Archived [2018-05-29] - Guide to Claims

This page has been archived on the Web

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

1. Date of publication

This guide was published on .

This guide replaces the provisions on claims in the Guideline on Claims and Ex Gratia Payments dated .

2. Application, purpose and scope

This guide applies to the organizations listed in section 6 of the Policy on Financial Management.

The purpose of this guide is to help departments manage claims against the Crown and claims by the Crown.

The guide supports the Directive on Payments and the Directive on Public Money and Receivables. It does not contain any new mandatory requirements for settling claims against or by the Crown. Examples are provided for illustrative purposes only and may not apply to all departments or situations.

The guide explains how to assess and manage various claims in accordance with the authorities set out in the above directives and with other payment authorities and government instruments.

Section 3 defines claims and sets out the principles of managing claims. It also highlights the importance of consulting departmental legal services when a claim is made against or by the Crown.

Section 4 explains the different types of claims, and identifies when the Directive on Payments applies.

Sections 5 and 6 outline the processes for managing claims against and by the Crown.

Section 7 discusses the accounting treatment of claims.

3. Overview of claims

3.1 Definition

When an incident that results in losses, expenditures or damages occurs between two parties, one party may request compensation from the other by means of a claim.

The Directive on Payments defines a claim as a request for compensation to cover losses, expenditures or damages sustained by the Crown or by another party (the claimant).

3.2 Manager’s responsibilities

Managers who have been delegated authority to issue payments for claims against the Crown or who are considering making a claim by the Crown should:

- make sure that the claim:

- meets the definition of a claim as set out in the Directive on Payments (see subsection 3.1 of this guide)

- is treated in accordance with existing authorities, governing instruments or policies, when applicable (see subsection 4 of this guide)

- make every reasonable effort to obtain value for money when resolving the claim

- consider the legal and other merits of the claim (see subsection 3.2.1 of this guide)

- consider administrative expediency and cost-effectiveness of making or settling the claim

- reduce the amount of the payment of a claim against the Crown when the acts or omissions of any person, including persons for whom a payment is being considered, contributed to the damages or loss incurred (see subsection 5.1.6 of this guide)

3.2.1 Importance of obtaining a legal opinion

When an incident occurs, the delegated departmental manager is responsible for managing the risk associated with dealing with any claim that may arise between a department and other entities (for example, the claimant).

Because of the legal nature of claims, managers who are involved in a claim should always seek advice from their departmental legal services; however, in some situations, managers must consult them. For example, when a claim involves legal proceedings or when a payment of an amount greater than $25,000 is being considered, senior departmental managers must refer the claim to departmental legal services to determine whether any potential legal liability exists (as per subsection A.2.2.2.2 of the Directive on Payments).

Claims involving Crown servants (either a claim against the Crown by Crown servants or a claim by the Crown against Crown servants) are generally negotiated by, or in conjunction with, the Department of Justice, without recourse to the courts, and according to the relevant authorities and procedures. “Crown servant” is defined in the Directive on Payments.

4. Types of claims

This section describes the different types of claims and identifies when the requirements of the Directive on Payments apply. Claims must be treated in accordance with the applicable authorities, governing instruments or policies, as such:

- CFOs are responsible for establishing procedures for claims covered by other authorities, governing instruments or policies that are processed pursuant to those other authorities or instruments (see subsection A.2.2.1.1.2 of the Directive on Payments).

- Managers with delegated authority to make payments for claims against the Crown must ensure that these payments are not covered by other authorities, governing instruments or policies (see subsection A.2.2.3.1.1 of the Directive on Payments).

Although some of the claims described in this section are covered under other authorities, governing instruments or policies and are therefore not covered under the Directive on Payments, managers can still refer to this guide when managing claims because a number of the steps involved are applicable (for example, conducting an investigation, seeking a legal opinion).

4.1 Claims in contract

Claims in contract are to be dealt with according to the terms of the applicable contract and pursuant to the applicable law. Departments must ensure that the interests of the Crown are protected and that all legal rights are exercised. This type of claim is not governed by Directive on Payments.

For example, a department cancels a contract with a supplier. The supplier files a claim for contract‑related damages. The claim is contractual in nature and should be dealt with in accordance with the contract and the applicable law.

4.2 Claims in tort (or extra-contractual liability in Quebec)

Claims in tort, known as extra‑contractual liability claims in Quebec, are claims that do not arise in the context of a written, oral or implied contractual agreement. Claims in tort between the Crown and a claimant are subject to the requirements of the Directive on Payments.

For example, a federal government organization cut down a tree on federal property. When it fell, the tree damaged a neighbour’s personal property. The neighbour filed a claim for damages. That claim would be considered a claim in tort because the actions of the Crown resulted in losses of the neighbour’s personal property.

4.3 Claims between departments

As a general rule, one federal government department cannot claim damages and receive payment from another federal government department. Such claims are dealt with in a manner that precludes departments from seeking damages from each other (for example, on the basis of mutual forbearance).

4.4 Claims between departments and Crown corporations

Departments and Crown corporations use negotiated settlements to settle claims. However, when a claim is pursued, each party should voluntarily supply the other with all information in its possession. If the parties themselves cannot agree on the claim’s merits and liabilities, then the legal officers of both organizations should try to reach an agreement. If the legal officers cannot agree, then the matter is referred to the Deputy Attorney General of Canada for arbitration.

4.5 Claims under the Canadian Human Rights Act

Claims under the Canadian Human Rights Act (CHRA) are subject to the investigation and conciliation requirements under the CHRA. The negotiation and payment of settlements and tribunal orders under the CHRA are subject to the requirements of the Directive on Payments.

The requirements of the Directive on Payments do not apply to complaints relating to equal pay for work of equal value lodged under section 11 of the CHRA. Those complaints are dealt with through Treasury Board policy instruments relating to people management and through other authorities.

4.6 Examples of claims covered by other governing instruments

Table 1 lists examples of claims that are covered under other governing instruments and not under the Directive on Payments. The instruments in the right‑hand column contain specific requirements for claims that arise in the situations listed in the left‑hand column. For example, claims by the Crown to recover losses of public money are covered under the Treasury Board Directive on Public Money and Receivables. These claims should therefore be treated in accordance with these policy instruments and not under the Directive on Payments.

| Situation | Governing instrument |

|---|---|

| Claims for recovery of losses of public money | Directive on Public Money and Receivables |

| Claims related to contract performance disputes | Contracting Policy |

| Claims related to relocation of household property and travel claims | National Joint Council’s (NJC) Relocation Directive and Travel Directive |

| Claims by the Crown resulting from automobile accidents and claims by or against the Crown with motor vehicle owners and their insurers in respect of collisions | Provincial legislation related to motor vehicle property damage Note: Departmental legal services or materiel management and fleet vehicle specialists should be consulted because provisions differ from province to province (see Appendix B for details). |

5. Claims against the Crown

5.1 Process when a claim is filed against the Crown

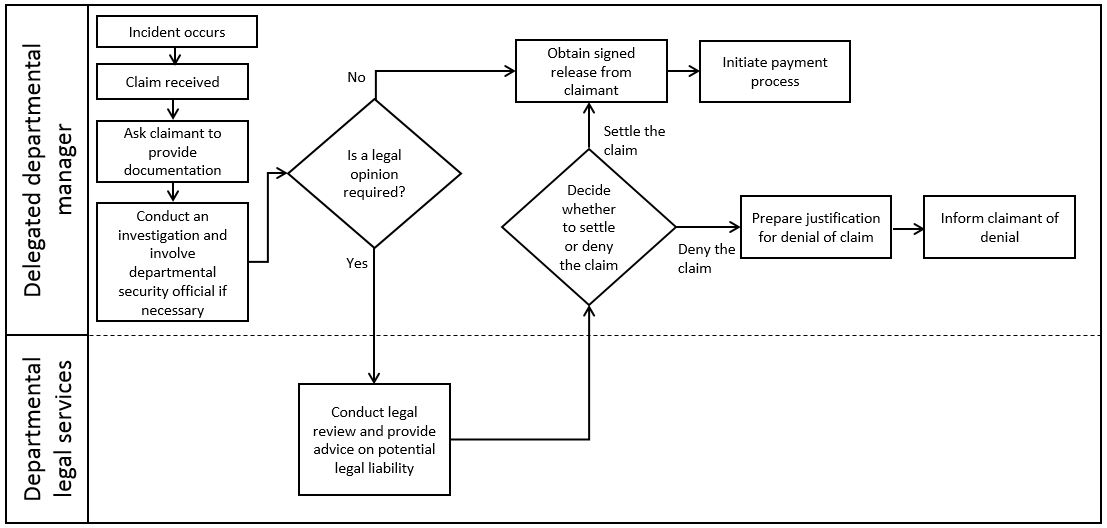

Figure 1 shows the process to be followed when a claim is made against the Crown. Subsections 5.1.1 to 5.1.6 describe the key steps of this process in detail.

Figure 1 - Text version

This figure shows the process to be followed when a claim is made against the Crown.

When an incident occurs, the delegated departmental manager:

- Receives the claim.

- Asks the claimant to provide documentation.

- Conducts an investigation and involves the departmental security official if necessary.

- Determines whether a legal opinion is required.

If a legal opinion is not required, the delegated departmental manager obtains a signed release from the claimant and then initiates the payment process.

If a legal opinion is required

- The delegated departmental manager contacts departmental legal services.

- Departmental legal services conducts a legal review and provides advice on the potential legal liability.

- The delegated departmental manager decides whether to settle the claim or deny the claim.

If the delegated departmental manager decides to settle the claim, he or she obtains a signed release from the claimant and then initiates the payment process.

If the delegated departmental manager decides to deny the claim, he or she prepares a justification for the denial of the claim and informs the claimant of the denial.

5.1.1 Gather documentation

Under subsection A.2.2.2.1 of the Directive on Payments, when a claim is made against the Crown after an incident has occurred, senior departmental managers with delegated authority to make payments for claims against the Crown are responsible for, without prejudice and without admitting liability, obtaining original copies of documents and for obtaining details from the claimant, such as:

- a detailed statement of the facts on which the claim is based

- a detailed statement showing how the amount of the claim was calculated

- documents confirming all disbursements

5.1.2 Conduct an investigation

An investigation should be conducted at the earliest reasonable opportunity. The delegated departmental manager should consider whether to request assistance from the departmental security officer, depending on the type of incident and the amount of the claim. The investigation should be formally documented.

The extent of the investigation depends on the type of incident, the amount of the claim and the potential cost of the investigation.

The investigation should include the following, as applicable:

- a full statement of the duties and responsibilities of any Crown servant involved

- details about the use of any Crown property involved and the authority for that use

- statements about the incident from Crown servants and other persons with knowledge of the circumstances

- copies of any reports made to the police in connection with the incident

- a complete account of the incident, including who was involved, what happened, where it happened, when it happened, how it happened and why it happened

- plans, sketches or photographs, as necessary, to contextualize or explain the nature and extent of the incident

- any additional information and material that may be required for a legal opinion

- the assistance of the Royal Canadian Mounted Police

- the assistance of private sector claims adjustment services or collection agencies

The department’s security officials are generally responsible for:

- conducting or directing investigations into claims, or assisting managers in this regard, unless the department has a dedicated section established for this purpose

- dealing with the appropriate law enforcement agency, if necessary

5.1.3 Determine whether a legal opinion is required

Managers should determine whether a legal opinion is required. The decision will be based on the magnitude and the complexity of the situation. See subsection 3.2.1 of this guide for more information.

If the manager determines that a legal opinion is required, the manager refers the claim to departmental legal services and sends them the formal documentation from the investigation (see subsection 5.1.2 of this guide) and any information received from the claimant (see subsection 5.1.1 of this guide).

The legal opinion should address the following:

- whether the Crown has any potential legal liability

- the steps, if any, to be taken to resolve the claim

- the terms and conditions on which it would be advisable to resolve the claim, when it is advisable to settle

5.1.4 Determine whether there is a legal liability for the Crown

If the legal opinion identifies a potential legal liability for the Crown, the delegated departmental manager should take the following steps to settle the claim, in accordance with subsection A.2.2.3.1 of the Directive on Payments:

- determine the amount(s) to be paid (see section 6.6 of this guide for more information)

- assess the administrative expediency and cost effectiveness of making the payment

If the legal opinion indicates that the Crown has no legal liability, the delegated departmental manager may decide, in consultation with departmental legal services, to settle the claim or deny the claim. The opinion could be used as a justification for the denial of the claim, and the delegated departmental manager would inform the claimant of the denial.

5.1.5 Obtain a release

In accordance with subsection A.2.2.2.4 of the Directive on Payments, when the Crown is to issue a payment to settle claim, the senior departmental manager must obtain a signed release from the claimant. An example of a release form is provided in Appendix A of this guide. The departmental legal services can also provide guidance on what to include in a release form.

5.1.6 Issue payment

In accordance with subsection A.2.2.3.1 of the Directive on Payments, when deciding whether to make a payment for a claim against the Crown, delegated departmental managers must:

- validate that there are no existing authorities, governing instruments or policies

- assess the legal or other merits of the claim

- negotiate an appropriate amount, including considering whether to offer a lesser amount when the acts or omissions of any person, including persons for whom a payment is being considered, contributed to the damages or loss incurred

5.2 Claims against the Crown by Crown servants

This section describes the process to follow for claims made against the Crown by Crown servants. This guide does not apply to Crown servants’ claims against the Crown that are covered by other authorities, governing instruments or policies. For example:

- claims and legal proceedings covered by the Policy on Legal Assistance and Indemnification

- claims under section 11 of the Equal Wages Guidelines (see subsection 5.3 of this guide for more information)

- claims for damages to Crown servants’ effects while on relocation or travel status. These claims are covered in instruments such as the National Joint Council’s Relocation Directive and the Travel Directive

- claims related to bodily injury while on duty. These claims are covered in the Government Employees Compensation Act

5.2.1 Claims for Crown servants’ effects

Under subsection A.2.2.2.3 of the Directive on Payments, senior departmental managers are responsible for conducting an investigation of reported incidents for claims of a Crown servant that include personal property that is damaged, lost, stolen or destroyed while in the performance of the Crown servant’s duties. This investigation is to be conducted with the assistance of the departmental security officials as required. See section 5.1.2 of this guide for more information on conducting an investigation.

When a Crown servant makes a claim against the Crown following an incident in which the Crown servant’s effects were damaged, lost, stolen or destroyed, the delegated departmental manager must investigate and consult with their departmental legal services to determine if there is any potential liability. The following criteria apply:

- Crown servants’ effects include only items considered to be reasonably related to the performance of the Crown servant’s duties at the time of the loss or damage.

- Compensation is based on the full cost to replace the effects with the same or equivalent quality or the reasonable cost for repair.

Ex gratia payments cannot be issued to employees of the Government of Canada. See the Guide to Ex Gratia Payments and Honorariums for more information.

For example, a Crown servant placed several file folders on a colleague’s desk and accidentally damaged the colleague’s eyeglasses. The colleague asked the manager for compensation to replace the damaged eyeglasses. The manager investigated and determined that this was an inadvertent incident that occurred during the performance of the Crown servant’s duties and that there was no other possible means of compensation. In this instance, the manager with the delegated authority may approve a payment to settle this claim.

6. Claims by the Crown

6.1 Process when a claim is filed by the Crown

Managers must make every reasonable effort to obtain value for money when resolving claims by the Crown. They should consider the administrative costs, level of effort, and cost‑effectiveness in pursuing the claim.

Figure 2 shows the process to be followed when a claim is filed by the Crown. Subsections 6.1.1 to 6.1.4 describe the key steps of this process in detail.

Figure 2 - Text version

This figure shows the process to be followed when a claim is filed by the Crown.

When an incident occurs, both the delegated departmental manager and departmental legal services have tasks to perform.

The delegated departmental manager:

- Investigates and documents the incident.

- Determines whether a legal opinion is required.

If a legal opinion is not required, the delegated departmental manager determines whether a recovery action is required.

If no recovery action is required, the delegated departmental manager documents the rationale.

If a recovery action is required, the delegated departmental manager signs the release after legal review (if requested) and initiates the recovery action.

If a legal opinion is required, departmental legal services determines whether litigation is required.

If litigation is not required, the matter returns to the delegated departmental manager, who determines whether a recovery action is required.

If no recovery action is required, the delegated departmental manager documents the rationale.

If a recovery action is required, the delegated departmental manager signs the release after legal review (if requested) and initiates the recovery action.

If litigation is required, departmental legal services starts the litigation process and pursues a recovery action as determined by the outcome of the litigation process.

6.1.1 Investigate and document the incident

When an incident occurs, delegated departmental managers must investigate and document the incident. See section 5.1.2 of this guide for more information on conducting an investigation.

6.1.2 Seek a legal opinion

In compliance with subsection A.2.2.2.2.1 of the Directive on Payments, senior departmental managers must refer all claims by the Crown involving legal proceedings to their departmental legal services.

In addition, senior departmental managers must obtain a legal opinion when:

- there is conflicting evidence or a lack of evidence

- there is uncertainty about which legal principles apply

6.1.3 Sign a release

As a condition of receiving a payment to resolve a claim by the Crown, both the manager with delegated authority to resolve claims and the party against whom the claim was made may be asked to sign a release form. The manager should ask departmental legal services to review the release before signing it.

6.1.4 Initiate recovery action

When pursuing a recovery action resulting from a claim by the Crown, the collection process must be consistent with the requirements of the Directive on Public Money and Receivables, including that timely and cost-effective collection actions are taken to pursue the recovery.

6.2 Claims by the Crown against Crown servants

Generally, claims by the Crown against Crown servants in relation to incidents involving work-related activities are negotiated without recourse to the courts, in accordance with the relevant authorities and procedures.

When a Crown servant is not covered under the Policy on Legal Assistance and Indemnification, the manager can seek recovery of funds from any money due to the Crown servant from the Crown after:

- notifying the Crown servant of the proposed retention of money due to him or her by the Crown and of his or her right to make representation (for example, the Crown servant has the option to present their perspective on the claim and its recovery) within 30 days

- considering the Crown servant’s representation before making a final decision

7. Accounting for claims

7.1 Claims against the Crown

All payments of claims against the Crown are to be reported in the Public Accounts in the fiscal year in which the payment is made. See Chapter 15 of the Receiver General Manual for more information.

7.2 Claims by the Crown

All payments anticipated to be received as a result of a claim by the Crown should be treated as accounts receivable. The accounts receivable section of the Financial Information Strategy Accounting Manual provides guidance on how to account for receivables.

8. References

8.1 Legislation

8.2 Related policy instruments

8.3 Other

- Direct Compensation Agreement (PDF, 2,644 KB)

- Ex gratia Payment Order, 1991 [(P.C.19918/1695) ]

- Financial Information Strategy Accounting Manual

- National Joint Council Relocation Directive

- National Joint Council Travel Directive

- Receiver General Manual

9. Enquiries

Members of the public may contact Treasury Board of Canada Secretariat Public Enquiries if they have questions about this guide.

Individuals from departments should contact their departmental financial policy group if they have questions about this guide.

Individuals from a departmental financial policy group may contact Financial Management Enquiries for interpretation of this guide.

Appendix A: example of a release form for claims against the Crown

Know all persons by these present that (name and address of claimant) does hereby remise, release and forever discharge Her Majesty the Queen in right of Canada and (name of any officer or servant of the Crown involved), from all manners of action, claims or demands, of whatever kind or nature that (name of claimant) ever had, now has or can, shall or may hereafter have by reason of damage to or personal injury, or both, (here set out subject matter of the damage) as a result of or in any way arising out of (here set out incident and the date, time and place of occurrence).

It is understood and agreed that this Release shall only be effective when payment will have been made on behalf of Her Majesty to (name of claimant) of the sum of $________.

It is also understood that Her Majesty the Queen in right of Canada does not admit any liability to (name of claimant) by acceptance of this Release or by payment of the said sum of $________.

Signed, Sealed and Delivered in the Presence of

Witness:

IN WITNESS WHEREOF, I have hereunto set my hand and seal this ________ day of _______, 20____.

Print Name _________________________

Signature _________________________

Phone number (_ _ _) _ _ _ - _ _ _ _

For the (department or agency name):

IN WITNESS WHEREOF, I have hereunto set my hand and seal this ________ day of _______, 20____.

Print Name _________________________

Signature _________________________

Phone number (_ _ _) _ _ _ - _ _ _ _

Witness:

IN WITNESS WHEREOF, I have hereunto set my hand and seal this ________ day of _______, 20____.

Print Name _________________________

Signature _________________________

Phone number (_ _ _) _ _ _ - _ _ _ _

For the Claimant or person duly authorized for the Claimant:

IN WITNESS WHEREOF, I have hereunto set my hand and seal this ________ day of _______, 20____.

Print Name _________________________

Signature _________________________

Phone number (_ _ _) _ _ _ - _ _ _ _

Appendix B: motor vehicle accident claims

B.1 Overview

This appendix discusses claims by or against the Crown resulting from motor vehicle accidents.

It provides background information and is not intended as legal advice. Departmental legal services should be consulted when a motor vehicle accident occurs.

Context:

- Except as specified in this appendix, claims for motor vehicle property damage must be handled in the usual manner as claims by or against the Crown as described in this guide.

- The Government of Canada does not typically purchase insurance in the commercial insurance market (see the Guideline on Self-Insurance for more information).

- The Crown is governed by the same liabilities imposed by provincial laws as any subject of the Crown.

B.2 Provincial unsatisfied judgment funds

The process to recover money from provincial unsatisfied judgment funds is complex and expensive. As a result, departments should first try to use another means to obtain satisfaction of a claim by the Crown resulting from a motor vehicle accident.

In cases where they must attempt to recover from provincial unsatisfied judgment funds, departments should:

- comply with all applicable provisions of provincial legislation, including any limitation period (departments should consult their legal services because limitation periods vary between provinces and may change)

- refer the claim to the Deputy Minister of Justice within the limitation period for claims with large amounts or with no alternative collection action

B.3 Motor vehicle property damage claims

The President of the Treasury Board, in consultation with the Minister of Justice, has the authority to commit federal organizations (listed in section 6 of the Policy on Financial Management) to:

- adopt a motor vehicle damage claim scheme in the provinces

- if necessary, enter into an agreement with a single representative of insurers in any province

Accordingly, the federal Crown has:

- filed a formal undertaking with the Ontario Insurance Commission for motor vehicle accidents in Ontario (refer to section B.3.1 of this appendix)

- negotiated an informal arrangement with the Groupement des assureurs automobiles (GAA) for motor vehicle accidents in Quebec (refer to section B.3.2 of this appendix)

B.3.1 Ontario

This section applies to property damage to motor vehicles resulting from an accident that occurred in Ontario. The claims arising from such damage and the resolution of those claims are to be processed according to the provisions of the Ontario Motorist Protection Plan.

Effective , and in accordance with the undertaking filed by the Treasury Board of Canada Secretariat with the Ontario Insurance Commission:

- departments (as defined in section 2 of the Financial Administration Act) are exempt from the requirement to be insured under the Compulsory Automobile Insurance Act

- in cases of automobile accidents occurring in Ontario that involve Ontario-insured vehicles and commercially uninsured government-owned or leased vehicles, the Crown will:

- pay for its own property damage

- make no claims against owners of Ontario-insured vehicles

B.3.2 Quebec

The following provisions apply to all collisions occurring in Quebec as of January 1, 1997, including:

- property damage to motor vehicles resulting from an accident that occurred in Quebec

- claims arising from such damage

- resolution of those claims in accordance with the Quebec Automobile Insurance Act

Under section 173 of the Quebec Automobile Insurance Act , GAA has established a Direct Compensation Agreement (DCA) (PDF, 2,644 KB) which stipulates that each driver is compensated directly by his or her own insurer, while the liability of each party involved in a collision is established using the Driver’s Fault Chart in the DCA.

B.3.2.1 Direct compensation in Quebec

Under an informal arrangement with the GAA as representative of insurers in Quebec, the following apply:

- The Crown will pay for its own motor vehicle property damage as a result of a collision, as defined in section 1 of the DCA, occurring in Quebec.

- The Crown will make no claim against owners of vehicles insured by an automobile liability policy in Quebec or any other party bound by the DCA, involved in such a collision.

- Those bound by the DCA have been advised by the GAA to forbear from suing the Crown for property damage resulting from a collision in Quebec involving Crown-owned motor vehicles.

B.3.2.2 Conditions

This informal arrangement with the GAA is subject to the following conditions:

- The Crown reserves the right to:

- sue

- defend any claims made against it by a party bound by the DCA or an insured party who insists on suing the Crown

- advance claims against vehicle owners whose insurers do not adhere to the direct compensation arrangement

- Consistent with section IV of the DCA, the Crown and other insurers have the right to sue in the following exceptional circumstances:

- where the Crown vehicle is damaged while in the care, custody and control of any garage owner, any parking lot operator, a motor vehicle dealer (as referred to in the Highway Safety Code of Quebec), and any towing business operator

- where the Crown vehicle is damaged while being towed

- where the Crown vehicle is damaged by a vehicle that is exempted from being insured under an automobile liability policy (for example, a farm tractor, a farm trailer, a snowmobile, or a vehicle intended for use off a public highway, as provided by the Regulations respecting exemptions from the obligation to hold a liability insurance contract, O.C. 614-84)

B.3.2.3 Special considerations

Where the owner of an exempted vehicle has chosen to have that vehicle covered by an automobile liability policy, then the provisions of the DCA apply to the settlement of a claim arising from an accident with that vehicle. This includes provisions for:

- property transported in a Crown vehicle that is lost or damaged as a result of an accident:

- The Crown will pay for the loss or damage to its own property (up to a maximum of $2,000).

- The Crown will have the right to claim any amount above the $2,000 maximum against the owner of the other vehicle.

- arbitration:

- The Crown is not bound by section V of the DCA pertaining to the arbitration of any dispute between parties bound by the DCA because the arrangement between the GAA and the Crown is informal.

B.4 Bodily injury claims

Bodily injury of a Crown servant caused by a motor vehicle accident while on duty should be handled as an injury on duty in the Treasury Board Workers’ Compensation and Injury-on-Duty Leave policy instruments.

Questions about the Crown servant’s benefits under the Public Service Disability Insurance Plan or under the Long-term Disability Insurance Plan of the Public Service Management Insurance Plan may be directed to the Pension and Benefits Sector of the Treasury Board of Canada Secretariat.