Guide to Departmental Collaboration with Recipients of Grants and Contributions

1. Purpose and Scope

This Guide is intended to build departmental understanding of the situations where collaboration between federal department(s) and grant and contribution (G&C) recipients may be acceptable from a Policy on Transfer Payment perspective. It addresses three specific collaboration scenarios and provides guidance to departments with respect to the type of considerations departments should bear in mind to facilitate such collaboration.

2. Background

In an era of innovation, and the commitment to finding better ways of doing business, some federal departments continue to explore opportunities to collaborate with one another and with G&C recipients in order to fulfill departmental mandates. By collaborating with G&C recipients, departments see opportunities to:

- leverage capacity across sectors

- transfer knowledge

- further shared objectives

Traditionally, collaboration between the government and G&C recipients has been limited by certain sections of the Policy on Transfer Payments, which has been interpreted as prohibiting any federal involvement in a project where a recipient is receiving G&C funding.

As a result:

- G&C recipients have not been able to access government expertise and facilities that could help achieve project outcomes

- federal government scientists have been prevented from working with colleagues in academia and other levels of government

As the government seeks ways to innovate in how it supports scientific, social and economic development, it raises the questions as to how departments can:

- collaborate with G&C recipients to build capacity and enhance Canada’s competitiveness

- remain in compliance with the Policy on Transfer Payments

3. Interpreting the Policy on Transfer Payments

The practice has been to interpret the Policy on Transfer Payments as prohibiting federal involvement in any project that it funds through grants and contributions. However, the policy can be interpreted more precisely to allow federal departments to:

- collaborate in projects that receive a G&C

- provide services and the use of facilities for funded G&C projects

When collaborating with a G&C recipient, departments are expected to:

- comply with all relevant legislation and Treasury Board policy in their interactions with recipients

- ensure that they follow the principles set out in the Policy on Transfer Payments

4. Three types of collaboration in the context of transfer payments

Three scenarios that generally raise questions around collaboration have been developed to help guide and clarify potential collaborations. These scenarios are not exhaustive and each situation is unique in nature due to its details. However, these represent the most common scenarios encountered.

Scenario 1: a G&C recipient uses a federal department’s services and/or facilities

G&C funding typically involves a direct relationship between a federal department as the funder and a recipient that:

- undertakes its project and related activities

- receives payment for eligible expenses incurred

In this scenario, collaboration refers to a federal department providing services and/or facilities to a recipient of a transfer payment. The recipient:

- is invoiced by the department for services provided

- claims the expenditure from the funding department as part of the G&C project

The G&C recipient uses its transfer payment dollars to pay for federal government services for which the department has the authority to charge (see Appendix A, Example 1, for more details).

In this scenario, the use of G&Cs by a recipient to procure services from a federal department that has charging authority is not deemed to be supporting the supplier department ongoing operations for which they have been appropriated.

Considerations for departments that provide services or the use of a facility (supplier departments)

A department that is considering providing services to the public that may have received G&C funding should ensure that:

- it has the authority to provide the service or the use of a facility to a recipient and to charge for the service

- the policy requirement for determining and charging fees for the service are followed, for example, an hourly rate for using a wind tunnel to test the design of a vehicle (the recipient is not to be given a reduced rate)

- the service is equally available to any potential customer (a recipient should not receive a service unless it is available to non-recipients)

Considerations for departments that fund recipients

Departments that are considering working with non-government entities to achieve a common goal should ensure that:

- the activity and associated expenditure are eligible according to the program’s terms and conditions, before the recipient engages the department for the service

- services provided by a department are eligible expenses under the funding agreement (for example, “professional services”)

- Any procurement transaction on the part of recipients are recorded as a separate and distinct accounting entry (that is, separate and distinct from the transfer payment)

- a recipient is not obligated to use the services of a specific department, as such a practice could be perceived as:

- providing an unfair competitive advantage

- discouraging competition

Scenario 2: a non-funding department collaborates on a G&C project using its own resources

In this scenario, the most common arrangement is where a non-funding department (collaborator department) has a shared interest in a project with a G&C recipient and they enter into a collaborative arrangement. The collaborator department is addressing an operational requirement uses its own operating funds, appropriated for this purpose.

Considerations for non-funding departments (collaborator departments)

Departments that are considering collaborating on a G&C recipient’s project should ensure that:

- the department has the authority to provide the use of a facility to a recipient, at a cost or at no costs.

- the arrangement is documented in a collaboration agreement that outlines the roles and responsibilities of the parties and the terms of the collaborator’s participation in the project (the agreement should be reviewed by the department’s legal services unit and procurement unit to ensure that it complies with the appropriate policies and legislation);

- key financial representatives within the department are contacted to determine whether costs related to the collaboration should be accounted for separately, with appropriate internal coding created

- an estimate of costs to be incurred is made available to any federal department that is:

- considering providing funding to a recipient

- considering participating in the project

Considerations for departments that fund recipients (funding departments)

When calculating the stacking limit,Footnote 1 the funding department includes the value of the collaborator department’s participation (as applicable). Doing so will ensure that the overall value of the recipient project includes all government funding (transfer payments and operations and maintenance).

Scenario 3: a non-funding federal department collaborates on a G&C project, and incremental costs are supported by the funding department via transfer of funds from Vote 10 to Vote 1

In situations where there is the potential for a department to share and leverage expertise but the department does not have sufficient resources to proceed with a collaborative arrangement with a recipient of a G&C, the funding department can propose to transfer funds to the collaborator department to offset the incremental cost of collaboration when there is a shared interest in the project.

Any potential transfer of funds to another department should be discussed with the Treasury Board of Canada Secretariat. The following need to be considered:

- Parliament must approve a transfer of funds between departments

- sufficient time for the transfer to be completed taking into consideration the supply cycle

- appropriate policy coverage

The value of the collaborator department’s participation should be part of the stacking calculations for the recipient of the transfer payment.

Considerations for non-funding departments (collaborator departments)

Departments that are considering collaborating on a G&C recipient’s project should ensure that:

- the arrangement is documented in a collaboration agreement to outline:

- the roles and responsibilities of the parties

- the terms of the collaborator department’s participation in the project

- the agreement is reviewed by the department’s legal services unit, procurement unit and financial unit to ensure that it complies with appropriate policies and legislation

Considerations for departments that fund recipients (funding departments)

Funding departments should ensure that, when calculating the stacking limit of a project, the value of a collaborator department’s participation in the project is considered as part of the government’s contribution, as applicable.

Considerations for departments that transfer funding

Departments that are considering supporting other departments in furthering a transfer payment project should ensure that:

- the transfer of funds from a Grants and Contributions Vote to an Operating Vote is not used for costs that have already received funding appropriated by Parliament, such as:

- fixed costs of government laboratories

- salary costs for staff already employed

- the transfer of funds is used only where participation in the project represents an incremental cost to the collaborator department (for example, the incremental cost of running a wind tunnel test when the facility would otherwise be idle, or hiring a term employee to take over the assigned duties of a salaried employee while the salaried employee is participating in the project)

- the transferred funds are not used to upgrade laboratory equipment or expand the facility for the purpose of participating in the funded project

Departments should note that when a significant amount of a department’s transfer payment funds are transferred to O&M funds of another department there may be the perception that the funds belong more appropriately in the O&M budget on a permanent basis.

5. Principles

Departments should follow these principles related to transfer payments when they participate in collaborative arrangements:

- Transparency and fairness: When considering potential transfer payment recipients, the assessment and selection process should be open and fair. All parties involved should be transparent about their involvement with potential recipients.

- Mandate: Federal government departments are restricted to activities that are within their mandate. For example:

- the activities that federal employees undertake when collaborating on a recipient’s project must be within the mandate of their department

- the provision of services to a recipient and the recipient’s use of facilities must be within the mandate of the department

- Questions about a department’s legal authority should be referred to the department’s legal services unit.

- Security: Departments are responsible for protecting sensitive information and assets under their control. Before entering into a collaboration agreement, departments should consult with their departmental security officials to assess the risk to departmental information and assets to ensure the collaboration agreement includes appropriate provisions in respect of departmental security obligations. The department’s legal services unit should also be consulted on these provisions. For information, please refer to the 2019 Policy on Government Security.

- Legal liability: Transfer payments are structured as an arm’s-length relationship in which the government’s only role is to provide funds. The objective is to limit legal liability. Where the government’s role, in relation to a recipient’s project, expands beyond providing funds, there is a potential to expose the government to greater liability. Departments that collaborate with a recipient of a transfer payment should consider the following when defining the relationship with the recipient in order to limit their exposure to legal liability:

- The collaborative agreement between the department and the recipient should clearly define:

- governance

- parties and the nature of the relationship (the agreement should make it clear that it is the recipient’s project)

- term and location

- intellectual property rights

- maintenance and access to records

- sharing of resources (employees, equipment)

- data management, including confidentiality and personal information

- potential conflicts of interest

- communications and publication

- jurisdiction and governing law

- indemnification and liability

- security

- termination security

- occupational health and safety

- insurance

- other requirements, as deemed necessary

- If the agreement involves the use of space, the agreement should clearly define:

- the space to be used

- the nature of use and access

- any applicable fees

- The collaborative agreement between the department and the recipient should clearly define:

- Separation: There should be a clear separation between the department that issues the transfer payment and the department that collaborates with the recipient. If the separation is not clear, there is a risk that the transfer payment could be perceived as an acquisition of goods or services by the Government of Canada, i.e. a department paying its O&M costs with transfer payment funds. A reminder that a transfer payment, as defined in the Policy on Transfer Payments, does not result in the acquisition by the Government of any goods, services or assets. Separation is clear when the collaborating department and funding department are not the same. If a single department is both funding a project and collaborating in it, there should be clear separation between the unit that administers the funding agreement and the unit that collaborates in the project. Departments must avoid creating unintended procurement processes (or the perception of a procurement process) when setting up collaboration and transfer payment agreements.

- Independence: A non-funding department that is considering a collaborative arrangement with a recipient should not be involved in:

- drafting a proposal

- assessing projects that are being considered for funding

- The recipient is solely responsible for achieving the expected results of the agreement with the funding department.

- Non-monetary contributions: Departments must not “contribute” the use of a government facility or the work of a federal government employee to a recipient’s project at no cost in the form of a transfer payment. A non-cash input made by the recipient to its own project could be considered an eligible expenditure provided it is supported under the funding department’s terms and conditions.

6. Reference

7. Enquiries

Members of the public may contact Treasury Board of Canada Secretariat Public Enquiries if they have questions about this guide.

Individuals from departments should contact their departmental transfer payment policy group if they have questions about this guide.

Individuals from a departmental transfer payment policy group may contact Financial Management Enquiries at fin-www@tbs-sct.gc.ca for interpretation of this guide.

Appendix A: examples of how to apply the Policy on Transfer Payment

This appendix outlines three simple examples to illustrate how federal departments can collaborate with funding recipients and still be in compliance with the Policy on Transfer Payments.

Before a department makes any decision about funding a project or collaborating with a recipient, it should consult with its legal services unit and transfer payment policy group. There can be significant risk associated with how transfer payment funding and collaboration are perceived when transfer payments are involved, and perceptions are subjective. Consultations with the appropriate departmental experts, can help ensure that such risks are mitigated.

Example 1: a G&C recipient uses a federal department’s services or facilities

Under certain circumstances, a recipient of G&C funding may procure services or facilities from a non-funding department (supplier department) that has the authority to provide services and charge for them.

A university researcher receives a $1-million grant from Sport Canada (Canadian Heritage) to undertake research on athletic uniforms in order to improve their aerodynamic properties. The researcher uses some of the grant funding to purchase time in National Research Council Canada’s (NRC’s) wind tunnel to perform tests on various materials.

In this case, NRC is not participating in the recipient’s project; it is strictly providing a service to a paying customer. There is no relationship between Canadian Heritage and the NRC.

Expenses related to testing materials are an eligible expense under the funding agreement between Canadian Heritage and the recipient under the category of “professional services.”

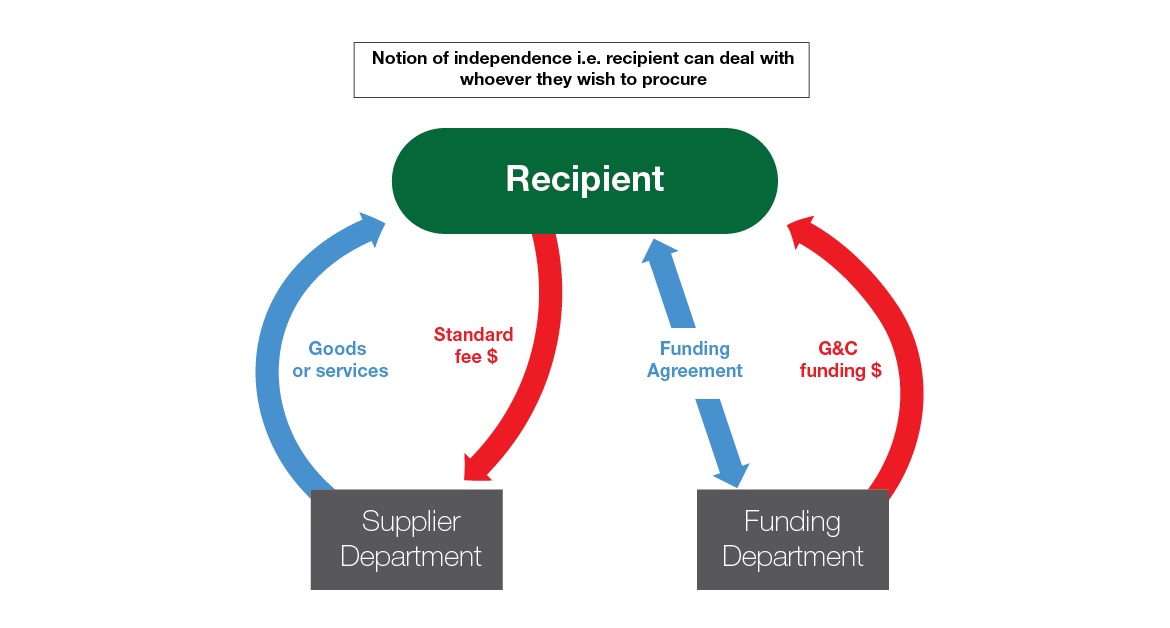

In Figure 1, the university researcher is represented by the “Recipient” box, Canadian Heritage is represented by the “Funding department” box, and NRC is represented by the “Supplier department” box. The red arrow at the right represents the grant issued by Canadian Heritage to the researcher, and the red arrow at the left represents the fee paid to NRC for the use of the wind tunnel. The blue arrow represents NRC providing the researcher with access to the wind tunnel. The light-blue double arrow represents the funding agreement between the researcher and Canadian Heritage.

Figure 1 - Text version

Notion of independence i.e. recipient can deal with whoever they wish to procure services or goods (private organization or government department)

Considerations for Supplier Department (NRC in this example):

- Cannot provide service/good free of charge

- Must have charging authority

Considerations for Funding Department (Canadian Heritage in this example):

- G&C authority needed

- No in-kind

- Cannot provide service/good it must be $,$$$ dollars

Example 2: a non-funding federal department collaborates on a G&C project using its own resources

In this scenario, a department enters into a collaboration with a G&C recipient using its own O&M funds, appropriated for this purpose. Considering the shared interest in the project by all parties, the collaborator department will receive a direct benefit (that is, fulfillment of part of its mandate). In addition, the recipient may receive G&C funding from a funding department. The value of the collaborator department’s participation should form part of the stacking calculations for the recipient of the G&C.

Natural Resources Canada (NRCan) is involved in a collaborative research project with a large forestry company to investigate the effects of various forestry management techniques. Through this collaborative activity:

- NRCan is fulfilling its mandate of promoting sustainable resource development

- the forestry company is gaining knowledge that will help it increase efficiency and profitability

NRCan’s participation includes four weeks of a scientist’s time and use of laboratory facilities. NRCan funds its participation through its own O&M budget. The forestry company contributes its forestry assets (land) and equipment to the project. In addition, the Atlantic Canada Opportunities Agency (ACOA) provides G&C funding to the forestry company because the project will generate jobs in the Atlantic provinces.

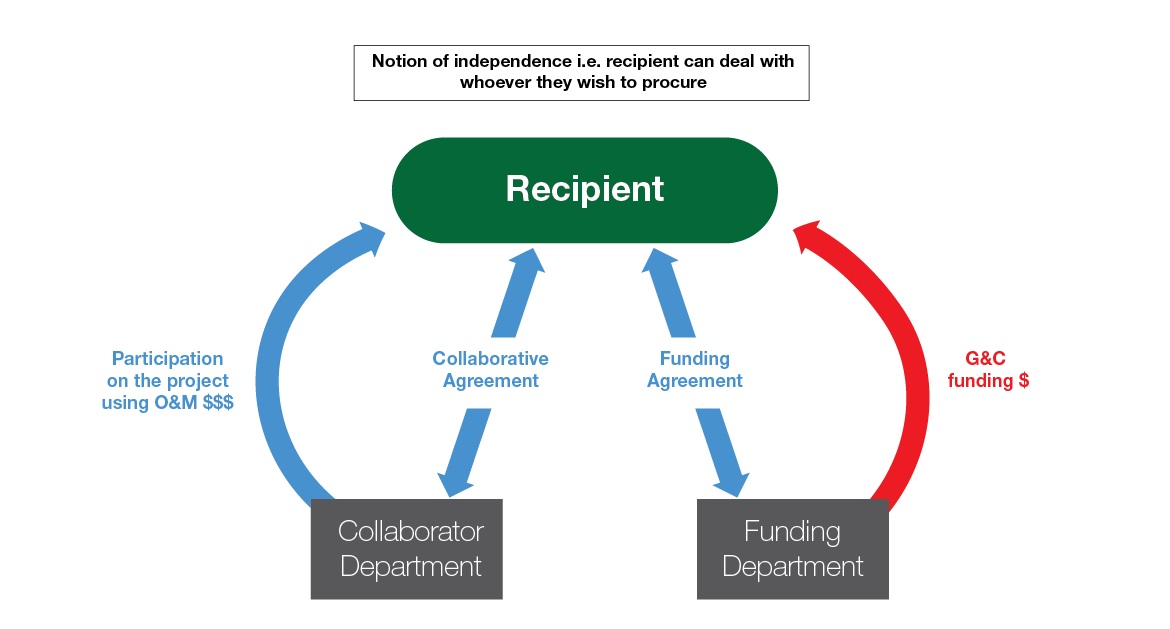

In Figure 2, the forestry company is represented by the “Recipient” box, ACOA is represented by the “Funding department” box, and NRCan is represented by the “Collaborator” box. The red arrow at the right represents the grant issued by ACOA to the forestry company. The blue arrow represents NRCan providing four weeks of a scientist’s time and use of laboratory facilities for the project. The light-blue double arrow at the right represents the funding agreement between the forestry company and ACOA, and the light-blue double arrow at the left represents the collaborative agreement between the forestry company and NRCan.

Figure 2 - Text version

Notion of independence i.e. recipient can deal with whoever they wish to procure services or goods or to collaborate (private organization or government department)

Considerations for Collaborator Department (NRCan in this example):

- Collaboration must be in support of the department mandate for which the department is appropriated (O&M)

- Incremental costs are to be calculated

- Must determine and asses whether collaboration could create an unintentional procurement or be perceived as a procurement

Considerations for Funding Department (ACOA in this example):

- G&C authority needed

- No in-kind

- Cannot provide service/good it must be $,$$$ dollars

Example 3: a non-funding federal department collaborates on a G&C project where incremental costs are supported by the funding department via transfer of funds from G&C Vote to Vote 1 O&M

In certain circumstances, a collaborator department may participate in a project that is receiving G&C funding to share and leverage expertise at the request of either a G&C recipient or a federal department. In this scenario, the funds to support the incremental collaboration cost are provided by the funding department through a G&C budget transfer (Vote 10) to the collaborator department’s O&M budget (Vote 1).

This scenario that may be used primarily where the collaborator department does not have sufficient resources to undertake the collaboration. The funding department can decide to transfer funds to the other department to offset the collaboration cost if the participation is deemed necessary for the project’s success where both have a shared interest in the project.

The value of the collaborator department’s participation is included in calculating the stacking limit under the funding agreement. In addition, the transfer of funds is:

- discussed with the Treasury Board of Canada Secretariat during the initial planning stage

- subject to Parliamentary approval through an Appropriation Act

- appropriate policy coverage

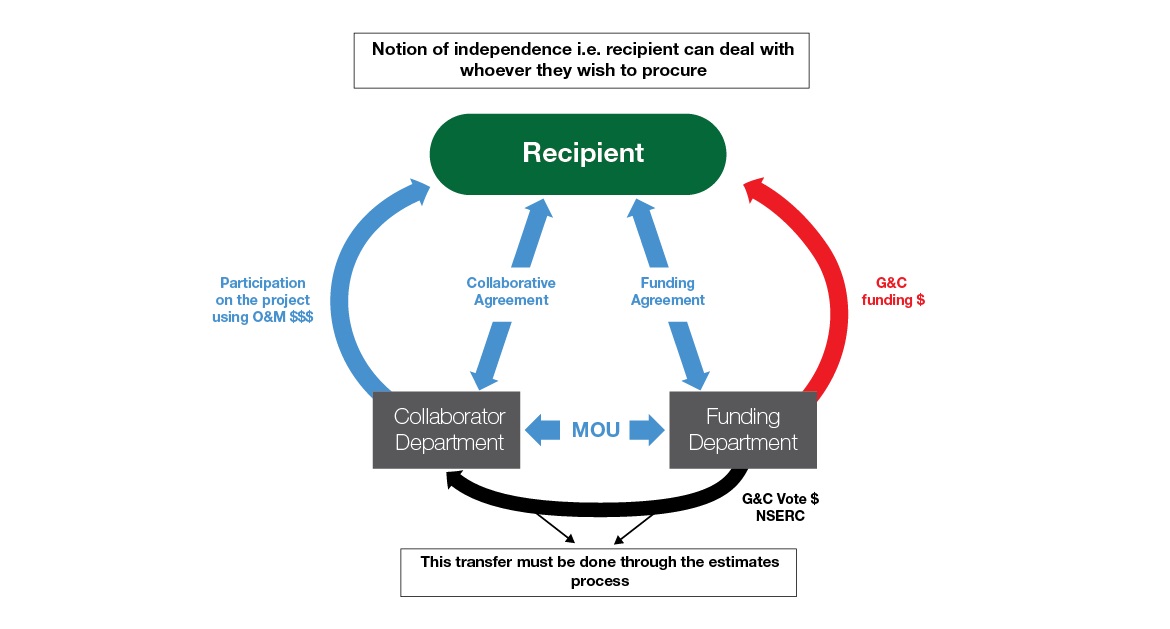

The National Sciences and Engineering Council of Canada (NSERC) funds a university researcher who is developing a new technology that requires expertise from National Research Council Canada (NRC).

NSERC provides contribution funding to the university researcher under a funding agreement. Under a separate agreement between the university researcher and NRC, a scientist at the NRC participates in the project for two weeks, using the NRC’s laboratory facilities.

The university researcher does not pay the NRC directly for its services, and neither are the services considered an eligible expense under the contribution agreement. The value of the services ($10,000) is considered to be part of the overall cost of the project and is therefore included in the calculation of stacking limits.

- Through the estimates process of the parliamentary financial cycle, NSERC transfers $10,000 from its Vote 10 (Grants and Contributions budget) to NRC’s Vote 1(Operating budget). Note that Vote transfers are not done using an interdepartmental settlement. Such settlements should be used only when purchasing goods and services from another department.

In Figure 3, the university researcher is represented by the “Recipient” box, NSERC is represented by the “Funding department” box, and NRC is represented by the “Collaborator” box. The red arrow at the right represents the grant issued by NSERC to the university researcher, and the black arrow represents the transfer of funds from NSERC to NRC. The blue arrow at the right represents the NRC scientist participating in the research for two weeks using an NRC laboratory. The light-blue double arrow at the right represents the funding agreement between the university researcher and NSERC, and the light-blue double arrow at the left represents the collaborative agreement between the university researcher and NRC. The lower light-blue double arrow represents the memorandum of understanding between the two departments.

Figure 3: illustration of how a non-funding department collaborating on a G&C project where costs are supported by the funding department via transfer of funds from G&C Vote to Vote 1 is administered

Difference from scenario 2:

- Collaborator department does not have $ to cover all collaboration cost.

- Funding department may only cover incremental cost related to the collaboration.

Difference from scenario 2:

- Collaborator department does not have $ to cover all collaboration cost.

- Funding department may only cover incremental cost related to the collaboration.

Figure 3 - Text version

Notion of independence i.e. recipient can deal with whoever they wish to procure services or goods

This transfer must be done through the estimates process and approved by Parliament in an Appropriation Act.

Considerations for Collaborator Department (O&M Vote $, NRC in this example):

- Collaboration must be in support of the department mandate for which the department is appropriated (O&M)

- Incremental costs are to be calculated

- Must determine and asses if collaboration could be perceived as a procurement

Considerations for Funding Department (G&C Vote $ and NSERC in this example):

- G&C authority needed

- No in-kind

- Cannot provide service/good it must be $,$$$ dollars

© Her Majesty the Queen in Right of Canada, represented by the President of the Treasury Board, 2012,

ISBN: