Common menu bar links

Breadcrumb Trail

ARCHIVED - RPP 2006-2007

Industry Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Appendix

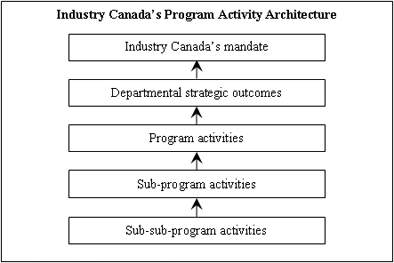

This appendix provides information on each of the sub-program and sub-sub-program activities identified in Industry Canada's Program Activity Architecture. Activities are listed by the program activity and strategic outcome to which they contribute. Information on these program activities and the departmental strategic outcomes is provided in sections 1 and 2 of this document. By working to achieve the expected results for these activities, Industry Canada makes progress toward achieving results at the program activity and strategic outcome levels, and therefore toward fulfilling its mandate. The expected results and indicators represent a preliminary attempt at demonstrating how Industry Canada will measure its performance.

| Strategic Outcome | |

| A fair, efficient and competitive marketplace | |

| Program Activity: Policy Sector — Marketplace | |

| Sub-Program Activity: Marketplace Framework Policy Branch | |

| Development of legislative and/or regulatory policies pertaining to corporate insolvency and intellectual property to ensure that the marketplace framework laws are responsive to market needs | |

| Expected Result | Performance Indicators |

| Development of policy to support legislative and regulatory initiatives | Reports and consultation papers published |

| Sub-Program Activity: Strategic Policy Branch | |

| Development of strategic policy frameworks for the marketplace | |

| Expected Result | Performance Indicators |

| Integration of departmental and governmental objectives into the development of marketplace policies | Number of unique marketplace items reviewed by the Director General Policy Committee (DGPC) |

| Sub-Program Activity: Microeconomic Policy Analysis Branch (MEPA) | |

| Microeconomic analysis in support of marketplace policy development | |

| Expected Result | Performance Indicators |

| High-quality microeconomic research and analysis of significant policy issues as input to policy development |

Number of:

|

| Sub-Program Activity: Small Business Policy Branch | |

| Research, analysis and action on regulatory compliance issues affecting SMEs | |

| Expected Result | Performance Indicators |

| Immediate: | Immediate: |

| Established benchmark for tracking progress in paperwork burden reduction | Established measure for the dollar cost of paperwork burden for small and medium-sized businesses by employment size of firm |

| Identification of practical solutions for implementation to reduce paperwork burden for small business | Dedicated resources to implement identified paperwork burden reduction solutions |

| Long-term: | Long-term: |

| Reductions in the cost of regulatory compliance facing small businesses | Dollar cost of paperwork burden for small and medium-sized businesses and the number of businesses affected by implemented paperwork burden reduction solutions |

| Sub-Program Activity: International and Intergovernmental Affairs | |

| Intergovernmental negotiation to reduce or eliminate barriers to the free movement of persons, goods, services and investments within Canada and to establish an open, efficient and stable domestic market | |

| Expected Result | Performance Indicators |

| Engaging with the provinces/territories to remove internal trade barriers | Results of annual ministerial meeting and number of meetings of federal/provincial/territorial officials |

| Sub-Program Activity: Regional Operations — Spectrum | |

| Compliance with spectrum regulations through licensing and enforcement | |

| Expected Result | Performance Indicators |

| Timely and effective assignment of the radio frequency spectrum | Meet national licensing service standards |

| Client satisfaction | |

| Compliance with legislation, regulation and conditions of licence | Percentage of stations operating in compliance with their authorized parameters |

| Sub-Program Activity: Measurement Canada | |

| Integrity and accuracy of measurement in Canada | |

| Expected Result | Performance Indicators |

| Integrity and accuracy of measurement in Canada | Year-over-year growth in number of service providers authorized by Measurement Canada |

| Year-over-year growth in the proportion of measurement system inspections performed by authorized service providers | |

| Sub-Program Activity: Office of the Superintendent of Bankruptcy Canada | |

| Integrity of the insolvency system through supervision of the administration of all estates to which the Bankruptcy and Insolvency Act applies | |

| Expected Result | Performance Indicators |

| The integrity of the bankruptcy and insolvency system is protected | Level of trustee compliance |

| Efficiency of the insolvency process | Percentage of consumer bankruptcies and proposals filed electronically |

| Percentage of trustees using the e-filing system | |

| Sub-Program Activity: Corporations Canada | |

| Administration of corporate laws and related acts, and duties of the Office of the Registrar General of Canada | |

| Expected Result | Performance Indicators |

| Improved compliance with corporate laws and regulations | Percentage of corporations that comply with statutory requirements |

| Improved ease of use and timeliness of access to incorporation services and information | Level of Corporations Canada's service standards achieved |

| High level of key services delivered electronically | Percentage of transactions completed online for key services |

| Improved and faster turnaround time for name search reports to business community and federal and provincial/territorial partners and stakeholders | Service standards are met |

| Sub-Program Activity: Spectrum/Telecom Program | |

| Facilitation of the development and use of world-class information and telecommunications technologies and services, while maintaining and promoting a fair, efficient and competitive communications marketplace | |

| Expected Result | Performance Indicators |

| Canadian interests and requirements pertaining to radiocommunications and telecommunications are reflected in international agreements and standards | Degree of client satisfaction with the way Canadian interests and requirements are reflected in international agreements and standards |

| Policies, regulations, standards and procedures are in place to enable the introduction of new radiocommunications/telecommunications technologies and services in the Canadian marketplace | Degree of client satisfaction in the manner with which new radiocommunications/telecommunications technologies and services are introduced in the Canadian marketplace |

| Canadians have access to a reliable ICT infrastructure during times of emergency | Percentage of mitigation communication systems in place and operational (wireless priority service / priority access dialing) |

| Percentage of population covered by Public Alerting System | |

| Sub-Program Activity: Electronic Commerce Branch | |

| Development of regulations and policies to promote e-business development and growth in Canada and strategies to encourage e-business adoption and use among Canadian businesses through analysis and measurement | |

| Expected Result | Performance Indicators |

| Increased awareness and use of e-commerce and e-business tools by Canadian industry | Assessment of Canada's e-business and e-commerce performance through surveys and formal economic analysis and reports |

| Up-to-date policies, legislation and regulations, enabling the development and growth of Canadian industries in e-business/e-economy, both domestically and abroad | New or updated legislation, policies, regulations shaping the Canadian e-economy and supporting the development of international frameworks consistent with Canadian interests |

| Sub-Program Activity: Consumer Policy | |

| Policy development, intergovernmental collaboration and the development of non-regulatory instruments for consumer protection | |

| Expected Result | Performance Indicators |

| Strengthened consumer research | Consumer policy research projects developed with the active engagement of the OCA |

| Strengthened intergovernmental collaboration | Intergovernmental collaborative projects developed with the active engagement of the OCA |

| Developed or strengthened non-regulatory instruments | Codes, guides, guidelines, standards and other non-regulatory instruments |

| Indications of usage of such non-regulatory instruments (where available) | |

| Sub-Program Activity: Consumer Information and Coordination | |

| Dissemination of consumer information products and services, and strengthened capacity building for the consumer voluntary sector | |

| Expected Result | Performance Indicators |

| Improved access to consumer information provided by government | Take-up of OCA online consumer information products and services |

| Client satisfaction | |

| Improved capacity of consumer groups | Research project proposals funded under the Contributions Program for Non-Profit Consumer and Voluntary Organizations, and project report distribution (where available) |

| Number of development project proposals funded under the Contributions Program for Non-Profit Consumer and Voluntary Organizations, and project follow-up (where available) | |

| Sub-Program Activity: Enforcement With Respect to Competition | |

| Expected Result | Performance Indicators |

| Marketplace awareness of the enforcement activities of the Competition Bureau | Extent to which target groups adjust behaviours based on their awareness and understanding of the enforcement activities of the Bureau |

| Companies cease their anti-competitive conduct following enforcement interventions | Extent to which companies cease their anti-competitive conduct |

| Sub-Program Activity: Framework Policy and Advocacy With Respect to Competition | |

| Expected Result | Performance Indicators |

| Awareness of competition principles by government policy-makers and stakeholders | Extent to which target groups are aware of, understand and consider competition principles when proposing changes to regulation and legislation |

| A modern policy framework | Extent to which framework policy responds to evolving technology and business arrangements, regulatory reform, increasing globalization and changing economic and social conditions |

| Sub-Program Activity: Services With Respect to Competition | |

| Expected Result | Performance Indicators |

| Provide businesses and consumers with quality, timely and efficient services | Extent to which service standards for the Competition Bureau services are respected |

| No sub-program activities or sub-sub-program activities have been identified. Therefore, the lowest reporting level is the program activity level. |

| Strategic Outcome | |

| An innovative economy | |

| Program Activity: Policy Sector — S&T and Innovation | |

| Sub-Program Activity: Advisory Council on Science and Technology (ACST) Secretariat | |

| Provision of secretariat services to the Advisory Council on Science and Technology | |

| Expected Result | Performance Indicators |

| Provide the government's Advisory Council on Science and Technology with quality research and support services | Number of recommendations made to the Minister of Industry and to the Prime Minister on issues related to science, technology, innovation and commercialization policies |

| Number of ACST meetings and consultation events (round tables, meetings, focus groups) | |

| Number of web-based requests for reports and background papers | |

| Sub-Program Activity: Strategic Policy Branch | |

| Development of strategic policy frameworks to improve Canada's science and technology, and commercialization environment | |

| Expected Result | Performance Indicators |

| Integration of departmental and governmental objectives into the development of innovation policies | Number of unique innovation items reviewed by the Director General Policy Committee (DGPC) |

| Sub-Program Activity: Microeconomic Policy Analysis Branch (MEPA) | |

| Microeconomic analysis in support of science and technology policy development | |

| Expected Result | Performance Indicators |

| High quality microeconomic research and analysis on significant policy issues as input to policy development |

Number of:

|

| Sub-Program Activity: Innovation Policy Branch | |

| Development of science, technology and innovation policies that enhance Canada's innovation capacity through promotion of investments in R&D infrastructure and skills development, and by ensuring the technology adoption capacity of the marketplace | |

| Expected Result | Performance Indicators |

| Promotion of investment in R&D infrastructure and skills development, and promotion of the development of policies and programs supporting R&D, innovation and commercialization in the private sector | Reports and consultation papers published, and Memoranda to Cabinet, policy documents, statistical reports, consultation papers and Treasury Board submissions |

| Sub-Sub-Program Activity: Canadian Institute for Advanced Research (CIAR) | |

| To bring together world-class researchers to tackle significant issues confronting Canadian society and challenging our understanding of the natural world | |

| Expected Result | Performance Indicators |

| Multidisciplinary teams of researchers are able to collaborate to push forward the frontiers of knowledge | Amount of national and international recognition and number of awards provided to those researchers involved with CIAR |

| Sub-Sub-Program Activity: Pierre Elliott Trudeau Foundation | |

| To support research and the dissemination of research findings in the following fields of study in the humanities and human sciences: Canadian studies, history, international relations, journalism, law, peace and conflict studies, philosophy, political economy, political science, sociology, and urban and community studies | |

| Expected Result | Performance Indicators |

| Expanded knowledge base in the social sciences and humanities and in public policy | Volume of research performed by awards recipients |

| Sub-Sub-Program Activity: Canada Foundation for Innovation (CFI) | |

| Funds targeted to strengthen the capability of Canadian universities, colleges, research hospitals and other not-for-profit institutions to carry out world-class research and technology development | |

| Expected Result | Performance Indicators |

| The strengthening of research capability at Canadian research institutions | Percentage of Innovation Fund recipients that rate the quality of their new infrastructure as near world-class or better, as a result of CFI awards |

| Attracting and retaining researchers at Canadian research institutions | Percentage of New Opportunities Fund and Canada Research Chairs fund recipients whose recruitment to Canada and/or retention in Canada was influenced by CFI awards |

| Sub-Sub-Program Activity: Canada-Israel Industrial Research and Development Foundation (CIIRDF) | |

| Co-funding of a private sector foundation (50 percent contribution from Canada, 50 percent from Israel), which supports research and development collaboration between Canadian and Israeli firms | |

| Expected Result | Performance Indicators |

| Strengthened Canadian business through global R&D cooperation | Increase of employment at firms that have CIIRDF-funded projects |

| Sub-Sub-Program Activity: Council of Canadian Academies (CCA) | |

| Expected Result | Performance Indicators |

| More informed public debate and government decision making on public policy issues that have scientific and/or technological underpinnings | References to CCA assessments in public policy discussions and Memoranda to Cabinet |

| Sub-Program Activity: Manufacturing Industries Branch | |

| Development of initiatives that stimulate R&D to accelerate the commercialization of emerging technologies in priority manufacturing sectors | |

| Expected Result | Performance Indicators |

| Sustainable manufacturing practices | Number of lean manufacturing workshops and workshops related to sustainable manufacturing |

| Number of business success stories developed | |

| Number of visits to the website on this topic | |

| Sub-Program Activity: Energy and Environmental Industries Branch | |

| Development of initiatives to stimulate research, development and commercialization of emerging technologies in priority energy sectors and environmental industries | |

| Expected Result | Performance Indicators |

| Development of emerging technologies in energy and environmental industry sectors | Revenues |

| Total employment | |

| Number of patents in the hydrogen and fuel cells sectors | |

| Improved appreciation of issues and policies related to climate change | Number of policies and programs contributed to through interdepartmental policy consultations |

| Number of consultations with and/or requests answered from clients (e.g. other government departments, partners within Industry Canada) | |

| Sub-Sub-Program Activity: Hydrogen Economy | |

| Acceleration of the development of a hydrogen economy through investments in R&D, demonstration and deployment of hydrogen and fuel cell technologies | |

| Expected Result | Performance Indicators |

| Expanded knowledge base for climate change mitigation related to a hydrogen economy | Number of research projects, scientific and technological studies; strategic plans |

| Increased collaboration between partners and improved activity coordination | Number of integrated working models, interdepartmental programs and partnerships |

| Sub-Program Activity: Service Industries Branch | |

| Development of initiatives that stimulate R&D to accelerate the commercialization of priority technologies in the service industries | |

| Expected Result | Performance Indicators |

| Improved awareness of international business opportunities by Canadian companies in the service industries sector | Number of website hits by Canadian firms |

| Sub-Program Activity: Aerospace, Defence and Marine Branch | |

| Development of initiatives that stimulate R&D to accelerate the commercialization of emerging technologies in priority aerospace, defence and marine sectors | |

| Expected Result | Performance Indicators |

| Development of Canadian technologies and innovations in the aerospace, space and defence industries | Number of collaborative projects with partners in industry, government and academia |

| Number of policies and programs developed and approved in support of S&T | |

| Number of patents | |

| Number of consultations with and/or requests from clients (e.g. sector advisory councils, laboratories, institutes, other government departments and other sector stakeholders) | |

| Value (in dollars) of foreign direct investment and domestic investments and reinvestments in aerospace, space and defence industries | |

| Increased awareness and knowledge of the ocean technology sector | Number of hits on website |

| Number of information packages and brochures distributed | |

| Number of Canadian companies attending key trade shows and conferences | |

| Sub-Program Activity: Life Sciences Branch | |

| Development of initiatives that stimulate R&D and commercialization in the priority life sciences sectors | |

| Expected Result | Performance Indicators |

| Increased commercialization performance in Canada's life sciences (biotechnology and health) industries | Number of public companies with less than two years of financing |

| Number and value of venture capital investments | |

| Number of products in biopharmaceutical pipeline | |

| Sub-Sub-Program Activity: Genome Canada | |

| The primary funding and information resource relating to genomics and proteomics in Canada, to enable Canada to become a world leader in key areas such as agriculture, environment, fisheries, forestry, health and new technology development, as well as ethical, environmental, economic, legal and social issues related to genomics (GE3LS) | |

| Expected Result | Performance Indicators |

| Effective management of the government's funding agreement with Genome Canada | Submissions for funding appropriations |

| Negotiations with TBS and the Department of Finance Canada | |

| Renewal of Genome Canada's mandate and funding | |

| Sub-Program Activity: Industrial Analysis and Sector Services Branch | |

| Support for the development of policies, programs and initiatives for priority sectors through policy analysis and research on issues related to the commercialization of emerging technologies | |

| Expected Result | Performance Indicators |

| Increased profile of industrial issues and policies involved in making the Canadian economy more innovative | Sectoral reports and Memoranda to Cabinet |

| Number of policy recommendations made to senior officials of Industry Canada | |

| Sub-Program Activity: Automotive and Industrial Materials Branch | |

| Development of initiatives that stimulate R&D to accelerate the commercialization of emerging technologies in priority aerospace, defence and automotive sectors | |

| Expected Result | Performance Indicators |

| Development of Canadian technologies and innovations in the automotive and industrial materials industries | Number of industrial policy recommendations developed and adopted in support of Canadian technologies and innovations in the automotive and industrial materials industries (e.g. number of Memoranda to Cabinet, policy papers) |

| Development and approval of new S&T policy and program initiatives (e.g. Technology Roadmaps) | |

| Value (in dollars) of foreign direct investment and domestic investments and reinvestments in automotive and industrial materials industries | |

| Number of responses given by branch in support of technology/R&D development by other federal departments and agencies (e.g. Technology Partnerships Canada) | |

| Sub-Program Activity: Canadian Biotechnology Secretariat | |

| Horizontal policy advice and program management in support of Canadian Biotechnology Strategy partner departments and agencies, and secretariat services to the Canadian Biotechnology Advisory Committee | |

| Expected Result | Performance Indicators |

| Coordination of the development of the Government of Canada's biotechnology agenda | Secretariat support to interdepartmental collaboration on biotechnology policy issues and implementation |

| Support to the Canadian Biotechnology Advisory Committee | Stakeholder consultations held and reports released |

| Research commissioned and reports released | |

| Advice provided to the Government of Canada | |

| Communication of the Government of Canada's biotechnology initiative | Expanded content of the BioPortal |

| Sub-Program Activity: Information and Communications Technologies Branch | |

| Strengthening of Canada's science and technology capacity by addressing human resource requirements, international linkages and commercialization issues; delivery of CANARIE and Precarn on behalf of the Government of Canada | |

| Expected Result | Performance Indicators |

| Ongoing investment in the R&D infrastructure | Investment in research organizations |

| Sub-Sub-Program Activity: CANARIE | |

| Collaborate with stakeholders to develop and use advanced networks, networking technologies and applications in order to deliver a range of benefits to Canadians and researchers | |

| Expected Result | Performance Indicators |

| An advanced research network across Canada | Number of institutions connected |

| Amount of money invested annually | |

| Sub-Sub-Program Activity: Precarn | |

| Support collaborative research for the development of the Canadian intelligent systems industry and encourage the diffusion and commercial exploitation of new technologies | |

| Expected Result | Performance Indicators |

| Increased development and use of intelligent systems technologies | Number of projects funded and amount of funding involved |

| Sub-Program Activity: CRC — Wireless and Photonics Research | |

| Conducting of R&D on innovative concepts, systems and enabling technologies for the convergence of telecommunications systems and to improve the security, interoperability and reliability of communications networks in Canada | |

| Expected Result | Performance Indicators |

| CRC is well positioned to provide strategic advice, as well as direct assistance, for the development of policy, regulations and standards, as well as for economic development in the telecommunications sector, as new technical developments and challenges arise | CRC participation on Industry Canada, national and international standards, policy and regulatory committees as technical experts |

| CRC participation in Industry Canada and other government industrial support programs as technical experts | |

| Sub-Program Activity: CRC — Defence R&D | |

| Provision of scientific knowledge and expertise in wireless communications to National Defence in order to improve decision making and operation capability of the Canadian Forces | |

| Expected Result | Performance Indicators |

| National Defence can make better and more informed decisions on new technologies related to future military communications systems | Technologies are adopted that enhance or provide new capabilities for Canadian Forces operations |

| Sub-Program Activity: CRC — Research Support | |

| To provide business development, technology transfer, and information networks and systems support of CRC R&D efforts, liaison and collaboration with the international science and technology community; and to increase opportunities for the commercialization of technologies | |

| Expected Result | Performance Indicators |

| Canadian telecommunications industry has knowledge of and efficient access to CRC's intellectual property portfolio | Industrial partnerships and revenue resulting from CRC's intellectual property portfolio, as well as communications regarding its technical capabilities |

| Sub-Program Activity: TPC — R&D Support Program | |

| Strategic investments in industrial research, pre-competitive development and related studies | |

| Expected Result | Performance Indicators |

| Leverage of private sector R&D investment | Weighted average (by value) TPC sharing ratio |

| Dollars of total innovation spending leveraged per dollar of TPC investment | |

| Increased skills, knowledge and competencies of Canadian companies | Actual number of new jobs created and/or maintained |

| Repayments recycled into program funds | Repayment amount relative to TPC business plan target |

| Sub-Program Activity: TPC — h2 Early Adopters Program | |

| Investments in new hydrogen technology demonstration projects that will bring Canada into the hydrogen economy | |

| Expected Result | Performance Indicators |

| Accelerate the market adoption of hydrogen and hydrogen-compatible technologies | Number of participants involved in demonstration projects |

| Leverage of private sector R&D investment | Weighted average (by value) TPC sharing ratio |

| Dollars of total innovation spending expected, leveraged per dollar of TPC investment | |

| Strategic Outcome | |

| Competitive industry and sustainable communities | |

| Program Activity: Policy Sector — Economic Development | |

| Sub-Program Activity: International and Intergovernmental Affairs — Economic Development | |

| Impact of international trade, investment and services negotiations on industry interests identified and assessed | |

| Expected Result | Performance Indicators |

| Alignment of federal and provincial/territorial innovation, industrial development and competitiveness policy | Extent to which provinces and territories are engaged or consulted in the development of policies and programs |

| Integration of departmental interests into the government's international policy positions | Number of trade-related Memoranda to Cabinet approved by Cabinet committees; number of international trips and missions coordinated for the Minister; number of Cabinet briefings on international issues |

| Timely processing of notifications and applications for review filed by foreign investors under the Investment Canada Act | Time required to process notifications and applications |

| Sub-Program Activity: Strategic Policy Branch — Economic Development | |

| Development of strategic policy frameworks for economic and sustainable development | |

| Expected Result | Performance Indicators |

| Integration of departmental and governmental objectives into the development of economic and sustainable development policies | Number of unique economic development and sustainable development items reviewed by the Director General Policy Committee (DGPC) |

| Sub-Sub-Program Activity: Sustainable Development Strategy | |

| Development and implementation of the Department's Sustainable Development Strategy | |

| Expected Result | Performance Indicators |

| Increased commercialization and adoption of eco-efficient tools and technologies by Canadian companies |

Number of Canadian companies that have

|

| Increased use by industry, institutions and communities of corporate responsibility and sustainability practices | |

| Sub-Program Activity: Microeconomic Policy Analysis Branch (MEPA) | |

| Microeconomic analysis in support of economic policy development | |

| Expected Result | Performance Indicators |

| High-quality microeconomic research and analysis on significant policy issues as input to policy development |

Number of

|

| Sub-Program Activity: Canada Small Business Financing (CSBF) Program | |

| Administration of the Canada Small Business Financing Act and the Small Business Loans Act | |

| Expected Result | Performance Indicators |

| Access to debt financing for SMEs | Number of loans registered |

| Value of loans registered | |

| Level of incrementality | |

| Awareness of and satisfaction with the CSBF Program on the part of participating lenders | Levels of awareness and satisfaction with the program and its parameters on the part of participating lenders |

| Sub-Program Activity: FedNor | |

| Economic stability, growth, diversification, job creation and sustainable communities in Northern and rural Ontario | |

| Expected Result | Performance Indicators |

| Improved community capacity and long-term sustainable economic development in Northern and rural Ontario | Assessment of individual program results |

| Sub-Sub-Program Activity: Community Futures Program | |

| Community economic development in rural Ontario | |

| Expected Result | Performance Indicators |

| Community economic development plans implemented | Number of community economic development plans implemented |

| Businesses created and strengthened | Number of SMEs created or strengthened |

| Sub-Sub-Program Activity: FedNor | |

| Regional and community development in Northern Ontario | |

| Expected Result | Performance Indicators |

| Improved retention and development of youth in Northern Ontario through improved skills and networking | Percentage of interns finding long-term employment upon conclusion of internship |

| Increased investment through the development of strategic partnerships | Leveraged funds from FedNor program investments |

| Sub-Sub-Program Activity: Eastern Ontario Development Program (EODP) | |

| Community economic development in Eastern Ontario | |

| Expected Result | Performance Indicators |

| Increased investment through the development of strategic partnerships | Leveraged funds from EODP investments |

| Businesses created | Number of SMEs created |

| Sub-Program Activity: Sectorial Strategies and Services Branch / Canada-Ontario Infrastructure Program (COIP) | |

| Improved community infrastructure through investments in rural and municipal infrastructure in Ontario, with an emphasis on green municipal infrastructure such as water and wastewater systems | |

| Expected Result | Performance Indicators |

| Improved community infrastructure in Ontario | Percentage of Ontario population that has benefited from investments made under COIP |

| Sub-Program Activity: Aboriginal Business Canada (ABC) | |

| Creation and expansion of viable businesses in Canada that are owned and controlled by Aboriginal peoples | |

| Expected Result | Performance Indicators |

| Maximizing the participation of Aboriginal people in the economy through support for the creation and expansion of viable businesses in Canada that are owned and controlled by Aboriginal people | Number of businesses established |

| Number of businesses expanded | |

| Average annual growth of the Aboriginal self-employed population between census years | |

| Funds leveraged with ABC funding | |

| Survival rate of businesses supported by ABC | |

| Yield on Aboriginal Capital Corporation loans | |

| Sub-Program Activity: Regional Delivery | |

| Delivery of programs and services across Canada | |

| Expected Result | Performance Indicators |

| Increased awareness and access to government business-related information, programs and services, and facilitated compliance for business | Service usage |

| Increased use of self-service channels | Channel usage trends |

| Improved departmental understanding of regional socio-economic environment, issues, and implications for policy, programs, implementation and other initiatives | Feedback on regional support, advice and intelligence from the Minister's Office and senior management |

| Sub-Program Activity: Section 41, Official Languages Act | |

| Improved participation by official-language minority communities (OLMCs) in existing federal economic development programs and services | |

| Expected Result | Performance Indicators |

| Encourage participation of OLMCs in Industry Canada's programs | The level of funding that OLMCs have received from Industry Canada |

| The level of funding leveraged from Industry Canada partners | |

| Sub-Program Activity: Service to Business: Strategy and Innovation | |

| Advancement of the service-to-business vision and improve client-centred government services to business | |

| Expected Result | Performance Indicators |

| Improved availability of multi-jurisdictional permit and licence information accessible to business | Level of client satisfaction |

| Sub-Program Activity: Canada Business — National Secretariat | |

| Increased awareness and access to government business-related information, programs and services and facilitated compliance with regulations for businesses | |

| Expected Result | Performance Indicators |

| Increased awareness and access to government business-related information, programs and services and facilitated compliance for businesses | Service usage |

| Increased use of self-service channels | Channel usage trends |

| Reduced complexity in accessing programs and services and compliance requirements for SMEs | Level of client satisfaction |

| Improved SME business planning and market research | Level of client satisfaction |

| Use of business support resources | |

| Sub-Program Activity: Student Connections | |

| Increased knowledge and use of Internet and e-commerce by Canadian SMEs and seniors, and increased youth knowledge, skills and marketability for employment | |

| Expected Result | Performance Indicators |

| Increased knowledge and skills related to the Internet and e-commerce applications and technologies on the part of SMEs and seniors | Client perceptions of increased knowledge and skills |

| Practical, short-term work experience for students in post-secondary IT-related studies | Number of youth hired |

| Sub-Program Activity: Manufacturing Industries Branch | |

| Development of initiatives to support global competitiveness and sustainable economic growth in priority manufacturing sectors | |

| Expected Result | Performance Indicators |

| Enhance international competitiveness and production of established industries (e.g. apparel and textiles, softwood lumber, plastics, and chemicals) | Number of market opportunities pursued for Canadian companies |

| Number of initiatives launched into key export markets | |

| Sub-Sub-Program Activity: Canadian Apparel and Textile Industries Program | |

| Expected Result | Performance Indicators |

| Increased competitiveness of Canadian apparel and textile firms | Dollar value of contribution agreements |

| Sub-Program Activity: Energy and Environmental Industries Branch | |

| Development of initiatives to support global competitiveness and sustainable economic growth in priority energy sectors and environmental industries | |

| Expected Result | Performance Indicators |

| Competitiveness and growth in mature energy and environmental industries | Sales by Canadian firms as a percentage share of world markets: equipment and services in electric power, oil and gas, and environmental industries |

| Capabilities of Canadian companies promoted to international markets | Number of market development opportunities pursued by Canadian firms |

| Sub-Sub-Program Activity: Border Air Quality Strategy | |

| The Border Air Quality Strategy is a bilateral initiative to improve coordinated air quality management in Canada and the United States, and to advance Canada's 10-year Clean Air Agenda. Industry Canada and Natural Resources Canada are partners in the Canada–United States Emissions Cap and Trading Feasibility Study for a nitrogen oxides and sulphur dioxide cap and trade system, headed by Environment Canada and the U.S. Environmental Protection Agency. | |

| Expected Result | Performance Indicators |

| Evaluation of program elements necessary in a joint Canada–United States nitrogen oxides and sulphur dioxide cap and trade program | Evaluation study |

| Contribution to research on the economic and technical feasibility of an emissions trading system | Availability of research |

| Sub-Program Activity: Service Industries Branch | |

| Development of initiatives that support global competitiveness and sustainable economic growth in priority service industries and service-related emerging technologies | |

| Expected Result | Performance Indicators |

| Competitiveness and growth in service industries (e.g. retail, logistics, professional services, language industries) | Number of market development and trade opportunities for Canadian firms |

| Service industries strategy developed and validated with key stakeholders | |

| Increased collaboration on tourism industry issues among federal, provincial and territorial governments | Tourism strategy developed and validated with key stakeholders |

| Increased awareness by stakeholders of policies that affect the growth of the tourism industry | Number of meetings and conferences with federal/provincial/territorial stakeholders |

| Number of contacts developed within the federal government | |

| Increased awareness of opportunities for Canadian firms in domestic and global marketplaces via SourceCAN | Number of business opportunities sent to Canadian companies |

| Number of partners providing bidding opportunities | |

| Number of successful Canadian company bids | |

| Sub-Sub-Program Activity: Language Industry Initiative (LII) | |

| Fostering of cooperation with the private sector to build a strong, competitive industry; support for firms wishing to undertake marketing and branding activities | |

| Expected Result | Performance Indicators |

| Steering Committee / LII Operations Group — clear strategic direction | Directions and conditions are clear and well understood |

| Strategic direction document reviewed and validated with key stakeholders (consensus) | |

| Marketing strategies — identifying national and international market opportunities | Complete national and international language industries macroeconomics information, including number of jobs, number of firms, firm revenues, level of international business (dollar amount); level of competition |

| Increased awareness by language industries of national and international market opportunities | Level of use of government programs for language industries (demands, number of projects) |

| Number and description of requests for participation in national and international trade promotion events (fairs, shows, missions, etc.) | |

| Comparative number of participation (baseline vs. language industry program) | |

| Increased awareness of language industries by target audiences | Level of knowledge of language industries by students and potential customers |

| Level of awareness of language industries promotional information on the part of students and potential customers | |

| Increased awareness (knowledge) of Canadian language industries by Canadian representatives abroad | Level of awareness (knowledge) of Canadian language industries on the part of Canadian representatives abroad |

| Sub-Program Activity: Aerospace, Defence and Marine Branch | |

| Development of initiatives that support global competitiveness and sustainable economic growth in aerospace, defence and marine sectors and aerospace and marine-related emerging technologies | |

| Expected Result | Performance Indicators |

| Competitiveness and growth of the aerospace, defence and space industries | Number of companies receiving benefits from government procurements |

| Dollar value of opportunities pursued on major platforms and programs | |

| Dollar value of transactions that improved the Canadian industrial base capabilities | |

| Dollar value of specific product investment in Canada through Inshore Rescue Boat program | |

| Capabilities of Canadian companies promoted to international markets | Number of Canadian companies attending trade shows |

| Number of companies registered in Canadian Company Capabilities database | |

| Number and dollar value of contracts under the Joint Strike Fighter program | |

| Competitiveness and growth in mature marine industries | Number of contacts between Canadian suppliers and foreign buyers initiated by Industry Canada (as reported through follow-up inquiries) |

| Amount of Shipbuilding and Industrial Marine Advisory Committee (SIMAC) stakeholder involvement in policy development (number of committee and sub-committee meetings, number of discussion papers and presentations developed by SIMAC) | |

| Sub-Sub-Program Activity: Structured Financing Facility (SFF) | |

| Stimulate economic activities in the Canadian shipbuilding and industrial marine industry by providing financial assistance to buyers/lessees of Canadian-built ships | |

| Expected Result | Performance Indicators |

| Increased awareness and knowledge about SFF benefits | Hits on website |

| Number of information packages, pamphlets or brochures used | |

| Increased use of SFF by Canadian and foreign buyers or lessees | Statistics/trends of SFF (Internal Revenue Service, Citizenship and Immigration Canada, and Canadian Industry Statistic) usage |

| SFF usage trends by Canadian and foreign buyers or lessees | |

| Actual SFF disbursements for contracts completed in current year, and resulting sales and employment in Canadian shipyards | |

| Expected SFF disbursements for projects contracted in current year, and expected sales and employment that will result for Canadian shipyards | |

| Sub-Program Activity: Life Sciences Branch — Economic Development | |

| Analysis and advice that supports global competitiveness and sustainable economic growth in the life sciences sector | |

| Expected Result | Performance Indicators |

| Promotion of life sciences industry to international trade and investment targets in the United States, Europe and Asia | Number of life science-related events with Canadian presence supported by Life Sciences Branch |

| Number of Canadian life science-related missions supported by Life Sciences Branch | |

| Number of Canadian life science-related promotional documentation published by Life Sciences Branch and distributed internationally | |

| Level of awareness among international business clients of Canada's capabilities in the life sciences sector | |

| Number of visitors on Life Sciences Branch's life sciences promotional websites | |

| Increased exports in Canada's life sciences sector | Export levels in life sciences industries |

| Increased international investment in Canada's life sciences industries | Foreign direct investment in life sciences industries |

| Sub-Program Activity: Industrial Analysis and Sector Services Branch — Economic Development | |

| Support for the development of policies, programs and initiatives for priority sectors and emerging technologies, by undertaking policy analysis and research on trade, investment and regulatory issues | |

| Expected Result | Performance Indicators |

| Increased profile of industrial issues and policies involved in making Canadian industries more competitive and Canadian communities more sustainable | Sectoral reports and Memoranda to Cabinet |

| Number of policy recommendations made to senior officials of Industry Canada | |

| Sub-Program Activity: Automotive and Industrial Materials Branch — Economic Development | |

| Development of initiatives that support global competitiveness and sustainable economic growth in aerospace, defence and automotive sectors and aerospace and automotive-related emerging technologies | |

| Expected Result | Performance Indicators |

| Competitiveness and growth of the automotive and industrial materials industries | Number of industrial policy recommendations developed and adopted in support of the competitiveness and growth of the automotive and industrial materials industries (e.g. number of Memoranda to Cabinet, policy papers) |

| Number of trade and investment strategies developed and implemented | |

| Dollar value of exports and related outcomes resulting from missions, company visits, trade fairs and investment promotion events | |

| Dollar value of foreign direct investment and domestic investments and reinvestments in automotive and industrial materials industries | |

| Number of responses given by branch in support of technology development / R&D by other federal government departments and agencies (e.g. TPC) | |

| Sub-Program Activity: Information and Communications Technologies Branch | |

| Improvement in the competitiveness and fostering of growth of the Canadian ICT industry | |

| Expected Result | Performance Indicators |

| Broad understanding of developments that affect sector growth in order to identify issues, gaps and opportunities for the ICT sector, to support directions for business development and policy activities | Assessments/studies of ICT sector and sub-sector growth |

| Informed advocacy for ICT stakeholder issues to influence government decisions on issues affecting the ICT industry | Number of issues addressed in policy forums and meetings with industry stakeholders |

| Increased business opportunities for the Canadian ICT sector | Number of corporate calls on investment targets |

| Client satisfaction rates at business development events | |

| Number of sales leads for Canadian companies | |

| Sub-Program Activity: Information Highway Applications Branch | |

| Acceleration of the participation of Canadians and their communities in the digital economy by fostering community networks and improving both access to, and use of, ICTs for lifelong learning and economic development | |

| Expected Result | Performance Indicators |

| Assisting Canadian individuals and communities in overcoming barriers to access and use of ICTs | Number of Canadians and communities accessing and using ICTs via broadband |

| Level of Internet use by Francophones | |

| Sub-Sub-Program Activity: Broadband for Rural and Northern Development Pilot Program | |

| Ensures Canadian communities and businesses have access to reliable modern ICT infrastructure by bringing broadband, or high-capacity, Internet to rural, remote Northern and First Nations communities | |

| Expected Result | Performance Indicators |

| Access by Canadian communities and businesses to reliable modern ICT infrastructure by bringing broadband, or high-capacity, Internet to rural, remote, Northern and First Nations communities | Number of communities served by broadband in Canada as a result of the program |

| Sub-Sub-Program Activity: Francommunautés virtuelles | |

| Aims to promote the active participation of Canada's French-speaking communities in ICTs to stimulate connectivity, access to the Internet, and the development of content and new media in French | |

| Expected Result | Performance Indicators |

| Improved access to French-language web applications, content and services on the part of Canada's Francophone and Acadian populations | Level of Internet use among Francophone population |

| Sub-Sub-Program Activity: National Satellite Initiative (NSI) | |

| Ensures Canadian communities and businesses have access to reliable, modern ICT infrastructure by bringing high-capacity Internet to communities in the Far North and Mid-North, and in isolated or remote areas of Canada, where satellite is the only reasonable means of connecting public institutions, residents and businesses | |

| Expected Result | Performance Indicators |

| Access by Canadian communities and businesses to modern ICT infrastructure by bringing high-capacity Internet to communities in the Far North and Mid-North, and in isolated or remote areas of Canada, via satellite | Number of communities able to access high-capacity Internet as a result of the National Satellite Initiative |

Table 13: Details on Transfer Payments Programs Over $5 Million

A Fair, Efficient and Competitive Marketplace

| International Telecommunication Union (ITU), Switzerland | ||||||

|

||||||

| Description | ||||||

| Canada is signatory to the ITU treaty agreement negotiated every four years at a plenipotentiary conference, in accordance with its treaty obligations of the ITU Constitution and Convention. Canada's membership, contribution and standing in the ITU, and its involvement in related events, allow us to achieve results internationally across a broad range of issues affecting radiocommunication, standardization and telecommunication development. Canada's contribution to the ITU is commensurate with its international standing and commitment to the United Nations and UN specialized agencies. | ||||||

| Strategic Outcome(s) | ||||||

| A fair, efficient and competitive marketplace | ||||||

| Expected Results | ||||||

| Membership allows Canada to achieve results across a broad range of issues affecting the international management of radio frequency spectrum and satellite orbits, the efficient and timely production of international standards, and the facilitation of connectivity in developing countries to help bridge the digital divide to the benefit of Canadian users and producers of telecommunication services and equipment. | ||||||

| Forecast Spending 2005–2006 |

Planned Spending 2006–2007 |

Planned Spending 2007–2008 |

Planned Spending 2008–2009 |

|||

| Program Activity: SITT — Marketplace | ||||||

| Total Grants | — | $6.8M | $6.8M | $6.8M | ||

| Total Program Activity | — | $6.8M | $6.8M | $6.8M | ||

| Planned Audits and Evaluations: Nil | ||||||

An Innovative Economy

| Technology Partnerships Canada — Program for Strategic Industrial Projects (PSIP) | ||||||

|

||||||

| Description | ||||||

| The program provides a framework within which a variety of larger strategic investment projects may be administered. Projects will normally be individually funded, in whole or in part, from the fiscal framework. PSIP will contribute to the achievement of Canada's objectives of increasing economic growth, creating jobs and wealth, and supporting sustainable development. It advances government initiatives by investing strategically in industrial research, pre-competitive development, and technology adaptation and adoption to encourage private sector investments. | ||||||

| Strategic Outcome(s) | ||||||

| An innovative economy | ||||||

| Expected Results | ||||||

|

||||||

| Forecast Spending 2005–2006 |

Planned Spending 2006–2007 |

Planned Spending 2007–2008 |

Planned Spending 2008–2009 |

|||

| Program Activity: Technology Partnerships Canada | ||||||

| Total Contributions | $163.3M | $58.5M | $52.0M | $21.5M | ||

| Total Program Activity | $163.3M | $58.5M | $52.0M | $21.5M | ||

| Planned Audits and Evaluations: Nil | ||||||

| Technology Partnerships Canada — Research and Development Program | ||||||

|

||||||

| Description | ||||||

| The programs provide funding support for strategic research and development, and demonstration projects that will produce economic, social and environmental benefits to Canadians. | ||||||

| Strategic Outcome(s) | ||||||

| An innovative economy | ||||||

| Expected Results | ||||||

|

||||||

| Forecast Spending 2005–2006 |

Planned Spending 2006–2007 |

Planned Spending 2007–2008 |

Planned Spending 2008–2009 |

|||

| Program Activity: Technology Partnerships Canada | ||||||

| Total Contributions | $299.4M | $300.2M | $207.3M | $207.3M | ||

| Total Program Activity | $299.4M | $300.2M | $207.3M | $207.3M | ||

| Planned Audits and Evaluations | ||||||

| The program will conduct recipient audits during the reporting period. The timing is still to be confirmed. | ||||||

| Technology Partnerships Canada — h2 Early Adopters Program | ||||||

|

||||||

| Description | ||||||

| The program provides funding support for strategic research and development, and demonstration projects that will produce economic, social and environmental benefits to Canadians. | ||||||

| Strategic Outcome(s) | ||||||

| An innovative economy | ||||||

| Expected Results | ||||||

|

||||||

| Forecast Spending 2005–2006 |

Planned Spending 2006–2007 |

Planned Spending 2007–2008 |

Planned Spending 2008–2009 |

|||

| Program Activity: Technology Partnerships Canada | ||||||

| Total Contributions | $5.1M | $14.8M | $15.1M | — | ||

| Total Program Activity | $5.1M | $14.8M | $15.1M | — | ||

| Planned Audits and Evaluations | ||||||

| The program will conduct recipient audits during the reporting period. The timing is still to be confirmed. A formative evaluation is scheduled for 2006–2007. | ||||||

Competitive Industry and Sustainable Communities

| Aboriginal Business Canada (ABC) Programs | ||||||

|

||||||

| Description | ||||||

| ABC provides financial assistance, information, resource materials and referrals to other possible sources of financing or business support. ABC provides repayable and non-repayable contributions. Most contributions, because of their size, are non-repayable. A contribution is a conditional payment. Money has to be accounted for and it is subject to audit. | ||||||

| Clients must be individuals of Canadian Indian (on- or off-reserve), Metis or Inuit heritage, or majority-owned Aboriginal organizations or development corporations. ABC also works in partnership with Aboriginal financial and business organizations, and with a range of other agencies, boards and departments, on initiatives that are helping to strengthen business skills and promote greater awareness of Aboriginal business achievement. In this way, ABC is working toward the shared goal of an inclusive and prosperous economy for all Canadians. | ||||||

| Strategic Outcome(s) | ||||||

| Competitive industry and sustainable communities | ||||||

| Expected Results | ||||||

| Maximize Aboriginal people's participation in the economy through support for the creation and expansion of viable businesses in Canada that are owned and controlled by Aboriginal people. | ||||||

| Forecast Spending 2005–2006 |

Planned Spending 2006–2007 |

Planned Spending 2007–2008 |

Planned Spending 2008–2009 |

|||

| Program Activity: Operations Sector — Economic Development | ||||||

| Total Contributions | $37.5M | $37.3M | $37.3M | $37.3M | ||

| Total Program Activity | $37.5M | $37.3M | $37.3M | $37.3M | ||

| Planned Audits and Evaluations | ||||||

| Recipient Audit of Selected Aboriginal Financial Institutions and Formative Evaluation of the Aboriginal Business Development Program, 2006–2007; Summative Evaluation of the Aboriginal Business Development Program, 2007–2008; and audit scheduled for 2008–2009. | ||||||

| Broadband for Rural and Northern Development Pilot Program | ||||||

|

||||||

| Description | ||||||

| The Broadband for Rural and Northern Development Pilot Program uses a competitive process to bring broadband, or high-capacity Internet, to unserved rural, remote and Aboriginal communities. | ||||||

| Strategic Outcome(s) | ||||||

| Competitive industry and sustainable communities | ||||||

| Expected Results | ||||||

| Access by Canadian communities and businesses to reliable modern ICT infrastructure by bringing broadband or high-capacity Internet to rural, remote, northern and First Nations communities. | ||||||

| Forecast Spending 2005–2006 |

Planned Spending 2006–2007 |

Planned Spending 2007–2008 |

Planned Spending 2008–2009 |

|||

| Program Activity: SITT — Economic Development | ||||||

| Total Contributions | $37.9M | $21.4M | — | — | ||

| Total Program Activity | $37.9M | $21.4M | — | — | ||

| Planned Audits and Evaluations | ||||||

| An internal audit scheduled for 2005–2006 has been rescheduled for 2006–2007 in order to include more comprehensive data. | ||||||

| Canadian Apparel and Textiles Industries Program (CATIP) | ||||||

|

||||||

| Description | ||||||

| The objective of CATIP is to assist Canadian apparel and textile firms with initiatives that will help to maximize productivity, identify high-value niche markets, improve e-commerce initiatives, enhance global marketing and branding strategies, and facilitate access to capital. The program has a firm component (private sector applicants) and a national initiatives component (non-profit industry associations that represent either the apparel or textile sectors on a national scale). Since 2004, the program has also had a production efficiency component targeted toward textile producers and, in 2006, introduced a transformative component for companies wanting to transform at least a portion of their current textile production from lesser value-added products to higher value-added textile products targeted at growth niche markets. | ||||||

| Strategic Outcome(s) | ||||||

| Competitive industry and sustainable communities | ||||||

| Expected Results | ||||||

| Increased competitiveness of Canadian apparel and textile firms. | ||||||

| Forecast Spending 2005–2006 |

Planned Spending 2006–2007 |

Planned Spending 2007–2008 |

Planned Spending 2008–2009 |

|||

| Program Activity: Industry Sector — Economic Development | ||||||

| Total Contributions | $7.2M | $14.3M | $9.5M | $2.2M | ||

| Total Program Activity | $7.2M | $14.3M | $9.5M | $2.2M | ||

| Planned Audits and Evaluations | ||||||

| A summative evaluation is scheduled for 2009–2010. A compliance audit is scheduled for 2007–2008. | ||||||

| Canada-Ontario Infrastructure Program (COIP) | ||||||

|

||||||

| Description | ||||||

| COIP uses a competitive process to provide funding assistance to municipalities for the construction, renewal, expansion or material enhancement of infrastructure that will contribute to improving the quality of life for Ontarians and to building the foundation for sustained, long-term economic growth in the 21st century. | ||||||

| Strategic Outcome(s) | ||||||

| Competitive industry and sustainable communities | ||||||

| Expected Results | ||||||

| Improved community infrastructure in Ontario. | ||||||

| Forecast Spending 2005–2006 |

Planned Spending 2006–2007 |

Planned Spending 2007–2008 |

Planned Spending 2008–2009 |

|||

| Program Activity: Operations Sector — Economic Development | ||||||

| Total Contributions | $120.4M | $57.9M | $39.3M | — | ||

| Total Program Activity | $120.4M | $57.9M | $39.3M | — | ||

| Planned Audits and Evaluations | ||||||

| An internal audit is scheduled for 2006–2007. | ||||||

| Community Access Program (CAP) | ||||||

|

||||||

| * CAP was to end on March 31, 2006. The program received Treasury Board approval for a reduced level of operating funds for 2006–2007. Pending conversion of some of the funding to the grants and contributions vote, planned expenditures for grants and contributions remain at zero. | ||||||

| The Government is presently reviewing the future of the Community Access Program and a decision about future spending will be forthcoming | ||||||

| Description | ||||||

| Starting in the 1995–1996 fiscal year, CAP was established under the government's Connecting Canadians initiative to provide affordable access to the Internet and the services and tools it provides. The program's goal was to have all Canadians and communities participate fully in the knowledge-based economy. CAP sites are located in schools, libraries, community centres and friendship centres, and they operate through partnerships with provincial/territorial governments and non-profit organizations. | ||||||

| Strategic Outcome(s) | ||||||

| Competitive industry and sustainable communities | ||||||

| Expected Results | ||||||

| Improved access to the Internet for Canadians most affected by the digital divide, with particular emphasis on First Nations, remote and rural communities. | ||||||

| Forecast Spending 2005–2006 |

Planned Spending 2006–2007 |

Planned Spending 2007–2008 |

Planned Spending 2008–2009 |

|||

| Program Activity: SITT — Economic Development | ||||||

| Total Contributions | $29.6M† | $0 | $0 | $0 | ||

| Total Program Activity † Includes $17.5M for CAP and $12.1M for the Youth Employment Strategy, funded by Human Resources and Social Development Canada |

$29.6M† | $0 | $0 | $0 | ||

| Planned Audits and Evaluations: Nil | ||||||

| FedNor — Northern Ontario Development Program | ||||||

|

||||||

| Description | ||||||

| The program contributes to regional economic development in Northern Ontario. | ||||||

| Strategic Outcome(s) | ||||||

| Competitive industry and sustainable communities | ||||||

| Expected Results | ||||||

|

||||||

| Forecast Spending 2005–2006 |

Planned Spending 2006–2007 |

Planned Spending 2007–2008 |

Planned Spending 2008–2009 |

|||

| Program Activity: Operations Sector — Economic Development | ||||||

| Total Contributions | $44.5M | $34.8M | $34.8M | $36.3M | ||

| Total Program Activity | $44.5M | $34.8M | $34.8M | $36.3M | ||

| Planned Audits and Evaluations: Nil | ||||||

| FedNor — Eastern Ontario Development Program (EODP) | ||||||

|

||||||

| * Approval being sought to extend the end date of this program until March 31, 2007. | ||||||

| Description | ||||||

| The program promotes rural socio-economic development in Eastern Ontario, leading to a competitive and diversified regional economy and contributing to the successful development of business and job opportunities, as well as sustainable self-reliant communities. | ||||||

| Strategic Outcome(s) | ||||||

| Competitive industry and sustainable communities | ||||||

| Expected Results | ||||||

|

||||||

| Forecast Spending 2005–2006 |

Planned Spending 2006–2007 |

Planned Spending 2007–2008 |

Planned Spending 2008–2009 |

|||

| Program Activity: Operations Sector — Economic Development | ||||||

| Total Contributions | $12.0M | $9.6M | $0 | $0 | ||

| Total Program Activity | $12.0M | $9.6M | $0 | $0 | ||

| Planned Audits and Evaluations: Nil | ||||||

| FedNor — Community Futures Program (Ontario) | ||||||

|

||||||

| Description | ||||||

| The program contributes to community economic development in rural Ontario. | ||||||

| Strategic Outcome(s) | ||||||

| Competitive industry and sustainable communities | ||||||

| Expected Results | ||||||

|

||||||

| Forecast Spending 2005–2006 |

Planned Spending 2006–2007 |

Planned Spending 2007–2008 |

Planned Spending 2008–2009 |

|||

| Program Activity: Operations Sector — Economic Development | ||||||

| Total Contributions | $20.3M | $20.5M | $20.9M | $21.4M | ||

| Total Program Activity | $20.3M | $20.5M | $20.9M | $21.4M | ||

| Planned Audits and Evaluations | ||||||

| An internal audit is scheduled for 2008–2009. A summative evaluation is scheduled for 2007–2008. | ||||||

| Structured Financing Facility (SFF) | ||||||

|

||||||

| Description | ||||||

| This program stimulates economic activities in the Canadian shipbuilding and industrial marine industry by providing financial assistance to buyers/lessees of Canadian-built ships. | ||||||

| Strategic Outcome(s) | ||||||

| Competitive industry and sustainable communities | ||||||

| Expected Results | ||||||

|

||||||

| Forecast Spending 2005–2006 |

Planned Spending 2006–2007 |

Planned Spending 2007–2008 |

Planned Spending 2008–2009 |

|||

| Program Activity: Industry Sector — Economic Development | ||||||

| Total Contributions | $16.0M | $17.1M | $12.6M | — | ||

| Total Program Activity | $16.0M | $17.1M | $12.6M | — | ||

| Planned Audits and Evaluations | ||||||

| An internal audit is planned for 2006–2007. A summative evaluation is planned for 2007–2008. | ||||||

| SchoolNet | ||||||

|

||||||

| * SchoolNet was to end on March 31, 2006. The program received Treasury Board approval for a reduced level of operating funds for 2006–2007. Pending conversion of some of the funding to the grants and contributions vote, planned expenditures for grants and contributions remain at zero. | ||||||

| Description | ||||||

| Industry Canada's SchoolNet works in collaboration with governments, non-profit organizations and the private sector to position Canada at the global forefront of e-learning readiness, to support the innovative use of ICTs for lifelong learning and to promote the competitiveness of the e-learning industry. | ||||||

| Strategic Outcome(s) | ||||||

| Competitive industry and sustainable communities | ||||||

| Expected Results | ||||||

| Increased access to, and effective use of, ICTs and the ICT infrastructure by First Nations students and learners, and other Canadian learners. | ||||||

| Forecast Spending 2005–2006 |

Planned Spending 2006–2007 |

Planned Spending 2007–2008 |

Planned Spending 2008–2009 |

|||

| Program Activity: SITT — Economic Development | ||||||

| Total Contributions | $20.1M† | $0 | $0 | $0 | ||

| Total Program Activity † Includes $16.7M for the SchoolNet Program and $3.4M for the Youth Employment Strategy, funded by Human Resources and Social Development Canada. |

$20.1M† | $0 | $0 | $0 | ||

| Planned Audits and Evaluations | ||||||

| A follow-up audit of the 2005 audit of SchoolNet is planned for 2006–2007. An audit is scheduled for 2008–2009. | ||||||

Details on Other Programs

Industry Canada is responsible for the Canada Small Business Financing (CSBF) program. This program does not provide grants and contributions; therefore, it is not reported in the table Details on Transfer Payments Programs. The CSBF is included under the business line Industry Sector Development.

| Canada Small Business Financing Program | ||||||

|

||||||

| Description | ||||||

| Loan loss sharing program, in partnership with financial institutions, designed to increase access to financing for Canadian SMEs. | ||||||

| Strategic Outcome(s) | ||||||

| Competitive industry and sustainable communities | ||||||

| Expected Results | ||||||

|

||||||

| Forecast Spending 2005–2006 |

Planned Spending 2006–2007 |

Planned Spending 2007–2008 |

Planned Spending 2008–2009 |

|||

| Program Activity: Operations Sector — Economic Development | ||||||

| Total Other Types of Transfer Payments | $73.0M | $89.5M | $92.0M | $84.8M | ||

| Total Program Activity | $73.0M | $89.5M | $92.0M | $84.8M | ||

| Planned Audits and Evaluations | ||||||

| An internal audit is scheduled for 2006–2007. | ||||||

Table 14: Conditional Grants (Foundations)

An Innovative Economy

| The Canadian Institute for Advanced Research (CIAR) | |||

|

|||

| Description | |||

| CIAR is a not-for-profit corporation that supports networks of some of the best Canadian and international researchers in conducting long-term research on scientific, social and economic issues of vital importance to Canada | |||

| Strategic Outcome | |||

| An innovative economy | |||

| Summary of Annual Plans of Recipient | |||

| In 2006–2007, CIAR plans to continue to support its existing research programs in earth system evolution; evolutionary biology; cosmology and gravity; nanoelectronics; quantum information processing; experience-based brain and biological development; genetic networks; institutions organizations and growth; neural computation and adaptive perception; quantum materials; social interactions, identity and well-being; and successful societies. CIAR plans to continue its effective communications and outreach work. | |||

| Planned Audits and Evaluations | |||

| An evaluation of CIAR was completed in March 2005. There are currently no additional reviews planned for the reporting period. |

| The Council of Canadian Academies (CCA), formerly the Canadian Academies of Science (CAS) | |||

|

|||

| Description | |||

| The Council of Canadian Academies (CCA) is an arm's length, not-for-profit organization that was established to assess the state of scientific knowledge underpinning key public policy issues. Its founding members are the Royal Society of Canada, the Canadian Academy of Engineering and the Canadian Academy of Health Sciences. The Government of Canada provided a $30 million one-time conditional grant in July 2005 from Budget 2005, which entitles the government to five assessments per year at no additional cost. Each assessment will likely take 18 months to two years to complete. | |||

| Strategic Outcome | |||

| An innovative economy | |||

| Summary of Annual Plans of Recipient | |||

| The CCA will launch at least two assessments in 2006–2007 and, once fully operational, will produce roughly five assessments for the government each year. The assessments undertaken for the federal government will normally not contain specific policy recommendations. Rather, they will report on the relevant science — identifying both what is known (or at least strongly believed) and where there are gaps in our knowledge. Such findings will be relevant for policy decisions in cases where scientific factors play a significant role. | |||

| Planned Audits and Evaluations | |||

| The Minister has undertaken to ensure that a compliance audit is conducted by December 31, 2006. | |||

| The Minister has undertaken to ensure that a value-for-money audit is performed at least once during the period of April 1, 2005 to March 31, 2010. | |||

| Website: www.scienceadvice.ca |

| CANARIE — CA*net 4 | |||

|

|||

| Description | |||

| CANARIE develops, operates and maintains CA*net 4, Canada's advanced research network. CA*net 4 provides researchers across Canada with high-speed, optical networking capability. | |||

| Strategic Outcome | |||

| An innovative economy | |||

| Summary of Annual Plans of Recipient | |||

| CANARIE plans for CA*net 4 will include the following: maintaining the national network and increasing international connections, providing users with access to CA*net 4 through collaborative arrangements with provincial/territorial and regional research networks, and developing innovative networking technologies. This will enable the country's research networks and institutions to participate in research activities across Canada and around the world. | |||

| Planned Audits and Evaluations | |||

| A summative evaluation of the CA*net 4 program was undertaken in 2005–2006 for completion in 2006–2007. |

| Genome Canada | |||

|

|||

| * This includes $60 million that has yet to flow in 2004–2005 but does not include the $165 million announced in Budget 2005. | |||

| Description | |||

| Genome Canada is an independent corporation with five regional genomics centres across Canada. Genome Canada, the primary funding and information resource concerned with genomics and proteomics in Canada, is enabling Canada to become a world leader in key areas such as agriculture, environment, fisheries, forestry, health and new technology development, as well as ethical, environmental, economic, legal, and social issues related to genomics (GE3LS). | |||

| Strategic Outcome | |||

| An innovative economy | |||

| Summary of Annual Plans of Recipient | |||

| The 2006–2009 period will focus on the following: elaborating Canada's world-class research strength in life sciences through continued investment in large-scale genomics and proteomics research projects; and continuing to provide information and education on genomics and proteomics to the public. | |||

| Genome Canada will continue to develop regional and sectoral strengths, contribute to the sustainability of traditional industries, leverage international dollars and knowledge through international consortia, create products and jobs, contribute to the “brain gain,” make cost-effective world-class S&T platforms available to the genomics research community, and contribute to health and environmental improvements. | |||

| Planned Audits and Evaluations | |||

| The recent evaluation against the indicators and measures outlined in its results-based management framework demonstrated the positive results being obtained from Genome Canada's activities. |

| Pierre Elliott Trudeau Foundation | |||

|

|||

| Description | |||

| To support research and the dissemination of research findings in the humanities and human sciences, such as Canadian studies, history, international relations, journalism, law, peace and conflict studies, philosophy, political economy, political science, sociology, and urban and community studies. | |||

| Strategic Outcome | |||

| An innovative economy | |||

| Summary of Annual Plans of Recipient | |||

| In 2006–2007, the Foundation will fully expend the annual allocations for the three awards programs (scholarship, fellowship and mentorship). The Foundation will host an academic conference to promote the dissemination of research findings. | |||

| Planned Audits and Evaluations | |||

| The first evaluation of the Foundation is due March 31, 2007; however a request for an extension until March 2009 has been made and is subject to approval by the Minister of Industry. After the first evaluation, an evaluation is required every five years thereafter. |

| Precarn Incorporated, Phase Four | |||

|

|||

| Description | |||

| Precarn is Canada's national organization for the development and commercialization of intelligent systems and robotics. In the model Precarn uses for commercializing R&D, a private-sector technology developer enters into a collaborative relationship with both an end-user of the technology and a university or research institute. | |||

| Strategic Outcome | |||

| An innovative economy | |||

| Summary of Annual Plans of Recipient | |||