Guide to Delegating and Applying Spending and Financial Authorities

More information

Directive:

Terminology:

Hierarchy

1. Date of publication

This guide takes effect on .

2. Application, purpose and scope

This guide applies to the organizations listed in section 6 of the Policy on Financial Management.

The purpose of this guide is to support departments in managing their delegation of spending and financial authorities.

This guide supports the requirements set out in the Directive on Delegation of Spending and Financial Authorities. Examples are provided for illustrative purposes only and may not apply to all departments or situations.

Section 3 of this guide presents an overview of spending and financial authorities and their delegation.

Section 4 elaborates on the spending and financial authorities and how they are to be exercised.

3. Delegating spending and financial authorities

This section provides an overview of spending and financial authorities by addressing the questions shown in Figure 1.

Figure 1 - Text version

This figure provides an overview of delegating spending and financial authorities by addressing specific questions shown and providing the reader where to find the answer within section 3 of this document.

| Questions Linking to Content in Section 3 | More information is provided in the following sections and subsections |

|---|---|

| What are spending and financial authorities? | Section 3.1 |

| What documentation is required? The documentation is also known as auditable evidence. | Section 4.6 |

| What is delegation and what are its benefits? | Section 3.2 and 3.3 |

| Who may delegate authorities? | Section 3.4 |

| Who may be delegated authorities? | Section 3.5 |

3.1 Definition of spending and financial authorities

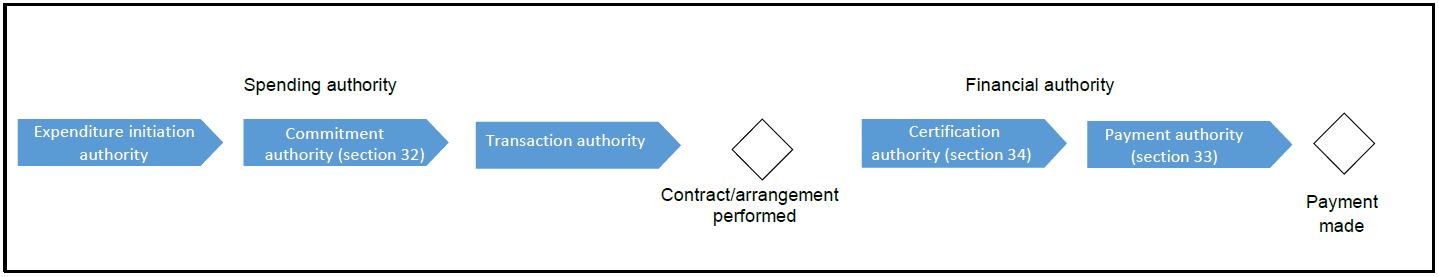

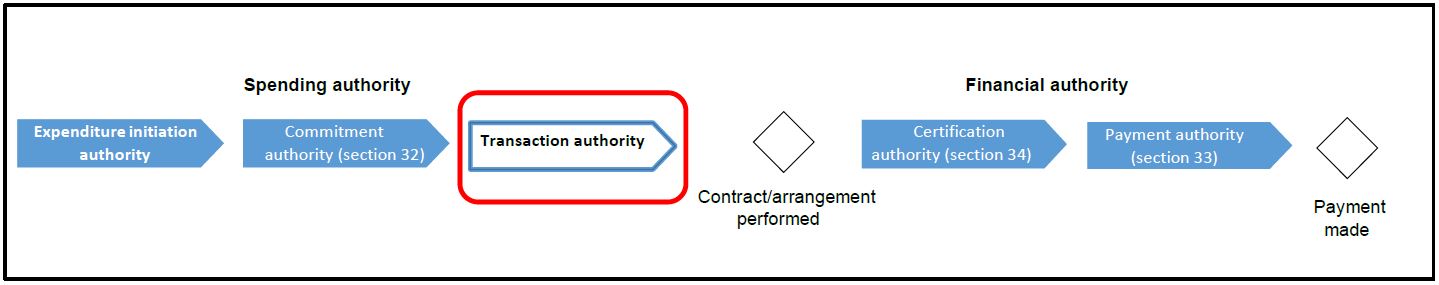

Managing expenditures is central to achieving the objectives of departments and of the government as a whole. The process of managing expenditures (see Figure 2) is controlled through a set of spending and financial authorities. These authorities are governed by the legislative requirements set out in the Financial Administration Act (FAA) and, in the case of transaction authority, by Public Services and Procurement Canada.

Figure 2 - Text version

Figure 2 demonstrates linearly, the process of managing expenditures through a set of spending and financial authorities that are governed by the legislative requirements set out in the Financial Administration Act (FAA) and, in the case of transaction authority, by Public Services and Procurement Canada.

The first three elements of the figure are within the Spending authority:

- expenditure initiation authority

- commitment authority (section 32 of the FAA)

- transaction authority

Following these spending authorities, a contract or arrangement can be performed.

The last two elements in the figure are within the Financial authority:

- certification authority (section 34 of the FAA)

- payment authority (section 33 of the FAA)

Following the payment authority, the payment is made.

- Figure 2 will be repeated in this guide as it elaborates on each of the 5 authorities:

- Figure 5.1 will elaborate on expenditure initiation authority

- Figure 5.2 will elaborate on commitment authority (section 32 of the FAA)

- Figure 5.3 will elaborate on transaction authority

- Figure 5.4 will elaborate on certification authority (section 34 of the FAA)

- Figure 5.5 will elaborate on payment authority (section 33 of the FAA)

Spending authority consists of three elements:

- expenditure initiation authority

- commitment authority (section 32 of the FAA)

- transaction authority

Financial authority consists of two elements:

- certification authority (section 34 of the FAA)

- payment authority (section 33 of the FAA)

Some authorities may occur simultaneously, as follows:

- expenditure initiation and section 32 commitment authority or

- expenditure initiation, section 32 commitment authority and transaction authority

Even when authorities occur at the same time, each has requirements that are to be met to ensure that expenditures are managed appropriately.

These spending and financial authorities apply to all charges against an appropriation, whether or not they will result in a payment or an interdepartmental settlement.

3.2 Delegation of spending and financial authorities

The delegation of spending and financial authorities is a key internal control in the expenditure management process. A well-designed delegation of spending and financial authorities empowers employees and helps create the appropriate balance between higher-risk decisions that require senior executive-level engagement and ongoing operational decisions made by employees.

It is important that federal ministers and deputy heads understand their department’s organizational risk environment and the controls that are in place to mitigate high risks. This understanding helps ensure that spending and financial authorities are delegated to the appropriate role and level, and at the appropriate dollar limit.

Spending and financial authorities are formally delegated through a delegation chart. A chart is often accompanied by supporting notes, specimen signature documents, electronic authorization rules and other instruments. An example of a delegation chart is provided in Appendix A.

3.3 Benefits of delegating spending and financial authorities

Delegating an authority fosters the efficient use of resources, thereby increasing the responsiveness of federal organizations, enhancing overall performance and providing better services for Canadians.

Delegation of routine business allows senior managers of federal departments and agencies to focus on more urgent matters by distributing certain tasks, with the necessary authority, to departmental personnel. Delegation also empowers staff to engage in decision making and helps them develop skills by learning the importance of their delegated roles with respect to the appropriate use of public funds.

Delegation is not an abdication of responsibility. The person who has the highest authority within the organization retains the responsibility and authority, even when they choose to delegate this authority to staff. For example, an assistant deputy minister (ADM) has the highest authority for his or her branch, a director general has the highest authority for his or her sector, and so on.

When delegations are appropriately implemented, employees are empowered to deliver effectively on day-to-day operations and transactional issues. Decisions that involve higher risk or high visibility can be referred to more senior officials.

3.4 Authority to delegate spending and financial authorities

Most ministerial authorities are:

- conferred by Parliament through statutes that set out the powers, duties and functions for which the minister is accountable

- granted under common law or

- assigned by the prime minister

Departments are to seek their minister’s approval whenever:

- new delegations are being implemented or

- where there is a proposed change to what delegations can be exercised, their limits and by whom

Ministerial approval is particularly important where departments are seeking the delegation of additional flexibility. In this way, departments can confirm their minister’s risk comfort level.

The FAA designates deputy heads as accounting officers for their organizations within the framework of ministerial accountability. In the accounting officer role, they are vested with various authorities, including financial management.

Through statutes and under common law, some deputy heads have the power to act for ministers. According to the Interpretation Act, and subject to departmental or other enabling legislation, a deputy of a minister can be empowered with the same authorities as those vested with the minister, except for the authority to make a regulation. A deputy of a minister may exercise this legislative flexibility in the administration of a department, including the management of the delegation of spending and financial authorities. Such delegation is unique to each department, and therefore legal counsel should be consulted to determine whether a deputy of a minister has been empowered within their department with the same authorities of the minister. In addition, not all deputy heads have the status of the deputy of a minister; a legal opinion from the department’s legal counsel is normally obtained to clarify the extent of the legislative flexibility that applies.

Table 1 outlines the delegation of spending and financial authorities to departments, along with limitations on this delegation.

| Authority | Description | |

|---|---|---|

| Note: Departments must consider any specific restrictions established through legislation, regulations and Treasury Board policies when establishing and delegating authorities. | ||

| Spending | Expenditure initiation authority | Ministers or deputy heads delegate expenditure initiation authority and vest this authority in writing to departmental officials, unless otherwise specified in other policies. |

| Commitment authority (FAA, section 32) | Deputy heads are vested with commitment authority and delegate this authority in writing to departmental officials. | |

| Transaction authority | Ministers and deputies of ministers, or the applicable legal authorities, delegate the authority to sign goods and services contracts, within limits determined by the Treasury Board and in consideration of other authoritative legislation. Sometimes, an agency such as Canada Economic Development for Quebec Regions, as a corporate body, has this authority and not the minister. | |

| Financial | Certification authority (FAA, section 34) | Ministers or deputies of ministers (as outlined in the Interpretation Act) delegate certification authority in writing to departmental officials. |

| Payment authority (FAA, section 33) | Ministers or deputies of ministers (as outlined in the Interpretation Act) delegate payment authority in writing to departmental officials. | |

Although some deputy heads have the legal authority to delegate spending and financial authorities to employees, it is recommended that ministers always be fully informed about the delegation of authorities to ensure that both the minister and the deputy head are comfortable with the balance between empowering departmental officials and maintaining control over high-risk areas.

It is a good practice to ensure clear communication between a minister and a deputy head when establishing delegations of spending and financial authorities, so that:

- both officials have a clear understanding of their legislative authorities regarding delegation

- delegated authorities from the minister and the deputy head are clearly identified in formal delegation documents and are aligned with their respective legislative authorities

- the delegations of authorities are communicated in writing, and both officials have opportunities to review delegation documents

3.5 Authority to receive delegated spending and financial authorities

It is the prerogative of the minister, deputy head and the deputy of the minister to determine the appropriate delegation of spending and financial authorities.

Departments are encouraged to delegate down as low as possible in the hierarchy, keeping in mind the organization’s risk environment, to the level supported by their controls.

According to subsection 4.1.5.1 of the directive, “authorities have been formally delegated to the position through the delegation chart.” The delegation chart is the instrument that captures the delegation of the department’s spending and financial authorities to a position.

The delegated position should align with managerial, budgetary and operational responsibilities, for example, a budget centre manager. However, such delegations may not always be pragmatic or feasible and may need to be to a position that does not have these responsibilities, for example, an administrative position. In such cases, it is advisable to have compensating controls in place, for example, having the manager review the payments on a monthly basis to confirm they were appropriately made. Section 3.8 of this guide provides details on the delegation chart.

In addition, there are situations where it is recommended that certain authorities be delegated to functional specialists, given the technical knowledge necessary to exercise the authorities, for example:

- transaction authority: it is expected that functional specialists in the area of procurement and contracting are given this authority

- payment authority (section 33 of the FAA): it is expected that functional specialists in the area of finance are given this authority

It is also good practice to delegate authority to one person for one cost centre to avoid having multiple budget centre managers who share responsibility for the same budget, thereby providing a level of control over the use of the cost centre.

The chief financial officer (CFO) and the deputy CFO can also be provided with delegated spending and financial authorities in their functional roles in the area of finance. These positions have both functional and managerial responsibilities, and they will have different types and levels of authority as defined in the delegation chart and in the chart’s supporting notes.

According to subsection 4.1.1.2 of the directive, “delegations are to positions identified by title and not to individuals identified by name.” Therefore, regardless of a person’s status as an employee or a non‑employee (for example, a contractor), that person may be delegated spending or financial authority. However, subsection 4.1.5.3 of the directive requires delegated persons to have successfully completed training before being granted delegated authority. Subsection 4.1.5.3.1 of the directive stipulates that individuals not subject to the Policy on People Management must have comparable training as established by the CFO or another person designated by the deputy head.

According to subsection 4.1.1.4 of the directive,“individuals with delegated spending and financial authority do not sub-delegate these authorities to others.” When a person is delegated authority, that person cannot allow another person in the organization to use this delegation on his or her behalf.

Authorities can be exercised on an acting basis (subject to restrictions) if the person acting has properly been delegated these authorities in writing and has fulfilled all the necessary requirements of the directive.

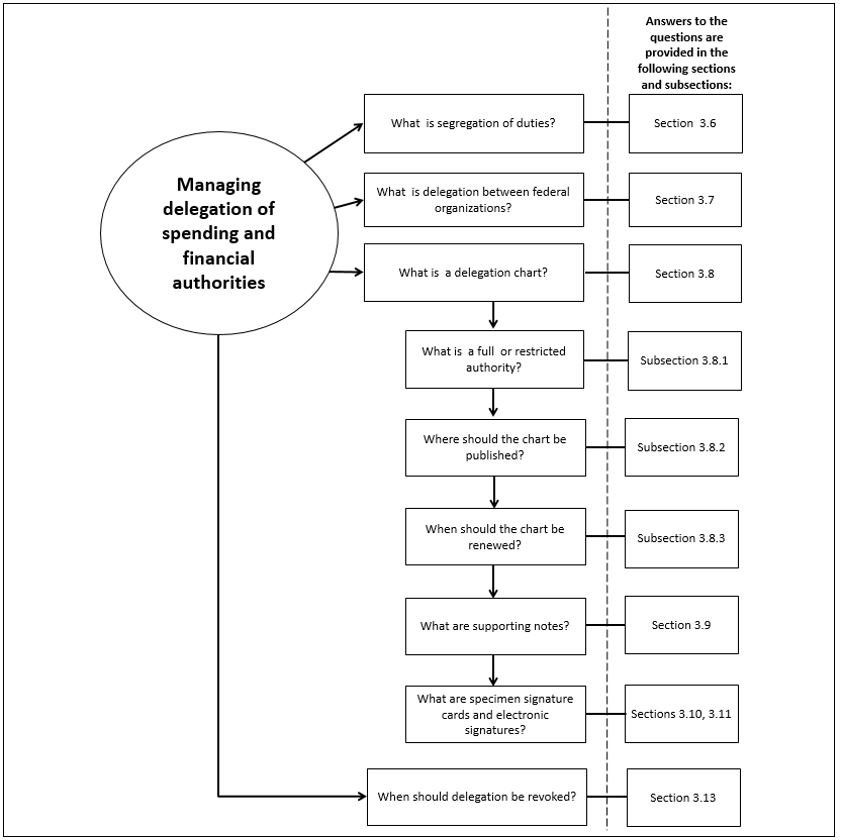

The remainder of section 3 of this guide focuses on managing delegation of spending and financial authorities by addressing the questions shown in Figure 3.

Figure 3 - Text version

This figure provides an overview for the management delegating spending and financial authorities and where to find the answer within section 3 of this document.

| Questions Linking to Content in Section 3 | More information is provided in the following sections and subsections |

|---|---|

| What is segregation of duties? | Section 3.6 |

| What is delegation between federal organizations? | Section 3.7 |

| What is a delegation chart? | Section 3.8 |

| What is a full or restricted authority? | Subsection 3.8.1 |

| Where the chart should be published? | Subsection 3.8.2 |

| When should the chart be renewed? | Subsection 3.8.3 |

| What are supporting notes? | Section 3.9 |

| What are specimen signature cards and electronic signatures? | Sections 3.10 and 3.11 |

| When should delegation be revoked? | Section 3.13 |

3.6 Description of segregation of duties

According to subsections 4.1.11.1 and 4.1.11.2 of the directive,the same individual cannot exercise the following:

- both transaction authority to enter into a contract and certification authority (s.34) on the same transaction unless the transaction has been designated by a department as a low-risk and low-value transaction

- both certification (s.34) and payment authority (s.33) on the same transaction

Segregation of duties is a critical internal control to effectively safeguard the department’s assets, reduce the risk of error, and minimize the potential for fraud. Segregation of duties enhances oversight by allowing an additional review of the transaction in order to identify potential errors and correct them before a payment is made.

In some cases, the segregation of duties may not be possible. For example, it may be difficult to segregate duties at small departments and agencies or at remote locations where there are not sufficient staff to perform the different roles. Where the authorities are exercised by the same person, additional compensating controls should be implemented.

The following are examples of compensating controls:

- increased oversight where transaction and certification (s.34) authorities have been exercised by the same person

- increased reporting of exceptions where certification (s.34) and payment authorities (s.33) have been exercised by the same person

- increased post-payment sampling for all expenditures over a certain threshold, to new vendors, with similar amounts, or for similar goods and services

Additional oversight or other control measures should be documented, along with the reasons why the segregation of duties is not possible.

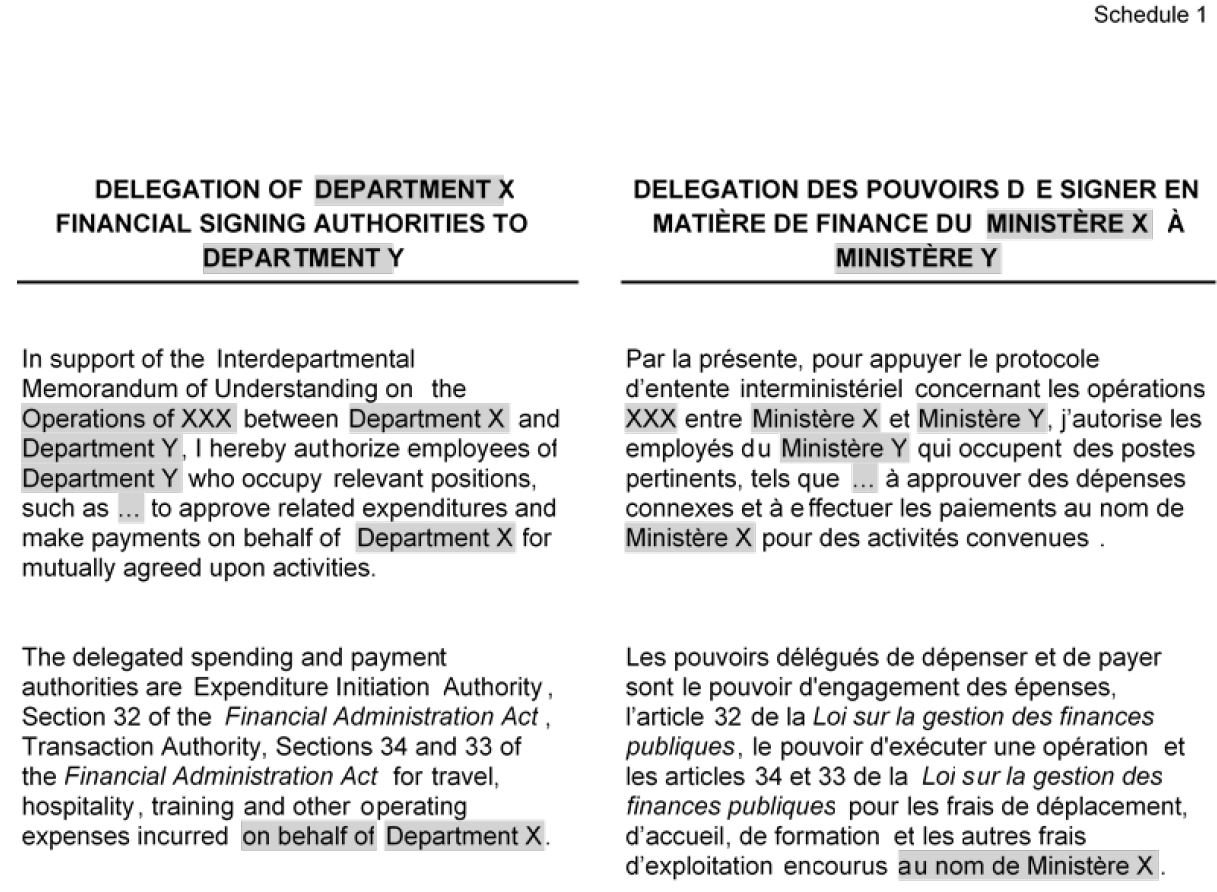

3.7 Delegation between federal organizations

Subsection 4.1.1.6 of the directive states that “financial authorities delegated to other departments require the signature of either the minister or the deputy of the minister.” This practice permits the delegation of financial authorities between departments where the approval of either the minister or the deputy of the minister is obtained.

The authority to delegate to other organizations does not include the transfer of functions that result from changes to the machinery of government. In such cases, the transfer of authorities and functions are subject to the prerogative of the prime minister.

Changes in the machinery of government include the creation of new departments, changes to departmental names, and the transfer of responsibilities between organizations. Such changes are pursuant to the Public Service Rearrangement and Transfer of Duties Act. When a transfer of functions or amalgamation of departments occurs, legal consultation is required to determine the impact on delegated authorities and of subsection 31.1 of the FAA.

When financial authorities are to be delegated under a Memorandum of Understanding or any other arrangement such as a letter of agreement between departments, the signature of either the minister or the deputy of a minister is required. It is good practice to discuss such a delegation with the minister or the deputy of the minister before delegating to other organizations. An example of a Memorandum of Understanding is provided in Appendix B. Departments should consult with their legal counsel to ensure that they are legally allowed to delegate transaction authority externally.

3.7.1 Internal support services

In accordance with subsection 29.2 of the FAA, departments may provide or receive internal support services from other departments.

Internal support services are administrative activities as listed in subsection 29.2(4) of the FAA, such as:

- human resources management

- financial management

- information management

- information technology

- communications

- real property

- materiel services

- acquisition services

- any other administrative service that is designated by order of the Governor in Council

Written agreements that define the scope of services, accountabilities and service standards are to be established and approved by departmental representatives involved in these arrangements. As part of this process, spending and financial authorities may need to be delegated by the minister or by the deputy of the organization that receives services. This delegation ensures that departmental officials from the organization that is providing services can exercise the necessary spending and financial authorities. More information on services between departments is provided in the Directive on Charging and Special Financial Authorities.

3.7.2 Other arrangements

Apart from internal services listed in subsection 29.2(4) of the FAA, a department may provide government-wide services to other departments when authorized by legislation or by other formal authorities (for example, information technology services provided by Shared Services Canada). Similar to internal support services, the delegation of authority between departments may be required and performed by the minister or the deputy of the minister.

3.8 Delegation charts

The delegation chart and supporting notes are key controls in the expenditure management process. The delegation chart, along with the supporting notes and other documents explaining the roles and accountabilities, specifies the departmental authorities that can be exercised by different positions.

A delegation chart of spending and financial authorities serves as the tool for ministers and deputy heads to delegate financial and spending authorities to departmental officials. An example of a delegation chart, along with best practices regarding other information to include in a delegation chart, is provided in Appendix A.

A delegated authority comes into effect when the minister and/or the deputy head signs the delegation chart. Subsection 4.1.1.5 of the directive requires that “the delegation chart has distinct signature areas for the minister and deputy head in order to clearly identify which parts apply to them.”

The signature area in the sample chart in Appendix A provides two signature options:

- Option 1:

- The Minister authorizes the chart except for Section 32 elements of the FAA; and

- The Deputy Head authorizes the chart for Section 32 elements as this administrative authority is under his or her responsibilities.

- Option 2:

- The Deputy of the MinisterFootnote 1 authorizes all elements of the chart; and

- The Minister signs the chart for information purposes to confirm having seen the delegated authorities for his or her department.

After the authority has been formally delegated to the position through the delegation chart, the individual in that position should be informed in writing by their supervisor. The delegation is usually done using a specimen signature card, as it identifies the position that has been granted authority. The person holding the position then receives the powers assigned to the position according to the delegation chart. However, that person cannot be granted delegated authority until he or she has completed the required training, as required by the directive. This training is to be revalidated every five years. Departments should use training available through the Canada School of Public Service. Separate agencies as listed in Schedule V of the FAA can develop training based on their respective requirements. Departments may wish to provide specific training for functional specialists, for example, a contracting authority or a financial payment authority.

3.8.1 Full or restricted authority

According to subsection 4.1.1.3 of the directive, “the extent of delegations (full or restricted authority) are specified for each position and each type of spending and financial authority.” Full authority is used to indicate that the person who has delegated authority has no limits for the transactions to the extent of the budget under their authority.

When there is a legal or policy requirement for a limit on a transaction, regardless of whether the limit is departmental or centrally imposed, the dollar limit should be shown in the delegation chart. Alternatively, an indication of a restricted authority with further details on the restriction should be provided in the supporting notes.

In addition, a delegated authority can be further restricted by an individual’s manager should he or she wish to do so. Such a restriction is usually demonstrated on the specimen signature card. The restriction and rationale can be included on the card.

3.8.2 Publication and communication of a delegation chart

Subsection 4.1.4 of the directive makes the CFO responsible for “ensuring that delegation of spending and financial authorities documents are available to all individuals involved in the delegation and administration of spending and financial authorities.” Therefore, it is good practice to publish the chart and supporting notes on the department’s internal website.

The chart is to be presented to a new deputy head for information purposes within 30 days of his or her appointment. The chart is usually part of the new deputy head’s briefing package prepared by the CFO.

3.8.3 Renewing a delegation chart

Delegation charts, supporting notes and other delegation documents such as specimen signature cards should be regularly reviewed, as determined by the department, to ensure that they reflect the department’s operating risks and structure.

Subsection 4.1.7 of the directive requires the CFO to review the delegation of spending and financial authorities at least annually. However, this does not mean that the authorities must be updated annually.

Subsection 4.1.8 of the directive requires the CFO to update the delegation chart and seek the signature of the minister when:

- there are significant changes that impact the management of spending and financial authorities (for example, changes to the organizational structure, business processes, legislation or Treasury Board policy)

- a change in minister occurs, at which time the revised delegation chart is to be submitted for the minister’s signature within 90 calendar days of his or her appointment date

The existing delegation chart remains in effect until a new chart is signed by the department’s minister or deputy head, as appropriate.

Reviews are an essential practice to ensure that delegation decisions align with the department’s current operational context and risk environment. Whenever changes affect the authorities being delegated, the delegation chart should be updated, even if such a change is outside the situations outlined above.

Each department is responsible for deciding what is considered a minor adjustment to a delegation chart and for identifying who is authorized to make such changes. However, the delegation chart will require the signature of the department’s minister or deputy head, as appropriate, when the change impacts what delegations can be exercised, their limits and by whom.

When a change to a Treasury Board policy instrument results in the option for the minister or deputy head to increase the delegated limits to departmental positions, the existing approved delegations already in place would continue to be valid. Any additional new flexibility afforded by a policy change would have to be formally delegated in writing before individuals could exercise such delegation.

When a change to a Treasury Board policy instrument imposes greater restrictions or limitations on authorities, these restrictions are deemed to be in effect as soon as the policy requirements take effect. As such, Individuals would no longer be able to exercise delegated authorities that exceeded restrictions established by Treasury Board policy instruments. In these situations, departments are advised to update their delegations as soon as possible to ensure departmental compliance.

When the deputy head has the status of the deputy of the minister and is the appropriate signing authority, the directive requires the department to provide an updated chart to the minister for information purposes. It is recommended that the minister sign the chart to indicate that he or she has seen it.

3.9 Supporting notes of a delegation chart

The supporting notes provide explanations, comments and restrictions and/or parameters regarding the delegation chart and how delegations are to be exercised. The notes:

- are to be read in conjunction with the chart

- should be included in the briefing package prepared by the CFO

- be provided to the minister and the deputy head

Supporting notes should be clear and precise. Minor changes to the supporting notes, as determined by the department, could be approved at a lower level of authority, and this process may be documented in the supporting notes.

As a suggested best practice, supporting notes should include the following:

- an introduction that outlines the principles and requirements regarding the delegated authorities

- a section corresponding to each column or authority listed in the chart with a brief description of the authority being granted, and explanatory notes or tables to clarify the delegation, for example, travel authority amounts and levels

- an explanation of any terminology used in the chart

- a description of the segregation of duties and, in the case where the department is not applying the segregation requirement, the reasons for this and a description of compensating controls in support of the application of the authority

- additional approvals or alternative approvals required in situations where an incumbent may personally benefit by exercising payment or spending authority (for example, personal expenses such as travel, relocation, hospitality, membership fees, training and reimbursement of tuition fees). There may be some exceptions such as the minister’s personal travel claims and hospitality functions. The minister may exercise section 34 financial signing authority according to Cabinet direction.

- a table of equivalent positions that lists the specific position titles (delegation of authority is to a position, not an individual)

- the requirements and process for being granted a delegation, for example, any training to be undertaken

- the individual responsible for maintaining and overseeing the chart

- an escalation process in case of revocation of delegated authority

When a restricted limit is applied to a delegation of authority, the supporting notes should indicate why the restriction is in place (for example, a policy requirement, with a reference to the underlying policy, or to a departmental decision, with reference to the decision and date). If the restriction involves additional controls related to the application of the authority, it is good practice to describe these controls.

3.10 Specimen signature cards

When a spending or financial authority is delegated to a position, it must be communicated in writing to the person holding the position. The specimen signature will be captured with a wet or electronic signature process. The delegated authority does not come into effect until the individual has completed the required training and the specimen signature card has been signed by both the individual receiving the delegation of authority and the person authenticating the signature, for example, the supervisor or manager.

The specimen signature card indicates:

- the periods during which the delegation applies

- the type of delegation of authority

- the level of authority (including value limits and cost centres or budget, and further restrictions by the delegating manager, as appropriate)

- the position receiving the delegation

Subsection 4.1.3 of the directive makes the CFO responsible for“ensuring the signatures (written or electronic) of individuals with delegated spending and financial authorities can be authenticated before and after processing of the transactions for expenditure decisions.” A specimen signature card can help meet these authentication requirements.

3.11 Electronic signatures

When electronic signatures are used, it is important to ensure the integrity of electronic financial transactions by safeguarding the electronic authentications and authorizations against unauthorized access, authority or disclosure, and against repudiation, destruction, removal, modification, misuse, incompleteness and inaccuracy. Departments should ensure through their system of internal control that:

- each individual’s electronic authorization is unique

- the individual providing the authorization can be identified

- the integrity of the authorization is maintained to ensure accountability and protection of the person assuming responsibilities (for example, the authorization cannot be tampered with or altered inappropriately)

- the integrity of the delegated authorities reflected in the system is protected (for example, the authorities and limits for a delegated individual cannot be tampered with or altered inappropriately)

Departments should examine their information technology controls over:

- access to financial systems

- their application controls to ensure they are being applied appropriately and consistently

It is suggested that departments assess and determine the appropriate level of assurance and associated security requirements, based on the risks for each type of financial transaction, using electronic authentication and authorization. Departments should:

- identify and document the key risks associated with each step of the process

- map them to the required assurance level

- ensure that controls are in place as designed

- validate that the controls provide the required assurance level

Controls should be periodically monitored and reassessed to ensure that they are functioning as intended.

3.12 Equivalent positions

Position titles may differ from the generic descriptions used in the delegation chart. Each department decides which positions are to be included within the generic titles and determines who will approve the list of equivalent positions. It is common practice for the approval of equivalent positions to be delegated to the CFO or the deputy CFO. A table of equivalent positions can be included in the supporting notes to the delegation chart.

3.13 Revoking spending and financial authorities

Spending and financial authorities should be consistently and appropriately applied to ensure that a person exercises his or her delegated authority in line with the requirements of the delegation chart.

Subsection 4.1.6 of the directive makes the CFO responsible for “restricting or revoking delegated spending and financial authorities of individuals where there is significant non-compliance with this directive or the departmental delegation of spending and financial authorities process” or where “the internal controls do not adequately mitigate risks associated with the delegation.”

It is good practice for a department to develop an escalation process for managing non-compliance in the application of spending and financial authorities. An escalation process should take the following into consideration:

- the number of instances of non-compliance

- the risk associated with non-compliance

- the type of non-compliance, for example:

- authority was provided for a payment when the person does not have that authority

- evidence that the delegated authority has performed his or her delegated activities is missing

- a signature confirming that the delegated authority has performed his or her delegated activities is missing

The CFO may choose to amend or revoke the person’s delegation. Amending a delegation may include:

- reducing the value of the transaction that can be authorized or

- requiring a second signature, such as from a manager, before the transaction can be subject to a payment authorization

As part of the escalation process, the department may:

- provide additional training

- implement restrictions (such as reducing the level of authorization) or

- revoke authority where necessary

It is also important to regularly review spending and financial authorities within the context of the internal controls in place to support the transaction. These reviews help determine whether risks are being sufficiently mitigated, for example, whether the additional internal controls that support non‑segregated duties are working effectively.

The escalation process, review of associated internal controls, and assessment of when to restrict or revoke a delegated authority should be documented in the supporting notes in the delegation chart to support the decision‑making process.

4. Exercising spending and financial authorities

This section provides details on exercising spending and financial authorities, by responding to the questions shown in Figure 4.

Figure 4 - Text version

This figure provides details on exercising spending and financial authorities by addressing specific questions shown and providing the reader where to find the answer within section 4 of this document.

| Questions Linking to Content in Section 4 | More information is provided in the following sections and subsections |

|---|---|

| What is expenditure initiation authority? | Section 4.1 |

| What is commitment authority? | Section 4.2 |

| What are commitment controls? | Subsections 4.2.2 and 4.5.3 |

| What is a blanket authority when it comes to commitments? | Subsection 4.2.3 |

| What is transaction authority? | Section 4.3 |

| What is certification authority? | Section 4.4 |

| What is payment authority? | Sections 4.5 and 4.5.1 |

| What if account verification is done prior to payment authority? | Subsection 4.4.1.1 |

| What if account verification is done after certification? | Subsection 4.4.1.2 |

| What if there are errors? | Subsections 4.4.2 and 4.5.5 |

| What is the payment authority process? | Subsection 4.5.2 |

| What about payment authority between departments? | Subsection 4.5.4 |

| What is the best approach for delegating low-value amounts? | Subsection 4.5.6 |

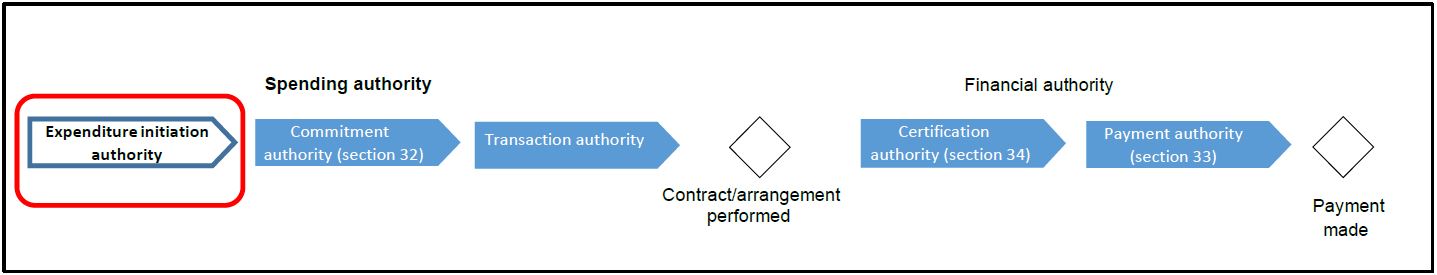

4.1 Expenditure initiation authority

Figure 5.1 - Text version

Figure 5.1 is a repetition of Figure 2 but will focus on Expenditure initiation authority. The box titled expenditure initiation authority is circled in red to highlight it as it will be discussed in section 4.1.

Figure 5.1 demonstrates linearly, the process of managing expenditures through a set of spending and financial authorities that are governed by the legislative requirements set out in the Financial Administration Act (FAA) and, in the case of transaction authority, by Public Services and Procurement Canada.

The first three elements of the figure are within the Spending authority:

- expenditure initiation authority (this box is circled in red to highlight it will be discussed in section 4.1)

- commitment authority (section 32 of the FAA)

- transaction authority

Following these spending authorities, a contract or arrangement can be performed.

The last two elements in the figure are within the Financial authority:

- certification authority (section 34 of the FAA)

- payment authority (section 33 of the FAA)

Following the payment authority, the payment is made.

Expenditure initiation is the authority to incur expenditures or to obtain goods or services that will result in the expenditure of funds. It is the first step in the expenditure process. The following are examples of expenditures that departments can make:

- obtain services, goods or construction that will involve expenditures through a contract, standing offer, purchase order, Memorandum of Understanding or other agreement

- make transfer payments that will involve expenditures through a contribution or grant agreement

- authorize ex gratia payments

- hire staff

- authorize travel

Expenditure initiation involves reviewing the proposed expenditure against the unencumbered balance within the department’s appropriation to ensure that:

- the planned transaction is for a legitimate operational or business requirement

- an authority exists that allows for the expenditure of public funds for that requirement

- the planned transaction represents the most efficient and economical means to meet the requirements

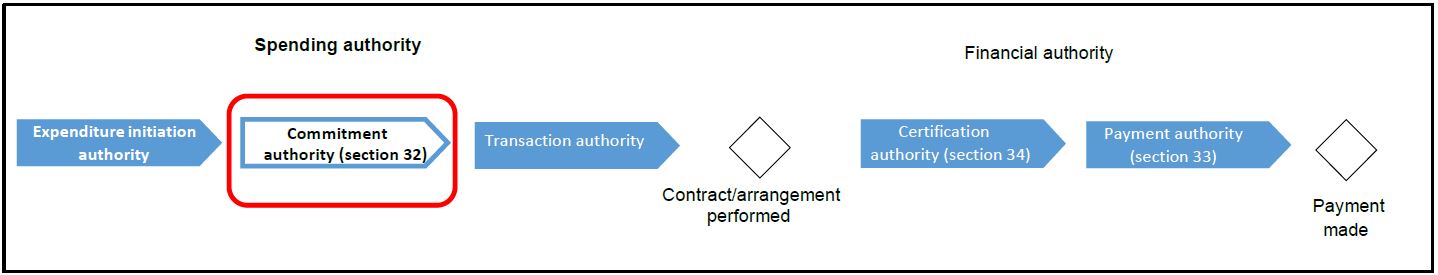

4.2 Commitment authority (section 32 of the FAA)

Figure 5.2 - Text version

Figure 5.2 is a repetition of Figure 2 but will focus on commitment authority (section 32 of the FAA). The box titled commitment authority is circled in red to highlight it as it will be discussed in section 4.2.

Figure 5.2 demonstrates linearly, the process of managing expenditures through a set of spending and financial authorities that are governed by the legislative requirements set out in the Financial Administration Act (FAA) and, in the case of transaction authority, by Public Services and Procurement Canada.

The first three elements of the figure are within the Spending authority:

- expenditure initiation authority

- commitment authority (section 32 of the FAA) (this box is circled in red to highlight it will be discussed in section 4.2)

- transaction authority

Following these spending authorities, a contract or arrangement can be performed.

The last two elements in the figure are within the Financial authority:

- certification authority (section 34 of the FAA)

- payment authority (section 33 of the FAA)

Following the payment authority, the payment is made.

Commitment authority is the authority to ensure that there is a sufficient unencumbered balance (see subsection 4.2.1 for more details) available before entering into a contract or other arrangement before a commitment is made.

A decision to spend (expenditure initiation authority) would be made in conjunction with commitment authority to ensure that there are available funds in the appropriation. Although often undertaken at the same time, expenditure initiation authority and commitment authority are separate steps:

- the decision to spend (expenditure initiation authority)

- the confirmation that sufficient funds are available (commitment authority)

An example of a checklist for commitment authority is provided in Appendix C.

Commitment authority involves:

- reviewing each planned expenditure to ensure that there is sufficient unencumbered balance to cover all applicable costs and that the related policy restrictions are addressed

- authorizing the planned expenditure before entering into the contract, human resources action or other arrangement, and making a commitment against the appropriation

- recording a commitment at the expected value and seeking advice from the CFO if it is impractical to record commitments individually

The person who has been delegated commitment authority is accountable for:

- establishing, maintaining and controlling records associated with commitment authority, as indicated in subsection 32(2) of the FAA

- ensuring that commitment information is provided to the person who has delegated transaction authority

All anticipated expenditures charged to a department’s appropriation, including expenditures that will eventually be cost-recovered, should be committed in the department’s financial system. This action ensures that funds are reserved for the expenditure and that the department does not spend more money than it has available. The commitment of funds is a critical financial management control.

Although the person who has delegated commitment authority may not necessarily be the same person inputting the commitment information into the financial system, he or she remains responsible for ensuring that this step is performed accurately.

4.2.1 Unencumbered balance

As per Subsection 32(1) of the FAA, departments need to ensure that there is a sufficient source of funds available before committing expenditures (for example, before signing a contract or entering into an arrangement). The control of financial commitments is essential for departments as it ensures that departments do not exceed their voted appropriations.

Subsection 32(1) of the FAA states that before entering into a contract or arrangement, a review must be performed to ensure that there is a sufficient unencumbered balance available out of:

- an appropriation by Parliament to which the payment will be charged;

- an item included in the Estimates then before the House of Commons to which the payment will relate;

- a commitment limit in an Appropriation Act to which the payment will relate; or

- revenues received or estimated revenues set out in estimates, in the case of a payment that will be charged to an authority – under an Appropriation Act or any other Act of Parliament – to expend revenues.

Departments must consider items a to d above before committing expenditures. For example, when a department does not have sufficient unencumbered balance in an appropriation to make a commitment, the commitment may be made when the item in the Estimates then before the House of Commons (when the Estimates have been tabled) is considered together with the balance of the appropriation.

The commitment limit, referred to in item c above, will appear in each departmental vote wording listed in the supply bill for the Interim Estimates which will be voted on or before April 1st. The Interim Estimates are meant to provide funding for the first three months of the fiscal year until the complete Main Estimates, which may now be tabled after April 1st, is approved by Parliament.

The commitment limit established in the Interim Estimates will allow departments to enter into commitments, for items (as per item b above), where they do not have sufficient available funds until the Supply of Main Estimates.

The commitment limit will be stated as follows:

- Authority to enter into commitments not exceeding $XXX in the fiscal year for the purposes of this vote.

There are two key components to item d:

- Departments can enter into commitments under item d when the estimated revenues are set out in the Estimates or in the supply bill as is the case for Interim Estimates only. Note that the estimated revenues are already included in the commitment limits of departmental votes that have a revenue spending authority.

- Departments can also enter into commitments under item d based on revenues received in excess of the amount set out in the Estimates or in the supply bill as is the case for Interim Estimates only, as long as the revenues have been collected and there is a sufficient unencumbered balance.

- As per item d above, if estimated revenues as set out in the Main Estimates will be higher than expected, a department should seek an approval through a Supplementary Estimates to increase the estimated revenues.

- Treasury Board approval is required if a department will exceed 125 per cent of the amount set out in the Estimates as per subsection 4.10.5 of the Directive on Charging and Special Financial Authorities.

Note that item c is a result of legislative changes that came into force on (item d was previously available in each Appropriation Act).

4.2.2 Commitment controls

Commitment controls are important management practices that are integral to sound appropriation control, forecasting, and allocation and reallocation of program resources. They ensure that a department’s appropriations are not exceeded. It is advisable that the recording of, and reporting on, commitments are standardized throughout the department. This includes defining commitment responsibilities and standardizing the process for recording and reporting commitments.

The following practices should be implemented:

- a firm (or hard) commitment should usually be recorded at the time of expenditure initiation

- a soft commitment process, used by some departments, reserves funds within an appropriation before a hard commitment is made to proceed with the expenditure. To avoid double commitments for the same transaction in the financial system, the hard commitment would reference any pre-existing soft commitment

- commitments should be recorded individually. When it is impractical to record commitments individually (for example, for low-value transactions), the department may seek advice from the CFO and implement documented procedures to make commitments in bulk

- commitment accounting entries should be recorded at the value expected to be incurred, with amounts broken out by period or fiscal year

- documentation on hard commitments should be recorded and retained to ensure that there is adequate auditable evidence of when and why a commitment was created

- employees should be given sufficient training on commitments (additional departmental training may be provided to that offered by the Canada School of Public Service when necessary)

In support of commitment control, the department’s financial system should:

- restrict access to authorized personnel responsible for making commitments

- allow commitments to be calculated and periodically reported over the fiscal year and over multiple years

- identify or prevent over commitments from occurring

- maintain and retain commitment data

- summarize relevant commitment information for management reporting

For individuals exercising expenditure initiation authority and commitment authority, it is important that they:

- know the available appropriation prior to committing in order to avoid exceeding the budget

- record commitments soon after the authority is provided

In addition, to ensure that the appropriation is accurate, the budget should include adjustments to the current year’s appropriation and allotments when:

- revenues, notably net voting and refunds, are received

- any reduction or additional resources approved by the Treasury Board

It is equally important that commitments are controlled for revolving fundsFootnote 2 so that payments, when netted against receipts, will not exceed the drawdown authority limit.

If commitment reporting results in expenditures exceeding the department’s appropriations, and expenditures cannot be managed within the department, the departmental CFO must notify the Treasury Board of Canada Secretariat as soon as possible.

4.2.3 Blanket authority

A blanket authority is a commitment authority (section 32 of the FAA) used to reduce administrative burden when:

- the expenditure is low-risk

- the value of the transaction is considered low by the department

- the transaction is repetitive

- a reimbursement can be obtained if an error in payment occurs

A blanket authority is usually given at the start of the year for repetitive transactions that occur during the year (for example, a television cable service for $100 per month, resulting in a total commitment of $1,200).

In addition to the normal expenditure initiation and commitment authority requirements, the blanket authority should also specify:

- the type of payment

- the payee

- the maximum amount

- the start and end dates of the blanket authority that cannot cross fiscal years

- the financial code

The blanket authority should be authorized by the person who has delegated authority. The rationale for the blanket authority should be documented according to the above criteria. Blanket authority documentation should be retained by the department and should be attached manually or electronically to each transaction sent for payment (in the example above, every month a section 34 payment is made for $100, thus lowering the balance available within the blanket authority).

4.3 Transaction authority

Figure 5.3 - Text version

Figure 5.3 is a repetition of Figure 2 but will focus on transaction authority. The box titled transaction authority is circled in red to highlight it as it will be discussed in section 4.3.

Figure 5.3 demonstrates linearly, the process of managing expenditures through a set of spending and financial authorities that are governed by the legislative requirements set out in the Financial Administration Act (FAA) and, in the case of transaction authority, by Public Services and Procurement Canada.

The first three elements of the figure are within the Spending authority:

- expenditure initiation authority

- commitment authority (section 32 of the FAA)

- transaction authority(this box is circled in red to highlight it will be discussed in section 4.3)

Following these spending authorities, a contract or arrangement can be performed.

The last two elements in the figure are within the Financial authority:

- certification authority (section 34 of the FAA)

- payment authority (section 33 of the FAA)

Following the payment authority, the payment is made.

Transaction authority is the legal authority to enter into contracts, including acquisition card purchases, and to sign off on legal entitlements.

Transaction authority involves:

- confirming that the most suitable procurement tool for the proposed expenditure has been chosen

- confirming that a commitment has been made for the planned expenditure

- confirming that commitment authority has been completed and signed by the appropriate authority

- identifying the position responsible for providing the transaction authority to enter into contracts and for managing the procurement or arrangement. The person who holds this position is accountable for the terms and conditions of the contract. The authority may be managed internally by a budget manager or by a contracting and procurement officer, depending on the authority required and the type of procurement tool used

- providing the authority to proceed once the above activities have been performed

The same individual should not exercise both transaction authority and certification authority (section 34 of the FAA) for the same transaction unless the transaction has been designated by the department as low-risk or low‑value. These exceptions recognize that a department may not always be able to segregate duties for transaction authority and certification authority, and may use compensating controls to ensure the integrity of the payment. Please refer to section 3.6 of this guide for more information on the segregation of duties.

The delegation of this authority is subject to legal and/or policy limits. For example, the delegation instrument for acquisition of goods is provided by Public Services and Procurement Canada, and the policy limits for goods and services contracts and transfer payment agreements is determined by the Treasury Board. Contracts must comply with:

- the FAA

- the Government Contracts Regulations

- Treasury Board policy, including the Contracting Policy

- departmental policies and practices

- federal government obligations under international and domestic trade agreements

- comprehensive land claim agreements

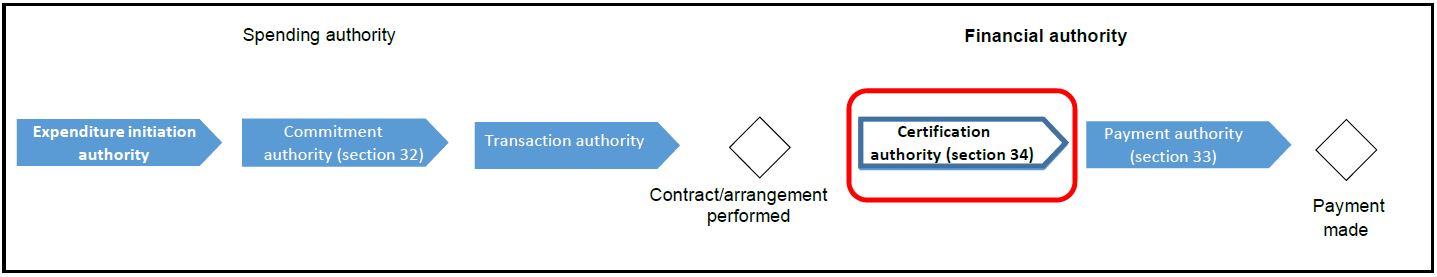

4.4 Certification authority (section 34 of the FAA)

Figure 5.4 - Text version

Figure 5.4 is a repetition of Figure 2 but will focus on certification authority (section 34 of the FAA). The box titled certification authority is circled in red to highlight it as it will be discussed in section 4.4.

Figure 5.4 demonstrates linearly, the process of managing expenditures through a set of spending and financial authorities that are governed by the legislative requirements set out in the Financial Administration Act (FAA) and, in the case of transaction authority, by Public Services and Procurement Canada.

The first three elements of the figure are within the Spending authority:

- expenditure initiation authority

- commitment authority (section 32 of the FAA)

- transaction authority

Following these spending authorities, a contract or arrangement can be performed.

The last two elements in the figure are within the Financial authority:

- certification authority (section 34 of the FAA) (this box is circled in red to highlight it will be discussed in section 4.4)

- payment authority (section 33 of the FAA)

Following the payment authority, the payment is made.

Certification authority is the authority to certify, before making a payment for the performance of work, the supply of goods or the rendering of services, that:

- the work has been performed, the goods have been supplied or the services have been rendered

- the terms and conditions of the contract or the agreement have been met, including price, quantity and quality

- the payee is entitled to or eligible for payment

All payments and interdepartmental settlements should undergo account verification in accordance with section 34 of the FAA. Account verification involves verifying that:

- in cases where an advance payment or progress payment is requested, the payment is a requirement of the contract

- the price charged conforms to the contract or authorized contract amendment

- the price is reasonable in exceptional circumstances where the price is not specified in the contract or agreement

- the payee is entitled to, or eligible for, the payment

- the payee information is accurate and complete

- the financial coding has been provided and is accurate and complete

- the department has the authority to make the payment (that is, all relevant statutes, regulations, orders-in-council, policy instruments and other legal obligations have been complied with) in compliance with the department’s delegation instrument

- the transaction is accurate, including verification that:

- the payment is not a duplicate

- discounts have been deducted and credit notes applied

- charges that are not payable have been removed

- the invoice or claim total has been correctly calculated

- sales taxes are appropriately applied

- income tax on salaries and benefits is withheld, remitted and reported to the applicable tax authority (the Canada Revenue Agency or Revenue Québec) in accordance with federal and provincial income tax legislation

- income tax on payments to non-residents, vendors for service contracts, and for mixed goods and service contracts is withheld, remitted and reported to the applicable tax authority in accordance with federal and provincial income tax legislation

- payments to Canadian vendors for service contracts and for mixed goods and service contracts are reported to the Canada Revenue Agency in accordance with federal income tax legislation

- the total value of the contract is not exceeded if the payment is a milestone payment

- the invoice is an original document or a certified copy of the original

- the documentation is complete (there is auditable evidence that the verification process has taken place, whether it is electronic or not)

It is important to use a checklist if the account verification process has recently changed or if there have been previous multiple and ongoing errors related to the performance of account verification. The checklist standardizes the expectations and performance of account verification across a department. If an electronic authorization is being provided, a checklist can sometimes be implemented as an account verification “pop-up” text box in software. An example of a checklist for certification authority is provided in Appendix D.

The signatures, either written or electronic, of the person who has delegated certification authority would be authenticated before or after the transaction is processed. The date the authority is provided and the authority’s signature, either physically or electronically, are to be recorded. Such information increases the department’s ability to authenticate the person’s delegated authority.

Employees should be given sufficient training on account verification and certification. When necessary, departmental training may be provided in addition to that offered by the Canada School of Public Service.

4.4.1 Prepayment account verification and Post-payment account verification

Departments are to conduct either prepayment account verification or post-payment account verification. Although departments are encouraged to conduct account verification prior to making a payment or interdepartmental settlement (prepayment account verification), completing the review after the payment or interdepartmental settlement (post-payment account verification) is permitted in medium-risk or low-risk situations (for example, monthly acquisition card consolidation payments made at the departmental level). Further details on these approaches follows.

4.4.1.1 Prepayment account verification

Prepayment account verification forms part of section 34 of the FAA. Prepayment verification ensures that:

- payments and interdepartmental settlements are for work that has been performed

- goods have been supplied or services have been rendered

- the relevant contract or agreement terms and conditions have been met

- the transaction is accurate

- associated authorities comply with the delegation chart

There are different categories of risk associated with transactions. High-risk transactions are fully reviewed before payment authority occurs and a payment is requisitioned.

4.4.1.2 Post-payment account verification

Account verification occurs when the payment is considered reasonable based on the following criteria:

- the invoice is from an established supplier or payee who has a consistent record of performance and where an established and continuing relationship exists

- it is simple to obtain a refund from, or to adjust a future payment to, the supplier or payee

- the supplier’s or payee’s invoice or claim does not appear to contain major inaccuracies

For interdepartmental settlements, the debtor department should have risk-based business processes in place to ensure the timely performance of account verification and certification authority by the responsible delegated authority.

Post-payment account verification, as with prepayment verification, ensures that:

- payments and interdepartmental settlements have been made for work that has been performed

- goods have been supplied or services have been rendered

- the terms and conditions of the relevant contract or agreement have been met

- the transaction is accurate

- the associated authorities comply with the delegation chart

It is good practice for departments to document their post-payment account verification procedures. Documentation should include a description of the approach and methodology used and the reasoning behind the treatment of specific payments and interdepartmental settlements that are being reviewed post‑payment.

The results of the post payment account verification should be periodically reported to management and the CFO to identify systemic errors and track error rates. If critical errors occur, or if error rates exceed the department’s accepted tolerances, the risk assessment payment review plan should be revised to reflect the increased risk of error. When critical errors occur that would impact the department’s financial reports, a request for recovery should be issued and an accounting adjustment made, as applicable.

4.4.2 Escalation process for errors

If an error in the certification authority is identified, corrective action is to be taken:

- If the payment has not already occurred, the transaction should not be approved for payment and should be returned to the certification authority

- If the payment has already occurred, steps should be taken to address the erroneous payment with the payee. An accounting correction will be necessary

In all cases, information about the error should be retained for process assessment purposes.

It is good practice for departments to develop an escalation process based on their risk tolerance. The person who exercised certification authority should be made aware of the error, with corrective action taken to ensure that the mistake does not reoccur. If the error continues to occur, then additional steps may be necessary. This may include involving the person’s direct supervisor, the branch or program’s director general, the assistant deputy minister, and eventually the CFO with revocation procedures detailed under section 3.13 of this guide being considered.

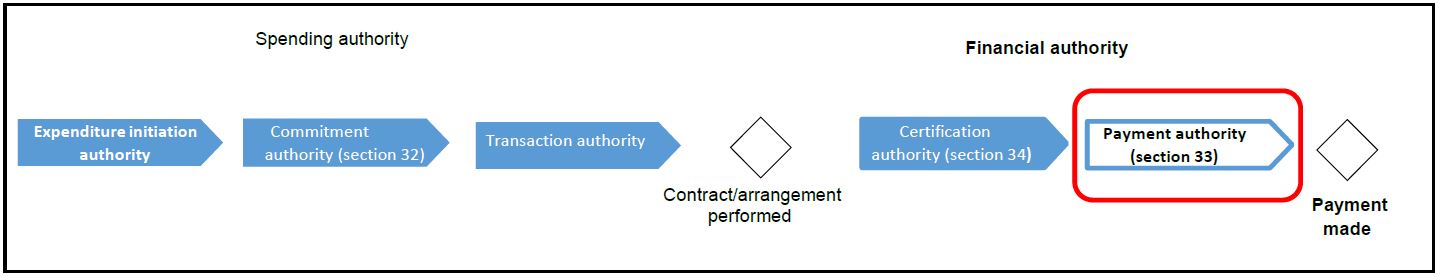

4.5 Payment authority (section 33 of the FAA)

Figure 5.5 - Text version

Figure 5.5 is a repetition of Figure 2 but will focus on payment authority (section 33 of the FAA). The box titled payment authority is circled in red to highlight it as it will be discussed in section 4.5.

Figure 5.5 demonstrates linearly, the process of managing expenditures through a set of spending and financial authorities that are governed by the legislative requirements set out in the Financial Administration Act (FAA) and, in the case of transaction authority, by Public Services and Procurement Canada.

The first three elements of the figure are within the Spending authority:

- expenditure initiation authority

- commitment authority (section 32 of the FAA)

- transaction authority

Following these spending authorities, a contract or arrangement can be performed.

The last two elements in the figure are within the Financial authority:

- certification authority (section 34 of the FAA)

- payment authority (section 33 of the FAA) (this box is circled in red to highlight it will be discussed in section 4.5)

Payment authority is the authority to requisition payments. Individuals exercising payment authority must ensure that no requisition is made when:

- the payment is not a lawful charge against an appropriation

- the payment would result in an expenditure in excess of the appropriation

- the payment would reduce the balance available in an appropriation, making it unable to meet the commitments charged against it

- the invoice is inaccurate

A limited review of all medium-risk and low-risk transactions may also be done before exercising payment authority to ensure that key information is available before payment. A limited review could involve confirming that:

- account verification (section 34 of the FAA) by a delegated authority has been performed

- the payee information is correct

- the payment will not result in an unlawful charge against the appropriation

4.5.1 Risk-based payment authority

It may not be cost-effective for persons who have delegated payment authority to review all transactions that have been verified and certified by an individual who has certification authority. For transactions where the risk of error is low, a risk-based payment authorization approach may be used to validate the overall probity of the account verification and certification process (section 34 of the FAA).

When relying on the account verification and section 34 certification authority, exercising payment authority involves ensuring that account verification, certification authority and related financial controls are adequate and being followed consistently. The risk-based payment authorization plan should be based on the characteristics of the payment transactions and the relative levels of risk of error associated with the payment, including the adequacy of controls. The plan should be approved by the CFO before being applied.

The risk-based approach includes quality assurance processes carried out by those who have payment authority, both before exercising payment authority (prepayment verification) and after exercising payment authority (post-payment account verification). The risk-based approach outlines the management practices and controls for the prepayment and post-payment verification processes and for the roles and responsibilities of those involved in the payment verification process.

All types of payments and interdepartmental settlements should be assessed and classified by degree of risk on the basis of:

- impact on the financial statements if a control error were to occur in a payment

- likelihood of the control error occurring, including:

- type of payment

- dollar value

- supplier or payee record of performance

- invoice error rates

- complexity of the transaction

Additional considerations in determining the degree of risk may also include:

- the results of previous internal control testing

- internal audits

- previous account verification activities

The department should define the terms “high-risk payment,” “medium-risk payment” and “low-risk payment” to ensure consistency across the department.

The risk assessment should be periodically reviewed and updated according to the department’s operating environment and system of internal controls.

4.5.2 Payment authority process

The position that has been delegated payment authority (section 33 of the FAA) should ensure that:

- auditable evidence exists demonstrating that account verification under section 34 has taken place

- certification (s.34) has been carried out by an individual who has the necessary delegated authority, including verification that the following details are correct:

- the value and date of the payment

- the financial code of the transaction

If the account certification is provided manually, the position that has payment authority would review the specimen signature card to confirm that the signature on the card matches the signature provided.

If account certification is automated, the department should periodically assess the information in its financial system to ensure that it reflects the delegation of authority and any acting delegated positions shown in the specimen signature cards.

The payment authorization process should ensure that all high-risk transactions are reviewed before payment to ensure that the requirements of the section 34 certification authority have been met. It is also good practice to review a sample of transactions identified as having medium to low risk, after payment has occurred, to demonstrate that the requirements of certification authority have been met. More information on the use of sampling is provided in Appendix E.

The person who digitally approves and processes the payment file for submission to the Receiver General would have delegated payment authority. Information about the person providing authorization is given every time a payment is authorized, either at the individual transaction level or the bulk authorization level. This information can be provided manually or electronically. Manual authorization requires:

- the signature of the person who has delegated authority, which can be confirmed against a specimen signature card

- the date, to ensure that the delegation is applicable at the time it was provided

Electronic authorization can be completed through protected access to the financial system, which records the person’s name and the date of the authorization.

4.5.3 Releasing the commitment

Once a transaction is authorized for payment, the commitment in the financial accounts should be released, as money is no longer on hold for the payment. The journal entry is normally made automatically in a department’s financial system when the payment is made. Departments that do not have the functionality to ensure that the commitment is released may need to undertake manual verification that the commitment has been released. It is advisable to periodically verify that commitments have been released.

4.5.4 Interdepartmental settlements

When exercising payment authority for interdepartmental settlements, delegated individuals should ensure that:

- all creditor-initiated interdepartmental settlements or debtor-initiated interdepartmental settlements are verified in accordance with the same quality assurance and risk assessment provisions as other types of payment

- requests for corrective action are made when critical errors are identified

4.5.5 Journal vouchers

Generally, journal vouchers may be grouped into one of two categories:

- those that are within the same appropriation

- those that have an impact on different appropriations

Regardless of the two categories, it is important to ensure the availability of funds for the budget being charged, especially if the funds were not already committed according to section 32 of the FAA.

4.5.5.1 Journal vouchers within the same appropriation

For journal vouchers that are considered as adjustments within the same appropriation, departments normally seek guidance from the last phrase of section 1 in the Payments and Settlements Requisitioning Regulations, 1997 SOR/98-130 (according to section 33 of the FAA) where it states that “settlement does not include adjusting or correcting entries within a particular appropriation.”

In this case, there is no requirement to exercise any delegated authority.

4.5.5.2 Journal vouchers that impact more than one appropriation

In circumstances where the adjusting journal vouchers impact different appropriations, certification would be required by the person with delegated authority as stipulated in the delegation chart for the organization.

4.5.6 Delegation for low-value amounts

The appropriate minister, or any person authorized in writing by that minister, determines whether the amount does not exceed the threshold in the Low-value Amounts Regulations. This requires a ministerial decision or a decision by someone authorized by the minister. As a result, a department may choose to have a specific delegation in its delegation chart for such decisions. A person who has been authorized to sign off on section 33 or 34 of the FAA may be an appropriate person, but it is up to the department to decide whether to have a delegation chart for low-value amounts and to decide what it appropriate in the circumstances.

A benefit of having a provision for low-value amounts in a department’s delegation chart is that the supporting notes can describe the rules that apply to the department, as set out in the Guide to Administering Low-Value Amounts.

4.6 Auditable evidence

For all authorities within the expenditure management process, retaining auditable evidence is key.

The verification and certification of payments and interdepartmental settlements involves ensuring that sufficient documentation exists to demonstrate that account verification has taken place and that certification authority (section 34 of the FAA) has been performed. The person auditing the transaction should be able to reach the same conclusion as the person providing the certification authority.

The following financial documentation should be retained in paper or electronic format:

- contracts

- receipt documents

- purchase orders

- invoices

- emails

- certification information related to section 34

- other relevant documents

The retention of documents is an important part of the auditable evidence component of financial management. Document retention periods are described in Library and Archives Canada’s Generic Valuation Tools. These tools provide Government of Canada institutions with a starting point for meeting two key requirements of the Treasury Board Directive on Recordkeeping:

- the identification of information resources of business value

- the establishment of retention specifications

Data on who provided the authority, when and for how much is also important. The department needs to be able to authenticate the transactions after payment as part of the payment’s audit trail.

Generic valuation tools do not provide the authority to dispose of any documents, whether through destruction, sending them to another institution, or transfer to Library and Archives Canada. The authority to dispose is granted through a disposition instrument signed by the Librarian and Archivist of Canada.

5. References

5.1 Legislation

5.2 Related policy instruments

6. Enquiries

Members of the public may contact Treasury Board of Canada Secretariat Public Enquiries if they have questions about this guide.

Individuals from departments should contact their departmental financial policy group if they have questions about this guide.

Individuals from a departmental financial policy group may contact Financial Management Enquiries for interpretation of this guide.

Appendix A: example of a delegation chart

Figure 6 - Text version