Rescinded [2017-10-18] - Guideline On Common Financial Management Business Process 5.1 - Pay Administration

This page has been archived on the Web

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Executive Summary

This guideline is part of a set of guidelines designed to assist departments See footnote 1 in implementing common financial management business processes.

This guideline presents the "should be" model for Pay Administration, which involves "pay" and "payroll." Pay and payroll are limited to gross pay and pay-related transactions identified in the Regional Pay System's detailed expenditure extract file, See footnote 2 and include the following:

- Basic pay;

- Allowances;

- Supplementary pay (including overtime); and

- Adjustments and credit backs, such as recoveries, garnishments, and non-statutory deduction adjustments.

This guideline describes roles, responsibilities and recommended procedures in the context of the Financial Administration Act (FAA), other legislation, and Government of Canada policy instruments.

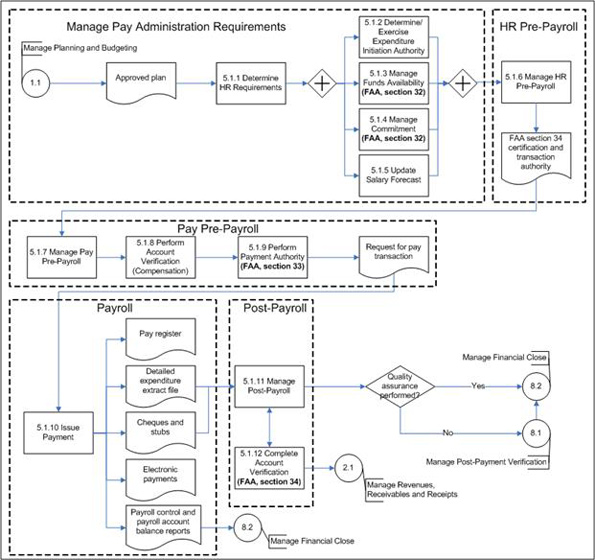

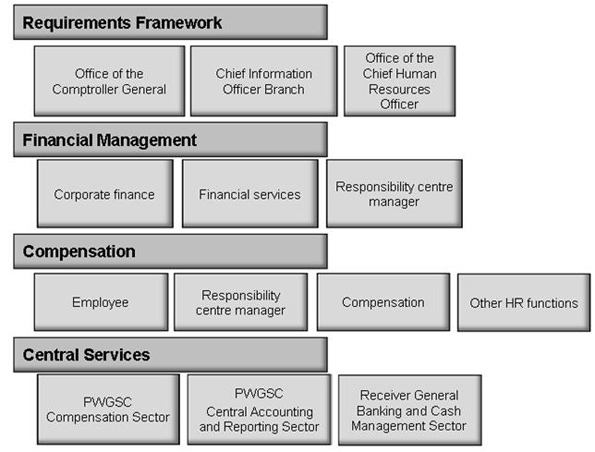

Figure 1: Pay Administration – Level 2 Process Flow

Text version: Figure 1: Pay Administration – Level 2 Process Flow

Note: The  symbol indicates that all four subprocesses should be completed before proceeding to the HR Pre-Payroll subprocess group.

symbol indicates that all four subprocesses should be completed before proceeding to the HR Pre-Payroll subprocess group.

As illustrated in Figure 1, Pay Administration comprises 12 subprocesses (5.1.1 to 5.1.12) that are arranged into 5 subprocess groups as follows.

Manage Pay Administration Requirements starts the Pay Administration business process by defining the pay administration requirements. The responsibility centre manager reviews the annual plan and approved budget, which is produced as part of Manage Planning and Budgeting (Business Process 1.1), and determines requirements for employees and positions. Once the pay requirement is decided, the responsibility centre manager exercises expenditure initiation and confirms the availability of funds. Commitments and salary forecast records are updated as per departmental procedures established by the deputy head.

Under HR Pre-Payroll, human resources (HR) actions are then undertaken. These HR subprocesses, as defined in the Common Human Resources Business Process, can lead to pay transactions by providing critical information for responsibility centre managers, compensation and employees (such as classification decisions, identification of successful candidates in a staffing action, decisions on disciplinary actions, or identification of recipients and amounts for special awards). The HR Pre-Payroll subprocesses terminate in confirmation of transaction authority; FAA section 34 certification; updates to commitments and salary management records in accordance with deputy head requirements; and a request for a pay transaction.

Pay Pre-Payroll involves the resulting compensation activities whereby the requested pay transaction is processed, including part of FAA section 34 verification and the FAA section 33 certification.

Under Payroll, following FAA section 33 certification, the Department of Public Works and Government Services (PWGSC) calculates employee pay for the pay period, issues the pay register for validation from departmental compensation, and completes the processing for payments related to employee pay. Using the Regional Pay System, PWGSC provides departments with a detailed expenditure extract report that identifies gross pay-run information and cancelled payments. Departments also receive control account and account balance details on a pay-run basis from PWGSC's Payroll System–General Ledger (PS-GL).

Post-Payroll processing occurs in the department upon issuance of the employee pay payments and receipt of the detailed expenditure extract file. Under the Manage Post-Payroll subprocess, departments record the pay transactions in the Departmental Financial and Materiel Management System (DFMS); gross pay accounting entries including any cancelled payments for pay transactions are completed; responsibility centre managers complete account verification by performing the last steps of FAA section 34 verification; and the Pay Administration business process ends. In the event that quality assurance was not performed prior to issuance of payment, the process proceeds to Manage Post-payment Verification (Business Process 8.1). PS-GL control account balances are reconciled and accounted for as part of Manage Financial Close (Business Process 8.2).

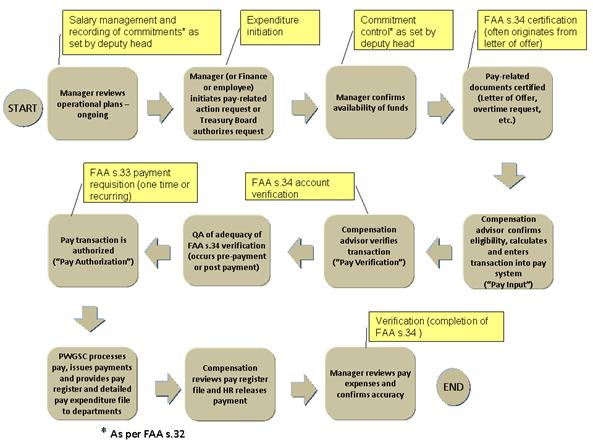

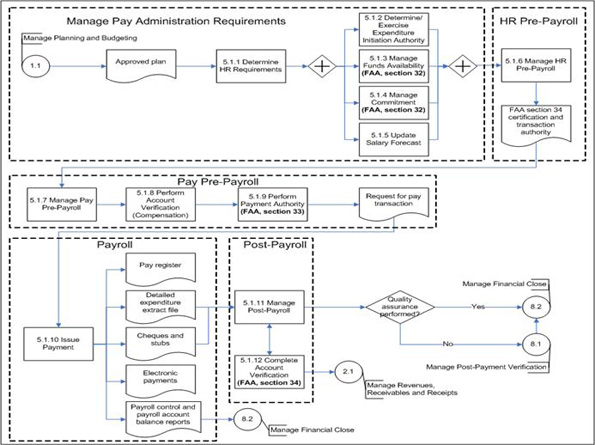

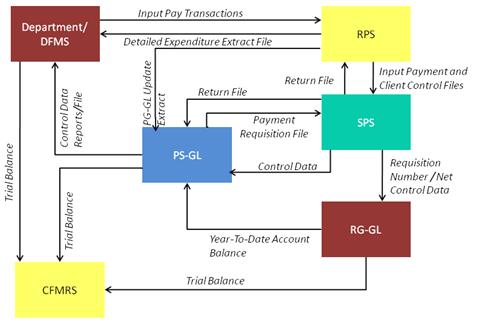

An alternate view of the Pay Administration business process is as follows:

Figure 2: Pay Administration Flow

Text version: Figure 2: Pay Administration Flow

Note: FAA s. 34 refers to section 34 of the Financial Administration Act. FAA s. 33 refers to section 33 of that Act, and FAA s. 32 refers to section 32 of that Act.

The following clarifications of existing policy and procedures for Pay Administration are implicit in the Pay Administration flow diagram:

- A pay transaction may be initiated by a responsibility centre manager, by an employee, by Finance or by the Treasury Board.

- Certification and verification pursuant to FAA section 34 is delegated to the responsibility centre manager, and FAA section 34 verification for pay input purposes is delegated to compensation advisors. Authority to perform FAA section 34 verification can be delegated to positions in other departments. See footnote 3

- The pay verification step corresponds to the first part of FAA section 34 account verification. As such, evidence of pay verification must exist for every transaction. See footnote 4

- FAA section 34 certification is frequently derived from, or may be implicit in, the employee's original letter of offer—for example, for statutory pay increases.

- Transaction authority is obtained or exercised based on the delegation of HR or financial authorities within the department.

- Payment authorization under section 33 of the FAA can be recurring and occurs before PWGSC processes pay.

- To complete the responsibilities under FAA section 34 account verification, the responsibility centre manager must verify pay expenses for accuracy. See footnote 5

1. Date of Issue

This guideline was issued on January 28, 2013.

2. Context

This guideline is part of a set of guidelines designed to assist departments See footnote 6 in implementing common financial management business processes. This guideline supports the Policy on the Stewardship of Financial Management Systems and the Directive on the Stewardship of Financial Management Systems.

This guideline presents the "should be" model for Pay Administration, describing roles, responsibilities and recommended activities from a financial management perspective. Most activities are financial in nature, but some non-financial activities are included in order to provide a comprehensive process description; these activities are identified as outside the scope of Pay Administration. The recommended activities comply with the Financial Administration Act (FAA), other legislation and Government of Canada policy instruments.

Recognizing that deputy heads are ultimately responsible for all aspects of financial management systems within their department, standardizing and streamlining financial management system configurations, business processes and data across government provides significant direct and indirect benefits relative to the quality of financial management in the Government of Canada. By establishing a common set of rules, standardization reduces the multitude of different systems, business processes and data that undermine the quality and cost of decision-making information. As government-wide standardization increases, efficiency, integrity and interoperability are improved. See footnote 7

For the purposes of this guideline, "pay" and "payroll" are limited to gross pay and pay-related transactions identified in the Regional Pay System's detailed expenditure extract file, See footnote 8 which include the following:

- Basic pay;

- Allowances;

- Supplementary pay (including overtime); and

- Adjustments and credit backs, such as recoveries, garnishments and non-statutory deduction adjustments.

3. Introduction

3.1 Scope

This guideline defines the Common Financial Management Business Process for Pay Administration.

This guideline covers the following subprocess groups:

- Manage Pay Administration Requirements

- HR Pre-Payroll;

- Pay Pre-Payroll;

- Payroll; and

- Post-Payroll.

Some financial management activities described in the business process are also related to internal controls. The intent is neither to provide a complete listing of controls nor to produce a control framework, but the process description may provide useful content for the development of a department's control framework.

3.2 Structure of the Guideline

The remainder of this guideline is structured as follows. Section 4 provides an overview of the organizational roles that carry out the Pay Administration business process. Section 5 presents a detailed description of the Pay Administration business process, including subprocess groups, subprocesses, activities and responsible roles. Appendix A provides definitions of terminology used in this guideline, and relevant abbreviations are listed in Appendix B. Appendix C describes the methodology used in the guideline, and Appendix D elaborates on the roles and responsibilities outlined in Section 4. Appendix E provides an analysis of pay transactions by originator type.

3.3 References

The following references apply to this guideline.

3.3.1 Acts and Regulations

- Financial Administration Act, sections 2, 7, 32, 33 and 34

3.3.2 Policy Instruments

- Directive on Account Verification

- Directive on Delegation of Financial Authorities for Disbursements

- Directive on Expenditure Initiation and Commitment Control

- Directive on Financial Management of Pay Administration

- Directive on Payment Requisitioning and Cheque Control

- Directive on Terms and Conditions of Employment

- Guideline on Financial Management of Pay Administration

- Guidelines for the Processing of Garnishments

- Policy on Financial Management Governance

3.3.3 Other References

- Common Human Resources Business Process

- Personnel-Pay Input Manual (PPIM)

- Policy Framework for the Management of Compensation

- Receiver General Manual, Chapter 6, "Payroll Systems (PS) and Departments"

- Receiver General Manual, Chapter 7, "Receiver General–General Ledger (RG-GL)"

- Receiver General Manual, Chapter 8, "Central Financial Management Reporting System (CFMRS) and Departments"

4. Roles and Responsibilities

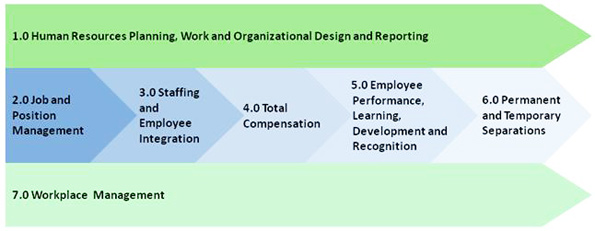

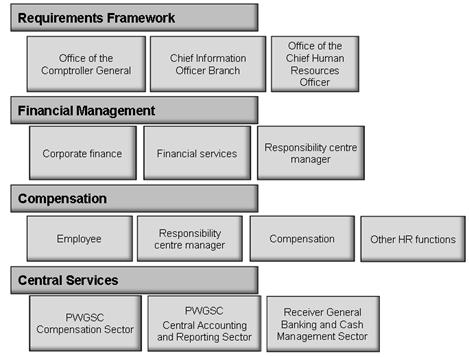

Figure 3 depicts the roles involved in the Pay Administration business process, grouped by stakeholder category.

Figure 3: Roles Involved in Pay Administration

Text version: Figure 3: Roles Involved in Pay Administration

In this guideline, a role is an individual or a group of individuals whose involvement in an activity is described using the Responsible, Accountable, Consulted and Informed (RACI) approach. Because of differences among departments, a role may not correspond to a specific position, title or organizational unit. The roles and responsibilities for Pay Administration are briefly described in Sections 4.1 to 4.4 and are explained in more detail in Appendix D.

4.1 Requirements Framework

Overall policy and processes for Pay Administration are set by the Office of the Comptroller General and the Office of the Chief Human Resources Officer. Information management requirements are set by the Chief Information Officer Branch of the Treasury Board Secretariat.

4.2 Financial Management

The function of corporate finance, in support of the responsibilities of the chief financial officer (CFO), is to establish and ensure adequate financial controls for the departmental portion of the pay process. Payroll accounting and financial control over pay administration processes are part of financial management, whereas employee compensation policies and procedures are part of HR management. Consequently, the CFO and HR senior management share the responsibility for Pay Administration in departments.

Financial services (a generic identifier that may be termed otherwise by a department) is the departmental organization that ensures the day-to-day application of financial controls for pay-related expenditures.

For this guideline, the role of responsibility centre manager from a financial perspective refers to individuals who are delegated financial, spending and transaction authorities to initiate expenditures related to pay and are responsible for commitment control, recording of commitments, and Financial Administration Act (FAA) section 34. In a pay administration context, the responsibility centre manager role can include individuals occupying positions that are typically responsible for an organization (e.g., a responsibility centre) or for a department, as in the case of the deputy head.

4.3 Compensation

Government of Canada employees initiate or are the recipients of compensation actions.

From an HR perspective, the responsibility centre manager who has delegated expenditure initiation authority for pay transactions and FAA section 32 authority is accountable for the initiation of the majority of pay-related expenditures and for fulfilling the requirements of departmental commitment control and recording, as defined by the deputy head.

The compensation role establishes the pay entitlements and deductions, and the calculation of gross pay amounts. The compensation advisor typically receives the pay-related document from the responsibility centre manager; however, requests for pay transactions can also originate from employees, "court" See footnote 9 orders or the Treasury Board. The compensation advisor confirms that the payee is eligible for the payment, performs required calculations, and enters the transaction into the Regional Pay System.

The final role under compensation in Figure 3, other HR functions, includes classification, staffing, labour relations, official languages, training, and performance appraisal (including awards and recognition). This role provides critical information for responsibility centre managers, compensation, and employees (such as classification decisions, identification of successful candidates in a staffing action, decisions on disciplinary actions, or identification of recipients and amounts for special awards) that can lead to pay transactions. Note, however, that this role does not directly initiate any pay transactions. The establishment of pay entitlements and deductions and the calculation of gross pay amounts are activities under the compensation role.

4.4 Central Services

The Compensation Sector See footnote 10 of the Department of Public Works and Government Services (PWGSC) provides payroll, benefits and pension plan administration services for the Public Service of Canada.

The Central Accounting and Reporting Sector is responsible for the government-wide central accounting and reporting functions of the Receiver General for Canada.

The Banking and Cash Management Sector supports the government-wide treasury function of the Receiver General for Canada through the receipt, transfer, holding and disbursement of public money, and the redemption and settlement of all payments.

Refer to Appendix D of this guideline for comprehensive definitions of each role.

5. Process Flows and Descriptions

Appendix C describes the methodology used in this section.

5.1 Overview of Pay Administration

As illustrated in Figure 4, the Pay Administration Level 2 business process comprises 12 subprocesses (5.1.1 to 5.1.12). These are arranged in five subprocess groups:

- Manage Pay Administration Requirements

- HR Pre-Payroll;

- Pay Pre-Payroll;

- Payroll; and

- Post-Payroll.

The subprocesses within each subprocess group and the roles and responsibilities relevant to each subprocess are summarized below.

Figure 4: Pay Administration - Level 2 Process Flow

Text version: Figure 4: Pay Administration - Level 2 Process Flow

Note: The  symbol indicates that all four subprocesses should be completed before proceeding to the HR Pre-Payroll subprocess group.

symbol indicates that all four subprocesses should be completed before proceeding to the HR Pre-Payroll subprocess group.

The subprocesses within each subprocess group and the roles and responsibilities are summarized below.

Manage Pay Administration Requirements starts the Pay Administration business process by defining the pay administration requirements. The responsibility centre manager reviews the annual plan and approved budget, which is produced as part of Manage Planning and Budgeting (Business Process 1.1), and determines requirements for employees and positions. Once the pay requirement is decided, the responsibility centre manager exercises expenditure initiation and confirms the availability of funds. Commitments and salary forecast records are updated as per departmental procedures established by the deputy head.

Under HR Pre-Payroll, human resources (HR) actions are then undertaken. These HR subprocesses, as defined in the Common Human Resources Business Process, can lead to pay transactions by providing critical information for responsibility centre managers, compensation and employees (such as classification decisions, identification of successful candidates in a staffing action, decisions on disciplinary actions, or identification of recipients and amounts for special awards). The HR Pre-Payroll subprocesses terminate in confirmation of transaction authority; Financial Administration Act (FAA) section 34 certification; updates to commitments and salary management records in accordance with deputy head requirements; and a request for a pay transaction.

Pay Pre-payroll involves the resulting compensation activities whereby the requested pay transaction is processed, including part of FAA section 34 verification and the FAA section 33 certification.

Under Payroll, following FAA section 33 certification, the Department of Public Works and Government Services (PWGSC) calculates employee pay for the pay period, issues the pay register for validation from departmental compensation, and completes the processing for payments related to employee pay. Using the Regional Pay System, PWGSC provides departments with a detailed expenditure extract report that identifies gross pay-run information and cancelled payments. Departments also receive control account and account balance details on a pay-run basis from PWGSC's Payroll System–General Ledger (PS-GL).

Post-Payroll processing occurs in the department, upon issuance of the employee pay payments and receipt of the detailed expenditure extract file. Under the Manage Post-Payroll subprocess, departments record the pay transactions in the Departmental Financial and Materiel Management System (DFMS); gross pay accounting entries including any cancelled payments for pay transactions are completed; responsibility centre managers complete account verification by performing the last steps of FAA section 34 verification; and the Pay Administration business process ends. In the event that quality assurance was not performed prior to issuance of payment, the process proceeds to Manage Post-Payment Verification (Business Process 8.1). Payroll System–General Ledger (PS-GL) control account balances are reconciled and accounted for as part of Manage Financial Close (Business Process 8.2).

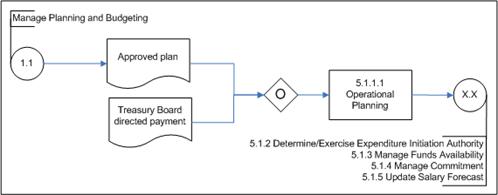

5.2 Alignment with the Common Human Resources Business Process

A number of subprocesses in the Manage Pay Administration Requirements, HR Pre-Payroll and Pay Pre-Payroll groups lead to or from processes that are described in the Common Human Resources Business Process (CHRBP). The CHRBP identifies seven cross-functional business processes, as illustrated in Figure 5. See footnote 11

Figure 5: CHRBP Business Processes

Text version: Figure 5: CHRBP Business Processes

Subprocesses 5.1.1 to 5.1.5 under Manage Pay Administration Requirements flow from CHRBP processes under 1.0 Human Resources Planning, Work and Organizational Design and Reporting, specifically at 1.03 Conduct Organizational Design. Similarly, Subprocess 5.1.6 under HR Pre-Payroll and subprocesses 5.1.7 through 5.1.9 under Pay Pre-Payroll connect with many of the activities under the remaining six business processes of the CHRBP model. This guideline identifies the cross-over points between Finance and HR for the subprocesses described below, along with the applicable roles, responsibilities and authoritative sources.

5.3 Manage Pay Administration Requirements

Manage Pay Administration Requirements starts the Pay Administration business process by defining the pay administration requirements. The responsibility centre manager reviews the annual plan and approved budget, which is produced as part of Manage Planning and Budgeting (Business Process 1.1), and determines requirements for employees and positions. Once the pay requirement is decided, the responsibility centre manager exercises expenditure initiation and confirms the availability of funds. Commitments and salary forecast records are updated as per departmental procedures established by the deputy head.

The subprocesses and activities under Manage Pay Administration Requirements align with the CHRBP at 1.0 Human Resources Planning, Work and Organization Design and Reporting.

5.3.1 Determine HR Requirements (Subprocess 5.1.1)

5.3.1.1 Activities

Based on the approved budget and approved plan from Manage Planning and Budgeting (Business Process 1.1), or on direction from the Treasury Board to make a payment (e.g., retroactive pay related to a new collective agreement), the subprocess Determine HR Requirements defines HR requirements that will have an impact on pay. Figure 6 depicts the Level 3 process flow for Determine HR Requirements.

Figure 6: Determine HR Requirements (Subprocess 5.1.1) – Level 3 Process Flow

Text version: Figure 6: Determine HR Requirements (Subprocess 5.1.1) – Level 3 Process Flow

Pay-related activities begin when the responsibility centre manager reviews operational plans (Activity 5.1.1.1 – Operational Planning) at the beginning of the fiscal year. These plans provide the responsibility centre manager with a current and target organizational structure, including authority to increase (or reduce) the workforce in his or her organization. The responsibility centre manager updates the forecast and commitments as part of salary management for the fiscal year, in accordance with the deputy head's approach to recording commitments. The responsibility centre manager also reviews the operational plan on an ongoing basis, adjusting salary forecasts (Subprocess 5.1.5) and commitments (Subprocess 5.1.4) as required, often in tandem with revising staffing plans.

Manage Pay Administration Requirements overlaps with the second-level CHRBP process 1.03 Conduct Organization Design and, more specifically, with the third-level CHRBP process 1.03.03 Approve Organizational Design. This process provides the starting point for Pay Administration through documentation of an organizational model or structure that is approved by senior management. CHRBP 1.03.03 Approve Organizational Design includes the following:

- Review organization package (CHRBP 1.03.03.01);

- Sign off and confirm financial resources (FAA section 32) (CHRBP 1.03.03.02);

- Prepare approach for transitioning to new organization (CHRBP 1.03.03.03);

- New or amended organization structure? (a decision point in the process); and

- Prepare action request (CHRBP 1.03.03.04).

5.3.1.2 Roles and Responsibilities

The responsibility centre manager, acting in both a financial and an HR capacity, works with HR, financial services and corporate finance to determine and confirm HR requirements. Table 1 provides an overview of roles and responsibilities, using the Responsible, Accountable, Consulted, and Informed (RACI) approach. These roles and responsibilities are further described in Appendix D.

Table 1: Determine HR Requirements (Subprocess 5.1.1) – RACI

Legend

- CF: Corporate finance

- DFMS: Departmental Financial Management and Materiel System

- FIN: Financial services

- HR: Other human resources functions

- RCM: Responsibility centre manager

| Activity | Related Data | Responsible | Accountable | Consulted | Informed | Authoritative Source |

|---|---|---|---|---|---|---|

| 5.1.1.1 Operational Planning |

|

RCM | RCM | FIN, HR | CF, HR | DFMS |

Refer to the HR Pre-Payroll and Pay Pre-Payroll RACI tables in section 5.4 and section 5.5 of this guideline for the HR and Finance activities associated with employee and position-related data.

5.3.2 Determine/Exercise Expenditure Initiation Authority (Subprocess 5.1.2)

Subprocess 5.1.2 occurs concurrently with Manage Funds Availability (Subprocess 5.1.3) and Manage Commitment (Subprocess 5.1.4).

5.3.2.1 Activities

Following the subprocess Determine HR Requirements, a decision leads to the initiation of a pay action. For example, a responsibility centre manager may submit a request to HR to staff a position, Finance may request refund of a recovery, the Treasury Board may sign a collective agreement that leads to salary increases, or a responsibility centre manager may approve an employee request to work overtime. These activities correspond toexpenditure initiation.

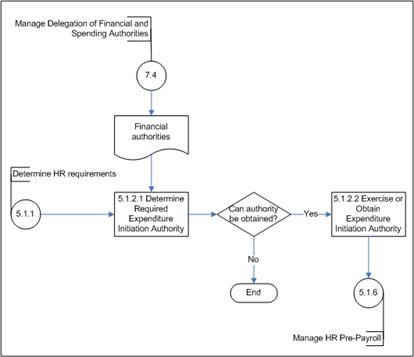

The responsibility centre manager requesting the pay action determines the appropriate expenditure initiation authority by referencing the department's financial management policies and delegation instruments, and exercises or obtains the authority. Figure 7 depicts the Level 3 process flow for Determine/Exercise Expenditure Initiation Authority.

Figure 7: Determine/Exercise Expenditure Initiation Authority (Subprocess 5.1.2) – Level 3 Process Flow

Within this subprocess, there are two types of authority: spending and financial. Spending authority consists of three elements: expenditure initiation authority, commitment authority and transaction authority. Financial authorities consist of certification and payment authority pursuant to sections 34 and 33 of the FAA. See footnote 12 Expenditure initiation authority is defined as "the authority to incur an expenditure or make an obligation to obtain goods or services that will result in the eventual expenditure of funds. This would include the decision … to order supplies or services." See footnote 13 The level of authority is based upon the department's delegation instruments approved by the minister and the deputy head. The creation and maintenance of the delegation instruments is excluded from the scope of Pay Administration. It is addressed in a separate process, Manage Delegation of Financial and Spending Authorities (Business Process 7.4).

When defining HR requirements, the responsibility centre manager must determine the appropriate expenditure initiation authority by consulting the delegation instruments (Activity 5.1.2.1 – Determine Required Expenditure Initiation Authority). See footnote 14 When the responsibility centre manager does not possess the required expenditure initiation authority, the appropriate authorities must be obtained (Activity 5.1.2.2 – Exercise or Obtain Expenditure Initiation Authority). See footnote 15 When the authority to initiate the expenditure cannot be obtained, the HR requirement may be redefined and/or the expenditure initiation process ends.

Once the appropriate expenditure initiation authority has been exercised, it is essential to also determine whether there are sufficient unencumbered funds to proceed with the pay transaction (refer to Section 5.3.3). Responsibility centre managers may also manage commitments (refer to section 5.3.4) and update salary forecasts (refer to section 5.3.5).

5.3.2.2 Roles and Responsibilities

The responsibility centre manager works with financial services and corporate finance to determine/exercise expenditure initiation authority and informs compensation of the outcome. Table 2 provides an overview of roles and responsibilities, using the Responsible, Accountable, Consulted, and Informed (RACI) approach. These roles and responsibilities are further described in Appendix D.

Table 2: Determine /Exercise Expenditure Initiation Authority (Subprocess 5.1.2) – RACI

Legend

- CF: Corporate finance

- COMP: Compensation

- DFMS: Departmental Financial Management and Materiel System

- FIN: Financial services

- RCM: Responsibility centre manager

| Activity | Related Data | Responsible | Accountable | Consulted | Informed | Authoritative Source |

|---|---|---|---|---|---|---|

| 5.1.2.1 Determine Required Expenditure Initiation Authority |

|

RCM | RCM | CF, FIN | COMP | DFMS |

| 5.1.2.2 Exercise or Obtain Expenditure Initiation Authority |

|

RCM | RCM | CF, FIN | COMP | DFMS |

5.3.3 Manage Funds Availability (Subprocess 5.1.3)

5.3.3.1 Activities

Before approving a letter of offer, an overtime request, or another request for a pay action that serves as a contractual arrangement or obligation, the responsibility centre manager confirms the availability of funds in accordance with the framework established by the deputy head in his or her organization.

Figure 8 depicts the Level 3 process flow for Manage Funds Availability.

Figure 8: Manage Funds Availability (Subprocess 5.1.3) – Level 3 Process Flow

Text version: Figure 8: Manage Funds Availability (Subprocess 5.1.3) – Level 3 Process Flow

Note: The authorization is pursuant to section 32 of the FAA once both the expenditure initiation and the commitment control is completed.

The deputy head is responsible for the development and implementation of departmental policies and procedures for the control of commitments. In addition, departments must See footnote 16 have the appropriate processes in place to verify the availability of funds at the time of expenditure initiation and prior to entering into a contract. See footnote 17 Commitment authority is delegated in writing to departmental officials by the deputy head. The responsibility centre manager requesting the pay transaction must ensure that there is a sufficient unencumbered balance available (Activity 5.1.3.1 – Determine Funds Availability) to proceed with the pay transaction. See footnote 18 Commitment control is an ongoing activity throughout the Pay Administration business process, which includes accounting for those commitments.

In the event there are insufficient funds, it is necessary to reallocate or adjust budgets, revise the approved budget and HR requirements through Manage Forecasting and Budget Review (Business Process 1.2), or stop the pay action.

If there are sufficient unencumbered funds, department-specific functions related to commitments are carried out. It is key to ensure that there is appropriate evidence to support the authorization pursuant to section 32 of the FAA (Activity 5.1.3.2 – Provide Authorization).

5.3.3.2 Roles and Responsibilities

The responsibility centre manager works with financial services and corporate finance to manage funds availability, and informs compensation of the outcome. Table 3 provides an overview of roles and responsibilities, using the Responsible, Accountable, Consulted, and Informed (RACI) approach. These roles and responsibilities are further described in Appendix D.

Table 3: Manage Funds Availability (Subprocess 5.1.3) – RACI

Legend

- CF: Corporate finance

- COMP: Compensation

- DFMS: Departmental Financial and Materiel Management System

- FIN: Financial services

- N/A : Not applicable

- RCM: Responsibility centre manager

| Activity | Related Data | Responsible | Accountable | Consulted | Informed | Authoritative Source |

|---|---|---|---|---|---|---|

| 5.1.3.1 Determine Funds Availability |

|

RCM | RCM | FIN | N/A | DFMS |

| 5.1.3.2 Provide Authorization (FAA section 32) |

|

RCM | RCM | CF | COMP | DFMS |

5.3.4 Manage Commitment (Subprocess 5.1.4)

5.3.4.1 Activities

Commitment control and recording of commitments apply from Manage Pay Administration Requirements through to Post-Payroll. For the purposes of this guideline, however, commitment control and recording of commitments are described in this section only.

The approach to commitment control and recording of commitments will vary from department to department due to deputy head responsibility for developing and implementing departmental policies and procedures. See footnote 19 Departments must have the appropriate procedures in place to verify the availability of funds before entering into a contractual arrangement, See footnote 20 such as a letter of offer or other obligating document (e.g., overtime request). It is recognized that it may be impractical to record commitments for salaries and wages on an individual basis; therefore, departments can implement alternative means for taking the effect of these commitments into account. Commitments can be recorded based on the department's operational plan and the financial implications of the approved organizational structure (although this may include positions that are not yet formally classified).

Commitment amounts are further adjusted as part of the HR Pre-Payroll, Pay Pre-Payroll and Post-Payroll subprocesses.

As funds availability is being confirmed, commitments are recorded and updated by the responsibility centre manager in accordance with departmental policy. Figure 9 depicts the Level 3 process flow for Manage Commitment.

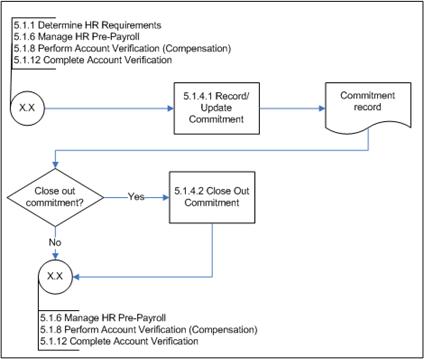

Figure 9: Manage Commitment (Subprocess 5.1.4) – Level 3 Process Flow

Text version: Figure 9: Manage Commitment (Subprocess 5.1.4) – Level 3 Process Flow

The responsibility centre manager is accountable for ensuring the commitment is recorded in accordance with departmental policy and procedure, including continuing commitments that impact future fiscal years. Over the course of the Pay Administration business process, the commitment is monitored and updated (Activity 5.1.4.1 – Record/Update Commitment) as needed.

Once the detailed expenditure extract file has been received, commitments are updated and closed out (Activity 5.1.4.2 – Close Out Commitment). The end objective of the expenditure initiation and commitment control subprocesses is that all commitments are managed and that responsibility centre managers do not exceed their allocated budgets and, by extension, the department does not exceed its appropriations.

5.3.4.2 Roles and Responsibilities

The responsibility centre manager works with financial services and compensation to manage commitments related to pay and informs other responsibility centre managers, including his or her management, of the outcome. Table 4 provides an overview of roles and responsibilities, using the Responsible, Accountable, Consulted, and Informed (RACI) approach. These roles and responsibilities are further described in Appendix D.

Table 4: Manage Commitment (Subprocess 5.1.4) – RACI

Legend

- COMP: Compensation

- DFMS: Departmental Financial and Materiel Management System

- FIN: Financial services

- RCM: Responsibility centre manager

| Activity | Related Data | Responsible | Accountable | Consulted | Informed | Authoritative Source |

|---|---|---|---|---|---|---|

| 5.1.4.1 Record/ Update Commitment |

|

RCM | RCM | COMP, FIN | RCM | DFMS |

| 5.1.4.2 Close Out Commitment |

|

RCM | RCM | FIN | RCM | DFMS |

5.3.5 Update Salary Forecast (Subprocess 5.1.5)

5.3.5.1 Activities

Commitment control and salary management overlap with the operational planning processes defined by the CHRBP. The subprocess Update Salary Forecast occurs throughout the Pay Administration business process. For the purposes of this guideline, however, Update Salary Forecast is described in this section only.

The approved organizational structure from the department's operational plan provides data that are required for salary forecasting. Salary forecasts and commitments are determined by the organizational structure and are updated for planned actions for current and future years. In HR Pre-Payroll and Pay Pre-Payroll processing, the organizational structure and related financial implications, including forecasts and commitments in the Departmental Financial and Materiel Management System (DFMS), are updated for requested changes in employee pay information or an HR event with pay implications (e.g., staffing, separation, performance pay, an employee-initiated event, or an employer event). Figure 10 depicts the Level 3 process flow for Update Salary Forecast.

Figure 10: Update Salary Forecast (Subprocess 5.1.5) – Level 3 Process Flow

Text version: Figure 10: Update Salary Forecast (Subprocess 5.1.5) – Level 3 Process Flow

5.3.5.2 Roles and Responsibilities

The responsibility centre manager works with HR and financial services to update and maintain the salary forecast, and informs management of the outcome. Table 5 provides an overview of roles and responsibilities, using the Responsible, Accountable, Consulted, and Informed (RACI) approach. These roles and responsibilities are further described in Appendix D.

Table 5: Update Salary Forecast (Subprocess 5.1.5) – RACI

Legend

- CF: Corporate finance

- COMP: Compensation

- DFMS: Departmental Financial and Materiel Management System

- FIN: Financial services

- HR: Other human resources functions

- RCM: Responsibility centre manager

| Activity | Related Data | Responsible | Accountable | Consulted | Informed | Authoritative Source |

|---|---|---|---|---|---|---|

| 5.1.5.1 Maintain Salary Forecast | Planned employee- and position-related dataA | RCM | RCM | COMP, FIN, HR | CF, HR | DFMS |

| 5.1.5.1 Maintain Salary Forecast | Planned employee- and position-related dataA | RCM | RCM | COMP, FIN, HR | CF, HR | DFMS |

| Forecast amounts | RCM | RCM | COMP, FIN, HR | CF | DFMS |

Note A: Financial implications of the organizational structure are determined (refer to Section 5.3.1), and commitments and forecasts are adjusted accordingly (refer to Section 5.3.4 and Section 5.3.5).

The DFMS is the authoritative source for planned information only. Once the plan is acted on as part of the HR Pre-Payroll and Pay Pre-Payroll subprocess groups, the authoritative source for this information becomes the Human Resources Management System (HRMS).

5.4 HR Pre-Payroll

Pre-Payroll subprocesses are undertaken by departmental staff, including HR officers, compensation advisors, responsibility centre managers and financial officers, as well as by Department of Public Works and Government Services pay offices. These subprocesses are bundled into two subprocess groups: HR Pre-Payroll and Pay Pre-Payroll. This section describes the HR Pre-Payroll subprocesses, where HR, Finance and mangers work together to initiate pay activities including exercising transaction (e.g., staffing) authority. From a financial perspective, these subprocesses include requirements under the FAA and related Treasury Board policies for expenditure initiation; FAA sections 32 and 34; and salary management.

5.4.1 Manage HR Pre-Payroll (Subprocess 5.1.6)

5.4.1.1 Activities

Manage HR Pre-Payroll begins with Activity 5.1.6.1 – Determine Required Transaction Authority. The required transaction authority must be determined by the responsibility centre manager in conjunction with HR. Transaction authority is the authority to enter into contracts or to sign off on legal entitlements. See footnote 21 In the context of pay, transaction authority is derived from HR delegations of authority (referred to as "delegations"), such as staffing delegations or classification delegations.

As part of defining the requirement, the requesting responsibility centre manager should ensure that he or she has been delegated the appropriate transaction authority, as determined by the approved delegation of authorities of the department. See footnote 22 When the responsibility centre manager does not possess the required transaction authority, the appropriate signatures of those with delegated authority must be obtained. See footnote 23 In some situations, the transaction authority may not be granted, and the Manage HR Pre-Payroll subprocess ends.

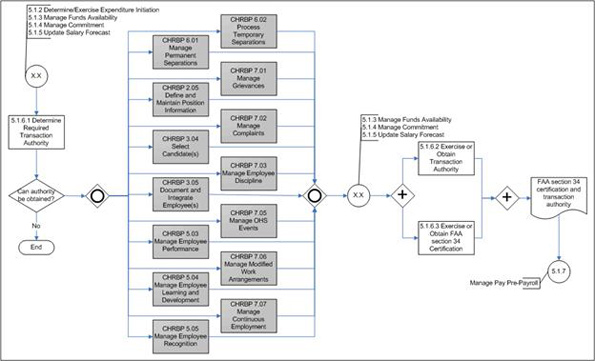

Following Activity 5.1.6.1 – Determine Required Transaction Authority, the subprocess Manage HR Pre-Payroll crosses over to HR. Within the context of an approved operational plan and organizational model, a responsibility centre manager or HR initiates one of the following CHRBP processes:

- Define and Maintain Position Information (CHRBP 2.05);

- Select Candidate(s) (CHRBP 3.04);

- Document and Integrate Employees (CHRBP 3.05);

- Manage Employee Performance (CHRBP 5.03);

- Manage Employee Learning and Development (CHRBP 5.04);

- Manage Employee Recognition (CHRBP 5.05);

- Manage Permanent Separation (CHRBP 6.01);

- Process Temporary Separations (CHRBP 6.02);

- Manage Grievances (CHRBP 7.01);

- Manage Complaints (CHRBP 7.02);

- Manage Employee Discipline (CHRBP 7.03);

- Manage Occupational Health and Safety (OHS) Events (CHRBP 7.05);

- Manage Modified Work Arrangements (CHRBP 7.06); and

- Manage Continuous Employment (including workforce adjustments) (CHRBP 7.07).

The HR Pre-Payroll subprocess group is completed when the responsibility centre manager obtains or exercises both transaction authority and FAA section 34 certification of the pay-related document. This could be the responsibility centre manager signing a letter of offer for a new hire, signing a request for overtime payment or signing a request for cash-out of compensatory or vacation time at year-end. Through analysis of the pay-related processes and confirmation of applicable policies and legislation, it is confirmed that FAA section 34 certification and verification is delegated to a responsibility centre manager and that FAA section 34 verification for pay input is delegated to compensation advisors.

Further, in the context of pay, FAA section 34 certification may be a one-time certification (e.g., payment of overtime, cash-out of accumulated compensatory time or cash-out of accumulated vacation time) or may originate from the FAA section 34 certification on the letter of offer. By signing the letter of offer, the responsibility centre manager has certified that the employee's pay is in accordance with the collective agreement (or terms and conditions) specified. These terms and conditions may be applied at different points in time throughout the duration of employment under the letter of offer. For example, when a pay transaction is later entered to provide an employee with payment for an allowance, the FAA section 34 certification is derived from the original letter of offer. Similarly, the FAA section 34 certification from the letter of offer is applied when pay transactions are required to reflect new collective agreements or statutory increases, for example.

Figure 11 depicts the Level 3 process flow for Manage HR Pre-Payroll.

Figure 11: Manage HR Pre-Payroll (Subprocess 5.1.6) – Level 3 Process Flow

Text version: Figure 11: Manage HR Pre-Payroll (Subprocess 5.1.6) – Level 3 Process Flow

The CHRBP processes included in Manage HR Pre-Payroll interrelate with each other in ways that are not depicted in Figure 11 and are therefore out of the scope of this guideline. For more information, readers can refer to the CHRBP documentation. See footnote 24 The balance of this section provides details and descriptions of the HR processes depicted in Figure 11 that were taken from the CHRBP. See footnote 25 Updates to these processes and future changes may apply to this guideline. See footnote 26

CHRBP 2.05 Define and Maintain Position Information

"This process involves initially documenting or updating…the position information. This involves activities associated with confirming key position attributes such as geographic location, security requirements and position language requirement, and verifying this information with subject matter experts, as appropriate (for OL [official languages] and security, for instance). Note: this process may also involve updating position information that results in changes to compensation or involve deleting a vacant or obsolete position." See footnote 27

This process includes the following:

- Confirm position-related information (CHRBP 2.05.01); and

- Document position information (CHRBP 2.05.02).

CHRBP 3.04 Select Candidate(s)

"This process includes identifying a selected candidate(s), completing the notification process, confirming the terms and conditions of employment, and preparing the letter of offer and candidate acceptance." See footnote 28

This process includes the following:

- Select candidate (CHRBP 3.04.01);

- Conduct notifications (CHRBP 3.04.02); and

- Extend employment offer (CHRBP 3.04.03).

CHRBP 3.05 Document and Integrate Employee(s)

"This process covers the full documentation and orientation of the employee, whether he/she is a new GoC [Government of Canada] employee or an existing employee going to a new role in current [department] or different [department] (cross-boarding). The process includes the creation of the employee's 'Employee Record,' their enrolment into pay, benefits and pension, as well as the setting up of their workplace (desk, computer, equipment), and their orientation to the new job." See footnote 29

This process includes the following:

- Document/update employee record (CHRBP 3.05.01);

- Establish employee workspace (CHRBP 3.05.02); and

- Orient employee (CHRBP3.05.03).

CHRBP 5.03 Manage Employee Performance

"Triggered by the annual performance measurement cycle, and supported with information from other HR processes, this process involves conducting performance reviews based on schedules established in the performance agreement or a performance event (an employee excelling in or not meeting objectives), and the completion of the assessment of the performance of an employee against commitment/objectives. Based on the results of these reviews and assessment, the process covers the actions implemented to address a competency issue or performance that meets or exceeds performance expectations. Should there be other performance issues the manager will consider next steps, which are addressed in the appropriate process such as Process 7.0 (discipline) or Process 6.0 (End of probation)." See footnote 30

This process includes the following:

- Review employee performance (CHRBP 5.03.01);

- Conduct annual performance assessment (CHRBP 5.03.02); and

- Determine actions to address performance results (CHRBP 5.03.03).

CHRBP 5.04 Manage Employee Learning and Development

"Based on the learning activities identified in the performance agreement, the employee registers for learning events [and] initiates developmental opportunities and education leave. This process also includes the completion of pre-work and post-learning discussion with manager to ensure transference of knowledge and skills to the position." See footnote 31

This process includes the following:

- Coordinate learning and development activity (CHRBP 5.04.01); and

- Conduct post-learning and development review (CHRBP 5.04.02).

CHRBP 5.05 Manage Employee Recognition

"Triggered by calls for nominations for formal recognition awards, long service awards, noteworthy performance events or merit- worthy performance identified in a performance review or assessment, this process involves the activities associated with identifying, documenting and awarding employees for both formal and informal recognition. A record of recognition information triggers Process 4.0 to assess taxable implications." See footnote 32

This process includes the following:

- Determine recognition (CHRBP 5.05.01); and

- Recognize employee (CHRBP 5.05.02).

Note that cash awards may also be processed as accounts payable processes. These transactions are addressed in Manage Other Payments (Business Process 3.3).

CHRBP 6.01 Manage Permanent Separation

"Triggered by…Process 5.0 (Performance assessment results-probation period), Process 7.0 (workforce adjustment, disciplinary action), an employee life event (e.g. resignation, retirement, death) or corporate event (end of term), this process involves activities associated with initiating, documenting and processing a separation (to the point of calculating severance and final payments), recovering assets and conducting employee exit interviews, prior to triggering activities in Process 4.0 and informing third parties. If the permanent separation is a transfer, this process forwards employee documents to [the] receiving department." See footnote 33

This process includes the following:

- Create separation notification (CHRBP 6.01.01);

- Process final payments (for permanent separation) (CHRBP 6.01.02);

- Process transfer-out adjustments (CHRBP 6.01.03);

- Prepare final documentation (CHRBP 6.01.04); and

- Conduct exit interview (CHRBP 6.01.05).

CHRBP 6.02 Process Temporary Separation

"Triggered from Process 7.0 (approved absence with pay, approved leave without pay, disciplinary action), Workers' Compensation Board (WCB) approved claim, or a workplace event (end of term), this process includes activities associated with documenting and processing a temporary separation (including leave with income averaging (LIA), pre-retirement transition leave (PRTL), determining pension deficiencies and insurance maintenance payments) and recovering assets, if required, prior to triggering activities in Process 4.0 and informing third parties." See footnote 34

This process includes the following:

- Process absence with pay OR leave without pay (CHRBP 6.02.01); and

- Process leave without pay pension and insurance options (CHRBP 6.02.02).

CHRBP 7.01 Manage Grievances

"Triggered by a workplace event by itself, this process involves initiating a grievance, logging it, assessing it, making a decision on the grievance at the various levels, and the decision to escalate or referring it to adjudication. Once decisions are rendered, there is a decision around whether to file an appeal to Federal Court for errors of law or procedure, or if a court order is required to enforce the decision." See footnote 35

This process includes the following:

- Initiate grievance (CHRBP 7.01.01);

- Receipt of grievance (CHRBP 7.01.02);

- Assess grievance and make decision (CHRBP 7.01.03);

- Prepare for classification grievance hearing (CHRBP 7.01.04);

- Conduct classification grievance hearing (CHRBP 7.01.05);

- Delegated authority decision (CHRBP 7.01.06);

- Review decision (CHRBP 7.01.07);

- Notice to Canadian Human Rights Commission (CHRC) (CHRBP 7.01.08);

- Adjudicate grievance (CHRBP 7.01.09);

- Update employee record (CHRBP 7.01.10); and

- Withdrawal of grievance (CHRBP 7.01.11).

CHRBP 7.02 Manage Complaints

"[This process is] triggered by [a] workplace or employer event or an internal appointment–related event. The process involves logging a complaint (PSLRB [Public Service Labour Relations Board], CHRC, staffing or harassment complaint) [and] forwarding it to the appropriate party who assesses/investigates the complaint and may adjudicate or render a decision depending on the nature of the complaint. Once decisions are rendered there is a decision around whether to file an appeal to Federal Court for errors of law or procedure." See footnote 36

This process includes the following:

Submit complaint (CHRBP 7.02.01);- Review PSLRB final decision (CHRBP 7.02.02);

- Review CHRC final decision (CHRBP 7.02.03);

- Review Public Service Staffing Tribunal (PSST) final decision (CHRBP 7.02.04);

- Review of harassment complaint (CHRBP 7.02.05);

- Conduct harassment complaint investigation (CHRBP 7.02.06);

- Render decision on harassment complaint (CHRBP 7.02.07);

- Withdrawal of complaint (CHRBP 7.02.08); and

- Update employee record (CHRBP 7.02.09).

CHRBP 7.03 Manage Employee Discipline

"Triggered by an employee or workplace event, or a decision that misconduct may have occurred, this process involves determining the need and nature of disciplinary action, and undertaking any action deemed appropriate given the circumstances of the alleged misconduct." See footnote 37

This process includes the following:

- Conduct investigation (CHRBP 7.03.01);

- Determine appropriate action (CHRBP 7.03.02); and

- Notify employee of determination and undertake any applicable action (CHRBP 7.03.03).

CHRBP 7.05 Manage OHS Events

"Triggered by an employee life or workplace event, this process includes those activities associated with 'Proactive Prevention' in terms of preventing hazardous occurrences. It includes recording and managing OHS events, including taking action to prevent additional events and reporting the event. Depending on the nature of the OHS event, it may involve providing employee assistance, which may result in a WCB [Workers' Compensation Board] claim. Monitoring workplace safety and hazard prevention is also included in this process. Also included is the discovery of hazards in the workplace, and its potential impact of the root cause of the presence of the hazard." See footnote 38

This process includes the following:

- Investigate potential and/or actual hazardous situation (CHRBP 7.05.01);

- Analyze potential/actual hazardous situation and determine required action (CHRBP 7.05.02);

- Administer employee OHS support (CHRBP 7.05.03); and

- Monitor workplace safety and hazard prevention (CHRBP 7.05.04).

The financial management activities that address OHS events are described in Manage Other Payments (Business Process 3.3).

CHRBP 7.06 Manage Modified Work Arrangements

"Triggered by an employee life or workplace event, this process involves assessing the need for specific work arrangements and/or accommodations of an employee, including both physical changes (to workstation), technical changes to software or computer, and possible changes for flexible work arrangements (inclusive of rebundling of duties within a work unit). Note that this includes links to facilities-materiel management, adaptive technology, workforce scheduling, and returns to work, etc." See footnote 39

This process includes the following:

- Assess request, consult with subject matter experts and provide modified work arrangement/accommodation requirements (CHRBP 7.06.01); and

- Plan and follow up modified work arrangement/accommodation (CHRBP 7.06.02).

CHRBP 7.07 Manage Continuous Employment (including workforce adjustments)

"This process is based on Parts 1 through 6 of the Work Force Adjustment Directive. Based on input from the Workplace and Workforce Plan (WFA Plan), this process involves assessing specific implications of a workforce adjustment situation, the notification requirements (to employees, unions, TBS [the Treasury Board Secretariat], PSC [the Public Service Commission]), and the activities associated with providing a guarantee of a reasonable job offer. This process also includes decisions by affected employees based on the options provided, which may lead to staffing in a new location (3.01 Confirm Staffing Approach), integrating the employee into a new position (3.04 Select Candidates) or supporting the employee in a permanent (6.01) or temporary separation (6.02)." See footnote 40

This process includes the following:

- Establish business transformation plan (CHRBP 7.07.01);

- Identify affected employees (CHRBP 7.07.02); and

- Select option (CHRBP 7.07.03).

5.4.1.2 Roles and Responsibilities

This subprocess includes the steps required to document the request for the pay action. Table 6 provides an overview of roles and responsibilities, using the Responsible, Accountable, Consulted, and Informed (RACI) approach. These roles and responsibilities are further described in Appendix D.

Table 6: Manage HR Pre-Payroll (Subprocess 5.1.6) – RACI

Legend

- CF: Corporate finance

- COMP: Compensation

- DFMS: Departmental Financial and Materiel Management System

- EE: Employee

- FIN: Financial services

- HR: Other human resources functions

- HRMS: Human Resources Management System

- CLR: Compensation and Labour Relations Sector

- RCM: Responsibility centre manager

- S1: Scenario 1

- S2: Scenario 2

| Activity | Related Data | Responsible | Accountable | Consulted | Informed | Authoritative Source |

|---|---|---|---|---|---|---|

| 5.1.6.1 Determine Required Transaction Authority | HR delegations | HR | HR | COMP | CF, RCM | HRMS |

| Delegation instrument | FIN | CF | COMP | COMP, HR | DFMS | |

| Specimen signature documents | FIN | FIN | COMP, RCM | COMP, HR | DFMS | |

| 5.1.6.2 Exercise or Obtain Transaction Authority | HR delegations | HR | HR | COMP | CF, RCM | HRMS |

| Delegation of HR authorities instrument | HR | HR | COMP | COMP, HR | DFMS | |

| 5.1.6.3 Exercise or Obtain FAA Section 34 Authority |

|

COMP, RCM | RCM | FIN | CF, HR | HRMS |

| Delegation instrument | FIN | CF | CF, FIN | COMP | DFMS | |

| Specimen signature documents | FIN | FIN | COMP, RCM | COMP, HR | DFMS | |

| Pay-related action request (CHRBP activity) |

Action request (staffing, classification, schedule request, etc.) | RCM | RCM | COMP, EE, HR | COMP, EE, FIN | HRMS |

| Entitlement request | S1: RCM S2: EE | S1: RCM S2: EE | S1: COMP S2: COMP | S1: EE, FIN, HR, RCM S2: EE, FIN, HR, RCM |

S1: HRMS S2: HRMS | |

| Court order (settlement, garnishment) | COMP | COMP | HR | RCM, EE, FIN | HRMS | |

| New collective agreement / restatement of entitlements |

COMP | CLR | HR | RCM, FIN, EE, CF | Treasury Board document |

5.5 Pay Pre-Payroll

Pre-Payroll subprocesses are undertaken by departmental staff, including HR officers, compensation advisors, responsibility centre managers and financial officers, as well as by Department of Public Works and Government Services (PWGSC) pay offices. These subprocesses are bundled into two subprocess groups: HR Pre-Payroll and Pay Pre-Payroll. This section describes the Pay Pre-Payroll subprocesses, where HR, Finance and mangers work together to finalize the pay transaction for PWGSC processing. From a financial perspective, these subprocesses include requirements under the FAA and related Treasury Board policies for FAA sections 32 and 34 and salary management.

5.5.1 Manage Pay Pre-Payroll (Subprocess 5.1.7)

5.5.1.1 Activities

The Pay Pre-Payroll subprocess group flows from the HR Pre-Payroll subprocess group (as described in section 5.4) and ends with the HR processes Administer Pay (CHRBP 4.02) or Maintain Employee Compensation Information (CHRBP 4.01). These processes are described under CHRBP 4.0 Total Compensation. See footnote 41

The pay processes include requirements under the FAA and related Treasury Board policies for the following:

- Expenditure initiation;

- FAA section 32;

- FAA section 34; and

- Salary management.

Under this subprocess group, the compensation advisor receives the pay-related document, in most cases from the responsibility centre manager. In cases where the employee initiates a pay action or where the transaction originates from the Treasury Board (or the employer) and affects the responsibility centre manager's budget, it is important that compensation ensure the responsibility centre manager is advised of the transaction. The compensation advisor confirms that the payee is indeed eligible for the payment, performs any required calculations, and enters the transaction into the Regional Pay System (RPS). Compensation refers to this step as "pay input."

Figure 12: Manage Pay Pre-Payroll (Subprocess 5.1.7) – Level 3 Process Flow

Text version: Figure 12: Manage Pay Pre-Payroll (Subprocess 5.1.7) – Level 3 Process Flow

The balance of this section provides details and descriptions of the pay and benefits processes depicted in Figure 12 that were taken from the CHRBP.Updates to these processes and future changes may apply.

CHRBP 4.01 Maintain Employee Compensation Information

"Triggered by an employee or workplace event that impacts employee information, this process involves assessing the compensation implications of the change and triggering the processing of payments (in 4.02) or updating information with third party providers (insurers, PWGSC Superannuation Directorate)." See footnote 42

This process includes the following:

- Initiate pay or deduction request/information change (CHRBP 4.01.01);

- Review employee payment request (CHRBP 4.01.02); and

- Process pay request/deduction request/information change (CHRBP 4.01.03).

As depicted in Figure 12, specific Treasury Board financial management policies and requirements under the FAA apply to the following functions of Maintain Employee Compensation Information (CHRBP 4.01):

- Initiation of the pay request (expenditure initiation in relation to staff and pay activities);

- Confirmation of the availability of funds and corresponding record of, and adjustment to, commitments before approving pay-related action requests, such as overtime or a letter of offer; and

- FAA section 34 verification and certification that services have been provided by the employee.

CHRBP 4.02 Administer Pay

"Triggered by a change in employee compensation information or an HR event with pay implications (e.g., staffing, separation, performance pay), this process involves documenting the transaction and initiating the payment (through PWGSC-RPS, financial institutions). This process also involves maintaining leave balances." See footnote 43

This process includes the following:

- Prepare pay information for processing (CHRBP 4.02.01);

- Release, cancellation and duplicate payment processing (CHRBP 4.02.02);

- Maintain employee leave banks (CHRBP 4.02.03); and

- Mandatory liquidation of leave and annual leave activities (CHRBP 4.02.04).

As depicted in Figure 12, specific Treasury Board financial management policies and requirements under the FAA apply to the Pay Administration function FAA section 34 verification.

5.5.1.2 Roles and Responsibilities

Triggered by a request from an employee, a responsibility centre manager, or the Treasury Board (or employer) and often following HR Pre-Payroll subprocesses (refer to section 5.4 of this guideline), Manage Pay Pre-Payroll includes the requisite steps performed by the compensation advisor to document the transaction and initiate the payment through the PWGSC, the RPS and a financial institution. The following common HR and Finance touch points and corresponding data were identified. The employee and position information identified is specific to the information shared between HR and Finance. Table 7 provides an overview of roles and responsibilities for information shared between HR and Finance during the Manage Pay Pre-Payroll subprocess, using the RACI approach. These roles and responsibilities are further described in Appendix D.

Table 7: Manage Pay Pre-Payroll (Subprocess 5.1.7) – RACI

Legend

- CF: Corporate finance

- COMP: Compensation

- DFMS: Departmental Financial and Materiel Management System

- EE: Employee

- FIN: Financial services

- HR: Other human resources functions

- HRMS: Human Resources Management System

- N/A: Not applicable

- PAY: Compensation Sector (PWGSC)

- PRI: Personal record identifier

- RCM: Responsibility centre manager

- RG-CS: Receiver General–Compensation Systems

| Activity | Related Data | Responsible | Accountable | Consulted | Informed | Authoritative Source |

|---|---|---|---|---|---|---|

| Employee Information |

|

COMP | COMP | EE, RCM | PAY, FIN, HR |

HRMS |

|

COMP | PAY | N/A | FIN, HR, RCM | RG-CS | |

|

COMP | COMP | N/A | FIN, HR, PAY, RCM | HRMS | |

|

COMP | COMP | HR, RCM | FIN, HR, PAY |

HRMS | |

|

COMP | PAY | EE | EE, FIN, HR, PAY, RCM |

RG-CS (Central Index) |

|

| Position Information |

|

RCM, COMP | RCM | FIN | FIN, HR, PAY |

DFMS |

|

HR, COMP | HR | RCM | COMP, FIN |

HRMS |

Notes:

- Employee entitlements include any amounts paid to the employee, including base pay, because of his or her status or achievements. Examples include bilingual bonus and supervisory differential.

- Financial coding assigned to a position (e.g., responsibility centre (RC), program, project) may or may not be included in the detailed pay expenditure file. If the financial coding is to be included in the detailed pay expenditure file, the compensation role must input this data into the RPS. See footnote 44

- Position attributes refer to characteristics of the position that affect pay once the position is encumbered—for example, exclusion status, geographic region (for certain classifications) and specific additional pay entitlements, such as isolation pay.

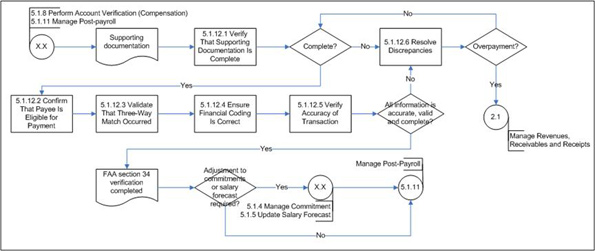

5.5.2 Perform Account Verification (Compensation) (Subprocess 5.1.8)

5.5.2.1 Activities

Account verification of pay transactions is performed by the compensation advisor and the responsibility centre manager. Compensation advisors validate that the payee is eligible for the payment and that the payment conforms to legislation, policies and collective agreements (e.g., meal allowances related to extra duty pay). However, the responsibility centre manager is ultimately accountable for the accuracy and completeness of all payroll transactions (e.g., that the employee is no longer employed by the department).

The guideline reflects this shared responsibility in Perform Account Verification (Compensation) (Subprocess 5.1.8) and Complete Account Verification (Subprocess 5.1.12).

Perform Account Verification (Compensation) corresponds to the compensation advisor's verification of the transaction as part of what the compensation community calls its "pay verification" process. First, compensation advisors confirm eligibility, and calculate and enter the transaction into the pay system (compensation's "pay input"). Then compensation advisors verify the transaction (i.e., "pay verification").

"Pay input" and "pay verification" constitute the first part of FAA section 34 account verification. Compensation advisors fulfilling this responsibility require FAA section 34 delegation for the purposes of pay verification. Authority to perform FAA section 34 verification can be delegated to positions in other departments. See footnote 45 Auditable evidence See footnote 46 of verification must exist for each pay transaction.

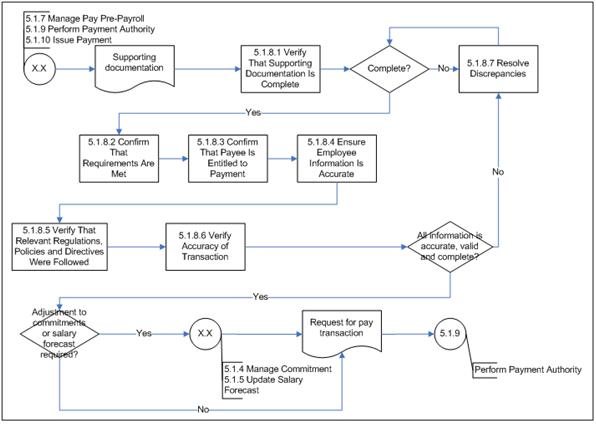

Figure 13 depicts the Level 3 process flow for Perform Account Verification (Compensation).

Figure 13: Perform Account Verification (Compensation) (Subprocess 5.1.8) – Level 3 Process Flow

Perform Account Verification (Compensation) begins when the employees, the responsibility centre managers, the Treasury Board and/or the courts send to compensation a request for a pay transaction (e.g., a signed letter of offer, a request for overtime payment, a request to cash out accumulated compensatory time, a request to cash out vacation time, a garnishment order See footnote 47). This request has been certified under FAA section 34.

For Pay Administration, account verification provides the necessary evidence required to demonstrate that the work has been performed; that the payee is entitled to, or eligible for, the payment; that the relevant contract or agreement terms and conditions have been met; that the transaction is accurate; and that all authorities have been complied with.

All payments and settlements must be certified pursuant to section 34 of the FAA. Primary responsibility for verifying individual accounts rests with responsibility centre managers (acting in a financial management capacity) who have the authority to confirm and certify entitlement pursuant to section 34 of the FAA. See footnote 48 Although account verification is normally performed prior to payment, completing account verification after the payment has been made is permitted in certain situations, such as with pay, provided that the claim for payment is reasonable and meets the criteria outlined in the Directive on Account Verification. See footnote 49

The Directive on Delegation of Financial Authorities for Disbursements requires that persons with delegated authority do not exercise the following: See footnote 50

- Certification authority and payment authority on the same payment; and

- Spending, certification or payment authority for an expenditure from which they can directly or indirectly benefit (e.g., when the payee is the individual with financial signing authority, or when the expenditure is incurred for the benefit of that individual).

To ensure adequate separation of duties, the following functions are kept separate when responsibility is assigned to individuals involved in the expenditures process: See footnote 51

- Authority to exercise transaction authority (Activity 5.1.6.2 – Exercise or Obtain Transaction Authority);

- Certification of the provision of services pursuant to section 34 of the FAA (certification authority) (Activity 5.1.6.3 – Exercise or Obtain FAA Section 34 Certification);

- Determination of entitlement, verification of accounts and preparation of requisitions for payment or settlement, pursuant to section 34 of the FAA (certification authority) (Perform Account Verification (Compensation) (Subprocess 5.1.8) and Complete Account Verification (Subprocess 5.1.12); and

- Certification of requisition for payment or settlement, pursuant to section 33 of the FAA (electronic or manual payment authority) (Activity 5.1.9.3 – Exercise Section 33 Certification).

If the process or other circumstances do not allow such separation of duties, alternative control measures are implemented and documented. In the context of Pay Administration, the role of the compensation advisor in performing part of the section 34 verification provides this additional control measure.

Perform Account Verification (Compensation) includes the following activities See footnote 52 and is completed by the responsibility centre manager under Complete Account Verification (Subprocess 5.1.12):

- Verifying that supporting documentation is complete and duly certified pursuant to the FAA, section 34, in other words, that the documentation allows an audit trail and demonstrates agreed terms, conditions and other specifications (i.e., conforms to letter of offer and collective agreements), as well as receipt of services and authorization according to the delegation of authorities (Activity 5.1.8.1 – Verify That Supporting Documentation Is Complete);

- Confirming that requirements have been met, in other words, that the employment contract, collective agreement or other applicable terms and conditions have been met and that the work has been performed (Activity 5.1.8.2 – Confirm That Requirements Are Met);

- Ensuring employee information is accurate (Activity 5.1.8.4 – Ensure Employee Information Is Accurate);

- Confirming that the payee is entitled to, or eligible for, the payment (Activity 5.1.8.3 – Confirm That Employee Is Entitled to Payment); completed by the responsibility centre manager in Complete Account Verification (Subprocess 5.1.12);

- Verifying that all relevant statutes, regulations, orders-in-council, policies and directives, collective agreements and other legal obligations have been complied with (Activity 5.1.8.5 – Verify That Relevant Regulations, Policies and Directives Were Followed); and

- Confirming the accuracy of the transaction, including that the payment is not a duplicate; that credits have been deducted; that charges not payable have been removed; and that the pay total has been calculated correctly (Activity 5.1.8.6 – Verify Accuracy of Transaction); completed by the responsibility centre manager in Complete Account Verification (Subprocess 5.1.12).

At any point during the account verification process, if a discrepancy is noted or if the information is incomplete, the compensation advisor or the responsibility centre manager is required to resolve this discrepancy by tracing the issue to its source (Activity 5.1.8.7 – Resolve Discrepancies). Once the issue is resolved, the account verification may resume or start over.

5.5.2.2 Roles and Responsibilities

The compensation advisor works with the responsibility centre manager, financial services and corporate finance to perform part of the FAA section 34 verification. Table 8 provides an overview of roles and responsibilities, using the Responsible, Accountable, Consulted, and Informed (RACI) approach. These roles and responsibilities are further described in Appendix D.

Table 8: Perform Account Verification (Compensation) (Subprocess 5.1.8) – RACI

Legend

- CF: Corporate finance

- COMP: Compensation

- DFMS: Departmental Financial and Materiel Management System

- FIN: Financial services

- HR: Other human resources functions

- HRMS: Human Resources Management System

- RCM: Responsibility centre manager

| Activity | Related Data | Responsible | Accountable | Consulted | Informed | Authoritative Source |

|---|---|---|---|---|---|---|

| 5.1.8.1 Verify That Supporting Documentation Is Complete |

|

COMP, RCM | RCM | FIN | CF, HR | HRMS |

| 5.1.8.2 Confirm That Requirements Are Met |

|

COMP, RCM | RCM | FIN | CF, HR | HRMS |

| 5.1.8.3 Confirm That Payee Is Eligible for Payment |

|

COMP, RCM | RCM | CF | CF, HR | HRMS |

| 5.1.8.4 Ensure Employee Information Is Correct |

|

COMP, RCM | RCM | CF | CF, HR | HRMS |

| 5.1.8.5 Verify That Relevant Regulations, Policies and Directives Were Followed |

|

COMP, RCM | RCM | CF, FIN | CF, HR | HRMS |

| 5.1.8.6 Verify Accuracy of Transaction |

|

COMP, RCM | RCM | CF, FIN | CF, HR | HRMS |

| 5.1.8.7 Resolve Discrepancies |

|

COMP, RCM | RCM | FIN | CF, HR | HRMS |

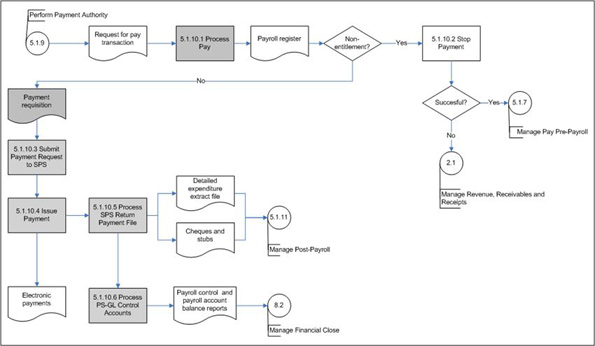

5.5.3 Perform Payment Authority (Subprocess 5.1.9)

5.5.3.1 Activities

The next step constitutes authorization under the FAA, section 33. Quality assurance for the adequacy of the FAA section 34 verification occurs either before or after the FAA section 33 authorization is applied. In the context of pay, FAA section 33 authorization can be a one-time occurrence (e.g., payment of overtime, cash-out of accumulated compensatory time, cash-out of accumulated vacation time) or can be recurring (e.g., base salary payment, bilingual bonus payment, shift differential payment, isolated post allowances payment). The FAA section 33 authorization corresponds to compensation's "pay authorization" step and ends with a request to PWGSC for a pay transaction.

This subprocess is a variation on Perform Payment Authority (FAA, section 33) (Subprocess 3.1.8) of Manage Procure to Payment (Business Process 3.1). The variation highlights the role of PWGSC and underlines the recurring FAA section 33 authorization inherent in many pay transactions.

Figure 14 depicts the Level 3 process flow for Perform Payment Authority.

Figure 14: Perform Payment Authority (Subprocess 5.1.9) – Level 3 Process Flow

Text version: Figure 14: Perform Payment Authority (Subprocess 5.1.9) – Level 3 Process Flow

The request for a pay transaction, which includes the pay transaction data, payment details, employee data and, optionally, the financial coding block, is sent to the "pay authorizer" (Activity 5.1.9.1 – Receive Request For Pay Transaction) for payment issuance. As part of this subprocess, the financial or HR officer delegated FAA section 33 performs quality assurance (Activity 5.1.9.2 – Perform Quality Assurance). The financial or HR officer exercises payment authority and is responsible for certifying and ensuring the following: See footnote 53

- There is auditable evidence demonstrating that account verification has taken place and has been certified by an individual with delegated financial signing authority pursuant to section 34 of the FAA;

- No payment is made when the payment:

- Is not a lawful charge against the appropriation;

- Will result in an expenditure exceeding the appropriation; or

- Will result in an insufficient balance in the appropriation to meet the commitments charged against it;

- When exercising payment authority,

- All high-risk transactions are subjected to a full review of the transaction; and

- A sample of medium- and low-risk transactions are selected based on a sample selection methodology and are subjected to a review of the most important aspects of each selected transaction;

- Certification of payments pursuant to the FAA, section 33, is provided to the Receiver General;

- Requirements of the Payments and Settlements Requisitioning Regulations and the Directive on Payment Requisitioning and Cheque Control are complied with; and

- Corrective action is taken when critical errors are identified during the quality assurance process for payment authority.

If a discrepancy is found during this process, the payment requisition is returned first to the compensation officer and, if necessary, to the responsibility centre manager for resolution.