Guidance for Crown Corporations on Preparing Corporate Plans and Budgets

Archives

This or these guideline(s) replace:

- Preparation of Corporate Plans, Guidelines for the [2018-03-27]

- Preparation of Summaries of Corporate Plans and Capital and Operating Budgets, Guidelines for the [2018-03-27]

- Amended Corporate Plans and Budgets, Guidelines on [2018-03-28]

1. Date of publication

This guidance was published on May 9, 2019.

This guidance replaces the following:

- Guidelines for the Preparation of Corporate Plans

- Guidelines for the Preparation of Summaries of Corporate Plans and Capital and Operating Budgets

- Guidelines on Amended Corporate Plans and Budgets

2. Purpose

This guidance will help parent Crown corporations prepare corporate plans and budgets, and summaries of and amendments to those plans and budgets.

3. Guiding principles

This guidance is based on the principles set out in the Open and Accountable Government statement.

Reporting effectively against the requirements set out in Part X of the Financial Administration Act enables the Government of Canada, as sole shareholder in each corporation, to fully understand the planned activities of each Crown corporation to ensure that the overall direction and performance of corporations align with the policy rationale for which the government created and maintains them.

The reporting requirements described in this guidance represent key milestones in the annual planning and reporting cycle, and are central to the accountability relationship between Crown corporations and the Government of Canada.

4. Background

Crown corporations are separate entities from government departments and are established through legislation, letters patent or articles of incorporation (usually under the Canada Business Corporations Act). They report to Parliament through a responsible portfolio minister, with the support of the portfolio secretariat.

They fill various public policy needs, in areas where outside expertise, managerial autonomy, openness to competitive market forces, or independence from government influence are required. Their mandates cover a wide range of activities in different sectors of the economy, including the financial, transportation and infrastructure, social and cultural sectors.

Crown corporations are not subject to the same administrative requirements as government departments. Crown corporations operate with considerable autonomy under the governance provisions in Part X of the Financial Administration Act, under their constituting statutes or under both. They also have additional managerial and administrative flexibility when dealing with customers, suppliers or competitors in commercial or quasi-commercial contexts. Appropriate ministerial control and oversight must always be maintained and is set out in legislation.

5. Responsibilities

This section outlines the responsibilities of the various parties involved in developing the corporate plans and budgets of Crown corporations and the summaries of and amendments to them, in accordance with the Open and Accountable Government statement.

- 5.1

Board of directors

Each Crown corporation's board of directors is appointed by the government. Acting in the best interests of the corporation and exercising due care and diligence, the board:

- oversees the corporation's business activities

- approves corporate plans and budgets that set out the corporation's strategic direction

- submits approved documents to the responsible minister for recommendation to the Treasury Board for approval

- contributes to the overall functioning of the portfolio

- 5.2

Chief executive officer

The corporation's chief executive officer (CEO), usually appointed by the Governor in Council, is:

- responsible for the corporation's day-to-day operations

- accountable to the board of directors for the overall management and performance of the corporation

- responsible for ensuring that the corporation achieves the planned results set out in the corporate plan

- 5.3

Responsible minister

Every Crown corporation has a responsible minister,Footnote1 who acts as the shareholder of the Crown corporation, on behalf of the government.

The responsible minister is accountable for:

- providing guidance to the board of directors for how the Crown corporation's objectives are to be interpreted

- monitoring and engaging with the corporation, as needed, to ensure that the corporation is meeting expectations

In fulfilling this role, the responsible minister:

- engages regularly with the corporation (through a variety of mechanisms, including regular meetings, mandate letters or statements of priorities and alignment, and portfolio secretariats) to convey the government's expectations concerning the corporation's public policy objectives

- guides and reviews the development of potential new activities of the corporation in respect of potential public policy objectives and benefits

- guides the development of performance indicators relating to the delivery of public policy objectives

- monitors the corporation's performance against public policy objectives, including regularly reviewing the alignment and appropriateness of the Crown corporation's mandate with the government's public policy objectives

- recommends the corporate plan and the operating and capital budgets (as relevant) for approval by the Treasury Board

- tables approved corporate plan summaries, budgets and annual reports in both houses of Parliament

- provides information to Parliament and Canadians about the corporation by answering questions in Question Period, coordinating materials for committee appearances or parliamentary returns, and, where appropriate, coordinates activities relating to public communications

- 5.4

Deputy minister and portfolio department

The deputy minister responsible for a Crown corporation:

- provides policy advice and public service support to the responsible minister, as required, including reviewing and commenting on the corporation's corporate plan

- promotes appropriate policy coordination and ensures integration in the undertakings of their minister's portfolio

- coordinates and communicates with Crown corporations, ministers and the Treasury Board of Canada Secretariat to ensure timely approval of plans and budgets

- coordinates the attestation by the chief financial officer for the portfolio department, which is required,for Estimates purposes,for new funding requests by Crown corporations that receive government funding

- 5.5

Minister of Finance

In addition to the Minister's role as the responsible minister for the Crown corporations in the Finance portfolio, the Minister of Finance:

- reviews and monitors the impact of all Crown corporations' activities on the fiscal framework, including potential new activities

- engages with Crown corporations and their responsible ministers to convey the government's fiscal priorities and expectations

- guides the development of Crown corporations' performance indicators relating to the government's fiscal priorities and corporations' financial performance

- recommends the approval of Crown corporations' corporate plans to the Treasury Board when he or she deems appropriateFootnote2

- approves Crown corporations' borrowing transactions with respect to the time and the terms and conditions of the proposed transaction

- 5.6

Treasury Board

The Treasury Board is a committee of the Privy Council. The Treasury Board has 2 roles: that of a management board and that of Governor in Council. For the purposes of this guidance, all subsequent references to the Treasury Board refers to its role as management board.Footnote3

The Treasury Board:

- reviews and approves Crown corporations’ corporate plans, operating budgets and capital budgets

- reviews and approves Crown corporations' corporate plans and budgets to ensure that they align with government priorities, public policy objectives and fiscal priorities, and that they will enable the corporation to deliver the desired results and achieve value for money

- works with the responsible minister and the Minister of Finance in guiding Crown corporations to develop appropriate performance indicators and targets

- monitors and evaluates corporations' performance in relation to overall government priorities

- 5.7

Treasury Board of Canada Secretariat

The Treasury Board of Canada Secretariat (TBS):

- advises Crown corporations and their portfolio departments on the development of corporations' corporate plans and budgets, and on the process requirements

- provides advice to Treasury Board ministers on corporate plan and budget approvals

- through the program sectors, acts as the single window for advice from relevant TBS policy centres and other central agencies

- 5.8

Privy Council Office

The Privy Council Office:

- provides information to the Prime Minister on the organization of the government and its relations with Parliament and the Crown, the appointment of senior public office holders, and the overall spending program of the government

- leads the Governor in Council appointment process for chief executive officers and directors of parent Crown corporations and the related compensation regime

- develops a training and orientation regime for new Governor in Council appointees

6. Reporting requirements

- 6.1

Main requirements

Part X of the Financial Administration Act (FAA) sets out the main reporting requirements for Crown corporations. Under Part X, most Crown corporations must provide:

- a corporate plan, an operating budget and a capital budget

- summaries of the corporate plan and budget (these are tabled in Parliament)

- quarterly financial reports

- annual report

- regular audits

- 6.2

Additional requirements

Additional requirements are set out in:

- Crown Corporation General Regulations

- Crown Corporation Corporate Plan, Budget and Summaries Regulations

- Canada Business Corporations Act

- other legislation

Reporting may also be required under certain Treasury Board policies or under legislation such as the following:

- Access to Information Act

- Privacy Act

- Official Languages Act

- Public Servants Disclosure Protection Act

Reporting requirements vary for a number of reasons. Section 85 of the FAA sets out exceptions and exemptions.

7. Reporting cycle

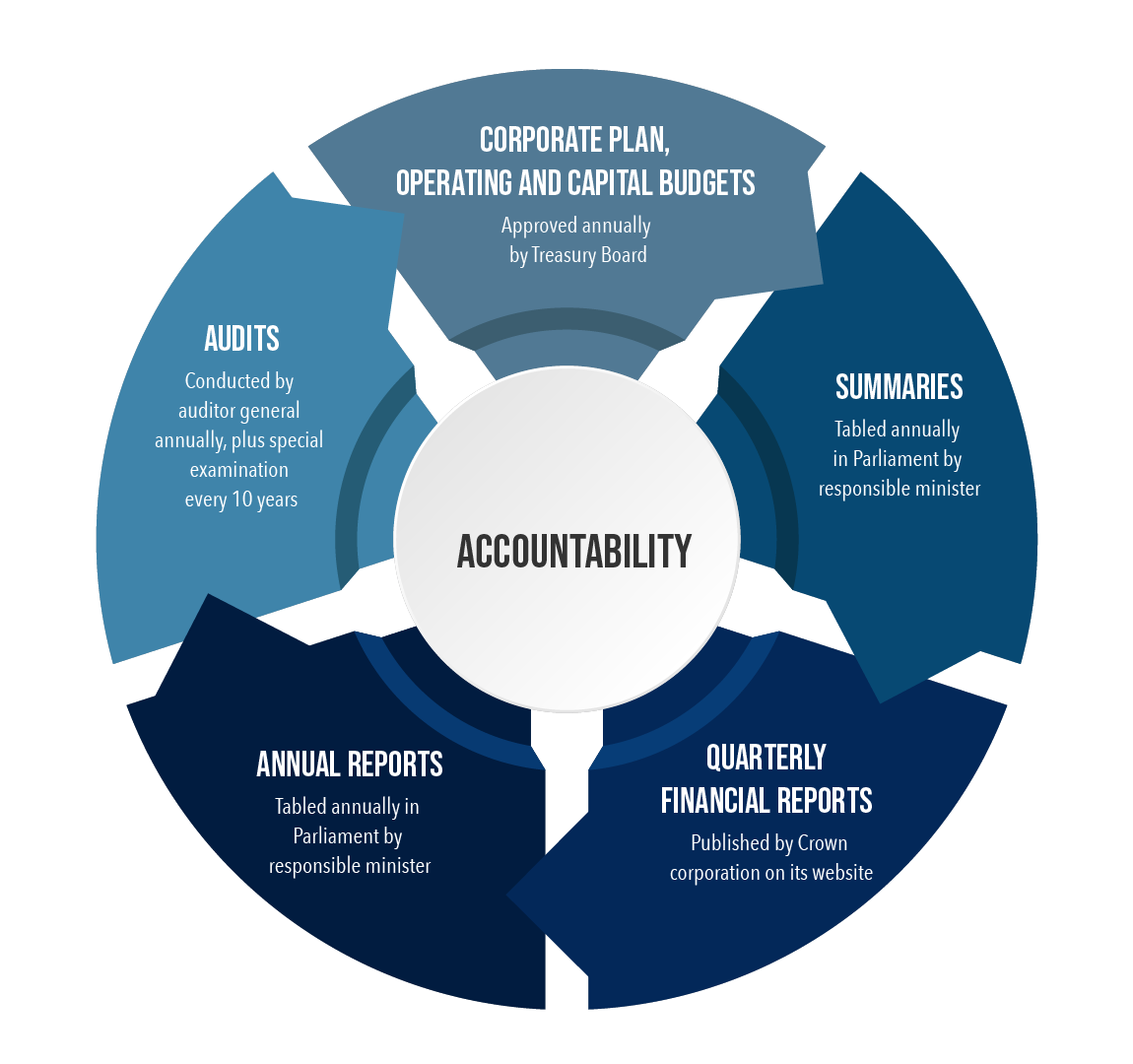

Section 7 describes the annual reporting cycle for Crown corporations. Figure 1 shows an outline of the cycle.

Figure 1 - Text version

Figure 1 consists of the word "accountability" in the centre, surrounded by 5 circles. Each circle contains text that describes a step in the reporting cycle for Crown corporations. Arrows between the circles show that the circles are to be read clockwise.

The content of the circles, starting with the circle in the top centre, is as follows:

- Corporate plan, operating and capital budgets: Approved annually by Governor in Council and Treasury Board

- Summaries: Tabled annually in Parliament by responsible minister

- Quarterly financial reports: Published by Crown corporation on its website

- Annual reports: Tabled annually in Parliament by responsible minister

- Audits: Conducted by auditor general annually, plus special examination every 10 years

- 7.1

Corporate plan, operating and capital budgets

The reporting cycle starts with the corporation preparing its:

- corporate plan

- operating budget

- capital budget

- 7.1.1

Corporate plan

The corporate plan updates the sole shareholder, represented by the responsible minister and by the Treasury Board, on the corporation's activities.

The corporate plan is presented to the Treasury Board for approval on the recommendation of the responsible minister (Financial Administration Act, (FAA), subsection 122(1)).Footnote4

- 7.1.2

Operating and capital budgets

At the same time as the Treasury Board ministers approve a Crown corporation's corporate plan, they also approve the corporation's operating and capital budgets.

Operating and capital budgets are approved by the Treasury Board on the recommendation of the responsible minister (FAA, subsections 123(1) and 124(1), respectively).

The recommendation of the Minister of Finance may also be required before a capital budget or an amendment to a capital budget can be submitted to the Treasury Board for approval (FAA, subsection 124(7)).

Crown corporations should consult the Department of Finance Canada and the Treasury Board of Canada Secretariat if the implementation of their capital plan could lead to significant financial risk or potential liabilities to the Crown corporation or to the government.

- 7.2

Summaries

After their corporate plan and their operating and capital budgets are approved, Crown corporations must produce summaries of the plan and the budgets (FAA, subsection 125(1)).

The summaries set out the corporation's main business activities and key financial information.

The responsible minister approves the summaries and tables them in both houses of Parliament (FAA, subsection 125(4)) within 30 sitting days after approval by the Treasury Board (SOR/95-223 S7(a)).

Treasury Board approval is not required for the summaries.

- 7.3

Quarterly financial reports

Crown corporations must publish quarterly financial reportsFootnote5 for the first 3 quarters of each fiscal year (FAA, subsection 131.1(1)). They are usually posted on the corporation's website.

The reports must be made public within 60 days after the end of the quarter.

They are not approved by the Treasury Board or tabled in Parliament, but they should be vetted through the Crown corporation's normal governance process, in accordance with Treasury Board practices.

- 7.4

Annual report

After the end of its financial year, every Crown corporation must submit an annual report to the President of the Treasury Board and to the responsible minister. The responsible minister tables the report in both houses of Parliament within the first 15 sitting days after it is received (FAA, subsection 150(1)).

The annual report serves as the last quarterly financial report of the fiscal year, concludes the year's activities and lays the groundwork for the next year. Results achieved should clearly link to the key components of the corporate plan, such as planned results, objectives and targets.

- 7.5

Audits and special examinations

Regular audits of Crown corporations' financial information help make sure the information is credible and consistent.

These audits include:

- annual auditor reports required under subsection 132(1) of the FAA

- special examination reports conducted at least every 10 years under subsection 138(1) of the FAA

- 7.6

Amendments

Sometimes, a Crown corporation will plan to undertake different activities from those it outlined in its last approved corporate plan (FAA, subsection 122(6)) or that would result in a significant variance from the last approved operating or capital budget (FAA, subsections 123(4) and 124(6)) or the borrowing plan. In these situations, the corporation must prepare an amendment for Treasury Board approval.

Amendments are exceptional and sometimes result from significant events such as a Budget announcement or a recent Cabinet decision. An amendment is an interim and exceptional measure meant to bridge the gap between annual corporate plan and budgets approvals to provide authority for a new activity.

8. Content of corporate plans

The plan contains:

- an outline of the major activities the corporation has planned

- a description of the corporation's operating environment and the risks associated with it

- the results the corporation expects to achieve

- an overview of the corporation's finances over 5 years

In accordance with the FAA and the Crown Corporation Corporate Plan, Budget and Summaries Regulations, the corporate plan must cover the major activities of the corporation and its wholly owned subsidiaries for the following years:

- the financial year in which the plan is submitted

- the preceding financial year

- the following 5 financial years

| -1 | 0 | +1 | +2 | +3 | +4 | +5 |

|---|---|---|---|---|---|---|

| Preceding year | Current year (forecast) | Planning year | Planning year | Planning year | Planning Year | Planning year |

Plans should be concise and written in plain language. The main audience of the plan is the responsible minister, the ministers of the Treasury Board and officials who support them.

Total expected length of corporate plan: 35 to 50 pages. This is a guideline. Some plans may be shorter or longer, depending on the corporation’s particular circumstances. Corporations that anticipate having a longer plan should consult with the responsible portfolio department and with TBS.

Corporate plans should include the sections outlined below, to ensure consistency.

- 8.1

Title page

The title page should contain:

- the name of the parent Crown corporation

- the title of document

- the planning period covered

Expected length: 1 page

- 8.2

Executive summary

The executive summary outlines the following:

- the overall condition of the corporation

- the strategic issues that need government attention over the planning period

- the corporation's major objectives, primary activities and risks

- the strategies planned to achieve the objectives

- major decisions the corporation anticipates facing during the planning period, including decisions about key capital projects, new activities, financing and borrowing plans

Expected length: 1 page

- 8.3

Overview

The overview outlines the corporation's business, including the following:

- mandate, including key authorities

- public policy role

- vision and mission statements

- main activities, principal programs, financial condition

- list in broad terms any other government programs or Crown corporations providing services aimed at the same clientele (both federal and provincial)

- reference to the most recent annual report for more information

Expected length: 1 to 2 pages

Do not place detailed information on the corporate governance structure in the Overview section. Place that information in the corporate governance structure appendix.

- 8.4

Operating environment

The operating environment section puts the planned activities into context by describing the corporation's operating environment, especially any new factors that are affecting that environment.

Indicate the main opportunities and threats relating to the internal environment. These could include but are not limited to:

- human resources overview, including number of employees, number of contractors, and considerations such as planned staffing increases or decreases, talent retention, pensions and collective agreements

- business processes and systems (for example, activities that define how business tasks are performed)

Indicate the opportunities and threats relating to the external environment. These could include but are not limited to:

- competitors

- technological changes

- environmental changes

- relevant economic indicators such as inflation, interest rates, or gross domestic product

- bargaining power of suppliers and customers

- new products and services

- recent or outstanding legal issues or actions

Include an analysis of the corporation's external economic and business environment projected over the planning period. Focus on the main determinants of success in each major business segment such as:

- the level of competition faced by the corporation

- markets

- labour relations

Identify the key strategic issues facing the corporation based on:

- its recent actual performance

- the anticipated external business environment

- its strengths and weaknesses based on performance against previously established objectives and in comparison with the performance of competitors

This section should also include the following:

- an overview of how the corporation is in compliance with Governor in Council and ministerial directives (FAA, section 89) and ministerial spirit and intent (also known as a statement of priorities and alignment)

- an overview of how the corporation’s plans align with government priorities and direction

- a list of Office of the Auditor General special examinations and an overview of how the corporation will address any outstanding recommendations

- a description of government or industry-wide reviews and other recent audits

Expected length: 2 to 3 pages

- 8.5

Objectives, activities, risks, expected results, and performance indicators

Outline the corporation's objectives, activities, risks, expected results, and performance indicators.

Objectives and activities

- the main objectives for the 5-year planning period

- the major activities and strategies that are planned to achieve those objectives, making sure to distinguish between existing activities and new activities

- implementation milestones

Risks

- an overview of key financial and non-financial risks

- an overview of proposed mitigation strategies

Detailed risk information, including the corporation’s overall risk strategy, risk ranking, risk impact and risk likelihood, should be provided in the risk and risk response appendix (see section 9.7).

Expected results and performance indicators

- an overview of expected results

- how they relate to the corporation's mandate and to government priorities

- what represents success for each major activity and for the corporation overall

- recent performance and related indicators or targets as a baseline and comparators or benchmarks from similar organizations

Detailed results information, including planned outcomes, performance indicators and targets, should be provided in the planned results appendix (see section 9.3).

Expected length: 5 to 10 pages

Recommended practice

Provide clear links between the previous annual report and the current corporate plan by referring to objectives, targets, results and so on.

- 8.6

Financial overview

This section should give a clear picture of the corporation's current and anticipated financial health. It should name the key factors that are expected to affect the financial planning over the 5-year horizon of the plan. The following elements should be included:

- a description of the overall financial management of the corporation

- a summary of the most significant items in the 5-year operating and capital budgets

- an explanation of major year-to-year variances in revenues, expenses and cash level

- a description of major assumptions and risks, and the impacts of changes to the assumptions (for example, inflation, exchange rates)

The following elements could also be included, as applicable:

- an explanation of how equity will be used and any plans for reinvestment

- an explanation of the main causes for profits or deficits

- a brief debt analysis

- a discussion of the corporation's retained earnings policy

- a rationale for the dividend level and an explanation of the projected payment scheduleFootnote6

- a comparison of the corporation's financial performance with industry benchmarks and with the performance of Crown corporations in other jurisdictions

Recommended practice

Use the actual results of at least the first 2 quarters as the basis for the presentation of financial information for the current year.

Do not place the 4 required financial statements in this section. Place them, along with the detailed operating and capital budget information and tables that support the overall narrative of the plan, in the financial statements and budgets appendix.

Note: Expenditure information for appropriated Crown corporations is published in the Main Estimates and in GC InfoBase.

Expected length: 1 to 3 pages

- 8.7

Appendices

The appendices to the corporate plan provide details on specific areas to support the narrative of the plan. Information on the content and form of the appendices is in section 9.

Expected length: 24 to 30 pages

9. Appendices to the corporate plan

The body of the corporate plan provides an overview of the organization, its operating environment, strategic objectives, key activities and expected results over the planning horizon.

The appendices to the plan provide details on specific areas to support the narrative of the plan.

The appendices are as follows:

- Direction from responsible minister

- Corporate governance structure

- Planned results

- Chief financial officer attestation

- Financial statements and budgets

- Borrowing plan

- Risk and risk responses

- Compliance with legislative and policy requirements

- Government priorities and direction

Crown corporations are expected to include all of these appendices in their corporate plans. If a corporation omits any of them, it must provide a rationale.

- 9.1

Direction from responsible minister

This appendix contains the most recent mandate letter or direction provided to the Crown corporation by the responsible minister to ensure the alignment of interests and conveys the government's expectations with regard to the corporation's public policy objectives. The mandate letter is also known as the statement of priorities and alignment (SPA). Including it in the corporate plan is consistent with the principles set out in the Open and Accountable Government statement.

Recommended practice

Regular engagement between the responsible minister and the Crown corporation, through a variety of mechanisms, including regular meetings, mandate letters or SPAs, and portfolio secretariats, conveys the government's expectations and supports the development of the corporate plan.

- 9.2

Corporate governance structure

This appendix provides detailed information about the corporation's structure.

It should include the following:

- a governance structure chart, including committees and information about committee structure, membership and attendance

- information on the corporation's leadership structure and, total compensation, including:

- the CEO

- the chair of the board of directors

- the members of the board of directors

- key senior executives

- length of terms

- expiry dates of terms

- current or imminent vacancies

- 9.3

Planned results

This appendix contains the following:

- a list of key short-, medium- and long-term expected outputs and/or outcomes

- performance indicators, targets, baselines and data strategies

- a chief executive officer (CEO) commitment

Reporting of planned results and the related CEO commitment reflects the Government of Canada’s overall approach to results (for more information, see the Mandate Letter Tracker: Delivering Results for Canadians).

See Appendix A for a possible template for the results and CEO commitment.

- 9.4

Chief financial officer attestation

This appendix contains an attestation that confirms the reasonableness, completeness, reliability and relevance of the financial and related information in the corporate plan and budget(s).

This attestation indicates the chief financial officer's (CFO's) professional opinion, as a financial management expert, of the parent Crown corporation's financial and related information. It is not an assessment of policy or program effectiveness.

The CFO attestation:

- meets the expectations of ministers and Cabinet committees

- supports informed decision making in the Government of Canada

- promotes a coherent and consistent approach to CFO due diligence review across parent Crown corporations

By attesting to the financial in the corporate plan, operating and capital budgets, as applicable, CFOs indicate that, as part of their due diligence, they have considered the following and other related aspects of the financial information or the financial management framework of the parent Crown corporation and its wholly owned subsidiaries:

- reasonableness

- completeness

- reliability

- relevance

See Appendix B for recommended content and wording for the CFO attestation.

- 9.5

Financial statements and budgets

This appendix should have 3 sections:

- financial statements and notes

- operating budget and notes

- capital budget and notes

Recommended practice

Financial statements should use the same accounting standard used for the annual report (Public Sector Accounting Standards or International Financial Reporting Standards).

- 9.5.1

Financial statements and notes

A Crown corporation's financial statements are a formal record of the corporation's financial activities. They quantify the corporation's financial strength, performance, liquidity and level of debt.

Financial statements reflect the financial effects of business transactions and events on the corporation.

In the financial statements and budgets, Crown corporations should indicate:

- the accounting or reporting standard used for their financial statements

- the impact of any changes to those standards on the information in the statements

Crown corporations must provide 4 financial statements. Each of them must cover the current year, the year before the planning period and each of the next 5 years.

- 9.5.2

Operating budget and notes

This section should provide a detailed projection of all estimated income and expenses, including investments, based on forecasted revenue over the planning period.

Under section 123 of the Financial Administration Act (FAA) and the related regulations, the operating budget is approved annually and must encompass all the businesses and activities of the corporation and its wholly owned subsidiaries.

The detailed operating budget table should be:

- presented on a cash basis

- broken down by major activities

The major activities should:

- reflect the structure of the organization

- relate to different client groups

- be supported by different operations or resources

- represent a significant portion of the corporation's total costs or expenses

A reconciliation table is required for Crown corporations that receive government funding. This table to provides a link between the operating budget (cash) and the financial statements (accrual).

Note: Crown corporations that use the International Financial Reporting Standards and that do not receive government funding, may present their detailed operating budget table on an accrual basis.

- 9.5.3

Capital budget and notesFootnote7

Capital expenditures are the costs associated with buying, upgrading or modifying current assets, such as property or equipment.

Under section 124 of the FAA and the related regulations, the capital budget is approved annually and must encompass all the businesses and activities, including all capital expenditures and investments, of the corporation and its wholly owned subsidiaries.

Unlike operating budgets, capital budgets receive multi-year approvals when required (FAA, section 124(3)), and they should be presented on a cash basis.

To determine whether they should disclose a particular planned capital expenditure in the budgets they provide to the Treasury Board, Crown corporations should assess the level of risk and the significance of the new planned expenditure against the 2-key risk criteria outlined in Appendix C.

See Appendix C for recommended content and wording for the financial statements and budgets, as well more information about the 2-key risk assessment.

- 9.6

Borrowing plan

In accordance with subsections 127(1), 127(2) and 127(3) of the FAA and sections 10 to 12 of the Crown Corporation General Regulations, Crown corporations intending to borrow funds must provide, as an appendix to their corporate plan, information on their borrowing plan. This information helps inform a recommendation by the Minister of Finance to the Treasury Board , an approval by the Minister of Finance with regard to the time and terms and conditions of each borrowing transaction, or both. If a Crown corporation plans to borrow funds, the approval of the Minister of Finance must be obtained before the Crown corporation enters into the transaction (FAA, subsection 127(3)).

The borrowing plan must:

- indicate the borrowing authority: the statutory authorities for the Crown corporation

- state the requested amount for approval for total short-term borrowings outstanding

- state the requested amount for approval for total long-term borrowings

- state the requested total amount for approval for upcoming leases

- provide some general context and a rationale for the borrowings: the borrowing approach, the sources of the financing and the primary use of the financing, and so on

- indicate total new and outstanding borrowings

Provide the following to explain the content of the plan:

- shifts between short- and long-term borrowings

- material and other changes from year to year

- any variance between the current year's authorized short-term borrowings and actual or projected short-term borrowings outstanding for the current year

- any variance between the current year's authorized long-term borrowings and actual or projected long-term borrowings outstanding for the current year

- any variance between the actual short-term borrowings outstanding for the current year and requested short-term borrowings for the plan year

- any variance between the actual long-term borrowings outstanding for the current year and requested long-term borrowings for the plan year

The borrowing plan must include 5 tables:

- Table 1: Outstanding borrowings at year-end

- Table 2: Short-term borrowings

- Table 3: Peak borrowings at any point during the year

- Table 4: Long-term borrowings

- Table 5: Approval for upcoming leases

Amendments to approved borrowing authority

When a Crown corporation requests amendments to its borrowing approval as a result of activities that are not consistent with the approved corporate plan, a corporate plan amendment is required. The standard borrowing approval, outlined above, must be followed.

See Appendix D for recommended content and sample tables for the borrowing plan.

- 9.7

Risk and risk responses

This appendix indicates:

- the financial risks to the corporation

- the non-financial risks to the corporation

- the probabilities of the risks happening

- the potential impact of the risks

- the proposed mitigation strategy for each risk

It should also contain an overview of the corporation's risk management approach or methodology.

If the corporation faces major financial risks relating to variables in the sector in which the corporation operates (for example, interest rates, exchange rates, commodity prices), conduct a sensitivity analysis. Present the results of the analysis in a table. Indicate the positive and negative impacts of different scenarios on the corporation's expense and revenue forecasts.

Crown corporations are encouraged to adopt a risk management framework that has been approved by its board of directors. Such a framework could include:

- an outline of the risks the corporation is facing

- a brief discussion of the corporation's risk tolerance

- 9.8

Compliance with legislative and policy requirements

This appendix contains information about the corporation's efforts to comply with legislation, Treasury Board policies, Governor in Council and ministerial directives such as:

- Access to Information Act

- Conflict of Interest Act

- Canadian Human Rights Act

- Corruption of Foreign Public Officials Act

- Employment Equity Act

- Official Languages Act

- Privacy Act

- Pay Equity Act

- Directive on Travel, Hospitality, Conference and Event Expenditures

- official languages policy instruments

- pension plan reform directives

- trade agreements

If the corporation is unable to fully comply with or is considered to be deviating from a Governor in Council or ministerial directive, explain why and indicate how the corporation plans to address the requirements in the future.

- 9.9

Government priorities and direction

Government-wide priorities are outlined in the Speech from the Throne and the Budget Plan.

This appendix describes how the corporation's priorities and activities align with government-wide priorities and highlights any notable activities in the following key areas.

- 9.9.1

Transparency and open government

Transparency and open government promote accountability. A transparent and open government informs citizens about what it is doing.

Indicate how the corporation is addressing transparency by removing barriers to information, for example, through:

- increased proactive disclosure

- access to information renewals

- providing greater access to industry

- access to corporate data

- 9.9.2

Gender-based analysis plus

Gender-based analysis plus (GBA+) is an analytical tool used to assess how women, men and gender-diverse people may experience policies, programs and initiatives.

The plus in "GBA+" acknowledges that GBA goes beyond biological (sex) and socio-cultural (gender) differences. GBA+ also considers many other identity factors such as:

- race

- ethnicity

- religion

- age

- mental or physical disability

Explain how the corporation has applied the GBA+ lens to its business and decision-making and how the corporation has considered these factors while executing its mandate and activities.

- 9.9.3

Diversity and employment equity

The government is committed to building a workforce that reflects the diversity of Canada's population. Outline actions taken to support these principles.

- 9.9.4

Indigenous issues

Crown corporations must consider their legal duty to consult Indigenous peoples. Indicate when the corporation has carried out such consultation and what accommodation was made.

- 9.9.5

Sustainable development and greening government operations

Sustainable development is defined as development that meets the needs of the present without compromising the ability of future generations to meet their own needs.

Describe the corporation's efforts to reduce the environmental impacts of its operations and, if applicable, actions taken to assist the government in greening its operations and implementing its Greening Government Strategy.

- 9.9.6

As federal employers, Crown corporations have an obligation to provide workplaces that are civil, respectful and free of harassment. Describe the corporation’s actions to support employees; to improve response capacity; and to understand, address and eliminate harassment in the workplace.

- 9.9.7

Describe the corporation’s actions to support accessibility and promote inclusion both within the corporation, and externally for stakeholders and clients.

- 9.9.1

10. Confidentiality

Corporate plans, budgets and amendments that are in the possession of a Crown corporation are not treated as confidences of the Queen's Privy Council for Canada.

These documents do, however, contain sensitive information, because they will ultimately be included in Treasury Board submissions, which are considered as Cabinet confidences. Crown corporations must therefore determine the level of classification of these documents based on their own injury assessment and classification system.

Corporations are encouraged to adopt their own security measures, such as printing only a few copies or numbering the copies, or both. Corporations should also provide guidelines to employees on how to handle and store electronic and paper documents securely.

To preserve Cabinet confidence immunity, signed Treasury Board submissions are not shared with Crown corporations.

11. Development and approval process

This section explains the development and approval process for the corporate plan, operating and capital budgets.

The process can be lengthy and involve many rounds of discussion. Good communication and cooperation between stakeholders is essential. TBS recognizes that some flexibility may be required so that portfolio departments and Crown corporations can keep to the recommended timeline.

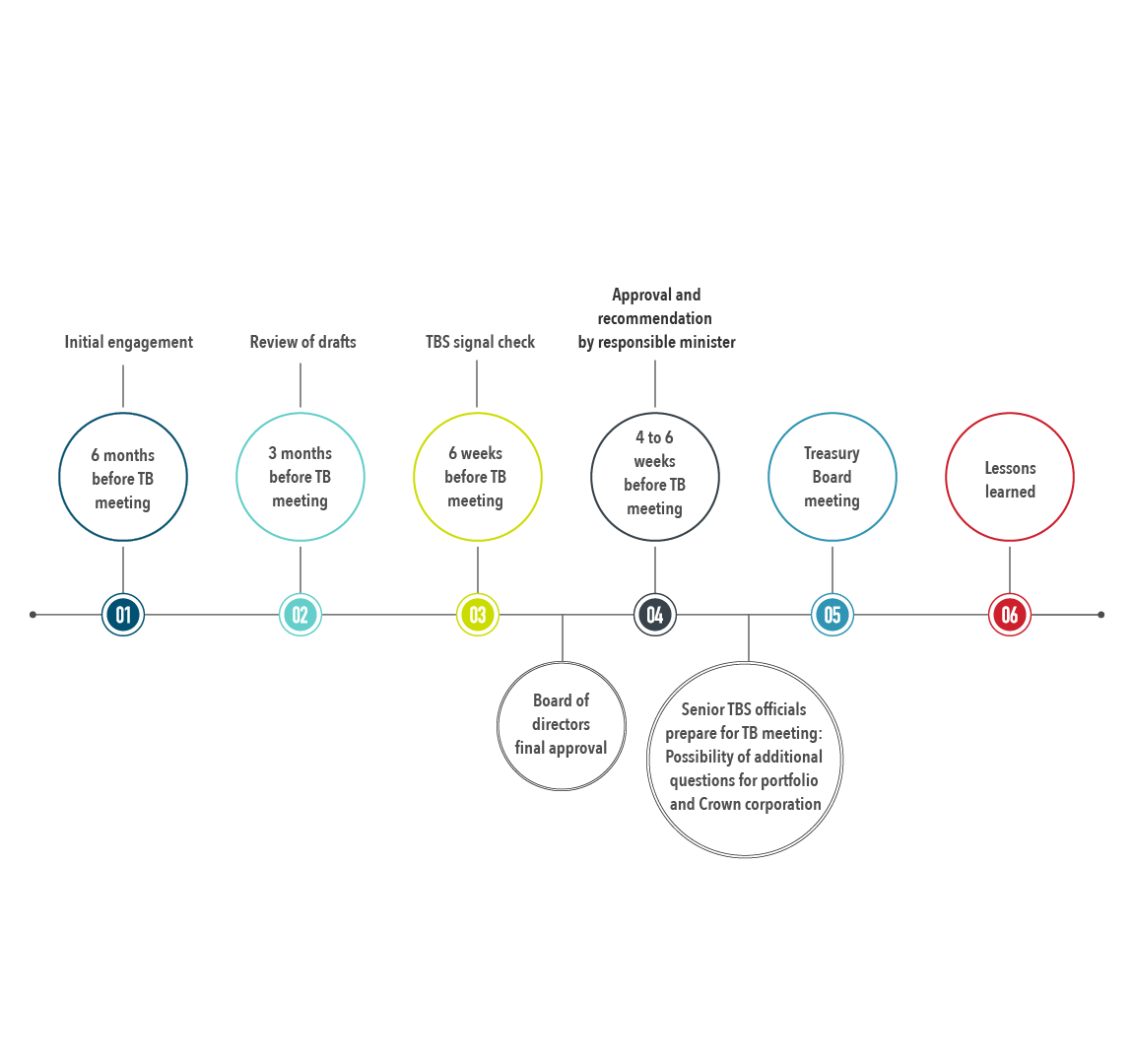

Figure 2 shows the recommended timeline for the approval process.

Figure 2 - Text version

Figure 2 consists of 6 circles, presented in a horizontal row, all containing text. Above each of the first 4 circles is text indicating a step in the approval process; each of those circles contains text indicating when the step is to be done.

The text associated with the first 4 circles is as follows :

- First circle

- Initial engagement: 6 months before TB meeting

- Second circle

- Review of drafts: 3 months before TB meeting

- Third circle

- TBS signal check: 6 weeks before TB meeting

- Fourth circle

- Approval and recommendation by responsible minister: 4 to 6 weeks before TB meeting

The fifth and sixth circles contain the following text:

- Fifth circle: Treasury Board meeting

- Sixth circle: Lessons learned

Below the space between the third and fourth circles is a box containing the following text:

- Board of directors final approval

Below the space between the fourth and fifth circles is a box containing the following text:

- Senior TBS officials prepare for TB meeting: Possibility of additional questions for portfolio and Crown corporation

TB : Treasury Board of Canada

TBS : Treasury Board of Canada Secretariat

Initial engagement

A Crown corporation should engage with its portfolio department and minister's office early in the process. They are the corporation's primary contacts in the Government of Canada.

About 6 months before the targeted Treasury Board meeting at which the corporate plan or budget will be presented, a kick-off meeting should be held to ensure that everyone understands the expectations and timelines. The meeting should involve all stakeholders, including the Treasury Board of Canada Secretariat (TBS) and the Department of Finance Canada (FIN).

At this meeting, TBS could clarify:

- new government initiatives or priorities that the corporation should reflect in its plan

- the roles and responsibilities in the Treasury Board submission process

- the phases of the process

- the format of the submission

- any other expectations

A draft corporate plan or budget is not expected at the meeting, but the corporation may choose to brief stakeholders on what it expects to cover in the plan.

Recommended practice

Crown corporations should hold a kick-off meeting with key stakeholders, including portfolio departments, TBS and FIN, to address any concerns about timing and the approval process to ensure timely consideration by Treasury Board.

Review of drafts

Review by portfolio department

About 3 months before the targeted Treasury Board meetingthe Crown corporation will share drafts of the corporate plan and budgets with the portfolio department, including key new information and financials.

The portfolio department will review the documents and may consult TBS or, where required, FIN, for guidance or clarification. This review should occur before the board of directors approves the final corporate plan, because the TBS assistant secretary who will be presenting the case to Treasury Board may request changes or additional content. This is known as the pre-submission phase of the Treasury Board submission process.

Usually, the portfolio department will draft the Treasury Board submission during this phase, before the corporate plan is finalized, and work with TBS to meet the necessary requirements.

Review by Minister of Finance (when required)

The Minister of Finance reviews and monitors the impact of Crown corporations' activities on the fiscal framework and has a number of supporting authorities, including authorities relating to dividend payments.

The Minister may require that her or his recommendation related to planned borrowings be obtained before the corporate plan is submitted for approval to the Treasury Board (FAA, subsection 127(2)).

The Minister of Finance can also require that her or his recommendation be obtained before a capital budget is submitted for Treasury Board approval (FAA, subsection 124(7)). FIN officials must be consulted if the implementation of the capital budget could lead to significant financial risk for the Crown corporation or for the government.

In certain circumstances, the Treasury Board can also make regulations that require Minister of Finance approval of a corporate plan (FAA, subsection 122(7)).

FIN officials should be engaged early in the drafting process, so documents should be shared as soon as possible to help make sure that the Minister of Finance's approval is obtained on time. This approval generally follows the TBS review process and the recommendation of the responsible minister.

FIN officials confirm the Minister of Finance's recommendation before the signed Treasury Board submission is presented to the Treasury Board Submission Control Centre. This confirmation is essential. If there is no FIN confirmation, the Treasury Board submission can be deemed incomplete and will not be put forward for consideration.

Treasury Board of Canada Secretariat signal check

In the second phase of the Treasury Board submission process, generally no later than 6 weeks before the Treasury Board meeting date, TBS finalizes its review of the corporate plan submission and confirms to the portfolio department that the plan and budget(s) meet the reporting requirement.

This step is known as the TBS signal check.

TBS will inform the portfolio department that the corporate plan submission can proceed for approval:

- first, by the Crown corporation's board of directors

- then by the responsible minister

Approval and recommendation by responsible minister

Once the board of directors has approved the final plan and budgets, the Crown corporation must submit them, through the portfolio department, to the responsible minister for approval and recommendation.Footnote 9

The department then sends the full submission package to the responsible minister for signature and recommendation, and then to the Minister of Finance, if required.

The final recommendation of the responsible minister for the Treasury Board submission to seek Treasury Board approval should always follow the TBS signal check.

The portfolio department then obtains all approvals and delivers them to TBS in the Treasury Board submission package. The instructions for delivering signed Treasury Board submissions are posted on the TBS website.

Even after the responsible minister's approval and recommendation, the portfolio department should stay in regular contact with the TBS program sector, because the TBS program sector may request clarification or information on behalf of the assistant secretary who will be presenting the submission at the Treasury Board meeting.

As the Treasury Board meeting approaches, senior TBS officials review both the submission and TBS advice to the Treasury Board ministers (known as the précis). To help the process go smoothly, the portfolio department and the Crown corporation should answer questions promptly and clearly.

Treasury Board meeting and decision

Once the Treasury Board has reviewed the corporate plan, budget(s) and submission, in other words, in the post-submission phase of the Treasury Board submission process, they may do any of the following:

-

Approve the corporate plan or budgets

TBS will provide confirmation to the deputy head of the portfolio department that the plan and budget(s) have been approved.

-

Approve the plan or budget(s) but impose terms and conditions

The Treasury Board could approve the plan and budget(s) but specify terms and conditions. It could, for example, require an adjustment to the funding level for a particular initiative, request an update on certain information, or request additional details about a particular initiative. Only the Treasury Board acting as the Governor in Council can impose conditions on the approval of a corporate plan. To do this, an Order in Council is drafted to outline the terms and conditions of the approval. The responsible minister recommends the Order in Council, and it is presented at a Treasury Board meeting for Governor in Council approval.

-

Withhold approval of the plan or budgets until concerns have been resolved

If the Treasury Board withholds approval, the corporation can continue to operate under the last approved plan, but it cannot undertake new activities until the Board approves a new plan or approves an amendment to the plan that includes the new activities.

Corporations whose capital budget has not been approved by the Treasury Board cannot incur or commit new capital expenditures until a budget covering those expenditures is approved, unless the expenditures meet the criteria set out in Financial Administration Act, paragraph 124(5)(b).

Lessons learned

After the Treasury Board decision has been made, the Crown corporation or the portfolio department can lead a meeting with all stakeholders to discuss lessons learned from the process.

They can discuss:

- what went well with the process

- what challenges were encountered

- areas for improvement

This discussion will help build relationships and improve the corporate plan submission process in the future.

12. Summaries of corporate plans and budgets

General

A summary must cover all the businesses and activities, including investments, of the parent Crown corporation and any wholly owned subsidiaries. It must also indicate the major business decisions the corporation has made in relation to those activities (FAA, subsection 125(2)).

The summary must be prepared in a form that clearly sets out information according to the major businesses or activities of the parent Crown corporation and any wholly owned subsidiaries (FAA, subsection 125(3)).

Summaries do not contain new information or analysis. They must include all the key elements described in the approved plan and budgets. They can exclude sensitive information that could harm the corporation's commercial interests or those of a wholly owned subsidiary (FAA, subsection 153(1)).

Recommended practice

Summaries of the corporate plan and budgets are usually included in the same document.

Contents of corporate plan summaries and budget summaries

Both the summaries of corporate plans and the summaries of operating budgets and capital budgets should include:

- an introduction

- the statutory authority for incorporation

- the main assumptions used in the preparation of the plan or budget

- the corporation's mandate

- the objectives of the plan or budget

- performance indicators

- results (expected and achieved)

- the corporation's borrowing intentions

- all financial statements for the planning period, as they were broken down in the corporate plan

Contents of operating budget summaries

Summaries of operating budgets should contain:

- an overview of the significant content in the approved budget

- a summary of the operating results for the preceding financial year and the projected results for the current and subsequent planning years

- an explanation of major variations or shifts over the rest of the planning period

Contents of capital budget summaries

Summaries of capital budgets should contain:

- an overview of the significant content in the approved budget

- a summary of capital expenditures and commitments for the preceding and current financial years

- projections and commitments over the rest of the planning period

Process for summaries

After the corporate plan, operating and capital budgets are approved, the Crown corporation must submit summaries to the responsible minister for her or his approval (FAA, subsection 125(1)).

The minister must then table the summaries in each House of Parliament within 30 sitting days of the approval of the corporate plan and budgets (Crown Corporation Corporate Plan, Budget and Summary Regulations, section 7).

Once the summaries are tabled, the Crown corporation should post them on its website. TBS posts consolidated information for all Crown corporations.

Because the summaries are made public, any sensitive information that would harm the commercial interests of the parent Crown corporation or the wholly owned subsidiary can be omitted at the discretion of the responsible minister (FAA, subsection 153(1)).

13. Amendments to corporate plans and budgets

Content of amendments

Amendments will differ in form and content. They are subject to the summary requirements set out in the Financial Administration Act (FAA).

All amendments should, however, include:

- the rationale or reasons for the amendment

- updated objectives, performance indicators or planned results to reflect the changes

- revised financial statements or budgets, as appropriate

- new assumptions for revised expenditures, revenues, and so on, for each major activity

Amendments to operating budgets should include:

- statement of income and retained earnings

- statement of changes in financial position

- a balance sheet

- an explanation of any variances from the results projected in the approved budget

Amendments to capital budgets should include:

- cash flows

- loans

- investments and appropriations (along with selection criteria for significant capital investments)

- the anticipated impact of the investment on financial objectives, performance and planned results

- an explanation of any variances from the results projected in the approved budgets

Recommended practice

Although it is not an absolute threshold, any variation of 5% or $10 million from the total amount of approved operating budget or capital budget, whichever is greater, should trigger a discussion with TBS about Treasury Board consideration.

Process for amendments

The approval process for amendments is the same as the approval process for corporate plans and budgets.

Need for amendments

To find out whether an amendment is required, parent Crown corporations must consult their portfolio department. The portfolio department, in turn, consults TBS.

A corporate plan requires an amendment when a parent Crown corporation proposes to carry on any business or activity in a manner that is inconsistent with the last approved corporate plan (FAA, subsection 122(6)). This refers to any activity that is new to the Crown corporation or that represents a significant change and which is generally exceptional, for example, a Budget announcement.

An operating budget requires an amendment when a Crown corporation anticipates that the total amount of expenditures in respect of any major business or activity will vary significantly from the total amount projected for that major business or activity in the last approved operating budget (FAA, subsection 123(4)).

Similarly, a capital budget requires an amendment when the Crown corporation anticipates that the total amount of capital expenditures or commitments to make capital expenditures in respect of any major business or activity will vary significantly from the projections in the last approved capital budget (FAA, subsection 124(6)).

A borrowing plan requires an amendment when a Crown corporation's plan to borrow funds is inconsistent with the last approved borrowing plan.

The following should be considered when determining whether an amendment is required:

- the uniqueness of the event or disparity with other approved activities

- whether the activity is inconsistent with the activities normally associated with the corporation's mandate

- deviation or variation from the conditions explicitly set by a previous Treasury Board decision

- the level of risk associated with the proposed activity and

- whether the significance of the change is such that the responsible minister and the Treasury Board should have the opportunity to recommend or approve the change and consider it in the context of the corporation's mandate and priorities

- the significance of the difference between the proposed expenditures associated with the activity and the previously approved operating or capital expenditures and commitments

- how much time has elapsed since a plan or budget was last approved (beyond a normal cycle)

Recommended practice

The amendment of a corporate plan should include details of only the changes for which Treasury Board approval is being sought. Only when the amendment would completely alter the corporation’s business operations must the entire corporate plan be revised.

Appendix A: Template for planned results

| Component | Outcome | Result indicator | Target | Data source and methodology |

|---|---|---|---|---|

| Short-term | [Should be directly attributable to the proposed activity or line of business] | [Relevant, meaningful measures of outputs or outcomes]

|

|

[Indicate source and frequency]

|

| Medium-term | [Should logically occur as a result of the short-term outcome(s), above] |

|

[Emphasize increases or improvements, if building on earlier results]

|

|

| Long-term | [Can be reasonably attributed to the proposed course of action, as a result of the short-term and medium term outcome(s) above] |

|

|

[include frequency for each data source] |

Chief Executive Officer commitment: I, [name], as Chief Executive Officer of [name of Crown corporation], am accountable to the Board of Directors of [name of Crown corporation] for the implementation of the results described in this corporate plan and outlined in this Appendix. I confirm that this commitment is supported by the balanced use of all available and relevant performance measurement and evaluation information.

[name], Chief Executive Officer

[name of Crown corporation]

Original signed

Date

Appendix B: Recommended content and wording for chief financial officer attestation

In my capacity as Chief Financial Officer of [Crown corporation name], accountable to the Board of Directors of [name of Crown corporation] through the Chief Executive Officer, I have reviewed the [corporate plan and budget(s) or amendments] and the supporting information that I considered necessary, as of the date indicated below. Based on this due diligence review, I make the following conclusions:

- The nature and extent of the financial and related information is reasonably described, and assumptions having a significant bearing on the associated financial requirements have been identified and are supported, with the following observations: [add as applicable]

- Significant risks having a bearing on the financial requirements, the sensitivity of the financial requirements to changes in key assumptions, and the related risk-mitigation strategies have been disclosed, with the following observations: [add as applicable]

- Financial resource requirements have been disclosed and are consistent with the stated assumptions, and options to contain costs have been considered, with the following observations: [add as applicable]

- Funding has been identified and is sufficient to address the financial requirements for the expected duration of the corporate plan, with the following observations, including observations with regard to appropriations that have not yet been approved: [add as applicable]

- The corporate plan and budget(s) are compliant with relevant financial management legislation and policies, and the proper financial management authorities are in place (or are being sought as described in the corporate plan), with the following observations: [add as applicable]

- Key financial controls are in place to support the implementation of proposed activities and ongoing operation of the parent Crown corporation and its wholly owned subsidiaries, with the following observations: [add as applicable]

In my opinion, the financial information contained in this corporate plan and budget(s) is sufficient overall to support decision making.

or

I am unable to assess the financial implications of the corporate plan and budget(s), as noted above.

or

In my opinion, the corporate plan and budget(s) have substantial financial and/or risk issues, as noted above.

[name], Chief Financial Officer

[name of Crown corporation]

Original signed

Date

Appendix C: Recommended content for financial statements and budgets

Required financial statements

Corporations must include 4 financial statements in their corporate plan.

- Statement of financial position

Also known as the balance sheet, this statement presents the corporation's financial position at a given date. It comprises assets, liabilities and equity. It provides a breakdown of current assets versus long-term assets and current liabilities versus long-term liabilities and indicates the corporation's liquidity and its ability to cover its short‑term liabilities.

- Income statement

Also known as the statement of profit and loss, the income statement reports the corporation's financial performance in terms of net profit or loss over a specified period.

The income statement contains:

- income (for example, sales revenue, appropriations, dividend income)

- expenses (for example, salaries and wages, depreciation, rental charges)

- net profit or loss

Notes to the income statement should include an explanation of any increases in expenses over the planning years if they do not aligned with revenue growth.

Financial Crown corporations should refer to the Capital and Dividend Policy Framework for additional guidance.

- Cash flow statement

The cash flow statement presents the movement in cash and bank balances over a specified period.

The cash flow statement contains:

- operating activities

- investment activities

- financing activities

Notes to the cash flow statement should include a liquidity statement that provides the narrative to support the level of cash required to operate over the next planning period.

- Statement of changes in equity

Also known as the statement of retained earnings, this statement details the movement in corporation's equity over a period.

The statement of changes in equity contains:

- net profits or losses during the period, as reported in the income statement

- share capital issued or repaid during the period

- dividend payments

- gains or losses recognized directly in equity (for example, revaluation surpluses)

- effects of a change in accounting policy or of a correction of an accounting error

Operating budget and notes

To support the operating budget, corporations must cover the following in the narrative to their budgets:

- New activities

- An overview of new activities or business lines, including alignment with mandate

- Projections

- An overview of budget projections for the upcoming planning years

- Major assumptions

- An explanation of major assumptions used in preparing budget projections for the current and planning years, and the impacts on the projections if the assumptions were to change

- Commitments or expectations

- An overview of expected and committed revenue and operating expenses

- Financial results

An outline of operating results (expected and achieved) by major category of revenue and operating expenses for the preceding, current and planning years.

This outline should include a breakdown of internal servicesFootnote 8costs, changes in net cash items and ending cash, including impacts of dividends, and reconciliation of appropriated funds with the Estimates.

- Variances

A description of variances between actual and forecasted numbers for operating expenses. Significant variations during the planning years (year 1 to year 5) in comparison with the last corporate plan should be explained.

More detailed information, including scenario analysis of variances related to specific variables can be further explained in the risk and risk response appendix.

- Human resources

- An outline of their human resources strategy, including changes in the size of the workforce and compensation strategy (changes to employee salaries based on compensation analysis and state of pension plans and benefits, including solvency surplus/deficit)

- Other key plans and strategies

- An overview of plans and strategies for, for example, fundraising, stewardship and engagement

Capital budget and notes

To support the capital budget, corporations must provide the following in the narrative to the capital budget:

- Overview or description

- An overview or description of the corporation's capital expenditures for the current year, including:

- details on the previous year's and planning years' expenditures

- an outline of capital expenditure commitments by major project

- Major assumptions

- An explanation of major assumptions used in preparing the projections for each major project, and the impacts on the projections if the assumptions were to change

- Return on investment

- The anticipated impact of the capital investments on revenues and profits in the future

- Source of funds (if applicable)

- Details on all sources of capital funds for each project, broken down by borrowings, appropriations and internal funds, as applicable

Note: Information about capital projects involving real property assets should take into account the requirement under the Policy on the Management of Real Property for Crown corporations to report on their real property assets in the Directory of Federal Real Property.

2 key risk criteria for mandatory disclosure

Treasury Board ministers assess and approve potential new activities by Crown corporations based on the information corporations provide in their corporate plan and budgets.

To determine whether they should disclose a particular planned capital expenditure in the budgets they provide to the Treasury Board, corporations should apply 2 tests to assess the value and the level of risk of the new planned expenditure.

- Value test

Corporations must disclose investments that represent:

- more than 5% of total assets

or

- more than $10 million in total investments over the course of the project or activity

whichever is greater

and

- more than 5% of total assets

- Risk test

Corporations must disclose investments that meet any of the following criteria:

- Uniqueness of the activity or project

- This is the first time the Crown corporation will be undertaking this type of activity or project.

- Significance of the activity or project

- The activity or project is considered a significant undertaking for the organization.

- Mandate

- The activity or project is inconsistent with the activities normally associated with the corporation's mandate, strategic objectives and outcomes.

The activity or project represents a deviation or variation from direction explicitly set by the responsible minister or by Treasury Board ministers. - Financial resources

- The activity or project requires a source of funds beyond internal financial resources.

For multi-year activities or projects, the source of funds is not confirmed beyond the first year. - Organizational capacity

- The complexity of the activity or project requires supplementary project management capacity to achieve the objectives.

- Solicitation procedure

- A non-competitive solicitation procedure is being considered or planned.

Corporations should complete the following table for any new project or activity that is worth more than 5% of its total assets or more than $10 million, whichever is greater, and that meets any of the risk criteria above.

Projects or initiatives greater than 5% of the total assets or over $10 million, whichever is greater

Overview or description of project:

Type of project (project, real estate, procurement, and so on):

Source of funds:

Major assumptions:

Proposed procurement process:

Description of project governance:

| Criteria | Actual | Actual or estimated | Forecast (plan year) |

Projected | Projected | Projected | Projected | Projected |

|---|---|---|---|---|---|---|---|---|

| Total project costs, including all project phases and breakdowns |

Note: Expenditures that must be disclosed include investments that will involve:

- a major change in service delivery

- real estate transactions

- capital leases

- acquisition of land

- major procurements involving, for example, fleet renewal, machinery, automation or back office services (payroll and financial systems, software and other IT projects)

Appendix D: Recommended content and sample tables for the borrowing plan

The borrowing plan must include 5 tables:

- Table 1: Outstanding borrowings at year-end

- Table 2: Short-term borrowings

- Table 3: Peak borrowings at any point during the year

- Table 4: Long-term borrowings

- Table 5: Approval of upcoming leases

| Borrowing | Actual value | Actual or projected value |

Forecast (plan year) value | Projected value | Projected value | Projected value | Projected value |

|---|---|---|---|---|---|---|---|

| Short-term borrowings | |||||||

| Long-term borrowings | |||||||

| Total borrowings |

Corporations must indicate, in the narrative to the borrowing plan, the aggregate principle amount of outstanding borrowings and whether it is below or above the maximum statutory limit.

Currency used |

Actual value | Actual or projected value | Forecast (plan year) value | Projected value | Projected value | Projected value | Projected value |

|---|---|---|---|---|---|---|---|

| Canadian dollars | |||||||

| US dollars (expressed in Canadian dollars) | |||||||

| Total short-term outstanding borrowings |

| Method and currency used | Actual value | Actual or projected value | Forecast (plan year) value | Projected value | Projected value | Projected value | Projected value |

|---|---|---|---|---|---|---|---|

| Line of credit: Canadian dollars | |||||||

| Line of credit: US dollars (expressed in Canadian dollars) |

|||||||

| Borrowings: Canadian dollars |

|||||||

| Borrowings: US dollars (expressed in Canadian dollars) | |||||||

| Total borrowings |

| Borrowing | Actual value | Actual or projected value | Forecast (plan year) value | Projected value | Projected value | Projected value | Projected value |

|---|---|---|---|---|---|---|---|

| Opening balance | |||||||

| Maturities | |||||||

| New issuances | |||||||

| Total | |||||||

| Split by type | |||||||

| Fixed-rate | |||||||

| Floating-rate | |||||||

| Total | |||||||

| Current authorities (from last approved plan) | Forecast year 1 value | Projected year 2 value | Projected year 3 value | Projected year 4 value | Projected year 5 value | Outer years’ value | |

|---|---|---|---|---|---|---|---|

| Assets or asset class: [office space, land, building, equipment, and so on] |

|||||||

| Short description, including maximum number of years: |

|||||||

| Maximum expected liability on the lease | |||||||

| Maximum expected number of years to be agreed | |||||||

The Minister of Finance may have to approve the timing and the terms and conditions of certain lease transactions, depending on the value of the lease as fixed under the Crown Corporation General Regulations. The new regulatory threshold is 5% of the Crown corporation’s total assets or $10 million, whichever is less.

To seek the Minister of Finance’s approval of upcoming lease transactions, corporations must include the following statement and provide a completed table for each upcoming lease or asset class:

[Name of Crown corporation] seeks the Minister of Finance’s approval to enter into [type of lease] worth a maximum amount of [$X] over a term no more than [number of years] years.

Because some lease transactions are signed a year or more before the start date, Crown corporations should seek approval for the lease transaction before they sign the agreement.

Also, in the year leading up to the start date of the lease, Crown corporations should state, in the borrowing plan appendix:

- the total lease obligation

- the number of years on the lease

- when ministerial approval was sought and received