Common menu bar links

Breadcrumb Trail

ARCHIVED - RPP 2007-2008

Canadian Radio-television and Telecommunications Commission

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

SECTION III:

Supplementary Information

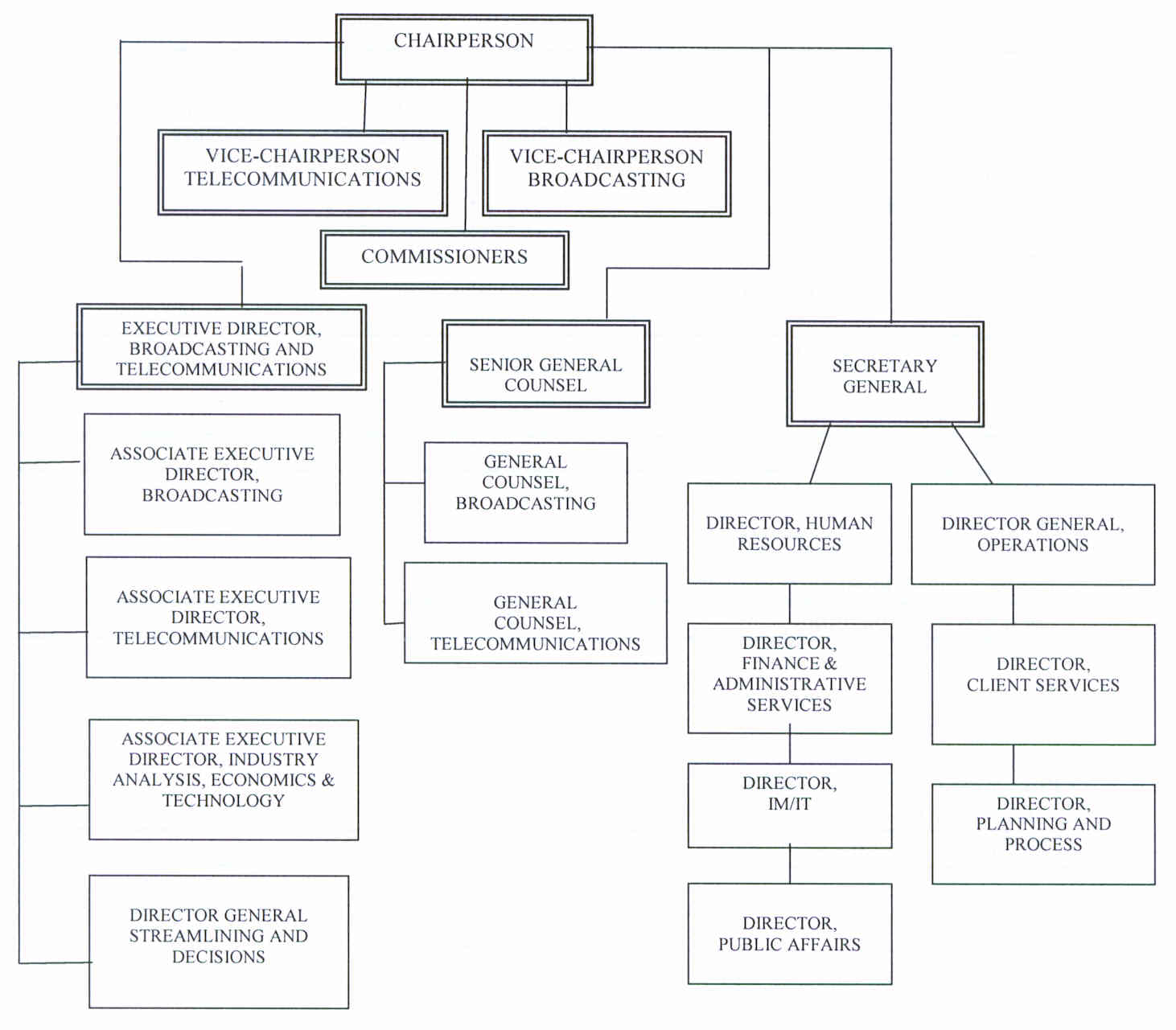

CRTC Organization Chart

Table 1: CRTC Planned Spending and Full-Time Equivalents

| ($ millions) |

Forecast Spending 2006-2007 |

Planned Spending 2007-2008 |

Planned Spending 2008-2009 |

Planned Spending 2009-2010 |

| Regulation and Supervision of the Canadian Broadcasting Industry |

23.4 |

23.5 |

23.5 |

23.5 |

| Regulation and Monitoring of the Canadian Telecommunications Industry |

22.2 |

22.3 |

22.3 |

22.3 |

| Budgetary Main Estimates (gross) |

45.6 |

45.8 |

45.8 |

45.8 |

| Less: Respendable Revenue |

39.8 |

40.1 |

40.1 |

40.1 |

| Total Main Estimates |

5.8 |

5.7 |

5.7 |

5.7 |

| Adjustment: | ||||

| Supplementary Estimates | ||||

| Operating budget carry forward |

1.9 |

- |

- |

- |

| Total Planned Spending |

7.7 |

5.7 |

5.7 |

5.7 |

| Planned Spending |

7.7 |

5.7 |

5.7 |

5.7 |

| Less: Non-Respendable revenue |

135.5 |

14.4 |

11.9 |

11.9 |

| Plus: Cost of services received without charge |

15.9 |

15.7 |

15.7 |

15.7 |

| Net Cost of Program |

(111.9) |

7.0 |

9.5 |

9.5 |

| Full Time Equivalents |

422 |

422 |

422 |

422 |

Table 2: Resources by Program Activity

|

2007-2008 |

||||||||||

|

Budgetary ($ millions) |

Non-Budgetary |

Total Main Estimates |

Adjustments (planned spending not in Main Estimates) |

Total Planned Spending |

||||||

|

Program Activity |

Operating |

Capital |

Grants and Contributions |

Gross |

Revenue |

Net |

Loans, Investments and Advances |

|||

| Regulation and Supervision of the Canadian Broadcasting Industry |

23.5 |

- |

- |

23.5 |

20.6 |

2.9 |

- |

2.9 |

- |

2.9 |

| Regulation and Monitoring of the Canadian Telecommunications Industry |

22.3 |

- |

- |

22.3 |

19.5 |

2.8 |

- |

2.8 |

- |

2.8 |

| Total |

45.8 |

- |

- |

45.8 |

40.1 |

5.7 |

- |

5.7 |

- |

5.7 |

Table 3: Voted and Statutory Items

|

($ millions) |

|||

|

2007-2008 |

2006-2007 |

||

|

Vote or Statutory Item |

Truncated Vote or Statutory Wording |

Current Main Estimates |

Previous Main Estimates |

|

40 |

CRTC Program Expenditures |

- |

- |

|

(S) |

Contributions to Employee Benefit Plans |

5.7 |

5.8 |

| Total |

5.7 |

5.8 |

|

Table 4: Services Received Without Charge

|

2007-2008 |

|||

| ($ millions) |

Regulation and Supervision of the Canadian Broadcasting Industry |

Regulation and Monitoring of the Canadian Telecommuni-cations Industry |

Total |

| Accommodation provided by Public Works and Government Services Canada (PWGSC) |

1.4 |

1.4 |

2.8 |

| Contributions covering employer's share of employees' insurance premiums and expenditures paid by TBS |

1.5 |

1.4 |

2.9 |

| Worker's compensation coverage provided by Human Resources and Social Development Canada (Note) |

- |

- |

- |

| Regulation of Broadcasting Spectrum – Industry Canada (IC) |

10.0 |

- |

10.0 |

| Total 2006-2007: Services received without charge |

12.9 |

2.8 |

15.7 |

Note: Amount is less than $0.1M; therefore, no amount is reflected in the table.

Table 5: Sources of Respendable and Non-Respendable Revenue

Respendable Revenue

| ($ millions) |

Forecast Revenue 2006-2007 |

Planned Revenue 2007-2008 |

Planned Revenue 2008-2009 |

Planned Revenue 2009-2010 |

| Regulation and Supervision of the Canadian Broadcasting Industry Broadcasting Licence Fees – Part I |

20.4 |

20.6 |

20.6 |

20.6 |

| Regulation and Monitoring of the Canadian Telecommunications Industry Telecommunications Fees |

19.4 |

19.5 |

19.5 |

19.5 |

| Total Respendable Revenue |

39.8 |

40.1 |

40.1 |

40.1 |

Non- Respendable Revenue

| ($ millions) |

Forecast Revenue 2006-2007 |

Planned Revenue 2007-2008 |

Planned Revenue 2008-2009 |

Planned Revenue 2009-2010 |

|

Regulation and Supervision of the Canadian Broadcasting Industry

Broadcasting Licence Fees – Part I |

6.5 |

7.4 |

6.0 |

6.0 |

|

128.3 |

7.4 |

6.0 |

6.0 |

|

| Regulation and Monitoring of the Canadian Telecommunications Industry Telecommunications Fees |

7.2 |

7.0 |

5.9 |

5.9 |

| Total Non-Respendable Revenue[2 ] |

135.5 |

14.4 |

11.9 |

11.9 |

| Total Respendable and Non-Respendable Revenue | 175.3 | 54.5 | 52.0 | 52.0 |

Table 6: CRTC Fees

| Name of Fee | Fee Type | Fee Setting Authority |

Reason for Fee Amendment |

Effective date of planned change to take effect |

Planned Consultation & Review Process (Note 2 & 3) |

| Telecommunications Fees (Note 1) | Regulatory Service(R) |

Telecommunications Act (Section 68)

Telecommunications Fee Regulations, 1995 |

Part VII application to revise Telecom Fee Regs (Note 4) |

To be determined |

Full public consultation. See section "Explanation of Revenue" for further information. Telecom Decision CRTC 2006-71 |

| Broadcasting Licence Fees (Note 1) |

Regulatory Service (R)

Right and Privilege (R&P) |

Part I licence fee Broadcasting Act (Section 11) Broadcasting Licence Fee Regulations, 1997

Part II licence fee Broadcasting Act (Section 11) Broadcasting Licence Fee Regulations, 1997 |

Note 5 |

-

Note 5 |

-

Note 5 |

| Note 1 | The Broadcasting Licence Fee Regulations, 1997 and the Telecommunications Fees Regulations, 1995 can be found on the CRTC website at: http://www.crtc.gc.ca/eng/LEGAL/LICENCE.HTM (i.e. broadcasting) and http://www.crtc.gc.ca/eng/LEGAL/TFEES.HTM (i.e. telecommunications) |

| Note 2 | Full public consultations occur with each change to the telecommunications fee regulations or the broadcasting licence fee regulations. |

| Note 3 |

The CRTC's dispute resolution process regarding the assessment of broadcasting licence fees and telecommunications fees is summarized as follows:

|

| Note 4 | Aliant Telecom Inc. and Bell Canada (8657-A53-200606692 ) filed an application dated 26 May 2006, pursuant to Part VII of the CRTC Telecommunications Rules of Procedure, requesting that the CRTC revise the current regulations regarding telecommunications fees and, in particular, the basis on which telecommunications fees are determined and levied. In Telecom Decision CRTC 2006-71, 6 November 2006, the CRTC stated that there is merit to initiating changes to the regulations such that telecommunications service providers, including those not required to file tariffs, would pay fees using the same approach that applies under the existing contribution regime. |

| Note 5 | A Federal Court decision rendered on 14 December, 2006 declared Part II fees to be a tax. See section ''Explanation of revenue'' for further information. |

Explanation of Revenues

The CRTC collects fees under the authority of the Broadcasting Act and Telecommunications Act and the regulations made pursuant to these acts, namely the Broadcasting Licence Fee Regulations, 1997 and the Telecommunications Fee Regulations, 1995. For fiscal year 2007-2008:

- CRTC Part I broadcasting licence fees are estimated at $28.0 million ($20.6 million respendable[3] and $7.4 million in non-respendable[4] revenue). The broadcasting non-respendable revenue also includes a "true-up" adjustment[5] of $1.6 million; and

- CRTC telecommunications fees are estimated at $26.5 million ($19.5 million respendable and $7.0 million in non-respendable revenue). The telecommunications non-respendable revenue also includes an estimated "true-up" adjustment of $1.4 million. The actual amount of the true-up will be calculated at the completion of the fiscal year 2006-2007 and reflected in the invoices sent to telecommunications carriers as part of the fiscal year 2007-2008 telecommunications billing.

Broadcasting Licence Fees

Section 11 of the Broadcasting Act empowers the CRTC to make regulations respecting licence fees. The Broadcasting Licence Fee Regulations, 1997 apply to all licensees other than those classes of undertakings specifically exempted under section 2 of the regulations. Every licensee subject to the regulations is required to pay a Part I and a Part II licence fee to the CRTC annually.

For 2006–2007, the CRTC estimates a total of $148.7 million in revenue from broadcasting undertakings ($26.9 million in Part I licence fees – including "true-up" and adjustments - and $121.8 million in Part II licence fees).

The Part I licence fee is based on the broadcasting regulatory costs incurred each year by the CRTC and other federal departments or agencies, excluding spectrum management costs, and is equal to the aggregate of:

- the costs of the CRTC's broadcasting activity;

- the share of the costs of the CRTC's administrative activities that is attributable to its broadcasting activity; and

- the other costs included in the net cost of the CRTC's program attributable to its broadcasting activities, excluding the costs of regulating the broadcasting spectrum.

The estimated total broadcasting regulatory costs of the CRTC are set out in the CRTC's Expenditure Plan published in Part III of the Estimates of the Government of Canada (i.e., Part III Report on Plans and Priorities). There is an annual adjustment ("true-up") amount to the Part I fee to adjust estimated costs to actual expenditures. Any excess fees or shortfalls are credited or charged to the licensee in a following year's invoice.

The Part II licence fee is calculated at 1.365 percent of a licensee's gross revenue derived from broadcasting activities in excess of an applicable exemption limit. The CRTC collects the Part II licence fees on behalf of the government, with all revenues collected being deposited to the Government of Canada's Consolidated Revenue Fund. The rationale for assessing this fee is three-fold:

- to earn a fair return for the Canadian public for access to, or exploitation of, a publicly owned or controlled resource (i.e. broadcasters' use of the broadcasting spectrum);

- to recover Industry Canada costs associated with the management of the broadcasting spectrum; and

- to represent the privilege of holding a broadcasting licence for commercial benefit.

Part II Licence Fee and Legal Proceedings

Several legal proceedings have been filed in the Federal Court of Canada by broadcasters[6] challenging the legality of the Part II licence fee. These claims also seek the return of fees paid pursuant to section 11 of the Broadcasting Licence Fee Regulations, 1997 (the Regulations) from 1998 to 2006, plus interest and costs.

On 14 December 2006, a decision was rendered by the Federal Court declaring that

- Part II licence fees prescribed by section 11 of the Regulations are a tax;

- Section 11 of the Regulations is ultra vires the authority conferred on the CRTC by Section 11 of the Broadcasting Act to establish a schedule of fees; and

- The plaintiffs are not entitled to the return of monies paid pursuant to section 11 of the Regulations for the years described in the plaintiffs' pleading.

The Federal Court suspended the fees prescribed by section 11 of the Regulations for a maximum of nine months to allow the appropriate branch of the government to react and to put in effect this judgement.

In January 2007, the plaintiffs filed Notices of Appeal regarding the portion of the decision of the Federal Court refusing the request for repayment of Part II licence fees, and the Crown filed Notices of Cross-Appeal regarding the issue of fee versus tax.

Telecommunications Fees

Section 68 of the Telecommunications Act sets out the authority for making the Telecommunications Fees Regulations. Each company that files tariffs must pay fees based on its operating revenue, as a percentage of the revenue of all the carriers that file tariffs. For 2006-2007, the CRTC assessed $26.6 million in telecommunications fees including "true-up" and adjustments.

The annual fees the CRTC collects is equal to the aggregate of:

- the cost of the CRTC's telecommunications activity;

- the share of the costs of the administrative activities that is attributable to its telecommunications activity; and

- the other costs included in the net cost of the CRTC's program attributable to its telecommunications activity.

The estimated total telecommunications regulatory costs of the CRTC are set out in the CRTC's Expenditure Plan published in Part III of the Estimates of the Government of Canada (i.e. Part III - Report on Plans and Priorities). There is an annual adjustment ("true-up") amount to the telecommunications fees to adjust estimated costs to actual expenditures. Any excess fees or shortfalls are credited or charged to the carriers in a following year's invoice.

Revision of the Telecommunications Fees Regulations

In Part VII application to revise the Telecommunications Fees Regulations, 1995, Telecom Decision CRTC 2006-71, 6 November 2006, the CRTC addressed a request by Aliant Telecom Inc. and Bell Canada for revisions to the Telecommunications Fees Regulations 1995 (the Fees Regulations). The CRTC considered there is merit to initiating changes to the Fees Regulations, with the share of fees paid by each telecommunications service provider being calculated using the approach that is used under the existing contribution regime for subsidizing local residential service in high-cost serving areas. This approach would exempt the telecommunications service providers with Canadian telecommunications services revenues below $10 million.

Changes to the Fees Regulations require Treasury Board approval and, as such, will require the initiation of government inter-departmental deliberations. The CRTC intends to commence the necessary process to draft wording changes to the Fees Regulations. The CRTC notes that the proposed regulations must be published in the Canada Gazette at least 60 days before their proposed effective date, and interested parties will be given opportunity to comment on the proposed regulations.