ARCHIVED - Treasury Board of Canada Secretariat - 2012–13 Departmental Performance Report

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

ISSN 1490-1498

President's Message

I am pleased to present the 2012–13 Departmental Performance Report for the Treasury Board of Canada Secretariat.

In 2012–13, the Secretariat continued to support the modernization of the Government of Canada through cost savings in government operations, by making it easier for Canadians to access information and services, and by managing people more effectively to enhance performance.

During the year, our organization, like every other federal department, implemented savings measures announced in Economic Action Plan 2012. In this process, the Secretariat achieved its own savings and supported ministers and departments in implementing ongoing annual savings of $5.2 billion, primarily through achieving greater operational efficiencies and enhancing productivity.

In addition, we improved the way our Government serves Canadians and businesses. For example, we announced Canada's Action Plan on Open Government with 12 commitments that support open information, open data and open dialogue with Canadians. We also focused on removing business irritants that burden Canadian businesses with unnecessary delays, costs and bureaucracy through initiatives such as the Red Tape Reduction Action Plan – one of the most far-reaching and ambitious plans in the world. This plan includes a “One-for-One” Rule that effectively caps the administrative costs of businesses in complying with federal government regulation. The Secretariat also took the lead in modernizing the Government of Canada's online presence. It has developed a Web Renewal Action Plan that will make it easier for Canadians to access government services and information on the Web and through social media.

Streamlining the government's internal operations has been another important priority. To that end, we are pursuing the standardization and consolidation of systems and processes for human resources and financial management. We are also ensuring that the government has the right policies in place to support a government-wide approach to IT infrastructure through Shared Services Canada – one that can drive economies of scale, achieve savings for taxpayers and improve service.

As stated in Economic Action Plan 2013, we are also committed to creating a high-performing and dynamic public service. As part of this, the Secretariat has developed a new performance management initiative, which will ensure that the performance of public service employees is tracked and employed to its fullest potential. It also designed a strategy to improve disability management, which is focused on active case management and proper support for ill and injured employees so they can return to work in a timely way. These reforms complement others such as the introduction of a 50-50 cost sharing for public-sector pension contributions, and the elimination of severance pay to public servants for voluntary departures.

Through these and other measures, the Secretariat is continuing to support productivity and efficiency in the public service to provide Canadians the best value for tax dollars. I invite you to read the 2012–13 Departmental Performance Report to see how the Secretariat is contributing to the modernization of the Government of Canada for the 21st century.

Original signed by

The Honourable Tony Clement

President of the Treasury Board

Erratum

Subsequent to tabling in Parliament and online publication of its 2012-2013 Departmental Performance Report (DPR), Treasury Board of Canada Secretariat determined that one table in both the English and French HTML versions was not included in Section III.

This table, which contains supplementary information on User Fees Reporting, can be found under Section III of the 2012-13 DPR.

The English and French HTML versions have been updated and a hyperlink to this table has been included on TBS's website.

Table of Contents

- President's Message

- Organizational Overview

-

Analysis of Programs and Sub-Programs by Strategic Outcome

-

Strategic Outcome

-

Strategic Outcome: Government is well managed and accountable, and resources are allocated to achieve results

-

Management Frameworks

- Performance Analysis and Lessons Learned

- 1.1.1 Strategic Management and Governance

- 1.1.2 Sound Management and Decision Making

- 1.1.3 Service Modernization

- 1.1.4 Information Management, Access and Privacy

- 1.1.5 Management of Information Technology

- 1.1.6 Government Security

- 1.1.7 Communications and Corporate Identity

- 1.1.8 Regulatory Management

- People Management

- Expenditure Management

- Financial Management

- Government-Wide Funds and Public Service Employer Payments

-

Management Frameworks

- Internal Services

-

Strategic Outcome: Government is well managed and accountable, and resources are allocated to achieve results

-

Strategic Outcome

- Supplementary Information

Raison d’être

The Treasury Board of Canada Secretariat (Secretariat) is the administrative arm of the Treasury Board, and the President of the Treasury Board is the Minister responsible for the Secretariat. This organization supports the Treasury Board by making recommendations and providing advice on program spending, regulations and management policies and directives, while respecting the primary responsibility of deputy heads in managing their organizations and their roles as accounting officers before Parliament. In this way, the Secretariat strengthens the way government is managed and helps to ensure value for money in government spending and results for Canadians.

Responsibilities

The Secretariat makes recommendations and supports the Treasury Board in each of its roles (see text box “Treasury Board Roles”).

Within the Secretariat, the Comptroller General of Canada provides government-wide leadership, direction, oversight and capacity building for financial management, internal audit and the management of assets and acquired services.

The Chief Human Resources Officer leads people management across the core public administration by developing workplace and workforce policies and programs; by centrally managing labour relations, compensation, and pension and benefit plans; and by developing executive leadership.

The Chief Information Officer provides government-wide leadership, direction, oversight and capacity building for information management, information technology, government security (including identity management), access to information, privacy, and internal and external service delivery.

The Treasury Board Portfolio consists of the Secretariat and the Canada School of Public Service. The Public Service Pension Investment Board, the Office of the Commissioner of Lobbying of Canada and the Office of the Public Sector Integrity Commissioner of Canada are arm's-length organizations that report to Parliament through the President of the Treasury Board.

When working with federal departments, agencies and Crown corporations, the Secretariat plays three central agency roles:

- A leadership role in driving and modelling excellence in public sector management;

- A challenge and oversight role that includes reporting on the government's management and budgetary performance and developing government-wide management policies and standards; and

- A community enabling role to help organizations improve management performance.

Treasury Board Roles

The Treasury Board is a Cabinet committee of ministers established in 1867. It oversees the government's financial, human resources and administrative responsibilities and establishes policies that govern each of these areas. In addition, the Prime Minister has designated the Treasury Board to act as the committee of the Queen's Privy Council for the consideration and approval of regulations and most orders-in-council. The Treasury Board, as the Management Board for the government, has three principal roles:

- It acts as the government's Management Office by promoting improved management performance. It also approves policies to support the prudent and effective management of the government's assets and financial, information and technology resources.

- It acts as the government's Budget Office by examining and approving the proposed spending plans of government departments and by reviewing the development of approved programs.

- It acts as the human resources office and the employer or People Management Office by managing compensation and labour relations for the core public administration. It also sets people management policies (including determining the terms and conditions of employment) to ensure coherence and consistency, where needed.

Strategic Outcome and Program Alignment Architecture

The Secretariat's Program Alignment Architecture (PAA) is made up of six programs that contribute to the achievement of the Secretariat's strategic outcome. Detailed information about the Secretariat's strategic outcome and about each of the programs in the PAA can be found in Analysis of Programs and Sub-Programs by Strategic Outcome.

2012–13 Program Alignment Architecture

-

1.1 Management Frameworks

- 1.1.1 Strategic Management and Governance

- 1.1.2 Sound Management and Decision Making

- 1.1.3 Service Modernization

- 1.1.4 Information Management, Access and Privacy

- 1.1.5 Management of Information Technology

- 1.1.6 Government Security

- 1.1.7 Communications and Corporate Identity

- 1.1.8 Regulatory Management

-

1.2 People Management

- 1.2.1 Direction Setting

- 1.2.2 Enabling Infrastructure

- 1.2.3 Comprehensive Management of Compensation

-

1.3 Expenditure Management

- 1.3.1 Results-Based Expenditure Management

- 1.3.2 Expenditure Management Advice and Reporting

- 1.3.3 Compensation Expenditure Management

-

1.4 Financial Management

- 1.4.1 Financial Management, Oversight and Reporting

- 1.4.2 Internal Audit

- 1.4.3 Assets and Acquired Services

- 1.5 Government-Wide Funds and Public Service Employer Payments

-

1.6 Internal Services

- 1.6.1 Governance and Management Support

- 1.6.1.1 Management and Oversight Services

- 1.6.1.2 Communications Services

- 1.6.1.3 Legal Services

- 1.6.2 Resource Management Services

- 1.6.2.1 Human Resources Management Services

- 1.6.2.2 Financial Management Services

- 1.6.2.3 Information Management Services

- 1.6.2.4 Information Technology Services

- 1.6.2.5 Travel and Other Administrative Services

- 1.6.3 Asset Management Services

- 1.6.3.1 Real Property Services

- 1.6.3.2 Materiel Services

- 1.6.3.3 Acquisition Services

- 1.6.1 Governance and Management Support

Organizational Priorities

In its 2012–13 Report on Plans and Priorities, the Secretariat established four organizational priorities that contribute to its strategic outcome, “Government is well managed and accountable, and resources are allocated to achieve results.”

- Priority 1: Support the government in ensuring value for money

- Priority 2: Advance initiatives to modernize government operations

- Priority 3: Enable a modern and sustainable approach to people management

- Priority 4: Pursue greater efficiency and effectiveness within the Secretariat

The results achieved under each priority are briefly summarized below. Further information on these results can be found in the Performance Analysis and Lessons Learned section of each of the Secretariat’s programs in Analysis of Programs and Sub-Programs by Strategic Outcome.

| Type | Strategic Outcome(s) and/or Program(s) |

|---|---|

| Ongoing | |

| Summary of Progress | |

|

The Secretariat followed through on plans identified in its 2012–13 Report on Plans and Priorities to support this priority. The Secretariat, for example:

Efforts in this area contributed to the government’s management agenda by ensuring value for money in government programs, services and operations. This priority contributed to the Secretariat’s strategic outcome by ensuring that government resources are effectively allocated to achieve results. More details on related initiatives and results achieved in support of this priority can be found in the Performance Results section under Program 1.3: Expenditure Management and Program 1.4: Financial Management. |

|

| Type | Strategic Outcome(s) and/or Program(s) |

|---|---|

| Ongoing | |

| Summary of Progress | |

|

The Secretariat moved forward on a number of plans identified in its 2012–13 Report on Plans and Priorities to support this priority. The Secretariat, for example:

Results achieved in support of this priority increased the overall efficiency and effectiveness of government operations, and responded to the evolving expectations of Canadians. This priority contributed to the Secretariat's strategic outcome by enabling well-managed and accountable government. More details on related initiatives and results achieved in support of this priority can be found in the Performance Results section under Program 1.1: Management Frameworks. |

|

| Type | Strategic Outcome(s) and/or Program(s) |

|---|---|

| Ongoing | |

| Summary of Progress | |

|

The Secretariat achieved significant progress on plans identified in its 2012–13 Report on Plans and Priorities to address this priority. The Secretariat, for example:

The Secretariat supported Economic Action Plan 2012 initiatives by working collaboratively with deputy heads to implement an integrated, long-term view of workforce planning and performance across government. This priority contributed to well-managed and accountable government by advancing a modern and efficient approach to human resources management across the core public administration. More details on related initiatives and results achieved in support of this priority can be found in the Performance Results section under Program 1.2: People Management and Program 1.3: Expenditure Management. |

|

| Type | Strategic Outcome(s) and/or Program(s) |

|---|---|

| Ongoing | |

| Summary of Progress | |

|

The Secretariat made progress on plans identified in its 2012–13 Report on Plans and Priorities to pursue greater efficiency and effectiveness within the Secretariat. The Secretariat, for example:

This priority contributed to the Secretariat's strategic outcome by ensuring that its human and financial resources and internal processes are optimized to support key results across all its programs. More details on related initiatives and results achieved in support of this priority can be found in the Performance Results section under Program 1.6: Internal Services. |

|

Risk Analysis

The Secretariat actively monitors its operating environment in order to identify and manage risks that could affect progress toward its strategic outcome and organizational priorities. Key risks are captured in the Secretariat's corporate risk profile (CRP), which is updated at least once per year. Starting in 2012–13, the time horizon for the CRP shifted from one year to three years. This change brought a broader perspective to risk discussions and supports the Secretariat in managing longer-term, strategic initiatives.

As part of the 2012–15 CRP exercise, the Secretariat identified and developed risk responses for its corporate risks. In 2012–13, concrete actions were taken to manage these risks and, where the risk continues over a longer period of time, these steps form part of an ongoing strategy.

| Risk | Risk Response Strategy | Link to Program Alignment Architecture | Link to Organizational Priorities |

|---|---|---|---|

|

Given the dynamic fiscal environment in which the Secretariat operates, the Secretariat was challenged to effectively enable the achievement of new and emerging fiscal objectives as departments and agencies worked to implement a number of ongoing restraint initiatives. |

The Secretariat focused on building and maintaining its internal capacity and on effectively supporting departments and agencies to respond to the government’s fiscal objectives. |

Priority 1: Support the government in ensuring value for money |

|

|

The drive for greater efficiency created an opportunity to accelerate government modernization. At the same time, the increased complexity and pace of change presented challenges for the Secretariat in enabling the implementation of wide-scale standardization and consolidation of government systems and processes. |

The Secretariat focused on ensuring that appropriate policies, frameworks, tools and guidance are in place to support the standardization and consolidation of government-wide systems. |

Priority 2: Advance initiatives to modernize government operations |

|

|

As government sought to strike the right balance between innovation, risk and control, adopting a simplified, risk-based approach to management oversight remained a key challenge for the Secretariat. |

The Secretariat increased its focus on adopting and promoting risk-based approaches to management oversight, reducing unnecessary reporting requirements and promoting the shift toward greater accountability for deputy heads. |

Priority 2: Advance initiatives to modernize government operations |

During the period under review, the Secretariat continued to be at the centre of the government’s commitment to modernize and transform government. It provided leadership and guidance to support more cost-effective approaches government-wide, while simultaneously pursuing greater efficiency and effectiveness in its own operations.

The Secretariat also continued to support the government’s focus on reducing costs and ensuring value for money. In Economic Action Plan 2012, the government committed to achieving ongoing savings of $5.2 billion, with improvements to operational efficiencies accounting for 70 per cent of the savings. At the same time, departments and agencies were implementing decisions taken as part of the previous Strategic Review exercise.

In the context of this environment, the Secretariat effectively managed risks identified in its 2012–15 CRP by developing risk response strategies and successfully implementing a number of specific mitigation measures. The Secretariat, for example:

- Supported departments, agencies and functional communities in addressing cost-reduction adjustments by:

- Establishing appropriate communications strategies in support of government fiscal objectives;

- Providing guidance on estimating workforce adjustment costs to organizations implementing Economic Action Plan 2012 deficit reduction measures, as well as directly supporting the regional development agencies in achieving deficit reduction targets by consolidating their internal audit functions at the Secretariat;

- Collaborating with partners (such as the Canada School of the Public Service and the Public Service Commission) to provide deputy heads with integrated tools, guidance and discussion forums. This included data analysis on attrition and workforce adjustment and on trends in hiring to support placing affected employees and for continued recruitment; and

- Temporarily modifying the rules for carrying forward unspent amounts to address the retroactive costs of collective bargaining settlements to be borne by departments during the operating budget freeze.

- Engaged deputy heads and functional communities through a variety of initiatives to support the standardization and consolidation of government-wide systems, including:

- Completing a model to enable standardization, transfer and exchange of data and information within and across departments. This model integrates performance, financial and human resources information to support evidence-based decisions and resource allocation;

- Overseeing the completion of the Cyber Authentication Renewal Initiative, which resulted in the replacement of Secure Channel epass. This initiative modernizes the manner in which clients access government online services, while reducing annual operational costs by over $35 million; and

- Supporting all levels of the financial management community through a number of initiatives, including the Chief Financial Officer Talent Management Initiative, to ensure that future financial management executive leaders are identified and possess the competencies necessary to fulfill upcoming opportunities.

- Continued to review and propose adjustments to the Treasury Board policy suite in order to embed risk-based decision making across management functions and reduce administrative burden through such initiatives as:

- Implementing a new quarterly electronic Inventory of Government of Canada Organizations that streamlines reporting requirements for federal organizations, resulting in increased efficiencies and more timely updates than the former annual report to Parliament;

- Instituting policy changes to ensure adequate disclosure of significant departmental events, and their associated costs, to departmental ministers;

- Developing and updating web-related policies in support of the Web Renewal initiative announced in Economic Action Plan 2013; and

- Amending provisions of the official languages policy suite for deputy heads to delegate decisions on the non-imperative staffing of bilingual positions to reduce administrative burden on institutions.

Through these and a number of other measures, some of which are complete and some ongoing, the Secretariat successfully managed its risks during 2012–13. Moving forward, the Secretariat will continue to review and assess its corporate risks, and adapt and adjust its risk response strategies and mitigation measures, as required.

Summary of Performance

| Total Budgetary Expenditures (Main Estimates 2012–13) | Planned Spending 2012–13 | Total Authorities (available for use) 2012–13 | Actual Spending (authorities used) 2012–13 | Difference (Planned vs. Actual Spending) |

|---|---|---|---|---|

| 5,685,174 | 5,693,376 | 4,003,118 | 2,762,026 | 2,931,350 |

| Planned 2012–13 | Actual 2012–13 | Difference 2012–13 |

|---|---|---|

| 2,066 | 1,914 | 152 |

Performance Summary Table for Strategic Outcome: Government is well managed and accountable, and resources are allocated to achieve results

| Program | Total Budgetary Expenditures (Main Estimates 2012–13) | Planned Spending | Total Authorities (available for use) 2012–13 | Actual Spending (authorities used) |

Alignment to Government of Canada Outcomes | ||||

|---|---|---|---|---|---|---|---|---|---|

| 2012–13 | 2013–14 | 2014–15 | 2012–13 | 2011–12 See endnote 1* | 2010–11 See endnote 1* | ||||

|

Notes:

|

|||||||||

| Management Frameworks | 53,878 | 59,741 | 53,842 | 50,963 | 64,764 | 58,544 | 65,304 | 57,643 | Government Affairs: Well-managed and efficient government operations |

| People Management | 57,710 | 59,431 | 51,859 | 47,286 | 62,253 | 60,975 | 65,444 | 64,923 | |

| Expenditure Management | 35,295 | 35,295 | 32,866 | 32,104 | 33,879 | 31,047 | 50,893 | 30,167 | |

| Financial Management | 32,912 | 32,912 | 32,613 | 32,524 | 33,962 | 30,867 | 36,470 | 36,940 | |

| Government-Wide Funds and Public Service Employer Payments | 5,430,433 | 5,430,433 | 5,420,474 | 5,411,574 | 3,718,185 | 2,500,373 | 2,192,869 | 1,968,478 | |

| Strategic Outcome Subtotal | 5,610,228 | 5,617,812 | 5,591,654 | 5,574,450 | 3,913,043 | 2,681,805 | 2,410,980 | 2,158,151 | |

| Internal Services | Total Budgetary Expenditures (Main Estimates 2012–13) | Planned Spending | Total Authorities (available for use) 2012–13 | Actual Spending (authorities used) |

||||

|---|---|---|---|---|---|---|---|---|

| 2012–13 | 2013–14 | 2014–15 | 2012–13 | 2011–12 See endnote 2* | 2010–11 See endnote 2* | |||

|

Notes:

|

||||||||

| Internal Services Subtotal | 74,946 | 75,564 | 71,245 | 67,704 | 90,075 | 80,221 | 93,528 | 95,829 |

| Strategic Outcome and Internal Services | Total Budgetary Expenditures (Main Estimates 2012–13) | Planned Spending | Total Authorities (available for use) 2012–13 | Actual Spending (authorities used) |

||||

|---|---|---|---|---|---|---|---|---|

| 2012–13 | 2013–14 | 2014–15 | 2012–13 | 2011–12 See endnote 3* | 2010–11 See endnote 3* | |||

|

Notes:

|

||||||||

| Total | 5,685,174 | 5,693,376 | 5,662,899 | 5,642,154 | 4,003,118 | 2,762,026 | 2,504,508 | 2,253,980 |

The above tables provide the total budgetary expenditures (Main Estimates), the planned spending, the authorities and the actual spending for 2012–13. These are discussed by program in Analysis of Programs and Sub-Programs by Strategic Outcome. For comparison purposes, the planned spending is provided for two future years, and the actual spending for two prior years.

Approximately 60 per cent of the planned spending for Program 1.5 Government-Wide Funds and Public Service Employer Payments is transferred to, and spent by, other departments and agencies for items such as operating and capital budget carry forward, severance, parental benefits and compensation requirements (Votes 5, 10, 15, 25, 30 and 33). The Secretariat’s total authorities are reduced accordingly. The most significant difference between the planned and the actual spending (on average $3.2 billion per year) relates to the amounts that were distributed from these votes to other departments and agencies (expenditures appear in their operating votes). The balance of funding within the program is for public service employer payments.

Overall, planned spending decreased by $30.5 million from 2012–13 to 2013–14 and by $20.7 million from 2013–14 to 2014–15. Reductions are primarily due to Economic Action Plan 2012 cost-containment measures and the 2008 Strategic Review of Vote 20. Overall, actual spending increased by $250.5 million from 2010–11 to 2011–12 and by $257.5 million from 2011–12 to 2012–13, as outlined below.

Actual spending for the Secretariat’s operations increased by $26.1 million from 2010–11 to 2011–12, largely as a result of one-time expenditures related to the professional service costs for external experts to support the review of departmental spending across government and payouts to employees resulting from the revision of specific collective agreements. These increases were offset by reductions related to the 2010 Strategic Review decisions and a transfer to Shared Services Canada.

Actual spending for the Secretariat's operations (i.e., excluding Government-Wide Funds and Public Service Employer Payments) decreased by $50 million from 2011–12 to 2012–13, largely as a result of the following:

- One-time expenditures related to the professional service costs for external experts to support the review of departmental spending across government;

- Payouts to employees resulting from the revision of specific collective agreements;

- Further reductions related to Economic Action Plan 2012 cost-containment measures;

- Project delays; and

- Deferral of staffing plans.

Net public service employer payments increased by approximately $224 million from 2010–11 to 2011–12 as a result of a one-time lump sum payment for the improvement of long-term disability benefits provided under the Service Income Security Insurance Plan, as well as increased payments under the various other public service health benefit plans. These increases were offset by the transfer of the management of pension, insurance and social security programs for locally engaged staff to Foreign Affairs and International Trade Canada See footnote [1] and to National Defence.

An increase of $307.5 million from 2011–12 to 2012–13 largely resulted from a statutory payment for an actuarial adjustment made in virtue of the Public Service Superannuation Act, which was offset by a decrease due to the one-time payment for the long-term disability benefits, referenced above.

Expenditure Profile

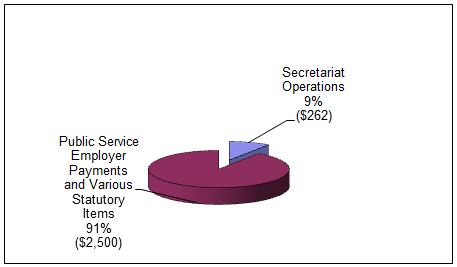

Figure 1: Treasury Board of Canada Secretariat 2012–13 Actual Spending ($ millions)

Figure 1: Treasury Board of Canada Secretariat 2012–13 Actual Spending - Text version

The Secretariat spent a total of $2.76 billion toward achieving its strategic outcome. Approximately 9 per cent of total spending represents expenditures for its operations. The remainder relates to funds for public service employer payments that the Secretariat manages centrally on the government's behalf.

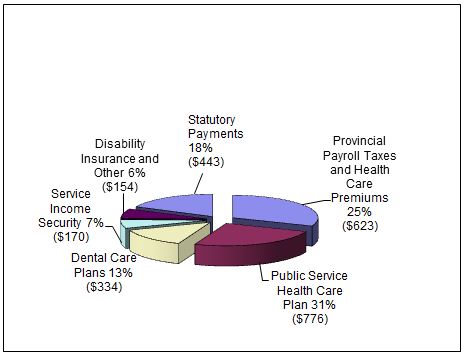

Figure 2: Treasury Board of Canada Secretariat Public Service Employer Payments 2012–13 Actual Spending ($ millions)

Total spending for public service employer payments was $2.50 billion in 2012–13. This included statutory payments and payments under 16 public service benefit plans and associated expenditures.

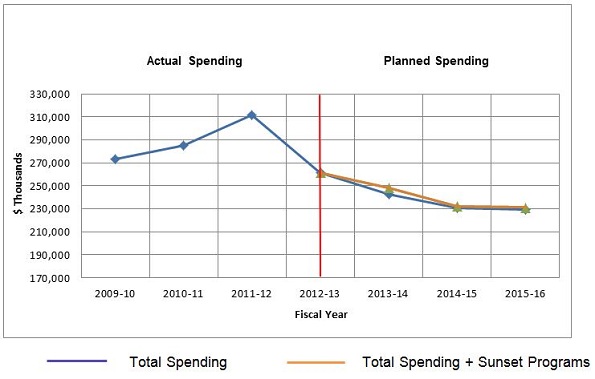

Figure 3: Spending Trend for Program Expenditures (Vote 1)

Figure 3: Spending Trend for Program Expenditures (Vote 1) - Text version

The Secretariat’s program expenditures include salaries, non-salary costs that support its operations, and contributions to employee benefit plans for its own employees, as well as other statutory payments.

The increase in spending from 2009–10 to 2011–12 is largely due to one-time expenditures related to professional service costs for external experts to support the review of departmental spending across government, and to payouts to employees resulting from the revision of specific collective agreements.

Decreases from 2011–12 to 2015–16 are mostly a result of Strategic Review 2010 reductions, transfers to Shared Services Canada and Public Works and Government Services Canada, and Economic Action Plan 2012 cost-containment measures.

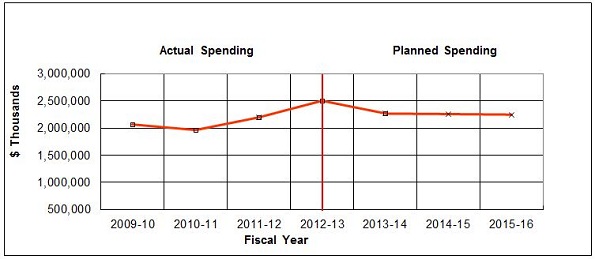

Figure 4: Spending Trend for Public Service Employer Payments and Various Statutory Items (Vote 20)

Expenditures for public service employer payments and statutory items include the payment of the employer’s share of contributions required under the various insurance plans sponsored by the Government of Canada. These amounts also include statutory items for payments under the Public Service Pension Adjustment Act (PSPAA); pay equity settlements, pursuant to section 30 of the Crown Liability and Proceedings Act; and employer contributions made under the Public Service Superannuation Act (PSSA), other retirement Acts and the Employment Insurance Act.

Net public service employer payments increased by approximately $224 million from 2010–11 to 2011–12 as a result of a one-time lump sum payment for improvement of long-term disability benefits provided under the Service Income Security Insurance Plan, and increased payments under the various other public service health benefit plans. These increases were offset by the transfer of the management of pension, insurance and social security programs for locally engaged staff to Foreign Affairs and International Trade Canada See footnote [2] and to National Defence.

Public service employer payments increased by $307.5 million from 2011–12 to 2012–13, mostly as a result of a $443 million actuarial adjustment to employer contributions made under the PSSA. The actuarial adjustment was offset by a decrease of $112.4 million due to a one-time payment under the Service Income Security Insurance Plan and by savings in the Public Service Health Care Plan and payroll taxes. This actuarial adjustment is not reflected in planned spending as it was not known at the time. It will be included in planned and actual spending in future years.

Planned spending between 2013–14 and 2015–16 will decrease by $19.1 million; the figures are based on approved authorities and are relatively stable over the planning horizon.

Estimates by Vote

For information on the Secretariat’s organizational votes and statutory expenditures, please see the Public Accounts of Canada 2013 (Volume II).

Contribution to the Federal Sustainable Development Strategy (FSDS)

The Federal Sustainable Development Strategy (FSDS) outlines the Government of Canada's commitment to improving the transparency of environmental decision making by articulating its key strategic environmental goals and targets.

The Secretariat ensures that consideration of these outcomes is an integral part of its decision-making processes. The Secretariat contributes to Theme IV of the FSDS, Shrinking the Environmental Footprint – Beginning with Government, as denoted by the following visual identifier.

During 2012–13, the Secretariat reviewed the environmental effects of initiatives subject to the Cabinet Directive on the Environmental Assessment of Policy, Plan and Program Proposals. Based on this review, it was determined that for 2012–13, there were no Strategic Environmental Assessments (SEAs) required for any initiatives led or co-led by the President of the Treasury Board under Theme IV of the FSDS, Shrinking the Environmental Footprint – Beginning with the Government.

For additional details on the Secretariat's activities to support sustainable development and SEAs, please consult the Secretariat's website. For complete details on the FSDS, see the Environment Canada website.

Strategic Outcome

The results achieved in support of the Secretariat's strategic outcome strengthen the effectiveness and efficiency of the federal government; support decision making by Parliament, the Treasury Board and Cabinet; and ensure that Canadians are well served by a government that is accountable and transparent. Effective government contributes to Canada's competitive advantage, providing a strong foundation for security, stability and prosperity.

The following links connect to performance summaries for each of the Secretariat's programs, which report progress against expected results, performance indicators and targets in line with the Policy on Management, Resources and Results Structures. Financial and human resources for each program as well as performance highlights for 2012–13 are also included.

The Secretariat’s 2012–13 Program Alignment Architecture (PAA) provides the basis of performance reporting in this report. In a few instances, expected results, performance indicators and targets included in the 2012–13 Report on Plans and Priorities have been updated or amended. The changes reflect a more targeted scope for data collection as a result of the assessment of fewer areas of management under the Management Accountability Framework for 2012–13, as well as efforts to strengthen some indicators.

2012–13 Program Alignment Architecture

-

1.1 Management Frameworks

- 1.1.1 Strategic Management and Governance

- 1.1.2 Sound Management and Decision Making

- 1.1.3 Service Modernization

- 1.1.4 Information Management, Access and Privacy

- 1.1.5 Management of Information Technology

- 1.1.6 Government Security

- 1.1.7 Communications and Corporate Identity

- 1.1.8 Regulatory Management

- 1.2 People Management

- 1.3 Expenditure Management

- 1.4 Financial Management

- 1.5 Government-Wide Funds and Public Service Employer Payments

- 1.6 Internal Services

Strategic Outcome: Government is well managed and accountable, and resources are allocated to achieve results

| Performance Indicator | Target | Actual Result |

|---|---|---|

| Canada’s ranking in The World Bank’s Worldwide Governance Indicators, for the third indicator, “Government Effectiveness” | Top ten among Organisation for Economic Co-operation and Development (OECD) member countries (annually) | The World Bank’s Worldwide Governance Indicators rank Canada sixth among OECD countries for government effectiveness |

The World Bank's Government Effectiveness Index (GEI) is one of six indices included in the World Bank's Worldwide Governance Indicators, which are issued annually. In 2012, Canada ranked 6th out of 34-OECD countries. The GEI captures perceptions of the quality of public services; the quality of the civil service and the degree of its independence from political pressures; and the quality of policy formulation and implementation, and the credibility of the government's commitment to such policies.

Program 1.1 Management Frameworks

The Management Frameworks Program establishes principles for sound governance and management in the Government of Canada by helping ministers set government-wide policy direction in targeted areas. These areas include service and program modernization, information management, information technology, security, communications and regulatory management.

This program achieves its results by communicating clear expectations for deputy heads and by adopting principles-based approaches and risk-informed oversight. Working with departments, agencies and functional communities (e.g., regulation, information technology, security), the Secretariat provides leadership, oversight, assessment and guidance in areas related to management policy and regulatory development, compliance and performance reporting. This work also includes responding to emerging public sector management issues and promoting informed risk-taking, innovation, cost-effectiveness, efficiency, transparency and accountability.

This program is underpinned by a broad set of enabling legislation, including the Financial Administration Act and the Federal Accountability Act.

| Total Budgetary Expenditures (Main Estimates) 2012–13 |

Planned Spending 2012–13 |

Total Authorities (available for use) 2012–13 |

Actual Spending (authorities used) 2012–13 |

Difference (Planned vs. Actual Spending) |

|---|---|---|---|---|

| 53,878 | 59,741 | 64,764 | 58,544 | 1,197 |

| Planned 2012–13 | Actual 2012–13 | Difference 2012–13 |

|---|---|---|

| 455 | 412 | 43 |

In 2012–13, the difference between the amounts under Main Estimates and Total Authorities is due to the receipt of funding for the Human Resources Modernization (HRMOD) initiative and cyber security and to the transfers from the Treasury Board central vote for severance payments and parental leave. Program spending aligned with planned spending, but incurred year-end surpluses due to project delays, notably in the areas of HRMOD and cyber security, and to the deferral of staffing plans.

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Continuous improvement in the quality of public service management in the Government of Canada | Percentage of departments and agencies that obtained a MAF rating of at least “Acceptable” for citizen-focused service, management of security, integrated risk management, information management, and information technology | 75% by March 2013 | 100% for integrated risk management |

Consistent with its initiatives to reduce the reporting burden on departments, the Secretariat implemented a targeted approach to the 2012–13 Management Accountability Framework (MAF) exercise and did not require the assessment of all areas of management. Of the five areas of management that feed this indicator, MAF 2012–13 required only the assessment of integrated risk management. All departments and agencies assessed demonstrated that they had integrated risk management into their strategic and operational planning processes.

Performance Analysis and Lessons Learned

Through the Management Frameworks Program, the Secretariat continued to support improved management performance and accountability within departments and agencies by implementing a range of plans set out in its 2012–13 Report on Plans and Priorities. The Secretariat, for example:

Advanced Open Government

- Released Canada's Action Plan on Open Government, with 12 commitments that support open information, open data and open dialogue with Canadians. These commitments will advance work to foster greater openness and accountability; provide more opportunities to learn about and participate in government; drive innovation and economic opportunities for all Canadians; and create a more cost-effective, efficient and responsive government.

Cut Regulatory Red Tape

-

Released the Red Tape Reduction Action Plan to address a broad range of irritants to businesses and the systemic barriers that frustrate and burden Canadian business with unnecessary delays and costs. As part of the Action Plan, the Secretariat:

- Implemented the “One-for-One” Rule. Under this rule, regulatory changes that impose new administrative burden on business must be offset with an equivalent reduction in administrative burden from the set of regulations that currently exist. In addition, regulating departments and agencies are required to remove an existing regulation when an entirely new regulation they introduce imposes administrative burden on business. In 2012–13, 26 final regulations subject to the “One-for-One” Rule were published in the Canada Gazette, resulting in a net reduction of approximately $3 million in administrative burden for businesses and 6 fewer regulations.

- Launched the Small Business Lens for departments and agencies, including detailed guidance. Federal organizations are now responsible for applying the lens when designing regulations, and for being sensitive and responsive to the impacts that regulations can have on small business.

- In response to a recommendation in the Mid-Term Evaluation of the Implementation of the Cabinet Directive on Streamlining Regulation, a database was implemented, along with other tools, to monitor the compliance of regulatory proposals with the federal regulatory policy. This helped to inform the development of the “One-for-One” Rule and Small Business Lens.

Reduced Administrative Burden

- Advanced a targeted review of Treasury Board policy instruments to simplify internal management rules and reduce the administrative and reporting burden placed on departments and agencies. The Secretariat also advanced an efficient, risk-based approach to management oversight. By 2012–13, 91 per cent of Treasury Board frameworks and policies and 70 per cent of mandatory supporting policy instruments were renewed, which included a focus on reducing reporting burden for departments.

- Launched consultations with deputy heads to develop a new approach to assessing departmental performance in meeting MAF expectations, which will significantly reduce the reporting burden for departments and increase the value of these assessments.

Supported the Consolidation of Information Technology Services

- In Economic Action Plan 2013, announced the consolidation and standardization of software procurement for federal employees’ end-user devices, which will result in an annual savings of $8.7 million beginning in 2014–15. Moving forward, the government will explore further whole-of-government approaches to reduce costs in the area of procurement of end-user devices and associated support services.

- Developed a Web Renewal Action Plan to significantly reduce the number of Government of Canada websites, modernize the government’s web processes and tools, reduce the costs of online publishing, and develop and implement web standards. This initiative, for implementation in 2013–14, provides an opportunity to rethink how the government serves, communicates with and engages Canadians and Canadian businesses.

- Created a joint policy steering committee to align Treasury Board policy requirements with the Shared Services Canada operational model in order to facilitate the consolidation of government information technology services (i.e., email, data centre and network services, end-user devices).

Standardized Business Processes

- Continued efforts to standardize, modernize and consolidate human resources systems and processes in implementing the Common Human Resources Business Process across government and advancing work on the first common human resource system.

- Developed a financial management transformation strategy aimed at increasing the standardization of financial business processes and common financial systems.

Sub-Program 1.1.1 Strategic Management and Governance

Through the Strategic Management and Governance sub-program, the Secretariat provides leadership across the Government of Canada to establish a broad management agenda and promote strategic approaches to crosscutting policy issues on public sector management. Policy centres and federal institutions receive advice and support to maintain the integrity of the suite of Treasury Board policies, to review and refine policy instruments to ensure they reflect government priorities, to achieve management goals, to appropriately manage risk and to impose minimal administrative burden.

Sub-program 1.1.1 also identifies new and emerging management and governance issues; promotes increased productivity and innovation in management practices; advances modern reporting; and develops efficient, cost-effective approaches to planning, risk management and oversight and to strengthening the government’s operating environment.

| Planned Spending 2012–13 | Actual Spending 2012–13 | Difference 2012–13 |

|---|---|---|

| 4,504 | 4,131 | 373 |

| Planned 2012–13 | Actual 2012–13 | Difference 2012–13 |

|---|---|---|

| 40 | 36 | 4 |

Actual spending and FTEs aligned with plans.

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Federal institutions are equipped with policy instruments to meet their accountabilities and achieve results | Percentage of active policy instruments that meet or exceed expected maturity milestones | 100% by 2013–14 | 64% and ongoing |

Maturity milestones refer to the four stages that policy instruments undergo as they are implemented and put into effect: awareness, adoption, achieving results and optimization. In 2012–13, satisfactory progress was made toward the 2013–14 target. Once the 2013–14 target is met, a baseline will be established from which future targets will be set.

Sub-Program 1.1.2 Sound Management and Decision Making

Through the Sound Management and Decision Making sub-program, the Secretariat provides independent strategic advice, guidance and support to federal organizations for implementing and applying Treasury Board policies, government priorities, risk-management strategies and performance management in support of sound decision making.

Sub-program 1.1.2 includes the Secretariat’s advice and guidance on resource allocation, risks and policy compliance provided to departments and agencies during the due diligence review of Treasury Board submissions.

It also includes the Secretariat’s MAF activities, which set out the Treasury Board’s expectations for good public service management. MAF is an integrated assessment tool that helps managers, deputy heads and central agencies assess progress and strengthen accountability for management results through clear indicators and measures that gauge performance over time. This sub-program captures the strategic direction and continuous evolution of MAF, which is informed by the management expectations set out in other sub-programs of the Secretariat’s PAA.

| Planned Spending 2012–13 | Actual Spending 2012–13 | Difference 2012–13 |

|---|---|---|

| 13,461 | 13,671 | (210) |

| Planned 2012–13 | Actual 2012–13 | Difference 2012–13 |

|---|---|---|

| 117 | 114 | 3 |

Actual spending and FTEs aligned with plans.

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Advice and direction provided to departments and agencies support sound management and decision making within departments and agencies | Percentage of a representative group of deputy heads in agreement that the advice and direction provided by the Secretariat supports sound management and decision making | 70% by March 2013 | 95% |

| Percentage of departments and agencies that obtained a MAF rating of at least “Acceptable” for use of information for decision making | 80% by March 2013 | 89% |

In the areas of sound management and decision making, the Secretariat performed well regarding both performance targets. For the first indicator, 95 per cent of deputy heads agreed that the Secretariat’s advice and direction support sound management and decision making.

For the second indicator, results reflect the average of MAF ratings for individual lines of evidence pertaining to “use of information for decision making” within the areas of management for internal audit, evaluation, integrated risk management, financial management and control, and people management.

Sub-Program 1.1.3 Service Modernization

Through the Service Modernization sub-program, the Secretariat provides direction and oversight to federal organizations to enhance internal and external service delivery efficiency and to improve service experiences and outcomes for individuals, businesses and employees.

Sub-program 1.1.3 works to promote client-centred service; build operational efficiency through a whole-of-government approach to service delivery; develop a culture of collaboration and service excellence; integrate multi-channel service delivery through effective use of modern technology; and enable the effective use of online technologies, including social media and collaborative technologies. This is accomplished through research, analysis, development and maintenance of policies and related policy instruments, community engagement, and leadership.

The authority for this sub-program is the Financial Administration Act.

| Planned Spending 2012–13 | Actual Spending 2012–13 | Difference 2012–13 |

|---|---|---|

| 8,746 | 10,549 | (1,803) |

| Planned 2012–13 | Actual 2012–13 | Difference 2012–13 |

|---|---|---|

| 56 | 52 | 4 |

Planned spending includes amounts approved through the Main Estimates, with the addition of funding for the Human Resources Modernization (HRMOD) initiative. Actual spending was on target due to funds received throughout the year.

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Departments and agencies are equipped with knowledge and guidance to implement sound service and Web 2.0 management practices | Percentage of planned policy activities completed | 80% by March 2013 | 93% |

In the area of service modernization, the Secretariat exceeded its performance target. In 2012–13, work progressed on a suite of service policy instruments, including the completion of the Guideline on Service Standards and two companion guidelines on service agreements.

At the same time, the Secretariat also adjusted its policy development priorities to respond to emerging priorities. This included the development of a new policy for acceptable and efficient use of Government of Canada electronic networks and devices, and a new standard to enable strategic and coherent management of Government of Canada official social media accounts.

Sub-Program 1.1.4 Information Management, Access and Privacy

Through the Information Management, Access and Privacy sub-program, the Secretariat ensures the continual improvement of the management of information across the Government of Canada by providing strategic direction and leadership to federal institutions on record-keeping, business intelligence, data management, web content management, access to information and privacy protection.

Sub-program 1.1.4 is focused on ensuring that information is safeguarded as a public trust and managed as a strategic asset. It further ensures that information is open to the public whenever possible, that Canadians can exercise their right to access and reuse information, and that personal information is protected against unauthorized collection, use and disclosure. The sub-program’s objectives are accomplished by developing and maintaining policy instruments, encouraging collaboration between government institutions, monitoring and overseeing activities, providing leadership and working with partners. This includes community development, learning and outreach activities.

The authority for this sub-program comes from the Financial Administration Act, the Access to Information Act and the Privacy Act.

| Planned Spending 2012–13 | Actual Spending 2012–13 | Difference 2012–13 |

|---|---|---|

| 9,242 | 9,111 | 131 |

| Planned 2012–13 | Actual 2012–13 | Difference 2012–13 |

|---|---|---|

| 62 | 56 | 6 |

Actual spending and FTEs aligned with plans.

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Institutions are equipped with knowledge and guidance to safeguard information as a public trust and manage it as a strategic asset | Percentage of planned policy activities completed | 80% by March 2013 | 94% |

The Secretariat exceeded its performance target with respect to planned policy activities for the reporting period. Specifically, through ongoing policy development, the Secretariat:

- Contributed to the implementation of the Directive on Recordkeeping;

- Supported Open Government initiatives within the Government of Canada; and

-

Contributed to the ongoing modernization of the Access to Information and Privacy program through such initiatives as:

- Treasury Board policy suite renewal;

- Development of policy direction on the use of web analytics to safeguard privacy; and

- Revision of the Access to Information Manual as guidance to departments and agencies on the interpretation of legislation and policy.

Sub-Program 1.1.5 Management of Information Technology

Through the Management of Information Technology sub-program, the Secretariat provides federal organizations with strategic direction and leadership on the management of information technology (IT). Its whole-of-government strategies focus on standardizing, consolidating and re-engineering IT systems to enable effective program and service delivery. The Secretariat also optimizes Government of Canada IT investments through effective management and governance of IT-enabled projects and supports Shared Services Canada, a centralized department that provides email, data centre and network services to the largest departments in the Government of Canada.

Sub-program 1.1.5 objectives are achieved through IT frameworks, policies, directives and standards, such as the Treasury Board Information Technology Standards (TBITS), that guide Government of Canada institutions in implementing specific technical issues. The Secretariat monitors departmental implementation of this sub-program through oversight, evaluation and reporting activities, including a challenge function that seeks to ensure best value for IT and web investments on behalf of taxpayers.

The authority for this program is the Financial Administration Act.

| Planned Spending 2012–13 | Actual Spending 2012–13 | Difference 2012–13 |

|---|---|---|

| 9,330 | 8,649 | 681 |

| Planned 2012–13 | Actual 2012–13 | Difference 2012–13 |

|---|---|---|

| 67 | 67 | 0 |

Actual spending and FTEs aligned with plans.

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Departments and agencies are equipped to move toward standardization and consolidation of the Government of Canada’s web presence and IT solutions | Percentage of planned policy activities completed | 80% by March 2013 | 73% |

| Percentage of departments and agencies showing progress in aligning with strategic direction for standardization, consolidation and re-engineering | 75% by March 2013 | 87% |

In 2012–13, the Secretariat completed 73 per cent of its planned policy activities in the areas of IT management, the Web and IT project oversight. In the area of IT management, the Secretariat achieved 80 per cent of its planned policy activities, despite significant growth in the portfolio. This included the development of the Standard on Enterprise Resource Planning Systems, which directs departments to common systems for financial management and human resource management.

The Secretariat also led the development of the strategy for standardizing, consolidating and re-engineering the procurement of software for federal employees’ end-user devices. 2012–13 marked the third consecutive year of the departmental IT expenditure data collection, which provided more concise information for making government-wide IT investment decisions regarding standardized and consolidated IT solutions. The Secretariat also established an Application Portfolio Management regime that will enable the management of IT applications on a whole-of government scale and aid in the mitigation of risks associated with aging IT.

In the area of the Web, the Secretariat achieved 100 per cent of its planned policy activities within extremely short timelines, including publishing the new Standard on Optimizing Websites and Applications for Mobile Devices, which ensures that Government of Canada information and services are optimized for mobile devices (e.g., smart phones, tablets) so that information and services reach the widest possible audience.

In the area of IT project oversight, the Secretariat achieved 38 per cent of its policy development target, as it diverted resources to support IT costing and Applications Rationalization and the Shared Services Canada transformation. In 2013–14, the Secretariat is continuing work on a data standard intended to establish a mandatory, standardized approach across the Government of Canada enterprise for the collection, tracking and reporting of IT-enabled project information. This standard will focus on a common nomenclature of data elements and their associated definitions and descriptions to support increased horizontal reporting on IT-enabled project performance.

For the second indicator, the Secretariat exceeded its target, with 87 per cent of departments and agencies showing progress in aligning with strategic direction for standardization, consolidation and re-engineering. The Secretariat supported this effort by continuing to promote enterprise solutions to departments and agencies seeking guidance related to IT policy and investments. The Secretariat worked closely with federal organizations to ensure that departmental IT investments were directed toward standardized, consolidated IT solutions, where feasible, in order to optimize IT investments and support efficient and effective delivery of government infrastructure and back office services.

Sub-Program 1.1.6 Government Security

Through the Government Security sub-program, the Secretariat contributes to improving the Government of Canada’s security posture by supporting departmental and government-wide security management to protect information, assets, individuals and services against internal and external threats. Sub-program 1.1.6 focuses on governance, departmental security management (including cyber security), identity management, individual security screening, physical security, security of information and of information technology, security in contracting and the continuity of government operations and services. These activities enable effective and efficient management of security within departments and throughout government.

The objectives of this sub-program are accomplished through developing and maintaining policy instruments; enabling the security community by providing guidance and sharing best practices; encouraging collaboration between departments; monitoring and overseeing security activities; providing leadership and working with partners; developing a cyber authentication renewal and federating identity program in support of service modernization; and supporting Government of Canada strategic security initiatives, including initiatives related to Canada’s Cyber Security Strategy.

The authority for this program derives from the Financial Administration Act.

| Planned Spending 2012–13 | Actual Spending 2012–13 | Difference 2012–13 |

|---|---|---|

| 5,732 | 6,288 | (556) |

| Planned 2012–13 | Actual 2012–13 | Difference 2012–13 |

|---|---|---|

| 43 | 40 | 3 |

Planned spending does not include additional authorities approved during the year for cyber security, severance pay and parental benefits. Some of this new funding remained unspent due to contracting delays.

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Departments and agencies are equipped with knowledge, direction and guidance to implement and evolve sound security management practices | Percentage of planned policy activities completed | 80% by March 2013 | 83% |

The Secretariat advanced work on drafting the Standard on Security Screening of Individuals, the Standard on Security in Contracting and other policy instruments. This work strengthens security management processes within departments government-wide and maintains trust between Canada and its allies in aligning with government modernization.

In addition, the Secretariat introduced the Standard on Identity and Credential Assurance, which enables departments to work together to reduce the risk associated with identifying individuals, organizations and devices for the purposes of providing services and administering programs.

Sub-Program 1.1.7 Communications and Corporate Identity

Through the Communications and Corporate Identity sub-program, the Secretariat helps Government of Canada departments and agencies effectively manage communications and corporate identity within their organizations. Sub-program 1.1.7 is necessary to ensure that federal organizations inform the public of government policies, programs, services and initiatives; consider the public’s views and needs in their development; and visually identify government assets and activities through the official symbols of the Government of Canada.

To meet these goals, the Secretariat proposes government-wide policy direction to Treasury Board ministers, implements approved policy instruments, examines the extent to which departments are in compliance with key policy requirements, and takes corrective measures to address compliance issues. To assist compliance with policy requirements, the Secretariat provides policy interpretation, advice and outreach to all government departments and agencies, in particular to communications staff.

The legislative authority for this program is section 7 of the Financial Administration Act.

| Planned Spending 2012–13 | Actual Spending 2012–13 | Difference 2012–13 |

|---|---|---|

| 876 | 911 | (35) |

| Planned 2012–13 | Actual 2012–13 | Difference 2012–13 |

|---|---|---|

| 8 | 9 | (1) |

Actual spending and FTEs aligned with plans.

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Departments and agencies are keeping the public informed of policies, programs, services and initiatives, and considering the public’s views in their development | Percentage of departments and agencies in compliance with key requirements of the Communications Policy of the Government of Canada and the Federal Identity Program Policy | 80% by December 2013 | 83% |

The Secretariat exceeded performance expectations in the area of communications and corporate identity. The government-wide monitoring of key policy requirements based on organizations’ self-assessment indicates that for 2012–13, 83 per cent of departments and agencies were in compliance with key requirements of the Communications Policy of the Government of Canada and the Federal Identity Program Policy.

Sub-Program 1.1.8 Regulatory Management

Through the Regulatory Management sub-program, the Secretariat supports the Treasury Board as a committee of ministers in considering Governor in Council regulations and orders. Regulation is one of the key instruments to advance the government’s policy agenda and to fulfill statutory responsibilities through a number of Acts to protect the health, safety and security of Canadians, their environment and economy. Regulations must be developed and implemented in a way that reduces burden on business, makes it easier to do business with regulators, and improves service and predictability for all stakeholders. Canada’s regulatory policy is the Cabinet Directive on Regulatory Management.

The Secretariat supports the Treasury Board for the continuum of regulatory development, implementation and monitoring through its three main business lines:

- Challenge function - regulatory proposals are reviewed on a submission-by-submission basis to ensure quality design;

- Policy leadership - guidelines and tools are developed to assist departments in complying with the directive when preparing regulatory submissions, including new requirements related to systemic regulatory reforms; and

- Oversight - ongoing monitoring and reporting of regulatory system performance to support red tape reduction efforts.

| Planned Spending 2012–13 | Actual Spending 2012–13 | Difference 2012–13 |

|---|---|---|

| 7,850 | 5,234 | 2,616 |

| Planned 2012–13 | Actual 2012–13 | Difference 2012–13 |

|---|---|---|

| 62 | 38 | 24 |

Actual spending was lower than planned spending due to the transfer during the year of the Canada-United States Regulatory Cooperation Council from the Secretariat to the Privy Council Office.

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Regulations approved by the Governor in Council address risks and limit new administrative burden on business via application of the reconciliation requirement of the “One-for-One” Rule | Percentage of regulations approved by the Governor in Council that address risks while controlling administrative burden on business through the “One for One” Rule | 90% by March 2015 | 100% as of March 2013 |

The Secretariat exceeded its performance target in 2012–13. In the “One-for-One” Rule’s inaugural year, all departments and agencies offset administrative burden and eliminated regulations in accordance with this rule, while continuing to design regulations that address risk.

Other red tape reduction reforms were also implemented including the Small Business Lens, forward regulatory plans and service standards for high-volume regulatory authorizations.

Program 1.2 People Management

The People Management Program supports activities of the Treasury Board in its role as the employer of the core public administration. The program’s primary objectives are to lead people management and promote leadership excellence, to support human resources infrastructure and to ensure the appropriate degree of consistency in people management across the public service. In certain instances, activities extend beyond the core public administration to separate agencies, members of the Royal Canadian Mounted Police and Canadian Forces, locally engaged staff, students and appropriation-dependent Crown corporations.

To support deputy heads and to provide Parliament and Canadians with a clear view of the overall state of people management, this program enables the development and implementation of direction-setting strategic frameworks and policies for classification, executive management, official languages, and values and ethics; the establishment of people management indicators, measures, oversight and monitoring; and the collection and analysis of reliable and consistent data regarding the public service. This program enables prudent fiscal management of resources in the areas of classification, total compensation (collective bargaining, wages and salaries, terms and conditions of employment, pensions and benefits) and labour relations, and supports departments to implement decisions by the Government of Canada regarding expenditures and programs.

Responsibilities in areas other than classification and labour relations are shared with the Expenditure Management program. The People Management program is underpinned by a number of pieces of legislation, which are identified in the Policy Framework for People Management and the Policy Framework for the Management of Compensation.

| Total Budgetary Expenditures (Main Estimates) 2012–13 |

Planned Spending 2012–13 |

Total Authorities (available for use) 2012–13 |

Actual Spending (authorities used) 2012–13 |

Difference (Planned vs. Actual Spending) |

|---|---|---|---|---|

| 57,710 | 59,431 | 62,253 | 60,975 | (1,544) |

| Planned 2012–13 | Actual 2012–13 | Difference 2012–13 |

|---|---|---|

| 494 | 437 | 57 |

In 2012–13, the difference between Main Estimates and Total Authorities is mainly due to the receipt of funding for the Human Resources Modernization (HRMOD) initiative and funding from the Treasury Board central vote for severance payments and parental leave. The program’s spending is on target for planned spending and actual year-end results.

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Effective people management in the Government of Canada | Percentage of assessed departments and agencies that obtained a MAF rating of at least “Acceptable” for people management | 95% by March 2017 | 100% |

| Percentage of assessed departments and agencies that obtained a MAF rating of at least “Acceptable” for areas of weakness identified in the previous round of assessment of people management | 65% by March 2014 | 68% |

For the first indicator, all of the 40 federal organizations assessed in the 2012–13 MAF process achieved a rating of at least “Acceptable” in the area of people management. There was a significant improvement in the number of employees that met the bilingual language requirement of their positions, with 60 per cent of organizations assessed achieving a rating of “Strong,” compared with 26 per cent in the two previous assessments.

For the second indicator, organizations have improved in setting performance expectations and appraising performance, with a 31-per-cent increase from 2011–12 in the number of organizations achieving a rating of “Acceptable” or “Strong” for workload and workplace planning effectiveness, an area that had previously been identified as weak.

Performance Analysis and Lessons Learned

Through the People Management program, the Secretariat continued to support its priority to enable a modern and sustainable approach to people management by implementing a range of plans set out in its 2012–13 Report on Plans and Priorities. The Secretariat, for example:

Strengthened Workforce Planning and Performance

- Obtained approval to implement the Directive on Performance Management, which will come into effect in April 2014. The directive will provide a standardized approach to the management of employee performance throughout the core public administration. It will better equip organizations and managers to recognize and reward good performance; to work with all employees to improve performance; and to manage unsatisfactory performance.

- Launched a strategic, comprehensive and coherent strategy to manage disability and sick leave across the Government of Canada. Engagement with bargaining agents is underway for a new, streamlined system that ensures active case management and comprehensive support for employees.

Advanced the Modernization of Public Sector Compensation

- In January 2013, announced public sector pension reforms that will save taxpayers $2.6 billion over the next five years and will bring federal public sector pension plans more in line with other public and private sector pension plans.

- Advanced a simplified, integrated and modern approach to public service pensions and benefits to facilitate long-term efficiencies, sustainability and cost containment, with a focus in 2012–13 on aligning the governance structures as well as the design of the various pension, health, dental and disability insurance plans. This included implementing pension reform proposals outlined in Economic Action Plan 2012 and establishing a governance committee to ensure the sound implementation of internal audit recommendations in the area of public service pensions.

- Published comprehensive regulatory policy documents and consulted with stakeholders in February 2013 for the development of regulations under the Public Sector Equitable Compensation Act. Work progressed on the development of an education and awareness plan to support policy implementation.

Enabled Deputy Head Accountability for People Management

-

Continued to support deputy heads in their accountability for effective people management by:

- Implementing the Values and Ethics Code for the Public Sector and the accompanying Policy on Conflict of Interest and Post-Employment;

- Renewing the official languages policy suite; and

- Continuing work to streamline the suite of Treasury Board policies, such as those related to the management of executives.

Sub-Program 1.2.1 Direction Setting

Through the Direction Setting sub-program, the Secretariat ensures that organizations of the core public administration receive high-quality advice, guidance and support for people management and related policy instruments.

Sub-program 1.2.1 includes developing and implementing strategic frameworks; establishing, assessing and monitoring performance expectations; and establishing risk-based policies in areas of employer responsibility. Directions on the management of talent are set for all employees, including executives, and are supported and implemented through corporate talent management and leadership development activities and programs.

This sub-program is supported by research, forecasting and business intelligence to enable evidence-based decision making.

| Planned Spending 2012–13 | Actual Spending 2012–13 | Difference 2012–13 |

|---|---|---|

| 21,205 | 22,701 | (1,496) |

| Planned 2012–13 | Actual 2012–13 | Difference 2012–13 |

|---|---|---|

| 172 | 168 | 4 |

Actual spending and FTEs aligned with plans.

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Federal organizations are equipped with the knowledge and guidance to address people management priorities | Percentage of the people management policy instruments that have been reviewed that comply with established review cycles | 100% by March 2020 | 90% for 2012–13 planned activities |

The performance indicator is a broad, long-term indicator that relates to periodic policy reviews generally done on a five-year cycle. The 2012–13 actual result relates to work done in that year to review the Treasury Board suite of people management policies, resulting in significant streamlining.

In 2012–13, the review of the official languages policy suite was completed, and the revised policy instruments were implemented. In addition, work continued on streamlining the people management policy suite. This streamlining included the development of the Workforce and Workplace Policy and associated directives and standards, which, once approved by Treasury Board, will replace approximately 10 current policy instruments. The new policy will provide high-level guidance that recognizes deputy head authority for people management.

Sub-Program 1.2.2 Enabling Infrastructure

Through the Enabling Infrastructure sub-program, the Secretariat guides and supports deputy heads’ collective responsibility for putting in place efficient and effective people management through common business processes, information systems, best practice tools and sound data.

The objectives of sub-program 1.2.2 are achieved by strengthening the existing governance of human resources management; championing the human resources functional community; and establishing a broad engagement strategy to facilitate a shift in human resources practices, behaviours and relationships, while leveraging Web 2.0 technology. Defining a common way to deliver human resources services throughout the Government of Canada will establish a comprehensive blueprint for deriving data architecture and definitions.

The Secretariat builds on this foundation by maximizing investments made in information technology solutions for modernizing human resources services and programs and by increasing its capacity to define, capture and measure business intelligence, and understand the perceptions and needs of public servants.

| Planned Spending 2012–13 | Actual Spending 2012–13 | Difference 2012–13 |

|---|---|---|

| 20,943 | 21,247 | (304) |

| Planned 2012–13 | Actual 2012–13 | Difference 2012–13 |

|---|---|---|

| 158 | 139 | 19 |

Planned spending includes amounts approved in the Main Estimates along with funding for the Human Resources Modernization (HRMOD) initiative. Financial resources and FTEs were on target at year-end due to funding received during the year (and reflected in total authorities) for paylist requirements such as severance pay and parental benefits.

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Federal organizations are equipped with processes, tools, data or systems to continuously improve their people management practices | Percentage of organizations that have adopted standardized processes, tools, data or systems | 100% by March 2020 | 99% of the core public administration and 95% of separate agencies are working to adopt common processes |