payment programs in excess of $5 million:

2007–08 to 2009–10

1. Compensation to Canadian agencies or entities established by an Act of Parliament for reduction of debts of debtor countries

2. Payments to the International Development Association

3. Debt payments on behalf of poor countries to international organizations

4. Fiscal Equalization (Part I, Federal-Provincial Fiscal Arrangements Act)

5. Territorial Formula Financing (Part I.1, Federal-Provincial Fiscal Arrangements Act)

6. Canada Health Transfer (Part V.1, Federal-Provincial Fiscal Arrangements Act)

7. Canada Social Transfer (Part V.1, Federal-Provincial Fiscal Arrangements Act)

8. Statutory Subsidies (Constitution Act, 1867, Constitution Act, 1982,and other statutory authorities)

9. Youth Allowances Recovery (Federal-Provincial Revision Act, 1964)

10. Alternative Payments for Standing Programs (Part VI, Federal-Provincial Arrangements Act)

11. Wait Times Reduction Transfer (Part V.1, Federal-Provincial Fiscal Arrangements Act)

For further information on the above-mentioned transfer payment programs, see http://www.tbs-sct.gc.ca/est-pre/estime.asp.

Details on Transfer Payment Programs (TPPs) for the Department of Finance Canada

Name of Transfer Payment Program: Grants and Debt Payments on Behalf of Poor Countries to International Organizations

Start Date: 2005–06

End Date: Ongoing

Description: Payments for Canada’s commitment to the G8-led Multilateral Debt Relief Initiative

Strategic Outcome: To create a fiscal, economic, social, and global advantage for Canada by providing appropriate policies and sound advice with respect to economic, social, and financial conditions and to the government’s overall agenda

Expected Results: Responsible administration of financial obligations under the Multilateral Debt Relief Initiative

| ($ thousands) | Forecast Spending 2006–07 |

Planned Spending 2007–08 |

Planned Spending 2008–09 |

Planned Spending 2009–10 |

| Program Activity: International Financial Organizations | ||||

| Grants | 45,605 | 51, 200 | 51,200 | 51,200 |

Planned Evaluations: Not applicable

Planned Audits: Audit of the Administrative Controls Over Subscription Payments and International Obligations

Name of Transfer Payment Program: Compensation to Canadian agencies or entities established by an Act of Parliament for reduction of debts of debtor countries

Start Date: 1991–92

End Date: Ongoing

Description: Compensate Export Development Canada (EDC) and the Canadian Wheat Board (CWB) for reduction of debts of debtor countries

Strategic Outcome: To create a fiscal, economic, social, and global advantage for Canada by providing appropriate policies and sound advice with respect to economic, social, and financial conditions and to the government’s overall agenda

Expected Results: Timely and accurate payments to the EDC and the CWB to compensate for debt relief to debtor countries

| ($ thousands) | Forecast Spending 2006–07 |

Planned Spending 2007–08 |

Planned Spending 2008–09 |

Planned Spending 2009–10 |

| Program Activity: International Financial Organizations | ||||

| Grants | 298,000 | 125,000 | 147,000 | 119,000 |

| Contributions | 55,000 | 45,000 | 21,000 | 20,000 |

| Total Payments | 353,000 | 170,000 | 168,000 | 139,000 |

Planned Evaluations: Not applicable

Planned Audits: Audit of the Administrative Controls Over Subscription Payments and International Obligations

Name of Transfer Payment Program: Statutory Funding—Payments to the International Development Association (IDA)

Start Date: 1960–61

End Date: Ongoing

Description: Encashment of demand notes to allow the IDA to disburse concessional financing for development projects and programs in the world’s poorest countries

Strategic Outcome: To create a fiscal, economic, social, and global advantage for Canada by providing appropriate policies and sound advice with respect to economic, social, and financial conditions and to the government’s overall agenda

Expected Results:

- Responsible administration of financial obligations to the IDA

- Results of IDA operations are detailed in the report on operations under the Breton Woods and Related Agreements Act that is tabled annually in Parliament

| ($ thousands) | Forecast Spending 2006–07* |

Planned Spending 2007–08 |

Planned Spending 2008–09 |

Planned Spending 2009–10 |

| Program Activity: International Financial Organizations | ||||

| Other Types of Transfer Payments | 318,270 | 318,270 | 318,280 | 318,280 |

| Total Program Activity | 720,275 | 539,470 | 537,480 | 508,480 |

Planned Evaluations: Not applicable

Planned Audits: Audit of the Administrative Controls Over Subscription Payments and International Obligations

* The 2006–07 forecast spending figure includes $3.4 million for payments to the International Monetary Fund’s Poverty Reduction and Growth Facility—Exogenous Shocks Facility Trust.

Name of Transfer Payment Program: Fiscal Equalization (Part I, Federal-Provincial Fiscal Arrangements Act)

Start Date: 1957

End Date: Ongoing

Description: Equalization payments are made to provincial governments based on a formula to enable them to provide reasonably comparable levels of public services at reasonably comparable levels of taxation. Equalization payments are unconditional. In 2006–07, eight provinces received payments under this program.

Strategic Outcome: To create a fiscal, economic, social, and global advantage for Canada by providing appropriate policies and sound advice with respect to economic, social, and financial conditions and to the government’s overall agenda

Expected Results: Financial support to Canadian provinces to assist them in providing public services

| ($ thousands) | Forecast Spending 2006–07 |

Planned Spending 2007–08 |

Planned Spending 2008–09 |

Planned Spending 2009–10 |

| Program Activity: Transfer Payments to Provinces and Territories | ||||

| Other Types of Transfer Payments | 11,535,600 | 11,676,353 | 12,085,025 | 12,508,001 |

Planned Evaluations: An evaluation of this transfer program is currently underway. This evaluation will take into account the June 2006 report of the expert panel that studied the program. Recent information about the panel is on the Department of Finance Canada website at http://www.fin.gc.ca/news05/05-074e.html.

Planned Audits: An audit of the program is not required at this time.

Name of Transfer Payment Program: Territorial Formula Financing (Part I.1, Federal-Provincial Fiscal Arrangements Act)

Start Date: 1985

End Date: Ongoing

Description: Transfer payments to territorial governments to support their budgetary revenues

Strategic Outcome: To create a fiscal, economic, social, and global advantage for Canada by providing appropriate policies and sound advice with respect to economic, social, and financial conditions and to the government’s overall agenda

Expected Results: Financial support for Canadian territories to assist them in providing public services

| ($ thousands) | Forecast Spending 2006–07 |

Planned Spending 2007–08 |

Planned Spending 2008–09 |

Planned Spending 2009–10 |

| Program Activity: Transfer Payments to Provinces and Territories | ||||

| Other Types of Transfer Payments | 2,071,864 | 2,142,450 | 2,217,436 | 2,295,046 |

Planned Evaluations: An evaluation of this transfer program is currently underway. This evaluation will take into account the June 2006 report of the expert panel that studied the program. Recent information about the panel is on the Department of Finance Canada website at http://www.fin.gc.ca/news05/05-074e.html.

Planned Audits: An audit of the program is not required at this time.

Name of Transfer Payment Program: Canada Health Transfer (Part V.1, Federal-Provincial Fiscal Arrangements Act)

Start Date: 2004

End Date: Ongoing

Description: The Canada Health Transfer (CHT) provides equal per capita support for health care through cash and tax transfers to provincial and territorial governments. The CHT supports the government’s commitment to maintain the national criteria and conditions of the Canada Health Act (comprehensiveness, universality, portability, accessibility, and public administration) and the prohibitions against user fees and extra-billing.

Strategic Outcome: To create a fiscal, economic, social, and global advantage for Canada by providing appropriate policies and sound advice with respect to economic, social, and financial conditions and to the government’s overall agenda

Expected Results: Financial support to Canadian provinces and territories to assist them in providing universally accessible health care services

| ($ thousands) | Forecast Spending 2006–07 |

Planned Spending 2007–08 |

Planned Spending 2008–09 |

Planned Spending 2009–10 |

| Program Activity: Transfer Payments to Provinces and Territories | ||||

| Other Types of Transfer Payments | 20,140,000 | 21,348,400 | 22,629,304 | 23,987,062 |

Planned Evaluations: There are no evaluations planned for this program.

Planned Audits: An audit of the program is not required at this time. An internal audit of the Canada Health and Social Transfer (CHST) was prepared in May 2002 and is available on the Department of Finance Canada website at http://www.fin.gc.ca/toce/2002/audit_transfers-e.html.

Name of Transfer Payment Program: Canada Social Transfer (Part V.1, Federal-Provincial Fiscal Arrangements Act)

Start Date: 2004

End Date: Ongoing

Description: The Canada Social Transfer (CST) provides equal per capita support through cash and tax transfers to provincial and territorial governments to assist them in financing post-secondary education, social assistance, and social services, including early childhood development and early learning, and child care services. The CST gives provinces and territories the flexibility to allocate payments among supported areas according to their own priorities and supports the government’s commitment to prohibit minimum residency requirements for social assistance.

Strategic Outcome: To create a fiscal, economic, social, and global advantage for Canada by providing appropriate policies and sound advice with respect to economic, social, and financial conditions and to the government’s overall agenda

Expected Results: Financial support for Canadian provinces and territories to assist them in providing post-secondary education, social assistance, and social services, including early childhood development and early learning, and child care

| ($ thousands) | Forecast Spending 2006–07 |

Planned Spending 2007–08 |

Planned Spending 2008–09 |

Planned Spending 2009–10 |

| Program Activity: Transfer Payments to Provinces and Territories | ||||

| Other Types of Transfer Payments | 8,500,000 | 8,800,000 | 8,800,000 | 8,800,000 |

Planned Evaluations: There are no evaluations planned for this program.

Planned Audits: An audit of the program is not required at this time. An internal audit of the Canada Health and Social Transfer (CHST) was prepared in May 2002 and is available on the Department of Finance Canada website at http://www.fin.gc.ca/toce/2002/audit_transfers-e.html.

Name of Transfer Payment Program: Statutory Subsidies (Constitution Act, 1867; Constitution Act, 1982; and other statutory authorities)

Start Date: 1867

End Date: Ongoing

Description: The statutory subsidies provide a source of funding to provinces in accordance with terms of entry into Confederation.

Strategic Outcome: To create a fiscal, economic, social, and global advantage for Canada by providing appropriate policies and sound advice with respect to economic, social, and financial conditions and to the government’s overall agenda

Expected Results: Financial support to provinces to assist them in providing public services

| ($ thousands) | Forecast Spending 2006–07 |

Planned Spending 2007–08 |

Planned Spending 2008–09 |

Planned Spending 2009–10 |

| Program Activity: Transfer Payments to Provinces and Territories | ||||

| Other Types of Transfer Payments | 32,000 | 32,000 | 32,000 | 32,000 |

Planned Evaluations: There are no evaluations planned for this program.

Planned Audits: An audit of the program is not required at this time.

Name of Transfer Payment Program: Youth Allowances Recovery (Federal-Provincial Revision Act, 1964)

Start Date: 1964

End Date: Ongoing

Description: The Youth Allowances Recovery is a recovery from the Province of Quebec for an additional tax point transfer (three points) above and beyond the Canada Health Transfer and Canada Social Transfer tax point transfer; in the 1960s, Quebec chose to use the federal government’s contracting-out arrangements for certain federal-provincial programs. Taken together, the Alternative Payments for Standing Programs and the Youth Allowances Recovery are known as the "Quebec Abatement."

Strategic Outcome: To create a fiscal, economic, social, and global advantage for Canada by providing appropriate policies and sound advice with respect to economic, social, and financial conditions and to the government’s overall agenda

Expected Results: Financial support for Quebec to assist that province in providing public services, universally accessible health care services, post-secondary education, and social assistance

| ($ thousands) | Forecast Spending 2006–07 |

Planned Spending 2007–08 |

Planned Spending 2008–09 |

Planned Spending 2009–10 |

| Program Activity: Transfer Payments to Provinces and Territories | ||||

| Other Types of Transfer Payments | -630,000 | -661,000 | -695,000 | -730,000 |

Planned Evaluations: There are no evaluations planned for this program.

Planned Audits: An audit of the program is not required at this time

Name of Transfer Payment Program: Alternative Payments for Standing Programs (Part VI, Federal-Provincial Fiscal Arrangements Act)

Start Date: 1977

End Date: Ongoing

Description: The Alternative Payments for Standing Programs are a recovery from the Province of Quebec for an additional tax point transfer (13.5 points) above and beyond the Canada Health Transfer and Canada Social Transfer tax point transfer; in the 1960s, Quebec chose to use the federal government’s contracting-out arrangements for certain federal-provincial programs. Taken together, the Alternative Payments for Standing Programs and the Youth Allowances Recovery are known as the "Quebec Abatement."

Strategic Outcome: To create a fiscal, economic, social, and global advantage for Canada by providing appropriate policies and sound advice with respect to economic, social, and financial conditions and to the government’s overall agenda

Expected Results: Financial support for Quebec to assist that province in providing public services, universally accessible health care services, post-secondary education, and social assistance

| ($ thousands) | Forecast Spending 2006–07 * |

Planned Spending 2007–08 |

Planned Spending 2008–09 |

Planned Spending 2009–10** |

| Program Activity: Transfer Payments to Provinces and Territories | ||||

| Other Types of Transfer Payments | -2,870,000 | -3,010,000 | -3,165,000 | -3,325,000 |

| Total Program Activity: | 38,825,499 | 40,328,203 | 41,903,765 | 43,817,109 |

| Planned Evaluations: There are no evaluations planned for this program. | ||||

| Planned Audits: An audit of the program is not required at this time. | ||||

| TOTAL TPPs | 39,545,774 | 40,867,673 | 42,441,245 | 44,325,589 |

|

* The total program activity figure for 2006-07 includes $46 million for payments to territorial governments, other than those provided under Territorial Formula Financing (TFF), to support their budgetary revenues. ** The program activity figure for 2009-10 includes $250 million for the Wait Times Reduction Transfer. |

||||

Table 9: Horizontal Initiative

Over the next three years, the Department of Finance Canada will be involved in the following horizontal initiative as the lead department:

2007–08 to 2009–10

1. National Initiative to Combat Money Laundering

For further information on the above-mentioned horizontal initiatives, see http://www.tbs-sct.gc.ca/est-pre/estime.asp.

Horizontal Initiative: Canada’s Anti-Money Laundering and Anti-Terrorist Financing Regime—formerly the National Initiative to Combat Money Laundering (NICML)

Lead Department: Department of Finance Canada

Start Date: June 2000

End Date: 2009–10

Total Funding Allocated: $429,006 (thousands)

Description:

The National Initiative to Combat Money Laundering (NICML) was formally established in 2000 as part of the government’s ongoing effort to combat money laundering in Canada. Legislation adopted that year, the Proceeds of Crime (Money Laundering) Act (PCMLA), created a mandatory reporting system for suspicious financial transactions, large cross-border currency transfers, and certain prescribed transactions. The legislation also established the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) to collect and analyze these financial transaction reports and to disclose pertinent information to law enforcement and intelligence agencies. In December 2001, the PCMLA was amended to include measures to fight terrorist financing activities and renamed the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA).

The NICML was expanded and is now known as Canada’s Anti-Money Laundering and Anti-Terrorist Financing Regime. In December 2006, Bill C-25 amended the PCMLTFA to ensure Canada’s legislation remains consistent with international anti-money laundering and anti-terrorist financing standards as set out by the Financial Action Task Force (FATF) and is responsive to areas of domestic risk. Amendments include enhanced client identification requirements, the creation of a registration regime for money services businesses, and the establishment of an administrative and monetary penalties regime to deal with lesser infractions of the Act.

Shared outcome(s):

To detect and deter money laundering and the financing of terrorist activities, and to facilitate the investigation and prosecution of money laundering and terrorist financing offences.

Governance structure(s):

Canada’s Anti-Money Laundering and Anti-Terrorist Financing Regime is a horizontal initiative comprised of both funded and non-funded partners. The funded partners include the Department of Finance Canada, the Department of Justice Canada, the Public Prosecution Service of Canada, FINTRAC, the Canada Border Services Agency (CBSA)—Immigration and Customs, the Canada Revenue Agency (CRA), and the Royal Canadian Mounted Police (RCMP); non-funded partners include Public Safety and Emergency Preparedness Canada (PSEPC), the Office of the Superintendent of Financial Institutions (OSFI), and the Canadian Security Intelligence Service (CSIS). An interdepartmental ADM-level group and working group, consisting of all partners and led by the Department of Finance Canada, has been established to direct and coordinate the government’s efforts to combat money laundering and terrorist financing activities.

| Federal Partners Involved in Each Program | Name of Program | Total Allocation ($ thousands) |

Planned Spending for 2007–08 ($ thousands) |

Expected Results for 2007–08 |

|---|---|---|---|---|

| Department of Finance Canada | Canada’s Anti-Money Laundering and Anti-Terrorist Financing Regime | 3,000 | 300 |

1. Consultations with public and private sector stakeholders to refine regulatory proposals.

2. Published regulations pursuant to the amended PCMLTFA. 3. Finalizing of the FATF mutual evaluation of the anti-money laundering and anti-terrorist financing regime. 4. Effective oversight of Canada’s Anti-Money Laundering and Anti-Terrorist Financing Regime. 5. Support for the 2006–07 Canadian presidency of the FATF. |

| Department of Justice Canada | Canada’s Anti-Money Laundering and Anti-Terrorist Financing Regime | 9,300 | 100 | The Criminal Division of the Department of Justice Canada plays a significant role in the regime. For 2007–08, it is anticipated that the Criminal Division will use the resources it receives to carry out work related to the FATF, including attending FATF-related international meetings, which will total five (5) over the relevant period. Attendance at the meetings is of particular importance during 2007, as Canada’s Anti-Money Laundering and Anti-Terrorist Financing Regime is being evaluated this year against the FATF’s 40+9 recommendations and our presence is necessary to ensure proper discussions of the Canadian evaluation report. In addition, the Criminal Division will be the relevant authority to respond to all legal issues that develop out of that evaluation. Resources will also be allocated to ensure the Criminal Division’s continued involvement in policy development relating to money laundering and terrorist financing. Finally, the Human Rights Law Section will receive money to deal with any ancillary constitutional issue raised during the prosecutions. |

| Public Prosecution Service of Canada | Canada’s Anti-Money Laundering and Anti-Terrorist Financing Regime | 6,900 | 2,300 | The Public Prosecution Service of Canada (PPSC) plays a significant role in the regime. For 2007–08, it is anticipated that information provided to law enforcement by FINTRAC will result in more prosecutorial legal advice being provided to law enforcement. It will also result in additional charges being laid for money laundering and terrorist financing offences and thus result in an increased workload for prosecutors. The PPSC also has responsibilities related to the PCMLTFA. The planned work includes applications for Production Orders, increases in border seizure and forfeiture work associated with suspected proceeds of crime, and prosecutions related to offences created within the Act. In addition, resources will be used to provide training to law enforcement personnel and prosecutors and for the development and coordination of policy as it relates to money laundering and terrorist financing. Finally, PPSC resources will carry out work related to the FATF, including attending the FATF international meeting. |

| FINTRAC | Canada’s Anti-Money Laundering and Anti-Terrorist Financing Regime | 266,591 | 38,595 |

Technology-driven financial intelligence analysis and case disclosures that are widely used by law enforcement and intelligence agencies with a program that fosters compliance by the reporting entities.

Implementation of amendments contained in Bill C-25. |

| CBSA | Canada’s Anti-Money Laundering and Anti-Terrorist Financing Regime | 55,952 | 7,525,826 | The CBSA is responsible for administering Part 2 of the PCMLTFA, "Reporting of Currency and Monetary Instruments." The Cross-Border Currency Reporting (CBCR) Program requires that travellers report the importation and exportation of currency and monetary instruments equal to or greater than CAD$10,000. Part 2 also provides for the enforcement element of the CBCR Program, which includes conducting searches, questioning individuals, and seizing non-reported or falsely reported currency and suspected proceeds of crime. |

| CRA | Canada’s Anti-Money Laundering and Anti-Terrorist Financing Regime | 8,800 | 2,200 | Projected number of audits is 105, with a projected federal tax recovery of $8,956,905. |

| RCMP (Money Laundering Units) | Canada’s Anti-Money Laundering and Anti-Terrorist Financing Regime | 57,103 | 7,978 |

Enhanced national and international opportunities for the detection and investigation of money laundering activities.

Development of FINTRAC disclosures, as well as other intelligence, to a point where resources from Integrated Proceeds of Crime Units or elsewhere in the RCMP could then be directed towards investigations in an effort to increase seizures. Increased resource level in Canada’s three major urban centres (Vancouver, Toronto, and Montreal) to help build up the investigative capacity in those centres to conduct investigations on leads related to Canada’s anti-money laundering regime. |

| RCMP (Anti-Terrorist Financing Team) | Canada’s Anti-Money Laundering and Anti-Terrorist Financing Regime | 21,360 | 5,340 | Through the gathering and analysis of financial intelligence, the Anti-Terrorist Financing Team will focus on converting that intelligence into proactive investigations, thus enhancing our ability to detect and deter terrorist financing activities. |

| Total | 429,006 | 52,899 | ||

Results to be achieved by non-federal partners (if applicable): Not applicable

Contact:

Lynn Hemmings, Chief

Financial Crimes Section

613-992-0553

Approved by:

Serge Dupont, Assistant Deputy Minister

Financial Sector Policy Branch

613-995-5798

Date Approved:

February 15, 2007

Canada’s Anti-Money Laundering and Anti-Terrorist Financing Regime, Allocation by Year ($ thousands)

| Dept./Agency | 2000–01 | 2001–02 | 2002–03 | 2003–04 | 2004–05 | 2005–06 | 2006–07 | 2007–08 | 2008–09 | 2009–10 | Total |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Department of Finance Canada | 300 | 300 | 300 | 300 | 300 | 300 | 300 | 300 | 300 | 300 | 3,000 |

| Department of Justice Canada | 600 | 1,200 | 1,200 | 1,200 | 1,200 | 1,200 | 2,400 | 100 | 100 | 100 | 9,300 |

| Public Prosecution Service of Canada | 2,300 | 2,300 | 2,300 | 6,900 | |||||||

| FINTRAC | 17,985 | 25,468 | 26,820 | 22,081 | 21,406 | 22,562 | 27,387 | 38,595 | 32,634 | 31,654 | 266,591 |

| CBSA1 | 4,298 | 4,298 | 4,298 | 4,298 | 4,298 | 4,298 | 7,589 | 7,525 | 7,525 | 7,525 | 55,952 |

| CRA | 2,200 | 2,200 | 2,200 | 2,200 | 8,800 | ||||||

| RCMP (Anti-Terrorist Financing Team) | 5,340 | 5,340 | 5,340 | 5,340 | 21,360 | ||||||

| RCMP (Anti-Money Laundering Units) | 2,600 | 4,900 | 4,900 | 4,900 | 4,900 | 4,900 | 7,683 | 7,978 | 7,171 | 7,171 | 57,103 |

| Total Allocation | 25,783 | 36,166 | 37,518 | 32,779 | 32,104 | 33,260 | 52,899 | 64,338 | 57,570 | 56,590 | 429,006 |

| 1 Funding from 2000 to 2006 was for the former Canada Customs and Revenue Agency, and Citizenship and Immigration Canada. | |||||||||||

Table 10: Sustainable Development Strategy

"Sustainable development" is defined as development that meets the needs of the present without compromising the ability of future generations to meet their own needs, and it is a key commitment of all federal departments. In 1995, the Auditor General Act was amended to require each department to prepare and update a sustainable development strategy (SDS). These strategies are tabled in the House of Commons, and the Commissioner of the Environment and Sustainable Development monitors the progress toward their implementation.

An SDS is intended to outline a department's goals and action plans for integrating sustainable development into its policies, programs, and operations over three-year planning periods.

The Department of Finance Canada's Sustainable Development Strategy (SDS) for the period of 2007–09 is the department's third update of its original SDS tabled in Parliament in December 1997. The 2007–09 SDS builds upon the foundation of previous strategies, including key achievements in debt reduction, evaluating environmental tax proposals, strategic environmental assessment, and green stewardship. The Department's 1998–2000, 2001–03, 2004–06, and 2007–09 strategies can be found at http://www.fin.gc.ca/purl/susdev-e.html.

The Department's vision for sustainable development is "Economic and fiscal policy frameworks and decisions that promote equity and enhance the economic, social, and environmental well-being of current and future generations." It highlights the long-term ideal that the Department will strive to achieve. For the 2007–09 SDS, the Department has set out five long-term goals that focus on key areas where it can contribute, within its mandate, to sustainable development: (1) fiscal sustainability and a high standard of living for future generations; (2) strong social foundations; (3) integration of sustainable development considerations into policy making; (4) integration of sustainable development considerations into the economy; and (5) demonstration of the Department's commitment to sustainable development in operations.

Under each of these five goals, the Department's action plan for sustainable development sets out a number of objectives and targeted actions over the planning period. In undertaking these actions over the next three years, the Department recognizes that fully achieving sustainable development will take time and continued effort. This requires a long-term strategic approach, while continuing to commit to short-term actions that make progress toward the departmental vision for sustainable development.

A detailed outline of the Department's objectives, actions, and planned results in its SDS in 2007–08 is available at http://www.fin.gc.ca/purl/susdev-e.html.

Table 11: Internal Audits and Evaluations

Internal audits will be undertaken as required under a three-year risk-based audit plan being developed and that is to be approved by the Internal Audit and Evaluation Committee in early 2007–08.

Development of a risk-based evaluation plan is planned for 2007–08 that will identify evaluation requirements for 2007–08, 2008–09, and 2009–10.

|

1. Name of Internal Audit / Evaluation |

2. Audit Type / Evaluation Type |

3. Status |

4. Expected Completion Date |

5. Electronic Link to Report |

|

Audit of Administrative Controls over the Foreign Debt Portfolio and Foreign Currency Asset Reserves |

Assurance |

Completed |

||

|

6. Electronic Link to Internal Audit and Evaluation Plan: Not Applicable |

||||